- GBX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

The Greenbrier Companies, Inc. (GBX) DEF 14ADefinitive proxy

Filed: 14 Nov 18, 6:05am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant☑

Filed by a Party other than the Registrant☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

The Greenbrier Companies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| ||

| (2) | Aggregate number of securities to which transaction applies: | |

| ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| ||

| (4) | Proposed maximum aggregate value of transaction: | |

| ||

| (5) | Total fee paid: | |

| ||

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| ||

| (2) | Form, Schedule or Registration Statement No.: | |

| ||

| (3) | Filing Party: | |

| ||

| (4) | Date Filed: | |

| ||

2019 The Greenbrier Companies Notice of Annual Meeting of Shareholders & Proxy Statement

LETTER TO OUR SHAREHOLDERS

“2018 WAS AN EXCITING YEAR FOR GREENBRIER. WE DELIVERED STRONG PERFORMANCE AND MUCH WAS ACCOMPLISHED. LOOKING FORWARD, WE WILL CONTINUE TO FOCUS ON DELIVERING SHAREHOLDER VALUE, AND POSITIONING THE COMPANY FOR LONG-TERM GROWTH.”

William A. Furman Chairman, Chief Executive Officer and President November 2018

|

|

| Letter to Our Shareholders |

To Our Shareholders:

On behalf of our Board of Directors, I am pleased to invite you to attend the 2019 Annual Meeting of Shareholders at 2:00 p.m. on Wednesday, January 9, 2019. The meeting will be held at the Benson Hotel located in Portland, Oregon. The annual meeting will include an update on our business operations and a discussion of other important matters. We hope you can attend and look forward to seeing you there.

Our values and culture are the foundation for our strong performance and transformative growth over the last five years

When we were a much smaller enterprise, I defined the core values to guide Greenbrier, including quality, integrity, respect for people, safety and customer commitment. As we have grown we strive to maintain these values that have long defined us. We believe an enduring commitment to these values is essential to Greenbrier’s long-term growth. Success in a manufacturing environment cannot be sustained without daily focus on keeping our employees safe and healthy. Serving our customers by designing and delivering high-quality products and services is another manifestation of our values.

Our Board is actively engaged in Greenbrier’s strategic direction

At Greenbrier, strong corporate governance is foundational to our success. A highly engaged Board of Directors helps Greenbrier test our understanding of our markets and industry trends. The Board meets annually to review the Company’s strategic plan. This year, the Board traveled to several of our worldwide locations to deepen their understanding of our customers, markets, and the cultures where we operate. Active engagement by the Board enables Greenbrier to refine our strategic direction to optimize long-term growth while maximizing current opportunities.

Our growth continues to be guided by diversity of thought, expression and background

Diversity helps business, society and individuals meet our highest potential. Greenbrier maintains a culture of diversity and works with others who share this commitment. Greenbrier’s company-wide talent development initiative emphasizes the importance of workplace diversity. Diversity is not limited to people. While maintaining focus on our key North American market, we continue to pursue new opportunities in geographically and culturally diverse markets around the world. Our growing worldwide footprint and international operations requires heightened cultural awareness from our Board and management team. International diversity allows us to better serve our customers and shareholders in many ways: supplementing our product offerings, accessing new markets and introducing new ideas and viewpoints.

We are committed to continuing engagement with our stakeholders

Greenbrier’s pursuit of growth and innovation is the result of committed focus on what has guided our success until now. This includes unwavering dedication to our customers, shareholders, employees and communities. We regularly engage with customers, attend investor conferences, hold quarterly employee meetings, take an active leadership role in industry associations and contribute our time and resources to community improvement efforts. Greenbrier maintains a commitment to meaningful interactions with our stakeholders. Over time we have emerged as one of the most trusted and respected firms in the freight rail transportation industry. This respect has made us the second-largest freight railcar builder in North America and the largest in South America and Europe. We work to earn this respect and be worthy of it, each day of the year.

Your vote is important

Whether or not you can attend the annual meeting in person, and no matter how many shares you own, please vote your shares as soon as possible. Your vote is very important. You may vote via the internet, by mail or by telephone following the instructions provided in the proxy statement.

On behalf of our Board of Directors and the entire Greenbrier team, we thank you for your continued support.

Sincerely,

William A. Furman

Chairman, Chief Executive Officer and President

November 2018

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

2019 ANNUAL MEETING INFORMATION

|  |  |  | |||

Meeting Date: Wednesday January 9, 2019 | Meeting Place: Benson Hotel 309 SW Broadway Portland, Oregon | Meeting Time: 2:00 p.m. (Pacific Time) | Record Date: November 7, 2018 |

PROXY VOTING

Your vote is very important. Whether or not you plan to attend the Annual Meeting in person, please promptly vote by telephone or over the Internet, or by completing, signing, dating and returning your proxy card or voting instruction form so that your shares will be represented at the Annual Meeting.

| IN PERSON

|

| ONLINE

|

| BY PHONE

|

| BY MAIL

|

Our Notice of Annual Meeting, Proxy Statement and Annual Report for the fiscal year ended August 31, 2018 are available atwww.edocumentview.com/GBX.

The Annual Meeting will be webcast live on our website atwww.gbrx.com under “Investors”—“Events” beginning at 2:00 p.m. Pacific Time on January 9, 2019. The Annual Meeting is being held for the purpose of voting on the items set forth below and to transact such other business as may properly come before the meeting.

ITEMS TO BE VOTED ON

|

—

|

|

Page 4

| |||

|

—

|

Advisory Approval of Executive Compensation

|

Page 16

| |||

|

—

|

Approval of Amendment to 2014 Employee Stock Purchase Plan

|

Page 40

| |||

|

—

|

Ratification of Appointment of Independent Auditors

|

Page 42

| |||

As of the date of this notice, the Company has not received notice of any matters, other than those set forth above, that may properly be presented at the Annual Meeting. If any other matters are properly presented for consideration at the meeting, the persons named as proxies on the proxy card, or their duly constituted substitutes, are authorized to vote the shares represented by proxy or otherwise act on those matters in accordance with their judgment.

Holders of record of our Common Stock at the close of business on November 7, 2018 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof.

By Order of the Board of Directors,

Sherrill A. Corbett Secretary November 14, 2018 |

| PROXY SUMMARY | 1 | |||

| ELECTION OF DIRECTORS (PROPOSAL 1) | 4 | |||

| BOARD COMPOSITION | 5 | |||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 9 | ||||

| CORPORATE GOVERNANCE | 10 | |||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| ENVIRONMENTAL, SOCIAL AND GOVERNANCE PRIORITIES | 15 | |||

| ADVISORY APPROVAL OF EXECUTIVE COMPENSATION (PROPOSAL 2) | 16 | |||

| EXECUTIVE COMPENSATION | 17 | |||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

PROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information you should consider. Please read this entire proxy statement carefully before voting. This proxy is first being released to shareholders on November 14, 2018.

