Use these links to rapidly review the document

TABLE OF CONTENTS

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

November 24, 2004

Commission File Number 33-79548

EURO DISNEY S.C.A.

(Translation of registrant's name into English)

Immeubles Administratifs

Route Nationale 34

77144 Chessy

France

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F: ý Form 40-F: o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: o No: ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: o No: ý

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes: o No: ý

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

Table of Contents

| I | Chairman's Letter | | 2 - 4 |

II |

Management Report on the Consolidated Financial Statements |

|

5 - 18 |

III |

Consolidated Financial Statements |

|

19 - 55 |

IV |

Supervisory Board Report on the Management of the Euro Disney Group |

|

56 - 58 |

V |

Statutory Auditors Report on the Consolidated Financial Statements |

|

59 - 60 |

VI |

Management Report on the Proposed Share Capital Increase and Other Issuances of Securities |

|

61 - 62 |

VII |

Supervisory Board Report on the Proposed Share Capital Increase and Other Issuances of Securities |

|

63 - 64 |

VIII |

Statutory Auditors' Special Reports on the Proposed Share Capital Increase and Other Issuances of Securities |

|

65 - 66 |

IX |

Management Report on the Proposed Contribution of Assets and Related Amendments to the Company's By-Laws |

|

68 - 217 |

X |

Supervisory Board Report on the Proposed Contribution of Assets and Related Amendments to the Company's By-Laws |

|

214 - 217 |

XI |

Resolutions presented at the Combined Shareholders Meeting |

|

218 - 232 |

XII |

Management Report on the Financial Statements of Euro Disney S.C.A. |

|

233 - 244 |

XIII |

Financial Statements of Euro Disney S.C.A. |

|

250 - 278 |

XIV |

List of Mandates of the Members of the Supervisory Board |

|

279 - 282 |

XV |

Supervisory Board Report on the Management of Euro Disney S.C.A. |

|

283 - 285 |

XVI |

Statutory Auditors Report on the Financial Statements of Euro Disney S.C.A. |

|

286 - 287 |

XVII |

5-years Financial Data Table for Euro Disney S.C.A. |

|

288 |

XVIII |

Supervisory Board Report on Related-Party Transactions |

|

289 - 290 |

XIX |

Statutory Auditors Special Report on Related-Party Transactions |

|

291 - 296 |

XX |

Draft of Proposed Amended By-Laws of Euro Disney S.C.A. |

|

297 - 313 |

XXI |

Admission Card Request Form |

|

314 |

XXII |

Request Form for Documentation and Information |

|

316 |

XXIII |

Glossary |

|

318 - 323 |

Chairman's Letter

As we ended our fiscal year on September 30, 2004, we began a new period of opportunity for development and growth. After two years of uncertainty in the context of extremely difficult conditions in the European travel and tourism industry, we reached agreement on a comprehensive financial restructuring that will solidify our financial position and allow us to invest in the future of the number one tourist destination in Europe.

We are asking Euro Disney shareholders to vote in favour of several parts of the financial restructuring, including a legal reorganisation, a share capital increase with preferential subscription rights maintained and technical changes to our by-laws (statuts). By approving these important steps, you will be giving Euro Disney the chance to benefit from a rebound of the travel and tourism industry, and to do even better by creating new attractions and reaching out to new customers to ensure growth and to improve our financial performance.

Fiscal year 2004

For the second year in a row, our financial results were disappointing. The European travel and tourism industry continued to suffer from slow economic growth and difficult geopolitical conditions. We were also adversely affected by the uncertainty surrounding our financial situation, as we announced successive waivers of our debt covenants and interim agreements with some of our lenders. In this context, our theme park attendance remained the same as the prior year, at 12.4 million visitors.

We began to take steps to attract new visitors to Walt Disney Studios Park with our Park Hopper ticket that allows guests to go back and forth between the parks during the day for a single, premium price. We also saw the opening of new "Selected and Associated Hotels", which are hotels operated on-site by third parties. The Selected and Associated Hotels are a key to our future growth potential, although they reduced the occupancy of our own hotels in their initial phase.

Revenues increased slightly to €1,048 million, reflecting mainly higher guest spending. Our operating margin was impacted by a legally mandated change in accounting principles that resulted in our recording depreciation charges on assets owned by special purpose financing companies (even though our relationship with those companies did not change), as well as the restoration of the accrual of royalties at full rates and management fees due to The Walt Disney Company. We generated earnings before income, taxes, depreciation and amortisation (EBITDA) of almost 12% of our revenues, and we generated operating cash flow of €124 million.

The Restructuring

After more than a year of negotiations, we now have an agreement on a comprehensive restructuring of our financial situation. Once the restructuring is implemented, it will provide an opportunity for our future development in three respects:

- •

- We will have new cash resources from a new credit line from The Walt Disney Company and a share capital increase.

- •

- Many of our cash payment obligations under our financing agreements will be deferred, giving us the breathing room to grow.

2

- •

- We will have the authorisation to implement an exciting new development plan that will give us the means to attract new visitors and invest in our future growth.

Our growth strategy

Continued innovation is essential to success. New attractions and shows give us opportunities to communicate the vitality of the Resort, attracting new visitors and giving our previous guests new reasons to return. We saw the benefits of this in fiscal year 2004 with the success of the newLegend of the Lion King show, which we opened in June.

We have planned an ambitious development programme, designed to take full advantage of the new financial flexibility that the restructuring will provide. The programme includes:

- •

- Three major new attractions scheduled to open in fiscal years 2006, 2007 and 2008, including two new attractions at Walt Disney Studios Park.

- •

- In fiscal year 2005, the relaunch ofSpace Mountain withMission 2, a new journey deeper into space beyond the moon to the far reaches of the universe, as well as a fireworks celebration for the 50th anniversary of the original Disneyland in California.

- •

- Important enhancements at our theme parks, providing even more of a magical experience designed to attract our core customer base of families with small children.

- •

- New seasonal events, including Magic Unlimited (allowing repeat rides without waiting in line for certain attractions), Kids Carnival and an Easter celebration.

We will also launch an ambitious communications programme designed to attract more first-time visitors to the Resort. Our research shows that there are substantial numbers of European families who have never visited the Resort but have indicated that they would like to do so, and we will be targeting this group to take advantage of the strong recognition of the Disney brand.

The shareholders meeting

To make all of this possible, we need our shareholders to approve parts of the restructuring at the combined general shareholders meeting scheduled for December 17, 2004. At the meeting, you will be asked to vote on the following:

- •

- At the ordinary portion of the meeting, the approval of our annual consolidated and statutory accounts for fiscal year 2004, the approval of certain related-party agreements and the appointment or renewal of members of the Supervisory Board.

- •

- At the extraordinary portion of the meeting, three important elements of the restructuring:

- –

- A €250 million to €300 million share capital increase (€100 million of which will be subscribed by The Walt Disney Company). The share capital increase will be implemented through the issuance of preferential subscription rights to all shareholders.

3

- –

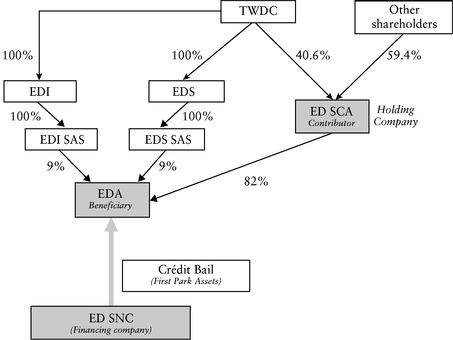

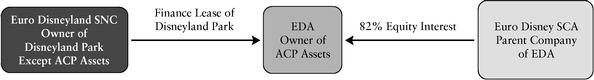

- A legal reorganisation that will result in our contributing substantially all of our assets and liabilities to Euro Disney Associés S.C.A. (EDA) in exchange for 82% of EDA's share capital (The Walt Disney Company will hold the remaining 18%). This will allow us to avoid making €292 million in payments to EDA that would have been necessary in order for the Company to exercise its option to directly re-acquire rights to the Disneyland Park and certain of its key attractions as provided in the leases relating to such assets.

- –

- Technical changes to our by-laws (statuts).

The materials that you are receiving with this letter include detailed reports on our fiscal year 2004 results, our development strategy, the restructuring and each of the items on which you will be asked to vote, along with various other documents that we regularly furnish to you pursuant to French law.

* * * * *

A positive vote at the shareholders meeting will allow us to go forward with a programme that we believe will be the catalyst for the future success of the Resort and our Company. We hope that you will help us realise our vision.

We believe in our future. Disneyland Resort Paris is and will remain the only truly magical destination in Europe.

Chessy, November 17, 2004

Euro Disney S.A.S.,Gérant

André Lacroix, Chairman and Chief Executive Officer

4

Euro Disney S.C.A. Group

Management Report on the Consolidated Financial Statements

Fiscal Year ended September 30, 2004

INTRODUCTION

Financial Restructuring and Development Strategy

The close of fiscal year 2004 brought an agreement on a comprehensive restructuring (the "Restructuring") of the financial obligations of Euro Disney S.C.A. (the "Company") and its consolidated subsidiaries (the "Group"). The Company signed a Memorandum of Agreement with its lenders and The Walt Disney Company ("TWDC") on a restructuring of the Group's financial obligations that, once implemented, will provide new cash resources, defer cash payment obligations and give the Group the flexibility to invest in new attractions and continue the development of the Disneyland Resort Paris (the "Resort") and its surrounding areas. Implementation of the Restructuring is subject to certain conditions, including the completion by March 31, 2005 of a share capital increase, through an equity rights offering, with gross proceeds of at least € 250 million (before deducting underwriting commissions and other costs).

