- AIV Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Apartment Investment and Management (AIV) DEF 14ADefinitive proxy

Filed: 7 Mar 16, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e) (2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Rule 14a-12 |

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

(Exact Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

Fee paid previously with preliminary materials.

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

4582 SOUTH ULSTER STREET, SUITE 1100

DENVER, COLORADO 80237

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On April 26, 2016

Youare cordially invited to attend the 2016 Annual Meeting of Stockholders (the “Meeting”) ofAPARTMENTINVESTMENT AND MANAGEMENTCOMPANY(“Aimco” or the “Company”) to be held onTuesday,April 26, 2016, at 8:30 a.m. atAimco’scorporate headquarters, 4582 South Ulster Street, Suite 1100, Denver, CO 80237, for the following purposes:

| 1. | Toelecteightdirectors,foratermofoneyeareach,untilthenextAnnualMeetingofStockholdersanduntiltheirsuccessors are elected andqualify; | |

| 2. | Toratify the selection of Ernst &YoungLLP,to serve as independent registered public accounting firm for the Company for the fiscal year ending December 31,2016; | |

| 3. | Toconduct an advisory vote on executive compensation;and | |

| 4. | Totransact such other business as may properly come before the Meeting or any adjournment(s)thereof. |

OnlystockholdersofrecordatthecloseofbusinessonFebruary19,2016,willbeentitledtonoticeof,andtovoteat,theMeeting or any adjournment(s)thereof.

WeareagainpleasedtotakeadvantageofSecuritiesandExchangeCommission(“SEC”)rulesthatallowissuerstofurnishproxy materials to their stockholders on the Internet.Webelieve these rules allow us to provide our stockholders with the information they need, while lowering the costs of delivery and reducing the environmental impact of ourMeeting.

OnoraboutMarch11,2016,weintendtomailourstockholdersanoticecontaininginstructionsonhowtoaccessour2016proxy statement(the“ProxyStatement”),AnnualReportonForm10-KfortheyearendedDecember31,2015,and2015CorporateCitizenship Report and vote online. The notice also provides instructions on how you can request a paper copy of these documents if you desire, and how you can enroll in e-delivery. If you received your annual materials via email, the email contains voting instructions and links to these documents on theInternet.

WHETHER OR NOT YOU EXPECT TO BE AT THE MEETING, PLEASE VOTE AS SOON AS POSSIBLE TO ENSURE THAT YOUR SHARES ARE REPRESENTED.

| BY ORDER OF THE BOARD OF DIRECTORS | |

| |

| Lisa R. Cohn | |

| Secretary | |

| March 7, 2016 |

Important Notice Regarding the Availability of Proxy Materials for

Aimco’s Annual Meeting of Stockholders to be held on April 26, 2016.

This Proxy Statement, Aimco’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, and 2015 Corporate Citizenship Report are available free of charge at the following website: www.edocumentview.com/aiv.

Table of Contents

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

4582 SOUTH ULSTER STREET, SUITE 1100

DENVER, COLORADO 80237

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 26, 2016

The Board of Directors (the “Board”) of Apartment Investment and Management Company (“Aimco” or the “Company”) has made these proxy materials available to you on the Internet,or,upon your request, has delivered printed versions of these materials to youbymail.WearefurnishingthisProxyStatementinconnectionwiththesolicitationbyourBoardofproxiestobevotedatour2016 AnnualMeeting(the“Meeting”).TheMeetingwillbeheldonTuesday,April26,2016,at8:30a.m.atAimco’scorporateheadquarters locatedat4582SouthUlsterStreet,Suite1100,Denver,Colorado80237,andatanyandalladjournmentsorpostponementsthereof.

Pursuant to rules adopted by the SEC, we are providing access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to each stockholder entitled to vote at the Meeting. The mailing of such Notice is scheduled to begin on or about March11,2016. All stockholders will have the ability to access the proxy materialsovertheInternetandrequesttoreceiveaprintedcopyoftheproxymaterialsbymail.Instructionsonhowtoaccesstheproxy materialsovertheInternetortorequestaprintedcopymaybefoundintheNotice.Inaddition,theNoticeincludesinstructionsonhow stockholders may request proxy materials in printed form by mail or electronically by email on an ongoingbasis.

ThissolicitationismadebymailonbehalfofAimco’sBoard.CostsofthesolicitationwillbebornebyAimco.Furthersolicitation of proxies may be made by telephone, fax or personal interview by the directors, officers and employees of the Company and its affiliates,whowillnotreceiveadditionalcompensationforthesolicitation.TheCompanyhasretainedtheservicesofAllianceAdvisors LLC,foranestimatedfeeof$10,000,plusout-of-pocketexpenses,toassistinthesolicitationofproxiesfrombrokeragehouses,banks, andothercustodiansornomineesholdingstockintheirnamesforothers.TheCompanywillreimbursebanks,brokerage firmsandother custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy material tostockholders.

Holders of record of the Class A Common Stock of the Company (“Common Stock”) as of the close of business on the record date,February19,2016(the“RecordDate”),areentitledtoreceivenoticeof,andtovoteat,theMeeting.EachshareofCommonStock entitles the holder to one vote. At the close of business on the Record Date, there were 156,599,775 shares of Common Stock issued andoutstanding.

Whetheryouarea“stockholderofrecord”orholdyoursharesthroughabrokerornominee(i.e.,in“streetname”)youmaydirect your vote without attending the Meeting inperson.

If you are a stockholder of record, you may vote via the Internet by following the instructions in the Notice. If you request printed copies of the proxy materials by mail, you may also vote by signing your proxy card and returning it by mail or by submitting your vote by telephone.Youshould sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity(forexample,asguardian,executor,trustee,custodian,attorneyorofficerofacorporation),youshouldindicateyournameand title orcapacity.

If you are the beneficial owner of shares held in street name, you may be eligible to vote your shares electronically over the InternetorbytelephonebyfollowingtheinstructionsintheNotice.Ifyourequestprintedcopiesoftheproxymaterialsbymail,youmay also vote by signing the voter instruction card provided by your bank or broker and returning it by mail. If you provide specific voting instructions by mail, telephone or the Internet, your shares will be voted by your broker or nominee as you havedirected.

The persons named as proxies are officers of Aimco. All proxies properly submitted in time to be counted at the Meeting will be voted in accordance with the instructions contained therein. If you submit your proxy without voting instructions, your shares will be voted in accordance with the recommendations of the Board. Proxies may be revoked at any time before voting by filing a notice of revocation with the Corporate Secretary of the Company, by filing a later dated proxy with the Corporate Secretary of the Company or by voting in person at theMeeting.

YouareentitledtoattendtheMeetingonlyifyouwereanAimcostockholderorjointholderasoftheRecordDateorifyouholda validproxyfortheMeeting.Ifyouarenotastockholderofrecordbutholdsharesinstreetname,youshouldprovideproofofbeneficial ownershipasoftheRecordDate,suchasyourmostrecentaccountstatementpriortoFebruary19,2016,acopyofthevotinginstruction card provided by your broker, trustee or nominee, or other similar evidence ofownership.

Brokers holding shares of record for customers generally are not entitled to vote on certain matters unless they receive voting instructionsfromtheircustomers.Ifyouareabeneficialownerofsharesanddonotprovideyourbroker,asstockholderofrecord,with voting instructions, your broker has authority under applicable stock market rules to vote those shares for or against “routine” matters at its discretion. At the Meeting, the following matters are not considered routine: the election of directors and the advisory vote on executive compensation. Where a matter is not considered routine, shares held by your broker will not be voted (a “broker non-vote”) absent specific instruction from you, which means your shares may go unvoted on those matters and not affect the outcome if you do not specify avote.

The principal executive offices of the Company are located at 4582 South Ulster Street, Suite 1100, Denver, Colorado 80237.

2

ELECTION OF DIRECTORS

Pursuant toAimco’sArticles of Restatement (the “Charter”) and Amended and Restated Bylaws (the “Bylaws”), directors are elected at each annual meeting of stockholders and hold office for one year, and until their successors are duly elected and qualify.Aimco’sBylawscurrentlyauthorizeaBoardconsistingofnotfewerthanthreenormorethanninepersons.TheBoardcurrentlyconsists of eightdirectors.

The nominees for election to the Board selected by the Nominating and Corporate Governance Committee of the Board and proposed by the Board to be voted upon at the Meeting are:

| James N. Bailey | Robert A. Miller | ||

| Terry Considine | Kathleen M. Nelson | ||

| Thomas L. Keltner | Michael A. Stein | ||

| J. Landis Martin | Nina A. Tran |

Messrs.Bailey,Considine,Keltner,Martin,Miller,andSteinandMs.NelsonwereelectedtotheBoardatthelastAnnualMeeting of Stockholders. Messrs. Bailey, Keltner, Martin, Miller, and Stein and Mses. Nelson and Tran are not employedby,or affiliated with, Aimco, other than by virtue of serving as directors of Aimco. Unless authority to vote for the election of directors has beenspecifically withheld, the persons named in the accompanying proxy intend to vote for the election of Messrs. Bailey, Considine, Keltner, Martin, Miller,andSteinandMses.NelsonandTrantoholdofficeasdirectorsforatermofoneyearuntiltheirsuccessorsareelectedandqualify atthenextAnnualMeetingofStockholders.AllnomineeshaveadvisedtheBoardthattheyareableandwillingtoserveasdirectors.

