UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant |X|

Filed by a Party other than the Registrant |_|

Check the appropriate box:

|_| Preliminary Proxy Statement

|_| Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2))

|X| Definitive Proxy Statement

|_| Definitive Additional Materials

|_| Soliciting Material Pursuant toss.240.14a-12

HOME PROPERTIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|X| No fee required.

|_| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

|_| Fee paid previously with preliminary materials.

|_| Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Persons who are to respond to the collection of information

contained in this form are not required to respond unless the form

displays a currently valid OMB control number.

March 30, 2006

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of

Home Properties, Inc. The Annual Meeting will be held on Thursday, May 4, 2006,

at 2:30 p.m. at the Dryden Theatre of the International Museum of Photography at

George Eastman House, 900 East Avenue, Rochester, New York 14607.

A Notice of Annual Meeting and a Proxy Statement are attached. They

describe the matters to be acted upon at the Annual Meeting.

I hope that you will join us at the meeting. Whether you attend or not,

your vote on all of the matters described in the Proxy Statement is very

important. Please sign, date and return the enclosed proxy card in the envelope

provided. Alternatively, you may choose to vote by telephone or internet. Voting

by any of these methods before the meeting will insure that your shares are

represented at the meeting.

I look forward to seeing you at the meeting.

Sincerely,

HOME PROPERTIES, INC.

/s/ Edward J. Pettinella

Edward J. Pettinella

President and Chief Executive Officer

HOME PROPERTIES, INC.

Suite 850

Clinton Square

Rochester, New York 14604

_______________________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 4, 2006

_______________________________________

NOTICE IS HEREBY GIVEN that the 2006 Annual Meeting of Stockholders of Home

Properties, Inc. (the "Company") will be held on Thursday, May 4, 2006 at 2:30

p.m. at the Dryden Theatre of the International Museum of Photography at George

Eastman House, 900 East Avenue, Rochester, New York 14607 for the following

purposes:

1. To elect twelve directors of the Company to serve until the 2007

Annual Meeting of Stockholders and until their respective successors

are elected;

2. To ratify the appointment of PricewaterhouseCoopers LLP as the

Company's independent registered public accounting firm for 2006; and

3. To consider and act upon any other matters that are properly brought

before the Annual Meeting and at any adjournments or postponements

thereof.

The Board of Directors set the close of business on March 8, 2006 as the

record date for the Annual Meeting. Only stockholders whose names appear on the

stock register of the Company at the close of business on the record date will

be entitled to notice of and to vote at the Annual Meeting and at any

adjournments or postponements. (If you hold your stock in the name of a

brokerage firm, bank or other nominee, only that entity can vote your shares.

Please give instructions for your shares to be voted to the person responsible

for your account.)

There are four ways to vote:

- by completing the enclosed proxy card and returning it in the

enclosed postage prepaid envelope;

- by internet at http://www.proxyvoting.com/hme;

- by toll-free telephone at 1-866-540-5760; or \ - by written

ballot at the meeting.

If you vote by internet or telephone, your vote must be received before

11:00 p.m. Eastern Standard Time on May 3, 2006, the day before the Annual

Meeting. You may change your vote or revoke your proxy at any time before the

Annual Meeting:

- by returning a later dated proxy card;

- by sending written notice to Ann M. McCormick, Secretary of the

Company at 850 Clinton Square, Rochester, New York 14604;

- by entering a new vote by internet or telephone; or

- by completing a written ballot at the Annual Meeting.

Rochester, New York By Order of the Board of Directors

March 30, 2006

/s/ Ann M. McCormick

Ann M. McCormick

Secretary

EVEN IF YOU PLAN TO ATTEND THE MEETING, PLEASE VOTE BY ONE OF THE ABOVE METHODS.

IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE IN PERSON IF YOU WISH, EVEN IF

YOU HAVE PREVIOUSLY VOTED.

HOME PROPERTIES, INC.

Suite 850

Clinton Square

Rochester, New York 14604

_______________________________________

PROXY STATEMENT

_______________________________________

FOR 2006 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 4, 2006

March 30, 2006

GENERAL INFORMATION

This Proxy Statement is delivered to you in connection with the

solicitation of proxies by the Board of Directors of Home Properties, Inc. (the

"Company") for use at the 2006 Annual Meeting of Stockholders of the Company

(the "Annual Meeting"). The Annual Meeting will be held on Thursday, May 4, 2006

at 2:30 p.m. at the Dryden Theatre of the International Museum of Photography at

George Eastman House, 900 East Avenue, Rochester, New York 14607. The

approximate date on which the enclosed form of proxy and this Proxy Statement

are first being sent to stockholders is March 30, 2006.

Who May Vote

Stockholders of the Company as of the Company's record date, March 8, 2006,

may vote.

Outstanding Shares

On March 8, 2006, 31,334,423 shares of the Company's Common Stock were

outstanding. Each share of Common Stock has one vote.

How to Vote

There are four ways to vote:

1. by completing the enclosed proxy card and returning it in the

enclosed postage prepaid envelope;

2. by internet at http://www.proxyvoting.com/hme;

3. by toll-free telephone at (866) 540-5760; or

4. by written ballot at the Annual Meeting.

How Proxies Work

The Company's Board of Directors is asking for your proxy. By giving us

your proxy, you authorize the proxy holder (Edward J. Pettinella, the Company's

Chief Executive Officer) to vote your shares at the Annual Meeting in the manner

you direct.

If you vote by any of the above methods but do not specify how you wish to

vote your shares, your shares will be voted "for" all the enumerated matters

specified in the Notice of Meeting. The proxy holder will also vote shares

according to his discretion on any other matter properly brought before the

meeting.

You may receive more than one proxy card depending on how you hold your

shares. For example, if you hold shares through someone else, such as a

stockbroker, you may get proxy material from them. In order for you to vote

those shares, you must provide instructions to the record holder as provided in

their instructions to you. Even though you have not provided instructions to

your record holder, they may vote your shares "for" the election of the nominees

for director and "for" the ratification of the independent registered public

accounting firm.

Quorum

In order to carry out the business of the Annual Meeting, we must have a

quorum. This means that at least a majority of the outstanding shares eligible

to vote must be represented at the meeting, either by proxy or in person.

Votes Needed

The affirmative vote of a plurality of the votes cast at the Annual Meeting

is required for the election of directors. The ratification of the appointment

of PricewaterhouseCoopers LLP as the Company's independent registered public

accounting firm for 2006 and any other matter properly brought before the

meeting requires the favorable vote of a majority of the votes cast. Under

Maryland law, if a stockholder abstains on a vote, the abstention does not

constitute a vote "for" or "against" a matter. Thus, abstentions are disregarded

in determining the "votes cast."

Changing Your Vote

You may revoke your proxy before it is voted at the meeting by entering a

new vote by internet or telephone, by submitting a new proxy with a later date,

by voting in person at the Annual Meeting or by notifying the Company's

Secretary in writing prior to the Annual Meeting as follows: Ann M. McCormick,

850 Clinton Square, Rochester, New York 14604.

PROPOSAL 1

ELECTION OF DIRECTORS

At the Annual Meeting, twelve individuals will be elected to serve as

directors until the 2007 Annual Meeting and until their successors are elected.

The Board of Directors has nominated William Balderston, III, Josh E.

Fidler, Alan L. Gosule, Leonard F. Helbig, III, Roger W. Kober, Nelson B.

Leenhouts, Norman P. Leenhouts, Edward J. Pettinella, Clifford W. Smith, Jr.,

Paul L. Smith, Thomas S. Summer, and Amy L. Tait to serve as directors (the

"Nominees"). Each of the Nominees is currently serving as a director of the

Company. The Board of Directors anticipates that each of the Nominees will serve

as a director if elected.

The affirmative vote of a plurality of the votes cast at the Annual Meeting

is required for the election of the Nominees as directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE NOMINEES.

