- VRE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Veris Residential (VRE) 8-KResults of Operations and Financial Condition

Filed: 24 Feb 25, 4:41pm

| Page(s) | |||||

| Key Financial Data | |||||

| Operating Portfolio | |||||

| Debt | |||||

| Reconciliations and Additional Details | |||||

Annex 1: Transaction Activity | |||||

Annex 2: Reconciliation of NOI | |||||

Annex 4: Unconsolidated Joint Ventures | |||||

Annex 5: Debt Profile Footnotes | |||||

Annex 6: Multifamily Property Information | |||||

| Three Months Ended December 31, | Twelve Months Ended December 31, | |||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||

| Net Income (loss) per Diluted Share | $(0.13) | $(0.06) | $(0.25) | $(1.22) | ||||||||||

| Core FFO per Diluted Share | $0.11 | $0.12 | $0.60 | $0.53 | ||||||||||

| Core AFFO per Diluted Share | $0.13 | $0.14 | $0.71 | $0.62 | ||||||||||

| Dividend per Diluted Share | $0.08 | $0.0525 | $0.2625 | $0.1025 | ||||||||||

| December 31, 2024 | September 30, 2024 | Change | |||||||||

| Same Store Units | 7,621 | 7,621 | —% | ||||||||

| Same Store Occupancy | 93.9% | 95.1% | (1.2)% | ||||||||

| Same Store Blended Rental Growth Rate (Quarter) | 0.5% | 4.6% | (4.1)% | ||||||||

| Average Rent per Home | $4,033 | $3,980 | 1.3% | ||||||||

| ($ in 000s) | Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||||||

| 2024 | 2023 | % | 2024 | 2023 | % | |||||||||||||||

| Total Property Revenue | $76,375 | $73,371 | 4.1% | $300,679 | $285,247 | 5.4% | ||||||||||||||

| Controllable Expenses | 13,907 | 13,829 | 0.6% | 53,349 | 52,190 | 2.2% | ||||||||||||||

| Non-Controllable Expenses | 11,649 | 12,199 | (4.5)% | 46,589 | 45,263 | 2.9% | ||||||||||||||

| Total Property Expenses | 25,556 | 26,028 | (1.8)% | 99,938 | 97,453 | 2.5% | ||||||||||||||

| Same Store NOI | $50,819 | $47,343 | 7.3% | $200,741 | $187,794 | 6.9% | ||||||||||||||

| Less: Real Estate Tax Adjustments | — | — | — | 1,689 | ||||||||||||||||

| Normalized Same Store NOI | $50,819 | $47,343 | 7.3% | $200,741 | $186,105 | 7.9% | ||||||||||||||

| Balance Sheet Metric ($ in 000s) | December 31, 2024 | September 30, 2024 | ||||||

| Weighted Average Interest Rate | 4.95% | 4.96% | ||||||

| Weighted Average Years to Maturity | 3.1 | 3.3 | ||||||

| TTM Interest Coverage Ratio | 1.7x | 1.7x | ||||||

| Net Debt | $1,647,892 | $1,645,447 | ||||||

| TTM EBITDA | $140,694 | $140,682 | ||||||

| TTM Net Debt to EBITDA | 11.7x | 11.7x | ||||||

| 2025 Guidance Ranges | Low | High | |||||||||

| Same Store Revenue Growth | 2.1% | — | 2.7% | ||||||||

| Same Store Expense Growth | 2.6% | — | 3.0% | ||||||||

| Same Store NOI Growth | 1.7% | — | 2.7% | ||||||||

| Core FFO per Share Guidance | Low | High | |||||||||

| Net Loss per Share | $(0.24) | — | $(0.22) | ||||||||

| Depreciation per Share | $0.85 | — | $0.85 | ||||||||

| Core FFO per Share | $0.61 | — | $0.63 | ||||||||

| Investors | Media | |||||||

| Mackenzie Rice | Amanda Shpiner/Grace Cartwright | |||||||

| Director, Investor Relations | Gasthalter & Co. | |||||||

| investors@verisresidential.com | veris-residential@gasthalter.com | |||||||

| December 31, 2024 | December 31, 2023 | |||||||

| ASSETS | ||||||||

| Rental property | ||||||||

| Land and leasehold interests | $458,946 | $474,499 | ||||||

| Buildings and improvements | 2,634,321 | 2,782,468 | ||||||

| Tenant improvements | 14,784 | 30,908 | ||||||

| Furniture, fixtures and equipment | 112,201 | 103,613 | ||||||

| 3,220,252 | 3,391,488 | |||||||

| Less – accumulated depreciation and amortization | (432,531) | (443,781) | ||||||