By reaching agreement on the Restructuring, the Group has the opportunity to pursue a strategy designed to attract new theme park visitors and hotel guests, and to increase repeat visitation by enhancing guest satisfaction and value perception. Coupled with what management hopes will be a strong rebound in the short break and theme park markets in Europe, the Group believes that its development strategy has the potential to increase its revenues and improve its financial performance. Over the next several years, the Group intends to:

- •

- invest in major new attractions in the theme parks, primarily the Walt Disney Studios Park, providing major new attendance draws in fiscal years 2006, 2007 and 2008,

- •

- make additional investments to enhance existing assets, including important short-term improvements during the period of construction of the new attractions, featuring an upgrade and relaunch ofSpace Mountain in fiscal year 2005,

- •

- implement an integrated marketing and sales strategy, including leveraging new channels, to attract first-time visitors in core countries, and

- •

- add new seasonal attractions and events to improve visitation rates during off-peak periods and to take advantage of special event opportunities.

The Group's development strategy and its financial implications are described in more detail below. See "Restructuring, Development Strategy and Outlook". The terms of the Restructuring and its impact on the Group are described in a special report. See Item IX "Management Report on the Proposed Contribution of Assets and Related Amendments to the Company's By-Laws".

5

Summary of Financial Results in Fiscal Year 2004

In fiscal year 2004, revenues increased slightly to total € 1,048.0 million, as increased spending by theme park visitors and hotel guests was mostly offset by lower hotel occupancy rates, as well as an anticipated decline in real estate development revenues. Attendance at the theme parks in fiscal year 2004 remained stable compared to the prior year at approximately 12.4 million visitors.

The Group incurred an operating loss of € 23.9 million in fiscal year 2004, which was € 56.0 million below the € 32.1 million of pro-forma operating income recorded in the prior year (the pro-forma presentation reflects a change in accounting method that significantly affected the scope of consolidation in fiscal year 2004, as discussed below). The increased loss was primarily due to the resumption of accruing royalties at full rates and management fees, following the waiver by TWDC of royalties and management fees in the last three quarters of fiscal year 2003. Higher marketing and sales spending partially offset by reduced general and administrative expenses also affected operating margin. Net loss increased from € 58.3 million (on a pro-forma basis) in fiscal year 2003 to € 145.2 million in fiscal year 2004, as a result of the lower operating margin as well as significant exceptional items.

The Group generated €124.6 million of operating cash flow in fiscal year 2004 despite the net loss, since a portion of the Group's operating expenses consist of non-cash depreciation and amortisation charges, and the Group's working capital requirements decreased as the increase in accrued royalties and management fees for fiscal year 2004 (which are not payable until fiscal year 2005), as well as accrued interest on the CDC loans for Walt Disney Studios Park (which was deferred under the terms of the relevant agreement), did not result in cash outlays. Under the terms of the Restructuring, the royalties and management fees for fiscal year 2004 will be paid when the Restructuring is implemented.

In preparing the consolidated financial statements, the Group has used the going-concern assumption based on management's belief that the conditions necessary to implement the Restructuring will be met within the contractual deadlines. If the principle of going concern had not been assumed, it would likely have had a significant impact on the valuation of assets and liabilities as of September 30, 2004.

6

FISCAL YEAR 2004 FINANCIAL RESULTS

Changes in Accounting Principles

Effective October 1, 2003 (the first day of fiscal year 2004), the Group adopted new accounting rules mandated by Article 133 of Financial Security Law (Loi de Sécurité Financière) with respect to the consolidation of special purpose financing companies that are not legally controlled by the Group. Under these new rules, the financing companies, from which the Group leases a substantial portion of its operating assets (the "Financing Companies"), have been included in the Group's consolidated financial statements. In the past, lease payments to the Financing Companies were recorded as incurred, along with disclosure by the Group of the leasing arrangements, contractual commitments for lease rentals, and the related debt obligations of the Financing Companies. As a result of the new consolidation rules, these operating assets are now consolidated, resulting in increased assets and borrowings. The Group's receivables from the Financing Companies have been eliminated in consolidation. In addition, shareholders' equity has been reduced, reflecting primarily past depreciation charges related to the operating assets owned by the Financing Companies, which exceeded the lease payments expensed for the same periods. The accounting change also affects the classification and amount of costs on the income statement, with increased operating expenses and depreciation and reduced lease rental expense (consequently, the income statement line item formerly entitled "lease and net financial charges" has been renamed "net financial charges"). The accounting change does not affect the legal structure, financial position or cash flows of the members of the Group.

To enhance comparability, the Group has provided financial information on a pro-forma basis in addition to its as-reported results. The pro-forma information has been prepared as if the fiscal year 2004 change in accounting principle discussed above was in effect during all of fiscal year 2003 (see also Notes 2 and 29 to the Consolidated Financial Statements). The following table summarises certain financial data derived from the Group's historical and pro-forma consolidated financial statements.

CONSOLIDATED CONDENSED PRO-FORMA STATEMENTS OF INCOME

| |

| | Fiscal Year 2003

| | Fiscal Year 2004/

Pro-Forma 2003

| |

|---|

| | Fiscal Year

2004

| | Pro-

Forma

| | Accounting

Change

| | As

Reported

| | Variance

| |

| |

|---|

(€ in millions)

| | Amount

| | %

| |

| |

|---|

| |

| |

|---|

| Revenues | | 1,048.0 | | 1,046.8 | | (0.7 | ) | 1,047.5 | | 1.2 | | – | | | |

| Costs and Expenses | | (1,071.9 | ) | (1,014.7 | ) | (99.6 | ) | (915.1 | ) | (57.2 | ) | (6 | )% | | |

| |

| |

| |

| |

| |

| |

|---|

| |

|---|

| Income (Loss) before Financial Charges | | (23.9 | ) | 32.1 | | (100.3 | ) | 132.4 | | (56.0 | ) | (175 | )% | | |

| Net Financial Charges | | (105.7 | ) | (111.2 | ) | 89.1 | | (200.3 | ) | 5.5 | | 5 | % | | |

| |

| |

| |

| |

| |

| |

|---|

| |

|---|

| Loss before Exceptional Items | | (129.6 | ) | (79.1 | ) | (11.2 | ) | (67.9 | ) | (50.5 | ) | (64 | )% | | |

| Exceptional gain (loss), net | | (22.3 | ) | 12.0 | | 0.1 | | 11.9 | | (34.3 | ) | (286 | )% | | |

| Minority interests | | 6.7 | | 8.8 | | 8.8 | | – | | (2.1 | ) | (24 | )% | | |

| Net Loss | | (145.2 | ) | (58.3 | ) | (2.3 | ) | (56.0 | ) | (86.9 | ) | (149 | )% | | |

| |

| |

| |

| |

| |

| |

|---|

| |

|---|

7

| | Theme Parks(1)

| | Hotels

|

|

|---|

Fiscal years

| | Total guests

(in millions)(2)

| | Spending

Per guest(3)

| | Occupancy

Rate(4)

| | Spending

Per room(5)

|

|

|---|

| |

|

|

|---|

| 2004 | | 12.4 | | € 42.7 | | 80.5% | | € 186.6 | |

| 2003 | | 12.4 | | € 40.7 | | 85.1% | | € 183.5 | |

| 2002 | | 13.1 | | € 40.1 | | 88.2% | | € 175.1 | |

| 2001 | | 12.2 | | € 38.9 | | 86.0% | | € 168.6 | |

| 2000 | | 12.0 | | € 38.1 | | 82.9% | | € 165.4 | |

- (1)

- Includes Disneyland Park and, from March 16, 2002, Walt Disney Studios Park.

- (2)

- Theme Park attendance is recorded on a "first click" basis, meaning that a person visiting both parks in a single day is counted as only one visitor.

- (3)

- Average daily admission price and spending for food,beverage and merchandise and other services sold in the Theme Parks, excluding VAT.

- (4)

- Average daily rooms sold as a percentage of total room inventory (total room inventory is approximately 5,800 rooms).

