UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

(Name of Registrant as specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

MPS GROUP, INC.

1 INDEPENDENT DRIVE

JACKSONVILLE, FLORIDA 32202

APRIL 30, 2003

DEAR MPS GROUP, INC. SHAREHOLDER:

On behalf of the Board of Directors and management of MPS Group, Inc. (the “Company”), we cordially invite you to attend the annual meeting of shareholders (the “Annual Meeting”) to be held on Thursday, May 29, 2003, at The Ponte Vedra Inn and Club at Ponte Vedra Beach, 200 Ponte Vedra Boulevard, Ponte Vedra Beach, Florida 32082, at 9:00 a.m., local time. The attached Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted at the Annual Meeting.

In addition to the specific matters to be acted upon, there also will be a report on the operations of the Company. Directors and officers of the Company will be present to respond to shareholders’ questions.

It is important that your shares be represented at the Annual Meeting. Regardless of whether you plan to attend, you are requested to mark, sign, date and promptly return the enclosed proxy in the envelope provided, or vote in any other manner described on your proxy card. If you attend the Annual Meeting, which we hope you will do, you may vote in person even if you have previously mailed a proxy card.

Sincerely,

| |

|

DEREK E. DEWAN | | TIMOTHY D. PAYNE |

Chairman of the Board of Directors | | President and Chief Executive Officer |

MPS GROUP, INC.

1 INDEPENDENT DRIVE

JACKSONVILLE, FLORIDA 32202

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 29, 2003

TO THE HOLDERS OF COMMON STOCK:

PLEASE TAKE NOTICE that the annual meeting of shareholders (the “Annual Meeting”) of MPS Group, Inc. (the “Company”) will be held on Thursday, May 29, 2003 at 9:00 a.m., local time, at The Ponte Vedra Inn and Club at Ponte Vedra Beach, 200 Ponte Vedra Boulevard, Ponte Vedra Beach, Florida 32082.

The Annual Meeting will be held for the following purposes:

| | 1. | | To elect eleven directors to serve terms scheduled to end in conjunction with the next annual meeting of shareholders or until their successors are elected and qualified; and |

| | 2. | | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

All shareholders are cordially invited to attend the Annual Meeting; however, only shareholders of record at the close of business on April 10, 2003, are entitled to notice of and to vote at the Annual Meeting.

By Order of the Board of Directors,

TIMOTHY D. PAYNE,

PRESIDENT AND

CHIEF EXECUTIVE OFFICER

Dated: April 30, 2003

Jacksonville, Florida

REGARDLESS OF WHETHER YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE MARK, SIGN, DATE AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED SELF-ADDRESSED ENVELOPE AS PROMPTLY AS POSSIBLE, OR VOTE IN ANY OTHER MANNER DESCRIBED ON YOUR PROXY CARD.

MPS GROUP, INC.

1 INDEPENDENT DRIVE

JACKSONVILLE, FLORIDA 32202

PROXY STATEMENT FOR ANNUAL MEETING OF

SHAREHOLDERS TO BE HELD MAY 29, 2003

INTRODUCTION

This Proxy Statement and the enclosed form of proxy are first being sent to shareholders of MPS Group, Inc., a Florida corporation (the “Company”), on or about April 30, 2003, in connection with the solicitation by the Company’s Board of Directors of proxies to be used at the annual meeting of shareholders (the “Annual Meeting”) of the Company to be held on Thursday, May 29, 2003, at 9:00 a.m., local time, or at any adjournment thereof. The Annual Meeting will be held at The Ponte Vedra Inn and Club at Ponte Vedra Beach, 200 Ponte Vedra Boulevard, Ponte Vedra Beach, Florida 32082.

Only shareholders of record at the close of business on April 10, 2003 (the “Record Date”) will be entitled to notice of and to vote at the Annual Meeting and any adjournments thereof. As of the Record Date, the Company had outstanding 101,959,829 shares of Common Stock, par value $.01 per share (the “Common Stock”).

VOTING PROCEDURES

The Board of Directors has designated Derek E. Dewan and Timothy D. Payne, and each or either of them, as proxies to vote the shares of common stock solicited on its behalf. If the enclosed form of proxy is executed and returned, it may nevertheless be revoked at any time before it has been exercised by: (i) giving written notice to the Secretary of the Company; (ii) delivery of a later dated proxy; or (iii) attending the Annual Meeting, notifying the Secretary of the Company or his delegate and voting in person. The shares represented by the proxy will be voted in accordance with the directions given unless the proxy is mutilated or otherwise received in such form as to render it illegible. If sufficient votes in favor of the election of directors are not received by the date of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit further solicitation of proxies.

Each outstanding share of Common Stock is entitled to one vote. The Company’s Bylaws provide that a majority of shares entitled to vote and represented in person or by proxy at a meeting of the shareholders constitutes a quorum. The Company’s Bylaws provide that directors are elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present. The Company’s Bylaws further provide that other matters are approved if affirmative votes cast by the holders of the shares represented at a meeting at which a quorum is present and entitled to vote on the subject matter exceed the votes opposing the action, unless a greater number of affirmative votes or voting by classes is required by the Florida Business Corporation Act or the Company’s Articles of Incorporation. Therefore, although abstentions and broker non-votes are counted for quorum purposes, abstentions and broker non-votes generally have no effect under Florida law. A broker non-vote occurs when a broker who holds shares in street name for a customer does not have authority to vote on certain non-routine matters under the rules of the New York Stock Exchange because its customer has not provided any voting instructions on the matter.

Regarding the election of Directors, shares may be voted for or withheld from each nominee. Abstentions and broker non-votes will have no effect on the election of Directors.

Shareholders should specify their choices on the enclosed form of proxy. If no specific instructions are given with respect to the matters to be acted upon, the shares represented by a signed proxy will be voted “FOR” the election of all nominees.

If your shares of Common Stock are held by a broker, bank, or other nominee (i.e., in “street name”), you will receive instructions from your nominee, which you must follow in order to have your shares voted—the instructions may appear on the special proxy card provided to you by your nominee (also called a “voting instruction form”). Your nominee may offer you different methods of voting, such as by telephone or Internet. If you do hold your shares in ‘street name’ and plan on attending the Annual Meeting, you should request a proxy from your broker or other nominee holding your shares in record name on your behalf in order to attend the Annual Meeting and vote at that time (your broker may refer to it as a “legal” proxy).

PROPOSAL ONE

ELECTION OF DIRECTORS

At the Annual Meeting, eleven individuals will be elected to serve as directors of the Company for terms scheduled to end in conjunction with the next annual meeting of shareholders or until their successors are duly elected and qualified. Each nominee has consented to be named herein and to serve as a director if elected. However, if any nominee becomes unavailable for election, it is the intention of the persons named in the accompanying form of proxy to nominate such other person as they may in their discretion determine, in which event the shares will be voted for such other person.

The Board of Directors is comprised of eleven directors, which are all in one class. Each director serves until the annual meeting of shareholders held in the next year. Proxies cannot be voted for a greater number of persons than the number of nominees named below. It is the intention of the persons named in the accompanying form of proxy, absent contrary instructions thereon, to vote such proxy for the election to the Board of Directors of the eleven individuals nominated.

Information concerning the Board of Directors’ nominees, based on data furnished by them, is set forth below. There are no family relationships between any directors or executive officers of the Company.

THE BOARD OF DIRECTORS OF THE COMPANY RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE FOLLOWING. PROXIES SOLICITED BY THE BOARD WILL BE SO VOTED UNLESS SHAREHOLDERS SPECIFY IN THEIR PROXIES A CONTRARY CHOICE.