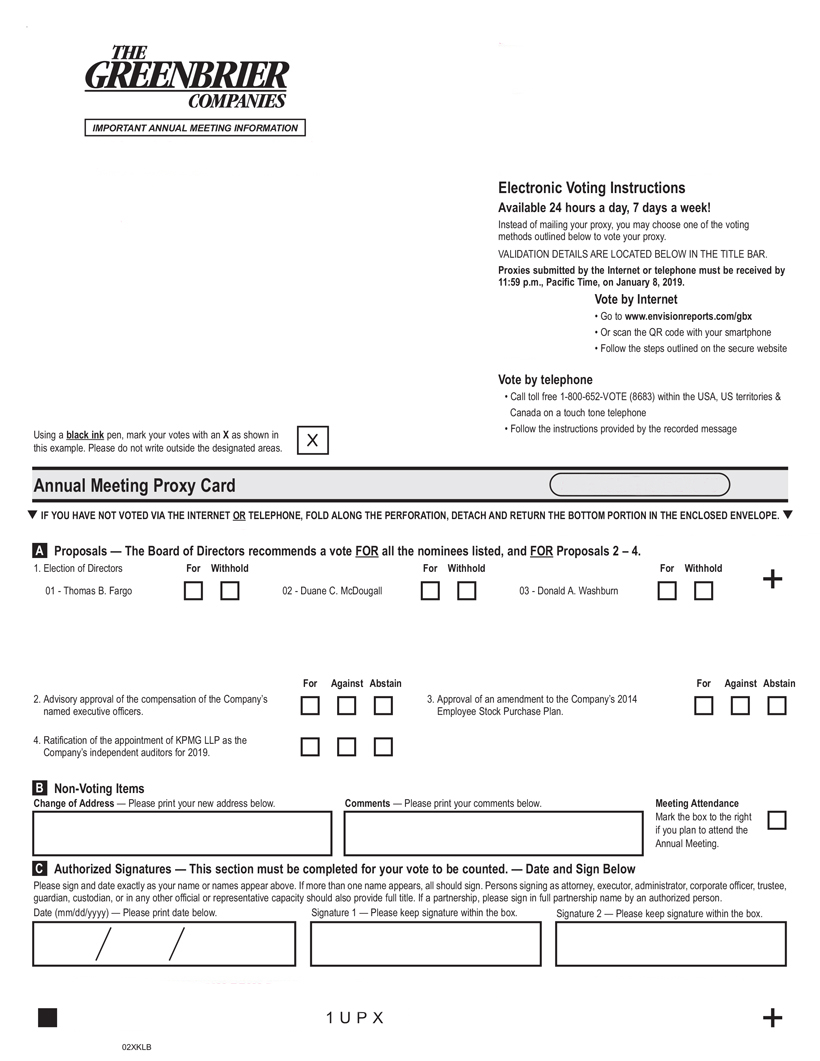

PROPOSAL 1 Election of Directors |

|

|

The Board recommends a vote FOR all Director Nominees

Our Nominating and Corporate Governance Committee and our Board recommend that shareholders vote “FOR” all director nominees as they have determined that each of the nominees possesses the right experience and qualifications to effectively oversee Greenbrier’s business strategy and risk management. All of the nominees are independent and all of the nominees are nominated for a three-year term.

|

| ||||

| See “Proposal 1, Election of Directors” beginning on page 4 of this Proxy Statement.

| |||||||

DIRECTOR NOMINEES

Name

| Primary Occupation & Other Directorships

| Age

|

Director Since

|

Committee Memberships

| ||||

Thomas B. Fargo |

Retired Military Commander

Directorships: Huntington Ingalls Industries (Chairman), Hawaiian Electric Industries, Matson

|

70 |

2015 |

C Chair G | ||||

Duane C. McDougall, Lead Director |

Retired Chairman & CEO

Directorships: Boise Cascade, LLC

|

66 |

2003 |

A,F C G | ||||

Donald A. Washburn | Private Investor and former Executive

Directorships: Amedisys, Inc. (Chairman), LaSalle Hotel Properties (Trustee)

|

74 |

2004 |

A C G |

| A Audit Committee | C Compensation Committee | G Governance Committee | F Audit Committee Financial Expert |

Director Nominee Highlights

Our Board is pleased at the high caliber of our director nominees. All nominees are independent according to our heightened standard of independence and two of the three nominees hold leadership positions on the Board. Mr. McDougall serves as Lead Director and Admiral Fargo as Chair of the Compensation Committee. Mr. Washburn is our most recent outgoing Chair of the Governance Committee. Together, the nominees have a complementary balance of skills and experience that add to the broad strengths of the Board, including:

| • | Public company CEO experience |

| • | Legal experience |

| • | Public company board service |

| • | Military leadership |

| • | Public policy experience |

| • | International business experience |

| • | Financial training and expertise |

| • | Audit committee financial expert |

| • | Risk management knowledge and experience |

THE GREENBRIER COMPANIES |

2019 Proxy Statement |

1

| ||||||

Proxy Summary |

Corporate Governance Highlights

Our corporate governance policies reflect best practices.

Independent Oversight |

• |

Greenbrier’s Board is composed of eight independent directors and our CEO andco-founder Bill Furman | ||||

• |

All eight independent directors meet the NYSE and SEC standards for independence | |||||

• |

Seven of the eight independent directors, including all committee members, committee Chairs, and the Lead Director, meet a heightened standard of independence |

| ||||

• |

Regular executive sessions of independent directors are held at Board and committee meetings | |||||

• |

The Board actively oversees strategy and risk management

| |||||

Board Refreshment |

•

• |

Appointed four new directors since 2014 to replace outgoing directors

The Board promotes ongoing director education | ||||

• |

Board succession planning is an ongoing process with a focus on diversity and mix of tenure of directors | |||||

• |

There is an ongoing process to identify highly qualified candidates for Board service | |||||

• |

Annual Board and committee self-assessments are conducted | |||||

• |

Directors cannot stand for election after reaching age 77

| |||||

High Governance Standards |

•

• |

Committed to shareholder engagement

Our Code of Business Conduct and Ethics is applicable to all directors and executives | ||||

• |

Average attendance of directors at Board and committee meetings exceeds 97% over the last five years | |||||

• |

Director and executive stock ownership requirements are maintained | |||||

• |

Annual review of all directors’ independence | |||||

• |

Hedging of Company stock by directors and executives is prohibited |

PROPOSAL 2 Advisory Approval |

|

The Board recommends a vote FOR this proposal

Our Board recommends that shareholders vote “FOR” the advisory approval of the compensation of our named executive officers for fiscal year 2018.

| ||||||

| See “Proposal 2, Advisory Approval of Executive Compensation” beginning on page 16 of this Proxy Statement.

| |||||||

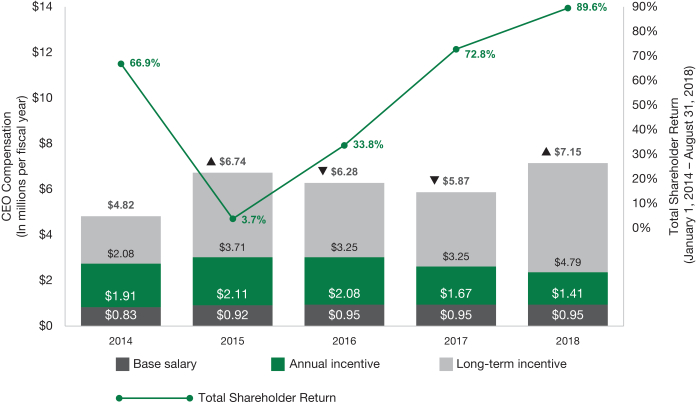

Executive CompensationAt-a-Glance

At our 2018 Annual Meeting, roughly 95% of shareholders who voted cast votes in favor of approving the compensation of our named executive officers. With shareholder feedback we have continued to modify our compensation practices by extending the measurement period for long-term incentives from 30 months to 36 months and by adding a relative performance metric.

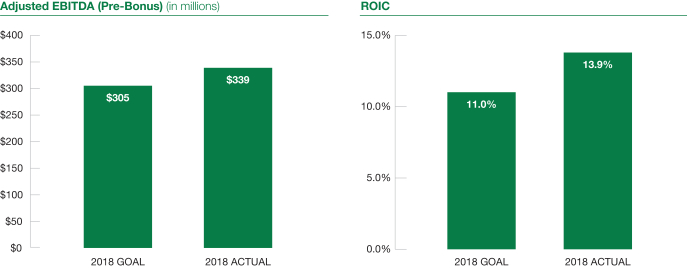

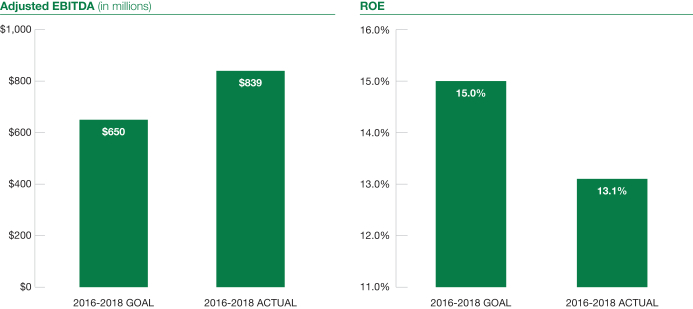

2018 Performance Highlights

Greenbrier delivered strong performance in fiscal year 2018. Below are a few of the measures used in our executive incentive compensation programs.

| Annual Adjusted EBITDA (Pre-Bonus) $339MILLION Goal: $305 million

|

| Return On Invested Capital (ROIC) 13.9% Goal: 11%

|

| 30-Month Cumulative EBITDA $839 MILLION Goal: $650 million

|

We also made significant progress against our strategic priorities included by the Board in our incentive compensation plan: the talent pipeline initiative and the integration of international operations in Europe and Brazil.