- (5)

- Average daily room price and spending on food, beverage and merchandise and other services sold in hotels, excluding VAT.

| |

| | Fiscal Year 2003

| | Fiscal Year 2004/

Pro-Forma 2003

| |

|---|

| | Fiscal Year

2004

| | Pro-

Forma

| | Accounting

Change

| | As-

Reported

| | Variance

| |

| |

|---|

(€ in millions)

| | Amount

| | %

| |

| |

|---|

| |

| |

|---|

| Theme Parks | | 531.3 | | 508.5 | | – | | 508.5 | | 22.8 | | 5 | % | | |

| Hotels and Disney Village | | 405.2 | | 416.7 | | – | | 416.7 | | (11.5 | ) | (3 | )% | | |

| Other | | 99.7 | | 98.0 | | (0.7 | ) | 98.7 | | 1.7 | | 2 | % | | |

| |

| |

| |

| |

| |

| |

|---|

| |

|---|

| Resort Segment | | 1,036.2 | | 1,023.2 | | (0.7 | ) | 1,023.9 | | 13.0 | | 1 | % | | |

| Real Estate Segment | | 11.8 | | 23.6 | | – | | 23.6 | | (11.8 | ) | (50 | )% | | |

| Total Revenues | | 1,048.0 | | 1,046.8 | | (0.7 | ) | 1,047.5 | | 1.2 | | – | | | |

| |

| |

| |

| |

| |

| |

|---|

| |

|---|

Theme park revenues increased 5% to € 531.3 million in fiscal year 2004 from € 508.5 million in the prior year as a result of higher per guest spending, coupled with stable attendance. The higher spending levels reflected three principal factors: an increase in average park admissions prices, the introduction of the "park hopper" ticket (which permits guests to visit both theme parks for a single price that is €9 higher than the single park price) and the elimination of low season reduced admission pricing. Merchandise and food and beverage revenues in the Theme Parks also increased.

Hotel and Disney Village revenues decreased 3% to € 405.2 million in fiscal year 2004 from € 416.7 million in the prior year, reflecting the decrease in hotel occupancy due to increased competition from new on-site capacity at hotels owned and operated by third parties. These hotels are part of the Group's overall development plan for the Resort, designed to increase overall hotel capacity to accommodate more visitors of the theme parks without requiring the Group itself to utilise capital to construct additional hotels. However, due to the soft demand environment, these new hotels had an adverse effect on occupancy at the Group's hotels. The impact on revenues of the decline in occupancy was partially offset by a 2% increase in average daily guest spending per room.

8

Other Revenues (which primarily include participant sponsorships, transportation and other travel services sold to guests) increased in fiscal year 2004 over the pro-forma prior year by € 1.7 million to € 99.7 million, reflecting an increase in transportation and other travel services sold to guests, partially offset by slightly lower participant sponsorship revenues.

Real Estate Development revenues decreased by €11.8 million in fiscal year 2004 compared to the prior year, reflecting a planned reduction in development projects. Real Estate Development revenues in fiscal year 2004 included primarily commercial and residential land sale transactions. In addition, revenues included ground lease income and fees for services provided to third-party developers that have signed contracts to either purchase or lease land on the Resort site for development. Given the successful completion of most of the additional hotel capacity projects in fiscal year 2003, the decrease reflected this planned reduction in development activity.

Costs and Expenses

Costs and expenses of the Group were composed of:

| |

| | Fiscal Year 2003

| | Fiscal Year 2004/

Pro-Forma 2003

| |

|---|

| | Fiscal Year

2004

| | Pro-

Forma

| | Accounting

Change

| | As

Reported

| | Variance

| |

| |

|---|

(€ in millions)

| | Amount

| | %

| |

| |

|---|

| |

| |

|---|

| Direct operating costs(1) | | 664.8 | | 655.2 | | 15.7 | | 639.5 | | 9.6 | | 2 | % | | |

| Marketing and sales expenses | | 112.6 | | 105.2 | | – | | 105.2 | | 7.4 | | 7 | % | | |

| General and administrative expenses | | 90.0 | | 96.7 | | – | | 96.7 | | (6.7 | ) | (7 | )% | | |

| Depreciation and amortisation | | 146.8 | | 149.5 | | 83.9 | | 65.6 | | (2.7 | ) | (2 | )% | | |

| Royalties and management fees | | 57.7 | | 8.1 | | – | | 8.1 | | 49.6 | | 612 | % | | |

| Total Costs and Expenses | | 1,071.9 | | 1,014.7 | | 99.6 | | 915.1 | | 57.2 | | 6 | % | | |

| |

| |

| |

| |

| |

| |

|---|

| |

|---|

- (1)

- Includes operating wages and employee benefits, cost of sales for merchandise and food and beverage, transportation services and real estate land sales and other costs such as utilities, maintenance, renovation expenses, insurance and operating taxes.

Direct operating costs increased € 9.6 million from the pro-forma prior year primarily reflecting the impact of higher labour costs. Marketing and sales expenses during fiscal year 2004 increased €7.4 million from the prior fiscal year, reflecting increased advertising during the second half of the fiscal year, associated largely with the promotion of the popular new show,The Legend of the Lion King. General and administrative expenses incurred during fiscal year 2004 decreased € 6.7 million from the prior fiscal year, reflecting decreased labour expenses.

Royalties and management fees totalled € 57.7 million in fiscal year 2004, € 49.6 million higher than the previous year, reflecting the October 1, 2003 (first day of fiscal year 2004) resumption of royalties at full rates and management fees subsequent to the waiver by TWDC of these fees for the last three quarters of fiscal year 2003. In fiscal year 2004, royalties totalled € 47.2 million after reinstatement to full contractual rates (fiscal year 1999 through 2003 rates were reduced to half of their original levels as a result of the 1994 financial restructuring). The fiscal year 2004 charge reflects the accrual of the royalties and management fees for the year, although cash payment of these amounts is not due until 2005.

9

| |

| | Fiscal Year 2003

| | Fiscal Year 2004/

Pro-Forma 2003

| |

|---|

| | Fiscal Year

2004

| | Pro-

Forma

| | Accounting

Change

| | As

Reported

| | Variance

| |

| |

|---|

(€ in millions)

| | Amount

| | %

| |

| |

|---|

| |

| |

|---|

| Resort Segment | | (25.6 | ) | 21.8 | | (100.3 | ) | 122.1 | | (47.4 | ) | (217 | )% | | |

| Real Estate Segment | | 1.7 | | 10.3 | | – | | 10.3 | | (8.6 | ) | (84 | )% | | |

| |

| |

| |

| |

| |

| |

|---|

| |

|---|

| Operating Margin(1) | | (23.9 | ) | 32.1 | | (100.3 | ) | 132.4 | | (56.0 | ) | (174 | )% | | |

| Depreciation and amortisation | | 146.8 | | 149.5 | | 83.9 | | 65.6 | | (2.7 | ) | (2 | )% | | |

| |

| |

| |

| |

| |

| |

|---|

| |

|---|

| EBITDA(2) | | 122.9 | | 181.6 | | (16.4 | ) | 198.0 | | (58.7 | ) | (32 | )% | | |

| | As a Percentage of Revenues | | 12% | | 17% | | – | | 19% | | – | | (5) | ppt | | |

| |

| |

| |

| |

| |

| |

|---|

| |

|---|

- (1)

- Operating Margin represents Income (Loss) before net financial charges and exceptional items as presented in the Consolidated Income Statement.

- (2)

- EBITDA represents Operating Margin before depreciation and amortisation.

Because of the substantial increase in depreciation and amortisation charges resulting from the consolidation of the Financing Companies, management has decided to use EBITDA as a tool to evaluate the performance of the Group's business. While management believes that EBITDA is a useful tool for evaluating performance, it is not a measure of financial performance defined under French generally accepted accounting principles, and should not be viewed as a substitute for operating margin, net income or operating cash flow in evaluating the Group's financial results.

EBITDA declined during fiscal year 2004 as a result of the lower operating margin in both the Resort and Real Estate operating segments. The Resort segment recorded an operating loss of € 25.6 million, reflecting a decrease of € 47.4 million from the pro-forma prior year performance, primarily reflecting increased royalties and management fees of € 49.6 million. Real Estate segment operating margin decreased € 8.6 million to € 1.7 million from € 10.3 million in the prior year, reflecting the planned reduction in development activities discussed above.

Net Financial Charges

Net financial charges were composed of:

| |

| | Fiscal Year 2003

| | Fiscal Year 2004/

Pro-Forma 2003

| |

|---|

| | Fiscal Year

2004

| | Pro-

Forma

| | Accounting

Change

| | As

Reported

| | Variance

| |

| |

|---|

(€ in millions)

| | Amount

| | %

| |

| |

|---|

| |

| |

|---|

| Lease rental expense | | – | | – | | 193.8 | | (193.8 | ) | – | | – | | | |

| Financial income | | 2.8 | | 3.8 | | (45.1 | ) | 48.9 | | (1.0 | ) | (26 | )% | | |

| Financial expense | | (108.5 | ) | (115.0 | ) | (59.6 | ) | (55.4 | ) | 6.5 | | 6 | % | | |

| Net Financial Charges | | (105.7 | ) | (111.2 | ) | 89.1 | | (200.3 | ) | 5.5 | | (5 | )% | | |

| |

| |

| |

| |

| |

| |

|---|

| |

|---|

10

Lease rental expense represents payments under financial lease arrangements with the consolidated Financing Companies and approximates the related debt service payments and operating expenses of such Financing Companies. Upon consolidation of the Financing Companies, this expense is eliminated.

