Searchable text section of graphics shown above

[LOGO]

Tracking, Identifying and Communicating with High-Value Assets

[GRAPHIC] | (AMEX:DOC) | [GRAPHIC] |

[LOGO]

Safe Harbor

The statements in this presentation that are not strictly historical, are “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and are intended to be covered by the safe harbors created by these sections. The forward-looking statements are subject to risks and uncertainties and the actual results that the Company achieves may differ materially from these forward-looking statements due to such risks and uncertainties, including, but not limited to, that the Company’s majority stockholder, Applied Digital Solutions, Inc. owns 55.2% of the Company’s common stock; that new accounting pronouncements may impact the Company’s future results of operation; that the Company may continue to incur losses, that infringements by third parties on the Company’s intellectual property or development of substantially equivalent proprietary technology by the Company’s competitors could negatively affect the Company’s business; that domestic and foreign government regulation and other factors could impair the Company’s ability to develop and sell the Company’s products in certain markets; that the Company relies on sales to government contractors of its animal identification products, and any decline in the demand by these customers for the Company’s products could negatively affect the Company’s business; that the Company depends on a single production arrangement for its patented syringe-injectable microchips; that the Company depends on principal customers; that the Company competes with other companies and the products sold by the Company’s competitors could become more popular than the Company’s products or render the Company’s products as obsolete; that the Company’s earnings will decline if the Company must write-off goodwill and other intangible assets; that the exercise of options and warrants outstanding and available for issuance may adversely affect the market price of the Company’s common stock; that currency exchange rate fluctuations could have an adverse effect on the Company’s sales and financial results; and that the Company depends on a small team of senior management and the Company may have difficulty attracting and retaining additional personnel. A detailed statement of risks and uncertainties is contained in the Company’s reports to the Securities and Exchange Commission, including in particular the Company’s Form 10-K for the fiscal year ended December 31, 2004. Investors and stockholders are urged to read this document carefully. The Company can offer no assurances that any projections, assumptions or forecasts made or discussed in this release will be met, and investors should understand the risks of investing solely due to such projections. The Company undertakes no obligation to revise any forward-looking statements in order to reflect events or circumstances that may arise after the date of this presentation.

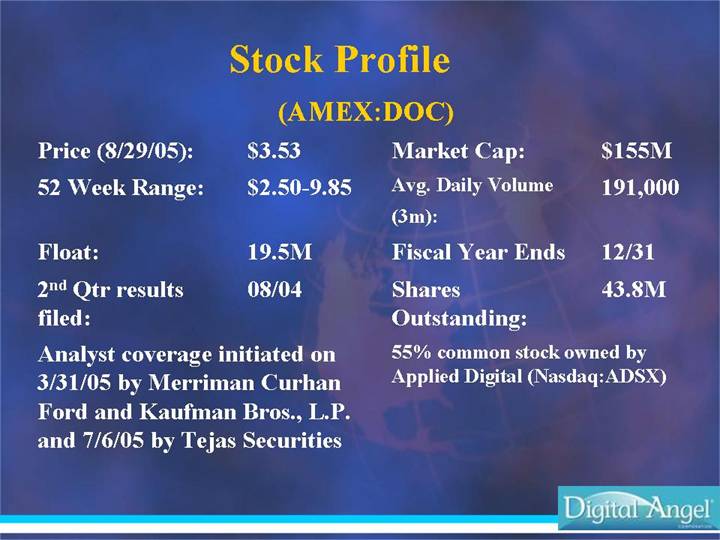

Stock Profile

(AMEX:DOC)

Price (8/29/05): | | $ | 3.53 | |

| | | |

52 Week Range: | | $ | 2.50-9.85 | |

| | | |

Float: | | 19.5M | |

| | | |

2nd Qtr results filed: | | 08/04 | |

Analyst coverage initiated on 3/31/05 by Merriman Curhan Ford and Kaufman Bros., L.P. and 7/6/05 by Tejas Securities

Market Cap: | | $ | 155M | |

| | | |

Avg. Daily Volume (3m): | | 191,000 | |

| | | |

Fiscal Year Ends | | 12/31 | |

| | | |

Shares Outstanding: | | 43.8M | |

55% common stock owned by Applied Digital (Nasdaq:ADSX)

Investment Highlights

| | 2003 | | 2004 | | 2005 Guidance | |

| | | | | | | |

Revenue | | $ | 36.7 million | | $ | 46.3 million | | $ | 60-65 million | |

| | | | | | | |

YE Cash | | $ | 900 thousand | | $ | 17 million | + | | |

| | | | | | | |

YE Debt | | $ | 8.7 million | | $ | 2.3 million | | | |

| | | | | | | |

Net Income | | (9.5 million | ) | $ | (5 million | ) | Positive 4th Qtr | |

| | | | | | | |

Strategic Direction | | Unfocused | | Focused | | Highly Focused | |

| | | | | | | | | | |

DIGITAL ANGEL |

| | |

Tracking and Identification

For Animals and Humans | | Tracking and Identification

For Military Pilots and Aircraft |

| | |

RFID and Visual | | GPS |

| | |

Goal: To Be The Global Leader

In Livestock and Pet

Identification and Tracking | | Goal: To Be The Global Leader

in Combat Search

and Rescue Beacons |

| | Tactics | | |

| | | | |

| | Focus on Growth | | |

| | | | |

Build Revenue

By Adding New Markets | | | | Significantly Reduce

Product Costs |

| | | | |

| | Establish Technical

Superiority in Key Arenas | | |

Livestock

[GRAPHIC]