Brief biographical descriptions of the Nominees follow. The information was

furnished to the Company by the Nominees. The information is up to date through

March 8, 2006.

William Balderston, III, age 78, has been a director of the Company since

1994. From 1991 to the end of 1992, he was an Executive Vice President of The

Chase Manhattan Bank, N.A. From 1986 to 1991, he was President and Chief

Executive Officer of Chase Lincoln First Bank, N.A., which was merged into The

Chase Manhattan Bank, N.A. He is a Senior Trustee of the University of Rochester

and a member of the Board of Governors of the University of Rochester Medical

Center. Mr. Balderston is a graduate of Dartmouth College.

Josh E. Fidler, age 50, has been a director of the Company since August,

2004. Mr. Fidler is a founding partner of Boulder Ventures, Ltd., a manager of

venture capital funds, which has been in operation since 1995. Since 1985, he

has also been a principal in a diversified real estate development business

known as The Macks Group. In 1999, the Company acquired 3,297 apartment units

from affiliates of The Macks Group. Mr. Fidler was also a principal of the

entity which owned a 240-unit apartment community which the Company purchased in

2004. He is a graduate of Brown University and received a law degree from New

York University. Mr. Fidler is a member of the Maryland Region Advisory Board of

SunTrust Bank and the Board of Trustees of The Park School.

Alan L. Gosule, age 65, has been a director of the Company since 1996. Mr.

Gosule has been a partner in the New York Office of the law firm of Clifford

Chance US LLP since August 1991 and prior to that time was a partner in the law

firm of Gaston & Snow. Mr. Gosule is a graduate of Boston University and its Law

School and received an LLM in Taxation from Georgetown University. Mr. Gosule

also serves on the Board of Directors of MFA Mortgage Investments, Inc. He is a

member of the Board of Advisors of Paloma, LLC, which is the general partner of

Simpson Housing Limited Partnership, and is a voting trustee of F.L. Putnam

Investment Management Company.

Leonard F. Helbig, III, age 60, has been a director of the Company since

1994. Since September 2002 he has served as a Director of Integra Realty

Advisors in Philadelphia. Between 1980 and 2002 he was employed with Cushman &

Wakefield, Inc. From 1990 until 2002, Mr. Helbig served as President, Financial

Services for Cushman & Wakefield, Inc.. Prior to that and since 1984, Mr. Helbig

was the Executive Managing Director of the Asset Services and Financial Services

Groups. He was a member of that firm's Board of Directors and Executive

Committee. Mr. Helbig is a member of the Urban Land Institute, the Pension Real

Estate Association and the International Council of Shopping Centers. Mr. Helbig

is a graduate of LaSalle University and holds the MAI designation of the

American Institute of Real Estate Appraisers.

Roger W. Kober, age 72, has been a director of the Company since 1994. He

was employed by Rochester Gas and Electric Corporation from 1965 until his

retirement on January 1, 1998. From March 1996 until January 1, 1998, Mr. Kober

served as Chairman and Chief Executive Officer of Rochester Gas & Electric

Corporation. He is a Trustee Emeritus of Rochester Institute of Technology. Mr.

Kober is a graduate of Clarkson College and holds a Masters Degree in

Engineering from Rochester Institute of Technology.

Nelson B. Leenhouts, age 70, has served as Board Co-Chair since his

retirement as Co-Chief Executive Officer effective January 1, 2004. He had

served as Co-Chief Executive Officer, President and a director of the Company

since its inception in 1993. Since their formation, he has also served as a

director of Home Properties Management, Inc. ("HP Management") and Home

Properties Resident Services ("HPRS"), for which he had also served in various

officer capacities prior to his retirement. Mr. Leenhouts also currently serves

as a Senior Advisor to the Company pursuant to an Employment Agreement and as an

employee relating to the development operations of the Company pursuant to a

Development Agreement. The term of both agreements expires on December 31, 2006.

Nelson Leenhouts was the founder, and a co-owner, together with Norman

Leenhouts, of Home Leasing Corporation ("Home Leasing"), and has served as

President of Home Leasing since 1967. He is a member of the Board of Directors

of the Genesee Valley Trust Company. Nelson Leenhouts is a graduate of the

University of Rochester. He is the twin brother of Norman Leenhouts.

Norman P. Leenhouts, age 70, has served as Board Co-Chair since his

retirement as Co-Chief Executive Officer effective January 1, 2004. He had

served as Board Chair, Co-Chief Executive Officer and a director of the Company

since its inception in 1993. Since their formation, he has also served as a

director of HP Management and HPRS. Mr. Leenhouts also currently serves as a

Senior Advisor to the Company pursuant to an Employment Agreement with a term

that expires on December 31, 2006. Prior to January 1, 2006, Norman Leenhouts

was a co-owner, together with Nelson Leenhouts, of Home Leasing, where he had

served as Board Chair since 1971. He is currently the Chairman of Broadstone

Ventures, LLC and Broadstone Real Estate, LLC, formed to continue the property

management business of Home Leasing. He is a member of the Board of Trustees of

the University of Rochester, Roberts Wesleyan College, The Charles E. Finney

School and the Free Methodist Foundation, where he also serves as Board Chair.

He is a graduate of the University of Rochester and is a certified public

accountant. He is the twin brother of Nelson Leenhouts.

Edward J. Pettinella, age 54, has served as President and Chief Executive

Officer of the Company since January 1, 2004. He is also a director. He joined

the Company in 2001 as an Executive Vice President and director. He is also the

President and Chief Executive Officer of HP Management and HPRS. From 1997 until

February 2001, Mr. Pettinella served as President, Charter One Bank (NY

Division) and Executive Vice President of Charter One Financial, Inc. From 1980

through 1997, Mr. Pettinella served in several managerial capacities for

Rochester Community Savings Bank, Rochester, NY, including the positions of

Chief Operating Officer and Chief Financial Officer. Mr. Pettinella serves on

the Board of Directors of United Way of Greater Rochester, Rochester Business

Alliance, The Lifetime Healthcare Companies, National Multi Housing Counsel,

Syracuse University School of Business and YMCA of Greater Rochester. He is also

on the Board of Governors of National Association of Real Estate Investment

Trusts and is a member of Urban Land Institute. Mr. Pettinella is a graduate of

the State University at Geneseo and holds an MBA Degree in finance from Syracuse

University.

Clifford W. Smith, Jr. age 59, has been a director of the Company since

1994. Mr. Smith is the Epstein Professor of Finance of the William E. Simon

Graduate School of Business Administration of the University of Rochester, where

he has been on the faculty since 1974. He has written numerous books and

articles on a variety of financial, capital markets and risk management topics

and has held editorial positions for a variety of journals. Mr. Smith is a

graduate of Emory University and has a PhD from the University of North Carolina

at Chapel Hill.

Paul L. Smith, age 70, has been a director of the Company since 1994. Mr.

Smith was a director, Senior Vice President and the Chief Financial Officer of

the Eastman Kodak Company from 1983 until he retired in 1993. He was a member of

the Financial Accounting Standards Advisory Council. He is currently a director

of Constellation Brands, Inc. He is also a member of the Board of Trustees of

the George Eastman House and Ohio Wesleyan University. Mr. Smith is a graduate

of Ohio Wesleyan University and holds an MBA Degree in finance from

Northwestern University.

Thomas S. Summer, age 52, has been a director of the Company since August,

2004. Mr. Summer has been the Executive Vice President and Chief Financial

Officer of Constellation Brands, Inc. since 1997. Prior to that, he held various

positions in financial management with Cardinal Health, Inc., PepsiCo, Inc., and

Inland Steel Industries. He is also a member of the Boards of Greatbatch, Inc.

and AIDS Rochester, Inc. Mr. Summer is a graduate of Harvard University and

holds an MBA degree in finance and accounting from the University of Chicago.

