QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrantý

|

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| ý | | Preliminary Proxy Statement |

| o | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to |

| o | | Rule 14a-11 (c) or rule 14a-12

|

INTRADO INC. |

(Name of Registrant as Specified In Its Charter) |

Not Applicable |

(Name of Person(s) Filing Proxy Statement,

if Other Than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| Fee paid previously with preliminary materials: |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | (1) | | Amount previously paid:

|

| | | (2) | | Form, Schedule or Registration Statement no.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

INTRADO INC.

6285 Lookout Road

Boulder, Colorado 80301

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 15, 2002

Dear Stockholder:

Our 2002 Annual Meeting of Stockholders will be held at the Westin Hotel, 10600 Westminster Boulevard, Westminster, Colorado, on Wednesday, May 15, 2002, beginning at 2:00 p.m. local time. At the meeting, the holders of our outstanding common stock will act on the following matters:

- •

- Election of two directors, each for a term of three years;

- •

- Approval of an amendment to our certificate of incorporation to increase the number of authorized shares of our common stock; and

- •

- Any other matters properly presented at the meeting or any postponements or adjournments of the meeting.

You may vote on these matters in person or by proxy. Whether or not you plan to attend the Annual Meeting, we ask that you vote by one of the following methods to ensure that your shares will be represented at the meeting in accordance with your wishes:

- •

- Vote by telephone, or electronically through the Internet, by following the instructions included with your proxy card; or

- •

- Vote by mail, by promptly completing and returning the enclosed proxy card in the enclosed addressed, stamped envelope.

Only stockholders of record at the close of business on March 22, 2002 may vote at the meeting or any postponements or adjournments of the meeting.

Boulder, Colorado

March , 2001

INTRADO INC.

6285 Lookout Road

Boulder, Colorado 80301

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

to be held on May 15, 2002

This proxy statement contains information related to the Annual Meeting of Stockholders (the "Annual Meeting") of Intrado Inc. to be held on Wednesday, May 15, 2002, beginning at 2:00 p.m. (local time) at the Westin Hotel, 10600 Westminster Boulevard, Westminster, Colorado, and at any postponements or adjournments thereof.

ABOUT THE ANNUAL MEETING

What is the purpose of the meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the accompanying Notice of Annual Meeting of Stockholders. In addition, management will report on our performance during fiscal 2001 and respond to questions from stockholders.

Who is entitled to vote?

Only stockholders of record at the close of business on the record date, March 22, 2002, are entitled to receive notice of the Annual Meeting and to vote the shares of common stock that they held on that date at the meeting, or at any postponement or adjournment of the meeting. Each outstanding share entitles its holder to cast one vote on each matter to be voted upon.

Who can attend the meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend the meeting. Seating, however, is limited. Admission to the meeting will be on a first-come, first-served basis. Registration and seating will begin at 1:30 p.m. (local time) and the meeting will begin at 2:00 p.m. (local time). Each stockholder may be asked to present valid picture identification, such as a driver's license or passport. Cameras, recording devices, and other electronic devices will not be permitted at the meeting.

Many of you hold your shares in "street name," that is, through a broker or other nominee. If you hold your shares in street name, you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date and check in at the registration desk at the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the record date will constitute a quorum, permitting the meeting to conduct its business. As of the record date, shares of common stock were outstanding and entitled to vote at the meeting. Thus, the presence of the holders of common stock representing at least shares will be required to establish a quorum.

Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting.

1

How do I vote?

If you complete and properly sign the accompanying proxy card and return it to us, it will be voted as you direct. If you are a registered stockholder and attend the meeting, you may deliver your completed proxy card in person. "Street name" stockholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares.

Can I vote by telephone or electronically?

Yes. You may vote by telephone, or electronically through the Internet, by following the instructions included with your proxy card.

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with our Corporate Secretary either a notice of revocation or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

What are the board's recommendations?

The Board of Directors recommends a votefor election of the nominated slate of directors andfor the proposal to amend the Certificate of Incorporation to increase the number of authorized shares of common stock.

The board's recommendation is also set forth together with the description of each item in this proxy statement. Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors.

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

What vote is required to approve each item?

The affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote on the matter is required to elect each director nominee. Approval of Proposal 2 requires the vote of a majority of the outstanding shares. A properly executed proxy marked:

- •

- "withhold authority" with respect to the election of one or more directors; or

- •

- "abstain" with respect to any other matters

will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, such a proxy will have the effect of a negative vote. A properly executed, but unmarked proxy will be votedfor the election of the nominated slate of two directors andfor each of the proposals.

2

What are "broker non-votes" and how will they be counted?

"Broker non-votes" occur when you hold your shares in "street name" through a broker or other nominee, and you do not give your broker or nominee specific instructions on your proxy card. If you fail to complete your proxy card:

- •

- your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon; and

- •

- your shares may not be voted on those matters and will not be counted in determining the number of shares necessary for approval.

Broker non-votes will have the effect of a negative vote; shares represented by "broker non-votes" will be counted in determining whether there is a quorum.

Who will bear the cost of soliciting proxies?

Intrado will bear the cost of soliciting proxies, including expenses in connection with preparing and mailing this proxy statement. In addition, we will reimburse brokerage firms and other persons representing you for their expenses in forwarding proxy material to you. Our directors, officers, and employees may also solicit you by telephone and other means, but they will not receive any additional compensation for the solicitation.

STOCK OWNERSHIP

Who are the largest holders of our common stock?

Based on a review of filings with the Securities and Exchange Commission, the following holders of our common stock own more than five percent of our outstanding common stock:

| | Shares Beneficially Owned (1)

| |

|---|

Name and Address of Beneficial Owner

| |

|---|

| | Number

| | Percent

| |

|---|

New Venture Partners II LP(2)

535 Mountain Avenue, New Providence, NJ 07974 | | 2,250,000 | | 14.9 | % |

Insight Capital Research & Management

2121 N. California Blvd., Suite 560, Walnut Creek, CA 94596 | | 810,762 | | 5.4 | % |

- (1)

- In accordance with Rule 13d-3 under the Securities Exchange Act of 1934, a person is deemed to be the beneficial owner, for purposes of this table, of any shares of common stock if such person has or shares voting power or investment power with respect to such security, or has the right to acquire beneficial ownership at any time within 60 days from February 15, 2002. For purposes of this table, "voting power" is the power to vote or direct the voting of shares and "investment power" is the power to dispose or direct the disposition of shares.

