4Q 2024 Earnings January 30, 2025

Summary of contents 4Q 2024 highlights Fleet strategy overview Initiative expectations and scorecard Critical path milestone reporting for assigned and premium seating 'Southwest. Even Better.' 2027 financial targets Page 2

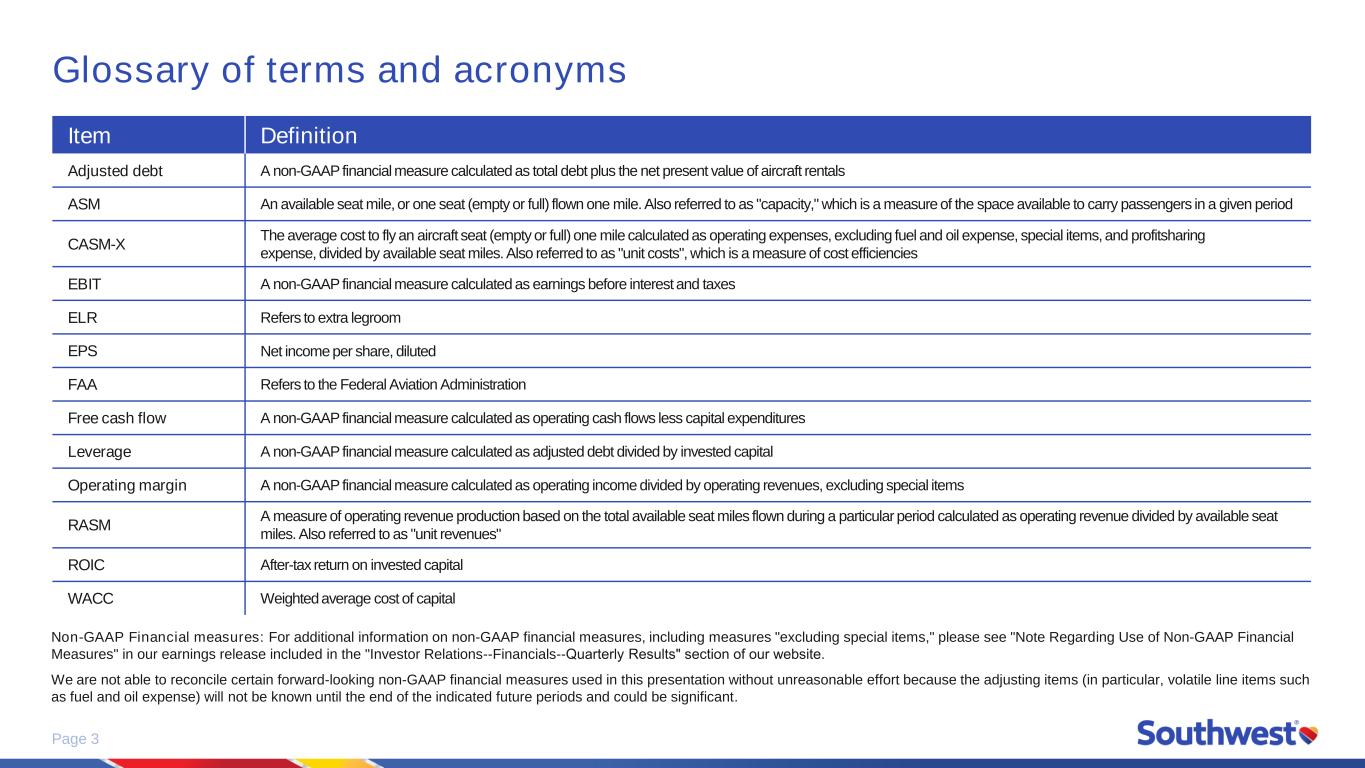

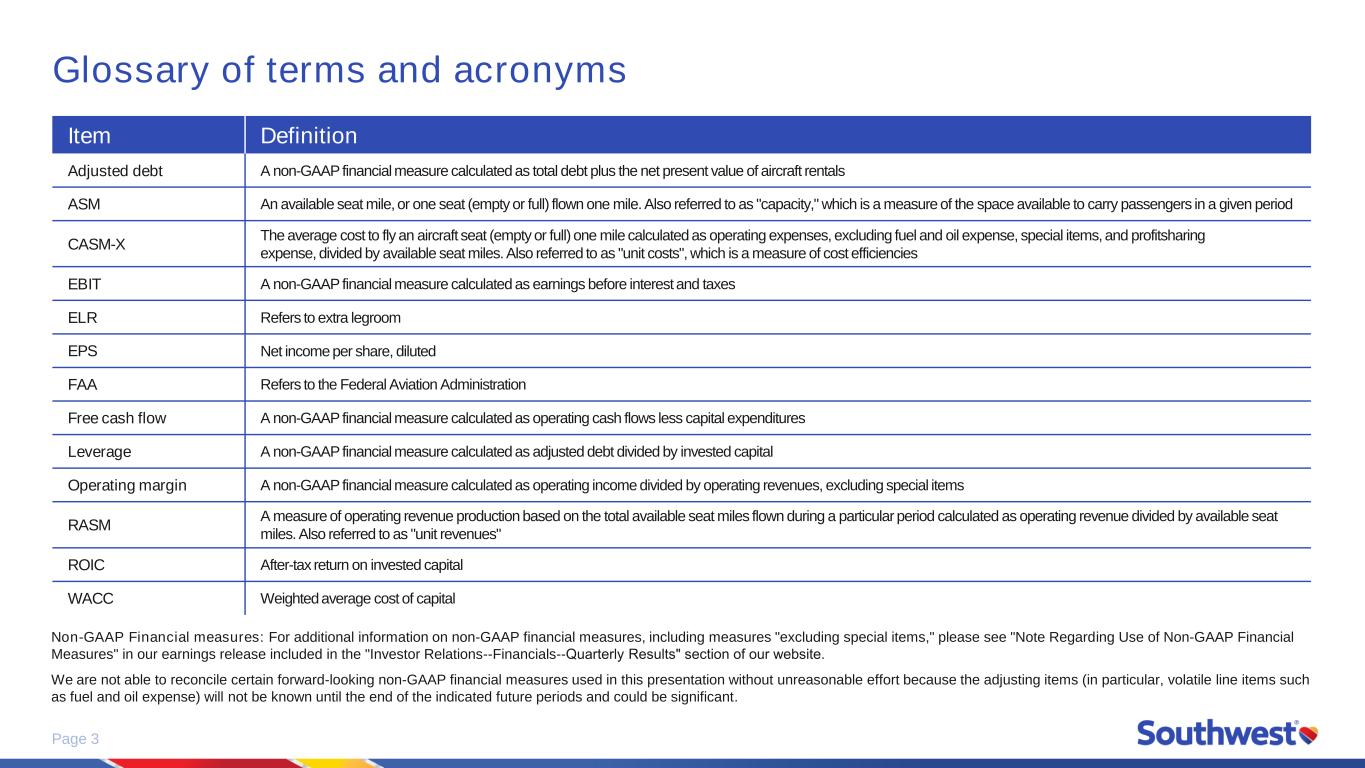

Page 3 Glossary of terms and acronyms Item Definition Adjusted debt A non-GAAP financial measure calculated as total debt plus the net present value of aircraft rentals ASM An available seat mile, or one seat (empty or full) flown one mile. Also referred to as "capacity," which is a measure of the space available to carry passengers in a given period CASM-X The average cost to fly an aircraft seat (empty or full) one mile calculated as operating expenses, excluding fuel and oil expense, special items, and profitsharing expense, divided by available seat miles. Also referred to as "unit costs", which is a measure of cost efficiencies EBIT A non-GAAP financial measure calculated as earnings before interest and taxes ELR Refers to extra legroom EPS Net income per share, diluted FAA Refers to the Federal Aviation Administration Free cash flow A non-GAAP financial measure calculated as operating cash flows less capital expenditures Leverage A non-GAAP financial measure calculated as adjusted debt divided by invested capital Operating margin A non-GAAP financial measure calculated as operating income divided by operating revenues, excluding special items RASM A measure of operating revenue production based on the total available seat miles flown during a particular period calculated as operating revenue divided by available seat miles. Also referred to as "unit revenues" ROIC After-tax return on invested capital WACC Weighted average cost of capital Non-GAAP Financial measures: For additional information on non-GAAP financial measures, including measures "excluding special items," please see "Note Regarding Use of Non-GAAP Financial Measures" in our earnings release included in the "Investor Relations--Financials--Quarterly Results" section of our website. We are not able to reconcile certain forward-looking non-GAAP financial measures used in this presentation without unreasonable effort because the adjusting items (in particular, volatile line items such as fuel and oil expense) will not be known until the end of the indicated future periods and could be significant.

