Use these links to rapidly review the document

TABLE OF CONTENTS

FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

ANNUAL REPORT PURSUANT TO SECTION 13

OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2003

Commission file number: 33-79548

Euro Disney S.C.A.

(Exact name of registrant as specified in its charter)

| |

|

|---|

N/A

(Translation of registrant's name into English) | | Republic of France

(Jurisdiction of incorporation or organization) |

Immeubles Administratifs

Route Nationale 34

77700 Chessy

France

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act: None

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Title of each class

| | Name of each exchange on which registered

|

|---|

| Ordinary Shares of Common Stock par value € 0.76 | | Euronext Paris, London Stock Exchange, SEAQ

International, Brussels Stock Exchange |

Subordinated Bonds Redeemable in Shares of Common Stock, par value € 60.98 per bond |

|

None |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: 1,055,937,724 shares of common stock, par value € 0.76.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ý Item 18 o

TABLE OF CONTENTS

2

PART I

PRESENTATION OF INFORMATION AND ACCOUNTING PRINCIPLES

Euro Disney S.C.A. (the "Company"), including its consolidated subsidiaries (together, the "Group"), publishes its consolidated financial statements ("Consolidated Financial Statements") in euros ("euro"). However, financial information for periods prior to January 1,1999 was originally prepared in French francs and has been translated into euros at the rate of 6.55957 French francs per euro, the official rate established on January 1, 1999. The euro did not exist prior to that date and the conversion rate used may not reflect the French franc/euro exchange rate that would have applied if the euro had existed at such times. In addition, you should not assume that you can accurately compare financial information thus translated from dates and periods before January 1, 1999, with the financial information of other companies that have translated a non-French franc European currency into euro. All currency amounts in this annual report on Form 20-F ("Annual Report") are expressed in euros. In this Annual Report, "we", "us" and "our" refer to the Group.

We prepare our Consolidated Financial Statements in accordance with accounting principles generally accepted in France ("French GAAP"), which differ in certain significant respects from generally accepted accounting principles in the United States of America ("U.S. GAAP"). Unless otherwise specified, all financial information presented in this Annual Report has been derived from or based on the Consolidated Financial Statements. For a discussion of the principal differences between French GAAP and U.S. GAAP as they relate to our consolidated results of operations and financial position, see Notes 2 and 27 to the Consolidated Financial Statements in Item 17—"Financial Statements".

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. SELECTED FINANCIAL DATA

Five-Year Selected Financial Data

The following table sets forth our selected consolidated financial data for the five-year period ended September 30, 2003. This table is qualified by reference to, and should be read in conjunction with, our Consolidated Financial Statements and the related notes thereto included in Item 17 "Financial Statements", and Item 5—"Operating and Financial Review and Prospects."

3

Five Year Financial Review

| | Year ended, September 30,

| |

|---|

(€ in millions, except per share data)

| |

|---|

| | 2003

| | 2002

| | 2001

| | 2000

| | 1999

| |

|---|

| Income Statement Data: | | | | | | | | | | | |

In accordance with French GAAP: |

|

|

|

|

|

|

|

|

|

|

|

| Segment Revenues | | | | | | | | | | | |

| | |

| |

| |

| |

| |

| |

| Resort activities | | 1,029.5 | | 1,048.7 | | 968.0 | | 944.7 | | 911.7 | |

| Real Estate development activities | | 23.6 | | 27.3 | | 37.2 | | 14.5 | | 8.5 | |

| | |

| |

| |

| |

| |

| |

| Total Revenues | | 1,053.1 | | 1,076.0 | | 1,005.2 | | 959.2 | | 920.2 | |

| | |

| |

| |

| |

| |

| |

| Income before Lease and Net Financial Charges | | 132.4 | | 175.7 | | 185.2 | | 175.8 | | 166.2 | |

| Income (loss) before exceptional items | | (67.9 | ) | 4.9 | | 37.7 | | 37.5 | | 21.2 | |

| Exceptional income (loss) | | 11.9 | | (38.0 | ) | (7.2 | ) | 1.2 | | 2.4 | |

| Net income (loss)(1) | | (56.0 | ) | (33.1 | ) | 30.5 | | 38.7 | | 23.6 | |

In accordance with U.S. GAAP: |

|

|

|

|

|

|

|

|

|

|

|

| Revenues | | 1,053.4 | | 1,078.3 | | 1,002.9 | | 960.7 | | 921.9 | |

| Net loss(2) | | (54.4 | ) | (67.3 | ) | (50.6 | ) | (66.2 | ) | (49.9 | ) |

| Net loss per share (in €)(2)(3): | | (0.05 | ) | (0.06 | ) | (0.05 | ) | (0.07 | ) | (0.07 | ) |

| | Year ended, September 30,

| |

|---|

(€ in millions, except per share data)

|

|

|---|

| | 2003

| | 2002

| | 2001

| | 2000

| | 1999

| |

|---|

| Pro forma U.S. GAAP net loss(4) | | (153.6 | ) | (144.5 | ) | (122.3 | ) | (135.7 | ) | (117.4 | ) |

| Pro forma net loss per share (in €)(4) | | (0.15 | ) | (0.14 | ) | (0.12 | ) | (0.14 | ) | (0.15 | ) |

| | |

| |

| |

| |

| |

| |

|

|

September 30,

|

|---|

(€ in millions)

|

|---|

| | 2003

| | 2002

| | 2001

| | 2000

| | 1999

|

|---|

| Balance Sheet Data: | | | | | | | | | | |

In accordance with French GAAP: |

|

|

|

|

|

|

|

|

|

|

| Total assets | | 2,583.6 | | 2,708.6 | | 3,106.1 | | 2,793.8 | | 2,518.8 |

| Borrowings | | 867.5 | | 821.3 | | 1,141.2 | | 916.8 | | 983.3 |

| Shareholders' equity and quasi-equity | | 1,237.2 | | 1,397.6 | | 1,430.7 | | 1,400.3 | | 1,141.9 |

In accordance with U.S. GAAP: |

|

|

|

|

|

|

|

|

|

|

| Total assets | | 2,946.8 | | 3,076.5 | | 3,539.0 | | 3,318.8 | | 3,149.1 |

| Borrowings(Current and Long-term(5)) | | 2,208.9 | | 2,218.6 | | 2,565.1 | | 2,349.8 | | 2,419.4 |

| Shareholders' equity | | 60.4 | | 112.6 | | 179.7 | | 238.1 | | 84.9 |

Common Shares Outstanding (in millions) |

|

1,055.9 |

|

1,055.9 |

|

1,055.8 |

|

1,055.8 |

|

767.8 |

| | |

| |

| |

| |

| |

|

- (1)

- French GAAP net loss for fiscal year 2003 includes the € 10.6 million net impact of a change in accounting principle for major fixed asset renovations and the impact of a conditional waiver of royalties and management fees for the last three quarters of the fiscal year (see Item 5, Section C—"Results of Operations").

4

- (2)

- The U.S. GAAP net loss for fiscal years 2003 and 2002 does not include a net unrealized gain of € 2.1 million and € 0.7 million, respectively, related to changes in fair value of certain interest rate derivatives, which are recorded directly in equity. The U.S. GAAP net loss for fiscal year 1999 reflects a one time net gain of € 52.1 million resulting from the reduction of the interest on, and extension of the maturity of, existing loans and lease financing provided by the Caisse des Dépôts et Consignations ("CDC").

- (3)

- Per share data is based upon the weighted average number of common shares outstanding of 1,056 million, 1,056 million, 1,056 million, 992 million and 768 million for each of the years ended September 30, 2003, 2002, 2001, 2000 and 1999, respectively, and does not give effect to the exercise of any contingently issuable shares as they were anti-dilutive.

- (4)

- The proforma net loss and proforma net loss per share present the U.S. GAAP net loss that we would have had if royalties and management fees to The Walt Disney Company had not been adjusted from their original schedule for modifications agreed since the inception of the agreement (See Notes 18(b) and 27 to the Consolidated Financial Statements in Item 17—"Financial Statements").

- (5)

- As of September 30, 2003, all U.S. GAAP borrowings have been classified as current as the Company may not be able to meet its debt obligations during fiscal year 2004. (See Note 28 to the Consolidated Financial Statements in Item 17—"Financial Statement")

Exchange Rates

On January 1, 1999, the eleven member states of the European Union introduced a single currency, the euro, to replace their national currencies. Pursuant to the Treaty on European Union, fixed exchange rates against the euro were established for each of the currencies of the participating member states. The rate of conversion for the French franc was fixed at FF 6.55957 per euro. Since the principal market for our common stock is the Euronext Paris exchange, fluctuations in the exchange rate between the euro and the U.S. dollar will affect the U.S. dollar value of an investment in our common stock and dividend and other distribution payments, if any, thereon.

