| 1Q23 Earnings Conference Call April 25, 2023 |

| Safe Harbor Statement 2 “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: Statements in this Presentation relating to plans, strategies, economic performance and trends, projections of results of specific activities or investments and other statements that are not descriptions of historical facts may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking information is inherently subject to risks and uncertainties, and actual results could differ materially from those currently anticipated due to a number of factors, which include, but are not limited to, risk factors discussed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and in other documents filed by the Company with the Securities and Exchange Commission from time to time. Forward-looking statements may be identified by terms such as “may”, “will”, “should”, “could”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, “forecasts”, “goals”, “potential” or “continue” or similar terms or the negative of these terms. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. The Company has no obligation to update these forward-looking statements. |

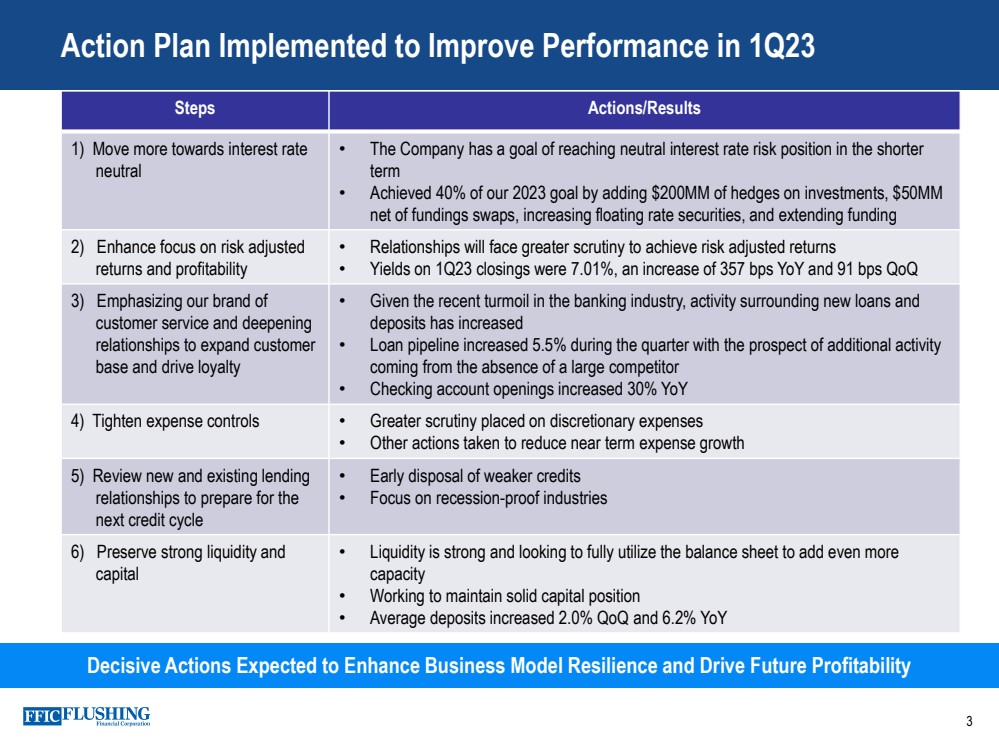

| Steps Actions/Results 1) Move more towards interest rate neutral • The Company has a goal of reaching neutral interest rate risk position in the shorter term • Achieved 40% of our 2023 goal by adding $200MM of hedges on investments, $50MM net of fundings swaps, increasing floating rate securities, and extending funding 2) Enhance focus on risk adjusted returns and profitability • Relationships will face greater scrutiny to achieve risk adjusted returns • Yields on 1Q23 closings were 7.01%, an increase of 357 bps YoY and 91 bps QoQ 3) Emphasizing our brand of customer service and deepening relationships to expand customer base and drive loyalty • Given the recent turmoil in the banking industry, activity surrounding new loans and deposits has increased • Loan pipeline increased 5.5% during the quarter with the prospect of additional activity coming from the absence of a large competitor • Checking account openings increased 30% YoY 4) Tighten expense controls • Greater scrutiny placed on discretionary expenses • Other actions taken to reduce near term expense growth 5) Review new and existing lending relationships to prepare for the next credit cycle • Early disposal of weaker credits • Focus on recession-proof industries 6) Preserve strong liquidity and capital • Liquidity is strong and looking to fully utilize the balance sheet to add even more capacity • Working to maintain solid capital position • Average deposits increased 2.0% QoQ and 6.2% YoY 3 Action Plan Implemented to Improve Performance in 1Q23 Decisive Actions Expected to Enhance Business Model Resilience and Drive Future Profitability |

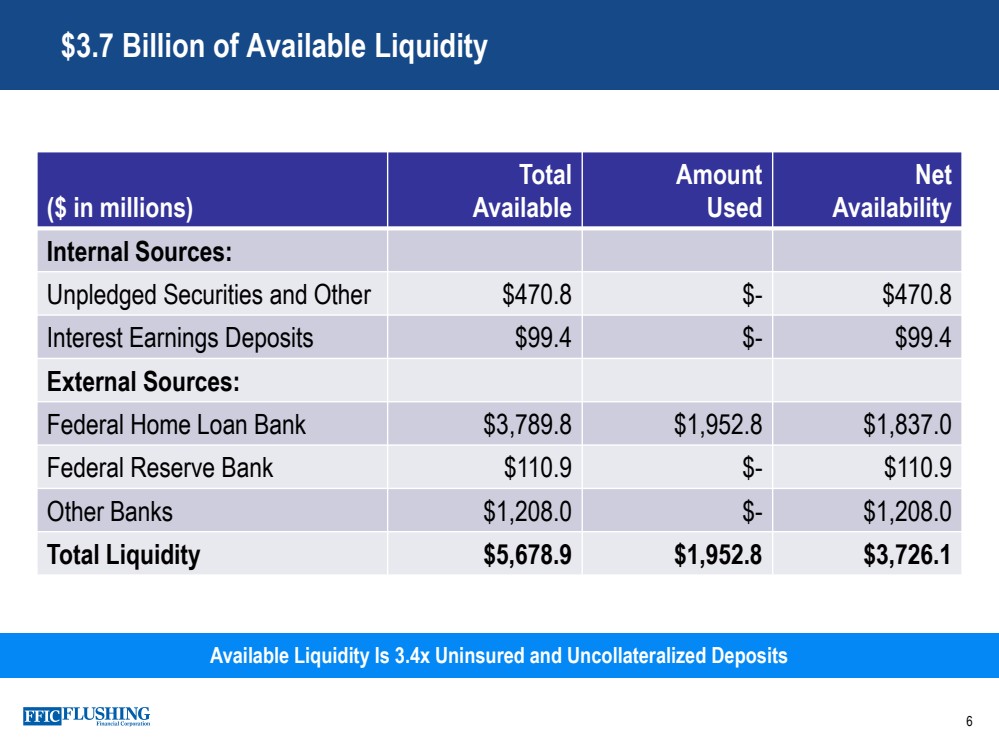

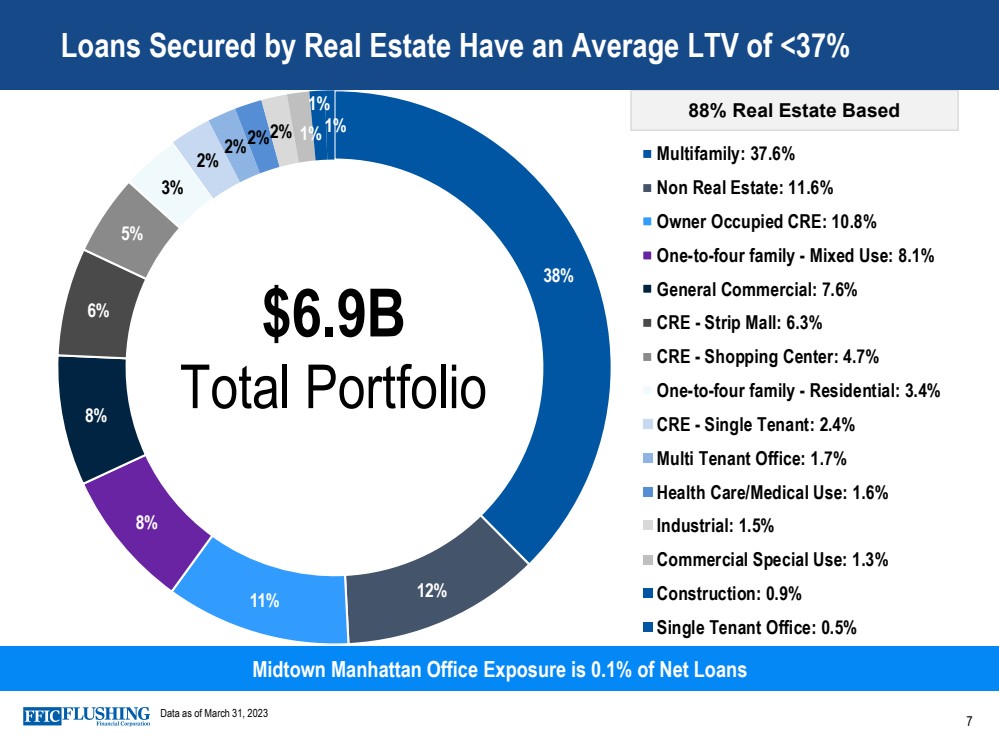

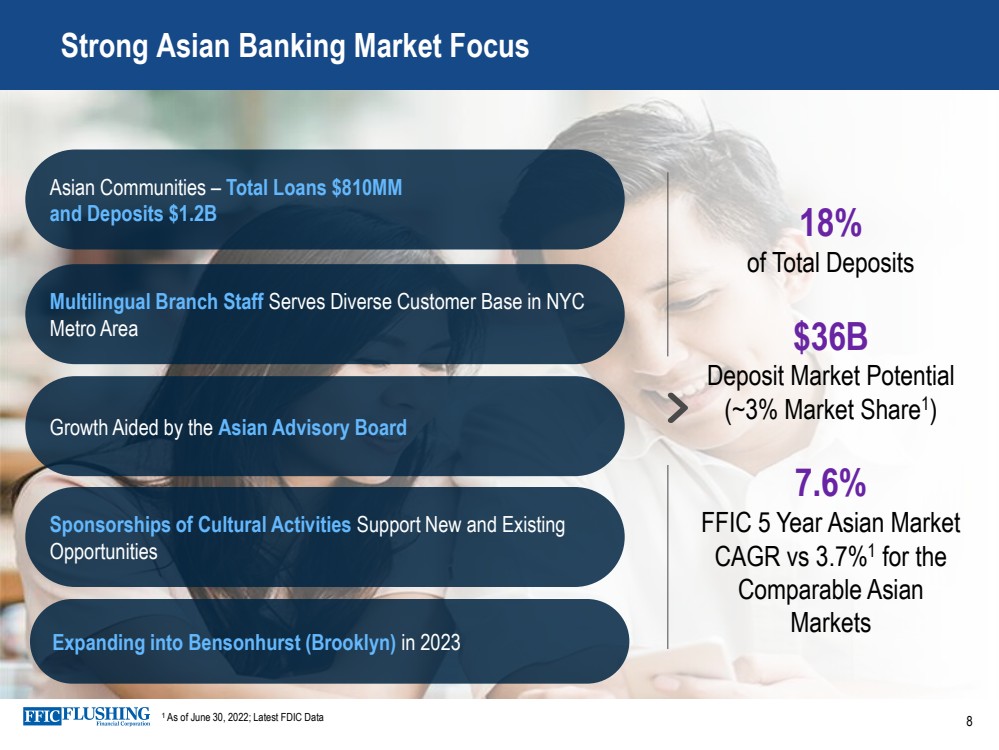

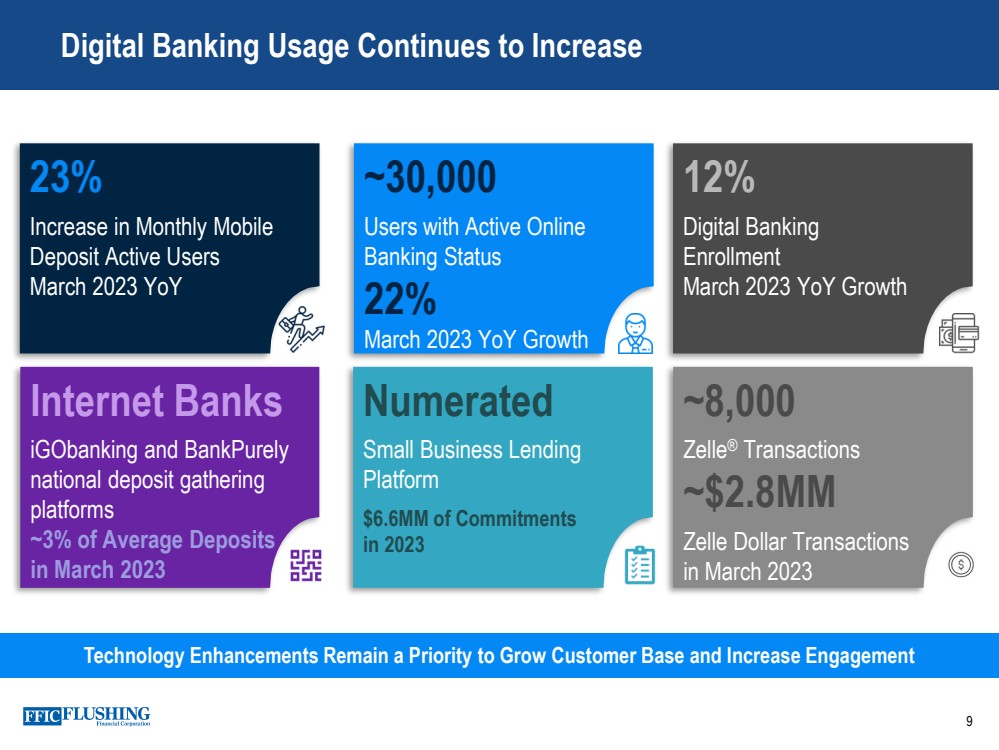

| 4 Areas of Focus for Long-term Success Credit Quality • Midtown Manhattan office exposure is 0.1% of net loans • The Company is a conservatively managed institution with a history of low and below industry levels of credit losses • Over 88% of the loan portfolio is collateralized by real estate with an average loan to value less than 37% • Weighted average DSR for multifamily and CRE is 1.9x • Resulting in strong level of coverage to absorb the impact of higher operating costs and principal and interest payments Interest Rate Risk • Historically the Company operated with a liability sensitive balance sheet resulting in liabilities repricing faster than assets when interest rates change • During 1Q23, the Company took significant actions to improve its interest rate risk position • These actions, which include adding hedges, floating rate assets, and extending funding, resulted in achievement of 40% of our goal for 2023 Liquidity • Deposits increased nearly $250 million in the first quarter, and we see new opportunities for growth due to market disruption and new branches • The Company continues to have ample liquidity with $3.7 billion of undrawn lines and resources or 3.4x uninsured and uncollateralized deposits • Uninsured and uncollateralized deposits were only 16.2% of total deposits at March 31, 2023 • Checking account openings were up 30% YoY in 1Q23 Customer Experience • Additional opportunities emerging as a result of a major competitor leaving the market • Approximately 33% of our branches are in Asian markets; a key focus of our business • Bensonhurst, our 27th branch, is expected to open in 2023 enhancing our Asian branch presence • Digital banking usage continues to increase with double digit growth in monthly mobile deposit active uses and digital banking enrollment in March 2023 versus a year ago |

