- GNSS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Genasys (GNSS) DEF 14ADefinitive proxy

Filed: 28 Jan 25, 4:33pm

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement | ☐ | Confidential, for Use of the Commission Only |

☒ | Definitive Proxy Statement | (as permitted by Rule 14a-6(e)(2)) | |

☐ | Definitive Additional Materials | ||

☐ | Soliciting Material under §240.14a-12 |

Genasys Inc.

(Name of Registrant As Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

16262 West Bernardo Drive

San Diego, California 92127

(858) 676-1112

January 28, 2025

Dear Fellow Stockholder:

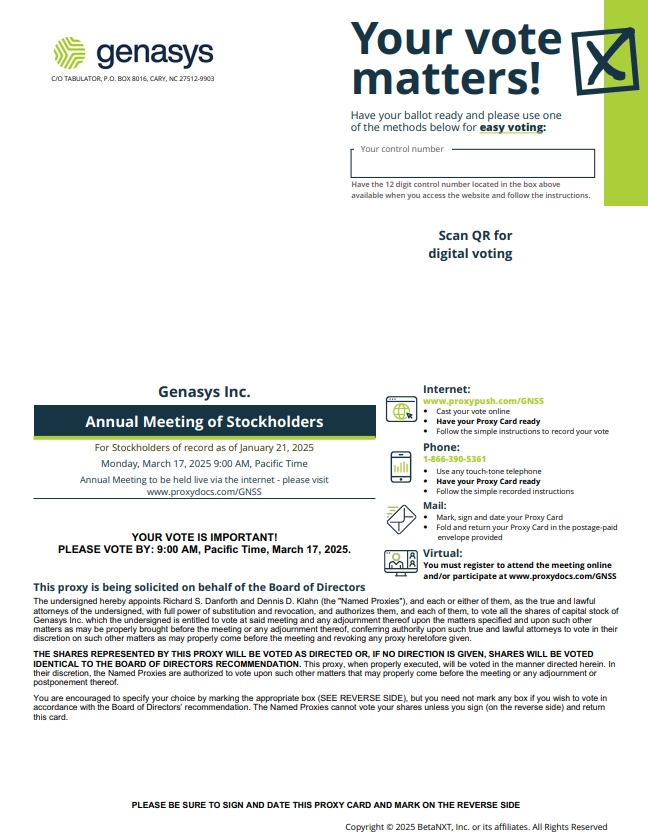

You are cordially invited to attend our Annual Meeting of Stockholders on Monday, March 17, 2025, at 9:00 a.m., Pacific Time. The Annual Meeting is a virtual meeting of stockholders which means that you are able to participate in the Annual Meeting, and vote and submit your questions during the Annual Meeting via live webcast by visiting www.proxydocs.com/GNSS and registering. Because the Annual Meeting is virtual and being conducted electronically, stockholders may not attend the Annual Meeting in person. The business to be conducted at the Annual Meeting is explained in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

The accompanying materials include the Notice of Annual Meeting of Stockholders and Proxy Statement. The Proxy Statement describes the business that we will conduct at the Annual Meeting. It also provides information about us that you should consider when you vote your shares.

To attend the Annual Meeting, you must enter the control number on your proxy card, voting instruction form or Notice Regarding the Availability of Proxy Materials, and register at www.proxydocs.com/GNSS prior to the deadline of Thursday, March 13, 2025, 5:00 p.m., Eastern Time. Whether or not you plan to attend the virtual Annual Meeting, we urge you to read the accompanying Proxy Statement carefully and vote as soon as possible. You may vote your shares by completing, signing, dating, and returning the proxy card today. For your convenience, you may also vote your shares via the Internet or by telephone by following the instructions on the proxy card or Notice Regarding the Availability of Proxy Materials. If you decide to attend the virtual Annual Meeting and you are a registered stockholder, you will be able to vote at the Annual Meeting by visiting and registering at www.proxydocs.com/GNSS prior to the deadline of Thursday, March 13, 2025, 5:00 p.m., Eastern Time, even if you have previously submitted your proxy.

Thank you for your support and continued interest in Genasys Inc.

| Sincerely,

Richard H. Osgood III |

16262 West Bernardo Drive

San Diego, California 92127

(858) 676-1112

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MONDAY, MARCH 17, 2025

TO THE STOCKHOLDERS OF GENASYS INC.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Genasys Inc., a Delaware corporation (the “Company”), will be held on Monday, March 17, 2025 at 9:00 a.m., Pacific Time. The Annual Meeting is a virtual meeting of stockholders which means that you are able to participate in the Annual Meeting, and vote and submit your questions during the Annual Meeting via live webcast by visiting and registering at www.proxydocs.com/GNSS prior to the deadline of Thursday, March 13, 2025, 5:00 p.m., Eastern Time. Because the Annual Meeting is virtual and being conducted electronically, stockholders may not attend the Annual Meeting in person. The Annual Meeting is being held for the following purposes:

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

I strongly encourage you to sign up for electronic delivery of our future annual reports and proxy materials in order to conserve natural resources and help us save costs in producing and distributing these materials. For more information, please see “Electronic Delivery of Proxy Materials and Annual Reports” on page 28 of the Proxy Statement.

The Board of Directors has fixed the close of business on Tuesday, January 21, 2025 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof. Stockholders of record present, via live webcast, at the Annual Meeting or who have submitted a valid proxy via the Internet, by telephone or by mail will be deemed to be present, via live webcast, to vote at the Annual Meeting.

| By Order of the Board of Directors,

Richard H. Osgood III Chairman of the Board |

San Diego, California

January 28, 2025

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING VIA LIVE WEBCAST. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE VIA LIVE WEBCAST IF YOU ATTEND THE VIRTUAL MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

2025 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MONDAY, MARCH 17, 2025.

THE PROXY STATEMENT, FORM OF PROXY AND THE ANNUAL REPORT FOR THE FISCAL YEAR ENDED

SEPTEMBER 30, 2024 ARE AVAILABLE AT www.proxydocs.com/GNSS.

GENASYS INC.

16262 West Bernardo Drive, San Diego, California 92127

(858) 676-1112

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To be held on Monday, March 17, 2025

INFORMATION CONCERNING

SOLICITATION AND THE ANNUAL MEETING

This Proxy Statement and the accompanying proxy card are being furnished in connection with the solicitation by the Board of Directors (the “Board”) of Genasys Inc., a Delaware corporation, of proxies for use at the 2025 Annual Meeting of Stockholders to be held on Monday, March 17, 2025, at 9:00 a.m., Pacific Time (the “Annual Meeting”), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting is a virtual meeting of stockholders, which means that the Annual Meeting will be conducted via live webcast and that you will be able to participate in the Annual Meeting, by visiting and registering at www.proxydocs.com/GNSS prior to the deadline of Thursday, March 13, 2025, 5:00 p.m., Eastern Time. Because the Annual Meeting is virtual and being conducted electronically, stockholders may not attend the Annual Meeting in person.

We intend to mail or electronically deliver this Proxy Statement, the accompanying proxy card and Notice of Annual Meeting on or about February 3, 2025 to all stockholders of record entitled to vote at the Annual Meeting.

QUESTIONS AND ANSWERS REGARDING

THE ANNUAL MEETING AND PROXY STATEMENT

What is a proxy?

A proxy is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. Richard S. Danforth, Chief Executive Officer, and Dennis D. Klahn, Chief Financial Officer and Secretary (the “proxyholders”), have been designated as proxies for the Annual Meeting.

What is a Proxy Statement?

A Proxy Statement is a document that the regulations of the Securities and Exchange Commission (“SEC”) require us to give you when we ask you to sign a proxy card designating the proxyholders as proxies to vote on your behalf. The Proxy Statement includes information about the proposals to be considered at the Annual Meeting and other required disclosures including information about our Board and executive officers.