2

|

2019 Proxy Statement |

THE GREENBRIER COMPANIES |

| |||||

| Proxy Summary |

Compensation Highlights

The Company’s strong results in fiscal year 2018 reflect the intended design of ourpay-for-performance program. These results translated into payouts on incentive awards for named executive officers that were above goal targets for fiscal year 2018.

| ANNUAL INCENTIVE | 2018 AWARD | PAYOUT (% above target) | ||||||||||||||

| 1-year performance period | Greenbrier achieved strong operating performance as we met or exceeded most of the financial goals we set for the year. | +30% | AVERAGE FOR ALL NEOS | ||||||||||||

| LONG-TERM INCENTIVE | 2018 PERFORMANCE AWARD VESTING | PAYOUT (% above target) | ||||||||||||||

| 30 month performance period

| Greenbrier also performed above target performancelevels over the 2016 - 2018 performanceperiodresulting in payouts above goal targets. | +15% | AVERAGE FOR ALL NEOS | ||||||||||||

PROPOSAL 3 Approval of Amendment to 2014 Employee Stock Purchase Plan |

|

The Board recommends a vote FOR this proposal

Our Board recommends that shareholders vote “FOR” approval of the Amendment to the 2014 Employee Stock Purchase Plan. This amendment extends the 2014 Employee Stock Purchase Plan for an additional five years.

| ||||||

| See “Proposal 3, Approval of Amendment to 2014 Employee Stock Purchase Plan” beginning on page 40 of this Proxy Statement.

| |||||||

Highlights of Employee Stock Purchase Plan

Our Employee Stock Purchase Plan (“ESPP”) is a valuable incentive that allows employees to use payroll deductions to purchase shares of the Company’s common stock. Matching contributions by the Company result in a 15% purchase price discount for employees.

NON-DILUTIVE IMPLEMENTATION

|

SUPPORTS TALENT INITIATIVE

| |||||||||||

Purchases of stock under our ESPP are made on the open market so as to avoid dilution.

|

Our ESPP contributes to our employment goals in several ways: it is an employee recruitment and retention tool for the Company, and it aligns our employee interests with shareholder interests by encouraging employees to become shareholders.

|

PROPOSAL 4 Ratification of Appointment of Auditors |

|

The Board recommends a vote FOR this proposal

Our Board recommends that shareholders vote “FOR” ratification of the appointment of KPMG LLP as auditors for fiscal year 2019.

| ||||||

| See “Proposal 4, Ratification of Appointment of Auditors” beginning on page 42 of this Proxy Statement.

| |||||||

THE GREENBRIER COMPANIES |

2019 Proxy Statement |

3

| ||||||

ELECTION OF DIRECTORS

The three nominees recommended by our Nominating and Corporate Governance Committee and by the Board of Directors for election as Class I directors are Thomas B. Fargo, Duane C. McDougall and Donald A. Washburn. The nominees are nominated to serve until the Annual Meeting of Shareholders in 2022, or until their respective successors are elected and qualified. If a nominee is unable or unwilling to serve as a director at the date of the Annual Meeting or any adjournment or postponement thereof, the proxies may be voted for a substitute nominee, designated by the proxy holders or by the present Board of Directors to fill such vacancy, or for the other nominees named without nomination of a substitute, or the number of directors may be reduced accordingly. The Board of Directors has no reason to believe that any of the nominees will be unwilling or unable to serve if elected a director.

Under Oregon law, the directors who receive the greatest number of votes cast will be elected directors. Abstentions and brokernon-votes will have no effect on the results of the vote.

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE ELECTION OF ADMIRAL FARGO, MR. MCDOUGALL AND MR. WASHBURN. UNLESS MARKED OTHERWISE, PROXIES RECEIVED WILL BE VOTEDFOR THE ELECTION OF THE THREE NOMINEES.

|

Directors are divided into three classes, with an equal number of directors in each class. One class is elected each year for a three-year term. The following table sets forth certain information about each nominee for election to the Board and each continuing director.

Name | Age | Independent | Positions | Director Since | Committee Memberships | Expiration of Term | ||||||||||||||||||

Nominees /Class I Directors | ||||||||||||||||||||||||

Thomas B. Fargo | 70 |  | Director | 2015 | C Chair, G | 2019 | ||||||||||||||||||

Duane C. McDougall | 66 |  | Director and Lead Director | 2003 | A, C, F, G | 2019 | ||||||||||||||||||

Donald A. Washburn | 74 |  | Director | 2004 | A, C, G | 2019 | ||||||||||||||||||

Class IIDirectors | ||||||||||||||||||||||||

Wanda F. Felton | 60 |  | Director | 2017 | A, G | 2020 | ||||||||||||||||||

Graeme A. Jack | 67 |  | Director | 2006 | A Chair, C, F, G | 2020 | ||||||||||||||||||

David L. Starling | 68 |  | Director | 2017 | C, G | 2020 | ||||||||||||||||||

Class IIIDirectors | ||||||||||||||||||||||||

William A. Furman | 74 | | Chairman of the Board, Chief Executive Officer and President | | 1981 | 2021 | ||||||||||||||||||

Charles J. Swindells | 76 |  | Director | 2005 | 2021 | |||||||||||||||||||

Kelly M. Williams

|

| 54

|

|

|

|

|

| Director

|

|

| 2015

|

|

| A, G Chair

|

|

| 2021

|

| ||||||

Independent A Audit Committee C Compensation Committee F Audit Committee Financial Expert G Nominating and Corporate Governance Committee

Independent A Audit Committee C Compensation Committee F Audit Committee Financial Expert G Nominating and Corporate Governance Committee

4

|

2019 Proxy Statement |

THE GREENBRIER COMPANIES |

| |||||

Our Board is composed of eight independent directors and our CEO andco-founder, Bill Furman. Below we have highlighted key areas of experience that qualify each director to serve on the Board. The Board has determined it is in the best interests of the Company and its shareholders for each director to continue serving on the Board subject to shareholder approval of each nominee at the Annual Meeting.

Thomas B. Fargo |

AGE:70 POSITION:Director and Chair of the Compensation Committee |

DIRECTOR SINCE: 2015

CURRENT TERM | EXPERIENCE: Admiral Fargo has served as a member of the Board since 2015. Admiral Fargo is a retired military commander with subsequent private sector experience in maritime and other transportation industries. As commander of the U.S. Pacific Command from 2002 until 2005, Admiral Fargo led the world’s largest unified command while directing the joint operations of the Army, Navy, Marine Corps and Air Force. In this role Admiral Fargo acted as U.S. military representative for collective defense arrangements in the Pacific, ultimately responsible to the President and the Secretary of Defense through the chairman, Joint Chiefs of Staff. Admiral Fargo’s naval career included six tours in Washington, D.C. and extensive duties in the Pacific, Indian Ocean and Middle East including serving as Commander-in-Chief of the U.S. Pacific Fleet and Commander of the Naval Forces of the Central Command. Admiral Fargo serves as Chairman of Huntington Ingalls Industries, America’s largest military shipbuilder, and on the Boards of Directors for Hawaiian Electric Industries, Matson and United States Automobile Association. Previously, he served on the Boards of Northrop Grumman Corporation, Alexander & Baldwin, Inc. and Hawaiian Airlines.

QUALIFICATIONS: Admiral Fargo brings executive leadership, operational and international expertise to the Board.

|

Wanda F. Felton |

AGE:60 POSITION:Director |

DIRECTOR SINCE: 2017

CURRENT TERM EXPIRATION:2020 | EXPERIENCE: Ms. Felton has served as a member of the Board since 2017. Ms. Felton has over 30 years of financial industry experience in commercial and investment banking. Ms. Felton was a Presidential Appointee, twice confirmed by the U.S. Senate to serve on the board of the Export Import Bank of the United States as Vice Chair of the Board and First Vice President from June 2011 to November 2016. In that role, she was on a team of economic deputies that advised the National Security Staff and the President’s Export Council. Ms. Felton was actively engaged in helping U.S. companies penetrate international markets and develop pragmatic financing solutions to win sales. Ms. Felton had oversight responsibility for the Office of the Chief Financial Officer and enterprise risk management functions, and served on the bank’s credit committee, which is responsible for approving debt financings over $10 million for a broad range of financing types across a range of industries. A significant portion of such financings supported the export of U.S.-manufactured transportation equipment, including rail equipment and aircraft, to emerging markets. Ms. Felton serves as a Trustee of The Cooper Union for the Advancement of Science and Art.