Financial income, before the consolidation of the Financing Companies, was principally composed of interest income earned on long-term loans provided to the Financing Companies (see Note 4 to the Consolidated Financial Statements) and interest income on cash and short-term investments, as well as net gains arising from foreign currency transactions. Since the consolidation of the Financing Companies, the interest income earned on the long-term loans to the Financing Companies is eliminated. Financial expense is principally composed of interest charges on the long-term borrowings of the Group (including the Financing Companies under the new consolidation method) and the net impact of interest rate hedging transactions.

Net financial charges decreased € 5.5 million to € 105.7 million in fiscal year 2004. This decrease was primarily attributable to the impact of lower variable interest rates and related hedging costs, partially offset by the resumption of full interest charges following the end of the interest waiver provisions of the 1994 financial restructuring as of September 30, 2003.

Exceptional Income (Loss), net

The fiscal year 2004 exceptional loss of € 22.3 million primarily includes € 12.6 million of fees and expenses incurred in connection with the Restructuring negotiations and a € 9.2 million loss related to the write-off of equipment withinVisionarium, an attraction in Disneyland Park, which has been closed so that the building can house a new attraction expected to open in fiscal year 2006. See "Restructuring, Development Strategy and Outlook".

Exceptional income totalled € 11.9 million in fiscal year 2003. The Group sold three apartment developments used to provide housing to employees within close proximity to the site. The transaction generated € 34.1 million in net sale proceeds and a gain of € 11.0 million. The Group continues to operate the apartment developments under leases with the buyers, with the rental expense constituting part of the Group's operating expenses.

CAPITAL INVESTMENT, FINANCING AND LIQUIDITY

Capital Investment

| |

| | Fiscal Year 2003

| | Fiscal Year 2004/

Pro-Forma 2003

| |

|---|

| | Fiscal Year 2004

| |

|---|

| |

| | Accounting

Changes

| | As

Reported

| | Variance

| |

| |

|---|

(€ in millions)

| | Pro-Forma

| | Amount

| | %

| |

| |

|---|

| |

| |

|---|

| Resort Segment | | 28.7 | | 23.0 | | – | | 23.0 | | 5.7 | | 25 | % | | |

| Real Estate Segment | | 0.6 | | 1.8 | | – | | 1.8 | | (1.2 | ) | (67 | )% | | |

| Capital Investment | | 29.3 | | 24.8 | | – | | 24.8 | | 4.5 | | 18 | % | | |

| |

| |

| |

| |

| |

| |

|---|

| |

|---|

11

Fiscal year 2004 Resort segment capital expenditures included primarily the costs of developing and staging the newLegend of The Lion King stage show, which is presented several times daily on theVideopolis stage in the Disneyland Park, improvements to the Halloween and Christmas festivals and various other improvements to the existing asset base.

Fiscal year 2003 capital expenditures for the Resort segment related primarily to the transformation of an existing Disney Village restaurant intoKing Ludwig's Castle, featuring authentic Bavarian cuisine, completion of theFantillusion parade, which had its debut at Disneyland Park last year, and various improvements to the existing asset base. Investments in the Real Estate segment represented the purchase of land that the Group has subsequently leased to third parties under long-term ground leases.

Effective from October 1, 2002 (the first day of fiscal year 2003), the Group adopted new accounting rules related to major fixed asset renovations. As a result, major fixed asset renovations that were previously capitalised as incurred and amortised over a five-year period are now accrued in advance on a straight-line basis during the period between planned renovations.

Debt

The consolidation of the Financing Companies substantially increased the amount of borrowings recorded on the Group's balance sheet as of September 30, 2004. The following table shows the impact of the accounting change on the Group's borrowings. All figures are set forth before taking into account the impact from the Restructuring.

| | As-Reported

September

2003

| | Consolidate

Financing

Companies

| |

| |

| |

|

|

|---|

| | Fiscal Year 2004

| | September

2004

|

|

|---|

(€ in millions)

| | Increases

| | Decreases

|

|

|---|

| |

| |

|

|

|---|

| CDC Senior Loans | | 40.6 | | 86.9 | | – | | – | | 127.5 | |

| CDC Subordinated Loans | | 509.4 | | 274.4 | | – | | – | | 783.8 | |

| Credit Facility – Phase IA | | 114.1 | | 263.7 | | – | | (37.7 | ) | 340.1 | |

| Credit Facility – Phase IB | | 24.3 | | 139.2 | | – | | (13.0 | ) | 150.5 | |

| Partner Advances – Phase IA | | – | | 304.9 | | – | | – | | 304.9 | |

| Partner Advances – Phase IB | | – | | 96.9 | | – | | – | | 96.9 | |

| TWDC Loans | | – | | 276.4 | | – | | (259.1 | ) | 17.3 | |

| TWDC Line of Credit | | 102.5 | | – | | 22.5 | | – | | 125.0 | |

| Other loans | | 15.5 | | – | | – | | (15.5 | ) | – | |

| | Sub-Total | | 806.4 | | 1,442.4 | | 22.5 | | (325.3 | ) | 1,946.0 | |

|

|---|

| Accrued Interest | | 61.1 | | 138.5 | | 93.7 | | (186.5 | ) | 106.8 | |

| Total Borrowings | | 867.5 | | 1,580.9 | | 116.2 | | (511.8 | ) | 2,052.8 | |

|

|---|

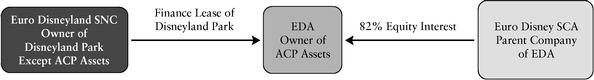

During fiscal year 2004, the Group made scheduled principal repayments of € 66.2 million, offset by € 22.5 million of new drawings on the Group's line of credit with TWDC. In addition, in September 2004, Euro Disney Associés S.C.A. ("EDA") an indirect, wholly-owned affiliate of TWDC and one of the consolidated Financing Companies, was re-capitalised by TWDC resulting in the transfer of borrowings (€ 259.1 million) and accrued interest (€ 125.0 million) in the total amount of € 384.1 million to minority interests. The Company will acquire an 82% interest in EDA in connection with the Restructuring. See Item IX "Management Report on the Proposed Contribution of Assets and Related Amendments to the Company's By-laws".

12

The Group's debt agreements include covenants with respect to its financing arrangements. These covenants include restrictions on additional indebtedness and capital expenditures, the provision of certain financial information and compliance with certain financial thresholds. The Group has received successive waivers of certain of these covenants for the fiscal year 2003 and 2004 reporting periods. The covenants are being renegotiated in connection with the Restructuring.

Cash Flows and Liquidity

As of September 30, 2004, cash and short-term investments totalled € 131.4 million (including € 49.1 million of cash and short-term investments held by the Financing Companies that were consolidated as of the beginning of fiscal year 2004). As presented in the Group's Consolidated Statements of Cash Flows, cash and cash equivalents increased by € 36.7 million from the pro-forma prior year to € 131.3 million as of September 30, 2004. Specifically, this increase in cash and cash equivalents resulted from:

| • Cash Flows from Operating Activities | | € 124.6 million |

| • Cash Flows used in Investing Activities | | € (28.8) million |

| • Cash Flows used in Financing Activities | | € (59.1) million |

Cash flows from operating activities remained stable compared to the pro-forma prior year, reflecting the impact of lower net income, which was offset by favourable changes in working capital items (principally relating to payables, including royalties and management fees, which did not result in cash payments).

Cash flows used in investing activities totalled € 28.8 million reflecting € 28.6 million of capital investment expenditures. Capital investment expenditures related primarily to the projects discussed above under "Capital Investment".

Cash flows used in financing activities totalled € 59.1 million reflecting debt repayments of € 66.2 million, payments totalling € 15.4 million to increase the debt security deposit and fund expenditures relating to the Restructuring, partially offset by € 22.5 million of additional drawings under the Group's € 167.7 million line of credit with TWDC, thereby bringing the outstanding balance of the credit line as of September 30, 2004 to € 125.0 million.

Based upon available cash and short-term investments and the additional resources made available in accordance with transition measures of the Restructuring, including a new line of credit from TWDC in the amount of € 150.0 million, management believes the Group will have in the normal course of business the resources necessary to meet funding requirements arising until the Restructuring is fully implemented, which is scheduled to occur no later than March 31, 2005. Absent implementation of the Restructuring or an alternative agreement with the lenders and TWDC within the 30-day period after March 31, 2005, management believes the Group would be unable to meet all of its debt obligations.

Equity

Shareholders' equity decreased to a deficit of € 59.9 million at September 30, 2004, compared to positive shareholders' equity of € 1,084.4 million as reported at September 30, 2003, reflecting the net loss for fiscal year 2004 of € 145.2 million and the € 1,151.6 million cumulative effect of a change in accounting principles related to the consolidation of the Financing Companies partially offset by the

13

€ 152.2 million impact of the issuance of 26.7 million of new shares upon the maturity of the ORAs in July 2004.

As of September 30, 2004, TWDC, through indirect wholly-owned subsidiaries, held 40.6% of the Company's shares and approximately 15.9% of the Company's shares were owned by trusts for the benefit of Prince Alwaleed Bin Talal Bin Abdulaziz Al Saud and his family. No other shareholder has indicated to the Group that it holds more than 5% of the share capital of the Company. No dividend allocation is proposed with respect to fiscal year 2004, and no dividends were paid with respect to fiscal years 2003, 2002 and 2001.

