Exhibit 99.1

Waterside Capital Corporation

410 Peachtree Parkway

Suite 4245

Cumming GA 30041

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD NOVEMBER 15, 2021

TO OUR SHAREHOLDERS:

This is notice that a special meeting of the shareholders of Waterside Capital Corporation, a Virginia corporation (the “Company”) will be held at 9:00 a.m., local time, on November 15, 2021.

| WHAT: | Special meeting of shareholders. |

| | |

| WHEN: | November 15, 2021, at 9:00 a.m. local time. |

| | |

| WHERE: | Hampton Inn Business Center, 450 Jesse Jewell Pkwy SW, Gainesville, GA 30501 |

WHY: At the special meeting, you will be asked to vote on a Plan of Conversion of the Company, pursuant to which the Company will convert from a Virginia corporation to a Nevada corporation (the “Conversion”). The Plan of Conversion is attached to this Notice as Exhibit A, and shareholders are urged to read the Plan of Conversion in its entirety.

Our Board of Directors unanimously recommends a vote FOR the approval of the Conversion and the Plan of Conversion. Pursuant to the Conversion, each share of common stock, par value $1.00 per share, of the Company (the “Common Stock”) will be converted to one share of common stock, par value $1.00 per share, of the resulting Nevada corporation.

The Articles of Incorporation and Bylaws of the Company as a Nevada corporation have materially the same terms and provisions as the current Articles of Incorporation and Bylaws of the Company as a Virginia corporation, until they may be amended by the Board of Directors and the shareholders of the Company following the Conversion. The Articles of Incorporation and Bylaws are attached to the Plan of Conversion.

At the effective time of the Conversion (the “Effective Time”), the directors and officers of the Company immediately prior to the Effective Time will be the directors and officers of the resulting Nevada corporation until the earlier of their respective deaths, resignations or removals or until their respective successors are duly elected and qualified, as the case may be. The description of the Plan of Conversion as set forth herein is qualified in its entirety to the complete Plan of Conversion as attached to this Notice as Exhibit A.

The reasoning for the Conversion is to prepare the Company for the expansion of its operations in a jurisdiction (Nevada) which is better suited to a public company, and which is more attractive to future potential investors in the Company.

A list of shareholders entitled to vote at the special meeting will be available for inspection by any shareholder, beginning two business days after this Notice is given and continuing through the Special Meeting, and any adjournment thereof, at the Company’s principal office as set forth above. The presence in person at the Special Meeting of shareholders holding more than two thirds of the votes entitled to be cast on the Plan of Conversion is required in order for a quorum to be at the meeting, and approval of the Plan of Conversion requires the approval of each class or series of shares voting as a separate voting group at a meeting at which a quorum of the voting group exists consisting of more than two thirds of the votes entitled to be cast on the plan by that voting group. The Company currently has only one class stock outstanding (the Common Stock), and Ryan Schadel, the Company’s Chief Executive Officer and Secretary, currently holds 69.7% of the issued and outstanding Common Stock, and Mr. Schadel is expected to vote his shares “FOR” the approval of the Conversion and the Plan of Conversion. Therefore, if Mr. Schadel is present at the Special Meeting, which the Company expects will be the case, a quorum will be present and the Conversion and the Plan of Conversion will be approved. The Company has determined that, pursuant to the Virginia Stock Corporation Act, dissenters’ appraisal rights are not available to the shareholders of the Company in connection with the Conversion.

Only stockholders of record at the close of business on October 8, 2021 (the record date set by the Board of Directors of the Company) will receive notice of, and be eligible to vote at, the Special Meeting or any adjournment, postponement or rescheduling thereof.

If you have any questions regarding the Conversion or the Special Meeting, please call Ryan Schadel at (770) 561-9111.

| | By Order of the Board of Directors, |

| |  |

| | Ryan Schadel |

| | Chairman of the Board and Chief Executive |

| | Officer Dated: October 22, 2021 |

Exhibit A

Plan of Conversion

(Attached)

PLAN OF CONVERSION

OF

WATERSIDE CAPITAL CORPORATION

Dated as of October 7, 2021

Subject to the approval of the shareholders of Waterside Capital Corporation, a Virginia corporation (the “Company”), this Plan of Conversion (together with the exhibits hereto, the “Plan”) is entered into by the Company and sets forth the terms of the conversion of the Company from a Virginia corporation to a Nevada corporation, pursuant to the provisions of the Virginia Stock Corporation Act (the “Act”) and the Nevada Revised Statutes (the “NRS”).

| 1. | The Company was formed in the Commonwealth of Virginia on July 13, 1993. |

| | |

| 2. | Article 12.2 of the Act permits the conversion of a Virginia corporation to a corporation organized under the laws of another State. |

| | |

| 3. | Chapter 78 and Chapter 92A of the NRS, including Section 92A.195 thereof, permits the conversion of a Virginia corporation into a Nevada corporation. |

| | |

| 4. | Upon the terms and subject to the conditions of this Plan and in accordance with the Act and the NRS, the Company will be converted into a Nevada corporation (the “Conversion”) to be named Waterside Capital Corporation (the “Corporation”). |

| | |

| 5. | This Plan shall be effective following its approval by the shareholders of the Company and the filing of Articles of Conversion, substantially in the form as attached hereto as Exhibit A with the Secretary of State of the Commonwealth of Virginia and Articles of Conversion, substantially in the form as attached hereto as Exhibit B, and the Articles of Incorporation for the Corporation (the “Articles of Incorporation”), substantially in the form as attached hereto as Exhibit C, with the Secretary of State of the State of Nevada. |

ARTICLE I. THE CONVERSION

Section 1.01 The Conversion. At the Effective Time, the Company shall be converted into the Corporation and, for all purposes of the laws of the Commonwealth of Virginia and the State of Nevada, the Conversion shall be deemed a continuation of the existence of the Company in the form of a Nevada corporation. At the Effective Time, for all purposes of the laws of the Commonwealth of Virginia and the State of Nevada, all of the rights, privileges and powers of the Company, and all property, real, personal and mixed, and all debts due to the Company, as well as all other things and causes of action belonging to the Company, shall thereby become vested in the Corporation and shall be the property of the Corporation, and the title to any real property vested by deed or otherwise in the Company shall not revert or be in any way impaired by reason of any provision of the NRS; but all rights of creditors and all liens upon any property of the Company shall be preserved unimpaired, and all debts, liabilities and duties of the Company shall be deemed to be those of the Corporation, and may be enforced against the Corporation to the same extent as if said debts, liabilities and duties had originally been incurred or contracted by it in its capacity as a corporation.

Section 1.02 Effective Time. The Conversion shall become effective upon the filing of Articles of Conversion with the Secretary of State of the Commonwealth of Virginia and Articles of Conversion and the Articles of Incorporation with the Secretary of State of the State of Nevada (such time of effectiveness, the “Effective Time”). The officers of the Company shall select the date and time that the Effective Time occurs.

Section 1.03 Articles of Incorporation and Bylaws of the Corporation. At and after the Effective Time, the Corporation shall be governed by the Articles of Incorporation, and the Board of Directors of the Corporation shall adopt bylaws for the Corporation substantially in the form as attached hereto as Exhibit D (the “Bylaws”).

Section 1.04 Directors and Officers. The initial directors of the Corporation shall be as set forth in the Articles of Incorporation, who shall be named to the initial Board of Directors of the Corporation. The initial officers of the Corporation shall be determined by the Board of Directors of the Corporation, promptly following the Conversion, in each case until their respective successors are duly elected or appointed and qualified.

Section 1.05 Termination. This Plan may be terminated and the Conversion abandoned at any time prior to the Effective Time by the action of the Board of Directors of the Company. In the event of termination of this Plan and abandonment of the Conversion, this Plan shall become void and of no further force and effect without liability on the part of any party hereto or their respective officers and agents.

ARTICLE II. CONVERSION; CERTIFICATES; COVENANTS

Section 2.01 Conversion of Shares.

| | (a) | At the Effective Time, by virtue of the Conversion and without any action on the part of the Company or the shareholders of the Company, each share of common stock of the Company, par value $1.00, shall be converted into one share of common stock, par value $1.00 per share (the “Common Stock”) of the Corporation (the “Conversion Rate”). |

| | | |

| | (b) | All warrants, options and other rights to acquire shares of common stock of the Company outstanding at the time of the Conversion shall automatically be converted to the right to receive Common Stock at the Conversion Rate, with equitable adjustments to the purchase price or conversion terms thereof, and shall thereafter constitute a right to acquire the Common Stock as set forth herein and therein. |

Section 2.02 Recordation of Shares.

| | (a) | Shares of Common Stock issued in connection with the Conversion shall be uncertificated unless otherwise determined by the Board of Directors of the Corporation, and the Corporation shall record such shares of Common Stock into which the common stock of the Company shall have been converted as a result of the Conversion in book-entry form in the books and records of the Corporation. |

| | | |

| | (b) | The shares of Common Stock issued upon the conversion of the common stock of the Company in accordance with the terms hereof shall be deemed to have been issued in full satisfaction of all rights pertaining to such shares of common stock of the Company, and shall, when issued, be duly authorized, validly issued, fully paid and non-assessable shares of Common Stock, as applicable. |

Section 2.03 Covenants.

| | (a) | Subject to the terms and conditions of this Plan, the Board of Directors of the Company and the officers of the Company (each, a “Party”) will use their commercially reasonable efforts to take, or cause to be taken, all actions and to do, or cause to be done, all things necessary or desirable to consummate the transactions contemplated by this Plan. Each Party shall execute and deliver such other documents, certificates, agreements and other writings and to take such other actions as may be necessary or appropriate in order to consummate or implement expeditiously the transactions contemplated hereunder. |

| | | |

| | (b) | The Parties agree to treat, for U.S. federal, state and local Tax purposes, the transactions contemplated by this Plan as governed by Section 368 of Internal Revenue NRS of 1986, as amended, and to report consistently with such treatment for all U.S. federal, state and local Tax purposes. |

ARTICLE III. MISCELLANEOUS

Section 3.01 Governing Law. This Plan shall be governed by, enforced, and construed under and in accordance with the laws of the Commonwealth of Virginia and the laws of the State of Nevada, without giving effect to the principles of conflicts of law thereunder.

Section 3.02 Entire Agreement. This Plan represent the entire agreement between the Parties relating to the subject matter thereof and supersedes all prior agreements, understandings and negotiations, written or oral, with respect to such subject matter.

Section 3.03 Amendment; Waiver. At any time prior to the Effective Date, this Plan may be amended, modified, superseded, terminated or cancelled, and any of the terms, covenants, representations, warranties or conditions hereof may be waived, only by a written instrument executed by the Board of Directors and shareholders of the Company holding a majority of the issued and outstanding shares of common stock of the Company.