- (2)

- New Venture Partners II LP is a limited partnership in which Coller Capital Management, an international investment firm, has an 80% equity interest and Lucent Technologies Inc. has a 20% equity interest. We issued 2,250,000 shares in connection with our May 2001 acquisition of Lucent Public Safety Systems, an internal venture of Lucent Technologies Inc.

As of February 15, 2002, we are not aware of any other entities that own more than five percent of our common stock.

How much stock do our directors and executive officers own and how do they intend to vote?

The following table shows the amount of common stock beneficially owned (unless otherwise indicated) by: (1) the directors and executive officers named in the Summary Compensation Table below and (2) the directors and executive officers as a group. The officers and directors have indicated that they intend to votefor election of the nominated slate of directors andfor the proposal to amend

3

the Certificate of Incorporation to increase the number of authorized shares of common stock. All information is as of February 15, 2002.

| | Shares Beneficially Owned (1)

| |

|---|

Name of Beneficial Owner

| |

|---|

| | Number

| | Percent

| |

|---|

| George A. Heinrichs(2) | | 423,029 | | 2.8 | % |

| Stephen M. Meer(3) | | 235,068 | | 1.6 | |

| David Kronfeld(4) | | 67,994 | | * | |

| Lawrence P. Jennings(5) | | 48,203 | | * | |

| Michael D. Dingman, Jr.(6) | | 42,000 | | * | |

| Winston J. Wade(7) | | 30,255 | | * | |

| Philip B. Livingston(8) | | 21,724 | | * | |

| Darrell A. Williams(9) | | 19,140 | | * | |

| Mary Beth Vitale(10) | | 8,622 | | * | |

| Stephen O. James(11) | | 7,807 | | * | |

| Craig W. Donaldson(12) | | 3,003 | | * | |

| All directors and executive officers as a group (12 persons)(13) | | 906,845 | | 5.9 | |

- *

- Less than one percent.

- (1)

- In accordance with Rule 13d-3 under the Securities Exchange Act of 1934, a person is deemed to be the beneficial owner, for purposes of this table, of any shares of common stock if such person has or shares voting power or investment power with respect to such security, or has the right to acquire beneficial ownership at any time within 60 days from February 15, 2002. For purposes of this table, "voting power" is the power to vote or direct the voting of shares and "investment power" is the power to dispose or direct the disposition of shares.

- (2)

- Includes options to purchase 6,666 shares of common stock exercisable within 60 days of February 15, 2002, 1,539 shares held by Mr. Heinrichs' minor daughter, and 1,539 shares held by Mr. Heinrichs' minor son.

- (3)

- Includes options to purchase 72,367 shares of common stock exercisable within 60 days of February 15, 2002.

- (4)

- Includes 25,000 shares held by Boston Capital Ventures III Limited Partnership, 26,194 shares held directly by Mr. Kronfeld and 16,800 shares of common stock exercisable within 60 days of February 15, 2002. Mr. Kronfeld serves as the general partner of BD Partners Limited Partnership, which, in turn, serves as the general partner of Boston Capital Ventures III Limited Partnership. Mr. Kronfeld disclaims beneficial ownership of any of the shares owned by Boston Capital Ventures III Limited Partnership, except to the extent of his pecuniary interest in such entities.

- (5)

- Includes options to purchase 39,350 shares of common stock exercisable within 60 days of February 15, 2002.

- (6)

- Includes options to purchase 36,000 shares of common stock exercisable within 60 days of February 15, 2002.

- (7)

- Includes options to purchase 16,800 shares of common stock exercisable within 60 days of February 15, 2002.

- (8)

- Includes options to purchase 13,800 shares of common stock exercisable within 60 days of February 15, 2002.

- (9)

- Includes options to purchase 15,600 shares of common stock exercisable within 60 days of February 15, 2002.

- (10)

- Includes options to purchase 5,300 shares of common stock exercisable within 60 days of February 15, 2002.

- (11)

- Includes options to purchase 3,600 shares of common stock exercisable within 60 days of February 15, 2002.

- (12)

- Includes options to purchase 3,003 shares of common stock exercisable within 60 days of February 15, 2002.

- (13)

- Includes options to purchase 229,286 shares of common are exercisable within 60 days of February 15, 2002. See Notes (2) through (12).

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors is divided into three classes, as nearly equal in number as possible. Each class serves three years, with the terms of office of the respective classes expiring in successive years. The term of office of the two Class B directors, David Kronfeld and Philip B. Livingston, expires at the

4

2002 Annual Meeting. The Board of Directors proposes that Messrs. Kronfeld and Livingston be re-elected for a new term of three years and until their successors are duly elected and qualified. Information about the directors, including their biographies, meeting attendance, committee participation and compensation, is provided below.

Background Information About Directors Standing for Election

The directors standing for election are:

| David Kronfeld | | Mr. Kronfeld has served as a director since March 1998, and previously served as a director from February 1992 to June 1996. Mr. Kronfeld has served as Manager of JK&B Capital LLC since he founded the company in October 1995. Since 1989, Mr. Kronfeld has been a general partner of Boston Capital Ventures Limited Partnership, Boston Capital Ventures II Limited Partnership, Boston Capital Ventures III L.P. and Boston Capital Ventures, all of which are venture capital funds. Mr. Kronfeld currently serves as a director of MPower Communications Corp. and MPower Holding Corporation. Mr. Kronfeld is 54 years old. |

Philip B. Livingston |

|

Mr. Livingston has served as a director since April 2000. Since January 1999, Mr. Livingston has been the President and Chief Executive Officer of Financial Executives International. From August 1995 to November 1998, Mr. Livingston was the Senior Vice President and Chief Financial Officer for Catalina Marketing Corporation. From March 1993 to July 1995, Mr. Livingston was the Vice President and Chief Financial Officer for Celestial Seasonings, Inc. Mr. Livingston is 45 years old. |

The Board of Directors has no reason to believe that any of the nominees will not serve if elected, but if any of them should become unavailable to serve as a director, and if the board designates a substitute nominee, the persons named as proxies will vote for the substitute nominee designated by the board.