Page 4 Cautionary statement regarding forward-looking statements This Investor Update contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on, and include statements about, the Company’s current estimates, intentions, beliefs, expectations, goals, strategies, and projections for the future and are not guarantees of future performance. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, statements related to (i) the Company’s fleet plans and expectations, including with respect to fleet utilization, fleet modernization, fleet management, flexibility, expected fleet deliveries and retirements, refreshed cabin design, in-seat power, larger overhead bins, increased WiFi, and new RECARO seats, and including factors and assumptions underlying the Company's plans and expectations; (ii) the Company's plans, estimates, and assumptions related to capital spending, repayment of debt obligations, leverage, credit ratings, interest expense, including factors and assumptions underlying the Company's expectations and projections; (iii) the Company’s initiatives, strategic priorities and focus areas, plans, goals, expectations, and opportunities, including with respect to (a) network optimization and maturation, (b) marketing and distribution evolution, (c) improving revenue performance and revenue management, (d) assigned and premium seating, (e) airline partnerships and enhanced vacation products, including Getaways by Southwest, (f) aircraft turn-time, (g) redeye flying and 24-hour operation capabilities, (h) innovation, Customer Service modernization, and Customer Experience enhancements, (i) managing and mitigating cost pressures and removing costs, (j) enhancing efficiency, growth initiatives and efficient use of capital, and capital allocation, (k) fleet strategy and extracting value from the fleet and the fleet order book, (l) creating value for Shareholders and Shareholder returns; and (m) maintaining investment grade credit rating; (iv) the Company's financial and operational outlook, expectations, goals, plans, strategies, targets, and projected results of operations, including with respect to its initiatives, and including factors and assumptions underlying the Company's expectations and projections; and (v) the Company’s plans and expectations with respect to its network, its capacity, its network optimization efforts, its network plan, network restructurings, market maturation, refining connection opportunities, and capacity and network adjustments, and including factors and assumptions underlying the Company's expectations and projections. Forward-looking statements involve risks, uncertainties, assumptions, and other factors that are difficult to predict and that could cause actual results to vary from those expressed in or indicated by them. Factors include, among others, (i) the impact of fears or actual outbreaks of diseases, extreme or severe weather and natural disasters, actions of competitors (including, without limitation, pricing, scheduling, capacity, and network decisions, and consolidation and alliance activities), consumer perception, economic conditions, banking conditions, fears or actual acts of terrorism or war, sociodemographic trends, and other factors beyond the Company's control, on consumer behavior and the Company's results of operations and business decisions, plans, strategies, and results; (ii) the Company's ability to timely and effectively implement, transition, operate, and maintain the necessary information technology systems and infrastructure to support its operations and initiatives, including with respect to revenue management and assigned and premium seating; (iii) the Company’s ability to obtain and maintain adequate infrastructure and equipment to support its operations and initiatives; (iv) the impact of fuel price changes, fuel price volatility, volatility of commodities used by the Company for hedging jet fuel, and any changes to the Company's fuel hedging strategies and positions, on the Company's business plans and results of operations; (v) the Company's dependence on The Boeing Company (“Boeing”) and Boeing suppliers with respect to the Company's aircraft deliveries, Boeing MAX 7 aircraft certifications, fleet and capacity plans, operations, maintenance, strategies, and goals; (vi) the Company's dependence on the Federal Aviation Administration with respect to safety approvals for the new cabin layout and the certification of the Boeing MAX 7 aircraft; (vii) the Company's dependence on other third parties, in particular with respect to its technology plans, its plans and expectations related to revenue management, operational reliability, fuel supply, maintenance, Global Distribution Systems, environmental sustainability, and the impact on the Company's operations and results of operations of any third party delays or nonperformance; (viii) the Company’s ability to timely and effectively prioritize its initiatives and focus areas and related expenditures; (ix) the impact of labor matters on the Company's business decisions, plans, strategies, and results; (x) the impact of governmental regulations and other governmental actions on the Company's business plans, results, and operations; (xi) the Company's dependence on its workforce, including its ability to employ and retain sufficient numbers of qualified Employees with appropriate skills and expertise to effectively and efficiently maintain its operations and execute the Company’s plans, strategies, and initiatives; (xii) the cost and effects of the actions of activist shareholders; and (xiii) other factors, as described in the Company's filings with the Securities and Exchange Commission, including the detailed factors discussed under the heading "Risk Factors" in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Page 5 4Q 2024 highlights Record revenue with momentum from initiatives • Benefits from tactical initiatives contributed to record yield performance • Continued demand strength, particularly during the holiday period Strong operational performance • 99.3% completion factor rounding out our industry-leading full year performance of 99.2% • 84.1% ontime performance, our best performance since 2020 • 63.9 Trip Net Promoter Score, our best performance since 2020 Maximizing Shareholder value and capital flexibility • Retired $1.3B in debt and finance lease obligations in 2024 • Incurred $1.2B in net capital spending in 2024 • Returned $680M in dividends and share repurchases in 2024 • Liquidity of $9.7B, well in excess of $6.7B outstanding debt $7.0B +3.3% YoY 4Q 2024 operating revenues1 c16.19 +8.0% YoY 4Q 2024 RASM1 c12.19 +11.1% YoY 4Q 2024 CASM-X1 $0.56 +47.4% YoY 4Q 2024 EPS1 1. Excludes special items