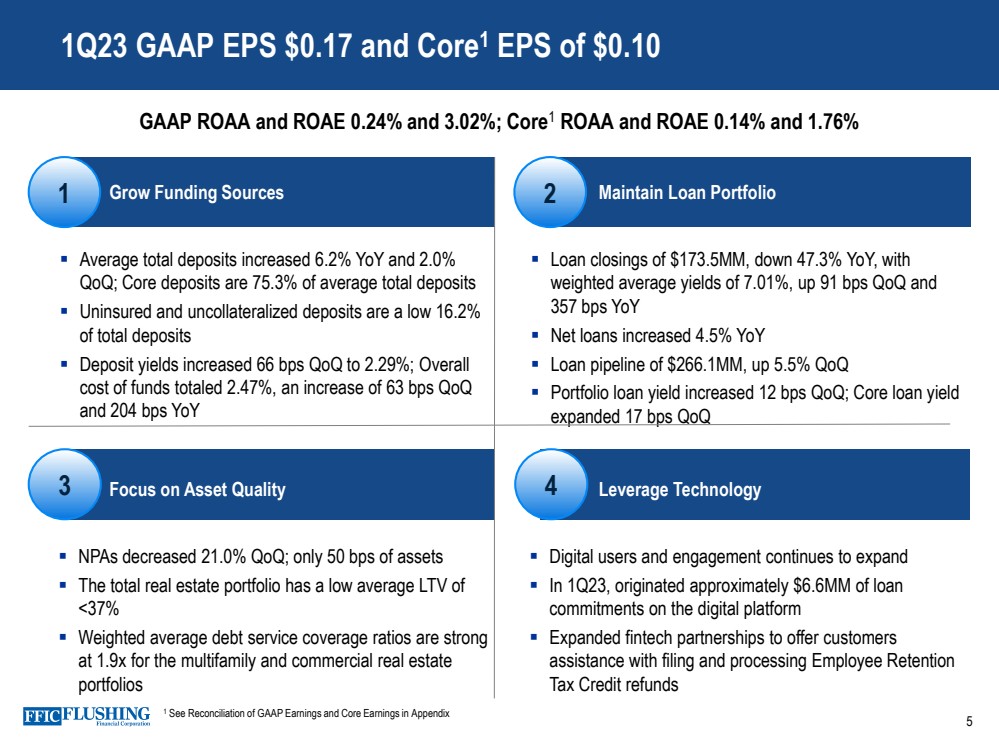

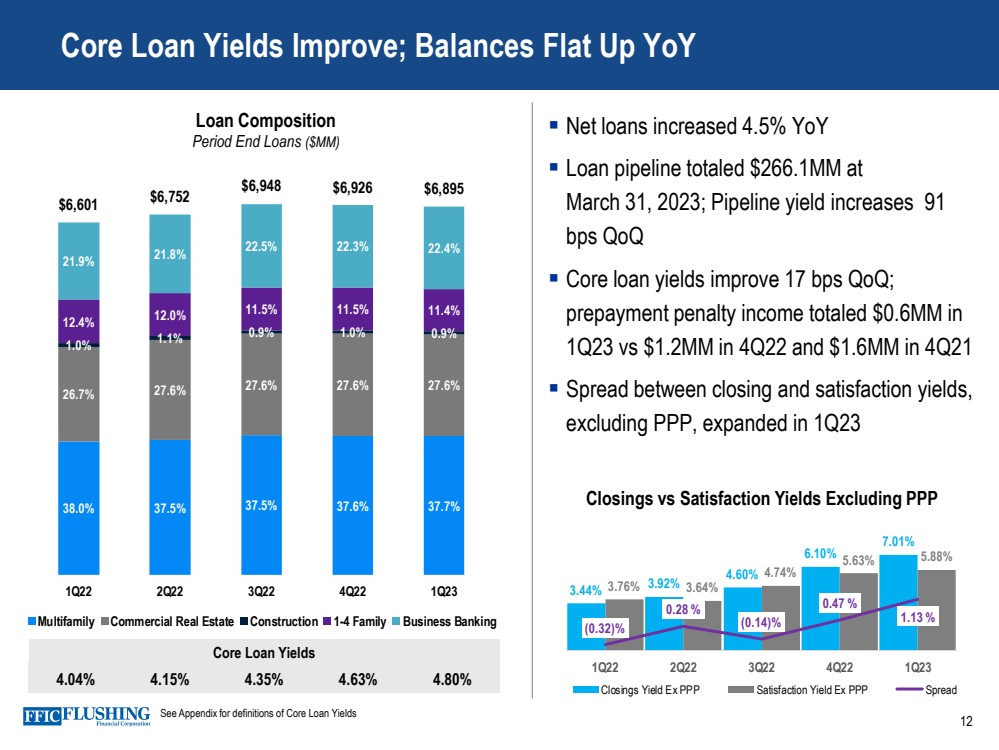

| 3 4 1 Grow Funding Sources 2 Maintain Loan Portfolio ▪ Average total deposits increased 6.2% YoY and 2.0% QoQ; Core deposits are 75.3% of average total deposits ▪ Uninsured and uncollateralized deposits are a low 16.2% of total deposits ▪ Deposit yields increased 66 bps QoQ to 2.29%; Overall cost of funds totaled 2.47%, an increase of 63 bps QoQ and 204 bps YoY ▪ Loan closings of $173.5MM, down 47.3% YoY, with weighted average yields of 7.01%, up 91 bps QoQ and 357 bps YoY ▪ Net loans increased 4.5% YoY ▪ Loan pipeline of $266.1MM, up 5.5% QoQ ▪ Portfolio loan yield increased 12 bps QoQ; Core loan yield expanded 17 bps QoQ Focus on Asset Quality Leverage Technology ▪ NPAs decreased 21.0% QoQ; only 50 bps of assets ▪ The total real estate portfolio has a low average LTV of <37% ▪ Weighted average debt service coverage ratios are strong at 1.9x for the multifamily and commercial real estate portfolios ▪ Digital users and engagement continues to expand ▪ In 1Q23, originated approximately $6.6MM of loan commitments on the digital platform ▪ Expanded fintech partnerships to offer customers assistance with filing and processing Employee Retention Tax Credit refunds 1Q23 GAAP EPS $0.17 and Core1 EPS of $0.10 5 GAAP ROAA and ROAE 0.24% and 3.02%; Core1 ROAA and ROAE 0.14% and 1.76% 1 See Reconciliation of GAAP Earnings and Core Earnings in Appendix |

| 6 $3.7 Billion of Available Liquidity ($ in millions) Total Available Amount Used Net Availability Internal Sources: Unpledged Securities and Other $470.8 $- $470.8 Interest Earnings Deposits $99.4 $- $99.4 External Sources: Federal Home Loan Bank $3,789.8 $1,952.8 $1,837.0 Federal Reserve Bank $110.9 $- $110.9 Other Banks $1,208.0 $- $1,208.0 Total Liquidity $5,678.9 $1,952.8 $3,726.1 Available Liquidity Is 3.4x Uninsured and Uncollateralized Deposits |

| Loans Secured by Real Estate Have an Average LTV of <37% Midtown Manhattan Office Exposure is 0.1% of Net Loans Data as of March 31, 2023 38% 12% 11% 8% 8% 6% 5% 3% 2% 2%2%2% 1% 1% 1% Multifamily: 37.6% Non Real Estate: 11.6% Owner Occupied CRE: 10.8% One-to-four family - Mixed Use: 8.1% General Commercial: 7.6% CRE - Strip Mall: 6.3% CRE - Shopping Center: 4.7% One-to-four family - Residential: 3.4% CRE - Single Tenant: 2.4% Multi Tenant Office: 1.7% Health Care/Medical Use: 1.6% Industrial: 1.5% Commercial Special Use: 1.3% Construction: 0.9% Single Tenant Office: 0.5% $6.9B Total Portfolio 88% Real Estate Based 7 |

| Strong Asian Banking Market Focus 18% of Total Deposits $36B Deposit Market Potential (~3% Market Share1 ) 7.6% FFIC 5 Year Asian Market CAGR vs 3.7%1 for the Comparable Asian Markets Asian Communities – Total Loans $810MM and Deposits $1.2B Multilingual Branch Staff Serves Diverse Customer Base in NYC Metro Area Growth Aided by the Asian Advisory Board Sponsorships of Cultural Activities Support New and Existing Opportunities 1 As of June 30, 2022; Latest FDIC Data Expanding into Bensonhurst (Brooklyn) in 2023 8 |

| Digital Banking Usage Continues to Increase 9 Technology Enhancements Remain a Priority to Grow Customer Base and Increase Engagement 23% Increase in Monthly Mobile Deposit Active Users March 2023 YoY ~30,000 Users with Active Online Banking Status 22% March 2023 YoY Growth 12% Digital Banking Enrollment March 2023 YoY Growth Numerated Small Business Lending Platform $6.6MM of Commitments in 2023 Internet Banks iGObanking and BankPurely national deposit gathering platforms ~3% of Average Deposits in March 2023 ~8,000 Zelle® Transactions ~$2.8MM Zelle Dollar Transactions in March 2023 |

| ▪ Announces Community Scholarship for NYC Kids Rise at P.S. 22Q ▪ Attends Manhattan Neighborhood Network Ribbon Cutting ▪ Opened Hauppauge Branch; Bensonhurst to open in 2023 10 Key Community Events During 1Q23 |

| 15.6% 16.2% 16.7% 14.7% 13.2% 31.8% 32.4% 28.8% 29.5% 28.9% 2.4% 2.4% 2.5% 2.2% 2.0% 35.2% 34.8% 34.0% 32.2% 30.2% 13.9% 12.7% 16.9% 20.2% 24.7% 1.1% 1.5% 1.1% 1.2% $6,410 $6,441 1.0% $6,277 $6,678 $6,810 0 1 00 0 2 00 0 3 00 0 4 00 0 5 00 0 6 00 0 7 00 0 8 00 0 1Q22 2Q22 3Q22 4Q22 1Q23 Noninterest Bearing NOW Accounts Savings Money Market CDs Mortgage Escrow Average Total Deposits Increase; Higher CD Percentage 11 Total Average Deposits ($MM) ▪ Average total deposits increased 2.0% QoQ and 6.2% YoY ▪ Noninterest bearing deposits are 13.2% of average total deposits, down from 15.6% a year ago ▪ 1Q23 checking account openings up 30% YoY ▪ Deposit growth driven by CDs, which have a ~12-18 month duration Average Noninterest Deposits ($MM) Deposit Costs 0.21% 0.29% 0.76% 1.63% 2.29% $1,001.6 $1,044.6 $1,050.3 $979.8 $896.5 - 100 100 300 500 700 900 1100 1300 1Q22 2Q22 3Q22 4Q22 1Q23 |

| 38.0% 37.5% 37.5% 37.6% 37.7% 26.7% 27.6% 27.6% 27.6% 27.6% 1.0% 1.1% 0.9% 1.0% 0.9% 12.4% 12.0% 11.5% 11.5% 11.4% 21.9% 21.8% 22.5% 22.3% 22.4% $6,601 $6,752 $6,948 $6,926 $6,895 - 1,0 00 2,0 00 3,0 00 4,0 00 5,0 00 6,0 00 7,0 00 8,0 00 1Q22 2Q22 3Q22 4Q22 1Q23 Multifamily Commercial Real Estate Construction 1-4 Family Business Banking Core Loan Yields Improve; Balances Flat Up YoY 12 Core Loan Yields 4.04% 4.15% 4.35% 4.63% 4.80% Loan Composition Period End Loans ($MM) ▪ Net loans increased 4.5% YoY ▪ Loan pipeline totaled $266.1MM at March 31, 2023; Pipeline yield increases 91 bps QoQ ▪ Core loan yields improve 17 bps QoQ; prepayment penalty income totaled $0.6MM in 1Q23 vs $1.2MM in 4Q22 and $1.6MM in 4Q21 ▪ Spread between closing and satisfaction yields, excluding PPP, expanded in 1Q23 See Appendix for definitions of Core Loan Yields Closings vs Satisfaction Yields Excluding PPP 3.44% 3.92% 4.60% 6.10% 7.01% 3.76% 3.64% 4.74% 5.63% 5.88% (0.32)% 0.28 % (0.14)% 0.47 % 1.13 % (0.50)% 0.00 % 0.50 % 1.00 % 1.50 % 2.00 % 2.50 % 3.00 % 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 1Q22 2Q22 3Q22 4Q22 1Q23 Closings Yield Ex PPP Satisfaction Yield Ex PPP Spread |

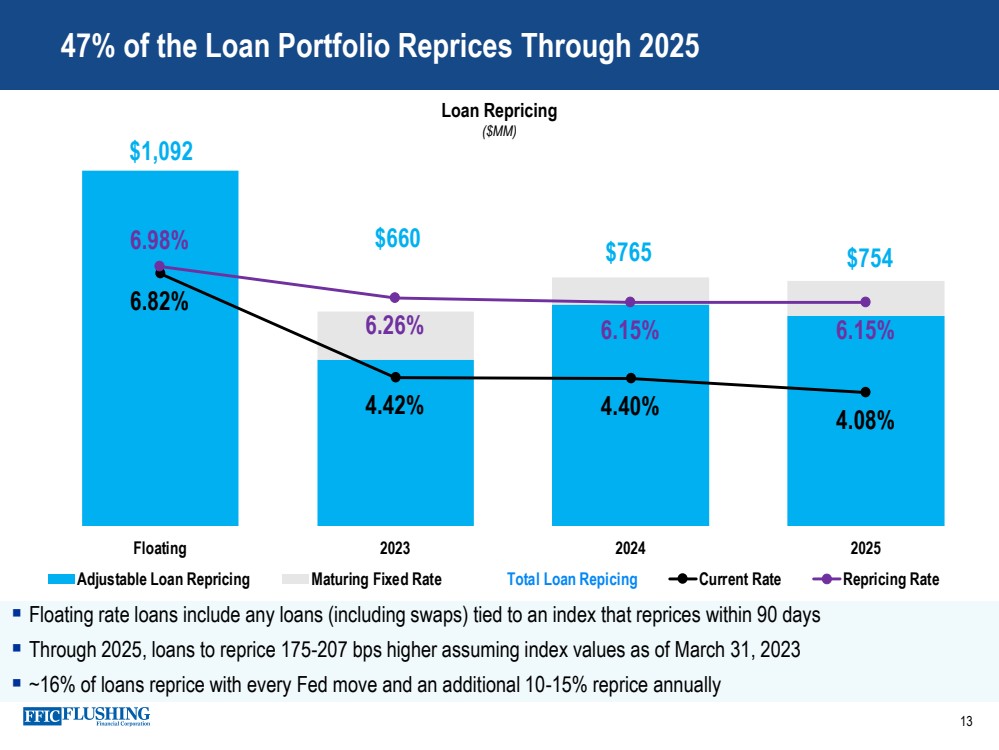

| $1,092 $660 $765 $754 6.82% 4.42% 4.40% 4.08% 6.98% 6.26% 6.15% 6.15% - 20 0 40 0 60 0 80 0 1,0 00 1,2 00 Floating 2023 2024 2025 Adjustable Loan Repricing Maturing Fixed Rate Total Loan Repicing Current Rate Repricing Rate ▪ Floating rate loans include any loans (including swaps) tied to an index that reprices within 90 days ▪ Through 2025, loans to reprice 175-207 bps higher assuming index values as of March 31, 2023 ▪ ~16% of loans reprice with every Fed move and an additional 10-15% reprice annually 47% of the Loan Portfolio Reprices Through 2025 13 Loan Repricing ($MM) |