5

The following tables set forth, for each of the periods indicated, certain information related to the euro/U.S. dollar exchange rate for 1999 through 2004 based on the noon buying rate in the city of New York for cable transfers in euro as certified for customs purposes by the Federal Reserve Bank of New York (the "Noon Buying Rates") expressed in euro per U.S.$1.00. Such rates are provided solely for the convenience of the reader and are not necessarily the rates that were used to prepare our Consolidated Financial Statements nor the selected consolidated financial data included herein.

Euro per U.S. dollar

| | High

| | Low

|

|---|

| February 2004 | | 0.81 | | 0.78 |

| January 2004 | | 0.81 | | 0.80 |

| December 2003 | | 0.84 | | 0.80 |

| November 2003 | | 0.88 | | 0.83 |

| October 2003 | | 0.86 | | 0.85 |

| September 2003 | | 0.93 | | 0.87 |

Fiscal Year

|

|

High

|

|

Low

|

|

Average(1)

|

|

End of Period

|

|---|

Euro per U.S. dollar(2)

| |

| |

| |

| |

|

|---|

| 2003 | | 1.03 | | 0.84 | | 0.92 | | 0.86 |

| 2002 | | 1.16 | | 0.98 | | 1.09 | | 1.01 |

| 2001 | | 1.21 | | 1.05 | | 1.13 | | 1.10 |

| 2000 | | 1.18 | | 0.92 | | 1.05 | | 1.13 |

| 1999 | | 0.99 | | 0.82 | | 0.91 | | 0.94 |

- (1)

- The average of the Noon Buying Rates on the last business day of each month during the relevant period.

- (2)

- Euro/U.S. dollar exchange rates for periods prior to the introduction of the euro, on January 1, 1999, have been calculated by applying the fixed exchange rate of 6.55957 French franc per euro to the French franc/U.S. dollar exchange rate based on the Noon Buying Rate at the introduction date.

The Noon Buying Rate on February 27, 2004 for the euro against the U.S. dollar was € 0.81 per $1.00 ($1.24 per euro). No representation is made that the French franc or the euro could have been converted into U.S. dollars at the rates shown herein or at any other rates for such periods or at such dates. In addition, there can be no assurance that the exchange rate trend between the U.S. dollar and the French franc prior to the existence of the euro would have been the same as the exchange rate trend that would have existed between the euro and the U.S. dollar during such period, had the euro been in existence. See also Item 5—"Operating and Financial Review and Prospects".

B. CAPITALIZATION AND INDEBTEDNESS

Not applicable.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

6

D. RISK FACTORS

Risks of Investing in Our Company

If we do not succeed in renegotiating our credit agreements before May 31, 2004, we will be unable to meet our financial obligations.

On November 3, 2003, the Group obtained waivers from its lenders, effective though March 31, 2004, with respect to certain financial covenants and other obligations, including a reduction in certain security deposit requirements. On March 22, 2004, this waiver was modified and extended until May 31, 2004. The purpose of this extension is to give management, the lenders and TWDC more time to find resolution regarding the Group's financial situation. Absent such a timely resolution, the waivers would expire and management believes the Group would then be unable to meet all of its debt obligations.

In preparing the consolidated financial statements, management has used the going-concern assumption based on management's belief that it is in the best interest of all stakeholders, including the lenders and TWDC to successfully resolve the Group's financial situation. This resolution would likely include modifying the Group's existing obligations, obtaining additional financing and potentially changing our legal structure. If the principle of going concern had not been assumed, it would likely have had a significant impact on the valuation of assets and liabilities as of September 30, 2003.

Our high level of borrowings requires us to devote a large portion of our operating cash flow to service debt, and may limit our operating flexibility.

We are highly leveraged. Under U.S. GAAP as of September 30, 2003, we had € 2.2 billion of borrowings and € 60.4 million of shareholders' equity. In addition, we pay significant royalties and management fees to affiliates of The Walt Disney Company. In fiscal year 2004, the contractual rates applied to revenues subject to royalties will double.

Our high degree of leverage can have important consequences for our business, such as:

- •

- Limiting our ability to invest operating cash flow in our business, because we use a substantial portion of these funds to pay debt service and because our covenants restrict the amount of our investments;

- •

- Limiting our ability to make capital investments in new attractions and maintenance of the parks and hotels, both of which are essential to our business;

- •

- Limiting our ability to borrow additional amounts for working capital, capital expenditures, debt service requirements or other purposes; and

- •

- Limiting our ability to withstand business and economic downturns, because of the high percentage of our operating cash flow that is dedicated to servicing our debt.

If we cannot pay our debt service, royalties and fees and meet our other liquidity needs from operating cash flow, we could have substantial liquidity problems. In those circumstances, we might have to sell assets, delay planned investments, obtain additional equity capital or restructure our debt. Depending on the circumstances at the time, we may not be able to accomplish any of these actions on favourable terms, or at all. Our financing agreements limit our ability to take some actions that could generate additional cash proceeds. They also require that we meet certain financial covenants. If we default on any of our debt, the relevant lenders could accelerate the maturity of the debt and take other actions that could adversely affect us. To avoid a default, we may need waivers from third parties, which might not be granted.

7

We have recently incurred losses, and continuing losses might reduce the value of our shares.

Under French GAAP, we had net losses of € 33.1 million and € 56.0 million for fiscal years ended September 30, 2002 and 2003. We incurred net losses under U.S. GAAP of € 67.3 million and € 54.4 million in fiscal years 2002 and 2003, respectively. If we continue to experience losses, this could reduce the value of our shares.

The U.S. GAAP losses for the Company would have been € 144.5 million and € 153.6 million for fiscal years ended September 30, 2002 and 2003, respectively, had it not been for the waiver of royalties and management fees by The Walt Disney Company arising from modifications to the original agreements. See Notes 18(b) and 27 to the Consolidated Financial Statements in Item 17—"Financial Statements".

We are subject to interest rate risk.

As of September 30, 2003, approximately 32% of our borrowings and lease commitments were tied to floating interest rates. While we attempt to reduce interest rate risks in respect of a substantial portion of our borrowings through the use of interest rate swaps and other hedging techniques, an increase in interest rates could adversely affect our financial condition and results of operations.

We are subject to exchange rate risk.

A portion of our purchases and capital investments are denominated in U.S. dollars and could be adversely affected by an increase in the relative value of the U.S. dollar against the euro. In addition, a significant portion of our guests (22% in fiscal year 2003) come from the United Kingdom, which is not part of the euro zone. An increase in the relative strength of the euro against the British pound would raise the price of a visit to the resort for guests visiting from the United Kingdom and could negatively affect their rates of attendance, per guest spending and hotel occupancy.

We have not paid any dividends in recent years, and we may not be able to pay dividends in the near future.

We paid no dividends in respect of fiscal year 2003 and do not expect to pay dividends in the near future. Our ability to pay dividends is dependent on the availability of distributable profits under French law which, in turn, depends on our operating results, liquidity and financial condition. In addition, certain of our loan agreements limit or prohibit the payment of dividends in certain circumstances.

Our relationship with The Walt Disney Company limits the rights of our public shareholders and could generate conflicts of interest.