Why is the Annual Meeting being held virtually?

The Annual Meeting will be held virtually because it enables increased stockholder accessibility, while improving meeting efficiency and reducing costs. Hosting a virtual meeting provides easy access for our stockholders and facilitates participation since stockholders can participate from any location around the world.

What if I have technical or other “IT” problems logging into or participating during the Annual Meeting live webcast?

We have established a toll-free technical support “help line” that can be accessed by any stockholder who experiences any problems logging into or participating during the Annual Meeting. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, please call the toll-free telephone number that will be shown on the login page for the virtual Annual Meeting and a member of the technical support team will assist you.

How can I participate and ask questions at the Annual Meeting?

We are committed to ensuring that our stockholders have substantially the same opportunities to participate in the virtual Annual Meeting as they would have at an in-person meeting. In order to submit a question at the Annual Meeting, you will need to login to the live webcast. Once you are logged in, you may submit questions online before and during the Annual Meeting. We encourage you to submit any question that is relevant to the business of the meeting. All appropriate questions asked during the Annual Meeting will be

read and addressed during the meeting. Stockholders are encouraged to login to the live webcast at least 15 minutes prior to the scheduled start time of the Annual Meeting to test their internet connectivity.

Who can vote at the Annual Meeting?

We have designated a record date of Tuesday, January 21, 2025 for the Annual Meeting. Only stockholders of record at the close of business on the record date will be entitled to notice of and to vote at the Annual Meeting, via live webcast at www.proxydocs.com/GNSS. At the close of business on Tuesday, January 21, 2025, we had outstanding and entitled to vote 44,929,634 shares of common stock. On all matters to be voted upon at the Annual Meeting, each holder of record of common stock on the record date will be entitled to one vote for each share held. All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes.

Stockholder of Record - Shares Registered in Your Name

If, at the close of business on the record date, your shares were registered directly in your name with our transfer agent, Issuer Direct Corporation, then you are a stockholder of record. As a stockholder of record, you may vote at www.proxydocs.com/GNSS at the Annual Meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to ensure your vote is counted by submitting your proxy by signing and dating the enclosed proxy card and returning it in the postage-paid envelope provided or by voting via the Internet or by telephone by following the instructions provided on the enclosed proxy card. Simply follow the instructions on the accompanying proxy card for each voting method.

Beneficial Owner - Shares Registered in the Name of a Broker, Bank or Other Agent

If, at the close of business on the record date, your shares were not held in your name, but rather in an account at a brokerage firm, bank or other agent, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by your broker, bank or other agent. The broker, bank or other agent holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting, via live webcast by visiting and registering at www.proxydocs.com/GNSS prior to the deadline of Thursday, March 13, 2025, 5:00 p.m., Eastern Time. However, since you are not the stockholder of record, you may not vote your shares at the meeting unless you request and obtain a valid proxy issued in your name from your broker, bank or other agent. If your broker holds your shares in its name and you do not instruct your broker how to vote, your broker will nevertheless have discretion to vote your shares on “routine” matters. Your broker will not have discretion to vote on “non-routine” matters absent direction from you. The election of directors (Proposal 1), the approval of the Genasys Inc. 2025 Equity Incentive Plan (Proposal 3), and the advisory vote on executive compensation (Proposal 4) are considered “non-routine” under applicable rules. The ratification of the appointment of Baker Tilly US, LLP as our independent registered public accounting firm for fiscal 2025 (Proposal 2) is considered “routine” under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on these proposals.

How can I attend the Annual Meeting?

You will be admitted to the virtual Annual Meeting, via live webcast, if you were a stockholder as of the close of business on Tuesday, January 21, 2025, or you have authority to vote under a valid proxy for the Annual Meeting. You must visit and register at www.proxydocs.com/GNSS prior to the deadline of Thursday, March 13, 2025, 5:00 p.m., Eastern Time. In order to register, you must use the control number that is printed on your proxy/voting instruction card, the Notice of Availability of Proxy Materials, or the email sending you the link to the proxy materials, as applicable. Approximately one hour prior to the meeting start time, all pre-registered shareholders will receive an email containing a unique URL link gaining them access to the meeting – as well as a link giving them the ability to vote during the meeting. To log in, you will need to follow the subsequent instructions you receive via this email communication. The virtual meeting platform is fully supported across browsers (Chrome, Firefox, Edge and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. If you encounter any technical difficulties logging onto or during the meeting, there will be a toll-free technical support “help line” to assist you. Technical support will be available 15 minutes prior to the start time of the meeting and through the conclusion of the meeting.

What proposals will be presented at the Annual Meeting?

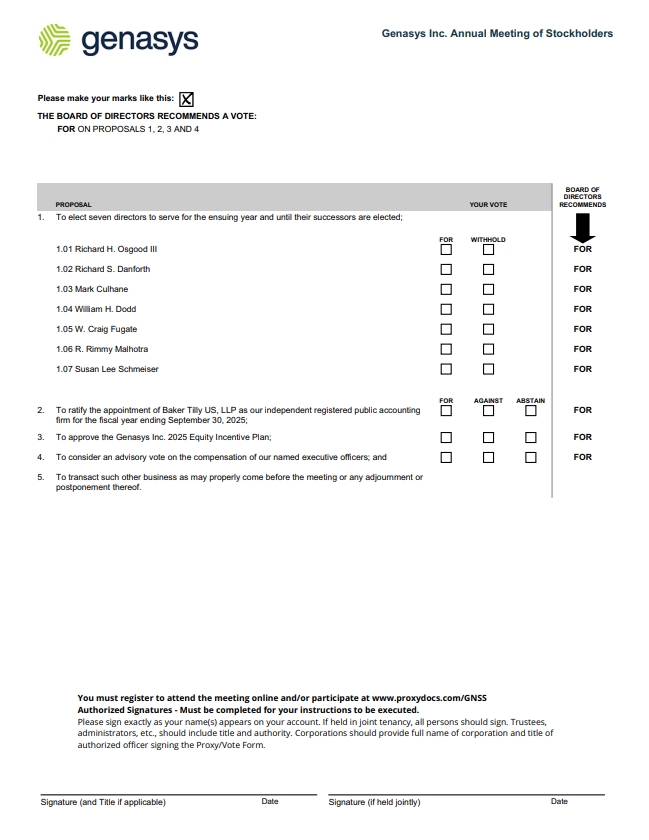

At the Annual Meeting, stockholders eligible to vote will consider and vote upon (1) the election of seven directors to serve for the ensuing year and until their successors are elected, (2) the ratification of the appointment of Baker Tilly US, LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2025, (3) the approval of the Genasys Inc. 2025 Equity Incentive Plan, (4) an advisory vote on the compensation of our named executive officers, and (5) such other business as may properly come before the meeting or any adjournment or postponement thereof.

2

How does the Board recommend I vote on these proposals?

Our Board’s recommendations are set forth, together with a description of the proposals, in this Proxy Statement. In summary, our Board recommends that you vote:

What vote is required to approve each matter and how are votes counted?

Virtual attendance at the Annual Meeting constitutes presence in person for purposes of a quorum. If a quorum is present at the Annual Meeting, the votes required for the proposals to be considered at the Annual Meeting and the treatment of abstentions and broker non-votes in respect of such proposals are as follows:

How do I vote?

It is important that your shares are represented at the Annual Meeting, whether or not you attend the Annual Meeting, via live webcast. To make sure that your shares are represented, we urge you to vote as promptly as possible by signing and dating the enclosed proxy card and returning it in the postage-paid envelope provided or by voting via the Internet or by telephone by following the instructions provided on the enclosed proxy card.