Market Risk and Financial Instruments

The Group is exposed to the impact of interest and foreign currency exchange rate changes. In the normal course of business, the Group employs established policies and procedures to manage its exposure to changes in interest and foreign currency exchange rates using primarily swaps and forward rate agreements. It is the Group's policy to enter into interest and foreign currency rate transactions only to the extent considered necessary to meet its objectives. The Group does not enter into interest and foreign currency rate transactions for speculative purposes.

The Group has significant variable rate debt. With respect to these interest rate sensitive obligations, a hypothetical 10% increase in interest rates, as of September 30, 2004 and 2003, would have a € 1.0 million and € 0.4 million, respectively, unfavourable impact on near-term annual cash flows. This amount excludes the positive cash flow impact such a change in interest rates would have on short-term investment income.

The Group's exposure to foreign currency risk arises primarily from British pound denominated sales and U.S. dollar denominated purchases. The Group primarily utilises foreign exchange forward contracts to hedge these expenditures. With respect to these foreign exchange rate sensitive instruments, a hypothetical 10% adverse change in the U.S. dollar and British pound exchange rates (correlation between currencies is not taken into account) as of September 30, 2004 and 2003 would result in a € 1.1 million and € 6.9 million decrease in their market value, respectively. No amount of this decrease would impact earnings since the loss on these instruments would be offset by an equal gain on the underlying exposure being hedged.

Management Compensation and Corporate Positions and Directorships Held

See Item XIV "Mandates of the Members of Supervisory Board", which is incorporated herein by reference.

14

RESTRUCTURING, DEVELOPMENT STRATEGY AND OUTLOOK

Restructuring

The Restructuring is an important step to the restoration of the Group's liquidity, a condition necessary to permit the Group to pursue its development strategy, outlined below. Once implemented, the Restructuring will:

- –

- provide the Group with new cash resources, with a new € 150.0 million credit line from TWDC (which will be reduced to € 100 million after September 30, 2009) and a share capital increase with gross proceeds of at least € 250.0 million (before deducting underwriting commissions and other costs);

- –

- convert the Group's existing credit line with TWDC (under which € 110 million will be outstanding when the Restructuring is implemented) into subordinated long-term debt;

- –

- eliminate certain of the Group's cash payment obligations in respect of its borrowings, and defer certain of the Group's other cash payment obligations in respect of its borrowings and royalty and management fee obligations, partially on an unconditional basis and partially on a conditional basis (based on the Group's EBITDA, adjusted for certain items), allowing the Group to reduce the impact of business cycles on its cash obligations;

- –

- increase the interest rate on approximately € 450 million of the Group's debt by approximately 2 percentage points per annum;

- –

- permit the Company to avoid paying €292.1 million (plus € 16 million of interest) to Euro Disney Associés S.C.A. ("EDA"), a TWDC affiliate, to exercise the Company's option to maintain its rights to the Disneyland Park and certain of its key attractions (which are currently leased from EDA), by instead acquiring 82% of the share capital of EDA in exchange for the contribution of substantially all of the Company's assets and liabilities to EDA (TWDC will indirectly hold the remaining 18% of EDA); and

- –

- allow the Group to implement a € 240.0 million investment plan and to increase annual expenditure on the maintenance and improvement of the existing asset base.

The Restructuring (including its cash impact) is described in more detail in Item IX "Management Report on the Proposed Contribution of Assets and Related Amendments to the Company's By-laws", of which the introduction and chapter I are incorporated herein by reference.

Development Strategy

By reaching agreement on the Restructuring, the Group has the opportunity to pursue a strategy designed to attract new theme park visitors and hotel guests, and to increase repeat visitation by enhancing guest satisfaction and value perception. Coupled with what management hopes will be a strong rebound in the short break and theme park markets in Europe, the Group believes that its development strategy has the potential to increase its revenues and improve its financial performance.

15

The Group has designed its development strategy to take advantage of what management believes are significant opportunities to attract and retain visitors. The Group's market research shows that guest satisfaction levels at the theme parks are very high – in recent surveys, guests indicating that they were "completely satisfied" or "very satisfied" represented over 80% of the guests surveyed at the Disneyland Park, and over 70% at the Walt Disney Studios Park (a differential consistent with second parks in other Disney resorts). Market research also indicates that there are substantial numbers of European families that have never visited the Resort, but have indicated that they might like to do so in the future.

The Group's strategy to take advantage of this opportunity includes the construction of three major new attractions scheduled to open in fiscal years 2006, 2007 and 2008, and the enhancement of existing attractions and the magical atmosphere of the theme parks. The enhancements will include significant short-term improvements designed to attract new visitors while the new attractions are being constructed, most prominently the upgrade and relaunch ofSpace Mountain in fiscal year 2005. The principal elements of the Group's development strategy are the following:

- •

- Revitalise the Disneyland Park Experience.

With the increase in ongoing capital expenditure authorisation provided by the Restructuring, the Group will reinvigorate its long-standing policy of continually upgrading Disneyland Park, starting with the fiscal year 2005 upgrade and relaunch ofSpace Mountain, creating a completely new experience in order to provide its visitors with a new twist on this already popular roller coaster ride. The Group also plans to introduce new children's attractions to further penetrate its core market. In addition to these major attractions, the Group will continue its ongoing efforts to enhance guest satisfaction, focusing on overall quality and waiting times, improved food and beverage experience and increased merchandising innovation.

- •

- Enhance the Walt Disney Studios Park Experience.

The Group intends to increase the appeal of the Walt Disney Studios Park to young children and their families. This will make the park more attractive to the Group's core customer base and should encourage more visitors to take advantage of the "Park Hopper" ticket. The Group also plans to construct certain of the major new attractions at Walt Disney Studios Park, enhancing the overall attractiveness of the park.

- •

- Expand Seasonal Events and Popular Shows.

Although the Group's business is seasonal, the Group has successfully employed a strategy to reduce the impact of seasonality through the staging of special promotional events in the off-peak season. The Group intends to add to its popular Halloween and Christmas events with new seasonal features that will include a "Magic Unlimited" season in January (allowing repeat rides without waiting in line), a Kids Carnival season and an Easter season. The Group also intends to continue theLegend of the Lion King show, which proved to be highly popular when it was introduced in June 2004.

The Group intends to capitalize on major events with promotional campaigns designed to maximize the number of visitors. For example, in fiscal year 2005, the Group will implement a promotional campaign around the re-launch ofSpace Mountain, expected to occur in the spring at the beginning of the high season. The Group plans to mark the 50th anniversary of the original Disneyland in California with a fireworks celebration during the summer of 2005.

16

- •

- Focus on Disney Hotel Differentiation.

The Group intends to focus visitors on the attractiveness of its own on-site hotels in order to meet the short-term challenges presented by the opening of the new on-site hotels operated by third-parties in fiscal years 2003 and 2004. Its marketing effort will highlight the proximity of its hotels to the theme parks and special attractions such as character breakfasts. In addition, the Group has determined that the prospective balance between the theme park and hotel price components of its travel packages shall give more weight to the ticket prices, and it intends to modify its policy to achieve a better competitive equilibrium and to improve the attractiveness of the Disney hotels in packages booked through tour operators.

- •

- Focus Sales and Marketing on First-Time Visitors and New Channels.

The Group will implement sales and marketing efforts designed specifically to encourage attendance by the first-time visitor, taking advantage of the large untapped population base in Europe discussed above. The marketing effort will include a new communication strategy that will familiarize European visitors with the theme park experience, while differentiating the Disneyland Resort Paris experience. The Group also intends to take advantage of new distribution channels to attract both first-time visitors and repeat customers, by establishing relationships with low-cost airlines and internet travel sites, as well as developing "call to actions" to trigger bookings when marketable news is released (for example, the re-launch ofSpace Mountain).

Outlook

The Group believes that the implementation of its development strategy and the improved financial flexibility from the Restructuring give it a significant opportunity to improve its financial performance, in what will hopefully be a stronger European travel and tourism market.

As a result of the Restructuring, the Group will benefit from a substantial improvement in its cash position. In addition, the Group's strategy to increase the number of visitors is intended to boost revenues, which should result in increased EBITDA margin in the medium term. At the same time, the combined effect of full royalties, management fees and interest expense (which will continue to accrue despite being partially deferred on a cash basis) and depreciation and amortisation resulting from the consolidation of the Financing Companies will continue to affect operating margin and net income. The Group anticipates that it will record net losses for at least the next several years.

In fiscal year 2005, management is seeking to achieve attendance growth. It believes that its seasonal events and new opportunities, such as the re-launch ofSpace Mountain and a new fireworks show celebrating the 50th anniversary of Disneyland in California, provide an opportunity to increase attendance, although attendance in the first half of fiscal year 2005 might be somewhat adversely impacted by the closure ofSpace Mountain in order to perform the necessary improvements, currently planned from January to March of 2005. The Group hopes to improve occupancy at its hotels by capturing a larger share of total visitors. It expects that per guest spending at the theme parks will increase as a result of regular admission price increases and the re-balancing of hotel package pricing. The re-balancing, which will not affect the overall package pricing of visitors to the Group's hotels, will attribute more of package prices to theme park attendance and less to overnight stays at the hotels.

