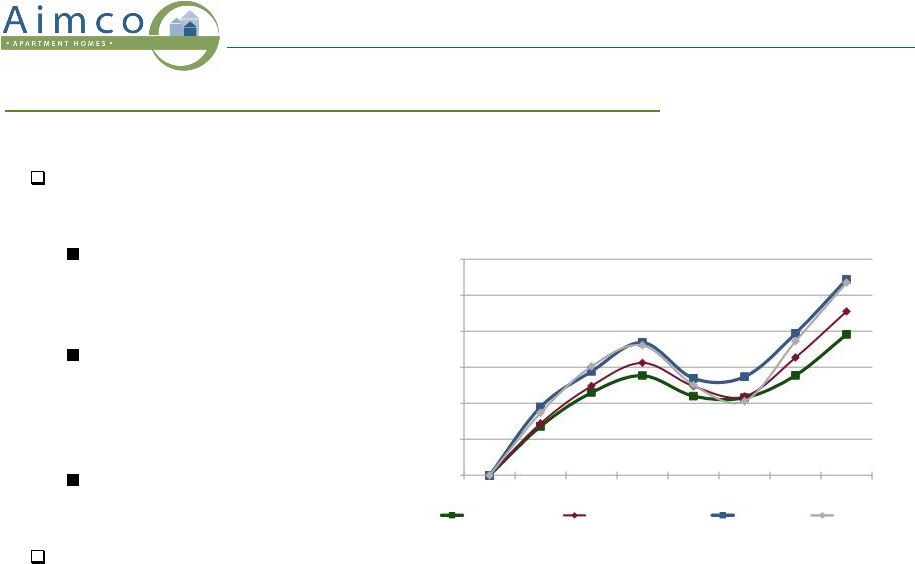

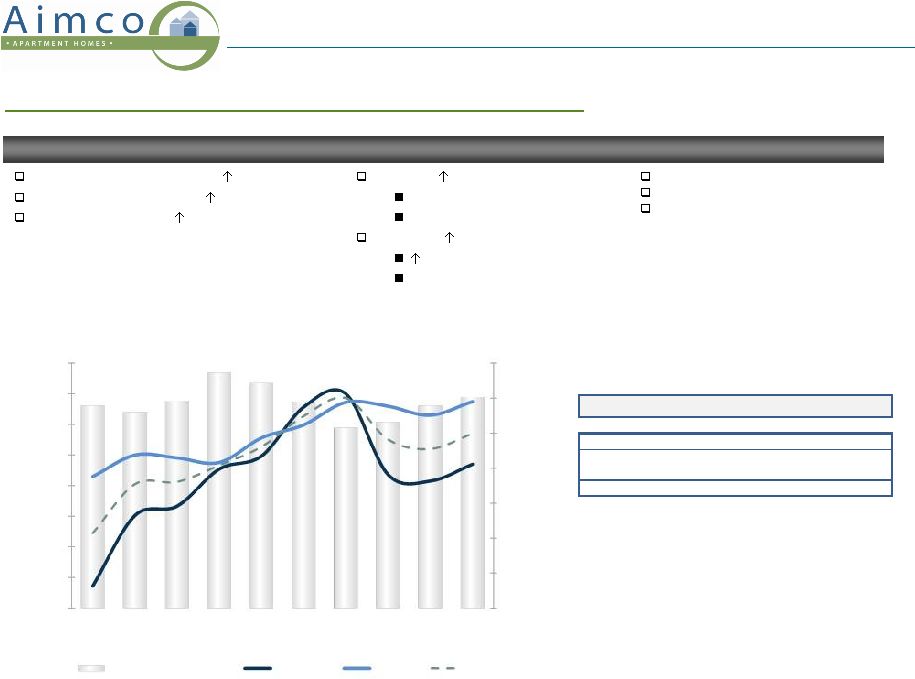

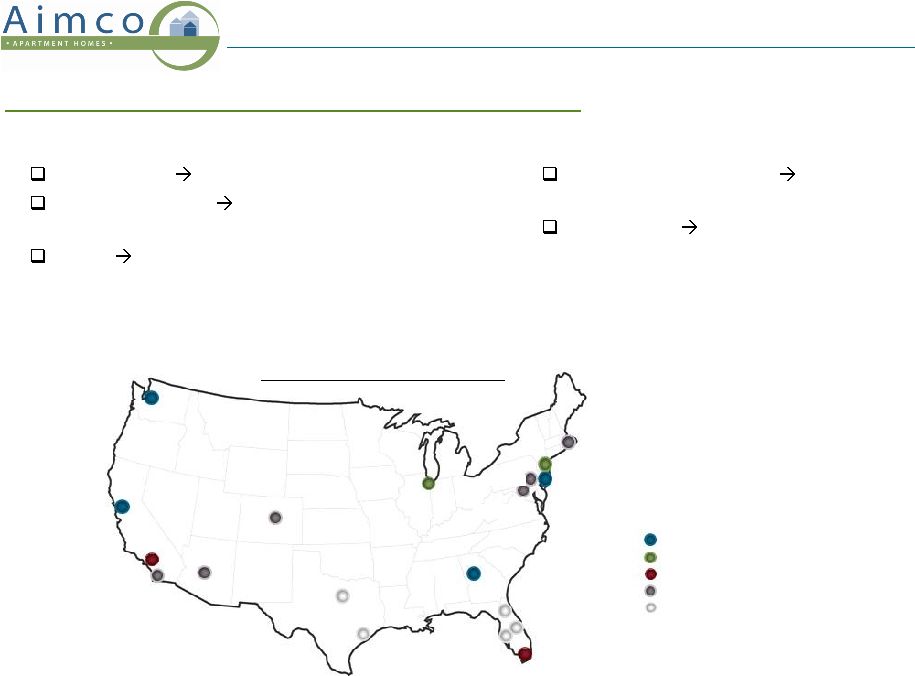

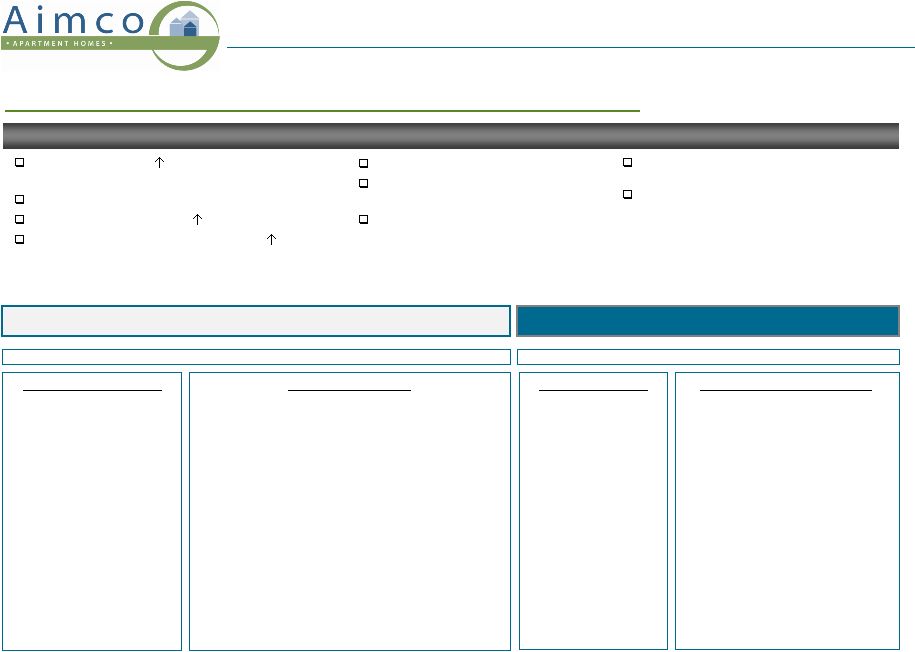

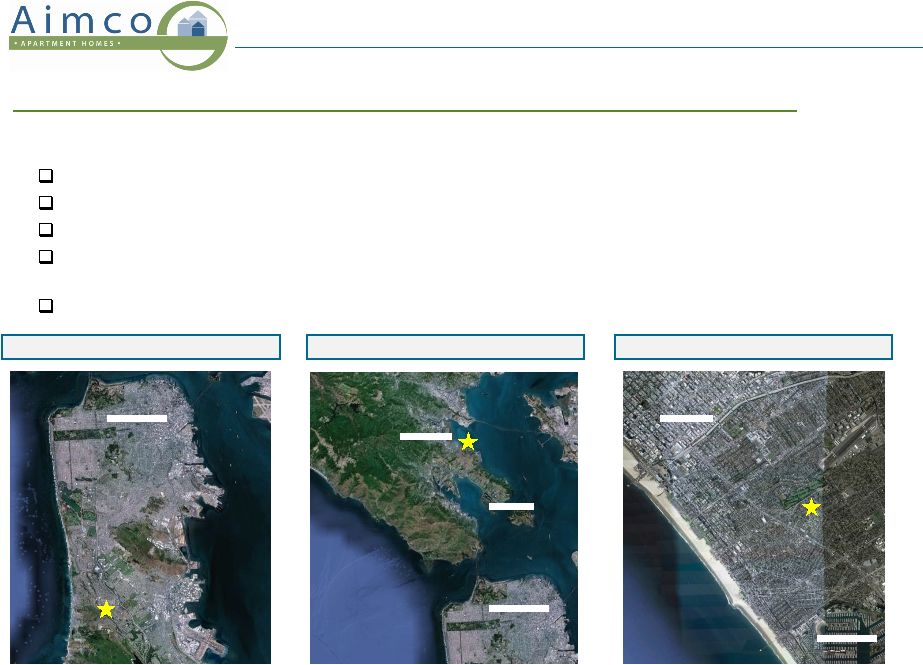

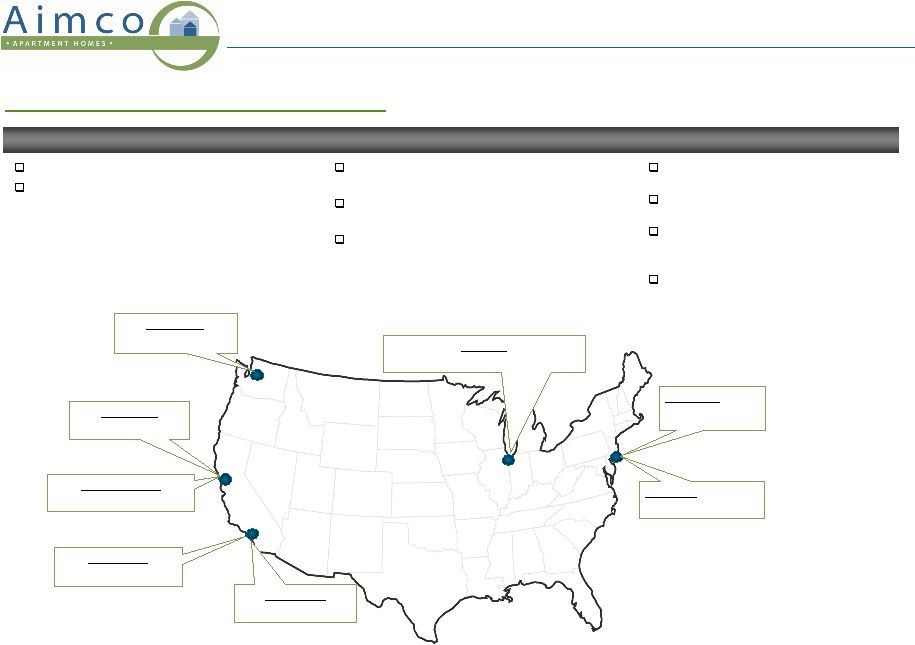

6 2012 Plan: Portfolio What We Expect How We Plan to Get There Year-to-Date Progress Conventional rents ~10% to $1,260 from $1,143 at the end of 2011 Affordable portfolio < 10% of NAV Conventional NOI margin ~1.5% to ~ 64% Conventional Free Cash Flow margin * ~3% to ~58% Dispositions $550 - $650M Acquisitions $220M+ with $160M in partnerships Opportunistic acceleration of 2013 - 2014 planned dispositions of ~$1B with average rents ~$800 would increase average rents at year-end 2012 to ~$1,400 Sold four properties with 725 units, Aimco