If you are a stockholder of record, there are four ways to vote:

3

If your shares are held in street name, please follow the voting instructions provided by your bank, broker or other agent. In most cases, you may submit voting instructions by telephone or by Internet to your bank, broker or other agent, or you can sign, date and return a voting instruction form to your bank, broker or other agent. If you provide specific voting instructions by telephone, by Internet or by mail, your bank, broker or other agent must vote your shares as you have directed.

At the Annual Meeting, you may vote by following the instructions after registering at www.proxydocs.com/GNSS prior to the deadline of Thursday, March 13, 2025 at 5:00 p.m., Eastern Time. If you hold your shares in street name, you must request a legal proxy from your bank, broker or other nominee to vote at the Annual Meeting.

How can I change or revoke my vote?

You can revoke your proxy at any time before the applicable vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any of the following ways:

If your shares are held by your broker, bank or other agent, follow the instructions provided by them.

How many shares must be present to hold the Annual Meeting?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares as of the close of business on the record date are represented by stockholders present at the meeting or by proxy. Virtual attendance at the Annual Meeting constitutes presence in person for purposes of a quorum. At the close of business on the record date, there were 44,929,634 shares outstanding and entitled to vote. Therefore, in order for a quorum to exist, 22,464,818 shares must be represented by stockholders present at the meeting or by proxy. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other agent) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement.

What if a quorum is not present at the meeting?

If a quorum is not present at the scheduled time of the Annual Meeting, we may adjourn the meeting, either with or without the vote of the stockholders. If we propose to have the stockholders vote whether to adjourn the meeting, the proxyholders will vote all shares for which they have authority in favor of the adjournment. We may also adjourn the meeting if for any reason we believe that additional time should be allowed for the solicitation of proxies. An adjournment will have No effect on the business that may be conducted at the Annual Meeting.

What if I do not specify a choice for a matter when returning a proxy?

If you indicate a choice on your proxy on a particular matter to be acted upon, the shares will be voted as indicated. If you are a stockholder of record and you return a signed proxy card but do not indicate how you wish to vote, the proxyholders will vote your shares in the manner recommended by our Board on all matters presented in this Proxy Statement and as the proxyholders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. If you do not return a proxy card, your shares will not be voted and will not be deemed present for the purpose of determining whether a quorum exists.

If you are a beneficial owner and the organization holding your account does not receive instructions from you as to how to vote those shares, under the rules of various national and regional securities exchanges, that organization may exercise discretionary authority to vote on routine proposals but may not vote on “non-routine” proposals. As a beneficial owner, you will not be deemed to have voted on such “non-routine” proposals. The shares that cannot be voted by brokers on “non-routine” matters are called broker non-votes. Broker non-votes will be deemed present at the Annual Meeting for purposes of determining whether a quorum exists for the Annual Meeting. The election of directors (Proposal 1), the approval of the Genasys Inc. 2025 Equity Incentive Plan (Proposal 3), and the advisory vote on executive compensation (Proposal 4) are considered “non-routine” under applicable rules. The ratification of

4

the appointment of Baker Tilly US, LLP as our independent registered public accounting firm for fiscal 2025 (Proposal 2) is considered “routine” under applicable rules.

What does it mean if I receive more than one proxy card?

If you hold your shares in more than one account, you will receive a proxy card for each account. To ensure that all of your shares are voted, please sign, date and return the proxy card for each account or vote via the Internet or by telephone following the instructions provided on the proxy card for each account.

How will voting on any other business be conducted?

Although we do not know of any business to be considered at the Annual Meeting other than the proposals described in this Proxy Statement, if any other business properly comes before the Annual Meeting, your proxy or voting instruction gives authority to the proxyholders to vote on those matters in their discretion.

May I propose matters for consideration at next year’s annual meeting or nominate individuals to serve as directors?

Yes. If you wish to propose a matter for consideration at next year’s annual meeting or if you wish to nominate a person for election as one of our directors, see the information set forth in “Stockholder Proposals” and “Stockholder Nominations” below.

How can I find out the results of the voting at the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting and publish final results in a Current Report on Form 8-K within four business days following the Annual Meeting.

Where can I access an electronic copy of the Proxy Statement and Annual Report on Form 10-K for the fiscal year ended September 30, 2024?

You may access an electronic copy of the Proxy Statement, form of proxy card, and the Annual Report on Form 10-K for the fiscal year ended September 30, 2024 at: www.proxydocs.com/GNSS.

5

PROPOSAL ONE

ELECTION OF DIRECTORS

Cooperation Agreement with Nicoya

During December of 2024, representatives of Nicoya Capital LLC and/or other affiliates (“Nicoya”) indicated to us its intention to nominate directors to stand for election at the Annual Meeting and solicit proxies in favor of its nominees. During December of 2024 and early January of 2025, Richard Danforth, our Chief Executive Officer, and Rick Osgood, Chairman of the Board, engaged in discussions with representatives of Nicoya regarding Nicoya’s intention to make such nominations. On January 14, 2015, we entered into a cooperation agreement (the “Cooperation Agreement”) with Nicoya and certain of its affiliates pertaining to the election of directors at the Annual Meeting. Pursuant to the Cooperation Agreement, among other things, we agreed to increase the size of our Board to seven and to appoint R. Rimmy Malhotra to the Board and to the Audit Committee of the Board, each effective January 15, 2025, and Nicoya agreed to abide by certain standstill restrictions and voting commitments, subject to certain limited exceptions, during the term of the Cooperation Agreement. The foregoing is not a complete description of the Cooperation Agreement. For a further description of the Cooperation Agreement and a copy of the Cooperation Agreement, please see our Current Report on Form 8-K filed with the SEC on January 16, 2025. Richard S. Danforth, Susan Lee Schmeiser, Richard H. Osgood III, Mark Culhane, William H. Dodd, and W. Craig Fugate are currently members of our Board, and R. Rimmy Malhotra was appointed pursuant to the terms of the Cooperation Agreement effective January 15, 2025. The Board unanimously recommends a vote IN FAVOR of each of the Board’s nominees for director.

Director Nominees

The Board currently consists of seven directors, Richard S. Danforth, Susan Lee Schmeiser, Richard H. Osgood III, Mark Culhane, William H. Dodd, W. Craig Fugate and R. Rimmy Malhotra. Messrs. Danforth and Osgood and Ms. Schmeiser were elected to our Board at the 2024 annual meeting of stockholders and Messrs. Culhane, Dodd, Fugate and Malhotra were appointed by the Board since the 2024 annual meeting of stockholders, Mr. Malhotra pursuant to the Cooperation Agreement.

Each director to be elected will hold office until the next annual meeting of stockholders and until his or her successor is elected and has qualified, or until such director’s earlier death, resignation or removal. The Board, upon recommendation by our Nominating and Corporate Governance Committee, has nominated the nominees listed below for election to our Board.

We encourage our Board members to attend our Annual Meeting of stockholders. All nominees who were members of the Board at the time attended the 2024 Annual Meeting of stockholders virtually.

Nomination Process

In considering candidates for election to the Board, the Nominating and Corporate Governance Committee seeks to assemble a Board that, as a whole, possesses the appropriate balance of professional, management and industry experience, qualifications, attributes, skills, expertise and involvement in areas that are of importance to our business and professional reputation. The Nominating and Corporate Governance Committee also considers other board service, business, financial and strategic judgment of potential nominees, and desires to have a Board that represents a diverse mix of backgrounds, perspectives and expertise consisting of directors who complement and strengthen the skills of other directors and who also exhibit integrity, collegiality, sound business judgment and any other qualities that the Nominating and Corporate Governance Committee views as critical to effective functioning of the Board. Each of the nominees for election to the Board has demonstrated a successful track record of strategic, business and financial planning and operating skills. In addition, each of the nominees for election to the Board has experience in management and leadership development and an understanding of operating and corporate governance issues for a public company such as Genasys Inc.

