Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

INTRADO INC. |

(Name of Registrant as Specified In Its Charter) |

Not Applicable |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

INTRADO INC.

1601 Dry Creek Drive

Longmont, Colorado 80503

Notice of Annual Meeting of Stockholders

to be held May 17, 2005

Dear Stockholder:

Our 2005 Annual Meeting of Stockholders will be held at the Park Hyatt Hotel, 800 North Michigan Avenue, Chicago, Illinois, on Tuesday, May 17, 2005, beginning at 1:30 p.m. local time. At the meeting, the holders of our outstanding common stock will act on the following matters:

- •

- Election of two Class B directors for a term of three years;

- •

- Ratification of the appointment of our independent registered public accounting firm for 2005;and

- •

- Any other matters properly presented at the meeting or any postponements or adjournments of the meeting.

You may vote on these matters in person or by proxy. Whether or not you plan to attend the Annual Meeting, we ask that you vote by one of the following methods to ensure that your shares will be represented at the meeting in accordance with your wishes:

- •

- Vote by telephone, or electronically through the Internet, by following the instructions included with your proxy card; or

- •

- Vote by mail, by promptly completing and returning the enclosed proxy card in the enclosed addressed, stamped envelope.

Only stockholders of record at the close of business on March 25, 2005 may vote at the meeting or any postponements or adjournments of the meeting.

|

|

By order of the Board of Directors, |

|

|

|

| | | George Heinrichs

Chairman of the Board, President,

and Chief Executive Officer |

Longmont, Colorado

April 15, 2005 |

|

|

TABLE OF CONTENTS

i

INTRADO INC.

1601 Dry Creek Drive

Longmont, Colorado 80503

Proxy Statement

Annual Meeting of Stockholders

to be held on May 17, 2005

This proxy statement contains information related to the Annual Meeting of Stockholders (the "Annual Meeting") of Intrado Inc. to be held on Thursday, May 17, 2005, beginning at 1:30 p.m. (local time) at the Park Hyatt Hotel, 800 North Michigan Avenue, Chicago, Illinois, and at any postponements or adjournments of the meeting. We expect to mail this proxy statement to stockholders on or about April 15, 2005.

About the Annual Meeting

What is the purpose of the Annual Meeting?

At our Annual Meeting, stockholders will act upon the matters outlined in the accompanying Notice of Annual Meeting of Stockholders, including the election of directors and ratification of our independent registered public accounting firm. In addition, management will report on our performance and respond to questions from stockholders.

Who is entitled to vote at the meeting?

Only stockholders of record at the close of business on March 25, 2005, the record date for the Annual Meeting, are entitled to receive notice of and to participate in the Annual Meeting. If you were a stockholder of record on March 25, 2005, you will be entitled to vote all of the shares you own at the Annual Meeting, or at any postponements or adjournments of the meeting.

What are the voting rights of the holders of Intrado common stock?

Each outstanding share of Intrado common stock will be entitled to one vote on each matter considered at the meeting.

Who can attend the meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend the meeting. Seating, however, is limited. Admission to the meeting will be on a first-come, first-served basis. Registration and seating will begin at 1:00 p.m. (local time) and the meeting will begin at 1:30 p.m. (local time). Each stockholder may be asked to present valid picture identification, such as a driver's license or passport. Cameras (including cell phones with photographic capabilities), recording devices, and other electronic devices will not be permitted at the meeting.

If you hold your shares in "street name" (that is, through a broker or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date and check in at the registration desk at the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of a majority of the shares of common stock outstanding on the record date will constitute a quorum, permitting the meeting to conduct its business. As of the record date, 17,618,319 shares of common stock were outstanding and

1

entitled to vote at the meeting. Thus, the presence of the holders of common stock representing at least 8,809,160 shares will be required to establish a quorum.

Proxies received but marked as abstentions and broker non-votes will be included in the number of shares considered to be present at the meeting.

How do I vote?

If you complete and properly sign the accompanying proxy card and return it to us, it will be voted as you direct. If you are a registered stockholder (that is, you hold your stock in certificate form) and attend the meeting, you may deliver your completed proxy card in person. "Street name" stockholders who wish to vote at the meeting will need to obtain a proxy form from the institution that holds their shares and bring it to the meeting.

Can I vote by telephone or electronically?

If you are a registered stockholder, you may vote by telephone, or electronically through the Internet, by following the instructions included with your proxy card. The deadline for voting by telephone or electronically for registered stockholders is 12:00 noon Central Standard Time, on May 16, 2005. If you hold your stock in "street name," please check your proxy card or contact your broker or nominee to determine whether you will be able to vote by telephone or electronically and any deadline for voting.

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by attending the Annual Meeting in person and voting by ballot or by filing with our Corporate Secretary either a notice of revocation or a duly executed proxy bearing a later date.

What are the Board's recommendations?

The Board of Directors recommends that you vote:

- •

- forelection of David Kronfeld and Art Zeile as Class B directors; and

- •

- forratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2005.

The Board's recommendation is also set forth together with the description of each proposal to be considered in this proxy statement. Unless you give other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the Board of Directors or, if no recommendation is given, in their own discretion.

What vote is required to approve each item and how will certain proxies be counted?

Proposal 1: Election of Director. The affirmative vote of the holders of a plurality of the shares represented in person or by proxy and entitled to vote is required to elect the director nominees. A properly executed proxy marked "WITHHOLD AUTHORITY" with respect to the election of one or more director nominees will not be voted with respect to the director indicated, although it will be counted for purposes of determining whether there is a quorum.

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm. The affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote is required to ratify the appointment of PricewaterhouseCoopers LLP as our

2

independent registered public accounting firm. A properly executed proxy marked "ABSTAIN" with respect to the ratification of the appointment of our independent registered public accounting firm will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

What are "broker non-votes" and how will they be counted?

"Broker non-votes" occur when you hold your shares in "street name" through a broker or other nominee, and you do not give your broker or nominee specific instructions on your proxy card. If you fail to provide specific instructions to your broker or nominee, your shares may not be voted on those matters. Shares represented by such "broker non-votes" will not be counted in determining the number of shares necessary for approval, but will be counted in determining whether there is a quorum.

Who will bear the cost of soliciting proxies?

We will bear the cost of soliciting proxies, including expenses in connection with preparing and mailing this proxy statement. In addition, we will reimburse brokerage firms and other persons representing you for their expenses in forwarding proxy material to you. Our directors, officers, and employees may also solicit you by telephone and other means, but they will not receive any additional compensation for the solicitation.

Stock Ownership

Who are the largest holders of our common stock?

Based on a review of filings with the Securities and Exchange Commission, the following holders owned more than five percent of our outstanding common stock at the time of their last filing:

| | Shares Beneficially Owned(1)

| |

|---|

Name and Address of Beneficial Owner

| | Common

Stock

| | Percent of

Common Stock

Outstanding

| |

|---|

William Blair & Company, LLC

222 W. Adams, 34th Floor, Chicago, IL 60606 | | 2,040,809 | | 11.5 | % |

Federated Investors, Inc.

Federated Investors Tower, 5800 Corporate Drive, Pittsburgh, PA 15222-3779 | | 1,117,190 | | 6.3 | % |

NV Partners II LP

98 Floral Avenue, Murray Hill, NJ 07974 | | 1,109,329 | | 6.3 | % |

- (1)

- In accordance with Rule 13d-3 under the Securities Exchange Act of 1934, a person is deemed to be the beneficial owner, for purposes of this table, of any shares of common stock if such person has or shares voting power or investment power with respect to such security, or has the right to acquire beneficial ownership at any time within 60 days from April 1, 2005. For purposes of this table, "voting power" is the power to vote or direct the voting of shares and "investment power" is the power to dispose or direct the disposition of shares.