17

The Group's targeted revenue growth in fiscal year 2005, if it is achieved, will be used partially to cover an anticipated increase in operating expenses resulting primarily from increased labour expenses due to an increase in the French minimum wage and reduction of subsidies related to the adoption of the 35-hour work week. The Group will also seek to control marketing and sales expenses in order to meet its objective of maintaining EBITDA margins at approximately the same level as in fiscal year 2004.

The Group's development strategy will result in part of the Group's increased cash resources being devoted to increased capital expenditures and spending on major asset renovations. In fiscal year 2005, the Group expects to record a substantial increase in capital expenditures, which could total approximately € 130.0 million based on the Group's current budget (compared to € 29.3 million in fiscal year 2004). The increase will result mainly from the relaunch ofSpace Mountain, the initial phase of the construction of new attractions and planned improvements in the magical atmosphere of the theme parks. The Group anticipates significant, but somewhat lower, spending in fiscal years 2006 and 2007. Afterwards, capital expenditures will be focused mainly on continued enhancements at the theme parks and the hotels.

The information, assumptions and estimates that the Group has used to determine its objectives are subject to change or modification due to economic, financial and competitive uncertainties. In particular, attendance could be affected by a number of factors, some of which are beyond the Group's control, including the state of the European travel and tourism industry (including the potential impact of increased oil prices), geopolitical considerations, factors affecting the French tourism market (such as weather conditions and the overall economy), the perceived attractiveness of the Resort compared to other travel destinations, and whether the Group is successful in implementing its Development Strategy and achieving the objectives of that strategy. Accordingly, the Group cannot give any assurance as to whether it will achieve the objectives described in this section, and it makes no commitment or undertaking to update or otherwise revise this information.

Chessy, November 8, 2004

Euro Disney S.A.S.,Gérant

André Lacroix, Chairman and Chief Executive Officer

18

Consolidated Financial Statements

of the Euro Disney Group

| |

| |

| | As-Reported

|

|

|---|

(€ in millions)

| | Notes

| | September 2004

| | September 2003

| | September 2002

|

|

|---|

|

|

|---|

| FIXED ASSETS | | | | | | | | | |

| Intangible assets | | | | 52.4 | | 57.6 | | 61.7 | |

| Tangible assets | | 3 | | 2,343.9 | | 928.0 | | 1,004.3 | |

| Financial Assets | | 4 | | 115.3 | | 1,332.2 | | 1,323.5 | |

| | | | | 2,511.6 | | 2,317.8 | | 2,389.5 | |

| OTHER ASSETS | | | | | | | | | |

| Inventories | | 5 | | 41.5 | | 41.8 | | 38.7 | |

| Accounts receivable: • Trade | | 6 | | 72.7 | | 76.9 | | 100.6 | |

| • Other | | 7 | | 59.8 | | 45.9 | | 70.7 | |

| Short-term investments | | 8 | | 120.8 | | 34.9 | | 14.2 | |

| Cash | | | | 10.6 | | 11.2 | | 8.2 | |

| | | | | 305.4 | | 210.7 | | 232.4 | |

| DEFERRED CHARGES | | 9 | | 59.6 | | 55.1 | | 86.7 | |

| Total Assets | | | | 2,876.6 | | 2,583.6 | | 2,708.6 | |

|

|---|

| SHAREHOLDERS' EQUITY (DEFICIT) | | | | | | | | | |

| Share capital | | 10 | | 10.8 | | 802.5 | | 804.9 | |

| Share premium | | 10 | | 1,235.6 | | 291.4 | | 289.0 | |

| Retained earnings (Accumulated deficit) | | 10 | | (1,306.3 | ) | (9.5 | ) | 150.9 | |

| | | | | (59.9 | ) | 1,084.4 | | 1,244.8 | |

| MINORITY INTERESTS | | 11 | | 339.6 | | – | | – | |

| QUASI-EQUITY | | 12 | | – | | 152.8 | | 152.8 | |

| PROVISIONS FOR RISKS AND CHARGES | | 13 | | 98.2 | | 120.1 | | 35.5 | |

| BORROWINGS | | 14 | | 2,052.8 | | 867.5 | | 821.3 | |

| CURRENT LIABILITIES | | | | | | | | | |

| Payable to related companies | | 15 | | 73.3 | | 56.9 | | 82.5 | |

| Accounts payable and accrued liabilities | | 16 | | 284.3 | | 214.3 | | 277.0 | |

| | | | | 357.6 | | 271.2 | | 359.5 | |

| DEFERRED REVENUES | | 17 | | 88.3 | | 87.6 | | 94.7 | |

| Total Shareholders' Equity and Liabilities | | | | 2,876.6 | | 2,583.6 | | 2,708.6 | |

|

|---|

The accompanying footnotes are an integral part of these financial statements.

19

| |

| |

| | As-Reported Fiscal Year

| |

|

|---|

| |

| | Fiscal Year 2004

| |

|

|---|

(€ in millions)

| | Notes

| | 2003

| | 2002

| |

|

|---|

| |

|

|---|

| REVENUES | | 18 | | 1,048.0 | | 1,047.5 | | 1,071.2 | | |

| COSTS AND EXPENSES | | 19 | | (1,071.9 | ) | (915.1 | ) | (895.5 | ) | |

INCOME (LOSS) BEFORE LEASE AND FINANCIAL CHARGES |

|

|

|

(23.9 |

) |

132.4 |

|

175.7 |

|

|

LEASE AND NET FINANCIAL CHARGES |

|

|

|

|

|

|

|

|

|

|

| Lease rental expense | | 25 | | – | | (193.8 | ) | (188.8 | ) | |

| Financial income | | | | 2.8 | | 49.0 | | 59.1 | | |

| Financial expense | | | | (108.5 | ) | (55.5 | ) | (41.1 | ) | |

| | | | | (105.7 | ) | (200.3 | ) | (170.8 | ) | |

INCOME (LOSS) BEFORE EXCEPTIONAL ITEMS |

|

|

|

(129.6 |

) |

(67.9 |

) |

4.9 |

|

|

Exceptional income/(loss), net |

|

20 |

|

(22.3 |

) |

11.9 |

|

(38.0 |

) |

|

Minority interests |

|

|

|

6.7 |

|

– |

|

– |

|

|

| Net Loss | | | | (145.2 | ) | (56.0 | ) | (33.1 | ) | |

| | |

Average number of common shares outstanding (in millions) |

|

10 |

|

1,062 |

|

1,056 |

|

1,056 |

|

|

| Loss per Share (in €) | | 2 | | (0.14 | ) | (0.05 | ) | (0.03 | ) | |

| | |

The accompanying footnotes are an integral part of these financial statements.

20

| |

| |

| | As-Reported Fiscal Year

| |

| |

|---|

| |

| | Fiscal Year

2004

| |

| |

|---|

(€ in millions)

| | Notes

| | 2003

| | 2002

| |

| |

|---|

| |

| |

|---|

| NET LOSS | | | | (145.2 | ) | (56.0 | ) | (33.1 | ) | | |

| MINORITY INTERESTS | | 11 | | (6.7 | ) | – | | – | | | |

| Operating Items Not Requiring Cash Outlays: | | | | | | | | | | | |

| | Depreciation and amortisation | | 19 | | 146.8 | | 65.6 | | 64.0 | | | |

| | Loan repayments received from Phase I Financing Companies | | | | – | | 52.1 | | 41.1 | | | |

| | Other | | | | 24.2 | | (10.6 | ) | 0.9 | | | |

| Changes in: | | | | | | | | | | | |

| | Receivables | | | | (2.7 | ) | 48.6 | | 28.0 | | | |

| | Inventories | | | | 0.3 | | (3.1 | ) | (1.7 | ) | | |

| | Payables and other accrued liabilities | | | | 107.9 | | (8.5 | ) | (50.5 | ) | | |

| Cash Flows from Operating Activities | | | | 124.6 | | 88.1 | | 48.7 | | | |

| |

|---|

| Proceeds from the sale of fixed assets | | | | – | | 45.4 | | 1.4 | | | |

| Capital expenditures for tangible and intangible assets | | 3 | | (28.6 | ) | (72.9 | ) | (262.5 | ) | | |

| Increase in deferred charges, net | | | | – | | – | | (10.5 | ) | | |

| Other | | | | (0.2 | ) | (1.3 | ) | 1.9 | | | |

| Cash Flows used in Investing Activities | | | | (28.8 | ) | (28.8 | ) | (269.7 | ) | | |

| |

|---|

| Proceeds from borrowings | | 14 | | 22.5 | | 40.0 | | 63.3 | | | |

| Repayments of borrowings | | 14 | | (66.2 | ) | (15.0 | ) | (381.8 | ) | | |

| (Increase)/Decrease in debt and other security deposits | | 4 | | (10.5 | ) | (59.6 | ) | 12.4 | | | |

| Restructuring costs | | | | (4.9 | ) | – | | – | | | |

| Cash Flows used in Financing Activities | | | | (59.1 | ) | (34.6 | ) | (306.1 | ) | | |