QUALIFICATIONS: Ms. Felton brings her significant prior experience with emerging markets business development and capital raising to the Board.

|

William A. Furman |

AGE:74 POSITIONS:Chairman of the Board of Directors, Chief Executive Officer and President |

DIRECTOR SINCE: 1981

CURRENT TERM EXPIRATION:2021 | EXPERIENCE: Mr. Furman has served as a member of the Board since 1981 and as the Company’s Chief Executive Officer since 1994. He has served as the Chairman of the Board of Directors since January 2014. Mr. Furman has been associated with the Company and its predecessor companies since 1974. Prior to 1974, Mr. Furman was Group Vice President for the Leasing Group of TransPacific Financial Corporation. Earlier he was General Manager of the Finance Division of FMC Corporation. Mr. Furman formerly served as a director of Schnitzer Steel Industries, Inc., a steel recycling and manufacturing company.

QUALIFICATIONS: As a founder of the Company,Mr. Furman brings executive management and railcar industry experience to the Board as well as historical perspective on the Company’s origins and evolution.

|

THE GREENBRIER COMPANIES |

2019 Proxy Statement |

5

| ||||||

Board Composition |

Graeme A. Jack |

AGE:67 POSITION:Director and Chair of the Audit Committee |

DIRECTOR SINCE: 2006

CURRENT TERM EXPIRATION:2020 | EXPERIENCE: Mr. Jack has served as a member of the Board since 2006. He is a retired partner of PricewaterhouseCoopers LLP in Hong Kong. Mr. Jack is an independent non-executive director of COSCO Shipping Development Company Limited, the trustee manager of Hutchison Port Holdings Trust and Hutchison China Meditech Limited.

QUALIFICATIONS: Mr. Jack brings accounting and financial reporting expertise to the Board as well as extensive experience in international business transactions in Asia generally and in China in particular.

|

Duane C. McDougall |

AGE:66 POSITIONS:Director and Lead Director |

DIRECTOR SINCE: 2003

CURRENT TERM EXPIRATION:2019 | EXPERIENCE: Mr. McDougall has served as a member of the Board since 2003 and as Lead Director since 2014. Mr. McDougall served as Chairman and Chief Executive Officer of Boise Cascade, LLC, a privately held manufacturer of wood products, from December 2008 to August 2009. He was President and Chief Executive Officer of Willamette Industries, Inc., an international forest products company, from 1998 to 2002. Prior to becoming President and Chief Executive Officer, he served as Chief Accounting Officer during his23-year tenure with Willamette Industries, Inc. He also served as Chairman of the Board of Boise Cascade until April 2015 and still serves as a director on the Board and also serves as a Director of StanCorp Financial Group, which was acquired in March 2016 by a Japanese company, Meiji Yasuda Life Insurance Company. Mr. McDougall has also served as a Director of West Coast Bancorp, a position from which he resigned effective December 31, 2011; as a Director of Cascade Corporation until its sale in 2013; and as a Director of several non-profit organizations.

QUALIFICATIONS: Mr. McDougall brings executive leadership and accounting and financial reporting expertise to the Board.

|

David L. Starling |

AGE:68 POSITION:Director |

DIRECTOR SINCE: 2017

CURRENT TERM EXPIRATION:2020 | EXPERIENCE: Mr. Starling has served as a member of the Greenbrier Board of Directors since 2017. Mr. Starling also serves as Chairman of the Board of Ports America, the largest port and terminal operator in the United States. Additionally, Mr. Starling is a Senior Advisor for Oaktree Infrastructure Fund, with nearly $2.5 billion assets under management, and a part of Oaktree Capital Management. The Fund invests in companies that provide products and services to support infrastructure assets. Previously, Mr. Starling served as Director, President and Chief Executive Officer of Kansas City Southern (KCS), a Class I railroad, from 2010 to 2016. He served as President and Chief Operating Officer of KCS from 2008 to 2010. Prior to that, he was Vice Chairman of the Board of Directors of Kansas City Southern de Mexico. Mr. Starling has served as Vice Chairman of the Board of Directors of Panama Canal Railway Company and Panarail. Before joining KCS, Mr. Starling served as President and Director General of Panama Canal Railway Company from 1999 through 2008.

QUALIFICATIONS: Mr. Starling’s more than 40 years of operating experience provides Greenbrier’s Board with unique railroading expertise in both North America and international markets.

|

6

|

2019 Proxy Statement |

THE GREENBRIER COMPANIES |

| |||||

Charles J. Swindells |

AGE:76 POSITION:Director |

DIRECTOR SINCE: 2005

CURRENT TERM EXPIRATION:2021 | EXPERIENCE: Mr. Swindells has served as a member of the Board since 2005. He also provides consulting services to the Company on international projects. Mr. Swindells is currently engaged as an advisor to Bessemer Trust, an independent provider of investment management and wealth planning to families and individuals. Mr. Swindells served as the Vice Chairman, Western Region of U.S. Trust, Bank of America, Private Wealth Management from August 2005 to January 2009. Mr. Swindells served as United States Ambassador to New Zealand and Samoa from 2001 to 2005. Before becoming Ambassador, Mr. Swindells was Vice Chairman of US Trust Company, N.A.; Chairman and Chief Executive Officer of Capital Trust Management Corporation; and Managing Director/Founder of Capital Trust Company. He also served as Chairman of World Wide Value Fund, a closed-end investment company listed on the NYSE. Mr. Swindells was one of five members on the Oregon Investment Council overseeing the $20 billion Public Employee Retirement Fund Investment Portfolio and was a member of numerous non-profit boards of trustees, including serving as Chairman of the Board for Lewis & Clark College in Portland, Oregon.

QUALIFICATIONS: Mr. Swindells brings financial and global business expertise to the Board.

|

Donald A. Washburn |

AGE:74 POSITION:Director |

DIRECTOR SINCE: 2004

CURRENT TERM EXPIRATION:2019 | EXPERIENCE: Mr. Washburn has served as a member of the Board since 2004. Mr. Washburn is a private investor. Mr. Washburn served as Executive Vice President of Operations of Northwest Airlines, Inc., an international airline, from 1995 to 1998. Mr. Washburn also served as Chairman and President of Northwest Cargo from 1997 to 1998. Prior to becoming Executive Vice President, he served as Senior Vice President for Northwest Airlines, Inc. from 1990 to 1995. Mr. Washburn served in several positions from 1980 to 1990 for Marriott Corporation, an international hospitality company, most recently as Executive Vice President. He also serves as Chairman of the Board of Amedisys, Inc., and serves as a trustee of LaSalle Hotel Properties as well as privately held companies and non-profit corporations. Mr. Washburn received his BBA, cum laude, from Loyola University of Chicago, an MBA from Northwestern University’s Kellogg School of Management and a J.D., cum laude, from Northwestern University’s Pritzker School of Law. He has continued his professional education in business and law attending Harvard Business School, Stanford Law School, Kellogg School of Management, Wharton Business School at the University of Pennsylvania and industry seminars, including the Boardroom Summit and Stanford Director’s College.

QUALIFICATIONS: Mr. Washburn brings executive management and operational expertise to the Board.

|

Kelly M. Williams |

AGE:54 POSITION:Director and Chair of the Nominating and Corporate Governance Committee |

DIRECTOR SINCE: 2015

CURRENT TERM EXPIRATION:2021 | EXPERIENCE: Ms. Williams has served as a member of the Board since 2015. Ms. Williams is a senior advisor of GCM Grosvenor Private Markets. Until June 1, 2015 Ms. Williams was President of GCM Grosvenor Private Markets, a member of its Management Committee and a member of its Investment Committee. Prior to joining GCM Grosvenor, Ms. Williams was a Managing Director, the Group Head and the chair of the compensation committee of the Customized Fund Investment Group of Credit Suisse Group AG from 2000 through 2013, after Credit Suisse acquired Donaldson, Lufkin and Jenrette, where Ms. Williams was Director of the Customized Fund Investment Group. While serving as Group Head of the Customized Fund Investment Group of Credit Suisse Group AG, she also chaired its Compensation Committee. She was with The Prudential Insurance Company of America from 1993 to 2000, where she was an Executive Director and a founder of the Customized Fund Investment Group in 1999. Prior to joining Prudential, Ms. Williams was an associate with Milbank, Tweed, Hadley & McCloy LLP, where she specialized in global project finance. She graduated magna cum laude from Union College in 1986 with a Bachelor of Arts degree in Political Science and Mathematics and received her Juris Doctor from New York University School of Law in 1989. Ms. Williams serves in leadership positions on the boards of several non-profits, and has won numerous awards for leadership and public service. In addition, Ms. Williams was named as one of The Most Powerful Women in Finance by American Banker Magazine from 2011- 2014. Ms. Williams also serves as a board member of a number of non-profit institutions, President of the Nantucket Historical Association, and as a board member of Union College.