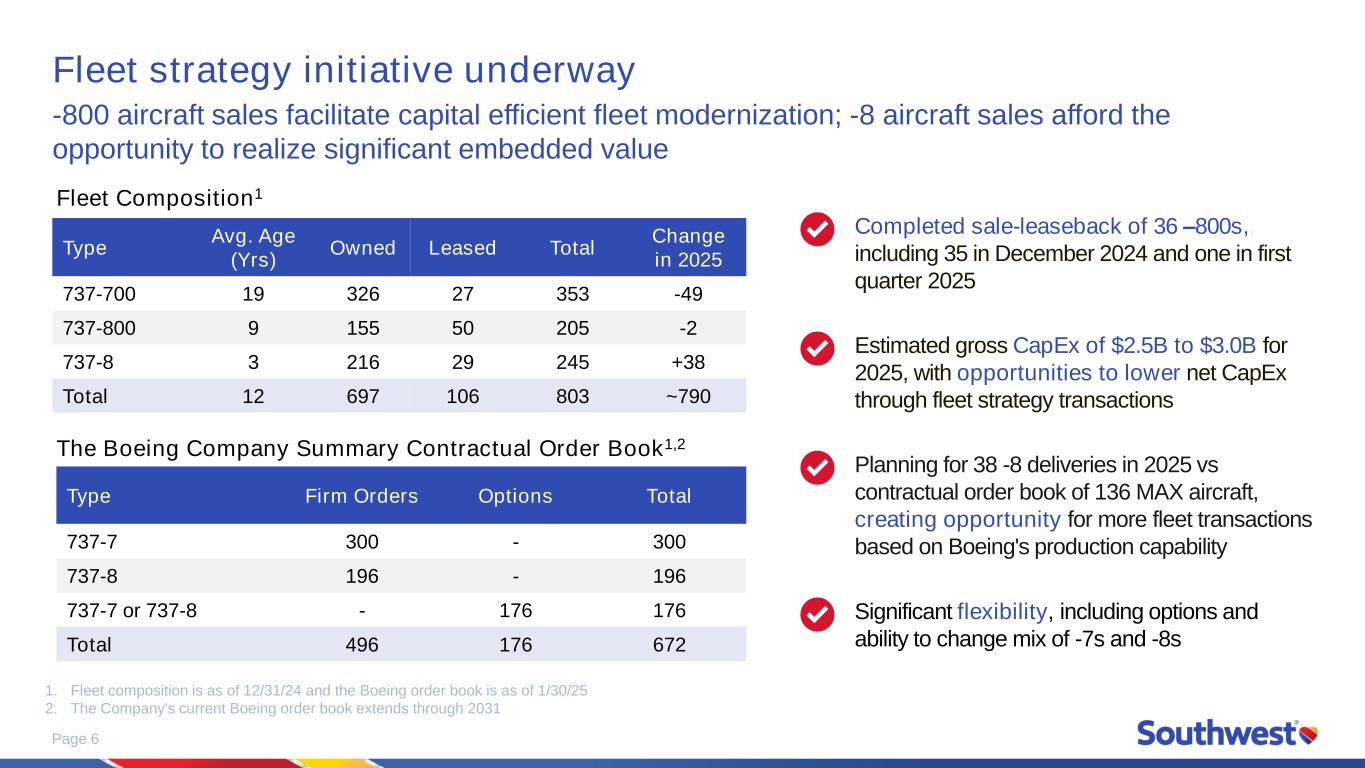

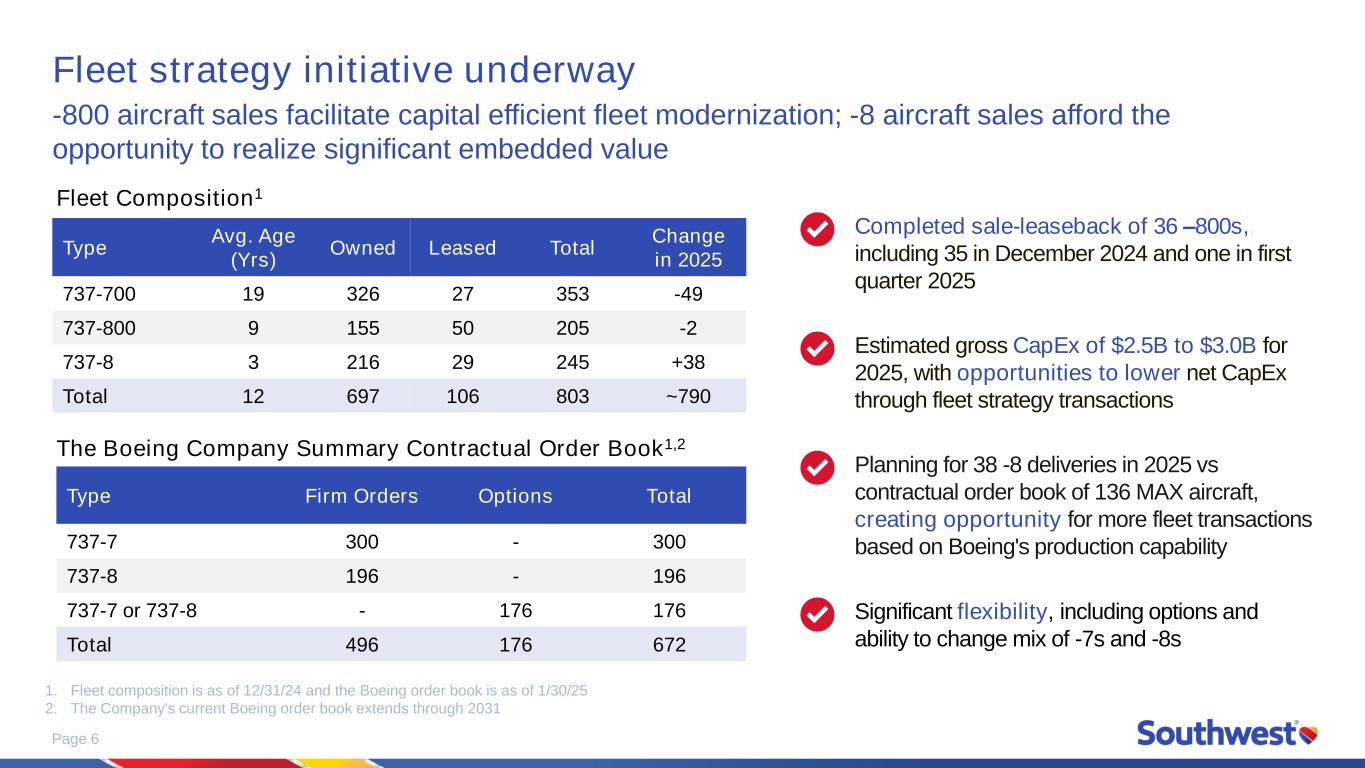

Page 6 Fleet strategy initiative underway Type Avg. Age (Yrs) Owned Leased Total Change in 2025 737-700 19 326 27 353 -49 737-800 9 155 50 205 -2 737-8 3 216 29 245 +38 Total 12 697 106 803 ~790 Completed sale-leaseback of 36 –800s,, including 35 in December 2024 and one in first quarter 2025 Significant flexibility, including options and ability to change mix of -7s and -8s Estimated gross CapEx of $2.5B to $3.0B for 2025, with opportunities to lower net CapEx through fleet strategy transactions -800 aircraft sales facilitate capital efficient fleet modernization; -8 aircraft sales afford the opportunity to realize significant embedded value Fleet Composition1 The Boeing Company Summary Contractual Order Book1,2 Type Firm Orders Options Total 737-7 300 - 300 737-8 196 - 196 737-7 or 737-8 - 176 176 Total 496 176 672 1. Fleet composition is as of 12/31/24 and the Boeing order book is as of 1/30/25 2. The Company's current Boeing order book extends through 2031 Planning for 38 -8 deliveries in 2025 vs contractual order book of 136 MAX aircraft, creating opportunity for more fleet transactions based on Boeing's production capability