| 2,787,721 | 2,947,707 | |||||||

| Real estate held for sale, net | 7,291 | 58,608 | ||||||

| Net investment in rental property | 2,795,012 | 3,006,315 | ||||||

| Cash and cash equivalents | 7,251 | 28,007 | ||||||

| Restricted cash | 17,059 | 26,572 | ||||||

| Investments in unconsolidated joint ventures | 111,301 | 117,954 | ||||||

| Unbilled rents receivable, net | 2,253 | 5,500 | ||||||

| Deferred charges and other assets, net | 48,476 | 53,956 | ||||||

| Accounts receivable | 1,375 | 2,742 | ||||||

| Total Assets | $2,982,727 | $3,241,046 | ||||||

| LIABILITIES & EQUITY | ||||||||

| Revolving credit facility and term loans | 348,839 | — | ||||||

| Mortgages, loans payable and other obligations, net | 1,323,474 | 1,853,897 | ||||||

| Dividends and distributions payable | 8,533 | 5,540 | ||||||

| Accounts payable, accrued expenses and other liabilities | 42,744 | 55,492 | ||||||

| Rents received in advance and security deposits | 11,512 | 14,985 | ||||||

| Accrued interest payable | 5,262 | 6,580 | ||||||

| Total Liabilities | 1,740,364 | 1,936,494 | ||||||

| Redeemable noncontrolling interests | 9,294 | 24,999 | ||||||

| Total Stockholders’ Equity | 1,099,391 | 1,137,478 | ||||||

| Noncontrolling interests in subsidiaries: | ||||||||

| Operating Partnership | 102,588 | 107,206 | ||||||

| Consolidated joint ventures | 31,090 | 34,869 | ||||||

| Total Noncontrolling Interests in Subsidiaries | $133,678 | $142,075 | ||||||

| Total Equity | $1,233,069 | $1,279,553 | ||||||

| Total Liabilities and Equity | $2,982,727 | $3,241,046 | ||||||

| Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||||

| REVENUES | 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenue from leases | $61,904 | $60,896 | $245,690 | $235,117 | |||||||||||||

| Management fees | 751 | 1,084 | 3,338 | 3,868 | |||||||||||||

| Parking income | 3,893 | 3,824 | 15,463 | 15,498 | |||||||||||||

| Other income | 1,535 | 1,216 | 6,583 | 5,812 | |||||||||||||

| Total revenues | 68,083 | 67,020 | 271,074 | 260,295 | |||||||||||||

| EXPENSES | |||||||||||||||||

| Real estate taxes | 10,173 | 9,529 | 37,424 | 34,687 | |||||||||||||

| Utilities | 1,955 | 1,836 | 8,151 | 7,700 | |||||||||||||

| Operating services | 12,885 | 13,570 | 48,239 | 50,769 | |||||||||||||

| Property management | 3,877 | 4,323 | 17,247 | 14,188 | |||||||||||||

| General and administrative | 10,040 | 9,992 | 39,059 | 44,443 | |||||||||||||

| Transaction-related costs | 159 | 576 | 1,565 | 7,627 | |||||||||||||

| Depreciation and amortization | 21,182 | 21,227 | 82,774 | 86,235 | |||||||||||||

| Land and other impairments, net | — | 5,928 | 2,619 | 9,324 | |||||||||||||

| Total expenses | 60,271 | 66,981 | 237,078 | 254,973 | |||||||||||||

| OTHER (EXPENSE) INCOME | |||||||||||||||||

| Interest expense | (23,293) | (21,933) | (87,976) | (89,355) | |||||||||||||

| Interest cost of mandatorily redeemable noncontrolling interests | — | — | — | (49,782) | |||||||||||||