As of April 1, 2005, we were not aware of any other individuals or entities that own more than five percent of our common stock.

How much stock do our directors and executive officers own and how do they intend to vote?

The following table shows the amount of Intrado common stock beneficially owned (unless otherwise indicated) by: (1) the directors and executive officers named in the Summary Compensation

3

Table on page 13 below and (2) the directors and executive officers as a group. The officers and directors have indicated that they intend to votefor election of the nominated directors andfor ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2005.

| | Shares Beneficially Owned(1)

| |

|---|

Name of Beneficial Owner

| | Common

Stock

| | Stock Options

Exercisable

Within 60

Days

| | Percent of

Common Stock

Outstanding

| |

|---|

| George Heinrichs(2) | | 455,590 | | 97,939 | | 3.1 | % |

| Stephen M. Meer | | 196,443 | | 78,540 | | 1.6 | % |

| Lawrence P. Jennings | | 8,853 | | 225,750 | | 1.3 | % |

| Michael D. Dingman, Jr. | | 7,000 | | 122,300 | | * | |

| Craig W. Donaldson | | 18,815 | | 60,543 | | * | |

| Stephen O. James | | 13,961 | | 60,800 | | * | |

| David Kronfeld | | 31,592 | | 74,000 | | * | |

| Winston J. Wade | | 23,050 | | 74,000 | | * | |

| Darrell A. Williams | | 19,625 | | 73,000 | | * | |

| Art Zeile(3) | | 3,282 | | 7,200 | | * | |

All directors and executive officers as a group (11 persons) (2)(3) |

|

790,374 |

|

948,072 |

|

9.4 |

% |

- *

- Less than one percent.

- (1)

- In accordance with Rule 13d-3 under the Securities Exchange Act of 1934, a person is deemed to be the beneficial owner, for purposes of this table, of any shares of common stock if such person has or shares voting power or investment power with respect to such security, or has the right to acquire beneficial ownership at any time within 60 days from April 1, 2005. For purposes of this table, "voting power" is the power to vote or direct the voting of shares and "investment power" is the power to dispose or direct the disposition of shares.

- (2)

- Includes 1,539 shares held by Mr. Heinrichs' minor daughter and 1,539 shares held by Mr. Heinrichs' minor son.

- (3)

- Includes 375 shares held by Mr. Zeile's spouse.

Compliance with Section 16 Reporting Requirements

Section 16(a) of the Securities Exchange Act requires our executive officers, our directors, and persons who own more than ten percent of a registered class of our equity securities, to file changes in ownership on Form 4 or Form 5 with the Securities and Exchange Commission. These executive officers, directors, and ten-percent stockholders are also required by Securities and Exchange Commission rules to furnish us with copies of all Section 16(a) reports they file. Based solely on our review of the copies of these forms, we believe that all Section 16(a) reports applicable to our executive officers, directors, and ten-percent stockholders with respect to reportable transactions during the year ended December 31, 2004 were filed on a timely basis, with the following exception of: Teri Depuy, Senior Vice President of Organization Development, who filed a report on February 28, 2005 to report three stock option exercises on February 3, 2004, March 11, 2004 and April 13, 2004; and Art Zeile, a director, who filed a report on November 12, 2004 to report a purchase of common stock on November 8, 2004 by his spouse.

4

Proposal 1—Election of Directors

The Board of Directors is divided into three classes, as nearly equal in number as possible. Each class serves three years, with the terms of office of the respective classes expiring in successive years. The term of office of the two Class B directors, David Kronfeld and Art Zeile, expires at the 2005 Annual Meeting. The Board of Directors proposes that Messrs. Kronfeld and Zeile be re-elected for a new term of three years and until their successors are duly elected and qualified. Information about Messrs. Kronfeld and Zeile, including their biographies, meeting attendance, committee participation and compensation, is provided below.

Directors Standing for Election

The directors standing for election are:

| | David Kronfeld | | Mr. Kronfeld has served as a director since March 1998, and previously served as a director from February 1992 to June 1996. Mr. Kronfeld has served as Manager of JK&B Capital LLC since he founded the company in October 1995. Since 1989, Mr. Kronfeld has been a general partner of Boston Capital Ventures Limited Partnership, Boston Capital Ventures II Limited Partnership, Boston Capital Ventures III L.P. and Boston Capital Ventures, all of which are venture capital funds. Mr. Kronfeld is 57 years old. |

| |

Art Zeile |

|

Mr. Zeile became a director in January 2004, after Mr. Zeile was recommended to the Corporate Governance Committee by a non-management director. Mr. Zeile co-founded Inflow, Inc., a provider of information technology outsourcing, in September 1997 and served as its Chief Executive Officer until January 2005, when Inflow was acquired by Sungard. Since January 2005, Mr. Zeile has served as the Chief Executive Officer of 32points Inc. From 1994 to 1997, Mr. Zeile served as Vice President of Business Operations for LINK-VTC, a global provider of videoconferencing services. Mr. Zeile is 41 years old. |

Each of the nominees has consented to serve if elected. If any nominee should become unavailable to serve as a director, the Board may designate a substitute nominee. In that event, the persons named as proxies will vote for the substitute nominee designated by the Board.

Directors will be elected by a plurality of the votes cast at the Annual Meeting. If elected, each nominee is expected to serve until the 2008 Annual Meeting of Stockholders and until his successor is duly elected and qualified.

The Board of Directors recommends that you vote FOR the election of the nominees named above.

5

Directors Continuing in Office

The directors continuing in office are:

| | George Heinrichs | | A co-founder of Intrado, Mr. Heinrichs has served as our President and a director since 1979 and as our Chairman and Chief Executive Officer since 1995. His current term as a director expires at the 2006 Annual Meeting of Stockholders. Mr. Heinrichs is 47 years old. |

| |

Stephen O. James |

|

Mr. James has served as a director since October 1999. His current term as a director expires at the 2007 Annual Meeting of Stockholders. Mr. James has been an independent executive business consultant since 1993 and has served as the Managing Partner of Boulder Telecom Partners since October 1999, Boulder Telecom Partners II since March 2001, Boulder Telecom Partners III since January 2004, Boulder Telcom Partners IV since January 2005, Boulder Telecom Partners V since January 2005, and Boulder Bancshares since March 2003. Mr. James has also served as a director of Stratagene Holding Corp. from January 1996 to August 2003. Mr. James is 61 years old. |

| |

Winston J. Wade |

|

Mr. Wade has served as a director since October 1999. His current term as a director expires at the 2006 Annual Meeting of Stockholders. Mr. Wade was the Chief Executive Officer of MediaOne Malaysia from 1997 until his retirement in 1999 and the Managing Director of MediaOne India, BPL/US West from 1996 to 1997. From 1981 through 1995, Mr. Wade held several positions with US West, including Vice President—Network Operations, Vice President—Network Infrastructure, Vice President—Technical Services and President—Information Technologies Group. Mr. Wade currently serves as a director of EFJ Inc. and of AmeritasAcacia Life Insurance Company. Mr. Wade is 66 years old. |

| |

Darrell A. Williams |

|

Mr. Williams has served as a director since January 2000, and previously served as a director from February 1998 to December 1999. His current term as a director expires at the 2006 Annual Meeting of Stockholders. Since January 2004, Mr. Williams has been the President and founder of DuSable Capital Inc., a corporate financial advisory services firm. From January 2000 to December 2003, Mr. Williams served as Chief Investment Officer of the Telecommunications Development Fund, a telecommunications investment fund. From 1992 to 1999, Mr. Williams was with Ameritech Development Corporation, last serving as Vice President, Venture Capital. Mr. Williams is 45 years old. |

6

Corporate Governance

What is the role of the Board of Directors?