QUALIFICATIONS: Ms. Williams brings executive management, financial and investment expertise to the Board.

|

THE GREENBRIER COMPANIES |

2019 Proxy Statement |

7

| ||||||

| Board Composition |

Board Composition |

We believe our Board best serves the Company and its shareholders when there is a balance between fresh perspectives and longer serving directors who bring continuity in a cyclical business. To promote thoughtful board refreshment we have:

| • | Appointed four new directors since 2014 to replace outgoing directors |

| • | Appointed two of the four recently appointed directors to serve in committee leadership positions: Admiral Fargo as Chair of the Compensation Committee and Ms. Williams as Chair of the Nominating and Corporate Governance Committee (the “Governance Committee”) |

| • | Adopted a policy that directors cannot stand for election after reaching age 77 |

| • | Updated the process for annual Board and committee reviews |

| • | Required that directors must meet a heightened standard of independence to serve on a committee |

In accordance with our governing documents, the Company has determined that a total of nine members on our Board of Directors is the most appropriate size at this time. The Company may adjust the size of the Board in the future as necessary to respond to changes in the Company’s scale, integration, size, capitalization and other factors.

The following are a few key metrics reflecting the balance of skills, qualifications and experience on our Board.

VARIED TENURE INTERNATIONAL EXPERIENCE MAJORITY INDEPENDENT |

| ||||||||||||||||||||||||||

Our Board is keenly focused on diversity as part of our company-wide talent development initiative, including at the Board and executive levels. The following provides an overview of our Board demographics.

| ||||||||||||||||||||||||||

| 2/9 WOMEN ON THE BOARD

|  | 1/9 MINORITIES ON THE BOARD

|  | 1/9 DIRECTORS BORN OUTSIDE THE U.S.

|  | 1/4 WOMEN IN BOARD LEADERSHIP POSITIONS

| |||||||||||||||||||

8

|

2019 Proxy Statement |

THE GREENBRIER COMPANIES |

| |||||

| Board Composition |

Experience Contributions

| Thomas

| Wanda

| William

| Graeme

| Duane

| David

| Charles

| Donald

| Kelly

| |||||||||

Public Company | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||

Financial Expertise | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||||

Rail/Transport/Industrial | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||||

Public Policy | 🌑 | 🌑 | 🌑 | 🌑 | ||||||||||||||

International | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||

Diversity Initiatives | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||

Legal Training | 🌑 | 🌑 | ||||||||||||||||

Risk Management | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||

Talent Development | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||

Government/Military | 🌑 | 🌑 | 🌑 | |||||||||||||||

CEO/President | 🌑 | 🌑 | 🌑 | 🌑 | 🌑 | |||||||||||||

The Governance Committee considers diversity of gender, race, ethnicity, gender identity and expression, age, cultural background, geographical and professional experience in evaluating candidates for membership on the Board. The Governance Committee believes that the backgrounds and qualifications of the directors, considered as a group, should provide a diverse mix of skills, knowledge, attributes and experiences that cover the spectrum of areas that affect the Company’s business. In general, the composition of the Board is diversified across financial, accounting, legal, operational and corporate governance expertise, as well as expertise within the Company’s business and industry, including experience in global markets, manufacturing, finance and rail. Candidates for director nominees are considered in the context of current perceived needs of the Board as a whole and the Governance Committee regularly assesses whether the mix of skills, experience and background of our Board is appropriate for the Company.

Director Continuing Education and Annual Evaluation

In addition to maintaining a comprehensive orientation program for all new directors, Greenbrier supports continuing education programs and performs annual evaluations to ensure the Board operates at the highest level. These measures contribute to increased levels of Board skills and knowledge and understanding of best practices and current trends. Led by the Governance Committee, the Board conducts an annual evaluation of itself, its committees and the directors, individually, to determine whether, in its judgment, the Board and its committees are functioning effectively. The Company is continually seeking to improve its performance including additional training when a director assumes a new leadership role. The Company pays the reasonable expenses of directors who attend continuing education programs.

Recommendations and Nominations for Directors

The Board, with the support of the Governance Committee, maintains a comprehensive process for the selection and nomination of directors.

In addition to specific skills and relevant experience required for the Board to be effective, all directors are expected to possess certain personal traits including:

| • | Personal qualities of leadership, character, judgment and adherence to the highest ethical standards |

| • | Whether a candidate is free of conflicts and has the time required for preparation, participation and attendance at meetings |

| • | Whether a candidate meets applicable standards of independence |

During fiscal year 2018, the Governance Committee focused on selecting and recommending director nominees for election at the Annual Meeting; developing and recommending corporate governance principles to guide the Company; and developing and overseeing programs for the evaluation of the Board, its committees and management, all in accordance with its charter.

The Governance Committee receives suggestions for potential director nominees from many sources, including members of the Board, advisors and shareholders. Any such nominations, together with appropriate biographical information, should be submitted to the Governance Committee in accordance with the Company’s policies governing submissions of nominees discussed below. Any candidates submitted by a shareholder or shareholder group are reviewed and considered by the Governance Committee in the same manner as other candidates. Any shareholder that would like to nominate a candidate for election to the Board should submit a written notice of nomination to the Governance Committee in accordance with the procedures described in this Proxy Statement under “Shareholder Proposals” on page 46. Upon completion of the review process, the Governance Committee makes its recommendation to the full Board. The Board then selects candidates for nomination for election by shareholders or by appointment to fill vacancies. We do not currently employ an executive search firm, or pay a fee to any other third party, to locate qualified candidates for director positions, though we may decide to do so in the future.

THE GREENBRIER COMPANIES |

2019 Proxy Statement |

9

| ||||||

Our Code of Business Conduct and Ethics and FCPA Compliance

At Greenbrier we observe the highest ethical standards in all of our business dealings. Our Code of Business Conduct and Ethics guides our Board, executives and employees in the work they do for the Company. We work hard to ensure that all of our employees fully understand and are empowered to implement ethical practices and promptly report any suspicious activity. The Company maintains the right to require any employee to supply a written statement certifying compliance with our Code of Business Conduct and Ethics. The Code of Business Conduct and Ethics applies to all of the Company’s directors, employees and consultants, including its principal executive officer, principal financial officer and principal accounting officer.

Our Code of Business Conduct and Ethics is closely tied to our FCPA (Foreign Corrupt Practices Act) and Anti-Corruption Policy. We are an international company, and as such compliance with all anti-bribery and anti-corruption laws is a key component of our ethics focus. In accordance with FCPA standards, we prohibit improperly influencing business decisions or improperly securing advantages. Our compliance team conducts ongoing compliance training at all of our locations across the globe. This dedication helps to ensure that our personnel are aware of their compliance obligations and best-equipped to implement them. We know that a commitment to the highest ethical standards drives our business and we are guided by this commitment.

Mr. Furman serves as Chairman of our Board, in addition to his roles as Chief Executive Officer and President of the Company. At this time, in view of Mr. Furman’s long experience and service to the Company in his capacity as Chief Executive Officer and director, the Board believes the most appropriate Board leadership structure is for Mr. Furman to continue to serve as Chairman of the Board, Chief Executive Officer and President.

In his position as Chief Executive Officer, Mr. Furman is responsible for the day-to-day leadership and performance of the Company. In his role as Chairman of the Board, Mr. Furman sets the strategic priorities for the Board, presides over its meetings, and communicates its recommendations, decisions, and guidance to the other members of senior management. The Board believes that the combination of these two roles with Mr. Furman enhances consistent communication and coordination throughout the organization. It also provides for effective and efficient implementation of corporate strategy. In addition, Mr. Furman is the most knowledgeable member of the Board regarding the Company’s business and challenges, and

the risks the Company faces. In his role as Chairman, Mr. Furman is able to facilitate the Board’s oversight of those matters most effectively. The Board has not adopted a specific policy on whether the same person should serve as both the Chief Executive Officer and Chairman of the Board or, if the roles are separate, whether the Chairman should be selected from thenon-employee directors or should be an employee. The Board believes it is appropriate to retain the discretion and flexibility to make these determinations from time to time as needed to provide appropriate leadership for the Company.

The Board has established a Lead Director position effective when the Chairman of the Board is not an independent director. The Board has appointed Duane C. McDougall to serve as our Lead Director. The Lead Director serves as a representative for the independent directors and presides at all Board meetings at which the Chairman of the Board is not present, including executive sessions of thenon-employee directors.