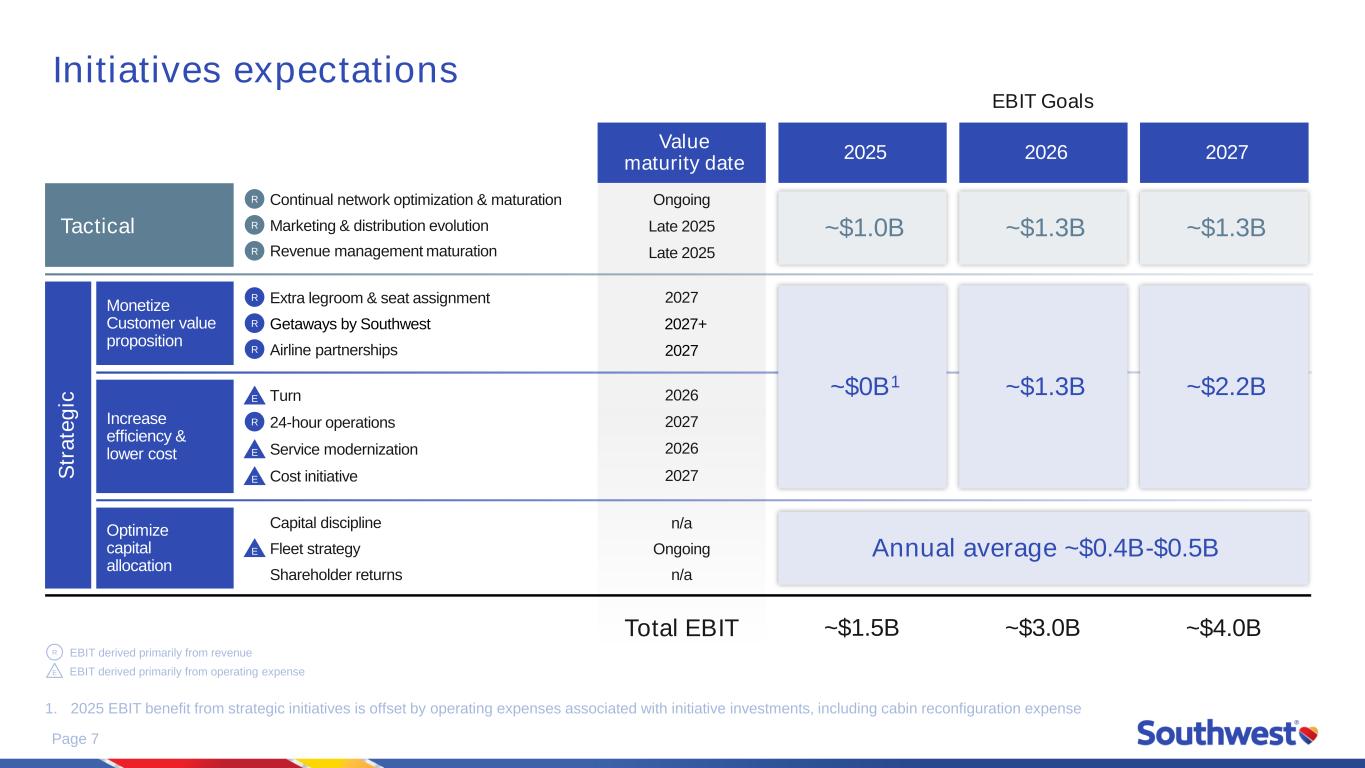

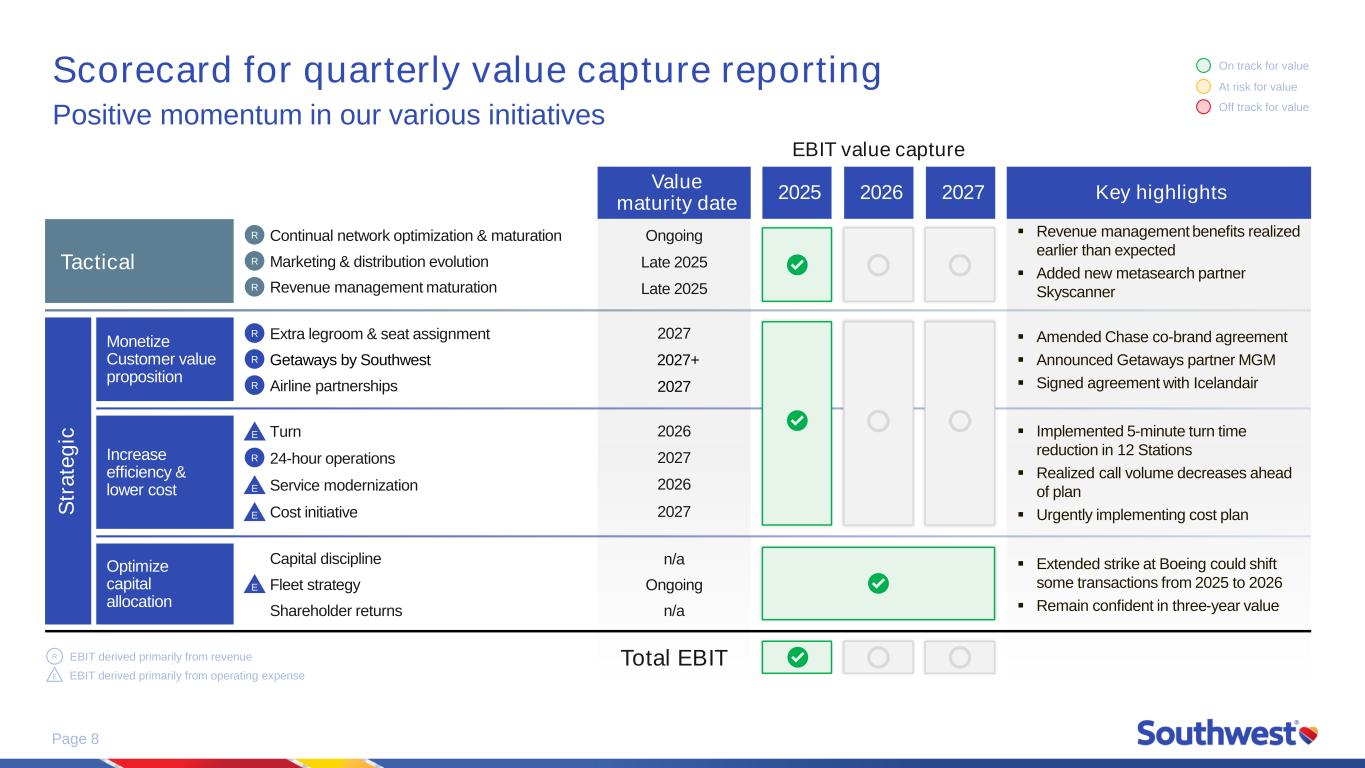

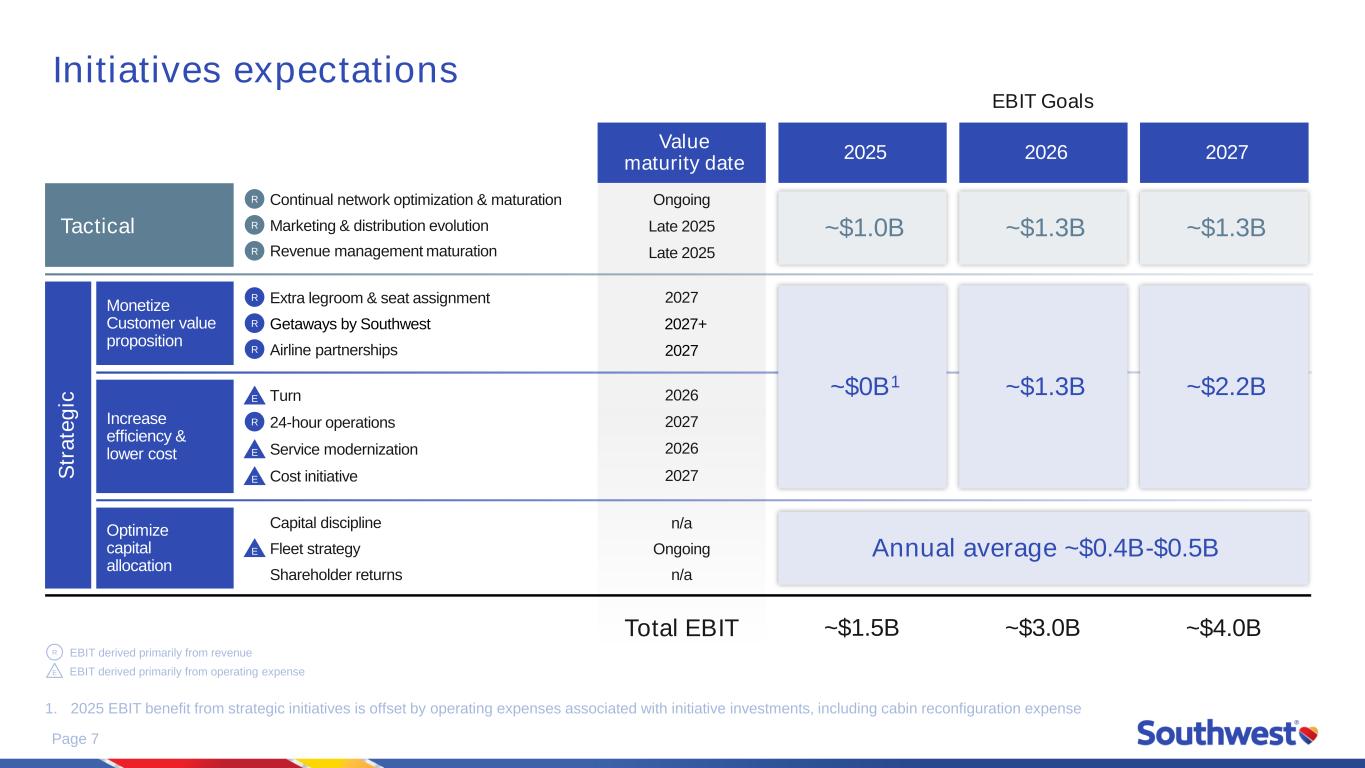

Page 7 Initiatives expectations 1. 2025 EBIT benefit from strategic initiatives is offset by operating expenses associated with initiative investments, including cabin reconfiguration expense Value maturity date Ongoing Late 2025 Late 2025 2027 2027+ 2027 2026 2027 2026 2027 n/a Ongoing n/a Total EBIT 2025 ~$1.5B 2026 2027 Monetize Customer value proposition Optimize capital allocation Increase efficiency & lower cost Tactical S tr a te g ic Continual network optimization & maturationR Marketing & distribution evolutionR Revenue management maturationR Extra legroom & seat assignmentR Getaways by SouthwestR Airline partnershipsR Capital discipline Fleet strategy Shareholder returns E Turn 24-hour operationsR E Service modernization E Cost initiative E EBIT derived primarily from revenue EBIT derived primarily from operating expenseE R ~$1.0B ~$0B1 ~$1.3B ~$1.3B ~$1.3B ~$2.2B Annual average ~$0.4B-$0.5B EBIT Goals ~$3.0B ~$4.0B