It is the paramount duty of the Board of Directors to oversee the Chief Executive Officer and other senior management in the competent and ethical operation of the company and to assure that the long-term interests of the stockholders are being served. To satisfy this duty, the directors take a proactive, focused approach to their position, and set standards to ensure that Intrado is committed to business success through maintenance of the highest standards of responsibility and ethics.

Members of the Board bring a wide range of experience, knowledge and judgment to Intrado. These varied skills mean that directors are expected to play an active and proactive role in corporate governance. Intrado's governance structure is designed to be a working structure for principled actions, effective decision-making and appropriate monitoring of both compliance and performance.

How often did the Board meet during 2004?

During 2004, the Board of Directors held six meetings, including four regularly scheduled quarterly meetings at which the Board met in executive session, without management directors and other members of management. The Board of Directors also took one action by written consent. Each director attended more than 75% of the total number of meetings of the Board and Committees on which he or she served.

How are directors compensated?

Base Compensation. During 2004, each non-employee director received a quarterly retainer of $6,500. The lead director (the non-employee director who presides over executive sessions of the Board of Directors) received an additional quarterly fee of $1,250. Members of the Audit Committee received a quarterly fee of $2,000 and the chair of the Audit Committee received an additional quarterly fee of $2,500. Members of the Compensation Committee received a quarterly fee of $1,000 and the chair of the Compensation Committee received an additional quarterly fee of $1,250. Members of the Corporate Governance Committee received a quarterly fee of $1,000 and the chair of the Corporate Governance Committee received an additional quarterly fee of $1,250. Quarterly retainers and meeting fees are payable in cash or stock at the director's discretion. During 2004, each member of the Board elected to have their quarterly retainers and meeting fees paid in Intrado stock. In addition, we reimbursed our directors for all reasonable and necessary travel and other incidental expenses incurred in connection with their attendance at meetings of the Board and Committees of the Board and other company-related functions. Board members (other than members of the Audit Committee) may be paid additional amounts for consulting services that extend beyond their normal Board duties, although no such payments have been made to date. Furthermore, members of the Audit Committee are prohibited from accepting any consulting, advisory, or other compensatory fee from Intrado other than those fees paid in their capacities as members of the Board of Directors or a Board committee.

Stock Options. Under the Discretionary Option Grant Program, which is part of our 1998 Stock Incentive Plan, each individual who first becomes a non-employee Board member will be granted an option to purchase 30,000 shares of common stock during the year in which the individual joins the Board, provided the individual was not previously employed by Intrado. In addition to the initial option grant, each incumbent non-employee Board member is eligible to receive an annual option grant. The amount of each annual option grant, if any, is determined by the Board. During 2004, each incumbent non-employee director received options to purchase a total of 12,500 shares of common stock pursuant to the Discretionary Option Grant Program. All options vest 24% on the one-year anniversary of the option grant date and 2% per month thereafter until 100% vested.

7

What committees has the Board established?

The Board of Directors has appointed an Audit Committee, a Compensation Committee and a Corporate Governance Committee. Each committee operates under a written charter adopted by the Board. The full text of each charter was included as appendix to last year's definitive proxy statement on Schedule 14A.

Audit Committee. The Audit Committee met eight times during 2004 and took one action by written consent. More information about the Audit Committee, including its functions and activities, can be found below on pages 20-21 under the caption "Report of the Audit Committee." The Audit Committee currently consists of Darrell A. Williams, Winston J. Wade and Art Zeile. Messrs. Williams and Wade served as members of the committee for all of 2004 and Mr. Zeile was appointed to the committee in May 2004. Mr. Williams serves as chair of the committee. Each member of the Audit Committee is independent within the meaning of SEC regulations, the listing standards of the NASDAQ Stock Market and our internal corporate governance guidelines. The Board has determined that Messrs. Williams, Wade and Zeile are each qualified as an audit committee financial expert within the meaning of SEC regulations and that each member of the Audit Committee during 2004 has accounting and related financial expertise within the meaning of the listing standards of the NASDAQ National Market. Mr. Williams is presently serving as the President, founder and owner of DuSable Capital Inc., a corporate financial advisory services firm. He previously served as the Chief Investment Officer of the Telecommunications Development Fund, a telecommunications development fund, and as Vice President, Venture Capital of Ameritech Development Corporation. In his current capacity, as well as his prior two positions, Mr. Williams actively analyzes and evaluates the financial statements of a wide variety of companies, utilizing his understanding of generally accepted accounting principles and their application to complex financial situations. Mr. Wade has served as an executive officer of two companies in which he directly supervised principal financial/accounting officers and controllers. Furthermore, Mr. Zeile has served as the chief executive officer of one company in which he directly supervised principal financial/accounting officers and controllers. Although the Audit Committee Charter is not posted on our website, it was attached as an appendix to last year's definitive proxy statement on Schedule 14A.

Compensation Committee. The Compensation Committee met seven times during 2004. The Compensation Committee:

- •

- reviews and acts on matters relating to compensation levels and benefits plans for our directors, executive officers and key employees;

- •

- is responsible for administering and granting stock, stock options and other awards under our existing incentive compensation plans; and

- •

- periodically reviews, at the request of the Board of Directors, management succession planning.

The Compensation Committee currently consists of Winston J. Wade, Stephen O. James and Darrell A. Williams. Mr. Wade serves as chair of the committee. Each member of the Compensation Committee is an "independent director," as defined under the listing standards of the NASDAQ Stock Market, a "non-employee director," as defined under SEC Rule 16b-3, and an "outside director," as defined under Section 162(m) of the Internal Revenue Code. The Compensation Committee Report on Executive Compensation can be found on pages 15-19. Although the Compensation Committee Charter is not posted on our website, it was attached as an appendix to last year's definitive proxy statement on Schedule 14A.

8

Corporate Governance Committee. The Corporate Governance Committee met five times during the 2004. The Corporate Governance Committee:

- •

- develops and implements policies and practices relating to corporate governance, including training;

- •

- advises the Chairman of the Board and Committee chairs with respect to agendas and information needs relating to Board and Committee meetings;

- •

- advises the Board with respect to the selection of Committee chairs;

- •

- establishes the criteria for Board membership, reviews background information for candidates for the Board, including incumbent directors and those recommended by stockholders, and makes recommendations to the Board regarding such candidates; and

- •

- gives executive management guidance on executive management requirements and qualifications and assists in the recruitment and selection of qualified executives.

The Corporate Governance Committee currently consists of Stephen O. James and Winston J. Wade. Mr. James serves as chair of the committee. Each member of the Corporate Governance Committee is an "independent director," as defined under the listing standards of the NASDAQ Stock Market. Although the Corporate Governance Committee's charter is not posted on our website, it was attached as an appendix to last year's definitive proxy statement on Schedule 14A. Mr. James, as Chairman of the Corporate Governance Committee, also serves as the Board's "lead director." As lead director, Mr. James presides over executive sessions of the Board of Directors in which management directors and other members of management do not participate. Executive sessions are held at each quarterly Board meeting. The Corporate Governance Committee's policies with regard to stockholder communications and director nominations are outlined below.

How do stockholders send communications to the Board or to individual directors?

Intrado's Corporate Governance Committee maintains a process by which stockholders may communicate with the Board or individual Board members. Stockholders wishing to do so may send their written communication in care of:

All communications must state the name of the communicating stockholder and the number of shares beneficially owned. The Corporate Secretary/General Counsel will promptly forward such communication to the Board or to the individual director or directors indicated in the communication. However, the Corporate Secretary reserves the right to withhold any abusive, threatening or otherwise inappropriate materials from the Board.

How do stockholders and other parties submit concerns regarding accounting or auditing matters?