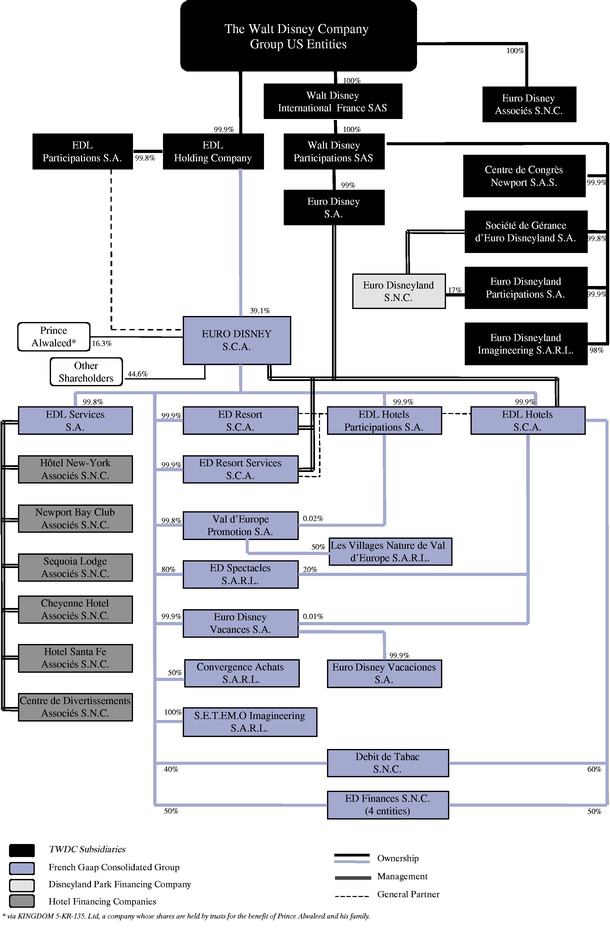

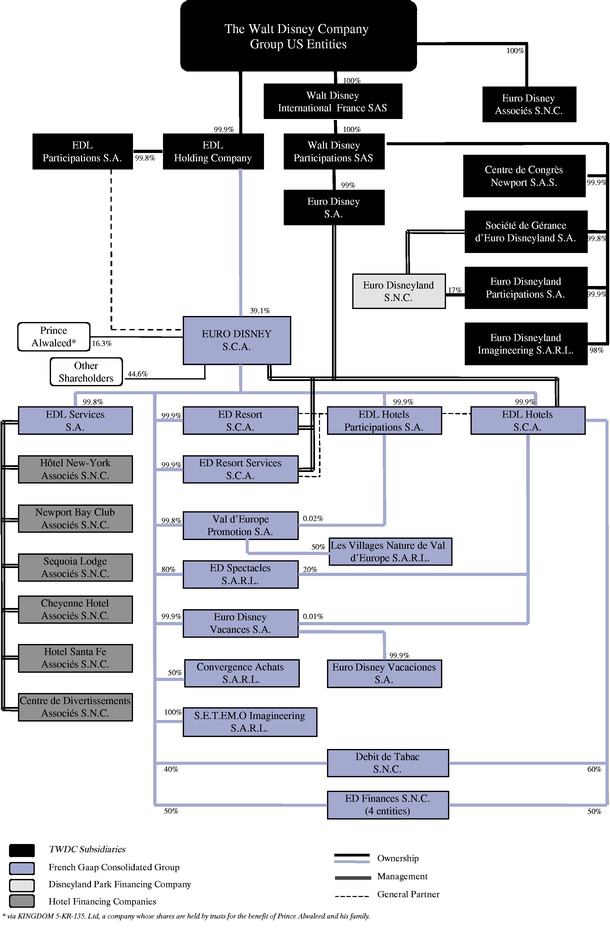

The Walt Disney Company currently owns 39.1% of our shares and voting rights through an indirect, wholly-owned subsidiary. Under French law, our business is managed by a management company (Gérant) that is appointed by a general partner (associé commandité). The shareholders elect a supervisory board to oversee the management company, but the supervisory board does not have the power to remove the management company. Both our Management Company and our General Partner are wholly-owned indirect subsidiaries of The Walt Disney Company.

8

We also have several business relationships with The Walt Disney Company that are important to our operations. We use Disney intellectual and industrial property rights, for which we pay royalties to affiliates of The Walt Disney Company. Our Management Company provides and arranges for a variety of additional technical and administrative services, for which it is reimbursed its direct and indirect costs. For example, the designer and construction manager for Walt Disney Studios Park was an affiliate of The Walt Disney Company. These relationships create potential conflicts of interest. We believe that our dealings with The Walt Disney Company and its affiliates are commercially reasonable. Although all such dealings must be approved by our Supervisory Board, we have not solicited bids or independent evaluations of the terms of our commercial relationships with The Walt Disney Company.

Risks of Investing in the Theme Park Resort Business

Demand for theme park resorts is variable, and can be impacted by economic and geopolitical conditions.

Disneyland Resort Paris is subject to significant seasonal and daily fluctuations in attendance and to the effects of general economic conditions. While we have implemented and continue to implement measures designed to alleviate fluctuations in attendance and to mitigate their impact, we cannot be certain that such measures will sufficiently offset fluctuations in demand. In addition, the effectiveness and timing of marketing campaigns can have a significant impact on attendance levels. Given the discretionary nature of vacation travel and the fact that travel and lodging expenses often represent a significant expenditure for the average consumer, such expenditures may be reduced, deferred or cancelled by consumers during times of economic downturn or uncertainty.

In addition, the international terrorist attacks of September 11, 2001, the subsequent military actions and the current geopolitical climate are examples of items that can adversely affect travel-related industries and precipitate sudden economic downturns. Although our management closely monitors our operating trends and has developed cost-reduction strategies to address such risks, such steps, depending on the duration and intensity of the downturn, may be insufficient to prevent our financial performance from being adversely affected.

We need to make significant, regular capital expenditures to continue to attract guests.

In order to continue to attract guests, we need to add new theme park attractions on a regular basis, which often requires significant capital expenditures. If we do not make these capital expenditures (for example, if our creditors do not permit us to make them pursuant to our financing agreements), this could result in a decrease in attendance, particularly from repeat guests, which could adversely affect our results of operations.

The theme park resort business is competitive, which could limit our ability to increase prices or to attract guests.

We compete for guests throughout the year with other European and international holiday destinations as well as other leisure and entertainment activities in the Paris region. We also compete with other European theme parks (See Item 4, Section A.4.2—"Competition"). We also rely on convention business, which is highly competitive, for a portion of our revenues, and to maintain hotel occupancy in off-peak periods.

Our hotels are subject to competition from the third-party hotels located on the Resort Site (approximately 1,576 rooms/units as of September 30, 2003), in central Paris and in the Seine-et-Marne area. We believe that our hotels are priced at a premium compared to the market, reflecting among other advantages, their proximity to the resort, their unique themes and the quality service that they offer. We are aware, however, that a number of less costly alternatives exist.

9

Competition limits our ability to raise prices, and may require us to make significant new investments to avoid losing guests to our competitors.

Risks of investing in our shares

No U.S. Public Market

There has been no public market in the United States for our shares and we have no present intention to apply to list the shares on any U.S. exchange. Therefore, the opportunity for U.S. holders to trade shares may be limited.

Preferential rights may not be exercisable by U.S. shareholders

Under French law, shareholders have preferential rights (which may be waived) to subscribe on a pro rata basis for cash issuances of new shares or other securities giving rights, directly or indirectly, to subscribe for additional shares. U.S. holders of our shares may not be able to exercise any preferential rights derived from such shares unless a registration statement under the Securities Act is effective for such preferential rights or an exemption from such registration requirements is available. If we decide to issue new shares, we are under no obligation to file such a registration statement. If the preferential subscription rights are transferable, then U.S. holders could sell those rights, although the value they might realize from such sales is uncertain. If such rights could not be sold, they would lapse, and the U.S. holders would not realize any value from the rights.

ITEM 4. INFORMATION ON THE COMPANY

A. HISTORY AND DEVELOPMENT OF THE COMPANY AND BUSINESS OVERVIEW

Introduction

We are primarily engaged in the development and operation of the Disneyland Resort Paris (the "Resort"), formerly Euro Disneyland. The Resort commenced operations on April 12, 1992 ("Opening Day") on a 1,943 hectares (approximately 4,800 acres) site located 32 kilometers (approximately 20 miles) east of Paris in Marne-la-Vallée, Seine-et-Marne, France. Disneyland Resort Paris principally consists of Disneyland Park, Walt Disney Studios Park, seven themed hotels, including two convention facilities, an entertainment center ("Disney Village"), and a 27-hole golf facility (the "Golf Course"). Most of these facilities are leased, directly or indirectly, by the Group from special-purpose financing companies (collectively, the "Phase I Financing Companies"). We have no ownership interest in these entities. Disneyland Resort Paris is modelled on the theme park and resort concepts developed by The Walt Disney Company.

Our principal executive offices are located at Immeubles Administratifs, Route Nationale 34, 77700 Chessy (Seine-et-Marne), France. The postal address is BP 100, 77777 Marne-la-Vallée Cedex 04, France. Our telephone number is (33) (1) 64 74 40 00.

A.1 Breakdown of Revenues by Segment and Activity

The Group operates in the following segments:

- •

- Resort activities include the operation of Disneyland Park and Walt Disney Studios Park (together, the "Theme Parks"), hotels and Disney Village and the various services that are provided to guests visiting our resort destination.

- •

- Real Estate Development activities include the conceptualization and planning of improvements and additions to our existing Resort activity, as well as other commercial and residential real estate projects, whether financed internally or through third-party partners.