Ifanynomineebecomesunavailableforanyreason(whichisnotanticipated),thesharesrepresentedbytheproxiesmaybevoted forsuchotherpersonorpersonsasmaybedeterminedbytheholdersoftheproxies(unlessaproxycontainsinstructionstothecontrary). In no event will the proxy be voted for more than eightnominees.

Inanuncontestedelectionatthemeetingofstockholders,anynomineetoserveasadirectoroftheCompanywillbeelectedifthe director receives a vote of the majority of votes cast, which means that the number of shares voted “for” a director exceeds the number ofvotes“against”thatdirector.Withrespecttoacontestedelection,apluralityofallthevotescastatthemeetingofstockholderswillbe sufficienttoelectadirector.Ifanomineewhocurrentlyisservingasadirectorreceivesagreaternumberof“against”votesforhisorher election than votes “for” such election (a “Majority AgainstVote”)in an uncontested election, Maryland law provides that the director wouldcontinuetoserveontheBoardasa“holdoverdirector.”However,underAimco’sBylaws,anynomineeforelectionasadirector in an uncontested election who receives a Majority AgainstVoteis obligated to tender his or her resignation to the Nominating and CorporateGovernanceCommitteeoftheBoardforconsideration.TheNominatingandCorporateGovernanceCommitteewillconsider any resignation and recommend to the Board whether to accept it. The Board is required to take action with respect to the Nominating and Corporate Governance Committee’srecommendation.

Forpurposesoftheelectionofdirectors,abstentionsorbrokernon-votesastotheelectionofdirectorswillnotbecountedasvotes castandwillhavenoeffectontheresultofthevote.Unlessinstructedtothecontraryintheproxy,thesharesrepresentedbytheproxies will be voted FOR the election of the eight nominees named above asdirectors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

EACH OF THE EIGHT NOMINEES.

3

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

ThefirmofErnst&YoungLLP,theCompany’sindependentregisteredpublicaccountingfirmfortheyearendedDecember31,2015, was selected by the Audit Committee to act in the same capacity for the year ending December 31, 2016, subject to ratification byAimco’sstockholders.TheaggregatefeesbilledforservicesrenderedbyErnst&YoungLLPduringtheyearsendedDecember31,2015 and2014,aredescribedbelowundertheheading“PrincipalAccountantFeesandServices.”

In selecting and overseeing the Company’s independent auditor, the Audit Committee considers, among other things:

| ● | Ernst &YoungLLP’shistorical and recent performance on the Aimco audit, including the results of an internal survey of Ernst &YoungLLP’sservice andquality; | |

| ● | External data relating to audit quality and performance, including recent Public Company Accounting Oversight Board (PCAOB) reports on Ernst &YoungLLP and its peerfirms; | |

| ● | The appropriateness of Ernst &YoungLLP’sfees; | |

| ● | Ernst &YoungLLP’stenure asAimco’sindependent auditor and its familiarity withAimco’soperations and business, accounting policies and practices and internal control over financialreporting; | |

| ● | The depths of Ernst &YoungLLP’scapabilities and resources to support our business in the areas of accounting, auditing, internal control over financial reporting, tax and related matters;and | |

| ● | Ernst &YoungLLP’sindependence. |

Basedonthisevaluation,theAuditCommitteebelievesthatErnst&YoungLLPisindependentandthatitisinthebestinterests ofAimcoandourstockholderstoretainErnst&YoungLLPtoserveasourindependentauditorfor2016.

Representatives of Ernst & Young LLP will be present at the Meeting and will be given the opportunity to make a statement if they so desire and to respond to appropriate questions.

TheaffirmativevoteofamajorityofthevotescastregardingtheproposalisrequiredtoratifytheselectionofErnst&YoungLLP.Abstentionsorbrokernon-voteswillnotbecountedasvotescastandwillhavenoeffectontheresultofthevoteontheproposal.Unlessinstructedtothecontraryintheproxy,thesharesrepresentedbytheproxieswillbevoted“for”theproposaltoratifytheselectionofErnst &YoungLLPtoserveastheCompany’sindependentregisteredpublicaccountingfirmforthefiscalyearendingDecember31,2016.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION

OF THE SELECTION OF ERNST & YOUNG LLP.

ADVISORY VOTE ON EXECUTIVE COMPENSATION

PursuanttoSection14AoftheSecuritiesExchangeActof1934,asamended,weprovideourstockholderswiththeopportunityto votetoapprove,onanonbinding,advisorybasis,thecompensationofournamedexecutiveofficers(“NEOs”)asdisclosedinthisproxy statement in accordance with the compensation disclosure rules of the SEC.Aimco’sproxy statement for the 2011 annual meeting of stockholders contained a proposal for stockholders to indicate whether they would prefer that we conduct advisory votes on executive compensation once every one, two, or three years. The Board recommended that stockholders vote “for” an annual advisory vote on executive compensation, as it would allow our stockholders to provide timely, direct input on the Company’s executive compensation philosophy, policies and practices as disclosed in the proxy statement eachyear.A majority of stockholders voted “for” an annual advisoryvoteonexecutivecompensation.Accordingly,theBoarddecideditwillincludeanadvisoryvoteonexecutivecompensationat eachannualmeetingofstockholdersuntilthenextrequiredadvisoryvoteonfrequencyofstockholdervotesonexecutivecompensation, which will occur no later than the 2017 annual meeting ofstockholders.

4

AtAimco’s2015 Annual Meeting of Stockholders, approximately 96% of the votes cast in the advisory vote on executive compensationthatwerepresentandentitledtovoteonthematterwereinfavorofthecompensationofAimco’sNEOs(alsocommonly referred to as “Say on Pay”) as disclosed inAimco’s2015 proxy statement. The Compensation and Human Resources Committee (the “Committee”) and management were pleased with these results, and remain committed to extensive engagement with stockholders as part of their ongoing efforts to formulate and implement an executive compensation program designed to align the long-term interests of our executive officers with ourstockholders.

During the third and fourth quarters of 2015 and into 2016, members of management arranged and participated in 15 detailed andsubstantivemeetingswithstockholders(representingover66%ofsharesofCommonStockoutstandingasofSeptember30,2015), including all 10 ofAimco’slargest stockholders as of that date, to solicit feedback onAimco’sexecutive compensation program and governance practices, including the numerous changes Aimco made to its 2015 program based on extensive stockholder feedback received in 2014 and into 2015. These changes were disclosed in detail inAimco’sproxy statement for the 2015 annual meeting of stockholders. Stockholder feedback on the changes was uniformly positive.Specifically:

| ● | With regard toAimco’sshort-term incentive (“STI”) plan, stockholders responded favorably to: the increased disclosure of goals, including an explanation of the objective of each goal and disclosure of threshold, target, and maximum achievement levelsforeachgoal;clarityaroundtheconnectionofeachgoaltoAimco’sstatedbusinessstrategy;areductioninthenumber of goals, from twelve for 2014 to eight for 2015; and an adjustment to the weightings for most goals such that the majority of goals are objective, financial goals, and an even higher percentage of goals are objectivegoals. | |

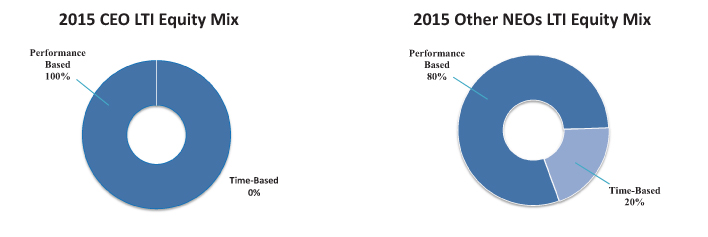

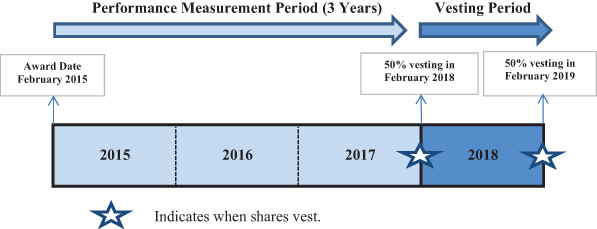

| ● | Stockholders responded favorably toAimco’snew long-term incentive(“LTI”)plan with the following key elements: performanceshareawardsthatvestbasedonrelativetotalshareholderreturn(“TSR”)ascomparedtotheNAREITApartment Index (60% weighting) and the MSCI US REIT Index (“REIT Index”) (40% weighting) over a forward looking, three-year performance period; requiring outperformance on relative return performance metrics in order to receive target payout; including a “modifier” if, for any three-year performance period, Aimco’s absolute return were negative; and providing for 100% of theCEO’sLTI,and a substantial proportion of theLTItarget for the other NEOs, to be “at risk,” or “performance based,” as opposed to “timebased.” | |

| ● | Stockholders responded favorably to the following governance changes: double trigger change in control provisions for all equity awards; adoption of anti-hedging and anti-pledging policies; a written commitment codifying our long term policies nottoprovidefutureexcisetaxgross-upsandnottorepriceunderwateroptions;andwrittendocumentationofourlongterm clawback policy, which covers all forms of bonus, incentive and equitycompensation. |

As described in detail under the heading “Compensation Discussion & Analysis,” we seek to align closely the interests of our NEOs with the interests of our stockholders. Our compensation program is designed to reward our NEOs for the achievement of short- term and long-term strategic and operational goals and the achievement of TSR greater than peers, while at the same time avoiding the encouragement of unnecessary or excessive risk-taking.