The Audit Committee has adopted a process by which stockholders and other parties may communicate their concerns regarding accounting or auditing matters. If you have a concern regarding

9

an accounting or auditing matter that you wish to submit, you may do so via U.S. mail, hand-delivery or overnight courier to the following address:

Intrado Inquiry

c/o Jack Lewis

Ireland, Stapleton, Pryor & Pascoe, P.C.

1675 Broadway, Suite 2600

Denver, CO 80202

Please label any submission as follows: "Intrado Inc.—Accounting/Auditing Matter." Please identify yourself, describe the nature of the complaint, and provide any supporting documents that will assist Ireland, Stapleton, Pryor & Pascoe, P.C. and the Audit Committee in their investigation of the complaint.

What "minimum qualifications," if any, are required of nominees, and what other skills and experience are required?

The Corporate Governance Committees Charter requires the committee to "conduct appropriate and necessary inquiries into the backgrounds and qualifications of Board candidates (including compliance with security procedures that are consistent with those required of senior management), with advice and assistance from internal and external legal, accounting, security and other advisors." The Corporate Governance Committee and the Board have determined that, in order for a nominee to be recommended to the Board of Directors, the nominee must demonstrate the following minimum qualifications:

- •

- Highest standard of ethics.

- •

- Common sense.

- •

- Business judgment.

- •

- Availability for meetings and communications.

- •

- No conflicts of interest.

- •

- Genuine commitment to carry out the fiduciary duties owed to stockholders.

- •

- Compliance with our security screening required of senior management including background checks and drug screening.

- •

- Willingness to challenge, be challenged and actively participate in meetings.

Other requisite qualities, experience, special technical skills or other characteristics that a nominee must possess are evaluated, initially by the Corporate Governance Committee and then if appropriate by the Board, based on our particular needs and circumstances at any given time. This evaluation is conducted in light of such factors as the future direction of the company, existing Board composition, commitment to diversity, desire or need for certain expertise and other relevant factors.

What process, if any, exists for stockholders to recommend Board candidates?

Intrado's Corporate Governance Committee's Charter requires the committee to "identify, consider, recommend and recruit candidates to fill vacancies or new positions on the Board, including consideration of candidates recommended by stockholders." Thus, the Corporate Governance Committee receives and considers recommendations for director nominees made by stockholders. The Corporate Governance Committee and the Board will evaluate all stockholder-recommended candidates in light of the above-stated requirements for minimum qualifications and other requisite qualities, skills, experience and characteristics and in contemplation of Intrado's particular needs and

10

circumstances at any given time. Stockholder-recommended candidates are evaluated on the same basis as any other recommended candidate. Stockholders may send recommendations to:

The recommendation should provide the nominee's qualifications, other relevant biographical information and the nominee's consent to serve as a director. Recommendations will be promptly logged and forwarded to the Corporate Governance Committee chair for further dissemination to the committee members.

Does Intrado have a code of ethics?

We have adopted aCode of Conduct and Business Ethics. The portion of theCode of Conduct and Business Ethics that deals with financial and accounting matters and that is specifically applicable to our principal executive officer, the principal financial officer and the principal accounting officer, which we refer to as theSarbanes Oxley Financial Code of Ethics, was filed as an exhibit to our Annual Report on Form 10-K for the year ended December 31, 2003. The fullCode of Conduct and Business Ethics, which is applicable to the Board and all of our employees, was filed as an exhibit to the Form 10-Q for the quarter ended March 31, 2004. Among other things, theCode of Conduct and Business Ethics establishes procedures for: (i) the receipt, retention, and treatment of complaints regarding accounting, internal accounting controls or auditing matters; and (ii) the confidential, anonymous submission by employees of "good faith" concerns regarding questionable accounting or auditing matters without fear of retaliation.

We intend to disclose amendments to or waivers from theCode of Conduct and Business Ethics (to the extent applicable to our chief executive officer, principal financial officer or principal accounting officer) in a Current Report on Form 8-K, which will be filed with the SEC.

What is our policy regarding director attendance at annual stockholder meetings?

While we do not require our directors to attend annual stockholder meetings, directors are encouraged to attend, and actively participate, particularly where travel plans can conveniently be arranged or where the director's residence is in close proximity to the meeting place. A director's record of attendance and participation are considered when the director is up for reelection. Five of six directors attended our 2004 Annual Stockholder Meeting.

11

Information About Executive Officers

Our executive officers and their ages as of April 1, 2005 are as follows:

George Heinrichs |

|

A co-founder of Intrado, Mr. Heinrichs has served as our President and a director since 1979 and as our Chairman and Chief Executive Officer since 1995. Mr. Heinrichs is 47 years old. |

Lawrence P. Jennings |

|

Mr. Jennings has served as our Chief Operating Officer since February 2002. Mr. Jennings joined Intrado in June 1999 as our Vice President of Sales and served as our Senior Vice President of Business Operations from December 1999 until February 2002. From 1995 through June 1999, Mr. Jennings served as Vice President of Operations and Vice President of Sales for Teletrac, Inc. Mr. Jennings is 50 years old. |

Stephen M. Meer |

|

A co-founder of Intrado, Mr. Meer has served as our Chief Technology Officer since 1979. Mr. Meer is 48 years old. |

Michael D. Dingman, Jr. |

|

Mr. Dingman has served as our Chief Financial Officer since September 2000. Mr. Dingman has also served as a director of Wheeling Pittsburgh Corp. since October 2003. From March 1999 to August 2000, he was Chief Financial Officer and Treasurer of RMI.NET. In July 2001, 11 months after Mr. Dingman resigned his position at RMI.NET, RMI.NET filed a voluntary petition for relief with the United States Bankruptcy Court for the District of Colorado. From January 1997 through February 1999, Mr. Dingman was the President of Qwon Investment Consultants, Inc. From March 1994 through December 1996, Mr. Dingman was President of Owen-Joseph Companies. Mr. Dingman is 51 years old. |

Craig W. Donaldson |

|

Mr. Donaldson has served as our General Counsel since August 1997 and has also served as our Senior Vice President and Corporate Secretary since January 2001. From 1988 to August 1997, Mr. Donaldson was in private law practice. Mr. Donaldson is 54 years old. |

Executive Compensation

The following table sets forth the compensation earned during each of last three calendar years by our "Named Executive Officers," who consist of our Chief Executive Officer and four other executive officers who served in the capacity of an executive officer on December 31, 2004 and earned more than $100,000 in combined salary and bonus in 2004.

12

Summary Compensation Table

| |

| |

| |

| | Long-Term

Compensation

| |

|

|---|

| |

| | Annual Compensation

| |

|

|---|

Name and Principal Position

| |

| | Securities

Underlying

Options(2)

| | All Other

Compensation(3)

|

|---|

| | Year

| | Salary

| | Bonus(1)

|

|---|

George Heinrichs

Chairman of the Board, President,

and Chief Executive Officer | | 2004

2003

2002 | | $

| 450,000

412,694

245,000 | | $

| 185,336

151,018

185,258 | | 75,000

75,000

80,000 | | $

| 4,865

2,000

2,000 |

Stephen M. Meer

Vice President and Chief

Technology Officer |

|

2004

2003

2002 |

|

|

325,000

312,416

205,000 |

|

|

98,537

114,323

186,554 |

|

57,000

50,000

51,000 |

|

|

2,898

2,000

2,000 |

Michael D. Dingman, Jr.

