UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07175

| Name of Registrant: | Vanguard Tax-Managed Funds |

| Address of Registrant: | P.O. Box 2600 |

| Valley Forge, PA 19482 |

| Name and address of agent for service: | Anne E. Robinson, Esquire |

| P.O. Box 876 | |

| Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2023—December 31, 2023

Item 1: Reports to Shareholders

| Vanguard Tax-Managed Balanced Fund |

| Vanguard Tax-Managed Capital Appreciation Fund |

| Vanguard Tax-Managed Small-Cap Fund |

Your Fund’s Performance at a Glance | 1 |

About Your Fund's Expenses | 2 |

Tax-Managed Balanced Fund | 4 |

Tax-Managed Capital Appreciation Fund | 62 |

Tax-Managed Small-Cap Fund | 80 |

| • | The financial markets delivered very robust returns for the 12 months ended December 31, 2023. Returns for the Vanguard Tax-Managed Funds ranged from 15.53% for the Tax-Managed Balanced Fund to 26.67% for Institutional Shares of the Tax-Managed Capital Appreciation Fund. The returns were in line with their benchmarks. |

| • | With inflation continuing to ease, a number of major central banks slowed and eventually stopped hiking interest rates. Global growth, employment, and consumer spending showed resilience, but the prospect of rates remaining high for an extended period spurred volatility at times. Toward year-end, however, global stocks and bonds rallied as falling inflation and softening economic growth raised market expectations for rate cuts in 2024. |

| • | In the U.S. equity market, large-capitalization stocks outpaced small-caps for the 12 months, and growth stocks outperformed value by a substantial margin, largely driven by a handful of tech names. |

| • | Municipal bonds, as measured by the Bloomberg 1–15 Year Municipal Index, posted a total return of 5.26%, slightly less than the 5.60% return of the Bloomberg U.S. Aggregate Float Adjusted Index, a proxy for the taxable investment-grade bond market. |

| Average Annual Total Returns Periods Ended December 31, 2023 | |||

| One Year | Three Years | Five Years | |

| Stocks | |||

| Russell 1000 Index (Large-caps) | 26.53% | 8.97% | 15.52% |

| Russell 2000 Index (Small-caps) | 16.93 | 2.22 | 9.97 |

| Russell 3000 Index (Broad U.S. market) | 25.96 | 8.54 | 15.16 |

| FTSE All-World ex US Index (International) | 15.82 | 1.98 | 7.52 |

| Bonds | |||

| Bloomberg U.S. Aggregate Float Adjusted Index (Broad taxable market) | 5.60% | -3.33% | 1.17% |

| Bloomberg Municipal Bond Index (Broad tax-exempt market) | 6.40 | -0.40 | 2.25 |

| FTSE Three-Month U.S. Treasury Bill Index | 5.26 | 2.24 | 1.91 |

| CPI | |||

| Consumer Price Index | 3.35% | 5.60% | 4.07% |

| • | Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. |

| • | Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds. |

| Six Months Ended December 31, 2023 | |||

| Beginning Account Value 6/30/2023 | Ending Account Value 12/31/2023 | Expenses Paid During Period | |

| Based on Actual Fund Return | |||

| Tax-Managed Balanced Fund | $1,000.00 | $1,059.60 | $0.47 |

| Tax-Managed Capital Appreciation Fund | |||

| Admiral™ Shares | $1,000.00 | $1,084.10 | $0.47 |

| Institutional Shares | 1,000.00 | 1,084.20 | 0.32 |

| Tax-Managed Small-Cap Fund | |||

| Admiral Shares | $1,000.00 | $1,094.20 | $0.48 |

| Institutional Shares | 1,000.00 | 1,094.40 | 0.32 |

| Based on Hypothetical 5% Yearly Return | |||

| Tax-Managed Balanced Fund | $1,000.00 | $1,024.75 | $0.46 |

| Tax-Managed Capital Appreciation Fund | |||

| Admiral Shares | $1,000.00 | $1,024.75 | $0.46 |

| Institutional Shares | 1,000.00 | 1,024.90 | 0.31 |

| Tax-Managed Small-Cap Fund | |||

| Admiral Shares | $1,000.00 | $1,024.75 | $0.46 |

| Institutional Shares | 1,000.00 | 1,024.90 | 0.31 |

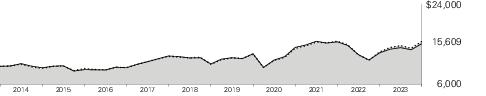

| Average Annual Total Returns Periods Ended December 31, 2023 | |||||

| One Year | Five Years | Ten Years | Final Value of a $10,000 Investment | ||

| Tax-Managed Balanced Fund | 15.53% | 8.82% | 7.27% | $20,172 |

| Tax-Managed Balanced Composite Index | 15.65 | 9.25 | 7.52 | 20,648 |

| Bloomberg Municipal Bond Index | 6.40 | 2.25 | 3.03 | 13,483 |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 26.06 | 15.05 | 11.40 | 29,422 |