Section 3.04 Headings. The headings contained in this Plan are intended solely for convenience and shall not affect the rights of the Parties.

*****

Exhibit A

Virginia Articles of Conversion

(Attached)

Articles of Conversion

Of

Waterside Capital Corporation

A Virginia Corporation

These Articles of Conversion (these “Articles”) are being filed by Waterside Capital Corporation, a Virginia corporation (the “Corporation”) pursuant to the provisions of the Virginia Stock Corporation Act (the “Act”) in connection with the conversion of the Corporation from a Virginia corporation to a corporation organized under the laws of the State of Nevada (the “Conversion”).

| | 1. | The name of the converting entity is Waterside Capital Corporation, a Nevada stock corporation (the “Corporation”). |

| | | |

| | 2. | The original name of the Corporation was Eastern Virginia Small Business Investment Corporation. |

| | | |

| | 3. | The date of formation of the Corporation was July 13, 1993. |

| | | |

| | 4. | The Corporation was originally formed in the Commonwealth of Virginia. |

| | | |

| | 5. | The Corporation is converting to a converting to a corporation under the laws of the State of Nevada. The name of the converted corporation in the State of Nevada shall be Waterside Capital Corporation. |

| | | |

| | 6. | The Plan of Conversion pursuant to which the Conversion is being undertaken (the “Plan”) is attached hereto as Exhibit A. |

| | | |

| | 7. | The Plan was approved and adopted by the Board of Directors of the Corporation on October 7, 2021. |

| | | |

| | 8. | The Plan was submitted by the Board of Directors of the Corporation to the shareholders of the Corporation in accordance with Chapter 9 of Title 13 of the Code of Virginia (the Virginia Stock Corporation Act) as was duly approved by the shareholders in the manner required by Chapter 9 of Title 13 of the Code of Virginia (the Virginia Stock Corporation Act) and the Articles of Incorporation of the Corporation, at a special meeting of the shareholders of the Corporation on November 15, 2021. |

| | | |

| | 9. | The Corporation revokes the authority of its registered agent to accept service on its behalf and appoints the clerk of the State Corporation Commission of Virginia as an agent for service of process in any proceeding based on a cause of action arising during the time it was incorporated in the Commonwealth of Virginia. |

| | | |

| | 10. | The mailing address to which the clerk of the State Corporation Commission of Virginia may mail a copy of any process served on the clerk under Section 9 is: Waterside Capital Corporation, Attn: Ryan Schadel, PO Box 1571, Cumming, Georgia, 30028. |

| | | |

| | 11. | The Corporation commits to notify the clerk of the State Corporation Commission of Virginia in the future of any change in its mailing address after the conversion becomes effective. |

| | 12. | The conversion is permitted by and was approved in accordance with the organic law of the Corporation as a foreign eligible entity. |

These Articles of Conversion of Waterside Capital Corporation have been duly executed as of the 15th day of November 2021.

| | Waterside Capital Corporation |

| | | |

| | By: | |

| | Name: | Ryan Schadel |

| | Title: | Chief Executive Officer |

Exhibit A

Plan of Conversion

(Attached)

[Intentionally omitted from

Exhibit]