Directors will be elected by a plurality of the votes cast at the Annual Meeting. If elected, the nominees are expected to serve until the 2005 Annual Meeting of Stockholders and until their successors are duly elected and qualified.

The Board of Directors recommends that you vote FOR the election of each of the nominees named above.

Background Information About Directors Continuing in Office

The directors continuing in office are:

| Stephen O. James | | Mr. James has served as a director since October 1999. His current term expires at the 2004 Annual Meeting of Stockholders. Mr. James has been an independent executive business consultant since 1993. Mr. James is 57 years old. |

5

Mary Beth Vitale |

|

Ms. Vitale has served as a director since October 1999. Her current term expires at the 2004 Annual Meeting of Stockholders. Since May 2001, Ms. Vitale has served as a principal of Pellera, LLC, a consulting firm. From March 2000 through November 2000, Ms. Vitale was the CEO and President of Westwind Media. Ms. Vitale was the President and Chief Operating Officer of RMI.NET from December 1998 through February 2000. In July 2001, 17 months after Ms. Vitale resigned her position at RMI.NET (now known as Internet Commerce & Communications, Inc.), RMI.NET filed a voluntary petition for relief with the United States Bankruptcy Court for the District of Colorado. Ms. Vitale was the President—Western States for AT&T in 1997 and held several positions, including Vice President and Corporate Officer, Local Service Organization, Western Region for AT&T from 1994 to 1996. Ms. Vitale is 48 years old. |

Winston J. Wade |

|

Mr. Wade has served as a director since October 1999. His current term expires at the 2003 Annual Meeting of Stockholders. Mr. Wade was the Chief Executive Officer of MediaOne Malaysia from 1997 to 1999 and the Managing Director of MediaOne India, BPL/US West from 1996 to 1997. From 1981 through 1995, Mr. Wade held several positions with US West, including Vice President—Network Operations, Vice President—Network Infrastructure, Vice President—Technical Services and President—Information Technologies Group. Mr. Wade currently serves as a director of Transcrypt International, Inc. Mr. Wade is 63 years old. |

Darrell A. Williams |

|

Mr. Williams has served as a director since January 18, 2000, and previously served as a director from February 1998 to December 1999. His current term as a director expires at the 2003 Annual Meeting of Stockholders. Since January 2000, Mr. Williams has been Chief Investment Officer of the Telecommunications Development Fund. From 1992 to 1999, Mr. Williams was with Ameritech Development Corporation, last serving as Vice President, Venture Capital. Mr. Williams is 42 years old. |

For biographical information about George K. Heinrichs, our Chief Executive Officer, President and Chairman of the Board of Directors, refer to "Information about Executive Officers" on page 7.

Meetings of the Board of Directors

During 2001, the Board of Directors held six meetings. Each director attended more than 75% of the total number of meetings of the board and committees on which he or she served.

Board Committees

The Board of Directors has appointed an Audit Committee, a Compensation Committee and an Executive Staffing Committee. It has not appointed a standing nominating committee.

Audit Committee. The Audit Committee met four times during 2001. The Audit Committee:

- •

- reviews the scope and results of the annual audit of our consolidated financial statements conducted by our independent accountants;

6

- •

- reviews the scope of other services provided by independent auditors;

- •

- reviews proposed changes in our financial and accounting standards and principles and in our policies and procedures for our internal accounting, auditing, and financial controls; and

- •

- makes recommendations to the Board of Directors on the engagement of the independent accountants.

The Audit Committee currently consists of Philip B. Livingston, Darrell A. Williams, Winston J. Wade, and Mary Beth Vitale. The Audit Committee's report can be found on pages 10-11.

Compensation Committee The Compensation Committee met five times during 2001. The Compensation Committee:

- •

- reviews and acts on matters relating to compensation levels and benefits plans for our executive officers and key employees; and

- •

- is responsible for granting stock options and other awards under our existing incentive compensation plans.

The Compensation Committee currently consists of Darrell A. Williams, Winston J. Wade, and Mary Beth Vitale. The Compensation Committee's report on executive compensation can be found on pages 9-10.

The Executive Staffing Committee was created on December 2, 1999. The Executive Staffing Committee:

- •

- reviews and acts on matters relating to executive staffing issues;

- •

- gives executive management guidance on executive management requirements and qualifications; and

- •

- assists executive management in the recruitment and selection of qualified individuals.

Executive Staffing Committee. The Executive Staffing Committee currently consists of Winston J. Wade, Mary Beth Vitale, and Stephen O. James. This committee did not meet in 2001.

Director Compensation

We reimburse our directors for all reasonable and necessary travel and other incidental expenses incurred in connection with their attendance at meetings of the board and committees of the board. In addition, all board members are eligible for compensation equal to $1,000 for each board meeting attended in person, $500 for each telephonic board meeting, $500 for each committee meeting, and a $3,000 quarterly retainer. Such compensation is payable in cash or stock at the director's discretion. Board members may be paid additional amounts for consulting services that extend beyond their normal board duties, although no such payments were made to date.

Under the Discretionary Option Grant Program, each individual who first becomes a non-employee board member will automatically be granted an option to purchase 30,000 shares of common stock on the date the individual joins the board, provided the individual has not been in the prior employ of Intrado. In addition to the initial option grant, each non-employee board member is eligible to receive an annual option grant. The amount of each annual option grant, if any, is determined by the board. During 2001, each non-employee director received options to purchase a total of 30,000 shares of common stock pursuant to the Discretionary Option Grant Program. All options vest 24% on the one-year anniversary of the option grant date and 2% per month thereafter until 100% vested.