Here are further details of the Aimco program:

| ● | All members of the Committee are independent directors. The Committee has established a thorough process for the review andapprovalofAimco’sexecutivecompensationprogram,includingamountsawardedtoexecutiveofficers.TheCommittee engagesandreceivesadvicefromanindependent,third-partycompensationconsultant.TheCommitteeselectsapeergroup of companies for the purpose of comparingAimco’s compensation of executive officers. | |

| ● | Aimcosetstargettotalcashcompensationandtargettotalcompensationnearthemedianofcorrespondingtargetsamongthe peer group, both as a measure of fairness and also to provide an economic incentive to remain with Aimco. Consistent withAimco’spay-for-performance philosophy, actual compensation is based onAimco’sresults. | |

| ● | Aimco does not provide executives with more than minimal perquisites, such as reserved parkingspaces. | |

| ● | Aimco does not maintain or contribute to any defined benefit pension plan, supplemental pension plan or nonqualified deferredcompensationplanforitsexecutiveofficers.ExecutiveofficersparticipateinAimco’s401(k)planonthesameterms as available to all Aimco teammembers. | |

| ● | Aimcodoesnotmaintainanyemploymentorseveranceagreementswithitsexecutiveofficers(otherthanforMr.Considine, whowasrequiredtohaveanemploymentagreementinconnectionwithAimco’sinitialpublicofferingin1994;theagreement was amended in2008). |

5

| ● | Aimco’scompensation program, which, among other things, includes caps on cash compensation, shared performance metrics across the organization, multiple performance metrics that align withAimco’spublicly communicated businessstrategy,the use ofLTIcompensation that is based on TSR, and stock ownership guidelines with required holding periods after vesting, are aligned with the long-term interests of theCompany. | |

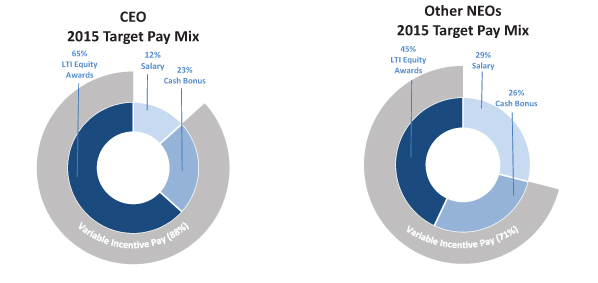

| ● | Consistent withAimco’spay-for-performance philosophy,Mr.Considine’s total compensation is highly variable from year to year, determined byAimco’sresults. In some years,Mr.Considine’s total compensation has been comprised of little or no cash compensation.Mr.Considine’s base salary of $600,000 has remained unchanged since 2006 and is well below the median for CEOs of his experience, expertise and tenure. One hundred percent ofMr.Considine’s target STI continues to be at risk. Unlike many other CEOs, there is no subjective, individual performance component toMr.Considine’s incentive compensation.Mr.Considine’s STI is based entirely onAimco’sperformance against its corporate goals, as determined by the Committee.Mr.Considine’s targetLTIcomprises the largest percentage of his target total compensation, comprising nearly two-thirds of his target total compensation. One hundred percent ofMr.Considine’sLTIis also at risk, based on relative returns over a forward looking, three-yearperiod. |

Here is how the Aimco program was applied in 2015:

| ● | Due to strong 2015 results, executive officers were awarded STI amounts that were above targetamounts. | ||

| ● | Aimco’s2015 performance highlights include thefollowing: | ||

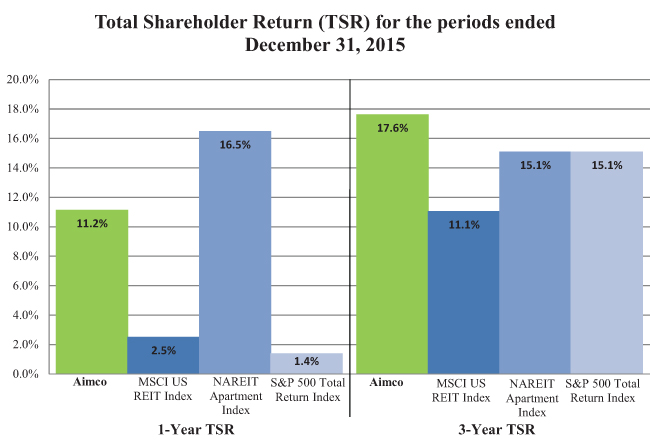

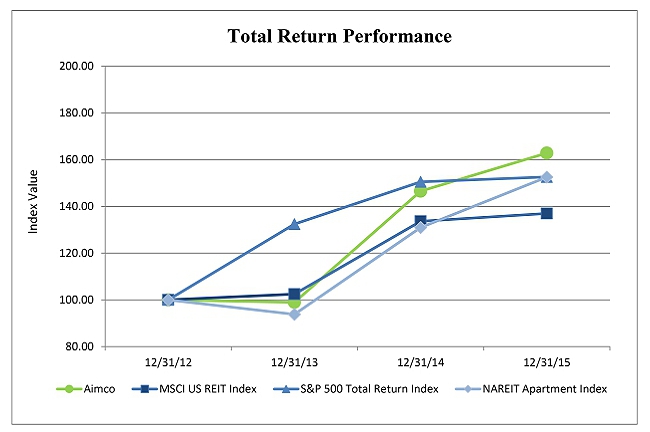

| ● | Aimcohad11.2%TSRin2015,aparticularlystrongresultconsideringAimcohad48%TSRin2014,firstamongmulti-familyREITpeers.AimcoTSRoutperformedtheREITIndexandtheStandard&Poor’s500TotalReturnIndex(“S&P 500 Index”) over the one-year period ended December 31, 2015, and Aimco TSR outperformed the REIT Index, the NAREITApartmentIndex,andtheS&PTotalReturnIndexoverthethree-yearperiodendedDecember31,2015. | ||

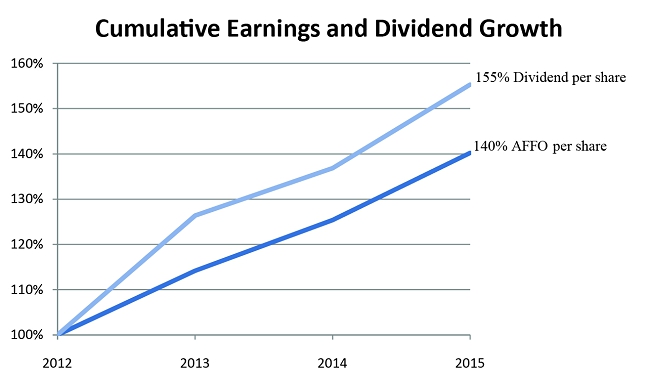

| ● | AdjustedFundsfromOperations(“AFFO”) pershare,whichisAimco’sprimarymeasureof currentprofitability, wasup 12%year-over-year. | ||

| ● | For the year ended December 31, 2015, consensus Net AssetValue(“NAV”)per share increased by 11%.Aimco’sEconomic Income, a measure of investment return representing the annual change inNAVper share plus cashdividends per share, and how the Company “keeps score,” was $5.28 per share, or a 14% return for theperiod. | ||

| ● | Full-year conventional same-store revenue was up 4.5%, and full-year conventional same-store net operating income (“NOI”) was up5.6%. | ||

| ● | Averagerevenue per apartment home was up 10% over oneyear,and up 46% over four years, to $1,840, reflectingAimco’sexecutionagainstitsportfoliomanagementstrategy–toselleachyearthe5%to10%ofitsportfoliowithlower projected returns, lower operatingmargins,and lower expected future rent growth, and to reinvest thesaleproceeds in apartment communities already in our portfolio, through property upgrades and redevelopment, or through the purchase of apartment communitieswithhigher projected returns and rent growth and, in limitedsituations,the development of apartmentcommunities. | ||

| ● | Investmentofapproximately$118millioninredevelopmentprojects,enhancingsixcommunitieswithatotalofmore than 2,500 apartment homes, and investment of approximately$116million in two developmentprojects. | ||

| ● | Aimcoreducedleverageby11%,toaratioofDebtandPreferredEquitytoEBITDAof6.8x. | ||

| ● | Aimco increased its unencumbered pool of properties to more than $1.8 billion in asset value, increasing financial flexibility. | ||

| ● | The Board declared a quarterly cash dividend of $0.33 per share ofAimco’sCommon Stock for the quarter ended December 31, 2015, an increase of 12% on an annualized basis compared to the dividends paid during2015. | ||

| ● | Reflecting Aimco’s intentional focus on a collaborative and collegial workplace with a specific focus on developing the Aimcocultureasacompetitiveadvantage,Aimcomaintaineditsrecordscoresforteamengagementandwasrecognized by The Denver Post, for a third consecutive year, as one of the top places to work inColorado. | ||

The vote on this resolution is not intended to address any specific element of compensation; rather, the vote relates to the overall compensation of our NEOs, as described in this proxy statement in accordance with the compensation disclosure rules of the SEC.

6

The vote is advisory, which means that the vote is not binding on the Company, our Board or the Committee. However, as described above, we take seriously the views of our stockholders, and to the extent there is any significant vote against our executive compensation as disclosed in this proxy statement, the Committee will evaluate whether any actions are necessary to address the concerns of stockholders.

In order to be approved at the Meeting, Proposal 3 must receive the affirmative vote of a majority of the total votes cast at the Annual Meeting. Abstentions and broker non-votes are not considered votes cast and will have no effect on the outcome of the vote.

