As filed with the Securities and Exchange Commission on August 30, 2024

Securities Act File No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Pre-Effective Amendment No.

Post-Effective Amendment No.

(Check appropriate box or boxes)

MATTHEWS INTERNATIONAL FUNDS

(Exact Name of Registrant as Specified in Charter)

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code: (415) 788-7553

James Cooper Abbott, President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

(Name and Address of Agent for Service)

Copies to:

Deepa Damre Smith, Vice President

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

David A. Hearth, Esq.

Paul Hastings LLP

101 California Street, 48th Floor

San Francisco, CA 94111

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933.

Title of securities being registered: Shares of beneficial interest, $0.001 par value per share.

Calculation of Registration Fee under the Securities Act of 1933: No filing fee is required because of reliance on Section 24(f) and Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Matthews International Funds

dba Matthews Asia Funds

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

[ ], 2024

Dear Shareholder:

You are receiving this Information Statement/Prospectus because you own shares in the following fund (the “Target Fund”):

| | ● | | Matthews Asian Growth and Income Fund, a series of Matthews Asia Funds |

We are writing to inform you about a reorganization of the Target Fund with the Matthews Emerging Markets Equity Fund (the “Acquiring Fund” and together with the Target Fund, the “Funds” and each, a “Fund”), also a series of the Trust. In this reorganization, your Target Fund shares will be exchanged for the same class of shares of the Acquiring Fund with the same aggregate net asset value of the Target Fund shares that you currently hold. It is currently anticipated that the reorganization of the Target Fund will be effected on a tax-free basis for federal income tax purposes on or about [November 8, 2024].

Following the reorganization, the Target Fund will be liquidated (such reorganization and liquidation, the “Reorganization”). The Acquiring Fund will continue to be managed by Matthews International Capital Management, LLC (“Matthews”).

Matthews believes that the Reorganization is in the best interests of shareholders of both the Target Fund and the Acquiring Fund. In recommending the Reorganization to the Board of Trustees of the Trust, Matthews noted that approximately 80% of the companies comprising the emerging markets equity investment universe (as represented by the MSCI Emerging Markets Index) are located in Asia, and, therefore, that there is a substantial overlap between an investment strategy focused on emerging market equity securities and one focused on growth and income-generating securities in the Asian region. Further, Matthews noted that the broader emerging markets universe in which the Acquiring Fund operates should benefit shareholders of the Target Fund and will have the potential to improve long-term performance for those shareholders. Matthews further believes that it is in the best interests of the Target Fund to combine the Target Fund’s assets with a fund with a lower overall expense structure and generally better performance, recognizing that the Acquiring Fund has a shorter operating history. Matthews also believes that the Acquiring Fund’s investment objective and strategies make it a compatible fund within the Trust for a reorganization with the Target Fund. Matthews believes that continuing to operate the Target Fund as currently constituted is not in the long-term best interests of the Target Fund. Matthews also believes that both Funds may benefit from potential operating efficiencies and economies of scale that may be achieved by combining the Funds’ assets in the Reorganization. As a result, Matthews determined it prudent to recommend the Reorganization to the Board of Trustees of the Trust.

The table below sets forth the Acquiring Fund and the anticipated schedule for the Reorganization:

| | | | |

| Target Fund | | Acquiring Fund | | Expected Closing Date |

Matthews Asian Growth and Income Fund | | Matthews Emerging Markets Equity Fund | | [November 8], 2024 |

The Reorganization will be conducted pursuant to an Agreement and Plan of Reorganization and Liquidation, which is included as Appendix A to these materials. The Reorganization is structured to be a tax-free reorganization under the U.S. Internal Revenue Code of 1986, as amended.

The Board of Trustees of the Funds, including all of the Independent Trustees (i.e., Trustees who are not “interested persons” of the Funds as that term is defined in the Investment Company Act of 1940), approved the Reorganization and determined, with respect to the Reorganization, that participation in the Reorganization is in the best interests of each Fund and the interests of existing shareholders of each Fund, as applicable, would not be diluted as a result of the Reorganization.

No shareholder vote is required to complete the Reorganization. We are not asking you for a proxy and you are requested not to send us a proxy.

If you do not wish to participate in the Reorganization, you can exchange your Target Fund shares for shares of another Matthews Asia Funds mutual fund or redeem your Target Fund shares before completion of the Reorganization. Prior to doing so, however, you should consider the tax consequences associated with either action.

1

The accompanying Information Statement/Prospectus provides more information about the Reorganization. Please carefully review the additional information provided in this document. If you have questions, please call 1-800-789-ASIA (2742).

Sincerely,

J. Cooper Abbott

Trustee and President

Matthews Asia Funds

2

QUESTIONS AND ANSWERS

Shareholders should read this entire Information Statement/Prospectus carefully.

The following is a brief Q&A that will help explain the Reorganization (as defined below), including the reasons for the Reorganization. A more detailed discussion of the Reorganization follows this section.

Q. What is happening to my investment? Why am I receiving an Information Statement/Prospectus?

A. You are receiving this Information Statement/Prospectus because you own shares in the Matthews Asian Growth and Income Fund (“Target Fund”).

The Target Fund will be reorganized into the Matthews Emerging Markets Equity Fund (the “Acquiring Fund” and together with the Target Fund, the “Funds”). All of your Target Fund shares will be exchanged for shares of the Acquiring Fund, as discussed below. Following the reorganization, the Target Fund will be liquidated (such reorganization and liquidation, the “Reorganization”). Following the completion of the Reorganization, the Acquiring Fund may be referred to as the “Combined Fund.” The chart below lists the name of the Target Fund and the Acquiring Fund:

| | |

| Target Fund | | Acquiring Fund |

Matthews Asian Growth and Income Fund | | Matthews Emerging Markets Equity Fund |

The Reorganization will be accomplished in accordance with an Agreement and Plan of Reorganization and Liquidation (the “Plan”). The Plan provides for the transfer of all of the assets and liabilities of the Target Fund to the Acquiring Fund in exchange for shares of the Acquiring Fund having an aggregate net asset value (“NAV”) equal to the aggregate NAV of the Target Fund followed immediately by the distribution by the Target Fund to its shareholders of the portion of shares of the Acquiring Fund to which each shareholder is entitled.

Q. Has the Board of Trustees of the Target Fund approved the Reorganization?

A. Yes. The Board of Trustees of each Fund is comprised of the same individuals because both Funds are series of the Trust. The Board of Trustees of the Funds (the “Board”) approved the Reorganization. The Board, including all of the Independent Trustees (i.e., Trustees who are not “interested persons” of the Funds as defined in the Investment Company Act of 1940 (the “1940 Act”)), determined that, for each Fund, the participation in the Reorganization is in the best interests of each Fund and that the interests of existing Fund shareholders will not be diluted as a result of the Reorganization.

Q. Why is the Reorganization occurring?

A. The Target Fund’s investment adviser, Matthews International Capital Management, LLC (“Matthews”), proposed the Reorganization because it believes that the Reorganization is in the best interests of shareholders of both the Target Fund and the Acquiring Fund. In recommending the Reorganization to the Board of Trustees of the Trust, Matthews noted that approximately 80% of the companies comprising the emerging markets equity investment universe (as represented by the MSCI Emerging Markets Index) are located in Asia, and, therefore, that there is a substantial overlap between an investment strategy focused on emerging market equity securities and one focused on growth and income-generating securities in the Asian region. Further, Matthews noted that the broader emerging markets universe in which the Acquiring Fund operates should benefit shareholders of the Target Fund and will have the potential to improve long-term performance for those shareholders. Matthews further believes that it is in the best interests of the Target Fund to combine the Target Fund’s assets with a fund with a lower overall expense structure and generally better performance, recognizing that the Acquiring Fund has a shorter operating history. Matthews also believes that the Acquiring Fund’s investment objective and strategies make it a compatible fund within the Trust for a reorganization with the Target Fund. Matthews believes that continuing to operate the Target Fund as currently constituted is not in the long-term best interests of the Target Fund. Matthews also believes that both Funds may benefit from potential operating efficiencies and economies of scale that may be achieved by combining the Funds’ assets in the Reorganization. As a result, Matthews determined it prudent to recommend the Reorganization to the Board of Trustees of the Trust.