Amy L. Tait, age 47, has served as a director of the Company since its

inception in 1993. Effective February 15, 2001, Mrs. Tait resigned her full-time

position as Executive Vice President of the Company and as a director of HP

Management. She continued as a consultant to the Company pursuant to a

consulting agreement that terminated on February 15, 2002. She is currently the

Chief Executive Officer and a director of Broadstone Ventures, LLC and

Broadstone Real Estate, LLC, where she also serves as Secretary. Mrs. Tait

joined Home Leasing in 1983 and held several positions with the Company,

including Senior and Executive Vice President and Chief Operating Officer. She

currently serves on the M & T Bank Regional Advisory Board and the boards of the

United Way of Rochester, Princeton Club of Rochester, Al Sigl Center, Center for

Governmental Research, Allendale Columbia School, and Monroe County Center for

Entrepreneurship. Mrs. Tait is a graduate of Princeton University and holds an

MBA from the William E. Simon Graduate School of Business Administration of the

University of Rochester. She is the daughter of Norman Leenhouts.

BOARD MATTERS

Board Composition

The Company is managed by its Board of Directors. If all of the Nominees

are elected, the Board will have twelve members.

Board Meetings

The Board holds regular meetings on a quarterly basis. Pursuant to the

Company's By-Laws, the Board Chair, President or a majority of the Board of

Directors may call for a special meeting of the Board. During 2005, the Board of

Directors met eight times, including regular and special meetings. Each director

attended at least 75% of the Board's meetings. Ten of the twelve directors

attended all of the meetings. Two directors each missed one meeting.

Board Independence

Nine of the Company's twelve Board members are not employed by the Company.

The Board of Directors has determined that eight of the non-employee directors

are "independent" within the meaning of the Securities and Exchange Commission

("SEC") and the New York Stock Exchange ("NYSE") current director independence

standards. The independent directors are: William Balderston, Josh Fidler, Alan

Gosule, Leonard Helbig, Roger Kober, Clifford Smith, Paul Smith and Thomas

Summer. This represents more than a majority of the members of the Board of

Directors.

In determining the independence of each director, the Corporate

Governance/Nominating Committee of the Board considered any relationships

between the Company and the individual director and the director's immediate

family members as required under the applicable standards. Consistent with the

standard of the NYSE with respect to ownership of common stock, the Board has

determined that ownership of limited partnership units ("Units") in Home

Properties, L.P. (the "Operating Partnership"), which are exchangeable on a

one-for-one basis for Common Stock and have customarily received distributions

equivalent to distributions on the Company's Common Stock, does not bar the

Board from determining that a director is independent of management. Messrs.

Balderston, Gosule, Helbig, Kober, C. Smith, P. Smith and Summer have no

relationship with the Company other than their compensation and benefits as

members of the Board and its Committees and ownership of the Company's Common

Stock.

In evaluating the independence of Mr. Fidler, the Corporate

Governance/Nominating Committee and the full Board considered the additional

relationships between Mr. Fidler and the Company and determined that none of

them was material and that Mr. Fidler is independent. Specifically, Mr. Fidler

is a principal in a diversified real estate development business known as The

Macks Group. In 1999, the Company acquired 3,297 apartment units from affiliates

of The Macks Group. As partial consideration for the purchase, Mr. Fidler and

members of his family acquired approximately 800,000 Units in Home Properties

L.P. Pursuant to the purchase agreement, the Company agreed not to sell or

refinance the apartments in a transaction which would require the sellers to

recognize taxable income deferred in connection with the sale. In addition, the

Company agreed to register with the SEC shares of its Common Stock for which the

Units could be exchanged, to pay dividends on the Units comparable to those paid

on the Company's Common Stock, and to provide the holders of the Units certain

rights to protect their tax and economic interests in the event of a "going

private" transaction involving the Company. The Board determined that these

rights are not material to the Company and do not impair Mr. Fidler's

independence from management. In addition, in 2004, the Company acquired a 240

unit apartment community for $29,496,000 in cash from an entity owned by Mr.

Fidler and members of his family. Certain customary representations and

warranties by both the Company and the sellers continue to survive, including

related indemnity obligations for any breaches. The Board determined that since

no breaches have occurred in the almost two years since the acquisition and

since any breaches by either the Company or the sellers would not be material to

the Company, the ongoing contractual provisions are not material to the Company

and do not impair Mr. Fidler's independence from management.

In considering the relationships between Amy Tait and the Company, the

Board has determined that Ms. Tait is not an independent director because of her

prior employment as an officer of the Company and because Norman Leenhouts, her

father, was Co-Chief Executive Officer until January 1, 2004.

Board Evaluation

In 2005, each Board member participated in a self-evaluation of their

performance as a Board member as well as an evaluation of the Board as a whole.

The Board and members of senior management also participated in a written

evaluation of the Chief Executive Officer.

Board Committees

Audit Committee. The Company has a separately designated Audit Committee,

which currently consists of Alan Gosule, Leonard Helbig, Roger Kober, Paul Smith

and Thomas Summer. Paul Smith chairs this Committee. The Audit Committee assists

the Board in fulfilling its responsibility for general oversight of the

integrity of the Company's financial statements, the Company's compliance with

applicable laws and regulations including the Company's own Code of Business

Conduct and Ethics, and the Company's internal and disclosure controls and

procedures. The Audit Committee also selects and oversees the Company's

independent registered public accounting firm.

The Audit Committee has adopted procedures for the receipt, retention and

treatment of concerns and complaints about accounting, internal controls and

auditing matters. The Audit Committee oversees the existence of a "hot line"

(1-877-888-0002) where such concerns and complaints can be anonymously reported.

The Board of Directors has reviewed the qualifications of each member of

the Audit Committee and has determined that each member is independent as

required by applicable securities laws and by the listing standards of the NYSE.

No Audit Committee member serves on the audit committee of more than one other

public company. In the exercise of its business judgment, the Board of Directors

has also determined that each member of the Audit Committee is financially

literate. Finally, the Board has determined that each of Roger Kober, Paul Smith

and Thomas Summer qualifies as an "audit committee financial expert" as defined

by applicable SEC rules.

The Audit Committee operates under a written charter approved by the

Committee and the Board. A copy of the charter is attached to this Proxy

Statement as Exhibit A and is available on the Company's website at

www.homeproperties.com under the heading "Investment Information/Corporate

Governance/Highlights." In 2005, the Audit Committee conducted a

self-evaluation.

The Audit Committee works closely with management and the Company's

independent registered public accounting firm. It meets quarterly to review the

Company's financial statements and on other occasions on an as needed basis. The

Audit Committee met seven times in 2005. Each of the members of the Audit

Committee attended at least 75% of the Committee's meetings.

Compensation Committee. The Company has a separately designated

Compensation Committee. The Compensation Committee currently consists of William

Balderston, Roger Kober and Clifford Smith, each of whom is independent as

required by applicable securities laws and by the listing standards of the NYSE.

Clifford Smith chairs this Committee. The Compensation Committee reviews and

approves, at least annually, the Company's goals and objectives relevant to

compensation of the Company's executive officers, including the Chief Executive

Officer, reviews on an annual basis the performance of the Chief Executive

Officer in light of those goals and objectives, recommends to the other

directors for approval the Chief Executive Officer's annual compensation,

approves the compensation levels of the other executive officers, reviews

significant employee benefit programs, and establishes and administers executive

compensation programs.

The Compensation Committee operates under a written charter approved by the

Committee and the Board. A copy of the charter is available on the Company's

website at www.homeproperties.com under the heading "Investment

Information/Corporate Governance/Highlights." In 2005, the Compensation

Committee conducted a self-evaluation.

The Compensation Committee met four times in 2005. Each of the members of

the Compensation Committee attended all of the Committee's meetings.