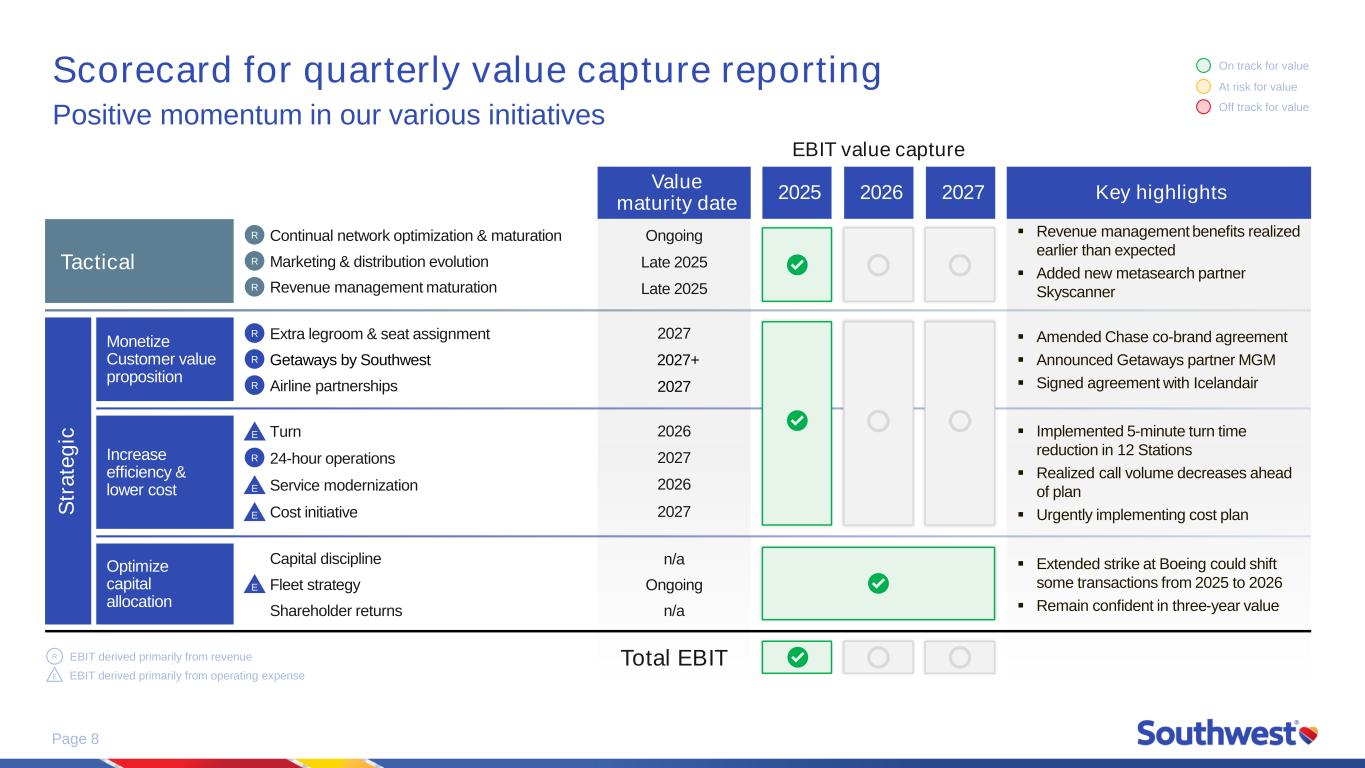

Page 8 Value maturity date Ongoing Late 2025 Late 2025 2027 2027+ 2027 2026 2027 2026 2027 Ongoing n/a Key highlights ▪ Revenue management benefits realized earlier than expected ▪ Added new metasearch partner Skyscanner ▪ Amended Chase co-brand agreement ▪ Announced Getaways partner MGM ▪ Signed agreement with Icelandair ▪ Implemented 5-minute turn time reduction in 12 Stations ▪ Realized call volume decreases ahead of plan ▪ Urgently implementing cost plan ▪ Extended strike at Boeing could shift some transactions from 2025 to 2026 ▪ Remain confident in three-year value Scorecard for quarterly value capture reporting Positive momentum in our various initiatives EBIT derived primarily from revenue EBIT derived primarily from operating expenseE R On track for value At risk for value Off track for value n/a Total EBIT Monetize Customer value proposition Optimize capital allocation Increase efficiency & lower cost Tactical S tr a te g ic Continual network optimization & maturationR Marketing & distribution evolutionR Revenue management maturationR Extra legroom & seat assignmentR Getaways by SouthwestR Airline partnershipsR Capital discipline Fleet strategy Shareholder returns E Turn 24-hour operationsR E Service modernization E Cost initiative E 2025 2026 2027 EBIT value capture

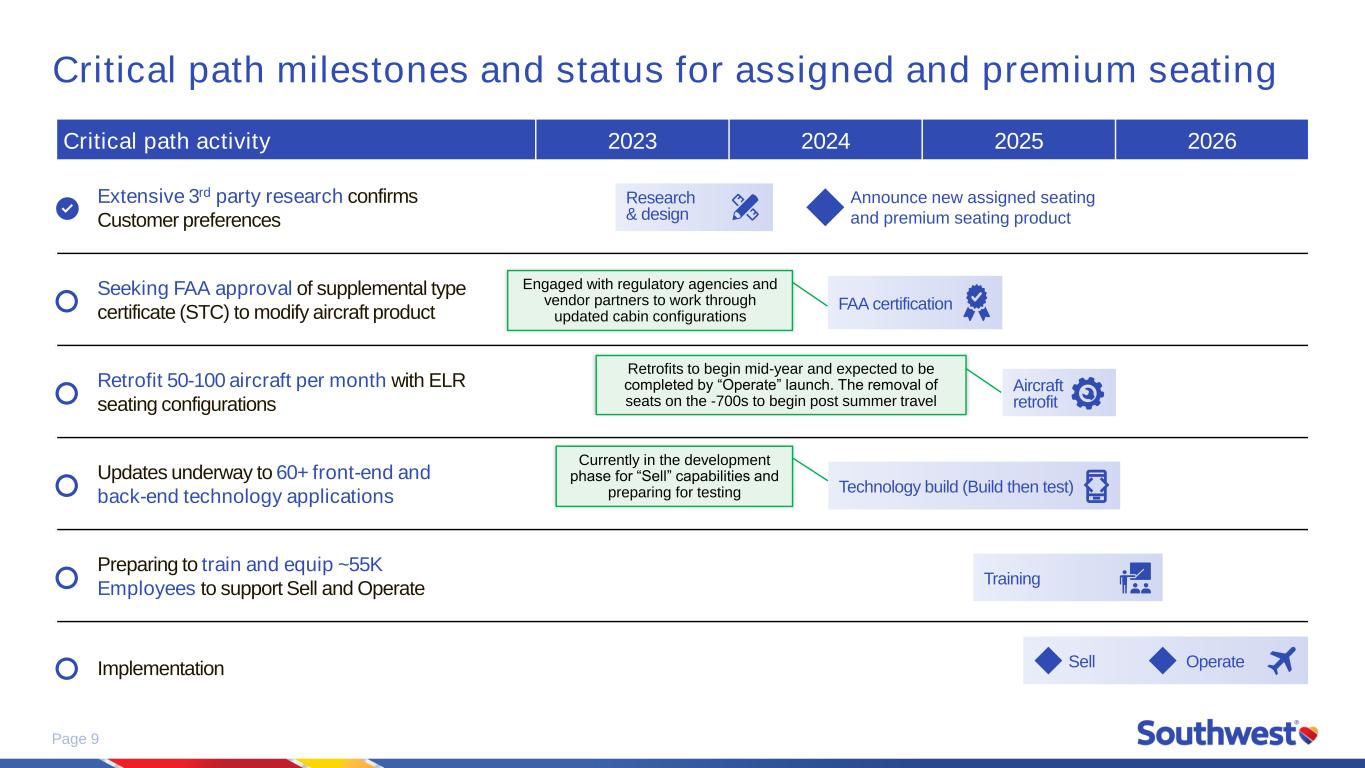

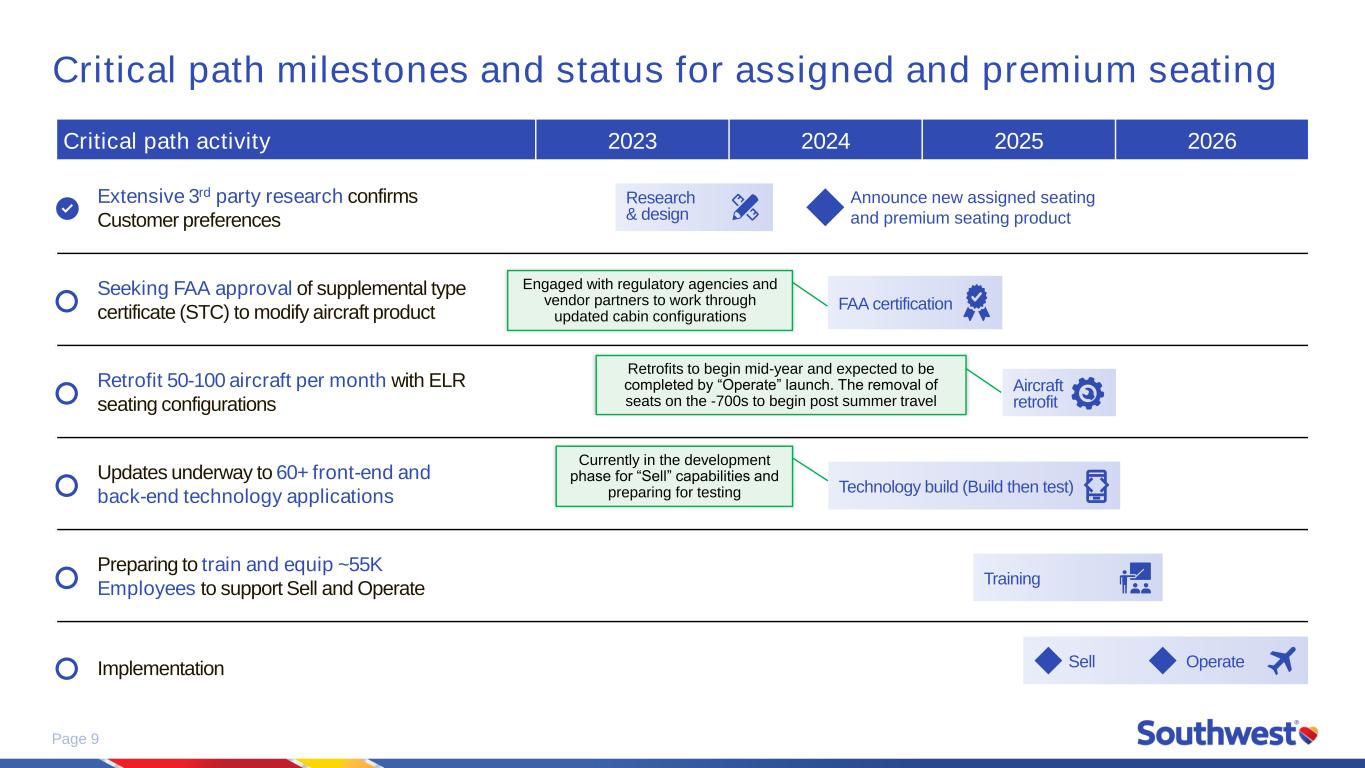

Page 9 Critical path milestones and status for assigned and premium seating Critical path activity 2023 2024 2025 2026 Extensive 3rd party research confirms Customer preferences Seeking FAA approval of supplemental type certificate (STC) to modify aircraft product Retrofit 50-100 aircraft per month with ELR seating configurations Updates underway to 60+ front-end and back-end technology applications Preparing to train and equip ~55K Employees to support Sell and Operate Implementation Research & design Announce new assigned seating and premium seating product FAA certification Aircraft retrofit Technology build (Build then test) Training Sell Operate Currently in the development phase for “Sell” capabilities and preparing for testing Retrofits to begin mid-year and expected to be completed by “Operate” launch. The removal of seats on the -700s to begin post summer travel Engaged with regulatory agencies and vendor partners to work through updated cabin configurations