The Acquiring Fund and the Target Fund both seek long-term capital appreciation as their primary investment objective. The Target Fund also has a secondary investment objective to seek income. While the Acquiring Fund does not have a secondary income objective, historically it has provided a similar investment experience in terms of dividend yield and its exposure to dividend-paying common stocks. In addition, effective upon completion of the Reorganization, the Acquiring Fund will adopt, as part of its principal investment strategies, a policy to invest at least 20% of the Acquiring Fund’s net assets in income-producing securities.

3

Q. How will the Reorganization affect me as a shareholder?

A. Pursuant to the Reorganization Agreement, all of the assets and liabilities of the Target Fund will be combined with those of the Acquiring Fund. Once the Reorganization is completed, shares of the Target Fund will be exchanged for shares of the Acquiring Fund based on a specified exchange ratio determined by the respective net asset values of the Funds’ shares. The aggregate net asset value of your Target Fund shares immediately before the Reorganization will be the same as the aggregate net asset value of your Acquiring Fund shares immediately following completion of the Reorganization, so that the Reorganization will not affect the value of your investment. However, following the Reorganization you will no longer own shares of the Target Fund but instead will own shares of the Acquiring Fund. After the completion of the Reorganization, you will own a smaller percentage of the Acquiring Fund than you did of the Target Fund because the Combined Fund will be larger than the Target Fund.

Q. Am I being asked to vote on the Reorganization?

A. No. Shareholders of the Target Fund are not required to approve the Reorganization under state or federal law, the 1940 Act, or the organizational documents governing the Target Fund. We are not asking you for a proxy and you are requested not to send us a proxy.

Q. Will the fees and expenses of the Acquiring Fund be lower than the fees and expenses of the Target Fund?

A. Yes. Following the Reorganization, the Acquiring Fund’s projected total annual operating expenses are expected to be below those of the Target Fund for each class of shares as a result of an expense cap implemented by Matthews with respect to the Acquiring Fund that will carry over to the Combined Fund.

Q. What will I have to do to open an account in the Acquiring Fund?

A. Your shares automatically will be converted into shares of the Acquiring Fund on the date of the completion of the Reorganization. You will receive written confirmation that this change has taken place. You will receive the same class of shares of the Acquiring Fund as you currently hold of the Target Fund. The aggregate net asset value of the shares you receive in the Reorganization relating to the Target Fund will be equal to the aggregate net asset value of the shares you own immediately prior to the Reorganization.

Q. Will I own the same number of shares of the Acquiring Fund as I currently own of the Target Fund?

A. No. However, you will receive shares of the Acquiring Fund with the same aggregate net asset value as the shares of the Target Fund you own prior to the Reorganization. The number of shares you receive will depend on the relative net asset value of the shares of the Target Fund and the Acquiring Fund on the Closing Date. Thus, on the Closing Date, if the net asset value of a share of the Acquiring Fund is lower than the net asset value of the corresponding share class of the Target Fund, you will receive a greater number of shares of the Acquiring Fund in the Reorganization than you held in the Target Fund before the Reorganization. On the other hand, if the net asset value of a share of the Acquiring Fund is higher than the net asset value of the corresponding share class of the Target Fund, you will receive fewer shares of the Acquiring Fund in the Reorganization than you held in the Target Fund before the Reorganization. The aggregate net asset value of your Acquiring Fund shares immediately after the Reorganization will be the same as the aggregate net asset value of the Target Fund shares you held immediately prior to the Reorganization.

Q. Who will advise the Acquiring Fund once the Reorganization is completed?

A. As you know, the Target Fund is advised by Matthews. The Acquiring Fund is also advised by Matthews and will continue to be advised by Matthews once the Reorganization is completed.

Q. Will my rights as a shareholder change after the Reorganization?

A. No, your rights as a shareholder will not change in any way as a result of the Reorganization, but you will be a shareholder of the Acquiring Fund, which is a separate series of the Trust. The shareholder services available to you after the Reorganization will be identical.

Q. Will the Target Fund or Acquiring Fund charge shareholders any sales charges (loads), commissions, or other similar fees in connection with the Reorganization?

A. No. Neither the Target Fund nor the Acquiring Fund will charge shareholders any sales charges (loads), commissions, or other similar fees in connection with the Reorganization.

4

Q. When is the Reorganization expected to occur?

A. Matthews anticipates that the Reorganization will occur after the close of trading on the following date (the “Closing Date”):

| | | | |

| Target Fund | | Acquiring Fund | | Expected Closing Date |

Matthews Asian Growth and Income Fund | | Matthews Emerging Markets Equity Fund | | [November 8], 2024 |

The Closing Date may be delayed. The Target Fund will publicly disclose any changes to the applicable Closing Date.

Q. Who will pay the costs in connection with the Reorganization?

A. Matthews has agreed to pay 30% of the expenses incurred in connection with the preparation and distribution of the Prospectus/Information Statement, including all direct and indirect expenses and out-of-pocket costs other than any transaction costs relating to the sale of the Target Fund’s portfolio securities prior to or after the closing of the Reorganization. The remaining expenses will be shared by the Target Fund and Acquiring Fund in proportion to each Fund’s net assets, subject to applicable expense limitations. Matthews has estimated that the brokerage commission and other portfolio transaction costs relating to the realignment of the Target Fund’s portfolio prior to the Reorganization will be approximately $[400,000] equal to approximately [0.14%] of the Target Fund’s assets or, based on shares outstanding as of June 30, 2024, $[0.02] per share. These costs will be borne by the Target Fund and indirectly by the Target Fund’s shareholders (including Target Fund shareholders who receive shares of the Acquiring Fund in the Reorganization). Please refer to “Information about the Reorganization – Who will pay the expenses of the Reorganization?” for additional information about the expenses associated with the Reorganization.

Q. Will the Reorganization result in any federal tax liability to me?

A. No, you will not recognize gain or loss for federal income tax purposes as a result of the Reorganization.

While the portfolio managers of the Acquiring Fund anticipate retaining a portion of the Target Fund’s holdings following the closing of the Reorganization, they do anticipate selling a material portion of the holdings of the Target Fund in preparation for the Reorganization. The extent of these sales is primarily because certain of the current holdings of the Target Fund are deemed not to be appropriate for the Acquiring Fund. Matthews anticipates that the proceeds from such sales will be reinvested in assets that are consistent with the Acquiring Fund’s investment process before and after the closing of the Reorganization. During this period, the Target Fund may deviate from its principal investment strategies. Matthews has estimated that the brokerage commission and other portfolio transaction costs relating to the realignment of the Target Fund’s portfolio prior to the Reorganization will be approximately $[400,000] equal to approximately [0.14%] of the Target Fund’s assets or, based on shares outstanding as of June 30, 2024, $0.[02] per share. These costs will be borne by the Target Fund.

Whether certain of the Target Fund’s portfolio holdings are sold will depend upon market conditions and portfolio composition of the Funds at the time of the Reorganization. The tax impact of any such sales will depend on the difference between the price at which such portfolio holdings are sold and the Target Fund’s tax basis in such holdings. Any capital gains recognized in these sales on a net basis prior to the closing of the Reorganization will be distributed, if required, to the shareholders of the Target Fund as capital gain dividends (to the extent of net realized long-term capital gains) and/or ordinary dividends (to the extent of net realized short-term capital gains) during or with respect to the year of sale. Any capital gains recognized in these sales on a net basis following the closing of the Reorganization will be distributed, if required, to the Combined Fund’s shareholders as capital gain dividends (to the extent of net realized long-term capital gains) and/or ordinary dividends (to the extent of net realized short-term capital gains) during or with respect to the year of sale. No significant distributions to Target Fund shareholders are expected, but any distributions could be taxable for shareholders depending on whether the shares are held in tax-advantaged accounts such as individual retirement accounts (“IRAs”).