| Investment Exposure | |

| Basic Materials | 0.8% |

| Consumer Discretionary | 7.0 |

| Consumer Staples | 2.2 |

| Energy | 1.8 |

| Financials | 5.0 |

| Health Care | 5.6 |

| Industrials | 6.3 |

| Other | 0.3 |

| Real Estate | 1.3 |

| Technology | 15.3 |

| Telecommunications | 1.1 |

| Utilities | 1.3 |

| Tax-Exempt Municipal Bonds | 52.0 |

| Shares | Market Value• ($000) | |||||

| Common Stocks (47.7%) | ||||||

| Basic Materials (0.8%) | ||||||

| Linde plc | 48,859 | 20,067 | ||||

| Freeport-McMoRan Inc. | 141,391 | 6,019 | ||||

| Air Products and Chemicals Inc. | 21,609 | 5,917 | ||||

| Ecolab Inc. | 21,275 | 4,220 | ||||

| Nucor Corp. | 23,200 | 4,038 | ||||

| Element Solutions Inc. | 120,371 | 2,785 | ||||

| Newmont Corp. | 66,255 | 2,742 | ||||

| Celanese Corp. Class A | 15,842 | 2,461 | ||||

| Alcoa Corp. | 70,034 | 2,381 | ||||

| Reliance Steel & Aluminum Co. | 6,900 | 1,930 | ||||

| Albemarle Corp. | 12,068 | 1,744 | ||||

| Westlake Corp. | 11,056 | 1,547 | ||||

| Fastenal Co. | 21,246 | 1,376 | ||||

| CF Industries Holdings Inc. | 16,859 | 1,340 | ||||

| Avery Dennison Corp. | 5,500 | 1,112 | ||||

| United States Steel Corp. | 18,000 | 876 | ||||

| Dow Inc. | 15,461 | 848 | ||||

| Huntsman Corp. | 27,901 | 701 | ||||

| Mosaic Co. | 18,068 | 646 | ||||

| * | Valvoline Inc. | 17,015 | 639 | |||

| * | MP Materials Corp. | 29,433 | 584 | |||

| FMC Corp. | 9,098 | 574 | ||||

| International Flavors & Fragrances Inc. | 7,083 | 573 | ||||

| LyondellBasell Industries NV Class A | 5,638 | 536 | ||||

| Ashland Inc. | 6,198 | 523 | ||||

| Steel Dynamics Inc. | 4,100 | 484 | ||||

| Royal Gold Inc. | 3,900 | 472 | ||||

| Timken Co. | 5,841 | 468 | ||||

| Eastman Chemical Co. | 5,040 | 453 | ||||

| Scotts Miracle-Gro Co. | 4,442 | 283 | ||||

| NewMarket Corp. | 390 | 213 | ||||

| SSR Mining Inc. | 8,772 | 94 | ||||

| 68,646 | ||||||

| Consumer Discretionary (7.0%) | ||||||

| * | Amazon.com Inc. | 873,196 | 132,673 | |||

| * | Tesla Inc. | 258,313 | 64,186 | |||

| Home Depot Inc. | 103,869 | 35,996 | ||||

| Costco Wholesale Corp. | 47,654 | 31,455 | ||||

| * | Netflix Inc. | 47,459 | 23,107 | |||

| Walmart Inc. | 142,753 | 22,505 | ||||

| McDonald's Corp. | 62,436 | 18,513 | ||||

| Lowe's Cos. Inc. | 75,512 | 16,805 | ||||

| Walt Disney Co. | 153,117 | 13,825 | ||||

| * | Booking Holdings Inc. | 3,829 | 13,582 | |||

| NIKE Inc. Class B | 120,861 | 13,122 | ||||

| * | Uber Technologies Inc. | 178,112 | 10,966 | |||

| Starbucks Corp. | 113,970 | 10,942 | ||||

| TJX Cos. Inc. | 106,628 | 10,003 | ||||

| * | Lululemon Athletica Inc. | 15,881 | 8,120 | |||

| * | Chipotle Mexican Grill Inc. Class A | 3,372 | 7,712 | |||

| * | O'Reilly Automotive Inc. | 8,103 | 7,698 | |||

| General Motors Co. | 193,935 | 6,966 | ||||

| * | Copart Inc. | 141,652 | 6,941 | |||

| Marriott International Inc. Class A | 28,408 | 6,406 | ||||

| Target Corp. | 42,065 | 5,991 | ||||

| Lennar Corp. Class A | 39,160 | 5,836 | ||||

| DR Horton Inc. | 37,302 | 5,669 | ||||

| Hilton Worldwide Holdings Inc. | 30,445 | 5,544 | ||||

| * | AutoZone Inc. | 2,094 | 5,414 | |||

| Ross Stores Inc. | 35,144 | 4,864 | ||||

| Yum! Brands Inc. | 31,728 | 4,146 | ||||

| * | Airbnb Inc. Class A | 30,100 | 4,098 | |||

| * | NVR Inc. | 569 | 3,983 | |||

| Dollar General Corp. | 28,880 | 3,926 | ||||

| Delta Air Lines Inc. | 89,337 | 3,594 | ||||

| * | Dollar Tree Inc. | 25,146 | 3,572 | |||

| * | Live Nation Entertainment Inc. | 35,096 | 3,285 | |||

| Shares | Market Value• ($000) | |||||

| Electronic Arts Inc. | 23,473 | 3,211 | ||||

| eBay Inc. | 70,736 | 3,086 | ||||

| * | Ulta Beauty Inc. | 5,996 | 2,938 | |||

| Estee Lauder Cos. Inc. Class A | 19,990 | 2,924 | ||||

| Tractor Supply Co. | 12,514 | 2,691 | ||||

| * | Capri Holdings Ltd. | 53,000 | 2,663 | |||

| PulteGroup Inc. | 25,300 | 2,611 | ||||

| * | MGM Resorts International | 57,046 | 2,549 | |||

| * | AutoNation Inc. | 16,312 | 2,450 | |||

| * | Deckers Outdoor Corp. | 3,623 | 2,422 | |||

| Toll Brothers Inc. | 22,801 | 2,344 | ||||

| * | Warner Bros Discovery Inc. | 204,744 | 2,330 | |||

| * | Take-Two Interactive Software Inc. | 14,415 | 2,320 | |||

| * | Expedia Group Inc. | 14,301 | 2,171 | |||

| * | Aptiv plc | 23,498 | 2,108 | |||

| * | Rivian Automotive Inc. Class A | 83,439 | 1,957 | |||

| Tempur Sealy International Inc. | 37,140 | 1,893 | ||||

| Ford Motor Co. | 150,000 | 1,828 | ||||

| * | Skechers USA Inc. Class A | 28,459 | 1,774 | |||

| Domino's Pizza Inc. | 4,261 | 1,757 | ||||

| LKQ Corp. | 36,460 | 1,742 | ||||

| * | Trade Desk Inc. Class A | 23,953 | 1,724 | |||

| * | United Airlines Holdings Inc. | 37,444 | 1,545 | |||

| * | Royal Caribbean Cruises Ltd. | 11,931 | 1,545 | |||

| * | Floor & Decor Holdings Inc. Class A | 13,773 | 1,537 | |||

| News Corp. Class A | 62,267 | 1,529 | ||||

| * | Carnival Corp. | 80,800 | 1,498 | |||

| Lear Corp. | 10,522 | 1,486 | ||||

| U-Haul Holding Co. (XNYS) | 20,513 | 1,445 | ||||

| Williams-Sonoma Inc. | 7,089 | 1,430 | ||||

| Thor Industries Inc. | 11,633 | 1,376 | ||||

| * | Liberty Media Corp.-Liberty Formula One Class C | 21,777 | 1,375 | |||

| Service Corp. International | 19,880 | 1,361 | ||||

| Gentex Corp. | 39,660 | 1,295 | ||||

| PVH Corp. | 10,390 | 1,269 | ||||

| * | CarMax Inc. | 16,457 | 1,263 | |||

| Dick's Sporting Goods Inc. | 8,512 | 1,251 | ||||

| Best Buy Co. Inc. | 15,931 | 1,247 | ||||

| Southwest Airlines Co. | 42,498 | 1,227 | ||||

| * | ROBLOX Corp. Class A | 26,606 | 1,216 | |||

| Paramount Global Class A | 61,408 | 1,207 | ||||

| * | Grand Canyon Education Inc. | 8,837 | 1,167 | |||

| * | Five Below Inc. | 5,244 | 1,118 | |||

| * | Bright Horizons Family Solutions Inc. | 11,722 | 1,105 | |||

| Sirius XM Holdings Inc. | 196,880 | 1,077 | ||||

| * | Norwegian Cruise Line Holdings Ltd. | 53,105 | 1,064 | |||

| * | Etsy Inc. | 13,105 | 1,062 | |||

| * | Burlington Stores Inc. | 5,298 | 1,030 | |||

| Rollins Inc. | 23,442 | 1,024 | ||||

| * | Peloton Interactive Inc. Class A | 161,083 | 981 | |||

| * | Mattel Inc. | 51,831 | 979 | |||

| Las Vegas Sands Corp. | 18,100 | 891 | ||||

| * | RH | 3,017 | 879 | |||

| * | Lyft Inc. Class A | 56,939 | 854 | |||

| * | American Airlines Group Inc. | 61,900 | 851 | |||

| New York Times Co. Class A | 15,400 | 754 | ||||

| Lennar Corp. Class B | 5,464 | 732 | ||||

| * | QuantumScape Corp. Class A | 90,000 | 625 | |||

| * | Spotify Technology SA | 3,225 | 606 | |||

| * | Planet Fitness Inc. Class A | 8,001 | 584 | |||

| Copa Holdings SA Class A | 4,762 | 506 | ||||

| BorgWarner Inc. | 13,734 | 492 | ||||

| Pool Corp. | 1,216 | 485 | ||||

| Wendy's Co. | 24,919 | 485 | ||||

| Garmin Ltd. | 3,700 | 476 | ||||

| Aramark | 16,753 | 471 | ||||

| * | Liberty Media Corp.-Liberty SiriusXM Class A | 16,247 | 467 | |||

| * | Ollie's Bargain Outlet Holdings Inc. | 6,100 | 463 | |||

| * | Madison Square Garden Sports Corp. | 2,448 | 445 | |||

| Ralph Lauren Corp. Class A | 3,073 | 443 | ||||

| Shares | Market Value• ($000) | |||||

| * | Penn Entertainment Inc. | 16,890 | 439 | |||

| Hyatt Hotels Corp. Class A | 3,344 | 436 | ||||

| * | Victoria's Secret & Co. | 14,850 | 394 | |||

| * | YETI Holdings Inc. | 7,558 | 391 | |||

| Wynn Resorts Ltd. | 4,199 | 383 | ||||

| * | Carvana Co. Class A | 6,796 | 360 | |||

| Avis Budget Group Inc. | 2,000 | 355 | ||||

| Lithia Motors Inc. Class A | 1,011 | 333 | ||||

| * | GameStop Corp. Class A | 18,414 | 323 | |||

| * | Liberty Media Corp.-Liberty Formula One Class A | 5,563 | 323 | |||

| * | Liberty Media Corp.-Liberty SiriusXM | 10,300 | 296 | |||

| Vail Resorts Inc. | 1,300 | 278 | ||||

| * | AMC Entertainment Holdings Inc. Class A | 44,990 | 275 | |||

| Advance Auto Parts Inc. | 4,451 | 272 | ||||

| Harley-Davidson Inc. | 6,470 | 238 | ||||

| Wyndham Hotels & Resorts Inc. | 2,776 | 223 | ||||

| RB Global Inc. | 3,309 | 221 | ||||

| * | DraftKings Inc. Class A | 6,161 | 217 | |||

| * | U-Haul Holding Co. | 2,887 | 207 | |||

| Macy's Inc. | 9,230 | 186 | ||||

| * | Petco Health & Wellness Co. Inc. Class A | 55,460 | 175 | |||

| Darden Restaurants Inc. | 884 | 145 | ||||

| Bath & Body Works Inc. | 3,339 | 144 | ||||

| Nexstar Media Group Inc. Class A | 802 | 126 | ||||

| * | Liberty Media Corp.-Liberty Live Class A | 3,224 | 118 | |||

| Phinia Inc. | 3,451 | 105 | ||||

| * | Wayfair Inc. Class A | 1,200 | 74 | |||

| Choice Hotels International Inc. | 444 | 50 | ||||

| * | Liberty Media Corp.-Liberty Live Class C | 932 | 35 | |||

| Paramount Global Class B | 1,873 | 28 | ||||

| 628,306 | ||||||

| Consumer Staples (2.2%) | ||||||

| Procter & Gamble Co. | 239,701 | 35,126 | ||||

| PepsiCo Inc. | 132,297 | 22,469 | ||||

| Coca-Cola Co. | 344,600 | 20,307 | ||||

| Mondelez International Inc. Class A | 149,779 | 10,849 | ||||

| CVS Health Corp. | 115,925 | 9,153 | ||||

| * | Monster Beverage Corp. | 156,646 | 9,024 | |||

| McKesson Corp. | 15,695 | 7,267 | ||||

| Kroger Co. | 143,587 | 6,563 | ||||

| Philip Morris International Inc. | 58,903 | 5,542 | ||||

| Kenvue Inc. | 237,451 | 5,112 | ||||

| * | Post Holdings Inc. | 55,842 | 4,917 | |||

| Colgate-Palmolive Co. | 59,644 | 4,754 | ||||

| Church & Dwight Co. Inc. | 46,395 | 4,387 | ||||

| Constellation Brands Inc. Class A | 17,884 | 4,323 | ||||

| Archer-Daniels-Midland Co. | 51,496 | 3,719 | ||||

| Corteva Inc. | 75,255 | 3,606 | ||||

| General Mills Inc. | 50,342 | 3,279 | ||||

| Cencora Inc. | 15,012 | 3,083 | ||||

| J M Smucker Co. | 22,860 | 2,889 | ||||

| Sysco Corp. | 38,874 | 2,843 | ||||

| Hershey Co. | 14,203 | 2,648 | ||||