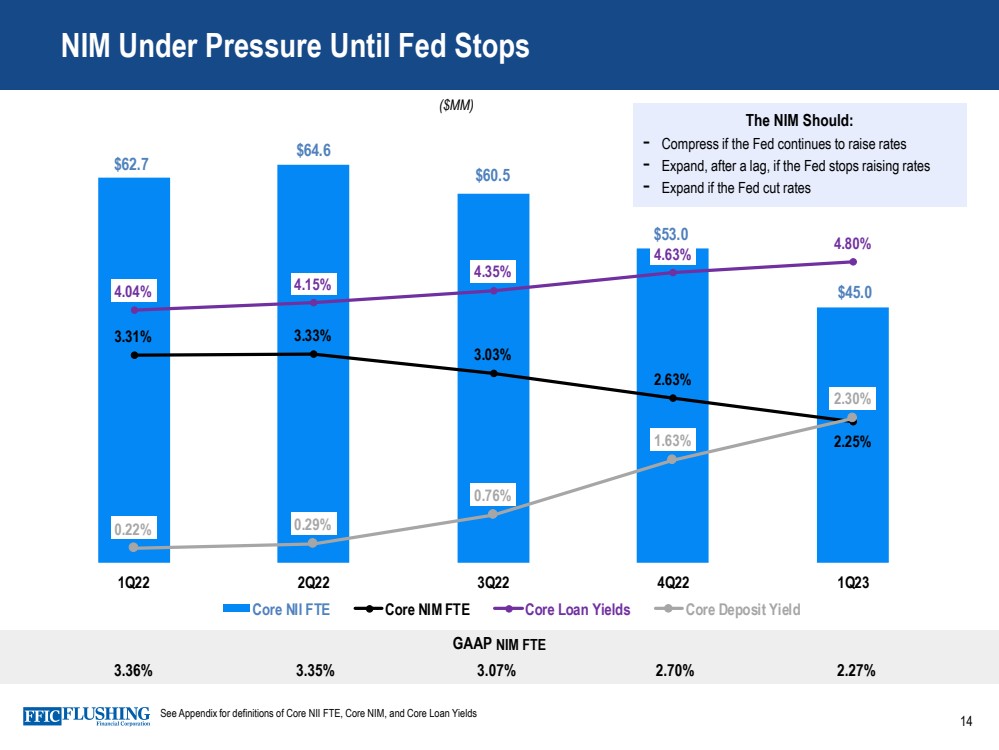

| $62.7 $64.6 $60.5 $53.0 $45.0 3.31% 3.33% 3.03% 2.63% 2.25% 4.04% 4.15% 4.35% 4.63% 4.80% 0.22% 0.29% 0.76% 1.63% 2.30% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% $10. 0 $20. 0 $30. 0 $40. 0 $50. 0 $60. 0 $70. 0 1Q22 2Q22 3Q22 4Q22 1Q23 Core NII FTE Core NIM FTE Core Loan Yields Core Deposit Yield GAAP NIM FTE 3.36% 3.35% 3.07% 2.70% 2.27% NIM Under Pressure Until Fed Stops 14 ($MM) See Appendix for definitions of Core NII FTE, Core NIM, and Core Loan Yields The NIM Should: - Compress if the Fed continues to raise rates - Expand, after a lag, if the Fed stops raising rates - Expand if the Fed cut rates |

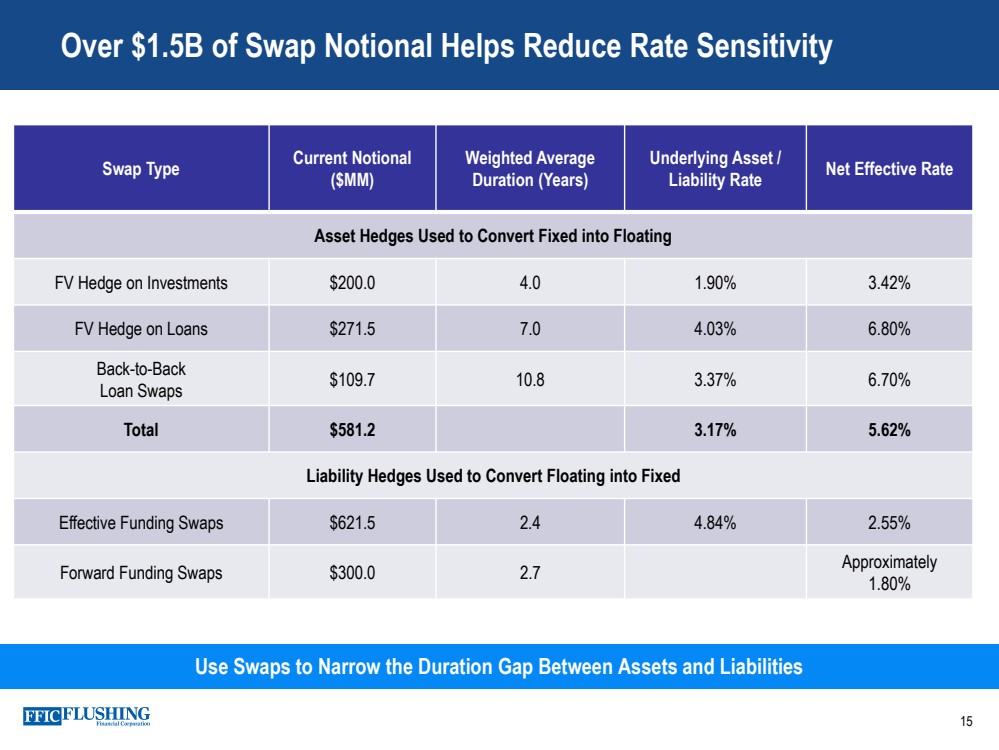

| 15 Over $1.5B of Swap Notional Helps Reduce Rate Sensitivity Swap Type Current Notional ($MM) Weighted Average Duration (Years) Underlying Asset / Liability Rate Net Effective Rate Asset Hedges Used to Convert Fixed into Floating FV Hedge on Investments $200.0 4.0 1.90% 3.42% FV Hedge on Loans $271.5 7.0 4.03% 6.80% Back-to-Back Loan Swaps $109.7 10.8 3.37% 6.70% Total $581.2 3.17% 5.62% Liability Hedges Used to Convert Floating into Fixed Effective Funding Swaps $621.5 2.4 4.84% 2.55% Forward Funding Swaps $300.0 2.7 Approximately 1.80% Use Swaps to Narrow the Duration Gap Between Assets and Liabilities |

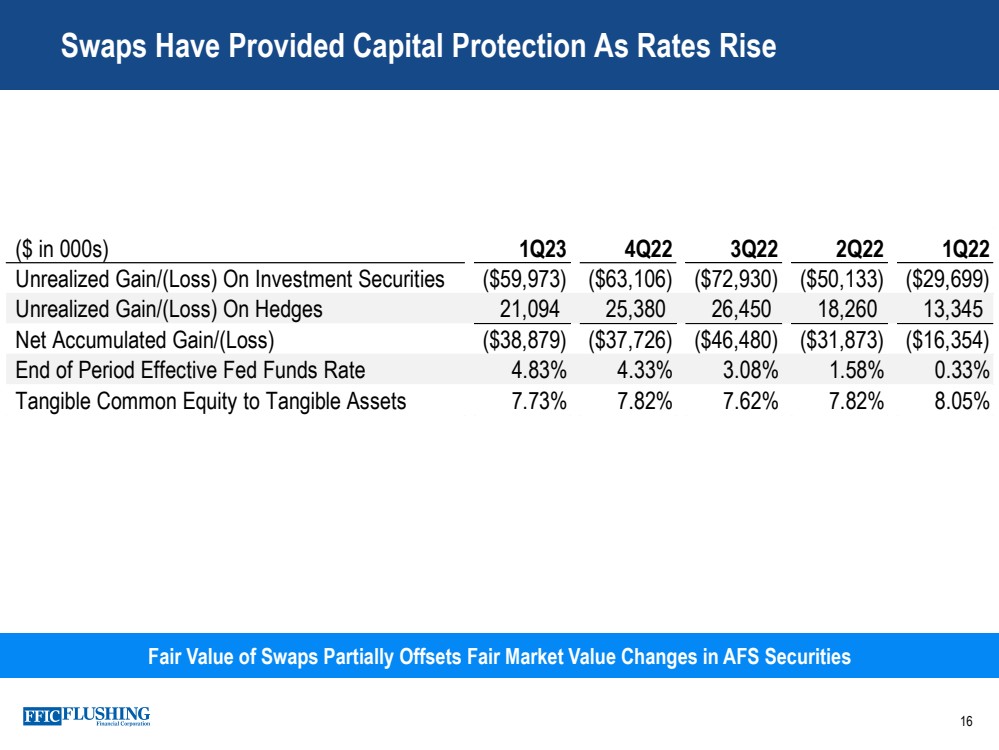

| 16 Swaps Have Provided Capital Protection As Rates Rise Fair Value of Swaps Partially Offsets Fair Market Value Changes in AFS Securities ($ in 000s) 1Q23 4Q22 3Q22 2Q22 1Q22 Unrealized Gain/(Loss) On Investment Securities ($59,973) ($63,106) ($72,930) ($50,133) ($29,699) Unrealized Gain/(Loss) On Hedges 21,094 25,380 26,450 18,260 13,345 Net Accumulated Gain/(Loss) ($38,879) ($37,726) ($46,480) ($31,873) ($16,354) End of Period Effective Fed Funds Rate 4.83% 4.33% 3.08% 1.58% 0.33% Tangible Common Equity to Tangible Assets 7.73% 7.82% 7.62% 7.82% 8.05% |

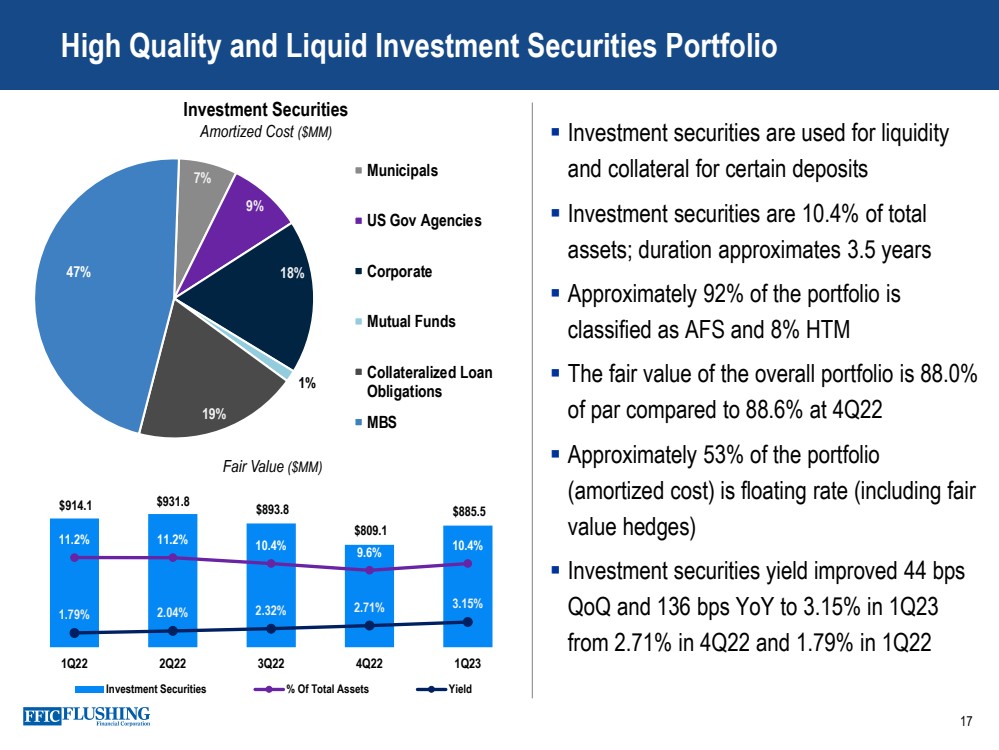

| 17 High Quality and Liquid Investment Securities Portfolio ▪ Investment securities are used for liquidity and collateral for certain deposits ▪ Investment securities are 10.4% of total assets; duration approximates 3.5 years ▪ Approximately 92% of the portfolio is classified as AFS and 8% HTM ▪ The fair value of the overall portfolio is 88.0% of par compared to 88.6% at 4Q22 ▪ Approximately 53% of the portfolio (amortized cost) is floating rate (including fair value hedges) ▪ Investment securities yield improved 44 bps QoQ and 136 bps YoY to 3.15% in 1Q23 from 2.71% in 4Q22 and 1.79% in 1Q22 Investment Securities Amortized Cost ($MM) 7% 9% 18% 1% 19% 47% Municipals US Gov Agencies Corporate Mutual Funds Collateralized Loan Obligations MBS $914.1 $931.8 $893.8 $809.1 $885.5 11.2% 11.2% 10.4% 9.6% 10.4% 1.79% 2.04% 2.32% 2.71% 3.15% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% $400.0 $800.0 $1,200.0 1Q22 2Q22 3Q22 4Q22 1Q23 Investment Securities % Of Total Assets Yield Fair Value ($MM) |

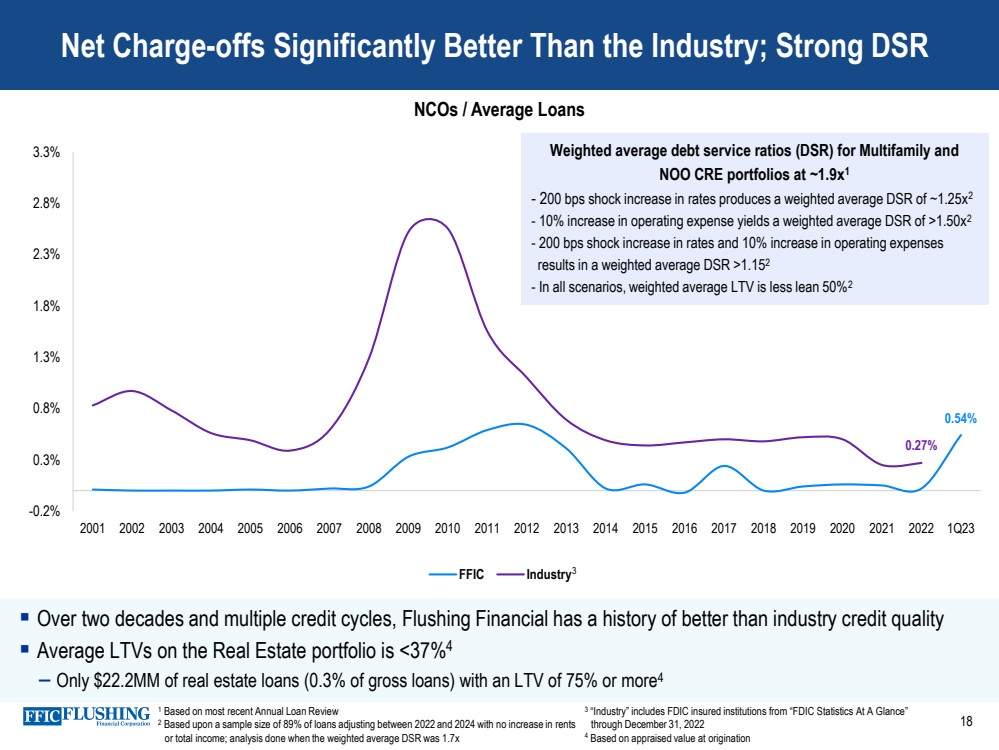

| ▪ Over two decades and multiple credit cycles, Flushing Financial has a history of better than industry credit quality ▪ Average LTVs on the Real Estate portfolio is <37%4 – Only $22.2MM of real estate loans (0.3% of gross loans) with an LTV of 75% or more4 Net Charge-offs Significantly Better Than the Industry; Strong DSR NCOs / Average Loans 0.54% 0.27% -0.2% 0.3% 0.8% 1.3% 1.8% 2.3% 2.8% 3.3% 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 1Q23 FFIC Industry Weighted average debt service ratios (DSR) for Multifamily and NOO CRE portfolios at ~1.9x1 - 200 bps shock increase in rates produces a weighted average DSR of ~1.25x2 - 10% increase in operating expense yields a weighted average DSR of >1.50x2 - 200 bps shock increase in rates and 10% increase in operating expenses results in a weighted average DSR >1.152 - In all scenarios, weighted average LTV is less lean 50%2 3 1 Based on most recent Annual Loan Review 2 Based upon a sample size of 89% of loans adjusting between 2022 and 2024 with no increase in rents or total income; analysis done when the weighted average DSR was 1.7x 3 “Industry” includes FDIC insured institutions from “FDIC Statistics At A Glance” through December 31, 2022 4 Based on appraised value at origination 18 |