Voting

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the seven nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as management may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve. There are no arrangements or understandings between us and any other person pursuant to which they or any other director has been selected as a director or nominee at the Annual Meeting.

The seven candidates receiving the highest number of affirmative votes cast at the meeting will be elected directors.

For the reasons set forth in this Proxy Statement, and in particular, each nominee’s qualifications and experience described below, the Board unanimously recommends a vote IN FAVOR of each of the Board’s nominees for director.

6

Nominees

The names of the nominees and certain information about them are set forth below. Such information includes their present positions, principal occupations and public company directorships held in the past five years as well as the specific experience, qualifications, attributes or skills of each nominee that led the Board to believe that, as of the date of this Proxy Statement, the nominee is qualified to serve on the Board. However, each member of the Board may have a variety of reasons for believing a particular person would be an appropriate Board member, and these views may differ from the views of other members of the Board.

Name |

| Age |

| Position and Offices |

| Director Since |

Richard H. Osgood III (2)(3) |

| 70 |

| Chairman of the Board |

| 2013 |

Richard S. Danforth |

| 65 |

| Chief Executive Officer and Director |

| 2017 |

Mark Culhane (1)(2) |

| 65 |

| Director |

| 2024 |

William H. Dodd (1)(2) |

| 68 |

| Director |

| 2024 |

W. Craig Fugate (3) |

| 65 |

| Director |

| 2024 |

R. Rimmy Malhotra (1) |

| 49 |

| Director |

| 2025 |

Susan Lee Schmeiser (1)(3) |

| 48 |

| Director |

| 2021 |

Richard H. Osgood III, age 70, has been a member of the Board since July 2013 and was appointed Chairman of our Board in November 2021. Mr. Osgood retired in 2012 after serving as Head of Equity Capital Markets for Wedbush Securities since January 2009. Mr. Osgood joined Wedbush Securities when it acquired Pacific Growth Equities, which Mr. Osgood founded in 1991. Mr. Osgood served in various capacities with Pacific Growth Equities prior to its acquisition, including President, Chief Executive Officer, Chief Operating Officer, Chairman and Executive Chairman. Prior to founding Pacific Growth Equities, Mr. Osgood was the Head of Capital Markets, Sales and Trading at Volpe, Welty and Company, a company he also co-founded in 1986. Previously, Mr. Osgood held senior positions in institutional sales at Montgomery Securities, Rotan Mosely and Smith Barney. Mr. Osgood holds a B.S. in Psychology from the University of the South. Mr. Osgood’s capital markets and securities industry expertise, as well as his management and strategic experience qualify him to serve on our Board.

Richard S. Danforth, age 65, was appointed Chief Executive Officer in August 2016. Mr. Danforth formed the strategic business consulting firm, RsD Aero, Ltd., in 2014, which provided consulting services for the Defense, Aerospace, Space and Transportation sectors, with an emphasis on M&A and Transatlantic trade. He served at DRS Technologies as Group President of DRS Integrated Defense Systems & Service (2013 – 2014); Chief Executive Officer, President and Board Member of DRS Defense Solutions (2008 – 2012); President, Command Control & Communication (2005 – 2008); President, Navy Electronics & Intelligence Systems (2004 – 2005); and Executive Vice President, Electronics Systems Group (2002 – 2004). He began his career at Raytheon in 1982 and held various manufacturing, quality assurance and program manager positions until 1996. Mr. Danforth was then appointed Vice President of Operations for Raytheon Aircraft Company (1996 – 2000). In 2000, he was named Senior Vice President of Raytheon Aircraft Company’s Commercial Aircraft Business division, where he led a staff of 370 sales, marketing and customer service personnel. Mr. Danforth holds a Bachelor of Science in Industrial Technology from the University of Massachusetts Lowell and a Masters in Engineering Management from Western New England College. Mr. Danforth’s extensive business experience with strategy, leadership and execution at large defense companies qualifies him to serve on our Board.

Mark Culhane, age 65, has been a member of the Board since July 2024. Mr. Culhane has been the Managing Partner of Culhane Advisory since 2016. From April 2017 to April 2022, Mr. Culhane served on the Board of Directors and was Audit Committee Chair of UserZoom. From November 2017 to June 2021, Mr. Culhane was Executive Vice President and Chief Financial Officer at Teradata Corporation. Mr. Culhane also served as Chief Financial Officer at Lithium Technologies from December 2012 to August 2016; Executive Vice President and Chief Financial Officer at DemandTec from August 2001 to May 2012; Chief Financial Officer at iManage from 1998 to 2001; Chief Financial Officer at SciClone Pharmaceuticals from 1992 to 1998; and from 1982 to 1992 held various positions with Pricewaterhouse Coopers. Mr. Culhane holds a B.S. in Business Administration from the University of South Dakota. Mr. Culhane’s extensive accounting and financial reporting expertise and business leadership experience qualify him to serve on our Board.

William H. Dodd, age 68, has been a member of the Board since May 2024. Mr. Dodd served in the California State Senate from December 2016 to December 2024. He finished his second term as Chair of the Government Organization Committee, a member of the Transportation Committee, Energy Utilities and Communications Committee, the Business Professions Committee, and the Insurance Committee. From November 2014 to November 2016, Mr. Dodd served in the California State Assembly. Mr. Dodd began public service in March 2000, serving on the Napa County Board of Supervisors until December 2014. Prior to his time in elected

7

office, Mr. Dodd owned and operated a full-service water company and served as president of the water quality industry’s state and national trade associations. Mr. Dodd earned a B.S. in Business Administration from California State University, Chico. Mr. Dodd’s extensive government service and experience, and industry and business management background, qualify him to serve on our Board.

W. Craig Fugate, age 65, has been a member of the Board since May 2024. Prior to starting Craig Fugate Consulting in March 2017 to pursue building a more resilient nation and train the next generation of emergency managers, Mr. Fugate served as Administrator of the Federal Emergency Management Agency (FEMA) from May 2009 to January 2017. Mr. Fugate led FEMA and oversaw the federal government’s response to major disasters, including the Joplin and Moore tornadoes, Hurricane Sandy, Hurricane Matthew, and Louisiana flooding. From October 2001 to May 2009, Mr. Fugate served as Director of the Florida Division of Emergency Management, leading the state of Florida’s emergency response to 11 declared disasters. Mr. Fugate began his emergency management career as a volunteer firefighter, paramedic, and a lieutenant with the Alachua County Fire Rescue before serving as Emergency Manager for Alachua County in Gainesville, Florida from 1987 to 1997. Mr. Fugate also serves on the Board of Directors of PG&E Corporation and Pacific Gas and Electric Company. Mr. Fugate’s local, state, and national leadership and substantial emergency management experience qualify him to serve on our Board.

R. Rimmy Malhotra, age 49, has been a member of the Board since January 2025. From 2013 to the present, Mr. Malhotra has served as the Managing Member and Portfolio Manager for Nicoya Fund LP, a private investment partnership. Previously, from 2008 to 2013 he served as portfolio manager of the Gratio Values Fund, a mutual fund registered under the Investment Act of 1940. Prior to this, he was an Investment Analyst at a New York based hedge fund. Since November 2019, Mr. Malhotra has been a member of the Board of Directors of Optex Systems Holdings, Inc. (NASDAQ:OPXS), is the Chair of its Nominating and Corporate Governance Committee, and sits on its Audit and Compensation Committees. Since January 2021 until August of 2024 when it merged with Horizon Kinetics, he had served on the Board of Directors as lead independent director and was Chair of the Audit Committee for Scott’s Liquid Gold-Inc. (OTCBB:SLGD). Since April 2016, he has been a member of the Board of Directors of HireQuest, Inc. (Nasdaq:HQI), where he serves as Vice-Chairman of its Board of Directors, its lead independent director and sits on its Audit and Compensation Committees. In October of 2024, he was appointed to the board of FRMO (OTC:FRMO) where he serves as the Chair of the Audit Committee. He earned an MBA in Finance from The Wharton School and a Master’s degree in International Relations from the University of Pennsylvania where he was a Lauder Fellow. Mr. Malhotra holds undergraduate degrees in Computer Science and Economics from Johns Hopkins University. Mr. Malhotra’s experience with public equity, including his service on the boards of directors of multiple public companies, and his qualifications as a financial matters expert qualify him to serve on our Board.