Weare asking theCompany’s stockholdersto approve, on an advisory basis, the following resolution:RESOLVED,thatthecompensationofthenamedexecutiveofficers,asdisclosedintheCompany’sProxyStatementforthe2016AnnualMeetingofStockholderspursuanttoItem402ofSECRegulationS-K,includingtheCompensationDiscussion&Analysis,the2015SummaryCompensationTableandtheotherrelatedtablesanddisclosure,isherebyAPPROVED.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”APPROVALOF

THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS,

AS DISCLOSED IN THIS PROXY STATEMENT.

7

BOARD OF DIRECTORS AND EXECUTIVE OFFICERS

TheexecutiveofficersoftheCompanyandthenomineesforelectionasdirectorsoftheCompany,theirages,datestheywerefirst elected an executive officer or director, and their positions with the Company or on the Board are set forthbelow.

| Name | Age | First Elected | Position | |||||

| Terry Considine | 68 | July 1994 | Chairman of the Board and Chief Executive Officer | |||||

| Paul L. Beldin | 42 | September 2015 | Executive Vice President and Chief Financial Officer | |||||

| John E. Bezzant | 53 | January 2011 | Executive Vice President and Chief Investment Officer | |||||

| Lisa R. Cohn | 47 | December 2007 | Executive Vice President, General Counsel and Secretary | |||||

| Miles Cortez | 72 | August 2001 | Executive Vice President and Chief Administrative Officer | |||||

| Patti K. Fielding | 52 | February 2003 | Executive Vice President – Redevelopment and Debt Financing, Treasurer | |||||

| Keith M. Kimmel | 44 | January 2011 | Executive Vice President, Property Operations | |||||

| James N. Bailey | 69 | June 2000 | Director, Chairman of the Nominating and Corporate Governance Committee | |||||

| Thomas L. Keltner | 69 | April 2007 | Director, Chairman of the Compensation and Human Resources Committee | |||||

| J. Landis Martin | 70 | July 1994 | Director, Lead Independent Director | |||||

| Robert A. Miller | 70 | April 2007 | Director, Chairman of the Redevelopment and Construction Committee | |||||

| Kathleen M. Nelson | 70 | April 2010 | Director | |||||

| Michael A. Stein | 66 | October 2004 | Director, Chairman of the Audit Committee | |||||

| Nina A. Tran | 47 | March 2016 | Director | |||||

The following is a biographical summary of the current directors and executive officers of the Company.

Terry Considine.Mr. Considine has been Chairman of the Board and Chief Executive Officer since July 1994. Mr. Considine also serves on the board of directors of Intrepid Potash, Inc., a publicly held producer of potash. Mr. Considine has over 45 years of experience in the real estate and other industries. Among other real estate ventures, in 1975 Mr. Considine founded and subsequently managed the predecessor companies that became Aimco at its initial public offering in 1994.

PaulL.Beldin.Mr.BeldinjoinedAimcoin2008asSeniorVicePresidentandChiefAccountingOfficer.PriortojoiningAimco, from October 2007 to March 2008,Mr.Beldin served as Chief Financial Officer of APRO Residential Fund. Prior to that, from May 2005toSeptember2007,Mr.BeldinservedasChiefFinancialOfficerofAmericaFirstApartmentInvestors,Inc.,thenapubliclytraded company. From 1996 to 2005,Mr.Beldin was with the firm of Deloitte & Touche,LLP,serving in numerous roles, including Audit SeniorManagerandinthefirm’snationalofficeasanAuditManagerinSECServices.Mr.Beldinisacertifiedpublicaccountant.

JohnE.Bezzant.Mr.BezzantwasappointedExecutiveVicePresidentandChiefInvestmentOfficerinAugust2013.Priortothat, heservedasExecutiveVicePresident,TransactionsbeginninginJanuary2011.HejoinedAimcoasSeniorVicePresident-DevelopmentinJune2006.Mr.Bezzantoverseescapitalinvestments,andisresponsibleforportfoliomanagement,anddispositionandacquisitionactivities.Priorto joining theCompany,Mr.Bezzantspentover 20 yearswith Prologis,Inc. and CatellusDevelopmentCorporation in a variety of executivepositions,includingthosewithresponsibilityfortransactions,fundmanagement,assetmanagement,leasing,andoperations.

LisaR.Cohn.Ms.CohnwasappointedExecutiveVicePresident,GeneralCounselandSecretaryinDecember2007.Inaddition to serving as general counsel, Ms. Cohn has responsibility for insurance and risk management, human resources, compliance and asset quality and service. Ms. Cohn also serves as chairman ofAimco’sinvestment committee. From January 2004 to December 2007, Ms. Cohn served as SeniorVicePresident and Assistant General Counsel. She joined Aimco in July 2002 asVicePresident and Assistant General Counsel. Prior to joining the Company, Ms. Cohn was in private practice with the law firm of Hogan & Hartson LLP with a focus on public and private mergers and acquisitions, venture capital financing, securities and corporategovernance.

8

Miles Cortez.Mr.Cortez was appointed ExecutiveVicePresident and Chief Administrative Officer in December 2007. He is responsible for administration, government relations, communications and special projects.Mr.Cortez joined Aimco in August 2001 as ExecutiveVicePresident, General Counsel andSecretary.Prior to joining the Company,Mr.Cortez was the senior partner of Cortez Macaulay Bernhardt & Schuetze LLC, a Denver, Colorado law firm, from December 1997 through September 2001. He served as presidentoftheColoradoBarAssociationfrom1996to1997andtheDenverBarAssociationfrom1982to1983.

Patti K. Fielding.Ms. Fielding was appointed ExecutiveVicePresident — Securities and Debt in February 2003 and Treasurer in January 2005. In late 2014, she assumed responsibility for redevelopment. In addition to redevelopment, she remains responsiblefor debtfinancingandtreasury.FromJanuary2000toFebruary2003,Ms.FieldingservedasSeniorVicePresident—SecuritiesandDebt. Ms. Fielding joined the Company as aVicePresident in February 1997. Prior to joining the Company, Ms. Fielding was with Hanover Capitalfrom1996to1997,andfrom1993to1995shewasViceChairman,SeniorVicePresidentandCo-FounderofCapSourceFunding Corp. She was also a GroupVicePresident with Duff & Phelps Rating Company from 1987 to 1993 and a commercial real estate appraiserwithAmericanAppraisalforthreeyears.

KeithM.Kimmel.Mr.KimmelwasappointedExecutiveVicePresidentofPropertyOperationsinJanuary2011.FromSeptember 2008 to January 2011,Mr.Kimmel served as the AreaVicePresident of property operations for the western region. Prior to that, from March 2006 to September 2008, he served as the RegionalVicePresident of property operations for California. He joined Aimco in March of 2002 as a Regional PropertyManager.Prior to joining Aimco,Mr.Kimmel was with Casden Properties from 1998 through 2002,andwasresponsiblefortheoperationofthenewconstructionandhigh-endproductline.Mr.Kimmelbeganhiscareerinthemulti- family real estate business in 1992 as a leasing consultant and on-sitemanager.

James N. Bailey.Mr.Bailey was first elected as a Director of the Company in June 2000 and is currently Chairman of the Nominating and Corporate Governance Committee. He is also a member of the Audit, Compensation and Human Resources, and Redevelopment and Construction Committees.Mr.Bailey co-founded Cambridge Associates, LLC, an investment consulting firm, in 1973andcurrentlyservesasitsSeniorManagingDirectorandTreasurer.Heisalsoaco-founder,directorandtreasurerofThePlymouth Rock Company and a director of SRB Corporation, Inc., both of which are insurance companies and insurance company affiliates.Mr.Bailey also serves as Chairman of the Board and Manager of Knights Bridge Vineyards LLC and Chairman of the Board of Knights Bridge Winery LLC.Mr.Bailey is a member of the Massachusetts Bar and the American Bar Associations.Mr.Bailey, a long-time entrepreneur, brings particular expertise to the Board in the areas of investment and financial planning, capital markets, evaluation of institutional real estate markets and managers of all propertytypes.

Thomas L.Keltner.Mr.Keltner was first elected as a Director of the Company in April 2007 and is currently chairman of the Compensation and Human Resources Committee. He is also a member of the Audit, Nominating and Corporate Governance, and RedevelopmentandConstructionCommittees.Mr.KeltnerservedasExecutiveVicePresidentandChiefExecutiveOfficer–Americas andGlobalBrandsforHiltonHotelsCorporationfromMarch2007throughMarch2008,whichconcludedthetransitionperiodfollowingHilton’sacquisition by The Blackstone Group.Mr.Keltner joined Hilton Hotels Corporation in 1999 and served in various roles.Mr.Keltner has more than 20 years of experience in the areas of hotel development, acquisition, disposition, franchising and management. Prior to joining Hilton Hotels Corporation, from 1993 to 1999,Mr.Keltner served in several positions with Promus Hotel Corporation, including President, Brand Performance and Development. Before joining Promus Hotel Corporation, he served in various capacities withHolidayInnWorldwide,HolidayInnsInternationalandHolidayInns,Inc.Inaddition,Mr.KeltnerwasPresidentofSaudiMarriott Company, a division of Marriott Corporation, and was a management consultant with Cresap, McCormick and Paget, Inc.Mr.Keltner brings particular expertise to the Board in the areas of property operations, marketing, branding, development and customerservice.