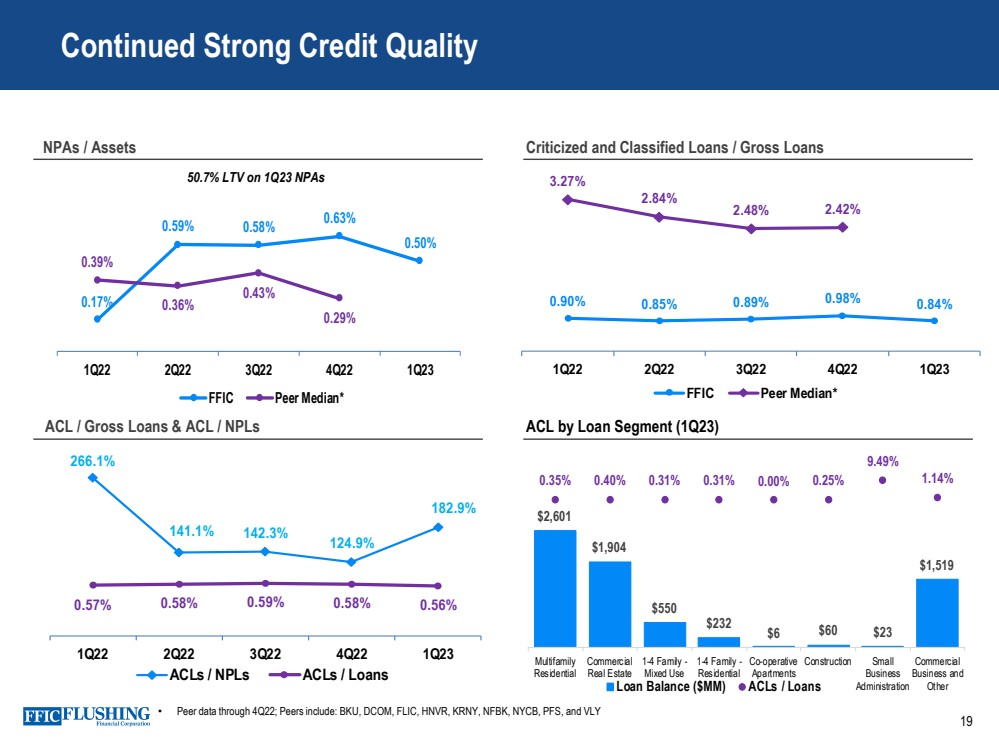

| 19 Continued Strong Credit Quality NPAs / Assets Criticized and Classified Loans / Gross Loans ACL / Gross Loans & ACL / NPLs ACL by Loan Segment (1Q23) $2,601 $1,904 $550 $232 $6 $60 $23 $1,519 0.35% 0.40% 0.31% 0.31% 0.00% 0.25% 9.49% 1.14% -7 0. 00% -6 0. 00% -5 0. 00% -4 0. 00% -3 0. 00% -2 0. 00% -1 0. 00% 0. 00 % 10 .0 0% Multifamily Residential Commercial Real Estate 1-4 Family - Mixed Use 1-4 Family - Residential Co-operative Apartments Construction Small Business Administration Commercial Business and Loan Balance ($MM) ACLs / Loans Other 266.1% 141.1% 142.3% 124.9% 182.9% 0.57% 0.58% 0.59% 0.58% 0.56% 0% 0% 0% 1% 1% 1% 1% 1% 2% 2% 2% 0% 50% 100% 150% 200% 250% 300% 1Q22 2Q22 3Q22 4Q22 1Q23 ACLs / NPLs ACLs / Loans 0.17% 0.59% 0.58% 0.63% 0.50% 0.39% 0.36% 0.43% 0.29% 0 .0 0% 0 .1 0% 0 .2 0% 0 .3 0% 0 .4 0% 0 .5 0% 0 .6 0% 0 .7 0% 0 .8 0% 0 .9 0% 1 .0 0% 1Q22 2Q22 3Q22 4Q22 1Q23 FFIC Peer Median* 50.7% LTV on 1Q23 NPAs • Peer data through 4Q22; Peers include: BKU, DCOM, FLIC, HNVR, KRNY, NFBK, NYCB, PFS, and VLY 0.90% 0.85% 0.89% 0.98% 0.84% 3.27% 2.84% 2.48% 2.42% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 1Q22 2Q22 3Q22 4Q22 1Q23 FFIC Peer Median* |

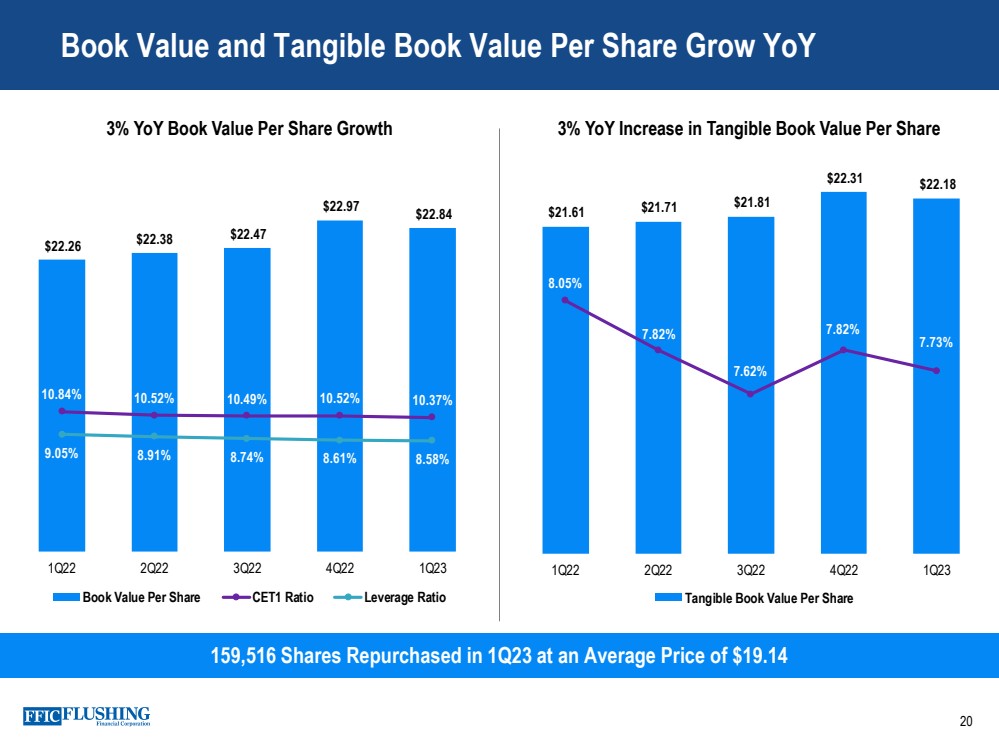

| Book Value and Tangible Book Value Per Share Grow YoY 20 159,516 Shares Repurchased in 1Q23 at an Average Price of $19.14 3% YoY Book Value Per Share Growth 3% YoY Increase in Tangible Book Value Per Share $21.61 $21.71 $21.81 $22.31 $22.18 8.05% 7.82% 7.62% 7.82% 7.73% 6.90% 7.10% 7.30% 7.50% 7.70% 7.90% 8.10% 8.30% 8.50% 8.70% $15. 00 $16. 00 $17. 00 $18. 00 $19. 00 $20. 00 $21. 00 $22. 00 $23. 00 1Q22 2Q22 3Q22 4Q22 1Q23 Tangible Book Value Per Share $22.26 $22.38 $22.47 $22.97 $22.84 10.84% 10.52% 10.49% 10.52% 10.37% 9.05% 8.91% 8.74% 8.61% 8.58% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% $17. 00 $18. 00 $19. 00 $20. 00 $21. 00 $22. 00 $23. 00 $24. 00 1Q22 2Q22 3Q22 4Q22 1Q23 Book Value Per Share CET1 Ratio Leverage Ratio |

| 21 ▪ The Company took significant actions to move to a more interest rate risk neutral position – After a lag, NIM should begin to recover once the Fed is done raising rates ▪ Solid deposit growth with additional market opportunities ▪ Uninsured and uncollateralized deposits are low and liquidity levels are high – Available liquidity represents 3.4x uninsured and uncollateralized deposits ▪ On going credit metrics are sound – We view the $9.2 million charge-off as an isolated event – Criticized and classified loans to gross loans improved 14 bps and delinquencies improved 16 bps QoQ ▪ Balance Sheet is conservative and low risk – Average real estate LTVs are less than 37% – Over 88% of the loan portfolio is real estate secured – Weighted average debt service coverage ratio of 1.9x for multifamily and nonowner occupied commercial real estate – Focus on maintaining conservative underwriting standards, full relationships, and appropriate risk-adjusted returns – Midtown Manhattan office buildings represent 0.1% of loans – Investment securities portfolio has an approximate 3.5 year duration and is shifting toward floating rate assets – Unrealized AFS securities losses are partially offset by derivatives to mitigate the impact on AOCI – Strong tangible capital Stable Business Model and Strong Liquidity; Position Flushing Financial for Success |

| Appendix 22 |

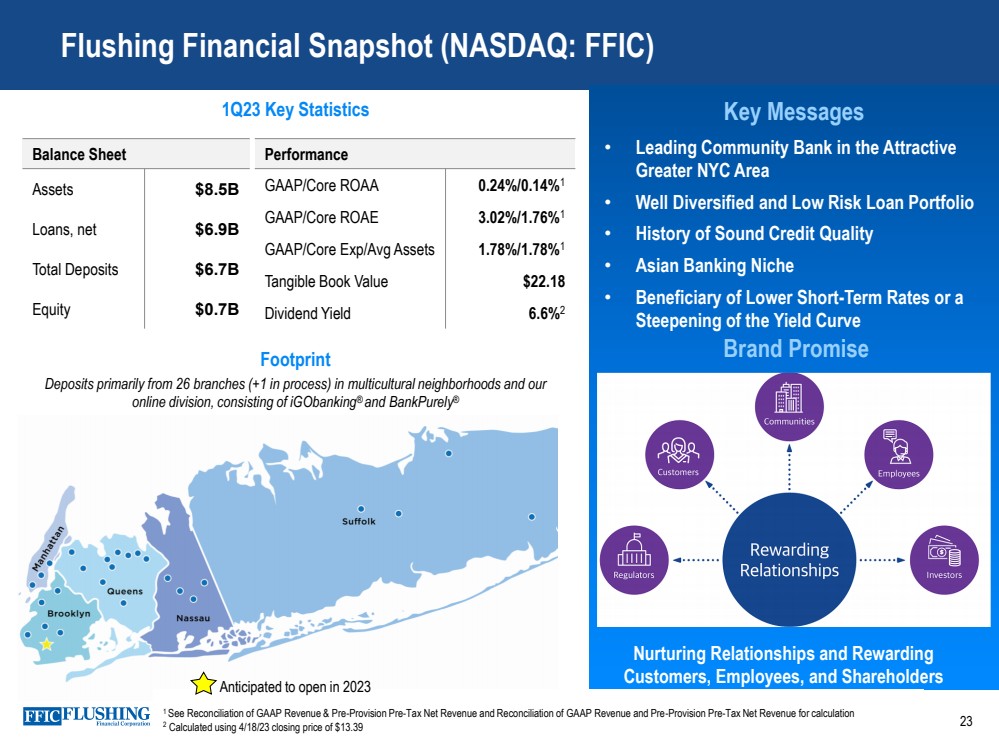

| Flushing Financial Snapshot (NASDAQ: FFIC) Key Messages Balance Sheet Assets $8.5B Loans, net $6.9B Total Deposits $6.7B Equity $0.7B Performance GAAP/Core ROAA 0.24%/0.14%1 GAAP/Core ROAE 3.02%/1.76%1 GAAP/Core Exp/Avg Assets 1.78%/1.78%1 Tangible Book Value $22.18 Dividend Yield 6.6%2 1Q23 Key Statistics Footprint Deposits primarily from 26 branches (+1 in process) in multicultural neighborhoods and our online division, consisting of iGObanking® and BankPurely® • Leading Community Bank in the Attractive Greater NYC Area • Well Diversified and Low Risk Loan Portfolio • History of Sound Credit Quality • Asian Banking Niche • Beneficiary of Lower Short-Term Rates or a Steepening of the Yield Curve 1 See Reconciliation of GAAP Revenue & Pre-Provision Pre-Tax Net Revenue and Reconciliation of GAAP Revenue and Pre-Provision Pre-Tax Net Revenue for calculation 2 Calculated using 4/18/23 closing price of $13.39 Brand Promise Nurturing Relationships and Rewarding Customers, Employees, and Shareholders Anticipated to open in 2023 23 |

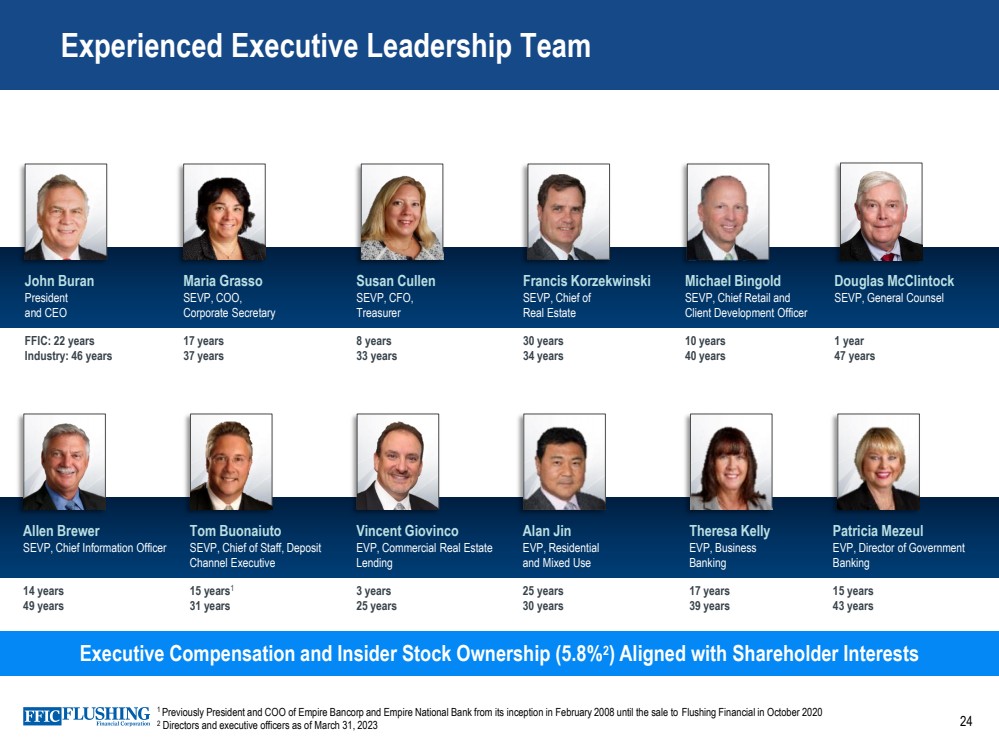

| Experienced Executive Leadership Team Executive Compensation and Insider Stock Ownership (5.8%2 ) Aligned with Shareholder Interests John Buran President and CEO Maria Grasso SEVP, COO, Corporate Secretary Susan Cullen SEVP, CFO, Treasurer Francis Korzekwinski SEVP, Chief of Real Estate Michael Bingold SEVP, Chief Retail and Client Development Officer Douglas McClintock SEVP, General Counsel FFIC: 22 years Industry: 46 years 17 years 37 years 8 years 33 years 30 years 34 years 10 years 40 years 1 year 47 years Allen Brewer SEVP, Chief Information Officer Tom Buonaiuto SEVP, Chief of Staff, Deposit Channel Executive Vincent Giovinco EVP, Commercial Real Estate Lending Alan Jin EVP, Residential and Mixed Use Theresa Kelly EVP, Business Banking Patricia Mezeul EVP, Director of Government Banking 14 years 49 years 15 years1 31 years 3 years 25 years 25 years 30 years 17 years 39 years 15 years 43 years 1 Previously President and COO of Empire Bancorp and Empire National Bank from its inception in February 2008 until the sale to Flushing Financial in October 2020 2 Directors and executive officers as of March 31, 2023 24 |