Susan Lee Schmeiser, age 48, has been a member of the Board since September 2021. Ms. Schmeiser has over 20 years of experience in digital marketing software, media, data analytics, and strategic partnerships. Prior to May 2023, Ms. Schmeiser served as Group President of Digital Marketing & Technology Solutions at Vericast, a MacAndrews & Forbes company, since November 2020. Prior to her current position, from April 2020 to November 2020, Ms. Schmeiser served as Chief Product Officer and Senior Executive Vice President at Vericast. From 2017 to 2020, Ms. Schmeiser was Senior Vice President of Business Development and Strategy at Valassis, a leader in marketing technology and consumer engagement. From 2011 to 2017, Ms. Schmeiser served as the Vice President of Corporate Development and Strategy of MaxPoint Interactive, Inc., which was acquired by Valassis after going public in 2017. Ms. Schmeiser served as Vice President, Ad Sales Strategy at Univision from 2007 to 2011. She also held the role of Vice President at MTV Networks from 2004 to 2007. She began her career as a Financial Analyst in the Financial Sponsors Group of Morgan Stanley’s Investment Banking Division. Ms. Schmeiser earned a B.A. in Economics from New York University and an M.B.A. in General Management from Harvard Business School. Ms. Schmeiser’s leadership experience, and expertise in corporate development and strategy qualify her to serve on our Board.

8

BOARD AND COMMITTEE MATTERS

AND CORPORATE GOVERNANCE MATTERS

Corporate Governance

We maintain a corporate governance page on our website that includes key information about our corporate governance initiatives, including our Code of Business Conduct and Ethics, our Charters for the committees of the Board, and our Whistleblower Protection Policy. The corporate governance page can be found at www.genasys.com by clicking on “Investors” and then clicking on “Investor Relations” and then clicking on “Governance.” The information contained on our website is not incorporated by reference into and does not form a part of this Proxy Statement.

Our policies and practices reflect corporate governance initiatives that are designed to be compliant with the listing requirements of the NASDAQ Stock Market and the corporate governance requirements of applicable securities laws, including:

Board of Directors

Our Board currently consists of seven directors: Richard S. Danforth, Susan Lee Schmeiser, Richard H. Osgood III, Mark Culhane, William H. Dodd, W. Craig Fugate and R. Rimmy Malhotra. During the fiscal year ended September 30, 2024, our Board held five meetings. All directors serving on the Board during the fiscal year ended September 30, 2024 attended at least 75% of the aggregate of the total number of the meetings of the Board and the total number of meetings held by all committees of the Board on which he or she served (in each case during the period in which he or she served).

Independence of the Board

As required under the NASDAQ Stock Market listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the board of directors. After review of all relevant transactions or relationships between each director, or any of his or her family members, and us, our senior management and our independent registered public accounting firm, our Board has affirmatively determined that Ms. Schmeiser and Messrs. Culhane, Dodd, Fugate, Malhotra and Osgood are independent directors within the meaning of the applicable NASDAQ listing standards.

Board Leadership Structure

Richard S. Danforth currently serves as our Chief Executive Officer and as a director. Richard H. Osgood III currently serves as Chairman of the Board. The Board does not have a formal policy with respect to separation of the offices of Chairman of the Board and Chief Executive Officer, and the Board believes that it should maintain flexibility to select our Chief Executive Officer, Chairman and board leadership structure from time to time. The Board believes that it is currently in our best interest, and that of our stockholders, for Mr. Danforth to serve as Chief Executive Officer and Mr. Osgood to serve as Chairman. The Board believes that separating these positions allows the Chief Executive Officer to focus on day-to-day business operations, while allowing the Chairman of the Board to lead the Board of Directors in its primary role of review and oversight of management.

Role of Board in Risk Oversight

Our management is primarily responsible to manage risk and inform the Board regarding our most material risks. The Board has oversight responsibility of the processes established to monitor and manage such risks. The Board believes that such oversight function is the responsibility of the entire Board through frequent reports and discussions at regularly scheduled Board meetings. In addition, the Board has delegated specific risk management oversight responsibility to the Audit Committee and to the independent members of the Board. In particular, the Audit Committee oversees management of risks related to accounting, auditing and financial

9

reporting and maintaining effective internal controls for financial reporting. The Compensation Committee oversees risk management related to our executive compensation plans and arrangements. The Nominating and Corporate Governance Committee oversees risk management related to the nomination of director candidates and our corporate governance practices. The Board believes that the leadership structure described above under “Board Leadership Structure” facilitates the Board’s oversight of risk management because it allows the Board, working through its committees to participate actively in the oversight of management’s actions. These specific risk categories and our risk management practices are regularly reviewed by the entire Board in the ordinary course of regular Board meetings.

Insider Trading Policy

We have adopted an Insider Trading Policy (the “Insider Trading Policy”) containing policies and procedures governing the purchase, sale and/or other dispositions of our securities by our directors or employees (including our executive officers), or by us. Such policies and procedures are reasonably designed to promote compliance with insider trading laws, rules and regulations, and any listing standards applicable to us.

Hedging Transactions

We have not adopted any practice or policy regarding the ability of our directors or employees (including our executive officers), or any of their designees, to engage in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of our common stock.

Clawback Policy

We have adopted a compensation recovery policy designed to comply with the mandatory compensation “clawback” requirements under applicable Nasdaq rules. Under the policy, in the event of certain accounting restatements, we will be required to recover erroneously received incentive‑based compensation from our executive officers representing the excess of the amount actually received over the amount that would have been received had the financial statements been correct in the first instance. The Compensation Committee has discretion to make certain exceptions to the clawback requirements (when permitted by Nasdaq rules) and ultimately determine whether any adjustment will be made.

Grants of Certain Equity Awards Close in Time to the Release of Material Nonpublic Information

We do not have any formal policy that requires us to grant, or avoid granting, equity-based compensation to our executive officers at certain times. Consistent with our annual compensation cycle, the Compensation Committee typically grants annual equity awards in December of each year. The timing of any equity grants to executive officers in connection with new hires, promotions, or other non-routine grants is tied to the event giving rise to the award (such as an executive officer’s commencement of employment or promotion effective date).

As a result, the Board and Compensation Committee (a) except as described below, grant awards without regard to the share price or the timing of the release of material nonpublic information, (b) wait until such material nonpublic information has been fully disclosed, widely disseminated to the public and at least two full business days has passed after such material nonpublic information has been disclosed and (c) do not time grants for the purpose of affecting the value of executive compensation.

Executive Sessions

As required under NASDAQ listing standards, during the calendar year ended December 31, 2024, our independent directors met at least twice in regularly scheduled executive sessions at which only independent directors were present.

Stockholder Communications with the Board

We have adopted a formal process by which stockholders may communicate with our Board. The Board recommends that stockholders initiate any communications with the Board in writing and send them in care of Investor Relations by mail to our principal offices, 16262 West Bernardo Drive, San Diego, CA 92127. This centralized process will assist the Board in reviewing and responding to stockholder communications in an appropriate manner. The name of any specific intended Board recipient should be noted in the communication. The Board has instructed Investor Relations to forward such correspondence only to the intended recipients; however, the Board has also instructed Investor Relations, prior to forwarding any correspondence, to review such correspondence and, in its discretion, not to forward certain items if they are deemed of a personal, illegal, commercial, offensive or frivolous nature or otherwise inappropriate for the Board’s consideration. In such cases, that correspondence will be forwarded to our corporate Secretary for review and possible response. This information is also contained on our website at www.genasys.com.