As a result of its annual review, the Board has determined that a majority of its directors qualify as independent pursuant to SEC and NYSE rules and standards as set forth in the table on page 4. In arriving at this determination, the Board thoroughly considered the consulting arrangement with Mr. Swindells and determined his independence and ability to exercise independent judgment.

All of our directors who serve on committees satisfy a heightened standard of independence as set forth in our Corporate Governance Guidelines available on the Company’s website athttp://www.gbrx.com. This heightened standard prohibits directors from serving on a committee if they have any consulting or similar relationship with the Company whereby they receive compensation in addition to their compensation for Board service. Applying this standard further safeguards our Board’s autonomy and alignment with shareholders.

The independent directors met without Company management present at all regularly scheduled meetings of the Board.

10

|

2019 Proxy Statement |

THE GREENBRIER COMPANIES |

| |||||

| Corporate Governance |

Board Committees, Meetings and Charters

The Board plays a critical enterprise-level oversight function. To effectively carry out this function, the Board maintains three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Each committee is composed entirely of independent directors in accordance with SEC and NYSE rules and standards. These directors serving on committees also satisfy our heightened standard of independence described above. Below is a general overview of the role each committee plays in overseeing the business and affairs of the Company.

Compensation Committee |

Audit Committee |

Nominating and Corporate

| ||||||||||||||||||||||||

The Compensation Committee is focused on increasing shareholder value by setting compensation for senior management and is responsible for:

1) Oversight of compensation strategy and plan design for Company executives

2) Evaluating CEO performance and recommending CEO compensation to the Board

3) Review of policies relating to director compensation and stock ownership guidelines

4) Assessing the independence of any compensation consultants

| The Audit Committee safeguards our shareholders’ investment in the Company by overseeing:

1) The integrity of the Company’s financial statements

2) Company compliance with legal and regulatory requirements

3) Performance of the Company’s internal audit plan and functions and internal controls

4) Engagement and oversight of independent registered public accounting firm

| The Nominating and Corporate Governance Committee works to ensure that shareholders are effectively represented by:

1) Guiding board refreshment including the identification of director nominees

2) Overseeing the development of process and protocols regarding CEO succession

3) Reviewing the structure and composition of Board committees

4) Overseeing annual evaluations of the Board and its committees | ||||||||||||||||||||||||

During fiscal year 2018, the Board at large held five meetings, the Audit Committee held four meetings, the Nominating and Corporate Governance Committee held four meetings, and the Compensation Committee held five meetings. All directors are invited and encouraged to attend all committee meetings. In addition, ournon-management independent Board members meet without management present in conjunction with committee meetings and at least once annually at a regularly scheduled executive session where the Lead Director presides. All of the incumbent directors attended at least 90% of the Board and committee meetings on which they served during the year. The Company’s policy is to encourage Board members to attend the Company’s Annual Meetings of Shareholders. All of the Company’s directors attended the Annual Meeting of Shareholders held on January 5, 2018. The composition of each of the Board committees is set out below.

Name

| Independent

| Audit Committee

| Compensation

|

Nominating and Corporate Governance Committee

| ||||||||||||||||

William A. Furman

| ||||||||||||||||||||

Thomas B. Fargo

|

|

|

| |||||||||||||||||

Wanda F. Felton

|

|

|

| |||||||||||||||||

Graeme A. Jack

|

|

|

|

| ||||||||||||||||

Duane C. McDougall (Lead Director)

|

|

|

|

| ||||||||||||||||

David L. Starling

|

|

|

| |||||||||||||||||

Charles J. Swindells

|

| |||||||||||||||||||

Donald A. Washburn

|

|

|

|

| ||||||||||||||||

Kelly M. Williams

|

|

|

| |||||||||||||||||

Independent

Independent  Member FAudit Committee Financial Expert

Member FAudit Committee Financial Expert

The Board of Directors has determined that Messrs. McDougall and Jack qualify as “audit committee financial experts” under federal securities laws. Each of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee maintains a charter. These charters, along with the Company’s Corporate Governance Guidelines and Code of Business Conduct and Ethics, are available to shareholders on the Company’s website atwww.gbrx.com.

THE GREENBRIER COMPANIES |

2019 Proxy Statement |

11

| ||||||

Corporate Governance |

Our Board works hard to oversee the direction of Greenbrier and to represent the interests of our shareholders. Navigating a course for growth requires constant engagement and insight into a variety of influences including global economic trends, political and trade considerations, customer needs and employee morale. The Board must be vigilant to an ever-changing business landscape in order to safeguard the Company against adversity. In 2018, our Board traveled to several of our worldwide locations as part of its ongoing efforts on behalf of the Company. The Board made use of this opportunity to tour operations, evaluate new opportunities, attend industry events, engage with a diverse group of employees and executives and deepen their understanding of our business. Our Board’s commitment to constructive engagement enables it to better understand our customers, markets and operations. As a result, the Board can tailor the strategic trajectory of the Company to best serve our shareholders, employees and other stakeholders.

In 2018, the Board has approved management’s strategic plan for the Company with four primary goals:

| • | Defending and growing in our core North American market |

| • | Expanding in international railcar markets |

| • | Aggressively extending our talent base through the creation of a robust Talent Pipeline |

| • | Efficiently deploying capital to grow at scale in new and existing markets |

In addition, the Company’s strategic agenda includes:

| • | Fortification of our balance sheet and key financial metrics |

| • | Leveraging our integrated business model |

| • | Customer service and commitment |

| • | Protecting our reputation and continuing to embed our core values and ethics into Company culture |

The Board regularly conducts reviews of the Company’s progress on strategic goals.

At Greenbrier, risk mitigation is an integral part of the Company’s strategic planning process and is divided primarily into two functions: risk management and risk oversight. The Company’s executive team is responsible for risk management, including designing processes to identify and mitigate risks. The Board is responsible for risk oversight, which focuses on the adequacy of the Company’s enterprise risk management processes designed and implemented by management. The Board administers its risk oversight function primarily through its committees. Each committee oversees risk within its area of responsibility. The committees report significant risk matters to the Board at large, other than those matters that are reported directly to the

Board because they do not fall within the purview of any committee. The Board may delegate specific risk-related tasks to a committee or directly to management.

The Company is confronted with a variety of risks including operational, competitive, business model and compliance risks. Growth involves taking risks, which can evolve over time. Management regularly provides the Board and its committees with a wide array of information to help the Board understand and address the risks facing the Company. The committees consider certain risks regularly. The Audit Committee has oversight of financial, compliance and safety risks. The Governance Committee has oversight of succession planning.

Specifically regarding compensation risk, the Compensation Committee noted in its fiscal year 2018 annual evaluation numerous ways in which risk is effectively managed or mitigated, including the balance between short-term and long-term incentives and use of multiple performance measures. Based on the results of its evaluation, the Compensation Committee concluded that any risks associated with the Company’s compensation programs are not reasonably likely to have a material adverse effect on the Company.

The Company’s Corporate Governance Guidelines establish majority voting procedures with respect to the election of directors. Pursuant to the policy, in an uncontested election of directors, any nominee who has received a greater number of votes withheld from his or her election than votes for his or her election will, within two weeks following certification of the shareholder vote by the Company, submit a written resignation offer to the Board of Directors for consideration by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee will consider the resignation offer and, within 60 days following certification of the shareholder vote by the Company, make a recommendation to the Board concerning the acceptance or rejection of the resignation offer.

In determining its recommendation to the Board, the Nominating and Corporate Governance Committee will consider all factors its members deem relevant, which may include:

| • | the stated reason or reasons why shareholders who cast withhold votes for the director did so; |

| • | the qualifications of the director (including, for example, whether the director serves on the Audit Committee of the Board as an “audit committee financial expert” and whether there are one or more other directors qualified, eligible and available to serve on the Audit Committee in such capacity); and |

| • | whether the director’s resignation from the Board of Directors would be in the Company’s best interests and the best interests of the Company’s shareholders. |

12

|

2019 Proxy Statement |

THE GREENBRIER COMPANIES |

| |||||

| Corporate Governance |

The Nominating and Corporate Governance Committee will also consider a range of possible alternatives concerning the director’s resignation offer as the Committee deems appropriate, which may include:

| • | acceptance of the resignation offer; |

| • | rejection of the resignation offer; or |

| • | rejection of the resignation offer coupled with a commitment to seek to address the underlying causes of the majority-withheld vote. |

Under the policy, the Board will take formal action on the recommendation within 90 days following certification of the shareholder vote by the Company. In considering the recommendation, the Board will consider the information, factors and alternatives considered by the Nominating and Corporate Governance Committee and any additional information, factors and alternatives the Board deems relevant. Any director tendering a resignation offer will not participate in the Committee’s or Board’s consideration of whether to accept such resignation offer. The Company will publicly disclose, in a Current Report on Form8-K filed with the SEC, the decision of the Board. The Board will also provide an explanation of the process by which the decision was made and, if applicable, its reasons for rejecting the tendered resignation.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is now or was an officer or employee of the Company or any of its subsidiaries. No member of the Compensation Committee had a relationship with the Company requiring disclosure as a related party transaction during fiscal year 2018. None of the Company’s executive officers served as a director or member of a compensation committee or its equivalent for any entity, the executive officers of which entity served as a director or member of the Compensation Committee of the Company during fiscal year 2018.