10

A breakdown of total revenues by major segment and activities during the past five fiscal years is set forth in the table below:

| | Year ended September 30,

|

|---|

(€ in millions)

|

|---|

| | 2003

| | 2002

| | 2001

| | 2000

| | 1999

|

|---|

| Theme Parks | | 508.5 | | 526.0 | | 476.4 | | 459.5 | | 460.2 |

| Hotels and Disney Village | | 416.7 | | 411.7 | | 386.5 | | 370.3 | | 352.0 |

| Other | | 104.3 | | 111.0 | | 105.1 | | 114.9 | | 99.5 |

| | |

| |

| |

| |

| |

|

| Resort Segment | | 1,029.5 | | 1,048.7 | | 968.0 | | 944.7 | | 911.7 |

Real Estate Development Segment |

|

23.6 |

|

27.3 |

|

37.2 |

|

14.5 |

|

8.5 |

| | |

| |

| |

| |

| |

|

| Total Revenues | | 1,053.1 | | 1,076.0 | | 1,005.2 | | 959.2 | | 920.2 |

| | |

| |

| |

| |

| |

|

A.2 History of our Company

In March 1987, The Walt Disney Company entered into an agreement on the creation and the operation of Euro Disneyland in France (the "Master Agreement") with the Republic of France and certain other French public authorities. The Master Agreement sets out a master land-use plan and general development program (the "Master Plan") establishing the type and size of facilities that the Company has the right, subject to certain conditions, to develop at the Resort site over a 30-year period ending in 2017. The Resort, as it exists today, represents the total fulfilment of the first phase of the Master Plan development of approximately 600 hectares of land (including all associated public and private infrastructure). See Item 4, Section A.6.1—"Agreements with French Governmental Authorities".

We experienced significant losses during the period from Opening Day through September 30, 1994. Net operating losses before the cumulative effect of an accounting change totalled approximately € 625 million under French GAAP and € 1.2 billion under U.S. GAAP for the two-and-a-half-year period ending September 30, 1994. In addition, we began to experience serious cash flow difficulties during fiscal year 1993.

During this period, The Walt Disney Company undertook to fund our liquidity needs through March 31, 1994. Had The Walt Disney Company not funded our liquidity needs during this critical period, we would not have had sufficient cash flow to continue operations.

In May 1994, our Company entered into a memorandum of agreement with major stakeholders outlining the terms of a major restructuring of our obligations and those of the Phase I Financing Companies to their creditors and partners and to The Walt Disney Company ("Financial Restructuring"). The agreement enabled us to meet our operating cash flow needs and to improve our overall financial condition. The memorandum of agreement essentially provided for concessions and contributions, to be made by such creditors and The Walt Disney Company, and for the prepayment of certain outstanding loan indebtedness of the Group and the Phase I Financing Companies with the € 907 million of proceeds received from the issuance of 595 million new shares.

11

In fiscal year 1999, our Company obtained the approval of our lenders to obtain the financing necessary for the construction of Walt Disney Studios Park, which opened on March 16, 2002 adjacent to Disneyland Park. The construction of Walt Disney Studios Park was financed using the proceeds received from the sale of 288 million new shares (€ 219.5 million) in fiscal year 2000 and a new long-term loan from the CDC (€381.1 million).

In 2003 and 2004, we entered into negotiations with our lenders with a view to restructuring our credit agreements. Those negotiations are ongoing as of the date of this Annual Report For further information, see Notes 1-3, and 28 to the Consolidated Financial Statements in Item 17—"Financial Statements" and Item 5—"Operating and Financial Review and Prospects".

A.3 Operations by Segment

A.3.1. Resort Segment

A.3.1.1Theme Parks

Within our Resort Segment, theme park activity includes all operations of Disneyland Park and Walt Disney Studios Park, including merchandise, food and beverage, special events and all other services provided to our guests in the parks. Theme park revenue is determined primarily by two factors: the number of guests and the total average spending per guest.

Our theme parks are operated on a year-round basis. In the first years of operations, Disneyland Park experienced significant difficulties in accommodating all prospective guests during peak days, which resulted in long wait times for attractions, guest dissatisfaction and lost revenues. Despite progress, operations continue to be subject to seasonal fluctuations.

Beginning in Fiscal Year 2004, seasonal theme park pricing has been eliminated and replaced with stable year-round ticket pricing. However, we offer from time to time specific packages for specific periods for specific markets.

The Company began offering and promoting a "Park Hopper" ticket for one-day, two-day and three-day periods in October 2003 whereby for an additional price of € 9 to € 12 over a single-gate admission price, a guest can go back and forth freely between Disneyland Park and Walt Disney Studios.

The following table summarizes the evolution of our single-gate, one day theme park admission prices, attendance and average spending per guest.

Fiscal Year

| | Total Guests(1)

(in millions)

| | Total Average

Spending

per Guest(2)

| | Theme Park

Admission Price

High Season(3)

| | Theme Park

Admission Price

Low Season(3)

|

|---|

| 2003(3) | | 12.4 | | € 40.7 | | € 39.0 | | € 29.0 |

| 2002(3) | | 13.1 | | € 40.1 | | € 38.0 | | € 27.0 |

| 2001 | | 12.2 | | € 38.9 | | € 36.0 | | € 25.9 |

| 2000 | | 12.0 | | € 38.1 | | € 33.5 | | € 25.2 |

| 1999 | | 12.5 | | € 36.7 | | € 33.5 | | € 24.4 |

- (1)

- Includes Disneyland Park and, from March 16, 2002, Walt Disney Studios Park.

- (2)

- Average daily admission price and spending for food, beverage and merchandise sold in the Theme Parks, excluding value added tax.

- (3)

- Represents at-gate park admission price for one adult, including value added tax at the end of the fiscal year. High season pricing generally applied to the period between April 1 and October 31 and the two weeks over Christmas and New Year's.

12

Disneyland Park is composed of five "themed lands":Main Street U.S.A., which transports guests to an American town at the turn of the 20thcentury, with its houses and shops,Frontierland, which takes guests on the path of the pioneers who settled the American West,Adventureland, where guests dive into a world of intrigue and mystery, reliving Disney's most extraordinary legends and best adventure movies,Fantasyland, a magical land where guests find the fairy tale heroes brought to life in Disney's animated films, andDiscoveryland, which lets guests discover different "futures" through the works of visionaries, inventors, thinkers and authors of science fiction from all periods.

There are 43 attractions in Disneyland Park, including upgraded versions of standard features of Disney theme parks around the world such as:Big Thunder Mountain, a roller coaster which simulates a mining railway train,Pirates of the Caribbean, which reproduces a pirate attack on a Spanish fort of the 17th century,Phantom Manor, a haunted Victorian mansion,It's a Small World, the most popular attraction inFantasyland, an exhibition of dolls from around the world, dressed in their national costumes, andHoney, I Shrunk the Audience!, a three-dimensional film with interactive special effects during which spectators participate in the illusion of being "shrunk". Other popular attractions that are unique to Disneyland Park include:Visionarium, a 360-degree "circle-vision" film theatre complex with "Audio-Animatronics" robotic figures,Indiana Jones and the Temple of Peril: Backwards!, a full-loop roller coaster ride through simulated ancient ruins, which underwent a full renovation in fiscal year 2000 that provided our guests with the opportunity to experience the attraction backwards and at the same time substantially increased the capacity per day, andSpace Mountain, From the Earth to the Moon, a roller coaster ride themed to the work of Jules Verne in which guests board a spaceship and are catapulted by a giant canon into outer space.

Disneyland Park also has five permanent theatres, including two, the Chaparral Theatre and Videopolis, which have recently been renovated. We present live stage shows in these venues throughout the year. Examples from the past and present includeMulan, the Legend; The Tarzan Encounter; andMickey's Winter Wonderland. In addition, we have parades and firework displays, such as theWonderful World of Disney Parade; Fantillusion Parade; andTinkerbell's Fantasy in the Sky Fireworks. As a result of the number of guests that they attract, our shows and parades enable us to increase the guest capacity of Disneyland Park while at the same time increasing guest satisfaction.

In addition to the permanent Disneyland Park attractions, parades and live stage shows, we hold numerous special events throughout the year which in the past have included aFestival of Flowers in April andthe California Dream Festival in September, theHalloween Festival in October,Guy Fawkes Night in November, special Christmas festivities in December and early January and The Lion KingCarnival in February and March. The appearance of Disney characters and their interaction with our guests is another important aspect of the entertainment provided in our theme parks.

In fiscal year 2000, an innovative reservation system calledFastPass was introduced in Disneyland Park. A free service available to all guests,FastPass provides an alternative to waiting in line. Guests choosingFastPass receive a ticket designating a specific window of time during which they may return and enter directly into the pre-show or boarding area. TheFastpass system has been installed at five major attractions:Space Mountain, Indiana Jones and the Temple of Peril, Backwards!,Peter Pan's Flight,Big Thunder Mountain andStar Tours.

Walt Disney Studios Park

Walt Disney Studios Park opened to the public on March 16, 2002. Walt Disney Studios Park is a live-action, animation and television studio, where guests experience movies and television both from behind the scenes and in front of the camera. Guests to the park discover the world of cinema, see how movies are made today and step into the future of movie making. They also have the opportunity to be part of the action, and get hands-on experience in animation techniques and special effects.