| Interest and other investment income | 111 | 232 | 2,366 | 5,515 | |||||||||||||

| Equity in earnings (loss) of unconsolidated joint ventures | 1,015 | 260 | 3,934 | 3,102 | |||||||||||||

| Realized gains (losses) and unrealized gains (losses) on disposition of rental property and impairments, net | — | (3) | — | — | |||||||||||||

| Gain (loss) on disposition of developable land | — | 7,090 | 11,515 | 7,068 | |||||||||||||

| Gain (loss) on sale of unconsolidated joint venture interests | (154) | — | 6,946 | — | |||||||||||||

| Gain (loss) from extinguishment of debt, net | — | (1,903) | (777) | (5,606) | |||||||||||||

| Other income (expense), net | (396) | 77 | (701) | 2,871 | |||||||||||||

| Total other (expense) income, net | (22,717) | (16,180) | (64,693) | (126,187) | |||||||||||||

| Income (loss) from continuing operations before income tax expense | (14,905) | (16,141) | (30,697) | (120,865) | |||||||||||||

| Provision for income taxes | (2) | (199) | (276) | (492) | |||||||||||||

| Income (loss) from continuing operations after income tax expense | (14,907) | (16,340) | (30,973) | (121,357) | |||||||||||||

| Income (loss) from discontinued operations | (1,015) | (33,377) | 862 | (32,686) | |||||||||||||

| Realized gains (losses) and unrealized gains (losses) on disposition of rental property and impairments, net | 1,899 | 43,971 | 3,447 | 41,682 | |||||||||||||

| Total discontinued operations, net | 884 | 10,594 | 4,309 | 8,996 | |||||||||||||

| Net Income (loss) | (14,023) | (5,746) | (26,664) | (112,361) | |||||||||||||

| Noncontrolling interest in consolidated joint ventures | 495 | 504 | 1,924 | 2,319 | |||||||||||||

| Noncontrolling interests in Operating Partnership of loss (income) from continuing operations | 1,238 | 1,389 | 2,531 | 11,174 | |||||||||||||

| Noncontrolling interests in Operating Partnership in discontinued operations | (76) | (913) | (371) | (779) | |||||||||||||

| Redeemable noncontrolling interests | (81) | (285) | (540) | (7,618) | |||||||||||||

| Net income (loss) available to common shareholders | $(12,447) | $(5,051) | $(23,120) | $(107,265) | |||||||||||||

| Basic earnings per common share: | |||||||||||||||||

| Net income (loss) available to common shareholders | $(0.13) | $(0.06) | $(0.25) | $(1.22) | |||||||||||||

| Diluted earnings per common share: | |||||||||||||||||

| Net income (loss) available to common shareholders | $(0.13) | $(0.06) | $(0.25) | $(1.22) | |||||||||||||

| Basic weighted average shares outstanding | 92,934 | 92,240 | 92,695 | 91,883 | |||||||||||||

Diluted weighted average shares outstanding(1) | 101,611 | 100,936 | 101,381 | 100,812 | |||||||||||||

| Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| Net loss available to common shareholders | $ | (12,447) | $ | (5,051) | $ | (23,120) | $ | (107,265) | |||||||||

| Add/(Deduct): | |||||||||||||||||

| Noncontrolling interests in Operating Partnership | (1,238) | (1,389) | (2,531) | (11,174) | |||||||||||||

| Noncontrolling interests in discontinued operations | 76 | 913 | 371 | 779 | |||||||||||||

Real estate-related depreciation and amortization on continuing operations(2) | 23,617 | 23,609 | 92,164 | 95,695 | |||||||||||||

| Real estate-related depreciation and amortization on discontinued operations | (33) | 1,819 | 635 | 12,689 | |||||||||||||

| Property impairments on discontinued operations | — | 32,516 | — | 32,516 | |||||||||||||

| Continuing operations: (Gain) loss on sale from unconsolidated joint ventures | 154 | — | (6,946) | — | |||||||||||||

| Continuing operations: Realized (gains) losses and unrealized (gains) losses on disposition of rental property, net | — | 3 | — | — | |||||||||||||

| Discontinued operations: Realized (gains) losses and unrealized (gains) losses on disposition of rental property, net | — | (4,700) | (1,548) | (2,411) | |||||||||||||