5

Q. Can I purchase, redeem, or exchange shares of the Target Fund before the Reorganization takes place?

A. Yes. Purchase orders, exchange orders, and redemption orders must be received by the Target Fund by the dates indicated below:

| | | | |

Target Fund | | Final Date to Purchase Target Fund Shares or Exchange Shares of Another Matthews Asia Funds Mutual Fund for Target Fund Shares | | Final Date to Redeem Target Fund Shares or Exchange Target Fund Shares for Shares of Another Matthews Asia Funds Mutual Fund |

Matthews Asian Growth and Income Fund | | [October 25], 2024 | | [November 7], 2024 |

These dates may change if the Closing Date of the Reorganization changes. Any changes to a Closing Date of the Reorganization will be communicated to shareholders.

If you redeem or exchange your Target Fund shares, you may recognize a taxable gain or loss based on the difference between your tax basis in the shares and the amount you receive for them.

Q. Whom do I contact for further information?

A. If you have questions, please call 1-800-789-ASIA (2742). You can also find information online at www.matthewsasia.com.

Important additional information about the Reorganization is set forth in the accompanying Information Statement/Prospectus. Please read it carefully.

6

The information in this Combined Prospectus/Information Statement is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Combined Prospectus/Information Statement is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED [ ], 2024

INFORMATION STATEMENT/PROSPECTUS

Dated [ ], 2024

Matthews International Funds

dba Matthews Asia Funds

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

This Information Statement/Prospectus is being furnished to shareholders of the Matthews Asian Growth and Income Fund (the “Target Fund”), a series of Matthews International Funds (dba Matthews Asia Funds) (the “Trust”). As provided in an Agreement and Plan of Reorganization (the “Plan”), the Target Fund will be reorganized into the Matthews Emerging Markets Equity Fund (the “Acquiring Fund”), also a series of the Trust. Following the reorganization, the Target Fund will be liquidated (such reorganization and liquidation, the “Reorganization”). The Acquiring Fund is advised by Matthews International Capital Management, LLC (“Matthews”), the same investment adviser to the Target Fund. Following the completion of the Reorganization, the Acquiring Fund may be referred to as the “Combined Fund.”

The Board of Trustees of each Fund is comprised of the same individuals because both Funds are series of the Trust. The Board of Trustees of the Funds (the “Board”) approved the Reorganization. The Board, including all of the Independent Trustees (i.e., Trustees who are not “interested persons” of the Funds as defined in the Investment Company Act of 1940 (the “1940 Act”)), determined that, for each Fund, participation in the Reorganization is in the best interests of the Fund and that the interests of existing Fund shareholders will not be diluted as a result of the Reorganization.

The Reorganization will be accomplished in accordance with the Plan. The Plan provides for the transfer of all of the assets and liabilities of the Target Fund to the Acquiring Fund in exchange for shares of the Acquiring Fund having an aggregate net asset value (“NAV”) equal to the aggregate NAV of the Target Fund followed immediately by the distribution by the Target Fund to its shareholders of the portion of shares of the Acquiring Fund to which the shareholder is entitled in complete liquidation of the Target Fund. A copy of the form of the Plan pertaining to the Reorganization is included as Appendix A to this Information Statement/Prospectus.

For federal income tax purposes, the Reorganization is intended to be structured as a tax-free transaction for the Target Fund, the Acquiring Fund, and the shareholders of the Target Fund. If you remain a shareholder of the Target Fund on the Closing Date (as defined below) of the Reorganization, you will receive shares of the Acquiring Fund.

THIS INFORMATION STATEMENT/PROSPECTUS IS FOR INFORMATION PURPOSES ONLY, AND YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO RECEIVING IT.

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE NOT REQUESTED TO SEND US A PROXY.

The Board has approved the Reorganization with respect to the Target Fund by which the Target Fund, a separate series of the Trust, an open-end management investment company, would be acquired by the Acquiring Fund. The Acquiring Fund and the Target Fund both seek long-term capital appreciation as their primary investment objective. The Target Fund also has a secondary investment objective to seek income. While the Acquiring Fund does not have a secondary income objective, historically it has provided a similar investment experience with respect to its dividend yield and its exposure to dividend-paying common stocks. In addition, effective upon completion of the Reorganization, the Acquiring Fund will adopt, as part of its principal investment strategies, a policy to invest at least 20% of the Acquiring Fund’s net assets in income-producing securities. The Acquiring Fund also has certain strategies that are similar and compatible with those of the Target Fund. The Target Fund and the Acquiring Fund, however, employ certain differing investment strategies to achieve their respective objectives, as discussed in more detail below. For more information on the Target Fund’s and the Acquiring Fund’s investment strategies, see “Summary—How do the Funds’ investment objectives, investment strategies, and fundamental investment policies compare?” below.

7

In the Reorganization, the Target Fund will transfer its assets to the Acquiring Fund. The Acquiring Fund will assume all of the liabilities of the Target Fund and will issue shares to the Target Fund in an amount equal to the aggregate net asset value of the outstanding shares of the Target Fund. Immediately thereafter, the Target Fund will distribute these shares of the Acquiring Fund to its shareholders. After distributing these shares, the Target Fund will be terminated as a series of the Trust. When the Reorganization is complete, the Target Fund’s shareholders will hold the same class of shares of the Acquiring Fund as they currently hold of the Target Fund. The aggregate net asset value of the Acquiring Fund shares received in the Reorganization will equal the aggregate net asset value of the Target Fund shares held by Target Fund shareholders immediately prior to the Reorganization. As a result of the Reorganization, however, a shareholder of the Target Fund will represent a smaller percentage of ownership in the Combined Fund than the shares held by those in the Target Fund prior to the Reorganization because the Combined Fund will be larger than the Target Fund.

This Combined Prospectus/Information Statement sets forth concisely the information shareholders of the Target Fund should know before the Reorganization and constitutes an offering of shares of the Acquiring Fund being issued in the Reorganization. Please read it carefully and retain it for future reference.

The Reorganization is anticipated to occur after the close of trading on the following dates (the “Closing Date”):

|

Expected Closing Date |

[November 8], 2024 |

The Closing Date may be delayed. The Target Fund in which you hold shares will publicly disclose any changes to the Closing Date.

In preparation for the closing of the Reorganization, purchase orders, exchange orders, and redemption orders must be received by the Target Fund by the dates indicated below:

| | | | |

Target Fund | | Final Date to Purchase Target Fund Shares or Exchange Shares of Another Matthews Asia Funds Mutual Fund for Target Fund Shares | | Final Date to Redeem Target Fund Shares or Exchange Target Fund Shares for Shares of Another Matthews Asia Funds Mutual Fund |

Matthews Asian Growth and Income Fund | | [October 25], 2024 | | [November 7], 2024 |

These dates may change if the Closing Date of the Reorganization changes. Any changes to the Closing Date of the Reorganization will be communicated to shareholders.

Any shares of the Target Fund that you hold after the final redemption dates listed above will be reorganized into shares of the Acquiring Fund as a result of the Reorganization.

This Information Statement/Prospectus, which you should read carefully and retain for future reference, sets forth concisely the information that you should know before investing. This Information Statement/Prospectus, which constitutes part of a Registration Statement filed by the Trust with the Securities and Exchange Commission (“SEC”) under the Securities Act of 1933, as amended, does not include certain information contained elsewhere in such Registration Statement. Reference is hereby made to the Registration Statement and to the exhibits and amendments thereto for further information with respect to the Acquiring Fund and the shares offered. Statements contained herein concerning the provisions of documents are necessarily summaries of such documents.

A statement of additional information relating to this Information Statement/Prospectus and the proposed Reorganization (the “Statement of Additional Information”), dated [ ], 2024, is available upon request and without charge by contacting the Funds. This Statement of Additional Information also is incorporated herein by reference and is legally deemed to be part of this Information Statement/Prospectus.