Name (Age)

| | Positions With the Company; Principal Occupations during Past 5 Years; Other Directorships

| | Year First Became Director of the Company

|

|

Derek E. Dewan (48) | | Chairman of the Board of the Company since June 1996; President and Chief Executive Officer of the Company from January 1, 1994 to November 1, 2000 and March 1, 2001, respectively; Director since January 28, 1994; Partner with the accounting firm of Coopers & Lybrand LLP (now PricewaterhouseCoopers LLP) for more than five years prior to joining the Company, most recently as the managing partner of the Jacksonville, Florida office. | | 1994 |

|

Timothy D. Payne (44) | | President and Chief Executive Officer of the Company since November 1, 2000 and March 1, 2001, respectively; Director since November 10, 2000; President and Chief Operating Officer of Modis, Inc., a subsidiary of the Company, from March 1997 to December 2000; from 1994 until March 1997, President and Chief Executive Officer of Openware Technologies, Inc., a systems integrator which was acquired by the Company in June 1996. | | 2000 |

|

Peter J. Tanous (64)*• | | President of Lynx Investment Advisory, Inc. since 1992. Previously Executive Vice President of Bank Audi (U.S.A.), Chairman of Petra Capital Corporation, and First Vice President and International Regional Director with Smith Barney. Mr. Tanous currently serves on the Board of Directors of Cedars Bank, Kistler Aerospace Corporation, Interstate Resources, Inc., and Worldcare, Ltd. | | 1997 |

|

T. Wayne Davis (56)•†* | | Private investor for the past five years; President and Chairman of the Board of Tine W. Davis Family-WD Charities, Inc.; Director of Enstar Group, Inc. and Winn-Dixie Stores, Inc. | | 1994 |

2

Name (Age)

| | Positions With the Company; Principal Occupations during Past 5 Years; Other Directorships

| | Year First Became Director of the Company

|

|

John R. Kennedy (72)•† | | Retired as President, Chief Executive Officer and Director of Federal Paper Board Company in 1996 after 44 years with that company. Currently serves as a Director of Holcim (USA), Inc. | | 1999 |

|

Michael D. Abney (67) | | Retired as Senior Vice President and Chief Financial Officer of the Company on December 31, 2000; Senior Vice President of the Company from March 1995 and Chief Financial Officer of the Company from November 1992. He was a partner with Coopers & Lybrand, LLP (now PricewaterhouseCoopers LLP) for 22 years prior to joining the Company, most recently as the managing partner of the Jacksonville, Florida office. Currently serves as a Director of Young Life-Jacksonville and Chairman and Trustee for the Episcopal High School Foundation, Inc. | | 1997 |

|

William M. Isaac (59)*• | | Chairman of The Secura Group, a consulting firm providing advisory services to financial institutions since 1986, and Chairman of Secura Burnett, LLC, an executive search firm servicing financial institutions since 1992; Senior Partner with the law firm of Arnold & Porter in Washington, D.C. from 1986 to 1993; Chairman of the Federal Deposit Insurance Corporation (“FDIC”) from August 1981 to October 1985, member of the Board of the FDIC from 1978 through 1985. Currently serves as Chairman of The Goodwill Foundation and Director of Kistler Aerospace, American Express Centerion Bank, and The Ohio State University. | | 2000 |

|

Michael L. Huyghue (41)†* | | President and Chief Executive Officer of Axcess Sports & Entertainment, LLC since November 2001. Formerly Senior Vice President of Football Operations for the Jacksonville Jaguars NFL football franchise. Mr. Huyghue joined the Jaguars in 1994 as Vice President of Football Operations and was promoted to Senior Vice President in 1996. Prior to joining the Jaguars, Mr. Huyghue was Vice President of Administration and General Counsel for the Detroit Lions NFL football franchise. | | 2000 |

|

Darla D. Moore (48)† | | Partner and Executive Vice President, Rainwater, Inc., a private investment firm, since 1993. Ms. Moore is a member of the boards of directors of Martha Stewart Living Omnimedia, New York University School of Medicine Foundation Board, and University of South Carolina. She is chairwomen and founder of The Palmetto Institute, a private policy research group based in South Carolina. | | 2002 |

|

Richard J. Heckmann (59) | | Chairman and Chief Executive Officer of K-2 Inc., a manufacturer of sporting goods equipment since April 2000 and October 2002, respectively. Mr. Heckmann retired as Chairman of Vivendi Water, an international water products group, in June 2001. Mr. Heckmann was Chairman, President, and Chief Executive Officer of United States Filter Corporation, a worldwide provider of water and wastewater treatment systems and services, from 1990 to 1999. Currently, Mr. Heckmann serves as Chairman of the Listed Company Advisory Committee of the New York Stock Exchange. | | 2003 |

3

Name (Age)

| | Positions With the Company; Principal Occupations during Past 5 Years; Other Directorships

| | Year First Became Director of the Company

|

|

Arthur B. Laffer (62) | | Chairman of Laffer Associates, an economic research and financial consulting firm, since 1994. Dr. Laffer has been Chief Executive Officer of Laffer Advisors, Inc., a broker-dealer, since 1981 and Chief Executive Officer of Laffer Investments, an investment management firm, since 1999. Dr. Laffer is a director of Nicholas-Applegate Growth Equity Fund, Oxigene, Inc., Mastec, Inc., Petco Animal Supplies, Inc. and Violia Environmental. | | 2003 |

| * | | Current member of the Corporate Governance and Nominating Committee. |

| • | | Current member of the Audit Committee. |

| † | | Current member of the Compensation Committee. |

OTHER BOARD OF DIRECTOR MATTERS.Two new board members, Richard J. Heckmann and Arthur B. Laffer, were added to the Board on April 28, 2003. Senator George J. Mitchell resigned from the Company’s Board in December 2002. Mr. Davis resigned as Chairman of the Board of Transit Group, Inc., a trucking company, in February 2002. Transit Group and several of its subsidiaries filed voluntary petitions for Chapter 11 relief under federal bankruptcy laws on December 28, 2001.

BOARD OF DIRECTORS AND STANDING COMMITTEES. Regular meetings of the Board of Directors are held approximately six times a year, with special meetings as needed. During 2002, the Board of Directors held six meetings and executed one unanimous written consent. Each director attended at least 75% of the aggregate of: (i) all meetings of the Board of Directors and (ii) all meetings of Board committees on which he or she served during 2002.

The Board of Directors has established three standing committees. The three standing committees are: the Audit Committee, the Compensation Committee, and the Corporate Governance and Nominating Committee. All of the committees are described below. Members of these committees are generally elected annually by the Board of Directors, but changes may be made at the Board’s discretion at any time.

AUDIT COMMITTEE. The Audit Committee was comprised of Messrs. Tanous (Chairman), Davis, Isaac and Kennedy during 2002. The Audit Committee met eight times during 2002. The principal responsibilities of and functions generally performed by the Audit Committee are reviewing the Company’s internal controls and the objectivity of its financial reporting, making recommendations regarding the Company’s employment of independent auditors and reviewing the annual audit with the auditors. The Audit Committee operates pursuant to a written charter, which it reviews and reassesses annually. The Board of Directors, in its business judgment, has determined that all members of the Audit Committee are “independent” and “financially literate” within the meaning of applicable listing standards of the New York Stock Exchange currently in effect. In addition, the required number of Audit Committee members have accounting and financial management experience, as the Board interprets those terms in its business judgment.

COMPENSATION COMMITTEE. The Compensation Committee was comprised of Messrs. Davis (Chairman), Kennedy, Huyghue, and Moore during 2002. During 2002, the Compensation Committee met five times. This Committee is responsible of approving the compensation arrangements for senior management of the Company, including annual incentive compensation. It also recommends to the Board of Directors adoption of any compensation plans in which officers and directors of the Company are eligible to participate.

CORPORATE GOVERNANCE AND NOMINATING COMMITTEE. In May 2002, the Company combined the Corporate Governance and Nominating Committees into one Committee to better coordinate good governance practices and director nominations and evaluation procedures. The Corporate Governance and

4

Nominating Committee was comprised of Messrs. Huyghue (Chairman), Tanous, Davis, and Isaac during 2002. During 2002, the Corporate Governance and Nominating Committee met two times. This Committee’s principal responsibilities are to oversee compliance with good corporate governance practices and investigate and nominate potential members of the Board. The Committee will consider nominees recommended by shareholders. In order to submit a recommendation regarding a possible candidate for election to the Board of Directors, shareholders should send the candidate’s name and biographical information to the attention of the Secretary, at the Company’s principal executive offices, in accordance with Rule 14a-8 under the Securities Exchange Act. The deadline for submitting nominee recommendations is set forth below in “Shareholder Proposals.”