Information Regarding the Board Committees

10

During the full fiscal year ended September 30, 2024, the Board had three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The current charters for the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee can be found on our website at www.genasys.com.

Audit Committee

Our Board has a separately designated standing Audit Committee established in accordance with Section 3(a)(58) of the Securities Exchange Act of 1934 (the “Exchange Act”). The Audit Committee oversees our corporate accounting and financial reporting processes. Among other functions, the Audit Committee:

The Audit Committee has the authority to retain special legal, accounting or other advisors or consultants as it deems necessary or appropriate to carry out its duties. The Audit Committee is composed of Mr. Culhane (Chair), Mr. Dodd, Mr. Malhotra and Ms. Schmeiser. The Audit Committee met four times during fiscal 2024.

The Board annually reviews the NASDAQ listing standards definition of independence for audit committee members and has determined that all members of our Audit Committee are independent under applicable SEC rules and NASDAQ listing standards. Our Board has determined that each member of the Audit Committee is able to read and understand fundamental financial statements, including our company’s balance sheet, income statement and cash flow statement. Our Board has also determined that Mr. Culhane qualifies as an “audit committee financial expert,” as defined in applicable SEC rules. In making such determination, the Board made a qualitative assessment of Mr. Culhane’s level of knowledge and experience based on a number of factors, including Mr. Culhane’s formal education and experience.

Compensation Committee

11

The Compensation Committee assists in the implementation of, and provides recommendations with respect to, our general and specific compensation policies and practices for our company’s executives. The Compensation Committee also administers our Amended and Restated 2015 Equity Incentive Plan. Among other functions, the Compensation Committee:

The Compensation Committee has the authority to retain special legal or other advisors or consultants as it deems necessary or appropriate to carry out its duties. The Compensation Committee is composed of Mr. Culhane (Chair), Mr. Dodd, and Mr. Osgood. The Compensation Committee held four meetings during fiscal 2024. Each member of the Compensation Committee is independent under applicable NASDAQ listing standards and a “non-employee director” as defined in Rule 16b-3 under the Exchange Act.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee identifies and recommends to our Board individuals qualified to become members of the Board, reviews and advises our Board with respect to corporate governance principals and policies, and oversees the annual evaluation of the Board’s effectiveness. Among other functions, the Nominating and Corporate Governance Committee:

The Nominating and Corporate Governance Committee has the authority to retain special legal or other advisors or consultants as it deems necessary or appropriate to carry out its duties. The Nominating and Corporate Governance Committee is composed of Mr. Osgood (chair), Ms. Schmeiser, and Mr. Fugate. The Nominating and Corporate Governance Committee held three meetings during fiscal 2024. Each member of the Nominating and Corporate Governance Committee is independent under applicable NASDAQ listing standards.

Director Nominations

The Nominating and Corporate Governance Committee makes recommendations to the full Board for nominations to fill vacancies on the Board and for selecting the management nominees for the directors to be elected by our stockholders at each annual meeting.

Director Qualifications

The Nominating and Corporate Governance Committee believes that new candidates for director should have certain minimum qualifications, including having the knowledge, capabilities, experience and contacts that complement those currently existing within our company; ability and qualifications to provide our management with an expanded opportunity to explore ideas, concepts and creative approaches to existing and future issues, and to guide management through the challenges and complexities of building a quality company; ability to meet contemporary public company board standards with respect to general governance; stewardship,

12

depth of review, independence, financial certification, personal integrity and responsibility to stockholders; genuine desire and availability to participate actively in the development of our future; and an orientation toward maximizing stockholder value in realistic time frames. The Nominating and Corporate Governance Committee also intends to consider for new Board members such factors as ability to contribute strategically through relevant industry background and experience, on either the vendor or the end user side; strong current industry contacts; ability and willingness to introduce and open doors to executives of potential customers and partners; current employment as the Chief Executive Officer of an acoustic products, media, advertising, military or government supply company larger than our company; independence from our company and current Board members; and a recognizable name that would add credibility and value to our company and its stockholders. The Nominating and Corporate Governance Committee does not have a formal policy regarding diversity, but as described above considers a broad range of attributes and characteristics in identifying and evaluating nominees for election to the Board. The Nominating and Corporate Governance Committee views diversity broadly to include diversity of experience, skills and viewpoint in addition to more traditional diversity concepts. The Nominating and Corporate Governance Committee may modify these qualifications from time to time.

Evaluating Nominees for Director

The Nominating and Corporate Governance Committee reviews candidates for director nominees in the context of the current composition of our Board, our operating requirements and the long-term interests of stockholders. In conducting this assessment, the Nominating and Corporate Governance Committee currently considers, among other factors, diversity, age, skills, and such other factors as it deems appropriate given the current needs of the Board and our company, to maintain a balance of knowledge, experience and capability. In the case of incumbent directors whose terms of office are set to expire, the Nominating and Corporate Governance Committee reviews such directors’ overall service to our company during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee must be independent, which determination is based upon applicable NASDAQ listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee intends to use a variety of means to compile a list of potential candidates, including recommendations from current Board members and executive officers and recommendations from shareholders. The Nominating and Corporate Governance Committee may also engage, if it deems appropriate, professional search firms and other advisors to assist it in identifying candidates for the Board. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the background and qualifications of possible candidates after considering the function and needs of our Board. The Nominating and Corporate Governance Committee meets to discuss and consider such candidates’ qualifications and then selects a nominee for recommendation to our Board by majority vote.

Stockholder Nominations

The Nominating and Corporate Governance Committee applies the same guidelines (described above) to stockholder nominees as applied to nominees from other sources. Any stockholder who wishes to recommend for the Nominating and Corporate Governance Committee or the Board’s consideration a prospective nominee to serve on the Board may do so by giving the candidate’s name and qualifications in writing to the Chair of the Nominating and Corporate Governance Committee at the following address: 16262 West Bernardo Drive, San Diego, California 92127.

Code of Business Conduct and Ethics

We have adopted a “Code of Business Conduct and Ethics,” a code of ethics that applies to all employees, including our executive officers. A copy of the Code of Business Conduct and Ethics is posted on our Internet site at www.genasys.com. In the event we make any amendments to, or grant any waivers of, a provision of the Code of Business Conduct and Ethics that applies to the principal executive officer, principal financial officer, or principal accounting officer that requires disclosure under applicable SEC rules, we intend to disclose such amendment or waiver and the reasons therefor on a Form 8-K or on our next periodic report.

13

PROPOSAL TWO

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected Baker Tilly US, LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2025. A representative of Baker Tilly US, LLP is expected to be present at the Annual Meeting. If present, the representative will have the opportunity to make a statement if he or she desires to do so and is expected to be available to respond to appropriate questions. Stockholder ratification of the selection of Baker Tilly US, LLP is not required by our bylaws or otherwise. However, we are submitting the selection of Baker Tilly US, LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will consider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interest of our company and our stockholders.