7

Information About Executive Officers

Background Information About Executive Officers

Our executive officers and their ages as of February 15, 2002 are as follows:

| George K. Heinrichs | | A co-founder of Intrado, Mr. Heinrichs has served as our President and a director since 1979 and as our Chief Executive Officer since 1995. His current term as a director expires at the 2003 Annual Meeting of Stockholders. Mr. Heinrichs is 44 years old. |

Lawrence P. Jennings |

|

Mr. Jennings has served as our Chief Operating Officer since February 2002. Mr. Jennings joined Intrado in June 1999 as our Vice President of Sales and served as our Senior Vice President of Business Operations from December 1999 until February 2002. From 1995 through June 1999, Mr. Jennings served as Vice President of Operations and Vice President of Sales for Teletrac, Inc. Mr. Jennings is 48 years old. |

Stephen M. Meer |

|

A co-founder of Intrado, Mr. Meer has served as our Chief Technology Officer since 1979. Mr. Meer is 44 years old. |

Michael D. Dingman, Jr. |

|

Mr. Dingman has served as our Chief Financial Officer since September 2000. From March 1999 to August 2000, he was Chief Financial Officer/Treasurer for RMI.NET. In July 2001, 11 months after Mr. Dingman resigned his position at RMI.NET (now known as Internet Commerce & Communications, Inc.), RMI.NET filed a voluntary petition for relief with the United States Bankruptcy Court for the District of Colorado. From January 1997 through February 1999, Mr. Dingman was the President of Qwon Investment Consultants, Inc. From March 1994 through December 1996, Mr. Dingman was President of Owen-Joseph Companies. Mr. Dingman is 48 years old. |

Craig W. Donaldson |

|

Mr. Donaldson has served as our General Counsel since August 1997 and has also served as our Vice President of Legal & Government Affairs since July 1999. From March 1990 to August 1997, Mr. Donaldson was in private law practice. Mr. Donaldson is 50 years old. |

Executive Compensation

The following table sets forth the compensation earned during the year ended December 31, 2001 by our "Named Executive Officers," who consist of our Chief Executive Officer and four other executive officers who served in the capacity of an executive officer on December 31, 2001 and earned more than $100,000 in combined salary and bonus in 2001.

8

Summary Compensation Table

| |

| |

| |

| | Long-Term

Compensation

| |

|

|---|

| |

| | Annual Compensation

| |

|

|---|

Name and Principal Position

| |

| | Securities

Underlying

Options(2)

| | All Other

Compensation

|

|---|

| | Year

| | Salary

| | Bonus(1)

|

|---|

George K. Heinrichs

President and Chief Executive

Officer | | 2001

2000

1999 | | $

| 245,000

245,000

245,000 | | $

| 236,357

190,440

120,000 | | —

—

66,667 | | $

| 2,240

1,240

999 |

Lawrence P. Jennings

Vice President Business Operations | | 2001

2000

1999 | | | 220,458

185,000

107,323 | | | 214,169

143,815

49,940 | | 100,000

—

100,000 | | | 2,559

1,180

1,148 |

Stephen M. Meer

Vice President and Chief

Technology Officer | | 2001

2000

1999 | | | 185,000

185,000

173,333 | | | 178,474

143,816

35,000 | | —

—

16,667 | | | 2,240

1,240

1,350 |

Michael D. Dingman, Jr.

Chief Financial Officer | | 2001

2000

1999 | | | 175,000

57,098

— | | | 168,827

35,538

— | | —

100,000

— | | | 2,441

1,120

— |

Craig W. Donaldson

Vice President and General Counsel | | 2001

2000

1999 | | | 179,167

124,117

97,967 | | | 44,425

16,835

5,202 | | 50,000

30,401

21,125 | | | 2,504

1,310

750 |

- (1)

- A portion of the bonuses included in each year were earned in that year, but not paid until the following year.

- (2)

- Options listed in the table were granted under the 1998 Stock Incentive Plan.

- (3)

- Includes matching contributions under our 401(k) Plan and premiums on term life and disability insurance policies.

Option Grants

The following table sets forth information regarding the stock option grants made to each of the Named Executive Officers in the 2001 fiscal year.

Options Granted During 2001

| |

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2)

|

|---|

| | Number of Securities Underlying Options Granted(1)

| | Percent of Total Options Granted to Employees In Fiscal Year

| |

| |

|

|---|

Name

| | Exercise Price Per Share

| | Expiration Date

|

|---|

| | 5%

| | 10%

|

|---|

| George K. Heinrichs | | — | | — | | $ | — | | — | | $ | — | | $ | — |

| Lawrence P. Jennings | | 100,000 | | 6 | % | | 8.28 | | 4/17/11 | | | 520,725 | | | 1,319,619 |

| Stephen M. Meer | | — | | — | | | — | | — | | | — | | | — |

| Michael D. Dingman, Jr. | | — | | — | | | — | | — | | | — | | | — |

| Craig W. Donaldson | | 50,000 | | 3 | % | | 14.18 | | 7/6/11 | | | 445,886 | | | 1,129,963 |

- (1)

- The options were granted to each of the Named Executive Officers pursuant to the 1998 Stock Incentive Plan. Options vest 24% one year from the date of grant and 2% each month thereafter.

- (2)

- The five percent and ten percent assumed annual rates of compounded stock price appreciation are mandated by the rules of the Securities and Exchange Commission. There can be no assurance provided to the option holder or any other holder of our securities that the actual stock price appreciation over the ten-year option term will be at the assumed five percent and ten percent levels or at any other defined level.

9

Option Exercises and Holdings

The following table sets forth information regarding exercises of stock options during the year ended December 31, 2001 and exercisable and unexercisable options held as of December 31, 2001 by each of the Named Executive Officers.

Aggregated Option Exercises in Last Fiscal Year

And Fiscal Year-End Option Values

| |

| |

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year-End

| | Value of Unexercised

In-the-Money Options

at Fiscal Year-End

|

|---|

| | Shares

Acquired

on

Exercise

| |

|

|---|

Name

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| George K. Heinrichs | | 246,647 | | $ | 5,982,711 | | 2,666 | | 28,000 | | $ | 54,869 | | $ | 612,136 |

| Lawrence P. Jennings | | 24,650 | | | 593,288 | | 33,350 | | 142,000 | | | 729,098 | | | 2,770,204 |

| Stephen M. Meer | | 7,567 | | | 199,446 | | 70,134 | | 10,663 | | | 1,616,826 | | | 235,526 |

| Michael D. Dingman, Jr. | | — | | | — | | 28,000 | | 72,000 | | | 561,400 | | | 1,443,600 |

| Craig W. Donaldson | | 28,334 | | | 690,626 | | 1,197 | | 81,995 | | | 25,527 | | | 1,297,717 |

The value realized by each option exercised equals the total market price of the shares purchased, based on the last sale price of the common stock on the Nasdaq National Market on the exercise date, minus the total exercise price paid for those shares. The value of each unexercised option is based on the excess, if any, of $26.80 per share, the last sale price of the common stock on the Nasdaq National Market on December 31, 2001, over the per share exercise price of each outstanding option.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee currently consists of Darrell A. Williams, Winston J. Wade, and Mary Beth Vitale. Mr. Williams, Mr. Wade, and Ms. Vitale have never been officers or employees of Intrado.