J. Landis Martin.Mr.Martin was first elected as a Director of the Company in July 1994 and serves as the Lead IndependentDirector.Mr.Martin is also a member of the Audit, Compensation and Human Resources, Nominating and Corporate Governance, and Redevelopment and Construction Committees. He is a former chairman of the Compensation and Human Resources Committee.Mr.Martin is the Founder and Managing Director of Platte River Equity LLC, a private equity firm. In November 2005,Mr.Martin retired as Chairman and CEO of Titanium Metals Corporation, a publicly held integrated producer of titanium metals, where he served since January 1994.Mr.Martin served as President and CEO of NL Industries, Inc., a publicly held manufacturer of titanium dioxide chemicals,from1987to2003.Mr.Martinisalsothenon-executivechairmanandadirectorofCrownCastleInternationalCorporation, apubliclyheldwirelesscommunicationscompany.HeisleaddirectorofHalliburtonCompany,apubliclyheldproviderofproductsand servicestotheenergyindustry,andIntrepidPotash,Inc.,apubliclyheldproducerofpotash.AsaformerchiefexecutiveoffourNYSE- listed companies and lawyer,Mr.Martin brings particular expertise to the Board in the areas of operations, finance andgovernance.

Robert A. Miller.Mr. Miller was first elected as a Director of the Company in April 2007 and is currently Chairman of the Redevelopment and Construction Committee. Mr. Miller is also a member of the Audit, Compensation and Human Resources, and Nominating and Corporate Governance Committees. Mr. Miller served as Executive Vice President and Chief Operating Officer,

9

International of MarriottVacationsWorldwide Corporation (“MVWC”) from 2011 to 2012, when he retired from this position, and servesasPresidentofRAMCOAdvisorsLLC,aninvestmentadvisoryandbusinessconsultingfirm.Mr.MillerservedasthePresidentof MarriottLeisurefrom1997toNovember2011,whenMarriottInternationalelectedtospin-offitssubsidiaryentity,MarriottOwnership Resorts,Inc.,byforminganewparententity,MVWC,asanewpubliclyheldcompany.PriortohisroleasPresidentofMarriottLeisure, from1984to1988,Mr.MillerservedasExecutiveVicePresident&GeneralManagerofMarriottVacationClubInternationalandthen asitsPresidentfrom1988to1997.In1984,Mr.Millerandapartnersoldtheircompany,AmericanResorts,Inc.,toMarriott.Mr.Miller co-foundedAmericanResorts,Inc.in1978,anditwasthefirstbusinessmodeltoencompassallaspectsoftimeshareresortdevelopment, sales,managementandoperations.PriortofoundingAmericanResorts,Inc.,from1972to1978,Mr.MillerwasChiefFinancialOfficer of Fleetwing Corporation, a regional retail and wholesale petroleum company. Prior to joining Fleetwing,Mr.Miller served for five years as a staff accountant for ArthurYoung& Company.Mr.Miller is past Chairman and currently a director of the American Resort DevelopmentAssociation (“ARDA”) andcurrentlyserves asChairmananddirectorofthe ARDA InternationalFoundation.Mr.Miller also currently serves as a director on the board ofWelkHospitality Group, Inc. As a successful real estate entrepreneur and corporate executive,Mr.MillerbringsparticularexpertisetotheBoardintheareasofoperations,management,marketing,sales,anddevelopment, as well as finance andaccounting.

Kathleen M. Nelson.Ms. Nelson was first elected as a Director of the Company in April 2010 and is currently a member of the Audit,CompensationandHumanResources,NominatingandCorporateGovernance,andRedevelopmentandConstructionCommittees. Ms.Nelsonhasanextensivebackgroundincommercialrealestateandfinancialserviceswithover40yearsofexperience,including36 years at TIAA-CREF. She held the position of Managing Director/Group Leader and Chief Administrative Officer for TIAA-CREF’s mortgage and real estate division. Ms. Nelson developed and staffedTIAA’sreal estate research department. She retired from this positioninDecember2004andfoundedandservesaspresidentofKMNAssociatesLLC,acommercialrealestateinvestmentadvisory and consulting firm. In 2009, Ms. Nelson co-founded and serves as Managing Principal of Bay Hollow Associates, LLC, acommercial realestateconsultingfirm,whichprovidescounseltoinstitutionalinvestors.Ms.NelsonservedastheInternational CouncilofShopping Centers’ chairman for the 2003-04 term and has been an ICSC Trustee since 1991. She also is a member of the ICSC AuditCommittee andisamemberofvariousothercommittees.Ms.NelsonservesontheBoardofDirectorsofCBL&AssociatesProperties,Inc.,which isapubliclyheldREITthatdevelopsandmanagesretailshoppingproperties.Ms.NelsonisalsoontheBoardofDirectorsandamember of the Risk Committee of Dime Community Bankshares, Inc., a publicly traded bank holding company, based in Brooklyn, NewYork.She is a member of Castagna Realty Company Advisory Board and has served as an advisor to the Rand Institute Center for Terrorism RiskManagementPolicyandontheboardoftheGreaterJamaicaDevelopmentCorporation.Ms.NelsonservesontheAdvisoryBoard oftheBeverlyWillis ArchitecturalFoundationand isamemberofthe AngloAmericanRealPropertyInstitute.Ms.Nelsonbringstothe Board particular expertise in the areas of institutional real estate investing, real estate finance andinvestment.

Michael A. Stein.Mr.Stein was first elected as a Director of the Company in October 2004 and is currently the Chairman of the AuditCommittee.Mr.SteinisalsoamemberoftheCompensationandHumanResources,NominatingandCorporateGovernance,and RedevelopmentandConstructionCommittees.FromJanuary2001untilitsacquisitionbyEliLillyinJanuary2007,Mr.Steinservedas SeniorVicePresidentandChiefFinancialOfficerofICOSCorporation,abiotechnologycompanybasedinBothell,Washington.From October1998toSeptember2000,Mr.SteinwasExecutiveVicePresidentandChiefFinancialOfficerofNordstrom,Inc.From1989to September 1998,Mr.Stein served in various capacities with Marriott International, Inc., including ExecutiveVicePresident and Chief FinancialOfficerfrom1993to1998.Mr.SteinpreviouslyservedontheBoardsofDirectorsofNautilus,Inc.andGettyImages,Inc.He presently serves on the Board of Directors of Providence Health & Services, the fourth largest not-for-profit health system in the U.S., operating hospitals and other health care facilities across Alaska, Washington, Montana, Oregon and California. As the former audit committee chairman or audit committee member of two NYSE-listed companies, the former chief financial officer of twoNYSE-listed companiesandaformerpartneratArthurAndersen,Mr.SteinbringsparticularexpertisetotheBoardintheareasofcorporateandreal estate finance, and accounting and auditing for large and complex businessoperations.

Nina A.Tran.Ms. Tran was first elected as a Director of the Company effective in March 2016and is currently a member of the Audit, Compensation and Human Resources, Nominating and Corporate Governance, and Redevelopment and Construction Committees.Ms.Tranhasover25yearsofrealestateandfinancialmanagementexperience,buildingandleadingfinanceandaccounting teams.SinceJanuary2013untilitsmergerwithColonyAmericanHomes,Inc.inJanuary2016,Ms.TranservedastheChiefFinancial Officer of StarwoodWaypointResidential Trust, a leading publicly-traded REIT that owns and operates single-family rental homes. Prior to joining Starwood Waypoint, Ms. Tran spent 18 years at AMB Property Corporation (now Prologis, Inc.), the largest publicly-tradedglobalindustrialREIT.Ms.TranservedasSeniorVicePresidentandChiefAccountingOfficer,andmostrecentlyasChiefGlobal ProcessOfficer,whereshehelpedleadthemergerintegrationbetweenAMBandPrologis.PriortojoiningAMB,Ms.TranwasaSenior Associate with PricewaterhouseCoopers, one of the big four public accounting firms. Ms. Tran is a certified public accountant(CPA)(inactive). Ms. Tran brings particular expertise to the Board in the areas of accounting, financial control and businessprocesses.

10

This chart provides a summary overview of Aimco’s governance practices, each of which is described in more detail in the information that follows.

| What Aimco Does |

| Supermajority Independent Board.The only member of management who serves on the Board is the Company’s founder, chairman and chief executive officer. Seven of the eight members of the Board, or 87.5% of the Board members, are independent. |

| Independent Standing Committees.Only independent directors serve on the standing committees, including Audit, Compensation and Human Resources, Nominating and Corporate Governance, and Redevelopment and Construction Services. |

| Each Independent Director Serves on Each Standing Committee.To ensure that each independent director hears all information unfiltered and to ensure the most efficient functioning of the Board, each independent director serves on each standing committee. |

| Lead Independent Director.The Company has a lead independent director who presides over regular independent director executive sessions. |

| Board Refreshment.The Nominating and Corporate Governance Committee has structured the Board such that there are directors of varying tenures and perspectives, with new directors joining the Board every few years, including in 2016, while retaining the institutional memory of longer-tenured directors. Of the original independent directors on the Aimco Board, one remains, and the Company has added a new director roughly every 2.5 to 6 years. |

| Regular Access to and Involvement with Management.In addition to regular access to management during Board and committee meetings, the independent directors have regular and direct access to members of management and to the Aimco business. This includes site visits (e.g., Mr. Miller and Ms. Nelson on redevelopment projects), regular discussion topics (e.g., Mr. Stein on accounting and finance matters, Mr. Keltner on compensation and personnel matters, Mr. Bailey on governance matters, and Mr. Martin on agenda items and board materials). |

| Engaged Board.In addition to regular access to management, the independent directors meet at least quarterly and receive written updates from Mr. Considine at least monthly. |