FFO(3) | $ | 10,129 | $ | 47,720 | $ | 59,025 | $ | 20,829 | |||||||||

| Add/(Deduct): | |||||||||||||||||

| (Gain) loss from extinguishment of debt, net | — | 1,903 | 777 | 5,618 | |||||||||||||

| Land and other impairments | — | 5,928 | 2,619 | 9,324 | |||||||||||||

| (Gain) loss on disposition of developable land | (1,899) | (46,361) | (13,414) | (46,339) | |||||||||||||

Rebranding and Severance/Compensation related costs (G&A)(4) | 32 | 129 | 2,111 | 7,987 | |||||||||||||

Rebranding and Severance/Compensation related costs (Property Management)(5) | 766 | 829 | 3,156 | 1,128 | |||||||||||||

| Severance/Compensation related costs (Operating Expenses) | — | — | — | 649 | |||||||||||||

| Rockpoint buyout premium | — | — | — | 34,775 | |||||||||||||

| Redemption value adjustments to mandatorily redeemable noncontrolling interests | — | — | — | 7,641 | |||||||||||||

Amortization of derivative premium(6) | 1,461 | 902 | 4,554 | 4,654 | |||||||||||||

| Derivative mark to market adjustment | 186 | — | 202 | — | |||||||||||||

| Transaction related costs | 578 | 576 | 1,984 | 7,627 | |||||||||||||

| Core FFO | $ | 11,253 | $ | 11,626 | $ | 61,014 | $ | 53,893 | |||||||||

| Add/(Deduct): | |||||||||||||||||

Straight-line rent adjustments(7) | (107) | 81 | (790) | 502 | |||||||||||||

| Amortization of market lease intangibles, net | (5) | — | (30) | (80) | |||||||||||||

| Amortization of lease inducements | — | 5 | 7 | 57 | |||||||||||||

| Amortization of stock compensation | 3,013 | 3,270 | 12,992 | 12,995 | |||||||||||||

| Non-real estate depreciation and amortization | 169 | 216 | 763 | 1,028 | |||||||||||||

| Amortization of deferred financing costs | 1,639 | 1,255 | 6,125 | 4,440 | |||||||||||||

| Add/(Deduct): | |||||||||||||||||

| Non-incremental revenue generating capital expenditures: | |||||||||||||||||

| Building improvements | (2,784) | (1,670) | (7,674) | (8,348) | |||||||||||||

Tenant improvements and leasing commissions(8) | (94) | (888) | (236) | (1,994) | |||||||||||||

Core AFFO(3) | $ | 13,084 | $ | 13,895 | $ | 72,171 | $ | 62,493 | |||||||||

| Funds from Operations per share/unit-diluted | $0.10 | $0.47 | $0.58 | $0.21 | |||||||||||||

| Core Funds from Operations per share/unit-diluted | $0.11 | $0.12 | $0.60 | $0.53 | |||||||||||||

| Core Adjusted Funds from Operations per share/unit-diluted | $0.13 | $0.14 | $0.71 | $0.62 | |||||||||||||

| Dividends declared per common share | $0.08 | $0.0525 | $0.2625 | $0.1025 | |||||||||||||

| Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| Core FFO (calculated on a previous page) | $ | 11,253 | $ | 11,626 | $ | 61,014 | $ | 53,893 | |||||||||

| Deduct: | |||||||||||||||||

| Equity in (earnings) loss of unconsolidated joint ventures | (1,015) | (260) | (4,196) | (3,102) | |||||||||||||

| Equity in earnings share of depreciation and amortization | (2,605) | (2,597) | (10,154) | (10,337) | |||||||||||||

| Add: | |||||||||||||||||

| Interest expense | 23,294 | 21,933 | 87,977 | 90,177 | |||||||||||||

| Amortization of derivative premium | (1,461) | (902) | (4,554) | (4,654) | |||||||||||||