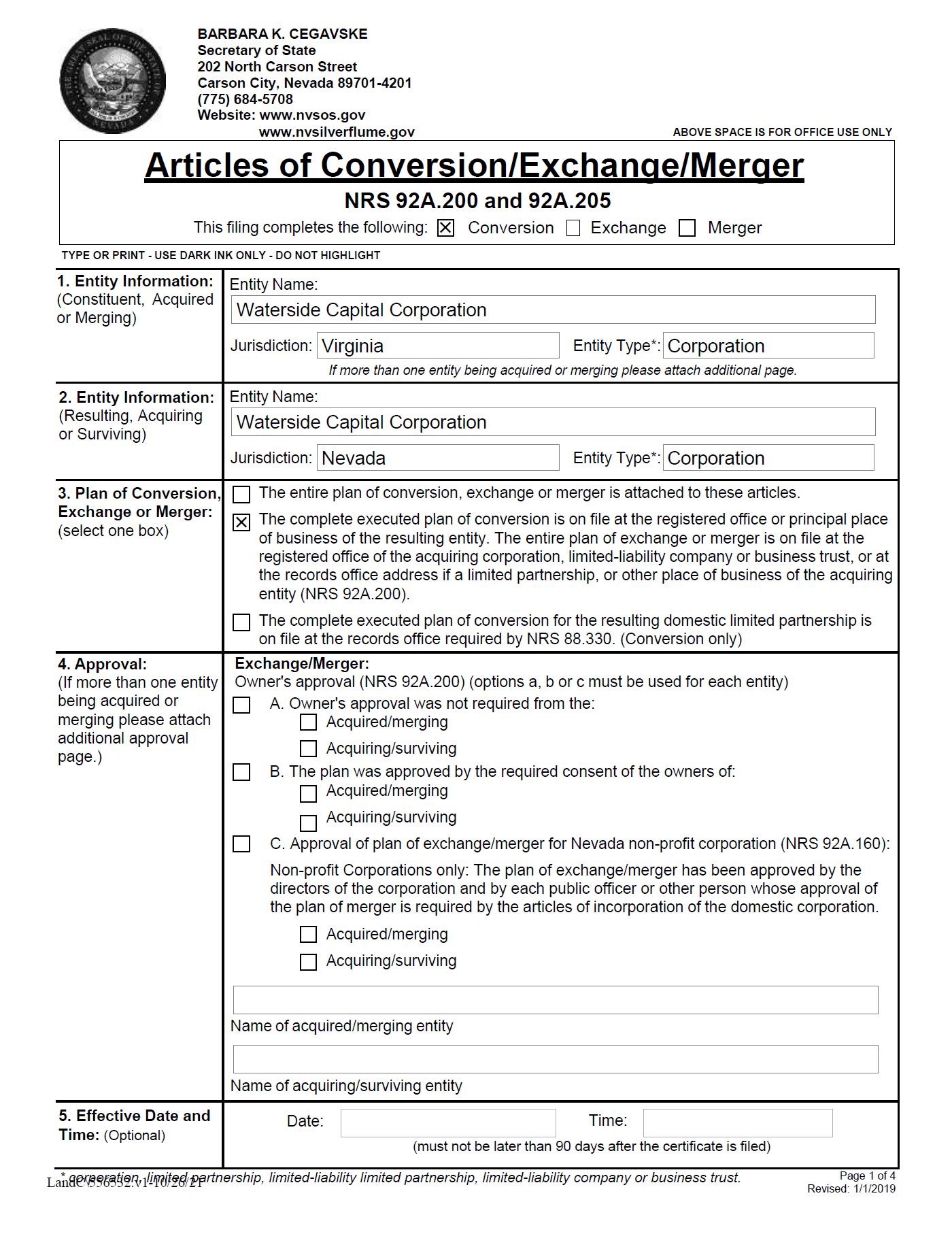

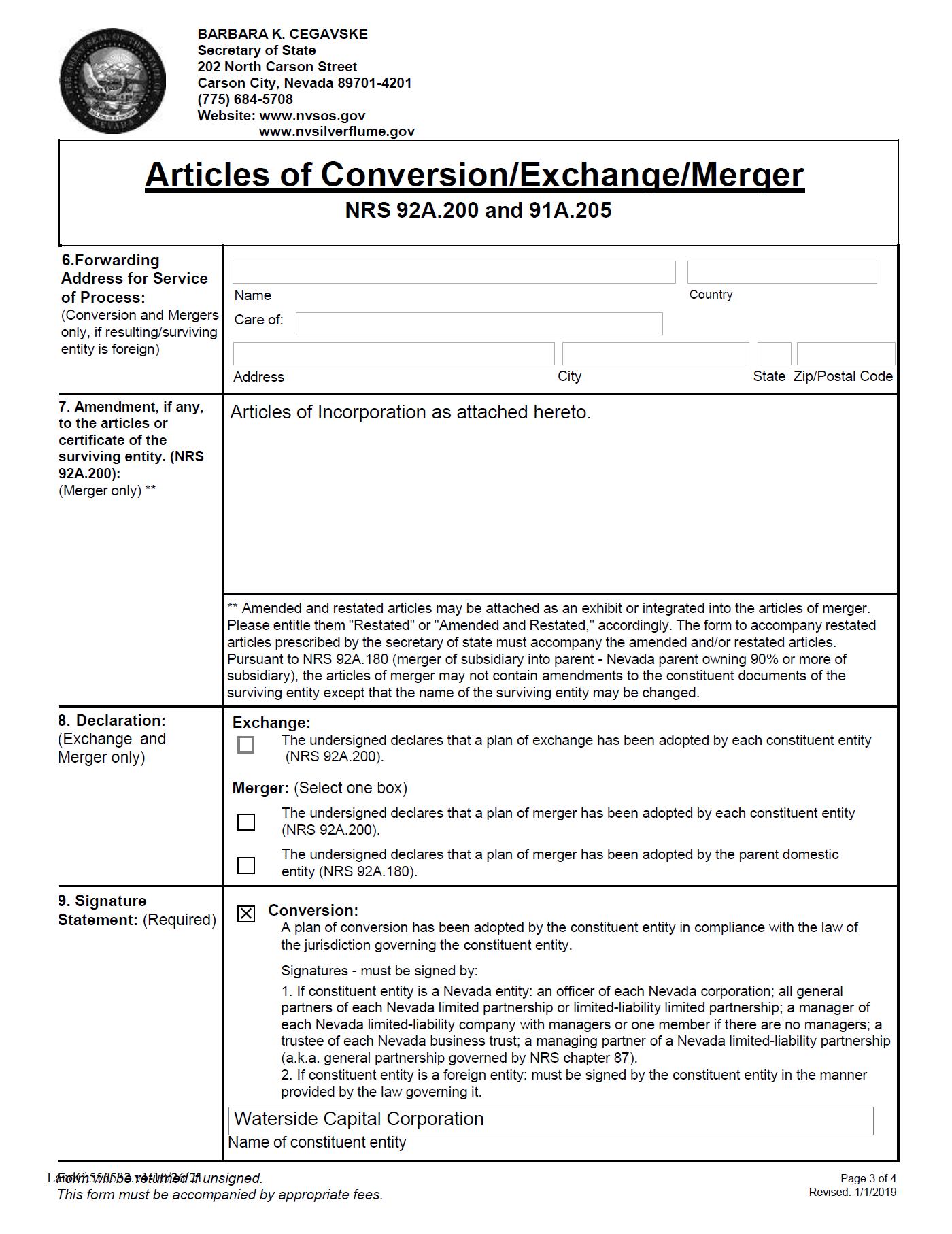

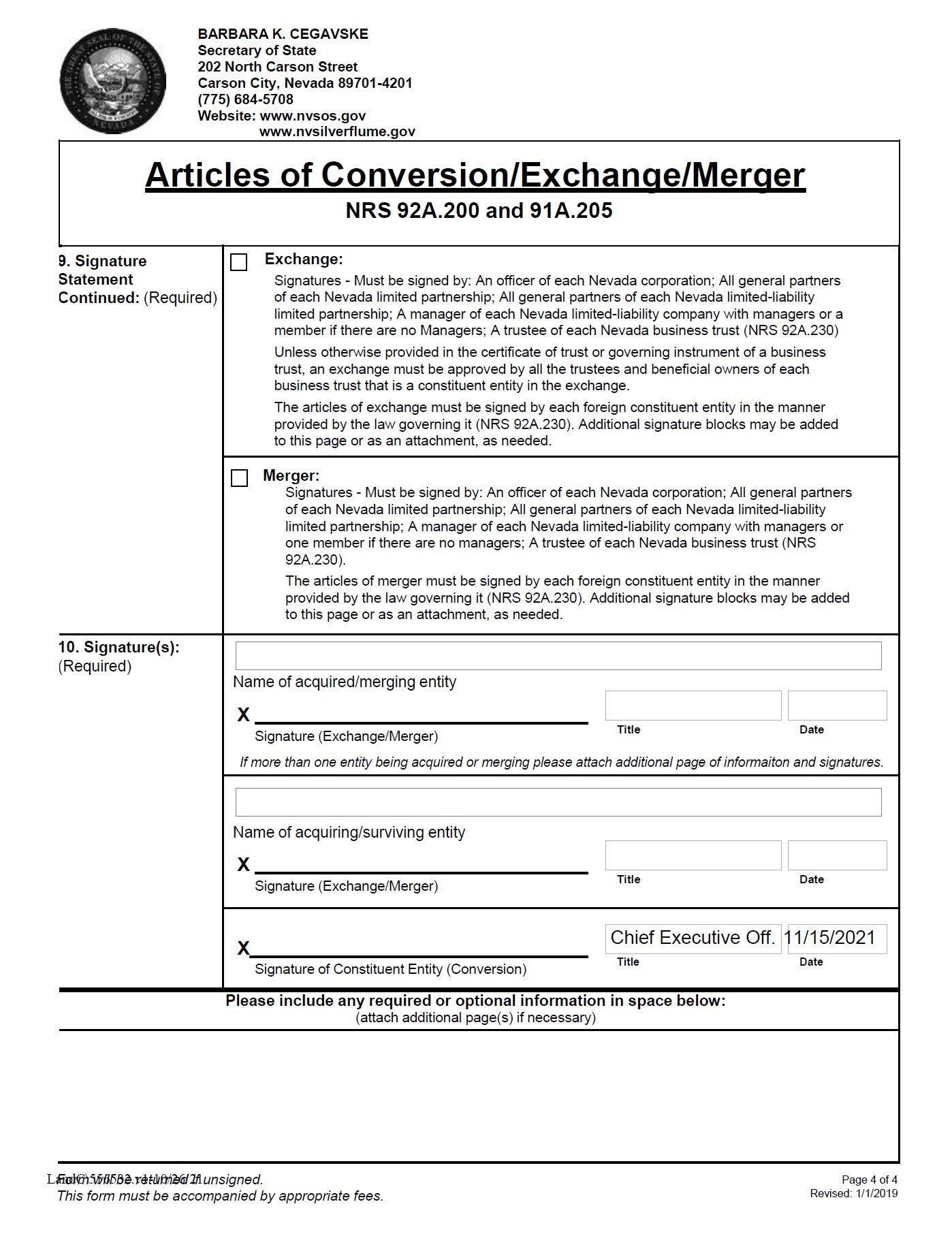

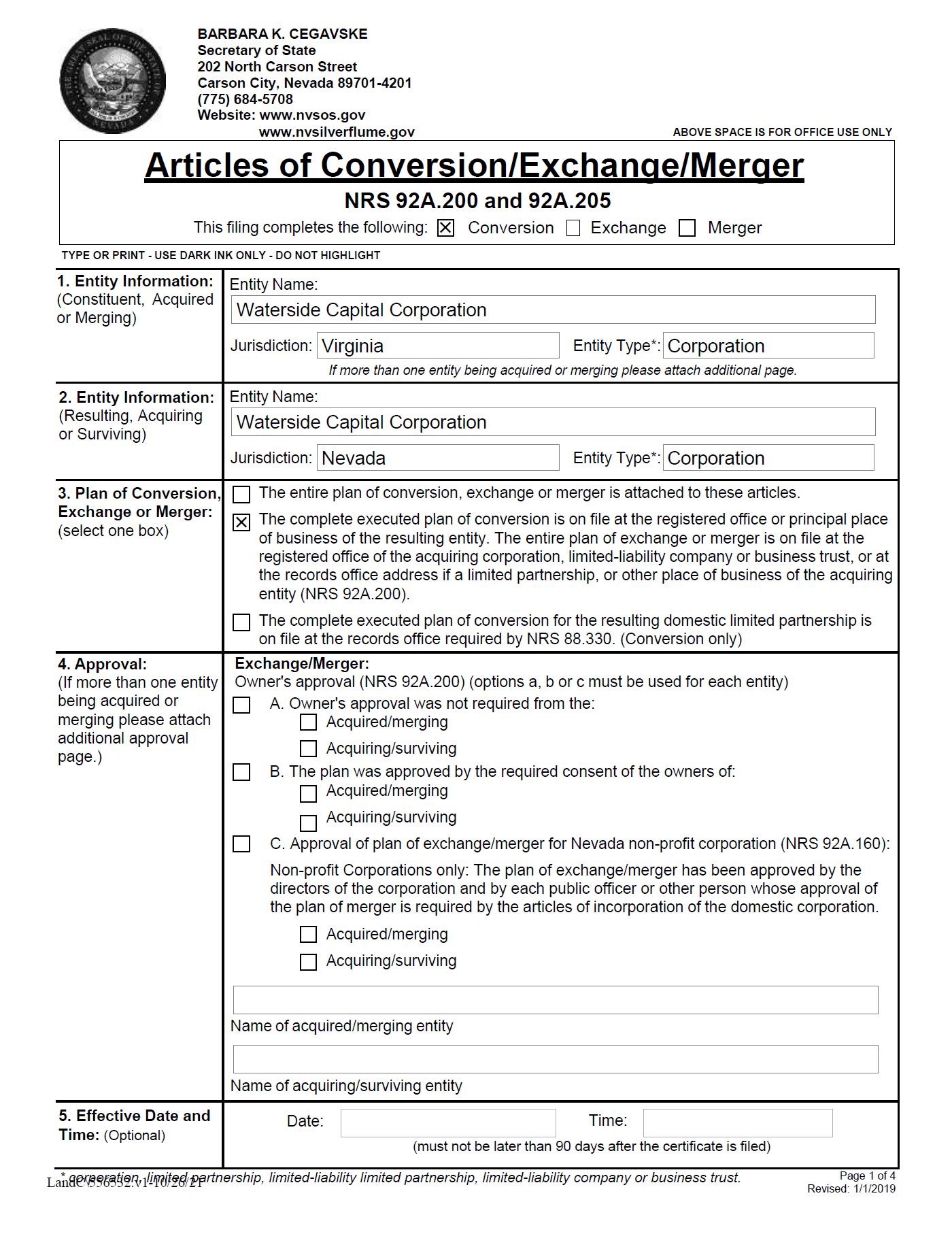

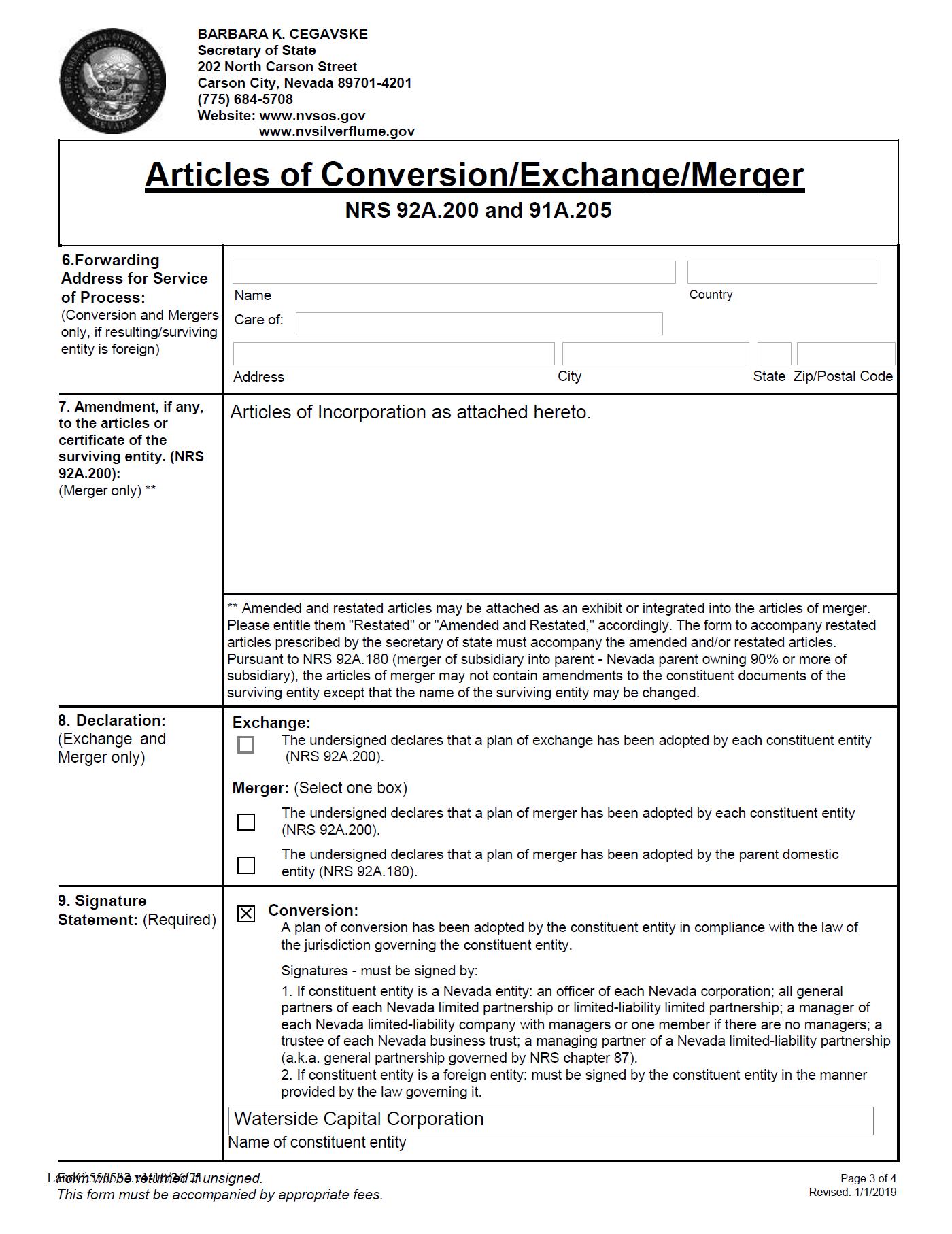

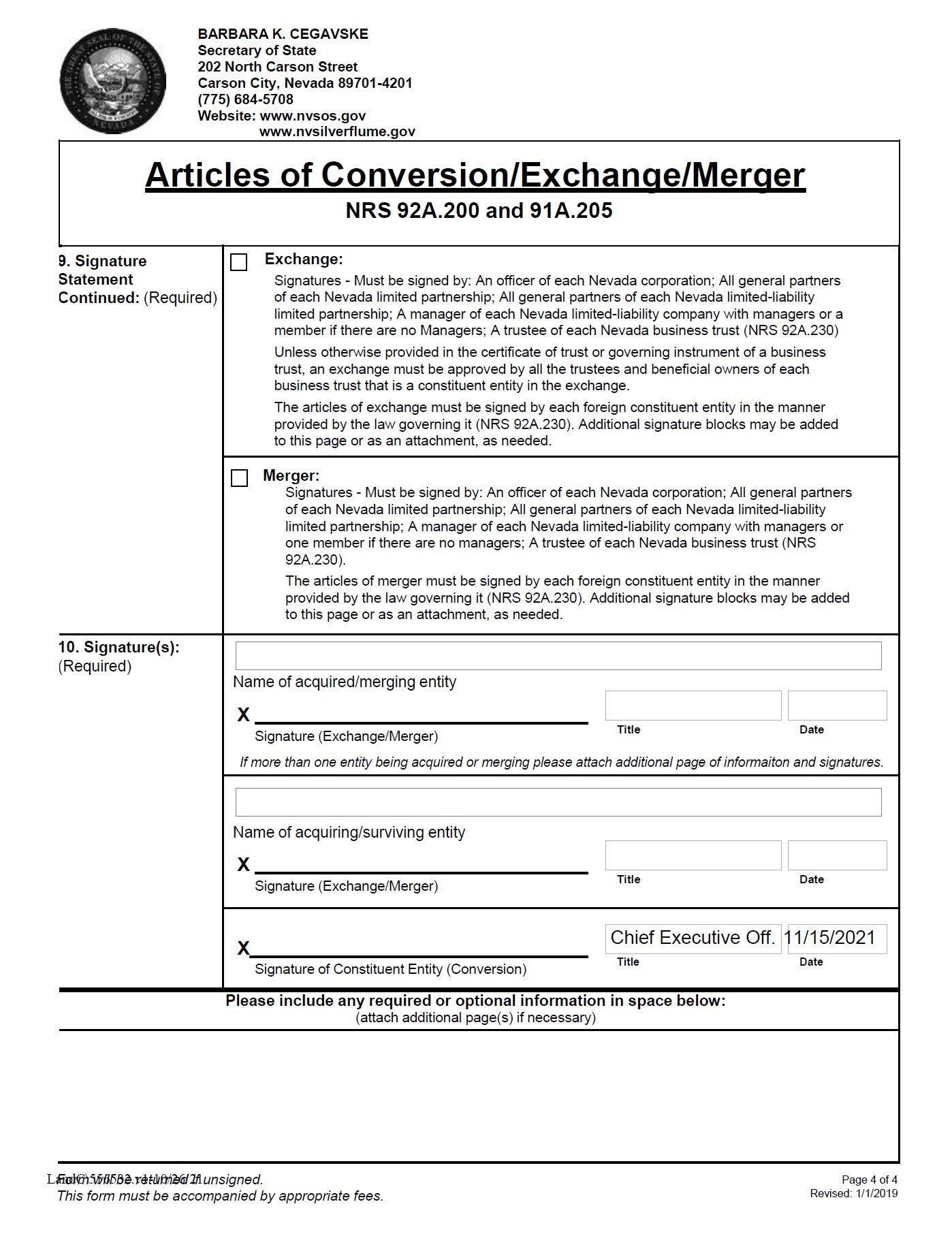

Exhibit B

Nevada Articles of Conversion

(Attached)

ARTICLES OF INCORPORATION

OF

Waterside Capital Corporation

The undersigned incorporator, in order to form a corporation pursuant to the Nevada Revised Statutes (the “NRS”), Chapter 78, certifies as follows:

Article I. Name. The name of the corporation is Waterside Capital Corporation (the “Corporation”).

Article II. Purpose.

Section 2.01 This Corporation is organized and chartered solely for the purpose of operating under the Small Business Investment Act of 1958, as amended (“SBIC Act”), and will operate in the manner and shall have the powers, responsibilities and be subject to the limitations provided by the SBIC Act and the regulations issued by the Small Business Administration (“SBA”) thereunder.

Section 2.02 Subject to the above, the Corporation shall have the power to do all things necessary or convenient to carry out its business and affairs and to engage in any lawful activity not required to be stated in these Articles of Incorporation, including, but not limited to, those activities and powers set forth in the NRS.

Section 2.03 Subject to the above, the powers and purposes in these Articles of Incorporation shall not be deemed to exclude in any way or limit by inference any powers or purposes granted to the Corporation by the laws of the State of Nevada, now or subsequently in effect, or implied by any reasonable construction of such laws.

Article III. Authorized Shares.

Section 3.01 Number and Designation. The aggregate number and designation of shares which the Corporation shall have the authority to issue and the par value per share are as follows: 10,000,000 shares of Common Stock, par value $1.00 per share, and 25,000 shares of Preferred Stock, par value 1.00 per share.

Section 3.02 Preemptive Rights. No holder of outstanding shares of any class shall have any preemptive right with respect to (i) any shares of any class of the Corporation, whether now or hereafter authorized, (ii) any warrants, rights or options to purchase any such shares, or (iii) any obligations convertible into or exchangeable for any such shares or into warrants, rights or options to purchase any such shares.

Article IV. Preferred Shares.

Section 4.01 Issuance in Series. The Board of Directors is authorized to issue the Preferred Shares from time to time in one or more series and to provide for the designation, preferences, limitations and relative rights of the shares of each series by the adoption of Articles of Amendment to the Articles of Incorporation of the Corporation setting forth:

| | (i) | The maximum number of shares in the series and the designation of the series, which designation shall distinguish the shares thereof from the shares of any other series or class; |

| | | |

| | (ii) | Whether shares of the series shall have special, conditional or limited voting rights, or no right to vote, except to the extent prohibited by law; |

| | (iii) | Whether shares of the series are redeemable or convertible (a) at the option of the Corporation, a shareholder or another person or upon the occurrence of a designated event, (b) for cash, indebtedness, securities or other property, and (c) in a designated amount or in an amount determined in accordance with a designated formula or by reference to extrinsic data or events: |

| | | |

| | (iv) | Any right of holders of shares of the series to distributions, calculated in any manner, including the rate or rates of dividends, and whether dividends shall be cumulative, noncumulative or partially cumulative; |

| | | |

| | (v) | The amount payable upon the shares of the series in the event of voluntary or involuntary liquidation. dissolution or winding up of the affairs of the Corporation; |

| | | |

| | (vi) | Any preference of the shares of the series over the shares of any other series or class with respect to distributions, including dividends, and with respect to distributions upon the liquidation, dissolution or winding up of the affairs of the Corporation; and |

| | | |