Corporate Governance/Nominating Committee. The Company has a separately

designated Corporate Governance/Nominating Committee. Pursuant to its charter,

this Committee at all times consists of at least three directors, all of whom

are independent directors and two of whom are the Chairs of the Audit and

Compensation Committees. This Committee currently consists of William

Balderston, Clifford Smith and Paul Smith, each of whom is independent as

required by applicable securities laws and by the listing standards of the NYSE.

William Balderston chairs this Committee. The Corporate Governance/Nominating

Committee identifies individuals qualified to become Board members consistent

with criteria approved by the Board, evaluates the size, composition and

organization of the Board, monitors implementation of specific corporate

governance initiatives, reviews any stockholder proposals submitted to the

Company and oversees the evaluation of the Board and management.

The Corporate Governance/Nominating Committee operates under a written

charter approved by the Committee and the Board. A copy of the charter is

available on the Company's website at www.homeproperties.com under the heading

"Investment Information/Corporate Governance/Highlights." In 2005, the Corporate

Governance/Nominating Committee conducted a self-evaluation.

The Corporate Governance Committee met four times in 2005. Each of the

members of this Committee attended all of the Committee's meetings.

Real Estate Investment Committee. The Company has a separately designated

Real Estate Investment Committee. Josh Fidler, Leonard Helbig, Nelson Leenhouts,

Edward Pettinella and Amy Tait are the current members of this Committee. Amy

Tait chairs this Committee. The charter for this Committee requires that it

consists of at least three directors, at least a majority of whom shall be

non-employee directors. The purpose of this Committee is to review potential

acquisitions and dispositions and to approve, or to recommend to the full Board

for approval, acceptable transactions pursuant to the authorization parameters

established by the Board.

The Real Estate Investment Committee operates under a written charter

approved by the Committee and the Board. A copy of the charter is available on

the Company's website at www.homeproperties.com under the heading "Investment

Information//Corporate Governance/Highlights." In 2005, the Real Estate

Investment Committee conducted a self-evaluation.

The Real Estate Investment Committee met six times in 2005. Each of the

members of the Committee attended all of the Committee's meetings.

Board Compensation

In 2005, the Company paid its non-employee directors an annual stipend of

$20,000. An additional annual stipend in the amount of $9,000 was paid to the

Chair of each of the Committees. Non-employee directors were also paid $1,200

per day for attendance (in person or by telephone) at Board and Committee

meetings provided the Committee meetings were held on a different day from the

Board meetings. In addition, in 2005, each of the non-employee directors was

issued 875 shares of restricted stock and 4,000 options pursuant to the

Company's Amended and Restated 2003 Stock Benefit Plan. The options were issued

at an exercise price of $41.95 per share, which was the closing price of a share

of the Company's common stock on the date of the 2005 Annual Meeting.

For 2006, the annual stipend will increase to $30,000, the additional

stipend paid to the Committee Chairs will increase to $10,000 and the meeting

fees will remain at $1,200 per day. The Amended and Restated 2003 Stock Benefit

Plan provides for the issuance of up to 1,000 shares of restricted stock to each

of the non-employee directors in 2006. The Board authorized a grant of 1,000

shares to each non-employee director, which was awarded in February, 2006. The

Amended and Restated 2003 Stock Benefit Plan also provides for the issuance of

up to 10,000 options to each of the non-employee directors in 2006. The Board

has approved the issuance of 4,000 options to each of the non-employee directors

immediately following the 2006 Annual Meeting. The Board determined the 2006

compensation level for non-employee directors based on an analysis of the amount

and type of consideration paid to the boards of the Company's peer group.

Under the Second Amended and Restated Director Deferred Compensation Plan

approved by the stockholders at the 2005 Annual Meeting, the non-employee

directors can defer up to 100% of their total annual cash compensation

(including meeting fees) for three, five or ten years and their compensation in

the form of restricted stock for five or ten years. The Company matches 10% of

the deferred cash amount, which amount vests after three years. A "phantom"

stock account is established for each of the director and the Company

contribution amounts. Each deferral and the Company contribution is reflected by

crediting those accounts with the phantom equivalent of the number of shares of

the Company's Common Stock that could be purchased with the amounts deferred and

contributed at the Common Stock's fair market value as of the day when the

compensation would otherwise have been paid, or with the number of shares of

restricted stock deferred. Participants' accounts are also credited with the

number of shares of the Company's Common Stock that could be purchased with

hypothetical dividends that would be paid with respect to shares previously

allocated to the accounts on the same date and at the same price that shares are

purchased for participants in the dividend reinvestment feature of the Company's

Dividend Reinvestment and Direct Stock Purchase Plan (the "DRIP"). Payments out

of the deferred accounts, upon vesting or otherwise, are made by issuance of

Common Stock, except in the event of payment by reason of a change in control in

which event payment may be made in cash or by issuance of Common Stock at the

election of the Compensation Committee. The Director Deferred Compensation Plan

is designed to provide substantially the same benefits to the non-employee

directors as are provided to eligible employees under the Company's Deferred

Bonus Plan. Under the Director Deferred Compensation Plan, five and four of the

nine non-employee directors elected to defer some or all of the compensation

earned by them in 2005 and 2006, respectively.

Directors of the Company who are employees of the Company do not receive

any compensation for their services as directors. All directors are reimbursed

for their expenses incurred in attending directors' meetings.

Director Qualifications

The Board has established certain minimum qualifications for prospective

Board members. These include a present or past (retired) successful professional

career as well as the potential to contribute to the effectiveness of the Board

as a whole. Specific qualifications or skills that a prospective Board member

must possess include candor, trustworthiness, high ethical standards, dedication

and a desire to work hard. Specific expertise must include one of the following:

successful financial, legal, academic, mergers and acquisitions, technology

utilization or business operating experience.

Identifying and Evaluating Nominees for Directors

The Corporate Governance/Nominating Committee utilizes a variety of methods

for identifying and evaluating nominees for director. The Committee develops and

updates a list of potential Board candidates that meet the Board qualifications.

Candidates may come to the attention of the Committee through current Board

members, stockholders, management or other persons. To date, the Committee has

not utilized the services of a professional service firm to identify potential

candidates, but it may do so in the future. If a vacancy on the Board occurs or

is anticipated, the Committee selects candidates to have personal meetings with

members of the Committee, the Co-Chairs of the Board and the Chief Executive

Officer. Selected candidates would then be invited to interact with other Board

members and management. A candidate, if acceptable, would then be elected by the

Board (in the event of a mid-term vacancy) or be nominated to stand for election

at the next annual stockholders meeting.

Stockholder Nominees

The Corporate Governance/Nominating Committee will consider director

candidates proposed by stockholders on the same basis as it considers other

potential candidates for Board membership. Stockholders may submit nominations,

which should include the name and address of the proposed candidate as well as

biographical information evidencing that the proposed candidate meets the

minimum qualifications and possesses the skills and expertise as required by the

Board and as described above under "Director Qualifications." The submission

must also include the candidate's written consent to the nomination and to serve

if elected. To be considered for nomination for election at the 2007 Annual

Meeting, stockholder submissions for nomination must be received at the office

of the Company in care of Secretary, Home Properties, Inc., 850 Clinton Square,

Rochester, New York 14604, on or prior to February 15, 2007.

Director Communications

Stockholders may communicate with the Board of Directors by sending written

materials to the Board or any of the directors in care of Secretary, Home

Properties, Inc., 850 Clinton Square, Rochester, New York 14604. Stockholders

may also communicate confidentially or anonymously through use of the Company's

hotline at 1-877-888-0002. The Company's Secretary will relay all written

communications to the Board of Directors or individual members designated by the

stockholder.