| Derivative mark to market adjustment | (186) | — | (202) | — | |||||||||||||

| Recurring joint venture distributions | 3,641 | 2,718 | 11,893 | 11,700 | |||||||||||||

| Noncontrolling interests in consolidated joint ventures1 | (495) | (504) | (1,924) | (2,319) | |||||||||||||

| Interest cost for mandatorily redeemable noncontrolling interests | — | — | — | 7,366 | |||||||||||||

| Redeemable noncontrolling interests | 81 | 285 | 540 | 7,618 | |||||||||||||

| Income tax expense | 3 | 199 | 300 | 492 | |||||||||||||

| Adjusted EBITDA | $ | 32,510 | $ | 32,498 | $ | 140,694 | $ | 150,834 | |||||||||

| Real Estate Portfolio | Other Assets | ||||||||||||||||

| Operating Multifamily NOI1 | Total | At Share | Cash and Cash Equivalents2 | $6,493 | |||||||||||||

| New Jersey Waterfront | $169,888 | $145,446 | Restricted Cash | 17,059 | |||||||||||||

| Massachusetts | 26,100 | 26,100 | Other Assets | 52,104 | |||||||||||||

| Other | 31,832 | 24,132 | Subtotal Other Assets | $75,656 | |||||||||||||

| Total Multifamily NOI | $227,820 | $195,678 | |||||||||||||||

| Commercial NOI3 | 1,980 | 1,159 | Liabilities and Other Considerations | ||||||||||||||

Add Back: Non-recurring NOI Impact4 | 1,368 | 1,368 | |||||||||||||||

| Total NOI | $231,168 | $198,205 | Operating - Consolidated Debt at Share | $1,261,196 | |||||||||||||

| Operating - Unconsolidated Debt at Share | 293,450 | ||||||||||||||||

| Non-Strategic Assets | Other Liabilities | 68,051 | |||||||||||||||

| Revolving Credit Facility5 | 145,000 | ||||||||||||||||

| Estimated Value of Remaining Land | $134,819 | Term Loan | 200,000 | ||||||||||||||

| Estimated Value of Land Under Binding Contract for Sale | 45,250 | Preferred Units | 9,294 | ||||||||||||||

| Total Non-Strategic Assets6 | $180,069 | Subtotal Liabilities and Other Considerations | $1,976,991 | ||||||||||||||

| Outstanding Shares7 | |||||||||||||||||

| Diluted Weighted Average Shares Outstanding for 4Q 2024 (in 000s) | 102,587 | ||||||||||||||||

| Operating Highlights | |||||||||||||||||||||||||||||

Percentage Occupied | Average Revenue per Home | NOI | Debt Balance | ||||||||||||||||||||||||||

| Ownership | Apartments | 4Q 2024 | 3Q 2024 | 4Q 2024 | 3Q 2024 | 4Q 2024 | 3Q 2024 | ||||||||||||||||||||||

| NJ Waterfront | |||||||||||||||||||||||||||||

| Haus25 | 100.0% | 750 | 95.3% | 95.8% | $4,986 | $4,950 | $7,803 | $7,931 | $343,061 | ||||||||||||||||||||

| Liberty Towers* | 100.0% | 648 | 85.6% | 91.7% | 4,319 | 4,237 | 4,543 | 5,506 | — | ||||||||||||||||||||

| BLVD 401 | 74.3% | 311 | 95.7% | 94.7% | 4,309 | 4,304 | 2,428 | 2,592 | 115,515 | ||||||||||||||||||||

| BLVD 425 | 74.3% | 412 | 95.6% | 95.2% | 4,175 | 4,147 | 3,246 | 3,413 | 131,000 | ||||||||||||||||||||

| BLVD 475 | 100.0% | 523 | 94.4% | 96.8% | 4,201 | 4,241 | 4,100 | 4,319 | 164,712 | ||||||||||||||||||||

| Soho Lofts* | 100.0% | 377 | 94.7% | 95.6% | 4,860 | 4,832 | 3,258 | 3,375 | — | ||||||||||||||||||||