| McCormick & Co. Inc. (Non-Voting) | 24,760 | 1,694 | ||||

| Brown-Forman Corp. Class B | 28,038 | 1,601 | ||||

| Altria Group Inc. | 37,080 | 1,496 | ||||

| Tyson Foods Inc. Class A | 27,013 | 1,452 | ||||

| Clorox Co. | 10,000 | 1,426 | ||||

| Molson Coors Beverage Co. Class B | 23,112 | 1,415 | ||||

| * | US Foods Holding Corp. | 30,138 | 1,369 | |||

| Campbell Soup Co. | 31,541 | 1,364 | ||||

| Keurig Dr Pepper Inc. | 37,058 | 1,235 | ||||

| Walgreens Boots Alliance Inc. | 45,645 | 1,192 | ||||

| Hormel Foods Corp. | 34,031 | 1,093 | ||||

| Kimberly-Clark Corp. | 8,872 | 1,078 | ||||

| Lamb Weston Holdings Inc. | 9,800 | 1,059 | ||||

| Conagra Brands Inc. | 34,661 | 993 | ||||

| Casey's General Stores Inc. | 3,314 | 911 | ||||

| * | Freshpet Inc. | 10,261 | 890 | |||

| * | Grocery Outlet Holding Corp. | 26,400 | 712 | |||

| Ingredion Inc. | 6,341 | 688 | ||||

| Bunge Global SA | 6,746 | 681 | ||||

| Spectrum Brands Holdings Inc. | 7,191 | 574 | ||||

| Brown-Forman Corp. Class A | 9,544 | 569 | ||||

| * | Pilgrim's Pride Corp. | 19,755 | 546 | |||

| * | Olaplex Holdings Inc. | 209,485 | 532 | |||

| WK Kellogg Co. | 38,526 | 506 | ||||

| * | Performance Food Group Co. | 6,632 | 459 | |||

| Seaboard Corp. | 97 | 346 | ||||

| Kraft Heinz Co. | 8,459 | 313 | ||||

| Shares | Market Value• ($000) | |||||

| Kellanova | 5,000 | 280 | ||||

| * | Boston Beer Co. Inc. Class A | 382 | 132 | |||

| 198,466 | ||||||

| Energy (1.8%) | ||||||

| Exxon Mobil Corp. | 352,718 | 35,265 | ||||

| Chevron Corp. | 153,042 | 22,828 | ||||

| ConocoPhillips | 110,127 | 12,782 | ||||

| Schlumberger NV | 149,820 | 7,797 | ||||

| Marathon Petroleum Corp. | 48,458 | 7,189 | ||||

| Devon Energy Corp. | 141,993 | 6,432 | ||||

| Marathon Oil Corp. | 225,300 | 5,443 | ||||

| Cheniere Energy Inc. | 31,747 | 5,420 | ||||

| Occidental Petroleum Corp. | 88,691 | 5,296 | ||||

| EOG Resources Inc. | 41,056 | 4,966 | ||||

| Diamondback Energy Inc. | 29,914 | 4,639 | ||||

| Phillips 66 | 31,976 | 4,257 | ||||

| Baker Hughes Co. Class A | 116,762 | 3,991 | ||||

| Hess Corp. | 27,022 | 3,896 | ||||

| Valero Energy Corp. | 28,900 | 3,757 | ||||

| Pioneer Natural Resources Co. | 15,691 | 3,529 | ||||

| Halliburton Co. | 92,654 | 3,349 | ||||

| Range Resources Corp. | 99,510 | 3,029 | ||||

| EQT Corp. | 72,232 | 2,792 | ||||

| Coterra Energy Inc. | 101,672 | 2,595 | ||||

| Murphy Oil Corp. | 59,729 | 2,548 | ||||

| * | First Solar Inc. | 12,625 | 2,175 | |||

| ChampionX Corp. | 68,231 | 1,993 | ||||

| * | Enphase Energy Inc. | 10,010 | 1,323 | |||

| Williams Cos. Inc. | 36,405 | 1,268 | ||||

| Targa Resources Corp. | 13,957 | 1,212 | ||||

| HF Sinclair Corp. | 20,892 | 1,161 | ||||

| ONEOK Inc. | 13,704 | 962 | ||||

| NOV Inc. | 43,700 | 886 | ||||

| Texas Pacific Land Corp. | 467 | 734 | ||||

| APA Corp. | 20,000 | 718 | ||||

| * | Plug Power Inc. | 127,971 | 576 | |||

| DT Midstream Inc. | 8,587 | 471 | ||||

| Vitesse Energy Inc. | 2,520 | 55 | ||||

| Kinder Morgan Inc. | 5 | — | ||||

| 165,334 | ||||||

| Financials (5.0%) | ||||||

| * | Berkshire Hathaway Inc. Class B | 196,755 | 70,175 | |||

| JPMorgan Chase & Co. | 294,849 | 50,154 | ||||

| Bank of America Corp. | 803,071 | 27,039 | ||||

| Wells Fargo & Co. | 366,221 | 18,025 | ||||

| S&P Global Inc. | 38,611 | 17,009 | ||||

| Morgan Stanley | 142,641 | 13,301 | ||||

| Goldman Sachs Group Inc. | 32,058 | 12,367 | ||||

| Progressive Corp. | 64,645 | 10,297 | ||||

| Marsh & McLennan Cos. Inc. | 50,714 | 9,609 | ||||

| Chubb Ltd. | 39,599 | 8,949 | ||||

| * | Arch Capital Group Ltd. | 118,526 | 8,803 | |||

| BlackRock Inc. | 10,567 | 8,578 | ||||

| Charles Schwab Corp. | 122,499 | 8,428 | ||||

| Aon plc Class A | 27,728 | 8,069 | ||||

| Citigroup Inc. | 137,658 | 7,081 | ||||

| Moody's Corp. | 17,333 | 6,770 | ||||

| Intercontinental Exchange Inc. | 51,833 | 6,657 | ||||

| Webster Financial Corp. | 97,211 | 4,934 | ||||

| Aflac Inc. | 57,474 | 4,742 | ||||

| MSCI Inc. Class A | 8,302 | 4,696 | ||||

| CME Group Inc. | 22,295 | 4,695 | ||||

| PNC Financial Services Group Inc. | 30,249 | 4,684 | ||||

| Arthur J Gallagher & Co. | 20,577 | 4,627 | ||||

| Pinnacle Financial Partners Inc. | 50,851 | 4,435 | ||||

| * | Coinbase Global Inc. Class A | 24,800 | 4,313 | |||

| Apollo Global Management Inc. | 43,815 | 4,083 | ||||

| Allstate Corp. | 28,624 | 4,007 | ||||

| Truist Financial Corp. | 108,153 | 3,993 | ||||

| First Citizens BancShares Inc. Class A | 2,775 | 3,938 | ||||

| Ameriprise Financial Inc. | 10,336 | 3,926 | ||||

| Travelers Cos. Inc. | 20,181 | 3,844 | ||||

| KKR & Co. Inc. | 45,775 | 3,792 | ||||

| American International Group Inc. | 52,675 | 3,569 | ||||

| Bank of New York Mellon Corp. | 66,105 | 3,441 | ||||

| MetLife Inc. | 50,516 | 3,341 | ||||

| Assured Guaranty Ltd. | 43,927 | 3,287 | ||||

| * | Markel Group Inc. | 2,262 | 3,212 | |||

| US Bancorp | 71,326 | 3,087 | ||||

| * | Brighthouse Financial Inc. | 52,982 | 2,804 | |||

| Shares | Market Value• ($000) | |||||

| Discover Financial Services | 23,912 | 2,688 | ||||

| Willis Towers Watson plc | 11,000 | 2,653 | ||||

| Hartford Financial Services Group Inc. | 31,450 | 2,528 | ||||

| Broadridge Financial Solutions Inc. | 10,218 | 2,102 | ||||

| Raymond James Financial Inc. | 18,625 | 2,077 | ||||

| Brown & Brown Inc. | 28,718 | 2,042 | ||||

| W R Berkley Corp. | 28,873 | 2,042 | ||||

| FactSet Research Systems Inc. | 4,244 | 2,025 | ||||

| Wintrust Financial Corp. | 21,290 | 1,975 | ||||

| State Street Corp. | 24,769 | 1,919 | ||||

| Globe Life Inc. | 15,679 | 1,908 | ||||

| Fifth Third Bancorp | 55,196 | 1,904 | ||||

| Blackstone Inc. | 14,437 | 1,890 | ||||

| Reinsurance Group of America Inc. | 11,595 | 1,876 | ||||

| White Mountains Insurance Group Ltd. | 1,198 | 1,803 | ||||

| East West Bancorp Inc. | 23,858 | 1,717 | ||||

| Voya Financial Inc. | 22,512 | 1,642 | ||||

| M&T Bank Corp. | 11,745 | 1,610 | ||||

| Zions Bancorp NA | 33,982 | 1,491 | ||||

| Cboe Global Markets Inc. | 8,286 | 1,480 | ||||

| RenaissanceRe Holdings Ltd. | 7,451 | 1,460 | ||||

| Nasdaq Inc. | 24,069 | 1,399 | ||||

| Prudential Financial Inc. | 12,838 | 1,331 | ||||

| Tradeweb Markets Inc. Class A | 14,600 | 1,327 | ||||

| Regions Financial Corp. | 66,902 | 1,297 | ||||

| Assurant Inc. | 7,101 | 1,196 | ||||

| * | Credit Acceptance Corp. | 2,161 | 1,151 | |||

| Ally Financial Inc. | 30,516 | 1,066 | ||||

| Popular Inc. | 12,967 | 1,064 | ||||

| LPL Financial Holdings Inc. | 4,562 | 1,038 | ||||

| Jefferies Financial Group Inc. | 25,339 | 1,024 | ||||

| * | Robinhood Markets Inc. Class A | 79,463 | 1,012 | |||

| Everest Group Ltd. | 2,700 | 955 | ||||

| KeyCorp | 65,863 | 948 | ||||

| Comerica Inc. | 16,291 | 909 | ||||

| Western Alliance Bancorp | 13,750 | 905 | ||||

| MGIC Investment Corp. | 45,667 | 881 | ||||

| * | Upstart Holdings Inc. | 20,900 | 854 | |||

| Hanover Insurance Group Inc. | 6,939 | 843 | ||||

| Commerce Bancshares Inc. | 14,286 | 763 | ||||

| Morningstar Inc. | 2,620 | 750 | ||||

| Cincinnati Financial Corp. | 7,091 | 734 | ||||

| Affiliated Managers Group Inc. | 4,562 | 691 | ||||

| Huntington Bancshares Inc. | 52,824 | 672 | ||||

| SEI Investments Co. | 9,913 | 630 | ||||

| First Horizon Corp. | 43,114 | 611 | ||||

| Lincoln National Corp. | 21,914 | 591 | ||||

| T. Rowe Price Group Inc. | 4,874 | 525 | ||||

| Bank OZK | 9,680 | 482 | ||||

| Equitable Holdings Inc. | 14,088 | 469 | ||||

| Primerica Inc. | 2,200 | 453 | ||||

| Citizens Financial Group Inc. | 12,703 | 421 | ||||

| Unum Group | 9,127 | 413 | ||||

| MarketAxess Holdings Inc. | 1,350 | 395 | ||||

| Synovus Financial Corp. | 10,314 | 388 | ||||

| Interactive Brokers Group Inc. Class A | 4,420 | 366 | ||||

| BOK Financial Corp. | 4,048 | 347 | ||||

| SLM Corp. | 17,179 | 328 | ||||

| Erie Indemnity Co. Class A | 872 | 292 | ||||

| Northern Trust Corp. | 3,400 | 287 | ||||

| * | SoFi Technologies Inc. | 22,812 | 227 | |||

| OneMain Holdings Inc. | 4,339 | 214 | ||||

| Ares Management Corp. Class A | 1,623 | 193 | ||||

| Fidelity National Financial Inc. | 3,318 | 169 | ||||

| Loews Corp. | 2,394 | 167 | ||||

| Blue Owl Capital Inc. Class A | 11,085 | 165 | ||||

| New York Community Bancorp Inc. | 15,937 | 163 | ||||

| Stifel Financial Corp. | 2,262 | 156 | ||||

| First American Financial Corp. | 2,201 | 142 | ||||

| Franklin Resources Inc. | 1,525 | 45 | ||||

| 451,042 | ||||||

| Health Care (5.6%) | ||||||

| Eli Lilly & Co. | 84,163 | 49,060 | ||||

| UnitedHealth Group Inc. | 91,396 | 48,117 | ||||

| Johnson & Johnson | 192,010 | 30,096 | ||||

| Merck & Co. Inc. | 240,113 | 26,177 | ||||

| AbbVie Inc. | 152,730 | 23,669 | ||||

| Thermo Fisher Scientific Inc. | 40,487 | 21,490 | ||||

| Abbott Laboratories | 164,142 | 18,067 | ||||

| Amgen Inc. | 53,330 | 15,360 | ||||

| Shares | Market Value• ($000) | |||||

| Danaher Corp. | 65,315 | 15,110 | ||||

| * | Intuitive Surgical Inc. | 38,465 | 12,977 | |||

| Pfizer Inc. | 395,207 | 11,378 | ||||

| * | Vertex Pharmaceuticals Inc. | 27,730 | 11,283 | |||

| Cigna Group | 37,283 | 11,164 | ||||

| Elevance Health Inc. | 23,239 | 10,959 | ||||

| Zoetis Inc. Class A | 53,753 | 10,609 | ||||

| * | Regeneron Pharmaceuticals Inc. | 11,003 | 9,664 | |||

| Stryker Corp. | 30,849 | 9,238 | ||||

| * | Boston Scientific Corp. | 144,841 | 8,373 | |||

| Gilead Sciences Inc. | 96,715 | 7,835 | ||||

| HCA Healthcare Inc. | 27,941 | 7,563 | ||||

| * | IDEXX Laboratories Inc. | 12,149 | 6,743 | |||

| * | IQVIA Holdings Inc. | 27,495 | 6,362 | |||

| Humana Inc. | 13,882 | 6,355 | ||||

| Medtronic plc | 76,410 | 6,295 | ||||