| | (vii) | Any other preferences, limitations or specified rights (including a right that no transaction of a specified nature shall be consummated while any shares of such series remain outstanding except upon the assent of all or a specified portion of such shares) now or hereafter permitted by the laws of the State of Nevada and not inconsistent with the provisions of this Section 4.01. |

| | | |

| | (viii) | Except as to the designations. preferences, limitations and relative rights of each series of Preferred Shares which the Board of Directors is authorized to establish, as is hereinabove set forth, all preferred Shares. regardless of series, shal1 rank in a parity as to dividends (whether or not the dividend rates or payment dates are different) and as to rights in the liquidation, dissolution or winding up of the affairs of the Corporation (whether or not the redemption or liquidation prices are different). |

Section 4.02 Articles of Amendment. Before the issuance of any shares of a series, Articles of Amendment establishing such series shall be filed with and made effective by the Secretary of State of the State of Nevada, as required by law.

Article V. Committees.

Section 5.01 Executive Committee.

| | (i) | There shall be an Executive Committee of the Board of Directors, consisting of not less than five nor greater than nine Directors who shall be elected annually by the Board of Directors. The Executive Committee shall at least annually elect one (1) of its members to preside at all meetings of the Executive Committee. The Executive Committee shall hold such regular meetings as its members shall determine, and. in addition, shall meet on call of the president or of any two members of the Executive Committee. |

| | (ii) | The Executive Committee shall have and may exercise all of the authority of the Board of Directors in the management of the property, business and affairs of the Corporation including approving the Corporation’s investments and valuing the assets of the Corporation; provided. however. that the Executive Committee shall not have the power to approve an amendment to the Articles of Incorporation, a plan of merger or consolidation. a sale, lease. exchange, pledge, mortgage or other disposition of all or substantially all of the property and assets of the Corporation other than in the usual and regular course of business, the voluntary dissolution of the Corporation. the revocation of voluntary dissolution proceedings, or to take any action prohibited by express resolution of the Board of Directors. The Executive Committee shall not have the power to fill vacancies on the Board of Directors or to adopt, amend or repeal the Bylaws. Any action duly taken by the Executive Committee within the course and scope of its authority shall bind the Corporation. The Executive Committee shall report at the next regular or special meeting of the Board of Directors any significant action taken on behalf of the Board of Directors since the last regular or special meeting of the Board of Directors. |

| | | |

| (iii) | The Board of Directors, by resolution adopted by a majority of Directors at the annual meeting, shall appoint all members of the Executive Committee. The Chairperson of the Board shall propose and submit his or her recommendations for appointments to the Executive Committee. The Board of Directors shall also consider any additional recommendations brought before it by motion of a Director and duly seconded by another Director. All members shall be appointed by confirmation of the Board of Directors. Members of the Executive Committee shall hold office for a one-year term or until their successors are elected by the Board of Directors, their committee is dissolved by the Board of Directors or their committee stands discharged. Any member of the Executive Committee may resign at any time by giving written notice of his or her intention to do so to the Board of Directors or may be removed, with or without cause, at any time by vote of a majority of the Board of Directors. |

Article VI. Registered Office and Registered Agent. The name and address of the registered agent of the Corporation in the State of Nevada is Corporate Creations Network Inc., 8275 South Eastern Avenue #200, Las Vegas, NV 89123, or such other agent and address as the Board of Directors of the Corporation shall from time to time select.