8

The following additional materials are incorporated herein by reference and are legally deemed to be part of this Information Statement/Prospectus.

| | ● | | Prospectus and Statement of Additional Information, each dated April 29, 2024, as supplemented, containing additional information about the Target Fund and the Acquiring Fund, which is on file with the SEC (File No. 811-08510) (Accession No. 0001193125-24-122238); and |

Except as otherwise described herein, the policies and procedures set forth herein relating to the shares of the Acquiring Fund will apply to the Institutional Class and Investor Class shares to be issued by the Acquiring Fund in connection with the Reorganization.

Each of the Funds is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”) and, in accordance therewith, files reports and other information, including proxy materials, with the SEC.

Copies of the foregoing and any more recent reports filed after the date hereof may be obtained without charge by calling or writing:

Matthews Asia Funds

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

1-800-789-ASIA (2742)

The prospectus and statement of additional information of the Target Fund and the Acquiring Fund are available at https://www.matthewsasia.com/resources/docs/fund-documents. The Annual Reports and Semi-Annual Reports of the Target Fund and the Acquiring Fund are available at https://www.matthewsasia.com/resources/docs/shareholder-reports.

All available materials have been filed with the SEC.

Each Fund also files proxy materials, information statements, reports, and other information with the SEC in accordance with the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act. These materials can be obtained electronically from the EDGAR database on the SEC’s Internet site (http://www.sec.gov) or, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov.

This Information Statement/Prospectus dated [ ], 2024, is expected to be mailed to shareholders of the Target Fund on or about [ ], 2024.

AN INVESTMENT IN THE FUNDS IS NOT A DEPOSIT OF ANY BANK AND IS NOT INSURED OR GUARANTEED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENT AGENCY. AN INVESTMENT IN THE FUNDS INVOLVES INVESTMENT RISK, INCLUDING THE POSSIBLE LOSS OF PRINCIPAL.

LIKE ALL FUNDS, THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS INFORMATION STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

9

TABLE OF CONTENTS

10

SUMMARY

This is only a summary of certain information contained in this Information Statement/Prospectus. Shareholders should carefully read the more complete information in the rest of this Information Statement/Prospectus, including the Plan relating to the Reorganization, a form of which is attached to this Information Statement/Prospectus in Appendix A, and the Acquiring Fund prospectus, which accompanies this Information Statement/Prospectus. For purposes of this Information Statement/Prospectus, the terms “shareholder,” “you,” and “your” refer to shareholders of the Target Fund.

What is happening to the Target Fund?

The Target Fund will be reorganized into the Acquiring Fund. Following the reorganization, the Target Fund will be liquidated. The Acquiring Fund is advised by Matthews International Capital Management, LLC (“Matthews”), the same investment adviser for the Target Fund. Following the completion of the Reorganization, the Acquiring Fund may be referred to as the “Combined Fund.”

In this reorganization, your Target Fund shares will be exchanged for the same class of shares of the Acquiring Fund with the same aggregate net asset value of the Target Fund shares that you currently hold. It is currently anticipated that the reorganization of the Target Fund will be effected on a tax-free basis for federal income tax purposes.

The reorganization of the Target Fund into the Acquiring Fund, along with the subsequent liquidation of the Target Fund, is referred to in this Information Statement/Prospectus as the “Reorganization,” and the Reorganization will be accomplished in accordance with an Agreement and Plan of Reorganization and Liquidation (the “Plan”). For reference purposes, the Target Fund and the Acquiring Fund are listed in the chart below.

| | |

| Target Fund | | Acquiring Fund |

Matthews Asian Growth and Income Fund | | Matthews Emerging Markets Equity Fund |

How will the Reorganization be implemented?

The Plan provides for the transfer of all of the assets and liabilities of the Target Fund to the Acquiring Fund in exchange for shares of the Acquiring Fund having an aggregate net asset value (“NAV”) equal to the aggregate net asset value of the Target Fund followed immediately by the distribution by the Target Fund to its shareholders of the portion of shares of the Acquiring Fund to which the shareholder is entitled in complete liquidation of the Target Fund.

After shares of the Acquiring Fund are distributed to the Target Fund’s shareholders, the Target Fund will be completely liquidated and dissolved. As a result of the Reorganization, you will cease to be a shareholder of the Target Fund and will become a shareholder of the Acquiring Fund. This exchange will occur after the close of business on the Closing Date of the Reorganization, which is the specific date on which the Reorganization takes place. The expected Closing Date of the Reorganization is indicated below:

|

| Expected Closing Date |

[November 8], 2024 |

The Closing Date may be delayed. The Target Fund in which you hold shares will publicly disclose any changes to the Closing Date.

Why is the Reorganization happening and did the Board approve the Reorganization?

After consideration of all relevant factors, including the potential impact of the Reorganization on the Target Fund’s shareholders, the Target Fund’s investment adviser, Matthews, proposed that the Target Fund be reorganized into the Acquiring Fund because Matthews believes that the Reorganization is in the best interests of shareholders of both the Target Fund and the Acquiring Fund. In recommending the Reorganization to the Board of Trustees of the Trust, Matthews noted that approximately 80% of the companies comprising the emerging markets equity investment universe (as represented by the MSCI Emerging Markets Index) are located in Asia, and, therefore, that there is a substantial overlap between an investment strategy focused on emerging market equity securities and one focused on growth and income-generating securities in the Asian region. Further, Matthews noted that the broader emerging markets universe in which the Acquiring Fund operates should benefit shareholders of the Target Fund and will have the potential to improve long-term performance for those shareholders. Matthews further believes that it is in the best interests of the Target Fund to combine the Target Fund’s assets with a fund with a lower overall expense structure and generally better performance, recognizing that the Acquiring Fund has a shorter operating history. Matthews also believes that the Acquiring Fund’s investment objective and strategies make it a compatible fund within the Trust for a reorganization with the Target Fund. Matthews believes that

11

continuing to operate the Target Fund as currently constituted is not in the long-term best interests of the Target Fund. Matthews also believes that both Funds may benefit from potential operating efficiencies and economies of scale that may be achieved by combining the Funds’ assets in the Reorganization. As a result, Matthews determined it prudent to recommend the Reorganization to the Board of Trustees of the Trust

The Board, including all of the Trustees who are not “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) (together, the “Independent Trustees”), determined that, with respect to the Reorganization, participation in the Reorganization is in the best interests of each Fund and the interests of the existing shareholders of the Funds, as applicable, will not be diluted as a result of the Reorganization. The Board made this determination based on various factors that are discussed in this Information Statement/Prospectus, under the discussion of the Reorganization in the section entitled “Reasons for the Reorganization.”

How will the Reorganization affect me?

When the Reorganization is consummated, you will cease to be a shareholder of the Target Fund and will become a shareholder of the Acquiring Fund. As described in more detail above, upon completion of the Reorganization, you will receive the same class of shares of the Acquiring Fund having an aggregate NAV equal to the aggregate NAV of the shares of the Target Fund you owned on the Closing Date of the Reorganization.

Who will bear the costs associated with the Reorganization?

Matthews has agreed to pay 30% of the expenses incurred in connection with the preparation and distribution of the Prospectus/Information Statement, including all direct and indirect expenses and out-of-pocket costs other than any transaction costs relating to the sale of the Target Fund’s portfolio securities prior to or after the closing of the Reorganization. The remaining expenses will be shared by the Target Fund and Acquiring Fund in proportion to each Fund’s net assets, subject to applicable expense limitations. Matthews has estimated that the brokerage commission and other portfolio transaction costs relating to the realignment of the Target Fund’s portfolio prior to the Reorganization will be approximately $[400,000 equal to approximately [0.14%] of the Target Fund’s assets] or, based on shares outstanding as of [June 30], 2024, $[0.02] per share. These costs will be borne by the Target Fund and indirectly by the Target Fund’s shareholders (including Target Fund shareholders who receive shares of the Acquiring Fund in the Reorganization). Please refer to “Information about the Reorganization – Who will pay the expenses of the Reorganization?” for additional information about the expenses associated with the Reorganization.

What are the U.S. federal income tax consequences of the Reorganization?