| * | Biogen Inc. | 23,174 | 5,997 | |||

| Bristol-Myers Squibb Co. | 99,301 | 5,095 | ||||

| * | Edwards Lifesciences Corp. | 65,256 | 4,976 | |||

| Becton Dickinson & Co. | 19,412 | 4,733 | ||||

| * | Dexcom Inc. | 35,301 | 4,381 | |||

| Agilent Technologies Inc. | 29,707 | 4,130 | ||||

| Laboratory Corp. of America Holdings | 15,797 | 3,591 | ||||

| West Pharmaceutical Services Inc. | 9,702 | 3,416 | ||||

| * | Alnylam Pharmaceuticals Inc. | 16,335 | 3,127 | |||

| * | Molina Healthcare Inc. | 7,532 | 2,721 | |||

| GE HealthCare Technologies Inc. | 34,816 | 2,692 | ||||

| * | Acadia Healthcare Co. Inc. | 33,932 | 2,639 | |||

| * | Elanco Animal Health Inc. | 175,845 | 2,620 | |||

| * | Centene Corp. | 32,484 | 2,411 | |||

| * | Moderna Inc. | 24,203 | 2,407 | |||

| * | Align Technology Inc. | 8,696 | 2,383 | |||

| * | BioMarin Pharmaceutical Inc. | 24,108 | 2,325 | |||

| * | Incyte Corp. | 36,483 | 2,291 | |||

| Royalty Pharma plc Class A | 76,450 | 2,147 | ||||

| * | Hologic Inc. | 29,853 | 2,133 | |||

| * | Charles River Laboratories International Inc. | 8,768 | 2,073 | |||

| ResMed Inc. | 11,913 | 2,049 | ||||

| * | Insulet Corp. | 9,365 | 2,032 | |||

| * | DaVita Inc. | 18,873 | 1,977 | |||

| Cooper Cos. Inc. | 5,136 | 1,944 | ||||

| * | Neurocrine Biosciences Inc. | 14,361 | 1,892 | |||

| * | Karuna Therapeutics Inc. | 5,747 | 1,819 | |||

| Quest Diagnostics Inc. | 12,819 | 1,768 | ||||

| * | Veeva Systems Inc. Class A | 8,933 | 1,720 | |||

| Zimmer Biomet Holdings Inc. | 13,570 | 1,651 | ||||

| Revvity Inc. | 14,596 | 1,596 | ||||

| Bio-Techne Corp. | 19,204 | 1,482 | ||||

| * | Sarepta Therapeutics Inc. | 15,123 | 1,458 | |||

| * | Envista Holdings Corp. | 58,701 | 1,412 | |||

| * | Ionis Pharmaceuticals Inc. | 26,826 | 1,357 | |||

| * | Tenet Healthcare Corp. | 16,964 | 1,282 | |||

| * | United Therapeutics Corp. | 5,594 | 1,230 | |||

| * | Azenta Inc. | 18,821 | 1,226 | |||

| * | Ultragenyx Pharmaceutical Inc. | 25,446 | 1,217 | |||

| * | ICU Medical Inc. | 12,051 | 1,202 | |||

| Universal Health Services Inc. Class B | 7,717 | 1,176 | ||||

| * | Bio-Rad Laboratories Inc. Class A | 3,572 | 1,153 | |||

| * | Penumbra Inc. | 4,163 | 1,047 | |||

| * | Illumina Inc. | 7,500 | 1,044 | |||

| * | QIAGEN NV | 23,461 | 1,019 | |||

| * | Globus Medical Inc. Class A | 19,103 | 1,018 | |||

| STERIS plc | 4,045 | 889 | ||||

| * | Inspire Medical Systems Inc. | 4,347 | 884 | |||

| * | Integra LifeSciences Holdings Corp. | 20,125 | 876 | |||

| Cardinal Health Inc. | 8,345 | 841 | ||||

| * | Enovis Corp. | 14,597 | 818 | |||

| * | Exact Sciences Corp. | 10,950 | 810 | |||

| * | Teladoc Health Inc. | 37,495 | 808 | |||

| Chemed Corp. | 1,305 | 763 | ||||

| * | Apellis Pharmaceuticals Inc. | 11,851 | 709 | |||

| * | Novocure Ltd. | 46,146 | 689 | |||

| * | Catalent Inc. | 13,276 | 597 | |||

| * | Masimo Corp. | 5,033 | 590 | |||

| * | QuidelOrtho Corp. | 7,748 | 571 | |||

| * | Fortrea Holdings Inc. | 15,797 | 551 | |||

| * | Exelixis Inc. | 20,965 | 503 | |||

| * | Mirati Therapeutics Inc. | 7,989 | 469 | |||

| * | Natera Inc. | 7,188 | 450 | |||

| * | Avantor Inc. | 18,405 | 420 | |||

| * | Shockwave Medical Inc. | 2,113 | 403 | |||

| Shares | Market Value• ($000) | |||||

| Organon & Co. | 27,435 | 396 | ||||

| Viatris Inc. | 36,014 | 390 | ||||

| Baxter International Inc. | 9,900 | 383 | ||||

| DENTSPLY SIRONA Inc. | 9,088 | 323 | ||||

| * | Sotera Health Co. | 17,800 | 300 | |||

| * | Roivant Sciences Ltd. | 23,424 | 263 | |||

| Teleflex Inc. | 1,039 | 259 | ||||

| Encompass Health Corp. | 3,143 | 210 | ||||

| * | Ginkgo Bioworks Holdings Inc. Class A | 120,214 | 203 | |||

| * | ICON plc | 574 | 163 | |||

| * | Amedisys Inc. | 1,487 | 141 | |||

| * | 10X Genomics Inc. Class A | 2,400 | 134 | |||

| * | Enhabit Inc. | 12,266 | 127 | |||

| * | Tandem Diabetes Care Inc. | 4,200 | 124 | |||

| Bruker Corp. | 1,507 | 111 | ||||

| * | Repligen Corp. | 398 | 72 | |||

| 505,243 | ||||||

| Industrials (6.2%) | ||||||

| Visa Inc. Class A | 164,196 | 42,748 | ||||

| Mastercard Inc. Class A | 86,386 | 36,845 | ||||

| Accenture plc Class A | 64,534 | 22,646 | ||||

| Union Pacific Corp. | 63,210 | 15,526 | ||||

| * | Boeing Co. | 58,781 | 15,322 | |||

| Honeywell International Inc. | 69,899 | 14,659 | ||||

| Caterpillar Inc. | 46,357 | 13,706 | ||||

| General Electric Co. | 105,976 | 13,526 | ||||

| Deere & Co. | 32,002 | 12,797 | ||||

| American Express Co. | 63,207 | 11,841 | ||||

| Lockheed Martin Corp. | 21,492 | 9,741 | ||||

| Capital One Financial Corp. | 72,570 | 9,515 | ||||

| RTX Corp. | 111,761 | 9,404 | ||||

| Sherwin-Williams Co. | 29,768 | 9,285 | ||||

| Automatic Data Processing Inc. | 35,387 | 8,244 | ||||

| United Parcel Service Inc. Class B | 52,034 | 8,181 | ||||

| Eaton Corp. plc | 32,455 | 7,816 | ||||

| CSX Corp. | 223,570 | 7,751 | ||||

| AMETEK Inc. | 46,011 | 7,587 | ||||

| * | Fiserv Inc. | 53,944 | 7,166 | |||

| United Rentals Inc. | 12,074 | 6,923 | ||||

| Illinois Tool Works Inc. | 26,377 | 6,909 | ||||

| Quanta Services Inc. | 30,093 | 6,494 | ||||

| Cintas Corp. | 10,685 | 6,439 | ||||

| TransDigm Group Inc. | 6,285 | 6,358 | ||||

| Vulcan Materials Co. | 25,908 | 5,881 | ||||

| Norfolk Southern Corp. | 24,670 | 5,832 | ||||

| * | PayPal Holdings Inc. | 94,204 | 5,785 | |||

| Howmet Aerospace Inc. | 105,166 | 5,692 | ||||

| Martin Marietta Materials Inc. | 11,027 | 5,501 | ||||

| Northrop Grumman Corp. | 11,746 | 5,499 | ||||

| FedEx Corp. | 20,696 | 5,235 | ||||

| Trane Technologies plc | 21,310 | 5,198 | ||||

| PACCAR Inc. | 51,621 | 5,041 | ||||

| Emerson Electric Co. | 48,895 | 4,759 | ||||

| Parker-Hannifin Corp. | 10,202 | 4,700 | ||||

| Global Payments Inc. | 34,918 | 4,435 | ||||

| Carrier Global Corp. | 74,958 | 4,306 | ||||

| Old Dominion Freight Line Inc. | 9,621 | 3,900 | ||||

| Eagle Materials Inc. | 18,979 | 3,850 | ||||

| * | Mettler-Toledo International Inc. | 3,121 | 3,786 | |||

| Ingersoll Rand Inc. | 48,482 | 3,750 | ||||

| Verisk Analytics Inc. Class A | 15,666 | 3,742 | ||||

| PPG Industries Inc. | 24,020 | 3,592 | ||||

| CNH Industrial NV | 281,399 | 3,427 | ||||

| General Dynamics Corp. | 13,091 | 3,399 | ||||

| * | Keysight Technologies Inc. | 21,308 | 3,390 | |||

| Rockwell Automation Inc. | 10,862 | 3,372 | ||||

| AECOM | 35,745 | 3,304 | ||||

| Fortive Corp. | 43,894 | 3,232 | ||||

| Equifax Inc. | 12,828 | 3,172 | ||||

| * | Middleby Corp. | 20,834 | 3,066 | |||

| * | Block Inc. Class A | 38,642 | 2,989 | |||

| Berry Global Group Inc. | 43,393 | 2,924 | ||||

| Textron Inc. | 36,284 | 2,918 | ||||

| * | Teledyne Technologies Inc. | 6,518 | 2,909 | |||

| Xylem Inc. | 25,125 | 2,873 | ||||

| L3Harris Technologies Inc. | 13,517 | 2,847 | ||||

| Otis Worldwide Corp. | 30,224 | 2,704 | ||||

| * | Fair Isaac Corp. | 2,234 | 2,600 | |||

| * | Waters Corp. | 7,833 | 2,579 | |||

| HEICO Corp. Class A | 17,003 | 2,422 | ||||

| Shares | Market Value• ($000) | |||||

| Expeditors International of Washington Inc. | 18,995 | 2,416 | ||||

| IDEX Corp. | 10,462 | 2,271 | ||||

| Nordson Corp. | 8,492 | 2,243 | ||||

| WW Grainger Inc. | 2,682 | 2,223 | ||||

| Jacobs Solutions Inc. | 16,864 | 2,189 | ||||

| ITT Inc. | 18,189 | 2,170 | ||||

| Crown Holdings Inc. | 23,514 | 2,165 | ||||

| BWX Technologies Inc. | 27,902 | 2,141 | ||||

| A O Smith Corp. | 25,732 | 2,121 | ||||

| * | Kirby Corp. | 27,000 | 2,119 | |||

| Lennox International Inc. | 4,681 | 2,095 | ||||

| Cummins Inc. | 8,721 | 2,089 | ||||

| Owens Corning | 13,342 | 1,978 | ||||

| Sealed Air Corp. | 51,417 | 1,878 | ||||

| 3M Co. | 16,900 | 1,848 | ||||

| Ball Corp. | 31,862 | 1,833 | ||||

| Veralto Corp. | 22,040 | 1,813 | ||||

| Fidelity National Information Services Inc. | 29,556 | 1,775 | ||||

| JB Hunt Transport Services Inc. | 8,852 | 1,768 | ||||

| * | FleetCor Technologies Inc. | 6,146 | 1,737 | |||

| Synchrony Financial | 45,220 | 1,727 | ||||

| AGCO Corp. | 13,710 | 1,665 | ||||

| Huntington Ingalls Industries Inc. | 6,396 | 1,661 | ||||

| * | Axon Enterprise Inc. | 6,300 | 1,627 | |||

| Masco Corp. | 23,716 | 1,589 | ||||

| Allegion plc | 12,151 | 1,539 | ||||

| TransUnion | 22,383 | 1,538 | ||||

| Johnson Controls International plc | 25,379 | 1,463 | ||||

| * | GXO Logistics Inc. | 23,880 | 1,461 | |||

| Fortune Brands Innovations Inc. | 18,587 | 1,415 | ||||

| Tetra Tech Inc. | 8,433 | 1,408 | ||||

| Packaging Corp. of America | 8,446 | 1,376 | ||||

| Oshkosh Corp. | 12,558 | 1,361 | ||||

| Dover Corp. | 8,810 | 1,355 | ||||

| * | Affirm Holdings Inc. Class A | 27,352 | 1,344 | |||

| Esab Corp. | 15,396 | 1,334 | ||||

| * | XPO Inc. | 15,015 | 1,315 | |||

| * | Trimble Inc. | 24,487 | 1,303 | |||

| DuPont de Nemours Inc. | 16,723 | 1,287 | ||||

| Valmont Industries Inc. | 5,396 | 1,260 | ||||

| Toro Co. | 13,011 | 1,249 | ||||

| Landstar System Inc. | 6,235 | 1,207 | ||||

| * | Axalta Coating Systems Ltd. | 32,960 | 1,120 | |||

| * | Gates Industrial Corp. plc | 81,389 | 1,092 | |||

| Booz Allen Hamilton Holding Corp. Class A | 8,401 | 1,075 | ||||

| Carlisle Cos. Inc. | 3,333 | 1,041 | ||||

| RPM International Inc. | 8,489 | 948 | ||||

| Silgan Holdings Inc. | 18,967 | 858 | ||||

| WESCO International Inc. | 4,845 | 842 | ||||

| Knight-Swift Transportation Holdings Inc. Class A | 14,300 | 824 | ||||

| Lincoln Electric Holdings Inc. | 3,765 | 819 | ||||

| Donaldson Co. Inc. | 12,229 | 799 | ||||

| * | Zebra Technologies Corp. Class A | 2,910 | 795 | |||

| Westinghouse Air Brake Technologies Corp. | 6,010 | 763 | ||||