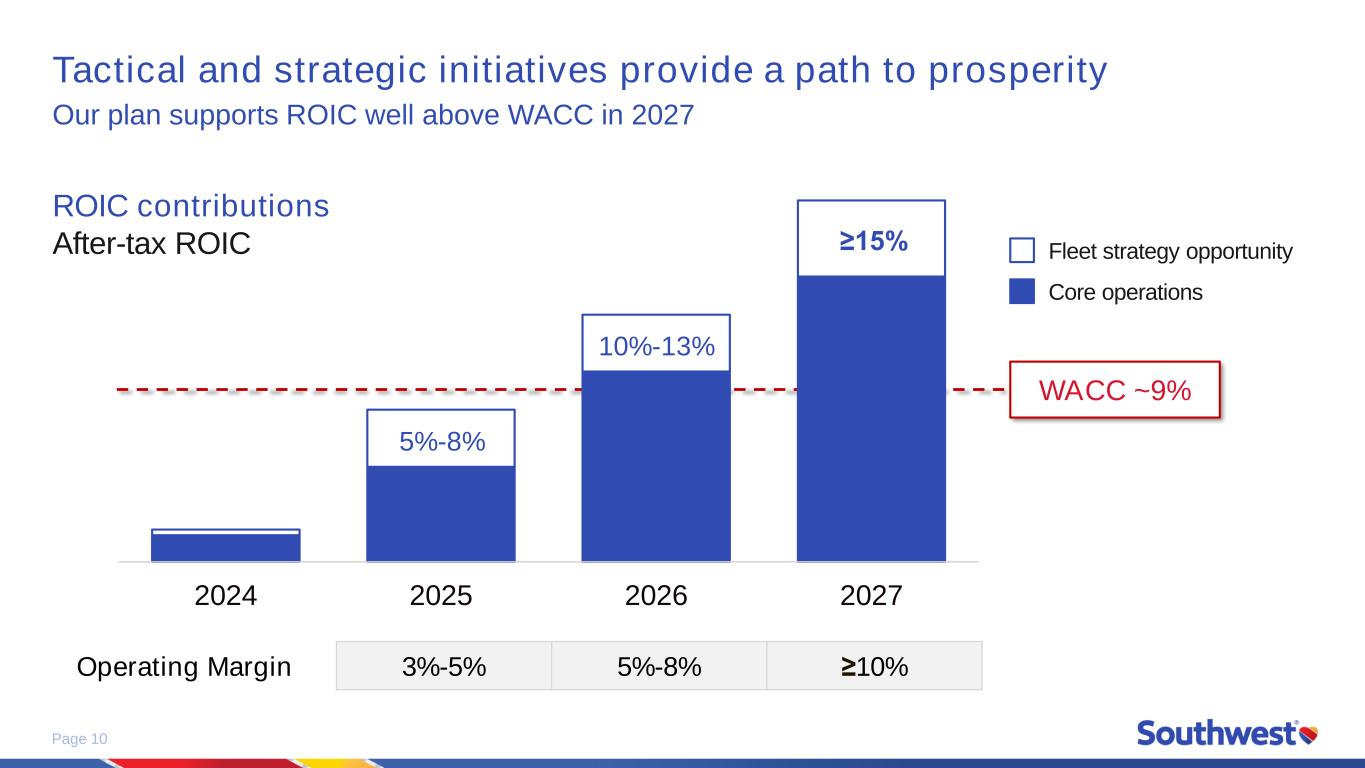

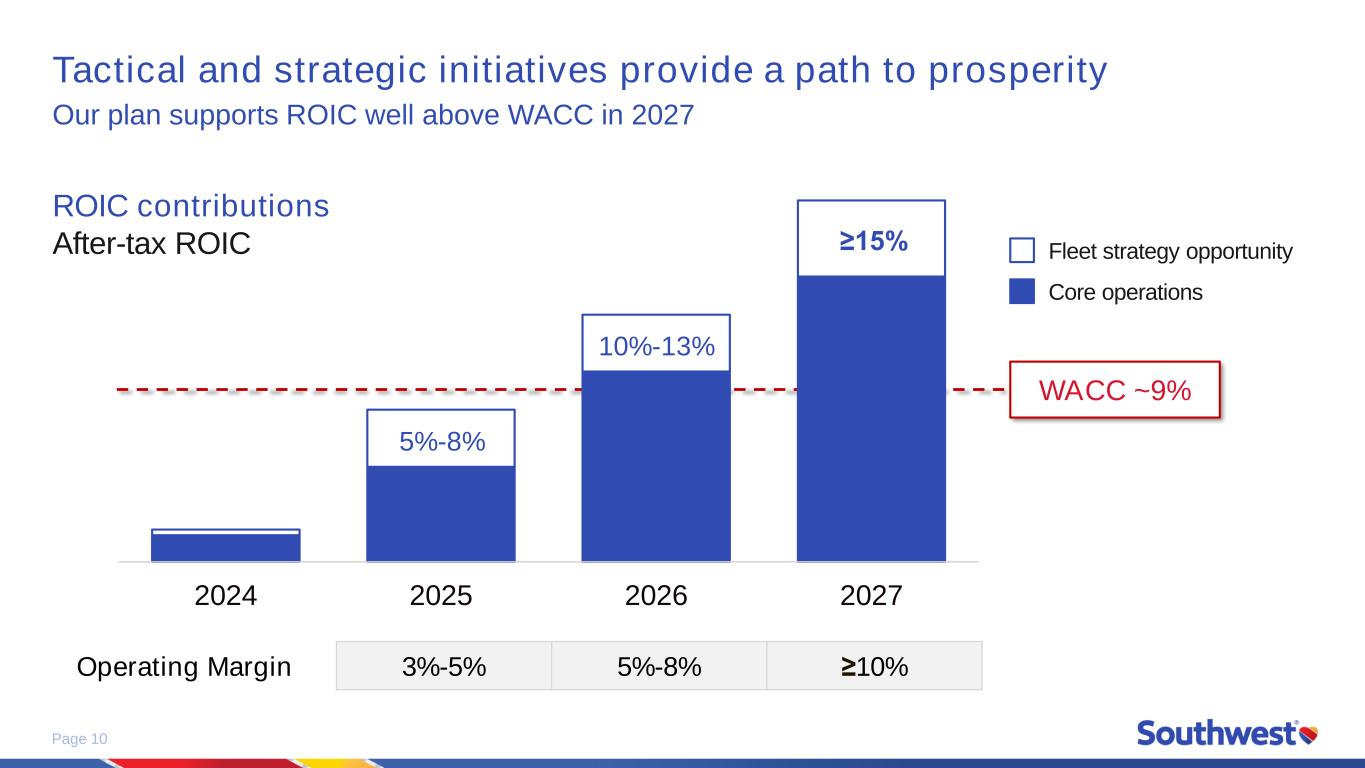

Page 10 Tactical and strategic initiatives provide a path to prosperity Our plan supports ROIC well above WACC in 2027 ROIC contributions After-tax ROIC 2024 2025 2026 2027 Operating Margin 3%-5% 5%-8% ≥10% 5%-8% 10%-13% ≥15% Fleet strategy opportunity Core operations WACC ~9%

Page 11 Our 2027 targets support strong Shareholder returns All targets are supported with, and without, contributions from the fleet strategy 1. As measured in year-over-year available seat miles 1% to 2% Capacity1 >$1 billion Free cash flow Low to mid 30% Leverage Investment-grade credit rating Balance sheet ~10% Operating margin ≥15% ROIC ≥