As a condition to the closing of the Reorganization, the Target Fund and the Acquiring Fund must receive an opinion of Paul Hastings LLP to the effect that the Reorganization will constitute a “reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that neither you nor, in general, the Target Fund will recognize gain or loss as a direct result of the Reorganization of the Target Fund, and the holding period and aggregate tax basis for the Acquiring Fund shares that you receive will be the same as the holding period and aggregate tax basis of the Target Fund shares that you surrender in the Reorganization. Capital gains from securities sales by the Target Fund prior to the Reorganization may be distributed by the Acquiring Fund after the Reorganization. Prior to the consummation of the Reorganization, you may redeem your Target Fund shares, generally resulting in the recognition of gain or loss for U.S. federal income tax purposes based on the difference between your tax basis in the shares and the amount you receive for them.

While the portfolio managers of the Acquiring Fund anticipate retaining a portion of the Target Fund’s holdings following the closing of the Reorganization, they do anticipate selling a material portion of the holdings of the Target Fund in preparation for the Reorganization The extent of these sales is primarily because certain of the current holdings of the Target Fund are deemed not to be appropriate for the Acquiring Fund. Matthews anticipates that the proceeds from such sales will be reinvested in assets that are consistent with the Acquiring Fund’s investment process before and after the closing of the Reorganization. During this period, the Target Fund may deviate from its principal investment strategies. Matthews has estimated that the brokerage commission and other portfolio transaction costs relating to the realignment of the Target Fund’s portfolio prior to the Reorganization will be approximately $[400,000 equal to approximately [0.14%] of the Target Fund’s assets] or, based on shares outstanding as of [June 30], 2024, $0.[02] per share. These costs will be borne by the Target Fund.

Whether certain of the Target Fund’s portfolio holdings are sold will depend upon market conditions and portfolio composition of the Funds at the time of the Reorganization. The tax impact of any such sales will depend on the difference between the price at which such portfolio holdings are sold and the Target Fund’s tax basis in such holdings. Any capital gains recognized in these sales on a net basis prior to the closing of the Reorganization will be distributed, if required, to the shareholders of the Target Fund as capital gain dividends (to the extent of net realized long-term capital gains) and/or ordinary dividends (to the extent of net realized short-term capital gains) during or with respect to the year of sale. Any capital gains recognized in these sales on a net basis following the closing of the

12

Reorganization will be distributed, if required, to the Combined Fund’s shareholders as capital gain dividends (to the extent of net realized long-term capital gains) and/or ordinary dividends (to the extent of net realized short-term capital gains) during or with respect to the year of sale. No significant distributions to Target Fund shareholders are expected, but any distributions could be taxable for shareholders depending on whether the shares are held in tax-advantages accounts such as IRAs.

How do the Funds’ investment objectives, investment strategies, and fundamental investment policies compare?

The Target Fund and the Acquiring Fund have compatible investment objectives and fundamental investment policies. The Acquiring Fund also has certain strategies that are similar and compatible with those of the Target Fund. The Target Fund and the Acquiring Fund, however, employ certain differing investment strategies to achieve their respective objectives, as discussed in more detail below.

Investment Objectives and Investment Strategies

Investment Objectives

Both the Target Fund and the Acquiring Fund have the same primary investment objective to seek long-term capital appreciation. The Target Fund also has a secondary fundamental investment objective to seek income. The investment objective of each Fund is fundamental, which means that it cannot be changed without a vote of a majority of the voting securities of the applicable Fund. Upon the completion of the Reorganization, the Acquiring Fund will adopt as part of its principal investment strategy that at least 20% of its net assets will be invested in income-generating securities, which is consistent with the Acquiring Fund’s historical level of income generation and will align the Acquiring Fund with the Target Fund’s secondary objective of seeking income without disrupting the Acquiring Fund’s past investment approach. Since its inception on April 30, 2020, the Acquiring Fund has invested between [60]% and [80]% of its net assets in income-generating securities, with approximately [75]% of the Acquiring Fund’s net assets invested in income-generating securities as of June 30, 2024. Therefore, Matthews views the Acquiring Fund’s level of income production as compatible with the secondary investment objective of the Target Fund.

Principal Investment Strategies

The Acquiring Fund currently seeks to achieve its goals by investing under normal circumstances at least 80% of its net assets, which include borrowings for investment purposes, in the common and preferred stocks of companies located in emerging market countries. A portion of these common and preferred stocks will generally include income-generating securities. As noted above, upon completion of the Reorganization, the Acquiring Fund will adopt as part of its principal investment strategy that at least 20% of its net assets will be invested in income-generating securities. Since its inception on April 30, 2020, the Acquiring Fund has invested between [60]% and [80]% of its net assets in income-generating securities, with approximately [75]% of the Acquiring Fund’s net assets invested in income-generating securities as of June 30, 2024. Emerging market countries generally include every country in the world except the United States, Australia, Canada, Hong Kong, Israel, Japan, New Zealand, Singapore and most of the countries in Western Europe. Certain emerging market countries may also be classified as “frontier” market countries, which are a subset of emerging market countries with newer or even less developed economies and markets, such as Sri Lanka and Vietnam. The list of emerging market countries and frontier market countries may change from time to time.

The Target Fund seeks to achieve its goals by investing under normal circumstances at least 80% of its net assets, which include borrowings for investment purposes, in dividend-paying common stock, preferred stock and other equity securities, and convertible securities as well as fixed-income securities, of any duration or quality, including high yield securities (also known as “junk bonds”), of companies located in Asia, which consists of all countries and markets in Asia, including developed, emerging, and frontier countries and markets in the Asian region.

A company or other issuer is considered to be “located” in a country or a region, and a security or instrument is deemed to be an Asian (or specific country) security or instrument, if it has substantial ties to that country or region. Matthews currently makes that determination based primarily on one or more of the following criteria: (A) with respect to a company or issuer, whether (i) it is organized under the laws of that country or any country in that region; (ii) it derives at least 50% of its revenues or profits from goods produced or sold, investments made, or services performed, or has at least 50% of its assets located, within that country or region; (iii) it has the primary trading markets for its securities in that country or region; (iv) it has its principal place of business in or is otherwise headquartered in that country or region; or (v) it is a governmental entity or an agency, instrumentality or a political subdivision of that country or any country in that region; and (B) with respect to an instrument or issue, whether (i) its issuer is headquartered or organized in that country or region; (ii) it is issued to finance a project that has at least 50% of its assets or operations in that country or region; (iii) it is at least 50% secured or backed by assets located in that country or region; (iv) it is a component of or its issuer is included in the Fund’s primary benchmark index; or (v) it is denominated in the currency of an Asian country (or other specific country) and

13

addresses at least one of the other above criteria. The term “located” and the associated criteria listed above have been defined in such a way that Matthews has latitude in determining whether an issuer should be included within a region or country. Each Fund may also invest in depositary receipts, including American, European and Global Depositary Receipts.

For each Fund, Matthews expects that the companies in which the Fund invests typically will be of medium or large size, but both the Acquiring Fund and the Target Fund may invest in companies of any size. Matthews measures a company’s size with respect to fundamental criteria such as, but not limited to, market capitalization, book value, revenues, profits, cash flow, dividends paid and number of employees. The implementation of the principal investment strategies of each Fund may result in a significant portion of each Fund’s assets being invested from time to time in one or more sectors, but each Fund may invest in companies in any sector.

Each Fund’s principal investment strategies may be changed without shareholder approval.

The Combined Fund’s principal investment strategies will be those of the Acquiring Fund, except that the Acquiring Fund will add a principal investment strategy to invest at least 20% of its net assets in income-producing securities.

Fundamental Investment Policies

The Target Fund and the Acquiring Fund have adopted compatible fundamental investment policies, which may not be changed without prior shareholder approval. The fundamental investment policies for the Acquiring Fund and the Target Fund are listed in the statement of additional information dated April 29, 2024, as supplemented, which is incorporated by reference into the Statement of Additional Information, and is available upon request.