| Stanley Black & Decker Inc. | 7,543 | 740 | ||||

| Pentair plc | 10,087 | 733 | ||||

| Regal Rexnord Corp. | 4,625 | 685 | ||||

| Jack Henry & Associates Inc. | 4,179 | 683 | ||||

| * | FTI Consulting Inc. | 3,400 | 677 | |||

| AptarGroup Inc. | 5,445 | 673 | ||||

| Armstrong World Industries Inc. | 6,812 | 670 | ||||

| Air Lease Corp. Class A | 15,591 | 654 | ||||

| Graco Inc. | 7,412 | 643 | ||||

| Snap-on Inc. | 2,097 | 606 | ||||

| nVent Electric plc | 10,087 | 596 | ||||

| Vontier Corp. | 17,060 | 589 | ||||

| Advanced Drainage Systems Inc. | 4,120 | 579 | ||||

| Woodward Inc. | 3,945 | 537 | ||||

| * | WEX Inc. | 2,540 | 494 | |||

| Curtiss-Wright Corp. | 2,100 | 468 | ||||

| * | Spirit AeroSystems Holdings Inc. Class A | 14,705 | 467 | |||

| * | NCR Atleos Corp. | 18,662 | 453 | |||

| Littelfuse Inc. | 1,678 | 449 | ||||

| CH Robinson Worldwide Inc. | 5,171 | 447 | ||||

| Robert Half Inc. | 5,000 | 440 | ||||

| Flowserve Corp. | 10,413 | 429 | ||||

| Graphic Packaging Holding Co. | 15,800 | 389 | ||||

| Genpact Ltd. | 11,065 | 384 | ||||

| Hubbell Inc. Class B | 1,100 | 362 | ||||

| Brunswick Corp. | 3,628 | 351 | ||||

| Schneider National Inc. Class B | 13,062 | 332 | ||||

| Shares | Market Value• ($000) | |||||

| * | Masterbrand Inc. | 18,587 | 276 | |||

| * | RXO Inc. | 11,342 | 264 | |||

| * | Builders FirstSource Inc. | 1,401 | 234 | |||

| * | Paylocity Holding Corp. | 1,300 | 214 | |||

| * | AZEK Co. Inc. Class A | 5,509 | 211 | |||

| Westrock Co. | 4,864 | 202 | ||||

| * | Trex Co. Inc. | 2,409 | 199 | |||

| ManpowerGroup Inc. | 2,450 | 195 | ||||

| HEICO Corp. | 1,087 | 194 | ||||

| Vestis Corp. | 8,376 | 177 | ||||

| * | Knife River Corp. | 2,487 | 165 | |||

| Sensata Technologies Holding plc | 4,000 | 150 | ||||

| Louisiana-Pacific Corp. | 2,046 | 145 | ||||

| * | Hayward Holdings Inc. | 10,084 | 137 | |||

| * | Mercury Systems Inc. | 3,690 | 135 | |||

| MDU Resources Group Inc. | 4,734 | 94 | ||||

| * | Mohawk Industries Inc. | 904 | 94 | |||

| Paychex Inc. | 518 | 62 | ||||

| * | Euronet Worldwide Inc. | 400 | 41 | |||

| Cognex Corp. | 801 | 33 | ||||

| *,1 | GCI Liberty Inc. | 25,555 | — | |||

| 563,124 | ||||||

| Other (0.3%) | ||||||

| 2 | Vanguard Tax-Exempt Bond Index ETF | 492,618 | 25,148 | |||

| Real Estate (1.3%) | ||||||

| Prologis Inc. | 99,320 | 13,239 | ||||

| American Tower Corp. | 52,349 | 11,301 | ||||

| Equinix Inc. | 9,921 | 7,990 | ||||

| * | CBRE Group Inc. Class A | 57,849 | 5,385 | |||

| SBA Communications Corp. Class A | 21,183 | 5,374 | ||||

| Crown Castle Inc. | 45,684 | 5,262 | ||||

| Iron Mountain Inc. | 68,339 | 4,782 | ||||

| * | CoStar Group Inc. | 42,915 | 3,750 | |||

| Public Storage | 12,156 | 3,708 | ||||

| Extra Space Storage Inc. | 21,998 | 3,527 | ||||

| Alexandria Real Estate Equities Inc. | 26,893 | 3,409 | ||||

| Digital Realty Trust Inc. | 22,270 | 2,997 | ||||

| AvalonBay Communities Inc. | 15,637 | 2,928 | ||||

| American Homes 4 Rent Class A | 81,183 | 2,919 | ||||

| Welltower Inc. | 29,375 | 2,649 | ||||

| JBG SMITH Properties | 130,155 | 2,214 | ||||

| * | Jones Lang LaSalle Inc. | 11,207 | 2,117 | |||

| Host Hotels & Resorts Inc. | 103,924 | 2,023 | ||||

| * | Howard Hughes Holdings Inc. | 22,902 | 1,959 | |||

| Sun Communities Inc. | 13,805 | 1,845 | ||||

| Equity LifeStyle Properties Inc. | 24,524 | 1,730 | ||||

| Essex Property Trust Inc. | 6,768 | 1,678 | ||||

| Healthpeak Properties Inc. | 82,877 | 1,641 | ||||

| Douglas Emmett Inc. | 102,886 | 1,492 | ||||

| Ventas Inc. | 27,680 | 1,380 | ||||

| Mid-America Apartment Communities Inc. | 9,294 | 1,250 | ||||

| Americold Realty Trust Inc. | 40,555 | 1,228 | ||||

| Kilroy Realty Corp. | 30,826 | 1,228 | ||||

| Weyerhaeuser Co. | 34,146 | 1,187 | ||||

| Camden Property Trust | 10,700 | 1,062 | ||||

| SL Green Realty Corp. | 22,832 | 1,031 | ||||

| * | Zillow Group Inc. Class A | 17,624 | 1,000 | |||

| First Industrial Realty Trust Inc. | 18,521 | 976 | ||||

| Realty Income Corp. | 16,442 | 944 | ||||

| Invitation Homes Inc. | 27,059 | 923 | ||||

| * | Zillow Group Inc. Class C | 15,191 | 879 | |||

| EastGroup Properties Inc. | 4,785 | 878 | ||||

| Equity Residential | 13,531 | 828 | ||||

| Lamar Advertising Co. Class A | 7,472 | 794 | ||||

| Simon Property Group Inc. | 4,494 | 641 | ||||

| Kimco Realty Corp. | 29,302 | 624 | ||||

| Vornado Realty Trust | 20,779 | 587 | ||||

| Rexford Industrial Realty Inc. | 10,000 | 561 | ||||

| Federal Realty Investment Trust | 4,442 | 458 | ||||

| * | Opendoor Technologies Inc. | 93,478 | 419 | |||

| VICI Properties Inc. Class A | 12,500 | 399 | ||||

| Park Hotels & Resorts Inc. | 21,560 | 330 | ||||

| WP Carey Inc. | 4,367 | 283 | ||||

| Rayonier Inc. | 5,100 | 170 | ||||

| NET Lease Office Properties | 8,381 | 155 | ||||

| EPR Properties | 3,121 | 151 | ||||

| Regency Centers Corp. | 2,045 | 137 | ||||

| Brixmor Property Group Inc. | 5,563 | 130 | ||||

| Omega Healthcare Investors Inc. | 4,245 | 130 | ||||

| Highwoods Properties Inc. | 5,071 | 116 | ||||

| Shares | Market Value• ($000) | |||||

| * | WeWork Inc. Class A | 294,119 | 82 | |||

| UDR Inc. | 2,100 | 80 | ||||

| Spirit Realty Capital Inc. | 3 | — | ||||

| 116,960 | ||||||

| Technology (15.2%) | ||||||

| Apple Inc. | 1,464,275 | 281,917 | ||||

| Microsoft Corp. | 742,384 | 279,166 | ||||

| NVIDIA Corp. | 237,516 | 117,623 | ||||

| * | Alphabet Inc. Class A | 636,116 | 88,859 | |||

| * | Meta Platforms Inc. Class A | 216,043 | 76,471 | |||

| * | Alphabet Inc. Class C | 505,280 | 71,209 | |||

| Broadcom Inc. | 36,674 | 40,937 | ||||

| * | Adobe Inc. | 49,641 | 29,616 | |||

| * | Advanced Micro Devices Inc. | 176,679 | 26,044 | |||

| * | Salesforce Inc. | 98,729 | 25,980 | |||

| Intuit Inc. | 28,645 | 17,904 | ||||

| Oracle Corp. | 165,126 | 17,409 | ||||

| Intel Corp. | 329,142 | 16,539 | ||||

| QUALCOMM Inc. | 108,410 | 15,679 | ||||

| Applied Materials Inc. | 91,615 | 14,848 | ||||

| Texas Instruments Inc. | 78,992 | 13,465 | ||||

| * | ServiceNow Inc. | 18,434 | 13,023 | |||

| Micron Technology Inc. | 132,374 | 11,297 | ||||

| International Business Machines Corp. | 65,574 | 10,725 | ||||

| Lam Research Corp. | 13,149 | 10,299 | ||||

| * | Palo Alto Networks Inc. | 31,628 | 9,326 | |||

| * | Cadence Design Systems Inc. | 33,815 | 9,210 | |||

| * | Synopsys Inc. | 17,645 | 9,086 | |||

| Roper Technologies Inc. | 14,570 | 7,943 | ||||

| Marvell Technology Inc. | 112,683 | 6,796 | ||||

| Analog Devices Inc. | 33,550 | 6,662 | ||||

| KLA Corp. | 11,370 | 6,609 | ||||

| * | Workday Inc. Class A | 23,847 | 6,583 | |||

| Amphenol Corp. Class A | 65,560 | 6,499 | ||||

| * | Autodesk Inc. | 22,471 | 5,471 | |||

| Microchip Technology Inc. | 57,040 | 5,144 | ||||

| * | ON Semiconductor Corp. | 58,609 | 4,896 | |||

| * | Atlassian Corp. Class A | 18,488 | 4,398 | |||

| * | Gartner Inc. | 9,051 | 4,083 | |||

| * | Snowflake Inc. Class A | 19,507 | 3,882 | |||

| * | ANSYS Inc. | 10,269 | 3,726 | |||

| Cognizant Technology Solutions Corp. Class A | 48,221 | 3,642 | ||||

| HP Inc. | 119,671 | 3,601 | ||||

| * | Fortinet Inc. | 60,810 | 3,559 | |||

| CDW Corp. | 15,357 | 3,491 | ||||

| * | Palantir Technologies Inc. Class A | 195,363 | 3,354 | |||

| * | Guidewire Software Inc. | 29,042 | 3,167 | |||

| * | MongoDB Inc. Class A | 7,494 | 3,064 | |||

| * | Tyler Technologies Inc. | 6,076 | 2,541 | |||

| Dell Technologies Inc. Class C | 31,391 | 2,401 | ||||

| * | Western Digital Corp. | 45,817 | 2,399 | |||

| * | VeriSign Inc. | 11,478 | 2,364 | |||

| * | Cloudflare Inc. Class A | 27,100 | 2,256 | |||

| * | Arrow Electronics Inc. | 17,906 | 2,189 | |||

| Teradyne Inc. | 19,532 | 2,120 | ||||

| Corning Inc. | 68,131 | 2,075 | ||||

| * | PTC Inc. | 11,822 | 2,068 | |||

| Hewlett Packard Enterprise Co. | 120,529 | 2,047 | ||||

| * | Crowdstrike Holdings Inc. Class A | 7,601 | 1,941 | |||

| * | Elastic NV | 17,000 | 1,916 | |||

| * | GoDaddy Inc. Class A | 17,857 | 1,896 | |||

| Vertiv Holdings Co. Class A | 39,400 | 1,892 | ||||

| * | Akamai Technologies Inc. | 15,501 | 1,835 | |||

| Skyworks Solutions Inc. | 15,100 | 1,698 | ||||

| * | Manhattan Associates Inc. | 7,597 | 1,636 | |||

| * | CACI International Inc. Class A | 5,009 | 1,622 | |||

| * | Datadog Inc. Class A | 12,940 | 1,571 | |||

| * | Zscaler Inc. | 6,613 | 1,465 | |||

| * | Splunk Inc. | 9,487 | 1,445 | |||

| Monolithic Power Systems Inc. | 2,144 | 1,352 | ||||

| * | Qorvo Inc. | 10,165 | 1,145 | |||

| * | HubSpot Inc. | 1,916 | 1,112 | |||

| Jabil Inc. | 8,300 | 1,057 | ||||

| * | F5 Inc. | 5,875 | 1,052 | |||

| * | EPAM Systems Inc. | 3,426 | 1,019 | |||

| * | SentinelOne Inc. Class A | 36,846 | 1,011 | |||

| NetApp Inc. | 11,362 | 1,002 | ||||

| * | Pure Storage Inc. Class A | 28,105 | 1,002 | |||

| * | Teradata Corp. | 22,886 | 996 | |||

| * | Informatica Inc. Class A | 32,443 | 921 | |||

| Shares | Market Value• ($000) | |||||

| * | Ceridian HCM Holding Inc. | 12,978 | 871 | |||

| * | Nutanix Inc. Class A | 18,189 | 867 | |||

| * | Clarivate plc | 91,130 | 844 | |||

| * | Pinterest Inc. Class A | 22,695 | 841 | |||

| Paycom Software Inc. | 3,751 | 775 | ||||

| Universal Display Corp. | 3,786 | 724 | ||||

| Dolby Laboratories Inc. Class A | 8,275 | 713 | ||||

| Concentrix Corp. | 7,250 | 712 | ||||

| * | Match Group Inc. | 19,384 | 708 | |||

| * | DoorDash Inc. Class A | 6,900 | 682 | |||

| Entegris Inc. | 5,006 | 600 | ||||

| * | Kyndryl Holdings Inc. | 28,580 | 594 | |||

| Leidos Holdings Inc. | 5,350 | 579 | ||||

| Gen Digital Inc. | 24,339 | 555 | ||||

| * | Unity Software Inc. | 12,900 | 528 | |||