5

PRINCIPAL SHAREHOLDERS AND SECURITIES

OWNERSHIP OF MANAGEMENT

The following table shows the beneficial ownership as of April 4, 2003 of: (i) each director and nominee for director, (ii) the Named Executive Officers, as defined below, (iii) those persons known to the Company to be beneficial owners of more than 5% of its outstanding Common Stock and (iv) all directors and executive officers as a group. Unless otherwise indicated, each of the shareholders listed below exercises sole voting and dispositive power over the shares.

| | | Shares Beneficially Owned

| |

Name

| | Number

| | Percent(1)

| |

Derek E. Dewan(2) | | 3,092,700 | | 2.97 | % |

T. Wayne Davis(3) | | 470,400 | | * | |

Peter J. Tanous (4) | | 228,000 | | * | |

John R. Kennedy(5) | | 189,000 | | * | |

Michael D. Abney(6) | | 1,015,539 | | * | |

William M. Isaac(7) | | 49,000 | | * | |

Darla D. Moore(8) | | 12,000 | | * | |

Michael L. Huyghue(9) | | 55,500 | | * | |

Richard J. Heckmann | | 0 | | * | |

Arthur B. Laffer | | 0 | | * | |

Timothy D. Payne(10) | | 748,144 | | * | |

Robert P. Crouch(11) | | 446,776 | | * | |

Richard L. White(12) | | 35,986 | | * | |

Sheri A. O’Brien(13) | | 51,628 | | * | |

Gregory D. Holland(14) | | 34,612 | | * | |

FMR Corp.(15) | | 10,901,290 | | 10.67 | % |

T. Rowe Price Associates, Inc.(16) | | 7,271,300 | | 7.12 | % |

Dimensional Fund Advisors Inc.(17) | | 5,506,600 | | 5.39 | % |

All directors and executive officers as a group (16 persons)(18) | | 6,467,969 | | 6.03 | % |

* Indicates less than 1%.

| (1) | | Percentage is determined on the basis of 102,122,629 shares of Common Stock outstanding as of April 4, 2003, plus shares of Common Stock deemed outstanding pursuant to Rule 13d-3(d)(1) promulgated under the Securities Exchange Act of 1934, as amended (the “1934 Act”). |

| (2) | | Mr. Dewan’s shares consist of: (i) 10,100 shares held in his name; (ii) 2,122,600 shares represented by options exercisable within 60 days of April 4, 2003; and (iii) 960,000 restricted shares that will vest on March 29, 2006, unless there is a change in control of the Company, Mr. Dewan dies or is disabled, Mr. Dewan is removed from the Board, or certain other events occur, in which case all restricted shares shall immediately vest. |

| (3) | | Mr. Davis beneficially owns or has options to acquire 540,400 shares of Common Stock, including the 470,400 shares shown in the table above. Mr. Davis’ shares consist of: (i) 130,000 shares held in his name; (ii) 30,000 shares held by Tine W. Davis Family-WD Charities, Inc., a foundation over which Mr. Davis has sole voting and dispositive power; (iii) 5,400 shares held in Mr. Davis’ wife’s name; (iv) 305,000 shares held pursuant to options that are exercisable within 60 days of April 4, 2003; and (v) options for 70,000 shares which vest over the next 2 years. |

| (4) | | Mr. Tanous owns or has options to acquire 298,000 shares of Common Stock, including the 228,000 shares shown in the table above. Mr. Tanous’ shares consist of: (i) 3,000 shares held in his name; (ii) 225,000 shares held pursuant to options that are exercisable within 60 days of April 4, 2003; and (iii) options for 70,000 shares which vest over the next 2 years. |

6

| (5) | | Mr. Kennedy owns or has options to acquire 283,000 shares of Common Stock, including the 189,000 shares shown in the table above. Mr. Kennedy’s shares consist of: (i) 8,000 shares held in his own name; (ii) 181,000 shares held pursuant to options that are exercisable within 60 days of April 4, 2003; and (iii) options for 94,000 shares which vest over the next 2 years. |

| (6) | | Mr. Abney’s shares consist of: (i) 12,820 shares held in his name; (ii) 12,719 shares held in his son’s name; and (iii) 990,000 shares held pursuant to options that are exercisable within 60 days of April 4, 2003. |

| (7) | | Mr. Isaac owns or has options to acquire 155,000 shares of Common Stock, including the 49,000 shares shown in the table above. Mr. Isaac’s shares consist of: (i) 49,000 shares held pursuant to options that are exercisable within 60 days of April 4, 2003; and (ii) options for 106,000 shares which vest over the next 2 years. |

| (8) | | Ms. Moore owns or has options to acquire 60,000 shares of Common Stock, including the 12,000 shares shown in the table above. Ms. Moore’s shares consist of: (i) 12,000 shares held pursuant to options that are exercisable within 60 days of April 4, 2003; and (ii) options for 48,000 shares which vest over the next 4 years. |

| (9) | | Mr. Huyghue owns or has options to acquire 161,500 shares of Common Stock, including the 55,500 shares shown in the table above. Mr. Huyghue’s shares consist of: (i) 2,500 shares held in his name; (ii) 4,000 shares held in his wife’s name; (iii) 49,000 shares held pursuant to options that are exercisable within 60 days of April 4, 2003; and (iv) options for 106,000 shares which vest over the next 2 years. |

| (10) | | Mr. Payne owns or has options to acquire 1,581,477 shares of Common Stock, including the 748,144 shares shown in the table above. Mr. Payne’s shares consist of: (i) 10,000 shares held in his own name; (ii) 100,000 restricted shares; (iii) 810 shares held the Company’s 401(k) plan; (iv) 637,334 shares held pursuant to options that are exercisable within 60 days of April 4, 2003; and (v) options for 833,333 shares which vest over the next 2 years. |

| (11) | | Mr. Crouch owns or has options to acquire 832,331 shares of Common Stock, including the 446,776 shares shown in the table above. Mr. Crouch’s shares consist of: (i) 2,500 shares held in his own name; (ii) 50,000 restricted shares; (iii) approximately 3,164 shares held in the Company’s 401(k) plan; (iv) 391,112 shares held pursuant to options that are exercisable within 60 days of April 4, 2003; and (v) options for 385,555 shares which vest over the next 2 years. |

| (12) | | Mr. White owns or has options to acquire 135,569 shares of Common Stock, including the 35,986 shares shown in the table above. Mr. White’s shares consist of: (i) 569 shares held in the Company’s employee stock purchase plan; (ii) 35,417 options exercisable within 60 days of April 4, 2003; and (iii) options for 99,583 shares which vest over the next 2 years. |

| (13) | | Ms. O’Brien owns or has options to acquire 149,961 shares of Common Stock, including the 51,628 shares shown in the table above. Ms. O’Brien’s shares consist of: (i) 561 shares held in the Company’s employee stock purchase plan; (ii) 51,067 options exercisable within 60 days of April 4, 2003; and (iii) options for 98,333 shares which vest over the next 2 years. |

| (14) | | Mr. Holland owns or has options to acquire 95,167 shares of Common Stock, including the 34,612 shares shown in the table above. Mr. Holland’s shares consist of: (i) 1,000 shares held in his own name; (ii) 33,612 options exercisable within 60 days of April 4, 2003; and (iii) options for 60,555 shares which vest over the next 2 years. |

| (15) | | Based on information the Company obtained from the Schedule 13-G/A filed jointly by FMR Corp., Edward C. Johnson 3d and Abigail P. Johnson as of December 31, 2002, the business address of FMR Corp. is 82 Devonshire Street, Boston, Massachusetts 02109. FMR Corp. reports to have sole voting power for 760,290 shares of Common Stock and shared dispositive power for 0 shares of Common Stock. These shares are held by various subsidiaries of FMR Corp., including Fidelity Management & Research Company and Geode Capital Management, LLC, both as investment advisers, and Fidelity Management Trust Company, a bank serving as investment manager of the institutional account(s). According to the |