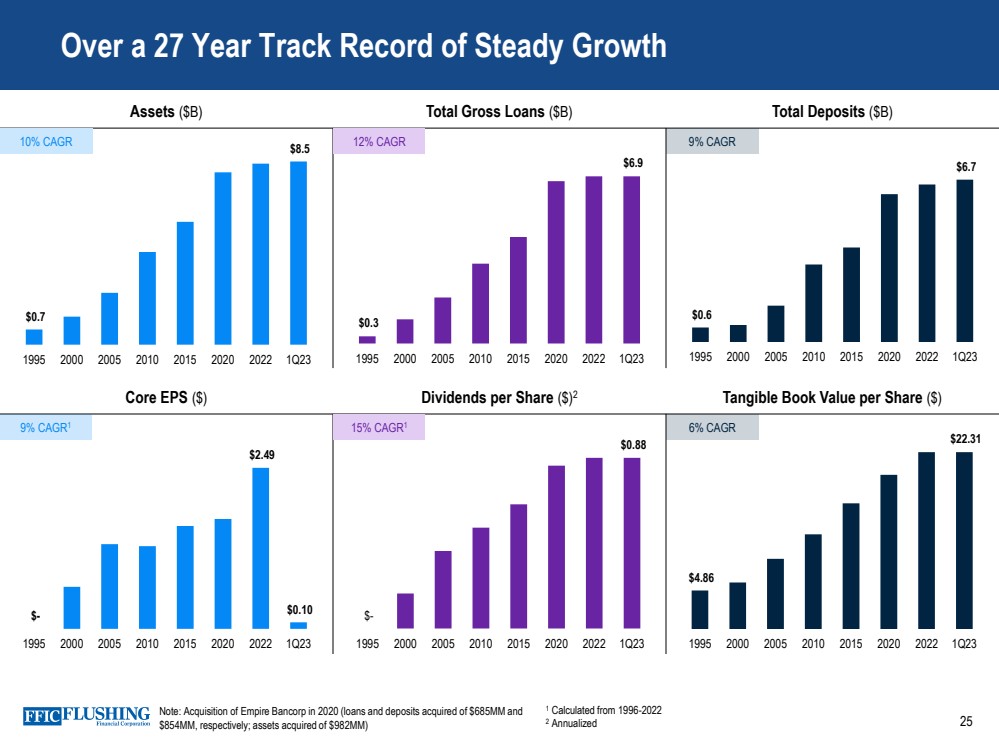

| Over a 27 Year Track Record of Steady Growth Core EPS ($) Dividends per Share ($)2 Tangible Book Value per Share ($) Assets ($B) Total Gross Loans ($B) Total Deposits ($B) $- $0.88 1995 2000 2005 2010 2015 2020 2022 1Q23 $- $2.49 $0.10 1995 2000 2005 2010 2015 2020 2022 1Q23 $0.6 $6.7 1995 2000 2005 2010 2015 2020 2022 1Q23 $0.3 $6.9 1995 2000 2005 2010 2015 2020 2022 1Q23 $0.7 $8.5 1995 2000 2005 2010 2015 2020 2022 1Q23 10% CAGR 12% CAGR 9% CAGR 9% CAGR1 15% CAGR1 $4.86 $22.31 1995 2000 2005 2010 2015 2020 2022 1Q23 6% CAGR Note: Acquisition of Empire Bancorp in 2020 (loans and deposits acquired of $685MM and $854MM, respectively; assets acquired of $982MM) 25 1 Calculated from 1996-2022 2 Annualized |

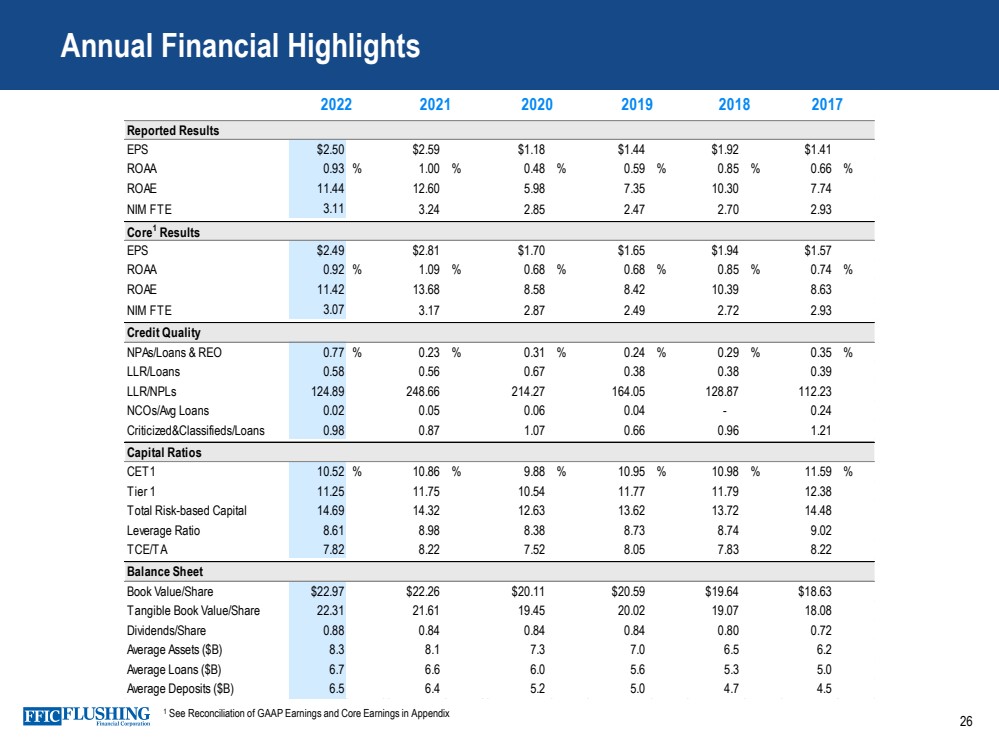

| 26 Annual Financial Highlights Reported Results EPS $2.50 $2.59 $1.18 $1.44 $1.92 $1.41 ROAA 0.93 % 1.00 % 0.48 % 0.59 % 0.85 % 0.66 % ROAE 11.44 12.60 5.98 7.35 10.30 7.74 NIM FTE 3.11 3.24 2.85 2.47 2.70 2.93 Core1 Results EPS $2.49 $2.81 $1.70 $1.65 $1.94 $1.57 ROAA 0.92 % 1.09 % 0.68 % 0.68 % 0.85 % 0.74 % ROAE 11.42 13.68 8.58 8.42 10.39 8.63 NIM FTE 3.07 3.17 2.87 2.49 2.72 2.93 Credit Quality NPAs/Loans & REO 0.77 % 0.23 % 0.31 % 0.24 % 0.29 % 0.35 % LLR/Loans 0.58 0.56 0.67 0.38 0.38 0.39 LLR/NPLs 124.89 248.66 214.27 164.05 128.87 112.23 NCOs/Avg Loans 0.02 0.05 0.06 0.04 - 0.24 Criticized&Classifieds/Loans 0.98 0.87 1.07 0.66 0.96 1.21 Capital Ratios CET1 10.52 % 10.86 % 9.88 % 10.95 % 10.98 % 11.59 % Tier 1 11.25 11.75 10.54 11.77 11.79 12.38 Total Risk-based Capital 14.69 14.32 12.63 13.62 13.72 14.48 Leverage Ratio 8.61 8.98 8.38 8.73 8.74 9.02 TCE/TA 7.82 8.22 7.52 8.05 7.83 8.22 Balance Sheet Book Value/Share $22.97 $22.26 $20.11 $20.59 $19.64 $18.63 Tangible Book Value/Share 22.31 21.61 19.45 20.02 19.07 18.08 Dividends/Share 0.88 0.84 0.84 0.84 0.80 0.72 Average Assets ($B) 8.3 8.1 7.3 7.0 6.5 6.2 Average Loans ($B) 6.7 6.6 6.0 5.6 5.3 5.0 Average Deposits ($B) 6.5 6.4 5.2 5.0 4.7 4.5 2022 2021 2020 2019 2018 2017 1 See Reconciliation of GAAP Earnings and Core Earnings in Appendix |

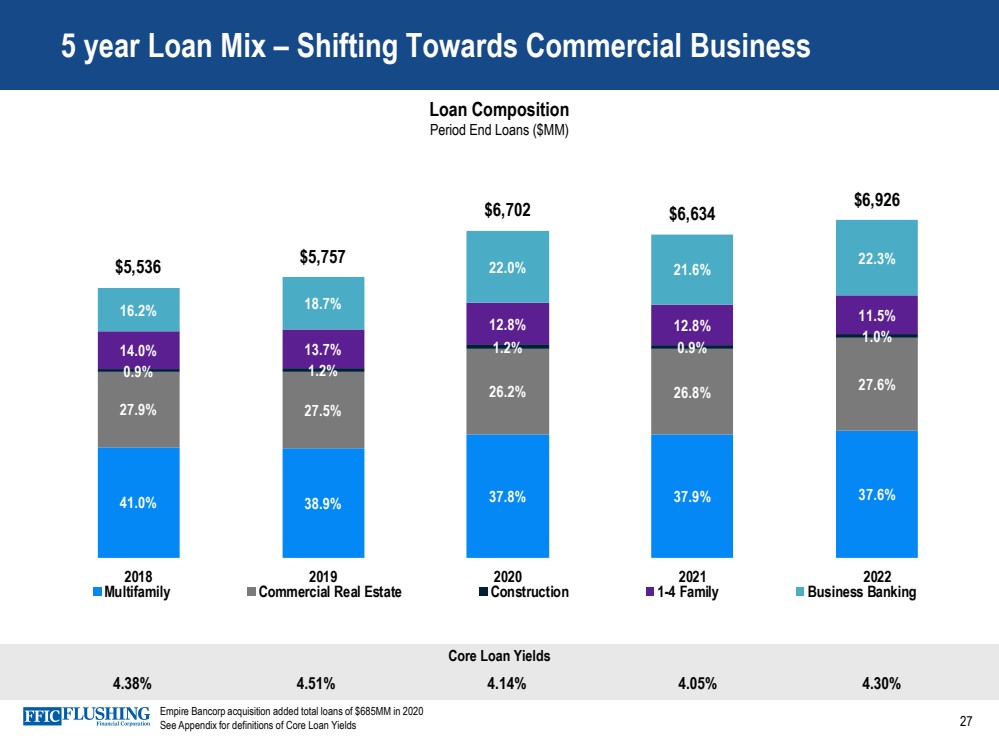

| 41.0% 38.9% 37.8% 37.9% 37.6% 27.9% 27.5% 26.2% 26.8% 27.6% 0.9% 1.2% 1.2% 0.9% 1.0% 14.0% 13.7% 12.8% 12.8% 16.2% 11.5% 18.7% 22.0% 21.6% 22.3% $5,536 $5,757 $6,702 $6,634 $6,926 - 1,0 00 2,0 00 3,0 00 4,0 00 5,0 00 6,0 00 7,0 00 8,0 00 2018 2019 2020 2021 2022 Multifamily Commercial Real Estate Construction 1-4 Family Business Banking 27 5 year Loan Mix – Shifting Towards Commercial Business Loan Composition Period End Loans ($MM) Empire Bancorp acquisition added total loans of $685MM in 2020 See Appendix for definitions of Core Loan Yields Core Loan Yields 4.38% 4.51% 4.14% 4.05% 4.30% |

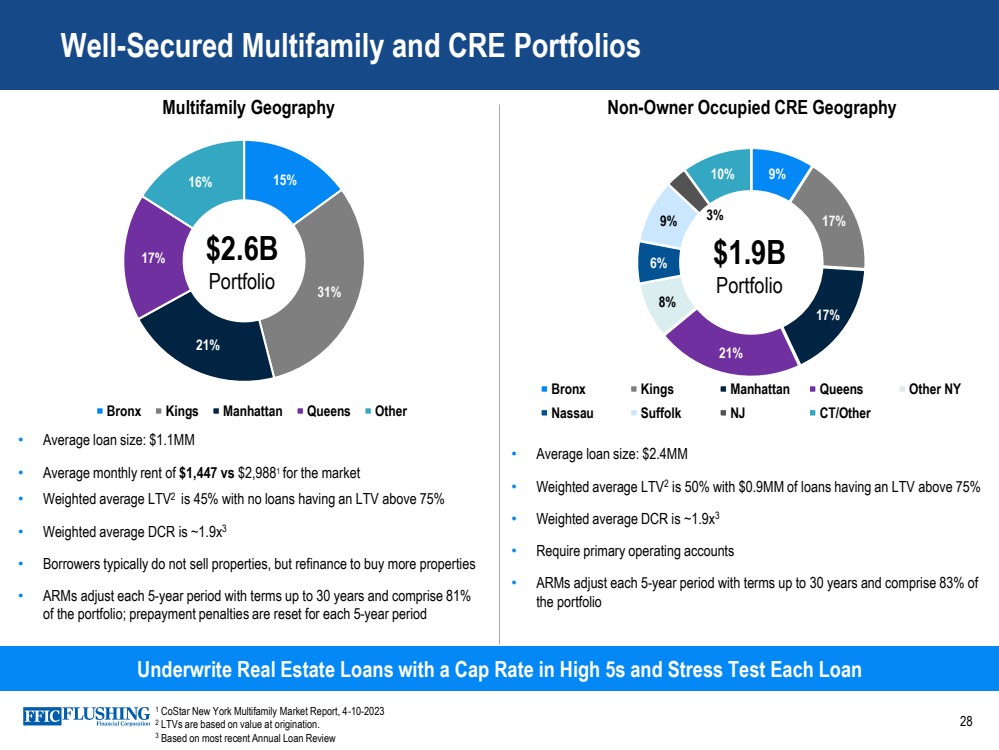

| Well-Secured Multifamily and CRE Portfolios 28 Underwrite Real Estate Loans with a Cap Rate in High 5s and Stress Test Each Loan Multifamily Geography 15% 31% 21% 17% 16% Bronx Kings Manhattan Queens Other $2.6B Portfolio • Average loan size: $1.1MM • Average monthly rent of $1,447 vs $2,9881 for the market • Weighted average LTV2 is 45% with no loans having an LTV above 75% • Weighted average DCR is ~1.9x3 • Borrowers typically do not sell properties, but refinance to buy more properties • ARMs adjust each 5-year period with terms up to 30 years and comprise 81% of the portfolio; prepayment penalties are reset for each 5-year period • Average loan size: $2.4MM • Weighted average LTV2 is 50% with $0.9MM of loans having an LTV above 75% • Weighted average DCR is ~1.9x3 • Require primary operating accounts • ARMs adjust each 5-year period with terms up to 30 years and comprise 83% of the portfolio Non-Owner Occupied CRE Geography 9% 17% 17% 21% 8% 6% 9% 3% 10% Bronx Kings Manhattan Queens Other NY Nassau Suffolk NJ CT/Other $1.9B Portfolio 1 CoStar New York Multifamily Market Report, 4-10-2023 2 LTVs are based on value at origination. 3 Based on most recent Annual Loan Review |