| * | AppLovin Corp. Class A | 12,252 | 488 | |||

| * | Dropbox Inc. Class A | 15,760 | 465 | |||

| Pegasystems Inc. | 9,302 | 455 | ||||

| * | DoubleVerify Holdings Inc. | 12,015 | 442 | |||

| * | Lattice Semiconductor Corp. | 6,221 | 429 | |||

| * | Coherent Corp. | 9,800 | 427 | |||

| * | Twilio Inc. Class A | 5,456 | 414 | |||

| * | NCR Voyix Corp. | 22,731 | 384 | |||

| * | Wolfspeed Inc. | 8,651 | 376 | |||

| * | IAC Inc. | 6,481 | 339 | |||

| * | Maplebear Inc. | 13,414 | 315 | |||

| * | Dynatrace Inc. | 4,970 | 272 | |||

| * | Alteryx Inc. Class A | 5,499 | 259 | |||

| SS&C Technologies Holdings Inc. | 4,100 | 251 | ||||

| Amdocs Ltd. | 2,400 | 211 | ||||

| Bentley Systems Inc. Class B | 3,941 | 206 | ||||

| * | nCino Inc. | 5,545 | 186 | |||

| TD SYNNEX Corp. | 1,700 | 183 | ||||

| * | Five9 Inc. | 2,137 | 168 | |||

| * | CCC Intelligent Solutions Holdings Inc. | 14,588 | 166 | |||

| * | DXC Technology Co. | 6,882 | 157 | |||

| * | Smartsheet Inc. Class A | 3,200 | 153 | |||

| * | Confluent Inc. Class A | 6,395 | 150 | |||

| * | Okta Inc. Class A | 1,635 | 148 | |||

| * | RingCentral Inc. Class A | 3,800 | 129 | |||

| * | IPG Photonics Corp. | 621 | 67 | |||

| * | UiPath Inc. Class A | 3 | — | |||

| 1,374,081 | ||||||

| Telecommunications (1.0%) | ||||||

| Cisco Systems Inc. | 376,287 | 19,010 | ||||

| Comcast Corp. Class A | 410,811 | 18,014 | ||||

| T-Mobile US Inc. | 78,984 | 12,663 | ||||

| Verizon Communications Inc. | 295,835 | 11,153 | ||||

| AT&T Inc. | 586,195 | 9,836 | ||||

| * | Arista Networks Inc. | 33,504 | 7,891 | |||

| Motorola Solutions Inc. | 15,378 | 4,815 | ||||

| * | Charter Communications Inc. Class A | 11,775 | 4,577 | |||

| * | Liberty Broadband Corp. Class C | 20,921 | 1,686 | |||

| * | Frontier Communications Parent Inc. | 58,546 | 1,484 | |||

| * | Roku Inc. Class A | 9,998 | 916 | |||

| * | Viasat Inc. | 26,599 | 743 | |||

| * | Ciena Corp. | 14,679 | 661 | |||

| * | Liberty Broadband Corp. Class A | 4,398 | 355 | |||

| 93,804 | ||||||

| Utilities (1.3%) | ||||||

| NextEra Energy Inc. | 199,740 | 12,132 | ||||

| Southern Co. | 98,422 | 6,901 | ||||

| DTE Energy Co. | 58,745 | 6,477 | ||||

| CenterPoint Energy Inc. | 226,420 | 6,469 | ||||

| Waste Management Inc. | 33,653 | 6,027 | ||||

| Duke Energy Corp. | 59,772 | 5,800 | ||||

| * | Clean Harbors Inc. | 31,700 | 5,532 | |||

| Consolidated Edison Inc. | 58,011 | 5,277 | ||||

| Sempra | 64,438 | 4,815 | ||||

| Constellation Energy Corp. | 40,963 | 4,788 | ||||

| PG&E Corp. | 260,094 | 4,690 | ||||

| Public Service Enterprise Group Inc. | 76,193 | 4,659 | ||||

| Exelon Corp. | 105,474 | 3,787 | ||||

| American Electric Power Co. Inc. | 43,400 | 3,525 | ||||

| Republic Services Inc. Class A | 17,596 | 2,902 | ||||

| Xcel Energy Inc. | 42,691 | 2,643 | ||||

| Eversource Energy | 42,484 | 2,622 | ||||

| American Water Works Co. Inc. | 18,062 | 2,384 | ||||

| AES Corp. | 120,726 | 2,324 | ||||

| WEC Energy Group Inc. | 26,464 | 2,227 | ||||

| Shares | Market Value• ($000) | |||||

| Dominion Energy Inc. | 46,682 | 2,194 | ||||

| Vistra Corp. | 51,991 | 2,003 | ||||

| NRG Energy Inc. | 32,838 | 1,698 | ||||

| Atmos Energy Corp. | 14,148 | 1,640 | ||||

| Edison International | 21,423 | 1,532 | ||||

| FirstEnergy Corp. | 41,305 | 1,514 | ||||

| Alliant Energy Corp. | 24,227 | 1,243 | ||||

| CMS Energy Corp. | 20,227 | 1,175 | ||||

| NiSource Inc. | 42,656 | 1,133 | ||||

| * | Sunrun Inc. | 57,360 | 1,126 | |||

| Entergy Corp. | 10,419 | 1,054 | ||||

| Essential Utilities Inc. | 24,886 | 929 | ||||

| Pinnacle West Capital Corp. | 10,008 | 719 | ||||

| Ameren Corp. | 9,798 | 709 | ||||

| OGE Energy Corp. | 19,986 | 698 | ||||

| UGI Corp. | 15,661 | 385 | ||||

| * | Stericycle Inc. | 3,528 | 175 | |||

| National Fuel Gas Co. | 2,430 | 122 | ||||

| Evergy Inc. | 1,443 | 75 | ||||

| 116,105 | ||||||

| Total Common Stocks (Cost $1,471,003) | 4,306,259 | |||||

| Coupon | Maturity Date | Face Amount ($000) | ||||

| Tax-Exempt Municipal Bonds (51.8%) | ||||||

| Alabama (1.5%) | ||||||

| Alabama Economic Settlement Authority BP Settlement Revenue | 4.000% | 9/15/33 | 500 | 501 | ||

| Alabama Federal AID Highway Finance Authority SO Revenue ETM | 5.000% | 9/1/25 | 3,525 | 3,655 | ||

| Alabama State Corrections Institution Finance Authority Revenue | 5.000% | 7/1/31 | 1,100 | 1,273 | ||

| Alabama State Public School & College Authority Tax-Exempt Capital Improvement & Refunding Bonds Revenue | 4.000% | 11/1/36 | 3,690 | 3,911 | ||

| Alabama State Public School & College Authority Tax-Exempt Capital Improvement & Refunding Bonds Revenue | 4.000% | 11/1/40 | 1,465 | 1,517 | ||

| Auburn AL GO | 5.000% | 8/1/38 | 1,000 | 1,137 | ||

| Birmingham-Jefferson AL Civic Center Authority Special Tax Bonds | 5.000% | 7/1/31 | 1,125 | 1,214 | ||

| Black Belt Energy Gas District Alabama Gas Prepay Revenue (Project No. 3) PUT | 4.000% | 12/1/25 | 880 | 882 | ||

| Black Belt Energy Gas District Alabama Gas Project Revenue PUT | 5.000% | 6/1/28 | 6,705 | 7,022 | ||

| Black Belt Energy Gas District Alabama Gas Project Revenue PUT | 5.500% | 12/1/28 | 1,250 | 1,335 | ||

| Black Belt Energy Gas District Alabama Gas Project Revenue PUT | 5.500% | 2/1/29 | 4,530 | 4,848 | ||

| Black Belt Energy Gas District Alabama Gas Project Revenue PUT | 5.250% | 6/1/29 | 13,810 | 14,747 | ||

| Black Belt Energy Gas District Alabama Gas Project Revenue PUT | 5.250% | 10/1/30 | 1,660 | 1,785 | ||

| 3 | Black Belt Energy Gas District Alabama Gas Project Revenue PUT | 5.250% | 12/1/30 | 1,095 | 1,191 | |

| Black Belt Energy Gas District Alabama Gas Project Revenue PUT | 5.500% | 6/1/32 | 3,610 | 3,988 | ||

| Black Belt Energy Gas District Alabama Gas Project Revenue (Project No. 6) PUT | 4.000% | 12/1/26 | 930 | 934 | ||

| Black Belt Energy Gas District Alabama Gas Project Revenue (Project No. 7) PUT | 4.000% | 12/1/26 | 8,745 | 8,784 | ||

| Coupon | Maturity Date | Face Amount ($000) | Market Value• ($000) | |||

| 4 | Black Belt Energy Gas District Alabama Gas Project Revenue (Project No. 7) PUT, SIFMA Municipal Swap Index Yield + 0.350% | 4.220% | 12/1/26 | 3,750 | 3,658 | |

| Black Belt Energy Gas District Alabama Gas Project Revenue (Project No. 8) PUT | 4.000% | 12/1/29 | 5,795 | 5,712 | ||

| 3 | Black Belt Energy Gas District Alabama Gas Supply Revenue PUT | 4.000% | 6/1/27 | 3,335 | 3,353 | |

| Energy Southeast AL Cooperative District Energy Supply Revenue PUT | 5.500% | 1/1/31 | 885 | 969 | ||

| Energy Southeast AL Cooperative District Energy Supply Revenue PUT | 5.750% | 11/1/31 | 3,145 | 3,522 | ||

| Huntsville AL Electric System Revenue | 5.000% | 12/1/30 | 510 | 550 | ||

| Huntsville AL GO | 5.000% | 5/1/35 | 1,125 | 1,217 | ||

| Huntsville AL GO | 5.000% | 5/1/38 | 1,860 | 2,034 | ||

| Huntsville AL GO | 5.000% | 3/1/42 | 1,620 | 1,836 | ||

| Huntsville AL Health Care Authority Revenue | 5.000% | 6/1/35 | 780 | 853 | ||

| Huntsville AL Health Care Authority Revenue PUT | 5.000% | 6/1/30 | 1,170 | 1,301 | ||

| Jefferson County AL Revenue | 5.000% | 9/15/29 | 1,470 | 1,578 | ||

| Jefferson County AL Revenue | 5.000% | 9/15/33 | 1,000 | 1,072 | ||

| 5 | Jefferson County AL Sewer Revenue | 0.000% | 10/1/25 | 500 | 460 | |

| Lower AL Gas District Gas Project Revenue | 5.000% | 9/1/34 | 2,000 | 2,180 | ||

| Lower AL Gas District Gas Project Revenue PUT | 4.000% | 12/1/25 | 3,255 | 3,267 | ||

| Mobile Alabama Industrial Development Board Pollution Control Revenue (Alabama Power Co. Barry Plant Project) PUT | 3.650% | 1/10/25 | 1,000 | 1,002 | ||

| Mobile Alabama Industrial Development Board Pollution Control Revenue (Alabama Power Co. Barry Plant Project) PUT | 3.780% | 6/16/26 | 250 | 252 | ||

| Montgomery AL GO | 4.000% | 12/1/36 | 400 | 418 | ||

| Montgomery AL GO | 4.000% | 12/1/39 | 450 | 461 | ||

| Orange Beach AL Water Sewer & Fire Protection Authority Revenue | 4.000% | 5/15/38 | 3,500 | 3,598 | ||

| Pell City AL Special Care Facilities Financing Authority Revenue (Noland Health Services Inc.) | 5.000% | 12/1/30 | 2,000 | 2,167 | ||

| Pell City AL Special Care Facilities Financing Authority Revenue (Noland Health Services Inc.) | 4.000% | 12/1/34 | 2,000 | 2,035 | ||

| Southeast Alabama Gas Supply District Revenue PUT | 4.000% | 4/1/24 | 6,680 | 6,683 | ||

| Southeast Alabama Gas Supply District Revenue PUT | 4.000% | 6/1/24 | 1,515 | 1,516 | ||

| Southeast Energy Authority AL Commodity Supply Revenue (Project No. 3) PUT | 5.500% | 12/1/29 | 1,270 | 1,379 | ||

| Southeast Energy Authority AL Cooperative District Commodity Supply Revenue (Project No. 1) PUT | 4.000% | 10/1/28 | 755 | 755 | ||

| Southeast Energy Authority AL Cooperative District Commodity Supply Revenue (Project No. 4) PUT | 5.000% | 8/1/28 | 4,400 | 4,598 | ||

| Southeast Energy Authority AL Cooperative District Commodity Supply Revenue (Project No. 5) PUT | 5.250% | 7/1/29 | 7,855 | 8,359 | ||

| 3 | Southeast Energy Authority AL Cooperative District Commodity Supply Revenue (Project No. 6) PUT | 5.000% | 6/1/30 | 1,115 | 1,190 | |

| Tuscaloosa AL City Board of Education School Tax Warrants Revenue | 5.000% | 8/1/27 | 530 | 561 | ||

| Tuscaloosa AL City Board of Education School Tax Warrants Revenue | 5.000% | 8/1/28 | 1,090 | 1,150 | ||

| University of Alabama General Revenue | 3.000% | 7/1/36 | 1,085 | 1,015 | ||

| Coupon | Maturity Date | Face Amount ($000) | Market Value• ($000) | |||

| 5 | University of South Alabama University Facilities Revenue | 5.000% | 11/1/34 | 2,265 | 2,363 | |

| West Jefferson AL Industrial Development Board Pollution Control Revenue | 3.650% | 6/1/28 | 550 | 551 | ||