The affirmative vote of a majority of the votes cast at the meeting, either in person or by proxy, is required to ratify the selection of Baker Tilly US, LLP. Abstentions and broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

Independent Registered Public Accountants Fees

The following table presents fees billed by Baker Tilly US, LLP, for professional services rendered for the fiscal years ended September 30, 2023 and 2024:

| Fiscal 2023 |

|

| Fiscal 2024 |

| |||

Audit Fees (1) |

| $ | 223,806 |

|

| $ | 375,407 |

|

Audit Related Fees (2) |

|

| 83,290 |

|

|

| 35,100 |

|

Tax Fees (3) |

|

| 2,200 |

|

|

| — |

|

All Other Fees (4) |

|

| — |

|

|

| — |

|

Total |

| $ | 309,296 |

|

| $ | 410,507 |

|

Audit Committee Pre-Approval Policies and Procedures

All audit and non-audit services are pre-approved by the Audit Committee, which considers, among other things, the possible effect of the performance of such services on the registered public accounting firm’s independence. The Audit Committee pre-approves the annual engagement of the principal independent registered public accounting firm, including the performance of the annual audit and quarterly reviews for the subsequent fiscal year, and pre-approves specific engagements for tax services performed by such firm. The Audit Committee has also established pre-approval policies and procedures for certain enumerated audit and audit related services performed pursuant to the annual engagement agreement, including such firm’s attendance at and participation at Board and committee meetings; services of such firm associated with SEC registration statements, periodic reports and other documents filed with the SEC or other documents issued in connection with securities offerings, such as comfort letters and consents; such firm’s assistance in responding to any SEC comment letters; and consultations with such firm as to the accounting or disclosure treatment of transactions or events and/or the actual or potential impact of final or proposed rules, standards or interpretations by the SEC, Public Company Accounting Oversight Board, Financial Accounting Standards Board, or other regulatory or standard-setting bodies. The Audit Committee is informed of each service performed pursuant to its pre-approval policies and procedures.

The Audit Committee has considered the role of Baker Tilly US, LLP in providing services to us for the fiscal year ended September 30, 2025 and has concluded that such services are compatible with such firm’s independence.

Our Board recommends a vote IN FAVOR of

the ratification of the selection of our independent registered public accounting firm.

14

PROPOSAL THREE

APPROVAL OF GENASYS INC. 2025 EQUITY INCENTIVE PLAN

On January 27, 2025, our Board of Directors approved the Genasys Inc. 2025 Equity Incentive Plan (the “2025 Plan”), subject to stockholder approval at the Annual Meeting. The 2025 Plan is the successor to our Amended and Restated 2015 Equity Incentive Plan (the “2015 Plan”). We are asking our stockholders to approve the 2025 Plan because the 2015 Plan expired in January 2025.

Overview

We believe that the adoption of the 2025 Plan is in the best interests of our company because of the continuing need to provide stock options and other equity-based incentives to attract, incentivize and retain qualified service providers and to respond to relevant market changes in equity compensation practices.

The use of equity compensation has historically been an important part of our overall compensation philosophy and is a practice that we plan to continue. The 2025 Plan will serve as an important part of this practice and is a critical component of the overall compensation package that we offer to retain and motivate our service providers. In addition, awards under the 2025 Plan will provide our service providers an opportunity to acquire or increase their ownership stake in our Company, and we believe this aligns their interests with those of our stockholders, creating strong incentives for our service providers to work hard for our future growth and success. If the 2025 Plan is not approved by our stockholders, we believe our ability to attract and retain the talent we need to compete in our industry would be seriously and negatively impacted, and this could affect our long-term success.

The 2025 Plan’s effectiveness is dependent on the approval of it by stockholders at the Annual Meeting. We are asking stockholders to approve the 2025 Plan because the 2015 Plan expired in January of 2025. If the 2025 Plan is approved, all outstanding stock awards granted under the 2015 Plan will continue to be subject to the terms and conditions as set forth in the agreements evidencing such stock awards and the terms of the applicable 2015 Plan, but no additional awards will be granted under the 2015 Plan.

Summary of our 2025 Equity Incentive Plan

The following is a summary of the principal provisions of the 2025 Plan, as proposed for approval. This summary does not purport to be a complete description of all of the provisions of the 2025 Plan. It is qualified in its entirety by reference to the full text of the 2025 Plan. A copy of the 2025 Plan is included as Appendix A to this proxy statement.

Description of the Material Features of the 2025 Plan

This section summarizes certain principal features of the 2025 Plan. The summary is qualified in its entirety by reference to the complete text of the 2025 Plan.

Eligibility and Administration

Employees (including officers), consultants, advisors and members of the Board (including non-employee directors) are eligible to participate in the 2025 Plan. As of January 27, 2025, there were approximately 210 employees, directors, and consultants, including two executive officers, and six non-employee directors that would have been eligible to receive awards under the 2025 Plan if the 2025 Plan had been effective as of that date. Since our executive officers and non-employee directors may participate in the 2025 Plan, each of our executive officers, non-employee directors and director nominees has an interest in this Proposal 3.

The Board or any of its committees, as directed by the Board (referred to collectively as the “Administrator”), will administer the 2025 Plan, subject to the limitations imposed under the 2025 Plan, Section 16 of the Exchange Act, stock exchange rules and other applicable laws. The Administrator will have the authority to take all actions and make all determinations under the 2025 Plan, to interpret the 2025 Plan and award agreements and to adopt, amend and repeal rules for the administration of the 2025 Plan as it deems advisable. The Administrator will also have the authority to determine which eligible service providers receive awards, grant awards and set the terms and conditions of all awards under the 2025 Plan, including any vesting and vesting acceleration provisions, subject to the conditions and limitations in the 2025 Plan.

Shares Available for Awards

The initial aggregate number of shares of our common stock that will be available for issuance under the 2025 Plan will be equal to the sum of (i) 6,000,000 shares of our common stock, which includes 5,057,285 new shares of our common stock plus 942,715 shares that were reserved under the 2015 Plan but were not granted prior to its expiration, and (ii) any shares which, as of the effective date of the 2025 Plan, are subject to awards under the 2015 Plan which, on or following the effective date of the 2025 Plan, become available for issuance pursuant to the 2025 Plan recycling provisions, described below.

15

If an award under the 2025 Plan or the 2015 Plan expires, lapses or is terminated, exchanged for or settled in cash, any shares subject to such award (or portion thereof) may, to the extent of such expiration, lapse, termination or cash settlement, be used again for new grants under the 2025 Plan. Shares tendered or withheld to satisfy the exercise price or tax withholding obligation for any award under the 2025 Plan or the 2015 Plan may, to the extent of such tender or withholding, be used for new grants under the 2025 Plan. Further, the payment of dividend equivalents in cash in conjunction with any awards under the 2025 Plan will not reduce the shares available for grant under the 2025 Plan.

Awards granted under the 2025 Plan upon the assumption of, or in substitution for, awards authorized or outstanding under a qualifying equity plan maintained by an entity with which we enter into a merger or similar corporate transaction will not reduce the shares available for grant under the 2025 Plan but will count against the maximum number of shares that may be issued upon the exercise of incentive stock options (“ISOs”).

The 2025 Plan provides that the sum of any cash compensation and the aggregate grant date fair value (determined as of the date of the grant under Financial Accounting Standards Board Accounting Standards Codification Topic 718, or any successor thereto) of all awards granted to a non-employee director as compensation for services as a non-employee director during any calendar year, or director limit, may not exceed an amount equal to $500,000 (which limits shall not apply to the compensation for any non-employee director who serves in any capacity in addition to that of a non-employee director for which he or she receives additional compensation).

Awards

The 2025 Plan provides for the grant of stock options, including ISOs and nonqualified stock options (“NSOs”), Stock Appreciation Rights (“SARs”), restricted stock, dividend equivalents, restricted stock units (“RSUs”) and other stock or cash based awards. Certain awards under the 2025 Plan may constitute or provide for payment of “nonqualified deferred compensation” under Section 409A of the Internal Revenue Code of 1986, as amended, which may impose additional requirements on the terms and conditions of such awards. All awards under the 2025 Plan will be evidenced by award agreements, which will detail the terms and conditions of awards, including any applicable vesting and payment terms and post-termination exercise limitations. Awards other than cash awards generally will be settled in shares of our common stock, but the applicable award agreement may provide for cash settlement of any award. A brief description of each award type follows.