13

Walt Disney Studios Park is a full-day experience, designed for a six or seven-hour stay and is one of three European parks with a cinema theme (the two others being the Warner Brothers Movie World Park in Germany and the Warner Brothers Movie World Park in Spain, that opened in 2002). Walt Disney Studios Park covers approximately 25 hectares (62 acres), which is about half the size of Disneyland Park, and may be expanded in the future. It is located in front of the TGV/RER train station, in walking distance from Disneyland Park and Disney Village.

Guests access Walt Disney Studios Park through a monumental gate designed to look like the entry gates of the major Hollywood studios in the 1930's. The main gate provides access to a richly decorated central hub where all the ticketing and guest welcome services are located.

Walt Disney Studios Park includes eight major attractions, several of which were specifically developed for our park. Examples include theStunt Show Spectacular, a live show in which stuntmen, facing an audience of up to 3,000 guests, simulate the filming of an action scene involving car and motorcycle chases and other special effects,Cinemagique, a lyrical and emotional salute to the classics of international cinema;Armageddon, a revealing look into the world of film special effects while on board a space ship hit by a meteorite shower andAnimagique, featuring some of the greatest moments of almost 80 years of Disney animation.

The park also features upgraded versions of attractions from Disney MGM-Studios near Orlando, Florida such asRock'n'Roller Coaster, a roller coaster ride themed to the music of Aerosmith and a visit to a music recording studio, andCatastrophe Canyon, the highlight of ourStudio Tram Tour, which allows guests to experience a simulated earthquake and the resulting explosions and floods.

Since June 2002, theDisney Cinema Parade celebrates the steps involved in movie making from A to Z, featuring well-known Disney characters. To add to the overall park ambience, Walt Disney Studios Park also includes street entertainers (e.g., movie "look-alikes" and musicians), Disney characters centered around the world of animation and special entertainment such asSister Act.

As in Disneyland Park, theFastPass system reduces guest waiting times atRock'n Roller Coaster and theFlying Carpets over Agrabah. The Company currently allows guests of Walt Disney Studios Park to cross-over to Disneyland Park after 5:00 p.m. at no additional charge.

A.3.1.2Hotels and Disney Village

Also included in the Resort Segment are our hotels and Disney Village operations. Revenues from these activities include room rental, food and beverage, merchandise, dinner shows, convention revenues and fixed and variable rent received from third-party partners operating within our Resort.

All of the hotel and resort amenities are currently operated on a year-round basis. Hotel operations are subject to significant seasonal fluctuations, as well as significant fluctuations between weekdays and weekends especially in off-peak seasons. The fiscal year 1998 opening of a second convention center, the continued success of seasonal promotions such asHalloween,Guy Fawkes andChristmas, and the introduction of travel inclusive packages have helped to reduce these fluctuations. Management believes that the successful implementation and marketing of these events is important to maintaining high average occupancy levels at our hotels.

In fiscal year 2003, approximately 25% of total hotel room-nights sold were generated in the three-month period from June through August, while approximately 24% were generated in the three-month period from November through January, versus 36% and 14%, respectively, in fiscal year 1993. We currently differentiate pricing according to the season and the level of demand with a focus on yield optimization.

14

Hotel Operations

Hotel revenue is determined primarily by two factors: the average occupancy rate and per room spending.

Fiscal Year

| | Average

Occupancy Rate(1)

| | Total Average

Daily Spending per

Occupied Room(2)

|

|---|

| 2003 | | 85.1 | % | € 183.5 |

| 2002 | | 88.2 | % | € 175.1 |

| 2001 | | 86.0 | % | € 168.6 |

| 2000 | | 82.9 | % | € 165.4 |

| 1999 | | 82.6 | % | € 159.6 |

- (1)

- Number of rooms occupied per night divided by the number of rooms available during the relevant period.

- (2)

- Average daily room price and spending on food, beverage and merchandise and other miscellaneous items sold in hotels, excluding value added tax.

We operate seven hotels at the Resort: the Disneyland Hôtel, the Hôtel New York, the Newport Bay Club, the Sequoia Lodge, the Hôtel Cheyenne, the Hôtel Santa Fe and the Davy Crockett Ranch. Together, the hotels have a total capacity of approximately 5,800 rooms. Each of the hotels was designed and built with a specific theme and for a particular market segment. The Disneyland Hôtel, which is located at the entrance of Disneyland Park, and the Hôtel New York are positioned as deluxe hotels offering service equivalent to that of the best hotels in Paris. The Newport Bay Club and the Sequoia Lodge are positioned as "first-class" hotels, while the Hôtel Cheyenne and the Hôtel Santa Fe were designed as "moderately-priced" hotels. The Davy Crockett Ranch campground is comprised of individual bungalows with private kitchens, camping sites, sports and leisure facilities and a retail shop. Both the Hôtel New York and the Newport Bay Club include convention facilities, which provide a total of approximately 10,500 square meters of meeting space. Resort amenities also include 12 restaurants, 9 bars, a 27-hole golf course, 5 swimming pools, 4 fitness centres, a tennis facility and an ice-skating rink.

We offer a wide range of services at our hotels. We provide transportation between each of the hotels and the train station and give guests the option to check into the hotels directly from the Chessy-Marne-la-Vallée train station or from on board the Eurostar (London) and Thalys (Brussels and Cologne) trains arriving at Disneyland Resort Paris. As part of our check-in process, we provide guests with room information and welcome booklets and also provide a luggage service for guests arriving by train, which allows them to go directly to the parks and have their luggage delivered from the train station to their rooms. Entertainment is also an integral part of our hotel services, including Disney character breakfasts and dinners, character meet-and-greets in the lobbies of certain hotels, face-painting workshops, and live music in the bars of certain hotels. Children's activity corners have also been set up where children can take part in various activities while allowing their parents additional leisure time.

15

In addition to the seven "Euro Disney" hotels described above, several new third-party managed hotels are currently operating on the site under various promotional agreements:

| | Designation

| | Category

| | Date opened

| | Number of Units

|

|---|

| Hotel Elysées Val d'Europe | | Associated | | 3* | | June 02 | | 154 |

| My Travel Explorer | | Selected | | 3* | | March 03 | | 390 |

| Kyriad | | Selected | | 2* | | March 03 | | 300 |

| Pierre et Vacances Tourist Residence | | Associated | | 3* | | April 03 | | 291 |

| Holiday Inn | | Selected | | 4* | | June 03 | | 396 |

| Marriot Vacation Club | | Associated | | 4* | | June 03 | | 45 |

|

| Total | | | | | | | | 1,576 |

|

These hotels which benefit from the Euro Disney "Selected Hotel" or "Associated Hotel" designations, depending on their level of integration in the Resort, benefit from transport shuttles to and from the theme parks as well as free parking for their guests (Selected Hotels only), and are an important source of guest attendance at our theme parks. For certain of these hotels, we have access to blocks of rooms and receive commissions for selling those rooms to our guests. Any revenues earned associated with these agreements is recorded in the "Other Revenue" line of our Resort Segment. See Item 4, Section A.3.2—"Real Estate Development Segment" for a discussion of hotel capacity development projects currently in process.

Disney Village Operations

Disney Village consists of approximately 30,000 square meters of themed dining, entertainment and shopping facilities. It is a free-entrance venue (except for certain events), situated next to the Chessy-Marne la Vallée RER/TGV train station and between the Theme Parks and the hotels.

The over-riding themes of Disney Village are "American Places" and "American Entertainment" in the spirit of a coast-to-coast trip from New York to Los Angeles. The largest of its facilities is an indoor arena seating more than 1,000 guests for dinner and a performance ofBuffalo Bill's Wild West Show. Other facilities include themed bars with music, themed restaurants, includingCafe Mickey,Planet Hollywood, Rainforest Café, Annette's Diner, McDonald's and King Ludwig's Castle (opened June 2003), retail shops and a 15-screen multiplex Gaumont cinema with one of the largest screens in Europe.

We manage certain of the facilities in the Disney Village, such as theBuffalo Bill's Wild West Show, merchandise boutiques and bars, while others are managed by third parties on our behalf. For example, certain of our restaurants are managed on our behalf by Flo, a French catering company. In addition, certain of the facilities, such as thePlanet Hollywood,Rainforest Café, King Ludwig's Castle andMcDonald's restaurants and the Gaumont cinema, are owned and managed by third parties.