7

| | Schedule 13-G/A, Edward C. Johnson 3d and Abigail P. Johnson, along with other unnamed members of the Johnson family, may be deemed to control FMR Corp. through their ownership of its voting common stock and their execution of a voting agreement with all holders of the voting common stock. |

| (16) | | Based on information the Company obtained from T. Rowe Price Associates, Inc.’s Schedule 13-G filed as of December 31, 2002, the business address of T. Rowe Price Associates, Inc. is 100 E. Pratt Street, Baltimore, Maryland 21202. T. Rowe Price Associates, Inc. reports to have sole voting power for 1,960,200 shares of Common Stock and shared dispositive power for 0 shares of Common Stock. |

| (17) | | Based on information the Company obtained from Dimensional Fund Advisors Inc.’s Schedule 13-G filed as of December 31, 2002, the business address of Dimensional Fund Advisors Inc. is 1299 Ocean Avenue, 11th Floor, Santa Monica, California, 90401. Dimensional Fund Advisors Inc. reports to have sole voting power for 5,506,600 shares of Common Stock and shared dispositive power for 0 shares of Common Stock. These shares are held by registered investment companies, commingled group trusts and separate accounts for which T. Rowe serves as investment adviser or manager. |

| (18) | | Includes 5,119,476 shares held pursuant to options that are exercisable within 60 days of April 4, 2003. |

8

COMPENSATION COMMITTEE REPORT

The following Compensation Committee Report and Comparative Stock Performance does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically requests that the information be treated as soliciting material or specifically incorporates this Report or Comparative Stock Performance by reference therein.

The Company’s overall compensation philosophy includes: attracting and retaining quality executive talent; reinforcing strategic performance objectives; and ensuring shared goals between the executive officers and shareholders. Thus, there are three components to executive compensation: base salary; incentive compensation; and equity participation.

BASE SALARY. In establishing the base salaries of executive officers, attention is given to attracting and retaining quality management. The Company looks to the levels of compensation in distributed services businesses generally and the personnel services industry in particular and also considers the marketplace for executives with similar experience and abilities to determine the amount of base compensation. The Company’s intent with respect to base compensation is to set the level commensurate with the total compensation level of the industry and marketplace. The Company does not rely solely on data from firms in the Self-Selected Peer Group shown in the Comparative Stock Performance graph, because the market for the executives that the Company seeks to attract and retain is broader than its direct competitors. The salaries earned by the executive officers in 2002, which appear below in the Summary Compensation Table, were generally maintained at their prior year level in accordance with these practices.

INCENTIVE COMPENSATION. The Compensation Committee, with advice from an outside compensation consulting firm, established the Senior Executive Annual Incentive Plan (the “Incentive Plan”), which the Committee has been utilizing every year since adoption in 1999. The purposes of the Incentive Plan are to encourage management to focus on key corporate, business unit, and individual performance objectives, to align management efforts and rewards with shareholder interests, and to assist in the attraction and retention of qualified management talent through a competitive compensation package. Under the Incentive Plan, each executive is assigned certain financial and other targets and the incentive compensation is based, in large part, upon the achievement by the Company, business unit and executive of such targets. Bonuses were paid to the executive officers in 2002 in accordance with these practices, as incentive targets were met for the year.

EQUITY PARTICIPATION. The Committee strongly believes that, to encourage the long-term growth of shareholders’ value, each executive officer must have some form of equity participation. Thus, each of the executive officers participates in stock ownership via either pre-existing ownership of stock, stock options or restricted stock. During 2002, pursuant to the Company’s stock plans, there were option or restricted stock grants for 1,120,000 shares of Common Stock to executive officers and 1,732,500 shares of Common Stock to other employees. Options and restricted stock granted to the executive officers in 2002 are set forth in the tables appearing below. The amount and nature of prior equity incentive awards are considered in determining new equity awards for executive officers.

CHIEF EXECUTIVE OFFICER. Mr. Payne’s base annual compensation of $500,000 was set by agreement, and he received $601,867 in incentive compensation for 2002. In addition, during the year Mr. Payne was granted: an option to acquire 500,000 shares of common stock which will vest over three years; and 100,000 shares of restricted stock that will vest over five years. The vesting of the option will accelerate and become fully vested upon a change in control, and the restricted stock will accelerate and become fully vested upon a change in control, termination of Mr. Payne’s employment without good cause by the Company or by Mr. Payne for good reason, or if our common stock trades at or above $15 per share for a defined period.

9

In determining Mr. Payne’s incentive and equity based compensation, the Compensation Committee adhered to the targets established under the Incentive Plan.

The Committee also noted the following accomplishments during 2002:

| | • | | The reduction in the Company’s long-term debt by $101 million to zero; |

| | • | | The Company’s ability to produce over $115 million of cash flow from operations in a very difficult economic environment; and |

| | • | | Launching of Soliant Health, a new healthcare staffing business line. |

The Committee believes the equity based incentive compensation component of the Mr. Payne’s compensation (as well as that of the other senior executive officers) is very important to the Company’s success, because, among other things, equity based incentive compensation aligns the interests of executives with those of our shareholders and makes a significant portion of executive compensation contingent on long-term positive share price performance. In considering future equity incentive grants to Mr. Payne, the Committee will take the 2002 option and restricted stock grants into consideration in its evaluation of whether to make any such future grants and, if so, the size of the grants. The Compensation Committee considers the amount of Mr. Payne’s compensation for services during 2002 to be reasonable.

As it has done in the past, the Committee intends to design future compensation awards for the executive officers so that the Company’s tax deduction for compensation is maximized without limiting the Committee’s flexibility to attract and retain qualified executives to manage the Company. The Committee will not necessarily limit executive compensation to the limit under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), which generally limits deductions for compensation paid to the executive officers named in the Summary Compensation Table to $1,000,000 unless certain requirements are met. The Committee will consider various alternatives to preserve the deductibility of compensation payments and benefits to the extent reasonably practicable and to the extent consistent with its other compensation objectives.

Interpretations of and changes in the tax laws and other factors beyond the Committee’s control affect the deductibility of compensation. The Committee believes that the Amended and Restated 1995 Stock Option Plan complies with Section 162(m) and, therefore, stock options, restricted shares and stock appreciation rights (“SARs”) granted under this plan up to an annual aggregate of 500,000 shares would qualify for the corporate tax deduction.

The Committee exercises judgment and discretion in the information it reviews and the analyses it considers.

The foregoing report has been furnished by:

MPS GROUP, INC.