Chief Financial Officer |

|

2004

2003

2002 |

|

|

305,000

273,075

197,913 |

|

|

118,349

99,927

149,100 |

|

57,000

50,000

51,000 |

|

|

2,000

2,000

2,000 |

Lawrence P. Jennings

Chief Operating Officer |

|

2004

2003

2002 |

|

|

315,000

303,649

222,000 |

|

|

102,296

111,115

167,867 |

|

57,000

50,000

56,000 |

|

|

2,000

2,000

2,000 |

Craig W. Donaldson

Senior Vice President, General

Counsel and Corporate Secretary |

|

2004

2003

2002 |

|

|

215,000

208,000

200,000 |

|

|

65,568

41,884

21,352 |

|

47,000

35,000

37,000 |

|

|

2,000

2,000

2,000 |

- (1)

- A portion of the bonuses included in each year were earned in that year, but not paid until the following year.

- (2)

- Options listed in the table were granted under the 1998 Stock Incentive Plan.

- (3)

- Includes matching contributions under our 401(k) Plan ($2,000 per person), payment of travel expenses associated with a routine medical examination, and gifts commemorating the 25th anniversary of Intrado.

Option Grants

The following table sets forth information regarding the stock option grants made to each of the Named Executive Officers during the year ended December 31, 2004.

13

Options Granted During 2004

| |

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2)

|

|---|

| | Number of

Securities

Underlying

Options

Granted(1)

| | Percent of Total

Options

Granted to

Employees In

Fiscal Year

| |

| |

|

|---|

Name

| | Exercise

Price Per

Share

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| George Heinrichs | | 75,000 | | 9.66 | % | $ | 16.88 | | 5/25/2014 | | $ | 796,181 | | $ | 2,017,678 |

| Lawrence P. Jennings | | 57,000 | | 7.34 | % | | 16.88 | | 5/25/2014 | | | 605,097 | | | 1,533,435 |

| Stephen M. Meer | | 57,000 | | 7.34 | % | | 16.88 | | 5/25/2014 | | | 605,097 | | | 1,533,435 |

| Michael D. Dingman, Jr. | | 57,000 | | 7.34 | % | | 16.88 | | 5/25/2014 | | | 605,097 | | | 1,533,435 |

| Craig W. Donaldson | | 47,000 | | 6.05 | % | | 16.88 | | 5/25/2014 | | | 498,940 | | | 1,264,412 |

- (1)

- The options were granted to each of the Named Executive Officers pursuant to the 1998 Stock Incentive Plan. Options vest 24% on the one-year anniversary of the option grant date and 2% per month thereafter.

- (2)

- The five percent and ten percent assumed annual rates of compounded stock price appreciation are mandated by the rules of the Securities and Exchange Commission. There can be no assurance provided to the option holder or any other holder of our securities that the actual stock price appreciation over the ten-year option term will be at the assumed five percent and ten percent levels or at any other defined level.

Option Exercises and Holdings

The following table sets forth information regarding exercises of stock options during the year ended December 31, 2004 and exercisable and unexercisable options held as of December 31, 2004 by each of the Named Executive Officers.

Aggregated Option Exercises in Last Fiscal Year And Fiscal Year-End Option Values

| |

| |

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End

| | Value of Unexercised In-the-Money Options at Fiscal

Year-End

|

|---|

| | Shares

Acquired

on

Exercise

| |

|

|---|

Name

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| George Heinrichs | | 40,827 | | $ | 521,659 | | 64,439 | | 155,400 | | $ | 220,402 | | $ | 276,720 |

| Lawrence P. Jennings | | 25,000 | | | 307,911 | | 201,470 | | 111,880 | | | 976,608 | | | 187,488 |

| Stephen M. Meer | | — | | | — | | 55,160 | | 111,240 | | | 215,200 | | | 189,662 |

| Michael D. Dingman, Jr. | | — | | | — | | 148,520 | | 109,480 | | | 695,002 | | | 181,848 |

| Craig W. Donaldson | | 45,426 | | | 367,053 | | 37,518 | | 95,363 | | | 98,067 | | | 137,653 |

The value realized by each option exercised equals the total market price of the shares purchased, based on the last sale price of the common stock on the NASDAQ National Market on the exercise date, minus the total exercise price paid for those shares. The value of each unexercised option is based on the excess, if any, of $12.10 per share, the last sale price of the common stock on the NASDAQ National Market on December 31, 2004, over the per share exercise price of each outstanding option.

Equity Compensation Plans

The following table summarizes information, as of December 31, 2004, relating to our equity compensation plans pursuant to which grants of stock options, warrants and other rights to acquire shares of Intrado common stock may be granted from time to time.

14

Summary of Equity Compensation Plans as of Fiscal Year-End

| | Number of Securities to

be Issued upon Exercise

of Outstanding Options,

Warrants and Rights

| | Weighted Average

Exercise Price of

Outstanding Options,

Warrants and Rights

| | Number of Shares Remaining

Available for Issuance Under

Equity Compensation Plans,

Excluding Securities Available

in First Column(1)

|

|---|

| Equity compensation plans approved by stockholders | | 3,259,290 | | $ | 11.24 | | 19,755 |

| Outstanding warrants | | 9,720 | | $ | 7.91 | | 0 |

| | |

| | | | |

|

| Total | | 3,269,010 | | $ | 11.23 | | 19,755 |

| | |

| | | | |

|

- (1)

- Our 1998 Stock Incentive Plan, which was approved by stockholders, includes an evergreen provision in which the number of shares issuable under the Plan automatically increases on the first trading day in January of each calendar year by an amount equal to 3% of the total number of shares of common stock outstanding on the last trading day in December of the preceding calendar year (but in no event shall such increase exceed 731,000 shares). On December 31, 2004, we had 17,478,598 shares outstanding. On January 3, 2005 (the first trading day in 2005), the number of shares issuable under the 1998 Stock Incentive Plan increased by 524,358 shares. This amount is not included in the "Number of Shares Remaining Available for Issuance" as of December 31, 2004.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee currently consists of Stephen O. James, Darrell A. Williams, and Winston J. Wade. No members of the Compensation Committee have ever been officers or employees of Intrado.

None of the Named Executive Officers have ever served as a member of the Board of Directors or Compensation Committee of any other entity that has or has had one or more executive officers serving as a member of our Board or Compensation Committee.

Compensation Committee Report on Executive Compensation

The Compensation Committee of Intrado's Board of Directors consists exclusively of non-employee, independent directors, and is responsible for establishing and administering the annual compensation and compensation procedures for the executive officers of Intrado, which includes the five executive officers named in this proxy statement (the "Named Executive Officers"). The Compensation Committee also administers Intrado's 1998 Stock Incentive Plan. It is the responsibility of the Compensation Committee to determine whether in its judgment the executive compensation policies are reasonable and appropriate, meet their stated objectives and effectively serve the best interests of Intrado and its stockholders.

Compensation Philosophy, Objectives and Policy. The fundamental philosophy of the Compensation Committee is to provide executive officers and key employees with performance-based, competitive compensation opportunities that relate to their overall contribution to Intrado's development and financial success. Committee objectives are:

- •

- rewards should be closely linked to company-wide and individual performance;

- •

- the interests of Intrado's employees should be aligned with those of its stockholders through potential stock ownership; and

- •

- compensation and benefits should encourage teamwork and be set at competitive levels that enable Intrado to attract, retain and improve the loyalty of high quality employees.

15

Accordingly, current policy has the compensation package for each executive officer comprised of three elements:

- •

- base salary, which principally reflects an executive officer's individual performance;

- •

- bonus, which principally reflects company-wide or business unit performance toward Intrado's annual goals; and

- •

- long-term stock-based incentive compensation, which strengthens the mutuality of interests between executive officers and stockholders.

The Committee exercises judgment and discretion in setting both short-term and long-term compensation incentives for executive officers. It also reviews the annual compensation elements of the other key employees to be certain they reflect the Committee's philosophy, objectives and policy with respect to compensation.