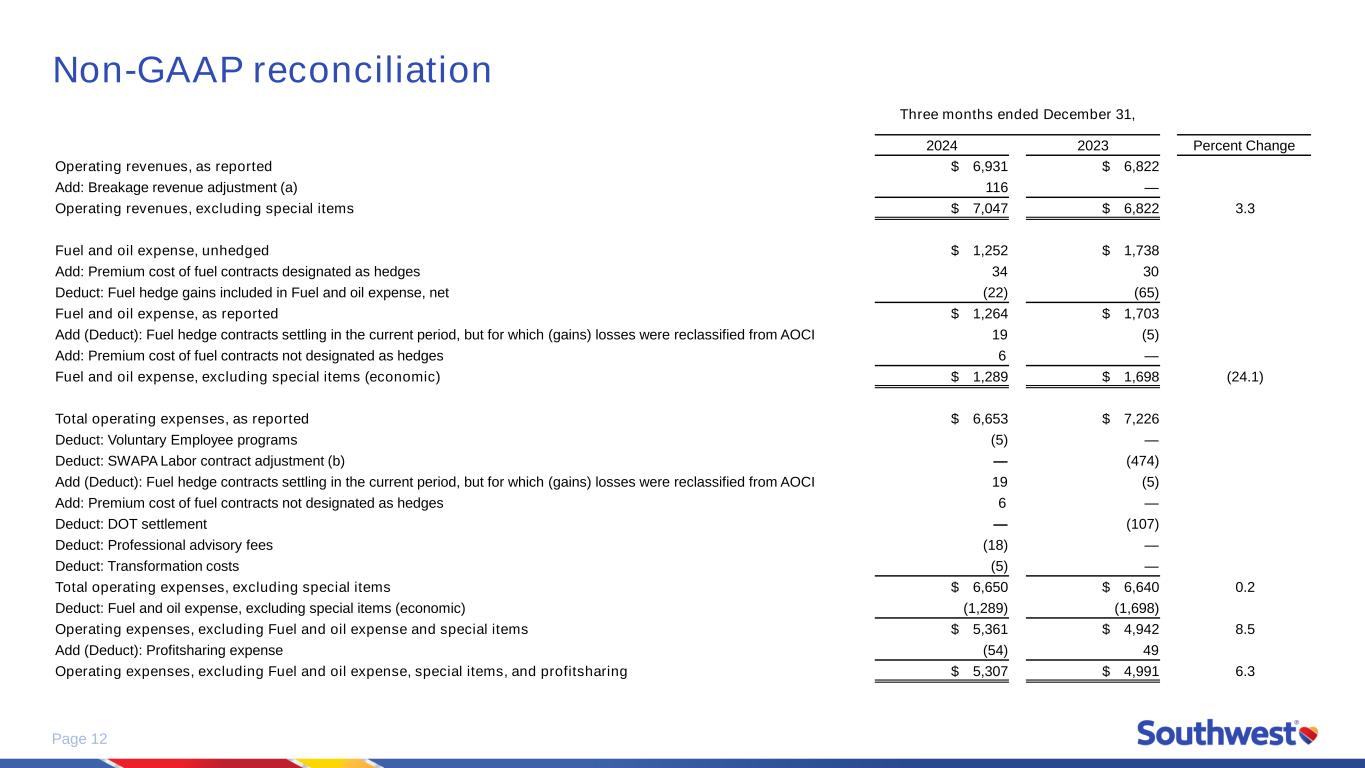

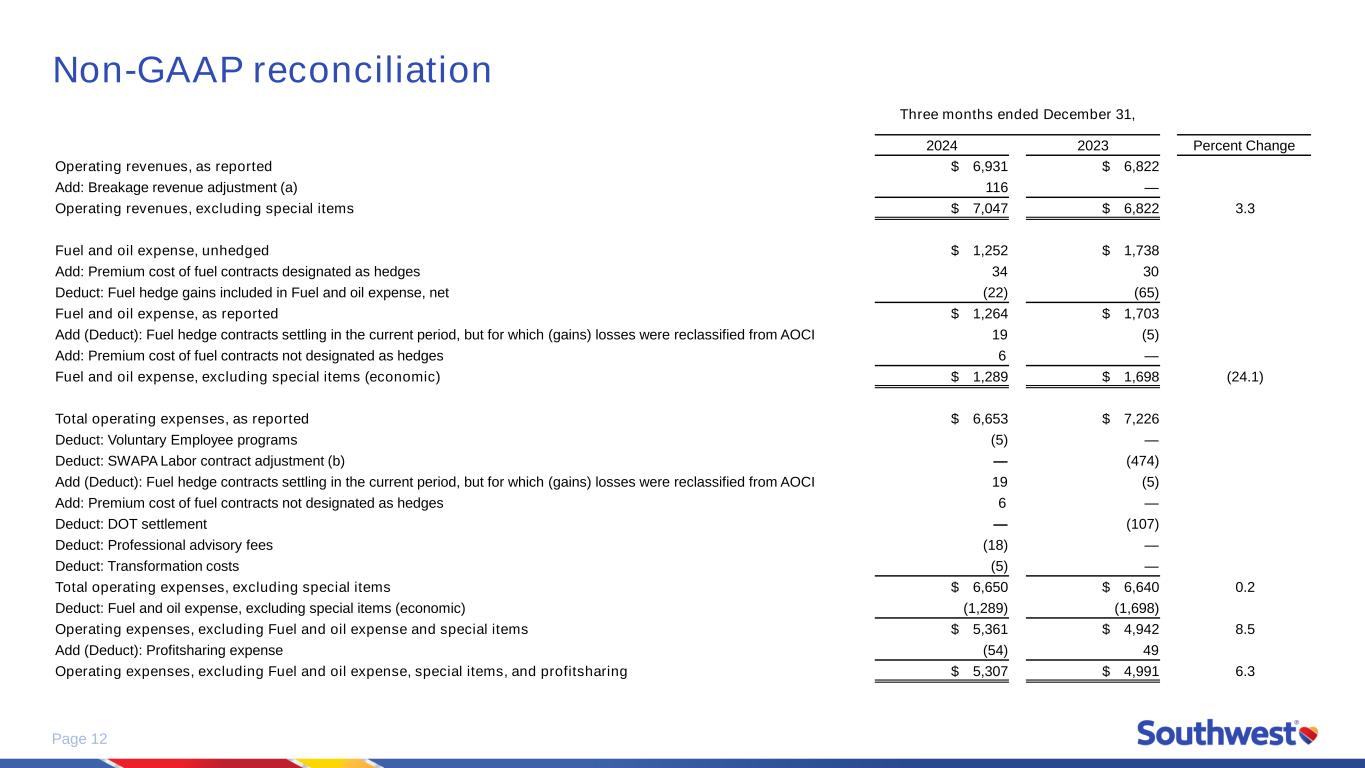

Page 12 Non-GAAP reconciliation Three months ended December 31, 2024 2023 Percent Change Operating revenues, as reported $ 6,931 $ 6,822 Add: Breakage revenue adjustment (a) 116 — Operating revenues, excluding special items $ 7,047 $ 6,822 3.3 Fuel and oil expense, unhedged $ 1,252 $ 1,738 Add: Premium cost of fuel contracts designated as hedges 34 30 Deduct: Fuel hedge gains included in Fuel and oil expense, net (22) (65) Fuel and oil expense, as reported $ 1,264 $ 1,703 Add (Deduct): Fuel hedge contracts settling in the current period, but for which (gains) losses were reclassified from AOCI 19 (5) Add: Premium cost of fuel contracts not designated as hedges 6 — Fuel and oil expense, excluding special items (economic) $ 1,289 $ 1,698 (24.1) Total operating expenses, as reported $ 6,653 $ 7,226 Deduct: Voluntary Employee programs (5) — Deduct: SWAPA Labor contract adjustment (b) — (474) Add (Deduct): Fuel hedge contracts settling in the current period, but for which (gains) losses were reclassified from AOCI 19 (5) Add: Premium cost of fuel contracts not designated as hedges 6 — Deduct: DOT settlement — (107) Deduct: Professional advisory fees (18) — Deduct: Transformation costs (5) — Total operating expenses, excluding special items $ 6,650 $ 6,640 0.2 Deduct: Fuel and oil expense, excluding special items (economic) (1,289) (1,698) Operating expenses, excluding Fuel and oil expense and special items $ 5,361 $ 4,942 8.5 Add (Deduct): Profitsharing expense (54) 49 Operating expenses, excluding Fuel and oil expense, special items, and profitsharing $ 5,307 $ 4,991 6.3