The Target Fund currently operates with two fundamental restrictions that the Acquiring Fund has not adopted: (A) the Target Fund is prohibited from owning more than 10% of outstanding voting securities of any one issuer; and (B) the Target Fund is prohibited from investing more than 5% of its assets in companies that are under three years old. Upon completion of the Reorganization, the Acquiring Fund will adopt these fundamental restrictions, such that the fundamental investment restrictions of the Target Fund and the Acquiring Fund will be the same at the closing of the Reorganization.

In addition, as noted above, the Target Fund has a secondary fundamental investment objective to seek income. Upon completion of the Reorganization, the Acquiring Fund will adopt as part of its principal investment strategy that at least 20% of its net assets will be invested in income-generating securities, which is consistent with the Acquiring Fund’s historical level of income generation and will align the Acquiring Fund with the Target Fund’s secondary fundamental investment objective without disrupting the Acquiring Fund’s past investment approach. Since its inception on April 30, 2020, the Acquiring Fund has invested between [60]% and [80]% of its net assets in income-generating securities, with approximately [75]% of the Acquiring Fund’s net assets invested in income-generating securities as of June 30, 2024. Therefore, Matthews views the Acquiring Fund’s level of income production as compatible with the secondary investment objective of the Target Fund.

What are the principal risks of an investment in the Acquiring Fund?

An investment in the Acquiring Fund has some risks that are similar to those of an investment in the Target Fund and some that are different. For further information about the risks of investments in the Funds, see the section entitled “Comparison of the Funds’ Risks” below.

How will the Reorganization affect my fees and expenses?

The Acquiring Fund and the Target Fund have the same management fee. Although the Acquiring Fund’s net expense ratio is higher than each class of the Target Fund, Matthews has agreed to waive fees and reimburse expenses through December 31, 2025, such that after waivers, the Acquiring Fund will have a lower net expense ratio than each share class of the Target Fund. A comparison of the fees and expenses of the Target Fund and Acquiring Fund is provided below under the heading, “What are the fees and expenses of the Funds and what might they be after the Reorganization?”

14

COMPARISON OF SOME IMPORTANT FEATURES OF THE FUNDS

How do the performance records of the Funds compare?

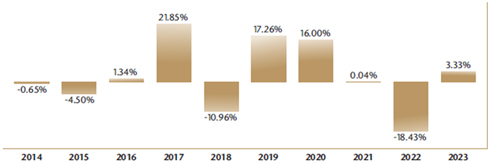

The following bar charts and tables illustrate the risks of investing in each Fund by showing changes in the Fund’s performance from calendar year to calendar year and comparing the Fund’s average annual returns to those of one or more broad-based securities indices. Of course, past performance is not necessarily an indication of how a Fund will perform in the future.

Calendar Year Total Returns, as of December 31 each year for

Investor Class Shares of the Target Fund (Matthews Asian Growth and Income Fund)

During the period shown in the bar chart, the highest return for a quarter was 15.52% (quarter ended December 31, 2020) and the lowest return for a quarter was -18.88% (quarter ended March 31, 2020).

Average Annual Total Returns (For the periods ended December 31, 2023)

| | | | | | | | | | |

| | | 1 Year | | 5 Years | | 10 Years | | Since Inception (10-29-10) | | Since Inception (9-12-94) |

Institutional Class Shares | | 3.39% | | 2.92% | | 1.95% | | 3.05% | | N/A |

Investor Class Shares | | 3.33% | | 2.78% | | 1.81% | | N/A | | 7.61% |

MSCI All Country Asia ex Japan Index | | 6.34% | | 4.01% | | 4.17% | | 3.85%1 | | 4.13%2 |

1 Calculated from 10-29-10.

2 Calculated from 8-31-94.

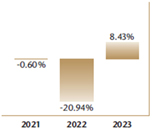

Calendar Year Total Returns, as of December 31 each year for

Investor Class Shares of the Acquiring Fund (Matthews Emerging Markets Equity Fund)

During the period shown in the bar chart, the highest return for a quarter was 22.15% (quarter ended December 31, 2020) and the lowest return for a quarter was -14.96% (quarter ended June 30, 2022).

Average Annual Total Returns (For the periods ended December 31, 2023)

| | | | |

| | | 1 Year | | Since Inception (4-30-20) |

Institutional Class Shares | | 8.63% | | 9.25% |

Investor Class Shares | | 8.43% | | 9.04% |

MSCI Emerging Markets Index | | 10.27% | | 5.82% |

15

Because the Combined Fund will most closely resemble the Acquiring Fund, the Acquiring Fund will be the accounting survivor of the Reorganization. The Combined Fund will also maintain the performance history of the Acquiring Fund at the closing of the Reorganization.

How do the procedures for purchase, redemption and valuation of shares of the Funds compare?

Procedures for the purchase, redemption and valuation of shares of the Target Fund and the Acquiring Fund are identical. Information about the Funds’ procedures for the purchase, redemption and valuation of shares is contained in the prospectuses and statement of additional information of the Target Fund and Acquiring Fund.

What are the fees and expenses of the Funds and what might they be after the Reorganization?

Fee Table

Fee Table of the Target Fund, the Acquiring Fund and the Pro Forma Combined Fund

(as of December 31, 2023 (unaudited))

The fee table below describes the fees and expenses that you may pay if you buy, hold and sell shares of the Funds. The percentages presented in the fee table are based on fees and expenses incurred during the 12-month period ended December 31, 2023 for each class of shares of the Funds and estimated pro forma fees and expenses attributable to each class of shares of the Pro Forma Combined Fund for the 12-month period ended December 31, 2023, assuming the Reorganization had taken place at the beginning of the fiscal year. Future fees and expenses may be greater or less than those indicated below.

| | | | | | | | | | | | |

| | | Actual | | | | Actual | | |

| | | Target Fund (Matthews Asian

Growth and

Income

Fund) | | Acquiring Fund (Matthews Emerging

Markets

Equity Fund) | | Pro Forma Combined Fund | | Target Fund (Matthews Asian

Growth and

Income

Fund) | | Acquiring Fund (Matthews Emerging

Markets

Equity Fund) | | Pro Forma Combined Fund |

| | | Institutional Class | | Institutional Class | | Institutional Class | | Investor Class | | Investor Class | | Investor Class |

| | | | | | | | | | | | | |

Shareholder Fees (fees paid directly

from your investment) | | | | | | | | | | | | |

Maximum Account Fee on Redemptions

(for wire redemptions only) | | $9 | | $9 | | $9 | | $9 | | $9 | | $9 |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | | | | | | | | | | | | |

Management Fees | | 0.68% | | 0.68% | | 0.68% | | 0.68% | | 0.68% | | 0.68% |

Service (12b-1) Fees | | None | | None | | None | | None | | None | | None |

Other Expenses | | 0.34% | | 0.83% | | [0.41]% | | 0.47% | | 1.02% | | [0.57]% |

Administrative and Shareholder Servicing Fees | | 0.18% | | 0.18% | | 0.18% | | 0.18% | | 0.18% | | 0.18% |

| Total Annual Fund Operating Expenses | | 1.02% | | 1.51% | | [1.09]% | | 1.15% | | 1.70% | | [1.25]% |

| Fee Waiver and Expense Reimbursement | | N/A | | (0.61)%1 | | [(0.19)]%1 | | N/A | | (0.58)%1 | | [(0.13)]%1 |

| Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement | | 1.02% | | 0.90% | | [0.90]% | | 1.15% | | 1.12% | | [1.12]% |

16

1 Matthews has contractually agreed (i) to waive fees and reimburse expenses to the extent needed to limit Total Annual Fund Operating Expenses (excluding Rule 12b-1 fees, taxes, interest, brokerage commissions, short sale dividend expenses, expenses incurred in connection with any merger or reorganization or extraordinary expenses such as litigation) of the Institutional Class of the Acquiring Fund and the Combined Fund to 0.90%, first by waiving class specific expenses (e.g., shareholder service fees specific to a particular class) of the Institutional Class and then, to the extent necessary, by waiving non-class specific expenses (e.g., custody fees) of the Institutional Class, and (ii) if any Fund-wide expenses (i.e., expenses that apply to both the Institutional Class and the Investor Class) are waived for the Institutional Class to maintain the 0.90% expense limitation, to waive an equal amount (in annual percentage terms) of those same expenses for the Investor Class of the Acquiring Fund and the Combined Fund. The Total Annual Fund Operating Expenses After Fee Waiver and Expense Reimbursement for the Investor Class of the Acquiring Fund and the Combined Fund may vary from year to year and will in some years exceed 0.90%. If the operating expenses fall below the expense limitation within three years after Matthews has made a waiver or reimbursement, the Fund may reimburse Matthews up to an amount that does not cause the expenses for that year to exceed the lesser of (i) the expense limitation applicable at the time of that fee waiver and/or expense reimbursement or (ii) the expense limitation in effect at the time of recoupment. This agreement will remain in place until April 30, 2025 and may be terminated at any time by the Board of Trustees on behalf of the Fund on 60 days’ written notice to Matthews. Matthews may decline to renew this agreement by written notice to the Trust at least 30 days before its annual expiration date.