Shareholders and other interested parties may communicate with members of the Board by mail addressed to the Chairman, to the Lead Director, to any other individual member of the Board, to the full Board, to thenon-management directors as a group or to a particular committee of the Board. In each case, such correspondence should be sent to the Company’s headquarters at One Centerpointe Drive, Suite 200, Lake Oswego, OR 97035. Such communications are distributed as appropriate.

Aircraft Usage Policy. William A. Furman, President, Chief Executive Officer and Chairman of the Board of Directors of the Company, owned a private aircraft managed by a private independent management company until December 2017. In December 2017, Mr. Furman sold the aircraft to a third party pursuant to an arrangement in which Mr. Furman provided seller financing to the third-party purchaser. Mr. Furman subsequently purchased a new private aircraft. From time to time, the Company’s business requires charter use of privately owned aircraft. During fiscal 2018, charters of the aircraft previously owned by Mr. Furman, before and after its sale to a third party, were placed with the company that managed Mr. Furman’s aircraft aggregating approximately $0.5 million. In addition, Mr. Furman’s new aircraft was leased directly by the Company for business travel on limited occasions during fiscal 2018 for lease payments aggregating approximately $20,000. Any charter of an aircraft in which Mr. Furman has an interest is subject to the Company’s travel and entertainment policy, and the fees paid to the management company or Mr. Furman, as applicable, are no less favorable than would have been available to the Company for similar services provided by unrelated parties.

Indebtedness of Management. Since the beginning of fiscal year 2018, none of our directors or executive officers has been indebted to us.

Policy. We follow a policy that all proposed transactions by us with directors, officers, five percent shareholders and their affiliates be entered into only if such transactions are on terms no less favorable to us than could be obtained from unaffiliated parties, are reasonably expected to benefit us and are reviewed and approved or ratified by a majority of the disinterested, independent members of the Board.

Members of the Board who are our employees are not separately compensated for serving on the Board. For fiscal year 2018, eachnon-employee director received an $80,000 annual cash retainer fee. The Audit Committee chairman received an additional annual cash retainer of $20,000, and each other committee chairman received an additional annual cash retainer of $15,000. Duane McDougall, the Lead Director, received an additional annual cash retainer of $70,000. Members of the Audit Committee received an additional annual cash retainer of $10,000, and Members of the Compensation and Governance Committees received an additional annual cash retainer of $7,500. All annual retainer fees are paid quarterly.

THE GREENBRIER COMPANIES |

2019 Proxy Statement |

13

| ||||||

| Corporate Governance |

Under the terms of the Company’s 2017 Amended and Restated Stock Incentive Plan, for fiscal year 2018, ournon-employee directors received annual grants of restricted shares of the Company’s Common Stock with a fair market value equal to $145,000 (rounded up to the nearest whole share) made immediately after the close of each annual meeting, with such shares vesting on the date of the next annual meeting or one year anniversary of the date of grant, whichever occurs first.

The Company has stock ownership guidelines for its directors, under which all directors of the Company are required to acquire and retain holdings of Company stock. In 2018, the director requirement to hold shares was increased from shares with a value equal to four times the annual cash retainer fee to shares with a value equal to five times the annual cash retainer fee. Four of our eightnon-employee directors have satisfied the director share ownership expectation, Thomas Fargo and Kelly Williams

have until 2020 to meet the holding requirement, and our two most recently appointednon-employee directors, Wanda Felton and David Starling, have until 2022 to meet the holding requirement.

In the event anon-employee director ceases to be a director due to death, disability or retirement, or because he or she is notre-elected to serve an additional term as a director, any unvested restricted shares shall immediately become fully vested. If anon-employee director ceases to be a director by reason of removal or resignation as a member of the Board, any unvested restricted shares shall automatically be forfeited, and the shares subject to such award shall be available for grant under the 2017 Amended and Restated Stock Incentive Plan.

The following table summarizes the compensation of thenon-employee Board members for fiscal year 2018.

Name | Fees Earned ($) | Stock Awards ($)(1) | Change in ($) | All Other ($)(2) | Total ($) | |||||

Thomas B. Fargo

|

107,500

|

145,027

|

—

|

2,771

|

255,298

| |||||

Wanda F. Felton

|

94,375

|

145,027

|

—

|

2,771

|

242,173

| |||||

Graeme A. Jack

|

121,250

|

145,027

|

—

|

2,771

|

269,048

| |||||

Duane C. McDougall

|

171,250

|

145,027

|

—

|

2,771

|

319,048

| |||||

David L. Starling

|

92,500

|

145,027

|

—

|

2,771

|

240,298

| |||||

Charles J. Swindells

|

81,875

|

145,027

|

—

|

122,771

|

349,673

| |||||

Donald A. Washburn

|

108,750

|

145,027

|

—

|

2,771

|

256,548

| |||||

Kelly M. Williams

|

101,875

|

145,027

|

—

|

2,771

|

249,673

|

| (1) | Amounts shown in this column are calculated based upon the aggregate grant date fair value. Such amounts may not correspond to the actual value that will be realized by them if and when the restricted stock awards vest. Each director received 2,842 shares as stock awards during fiscal year 2018. |

| (2) | Amounts in this column represent payment of dividends from the Company on shares of restricted stock during fiscal year 2018, and for Mr. Swindells also include $120,000 in consulting fees he received in fiscal year 2018 pursuant to a consulting agreement with the Company entered into in January 2016. |

14

|

2019 Proxy Statement |

THE GREENBRIER COMPANIES |

| |||||

GOVERNANCE PRIORITIES

In fiscal year 2019 the Company continues its steady effort to increase transparency with respect to our environmental, social and governance (“ESG”) priorities. Our stakeholders trust us to act with integrity and to focus relentlessly on quality. We do this by ensuring that we practice responsible governance, maintain social accountability, respect people, particularly our workforce and promote sustainability. Below are some highlights of the Company current ESG priorities.

| Putting People First

We acknowledge and appreciate that our employees drive our success. We are committed to the continuing health and safety of our employees and recognize it as our number one priority. We know that our shareholders desire to invest in a company that respects and values its employees.

| |

| Shareholder Engagement

We have implemented a more active shareholder engagement process to specifically engage designated Board members and management with shareholders on matters related to Board composition, governance and compensation. We invited our top four shareholders, who each owned more than 4% of our outstanding shares at the time, to engage directly with us. No other shareholders owned more than 4% of our outstanding shares individually at the time.

Board Chairs and management team members were directly involved in engagement efforts that served to reinforce our open door policy with shareholders. The efforts included:

• Specific invitations to top shareholders to meet with us

• Meeting with shareholders

• Utilizing consultants for best practices in compensation and governance

• Investor road shows and conferences

• Presenting shareholder feedback, if any, to the Board

• Considering letters from shareholders

Our ongoing engagement efforts allow shareholders the opportunity to provide feedback. The Compensation Committee carefully considers shareholder and advisor feedback, among other factors discussed in the Compensation Discussion and Analysis beginning on page 17, in making its compensation decisions. Shareholder feedback has |

influenced and reinforced a number of compensation design changes over the years.

Feedback from our shareholders is appreciated and we plan to continue these engagement efforts.

| ||

| Cultivating Strong Communities

We believe it is our duty to be good neighbors in every community where we operate, which is why we carefully foster a spirit of civic engagement and volunteerism. Our charitable giving program actively encourages employees to provide service to their local communities. Each year, there are a wide range of different causes that the Company and its employees donate their time and resources to.

| |

| Practicing Responsible Governance

Our Board provides critical strategic planning and risk oversight functions. Always thoughtful of these important priorities, we maintain rigorous director qualification standards and are keenly focused on Board diversity and engagement. Active engagement by our Board promotes long-term value for our stakeholders.

| |

| Advancing Sustainability

We are committed to environmental protection and awareness. We manufacture products that help minimize the total environmental impact of freight transportation. Our innovative programs and practices at our facilities reflect our desire to advance sustainability. | |

We remain committed to responsible governance, social accountability and sustainability. As we pursue growth and innovation, we will continue to focus on what has helped us succeed; dedication to serving our customers, shareholders, employees and communities.