| |

|---|

| Change in cash and cash equivalents | | | | 36.7 | | 24.7 | | (527.1 | ) | | |

| Change in accounting principle(1) | | 2 | | 48.6 | | – | | – | | | |

| Cash and cash equivalents, beginning of period | | | | 46.0 | | 21.3 | | 548.4 | | | |

| Cash and Cash Equivalents, end of period | | | | 131.3 | | 46.0 | | 21.3 | | | |

| |

|---|

| SUPPLEMENTAL CASH FLOW INFORMATION: | | | | | | | | | | | |

| Interest paid | | | | 61.1 | | 20.3 | | 42.7 | | | |

| Lease rental expense paid, net | | | | – | | 95.0 | | 92.9 | | | |

| NON-CASH TRANSACTIONS: | | | | | | | | | | | |

| Conversion of ORAs and OBSAs into equity | | 12 | | 152.5 | | – | | – | | | |

| Transfer of EDA borrowings and accrued interest to minority interests | | 11 | | 384.1 | | – | | – | | | |

| |

|---|

| |

| | September

2004

| | September

2003

| | September

2002

| |

| |

|---|

| |

| |

|---|

| RECONCILIATION TO BALANCE SHEET: | | | | | | | | | | | |

| Cash | | | | 10.6 | | 11.2 | | 8.2 | | | |

| Short-term investments | | | | 120.8 | | 34.9 | | 14.2 | | | |

| Bank overdrafts (recorded in accounts payable and accruals) | | | | (0.1 | ) | (0.1 | ) | (1.1 | ) | | |

| Cash and Cash Equivalents, end of period(2) | | | | 131.3 | | 46.0 | | 21.3 | | | |

| |

|---|

- (1)

- Represents cash and short-term investment of the consolidated Financing Companies as of September 30, 2003.

- (2)

- Includes € 49.1 million of cash and short-term investment of the consolidated Financial Companies as of September 30, 2004.

21

Notes to Consolidated Financial Statements

1 DESCRIPTION OF THE BUSINESS AND THE FINANCIAL NEGOTIATIONS

1-1 Description of the business

Euro Disney S.C.A. (the "Company") and its subsidiaries (the "Legally Controlled Group") and consolidated financing companies (collectively, the "Group") commenced operations with the official opening of Disneyland Resort Paris on April 12, 1992 ("Opening Day"). The Group operates Disneyland Resort Paris, which includes two theme parks (collectively, the "Theme Parks"), Disneyland Park and Walt Disney Studios Park, which opened to the public on March 16, 2002, seven themed hotels, two convention centres, the Disney Village entertainment centre and a golf course in Marne-la-Vallée, France. In addition, the Group manages the real estate development and expansion of the related infrastructure of the approximately 2,000 hectares of land encompassing the Disneyland Resort Paris and surrounding areas.

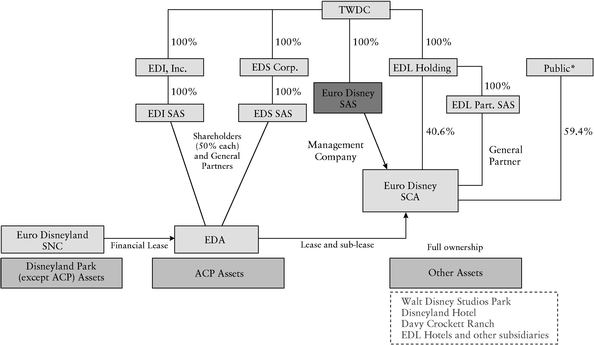

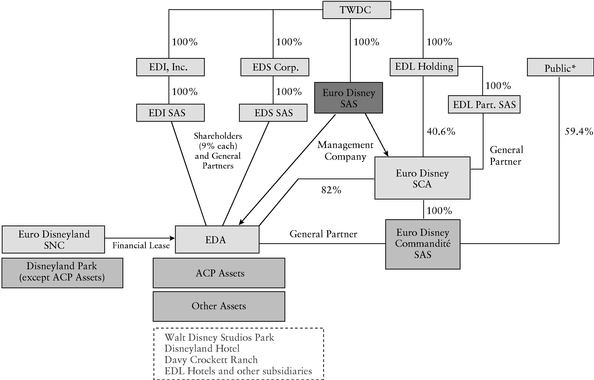

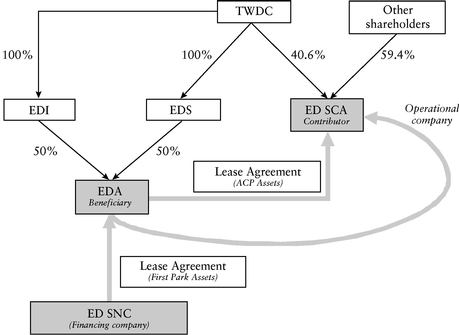

The Company, a publicly held French company, is 40.6% owned by EDL Holding Company, an indirect, wholly-owned subsidiary of The Walt Disney Company ("TWDC") and managed by Euro Disney S.A.S. (the Company'sGérant), an indirect, wholly-owned subsidiary of TWDC. The General Partner is EDL Participations S.A.S., also an indirect, wholly-owned subsidiary of TWDC. Entities included in the fiscal year 2004 consolidated financial statements and their primary operating activities are as follows:

|

|---|

Company

| | % OF

OWNERSHIP

| | PRIMARY OPERATING ACTIVITY

|

|

|---|

| EURO DISNEY S.C.A. | | Parent | | Operator of the Theme Parks, Disneyland Hotel, Davy Crockett Ranch and golf course, and manager of real estate development | |

| EDL HÔTELS S.C.A. | | 99.9 | | Operator of 5 of our 7 themed hotels plus the Disney Village, collectively, the Phase IB Facilities | |

| EDL SERVICES S.A.S. | | 100.0 | | Management company of the Phase IB Financing Companies | |

| EDL HÔTELS PARTICIPATIONS S.A.S | | 100.0 | | General Partner of EDL Hôtels S.C.A. and ED Resort Services S.A.S. | |

| EURO DISNEY VACANCES S.A.S | | 100.0 | | Tour operator selling Disneyland Resort Paris holiday packages, principally to guests from Germany, Benelux, the United Kingdom and Italy | |

| EURO DISNEY VACACIONES S.A. | | 99.9 | | Spanish subsidiary of Euro Disney Vacances S.A.S. (company currently inactive) | |

| VAL D'EUROPE PROMOTION S.A.S. | | 100.0 | | Real estate developer | |

| LES VILLAGES NATURE DE VAL D'EUROPE S.A.R.L. | | 50.0 | | Joint venture with Pierre &Vacances Group to establish a feasibility study | |

| S.E.T.E.M.O. IMAGINEERING S.A.R.L. | | 100.0 | | Provides studies and supervision of construction for theme parks attractions | |

| ED SPECTACLES S.A.R.L. | | 100.0 | | Operator of Buffalo Bill's Wild West Show | |

| DÉBIT DE TABAC S.N.C. | | 100.0 | | Tobacco retailer at Disney Village | |

| CONVERGENCE ACHATS S.A.R.L. | | 50.0 | | Joint venture created with Groupe Flo to negotiate food purchasing contracts | |

| EURO DISNEY COMMANDITÉ S.A.S. | | 100.0 | | General Partner of Euro Disney Associés S.C.A. | |

| | | | | | |

22

| ED RESORT SERVICES S.A.S. | | 100.0 | | Company currently inactive | |

| ED FINANCES 1 S.N.C. | | 100.0 | | Company currently inactive | |

| ED FINANCES 2 S.N.C. | | 100.0 | | Company currently inactive | |

| ED FINANCES 3 S.N.C. | | 100.0 | | Company currently inactive | |

| ED FINANCES 4 S.N.C. | | 100.0 | | Company currently inactive | |

| EURO DISNEYLAND S.N.C.(1) | | 0.0 | | Financing company for Phase IA assets | |

| EURO DISNEY ASSOCIÉS S.C.A.(1)(2) | | 0.0 | | Financing company for Phase IA assets and Additional Capacity Disneyland Park Assets | |

| HOTEL NEW-YORK ASSOCIÉS S.N.C.(1) | | 0.0 | | Financing company for Phase IB Facilities | |

| NEWPORT BAY CLUB ASSOCIÉS S.N.C.(1) | | 0.0 | | Financing company for Phase IB Facilities | |

| SEQUOIA LODGE ASSOCIÉS S.N.C.(1) | | 0.0 | | Financing company for Phase IB Facilities | |

| HOTEL CHEYENNE ASSOCIÉS S.N.C.(1) | | 0.0 | | Financing company for Phase IB Facilities | |

| HOTEL SANTA FE ASSOCIÉS S.N.C. (1) | | 0.0 | | Financing company for Phase IB Facilities | |

| CENTRE DE DIVERTISSEMENTS ASSOCIÉS S.N.C.(1) | | 0.0 | | Financing company for Phase IB Facilities | |

| CENTRE DE CONGRÈS NEWPORT S.A.S.(1) | | 0.0 | | Financing company for Newport Bay Club Convention Centre assets | |

|

|---|

- (1)

- Effective October 1, 2003 these entities were consolidated as a result of the adoption of new accounting rules related to financing companies (See Note 2)

- (2)

- Formerly Euro Disneyland Associés S.N.C., was transformed into Euro Disneyland Associés S.C.A. on September 30, 2004.