share of gross proceeds ~$45M Completed seven public partnership mergers, acquiring $130M of real estate Portfolio plan is on track, may accelerate asset sales AIV Share: $550 - $650M Conventional Properties Portfolio average rents increase ~5% through sales of 25+ properties with average rents < $700 AIV share of gross dispositions $500 - $600M FCF margin increases at rate twice that of NOI margin due to levering effect of capital replacement spending Affordable Properties Sell 60+ properties in which Aimco's average ownership is ~41% AIV share of gross dispositions ~$50M In connection with sale of asset managed portfolio, sell 20+ consolidated NAPICO properties in which Aimco’s average ownership is ~14% YE 2012 affordable portfolio: • ~25 properties to be sold by the end of 2013 • ~65 tax credit redevelopment properties, most to be liquidated over the next five years as credits are delivered Eliminate compliance activities, lower offsite costs INVESTMENTS Real Estate: $220M $130M in seven public partnerships $90M in other partnership tenders and mergers, and property purchases DISPOSITIONS Total: $345 - $370M Redevelopment: $125 - $150M Eight projects underway in 2012; four in coastal California and four others in Seattle, Chicago and Philadelphia; ~$400M multi-year investment Three vacant properties; ~1,220 units returned to service over next two years; target rents > $2,400 Current returns on un-trended rents > 7%, Free Cash Flow IRRs > 10% * Free Cash Flow is defined as property NOI less assumed capital replacement expenditures of $850 per unit |