| Stockholder Engagement.Under the direction of the Board, including the participation of Board members when requested by stockholders, Aimco regularly engages with stockholders on governance, pay and business matters. |

| Director Stock Ownership.By the completion of five years of service, an independent director is expected to own, at a minimum, the lesser of 27,500 shares or shares having a value of at least $550,000. |

| Risk Assessment.The Board conducts an annual risk assessment. Areas involving risk that are reported on by management and considered by the Board, include: operations, liquidity, leverage, finance, financial statements, the financial reporting process, accounting, legal matters, regulatory compliance, compensation and human resources. |

| MajorityVotingwith a Resignation Policy.Since inception,Aimco’sdirectors have been elected annually, and Aimco requires its directors to be elected by a majority of the votes cast. Directors failing to get a majority of the votes cast are expected to tender their resignation. |

| Proxy Access.Following last year’s stockholder vote in favor of proxy access and after extensive engagement with stockholders, the Board amended the Company’s bylaws to provide proxy access. A stockholder or a group of up to 20 stockholders, owning at least 3% of our shares for 3 years, may submit nominees for up to 20% of the Board, or two nominees, whichever is greater, for inclusion in our proxy materials, subject to complying with the requirements contained in our bylaws. |

| What Aimco Does Not Do |

| Related Party Transactions.The Nominating and Corporate Governance Committee maintains a related party transaction policy to ensure that Aimco’s decisions are based on considerations only in the best interests of Aimco and its stockholders. Since the beginning of 2015 and to date, there have been no related person transactions that required review under the policy. |

| Interlocking Directorships.No Aimco director or member of Aimco management serves on a Board or a compensation committee of a company at which an Aimco director is also an employee. |

| Overboard Directors.Aimco’s corporate governance guidelines and committee charters limit the number of other boards and the number of other audit committees on which an Aimco director may serve. |

| Retirement Age or Term Limits.Rather than imposing arbitrary limits on service, the Company regularly (and at least annually) reviews each director’s continued role on the Board and the need for periodic board refreshment. |

| Staggered Board.All Aimco directors have always been elected annually. |

11

The Board has determined that to be considered independent, an outside director may not have a direct or indirect material relationshipwithAimcooritssubsidiaries(directlyorasapartner,stockholderorofficerofanorganizationthathasarelationshipwith the Company). A material relationship is one that impairs or inhibits, or has the potential to impair or inhibit, a director’s exercise of critical and disinterested judgment on behalf of Aimco and its stockholders. In determining whether a material relationship exists, the Boardconsidersallrelevantfactsandcircumstances,includingwhetherthedirectororafamilymemberisacurrentorformeremployee oftheCompany,familymemberrelationships,compensation,businessrelationshipsandpayments,andcharitablecontributionsbetween Aimco and an entity with which a director is affiliated (as an executive officer, partner or substantial stockholder). The Board consults withtheCompany’scounseltoensurethatsuchdeterminationsareconsistentwithallrelevant securitiesandotherlawsandregulations regarding the definition of “independent director,” including but not limited to those categorical standards set forth in Section 303A.02 of the listing standards of the NewYorkStock Exchange as in effect from time totime.

Consistent with these considerations,theBoard affirmativelyhasdetermined that Messrs.Bailey,Keltner,Martin,Miller,andSteinandMses. NelsonandTranareindependent directors (collectivelythe“IndependentDirectors”).

The Board held five meetings during the year ended December 31, 2015. During 2015, there were four committees: Audit; Compensation and Human Resources; Nominating and Corporate Governance; and Redevelopment and Construction. During 2015, no director attended fewer than 75% of the total number of meetings of the Board, and, in fact, each director was present at all such meetings.

The Corporate Governance Guidelines, as describedbelow,provide that the Company generally expects that the Chairman of the Board will attend all annual and special meetings of the stockholders. Other members of the Board are not required to attend such meetings.AllofthemembersoftheBoardattendedtheCompany’s2015AnnualMeetingofStockholders,andtheCompanyanticipates that all of the members of the Board will attend the Meeting thisyear.

Below is a table illustrating the current standing committee memberships and chairmen. Additional detail on each committee follows the table.

| Director | Audit Committee | Compensation and Human Resources Committee | Nominating and Corporate Governance Committee | Redevelopment and Construction Committee | ||||||||||||

| James N. Bailey | X | X | † | X | ||||||||||||

| Terry Considine | — | — | — | — | ||||||||||||

| Thomas L. Keltner | X | † | X | X | ||||||||||||

| J. Landis Martin* | X | X | X | X | ||||||||||||

| Robert A. Miller | X | X | X | † | ||||||||||||

| Kathleen M. Nelson | X | X | X | X | ||||||||||||

| Michael A. Stein | † | X | X | X | ||||||||||||

| Nina A. Tran | X | X | X | X |

| X | indicates a member of thecommittee |

| † | indicates the committeechairman |

| * | indicates lead independentdirector |

Audit Committee

The Audit Committee currently consists of the seven Independent Directors.Mr.Stein serves as the chairman of the Audit Committee. The Audit Committee has a written charter that is reviewed annually and was last amended in January 2013. In addition to the work of the Audit Committee,Mr.Stein has regular and recurring conversations withMr.Beldin, Aimco’s Chief Financial Officer (“CFO”),Ms.Cohn,Aimco’sGeneralCounsel,AndrewHigdon,Aimco’sChiefAccountingOfficer,theheadofAimco’sinternalaudit function, and representatives of Ernst &YoungLLP.The Audit Committee’s charter is posted onAimco’swebsite (www.aimco.com) and is also available in print to stockholders, upon written request toAimco’sCorporateSecretary.

12

Pursuant to its charter, the Audit Committee is responsible for overseeing Aimco’s accounting and financial reporting processes and audits of Aimco’s financial statements. The Audit Committee is directly responsible for the appointment and oversight of the independent auditors and makes such a determination on the basis of a variety of factors, including those described in Proposal 2. In addition, the Audit Committee also evaluates the performance of the lead audit partner.

Among other matters, the Audit Committee also:

| ● | Reviews the scope, and overall plans for and results of the annual audit and internal auditactivities; | |

| ● | Consults with management and Ernst &YoungLLP with respect toAimco’sprocesses for risk assessment and risk management. Areas involving risk that are reported on by management and considered by the Audit Committee, the other Boardcommittees,ortheBoard,include:operations,liquidity,leverage,finance,financialstatements,thefinancialreporting process, accounting, legal matters, regulatory compliance, and humanresources; | |

| ● | ConsultswithmanagementandErnst&YoungLLPandprovidesoversightforAimco’sfinancialreportingprocess,internal control over financial reporting, the Company’s internal audit function and, in conjunction with the Board, the Company’s enterprise risk managementprocesses; | |

| ● | ReviewsandapprovestheCompany’spolicywithregardtothehiringofformeremployeesofindependentauditorsproviding service to theCompany; | |

| ● | ReviewsandapprovestheCompany’spolicyforthepre-approvalofauditandpermittednon-auditservicesbytheindependent auditor; | |

| ● | Receives reports pursuant to Aimco’s policy for the submission and confidential treatment of communications from team members and others concerning accounting, internal control and auditingmatters; | |

| ● | Reviews and discusses quarterly earnings releases prior to their issuance and quarterly reports on Form 10-Q and annual reports on Form 10-K prior to theirfiling; |

| ● | Reviews with management the scope and effectiveness of the Company’s disclosure controls and procedures, including for purposes of evaluating the accuracy and fair presentation of the Company’s financial statements in connection with the certifications made by the CEO and CFO;and | |

| ● | Meets regularly with members of Aimco management and with Ernst &YoungLLP. |

Inadditiontoitsroutineresponsibilities,inearly2015,theAuditCommitteeandmanagementcommencedarequestforproposal, orRFP,process forAimco’saudit services. The Audit Committee believes it is good practice to periodically evaluate service providers andconsideredavarietyoffactorsindecidingtopursueanRFP.ThosefactorsincludethelengthoftimeErnst&YoungLLPhasserved as Aimco’s independent auditor, the potential benefits of a new perspective on key risk areas, and the approach to and cost of the audit in light of the reductions in both the complexity and scale ofAimco’sbusiness in recent years. The competitive process was guided byMr.Stein with the involvement of a number of members of management. The process included evaluation of written proposals and in- personmeetingswithandpresentationsfromeachofthe“BigFour”auditfirms.Followingthosemeetingsandpresentations,theAudit CommitteeselectedErnst&YoungLLPtocontinueasAimco’sindependentregisteredpublicaccountingfirmforthefiscalyearended December 31,2015.

TheAuditCommitteeheldfivemeetingsduringtheyearendedDecember31,2015.AssetforthintheAuditCommittee’scharter, nodirectormayserveasamemberoftheAuditCommitteeifsuchdirectorservesontheauditcommitteeofmorethantwootherpublic companies,unlesstheBoarddeterminesthatsuchsimultaneousservicewouldnotimpairtheabilityofsuchdirectortoeffectivelyserve ontheAuditCommittee.NomemberoftheAuditCommitteeservesontheauditcommitteeofmorethantwootherpubliccompanies.

Audit Committee Financial Expert

Aimco’s Board has designatedMr.Stein as an “audit committee financial expert.” In addition, all of the members of the audit committeequalifyasauditcommitteefinancialexperts.EachmemberoftheAuditCommitteeisindependent,asthattermisdefinedby Section303AofthelistingstandardsoftheNewYorkStockExchangerelatingtoauditcommittees.