| 132,339 | ||||||

| Alaska (0.1%) | ||||||

| Alaska Housing Finance Corp. Revenue | 5.000% | 12/1/35 | 1,500 | 1,663 | ||

| Alaska Housing Finance Corp. State Capital Project Revenue | 5.000% | 6/1/31 | 1,095 | 1,261 | ||

| Alaska Housing Finance Corp. State Capital Project Revenue | 5.000% | 6/1/34 | 1,285 | 1,456 | ||

| Alaska Municipal Bond Bank Authority Revenue | 5.000% | 12/1/37 | 3,000 | 3,369 | ||

| Matanuska-Susitna Borough AK Lease Revenue (Goose Creek Correctional Center) | 5.000% | 9/1/31 | 1,345 | 1,381 | ||

| Municipality of Anchorage GO | 4.000% | 9/1/36 | 785 | 838 | ||

| North Slope Borough Alaska GO | 5.000% | 6/30/29 | 1,405 | 1,573 | ||

| Northern Tobacco Securitization Corp. AK Revenue | 4.000% | 6/1/38 | 1,000 | 1,007 | ||

| 12,548 | ||||||

| Arizona (0.8%) | ||||||

| Arizona Board of Regents Arizona State University System Revenue | 5.000% | 7/1/30 | 675 | 696 | ||

| Arizona Board of Regents Arizona State University System Revenue | 5.000% | 7/1/31 | 545 | 550 | ||

| Arizona COP ETM | 5.000% | 10/1/26 | 2,000 | 2,133 | ||

| Arizona Excise Taxes Obligations Revenue | 1.500% | 7/1/29 | 600 | 554 | ||

| Arizona Excise Taxes Obligations Revenue | 2.100% | 7/1/36 | 1,000 | 843 | ||

| Arizona Industrial Development Authority Charter School Revolving Loan Fund Revenue | 5.000% | 11/1/28 | 1,000 | 1,083 | ||

| 3,6 | Arizona Industrial Development Authority Multifamily Housing Revenue TOB VRDO | 4.470% | 1/2/24 | 400 | 400 | |

| 3,6 | Arizona Industrial Development Authority Multifamily Housing Revenue (Agave House Apartments) TOB VRDO | 4.470% | 1/2/24 | 5,530 | 5,530 | |

| 3,6 | Arizona Industrial Development Authority Multifamily Housing Revenue (Mesa Vista Project) TOB VRDO | 4.470% | 1/2/24 | 5,600 | 5,600 | |

| 6,7 | Arizona Industrial Development Authority Revenue (Economic Legacy Cares) | 6.375% | 7/1/25 | 180 | 11 | |

| 6,7 | Arizona Industrial Development Authority Revenue (Economic Legacy Cares) | 6.500% | 7/1/26 | 100 | 6 | |

| 6,7 | Arizona Industrial Development Authority Revenue (Economic Legacy Cares) | 6.625% | 7/1/27 | 265 | 16 | |

| 6,7 | Arizona Industrial Development Authority Revenue (Economic Legacy Cares) | 6.750% | 7/1/28 | 305 | 18 | |

| Arizona Industrial Development Authority Revenue (Greathearts Arizona Projects) | 3.000% | 7/1/37 | 695 | 635 | ||

| Arizona Industrial Development Authority Revenue (Lincoln South Beltway Project) | 5.000% | 11/1/28 | 1,290 | 1,436 | ||

| 8 | Arizona Sports & Tourism Authority Revenue (Multipurpose Stadium Facility Project) | 5.000% | 7/1/31 | 3,000 | 3,406 | |

| Arizona State Transportation Board Highway Revenue | 5.000% | 7/1/28 | 2,500 | 2,649 | ||

| Arizona State University Revenue | 5.000% | 7/1/40 | 1,000 | 1,093 | ||

| Arizona State University Revenue (McAllister Academic Village LLC) | 5.000% | 7/1/36 | 1,620 | 1,688 | ||

| Arizona Transportation Board Highway Revenue | 5.000% | 7/1/33 | 1,000 | 1,057 | ||

| Arizona Water Infrastructure Finance Authority Revenue | 5.000% | 10/1/27 | 1,000 | 1,015 | ||

| Chandler AZ GO | 5.000% | 7/1/26 | 2,000 | 2,122 | ||

| Coconino AZ County Pollution Control Corp. Revenue PUT | 3.750% | 3/31/26 | 100 | 101 | ||

| Glendale City AZ Excise Tax Refunding Obligations Revenue | 5.000% | 7/1/28 | 1,785 | 1,937 | ||

| Coupon | Maturity Date | Face Amount ($000) | Market Value• ($000) | |||

| La Paz County AZ Industrial Development Authority Education Facility Lease Revenue (Harmony Public Schools Project) | 5.000% | 2/15/31 | 100 | 107 | ||

| Maricopa County AZ Elementary School District No. 14 (Creighton) GO | 3.000% | 7/1/32 | 1,000 | 1,002 | ||

| 6 | Maricopa County AZ Industrial Development Authority Education Revenue (Legacy Traditional Schools Projects) | 3.000% | 7/1/31 | 650 | 589 | |

| Maricopa County AZ Industrial Development Authority Hospital Revenue (Banner Health) PUT | 5.000% | 11/1/30 | 1,000 | 1,115 | ||

| Maricopa County AZ Industrial Development Authority Hospital Revenue (Honorhealth) | 5.000% | 9/1/33 | 830 | 895 | ||

| Maricopa County AZ Industrial Development Authority Revenue (Banner Health) PUT | 5.000% | 5/15/26 | 1,000 | 1,043 | ||

| Maricopa County AZ Pollution Control Corp. Revenue (Southern California Edison Co.) | 2.400% | 6/1/35 | 1,000 | 814 | ||

| Maricopa County AZ School District No. 83 Revenue | 3.000% | 10/1/39 | 1,000 | 841 | ||

| Mesa AZ GO | 5.000% | 7/1/27 | 2,565 | 2,788 | ||

| 9,10 | Phoenix AZ Civic Improvement Corp. Distribution Revenue | 5.500% | 7/1/42 | 1,500 | 1,905 | |

| 11 | Phoenix AZ Civic Improvement Corp. Distribution Revenue | 5.500% | 7/1/42 | 1,000 | 1,262 | |

| 11 | Phoenix AZ Civic Improvement Corp. Distribution Revenue | 5.500% | 7/1/43 | 1,250 | 1,581 | |

| Phoenix AZ Civic Improvement Corp. Wastewater System Revenue | 5.000% | 7/1/27 | 1,295 | 1,372 | ||

| Phoenix AZ Civic Improvement Corp. Wastewater System Revenue | 4.000% | 7/1/28 | 2,015 | 2,024 | ||

| Phoenix AZ Civic Improvement Corp. Water System Revenue | 5.000% | 7/1/35 | 1,900 | 1,997 | ||

| Phoenix AZ GO | 5.000% | 7/1/31 | 1,500 | 1,769 | ||

| 6 | Phoenix AZ Industrial Development Authority Education Revenue (Legacy Traditional Schools Project) | 5.000% | 7/1/36 | 1,000 | 1,005 | |

| Phoenix AZ Industrial Development Authority Lease Revenue (Downtown Phoenix Student Housing LLC) | 5.000% | 7/1/27 | 300 | 312 | ||

| Phoenix AZ Industrial Development Authority Lease Revenue (Downtown Phoenix Student Housing LLC) | 5.000% | 7/1/28 | 250 | 263 | ||

| 6 | Pima County AZ Industrial Development Authority Revenue (American Leadership Academy Project) | 4.000% | 6/15/31 | 1,050 | 1,002 | |

| Pima County AZ Industrial Development Authority Revenue (Tucson Medical Center) | 4.000% | 4/1/38 | 1,040 | 1,045 | ||

| Pima County AZ Sewer System Revenue | 5.000% | 7/1/25 | 1,000 | 1,002 | ||

| Regional Public Transportation Authority Arizona Excise Tax Revenue (Maricopa County Public Transportation) | 5.250% | 7/1/24 | 1,125 | 1,137 | ||

| Salt River Projects Arizona Agricultural Improvement & Power District Revenue | 5.000% | 1/1/36 | 1,540 | 1,642 | ||

| Salt River Projects Arizona Agricultural Improvement & Power District Revenue | 5.000% | 1/1/39 | 1,370 | 1,472 | ||

| Salt River Projects Arizona Agricultural Improvement & Power District Revenue | 5.000% | 1/1/43 | 1,000 | 1,136 | ||

| Salt Verde AZ Financial Corp. Gas Revenue | 5.250% | 12/1/24 | 910 | 921 | ||

| Salt Verde AZ Financial Corp. Gas Revenue | 5.250% | 12/1/26 | 2,500 | 2,607 | ||

| Coupon | Maturity Date | Face Amount ($000) | Market Value• ($000) | |||

| Salt Verde AZ Financial Corp. Gas Revenue | 5.250% | 12/1/28 | 640 | 683 | ||

| Salt Verde AZ Financial Corp. Gas Revenue | 5.000% | 12/1/37 | 1,015 | 1,131 | ||

| 71,041 | ||||||

| Arkansas (0.1%) | ||||||

| Arkansas Development Finance Authority Health Care Revenue Baptist Memorial Health Care Corp. | 5.000% | 9/1/32 | 2,000 | 2,142 | ||

| El Dorado AR School District No. 15 GO | 5.000% | 2/1/43 | 1,385 | 1,472 | ||

| El Dorado AR School District No. 15 GO | 5.000% | 2/1/45 | 2,920 | 3,096 | ||

| Pulaski County AR Hospital Revenue (Arkansas Children's Hospital) | 5.000% | 3/1/29 | 1,075 | 1,136 | ||

| Pulaski County AR Hospital Revenue (Arkansas Children's Hospital) | 5.000% | 3/1/38 | 500 | 566 | ||

| Rogers AR Arkansas Sales Tax Revenue | 4.000% | 11/1/32 | 1,090 | 1,112 | ||

| 8 | Springdale AR Sales & Use Revenue Prere. | 5.000% | 4/1/24 | 1,000 | 1,005 | |

| Springdale AR School District No. 50 GO | 3.000% | 6/1/32 | 495 | 486 | ||

| University of Arkansas Revenue | 5.000% | 11/1/24 | 850 | 864 | ||

| University of Arkansas Revenue | 5.000% | 4/1/38 | 1,000 | 1,146 | ||

| 13,025 | ||||||

| California (4.1%) | ||||||

| 5 | ABAG Finance Authority for Nonprofit Corps. California Revenue (Windemere Ranch Infrastructure Financing Program) | 5.000% | 9/2/30 | 1,135 | 1,238 | |

| 12 | Alameda CA Corridor Transportation Authority Revenue | 0.000% | 10/1/30 | 740 | 598 | |

| Alameda CA Corridor Transportation Authority Revenue | 5.000% | 10/1/37 | 1,000 | 1,029 | ||

| Antelope Valley CA Community College District Election GO | 0.000% | 8/1/35 | 650 | 429 | ||

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 2.125% | 4/1/25 | 2,950 | 2,902 | ||

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 2.850% | 4/1/25 | 960 | 953 | ||