None of the Named Executive Officers have ever served as a member of the Board of Directors or Compensation Committee of any other entity that has or has had one or more executive officers serving as a member of our board or Compensation Committee.

Management Incentive Compensation Plan

During 2001, the executive officers bonuses paid were based on achieving certain quarterly revenue, operating income, and cash targets.

Compensation Committee Report on Executive Compensation

The Compensation Committee reviews and acts on matters relating to compensation levels and benefits plans for our executive officers and key employees. The Compensation Committee also provides for grants of stock awards, stock options, stock appreciation rights, and other awards to be made under our existing incentive compensation plans.

General Compensation Policy. The fundamental policy of the Compensation Committee is to provide our executive officers with competitive compensation opportunities based upon their contribution to our development and financial success and their personal performance. The Compensation Committee's objective is to have a portion of each executive officer's compensation contingent on our performance as well as on the executive officer's own level of performance. Accordingly, the compensation package for each executive officer is comprised of three elements:

10

(1) base salary, which principally reflects an executive officer's performance and is designed primarily to be competitive with salary levels in the industry; (2) bonus, which principally reflects our performance; and (3) long-term incentive compensation, which strengthens the mutuality of interests between our executive officers and stockholders.

Factors. The principal factors that the Compensation Committee considered in ratifying the components of each executive officer's compensation package for 2001 are summarized below. The Compensation Committee may apply entirely different factors in advising the Chief Executive Officer and the Board of Directors with respect to executive compensation for future years.

- •

- Base Salary. The suggested base salary for each executive officer is determined on the basis of experience, personal performance, the salary levels in effect for comparable positions within and without the industry, and internal base salary comparability considerations. The weight given to each of these factors differs from individual to individual, as the Compensation Committee deems appropriate.

- •

- Bonus. The Compensation Committee may suggest a bonus for each executive officer determined on the basis of our performance, personal performance, and the bonus levels in effect for comparable positions within and without the industry. The Compensation Committee establishes annual bonus amounts for each executive officer based on the bonus levels for comparable positions, and earned bonus amounts are based on performance results. The weight given to each of these factors differs from individual to individual, as the Compensation Committee deems appropriate. In addition, the Compensation Committee may from time to time award additional cash bonuses when it determines those bonuses to be in our best interest.

- •

- Long-Term Incentive Compensation. Long-term incentives are provided primarily through grants of stock options under our 1998 Stock Incentive Plan. The grants are designed to align the interests of each executive officer with those of the stockholders and to provide each individual with a significant incentive to manage Intrado from the perspective of an owner with an equity stake. Each option grant allows the executive officer to acquire shares of the common stock at a fixed price per share, typically equal to the market price on the grant date, over a specified period of time of up to ten years. Options generally become exercisable in installments over a 50-month period, contingent upon an executive officer's continued employment with Intrado. Accordingly, an option grant generally provides a return to the executive officer only if the executive officer remains employed by us during the vesting period, and then only if the market price of the underlying shares appreciates. The number of shares subject to each option grant is set at a level intended to create a meaningful opportunity for stock ownership based on the executive officer's current position, the base salary associated with that position, the size of comparable awards made to individuals in similar positions within the industry, the executive officer's potential for increased responsibility and promotion over the option term, and the executive officer's personal performance in recent periods. The Compensation Committee also considers the number of unvested options held by the executive officer in order to maintain an appropriate level of equity incentive for that executive officer. The Compensation Committee does not adhere to any specific guidelines as to the relative option holdings of our executive officers.

Chief Executive Officer Compensation. Securities and Exchange Commission regulations require the Board of Directors to disclose the basis for compensation paid to George Heinrichs, our President and Chief Executive Officer, in 2001 and to discuss the relationship between our performance factors and Mr. Heinrichs' performance in 2001. In advising the board with respect to Mr. Heinrichs' compensation, the Compensation Committee seeks to establish a level of base salary competitive with that paid by companies of comparable size within the industry and by companies outside of the industry with which we compete for executive talent. Mr. Heinrichs' 2001 base salary was established on the

11

basis of the foregoing criteria and was intended to provide a level of stability and certainty to Intrado and its security holders. Accordingly, this element of compensation was not affected to any significant degree by our performance factors.

Compliance with Internal Revenue Code Section 162(m). As a result of Section 162(m) of the Internal Revenue Code, we are not allowed a federal income tax deduction for compensation paid to certain executive officers to the extent that compensation exceeds $1,000,000 per officer in any year. This limitation applies to all compensation paid to the covered executive officers that is not considered to have been performance based. The management incentive compensation plan contains provisions intended to ensure that any compensation deemed paid in connection with the exercise of stock options granted under the plan with an exercise price equal to the market price of the common stock on the grant date will qualify as performance-based compensation. The Compensation Committee does not expect that the compensation that will be paid to any of our executive officers during 2002 will exceed $1,000,000.

Information About Our Independent Public Accountants and Audit Committee Report

Independent Public Accountants. The firm of Arthur Andersen LLP ("Andersen") serves as our independent public accountants. The Audit Committee, in its discretion, may direct the appointment of different independent public accountants at any time during the year if the Audit Committee believes that a change would be in the best interests of our stockholders. Although members of the Audit Committee have not reached a decision regarding our independent public accountants for 2002, they may consider engaging another independent accounting firm for reasons that are unrelated to Andersen's audit of our financial statements. For this reason, we will not be asking stockholders to ratify Andersen as our independent public accountants at the Annual Meeting. If members of the Audit Committee decide to change our independent public accountants, we will promptly provide the disclosure required by the regulations of the Securities and Exchange Commission.

A representative of Andersen is expected to be present at the Annual Meeting, will have the opportunity to make a statement if he or she desires to do so, and will be available to respond to appropriate questions.