THE GREENBRIER COMPANIES |

2019 Proxy Statement |

15

| ||||||

ADVISORY APPROVAL OF EXECUTIVE COMPENSATION

Pursuant to Section 14A of the Exchange Act, we are seeking approval on a nonbinding, advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement. We provide our shareholders with the opportunity to vote on an advisory basis on the compensation of our named executive officers annually. While this vote is non-binding, consistent with the value we assign to shareholder engagement, we consider the outcome of the vote when making future compensation decisions.

At our 2018 Annual Meeting, our seventh advisory vote on executive compensation passed by a vote of approximately 95% of votes cast, following approval in 2017 by a vote of approximately 98% of the votes cast. We believe that these favorable votes are a result of our continuing engagement with shareholders, and the actions we have taken in response to the feedback we received from shareholders.

In considering your vote, we invite you to review the Compensation Discussion and Analysis beginning on page 17 of this Proxy Statement. As described therein, we believe that Greenbrier’s executive compensation programs effectively align the interests of our executive officers with those of our shareholders by linking a significant portion of their

compensation to Greenbrier’s performance and by providing a competitive level of compensation designed to recruit, develop, retain and motivate talented executives critical to Greenbrier’s long-term success.

This Proposal 2 allows our shareholders to express their opinions regarding the decisions of the Compensation Committee on the compensation paid to the named executive officers through a vote on the following resolution:

“RESOLVED, that the Company’s shareholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in accordance with the rules of the SEC, which disclosures include the disclosures in the Compensation Discussion and Analysis and the compensation tables and narrative disclosures following the Compensation Discussion and Analysis.”

In order for this Proposal 2 to be approved, the number of votes cast “FOR” approval must exceed the number of votes cast “AGAINST” approval. Broker discretionary voting of uninstructed shares is not permitted on this Proposal 2. Abstentions and brokernon-votes of uninstructed shares will not affect the outcome of voting on this Proposal 2.

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE RESOLUTION SET FORTH IN PROPOSAL 2 ABOVE. UNLESS MARKED OTHERWISE, PROXIES RECEIVED WILL BE VOTEDFOR THIS PROPOSAL.

|

16

|

2019 Proxy Statement |

THE GREENBRIER COMPANIES |

| |||||

Compensation Discussion and Analysis

This section discusses material information relating to our executive compensation program and plans for our named executive officers or “NEOs” for 2018:

William A. Furman,

Chairman, Chief Executive Officer and President

Lorie L. Tekorius,

Executive Vice President and Chief Operating Officer

Mark J. Rittenbaum,

Executive Vice President, Chief Commercial and Leasing Officer

Alejandro Centurion,

Executive Vice President and President of Global Manufacturing Operations

Brian J. Comstock,

Executive Vice President, Sales and Marketing

Adrian J. Downes,

Senior Vice President, Chief Accounting Officer and Acting Chief Financial Officer

Ms. Tekorius assumed the role of Chief Operating Officer in August 2018. Mr. Downes assumed the role of Acting Chief Financial Officer in August 2018. During this important leadership transition, Ms. Tekorius will retain the responsibility of the Principal Financial Officer.

Mr. Comstock was promoted to Executive Vice President in April 2018.

This Compensation Discussion and Analysis makes reference to financial data derived from our financial statements prepared in accordance with generally accepted accounting principles (“GAAP”) and certain other financial data prepared usingnon-GAAP components. For a reconciliation of thesenon-GAAP components to the most comparable GAAP components, see Reconciliation ofNon-GAAP Financial Measures set forth in Appendix C.

The Compensation Committee has designed the Company’s executive compensation program to be consistent with the goals of its executive compensation philosophy: to drive performance and increase shareholder value. The current compensation strategy, set by the Committee, is designed to strengthen the link between pay and performance.

The objectives of our executive compensation program are to:

| • | Align the interests of key executives with the long-term interests of shareholders |

| • | Attract, develop, retain and motivate key executives to drive our business and financial performance |

| • | Link a significant amount of executive compensation to achievement ofpre-established financial metrics and business goals that are directly tied to our overall business strategy |

| • | Incentivize the management team to create long-term shareholder value by balancing growth and return on capital at all points in the business cycle |

Our compensation principles state that:

| • | A significant portion of compensation should be performance-based |

| • | Total direct compensation is based on the complexity of an executive’s assignment, years and depth of experience, and readiness for leadership in the CEO and key executive succession plan |

THE GREENBRIER COMPANIES |

2019 Proxy Statement |

17

| ||||||

Executive Compensation |

| • | Annual incentive awards should be aligned with the Company’s operating, financial and strategic objectives while considering the cyclical nature of our business |

| • | Long-term incentive plans should promote retention and reward absolute performance |

| • | A meaningful equity stake helps ensure that executive and shareholder interests are aligned |

| • | Defend and grow in our core North American markets |

| • | Expand in international railcar markets |

| • | Aggressively extend our talent base through the creation of a robust Talent Pipeline |

| • | Efficiently deploy capital to grow at scale in new and existing markets |

Our selected performance metrics and equity compensation vehicles discussed herein support this strategy by incentivizing executives based on various metrics that reflect progress on these goals including EBITDA, which promotes defending and growing our core market, and return on invested capital (“ROIC”), which promotes efficient deployment of capital.

Selected Financial Highlights and Key Accomplishments

Amidst constantly changing market conditions, we have delivered strong financial performance, continued to focus on international expansion as a strategic priority and further strengthened our balance sheet and improved liquidity:

| • | Revenue increase of over 16% to $2.5 billion |

| • | Adjusted EBITDA of $318 million |

| • | Net earnings increase of 31% to $152 million |

| • | Diluted EPS of $4.68 |

| • | Record levels of available liquidity and positioned for favorable refinancing in early 2019 |

Continued focus on core markets:

| • | Increased deliveries 31% to 20,900, a 13% increase in North America and a 166% increase internationally |

| • | Managed fleet grew by 6% to 357,000 railcars |

| • | Entered agreement for construction of 204,000 barrel capacity oil and chemical tank barge, with optional second barge |

| • | Discontinued the GBW railcar repair joint venture |

International expansion:

| • | Roughly 20% of our backlog as of August 31, 2018 was for orders outside of the US |

| • | Completed agreement for acquisition of majority interest in the Turkish railcar builder Rayvag |

| • | Concluded successful delivery of tank cars for industrial mining in Saudi Arabia |

| • | Further developed Greenbrier-Astra Rail, our majority owned subsidiary that is the largest freight car manufacturing, engineering and repair business in Europe |

| • | Executed on strategy in Brazil through Greenbrier-Maxion, our Brazilian railcar manufacturing affiliate |

Returns to shareholders:

| • | Dividends increased nearly 12% to $0.96 per share for the year. Dividends have increased 67% since July 2014 |

| • | Returned $30 million to shareholders through dividends |

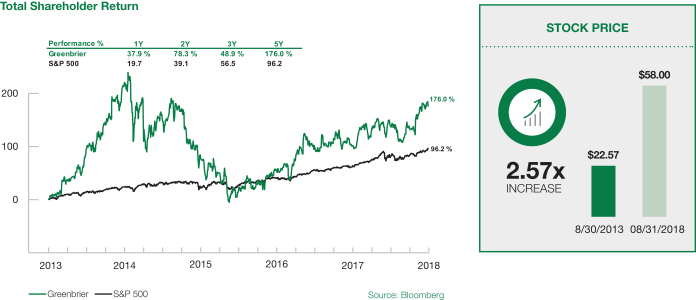

| • | Total Shareholder Return for fiscal year 2018 was 37.9% and we outperformed the S&P 500 by 18.2% |

Many of these key accomplishments were the result of capitalizing on relationships, market conditions and continued expansion in diverse global markets.

18

|

2019 Proxy Statement |

THE GREENBRIER COMPANIES |

| |||||

| Executive Compensation |

Chairman andCEOPay-for-Performance Alignment

Over the last five years our CEO has led a period of significant expansion in our operations. At Greenbrier there is a direct link between CEO compensation and Company performance.