Expense Example

The Example is meant to help you compare the cost of investing in the Acquiring Fund with the cost of investing in the Target Fund.

The Example assumes that you invest $10,000 in the Funds for the time periods indicated. The Example also assumes that your investment has a 5% return each year and that a Fund’s operating expenses are equal to the total annual fund operating expenses. Pro forma numbers are estimated in good faith and are hypothetical. Pro forma numbers do not reflect any potential liquidation of shareholders associated with the Reorganization. The example for the Acquiring Fund and the Combined Fund reflects the expense limitation for the one-year period only. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | | | | | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| | | | |

Matthews Asian Growth and Income Fund — Target Fund | | | | | | | | |

| | | | |

Institutional Class | | $104 | | $325 | | $563 | | $1,248 |

| | | | |

Investor Class | | $117 | | $365 | | $633 | | $1,398 |

| | | | |

Matthews Emerging Markets Equity Fund — Acquiring Fund | | | | | | | | |

| | | | |

Institutional Class | | $92 | | $417 | | $766 | | $1,749 |

| | | | |

Investor Class | | $114 | | $479 | | $869 | | $1,960 |

| | | | |

Pro Forma — Combined Fund | | | | | | | | |

| | | | |

Institutional Class | | $[92] | | $[328] | | $[582] | | $[1,312] |

| | | | |

Investor Class | | $[114] | | $[384] | | $[674] | | $[1,500] |

How do the portfolio turnover rates of the Funds compare?

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example of fund expenses, affect the Fund’s performance. During the most recent fiscal year, the Target Fund’s portfolio turnover rate was 12% of the average value of its portfolio. For the same period, the Acquiring Fund’s portfolio turnover rate was 26%.

What are the Funds’ income and capital gain distribution policies?

The distribution policies of the Target Fund are the same as the Acquiring Fund with respect to the timing of distributions. Each Fund generally distributes net investment income once annually in December. With respect to each Fund, any net realized gain from the sale of portfolio securities and net realized gains from foreign currency transactions are distributed at least once each year unless they are used to offset losses carried forward from prior years.

Who manages the Funds?

The Target Fund and Acquiring Fund are each series of the Trust. The Trust is governed by the Board, which is responsible for overseeing all business activities of the Funds.

17

Matthews is the investment adviser to the Target Fund and the Acquiring Fund. Matthews is located at Four Embarcadero Center, Suite 550, San Francisco, CA 94111. Matthews was founded in 1991 by G. Paul Matthews. Matthews specializes in managing portfolios of Asian and emerging markets securities.

The Funds’ portfolio management teams are composed as follows:

| | |

| Fund | | Portfolio Managers |

Matthews Asian Growth and Income Fund — Target Fund | | Kenneth Lowe, CFA, Lead Manager Siddhartha Bhargava, Co-Manager Elli Lee, Co-Manager |

Matthews Emerging Markets Equity Fund — Acquiring Fund | | Sean Taylor, Lead Manager Alex Zarechnak, Lead Manager Andrew Mattock, CFA, Co-Manager Peeyush Mittal, CFA, Co-Manager Jeremy Sutch, Co-Manager |

The Target Fund is managed by Kenneth Lowe, CFA, as Lead Manager. The Lead Manager is supported by and consults with the Target Fund’s Co-Managers, Siddhartha Bhargava and Elli Lee.

Mr. Lowe, Lead Manager of the Target Fund, joined Matthews in 2010. He manages the firm’s Asian Growth and Income and Asia Dividend Strategies. Before joining Matthews, he was an Investment Manager on the Asia and Global Emerging Market Equities Team at Martin Currie Investment Management in Edinburgh, Scotland. Kenneth received an M.A. in Applied Mathematics and Economics from the University of Glasgow. Mr. Lowe has been a Portfolio Manager of the Target Fund since 2011.

Mr. Bhargava, Co-Manager of the Target Fund, joined Matthews in 2011. He co-manages the firm’s Asian Growth and Income and Asia Dividend Strategies. Before joining Matthews, he was an Investment Analyst at Navigator Capital. Mr. Bhargava also served as a credit and debt market research assistant to Dr. Edward Altman at the New York University Salomon Center. From 2005 to 2008, he was a Credit Analyst at Sandell Asset Management. Siddharth received a B.A. in Economics from the University of Virginia and an MBA from the Stern School of Business at New York University. He is fluent in Hindi and conversational in German. Mr. Bhargava managed the Target Fund since 2021.

Ms. Lee, Co-Manager of the Target Fund, joined Matthews in 2016. She manages the firm’s Korea Strategy and co-manages the firm’s Asia Dividend, China Dividend and Asian Growth and Income Strategies. Before joining Matthews, Ms. Lee worked at Bank of America Merrill Lynch for 10 years, most recently in Korean Equity Sales and previously as an Equity Research Analyst covering South Korea’s engineering, construction, steel and education sectors. From 2003 to 2005, she was an Investor Relations Specialist at Hana Financial Group in Seoul. Ms. Lee earned a Master of Science in Global Finance from the Hong Kong University of Science and Technology Business School and New York University Stern School of Business, and received a B.A. in Economics from Bates College. She is fluent in Korean. Ms. Lee has been a Portfolio Manager of the Target Fund since 2023.

The Acquiring Fund is managed by Sean Taylor and Alex Zarechnak as Lead Managers. The Lead Managers are supported by and consult with the Acquiring Fund’s Co-Managers, Andrew Mattock, CFA, Peeyush Mittal, CFA, and Jeremy Sutch.

Mr. Taylor, Lead Manager of the Acquiring Fund, joined Matthews as Chief Investment Officer and Portfolio Manager in 2023. He manages the firm’s Pacific Tiger, Emerging Markets Equity and Asia ex Japan Total Return Equity Strategies and co-manages the firm’s Emerging Markets ex China Strategy. Before joining Matthews, Mr. Taylor was Chief Investment Officer APAC, Global Head of Emerging Markets Equity at DWS Group based in Hong Kong since 2013. From 2004 to 2011, he was an Investment Director at GAM Investments, based in London and Dubai. From 1997 to 2004, he was at Societe Generale as Head of International and Emerging Markets. Mr. Taylor has over 30 years of experience, including more than a decade as a CIO. He has overseen a number of emerging markets active strategies, including Latin America, India, China, Brazil, and Russia as well as international and global strategies during his career. He received his MBA from Manchester Business School and is a graduate of the Royal Military Academy, Sandhurst. Mr. Taylor has been a Portfolio Manager of the Acquiring Fund since 2023.