Audit and Non-Audit Fees. Fees for professional services provided by Andersen during 2001 were approximately $105,000 for audit-related services and approximately $55,000 for non-audit services. Audit related services include services rendered for the audit of the financial statements included in our 2001 Annual Report on Form 10-K and the reviews of our financial statements included in our Quarterly Reports on Form 10-Q. Non-audit services include fees for due diligence procedures associated with mergers and acquisitions and accounting consultations.

Audit Committee Report. The following Report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Intrado filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this report by reference therein.

Audit Committee Report

During fiscal 2000, the Audit Committee of the Board of Directors developed an updated charter, which was subsequently approved by the full Board of Directors. The complete text of the new charter,

12

which reflects standards set forth in new Securities and Exchange Commission regulations and Nasdaq Stock Market rules, recognizes three broad categories of Audit Committee responsibilities:

- •

- monitoring the preparation of quarterly and annual financial reports by management, including discussions with management and outside auditors about draft annual financial statements and key accounting and reporting matters;

- •

- the relationship between management and outside auditors, including: recommending their appointment or removal; reviewing the scope of their audit services and non-audit services and related fees; and determining whether the outside auditors are independent (based in part on the annual letter provided to management pursuant to Independence Standards Board Standard No. 1); and

- •

- overseeing management's implementation of effective systems of internal controls, including review of policies relating to legal and regulatory compliance, ethics and conflicts of interests.

The Audit Committee has implemented procedures to ensure that during the course of each fiscal year it devotes the attention that it deems necessary or appropriate to each of the matters assigned to it under the Committee's charter. To carry out its responsibilities, the Audit Committee met four times during fiscal 2001.

In overseeing the preparation of the financial statements, the Audit Committee met with both management and outside auditors to review and discuss all financial statements prior to their issuance and to discuss significant accounting issues. Management advised the Audit Committee that all financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee discussed the statements with both management and the outside auditors. The Audit Committee's review included discussion with the outside auditors of matters required to be discussed pursuant to Statement on Auditing Standards No. 61 (Communication With Audit Committees).

With respect to the outside auditors, the Audit Committee, among other things, discussed with Arthur Andersen LLP matters relating to its independence, including the disclosures made to the Committee as required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees).

On the basis of these reviews and discussions, the Audit Committee recommended to the Board of Directors that the board approve the inclusion of the audited financial statements in the Annual Report on Form 10-K for the fiscal year ended December 31, 2001, for filing with the Securities and Exchange Commission.

13

Information About Related-Party Transactions

As part of our May 2001 acquisition of Lucent Public Safety Systems ("LPSS"), an internal venture of Lucent Technologies, Inc. ("Lucent"), we provide maintenance services to former customers of Lucent on database and call handling contracts on a subcontracted basis. Because these contracts were not assigned directly to us under the acquisition agreement, we bill Lucent for services rendered and Lucent, in turn, bills the customer. Although Lucent is merely a pass-through entity for billing purposes, we recognize a large amount of revenue from this arrangement. Since the acquisition date, we have recognized approximately $6.2 million in revenue under the sub-contracted services agreement with Lucent. As of December 31, 2001, Lucent owes us approximately $416,000 for services we have rendered. As part of the LPSS acquisition, we:

- •

- issued 2,250,000 shares of our common stock to Lucent; and

- •

- incurred an obligation to purchase inventory from Lucent, which was valued at approximately $4.4 million as of December 31, 2001.

Lucent continued to hold all 2,250,000 shares, representing approximately 14.9% or our common stock, until January 2002, when Lucent created a new venture capital partnership named New Ventures Partners II LP ("NVP II") and transferred its shares of Intrado common stock to NVP II. Lucent then transferred 80% of NVP II to Coller Capital Management, an international investment firm, but continues to hold a 20% equity interest in NVP II.

We provide data management and consulting services pursuant to a service agreement dated August 31, 1994 with Ameritech Information Systems. Under a master lease agreement dated March 11, 1996, we lease personal property from Ameritech Credit Corporation. Ameritech Information Systems, Ameritech Credit Corporation and Ameritech Mobile Communications are affiliates of Ameritech Development Corp., which beneficially owned approximately 1.6 million shares of our common stock until June 2000. A member of our Board of Directors was a representative of Ameritech Development Corp. at the time the service and master lease agreements were executed.

During the years ended December 31, 2001, 2000, and 1999, we recognized approximately $9.9 million, $9.8 million and $8.9 million in revenue, respectively, from the Ameritech service agreement. As of December 31, 2001 and 2000, Ameritech owed us approximately $2.2 million and $1.7 million, respectively, for services provided. During the years ended December 31, 2001, 2000, and 1999, we paid Ameritech approximately $1.6 million, $2.1 million, and $3.4 million, respectively, pursuant to lease schedules to the master lease agreement. As of December 31, 2001 and 2000, we owed approximately $1.8 million and $1.6 million, respectively, pursuant to lease schedules to the master lease agreement. The leases have interest rates ranging from 6.27% to 9.50%, require monthly payments and have expiration dates varying through December 2004.

We believe that the terms of the transactions described above were no less favorable to us than would have been obtained from an unaffiliated third party. Any further transactions with any of our officers, directors, or principal stockholders will be on terms no less favorable to us than could be obtained from unaffiliated third parties and will be approved by a majority of the independent and disinterested members of the Board of Directors.

Compliance with Section 16 Reporting Requirements

Section 16(a) of the Securities Exchange Act requires our executive officers, our directors, and persons who own more than ten percent of a registered class of our equity securities, to file changes in ownership on Form 4 or 5 with the Securities and Exchange Commission. These executive officers, directors, and ten-percent stockholders are also required by Securities and Exchange Commission rules to furnish us with copies of all Section 16(a) reports they file. Based solely on our review of the copies of these forms, we believe that all Section 16(a) reports applicable to our executive officers, directors,

14

and ten-percent stockholders with respect to reportable transactions during the fiscal year ended December 31, 2001 were filed on a timely basis.