13

Compensation and Human Resources Committee

The Compensation and Human Resources Committee currently consists of the seven Independent Directors.Mr.Keltner serves as the chairman of the Compensation and Human Resources Committee.Mr.Keltner meets regularly with Ms. Cohn,Aimco’sGeneral Counsel and with Jennifer Johnson,Aimco’sSeniorVicePresident of Human Resources.Mr.Keltner also has regular conversations withtheCommittee’sindependentcompensationconsultant,BoardAdvisory,LLC(“BoardAdvisory”).TheCompensationandHuman Resources Committee has a written charter that is reviewed annually and was last amended in April 2013. The Compensation and Human Resources Committee’s charter is posted onAimco’swebsite (www.aimco.com) and is also available in print to stockholders, upon written request toAimco’sCorporateSecretary.

The Compensation and Human Resources Committee’s purposes are to:

| ● | Oversee the goals and objectives of the Company’s executive compensationplans; | |

| ● | Annually evaluate the performance of theCEO; | |

| ● | Determine theCEO’scompensation; | |

| ● | Review the decisions made by the CEO as to the compensation of the other executiveofficers; | |

| ● | Approve and grant any equitycompensation; | |

| ● | Consider the results of stockholder advisory votes on executive compensation and take such results into consideration in connection with the review and approval of executive officercompensation; | |

| ● | Review and discuss the Compensation Discussion & Analysis withmanagement; | |

| ● | Reviewcompensationarrangementstoevaluatewhetherincentiveandotherformsofpayencourageunnecessaryorexcessive risk taking; | |

| ● | Review and approve the terms of any compensation “clawback” or similar policy or agreement between the Company and the Company’s executiveofficers; |

| ● | Review periodically the goals and objectives of the Company’s executive compensation plans, and amend, or recommend that the Board amend, these goals and objectives ifappropriate; | |

| ● | Address successionplanning; | |

| ● | Oversee the Company’s talent pipeline process;and | |

| ● | OverseetheCompany’sculture,withaparticularfocusoncollegiality,collaborationandteam-building. |

In particular in 2015, the Compensation and Human Resources Committee focused on executive compensation and succession planning,includinganannualupdateoftheCompany’ssuccessionplan.TheCompanyhashadinplaceatalentpipelineandsuccession planning process since inception, which includes all officer positions including the CEO. At least annually, the Compensation and Human Resources Committee reviews that pipeline and process. For each senior management role, the Compensation and Human Resources Committee knows who the potential candidates are, and each potential candidate has in place a development plan. If and when the need to draw upon that talent pool arises, the Compensation and Human Resources Committee and senior management considertherelevantbusinessneedsoftheorganization,thebusinessenvironment,andthecandidates’fit.Thisprocesswasusedduring thetransitionofchieffinancialofficerandchiefaccountingofficer,bothofwhichoccurredduring2015.

The Compensation and Human Resources Committee held seven meetings during the year ended December 31, 2015.

Nominating and Corporate Governance Committee

TheNominatingandCorporateGovernanceCommitteecurrentlyconsistsofthesevenIndependentDirectors.Mr.Baileyserves asthechairmanoftheNominatingandCorporateGovernanceCommittee.TheNominatingandCorporateGovernanceCommitteehasa writtencharterthatisreviewedannuallyandwaslastamendedinOctober2012.TheCommittee’scharterispostedonAimco’swebsite (www.aimco.com) and is also available in print to stockholders, upon written request toAimco’sCorporateSecretary.

14

Among other matters, the Nominating and Corporate Governance Committee:

| ● | Focuses on Board candidates and nominees, andspecifically: |

| ● | Identifies and recommends to the Board individuals qualified to serve on theBoard; | |

| ● | Identifies, recruits, and, if appropriate, interviews candidates to fill positions on the Board, including persons suggested by stockholders or others;and | |

| ● | ReviewseachBoardmember’ssuitabilityforcontinuedserviceasadirectorwhenhisorhertermexpiresandwhenheor she has a change in professional status and recommends whether or not the director should bere-nominated. |

| ● | Focuses on Board composition and procedures as a whole and recommends, if necessary, measures to be taken so that the Board reflects the appropriate balance of knowledge, experience, skills, and expertise required for the Board as awhole; | |

| ● | Develops and recommends to the Board a set of corporate governance principles applicable to Aimco and itsmanagement; | |

| ● | Maintains a related party transaction policy and oversees any potential related partytransactions; | |

| ● | Oversees a systematic and detailed annual evaluation of the Board, committees and individual directors in an effort to continuously improve the function of the Board;and | |

| ● | Considers corporate governance issues that may arise and develops appropriate recommendations, including providing the forum for the Board to consider important matters of public policy and vet stockholder input on a variety ofissues. |

In particular in 2015, the Nominating and Corporate Governance Committee focused on developing an amendment to the Company’sbylawstoprovidefor“proxyaccess”(asdescribedinmoredetailunderthe“ProxyAccess”headingbelow)andinrecruiting a new director to join the Board in 2016. NinaTran’selection to the Board effective in March 2016 and her nomination for re-election attheMeetingaretheresultoftheNominatingandCorporateGovernanceCommittee’seffortsduring2015andinto2016toensurethat theAimcoBoardhasabroadrangeandbalanceofskillsandabilitiesandvaryingtenures,asdescribedinmoredetailunderthe“Board Composition” headingbelow.

The Nominating and Corporate Governance Committee held four meetings during the year ended December 31, 2015.

Redevelopment and Construction Committee

TheRedevelopmentandConstructionCommitteecurrentlyconsistsofthesevenIndependentDirectors.Mr.Millerservesasthe chairmanoftheRedevelopmentandConstructionCommittee.Mr.MillermeetsregularlywithAimco’sredevelopmentandconstruction leadership and tours projects undergoing redevelopment to assess the process of redevelopment and project status. TheRedevelopment andConstructionCommittee’spurposesaretoprovideoversightandguidancetotheCompany’smanagementregardingredevelopment and construction projects by reviewing work process, policies and standards, recommending modifications thereto and directing related analytical and progress reporting. The Redevelopment and Construction Committee held four meetings during the year ended December 31,2015.

Board Composition

TheNominatingandCorporateGovernanceCommitteeselectsnomineesfordirectoronthebasisof,amongotherthings,breadth and depth of experience, knowledge, skills, expertise, integrity, ability to make independent analytical inquiries, understanding ofAimco’sbusinessenvironmentandwillingnesstodevoteadequatetimeandefforttoBoardresponsibilities.Inconsideringnomineesfor director, the Nominating and Corporate Governance Committee seeks to have a diverse range of experience and expertise relevant toAimco’sbusiness.TheNominatingandCorporateGovernanceCommitteeplacesapremiumondirectorswhoworkwellinthecollegial andcollaborativenatureoftheBoard(whichisalsoconsistentwiththeAimcoculture)andyetalsorequiresdirectorswhothinkandact independently,andhavetheabilitytoclearlyandeffectivelycommunicatetheirconvictions.TheNominatingandCorporateGovernance Committee assesses the appropriate balance of criteria required of directors and makes recommendations to theBoard.

The Nominating and Corporate Governance Committee has specifically considered the feedback of some stockholders as well as the discussions of some commentators that suggest that lengthy Board tenure should be balanced with new perspectives. Specific to Aimco,theNominatingandCorporateGovernanceCommitteehasstructuredtheBoardsuchthattherearedirectorsofvaryingtenures, with new directors and perspectives joining the Board every few years while retaining the institutional memory of longer-tenured directors. Longer-tenured directors, balanced with less-tenured directors, enhance the Board’s oversight capabilities.Aimco’sdirectors

15

work effectively together, coordinate closely with senior management, comprehendAimco’schallenges and opportunities, and frameAimco’sbusinessstrategy.Aimco’sBoardmembershaveestablishedrelationshipsthatallowtheBoardtoapplyeffectivelyitscollective business savvy in guiding the Aimcoenterprise.

WhenformulatingitsBoardmembershiprecommendations,theNominatingandCorporateGovernanceCommitteealsoconsiders advice and recommendations from others, including stockholders, as it deems appropriate. Such recommendations are evaluated on the basis of the same criteria noted above. The Nominating and Corporate Governance Committee will consider as nominees to the Board for election at next year’s annual meeting of stockholders persons who are recommended by stockholders in writing, marked to the attention ofAimco’sCorporateSecretary,no later than July 1, 2016. During 2015, no Aimco stockholder (other than the existing directors) expressed interest in serving on the Board, or recommended anyone to serve on theBoard.

TheBoardisresponsiblefornominatingmembersforelectiontotheBoardandforfillingvacanciesontheBoardthatmayoccur between annual meetings of stockholders. The Board elected Ms. Tran effective March 1, 2016. Based on recommendations from the Nominating and Corporate Governance Committee, the Board determined to nominate Messrs. Bailey, Considine, Keltner, Martin, Miller,andSteinandMses.NelsonandTranforre-election.