CORPORATE GOVERNANCE

Code of Ethics

A very significant part of the Company's culture is the focus on "doing the

right thing." The Company has adopted a Code of Business Conduct and Ethics

("Code of Ethics") to embody the Company's commitment to continue to conduct

business in accordance with the highest ethical standards. The Code of Ethics

applies to all employees and directors of the Company. The Code of Ethics covers

such topics as conflicts of interest, proper use of Company property, complete

and accurate reporting and disclosure of its business and financial results and

compliance with laws. Each employee and each member of the Board of Directors is

required on an annual basis to acknowledge that they have received a copy of and

reviewed the Code of Ethics.

The Company has also adopted a Code of Ethics for Senior Financial Officers

("Senior Financial Officer Code of Ethics") that applies to the Chief Executive

Officer, Chief Financial Officer, Treasurer and Controller. These individuals

are also required to comply with the Code of Ethics.

The Code of Ethics and Senior Financial Officer Code of Ethics meet the

definition of "Code of Ethics" under the rules and regulations of the SEC and

the listing standards of the NYSE. Both Codes are available on the Company's

website at www.homeproperties.com under the heading "Investment

Information/Corporate Governance/Highlights." Amendments to the Code of Ethics

and Senior Financial Officer Code of Ethics and any waivers granted thereunder

will be posted on the Company's website under that heading. The Audit Committee

of the Board of Directors monitors the implementation and enforcement of both

Codes.

Corporate Governance Guidelines

The Board of Directors has adopted a set of corporate governance guidelines

(the "Guidelines") which meet the requirements of the listing standards of the

NYSE and cover such topics as director qualifications and responsibilities,

director access to management, and director orientation and continuing

education. Some specific policies included in the Guidelines follow.

Retirement Age. The retirement age for directors was changed in February

2006 to 75. Previously, the retirement age of 75 was subject to exceptions if a

determination was made by the other directors after confidential discussion that

the over age 75 director was expected to make a significant contribution to the

Company during the following year. As of the 2007 Annual Meeting, no exceptions

will be permitted.

Change of Employment. Any director who changes jobs or employers or

otherwise experiences a significant change in job responsibilities is to submit

a letter to the Board offering to resign as a Board member.

Other Boards. Directors may not serve on the boards of more than two

additional public companies.

Stock Ownership. Within five years of becoming a director of the Company,

directors are required to have equity in the Company having a then current value

of not less than $100,000.

Meeting Attendance. Directors are expected to attend each annual

stockholders meeting, all Board meetings and meetings of the Committees on which

they serve. All of the directors attended the 2005 Annual Meeting of

Stockholders.

Executive Sessions. The non-management directors are to meet at least

quarterly in executive sessions and, at least once per year, without any

directors who are not independent directors. The Chair of the Corporate

Governance/ Nominating Committee presides at the executive sessions unless the

Board determines otherwise.

A copy of the Guidelines is available on the Company's website at

www.homeproperties.com under the heading "Investment Information/Corporate

Governance/Highlights."

Stock Option Restrictions

The Amended and Restated 2003 Stock Benefit Plan approved by the Company's

stockholders at the 2005 Annual Meeting includes some features that are designed

to closely align the interests of management with those of the stockholders.

Options may not be repriced. Options do not vest automatically upon retirement

but continue to vest as scheduled. Directors and the executive officers of the

Company must hold an equivalent number of shares as were issued on an option

exercise for a one year period and are not permitted to receive cash on an

option exercise other than the amount necessary to pay the exercise price and

withholding taxes.

EXECUTIVE COMPENSATION

The following table sets forth the compensation paid during 2003, 2004 and

2005 to the Company's Chief Executive Officer, the four next most highly

compensated executive officers and the two Board Co-Chairs and Senior Advisors

(collectively the "Named Executives").

Summary Compensation Table

Long-Term

Compensation Awards

Securities

Annual Compensation($) Restricted Underlying All Other

Name and Principal Position Year Salary Bonus (1) Stock Awards($)(2) Options(#)(3) Compensation($)(4)

- --------------------------- ---- ------ --------- ---------------------------------------------------

Edward J. Pettinella (5) 2003 $400,000 $113,520 $411,450 50,000 $6,000

President and Chief Executive 2004 475,000 433,770 529,320 55,000 6,150

Officer 2005 500,000 352,625 416,500 65,000 6,300

David P. Gardner (6) 2003 215,000 92,498 97,725 15,000 6,000

Executive Vice President and 2004 245,000 171,673 246,608 15,000 6,150

Chief Financial Officer 2005 263,000 114,142 229,075 25,000 6,300

Ann M. McCormick (7) 2003 205,000 89,023 80,905 15,000 6,000

Executive Vice President 2004 235,000 165,412 203,808 15,000 6,150

General Counsel and Secretary 2005 248,000 107,632 189,578 20,000 6,300

Scott A. Doyle (8) 2003 175,000 64,217 31,650 10,000 6,000

Senior Vice President 2004 215,000 130,349 126,817 12,500 6,150

2005 233,000 88,482 124,950 15,000 6,300

John E. Smith (9) 2003 170,000 60,966 31,650 10,000 6,000

Senior Vice President 2004 189,166 99,433 64,160 10,000 6,150

2005 205,000 77,849 83,300 15,000 6,300

Other Employees:

Nelson B. Leenhouts (10) 2003 450,000 127,710 2,970,282 50,000 6,000

Co-Chair and Senior Advisor 2004 300,000 273,960 434,655 33,330 6,150

2005 225,000 146,475 222,685 25,000 6,300

Norman P. Leenhouts (11) 2003 450,000 127,710 2,969,967 50,000 6,000

Co-Chair and Senior Advisor 2004 300,000 273,960 434,655 33,330 6,150

2005 225,000 146,475 222,685 25,000 6,300

(1) All amounts listed in the following footnotes as having been subject to

mandatory deferral were required to be deferred under the Company's

Incentive Compensation Plan. When the deferred amounts are paid, they are

paid with interest as provided in that plan. See the description of this

plan under "Incentive Compensation Plan" on page 15 of this Proxy

Statement.

(2) Amounts in this column include the value of shares of restricted stock and,

where applicable, the amount of the Company's contribution of 10% of the

bonus deferred voluntarily by the Named Executives pursuant to the

Company's Deferred Bonus Plan (a "10% Company Contribution"). The value of

the restricted stock is based on the closing price of a share of Common

Stock on the NYSE on the date of grant. The amount of the 10% Company

Contribution under the Deferred Bonus Plan is credited to the applicable

Named Executive's account in the form of shares as described under

"Deferred Bonus Plan" on page 16 of this Proxy Statement ("Plan Shares").

The restrictions on the shares of restricted stock granted in February 2003

lapse in February 2008. The restrictions on the shares of restricted stock

granted to Nelson and Norman Leenhouts in October 2003 vest 20% per year on

the anniversary date of the grant. The restrictions on the shares of

restricted stock granted in 2004 and 2005 vest 25% per year on the

anniversary date of the grant. The Plan Shares vest on the three-year

anniversary of the date they were first credited to the applicable Named

Executive's deferred bonus account. Dividends are paid on the restricted

shares as and when dividends are paid on the Common Stock. The equivalents

of dividends are paid on the Plan Shares at the time dividends are paid on

the Common Stock and are reinvested. The value of all of the restricted

stock (including Plan Shares) listed in this column for the Named

Executives as of December 31, 2005 was as follows: Edward Pettinella

$1,342,320; David Gardner $539,939; Ann McCormick $444,139; Scott Doyle

$261,918; John Smith $171,360; Nelson Leenhouts $2,800,503; Norman

Leenhouts $2,800,144.

(3) All options granted in 2003, 2004 and 2005 were granted under the 2003

Stock Benefit Plan. All options are exercisable for ten years following

grant. All options vest 20% each year for five years. The exercise price

for all options granted in 2003 is $36.85 per share. The exercise price for

all options granted in 2004 is $38.83 per share. The exercise price for all

options granted in 2005 is $41.95 per share. The exercise price for all

options granted is the closing price of a share of the Company's Common

Stock on the date of grant.