COMPENSATION COMMITTEE

Compensation Committee Members:

T. Wayne Davis, Chairman John R. Kennedy Michael L. Huyghue Darla D. Moore

10

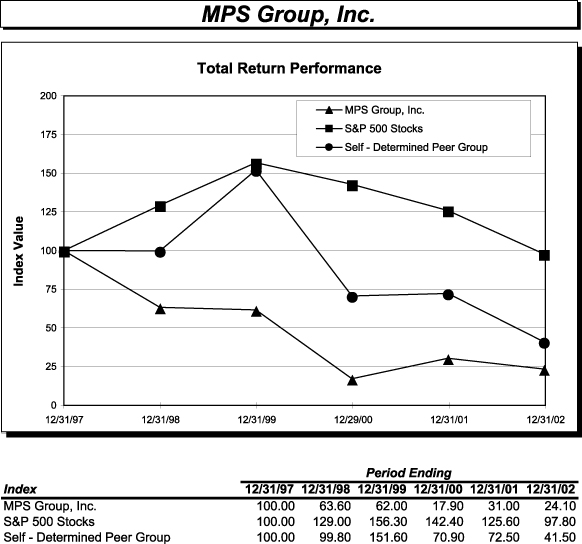

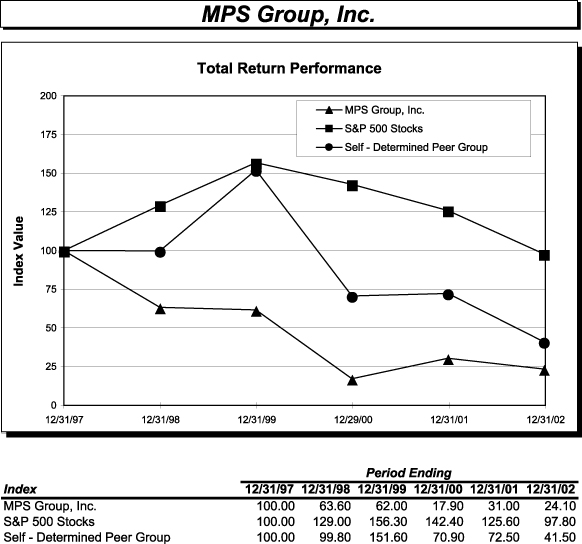

COMPARATIVE STOCK PERFORMANCE

The following graph compares the cumulative total shareholder return (stock price appreciation) on the Common Stock with the cumulative total return (stock price appreciation and reinvested dividends) on the S&P 500 index, and the common stock of seven companies in the information technology (IT) services, IT solutions, and/or professional services business (the “Self-Determined Peer Group”) as described below, for the period beginning December 31, 1997 and ending December 31, 2002 (the last trading date in the Company’s 2002 fiscal year), assuming the reinvestment of any dividends and assuming the investment of $100 in each. The Common Stock was traded on the Nasdaq National Market until November 15, 1996, at which time it commenced trading on the New York Stock Exchange under the symbol ASI. On September 27, 1998, the Company’s stock symbol on the New York Stock Exchange changed to MPS when it changed its name to Modis Professional Services, Inc. The Company changed its name to MPS Group, Inc. effective January 1, 2002, but maintained MPS as its stock symbol on the New York Stock Exchange.

Total return calculations for the Company, the S&P 500 Stocks and the Self-Determined Peer Group, were prepared by the Center for Research in Security Prices, The University of Chicago. The Self-Determined Peer Group is composed of the stocks of certain companies selected by the Company in the information technology

11

(IT) services, IT solutions, and/or professional services business, and includes the following companies: CDI Corp., Computer Horizons Corp., Keane, Inc., Kforce Inc., On Assignment, Inc., Robert Half International, Inc., and Sapient Corp. Scient Corp. is no longer included in the Self-Determined Peer Group due to its acquisition by SBI and Company. Total returns were calculated based on cumulative total return, assuming the value of the investment in the Common Stock and in each index on December 31, 1997 was $100 and that all dividends were reinvested. The indexes are reweighted daily, using the market capitalization on the previous trading day.

12

EXECUTIVE COMPENSATION

At December 31, 2002, the Company’s executive officers were Timothy D. Payne, President and Chief Executive Officer; Robert P. Crouch, Senior Vice President, Chief Financial Officer and Treasurer; Richard L. White, Senior Vice President and Chief Information Officer; Gregory D. Holland, Vice President, Chief Legal Officer, and Secretary; Tyra H. Tutor, Vice President, Corporate Development; and Sheri A. O’Brien, Senior Vice President, Operations.

Mr. Crouch has served as Senior Vice President, Chief Financial Officer, and Treasurer since January 1, 2001. Mr. Crouch joined the Company in November 1995 as Director of Financial Reporting and in June 1997 was promoted to Vice President and Controller. Mr. Crouch was named Chief Accounting Officer in 2000. From 1992 to November 1995, he was employed by Arthur Andersen LLP as a certified public accountant. Mr. Crouch is 34 years old.

Mr. White has served as Chief Information Officer since joining the Company in May 2000. Mr. White was promoted to Senior Vice President on May 20, 2002. From November 1996 to May 2000, Mr. White was Vice President and Chief Information Officer at Cellstar Corporation, a global provider of distribution and value-added logistics services to the wireless industry. Mr. White served as a director with BSG Alliance/IT from October 1995 to November 1996. Mr. White is 44 years old.

Mr. Holland has served as Chief Legal Officer and Secretary since May 20, 2002, and as Vice President since January 1, 2001. Mr. Holland joined the Company in October 1997 as Associate General Counsel. Prior to his employment with the Company, Mr. Holland was with the law firms of McGuire Woods, LLP and Coffman, Coleman, Andrews & Grogan in Jacksonville, Florida for a total of 6 years. Mr. Holland is 37 years old.

Ms. Tutor has served as Vice President—Corporate Development since January 1, 2001. Ms. Tutor joined the Company in May 1997 as Director—Office of the Chairman and in March 2000 was promoted to Vice President—Office of the Chairman. From January 1992 to May 1997, Ms. Tutor was employed as a certified public accountant for Coopers & Lybrand LLP (now PricewaterhouseCoopers LLP). Ms. Tutor is 34 years old.

Ms. O’Brien served as Senior Vice President—Operations from May 20, 2002 to April 1, 2003 and has served as Vice President—Operations since August 2001. Since April 1992, Ms. O’Brien held various positions with Modis, Inc., a subsidiary of the Company, most recently as Senior Vice President of Modis from November 1997 to August 2001. Ms. O’Brien is 45 years old. Effective April 1, 2003, Ms. O’Brien resigned her position as an Executive Officer.

13

The following table summarizes for the last three fiscal years the compensation paid or accrued by the Company for services rendered by the Company’s Chief Executive Officer and the Company’s other four most highly compensated executive officers who were serving the Company as executive officers on December 31, 2002 and whose total salary and bonus exceeded $100,000 during the year ended December 31, 2002 (the “Named Executive Officers”). The Company did not grant any stock appreciation rights or make any long-term incentive plan payouts during the periods shown.

SUMMARY COMPENSATION TABLE

| | | Annual Compensation

| | Long-Term Compensation Awards

| | | | |

| | | Year

| | Salary($)

| | Bonus($)

| | Restricted Stock Award(s)($)(1)

| | Securities Underlying Options/SARs

| | | All Other Compensation($)

| |

Timothy D. Payne | | 2002 | | $ | 500,000 | | $ | 601,867 | | $ | 524,000 | | 500,000 | | | $ | 750,000 | (2) |

President and Chief Executive | | 2001 | | | 500,000 | | | 332,000 | | | 787,600 | | 970,667 | (3) | | $ | 750,000 | (2) |

Officer | | 2000 | | | 400,000 | | | 1,500,000 | | | — | | — | | | | — | |

|

Robert P. Crouch | | 2002 | | | 250,000 | | | 240,747 | | | 262,000 | | 250,000 | | | | — | |

Senior Vice President, Chief | | 2001 | | | 250,000 | | | 133,000 | | | 196,900 | | 776,667 | (4) | | | — | |

Financial Officer, and Treasurer | | 2000 | | | 225,000 | | | — | | | — | | — | | | | — | |

|

Richard L. White | | 2002 | | | 185,000 | | | 111,345 | | | — | | 60,000 | | | | — | |

Senior Vice President and Chief Information Officer | | 2001 | | | 185,000 | | | 39,067 | | | — | | 50,000 | | | | — | |

|

Sheri A. O’Brien | | 2002 | | | 175,000 | | | 120,373 | | | — | | 60,000 | | | | — | |

Senior Vice President—Operations | | 2001 | | | 162,000 | | | 39,400 | | | — | | 50,000 | | | | — | |

|

Gregory D. Holland | | 2002 | | | 140,000 | | | 72,224 | | | — | | 50,000 | | | | — | |