A.3.1.3Food and Beverage

We have 64 restaurants and bars throughout the Resort. Restaurants are themed both in decoration and menu, based upon their location within the Resort, and offer guests a wide variety of dining experiences including quick service, cafeteria-style, table service (including convention catering), and sophisticated French cuisine. There are also food carts and kiosks located throughout the Resort which offer fast-food. We offer guests the option of a fixed-price menu in all of our table service restaurants. During fiscal years 2001 and 2002, the capacity of three Disney Village facilities were increased:Billy Bob's Country Western Bar (+94 seats),The Steakhouse (+180 seats) andAnnette's Diner (+ 90 seats). In fiscal year 2003, theRock'n Roll America was transformed into King Ludwig's Castle, a 296 seat restaurant specializing in German cuisine.

16

A.3.1.4Merchandising

Our merchandising facilities include 54 boutiques, 4 kiosks and a large number of mobile carts strategically located throughout the Resort, which offer a wide range of both Disney-themed and non-Disney-themed goods. The product mix is constantly re-evaluated in an effort to better adapt to guest preferences and guest mix. New merchandise development focuses on Disney character products, such as theMickey Sorcerer line, which is popular with guests, and on more variety for the repeat guest. Other innovative merchandising options include photo locations at four attractions,Big Thunder Mountain,Space Mountain, From the Earth to the Moon,Pirates of the Caribbean andRock'n'Roller Coaster, which offer to our guests the opportunity to purchase candid photos taken of them during their ride.

A.3.2 Real Estate Development Segment

Our activities include the planning and development of the 1,943 hectare site on which the Resort is located, in accordance with the Master Plan. Development activities include the conceptualization and planning of improvements and additions to the existing Resort activity, as well as other commercial and residential real estate projects to be located on the site, whether financed internally or through third-party partners.

Our principal real estate development revenues are derived from conceptual design services related to third party development projects on the site and to the sale of land development rights or from ground lease income from third party developers. Such transactions not only provide a source of up-front cash inflows but also contribute to improving the potential of future resort and real estate development projects and to increasing the potential local clientele for Disneyland Resort Paris.

The following table summarizes the financial impact of real estate development activities on our financial statements:

| | Year ended September 30,

| |

|---|

(€ in millions)

| |

|---|

| | 2003

| | 2002

| | 2001

| | 2000

| | 1999

| |

|---|

| Revenues: | | | | | | | | | | | |

| | Operating | | 23.6 | | 27.3 | | 37.2 | | 14.5 | | 8.5 | |

| | Exceptional | | 0.1 | | — | | 0.4 | | 0.6 | | — | |

| | |

| |

| |

| |

| |

| |

| | | 23.7 | | 27.3 | | 37.6 | | 15.1 | | 8.5 | |

Costs and Expenses |

|

(13.3 |

) |

(15.2 |

) |

(13.4 |

) |

(11.6 |

) |

(8.5 |

) |

| | |

| |

| |

| |

| |

| |

| Net Income Statement Impact | | 10.4 | | 12.1 | | 24.2 | | 3.5 | | — | |

| | |

| |

| |

| |

| |

| |

In conjuction with the first phase of development, which was essentially devoted to the creation of the resort destination, our second phase between 1998 and 2003 focused on the emergence of the development of an urban center located adjacent to our resort (Val d'Europe). This second phase of development resulted in:

- •

- New infrastructure such as a second RER train station (Val d'Europe) on the site and a new interchange on the A4 motorway.

- •

- An International Shopping Mall atVal d'Europe, which comprises 104,000 square meters of retail space. We own the land on which the mall is located and are leasing it to the developer under a 75-year ground lease.

- •

- Development of theVal d'Europe town center, which currently includes residential, retail and commercial developments and theElysées Val d'Europe hotel, which opened in June 2002 on land leased from us.

17

With the development of Walt Disney Studios, we also focused on the expansion of our on-site resort lodging capacity. A number of projects have been completed or are in various stages of progress with third party international hotel developers/tour operators for the creation of additional hotels and vacation units. These projects have or will be constructed, owned and operated by third-parties on land purchased from us or leased from us under long-term ground leases. In addition, we have and will earn conceptualization fees and other development service fees related to these transactions.

As a result of these projects, approximately 1,400 hotel/vacation units were opened on the site in fiscal year 2003, bringing our total on-site capacity to approximately 7,350 total rooms units. For more information on the projects already completed and operating on the site, see Section A.3.1.2. "Resort Segment—Hotels and Disney Village."

The agreements and projects currently in place will result in a total of approximately 800 additional hotel/vacation units on the Resort Site between fiscal year 2004 and 2006 (including approximately 450 in fiscal year 2004).

We also sell land to third-party residential developers working on projects in the areas surrounding the Resort, including the commercially successful middle and high-end housing developments near our golf course in the communities of Magny-le-Hongre and Bailly-Romainvilliers.

To date, this residential development has been financed by third parties. Our role has been limited to overseeing the master planning and architectural design of each development, and to selling to selected developers the land development rights necessary to realise the projects. We do not anticipate significant changes in our role for future residential development projects, although we may expand our role in a certain number of these projects to include an equity participation on our part via joint ventures with the third party-developers.

More recently, a third phase of development was signed with the French Public Authorities on July 9, 2003 and covers the period 2004 through 2010. In this phase of development we anticipate the following:

- •

- The expansion of Disney Village, the development of business tourism and additional hotel capacity, when needed,

- •

- The continuation of theVal d'Europe town center expansion (residential and office development),

- •

- New public services such as the development of theUniversity of Marne La Vallée, a High School with international sections and a new hospital, as well as a new module for the TGV Station,

- •

- The continuation of the International Business Park development (second phase), and

- •

- Other residential developments in theVal d'Europe district golf area.

18

A.4Marketing and Sales Strategy

A.4.1 Marketing and Sales

Product Offer

Disneyland Paris Resort is the number one tourist destination in Europe in terms of guest visitation with a product offer that currently includes two theme parks, 7 themed hotels (5,800 total rooms), two separate convention facilities (totaling 10,500 square meters), a dining, shopping and entertainment center and a 27-hole golf course.

With the opening of Walt Disney Studios Park, our package offers were modified to focus on 2-night, 3-day visits. During fiscal year 2003 we re-introduced a widely distributed 1-night, 2-day package to accommodate our guests desiring a shorter break. Our resort packages include "Park Hopper" tickets whereby guests can go back and forth freely between Disneyland Park and Walt Disney Studios.

Strategic Location

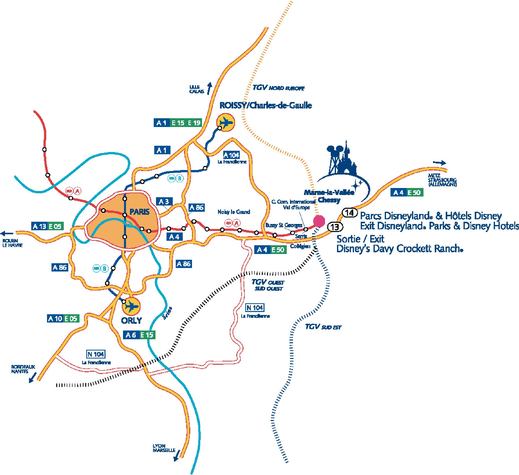

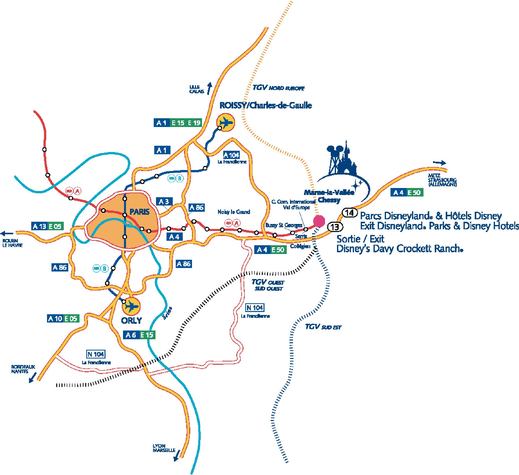

Disneyland Resort Paris is located approximately 32 kilometres (20 miles) east of Paris, France and benefits from access to a highly developed transportation network. In addition to service to Paris on the French suburban rail system, Disneyland Resort Paris has access to an extensive highway network that links it in less than one hour to both Paris and the two international airports serving the Paris area, and also makes it easily accessible to most other regions of France. In addition, the train station that is located on the site of the Resort is one of the most active in France, with about forty high speed trains arriving per day and providing service to London in three hours by the Eurostar, and to Brussels in 1 hour and 30 minutes, Amsterdam in 4 hours and 30 minutes, and Cologne in 4 hours by the Thalys train. The strategic geographic location allows access to a market of 17 million potential guests less than 2 hours away by road or rail transport and 320 million potential guests less than 2 hours away by plane.