(4) Represents contributions made by the Company to the Named Executive's

account under the Company's retirement savings plan.

(5) The amount in the restricted stock column represents the value of 13,000

shares of restricted stock granted to Mr. Pettinella in 2003, 13,200 shares

granted to him in 2004 and 10,000 shares granted to him in 2005. In

addition to the listed compensation, in 2005 Mr. Pettinella received

$93,357 in dividends paid on the restricted stock held by him.

(6) Mr. Gardner's 2003 and 2004 bonuses include $21,311 and $22,517,

respectively, which represents 50% of his 2002 bonus that was subject to

mandatory deferral plus interest. The amount in the restricted stock column

includes the 10% Company Contribution which was credited to Mr. Gardner's

deferred bonus account in the form of 70 and 149 Plan Shares, respectively,

for 2003 and 2004. The amount in the restricted stock column also includes

the value of 3,000 shares of restricted stock granted to Mr. Gardner in

2003, 6,000 shares granted to him in 2004 and 5,500 shares granted to him

in 2005. In addition to the listed compensation, in 2005 Mr. Gardner

received $37,950 in dividends paid on the restricted stock held by him.

(7) Mrs. McCormick's 2003 and 2004 bonuses include $21,147 and $22,344,

respectively, which represents 50% of her 2002 bonus that was subject to

mandatory deferral plus interest. The amount in the restricted stock column

includes the 10% Company Contribution which was credited to Mrs.

McCormick's deferred bonus account in the form of 45, 82 and 43 Plan

Shares, respectively, for 2003, 2004 and 2005. The amount in the restricted

stock column also includes the value of 2,500 shares granted to Mrs.

McCormick in 2003, 5,000 shares granted to her in 2004 and 4,500 shares

granted to her in 2005. In addition to the listed compensation, in 2005

Mrs. McCormick received $32,257 in dividends paid on the restricted stock

held by her.

(8) Mr. Doyle's 2003 and 2004 bonuses include $14,552 and $15,375,

respectively, which represents 50% of his 2002 bonus that was subject to

mandatory deferral plus interest. The amount in the restricted stock column

includes the 10% Company Contribution which was credited to Mr. Doyle's

deferred bonus account in the form of 162 Plan Shares for 2004. The amount

in the restricted stock column represents the value of 1,000 shares granted

to Mr. Doyle in 2003, 3,000 shares granted to him in 2004 and 3,000 shares

granted to him in 2005. In addition to the listed compensation, in 2005 Mr.

Doyle received $19,860 in dividends paid on the restricted stock held by

him.

(9) Mr. Smith's 2003 and 2004 bonuses include $12,720 and $13,440,

respectively, which represents 50% of his 2002 bonus that was subject to

mandatory deferral plus interest. The amount in the restricted stock column

represents the value of 1,000 shares granted to Mr. Smith in 2003, 1,600

shares granted to him in 2004 and 2,000 shares granted to him in 2005. In

addition to the listed compensation, in 2005 Mr. Smith received $14,674 in

dividends paid on the restricted stock held by him.

(10) Prior to January 1, 2004, Nelson Leenhouts served as President of the

Company. The amount in the restricted stock column includes the Company's

10% Contribution which was credited to Nelson Leenhouts' deferred bonus

account in the form of 315, 671 and 291 Plan Shares for 2003, 2004 and

2005, respectively. For 2003, 2004 and 2005, the restricted stock column

also includes the value of 80,935, 10,166 and 5,000 shares, respectively,

of restricted stock granted to Mr. Leenhouts in those years. In addition to

the listed compensation, in 2005 Mr. Leenhouts received $203,128 in

dividends paid on the restricted stock held by him.

(11) Prior to January 1, 2004, Norman Leenhouts served as Chairman of the

Company. The amount in the restricted stock column includes the 10% Company

Contribution which was credited to Norman Leenhouts' deferred bonus account

in the form of 307, 671 and 291 Plan Shares, respectively, for 2003, 2004

and 2005. The amount in the restricted stock column for 2003, 2004 and 2005

also includes the value of 80,935, 10,166 and 5,000 shares, respectively,

of restricted stock granted to Mr. Leenhouts in those years. In addition to

the listed compensation, in 2005 Mr. Leenhouts received $203,128 in

dividends paid on the restricted stock held by him.

Stock Benefit Plans

The Company's 1994 Stock Benefit Plan was adopted by the Company at the

time of its initial public offering. As of March 8, 2006, options to purchase

1,542,381 shares have been granted to employees and options to purchase 153,654

shares have been granted to non-employee directors under the 1994 Stock Benefit

Plan. Of the options granted under the 1994 Stock Benefit Plan, 42,991 issued to

employees and none issued to non-employee directors were outstanding on March 8,

2006. The Board of Directors has determined that no additional awards will be

made under this Plan.

At the 2000 Annual Meeting, the stockholders approved the Company's 2000

Stock Benefit Plan. As of March 8, 2006, options to purchase 2,101,220 shares

have been granted to employees and options to purchase 163,760 shares have been

granted to non-employee directors under the 2000 Stock Benefit Plan. In

addition, as of March 8, 2006, 350,702 shares of restricted stock have been

issued under the 2000 Stock Benefit Plan to the executive officers and other key

employees and 2,700 shares of restricted stock had been issued to the

non-employee directors under the 2000 Stock Benefit Plan. Of the awards made

under the 2000 Stock Benefit Plan 818,077 options and 223,963 shares of

restricted stock issued to employees and 49,000 options and 2,100 shares of

restricted stock issued to the non-employee directors were outstanding on March

8, 2006. The Board of Directors has determined that no additional awards will be

made under this Plan.

At the 2003 Annual Meeting, the stockholders approved the Company's 2003

Stock Benefit Plan. The stockholders approved an amended and restated version of

that plan at the 2005 Annual Meeting. The Amended and Restated 2003 Stock

Benefit Plan provides up to 2,500,000 shares for issuance of stock options to

employees (including the executive officers) and 110,000 shares for issuance of

shares of restricted stock to employees (including the executive officers),

220,000 shares for issuance of stock options to non-employee directors and

29,475 shares for issuance of shares of restricted stock to non-employee

directors. As of March 8, 2006, options to purchase 1,694,130 shares have been

granted to employees and no shares of restricted stock have been granted to

employees, options to purchase 148,000 shares have been issued to non-employee

directors and 20,475 shares of restricted stock have been granted to

non-employee directors under the original and the Amended and Restated 2003

Stock Benefit Plan. Of the options granted under the original and the Amended

and Restated 2003 Stock Benefit Plan, 1,381,675 issued to employees and 148,000

issued to non-employee directors were issued and outstanding as of March 8,

2006. All 20,475 shares of restricted stock granted to non-employee directors

also remain issued and outstanding as of March 8, 2006.

Options and restricted stock that have been issued and that are

subsequently terminated, cancelled or surrendered without being exercised are

available for future grant under the Amended and Restated 2003 Stock Benefit

Plan. Taking those shares in account, as of March 8, 2006, 1,028,590 are

available for issuance of stock options to employees and 110,000 shares are

available for issuance of restricted stock to employees. In addition 72,000

shares are available for issuance of stock options to non-employee directors and

9,000 shares are available for issuance of restricted stock to non-employee

directors.

As of March 8, 2006 and with respect to all three of the Company's Stock

Benefit Plans, the aggregate of the shares of Common Stock subject to

outstanding option grants, the shares of restricted stock outstanding and the

shares still available for issuance of awards equals 8.1% of the aggregate of

the Company's outstanding Common Stock and other equity that is convertible into

Common Stock on an as-converted basis.

Option Grants in Fiscal Year 2005

The following table sets forth certain information relating to options

granted to the Named Executives during the fiscal year ended December 31, 2005.