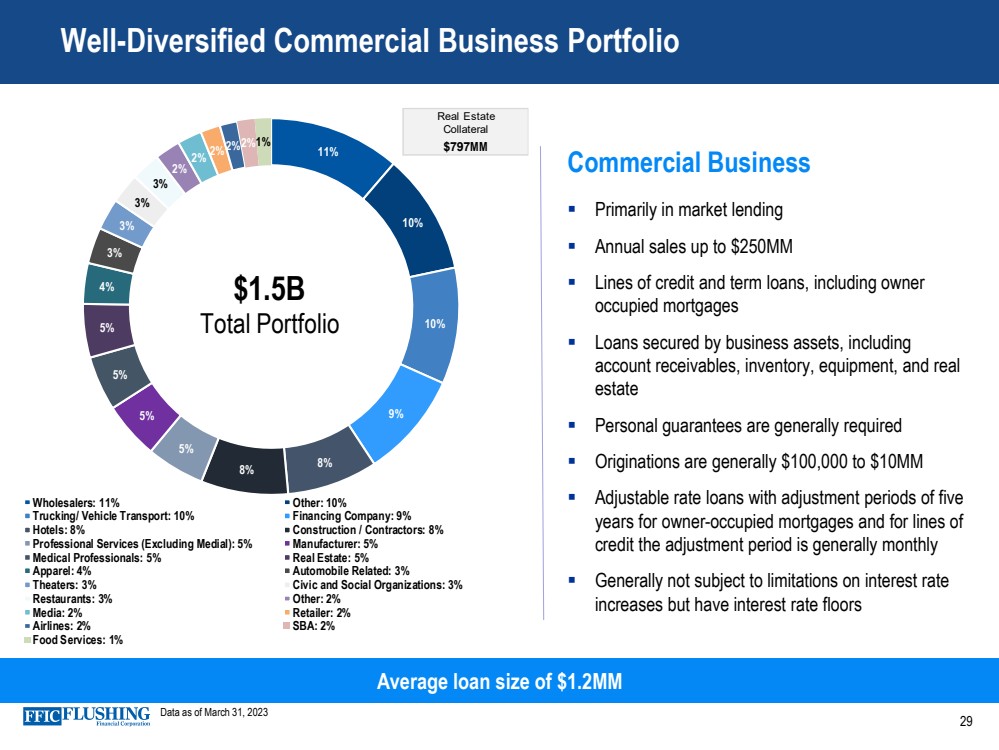

| 29 Well-Diversified Commercial Business Portfolio Commercial Business ▪ Primarily in market lending ▪ Annual sales up to $250MM ▪ Lines of credit and term loans, including owner occupied mortgages ▪ Loans secured by business assets, including account receivables, inventory, equipment, and real estate ▪ Personal guarantees are generally required ▪ Originations are generally $100,000 to $10MM ▪ Adjustable rate loans with adjustment periods of five years for owner-occupied mortgages and for lines of credit the adjustment period is generally monthly ▪ Generally not subject to limitations on interest rate increases but have interest rate floors Average loan size of $1.2MM Data as of March 31, 2023 11% 10% 10% 9% 8% 8% 5% 5% 5% 5% 4% 3% 3% 3% 3% 2% 2% 2%2%2%1% Wholesalers: 11% Other: 10% Trucking/ Vehicle Transport: 10% Financing Company: 9% Hotels: 8% Construction / Contractors: 8% Professional Services (Excluding Medial): 5% Manufacturer: 5% Medical Professionals: 5% Real Estate: 5% Apparel: 4% Automobile Related: 3% Theaters: 3% Civic and Social Organizations: 3% Restaurants: 3% Other: 2% Media: 2% Retailer: 2% Airlines: 2% SBA: 2% Food Services: 1% $1.5B Total Portfolio Real Estate Collateral $797M M |

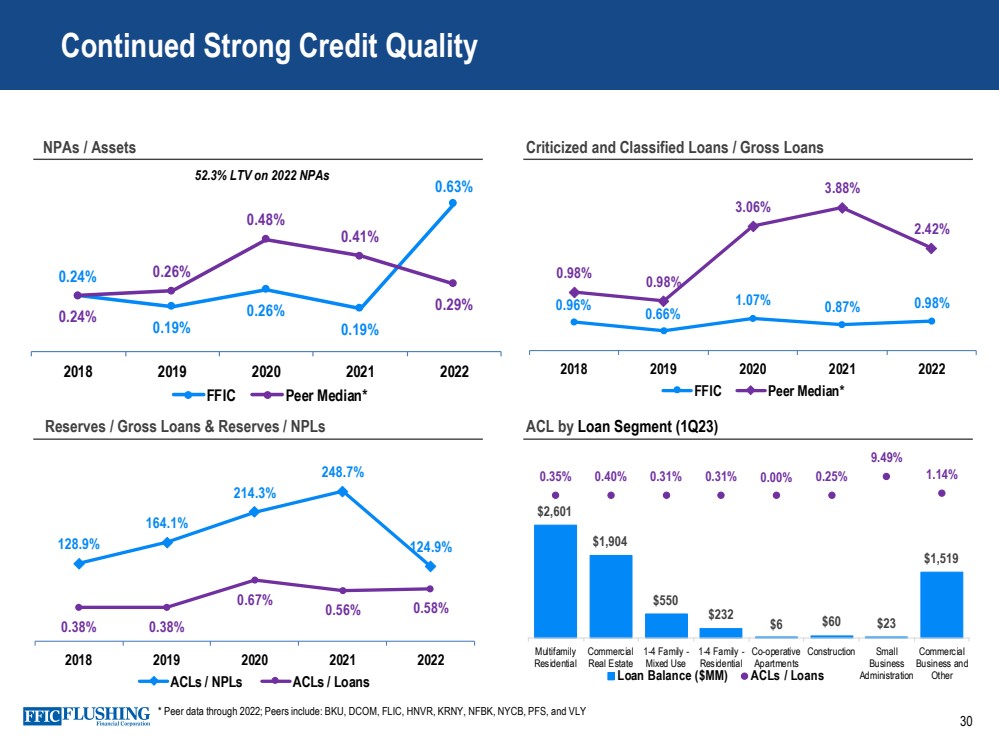

| 30 Continued Strong Credit Quality NPAs / Assets Criticized and Classified Loans / Gross Loans Reserves / Gross Loans & Reserves / NPLs ACL by Loan Segment (1Q23) $2,601 $1,904 $550 $232 $6 $60 $23 $1,519 0.35% 0.40% 0.31% 0.31% 0.00% 0.25% 9.49% 1.14% -7 0. 00% -6 0. 00% -5 0. 00% -4 0. 00% -3 0. 00% -2 0. 00% -1 0. 00% 0. 00 % 10 .0 0% Multifamily Residential Commercial Real Estate 1-4 Family - Mixed Use 1-4 Family - Residential Co-operative Apartments Construction Small Business Administration Commercial Business and Loan Balance ($MM) ACLs / Loans Other 0.24% 0.19% 0.26% 0.19% 0.63% 0.24% 0.26% 0.48% 0.41% 0.29% 0 .0 0% 0 .1 0% 0 .2 0% 0 .3 0% 0 .4 0% 0 .5 0% 0 .6 0% 0 .7 0% 2018 2019 2020 2021 2022 FFIC Peer Median* 52.3% LTV on 2022 NPAs 0.96% 0.66% 1.07% 0.87% 0.98% 0.98% 0.98% 3.06% 3.88% 2.42% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2018 2019 2020 2021 2022 FFIC Peer Median* * Peer data through 2022; Peers include: BKU, DCOM, FLIC, HNVR, KRNY, NFBK, NYCB, PFS, and VLY 128.9% 164.1% 214.3% 248.7% 124.9% 0.38% 0.38% 0.67% 0.56% 0.58% 0% 0% 0% 1% 1% 1% 1% 1% 2% 2% 2% 0% 50% 100% 150% 200% 250% 300% 2018 2019 2020 2021 2022 ACLs / NPLs ACLs / Loans |

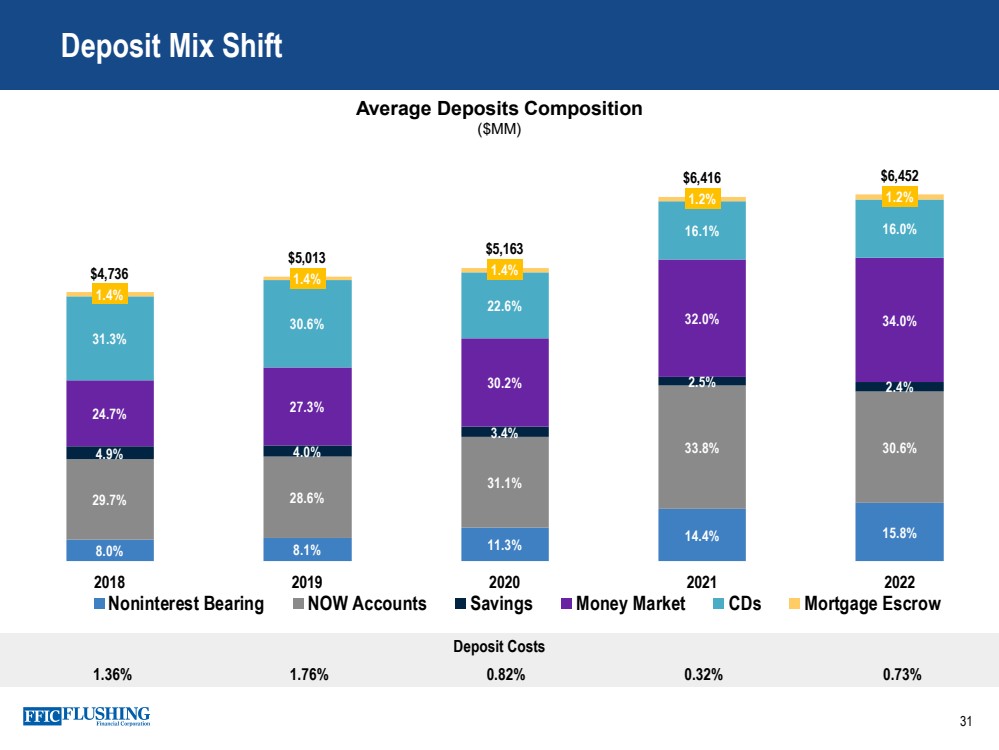

| 31 Deposit Mix Shift Average Deposits Composition ($MM) 8.0% 8.1% 11.3% 14.4% 15.8% 29.7% 28.6% 31.1% 33.8% 30.6% 4.9% 4.0% 3.4% 2.5% 2.4% 24.7% 27.3% 30.2% 32.0% 34.0% 31.3% 30.6% 22.6% 16.1% 16.0% 1.4% 1.4% 1.4% 1.2% 1.2% $4,736 $5,013 $5,163 $6,416 $6,452 0 1 00 0 2 00 0 3 00 0 4 00 0 5 00 0 6 00 0 7 00 0 2018 2019 2020 2021 2022 Noninterest Bearing NOW Accounts Savings Money Market CDs Mortgage Escrow Deposit Costs 1.36% 1.76% 0.82% 0.32% 0.73% |

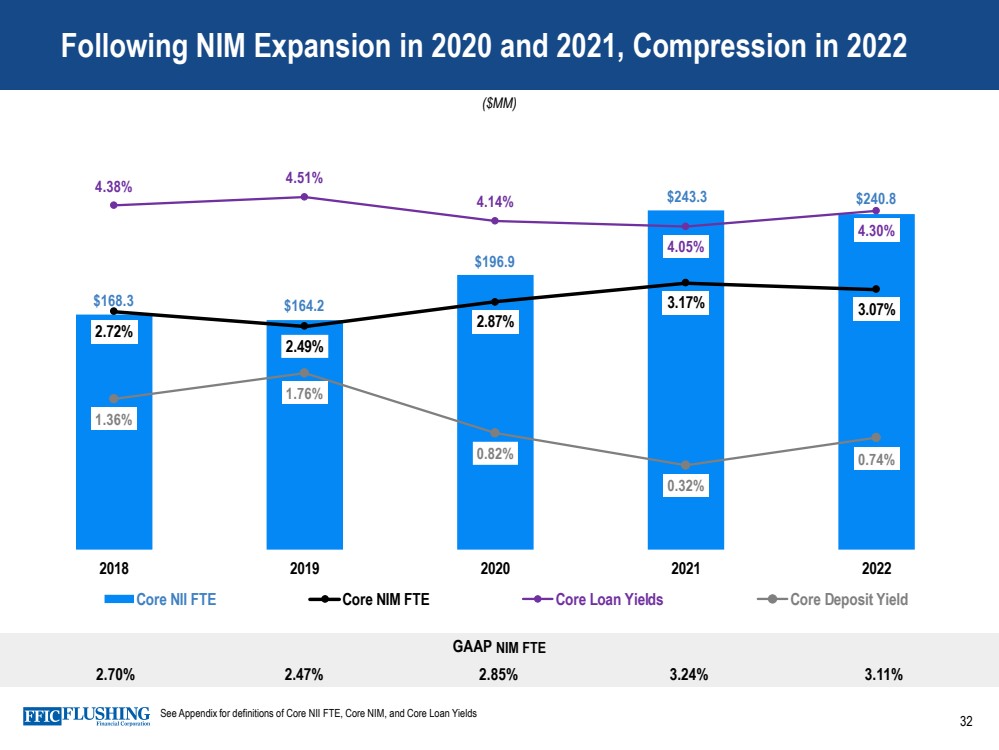

| $168.3 $164.2 $196.9 $243.3 $240.8 2.72% 2.49% 2.87% 3.17% 3.07% 4.38% 4.51% 4.14% 4.05% 4.30% 1.36% 1.76% 0.82% 0.32% 0.74% -1.00% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 2018 2019 2020 2021 2022 Core NII FTE Core NIM FTE Core Loan Yields Core Deposit Yield Following NIM Expansion in 2020 and 2021, Compression in 2022 32 GAAP NIM FTE 2.70% 2.47% 2.85% 3.24% 3.11% ($MM) See Appendix for definitions of Core NII FTE, Core NIM, and Core Loan Yields |

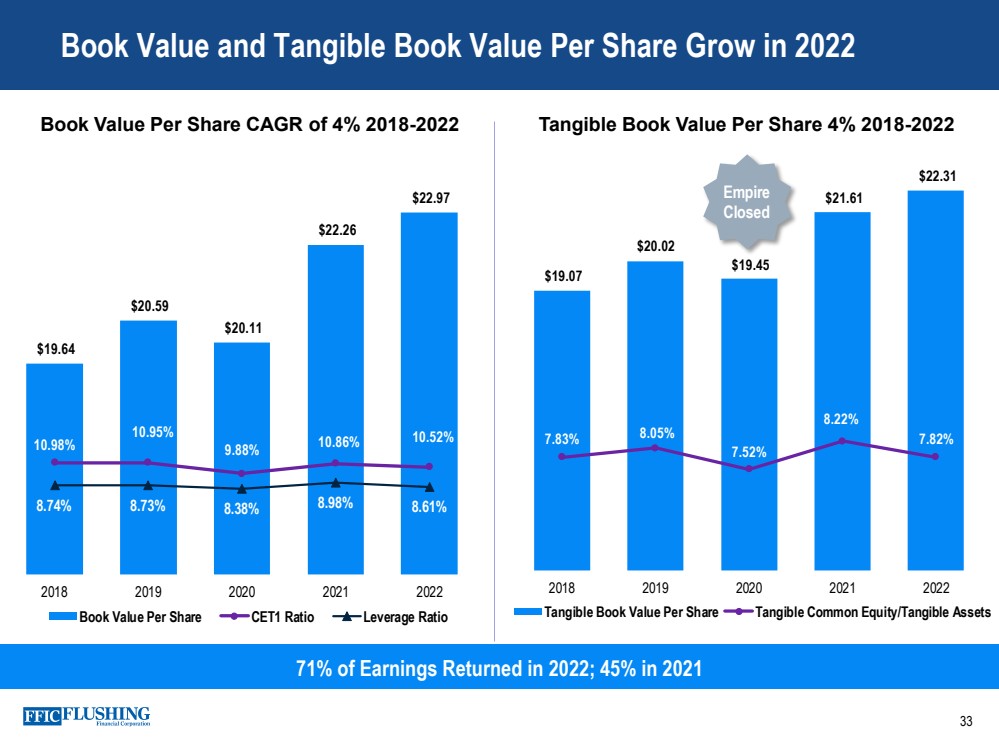

| 71% of Earnings Returned in 2022; 45% in 2021 Book Value and Tangible Book Value Per Share Grow in 2022 33 Book Value Per Share CAGR of 4% 2018-2022 Tangible Book Value Per Share 4% 2018-2022 $19.64 $20.59 $20.11 $22.26 $22.97 10.98% 10.95% 9.88% 10.86% 10.52% 8.74% 8.73% 8.38% 8.98% 8.61% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00% 40.00% $15. 00 $16. 00 $17. 00 $18. 00 $19. 00 $20. 00 $21. 00 $22. 00 $23. 00 $24. 00 2018 2019 2020 2021 2022 Book Value Per Share CET1 Ratio Leverage Ratio $19.07 $20.02 $19.45 $21.61 $22.31 7.83% 8.05% 7.52% 8.22% 7.82% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00% 14.00% 15.00% $10. 00 $12. 00 $14. 00 $16. 00 $18. 00 $20. 00 $22. 00 2018 2019 2020 2021 2022 Tangible Book Value Per Share Tangible Common Equity/Tangible Assets Empire Closed |

| 34 Environmental, Social, and Governance Environmental – reduction of carbon footprint and assessing climate change through underwriting Social - Building rewarding relationships with communities, customers, and employees See more details in our ESG Report under Investor Relations at FlushingBank.com Governance - Corporate governance is a strength through oversight and risk management |

| Reconciliation of GAAP Earnings and Core Earnings 35 Non-cash Fair Value Adjustments to GAAP Earnings The variance in GAAP and core earnings is partly driven by the impact of non-cash net gains and losses from fair value adjustments. These fair value adjustments relate primarily to borrowing carried at fair value under the fair value option. Core Net Income, Core Diluted EPS, Core ROAE, Core ROAA, Pre-provision, Pre-tax Net Revenue, Core Net Interest Income FTE, Core Net Interest Margin FTE, Core Interest Income and Yield on Total Loans, Core Noninterest Income, Core Noninterest Expense and Tangible Book Value per common share are each non-GAAP measures used in this presentation. A reconciliation to the most directly comparable GAAP financial measures appears below in tabular form. The Company believes that these measures are useful for both investors and management to understand the effects of certain interest and noninterest items and provide an alternative view of the Company's performance over time and in comparison to the Company's competitors. These measures should not be viewed as a substitute for net income. The Company believes that tangible book value per common share is useful for both investors and management as these are measures commonly used by financial institutions, regulators and investors to measure the capital adequacy of financial institutions. The Company believes these measures facilitate comparison of the quality and composition of the Company's capital over time and in comparison to its competitors. These measures should not be viewed as a substitute for total shareholders' equity. These non-GAAP measures have inherent limitations, are not required to be uniformly applied and are not audited. They should not be considered in isolation or as a substitute for analysis of results reported under GAAP. These non-GAAP measures may not be comparable to similarly titled measures reported by other companies. |