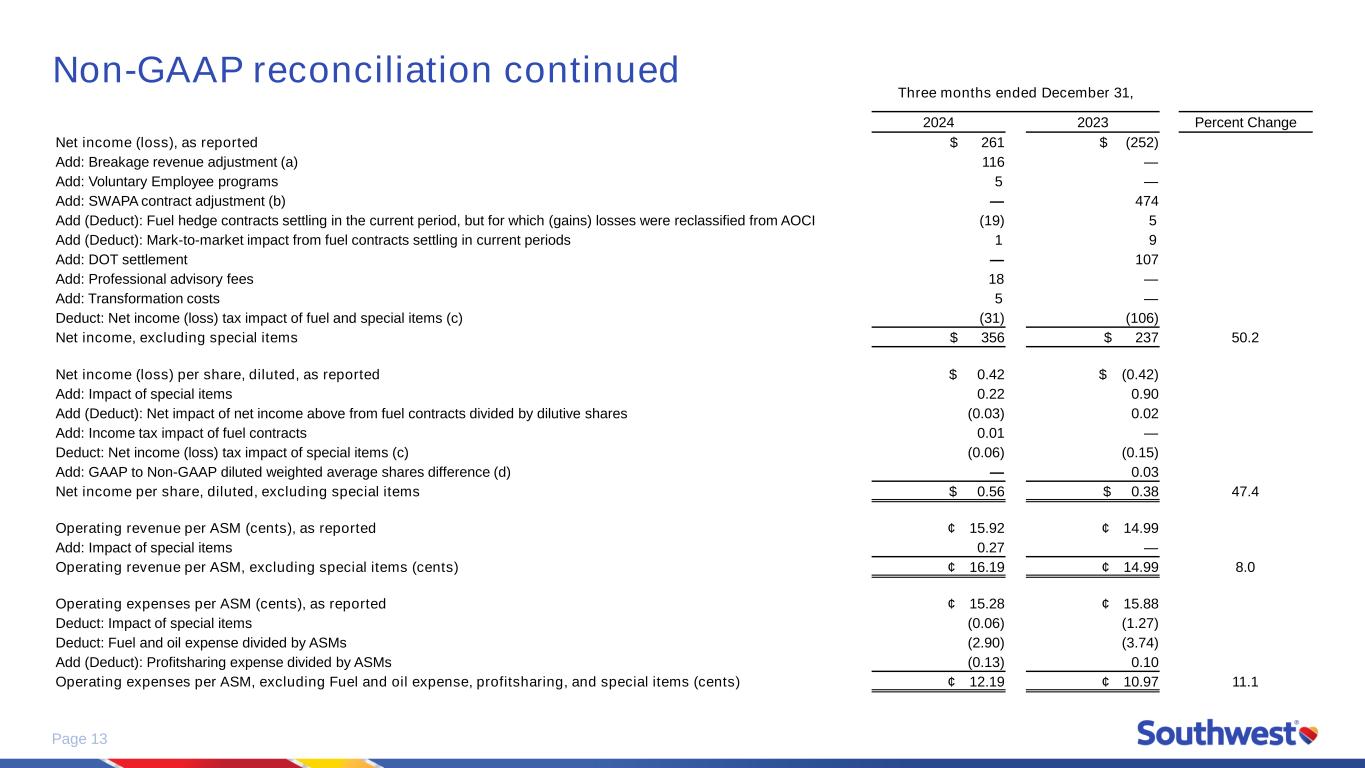

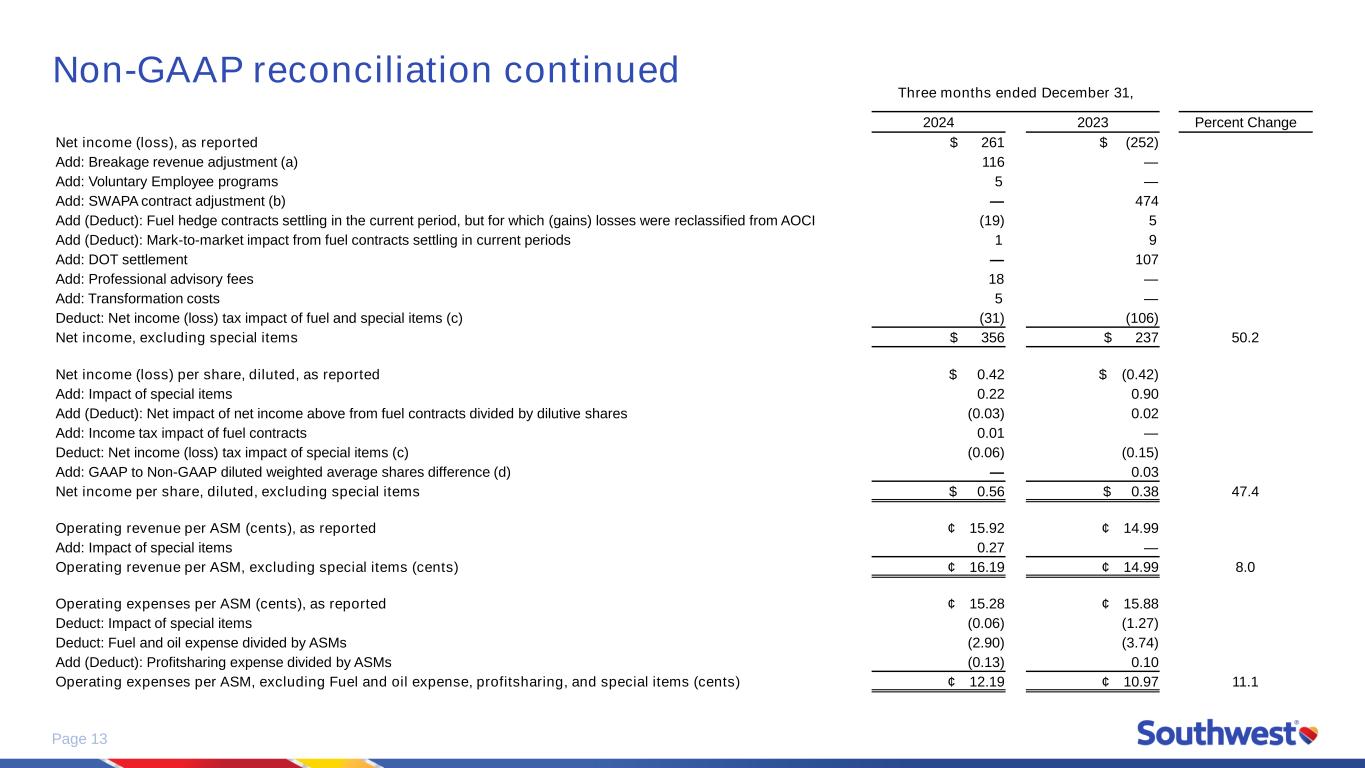

Page 13 Non-GAAP reconciliation continued Three months ended December 31, 2024 2023 Percent Change Net income (loss), as reported $ 261 $ (252) Add: Breakage revenue adjustment (a) 116 — Add: Voluntary Employee programs 5 — Add: SWAPA contract adjustment (b) — 474 Add (Deduct): Fuel hedge contracts settling in the current period, but for which (gains) losses were reclassified from AOCI (19) 5 Add (Deduct): Mark-to-market impact from fuel contracts settling in current periods 1 9 Add: DOT settlement — 107 Add: Professional advisory fees 18 — Add: Transformation costs 5 — Deduct: Net income (loss) tax impact of fuel and special items (c) (31) (106) Net income, excluding special items $ 356 $ 237 50.2 Net income (loss) per share, diluted, as reported $ 0.42 $ (0.42) Add: Impact of special items 0.22 0.90 Add (Deduct): Net impact of net income above from fuel contracts divided by dilutive shares (0.03) 0.02 Add: Income tax impact of fuel contracts 0.01 — Deduct: Net income (loss) tax impact of special items (c) (0.06) (0.15) Add: GAAP to Non-GAAP diluted weighted average shares difference (d) — 0.03 Net income per share, diluted, excluding special items $ 0.56 $ 0.38 47.4 Operating revenue per ASM (cents), as reported ¢ 15.92 ¢ 14.99 Add: Impact of special items 0.27 — Operating revenue per ASM, excluding special items (cents) ¢ 16.19 ¢ 14.99 8.0 Operating expenses per ASM (cents), as reported ¢ 15.28 ¢ 15.88 Deduct: Impact of special items (0.06) (1.27) Deduct: Fuel and oil expense divided by ASMs (2.90) (3.74) Add (Deduct): Profitsharing expense divided by ASMs (0.13) 0.10 Operating expenses per ASM, excluding Fuel and oil expense, profitsharing, and special items (cents) ¢ 12.19 ¢ 10.97 11.1

Page 14 Non-GAAP reconciliation continued (a) Represents a change in breakage revenue estimate related to flight credits the Company issued to Passengers during 2022 and prior. On July 28, 2022, the Company modified its policy and announced that all unexpired flight credits as of that date, including a significant volume of such credits issued to impacted Customers during the COVID-19 pandemic as the Company was making significant changes to its schedules based on fluctuating demand, will no longer have an expiration date and thus will be able to be redeemed by Customers indefinitely. This change in policy was considered a contract modification under ASC 606, Revenue from Contracts with Customers, and the Company accounted for such change prospectively in third quarter 2022. At that time, based on historical Customer behavior, the Company estimated that redemptions of these flight credits would have been reduced to an immaterial amount during 2024 and recognized breakage revenue in prior periods for these flight credits accordingly; however, based on actual Customer redemptions throughout 2024, as well as currently projected redemptions beyond 2024, the Company determined a reversal of a portion of this prior breakage revenue was warranted in the current period. This adjustment is not reflective of base business revenue trends in fourth quarter 2024 or beyond. (b) Represents changes in estimate related to the contract ratification bonus for the Company’s Pilots as part of the tentative agreement reached in December 2023 with Southwest Airlines Pilots Association ("SWAPA"). The Company began accruing for all of its open labor contracts on April 1, 2022, and this incremental $474 million expense represented an increase in retroactive pay associated with wage rates for purposes of calculating the ratification bonus agreed to for Pilots for periods prior to fourth quarter 2023. (c) Tax amounts for each individual special item are calculated at the Company's effective rate for the applicable period and totaled in this line item. (d) Adjustment related to GAAP and Non-GAAP diluted weighted average shares difference, due to the Company being in a Net loss position on a GAAP basis versus a Net income position on a Non-GAAP basis for the three months ended December 31, 2023.