Vice President, Chief Legal Officer, and Secretary | | | | | | | | | | | | | | | | | | |

| (1) | | Value of restricted stock shown in table is as of the date of award. As of December 31, 2002, total restricted stock awards outstanding and related fair market values were as follows: Mr. Payne—100,000 shares ($554,000); and Mr. Crouch—50,000 shares ($277,000). The grants to Messrs. Payne and Crouch in 2002 vest in five equal annual increments beginning on January 1, 2003, but may vest earlier upon the Common Stock’s trading price equaling or exceeding $15 per share over a ten consecutive business day period. The awards may also vest earlier upon a change in control of the Company, upon the termination of the grantee by the Company without cause or by the grantee for good reason, or upon the death or disability of the grantee. Outstanding shares of restricted stock are entitled to vote and to receive dividends when and if declared on the Company’s Common Stock. The grant to Mr. Payne in 2001 (200,000 shares) vested upon the Common Stock’s trading price equaling or exceeding $8 a share. The grant to Mr. Crouch in 2001 (50,000 shares) was originally set to vest in three equal annual increments beginning on the first anniversary of the date of grant. In 2002, the Compensation Committee accelerated vesting of this award. |

| (2) | | Amount forgiven pursuant to the terms and conditions of a Promissory Note issued by Mr. Payne on March 1, 2001 in favor of the Company. For additional information, see “Certain Relationships and Related Transactions.” |

| (3) | | 470,667 options issued pursuant to the 2001 Voluntary Stock Option Exchange Plan (the “Exchange Plan”), defined below. |

| (4) | | 426,667 options issued pursuant to the Exchange Plan. |

During 2001, the Company granted options to replace options that had previously been cancelled under a program called the 2001 Voluntary Stock Option Exchange Plan (the “Exchange Plan”). Under the Exchange Plan, all Company employees who had received options under or who received special grants outside of the Company’s 1995 Amended and Restated Stock Option Plan were given a choice to cancel stock options granted to them in exchange for new options in the future. The Company completed the Exchange Plan on August 13, 2001.

14

OPTIONS GRANTED IN LAST FISCAL YEAR

The following table sets forth information concerning each grant of stock options to the Named Executive Officers during the year ended December 31, 2002.

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(2)

|

Name

| | Number of Securities Underlying Options Granted

| | Percent of Total Options Granted to Employees in Fiscal Year

| | | Exercise or Base Price ($/Sh)(1)

| | Expiration Date

| | 5%

| | 10%

|

Timothy D. Payne | | 500,000 | | 18.5 | % | | $ | 5.24 | | 09/17/12 | | $ | 1,647,704 | | $ | 4,175,605 |

Robert P. Crouch | | 250,000 | | 9.3 | % | | | 5.24 | | 09/17/12 | | | 823,852 | | | 2,087,803 |

Richard L. White | | 60,000 | | 2.2 | % | | | 5.24 | | 09/17/12 | | | 197,724 | | | 501,073 |

Sheri A. O’Brien | | 60,000 | | 2.2 | % | | | 5.24 | | 09/17/12 | | | 197,724 | | | 501,073 |

Gregory D. Holland | | 50,000 | | 1.9 | % | | | 5.24 | | 09/17/12 | | | 164,770 | | | 417,561 |

| (1) | | All options were granted at the market value on the date of grant based generally on the last sale price on the date of grant of the Common Stock. These grants vest in three equal annual increments beginning on the first anniversary of the date of grant, September 17, 2002. These grants may vest earlier upon a change in control of the Company and the exercise period may be extended past retirement until the expiration date if a non-compete agreement is executed within three months of the date of retirement. |

| (2) | | The dollar amounts under these calculations are the result of calculations at the 5% and 10% rates set by the Securities and Exchange Commission and, therefore, are not intended to forecast possible future appreciation, if any, of the price of the Common Stock or the present or future value of the options. |

The following table sets forth information regarding the number of options exercised, the value realized on such exercises and the value of unexercised options as of December 31, 2002, by each of the Named Executive Officers.

Aggregated Option Exercises in Last Fiscal

Year and Fiscal Year-End Option Values

Name

| | No. of Shares Acquired on Exercise

| | Value Realized

| | Number of Securities Underlying Unexercised Options at Fiscal Year End Exercisable/Unexercisable

| | Value of Unexercised In-the-Money Options at Fiscal Year End Exercisable/Unexercisable(1)

|

Timothy D. Payne | | — | | | — | | 637,334 | | / | | 833,333 | | $ | 281,667 | | / | | $ | 713,333 |

Robert P. Crouch | | 50,000 | | $ | 125,400 | | 391,112 | | / | | 385,555 | | | 84,500 | | / | | | 244,000 |

Richard L. White | | — | | | — | | 29,167 | | / | | 105,833 | | | 28,167 | | / | | | 74,333 |

Sheri A. O’Brien | | — | | | — | | 46,067 | | / | | 103,333 | | | 33,495 | | / | | | 74,333 |

Gregory D. Holland | | — | | | — | | 33,612 | | / | | 60,555 | | | 8,450 | | / | | | 31,900 |

| (1) | | The closing price of the Company’s Stock on the New York Stock Exchange on December 31, 2002, the last trading day of the Company’s fiscal year, was $5.54. |

15

The following table sets forth certain information, as at December 31, 2002, with respect to the Company’s equity compensation plans:

EQUITY COMPENSATION PLANS

Plan Category

| | Number of securities to be issued upon exercise of outstanding options, warrants, and rights(1)

| | Weighted-average exercise price of outstanding options, warrants, and rights

| | Number of securities remaining available for future issuance under equity compensation plans

|

Equity compensation plans approved by security holders: | | | | | | | |

1995 Plan(2) | | 11,532,649 | | $ | 6.11 | | 1,211,505 |

Non-Employee Director Plan | | 1,380,000 | | $ | 8.00 | | 160,000 |

2001 Employee Stock Purchase Plan | | — | | | — | | 684,007 |

Equity compensation plans not approved by security holders: | | | | | | | |

Executive Option Plan(3) | | 950,000 | | $ | 6.00 | | 0 |

Compensation Arrangement(4) | | 500,000 | | $ | 3.85 | | 0 |

| | |

| |

|

| |

|

Total | | 14,362,649 | | $ | 6.21 | | 2,055,512 |

| | |

| |

|

| |

|

| (1) | | Upon the expiration, cancellation, or termination of unexercised granted options, shares subject to those options will again be available for the grant of options under the plan. The Company assumed two stock option plans from prior year acquisitions and the outstanding shares under these plans are not included in the table above. One plan has 7,803 shares outstanding at an average exercise price of $4.25 and the second plan has 2,731 shares outstanding at an average exercise price of $7.42. No additional shares will be issued under these assumed plans. |

| (2) | | In addition to being available for future issuance upon exercise of options, shares may instead be issued in connection with stock appreciation rights, restricted stock, performance units, performance shares or other equity-based awards. |

| (3) | | The Executive Option Plan was approved by the Compensation Committee and was effective January 1, 1999 between Derek E. Dewan and the Company. These options vested immediately upon grant. These option shares were cancelled and re-issued pursuant to the Exchange Plan on August 13, 2001 at $6.00, the fair market value. |

| (4) | | This individual compensation arrangement was approved by the Compensation Committee and was effective on September 25, 2001 between Timothy D. Payne and the Company. The last of such arrangement was entered into during 2001. The option grant under this arrangement vests annually over a three-year period. The vesting of the option may accelerate upon a change in control, or termination of Mr. Payne’s employment without good cause by the Company or by Mr. Payne for good reason. |

EMPLOYMENT AGREEMENTS

Effective November 1, 2000, the Company entered into an Amended and Restated Employment Agreement with Timothy D. Payne that provides for an annual base salary of $500,000 plus targeted incentive compensation under the Incentive Plan of 100% of base salary. Pursuant to the agreement, if Mr. Payne’s employment is terminated by the Company without cause or by Mr. Payne for good reason, he will receive a lump sum payment equal to three (3) times the sum of (i) his base salary as of the date of termination and (ii) his target bonus opportunity under the Incentive Plan based on the target bonus opportunity for the year of termination. In addition, in the event of termination by the Company without cause or by Mr. Payne with good reason, or if there is a change in control of the Company, the agreement provides for the automatic vesting of any unvested stock options and all unvested restricted stock held by Mr. Payne on such date. The term of this employment agreement expires every December 31st, subject to an automatic one-year renewal unless terminated by either party in accordance with the terms of the employment agreement.