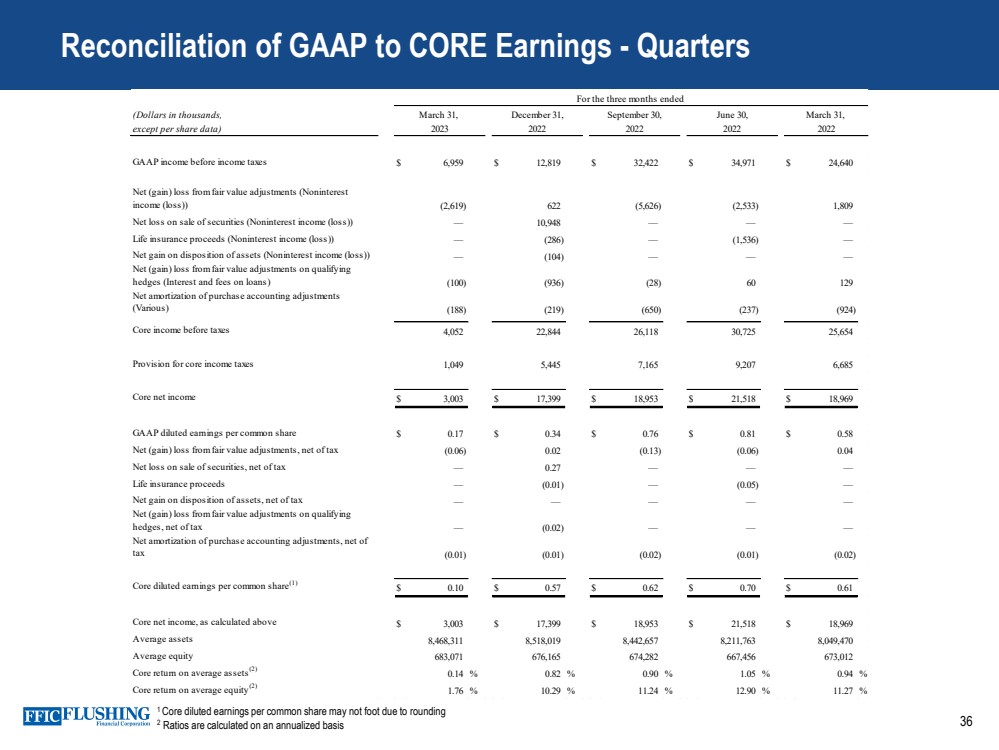

| 36 1 Core diluted earnings per common share may not foot due to rounding 2 Ratios are calculated on an annualized basis Reconciliation of GAAP to CORE Earnings - Quarters (Dollars in thousands, except per share data) GAAP income before income taxes $ 6,959 $ 12,819 $ 32,422 $ 34,971 $ 24,640 Net (gain) loss from fair value adjustments (Noninterest income (loss)) (2,619) 622 (5,626) (2,533) 1,809 Net loss on sale of securities (Noninterest income (loss)) — 10,948 — — — Life insurance proceeds (Noninterest income (loss)) — (286) — (1,536) — Net gain on disposition of assets (Noninterest income (loss)) — (104) — — — Net (gain) loss from fair value adjustments on qualifying hedges (Interest and fees on loans) (100) (936) (28) 60 129 Net amortization of purchase accounting adjustments (Various) (188) (219) (650) (237) (924) Core income before taxes 4,052 22,844 26,118 30,725 25,654 Provision for core income taxes 1,049 5,445 7,165 9,207 6,685 Core net income $ 3,003 $ 17,399 $ 18,953 $ 21,518 $ 18,969 GAAP diluted earnings per common share $ 0.17 $ 0.34 $ 0.76 $ 0.81 $ 0.58 Net (gain) loss from fair value adjustments, net of tax (0.06) 0.02 (0.13) (0.06) 0.04 Net loss on sale of securities, net of tax — 0.27 — — — Life insurance proceeds — (0.01) — (0.05) — Net gain on disposition of assets, net of tax — — — — — Net (gain) loss from fair value adjustments on qualifying hedges, net of tax — (0.02) — — — Net amortization of purchase accounting adjustments, net of tax (0.01) (0.01) (0.02) (0.01) (0.02) Core diluted earnings per common share(1) $ 0.10 $ 0.57 $ 0.62 $ 0.70 $ 0.61 Core net income, as calculated above $ 3,003 $ 17,399 $ 18,953 $ 21,518 $ 18,969 Average assets 8,468,311 8,518,019 8,442,657 8,211,763 8,049,470 Average equity 683,071 676,165 674,282 667,456 673,012 Core return on average assets(2) 0.14 % 0.82 % 0.90 % 1.05 % 0.94 % Core return on average equity(2) 1.76 % 10.29 % 11.24 % 12.90 % 11.27 % 2023 March 31, December 31, 2022 2022 September 30, June 30, 2022 2022 March 31, For the three months ended |

| 37 Reconciliation of GAAP Revenue and Pre-provision Pre-tax Net Revenue - Quarters (Dollars in thousands) GAAP Net interest income $ 45,262 $ 54,201 $ 61,206 $ 64,730 $ 63,479 Net (gain) loss from fair value adjustments on qualifying hedges (100) (936) (28) 60 129 Net amortization of purchase accounting adjustments (306) (342) (775) (367) (1,058) Core Net interest income $ 44,856 $ 52,923 $ 60,403 $ 64,423 $ 62,550 GAAP Noninterest income (loss) $ 6,908 $ (7,652) $ 8,995 $ 7,353 $ 1,313 Net (gain) loss from fair value adjustments (2,619) 622 (5,626) (2,533) 1,809 Net loss on sale of securities — 10,948 — — — Life insurance proceeds — (286) — (1,536) — Net gain on sale of assets — (104) — — — Core Noninterest income $ 4,289 $ 3,528 $ 3,369 $ 3,284 $ 3,122 GAAP Noninterest expense $ 37,703 $ 33,742 $ 35,634 $ 35,522 $ 38,794 Net amortization of purchase accounting adjustments (118) (123) (125) (130) (134) Core Noninterest expense $ 37,585 $ 33,619 $ 35,509 $ 35,392 $ 38,660 Net interest income $ 45,262 $ 54,201 $ 61,206 $ 64,730 $ 63,479 Noninterest income (loss) 6,908 (7,652) 8,995 7,353 1,313 Noninterest expense (37,703) (33,742) (35,634) (35,522) (38,794) Pre-provision pre-tax net revenue $ 14,467 $ 12,807 $ 34,567 $ 36,561 $ 25,998 Core: Net interest income $ 44,856 $ 52,923 $ 60,403 $ 64,423 $ 62,550 Noninterest income 4,289 3,528 3,369 3,284 3,122 Noninterest expense (37,585) (33,619) (35,509) (35,392) (38,660) Pre-provision pre-tax net revenue $ 11,560 $ 22,832 $ 28,263 $ 32,315 $ 27,012 Efficiency Ratio 76.5 % 59.6 % 55.7 % 52.3 % 58.9 % For the three months ended March 31, December 31, September 30, June 30, March 31, 2023 2022 2022 2022 2022 |

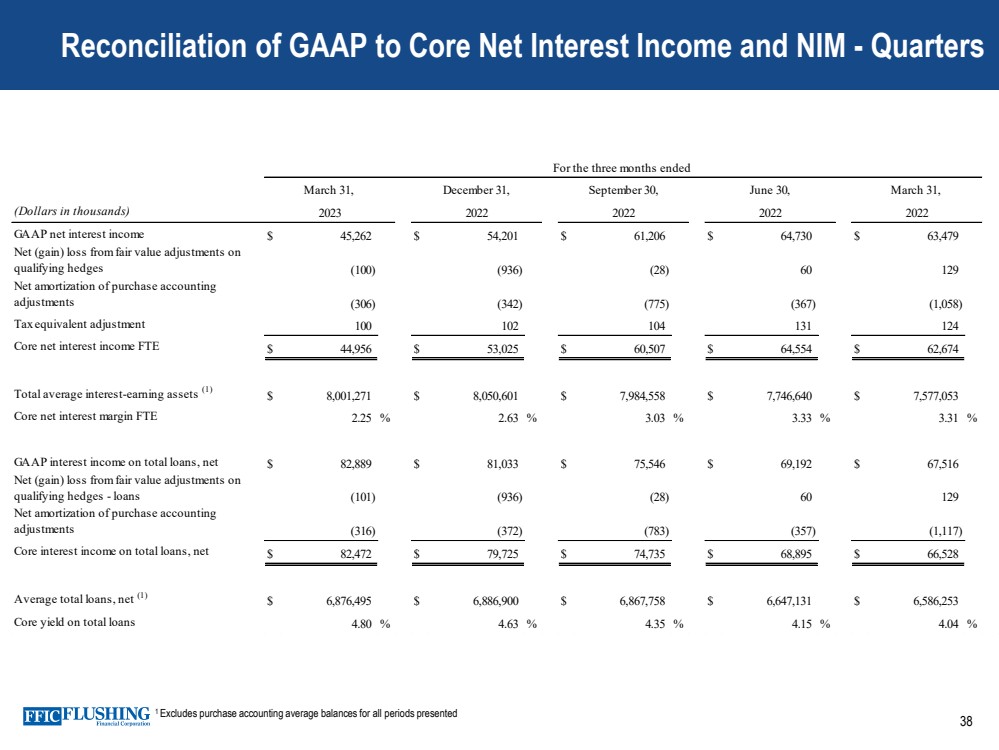

| 38 1 Excludes purchase accounting average balances for all periods presented Reconciliation of GAAP to Core Net Interest Income and NIM - Quarters (Dollars in thousands) GAAP net interest income $ 45,262 $ 54,201 $ 61,206 $ 64,730 $ 63,479 Net (gain) loss from fair value adjustments on qualifying hedges (100) (936) (28) 60 129 Net amortization of purchase accounting adjustments (306) (342) (775) (367) (1,058) Tax equivalent adjustment 100 102 104 131 124 Core net interest income FTE $ 44,956 $ 53,025 $ 60,507 $ 64,554 $ 62,674 Total average interest-earning assets (1) $ 8,001,271 $ 8,050,601 $ 7,984,558 $ 7,746,640 $ 7,577,053 Core net interest margin FTE 2.25 % 2.63 % 3.03 % 3.33 % 3.31 % GAAP interest income on total loans, net $ 82,889 $ 81,033 $ 75,546 $ 69,192 $ 67,516 Net (gain) loss from fair value adjustments on qualifying hedges - loans (101) (936) (28) 60 129 Net amortization of purchase accounting adjustments (316) (372) (783) (357) (1,117) Core interest income on total loans, net $ 82,472 $ 79,725 $ 74,735 $ 68,895 $ 66,528 Average total loans, net (1) $ 6,876,495 $ 6,886,900 $ 6,867,758 $ 6,647,131 $ 6,586,253 Core yield on total loans 4.80 % 4.63 % 4.35 % 4.15 % 4.04 % For the three months ended March 31, December 31, September 30, June 30, March 31, 2023 2022 2022 2022 2022 |

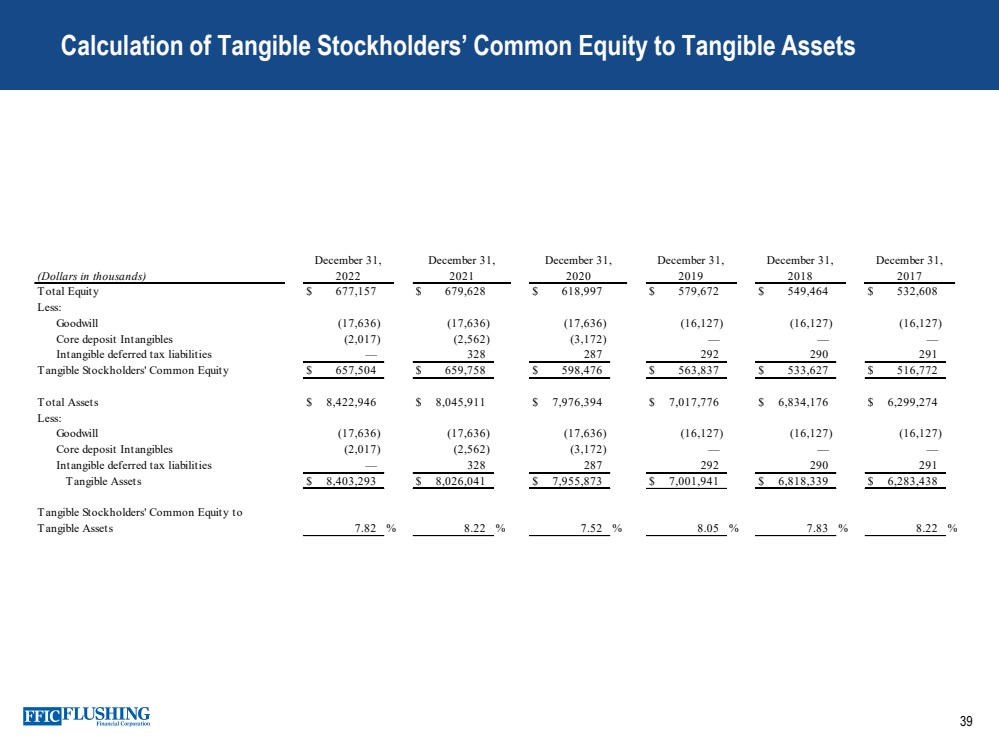

| 39 Calculation of Tangible Stockholders’ Common Equity to Tangible Assets (Dollars in thousands) Total Equity $ 677,157 $ 679,628 $ 618,997 $ 579,672 $ 549,464 $ 532,608 Less: Goodwill (17,636) (17,636) (17,636) (16,127) (16,127) (16,127) Core deposit Intangibles (2,017) (2,562) (3,172) — — — Intangible deferred tax liabilities — 328 287 292 290 291 Tangible Stockholders' Common Equity $ 657,504 $ 659,758 $ 598,476 $ 563,837 $ 533,627 $ 516,772 Total Assets $ 8,422,946 $ 8,045,911 $ 7,976,394 $ 7,017,776 $ 6,834,176 $ 6,299,274 Less: Goodwill (17,636) (17,636) (17,636) (16,127) (16,127) (16,127) Core deposit Intangibles (2,017) (2,562) (3,172) — — — Intangible deferred tax liabilities — 328 287 292 290 291 Tangible Assets $ 8,403,293 $ 8,026,041 $ 7,955,873 $ 7,001,941 $ 6,818,339 $ 6,283,438 Tangible Stockholders' Common Equity to Tangible Assets 7.82 % 8.22 % 7.52 % 8.05 % 7.83 % 8.22 % December 31, 2022 December 31, 2021 December 31, December 31, December 31, December 31, 2020 2019 2018 2017 |