19

Target Markets

We have six key proximate markets: France, the United Kingdom, Benelux (Belgium, Luxembourg and the Netherlands), Germany, Italy and Spain. Within these markets, our primary target market is families with children from 3-15 years old but secondary markets also include groups, young adults and convention planners. Each year, our success in marketing to specific countries and markets is impacted by a variety of strategic decisions, including our pricing policy and our package offers, as well as external factors such as the strength of local economies, exchange rates, cultural interests, and holiday and vacation timing. The introduction of the euro has eliminated exchange rate concerns in all key markets except the United Kingdom.

Based on internal surveys, the geographical breakdown of our theme park guest attendance is as follows:

| | 2003

| | 2002

| | 2001

| |

|---|

| France | | 39 | % | 40 | % | 40 | % |

| United Kingdom | | 22 | % | 21 | % | 18 | % |

| Belgium, Luxembourg and the Netherlands | | 16 | % | 15 | % | 16 | % |

| Italy/Spain | | 9 | % | 9 | % | 8 | % |

| Germany | | 6 | % | 7 | % | 8 | % |

| Other | | 8 | % | 8 | % | 10 | % |

| | |

| |

| |

| |

| Total | | 100 | % | 100 | % | 100 | % |

| | |

| |

| |

| |

Distribution

We distribute our product offer through a wide variety of channels. Tour packages, which in many cases include transportation, lodging, food and theme park tickets are distributed through our call centres, on our internet site or through third-party distributors.

Theme park tickets are sold not only within these packages, but also through tourism intermediaries, directly at the gate and by various retail outlets (the Disney Stores, FNAC, Virgin Mega-Stores, and at French, Belgian and Swiss railway stations and others).

20

Hotel bookings can be made with us by individual guests, either directly or throughEuro Disney Vacances S.A., our in-house tour operator. The call centres, based at the Resort site and in the United Kingdom, receive an average approximately 6,100 calls per day from all over Europe. Apart from the United Kingdom, all other markets are serviced from the central reservation office at the Resort site in Paris, with country-specific telephone numbers. Third-party distributors, including tour operators with their own packages and group sales, currently account for the remaining hotel reservations.

Euro Disney Vacances S.A. focuses on distribution of short-break packages, with offices in Paris and other French cities as well as regional offices in Amsterdam, Brussels, Copenhagen, Frankfurt, London and Madrid. These offices provide a local marketing presence and the necessary travel industry trade support. We also work with a select number of tour operators in our major markets.

In addition, we have established special travel alliance partnerships with the principal European transporters. Travel alliance agreements have been completed with Air France on a pan-European basis and with Eurostar and Thalys. These agreements provide carriers with the right to use Disneyland Resort Paris in their advertising campaigns and some with the right to special joint promotional packages. In return, we have the right to provide airline or train tickets in our short-break packages and to secure allotments. Guest visitation from the United Kingdom, Spain, Italy and Belgium reflects our relationship with these partners.

Our internet site atwww.disneylandparis.com is available in 6 languages and allows site visitors to learn about our Resort, order a brochure, e-mail reservation requests directly to our reservation center, purchase theme park-tickets, and to book certain packages. We are currently working on projects to expand and improve our ability to sell our products directly to guests on our internet site.

A.4.2Competition

We compete for guests throughout the year with theme parks as well as other European and international holiday destinations (including ski and seaside resorts) and with other leisure and entertainment activities (including museums and cultural activities) in the Paris region. Our hotels compete with other hotels on our site and in the Paris region and convention centres all over Europe. Our Resort also competes with major international tourist-attracting events such as the festivities that were organised in connection with the 1999 "Millennium" celebrations (the Universal Exposition of Hanover, the Jubilee of Rome and the Millennium Dome of London) and major sporting events, such as the soccer World Cup and the Olympic Games.

The theme park market in Europe has grown significantly over the last two decades. According to the publicationAmusement Business, the ten largest European theme parks attracted approximately 36.2 million guests in 2003. The following table sets forth the attendance of each of these ten destinations.

21

Theme Parks in Europe(1)

(in millions)

| |

| | Attendance

|

|---|

Theme Park

| | Location

|

|---|

| | 2003

| | 2002

|

|---|

| Disneyland Resort Paris (fiscal year ended September 30) | | France | | 12.4 | | 13.1 |

| Europa Park | | Germany | | 3.3 | | 3.3 |

| Tivoli Gardens | | Denmark | | 3.3 | | 3.8 |

| Gardaland | | Italy | | 3.2 | | 2.9 |

| De Efteling | | Netherlands | | 3.1 | | 3.0 |

| Lieseberg | | Sweden | | 3.0 | | 3.1 |

| Universal's Medditerrania (formerly Port Aventura) | | Spain | | 2.7 | | 3.2 |

| Bakken | | Denmark | | 2.7 | | 2.5 |

| Alton Towers | | United Kingdom | | 2.5 | | 2.5 |

| | | | |

| |

|

| | | | | 36.2 | | 37.4 |

| | | | |

| |

|

- (1)

- Source: Amusement Business. Excluding non-gated amusement parks.

A.5Human Resource Management

To entertain our guests, we employed an average of approximately 12,200 employees during fiscal year 2003 on a full-time equivalent basis. Our employees come from approximately 100 different countries and more than half of them have been employed by us since Opening Day. The table below presents the average number of persons employed by the Group as well as the associated employee costs for each of the last five fiscal years:

Fiscal Year

| | Average Number

of Employees

| | Total Employee Costs

(€ in millions)

|

|---|

| 2003 | | 12 223 | | 365.7 |

| 2002 | | 12 467 | | 352.0 |

| 2001 | | 11 109 | | 307.0 |

| 2000 | | 11 432 | | 297.6 |

| 1999 | | 10 574 | | 283.6 |

The seasonal nature of our business means that the need for employees is, to a certain extent, also seasonal. Accordingly, we have developed a system, used in both the theme parks and the hotels, to optimize scheduling and automate labour exchange between operations. The system improves efficiency by automating both scheduling and the corresponding pay systems. In conjunction with this system, flexible working contracts have been negotiated with the employee representatives. Special part-time contracts such as four-day working weeks, 32-hour weeks or individually negotiated contracts, have been implemented. As a result, over the past three fiscal years, many temporary jobs have been turned into flexible long-term contracts with Disneyland Resort Paris, facilitating job security and better training for employees. This new flexibility has helped management to better match the number of employees to the levels of customer demand.

22

An internal university provides permanent training for all employees in matters of service and entertainment. To improve quality, approximately 46,947 training days were provided to employees in 2003. To enhance the diversity of skills, training classes range from finance to more specific subjects such as the welcoming of guests "Disney Style". We are continually seeking to enhance our image as a "teaching" company, recognised for outstanding training techniques. As an example, in November 2000, we signed an agreement with certain of our labour unions for the creation of a new program aimed at providing employees with a new professional status called "Hôte d'Accueil Touristique" and thus a wider recognition of their skills on a national scale. Our objective is to develop the competencies of approximately 800 employees, over a period of fifteen months, through group training that permits them to earn four different state-recognized professional competency certificates.

Seven French labour unions, theConfédération Générale du Travail (C.G.T.), theConfédération Française Démocratique du Travail (C.F.D.T.), theConfédération Générale de l'Encadrement (C.F.E./C.G.E.),Force Ouvrière (C.G.T./F.O.), theConfédération des Travailleurs Chrétiens (C.F.T.C.), theSyndicat Indépendant du Personnel Euro Disney (S.I.P.) and theUnion Nationale des Syndicats Autonomes (U.N.S.A.), are represented at Disneyland Resort Paris. We comply with information and consultation requirements with respect to the unions and hold other periodic consultations with employee representatives. Since Opening day, there have been no significant strikes or work stoppages.

In June 1998, the French Government enacted a law to reduce the official work week from 39 to 35 hours. For companies that implemented the 35-hour week before July 1, 1999, the French government is providing subsidies in the form of lower payroll taxes for each of the five years following the date of implementation. We began operating on the basis of a 35-hour work-week on June 6, 1999 and benefit from such subsidies (which will expire in 2004), which have helped to offset the costs of additional employees.

We have made no distributions under our statutory profit sharing plan. However, since October 1, 1995, the Group has provided employees a supplemental profit sharing plan. Under the latest plan amendment signed March 10, 2003 applying to fiscal years 2003 and 2004, employees are eligible to receive a bonus of between 0% to 3.0% of their annual salary, if Income before Lease and Net Financial Charges as presented in the Consolidated Financial Statements of the Group reaches certain pre-defined thresholds.

The following table summarizes amounts paid under this profit sharing plan for each of the last five fiscal years:

| | Year ended September 30,

|

|---|

(€ in millions)

|

|---|

| | 2003

| | 2002

| | 2001

| | 2000

| | 1999

|

|---|

| Total Profit Sharing Expense | | — | | — | | 1.9 | | — | | 1.7 |

In addition, an employee savings plan exists in order to facilitate and encourage individual savings. The Company matches 30% of the first € 3,050 of each employees' contribution to the plan each year.