EachindividualbringsspecificcontributionstotheBoardconsistentwithprofessionalandpersonalcharacteristicsnotedaboveas criteriaforselectionforservice.Tosummarize,Mr.Bailey,along-timeentrepreneur,bringsparticularexpertisetotheBoardintheareas of investment and financial planning, capital markets, evaluation of institutional real estate markets and managers of all propertytypes.Mr.KeltnerbringsparticularexpertisetotheBoardintheareasofpropertyoperations,marketing,branding,developmentandcustomer service.AsaformerlawyerandchiefexecutiveoffourNYSE-listedcompanies,Mr.MartinbringsparticularexpertisetotheBoard inthe areasofoperations,financeandgovernance.Asasuccessfulrealestateentrepreneurandcorporateexecutive,Mr.Millerbringsparticular expertise to the Board in the areas of operations, management, marketing, sales, and development, as well as finance and accounting. Ms. Nelson brings to the Board particular expertise in the areas of institutional real estate investing, real estate finance and investment. As the former audit committee chairman or audit committee member of two NYSE-listed companies, the former chief financial officer oftwoNYSE-listedcompaniesandaformerpartneratArthurAndersen,Mr.SteinbringsparticularexpertisetotheBoardintheareasof corporate and real estate finance, and accounting and auditing for large and complex business operations. As the newest member ofthe Board,Ms.TranbringsparticularexpertisetotheBoardintheareasofaccounting,financialcontrolandbusinessprocesses.

Board Leadership Structure

Atthistime,Aimco’sBoardbelievesthatcombiningtheChairmanandCEOroleismosteffectivefortheCompany’sleadership andgovernance.HavingonepersonasChairmanandCEOprovidesunifiedleadershipanddirectiontotheCompanyandstrengthensthe ability of the CEO to develop and implement strategic initiatives and respond efficiently in various situations. The Board also believes the combination of Chairman and CEO positions is appropriate in light of the independent oversight provided by theBoard.

Aimco has a Lead Independent Director, currently Mr. Martin, who in this capacity:

| ● | Presides over executive sessions of independent directors, which are held regularly and not less than four times peryear; | |

| ● | Serves as a liaison between the chairman and independentdirectors; | |

| ● | Helps frame and approves meeting agendas andschedules; | |

| ● | Reviews information sent todirectors; | |

| ● | Regularly calls meetings of independent directors;and | |

| ● | Is available for direct communication withstockholders. |

In addition to the Lead Independent Director, the Board has a majority of independent directors. Seven out of the eight director nominees are independent. All four standing committees (Audit; Compensation and Human Resources; Nominating and Corporate Governance; and Redevelopment and Construction) are composed solely of independent directors.

Separate Sessions of Non-Management Directors and Lead Independent Director

Aimco’sCorporateGovernanceGuidelines(describedbelow)providethatthenon-managementdirectorsshallmeetinexecutive sessionwithoutmanagementonaregularlyscheduledbasis,butnolessthanfourtimesperyear.Thenon-managementdirectors,which groupcurrentlyismadeupofthesevenIndependentDirectors,metinexecutivesessionwithoutmanagementfourtimesduringtheyear ended December 31, 2015.Mr.Martin was the Lead Independent Director who presided at such executive sessions in 2015, and he has been designated as the Lead Independent Director who will preside at such executive sessions in2016.

16

The following table sets forth the number of meetings held by the Board and each committee during the year ended December 31,2015.

| Board | Non-Management Directors | Audit Committee | Compensation and Human Resources Committee | Nominating and CorporateGovernanceCommittee | Redevelopment and Construction Committee | |||||||||||||||||||||

| Number of Meetings | 5 | 4 | 5 | 7 | 4 | 4 | ||||||||||||||||||||

Majority Voting for the Election of Directors

In an uncontested election at the meeting of stockholders, any nominee to serve as a director of the Company will be elected if thedirectorreceivesamajorityofvotescast,whichmeansthatthenumberofsharesvoted“for”adirectorexceedsthenumberofshares voted “against” that director. With respect to a contested election, a plurality of all the votes cast at the meeting of stockholders will be sufficient to elect a director. If a nominee who currently is serving as a director receives a greater number of “against” votes for his or her election than votes “for” such election (a “Majority AgainstVote”)in an uncontested election, Maryland law provides that the directorwouldcontinuetoserveontheBoardasa“holdoverdirector.”However,underAimco’sBylaws,anynomineeforelectionasa director in an uncontested election who receives a Majority AgainstVoteis obligated to tender his or her resignation to the Nominating and Corporate Governance Committee for consideration. The Nominating and Corporate Governance Committee will consider any resignation and recommend to the Board whether to accept it. The Board is required to take action with respect to the Nominating and Corporate Governance Committee’s recommendation. Additional details are set out in Article II, Section 2.03 (Election andTenureof Directors; Resignations) ofAimco’sBylaws.

Proxy Access

At our 2015 annual meeting, a proxy access stockholder proposal received the support of a majority of the votes cast. That proposal would require the Board to adopt a bylaw that would require the Company to include in its proxy materials nominees for director proposed by a stockholder or group that owns at least 3% of our outstanding shares for at least three years. Following that meeting,throughthesummerandfallof2015andinto2016,weengagedinextensivestockholderoutreachanddiscussedproxyaccess withstockholdersrepresentingover66%ofsharesofCommonStockoutstandingasofSeptember30,2015,includingall10ofAimco’slargest stockholders as of thatdate.

Althoughourstockholdersexpressedvaryingviewsonproxyaccessgenerally,andonthespecifictermsofaproxyaccessbylaw,many stockholders indicated that they viewed proxy access as an important stockholder right. At the same time, many stockholders expressed concern that stockholders with a small economic interest could abuse proxy access and impose unnecessary costs on the Company. In particular, stockholders expressed support for a reasonable limit on the number of stockholders who could come together to form a nominating group, with a consensus around a 20 stockholder limit, so long as certain related funds were counted as one stockholderforthispurpose.Inaddition,manystockholdersexpressedsupportfortheprinciplethataproxyaccessbylawprovidefora minimumoftwocandidates,withthatprinciplebeingmoremeaningfultostockholdersthanthepercentageoftheboardusedtocalculate the number of permitted proxy accesscandidates.

Stockholders expressed general flexibility concerning most other proxy access terms, including counting directors nominated as accesscandidateswhoareelectedandre-nominatedbytheBoardwhendeterminingthelimitonaccesscandidatesforalimitednumber of years, and eliminating proxy access at the same annual meeting for which a nomination notice outside of proxy access has been submitted by another stockholder. Also, stockholders indicated that post-meeting holding requirements would be considered overly restrictive, but that a statement regarding post-meeting intentions that did not require continued ownership wasacceptable.

The feedback received from stockholders was reported to the Nominating and Corporate Governance Committee and to the Board. Following a review of that feedback, corporate governance best practices and trends and the Company’s particular facts and circumstances, the Board amended the Company’s bylaws to provide a proxy access right to stockholders. As a result, a stockholder or a group of up to 20 stockholders, owning at least 3% of our shares for 3 years, may submit nominees for up to 20% of the Board, or two nominees, whichever is greater, for inclusion in our proxy materials, subject to complying with the requirements contained in our bylaws.

17

2015

In formulating its recommendation for director compensation, the Nominating and Corporate Governance Committee reviews director compensation for independent directors of companies in the real estate industry and companies of comparable market capitalization,revenueandassetsandconsiderscompensationtrendsforotherNYSE-listedcompaniesandS&P500companies.Forthe year ended December 31, 2015, Aimco paid the directors serving on the Board during that year asfollows:

| Name | Fees Earnedor Paid in Cash ($)(1) | StockAwards | OptionAwards ($) | Non-Equity Incentive Plan Compensation($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other | Total ($) | |||||||||||||||||||||

| James N. Bailey | 23,000 | 184,050 | — | — | — | — | 207,050 | |||||||||||||||||||||

| Terry Considine (3) | — | — | — | — | — | — | — | |||||||||||||||||||||

| Thomas L. Keltner (4) | 27,000 | 184,050 | — | — | — | — | 211,050 | |||||||||||||||||||||

| J. Landis Martin | 21,000 | 184,050 | — | — | — | — | 205,050 | |||||||||||||||||||||

| Robert A. Miller (5) | 27,000 | 184,050 | — | — | — | — | 211,050 | |||||||||||||||||||||

| Kathleen M. Nelson (6) | 27,000 | 184,050 | — | — | — | — | 211,050 | |||||||||||||||||||||

| Michael A. Stein | 26,000 | 184,050 | — | — | — | — | 210,050 | |||||||||||||||||||||

| (1) | The Independent Directors each received a cash fee of $1,000 for attendance in person or telephonically at each meeting of the Board, and a cash fee of $1,000 for attendance at each meeting of any Board committee. Joint meetings are sometimesconsidered as a single meeting for purposes of director compensation. |

| (2) | For 2015, Messrs. Bailey, Keltner, Martin, Miller and Stein and Ms. Nelson were each awarded 4,500 shares of Common Stock, which shares were awarded on January 26, 2015. The dollar value shown above represents the aggregate grant date fair value computedinaccordancewithFinancialAccountingStandards Board(“FASB”)Accounting StandardsCodification(“ASC”)Topic718andiscalculatedbasedontheclosingpriceofAimco’sCommonStockontheNewYorkStockExchangeonJanuary26,2015, of $40.90. |

| (3) | Mr.Considine, who is not an Independent Director, does not receive any additional compensation for serving onthe Board. |

| (4) | Mr.Keltner holds an option to acquire 4,429 shares, which is fully vested andexercisable. |

| (5) | Mr.Miller holds an option to acquire 4,429 shares, which is fully vested andexercisable. |

| (6) | Ms. Nelson holds an option to acquire 3,000 shares, which is fully vested andexercisable. |

2016

Compensation for each of the Independent Directors in 2016 is an annual fee of 4,600 shares of Common Stock, which shares wereawardedonJanuary26,2016.TheclosingpriceofAimco’sCommonStockontheNewYorkStockExchangeonJanuary26,2016, was $38.73. The Independent Directors also received a cash fee of $25,000. The Board will not pay meeting fees in2016.