Stock Performance Graph

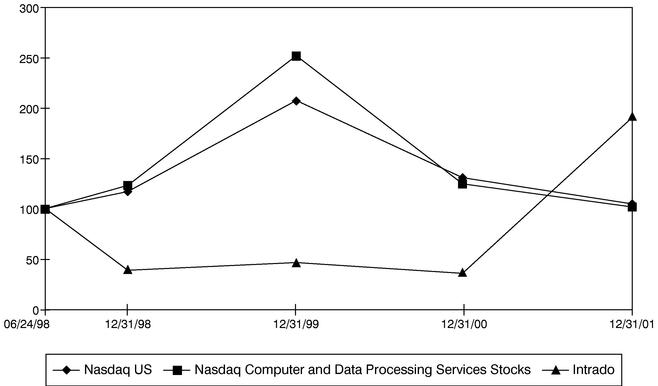

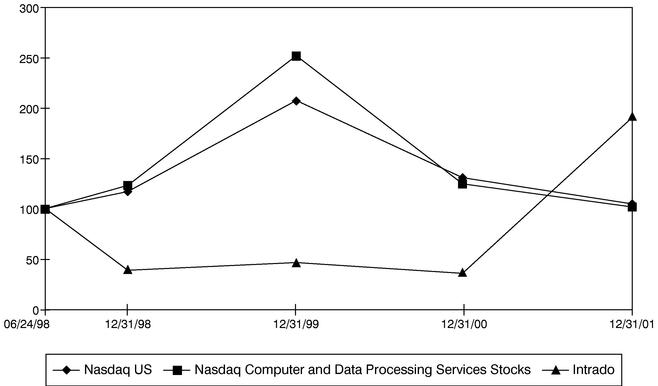

The graph depicted below compares the performance of Intrado common stock with the performance of the Nasdaq Stock Market-US and the Nasdaq Computer and Data Processing Services indices over the period beginning on June 24, 1998, the date on which our common stock began trading on the Nasdaq National Market, and ending on December 31, 2001. The graph assumes that $100 was invested on June 24, 1998 in our common stock and in each index, the Nasdaq Stock Market-US Index, and the Nasdaq Computer and Data Services Index, and that all dividends were reinvested. We have not declared any dividends on our common stock.

Comparison of Cumulative Total Return

Based on investment of $100 on June 24, 1998

PROPOSAL 2

Approval of an Amendment to Our Certificate Of Incorporation

to Increase the Number of Authorized Shares of Common Stock

The Board of Directors has approved, and is recommending to the stockholders for approval at the Annual Meeting, an amendment to Section 1 of Article IV of our Certificate of Incorporation to increase the number of shares of common stock which we are authorized to issue from 30,000,000 to 50,000,000. The Board of Directors has determined that this amendment is advisable and should be considered at the Annual Meeting. The full text of the proposed amendment to the Certificate of Incorporation is set forth below. We are currently authorized to issue 15,000,000 shares of preferred stock, par value $0.001 per share, and the proposed amendment will not affect this authorization.

15

Purposes and Effects of Proposed Increase in the Number of Authorized Shares of Common Stock

The proposed amendment would increase the number of shares of common stock we are authorized to issue from 30,000,000 to 50,000,000. The additional 20,000,000 shares would be a part of the existing class of common stock and, if and when issued, would have the same rights and privileges as the shares of common stock presently issued and outstanding. As of February 15, 2002, 15,080,423 shares of common stock were outstanding and an additional 3,031,165 shares were reserved for issuance upon exercise of outstanding options and warrants.

We have no present commitments, agreements, or intent to issue additional shares of common stock, other than with respect to currently reserved shares, in connection with transactions in the ordinary course of our business, or shares which may be issued under our stock option, stock purchase, and other existing employee benefit plans. However, the Board of Directors believes the increase in the authorized shares will provide flexibility to act in the future with respect to potential financing programs, acquisitions, stock splits, and other corporate purposes, without the delay and expense associated with obtaining special stockholder approval each time an opportunity requiring the issuance of shares may arise.

The proposed amendment to Section 1 of Article IV would permit the issuance of additional shares up to the new 50,000,000 maximum authorization without further action or authorization by stockholders (except as may be required in a specific case by law or the Nasdaq Stock Market rules). The authorization of additional shares of common stock pursuant to this proposal will have no immediate dilutive effect upon the proportionate voting power of our present stockholders. However, the holders of our common stock are not entitled to preemptive rights or cumulative voting. Accordingly, the issuance of additional shares of common stock might dilute, under certain circumstances, the ownership and voting rights of stockholders.

Although the proposed increase in the number of shares of common stock we are authorized to issue is not intended to inhibit a change in control, the availability of additional shares of common stock could discourage, or make more difficult, efforts to obtain control of Intrado. For example, the issuance of shares of common stock in a public or private sale, merger, or similar transaction would increase the number of outstanding shares, thereby possibly diluting the interest of a party attempting to obtain control of Intrado. We are not aware of any pending or threatened efforts to acquire control of Intrado.

If the proposal is approved, we intend to file an amendment to the Certificate of Incorporation shortly after the Annual Meeting. The amendment to the Certificate of Incorporation will be effective immediately upon acceptance of filing by the Secretary of the State of Delaware.

Amendment to Restated Certificate of Incorporation

If approved, Section 1 of Article IV of our Restated Certificate of Incorporation would be amended and restated as follows:

ARTICLE IV

1. Classes of Stock. This corporation is authorized to issue two classes of stock, denominated Common Stock and Preferred Stock. The Common Stock shall have a par value of $0.001 per share and the Preferred Stock shall have a par value of $0.001 per share. The total number of shares of Common Stock which the Corporation is authorized to issue is Fifty Million (50,000,000), and the total number of shares of Preferred Stock which the Corporation is authorized to issue is Fifteen Million (15,000,000), which shares of Preferred Stock shall be undesignated as to series.

16

Vote Required

Approval of the proposed amendment to the Certificate of Incorporation requires the affirmative vote of a majority of the shares of common stock outstanding and entitled to vote at the meeting.

The Board of Directors recommends that you vote FOR the proposal to amend our Certificate of Incorporation to increase the number of authorized shares of common stock.