Committee Procedures. The Compensation Committee periodically reviews executive compensation of companies deemed comparable by industry, size and other factors. During the fourth quarter of each fiscal year, the Committee holds several meetings to review the compensation practices of comparable companies, and consider numerous other factors, including Intrado's financial performance, the individual contribution of each executive officer and general economic factors, all of which are factors used to determine the compensation for Intrado's Chief Executive Officer. In addition, the Committee considers the factors discussed above, along with the annual compensation recommendations submitted by Intrado's Chief Executive Officer, to set the compensation for other executive officers. The Committee also reviews comparable information for other key employees, whose annual compensation is determined by the Chief Executive Officer after consultation with the Committee. Committee consensus of the three elements of the executive officer compensation packages may be reached at different Committee meetings. However, the final annual executive officer compensation packages are approved together after review as a whole, during the first quarter of the fiscal year, effective for that year.

Base Salary. The base salary for each executive officer is determined on the basis of experience, personal performance, the salary levels in effect for comparable positions within and without the industry, and internal base salary comparability considerations. The weight given to each of these factors differs from individual to individual, as the Compensation Committee deems appropriate.

Bonus Compensation. The Compensation Committee establishes potential bonus amounts for executive officers and reviews those for other key employees based on the bonus levels for comparable positions and the achievement of specific quarterly performance targets that are set early in each year. In 2004, the Compensation Committee set performance targets based on the following business criteria:

- •

- revenue;

- •

- operating income; and

- •

- cash levels.

The weight given to each of these factors differs from individual to individual, as the Compensation Committee deems appropriate. The Compensation Committee may, from time to time, exercise discretion to award additional cash bonuses or to reduce cash bonuses when it determines that such adjustments are in Intrado's best interest or that such adjustments up or down are equitable based on unforeseen factors during the year.

Long-Term Incentive Compensation. Long-term incentives have historically been provided primarily through grants of stock options under Intrado's 1998 Stock Incentive Plan. The grants are designed to align the interests of each executive officer with those of the stockholders and to provide each

16

individual with a significant incentive to manage Intrado from the perspective of an owner with an equity stake. Each option grant allows the executive officer to acquire shares of the common stock at a fixed price per share, typically equal to the market price on the grant date, over a specified period of time of up to ten years. Options generally vest 24% on the first anniversary of the date of grant and 2% per month thereafter until fully exercisable, contingent upon an executive officer's continued employment with Intrado. Accordingly, an option grant generally provides a return to the executive officer only if the executive officer remains employed by Intrado during the vesting period, and then only if the market price of the underlying shares appreciates. The number of shares subject to each option grant is set at a level intended to create a meaningful opportunity for stock ownership based on the executive officer's current position, the base salary associated with that position, the size of comparable awards made to individuals in similar positions within the industry, the executive officer's potential for increased responsibility and promotion over the option term, and the executive officer's personal performance in recent periods. The Compensation Committee also considers the number of unvested options held by the executive officer in order to maintain an appropriate level of equity incentive for that executive officer. The Compensation Committee does not adhere to any specific guidelines as to the relative option holdings of executive officers.

Benefits and Compensation upon a Change in Control. In the event of a "change in control" of Intrado, the Compensation Committee has authority to provide for the automatic acceleration of vesting of one or more outstanding options issued under the 1998 Stock Incentive Plan so that each accelerated option becomes exercisable or non-forfeitable in full. In addition, the Compensation Committee has authority to condition the automatic acceleration of vesting upon the involuntary termination of an employee's service within a designated period (not to exceed 18 months) following a "change in control." "Involuntary termination" includes involuntary dismissal for reasons other than misconduct or voluntary resignation following: (1) a change in the employee's position which materially reduces employees duties and responsibilities or the level of management to which the employee reports, (2) a reduction in the employee's level of compensation (including base salary, fringe benefits and target bonus under any corporate-performance based bonus or incentive programs) by more than 15%; or (3) a relocation of the individual's place of employment by more than 50 miles, provided and only if such change, reduction or relocation is effected without the individual's consent.

Furthermore, Intrado has entered Non-Competition Agreements with each of the Named Executive Officers. Under these agreements, the Named Executive Officers are entitled to severance pay following a "change in control" if: (1) the executive is terminated for reasons other than the executive's fraudulent conduct or theft involving the assets of Intrado or its affiliated companies; or (2) the executive voluntarily resigns employment within one-year of the change in control. Messrs. Heinrichs and Meer, as co-founders of Intrado, are entitled to three years of severance pay, but must agree not to compete with the surviving corporation for three years after termination of employment. Messrs. Jennings and Dingman are entitled to two years of severance pay, but must agree not to compete with the surviving corporation for two years after termination of employment. Mr. Donaldson is entitled to one year of severance pay, but must agree not to compete with the surviving corporation for one year after termination of employment.

Chief Executive Officer Compensation. Mr. Heinrichs' compensation in 2004, including base salary, bonus award and stock option grant, was determined within the framework established for all executive officers and was intended to provide a level of stability and certainty to Intrado and its security holders. In 2004, Mr. Heinrichs' base salary was $450,000, an increase of 9% from his 2003 base salary of $412,694. In determining Mr. Heinrichs' 2004 compensation, the Compensation Committee subjectively took into account Intrado's performance in 2003, as well as Intrado's progress in establishing itself in its industry leading position. Mr. Heinrichs also received a 2004 bonus award in the amount of $185,336, an increase of 23% from his 2003 bonus award of $151,018, which was determined in accordance with the achievement of the quarterly performance targets (see "Bonus Compensation"

17

above), which were set at the beginning of 2004. The increase in Mr. Heinrichs' bonus from 2003 resulted from an increase in the bonus opportunity in 2004, based upon the Committee's determination that this feature of Mr. Heinrichs' total cash compensation was significantly below market (the peer group average).

During fiscal year 2004, the Compensation Committee granted Mr. Heinrichs an option to purchase 75,000 shares of Intrado common stock at an exercise price of $16.88 per share. The exercise price was set at fair market value on the date of grant. Subject to the terms applicable to this grant, the stock option vests 24% on the first anniversary of the date of grant and 2% per month thereafter until fully vested. The stock option expires ten years from the date of grant.

In 2004, Intrado made a matching contribution of $2,000 to Mr. Heinrichs' 401(k) account, reimbursed Mr. Heinrichs for $1,967 of travel expenses associated with a routine medical examination, and gave Mr. Heinrichs a gift valued at $898 to commemorate Intrado's 25th anniversary.

Review of All Components of CEO Compensation. The Compensation Committee reviewed all components of Intrado's Chief Executive Officer and four other most highly compensated executive officers' compensation, including salary, bonus, equity incentive compensation, accumulated realized and unrealized stock option gains, the dollar value to the executive and cost to Intrado of perquisites and other personal benefits, if any, the accelerated vesting benefits and the payout obligations under the "change of control" automatic vesting provisions and the Non-Competition Agreement, respectively.

The Compensation Committee's Conclusion. Based on this review, the Committee finds Mr. Heinrichs' total compensation (and, in the case of the severance and change-in-control scenarios, the potential payments and other benefits) in the aggregate to be reasonable and not excessive and consistent with the Committee's objectives and policies. It should be noted that when the Committee considers any component of Mr. Heinrichs' total compensation, the aggregate amounts and mix of all the components, including accumulated (realized and unrealized) option gains are taken into consideration in the Committee's decisions. In addition, as noted above, it is the Committee's policy to make most compensation decisions in a several-step process and to approve Mr. Heinrichs' compensation package as a whole.

Internal Pay Equity. In the process of reviewing each component separately, and in the aggregate, the Compensation Committee receives from Intrado a report showing "internal pay equity" within Intrado. This report shows the relationship between management levels of compensation within Intrado (e.g., between the CEO and the CFO and other Named Executive Officers). The Committee believes that the relative difference between CEO compensation and the compensation of Intrado's other executives has not increased significantly over the years.