23

A.6Significant Operating Contracts

A.6.1 Agreements with French Governmental Authorities

On March 24, 1987, The Walt Disney Company entered into the Master Agreement with the Republic of France, the Region of Ile-de-France, the Department of Seine-et-Marne, the Public Establishment for the Development of the new town of Marne-la-Vallée (l'Etablissement Public d'Aménagement de la Ville Nouvelle de Marne-la-Vallée—EPAMarne) and the Suburban Paris Transportation Authority "RATP", for the development of the Resort and other various development phases for the 1,943 hectares of undeveloped land located 32 kilometres east of Paris in Marne-la-Vallée, France. Immediately after, The Walt Disney Company assigned its rights and obligations under the Master Agreement to Euro Disney Corporation, a wholly-owned subsidiary incorporated in Delaware. The French governmental authorities party to the Master Agreement have subsequently waived all rights of recourse against The Walt Disney Company under the Master Agreement. In addition, in 1988 a new governmental authority named the Public Establishment for the Development of Sector IV of Marne-la-Vallée ("EPA France"), with responsibility for the development of the entirety of the Resort, was created pursuant to the Master Agreement and became a party thereto. The Company and Euro Disneyland S.N.C. ("the Phase IA Financing Company") became parties to the Master Agreement in April 1989, and Euro Disney Associés S.N.C. ("EDA SNC") became a party in January 1995 following the Financial Restructuring. While the Company, the Phase IA Financing Company and EDA SNC are severally responsible to the French public authorities for the performance under the Master Agreement, the Company, in its capacity as main partner and the main beneficiary of the undertakings of the Master Agreement, has ultimate responsibility for the performance obligations under the Master Agreement. See Item 4—Section C.2 "Financing Companies" for additional information on the Phase IA Financing Company and EDA SNC.

The Master Agreement, as amended from time to time, determines the general outline of each phase of development as well as the legal and initial financial structure. It provides that loans with specific terms and conditions shall be granted. The significant components thereof are summarized below.

Development planning

The Master Agreement sets out a master plan for the development of the land and a general development program defining the type and size of facilities that we have the right to develop, subject to certain conditions, over a 30-year period ending no sooner than 2017. Before beginning any new development phase, we must provide EPA France and several other French public authorities a proposal and other relevant information for approval. On the basis of the information provided, the Company and the authorities involved develop detailed development programmes.

After having concluded negotiations for a detailed program for the second phase of Val d'Europe urban development on December 9, 1997, the Company and EPA France concluded negotiations for a detailed program for the third phase of the Val d'Europe urban development on July 9, 2003. (Sec Item 4, section A.3.2 "Real Estate Development segment").

Financing of infrastructure

The Master Agreement specifies the infrastructure to be provided by the French authorities to the Resort. The relevant French public authorities have a continuing obligation to finance construction of the primary infrastructure, such as highway interchanges, primary roadways to access the site, water distribution and storage facilities, rain water and waste water treatment installations, waste treatment facilities, gas and electricity distribution systems as well as telecommunication networks. The Master Agreement also specifies the terms and conditions of our contribution to the financing of certain infrastructure.

24

Infrastructure provided by the French governmental authorities included the extension on the "A" line of the RER suburban rail link (which links Paris and its eastern and western suburbs to Disneyland Resort Paris site with two stations), the construction of two interchanges linking the Resort directly with the A4 motorway, a TGV (high speed train) station linking the Resort to other major cities of Europe and the completion of an access road around the Resort site.

Land rights

The Master Agreement provides for our right, subject to certain conditions, to acquire the land necessary for the expansion of the Disneyland Resort Paris on the Marne-la-Vallée site. Our exercise of these acquisition rights is subject to certain development deadlines, which if not met would result in the expiration of these rights. Through the date of this Annual Report, all minimum development deadlines have been met and no land rights have expired unused. The next deadline for the expiration of land right options will be December 31, 2007.

In order to maintain our land acquisition rights for the remaining undeveloped land around the Resort (approximately 1,000 hectares), we are required to pay annual fees to EPA France. For fiscal year 2003, these fees totalled € 0.8 million.

Department of Seine-et-Marne tax guarantee

Pursuant to the Master Agreement, our Company, the Phase IA Financing Company, EDA SNC and the Republic of France guaranteed a minimum level of tax revenues to the Department of Seine-et-Marne. If the Department's tax revenues are less than the amount of charges borne by the Department for primary and secondary infrastructure during the period from 1992 to 2003, the Republic of France and our Company will each reimburse, in equal shares to the Department, the difference between the tax revenues collected and the charges borne, up to an aggregate amount of approximately € 45.0 million (adjusted for inflation from 1986). No amounts were due with respect to this tax guarantee as of the end of the first measurement period on December 31, 1998. A second and last assessment, covering the entire period through December 31, 2003, will be made in 2004. Based upon current estimates, the Company will be required to pay the Department approximately € 22 million under the terms of the guarantee.

A.6.2 Participant Agreements

Our Company has entered into long-term participant agreements with companies that are leaders in their fields. As of the close of fiscal year 2003, 14 participant agreements were in effect, with the following companies: Coca-Cola, Esso, France Telecom, and its subsidiary Orange, General Motors, Hasbro Inc., Hertz, IBM, Kellogg's, Kodak, McDonald's, Nestlé, and its subsidiary Perrier-Vittel, and Visa. These participant agreements provide the Disneyland Resort Paris participants with the following rights in exchange for an individually negotiated fee: (i) a presence on site through the sponsorship of one or more of Disneyland Park, Walt Disney Studios Park or Disney Village's attractions, restaurants or other facilities, (ii) promotional and marketing rights with respect to the category of product which is covered by the participant agreement, and (iii) the status of privileged supplier of our Company. Each participant agreement terminates automatically in the event of termination of the License Agreement between The Walt Disney Company (Netherlands) B.V. and the Company. (See "License Agreement" discussion in Item 4, Section A.6.3—"Undertakings and Agreements with The Walt Disney Company and Subsidiaries").

25

A.6.3 Undertakings and Agreements with The Walt Disney Company and Subsidiaries

Undertakings

In connection with the Financial Restructuring, The Walt Disney Company agreed, so long as certain indebtedness is outstanding to our major creditors, to hold at least 34% of the common stock of our Company until June 10, 1999, at least 25% until June 10, 2004 and at least 16.67% thereafter. In connection with the financing of Walt Disney Studios Park, The Walt Disney Company has committed to the CDC to hold at least 16.67% of our common stock until 2027.

Our Company and Euro Disneyland Participations S.A., an indirect 99.9%-owned subsidiary of The Walt Disney Company (which is also a partner of the Phase IA Financing Company) have agreed to indemnify the partners of the Phase IA Financing Company as to all liabilities arising for our Company and the Phase IA Financing Company under the Master Agreement. To the extent the resources of our Company and the Phase IA Financing Company are insufficient to cover any such indemnity, The Walt Disney Company, through a wholly-owned subsidiary, has agreed to indemnify the partners of the Phase IA Financing Company up to an additional € 76.2 million. In connection with the Financial Restructuring, EDA SNC also undertook certain indemnification obligations in favour of the partners of the Phase IA Financing Company in respect of certain liabilities arising under the Master Agreement.

Development Agreement

Pursuant to the Development Agreement dated February 28, 1989 with our Company (the "Development Agreement"), Euro Disney S.A. provides and arranges for other subsidiaries of The Walt Disney Company to provide a variety of technical and administrative services to the Company. These services are in addition to the services Euro Disney S.A. is required to provide as Management Company (see Item 10, Section B.1— The Management Company) and include, among other things, the development of conceptual designs for our existing Theme Parks and future facilities and attractions, the manufacture and installation of specialized show elements, the implementation of specialized training for operating personnel, the preparation and updating of operations, maintenance and technical manuals, and the development of a master land use plan and real estate development strategy. As the Development Agreement concerns the entire Resort, the services provided by Euro Disney S.A. pursuant to the Development Agreement extend to all the installations of Walt Disney Studios Park, primarily for the design and construction of said installations. Euro Disneyland Imagineering S.A.R.L. ("EDLI"), an indirect subsidiary of The Walt Disney Company, was responsible for management and administration of the overall design as well as the construction of our theme parks, including the design and procurement of the show-and-ride equipment. Most of the other facilities of the Resort were designed under our supervision with the administrative and technical assistance of affiliates of The Walt Disney Company specialized in the development of hotels, resorts and other retail and commercial real estate projects in the United States, in accordance with the related servicing agreements.