16

Effective January 1, 2001, the Company entered into an Amended and Restated Employment Agreement with Robert P. Crouch that provides for an annual base salary of $250,000 plus targeted incentive compensation opportunity under the Incentive Plan of 80% of base salary. Pursuant to the agreement, if Mr. Crouch’s employment is terminated by the Company without cause or by Mr. Crouch for good reason, he will receive a lump sum payment equal to two (2) times the sum of (i) his base salary as of the date of termination and (ii) his target bonus opportunity under the Incentive Plan based on the target bonus opportunity for the year of termination. In addition, in the event of termination by the Company without cause or by Mr. Crouch with good reason, or if there is a change in control of the Company, the agreement provides for the automatic vesting of any unvested stock options and all unvested restricted stock held by Mr. Crouch on such date. The term of this employment agreement expires every December 31st, subject to an automatic one-year renewal unless terminated by either party in accordance with the terms of the employment agreement.

Effective January 1, 2003, the Company entered into Employment Agreements with Richard L. White, Gregory D. Holland, and Tyra H. Tutor, that provide for an annual base salary plus a targeted incentive compensation opportunity under the Incentive Plan, to be set periodically by the Company for each executive. Pursuant to each of the agreements, if the executive’s employment with the Company is terminated by the Company, other than for circumstances equating to good cause, the executive will receive payment equal to his or her base annual salary as of the date of termination and target bonus opportunity under the Incentive Plan based on the target bonus opportunity for the year of termination. In addition, if there is a change in control of the Company, each of the agreements provides for the automatic vesting of any unvested stock options held by the executive on such date. The term of each of these employment agreements continues for a period of indefinite duration, through and until either party terminates the agreement upon at least ten days notice, or immediately upon the executive’s death or disability.

Effective April 1, 2003, Sheri O’Brien resigned from her position as Senior Vice President of Operations and agreed to serve in a transitional role for a period of time. Ms. O’Brien has an employment agreement under which she will receive the severance benefits substantially similar to those contained in Messrs. White and Holland’s and Ms. Tutor’s employment agreement as set forth above.

DIRECTORS’ COMPENSATION

FEES AND OTHER COMPENSATION. For 2002, each non-employee director received from the Company an annual retainer of $25,000, which increased to $40,000 effective January 1, 2003, accrued and payable in quarterly installments. Until November 1, 2002, Committee Chairs received an additional annual fee of $2,500, and all directors received attendance fees of $1,000 per Board meeting ($500 for telephonic meetings) and $500 for Committee meetings not held on the day of a regularly scheduled Board meeting. Effective November 1, 2002, the Board fees were increased as follows: Attendance fees for Board Meetings were raised to $3,000 per meeting ($1,000 for telephonic meetings); Audit Committee Chair fee was increased to $10,000 annually and all other Committee Chair fees were increased to $5,000 annually; Committee attendance fees were raised to $1,500 per meeting for Audit Committee meetings ($1,000 for telephonic meetings) and $1,000 per meeting for all other Committee meetings ($500 for telephonic meetings).

Effective March 1, 2001, the Company entered into a Chairman Employment Agreement with Derek E. Dewan that provides for an annual salary of $200,000. Pursuant to the agreement, if Mr. Dewan’s employment is terminated by the Company for any reason, subject to limited exceptions, he will receive a lump sum payment equal to the full, undiscounted value of his remaining aggregate compensation and benefits and will be entitled to begin receiving any retirement benefits under Company plans. The agreement also provides that the Company will provide Mr. Dewan, his spouse and their dependents major medical health and hospital coverage until he reaches age 65, regardless of whether the agreement is earlier terminated by Mr. Dewan or the Company for any reason. The agreement expires on its fifth anniversary, subject to an automatic one-year renewal unless terminated by either party at least 90 days prior to the expiration of the initial term or any one-year extension. This agreement does not provide for any incentive compensation and Mr. Dewan receives no Board fees. In addition, Mr. Dewan received other compensation in 2002 in the amount of $47,778 due to life insurance premiums paid on his behalf.

17

AMENDED AND RESTATED NON-EMPLOYEE DIRECTOR STOCK PLAN. The Company provides a stock option plan for non-employee directors (the “Director Plan”). A total of 1,600,000 shares of Common Stock are currently reserved for issuance under the Director Plan. The Director Plan is administered by the full Board of Directors.

The Director Plan provides for the issuance of non-qualified options to purchase 60,000 shares of Common Stock to each new non-employee director, upon first being appointed or elected, at an exercise price equal to the market value on the date of grant based generally on the last sale price on the date of grant of the Common Stock. The options vest annually over a five-year period. The awards have a term of ten years but are only exercisable for a maximum of three years after the participant ceases to be a director of the Company; however, if a participant ceases to be a director within one year of initial appointment or election, the options granted shall be canceled.

In addition, the Director Plan provides for the annual issuance of non-qualified options to purchase 20,000 shares of Common Stock to each director, upon reelection, at an exercise price equal to the market value on the date of grant based generally on the last sale price on the date of grant of the Common Stock. The options vest annually over a three-year period. The Board of Directors may also grant additional options to non-employee directors from time to time as the Board may determine in its discretion. The Board has agreed to assess the continued viability of this Plan in light of proposed accounting changes, which make the Director Plan costlier to the Company. In lieu of continuing to award stock options, the Board will consider other forms of equity participation for non-employee directors.

COMPENSATION COMMITTEE INTERLOCKS

AND INSIDER PARTICIPATION

The Compensation Committee, which was formed in fiscal 1994, is presently comprised of Messrs. Davis, Kennedy, Huyghue, and Moore, none of whom are employed by the Company. No interlocking relationship exists between the Company’s Board of Directors, Compensation Committee or executive officers and the board of directors, compensation committee or executive officers of another company.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

On March 1, 2001, Mr. Payne executed a promissory note in favor of the Company in the principal amount of $1,500,000. Mr. Payne voluntarily returned 167,666 options to purchase shares of Common Stock in consideration of the loan from the Company. The note, which bore interest at the rate of 4.86% per annum, matured on January 1, 2003. Pursuant to the terms of the note, principal and interest that would otherwise come due from time to time would be forgiven if: (i) Mr. Payne was in the employ of the Company (including its subsidiaries and affiliates) on such dates, (ii) Mr. Payne’s employment was terminated without cause by the Company or for good reason by Mr. Payne, (iii) Mr. Payne died or became disabled, or (iv) there was a change in control of the Company. Because Mr. Payne remained employed with the Company on such dates, $750,000 of principal was forgiven under the terms of the note on each of January 1, 2002 and 2003 and such note cancelled on its own terms on the maturity date. Mr. Payne’s former promissory note was approved by the Compensation Committee of the Board of Directors.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s executive officers and directors and persons who beneficially own more than 10% of a registered class of the Company’s equity securities to file reports of securities ownership and changes in such ownership with the Securities and Exchange Commission. The Company is not aware of any failure to timely file any report required by Section 16(a) except for a Form 3 that Darla D. Moore, a Company director, inadvertently filed 30 days late.

18

REPORT OF THE AUDIT COMMITTEE

The following Report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Company specifically requests that the information be treated as soliciting material or specifically incorporates this Report by reference therein.