Article VII. Indemnification.

Section 7.01 Standard of Care.

| | (i) | Neither the Board of Directors, any Investment Advisor/manager nor any shareholder, officer or employee nor any Affiliate of any thereof shall be liable to the Corporation for any action taken or omitted to be taken by it or any other person in good faith and in a manner they reasonably believed to be in, or not opposed to, the best interests of the Corporation. and. with respect to any criminal action or proceeding, had no reasonable cause to believe their conduct was unlawful. |

| | | |

| | (ii) | The Board of Directors and any Investment Advisor/manager, the stockholders, officers. employees and partners of either thereof and any member of a Corporation committee or board. may consult with reputable legal counsel selected by them and shall be fully protected, and shall incur no liability to the Corporation in acting or refraining to act in good faith in reliance upon the opinion or advice of such counsel. |

| | | |

| | (iii) | This Section 7.01 shall not constitute a modification, limitation or waiver of 15 U.S.C.A. 314(b), or a waiver by the SBA of any of its rights pursuant to such Section 314(b). |

| | | |

| | (iv) | In addition to the standards of care set forth in this Section 7.01 the Bylaws may also provide for additional standards of care which must also be met. |

Section 7.02 Indemnification.

| | (i) | The Corporation shall indemnify and hold harmless. but only to the extent of Assets Under Management, the Board of Directors, any Investment Advisor/manager, and any shareholder, officer, employee or any Affiliate of any thereof from any and all costs. expenses. damages, claims. liabilities, fines and judgments (including the reasonable cost of the defense of any claim or action and any sums which may be paid with the consent of the Corporation in settlement thereof) which may be incurred by or asserted against such person or entity, by reason of any action taken or omitted to be taken on behalf of the Corporation and in furtherance of its interests. |

| | | |

| | (ii) | The Corporation shall have the power, in the discretion of the Board of Directors, to agree to indemnify on the same terms as set forth in Section 7.02(i) any person who is or was serving, pursuant to a prior written request from the Corporation. as a consultant to, agent for, or representative of, the Corporation as a director, officer, employee, agent of or consultant to another corporation, partnership, joint venture, trust or other enterprise, against any liability asserted against such person and incurred by such person in any such capacity, or arising out of such person’s status as such. |

| | | |

| | (iii) | No person shall be entitled to claim any indemnity or reimbursement under Section 7.02(i) or Section 7.02(ii) in respect of any cost, expense, damage, liability, claim. fine, judgment (including any cost of the defense of any claim, action, suit, proceeding or investigation, by or before any court or administrative or legislative body or authority) that may be incurred by such person which results from the failure of such person to act in accordance with the provisions of these Articles and the applicable standard of care set forth in Section 7.01. The termination of any action. suit or proceeding by judgment, order. settlement. conviction, or upon a plea of nolo contendere or its equivalent, shall not. of itself. preclude a determination that such person acted in accordance with the applicable standard of care set forth in Section 7.01. |

| | | |

| | (iv) | To the extent that a person claiming indemnification under Section 7.02(i) or Section 7.02(ii) has been successful on the merits in defense of any action, suit or proceeding referred to in Section 7.02(i) or Section 7.02(ii) or in defense of any claim, issue or matter therein, such person shall be indemnified with respect to such matter as provided in such Section. Except as provided in the foregoing sentence and as provided in Section 7.02(vii) with respect to advance payments. any indemnification under this Section 7.02 shall be paid only upon determination that the person to be indemnified has met the applicable standard of conduct set forth in Section 7.02(i). |

| | | |

| | (v) | A determination that a person to be indemnified under this Section 7.02 has met the applicable standard set forth in Section 7.02(i) shall be made by (a) the Board of Directors with respect to indemnification of any person other than a person claiming indemnification under Section 7.02(i), (b) a committee of the Corporation whose members are not affiliated with the Board of Directors or any Investment Advisor/Manager with respect to indemnification of any person indemnified under Section 7.02(i), or (c) at the election of the Board of Directors. independent legal counsel selected by the Board of Directors with respect to the indemnification of any person indemnified under Section 7.02 in a written opinion. |

| | (vi) | In making any such determination with respect to indemnification under Section 7.02(v), the Corporation, a committee of the Corporation whose members are not affiliated with the Board of Directors or any Investment Advisor/manager or independent legal counsel, as the case may be. shall be authorized to make such determination on the basis of its evaluation of the records of the Corporation or any Investment Advisor/manager to the Corporation and of the statements of the party seeking indemnification with respect to the matter in question and shall not be required to perform any independent investigation in connection with any such determination. Any party making any such determination is authorized, however, in its sole discretion, to take such other actions (including engaging counsel) as it deems advisable in making such determination. |

| | | |

| | (vii) | Expenses incurred by any person in respect of any such costs, expenses, damages. claims, liabilities. fines, and judgments (including any cost of the defense of any claim, action. suit, proceeding or investigation, by or before any court or administrative or legislative body or authority) may be paid by the Corporation in advance of the final disposition of any such claim or action upon receipt of any undertaking by or on behalf of such person to repay such amount unless it shall ultimately be determined as provided in Section 7.02(iv) or (v) that such person is entitled to be indemnified by the Corporation as authorized in this Section. |

| | |

| | (viii) | The rights provided by this Section 7.02 shall inure to the benefit of the heirs, executors, administrators. successors, and assigns of each person eligible for indemnification hereunder. |

| | |

| | (ix) | The rights to indemnification provided in this Section 7.02 shall be the exclusive rights of all those seeking indemnification to indemnification by the Corporation. No director, officer, employee, or agent of the Corporation shall enter into, or make any claim under, any other agreement with the Corporation (whether direct or indirect) providing for indemnification. The Board of Directors shall not enter into any agreement with any person which is an employee. officer, partner or shareholder. or an affiliate. associate or control person of any of the foregoing providing for indemnification of any such person unless such agreement provides for a determination with respect to such indemnification as provided under Section 7.02(v), clause (b) or (c). The provisions of this Section 7.02 shall not apply to indemnification of any person which is not at the expense (whether in whole or in part) of the Corporation. |

| | | |

| | (x) | The Corporation may purchase and maintain insurance on its own behalf, or on behalf of any person or entity, with respect to liabilities of the types described in this Section 7.02. The Corporation may purchase such insurance regardless of whether such person is acting in a capacity described in this Section 7.02 or whether the Corporation would have the power to indemnify such person against such liability under the provisions of this Section 7.02. |

Article VIII. Consent to Removal of Officers and Directors and/or Appointment of Receiver by the Small Business Administration

Section 8.01 Upon the occurrence of any of the events specified in 13 C.F.R. 107.1810(d)(l)-(6), 107.1810(f)(l)-(3), 107.1820(b) or 107.1820(c) as determined by the SBA, SBA shall have the right, and the corporation consents to, SBA’s exercise of such right:

| | (i) | upon written notice, to require the corporation to replace, with individuals approved by SBA, one or more of the Corporation’s officers and/or such number of members of . the Corporation’s Executive Committee as is sufficient to constitute a majority of such Executive Committee; or |

| | (ii) | to obtain the appointment of SBA or its designee as receiver of the corporation pursuant to § 31l(c) of the SBIC Act for the purpose of continuing to operate the Corporation. |

Article IX. SBIC Provisions

Section 9.01 Approval of Executive Committee and Officers. No person may serve as an Executive Committee Member or officer of the Corporation without the prior approval of the SBA.

Section 9.02 SBA As Third Party Beneficiary. The SBA shall be deemed an express third party beneficiary of the provisions of these Articles of Incorporation to the extent of the rights of the SBA hereunder and under the SBIC Act, and the SBA shall be entitled to enforce such provisions for its benefit.

IN WITNESS WHEREOF, the undersigned has executed these Articles of Incorporation as of November 15, 2021.

| | Sole Incorporator |

| | | |

| | By: | |

| | | Ryan Schadel |

Exhibit C

Articles of Incorporation

(Attached)

ARTICLES OF INCORPORATION

OF

Waterside Capital Corporation

The undersigned incorporator, in order to form a corporation pursuant to the Nevada Revised Statutes (the “NRS”), Chapter 78, certifies as follows:

Article I. Name. The name of the corporation is Waterside Capital Corporation (the “Corporation”).

Article II. Purpose.

Section 2.01 This Corporation is organized and chartered solely for the purpose of operating under the Small Business Investment Act of 1958, as amended (“SBIC Act”), and will operate in the manner and shall have the powers, responsibilities and be subject to the limitations provided by the SBIC Act and the regulations issued by the Small Business Administration (“SBA”) thereunder.

Section 2.02 Subject to the above, the Corporation shall have the power to do all things necessary or convenient to carry out its business and affairs and to engage in any lawful activity not required to be stated in these Articles of Incorporation, including, but not limited to, those activities and powers set forth in the NRS.

Section 2.03 Subject to the above, the powers and purposes in these Articles of Incorporation shall not be deemed to exclude in any way or limit by inference any powers or purposes granted to the Corporation by the laws of the State of Nevada, now or subsequently in effect, or implied by any reasonable construction of such laws.

Article III. Authorized Shares.

Section 3.01 Number and Designation. The aggregate number and designation of shares which the Corporation shall have the authority to issue and the par value per share are as follows: 10,000,000 shares of Common Stock, par value $1.00 per share, and 25,000 shares of Preferred Stock, par value 1.00 per share.

Section 3.02 Preemptive Rights. No holder of outstanding shares of any class shall have any preemptive right with respect to (i) any shares of any class of the Corporation, whether now or hereafter authorized, (ii) any warrants, rights or options to purchase any such shares, or (iii) any obligations convertible into or exchangeable for any such shares or into warrants, rights or options to purchase any such shares.

Article IV. Preferred Shares.

