- AIV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Apartment Investment and Management (AIV) 8-KOther events

Filed: 3 Jun 03, 12:00am

| Investor Relations (303) 691-4350 Investor@aimco.com Jennifer Martin Vice President—Investor Relations (303) 691-4440 |

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

ANNOUNCES MAY OPERATING METRICS

DENVER, COLORADO, June 3, 2003

Apartment Investment and Management Company (NYSE:AIV) ("Aimco") announced today operating metrics for its "Same Store" portfolio for the month of May 2003. "Same Store" properties had average occupancy of 93.0%, average rent per unit of $694 and net rental income ("NRI") of $93.5 million. In the second quarter of 2003, the "Same Store" portfolio includes 16 conventional properties having 4,767 units in Southern California that were acquired in March 2002. The 11 properties acquired in New England in August 2002 are not part of the "Same Store" portfolio. These properties had occupancy of 95.8% and average rent per unit of $1,146 in May 2003 compared with 89.1% and $1,179, respectively, in January 2003.

| | Same Store Portfolio | ||||||

|---|---|---|---|---|---|---|---|

| | Occupancy | Rent per Unit | NRI ($mm) | ||||

| 2002 | |||||||

| April | 94.0 | % | $ | 709 | 96.5 | ||

| May | 93.4 | % | 718 | 97.1 | |||

| June | 93.4 | % | 711 | 96.1 | |||

| July | 93.0 | % | 708 | 95.3 | |||

| August | 94.0 | % | 705 | 96.0 | |||

| September | 93.5 | % | 700 | 94.8 | |||

| October | 92.3 | % | 706 | 94.3 | |||

| November | 91.4 | % | 708 | 93.7 | |||

| December | 90.5 | % | 709 | 93.0 | |||

| 2003 | |||||||

| January | 90.2 | % | 710 | 92.7 | |||

| February | 90.5 | % | 703 | 92.2 | |||

| March | 91.4 | % | 694 | 91.8 | |||

| April | 92.2 | % | 695 | 92.8 | |||

| May | 93.0 | % | 694 | 93.5 | |||

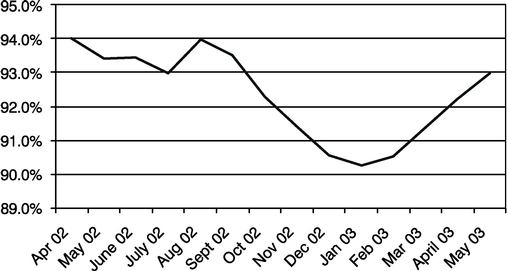

Same Store Occupancy has improved from 90.2% in January to 93.0% in May

Occupancy

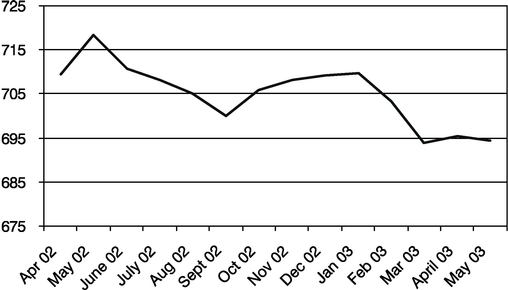

Same Store Average Rent per Unit has been stable since March

Average Rent per Unit

2

Same Store Net Rental Income has increased $1.7 million in May from the March low

Net Rental Income

The "Same Store" portfolio represents stabilized properties owned for the current and preceding 12 months. The composition of this portfolio may change each month with additions from properties held for more than one year and subtractions from properties sold or withdrawn for redevelopment. As of April 2003, the "Same Store" portfolio includes the Southern California properties acquired in March 2002.

Aimco is a real estate investment trust headquartered in Denver, Colorado owning and operating a geographically diversified portfolio of apartment communities through 19 regional operating centers. Aimco, through its subsidiaries, operates approximately 1,760 properties, including approximately 313,000 apartment units, and serves approximately one million residents each year. Aimco's properties are located in 47 states, the District of Columbia and Puerto Rico. Aimco has been recently included in the S&P 500.

3