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 2.625% | 4/1/26 | 2,000 | 1,959 | ||

| Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT | 2.950% | 4/1/26 | 985 | 970 | ||

| 4 | Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT, SIFMA Municipal Swap Index Yield + 0.300% | 4.170% | 4/1/27 | 1,000 | 975 | |

| 4 | Bay Area Toll Authority California Toll Bridge Revenue (San Francisco Bay Area) PUT, SIFMA Municipal Swap Index Yield + 0.410% | 4.280% | 4/1/28 | 1,000 | 972 | |

| 12 | Brea CA Redevelopment Agency Tax Allocation Bonds (Redevelopment Project AB) | 0.000% | 8/1/29 | 1,000 | 832 | |

| California Community Choice Financing Authority Revenue PUT | 4.000% | 12/1/27 | 3,585 | 3,610 | ||

| California Community Choice Financing Authority Revenue PUT | 4.000% | 8/1/28 | 3,745 | 3,800 | ||

| California Community Choice Financing Authority Revenue PUT | 5.500% | 11/1/28 | 7,065 | 7,612 | ||

| California Community Choice Financing Authority Revenue PUT | 5.000% | 8/1/29 | 1,385 | 1,472 | ||

| California Community Choice Financing Authority Revenue PUT | 5.000% | 8/1/29 | 8,535 | 9,066 | ||

| California Community Choice Financing Authority Revenue PUT | 5.250% | 4/1/30 | 6,000 | 6,497 | ||

| California Community Choice Financing Authority Revenue PUT | 5.500% | 11/1/30 | 3,325 | 3,688 | ||

| California Community Choice Financing Authority Revenue PUT | 5.000% | 3/1/31 | 5,575 | 6,018 | ||

| California Community Choice Financing Authority Revenue PUT | 4.000% | 8/1/31 | 3,530 | 3,554 | ||

| Coupon | Maturity Date | Face Amount ($000) | Market Value• ($000) | |||

| California Educational Facilities Authority Revenue | 5.250% | 10/1/34 | 1,000 | 1,118 | ||

| California Educational Facilities Authority Revenue | 5.000% | 6/1/43 | 1,000 | 1,252 | ||

| 3,6 | California Educational Facilities Authority Revenue TOB VRDO | 3.720% | 1/2/24 | 4,800 | 4,800 | |

| California GO | 5.000% | 4/1/24 | 2,000 | 2,011 | ||

| California GO | 5.000% | 10/1/24 | 2,000 | 2,033 | ||

| California GO | 5.000% | 3/1/26 | 660 | 678 | ||

| California GO | 5.000% | 10/1/26 | 1,000 | 1,067 | ||

| California GO | 5.000% | 4/1/27 | 2,000 | 2,162 | ||

| California GO | 5.000% | 4/1/27 | 1,000 | 1,081 | ||

| California GO | 3.500% | 8/1/27 | 1,515 | 1,574 | ||

| California GO | 5.000% | 10/1/27 | 1,000 | 1,094 | ||

| California GO | 5.000% | 4/1/28 | 5,125 | 5,676 | ||

| California GO | 5.000% | 4/1/28 | 1,000 | 1,107 | ||

| California GO | 5.000% | 10/1/28 | 1,000 | 1,121 | ||

| California GO | 5.000% | 4/1/29 | 1,000 | 1,134 | ||

| California GO | 5.000% | 9/1/29 | 455 | 483 | ||

| California GO | 5.000% | 11/1/29 | 5,000 | 5,740 | ||

| California GO | 5.000% | 11/1/29 | 920 | 922 | ||

| California GO | 5.000% | 9/1/30 | 5,000 | 5,839 | ||

| California GO | 5.000% | 4/1/31 | 1,000 | 1,181 | ||

| California GO | 4.000% | 8/1/31 | 1,675 | 1,717 | ||

| California GO | 5.000% | 4/1/32 | 2,500 | 2,830 | ||

| California GO | 5.000% | 9/1/32 | 1,000 | 1,002 | ||

| California GO | 5.000% | 10/1/32 | 1,875 | 1,898 | ||

| California GO | 4.000% | 8/1/33 | 1,520 | 1,556 | ||

| California GO | 5.000% | 8/1/33 | 2,865 | 3,027 | ||

| California GO | 4.000% | 9/1/33 | 2,000 | 2,048 | ||

| California GO | 3.000% | 10/1/34 | 2,725 | 2,688 | ||

| California GO | 5.000% | 11/1/34 | 1,340 | 1,562 | ||

| California GO | 5.000% | 3/1/35 | 2,000 | 2,302 | ||

| California GO | 5.000% | 4/1/35 | 210 | 232 | ||

| California GO | 3.000% | 10/1/35 | 1,815 | 1,776 | ||

| California GO | 4.000% | 3/1/36 | 1,000 | 1,072 | ||

| California GO | 5.000% | 4/1/36 | 5,000 | 5,615 | ||

| California GO | 5.000% | 9/1/36 | 1,000 | 1,052 | ||

| California GO | 4.000% | 10/1/36 | 1,155 | 1,247 | ||

| California GO | 4.000% | 4/1/42 | 1,000 | 1,047 | ||

| California GO | 5.000% | 10/1/42 | 1,500 | 1,642 | ||

| California GO | 5.000% | 9/1/43 | 2,500 | 2,892 | ||

| California Health Facilities Financing Authority Revenue PUT | 5.000% | 11/1/29 | 6,250 | 7,051 | ||

| California Health Facilities Financing Authority Revenue (Adventist Health System/West) PUT | 5.000% | 9/1/28 | 1,000 | 1,065 | ||

| California Health Facilities Financing Authority Revenue (Common Spirit Health) | 4.000% | 4/1/37 | 1,000 | 1,024 | ||

| California Health Facilities Financing Authority Revenue (Providence St. Joseph Health Obligated Group) PUT | 5.000% | 10/1/25 | 895 | 919 | ||

| California Health Facilities Financing Authority Revenue (Sutter Health) | 5.000% | 11/15/36 | 1,000 | 1,066 | ||

| California Housing Finance Agency Municipal Certificates Revenue | 4.000% | 3/20/33 | 2,478 | 2,519 | ||

| California Housing Finance Agency Municipal Certificates Revenue | 4.250% | 1/15/35 | 546 | 550 | ||

| California Housing Finance Agency Municipal Certificates Revenue | 3.750% | 3/25/35 | 2,526 | 2,496 | ||

| California Housing Finance Agency Municipal Certificates Revenue | 3.500% | 11/20/35 | 1,438 | 1,400 | ||

| California Housing Finance Agency Municipal Certificates Revenue | 3.250% | 8/20/36 | 3,195 | 3,005 | ||

| California Housing Finance Agency Municipal Certificates Revenue | 4.375% | 9/20/36 | 498 | 500 | ||

| 10 | California Infrastructure & Economic Development Bank Revenue (Bay Area Toll Bridges Seismic Retrofit) Prere. | 5.000% | 1/1/28 | 500 | 551 | |

| 4 | California Infrastructure & Economic Development Bank Revenue (California Academy of Sciences) PUT, SIFMA Municipal Swap Index Yield + 0.350% | 4.220% | 8/1/24 | 1,000 | 993 | |

| California Infrastructure & Economic Development Bank Revenue (County Museum of Art Project) PUT | 1.200% | 6/1/28 | 1,000 | 889 | ||

| Coupon | Maturity Date | Face Amount ($000) | Market Value• ($000) | |||

| California Infrastructure & Economic Development Bank Revenue (J. Paul Getty Trust) PUT | 5.000% | 10/1/26 | 6,560 | 6,972 | ||

| California Municipal Finance Authority Revenue (Anaheim Electric Utility Distribution System) | 5.000% | 10/1/30 | 965 | 1,008 | ||

| California State Department of Water Resources Central Valley Project Revenue | 5.000% | 12/1/30 | 5,425 | 6,450 | ||

| California State Public Works Board Lease Revenue (Various Capital Projects) | 5.000% | 12/1/26 | 1,000 | 1,073 | ||

| California State Public Works Board Lease Revenue (Various Capital Projects) | 5.000% | 12/1/28 | 1,000 | 1,127 | ||

| California State Public Works Board Lease Revenue (Various Capital Projects) | 5.000% | 8/1/30 | 1,000 | 1,167 | ||

| California State University Systemwide Revenue | 5.000% | 11/1/35 | 2,000 | 2,156 | ||

| California State University Systemwide Revenue | 5.000% | 11/1/37 | 1,000 | 1,036 | ||

| California State University Systemwide Revenue | 5.000% | 11/1/41 | 1,400 | 1,455 | ||

| California State University Systemwide Revenue Prere. | 5.000% | 11/1/24 | 40 | 41 | ||

| California Statewide Communities Development Authority Pollution Control Revenue (Southern Edison Co.) | 1.750% | 9/1/29 | 1,000 | 884 | ||

| California Statewide Communities Development Authority Pollution Control Revenue (Southern Edison Co.) | 4.500% | 11/1/33 | 500 | 545 | ||

| California Statewide Communities Development Authority Revenue (Kaiser Foundation Hospitals) PUT | 5.000% | 11/1/29 | 2,250 | 2,537 | ||

| California Statewide Communities Development Authority Revenue (Kaiser Foundation Hospitals) PUT | 5.000% | 11/1/29 | 1,000 | 1,128 | ||

| 6 | California Statewide Communities Development Authority Revenue (Loma Linda University Medical Center) | 5.000% | 12/1/28 | 400 | 412 | |

| 5 | Centinela Valley CA Union High School District GO | 4.000% | 8/1/29 | 1,035 | 1,074 | |

| 5 | Chino CA Public Financing Authority Special Tax Revenue | 5.000% | 9/1/30 | 800 | 829 | |

| Chino Valley Unified School District GO | 0.000% | 8/1/31 | 600 | 480 | ||

| Citrus CA Community College District GO Prere. | 5.000% | 2/1/24 | 1,000 | 1,002 | ||

| 6 | CSCDA Community Improvement Authority Revenue | 2.650% | 12/1/46 | 1,500 | 1,132 | |

| 6 | CSCDA Community Improvement Authority Revenue | 2.450% | 2/1/47 | 800 | 625 | |

| 6 | CSCDA Community Improvement Authority Revenue | 3.500% | 5/1/47 | 500 | 399 | |

| 3,6 | Deutsche Bank Spears Lifers Revenue VRDO | 4.550% | 1/2/24 | 2,395 | 2,395 | |

| 5 | East Side CA Union High School District Santa Clara County GO | 3.000% | 8/1/32 | 1,000 | 992 | |

| East Side CA Union High School District Santa Clara County GO | 2.000% | 8/1/33 | 1,000 | 888 | ||

| 4 | Eastern Municipal Water & Wastewater Revenue PUT, SIFMA Municipal Swap Index Yield + 0.100% | 3.970% | 7/1/24 | 300 | 299 | |

| 13 | Foothill/Eastern Transportation Corridor Agency California Toll Road Revenue, 6.200% coupon rate effective 1/15/2024 | 0.000% | 1/15/29 | 1,390 | 1,625 | |

| Gavilan CA Joint Community College District GO | 5.000% | 8/1/28 | 1,000 | 1,038 | ||

| Golden State Tobacco Securitization Corp. California Revenue ETM | 5.000% | 6/1/25 | 500 | 515 | ||

| 12 | Golden State Tobacco Securitization Corp. California Revenue ETM | 0.000% | 6/1/27 | 2,070 | 1,894 | |

| Golden State Tobacco Securitization Corp. California Revenue Prere. | 5.000% | 6/1/25 | 1,140 | 1,177 | ||

| Coupon | Maturity Date | Face Amount ($000) | Market Value• ($000) | |||

| La Quinta CA Redevelopment Agency Successor Tax Allocation Refunding Bonds (Redevelopment Project 2014A) Prere. | 5.000% | 9/1/24 | 1,000 | 1,016 | ||

| 9 | Long Beach CA Unified School District GO | 0.000% | 8/1/24 | 1,290 | 1,268 | |

| Los Angeles CA Department of Airports International Airport Revenue | 5.000% | 5/15/31 | 2,000 | 2,316 | ||

| Los Angeles CA Department of Airports International Airport Revenue | 4.000% | 5/15/36 | 370 | 402 | ||

| Los Angeles CA Department of Airports International Airport Revenue | 4.000% | 5/15/40 | 2,055 | 2,149 | ||

| Los Angeles CA Department of Airports International Airport Revenue | 5.000% | 5/15/41 | 1,400 | 1,587 | ||

| Los Angeles CA Department of Water & Power Revenue | 5.000% | 7/1/33 | 1,375 | 1,479 | ||

| Los Angeles CA Department of Water & Power Revenue | 5.000% | 7/1/35 | 1,330 | 1,474 | ||

| Los Angeles CA Department of Water & Power Revenue | 5.000% | 7/1/36 | 1,000 | 1,044 | ||

| Los Angeles CA Department of Water & Power Revenue | 5.000% | 7/1/36 | 1,695 | 1,876 | ||

| Los Angeles CA Department of Water & Power Revenue | 5.000% | 7/1/36 | 1,000 | 1,206 | ||

| Los Angeles CA Department of Water & Power Revenue | 5.000% | 7/1/37 | 1,000 | 1,065 | ||

| Los Angeles CA Department of Water & Power Revenue | 5.000% | 7/1/37 | 1,145 | 1,259 | ||

| Los Angeles CA Department of Water & Power Revenue | 5.000% | 7/1/38 | 500 | 531 | ||

| Los Angeles CA Department of Water & Power Revenue | 5.000% | 7/1/38 | 2,550 | 2,790 | ||

| Los Angeles CA Department of Water & Power Revenue | 5.000% | 7/1/39 | 2,635 | 3,065 | ||

| Los Angeles CA Department of Water & Power Revenue | 5.000% | 7/1/39 | 1,005 | 1,166 | ||