Major Growth Area Over the Next Several Years

• Two big markets

• Visual for herd management

• Electronic for traceability

• Global “mad cow” concern impetus for electronic ID systems

• US announced 3 phase deployment of national ID system

• Canada implementing system

• European Union has announced switch to electronic systems by 2007

• Significant industry support for rapid roll-out of national ID system

• National Cattleman’s Beef Association, Pork Producers, Wal-mart, McDonald’s

Our Industry-Leading Products

LIVESTOCK

Visual | Laser Bar

Coded | e.Tag | Implantable

microchip |

| | | |

[GRAPHIC] | [GRAPHIC] | [GRAPHIC] | [GRAPHIC] |

Livestock

• Current global livestock tagging market - $150- $200 million per year

• Estimated market will grow to $500 million per year

• Europe – acquired Daploma, aggressive cost competitive European tag manufacturer

• Latin America – launched sales activity in Argentina and Brazil

• Revenue

[CHART]

Companion Pets

[GRAPHIC]

• 2004 revenue of $9.4 million

• Schering-Plough Exclusive Distributor in US; Meriel Exclusive Distributor in Europe; Dainipon Exclusive Distributor in Japan

• 1+ million ID chips sold in U.S. in 2004 (30% growth)

• 7,000 recoveries per month

• New 10-year contract with Schering-Plough includes increases in sales price/margins

• Projected launch of new chip (BIO-THERMO™) in U.S. in 4rd Quarter of 2005

• Scans temperature as well as identity

• Chip demand in U.S. can reach 3-4 million after introduction of BIO-THERMO™ chip

VeriChipTM

Implantable RFID Microchip

[GRAPHIC]

• Applications

• Healthcare (portal to medical records)

• FDA cleared Oct ‘04 for medical use in humans

• Only implantable chip approved for use in humans

• Security, financial

• Will initiate clinical studies for future FDA approval of VeriChip with Bio-Thermo

• Marketed exclusively by VeriChip

• Forecast market of several million units per year

• Clinical implementation underway in 9 Medical Centers including Beth Israel Deaconness & Hackensack University Medical Centers

Signature Industries

[GRAPHIC]

• 2004 revenue of $19 million

• Emergency sounders

• Solenoids

• Rental radios

• Search and rescue beacon equipment (SARBE)

• Encrypted GPS emergency rescue radio for military pilots

• Entire world’s fleet (100k units) must be replaced in next 4 years

• Delivered SARBE to 40+ countries/primary vendor to RAF

• ~$8 million contract for Indian Air Force - deliveries completed

• April, 2005 - $1 million contract for upgraded SARBE 7 antenna extensions

[GRAPHIC]

SARBE G2R in Combat Recovery Mode

[GRAPHIC]

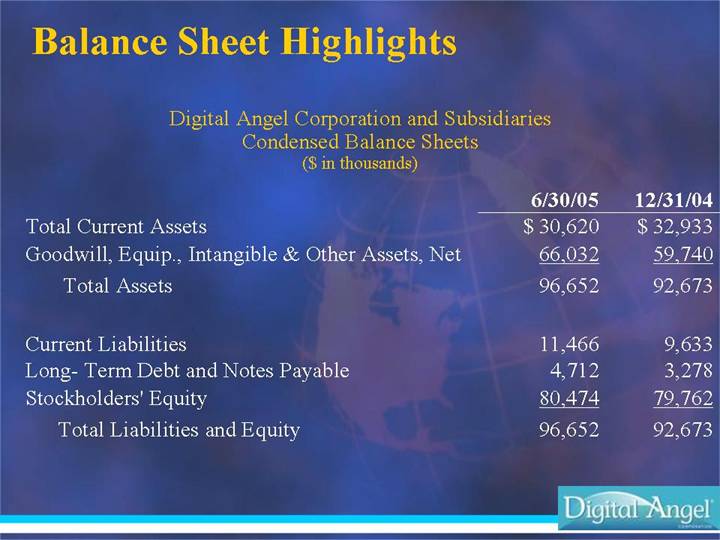

Balance Sheet Highlights

Digital Angel Corporation and Subsidiaries

Condensed Balance Sheets

($ in thousands)

| | 6/30/05 | | 12/31/04 | |

Total Current Assets | | $ | 30,620 | | $ | 32,933 | |

Goodwill, Equip., Intangible & Other Assets, Net | | 66,032 | | 59,740 | |

Total Assets | | 96,652 | | 92,673 | |

| | | | | |

Current Liabilities | | 11,466 | | 9,633 | |

Long- Term Debt and Notes Payable | | 4,712 | | 3,278 | |

Stockholders’ Equity | | 80,474 | | 79,762 | |

Total Liabilities and Equity | | 96,652 | | 92,673 | |

| | | | | | | |

Experienced Management

• Chairman - Scott Silverman

• CEO and President - Kevin McGrath

• President, Animal Applications – Lasse Nordfjeld

• CFO – James Santelli

• VP Business Development - Jay McKeage

• Signature Managerial Director - David Cairnie

• VP and General Counsel - James G. Naro

2005 Outlook

• $60-65 MM in revenue and profitable by year-end

• Position Company for further growth

• Continue to strengthen balance sheet

• Significant potential business upside in following areas

• Livestock

• SARBE

• VeriChip

• Signature

• Grow current businesses, grow through strategic acquisitions

• 45-48% Gross Margin versus ~42% for 2004

[LOGO]

Tracking, Identifying and Communicating

with High-Value Assets

[GRAPHIC] | | (AMEX:DOC) | | [GRAPHIC] |