Compliance with Internal Revenue Code Section 162(m). Under Section 162(m) of the Internal Revenue Code, Intrado may not deduct, for federal income tax purposes, compensation paid to the chief executive officer and four other most highly paid executive officers to the extent that compensation exceeds $1,000,000 per officer in any year. This limitation applies to all compensation paid to the covered executive officers that is not considered to have been performance based. Intrado's 1998 Stock Incentive Plan contains provisions intended to ensure that any compensation deemed paid in connection with the exercise of stock options granted under the plan with an exercise price equal to the market price of the common stock on the grant date will qualify as performance-based compensation. The Compensation Committee does not expect that the compensation paid to any of Intrado's executive officers during 2004 will exceed $1,000,000. However, the Compensation Committee recognizes the need to retain flexibility to make compensation decisions that may not meet Section 162(m) standards when necessary to enable Intrado to meet its overall objectives, even if

18

Intrado may not deduct all of the compensation paid. Accordingly, the Compensation Committee reserves the authority to approve non-deductible compensation in appropriate circumstances.

| | | Members of the Compensation Committee |

|

|

Winston J. Wade, Chairman

Stephen O. James

Darrell A. Williams |

Stock Performance Graph

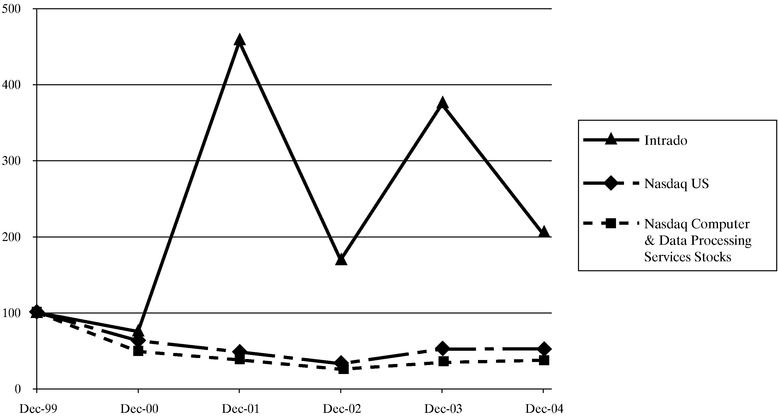

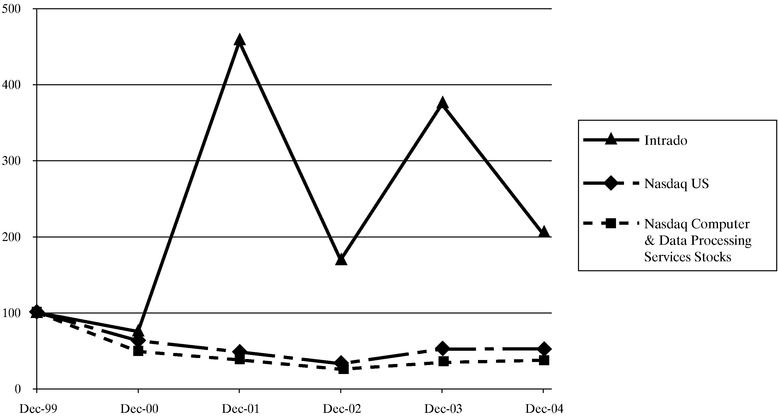

The graph depicted below compares the performance of Intrado common stock with the performance of the NASDAQ Stock Market-US and the NASDAQ Computer and Data Processing Services indices over the period beginning on December 31, 1999 and ending on December 31, 2004. The graph assumes that $100 was invested on December 31, 1999 in our common stock and in each comparison index (the NASDAQ Stock Market-US Index and the NASDAQ Computer and Data Services Index), and that all dividends were reinvested. We have not declared any dividends on our common stock.

Comparison of Cumulative Total Return

Based on investment of $100 on December 31, 1998

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

|

|---|

| Intrado (NASDAQ: TRDO) | | $ | 100 | | $ | 72 | | $ | 456 | | $ | 167 | | $ | 374 | | $ | 206 |

| NASDAQ US | | $ | 100 | | $ | 60 | | $ | 48 | | $ | 33 | | $ | 49 | | $ | 53 |

| NASDAQ Computer and Data Processing Services Stocks | | $ | 100 | | $ | 46 | | $ | 37 | | $ | 26 | | $ | 34 | | $ | 37 |

19

Report of the Audit Committee

The following Report of the Audit Committee, including the Audit Committee Charter, does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent we specifically incorporate this Report by reference therein.

The purpose of the Audit Committee of Intrado's Board of Directors is to assist the Board of Directors in its oversight of:

- •

- the integrity of Intrado's financial statements, including compliance with legal and regulatory requirements relating to financial reporting and disclosure;

- •

- the qualifications and independence of Intrado's independent registered public accounting firm; and

- •

- the performance of Intrado's independent registered public accounting firm and of Intrado's internal audit function.

In carrying out these responsibilities, the Audit Committee, among other things:

- •

- reviews quarterly and annual financial reports prepared by Intrado's management and discusses the reports with management;

- •

- supervises the relationship between Intrado and its independent registered public accounting firm and has direct responsibility for appointment, removal, compensation, oversight and confirmation of the independence of the independent registered public accounting firm;

- •

- reviews the scope of and pre-approves audit, non-audit, tax and other services;

- •

- meets with Intrado's independent registered public accounting firm to discuss critical accounting policies and practices, alternative treatments of financial statement items, and other matters; and

- •

- oversees management's implementation and maintenance of internal and disclosure controls systems; and

- •

- reviews Intrado's policies relating to legal and regulatory compliance, ethics, conflicts of interests and related party transactions.

In April 2004, Intrado's Board of Directors adopted a new charter for the Audit Committee. Although the Audit Committee Charter is not posted on our website, it was attached as an appendix to last year's definitive proxy statement on Schedule 14A.

The Audit Committee met eight times during 2004. The Committee schedules its meetings with a view to ensuring that it devotes appropriate attention to all of its tasks. The Committee's meetings include, whenever appropriate, separate executive sessions with Intrado's independent registered public accounting firm, and Intrado's management.

As part of its oversight of Intrado's financial statements, the Committee reviews and discusses with both management and Intrado's independent registered public accounting firm all annual financial statements and quarterly operating results prior to their issuance. During 2004, management advised the Committee that each set of financial statements reviewed had been prepared in accordance with generally accepted accounting principles. In addition, management periodically reviewed significant accounting and disclosure issues with the Committee. The Committee discussed with the independent registered public accounting firm of matters required to be discussed pursuant toStatement on Auditing Standards No. 61 (Communication with Audit Committees), including the quality of Intrado's accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. The Committee also discussed with PricewaterhouseCoopers LLP matters relating to its

20

independence, including a review of audit and non-audit fees and the disclosures made to the Committee pursuant toIndependence Standards Board Standard No. 1 (Independence Discussions with Audit Committees).

Based on the reviews and discussions described above, the Audit Committee recommended to the Board of Directors that the Board approve the inclusion of Intrado's audited financial statements in Intrado's Annual Report on Form 10-K for the fiscal year ended December 31, 2004, for filing with the Securities and Exchange Commission.

| | | Members of the Audit Committee |

|

|

Darrell A. Williams, Chairman

Winston J. Wade

Art Zeile |

Information About Related Party Transactions

We believe that the terms of the transactions described below were no less favorable to us than would have been obtained from an unaffiliated third party. Any further transactions with any of our officers, directors, or principal stockholders will be on terms no less favorable to us than could be obtained from unaffiliated third parties and will be approved by the members of our Audit Committee, which is comprised solely of independent and disinterested members of the Board of Directors.