The Audit Committee’s primary responsibilities fall into three broad categories:

(1) The Audit Committee is charged with monitoring the preparation of quarterly and annual financial reports by the Company’s management, including discussions with management and the Company’s outside auditors about draft annual financial statements and key accounting and reporting matters;

(2) The Audit Committee is responsible for matters concerning the relationship between the Company and its outside auditors, including recommending their appointment or removal, reviewing the scope of their audit services and related fees as well as any other services being provided to the Company, and determining whether the outside auditors are independent; and

(3) The Audit Committee oversees management’s implementation of effective systems of internal controls, including review (with and without management present) with internal and independent auditors, of such control systems as well as policies relating to legal and regulatory compliance, ethics, and conflicts of interests, and the activities and recommendations of the Company’s internal auditors.

The Company’s management is responsible for its internal accounting controls and the financial reporting process. The Company’s independent accountants are responsible for performing an audit of the Company’s consolidated financial statements in accordance with auditing standards generally accepted in the United States and for expressing an opinion as to their conformity with generally accepted accounting principles.

In overseeing the preparation of the Company’s financial statements, the Audit Committee met with both management and the Company’s outside auditors to review and discuss all financial statements prior to their issuance. The Audit Committee’s review included discussion with the outside auditors of matters required to be discussed pursuant to Statement on Auditing Standards No. 61 (Communication with Audit Committees).

With respect to the Company’s outside auditors, the Audit Committee, among other things, discussed with PricewaterhouseCoopers LLP matters relating to its independence, including the disclosures made to the Audit Committee as required by the Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), addressing all relationships between the auditors and the Company that might bear on the auditors’ independence. The Audit Committee has considered such discussions and considered whether the provision of non-audit services discussed below under “Independent Public Accountants” are compatible with maintaining PricewaterhouseCoopers LLP’s independence, and has satisfied itself that the provision of these services is so compatible.

In reliance upon the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board approved, that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the Securities and Exchange Commission. The Audit Committee also recommended to the Board of Directors, and the Board approved, the retention of PricewaterhouseCoopers LLP as the Company’s independent auditors for the fiscal year ending December 31, 2003.

By the Audit Committee:

Peter J. Tanous (Chairman) T. Wayne Davis John R. Kennedy William M. Isaac

19

INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

The Company has selected the firm of PricewaterhouseCoopers LLP to serve as the independent certified public accountants for the Company for the current fiscal year ending December 31, 2003. That firm has served as the auditors for the Company since 1992. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting and will be accorded the opportunity to make a statement, if they so desire, and to respond to appropriate questions.

Audit and Accounting Related Expenses

During fiscal year 2002, PricewaterhouseCoopers LLP provided various audit, audit related and non-audit services to the Company as follows:

(a) Audit Fees: Aggregate fees billed for professional services rendered by PricewaterhouseCoopers LLP for the audit of the Company’s fiscal year 2002 annual financial statements and review of financial statements in the Company’s Form 10-Q Reports: $619,590.

(b) Financial Information Systems Design and Implementation Fees: $0.00.

(c)All Other Fees: Includes fees associated with tax compliance and advisory services and fees associated with registration statements and other filings with the Securities and Exchange Commission: $108,762. Of this amount, $89,992 was directly related to tax compliance.

The Audit Committee of the Board has considered whether provision of the services described in sections (b) and (c) above is compatible with maintaining the independent accountant’s independence and has determined that such services have not adversely affected PricewaterhouseCoopers LLP’s independence.

OTHER MATTERS

The Board of Directors does not know of any other matters to come before the Annual Meeting; however, if any other matters properly come before the Annual Meeting, it is the intention of the persons designated as proxies to vote in accordance with their best judgment on such matters. If any other matter should come before the Annual Meeting, such matter will be approved if the number of votes cast in favor of the matter exceeds the number opposed.

SHAREHOLDER PROPOSALS

Shareholders are hereby notified that if they wish to include a proposal in the Company’s Proxy Statement and form of proxy relating to the 2004 annual meeting, a written copy of their proposal must be received at the principal executive offices of the Company no later than December 27, 2003. To ensure prompt receipt by the Company, proposals should be sent certified mail return receipt requested. Proposals must comply with the proxy rules relating to shareholder proposals in order to be included in the Company’s proxy materials.

In accordance with the Company’s Bylaws, shareholders who wish to submit a proposal for consideration at the Company’s 2004 annual meeting of shareholders, including nominations of members for our Board of Directors, but who do not wish to submit the proposal for inclusion in the Company’s proxy statement pursuant to Rule 14a-8 as promulgated under the Securities Exchange Act of 1934, must deliver a copy of their proposal to the Company at its principal executive offices no later than December 27, 2003.

20

ANNUAL REPORT

A copy of the Company’s Annual Report to Shareholders for the year ended December 31, 2002 accompanies this Proxy Statement. Copies of the Company’s Annual Report on Form 10-K for the year ended December 31, 2002 will be provided free of charge upon written request to: Tyra H. Tutor, Vice President, at 1 Independent Drive, Jacksonville, Florida 32202. Copies of any exhibits to the Annual Report on Form 10-K for the year ended December 31, 2002 will also be furnished on request and upon payment of the Company’s expenses in furnishing the exhibits.

EXPENSES OF SOLICITATION

The cost of soliciting proxies will be borne by the Company. The Company does not expect to pay any compensation for the solicitation of proxies but will reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their expenses for sending proxy material to principals and obtaining their proxies. Certain officers and regular employees of the Company or its subsidiaries, without additional compensation, may use their personal efforts, by telephone or otherwise, to obtain proxies in addition to solicitation by mail. Should the Company’s management deem it appropriate, the Company may also retain the services of Corporate Communications, Inc. and/or Morrow & Co., Inc. to aid in the solicitation of proxies for which the Company anticipates it would pay a fee not to exceed, in the aggregate, $10,000 plus reimbursement of expenses.

Date: April 30, 2003

SHAREHOLDERS ARE URGED TO SPECIFY THEIR CHOICES, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE, POSTAGE FOR WHICH HAS BEEN PROVIDED. YOUR PROMPT RESPONSE WILL BE APPRECIATED.

21

MPS GROUP, INC.

1 Independent Drive

Jacksonville, Florida 32202

This Proxy is Solicited on Behalf of the Board of Directors.

KNOW ALL MEN BY THESE PRESENTS that I, the undersigned shareholder of MPS Group, Inc., a Florida corporation (the “Company”), do hereby nominate, constitute, and appoint Derek E. Dewan and Timothy D. Payne, or any one or more of them, my true and lawful attorney(s) with full power of substitution for me and in my name, place and stead, to vote all of the Common Stock, par value $.01 per share, of the Company, standing in my name on its books on April 10, 2003, at the Annual Meeting of its Shareholders to be held at The Ponte Vedra Inn and Club at Ponte Vedra Beach, 200 Ponte Vedra Boulevard, Ponte Vedra Beach, Florida 32082, on May 29, 2003, at 9:00 a.m., local time, or at any adjournment thereof.

1. Election of the following nominees as directors:

Derek E. Dewan, Timothy D. Payne, Peter J. Tanous, T. Wayne Davis, John R. Kennedy, Michael D. Abney,

William M. Isaac, Michael L. Huyghue, Darla D. Moore, Richard J. Heckmann, and Arthur B. Laffer

¨ | | | FOR all nominees listed (except as marked to the contrary) | | ¨ | | | WITHHOLD AUTHORITYto vote for all nominees listed |

(INSTRUCTION: To withhold authority to vote for any individual nominee(s), write that nominee’s name(s) in the space provided below.)

(Continued on the other side)

2. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting.

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder. If you sign without otherwise marking the form, the securities will be voted as recommended by the Board of Directors on all matters to be considered at the meeting.Please sign exactly as your name appears hereon.When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by president or other authorized officer. If a partnership please sign in partnership name by authorized person.Make sure that the name on your stock certificate(s) is exactly as you indicate below.

| | | |

| | | |

| | | ___________________________________ Signature |

| | | |

| | | ___________________________________ Signature if held jointly |

| | | |

| | | |

| | | Dated:_________________________________, 2003 |

| | | |

| | | |

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING

THE ENCLOSED SELF-ADDRESSED ENVELOPE.