OTHER MATTERS

As of the date of this proxy statement, we know of no business that will be presented for consideration at the Annual Meeting other than the items referred to above. If any other matter is properly brought before the meeting for action by stockholders, proxies in the enclosed form returned to us will be voted in accordance with the recommendation of the Board of Directors or, in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

STOCKHOLDER PROPOSALS FOR 2003 ANNUAL MEETING

A stockholder who intends to present a proposal at the 2003 Annual Meeting of Stockholders for inclusion in our 2003 proxy statement must submit the proposal by December 1, 2002. In order for the proposal to be included in the proxy statement, the stockholder submitting the proposal must meet certain eligibility standards and must comply with certain procedures established by the Securities and Exchange Commission, and the proposal must comply with the requirements as to form and substance established by applicable laws and regulations. The proposal must be mailed to Craig W. Donaldson, our Corporate Secretary, at the address set forth on the Notice of the 2002 Annual Meeting of Stockholders appearing before this proxy statement.

In addition, in accordance with our bylaws, a stockholder wishing to bring an item of business before the 2003 Annual Meeting must deliver notice of the item of business to us at our principal offices by no later than December 1, 2002, even if the item is not to be included in our proxy statement.

Boulder, Colorado

March , 2002

17

INTRADO INC.

Annual Meeting of Stockholders,

May 15, 2002

This Proxy is Solicited on Behalf of the Board of Directors

The undersigned revokes all previous proxies, acknowledges receipt of the Notice of the 2002 Annual Meeting of Stockholders of Intrado Inc. ("Intrado") to be held on May 15, 2002 and the related proxy statement, and appoints George K. Heinrichs, Michael D. Dingman, Jr., and Craig W. Donaldson, and each of them, the proxy of the undersigned, with full power of substitution, to vote all shares of common stock of Intrado that the undersigned is entitled to vote, either on his or her own behalf or on behalf of any entity or entities, at the 2002 Annual Meeting of Stockholders of Intrado to be held at the Westin Hotel, 10600 Westminster Boulevard, Westminster, Colorado, on Wednesday, May 15, 2002, beginning at 2:00 p.m. local time and at any adjournment or postponement thereof, with the same force and effect as the undersigned might or could do if personally present thereat.

The shares represented by this proxy, when properly executed, shall be voted as specified by the undersigned.If no specification is made, this proxy will be voted, FOR the election of all nominees for director (proposal 1), FOR proposal 2, and according to the discretion of the proxy holders on any other matters that may properly come before the meeting or any postponement or adjournment thereof.

Please date, sign exactly as your name appears on the form, and mail the proxy card promptly. When signing as an attorney, executor, administrator, trustee, or guardian, please give your full title as such. If shares are held jointly, both owners must sign.

See reverse for voting instructions

THERE ARE THREE WAYS TO VOTE YOUR PROXY. IF YOU WISH TO VOTE BY TELEPHONE, INTERNET OR MAIL, PLEASE READ THE INSTRUCTIONS BELOW

|

Intrado Inc. encourages you to take advantage of new and convenient ways to vote your shares for matters to be covered at the 2002 Annual Meeting of Stockholders. Please take the opportunity to use one of the three voting methods outlined below to cast your ballot.

VOTING BY TELEPHONE: 1-800-240-6326 *** QUICK *** EASY *** IMMEDIATE

Use any touch-tone telephone to vote your proxy 24 hours a day, 7 days a week. Have your proxy card in hand when you call. You will be prompted to enter your 3-digit Company Number and your 7-digit Control Number, which is located above, and then follow the simple instructions the voice provides you.

VOTING BY INTERNET: WWW.EPROXY.COM/TRDO/ *** QUICK *** EASY *** IMMEDIATE

Use the Internet to vote your proxy 24 hours a day, 7 days a week. Have your proxy card in hand when you access the web site. You will be prompted to enter your 3-digit Company Number and your 7-digit Control Number, which is located above, to obtain your records and create an electronic ballot.

VOTING BY MAIL

Mark, sign, and date your proxy card and return it in the postage-paid envelope we've provided or return it to Intrado Inc., c/o Shareowner Services(SM), P.O. Box 64873, St. Paul, Minnesota 55164-9397.

If you vote by telephone or vote using the Internet, please do not mail your proxy.

THANK YOU FOR VOTING

\*/ Please detach here \*/

The Board of Directors recommends a vote FOR items 1 and 2.

| 1. | | To elect David Kronfeld and Philip B. Livingston as directors to serve for three-year terms ending in the year 2005 or until successors are duly elected and qualified; | | o | | FOR all nominees listed above (except as marked to the contrary below). | | o | | WITHHOLD AUTHORITY to vote for all nominees listed above. |

INSTRUCTION: To withhold authority to vote for any individual nominee, mark "FOR" above and write the name of the nominee as to which you wish to withhold authority in the space below: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

To approve an amendment to the Certificate of Incorporation to increase the number of authorized shares of common stock outstanding. |

|

o |

|

FOR |

|

o |

|

AGAINST |

|

o |

|

ABSTAIN |

If you plan on attending the meeting, please check the box to the right. o |

|

|

|

|

|

|

|

|

|

|

|

|

| Please print the name(s) appearing on each share certificate(s) over which you have voting authority: | |

(Print name(s) on certificate) | | |

| Please sign your name: | |

Authorized Signature(s) | | Date: | |

|

| | |

Authorized Signature(s) of Joint Owners, if any | | Date: | |

|

| | | | | | | Please date, sign exactly as your name appears on the form, and mail the proxy promptly. When signing as an attorney, executor, administrator, trustee, or guardian, please give your full title as such. If shares are held jointly, both owners must sign. |

QuickLinks

INTRADO INC. 6285 Lookout Road Boulder, Colorado 80301PROXY STATEMENT ANNUAL MEETING OF STOCKHOLDERS to be held on May 15, 2002ABOUT THE ANNUAL MEETINGSTOCK OWNERSHIPPROPOSAL 1 ELECTION OF DIRECTORSInformation About Executive OfficersSummary Compensation TableOptions Granted During 2001Aggregated Option Exercises in Last Fiscal Year And Fiscal Year-End Option ValuesCompensation Committee Report on Executive CompensationAudit Committee ReportComparison of Cumulative Total Return Based on investment of $100 on June 24, 1998PROPOSAL 2 Approval of an Amendment to Our Certificate Of Incorporation to Increase the Number of Authorized Shares of Common StockARTICLE IVOTHER MATTERSSTOCKHOLDER PROPOSALS FOR 2003 ANNUAL MEETING