TechnoCom Corporation

During the year ended December 31, 2002, we purchased 294,118 shares of TechnoCom Corporation's Series A Preferred Stock for $500,000, representing 2.9% of the aggregate dilutive voting power of TechnoCom as of September 30, 2002. We do not exercise any control or influence over TechnoCom and does not have any board representation. As a result, we have has accounted for our investment on a cost rather than equity basis. TechnoCom is under contract to provide development and implementation services to the Wireless business unit in connection with our PDE service offering. TechnoCom also provides subcontracted services to our ILEC customers. During the years ended December 31, 2004 and 2003, we paid TechnoCom $505,000 and $316,000, respectively, for their services.

On March 25, 2004, TechnoCom redeemed the preferred stock by issuing a $500,000 promissory note to us, which bears interest at 4% per year. TechnoCom repaid $150,000 of principal on the promissory note in 2004. We will receive principal and interest payments on the remaining $350,000 note balance in quarterly installments of $27,000 through March 2008.

Proposal 2—Ratification of Appointment of Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has appointed PricewaterhouseCoopers LLP as Intrado's independent registered public accounting firm for the fiscal year ending December 31, 2005. PricewaterhouseCoopers LLP began serving as our independent auditors in June 2002 and served as our independent auditors for the fiscal years ended December 31, 2004, 2003 and 2002 (the term "independent registered public accounting firm" was adopted in 2004). In taking this action, the Audit Committee carefully considered PricewaterhouseCoopers LLP's performance since its retention, its independence with respect to the services to be performed and its general reputation for adherence to professional auditing standards. Services provided to Intrado and its subsidiaries by PricewaterhouseCoopers LLP in 2004 and 2003 are described under the caption "Fees Paid to Independent Registered Accounting Firm" below.

21

Policy on Audit Committee Pre-Approval of Services Performed by Independent Registered Public Accounting Firm

In accordance with the policy of our Audit Committee and legal requirements, all services to be provided by PricewaterhouseCoopers are pre-approved by the Audit Committee. Pre-approved services include audit services, audit-related services, tax services and other services. In some cases, pre-approval is provided by the full Audit Committee for up to a year, and such services relate to a particular defined task or scope of work and are subject to a specific budget. In other cases, the Chairman of the Audit Committee has the delegated authority from the Audit Committee to pre-approve additional services, and such action is then communicated to the full Audit Committee. To avoid certain potential conflicts of interest, the law prohibits a publicly traded company from obtaining certain non-audit services from its auditing firm. If we need such services, we obtain them from other service providers.

Fees Paid to Independent Registered Public Accounting Firm

The following table sets forth the fees we paid to PricewaterhouseCoopers LLP, our independent registered public accounting firm, for professional services provided during 2004 and 2003. All fees paid to PricewaterhouseCoopers LLP were pre-approved by the Audit Committee, which concluded that the provision of such services by PricewaterhouseCoopers LLP was compatible with the maintenance of that firm's independence in the conduct of its auditing functions.

Type of Fee

| | 2004

| | 2003

|

|---|

| Audit Fees(1) | | $ | 1,163,000 | | $ | 228,000 |

| Audit-Related Fees(2) | | | 3,000 | | | 12,000 |

| Tax Fees | | | 12,000 | | | 139,000 |

| All Other Fees | | | 15,000 | | | -0- |

| | |

| |

|

| Total fees | | $ | 1,193,000 | | $ | 379,000 |

| | |

| |

|

- (1)

- Audit fees relate to professional services rendered in connection with the: (i) audit of our annual financial statements included in our Annual Report on Form 10-K and services attendant to, or required by, statute or regulation, such as; (ii) quarterly review of financial statements included in our quarterly reports on Form 10-Q; (iii) comfort letters, consents and other audit services related to SEC and other regulatory filings; (iv) accounting consultation attendant to the audit; and (v) the audit of internal controls and management's report on the effectiveness of internal controls, as required by Section 404 of the Sarbanes-Oxley Act of 2002.

- (2)

- Audit-related fees include professional services related to the: (i) consultation on accounting standards or transactions; and (ii) audits of employee benefit plans.

- (3)

- Tax fees include professional services rendered in connection with tax compliance, tax advice, tax consulting and tax planning. We do not engage PricewaterhouseCoopers to perform personal tax services for our executive officers.

- (4)

- All other fees include fees for due diligence procedures associated with mergers and acquisitions.

Availability at 2005 Annual Meeting

Representatives of PricewaterhouseCoopers LLP will be present at the Annual Meeting to respond to appropriate questions and to make such statements as they may desire.

Vote Required for Ratification

The affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote is required to ratify the appointment of PricewaterhouseCoopers LLP as our

22

independent registered public accounting firm for 2005. However, the Audit Committee has sole authority for appointing and terminating Intrado's independent registered public accounting firm for 2005. Accordingly, stockholder approval is not required to appoint PricewaterhouseCoopers LLP as Intrado's independent registered public accounting firm. The Audit Committee believes, however, that submitting the appointment of PricewaterhouseCoopers LLP to the stockholders for ratification is a matter of good corporate governance. In the event stockholders do not ratify the appointment, the Audit Committee will reconsider the appointment.

The Board of Directors and the Audit Committee of the Board of Directors recommend that stockholders vote "FOR" ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2005.

Other Matters

As of the date of this proxy statement, we know of no business that will be presented for consideration at the Annual Meeting other than the items referred to above. If any other matter is properly brought before the meeting for action by stockholders, proxies in the enclosed form returned to us will be voted in accordance with the recommendation of the Board of Directors or, in the absence of such a recommendation, in accordance with the judgment of the proxy holder.

Stockholder Proposals for 2006 Annual Meeting

A stockholder who intends to present a proposal at the 2006 Annual Meeting of Stockholders for inclusion in our 2006 proxy statement must submit the proposal by December 1, 2005. In order for the proposal to be included in the proxy statement, the stockholder submitting the proposal must meet certain eligibility standards and must comply with certain procedures established by the Securities and Exchange Commission, and the proposal must comply with the requirements as to form and substance established by applicable laws and regulations. The proposal must be mailed to our Corporate Secretary, 1601 Dry Creek Drive, Longmont, Colorado 80503.

In addition, in accordance with our bylaws, a stockholder wishing to bring an item of business before the 2006 Annual Meeting must deliver notice of the item of business to us at our principal offices by no later than December 1, 2005, even if the item is not to be included in our proxy statement.

| | | THE BOARD OF DIRECTORS

INTRADO INC. |

Longmont, Colorado

April 15, 2005

23

INTRADO INC.

ANNUAL MEETING OF STOCKHOLDERS

Tuesday, May 17, 2005

1:30 p.m. local time

Park Hyatt Hotel

800 North Michigan Avenue

Chicago, Illinois

Intrado Inc.

1601 Dry Creek Drive

Longmont, CO 80503 | | proxy |

|

This proxy is solicited on behalf of the Board of Directors.

The undersigned revokes all previous proxies, acknowledges receipt of the Notice of the 2005 Annual Meeting of Stockholders of Intrado Inc. ("Intrado") to be held on May 17, 2005 and the related proxy statement, and appoints George Heinrichs, Michael D. Dingman, Jr., and Craig W. Donaldson, and each of them (the "Named Proxies"), the proxy of the undersigned, with full power of substitution, to vote all shares of common stock of Intrado that the undersigned is entitled to vote, either on his or her own behalf or on behalf of any entity or entities, at the 2005 Annual Meeting of Stockholders of Intrado to be held at the Park Hyatt Hotel, 800 North Michigan Avenue, Chicago, Illinois, on Tuesday, May 17, 2005, beginning at 1:30 p.m. local time and at any adjournment or postponement thereof, with the same force and effect as the undersigned might or could do if personally present thereat.