These options were granted under the Amended and Restated 2003 Stock Benefit

Plan. The columns labeled "Potential Realizable Value" are based on hypothetical

5% and 10% growth assumptions in accordance with the rules of the SEC. The

Company cannot predict the actual growth rate of the Common Stock.

Option Grants in Last Fiscal Year(1)

Individual Grants

Percent of

Number of Total Options Potential Realizable Value

Shares Granted to at Assumed Annual Rates of

Underlying Employees in Exercise or Stock Price Appreciation Grant Date

Options Fiscal Base Price Expiration for Option Term($) Fair

Name Granted(#) Year ($/sh.) (2) Date 5% 10% Value($)(3)

---- ---------- ---- ----------- ---- -- --- -----------

Executive Officers:

Edward J. Pettinella 65,000 12.5% $41.95 05/06/2015 $1,714,838 $4,345,737 $228,743

David P. Gardner 25,000 4.8% 41.95 05/06/2015 659,553 1,671,437 87,978

Ann M. McCormick 20,000 3.8% 41.95 05/06/2015 527,643 1,337,150 70,383

Scott A. Doyle 15,000 2.9% 41.95 05/06/2015 395,732 1,002,862 52,787

John E. Smith 15,000 2.9% 41.95 05/06/2015 395,732 1,002,862 52,787

Other Employees:

Nelson B. Leenhouts 25,000 4.8% 41.95 05/06/2015 659,553 1,671,437 87,978

Norman P. Leenhouts 25,000 4.8% 41.95 05/06/2015 659,553 1,671,437 87,978

(1) Stock appreciation rights were not granted in 2005.

(2) The exercise price was the closing price of a share of the Company's Common

Stock on the NYSE on the date of grant, May 6, 2005.

(3) The value of stock option awards granted in May, 2005 is based on the grant

date fair value estimated by the Company for financial reporting purposes

($3.52 per option) using the Black-Sholes option-pricing model. The

ultimate values of the options will depend on the future market price of

the Company's stock, which cannot be forecasted with reasonable accuracy.

The actual value, if any, an employee will realize upon exercise of an

option will depend on the excess of the fair market value of the Company's

common stock less the grant price on the date the option is exercised.

Option Exercises and Year-End Option Values

The following table sets forth the value of options held as of December 31,

2005 by the Company's Named Executives.

Aggregated Option Exercises in Last Fiscal Year and

Fiscal Year-End Option Values (1)

Number of

Shares Number of Shares Value of Unexercised

Acquired Underlying Unexercised in-the-Money Options at

On Value Options at Fiscal Year End(#) Fiscal Year End($)(2) End(#)

Name Exercise(#) Realized($) Exercisable Unexercisable Exercisable Unexercisable

---- ----------- ----------- ----------- ------------- ----------- -------------

Executive Officers:

Edward J. Pettinella 0 0 231,000 139,000 $2,319,670 $205,180

David P. Gardner 11,140 $173,829 45,960 55,000 367,263 128,040

Ann M. McCormick 0 0 57,600 50,000 530,440 128,040

Scott A. Doyle 0 0 39,000 37,000 353,938 89,300

John E. Smith 7,000 103,080 25,000 35,000 188,965 85,360

Other Employees:

Nelson B. Leenhouts 3,686 45,319 76,666 111,664 477,382 400,528

Norman P. Leenhouts 3,187 25,257 73,479 111,664 447,345 400,528

(1) Stock appreciation rights were not granted in 2005.

(2) Based on the closing price of a share of the Company's Common Stock on the

NYSE on December 31, 2005 of $40.80 less the per share exercise price of

the options.

Employment Agreements

Edward Pettinella entered into an employment agreement with the Company for

a term that commenced on January 1, 2004 and terminates on December 31, 2006.

The agreement provides for the employment of Mr. Pettinella during that term as

the President and Chief Executive Officer of the Company. Pursuant to the

agreement, his base salary for 2004 was $475,000 and his base salary for 2005

and 2006 is to be determined in the discretion of the Compensation Committee,

but is to be no less then $475,000. The factor to be applied to his salary for

purposes of determining his bonus pool under the Company's Incentive

Compensation Plan is to be a minimum of 12% for all three years. The

Compensation Committee determined Mr. Pettinella's salary for 2005 and 2006

(actually March 15, 2006 to March 14, 2007) was to be $500,000 and $525,000,

respectively. The Committee increased his bonus factor to 13% in 2005 where it

remains for 2006. Options and restricted stock awards to be made to Mr.

Pettinella during the term of the agreement are not specified but are rather to

be made in the discretion of the Compensation Committee. The Compensation

Committee recommended and the full Board approved the issuance of 55,000 and

65,000 stock options in 2004 and 2005, respectively and the issuance of 13,200

and 10,000 shares of restricted stock in 2004 and 2005, respectively. The

Compensation Committee expects to make a recommendation as to the number of

options and shares of restricted stock to be issued in 2006 to Mr. Pettinella at

the May 2006 Board meeting. The "Compensation Committee Report on Executive

Compensation" included later in the Proxy Statement describes the rationale for

the Committee's prior recommendations relating to Mr. Pettinella's compensation.

Mr. Pettinella's employment agreement also provides that, if employment is

terminated by the Company without cause or by Mr. Pettinella for good reason,

Mr. Pettinella is entitled to receive an amount equal to two times his base

salary and incentive compensation for the year preceding the termination plus,

in the year following termination, the amount of incentive compensation that he

would have earned if he had been an employee on December 31 of the year of

termination. In such event, Mr. Pettinella would also be paid an amount to

compensate him for the loss of future awards of stock options and restricted

stock. In addition, all options previously granted to him would vest and the

restrictions would lapse on all restricted stock held by Mr. Pettinella.

Pursuant to the employment agreement, Mr. Pettinella is subject to a covenant

not to compete until January 1, 2007 unless he is terminated by the Company for

cause or if he resigns without good reason, in which event the covenant applies

for two years after termination.

In the event of a change of control, Mr. Pettinella is entitled to receive

the benefits provided under the Executive Retention Plan (described on page 16

of this Proxy Statement) except he would receive three times his base salary and

bonus instead of two times as provided to other beneficiaries of that plan.

In October, 2003, Nelson and Norman Leenhouts entered into employment

agreements with the Company providing for a three-year term expiring on December

31, 2006. Under the employment agreements, the Leenhoutses agree to serve as

Senior Advisors as well as Co-Chairs of the Board (provided they continue to be

elected by the stockholders as directors of the Company). These employment

agreements reflect the gradual reduction of the Leenhoutses' obligations to act

as Senior Advisors to the Company with the portion of their business time to be

spent on those obligations reducing from a maximum of two-thirds in 2004, to

one-half in 2005, to one-third in 2006. Their base salary is also

proportionately reduced under the employment agreements from $225,000 in 2005 to

$150,000 in 2006. They remain entitled to receive incentive compensation at

their pre-retirement bonus level factor of 12% but since the Company's Incentive

Bonus Plan provides that the bonus paid is calculated based on base salary, if

the total bonus payout remained the same, the bonus to be paid to the

Leenhoutses will be proportionately reduced as well.

Pursuant to their employment agreements, each of the Leenhoutses was

granted 64,935 shares of restricted stock in October 2003 in consideration for

both past and future services to the Company. The restrictions on those shares

lapse in equal amounts over the five years following the execution of the

employment agreements. The agreements also provide for minimum option and

restricted stock grants to the Leenhoutses. The minimum amount of options to be

granted to each of the Leenhoutses is 25,000 in 2005 and 16,665 in 2006. The

minimum number of shares of restricted stock to be granted to each is 5,000 in

2005 and 3,333 in 2006. The Leenhoutses each were granted 5,000 shares of

restricted stock in 2005. No determination has been made yet with respect to

2006 grants.