Section 4.01 Issuance in Series. The Board of Directors is authorized to issue the Preferred Shares from time to time in one or more series and to provide for the designation, preferences, limitations and relative rights of the shares of each series by the adoption of Articles of Amendment to the Articles of Incorporation of the Corporation setting forth:

| | (i) | The maximum number of shares in the series and the designation of the series, which designation shall distinguish the shares thereof from the shares of any other series or class; |

| | (ii) | Whether shares of the series shall have special, conditional or limited voting rights, or no right to vote, except to the extent prohibited by law; |

| | (iii) | Whether shares of the series are redeemable or convertible (a) at the option of the Corporation, a shareholder or another person or upon the occurrence of a designated event, (b) for cash, indebtedness, securities or other property, and (c) in a designated amount or in an amount determined in accordance with a designated formula or by reference to extrinsic data or events: |

| | | |

| | (iv) | Any right of holders of shares of the series to distributions, calculated in any manner, including the rate or rates of dividends, and whether dividends shall be cumulative, noncumulative or partially cumulative; |

| | | |

| | (v) | The amount payable upon the shares of the series in the event of voluntary or involuntary liquidation. dissolution or winding up of the affairs of the Corporation; |

| | | |

| | (vi) | Any preference of the shares of the series over the shares of any other series or class with respect to distributions, including dividends, and with respect to distributions upon the liquidation, dissolution or winding up of the affairs of the Corporation; and |

| | | |

| | (vii) | Any other preferences, limitations or specified rights (including a right that no transaction of a specified nature shall be consummated while any shares of such series remain outstanding except upon the assent of all or a specified portion of such shares) now or hereafter permitted by the laws of the State of Nevada and not inconsistent with the provisions of this Section 4.01. |

| | | |

| | (viii) | Except as to the designations. preferences, limitations and relative rights of each series of Preferred Shares which the Board of Directors is authorized to establish, as is hereinabove set forth, all preferred Shares. regardless of series, shal1 rank in a parity as to dividends (whether or not the dividend rates or payment dates are different) and as to rights in the liquidation, dissolution or winding up of the affairs of the Corporation (whether or not the redemption or liquidation prices are different). |

Section 4.02 Articles of Amendment. Before the issuance of any shares of a series, Articles of Amendment establishing such series shall be filed with and made effective by the Secretary of State of the State of Nevada, as required by law.

Article V. Committees.

Section 5.01 Executive Committee.

| | (i) | There shall be an Executive Committee of the Board of Directors, consisting of not less than five nor greater than nine Directors who shall be elected annually by the Board of Directors. The Executive Committee shall at least annually elect one (1) of its members to preside at all meetings of the Executive Committee. The Executive Committee shall hold such regular meetings as its members shall determine, and. in addition, shall meet on call of the president or of any two members of the Executive Committee. |

| | | |

| | (ii) | The Executive Committee shall have and may exercise all of the authority of the Board of Directors in the management of the property, business and affairs of the Corporation including approving the Corporation’s investments and valuing the assets of the Corporation; provided. however. that the Executive Committee shall not have the power to approve an amendment to the Articles of Incorporation, a plan of merger or consolidation. a sale, lease. exchange, pledge, mortgage or other disposition of all or substantially all of the property and assets of the Corporation other than in the usual and regular course of business, the voluntary dissolution of the Corporation. the revocation of voluntary dissolution proceedings, or to take any action prohibited by express resolution of the Board of Directors. The Executive Committee shall not have the power to fill vacancies on the Board of Directors or to adopt, amend or repeal the Bylaws. Any action duly taken by the Executive Committee within the course and scope of its authority shall bind the Corporation. The Executive Committee shall report at the next regular or special meeting of the Board of Directors any significant action taken on behalf of the Board of Directors since the last regular or special meeting of the Board of Directors. |

| | (iii) | The Board of Directors, by resolution adopted by a majority of Directors at the annual meeting, shall appoint all members of the Executive Committee. The Chairperson of the Board shall propose and submit his or her recommendations for appointments to the Executive Committee. The Board of Directors shall also consider any additional recommendations brought before it by motion of a Director and duly seconded by another Director. All members shall be appointed by confirmation of the Board of Directors. Members of the Executive Committee shall hold office for a one-year term or until their successors are elected by the Board of Directors, their committee is dissolved by the Board of Directors or their committee stands discharged. Any member of the Executive Committee may resign at any time by giving written notice of his or her intention to do so to the Board of Directors or may be removed, with or without cause, at any time by vote of a majority of the Board of Directors. |

Article VI. Registered Office and Registered Agent. The name and address of the registered agent of the Corporation in the State of Nevada is Corporate Creations Network Inc., 8275 South Eastern Avenue #200, Las Vegas, NV 89123, or such other agent and address as the Board of Directors of the Corporation shall from time to time select.

Article VII. Indemnification.

Section 7.01 Standard of Care.

| | (i) | Neither the Board of Directors, any Investment Advisor/manager nor any shareholder, officer or employee nor any Affiliate of any thereof shall be liable to the Corporation for any action taken or omitted to be taken by it or any other person in good faith and in a manner they reasonably believed to be in, or not opposed to, the best interests of the Corporation. and. with respect to any criminal action or proceeding, had no reasonable cause to believe their conduct was unlawful. |

| | | |

| | (ii) | The Board of Directors and any Investment Advisor/manager, the stockholders, officers. employees and partners of either thereof and any member of a Corporation committee or board. may consult with reputable legal counsel selected by them and shall be fully protected, and shall incur no liability to the Corporation in acting or refraining to act in good faith in reliance upon the opinion or advice of such counsel. |

| | | |

| | (iii) | This Section 7.01 shall not constitute a modification, limitation or waiver of 15 U.S.C.A. 314(b), or a waiver by the SBA of any of its rights pursuant to such Section 314(b). |

| | | |

| | (iv) | In addition to the standards of care set forth in this Section 7.01 the Bylaws may also provide for additional standards of care which must also be met. |

Section 7.02 Indemnification.

| | (i) | The Corporation shall indemnify and hold harmless. but only to the extent of Assets Under Management, the Board of Directors, any Investment Advisor/manager, and any shareholder, officer, employee or any Affiliate of any thereof from any and all costs. expenses. damages, claims. liabilities, fines and judgments (including the reasonable cost of the defense of any claim or action and any sums which may be paid with the consent of the Corporation in settlement thereof) which may be incurred by or asserted against such person or entity, by reason of any action taken or omitted to be taken on behalf of the Corporation and in furtherance of its interests. |

| | | |

| | (ii) | The Corporation shall have the power, in the discretion of the Board of Directors, to agree to indemnify on the same terms as set forth in Section 7.02(i) any person who is or was serving, pursuant to a prior written request from the Corporation. as a consultant to, agent for, or representative of, the Corporation as a director, officer, employee, agent of or consultant to another corporation, partnership, joint venture, trust or other enterprise, against any liability asserted against such person and incurred by such person in any such capacity, or arising out of such person’s status as such. |

| | | |

| | (iii) | No person shall be entitled to claim any indemnity or reimbursement under Section 7.02(i) or Section 7.02(ii) in respect of any cost, expense, damage, liability, claim. fine, judgment (including any cost of the defense of any claim, action, suit, proceeding or investigation, by or before any court or administrative or legislative body or authority) that may be incurred by such person which results from the failure of such person to act in accordance with the provisions of these Articles and the applicable standard of care set forth in Section 7.01. The termination of any action. suit or proceeding by judgment, order. settlement. conviction, or upon a plea of nolo contendere or its equivalent, shall not. of itself. preclude a determination that such person acted in accordance with the applicable standard of care set forth in Section 7.01. |

| | | |

| | (iv) | To the extent that a person claiming indemnification under Section 7.02(i) or Section 7.02(ii) has been successful on the merits in defense of any action, suit or proceeding referred to in Section 7.02(i) or Section 7.02(ii) or in defense of any claim, issue or matter therein, such person shall be indemnified with respect to such matter as provided in such Section. Except as provided in the foregoing sentence and as provided in Section 7.02(vii) with respect to advance payments. any indemnification under this Section 7.02 shall be paid only upon determination that the person to be indemnified has met the applicable standard of conduct set forth in Section 7.02(i). |

| | | |

| | (v) | A determination that a person to be indemnified under this Section 7.02 has met the applicable standard set forth in Section 7.02(i) shall be made by (a) the Board of Directors with respect to indemnification of any person other than a person claiming indemnification under Section 7.02(i), (b) a committee of the Corporation whose members are not affiliated with the Board of Directors or any Investment Advisor/Manager with respect to indemnification of any person indemnified under Section 7.02(i), or (c) at the election of the Board of Directors. independent legal counsel selected by the Board of Directors with respect to the indemnification of any person indemnified under Section 7.02 in a written opinion. |

| | (vi) | In making any such determination with respect to indemnification under Section 7.02(v), the Corporation, a committee of the Corporation whose members are not affiliated with the Board of Directors or any Investment Advisor/manager or independent legal counsel, as the case may be. shall be authorized to make such determination on the basis of its evaluation of the records of the Corporation or any Investment Advisor/manager to the Corporation and of the statements of the party seeking indemnification with respect to the matter in question and shall not be required to perform any independent investigation in connection with any such determination. Any party making any such determination is authorized, however, in its sole discretion, to take such other actions (including engaging counsel) as it deems advisable in making such determination. |

| | | |

| | (vii) | Expenses incurred by any person in respect of any such costs, expenses, damages. claims, liabilities. fines, and judgments (including any cost of the defense of any claim, action. suit, proceeding or investigation, by or before any court or administrative or legislative body or authority) may be paid by the Corporation in advance of the final disposition of any such claim or action upon receipt of any undertaking by or on behalf of such person to repay such amount unless it shall ultimately be determined as provided in Section 7.02(iv) or (v) that such person is entitled to be indemnified by the Corporation as authorized in this Section. |

| | | |

| | (viii) | The rights provided by this Section 7.02 shall inure to the benefit of the heirs, executors, administrators. successors, and assigns of each person eligible for indemnification hereunder. |

| | | |

| | (ix) | The rights to indemnification provided in this Section 7.02 shall be the exclusive rights of all those seeking indemnification to indemnification by the Corporation. No director, officer, employee, or agent of the Corporation shall enter into, or make any claim under, any other agreement with the Corporation (whether direct or indirect) providing for indemnification. The Board of Directors shall not enter into any agreement with any person which is an employee. officer, partner or shareholder. or an affiliate. associate or control person of any of the foregoing providing for indemnification of any such person unless such agreement provides for a determination with respect to such indemnification as provided under Section 7.02(v), clause (b) or (c). The provisions of this Section 7.02 shall not apply to indemnification of any person which is not at the expense (whether in whole or in part) of the Corporation. |

| | | |

| | (x) | The Corporation may purchase and maintain insurance on its own behalf, or on behalf of any person or entity, with respect to liabilities of the types described in this Section 7.02. The Corporation may purchase such insurance regardless of whether such person is acting in a capacity described in this Section 7.02 or whether the Corporation would have the power to indemnify such person against such liability under the provisions of this Section 7.02. |

Article VIII. Consent to Removal of Officers and Directors and/or Appointment of Receiver by the Small Business Administration

Section 8.01 Upon the occurrence of any of the events specified in 13 C.F.R. 107.1810(d)(l)-(6), 107.1810(f)(l)-(3), 107.1820(b) or 107.1820(c) as determined by the SBA, SBA shall have the right, and the corporation consents to, SBA’s exercise of such right:

| | (i) | upon written notice, to require the corporation to replace, with individuals approved by SBA, one or more of the Corporation’s officers and/or such number of members of . the Corporation’s Executive Committee as is sufficient to constitute a majority of such Executive Committee; or |

| | (ii) | to obtain the appointment of SBA or its designee as receiver of the corporation pursuant to § 31l(c) of the SBIC Act for the purpose of continuing to operate the Corporation. |

Article IX. SBIC Provisions

Section 9.01 Approval of Executive Committee and Officers. No person may serve as an Executive Committee Member or officer of the Corporation without the prior approval of the SBA.