Mr. Zarechnak, Lead Manager of the Acquiring Fund, joined Matthews in 2020. He manages the firm’s Emerging Markets Equity and Emerging Markets ex China Strategies and co-manages the firm’s Emerging Markets Small Companies, Emerging Markets Discovery and Emerging Markets Sustainable Future Strategies. Before joining Matthews, he spent a total of 15 years (1998–2006 and 2012–2019) at Wellington Management as an analyst for the firm’s flagship Emerging Markets Equity Fund as a generalist first covering CEEMEA, then Latin America. From 2006 to 2012, he was a regional equity analyst at Capital Group, covering Emerging Markets with a focus on energy, telecoms and consumer sectors in Latin America and CEEMEA. Mr. Zarechnak began his Emerging Markets career as a Russia equity analyst with Templeton Emerging Markets, based in Moscow. He earned a B.A. in Economics and Government from the College of William and Mary. He is fluent in Russian. Mr. Zarechnak has been a Portfolio Manager of the Acquiring Fund since 2022.

18

Mr. Mattock, Co-Manager of the Acquiring Fund, joined Matthews in 2015. He manages the firm’s China, China Small Companies and China Discovery Strategies, and co-manages the firm’s Pacific Tiger, China Dividend, and Emerging Markets Equity Strategies. Before joining Matthews, he was a Fund Manager at Henderson Global Investors for 15 years, first in London and then in Singapore, managing Asia Pacific equities. Mr. Mattock holds a Bachelor of Business majoring in Accounting from Australian Catholic University. He began his career at PricewaterhouseCoopers LLP and qualified as a Chartered Accountant. Mr. Mattock has been a Portfolio Manager of the Acquiring Fund since 2023.

Mr. Mittal, Co-Manager of the Acquiring Fund, joined Matthews in 2015. He manages the firm’s India Strategy and co-manages the firm’s Emerging Markets Equity, Emerging Markets ex China, Pacific Tiger and Asia Growth Strategies. Before joining Matthews, he spent over three years at Franklin Templeton Asset Management India, most recently as a Senior Research Analyst. Previously, he was with Deutsche Asset & Wealth Management New York, from 2009 to 2011, researching U.S. and European stocks in the industrials and materials sectors. Mr. Mittal began his career in 2003 with Scot Forge as an Industrial Engineer, and was responsible for implementing Lean Manufacturing systems on the production shop floor. He earned his M.B.A from The University of Chicago Booth School of Business. He received a Master of Science in Industrial Engineering from The Ohio State University and received a Bachelor of Technology in Metallurgical Engineering from The Indian Institute of Technology Madras. He is fluent in Hindi. Mr. Mittal has been a Portfolio Manager of the Acquiring Fund since 2023.

Mr. Sutch, Co-Manager of the Acquiring Fund, joined Matthews in 2015. He manages the firm’s Emerging Markets ex China Strategy, and co-manages the Emerging Markets Equity, Emerging Markets Small Companies, Emerging Markets Discovery, Asia Small Companies, Asia ex Japan Total Return Equity and Pacific Tiger Strategies. Before joining Matthews, he was Director and Global Head of Emerging Companies at Standard Chartered Bank in Hong Kong from 2012 to 2015, responsible for the fundamental analysis of companies in Asia, with a particular focus on small- and mid-capitalization companies. From 2009 to 2012, he was Managing Director at MJP Capital in Hong Kong, which he co-founded. His prior experience has included managing small-cap equities at Indus Capital Advisors and serving as Head of Hong Kong Research for ABN AMRO Asia Securities. Jeremy earned an M.A. in French and History from the University of Edinburgh. Mr. Sutch has been a Portfolio Manager of the Acquiring Fund since 2013.

The Portfolio Managers of the Acquiring Fund will be the Portfolio Managers of the Combined Fund.

Matthews may delegate certain portfolio management activities with respect to the Funds to a wholly owned subsidiary based outside of the United States. Any such participating affiliate would enter into a participating affiliate agreement with Matthews related to the Funds, and Matthews would remain fully responsible for the participating affiliate’s services as if Matthews had performed the services directly. Any delegation of services in this manner would not increase the fees or expenses paid by the Funds, and would normally be used only where a portfolio manager or other key professional is located in the country where the subsidiary is based.

As discussed above, following the Reorganization, the Acquiring Fund will have a lower net expense ratio than each share class of the Target Fund. However, the contractual agreements related to each Fund’s net expense ratio are different, as discussed below. In addition, unlike the Target Fund, the Acquiring Fund will be subject to a unitary fee structure, which will require Matthews to pay the Acquiring Fund’s ordinary operating expenses without any increase in its fee for advisory services, thus resulting in lower fees and expenses to shareholders. This obligation to bear Acquiring Fund expenses is part of the Acquiring Fund’s investment management agreement and cannot be changed without a vote of a majority of the voting securities of the Acquiring Fund.

Investment Advisory Agreement

Pursuant to the Trust’s Investment Advisory Agreement with Matthews (the “Advisory Agreement”), each of the Target Fund and the Acquiring Fund pays Matthews 0.75% of the aggregate average daily net assets of the Fund up to $2 billion (including the assets of various other series of the Trust, referred to as the “Family Priced Funds”), 0.6834% of the aggregate average daily net assets of the Fund and other Family Priced Funds over $2 billion up to $5 billion, 0.65% of the aggregate average daily net assets of the Fund and other Family Priced Funds over $5 billion up to $25 billion, 0.64% of the aggregate average daily net assets of the Fund and other Family Priced Funds over $25 billion up to $30 billion, 0.63% of the aggregate average daily net assets of the Fund and other Family Priced Funds over $30 billion up to $35 billion, 0.62% of the aggregate average daily net assets of the Fund and other Family Priced Funds over $35 billion up to $40 billion, 0.61% of the aggregate average daily net assets of the Fund and other Family Priced Funds over $40 billion up to $45 billion, and 0.60% of the aggregate average daily net assets of the Fund and other Family Priced Funds over $45 billion. The Funds shall pay to Matthews a monthly fee at the annual rate using the applicable management fee calculated based on the actual number of days of that month and based on such Funds’ average daily net assets for the month.

19

For the fiscal year ended December 31, 2023, each Fund paid investment management fees to Matthews as follows (as a percentage of average net assets):

| | |

| Fund | | Fee |

Target Fund (Matthews Asian Growth and Income Fund) | | 0.68% |

| |

Acquiring Fund (Matthews Emerging Markets Equity Fund) | | 0.68% |

The terms of the Advisory Agreement are identical and the services provided to each Fund under its Advisory Agreement are identical.

A discussion regarding the basis for the Board of Trustees’ approval of the Advisory Agreement is available in the most recent annual report to shareholders.

INFORMATION ABOUT THE REORGANIZATION

Board Considerations Relating to the Reorganization

In considering and approving the Reorganization, the Board discussed Matthews’ views as to the future of the Target Fund, the current challenges faced by the Fund and the advantages of reorganizing it into the Acquiring Fund. The Board considered Matthews’ recommendation to approve the Reorganization at meetings held on May 15-16, 2024 and on August 27-28, 2024. Prior to approving the Reorganization, the Board reviewed substantial information and other materials provided prior to and during the meetings and at other meetings throughout the past year. Among other things, the Board reviewed, with the assistance of independent legal counsel, the overall proposal for the Reorganization, the principal terms and conditions of the Plan, including that the Reorganization be consummated on a tax-free basis.

In considering the Reorganization, the Board also took into account a number of factors. Some of the more prominent considerations are discussed further below. The Board considered the following matters, among others and in no order of priority:

| | ● | | The fact that the primary investment objective of the Target Fund is identical to the investment objective of the Acquiring Fund, that the Funds’ historical dividend yields and investment in dividend paying securities have been similar. They also considered that, effective upon completion of the Reorganization, the Acquiring Fund will adopt a principal investment strategy to invest at least 20% of its assets in income-producing securities, which will make the Acquiring Fund’s investment policies compatible with the Target Fund’s secondary investment objective to seek income. The fact that certain strategies of the Target Fund and the Acquiring Fund are compatible, while others are different. See “Summary—How do the Funds’ investment objectives, investment strategies, and fundamental investment policies compare?”; |

| | ● | | The fact that the Acquiring Fund has the same investment adviser as the Target Fund and the Board will continue to oversee the Acquiring Fund; |