Upon to a change related to the US Accounting Regulation, the Company is now consolidated by TWDC, based in Burbank, California.

1-2 Disneyland Resort Paris Financing

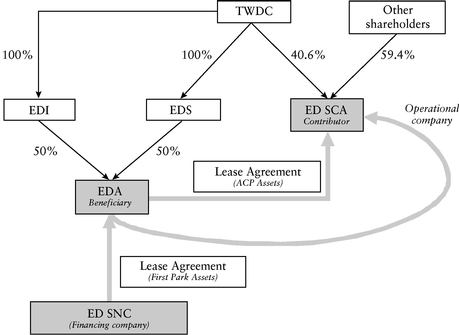

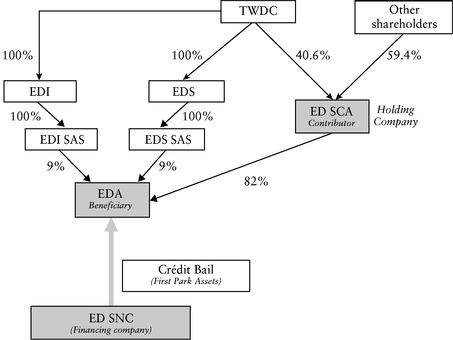

The Legally Controlled Group owns Walt Disney Studios Park, the Disneyland Hotel, the Davy Crockett Ranch, the golf course, the underlying land thereof and the land on which the five other hotels and the Disney Village entertainment centre are located and leases substantially all the remaining operating assets as follows:

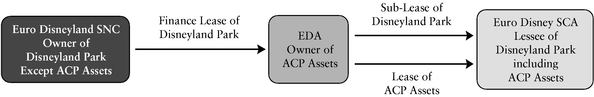

Phase IA

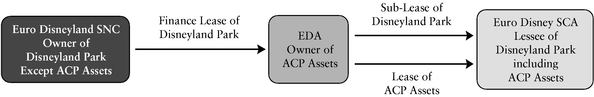

In 1989, various agreements were signed between the Company and Euro Disneyland S.N.C. (the "Phase IA Financing Company") for the development and financing of Disneyland Park. Pursuant to the original sale/leaseback agreement, all of the assets of Disneyland Park and the underlying land, as of Opening Day, were sold by the Company to the Phase IA Financing Company and simultaneously leased back to the Company. In 1994, the Company cancelled its original agreement with the Phase IA Financing Company and established certain new agreements. Under this new lease structure, the Phase IA Financing Company is leasing substantially all of Disneyland Park assets to Euro Disney Associés S.C.A. ("EDA"), an indirect, wholly-owned affiliate of TWDC, which is in turn sub-leasing those assets to the Company. The Group has no ownership interest in the Phase IA Financing Company or EDA.

23

Phase IB

In 1991, various agreements were signed for the development and financing of five hotels: Hotel New York, Newport Bay Club, Sequoia Lodge, Hotel Cheyenne and Hotel Santa Fe, and the Disney Village entertainment centre (collectively, the "Phase IB Facilities"). Pursuant to sale/leaseback agreements, the Phase IB Facilities were sold by the Company to six special purpose companies that were established for the financing of Phase IB (the "Phase IB Financing Companies") and are being leased back to the operator, EDL Hôtels S.C.A. The Group has no ownership interest in the Phase IB Financing Companies.

Hereafter, reference to the "Phase I S.N.C.s" includes the Phase IA Financing Company and the Phase IB Financing Companies.

Additional Capacity Disneyland Park Assets

In 1994, the Company entered into a sale/leaseback agreement with EDA for certain Disneyland Park assets which were constructed subsequent to Opening Day. Pursuant to this agreement, these assets were sold by the Company and the Phase IA Financing Company to EDA and are being leased back to the Company.

Newport Bay Club Convention Centre

In 1996, various agreements were signed with Centre de Congrès Newport S.A.S., an indirect, wholly-owned affiliate of TWDC for the development and financing of a second convention centre located adjacent to the Newport Bay Club hotel. Pursuant to sale/leaseback agreements, the assets of the Newport Bay Club Convention Centre were sold as they were constructed by EDL Hôtels S.C.A. to Centre de Congrès Newport S.A.S. and are leased back to the operator, EDL Hôtels S.C.A.

Hereafter, reference to the "Financing Companies" includes the Phase IA Financing Company, the Phase IB Financing Companies, EDA and Centre de Congrès Newport S.A.S.

1-3 Financial Restructuring

In September 2004, the Group reached final agreement with its lenders and The Walt Disney Company on a comprehensive restructuring of the Group's financial situation (the "Restructuring"). The Restructuring, which is subject to certain conditions described below, will allow the Group to restore liquidity and to obtain capital to further grow and develop its activities.

The Group began negotiating the Restructuring in light of reduced revenues and increased losses that it incurred beginning in fiscal year 2003. The reduction in revenues was primarily the result of a prolonged downturn in European travel and tourism, combined with challenging general economic and geopolitical conditions in key markets. While this was partially offset by the impact of the opening of Walt Disney Studios Park, the number of visitors and revenues from the new park were below expectations. The increased losses were a result of reduced revenues, as well as higher operating costs due to the opening of Walt Disney Studios Park and higher marketing and sales expenses.

24

As a result of this situation, the Company determined that it would not be in compliance with certain financial covenants contained in its credit agreements and that in the absence of a new Restructuring, it would not be able to restore compliance in the near term, or to meet certain of its financial obligations. At the time it began negotiations with its lenders, it obtained limited waivers of covenant violations and certain security deposit obligations, which were successively renewed as the negotiations progressed. The Company also determined that, absent a Restructuring, it would not have the financial resources or the authority under its credit agreements to invest in new attractions and improvements at the Resort.

The principal features of the Restructuring are the following:

- –

- The Company will conduct a share capital increase of at least € 250 million, before deduction of equity issuance costs, to be partially, directly or indirectly, subscribed by TWDC, with the remainder to be underwritten by a group of banks, subject to certain conditions.

- –

- The Company will have access to additional financial resources under a new € 150 million credit line to be granted by TWDC.

- –

- The Group's debt service obligations will be deferred partially on an unconditional basis and partially on a conditional basis, and its obligation to maintain security deposits will be eliminated (with its existing security deposit used to prepay debt), in exchange for which the Company will pay an increased interest rate on some of its debt.

- –

- A portion of the management fees and royalties payable to affiliates of TWDC will be deferred, partially on an unconditional basis (€ 125 million) and partially on a conditional basis (€ 200 million), with the conditional portion depending on the Company's financial performance.

- –

- The Company will avoid making payments in the amount of € 292.1 million, (plus € 16 million of interest that would have been payable) to EDA, to exercise its option to maintain its rights to the Disneyland Park and certain of its key attractions (which are currently leased from EDA), by instead acquiring 82% of the share capital of EDA in exchange for the contribution of substantially all of the Company's assets and liabilities (TWDC will indirectly hold the remaining 18% of EDA).

- –

- The Group will have the authorisation to implement a € 240 million plan to develop new Theme Park attractions and to expend more each year on maintaining and improving the existing asset base.

The Restructuring agreement (the "Memorandum of Agreement") is subject to definitive documentation, pending which the waiver of certain covenant violations under the Company's credit agreements has been extended to December 1, 2004. The Restructuring is subject to, and certain portions of the Restructuring will become effective upon, the completion of the share capital increase and the legal Restructuring described above, no later than March 31, 2005. If those transactions do not occur by March 31, 2005, the parties will have 30 days to negotiate a new arrangement. If the negotiations do not succeed, most of the provisions of the Memorandum of Agreement will become null and void and management believes the Group would be unable to meet all of its debt obligations.

25

Once effective (i.e., no longer subject to conditions), the Restructuring will provide significant liquidity, protective measures intended to mitigate the adverse impact of business volatility (through conditional deferrals of expenditures) as well as capital to invest in new attractions. Additionally, the Restructuring's effect on the Group's balance sheet will be increased cash and shareholders' equity resulting from the share capital increase. Prospectively, the Group's statement of income will be affected by the interest impact of debt and royalties and management fees deferrals and increased cash, as well as a larger minority interest. Increased minority interest will reflect the retained ownership in EDA by indirect, wholly-owned TWDC subsidiaries after the contribution of most of the Company's assets and liabilities.

2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation

The Group's consolidated financial statements are prepared in conformity with French accounting rules and regulations in accordance with theRèglements no 99-02 of the Comité de la Réglementation Comptable (CRC-French Regulatory Board). Such principles have been consistently applied in relation to those used in the preparation of the consolidated financial statements for the fiscal year ended September 30, 2004, 2003 and 2002, except with respect to the changes in accounting principles described below, which affect the comparability of the years reported.

The Group, in preparing the consolidated financial statements has used the going-concern assumption based on management's belief that the conditions necessary to implement the Restructuring will be met within the contractual deadlines. If the principle of going concern had not been assumed, it would likely have had a significant impact on the valuation of assets and liabilities as of September 30, 2004.

Accounting Changes