Section 9.02 SBA As Third Party Beneficiary. The SBA shall be deemed an express third party beneficiary of the provisions of these Articles of Incorporation to the extent of the rights of the SBA hereunder and under the SBIC Act, and the SBA shall be entitled to enforce such provisions for its benefit.

IN WITNESS WHEREOF, the undersigned has executed these Articles of Incorporation as of November 15, 2021.

| | Sole Incorporator |

| | | |

| | By: | |

| | | Ryan Schadel |

Exhibit D

Bylaws

(Attached)

Bylaws of Waterside Capital Corporation

Article I. SHAREHOLDERS’ MEETINGS

Section 1.01 Annual Meeting. The annual meeting of the Shareholders for the election of directors and the transaction of such other business as may properly come before it shall be held at the principal office of Waterside Capital Corporation (the “Corporation”) in the State of Nevada, or at such place within or without the State of Nevada as shall be set forth in the notice of annual meeting. The meeting shall be held on the second Monday in July of each and every year, at 8:00 a.m. or at such other date and time as is designated in the notice of annual meeting. The Secretary shall give the notice of annual meeting, which shall include the place, date and hour of the meeting. Such notice shall be given, either personally or by U.S. mail, not less than ten (10) nor more than sixty (60) days before the meeting date. If mailed, the notice shall be addressed to the Shareholder at his address as it appears on the Corporation’s record of Shareholders, unless he shall have filed with the Secretary of the Corporation a written request that notices intended for him are to be mailed to a different address. Notice of annual meetings may be waived by a Shareholder by submitting a signed waiver to the Secretary of the Corporation either before or after the meeting, or by attendance at the meeting.

Section 1.02 Special Meeting. Special meetings of Shareholders, other than those regulated by statute, may be called at any time by a majority of the directors or by the President. A special Shareholder’s meeting must be called by the President upon written request of the holders of twenty percent (20%) of the outstanding shares entitled to vote at such special meeting. Written notice of special Shareholder’s meetings, stating the place within or without the State of Nevada, the date and hour of the meeting, the purpose or purposes for which it is called, and the name of the person by whom or at whose direction the meeting is called, shall be given not less than ten (10) nor more than sixty (60) days before the date set for the meeting. The notice shall be given to each Shareholder of record in the same manner as the notice of the annual meeting. No business other than that specified in the notice shall be transacted at any such special meeting. Notice of a special Shareholder’s meeting may be wsaived by submitting a signed waiver to the Secretary or by attendance at the meeting.

Section 1.03 Quorum. The presence, in person or by proxy, of the holders of a majority of the outstanding shares entitled to vote shall constitute a quorum for the transaction of business at all meetings of Shareholders. If a quorum does not exist, less than a quorum may adjourn the meeting to a future date at which a quorum shall be present or represented. At such adjourned meeting, any business may be transacted which might have been transacted at the meeting as originally called.

Section 1.04 Record Date. The Board of Directors may fix in advance the record date for the determination of Shareholders entitled to notice of a meeting, or for any other purposes requiring such a determination. The record date may not be more than seventy (70) days before the meeting or action. A determination of Shareholders entitled to notice of, or to vote at, a Shareholders meeting is effective for any adjournment of the meeting unless the meeting is adjourned to a date more than one hundred twenty (120) days after the date fixed for the original meeting. In such case, a new record date must be fixed, and notice must be given to all persons who are Shareholders as of the new record date.

Section 1.05 Voting. A Shareholder entitled to vote at a meeting may vote in person or by proxy. Except as otherwise provided by the Nevada Revised Statutes (the “NRS”) or the Articles of Incorporation, every Shareholder shall be entitled to one vote for each share standing in his name on the Corporation’s record of Shareholders. Except as otherwise provided by these Bylaws, the Articles of Incorporation, or the NRS, the affirmative vote of a majority of the shares represented at the meeting and entitled to vote shall be the act of the Shareholders.

Section 1.06 Proxies. Every proxy must be dated and signed by the Shareholder or by his attorney-in-fact. No proxy shall be valid after the expiration of eleven (11) months from the date of its execution, unless otherwise provided therein. Every proxy shall be revocable at the pleasure of the Shareholder executing it, except where an irrevocable proxy is permitted by statute.

Section 1.07 Consents. Actions required or permitted by the NRS, the Articles of Incorporation or these Bylaws, to be taken at a Shareholder meeting may be taken without a meeting if one or more written consents are signed by all the Shareholders entitled to vote on the action and such consents are delivered to the Secretary.

Article II. DIRECTORS

Section 2.01 Number and Qualifications. The board of directors (hereinafter, “Board of Directors” or “Board”) shall consist of at least three (3) members and not more than thirty- three (33). Directors need not be Shareholders of the Corporation. The number of directors may be changed by an amendment to the Bylaws adopted by the Shareholders.

Section 2.02 Manner of Election. The directors shall be elected at the annual meeting of the Shareholders by a plurality vote.

Section 2.03 Term of Office. The term of office of each director shall be until the next annual meeting of the Shareholders and until his successor has been duly elected and qualified.

Section 2.04 Duties and Powers. The Board of Directors shall control and manage the affairs and business of the Corporation. The directors may adopt such rules and regulations for the conduct of their meetings and the management of the Corporation as they may deem proper, not inconsistent with the NRS, the Articles of Incorporation or these Bylaws. The Board of Directors may elect a chairperson who shall preside at all meetings of the Board of Directors.

Section 2.05 Meetings. The Board of Directors shall meet for the election or appointment of officers and for the transaction of any other business as soon as practicable after the adjournment of the annual meeting of the Shareholders. Other regular meetings of the Board shall be held at such times as the Board may from time to time determine. Special meetings of the Board of Directors may be called by the President at any time. Upon the written request of any two directors, the President must call a special meeting to be held not more than seven (7) days after the receipt of such request.

Section 2.06 Notice of Meetings. No notice need be given of any regular meeting of the Board. The Secretary shall serve notice of special meetings upon each director in person or by regular U. S. Mail, addressed to him/her at his/her last known post office address, at least ten (10) days prior to the date of such meeting, specifying the time and place of the meeting and the business to be transacted. At any meeting at which all of the directors shall be present, although held without notice, any business may be transacted which might have been transacted if the meeting had been duly called.

Section 2.07 Place of Meeting. The Board of Directors may hold its meeting within or without the State of Nevada, at such place as may be designated in the notice of the meeting.

Section 2.08 Quorum. At any meeting of the Board of Directors, the presence of a majority of the Board shall constitute a quorum for the transaction of business. Should a quorum not be present, a lesser number may adjourn the meeting to some further time, not more than seven (7) days later.

Section 2.09 Voting. At all meetings of the Board of Directors, each director shall have one vote irrespective of the number of shares that he may hold. If a quorum is present for a Board meeting, the vote of a majority of the Board, except as otherwise provided by the NRS or the Articles of Incorporation, shall be the act of the Board.

Section 2.10 Compensation. Each director shall be entitled to receive for attendance at each meeting of the Board, or of any duly constituted committee of the Board, such fee as is fixed by the Board.

Section 2.11 Vacancies. Any vacancy occurring in the Board of Directors by death, resignation, or otherwise, shall be filled promptly by a majority vote of the remaining directors at a special meeting which shall be called for that purpose within thirty (30) days after the occurrence of the vacancy. The director thus chosen shall hold office for the unexpired term of his predecessor and until the election and qualification of his successor.

Section 2.12 Removal of Directors. The Shareholders may, by majority vote, remove a director with or without cause at a special meeting expressly called for such purpose. Notice of the meeting must specifically state that the purpose of the meeting is to remove the director. Except as otherwise prescribed by the NRS, a director may also be removed for cause by vote of a majority of the entire Board.

Section 2.13 Resignation. Any director may resign his office at any time by delivering written notice to the Board, the President or the Secretary. A resignation is effective upon delivery of the notice.

Article III. OFFICERS.

Section 3.01 Officers and Qualifications. The officers of the Corporation shall consist of a President and a Secretary. Other officers of the Corporation may include one (1) or more Vice Presidents, a Treasurer and such other officers as the Board of Directors may appoint. Except for the offices of President and Secretary, the same individual may simultaneously hold more than one (1) office.

Section 3.02 Election. All officers of the Corporation shall be elected annually by the Board of Directors at its meeting held immediately after the annual meeting of Shareholders.

Section 3.03 Term of Office. All officers shall hold office until their successors have been duly elected and have qualified, or until removed as hereinafter provided.

Section 3.04 Removal of Officers. Any officer may be removed with or without cause by the vote of a majority of the Board of Directors.

