December 30, 2019

| | Re: | 2020 Annual Shareholder Meeting of The Greenbrier Companies, Inc. (January 8, 2020) |

Proposal 2 – Advisory Approval of Executive Compensation

Dear Greenbrier Shareholder:

On behalf of the Board of Directors and the Compensation Committee of the Company,we are writing torequest your continued support of our compensation practices by voting “FOR” Proposal 2 – Advisory Approval of Executive Compensation at our 2020 Annual Meeting.

We appreciate shareholders’ past support, with“say-on-pay” approval ranging from 93% to 98% over the last five years. We believe this reflects successful alignment of pay with performance and Glass Lewis has recommended voting “FOR” approval of the Company’s executive compensation at the 2020 Annual Meeting. However, Institutional Shareholder Services (ISS) recommended against the proposal. We strongly disagree with the ISS recommendation as it does not sufficiently incorporate the business context and strategic accomplishments of the executive team. These accomplishments include the acquisition of a major North American railcar manufacturing business in fiscal 2019 which added significant responsibilities to the management team. In addition, we believe our pay is aligned with performance when considering the cyclical nature of the railcar manufacturing business and global market uncertainties. Lastly, our board is engaged in critical leadership and succession planning which require judicious decisions to both retain and reward executives in transition as well as adjust pay for those stepping into new roles and responsibilities.

At Greenbrier we have a pay for performance culture. We ask our shareholders to view the Company’s executive compensation based on the merits described below and in our 2020 Proxy Statement.

EXECUTIVE COMPENSATION GENERALLY

Cumulative Total Shareholder Return (TSR) has limited value as an absolute performance metric in a cyclical industry.

Railcar manufacturing is a cyclical industry. The Compensation Committee evaluates compensation based on industry-wide trends. Viewing TSR on a cumulative basis without full context can paint a picture inconsistent with overall performance, particularly in a year of stock price pressure such as Greenbrier saw in 2019. One year ago, our one and five year TSR metrics outperformed both the Russell 3000 Index and our Global Industry Classification Standard peers.

TSR is an important component of our comprehensive performance analysis, which is why we added a relative TSR modifier to our 2020 Restricted Stock Unit (RSU) program. This analysis also includes other important factors such as industry positioning, market cycles, talent development and succession management. Compensation is a key driver for achieving results in all of these areas.

Compensation is in line with peers.

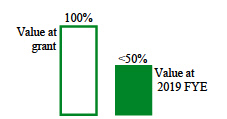

Greenbrier pays its executives market-based compensation. As noted by Glass Lewis, compensation for our CEO and named executive officers (NEOs) is consistent with Company peers. However, ISS makes note of increases in compensation for our NEOs in fiscal 2019. Raises for NEOs in fiscal 2019 reflect the fact that all of them are now responsible for worldwide operations in seven countries resulting from expansion and acquisition activities. Three of our NEOs are new to their executive roles as President, CFO and EVP Commercial, and two are heavily engaged in grooming their succession benches within the next three years. During this process, the Board has incentivized our CEO to commit to at least two years in his current role by tailoring his long-term incentive grant to retain him and recognize his leadership.