The employment agreements also provide that if employment is terminated by

the Company without cause, or by the Leenhoutses for good reason at any time,

each of the Leenhouts is entitled to receive an amount equal to twice his base

salary and incentive compensation for the year preceding termination plus, in

the year following termination, the amount of incentive compensation that he

would have earned if he had been an employee on December 31 of the year of

termination. In such event, the Leenhoutses would also receive the minimum

number of restricted shares yet to be issued under the employment agreements as

well as the value of the options not yet granted. In addition, all options

previously granted to them would vest and the restrictions would lapse on all

restricted stock held by them. Pursuant to their employment agreements, each of

Norman and Nelson Leenhouts are subject to a covenant not to compete with the

Company during the term of the agreements and, if either is terminated by the

Company for cause or resigns without good reason, for two years thereafter.

In addition, Nelson Leenhouts recently entered into a Development Agreement

with the Company whereby he agrees to perform certain additional functions

related to the development activities of the Company. That agreement is

described in more detail on page 27 of this Proxy Statement.

Incentive Compensation Plan

Under the Company's Incentive Compensation Plan as in effect for 2005 and

2006, eligible officers and key employees could earn a cash bonus based on two

metrics: (1) year over year growth in the Company's FFO per share/unit (computed

on a diluted basis); and (2) percentage of growth in the Company's same store

net operating income ("NOI") from the prior year as compared to its peer group

performance for the same period. Certain non-recurring items are removed from

published FFO results for purposes of making the bonus calculation. In

calculating the bonus units, the FFO component receives 75% weighting and the

NOI component receives 25% weighting.

In the event the Company experiences financial performance in either of the

metrics below the established floor or above the established ceiling, the

Compensation Committee has complete discretion in determining bonus unit award

levels that it will recommend for the Board's approval.

To calculate the actual bonus amount payable to each participant, the

number of bonus units is multiplied by a factor that is assigned to each

participant. That product is then multiplied by each participant's salary to

calculate the bonus payable to them.

The entire amount of the bonus otherwise payable to the Chief Executive

Officer is payable in the discretion of the Compensation Committee and 50% of

the bonus otherwise payable to other participants is payable in the discretion

of senior management.

Incentive Plan participants in the 1% and 2% bonus categories are limited

to bonuses equal to 10% and 20%, respectively, of their salaries. There is no

limit for participants in the 3% bonus category and above, except there is a

deferral component if the number of bonus units awarded exceeds eight bonus

units. For 2005, 5.425 bonus units were awarded. No changes to the Incentive

Compensation Plan are anticipated in 2006.

Deferred Bonus Plan

Eligible employees can elect to defer up to 100% of their bonus under the

Incentive Compensation Plan for three, five or ten years. The Company matches

10% of the amount deferred, which amount vests after three years. A "phantom"

stock account is established for both amounts. Each deferral and Company

contribution is reflected by crediting those accounts with the number of shares

of the Company's Common Stock that could be purchased with the amounts deferred

and contributed at the Common Stock's fair market value as of the day when the

bonus would otherwise have been paid. The equivalent of dividends on those

shares is also credited to the accounts at the time dividends are paid on the

Company's Common Stock. Shares that could be purchased with the hypothetical

dividends are credited to accounts at the same price that shares are purchased

for participants under the dividend reinvestment feature of the Company's DRIP.

Payments out of deferred accounts, upon vesting or otherwise, are made by

issuance of Common Stock, except in the event of payment by reason of a change

in control in which event payment may be made in cash or by issuance of Common

Stock at the election of the Compensation Committee.

This plan was adopted in 1998 and has not been submitted to the

stockholders for approval. It provides for the issuance of 100,000 shares. As of

December 31, 2005, 72,320 shares have been issued or reserved for issuance under

this plan.

Under the Deferred Bonus Plan, the Named Officers collectively deferred

approximately $310,000 of their 2005 bonuses.

Executive Retention Plan

The Company's Executive Retention Plan provides for severance benefits and

other compensation to be received by certain employees, including the executive

officers, in the event of a change of control of the Company and a subsequent

termination of their employment by the employer without cause or by the employee

for good reason at any time following the change of control and, with respect to

the executive officers, for any reason for a thirty day window following the one

year anniversary of the change of control. Under this Plan, the executive

officers, in the event of a termination covered by the Plan, would receive a

lump sum payment equal to two times their current base salary, two times their

last paid bonus under the Incentive Compensation Plan plus a "gross-up" amount

necessary to pay any excise tax due on the payment. In addition, all accrued or

deferred bonuses under the Incentive Compensation Plan would be paid, all stock

options would vest and the restrictions on all restricted stock would lapse

automatically.

Compensation Committee Interlocks and Insider Participation in Compensation

Decisions

During the fiscal year 2005, the Compensation Committee was comprised of

William Balderston, III, Roger Kober and Clifford W. Smith, Jr. None of the

above individuals has ever been an officer of the Company or any of its

subsidiaries.

Compensation Committee Report on Executive Compensation

The Compensation Committee administers the Company's executive compensation

program, as well as broad based compensation plans for the Company's other

officers and employees. In this regard, the role of the Committee is to oversee

all compensation plans and policies and to administer the Company's stock option

plans (including reviewing and approving stock option grants and other awards to

executive officers). On an ongoing basis, the Committee also reviews and

approves the Company's goals and objectives relevant to compensation of the

executive officers and considers the structure of the Company's compensation

program as it applies to all employees. When appropriate, the Committee

recommends to the full Board changes to the executive and the general

compensation plans. In addition, on an annual basis, the Committee also makes

specific annual compensation recommendations to the Board relating to the

Company's Chief Executive Officer and generally approves the compensation for

the other executive officers.

The Compensation Committee consists solely of independent directors. The

Committee meets on at least a quarterly basis and more often as appropriate. The

Committee Chair reports on Committee actions and recommendations at Board

meetings. The Committee's Charter reflects the various responsibilities of the

Committee and the Board periodically reviews and revises the Committee's

Charter.

The Company's human resources team supports the Committee and its work and,

in some cases, acts pursuant to delegated authority to fulfill various functions

in administering the Company's compensation programs. In addition, the Committee

has the authority to engage the services of outside advisors and experts to

assist the Committee.

Compensation Philosophy. The Company's compensation philosophy is designed

to support its primary goal of creating long-term value for its stockholders.

The Committee continues to believe that the success of the Company in achieving

that goal is, in large part, attributable to the performance and dedication of

its employees and, in particular, to the leadership efforts of its executive

officers. The Committee also continues to believe that it is important that the

interests of its executives and other employees are aligned closely with the

interests of the Company's stockholders.

Compensation Objectives. The Committee's objectives for the Company's

compensation program continue to be to: (i) attract and retain highly capable

employees by offering a competitive total compensation package; (ii) link

compensation to the operating and financial performance of the Company; and

(iii) provide appropriate incentives to motivate employees to maximize the

long-term going-concern value of the Company.

Components of Compensation. The Company's executive compensation program

consists of three components: base salary, annual incentive compensation in the

form of a bonus under the Incentive Compensation Plan, and awards of restricted

stock and stock options under the Company's stock benefit plans. It is the

Committee's practice to provide a balanced mix of cash and equity based

compensation that the Committee believes appropriate to align the short and

long-term interests of the Company's executives with that of its stockholders

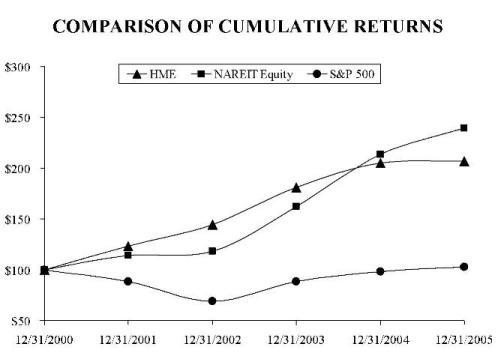

and to encourage executives to act as equity owners of the Company. When the