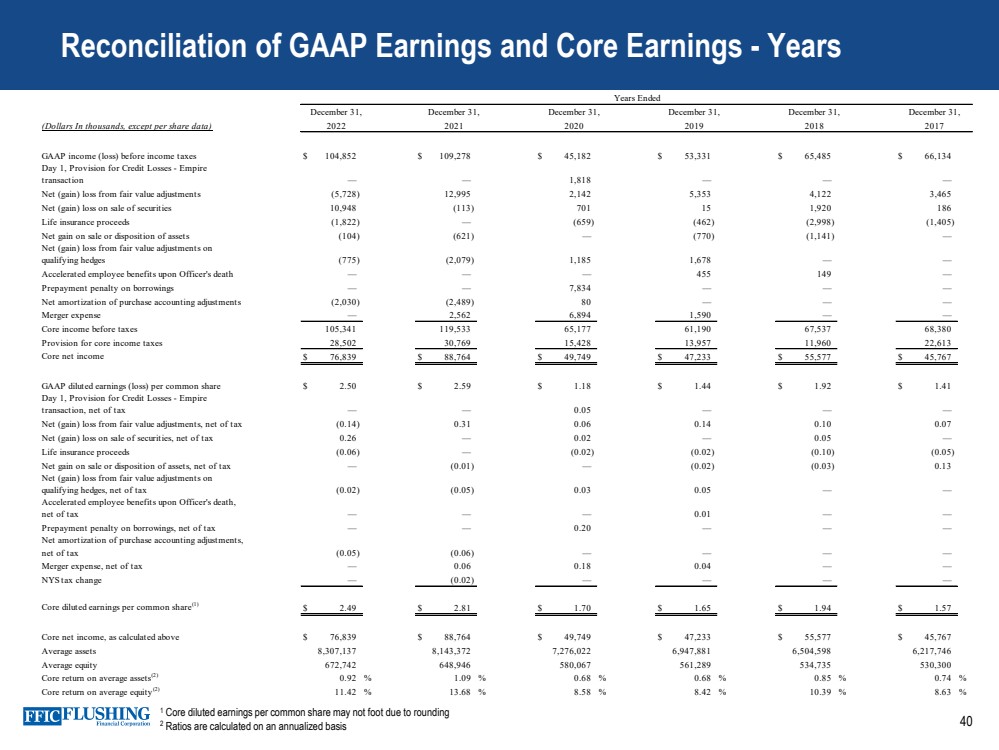

| 40 Reconciliation of GAAP Earnings and Core Earnings - Years 1 Core diluted earnings per common share may not foot due to rounding 2 Ratios are calculated on an annualized basis (Dollars In thousands, except per share data) GAAP income (loss) before income taxes $ 104,852 $ 109,278 $ 45,182 $ 53,331 $ 65,485 $ 66,134 Day 1, Provision for Credit Losses - Empire transaction — — 1,818 — — — Net (gain) loss from fair value adjustments (5,728) 12,995 2,142 5,353 4,122 3,465 Net (gain) loss on sale of securities 10,948 (113) 701 1 5 1,920 186 Life insurance proceeds (1,822) — (659) (462) (2,998) (1,405) Net gain on sale or disposition of assets (104) (621) — (770) (1,141) — Net (gain) loss from fair value adjustments on qualifying hedges (775) (2,079) 1,185 1,678 — — Accelerated employee benefits upon Officer's death — — — 455 149 — Prepayment penalty on borrowings — — 7,834 — — — Net amortization of purchase accounting adjustments (2,030) (2,489) 8 0 — — — Merger expense — 2,562 6,894 1,590 — — Core income before taxes 105,341 119,533 65,177 61,190 67,537 68,380 Provision for core income taxes 28,502 30,769 15,428 13,957 11,960 22,613 Core net income $ 76,839 $ 88,764 $ 49,749 $ 47,233 $ 55,577 $ 45,767 GAAP diluted earnings (loss) per common share $ 2.50 $ 2.59 $ 1.18 $ 1.44 $ 1.92 $ 1.41 Day 1, Provision for Credit Losses - Empire transaction, net of tax — — 0.05 — — — Net (gain) loss from fair value adjustments, net of tax (0.14) 0.31 0.06 0.14 0.10 0.07 Net (gain) loss on sale of securities, net of tax 0.26 — 0.02 — 0.05 — Life insurance proceeds (0.06) — (0.02) (0.02) (0.10) (0.05) Net gain on sale or disposition of assets, net of tax — (0.01) — (0.02) (0.03) 0.13 Net (gain) loss from fair value adjustments on qualifying hedges, net of tax (0.02) (0.05) 0.03 0.05 — — Accelerated employee benefits upon Officer's death, net of tax — — — 0.01 — — Prepayment penalty on borrowings, net of tax — — 0.20 — — — Net amortization of purchase accounting adjustments, net of tax (0.05) (0.06) — — — — Merger expense, net of tax — 0.06 0.18 0.04 — — NYS tax change — (0.02) — — — — Core diluted earnings per common share(1) $ 2.49 $ 2.81 $ 1.70 $ 1.65 $ 1.94 $ 1.57 Core net income, as calculated above $ 76,839 $ 88,764 $ 49,749 $ 47,233 $ 55,577 $ 45,767 Average assets 8,307,137 8,143,372 7,276,022 6,947,881 6,504,598 6,217,746 Average equity 672,742 648,946 580,067 561,289 534,735 530,300 Core return on average assets(2) 0.92 % 1.09 % 0.68 % 0.68 % 0.85 % 0.74 % Core return on average equity(2) 11.42 % 13.68 % 8.58 % 8.42 % 10.39 % 8.63 % Years Ended December 31, 2022 December 31, 2021 December 31, 2020 2018 December 31, December 31, 2017 December 31, 2019 |

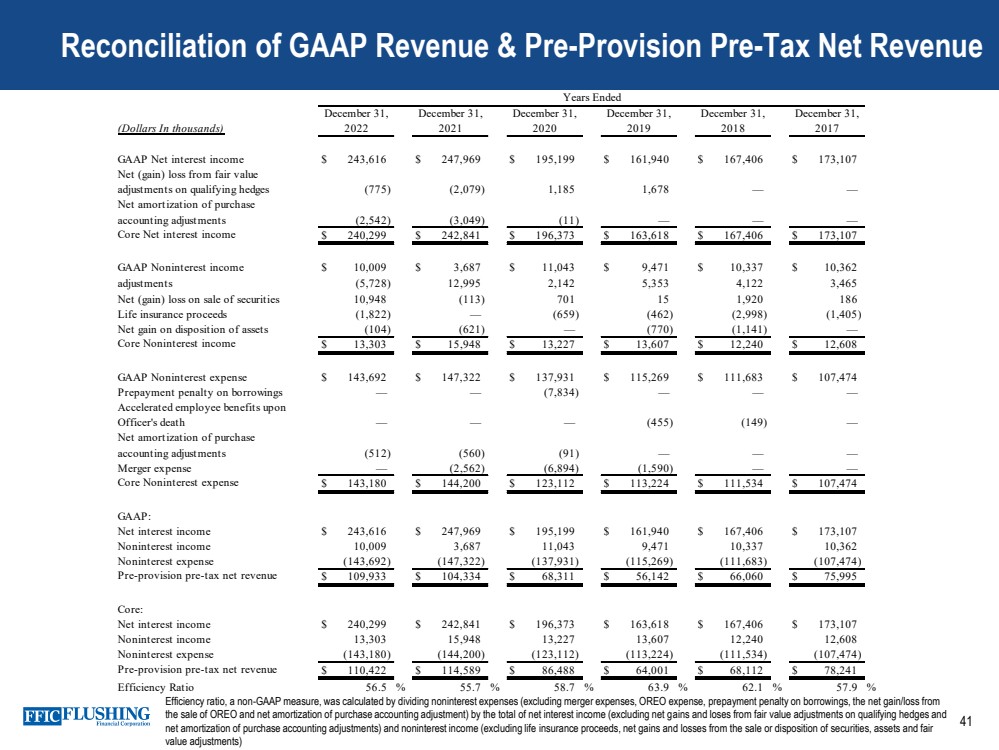

| 41 Reconciliation of GAAP Revenue & Pre-Provision Pre-Tax Net Revenue Efficiency ratio, a non-GAAP measure, was calculated by dividing noninterest expenses (excluding merger expenses, OREO expense, prepayment penalty on borrowings, the net gain/loss from the sale of OREO and net amortization of purchase accounting adjustment) by the total of net interest income (excluding net gains and loses from fair value adjustments on qualifying hedges and net amortization of purchase accounting adjustments) and noninterest income (excluding life insurance proceeds, net gains and losses from the sale or disposition of securities, assets and fair value adjustments) (Dollars In thousands) GAAP Net interest income $ 243,616 $ 247,969 $ 195,199 $ 161,940 $ 167,406 $ 173,107 Net (gain) loss from fair value adjustments on qualifying hedges (775) (2,079) 1,185 1,678 — — Net amortization of purchase accounting adjustments (2,542) (3,049) (11) — — — Core Net interest income $ 240,299 $ 242,841 $ 196,373 $ 163,618 $ 167,406 $ 173,107 GAAP Noninterest income Net (gain) loss from fair value $ 10,009 $ 3,687 $ 11,043 $ 9,471 $ 10,337 $ 10,362 adjustments (5,728) 12,995 2,142 5,353 4,122 3,465 Net (gain) loss on sale of securities 10,948 (113) 701 1 5 1,920 186 Life insurance proceeds (1,822) — (659) (462) (2,998) (1,405) Net gain on disposition of assets (104) (621) — (770) (1,141) — Core Noninterest income $ 13,303 $ 15,948 $ 13,227 $ 13,607 $ 12,240 $ 12,608 GAAP Noninterest expense $ 143,692 $ 147,322 $ 137,931 $ 115,269 $ 111,683 $ 107,474 Prepayment penalty on borrowings — — (7,834) — — — Accelerated employee benefits upon Officer's death — — — (455) (149) — Net amortization of purchase accounting adjustments (512) (560) (91) — — — Merger expense — (2,562) (6,894) (1,590) — — Core Noninterest expense $ 143,180 $ 144,200 $ 123,112 $ 113,224 $ 111,534 $ 107,474 GAAP: Net interest income $ 243,616 $ 247,969 $ 195,199 $ 161,940 $ 167,406 $ 173,107 Noninterest income 10,009 3,687 11,043 9,471 10,337 10,362 Noninterest expense (143,692) (147,322) (137,931) (115,269) (111,683) (107,474) Pre-provision pre-tax net revenue $ 109,933 $ 104,334 $ 68,311 $ 56,142 $ 66,060 $ 75,995 Core: Net interest income $ 240,299 $ 242,841 $ 196,373 $ 163,618 $ 167,406 $ 173,107 Noninterest income 13,303 15,948 13,227 13,607 12,240 12,608 Noninterest expense (143,180) (144,200) (123,112) (113,224) (111,534) (107,474) Pre-provision pre-tax net revenue $ 110,422 $ 114,589 $ 86,488 $ 64,001 $ 68,112 $ 78,241 Efficiency Ratio 56.5 % 55.7 % 58.7 % 63.9 % 62.1 % 57.9 % December 31, 2018 December 31, 2017 Years Ended December 31, 2019 December 31, 2022 December 31, 2021 December 31, 2020 |

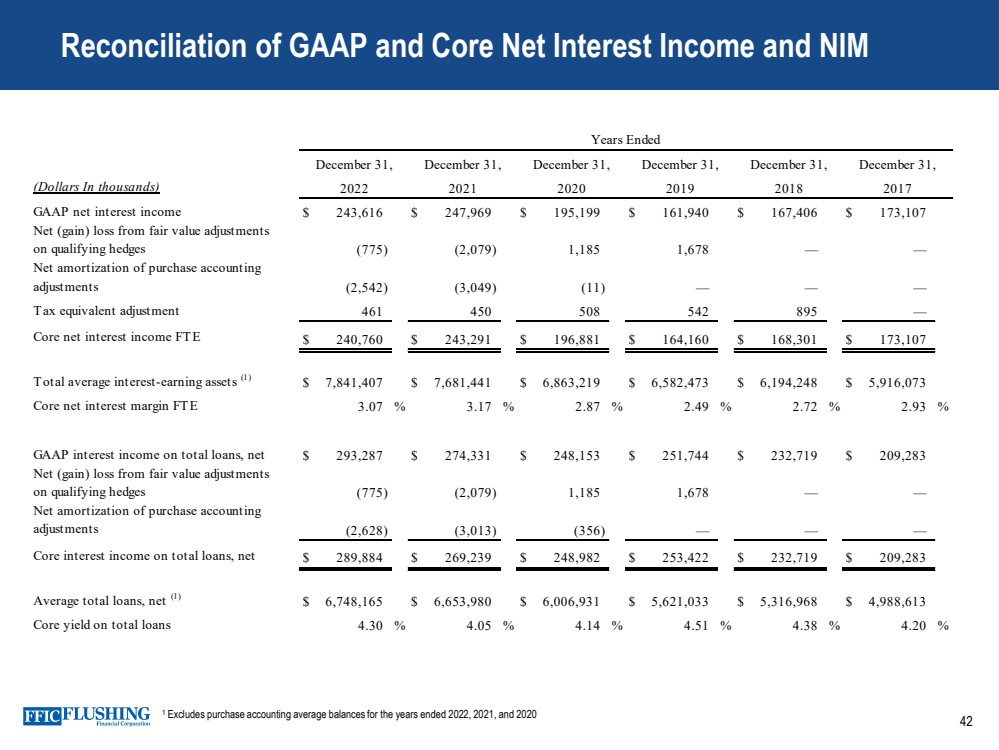

| 42 Reconciliation of GAAP and Core Net Interest Income and NIM 1 Excludes purchase accounting average balances for the years ended 2022, 2021, and 2020 (Dollars In thousands) GAAP net interest income $ 243,616 $ 247,969 $ 195,199 $ 161,940 $ 167,406 $ 173,107 Net (gain) loss from fair value adjustments on qualifying hedges (775) (2,079) 1,185 1,678 — — Net amortization of purchase accounting adjustments (2,542) (3,049) (11) — — — Tax equivalent adjustment 461 450 508 542 895 — Core net interest income FTE $ 240,760 $ 243,291 $ 196,881 $ 164,160 $ 168,301 $ 173,107 Total average interest-earning assets (1) $ 7,841,407 $ 7,681,441 $ 6,863,219 $ 6,582,473 $ 6,194,248 $ 5,916,073 Core net interest margin FTE 3.07 % 3.17 % 2.87 % 2.49 % 2.72 % 2.93 % GAAP interest income on total loans, net $ 293,287 $ 274,331 $ 248,153 $ 251,744 $ 232,719 $ 209,283 Net (gain) loss from fair value adjustments on qualifying hedges (775) (2,079) 1,185 1,678 — — Net amortization of purchase accounting adjustments (2,628) (3,013) (356) — — — Core interest income on total loans, net $ 289,884 $ 269,239 $ 248,982 $ 253,422 $ 232,719 $ 209,283 Average total loans, net (1) $ 6,748,165 $ 6,653,980 $ 6,006,931 $ 5,621,033 $ 5,316,968 $ 4,988,613 Core yield on total loans 4.30 % 4.05 % 4.14 % 4.51 % 4.38 % 4.20 % Years Ended December 31, 2019 December 31, 2022 December 31, 2021 December 31, 2020 December 31, 2018 2017 December 31, |

| 43 Contact Details Susan K. Cullen SEVP, CFO & Treasurer Phone: (718) 961-5400 Email: scullen@flushingbank.com Al Savastano, CFA Director of Investor Relations Phone: (516) 820-1146 Email: asavastano@flushingbank.com |

|