16

Certain Transactions

The Administrator has broad discretion to take action under the 2025 Plan, as well as make adjustments to the terms and conditions of existing and future awards, to prevent the dilution or enlargement of intended benefits and facilitate necessary or desirable changes in the event of certain transactions and events affecting our common stock, such as stock dividends, stock splits, mergers, acquisitions, consolidations and other corporate transactions. In addition, in the event of certain non-reciprocal transactions with our stockholders known as “equity restructurings,” the Administrator will make equitable adjustments to the 2025 Plan and outstanding awards. In the event of a change in control (as defined in the 2025 Plan), to the extent that the surviving entity declines to continue, convert, assume or replace outstanding awards, then all such awards will become fully vested and exercisable in connection with the transaction.

Repricing

The exercise price of an option or SAR may not be reduced (repriced) without first obtaining stockholder approval, except as provided above regarding certain transactions or to comply with applicable law.

Plan Amendment and Termination

The Administrator may amend or terminate the 2025 Plan at any time; however, no amendment, other than an amendment that increases the number of shares available under the 2025 Plan, may materially and adversely affect an award outstanding under the 2025 Plan without the consent of the affected participant, and stockholder approval will be obtained for any amendment to the extent necessary to comply with applicable laws. The 2025 Plan will remain in effect until the tenth anniversary of the date the Board adopted the 2025 Plan, unless earlier terminated. No awards may be granted under the 2025 Plan after its termination.

Foreign Participants, Claw-Back Provisions, Transferability and Participant Payments

The Administrator may modify award terms, establish subplans and/or adjust other terms and conditions of awards, subject to the share limits described above, in order to facilitate grants of awards subject to the laws and/or stock exchange rules of countries outside of the United States. All awards will be subject to any company clawback policy as set forth in such clawback policy or the applicable award agreement. Awards under the 2025 Plan are generally non-transferable, except by will or the laws of descent and distribution, or, subject to the Administrator’s consent, pursuant to a domestic relations order, and are generally exercisable only by the participant. With regard to tax withholding, exercise price and purchase price obligations arising in connection with awards under the 2025 Plan, the Administrator may, in its discretion, accept cash or check, shares of our common stock that meet specified conditions, a “market sell order” or such other consideration as it deems suitable.

The summary of the 2025 Plan provided above is a summary of the principal features of the 2025 Plan. This summary, however, does not purport to be a complete description of all of the provisions of the 2025 Plan. It is qualified in its entirety by references to the full text of the 2025 Plan. A copy of the 2025 Plan is attached as Appendix A to this Proxy Statement.

Material U.S. Federal Income Tax Consequences

The following is a general summary under current law of the principal United States federal income tax consequences related to awards under the 2025 Plan. This summary deals with the general federal income tax principles that apply and is provided only for general information. Some kinds of taxes, such as state, local and foreign income taxes and federal employment taxes, are not discussed. This summary is not intended as tax advice to participants, who should consult their own tax advisors.

17

Section 409A of the Code

Certain types of awards under the 2025 Plan may constitute, or provide for, a deferral of compensation subject to Section 409A of the Code. Unless certain requirements set forth in Section 409A of the Code are complied with, holders of such awards may be taxed earlier than would otherwise be the case (e.g., at the time of vesting instead of the time of payment) and may be subject to an additional 20% penalty tax (and, potentially, certain interest, penalties and additional state taxes). To the extent applicable, the 2025 Plan and awards granted under the 2025 Plan are intended to be structured and interpreted in a manner intended to either comply with or be exempt from Section 409A of the Code and the Department of Treasury regulations and other interpretive guidance that may be issued under Section 409A of the Code. To the extent determined necessary or appropriate by the Administrator, the 2025 Plan and applicable award agreements may be amended to further comply with Section 409A of the Code or to exempt the applicable awards from Section 409A of the Code.

New Plan Benefits

Grants under the 2025 Plan will be made at the discretion of the Administrator and are not currently determinable. The value of the awards granted under the 2025 Plan will depend on a number of factors, including the fair market value of our common stock on future dates, the exercise decisions made by the participants and the extent to which any applicable performance goals necessary for vesting or payment are achieved.

Vote Required; Recommendation of the Board of Directors

The affirmative vote of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal is required to approve the Genasys Inc. 2025 Equity Incentive Plan. Abstentions will have the effect of votes against this proposal. Broker non-votes, if any, will have no effect on the results of this vote.

Our Board recommends a vote FOR

the approval of the Genasys Inc. 2025 Equity Incentive Plan.

18

PROPOSAL FOUR

ADVISORY VOTE ON EXECUTIVE COMPENSATION

Consistent with the vote of our stockholders, our Board has determined to submit the approval of our executive compensation annually to our stockholders on a non-binding basis. This proposal, commonly known as a “say-on-pay” proposal, gives stockholders the opportunity to express their views on the compensation of our named executive officers. The vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers. Our executive compensation program received the support of stockholders holding 94.3% of our stock that was voted on the matter at our 2024 annual meeting of stockholders.

Our executive compensation program is designed to attract, motivate and retain a talented team of executives. We seek to accomplish this goal in a way that rewards performance that is aligned with our stockholders’ long-term interests. We believe that our executive compensation program satisfies this goal and is strongly aligned with the long-term interests of our stockholders.

In accordance with the requirements of Section 14A of the Exchange Act, we are including in this Proxy Statement a separate resolution, subject to a non-binding stockholder vote, to approve the compensation of our named executive officers as disclosed in this Proxy Statement. Accordingly, the following resolution is submitted for stockholder vote at the 2025 Annual Meeting:

“RESOLVED, that the stockholders of Genasys Inc. approve, on an advisory basis, the compensation of its named executive officers as disclosed in the tabular disclosure regarding named executive officer compensation and the accompanying narrative disclosure in the Proxy Statement for the 2025 Annual Meeting.”

As an advisory vote, this proposal is not binding. However, the Compensation Committee, which is responsible for designing and administering our executive compensation program, values the opinions expressed by stockholders in their vote on this proposal and will continue to consider the outcome of the vote when making future compensation decisions for named executive officers.

Our Board recommends that stockholders vote FOR the approval, on an advisory basis,

of the compensation of our named executive officers, as disclosed in this Proxy Statement.

19

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of our common stock as of January 28, 2025 by: (i) each director and nominee; (ii) each of the named executive officers reflected in the Summary Compensation Table; (iii) all of our executive officers and directors as a group; and (iv) all those known by us to be beneficial owners of more than five percent of our common stock. Unless otherwise indicated, the business address of each person named below is c/o Genasys Inc., 16262 West Bernardo Drive, San Diego, California 92127.

Title of Class |

| Name and Address of Beneficial Owner |

| Amount and Nature of |

|

|

| Percent of Class (1) |

| ||

Common Stock |

| Integrity Wealth Advisors Inc. |

|

| 6,654,818 |

| (2) |

|

| 14.8 | % |

| 196 S Fir Street, Suite 140 |

|

|

|

|

|

|

| |||

| Ventura, CA 93001 |

|

|

|

|

|

|

| |||

Common Stock |

| AWM Investment Company, Inc. |

|

| 5,649,544 |

| (3) |

|

| 12.6 | % |

| 527 Madison Avenue, Suite 2600 |

|

|

|

|

|

|

| |||

| New York, New York 10022 |

|

|

|

|

|

|

| |||

Common Stock |

| Whitebox Advisors LLC, |

|

| 3,068,182 |

| (4) |

|

| 6.8 | % |

|

| Whitebox General Partner LLC |

|

|

|

|

|

|

| ||

| 3033 Excelsior Boulevard, Suite 500 |

|

|

|

|

|

|

| |||

| Minneapolis, MN 55416 |

|

|

|

|

|

|

| |||