Section 3.05 Duties of Officers. The duties and powers of the officers of the Corporation shall be as follows and as shall hereafter be set by resolution of the Board of Directors:

| | (A) | The President shall preside at all meetings of the Board of Directors, unless the Board of Directors has elected a Chairperson, and at all meetings of the Shareholders. |

| | | |

| | (B) | He shall present at each annual meeting of the Shareholders and directors a report of the condition of the business of the Corporation. |

| | | |

| | (C) | He shall cause to be called regular and special meetings of the Shareholders and directors as required by the NRS and these Bylaws. |

| | | |

| | (D) | He shall, subject to the approval of the Board, appoint, discharge, and fix the compensation of all employees and agents of the Corporation other than the duly elected officers. |

| | | |

| | (E) | He has authority to sign and execute, in the name of the Corporation, all contracts, and all notes, drafts, or other orders for the payment of money. |

| | | |

| | (F) | He shall sign all certificates representing shares. |

| | | |

| | (G) | He shall cause all books, reports, statements, and certificates to be properly kept and filed as required by the NRS. |

| | | |

| | (H) | He shall enforce these Bylaws and perform all duties incident to his office required by the NRS. Generally, he shall supervise and control the business and affairs of the Corporation. |

| | | |

| | (I) | He shall, in the absence of any officer, resume any absent officer’s duties as set forth in these Bylaws. |

| | (2) | Vice President. During the absence or incapacity of the President, the Vice President in order of seniority of election shall perform the duties of the President, and when so acting, he shall have all the powers and be subject to all the responsibilities of the office of President, and shall perform such duties and functions as the Board may prescribe. |

| | (A) | The Secretary shall keep the minutes of the meetings of the Board of Directors and of the Shareholders in appropriate books. He shall also keep a record of all actions taken, with or without a meeting, by the Shareholders, Board of Directors or any committee of the Board. |

| | | |

| | (B) | He shall attend to the giving of notice of special meetings of the Board of Directors and of all the meetings of the Shareholders of the Corporation. |

| | | |

| | (C) | He shall be custodian of the records and seal of the Corporation and shall affix the seal to the certificates representing shares and other corporate papers when required. |

| | | |

| | (D) | He shall keep a record of the Shareholders containing the names of all Shareholders, their places of residence, the number and class of shares held by each and the dates when each became owners of record. He shall keep a record of all written communications to Shareholders generally within the past three (3) years. |

| | | |

| | (E) | He shall keep all records open for inspection, daily during the usual business hours, within the limits prescribed by the NRS. At the request of the person entitled to an inspection thereof, he shall prepare and make available a current list of the officers and directors of the Corporation and their business addresses. |

| | | |

| | (F) | He shall sign all certificates representing shares and affix the corporate seal. |

| | | |

| | (G) | He shall attend to all correspondence and present to the Board of Directors at its meeting all official communications received by him. |

| | | |

| | (H) | He shall perform all the duties incident to the office of Secretary of the Corporation. |

| | (A) | The Treasurer shall have the care and custody of and be responsible for all the funds and securities of the Corporation, and shall deposit funds and securities in the name of the Corporation in such banks or safe deposit companies as the Board of Directors may designate. |

| | | |

| | (B) | He has authority to make, sign, and endorse, in the name of the Corporation, all checks, drafts, notes, and other orders for the payment of money, and pay out and dispose of such under the direction of the President or the Board of Directors. |

| | | |

| | (C) | He shall keep at the principal office of the Corporation accurate books of account of all its business and transactions and shall at all reasonable hours exhibit books and accounts to any director upon application at the office of the Corporation during business hours. |

| | | |

| | (D) | He shall render a report of the condition of the finances of the Corporation at each regular meeting of the Board of Directors and at such other times as shall be required of him, and he shall make a full financial report at the annual meeting of the Shareholders. |

| | (E) | He shall further perform all duties incident to the office of Treasurer of the Corporation. |

| | | |

| | (F) | If required by the Board of Directors, he shall give such bond as it shall determine appropriate for the faithful performance of his duties. |

| | (5) | Other Officers. Other officers shall perform such duties and have such powers as may be assigned to them by the Board of Directors. |

Section 3.06 Vacancies. All vacancies in any office shall be filled promptly by the Board of Directors, either at regular meetings or at a meeting specially called for that purpose.

Section 3.07 Compensation of Officers. The officers shall receive such salary or compensation as may be fixed by the Board of Directors.

Section 3.08 Reimbursement of Compensation of Officers. Any payments made to an officer of the Corporation such as salary, commission, bonus, interest, or rent, or entertainment expense incurred by him, which shall be disallowed in whole or in part as a deductible expense by the Internal Revenue Service, shall be reimbursed by such officer to the Corporation to the full extent of such disallowance. It shall be the duty of the directors, as a Board, to enforce payment of each amount disallowed. In lieu of payment by the officer, subject to the determination of the directors, proportionate amounts may be withheld from his future compensation payments until the amount owed to the Corporation has been recovered.

Article IV. COMMITTEES.

Section 4.01 Audit Committee. The Audit Committee shall be responsible for the review and analysis of significant financial information of the Corporation for the purpose of assuring that the information obtained and presented is accurate and timely and that all appropriate disclosures are made. The Audit Committee shall have the additional responsibility of overseeing both the internal and external audit function and ascertaining that effective accounting and internal control systems exist within the Corporation. The Audit Committee shall be appointed by the Board of Directors. The Audit Committee shall be composed of no less than three (3) and no more than ten (10) members of the Board of Directors.

Section 4.02 Compensation/Stock Option Committee. The Compensation/Stock Option Committee shall be responsible for making recommendations to the Board concerning compensation and benefits of the President, Vice Presidents and executives of the Corporation. In this regard, the Compensation/Stock Option Committee shall review and analyze the performance of the Corporation as well as the performance of the President, Vice Presidents and executives. The Compensation/Stock Option Committee shall be appointed by the Board of Directors. The Compensation/Stock Option Committee shall be composed of no less than three (3) and no more than ten (10) members of the Board of Directors.

Article V. SEAL. The seal of the Corporation shall be as determined by the Board of Directors.

Article VI. SHARES

Section 6.01 Certificates. The shares of the Corporation shall be represented by certificates prepared by the Board of Directors and signed by the President and the Secretary, and sealed with the seal of the Corporation or a facsimile. The certificates shall be numbered consecutively and in the order in which they are issued, and a record shall be maintained of the name of the person to whom the shares represented by each such certificate is issued, and the number and class or series of such shares, and the date of issue. Each certificate shall state the registered holder’s name, the number and class of the shares represented, the date of issue, the par value of such shares, or that they are without par value. The Corporation shall also permit book-entry ownership of the shares.

Section 6.02 Subscriptions. Subscriptions to the shares shall be paid at such times and in such installments as the Board of Directors may determine. If default shall be made in the payment of any installment as required by such resolution, the Board may, in the manner prescribed by the NRS, declare the shares and all previous payments thereon forfeited for the use of the Corporation.

Section 6.03 Transfer of Shares. The shares of the Corporation shall be assignable and transferable only on the books and records of the Corporation and by the registered owner, or by his duly authorized attorney, upon surrender of the certificate duly and properly endorsed with proper evidence of authority to transfer. The Corporation shall issue a new certificate for the shares surrendered to the person or persons entitled to receive such shares. The Corporation shall also permit book-entry ownership of the shares.

Section 6.04 Return Certificates. All certificates for shares changed or returned to the Corporation for transfer shall be marked by the Secretary “Cancelled,” with the date of cancellation, and the transaction shall be immediately recorded in the certificate book opposite the memorandum of their issue. The returned certificate may be inserted in the certificate book.

Article VII. DISTRIBUTIONS. The Board of Directors, at any regular or special meeting, may authorize and make distributions to its Shareholders. However, no distribution may be made if, after giving it effect: (1) the Corporation would not be able to pay its debts as they become due in the usual course of business, or (2) the Corporation’s total assets would be less than its total liabilities.

Article VIII. BILLS, NOTES, ETC.

Section 8.01 All bills payable, notes, checks, drafts, warrants, or other negotiable instruments of the Corporation shall be made in the name of the Corporation and shall be signed by the President and Secretary, or by at least two other officers as the Board of Directors shall from time to time by resolution direct, to the extent required by applicable regulations of the U.S. Small Business Administration. No bills payable, notes, checks, drafts, warrants, or other negotiable instruments of the Corporation shall be signed in blank.

Section 8.02 No officer or agent of the Corporation, either singularly or jointly with others, shall have the power to make any bill payable, note, check, draft, warrant, or other negotiable instrument, or endorse the same in the name of the Corporation, or contract or cause to be contracted any debt of liability in the name and on behalf of the Corporation except as herein expressly prescribed and provided.

Article IX. OFFICES. The principal office of the Corporation shall be as determined by the Board of Directors. The Board of Directors may change the location of the principal office of the Corporation and may, from time to time, designate other offices within or without the state as the business of the Corporation may require.

Article X. AMENDMENTS. These Bylaws may be altered, amended or repealed, or new Bylaws adopted by a majority of the entire Board of Directors at a regular or special meeting of the Board.

Article XI. WAIVER OF NOTICE. Whenever under the provisions of these Bylaws or the NRS, any Shareholder or director is entitled to notice of any regular or special meeting or of any action to be taken by the Corporation, such meeting may be held or such action may be taken without the giving of such notice, provided every Shareholder or director entitled to such notice waives the notice requirement in a signed writing delivered to the Secretary of the Corporation.

Article XII. GENDER. All pronouns shall be deemed to refer to the masculine, feminine or neuter, singular or plural, as the identity of the party may require.

Article XIII. INDEMNIFICATION

Section 13.01 Definitions.

| | (1) | “Corporation” includes any domestic or foreign predecessor entity of the Corporation in a merger or other transaction in which the predecessor’s existence ceased upon consummation of the transaction. |

| | | |

| | (2) | “Director” means an individual who is or was a director of the Corporation or an individual who, while a director of the Corporation, is or was serving at the Corporation’s request as a director, officer, partner, trustee, employee, or agent of another foreign or domestic corporation, partnership, joint venture, trust, employee benefit plan, or other enterprise. A director is considered to be serving an employee benefit plan at the Corporation’s request if his duties to the Corporation also impose duties on, or otherwise involve services by him to the plan or to participants in or beneficiaries of the plan. “Director” includes, unless the context requires otherwise, the estate or personal representative of a director. |

| | | |

| | (3) | “Expenses” include counsel fees. |

| | | |

| | (4) | “Liability” means the obligation to pay a judgment, settlement, penalty, fine, including any excise tax assessed with respect to an employee benefit plan, or reasonable expenses incurred with respect to a proceeding. |

| | | |

| | (5) | “Official capacity” means, (i) when used with respect to a director, the office of director in the Corporation; or (ii) when used with respect to an individual other than a director, as contemplated in Section 13.09, the office in the Corporation held by the officer or the employment or agency relationship undertaken by the employee or agent on behalf of the Corporation. “Official capacity” does not include service for any other foreign or domestic corporation or any partnership, joint venture, trust, employee benefit plan, or other enterprise. |

| | (6) | “Party” includes an individual who was, is, or is threatened to be made a named defendant or respondent in a proceeding. |

| | | |

| | (7) | “Proceeding” means any threatened, pending, or completed action, suit, or proceeding, whether civil, criminal, administrative or investigative and whether formal or informal. |

Section 13.02 Provisions. Except as provided in Section 13.05, the Corporation shall indemnify an individual made a part to a proceeding because he is or was a director, officer, employee or agent against liability incurred in the proceeding if:

| | (1) | He conducted himself in good faith; and |

| | | |

| | (2) | He reasonably believed: |

| | (A) | In the case of conduct in his official capacity with the Corporation, that his conduct was in its best interests; and |

| | | |