| Urby Harborside | 85.0% | 762 | 94.4% | 96.5% | 4,322 | 4,094 | 6,455 | 5,866 | 182,604 | ||||||||||||||||||||

| RiverHouse 9 at Port Imperial | 100.0% | 313 | 95.4% | 96.2% | 4,516 | 4,392 | 2,674 | 2,661 | 110,000 | ||||||||||||||||||||

| RiverHouse 11 at Port Imperial | 100.0% | 295 | 96.3% | 96.3% | 4,405 | 4,363 | 2,479 | 2,500 | 100,000 | ||||||||||||||||||||

| RiverTrace | 22.5% | 316 | 94.4% | 95.3% | 3,851 | 3,829 | 2,243 | 2,113 | 82,000 | ||||||||||||||||||||

| Capstone | 40.0% | 360 | 95.1% | 94.4% | 4,590 | 4,471 | 3,243 | 3,154 | 135,000 | ||||||||||||||||||||

| NJ Waterfront Subtotal | 85.0% | 5,067 | 93.8% | 95.3% | $4,441 | $4,371 | $42,472 | $43,430 | $1,363,892 | ||||||||||||||||||||

| Massachusetts | |||||||||||||||||||||||||||||

| Portside at East Pier | 100.0% | 180 | 95.2% | 95.9% | $3,265 | $3,269 | $1,207 | $1,245 | $56,500 | ||||||||||||||||||||

| Portside 2 at East Pier | 100.0% | 296 | 93.9% | 94.8% | 3,425 | 3,446 | 2,070 | 2,108 | 95,427 | ||||||||||||||||||||

| 145 Front at City Square* | 100.0% | 365 | 94.0% | 95.1% | 2,524 | 2,475 | 1,549 | 1,467 | — | ||||||||||||||||||||

| The Emery at Overlook Ridge | 100.0% | 326 | 92.9% | 94.0% | 2,865 | 2,840 | 1,699 | 1,688 | 70,653 | ||||||||||||||||||||

| Massachusetts Subtotal | 100.0% | 1,167 | 93.9% | 94.8% | $2,962 | $2,946 | $6,525 | $6,508 | $222,580 | ||||||||||||||||||||

| Other | |||||||||||||||||||||||||||||

| The Upton | 100.0% | 193 | 91.4% | 88.8% | $4,411 | $4,525 | $1,238 | $1,392 | $75,000 | ||||||||||||||||||||

| The James* | 100.0% | 240 | 95.8% | 93.8% | 3,168 | 3,148 | 1,447 | 1,535 | — | ||||||||||||||||||||

| Signature Place* | 100.0% | 197 | 96.5% | 96.1% | 3,312 | 3,201 | 1,050 | 1,022 | — | ||||||||||||||||||||

| Quarry Place at Tuckahoe | 100.0% | 108 | 95.8% | 98.1% | 4,368 | 4,293 | 821 | 723 | 41,000 | ||||||||||||||||||||

| Riverpark at Harrison | 45.0% | 141 | 95.7% | 97.2% | 2,995 | 2,823 | 626 | 570 | 30,192 | ||||||||||||||||||||

| Metropolitan at 40 Park | 25.0% | 130 | 93.7% | 95.6% | 3,741 | 3,722 | 771 | 731 | 34,100 | ||||||||||||||||||||

| Station House | 50.0% | 378 | 91.8% | 94.7% | 2,989 | 3,017 | 2,005 | 1,705 | 87,350 | ||||||||||||||||||||

| Other Subtotal | 73.8% | 1,387 | 94.0% | 94.5% | $3,442 | $3,421 | $7,958 | $7,678 | $267,642 | ||||||||||||||||||||

Operating Portfolio1,2 | 85.2% | 7,621 | 93.9% | 95.1% | $4,033 | $3,980 | $56,955 | $57,616 | $1,854,114 | ||||||||||||||||||||

| Commercial | Location | Ownership | Rentable SF1 | Percentage Leased 4Q 2024 | Percentage Leased 3Q 2024 | NOI 4Q 2024 | NOI 3Q 2024 | Debt Balance | ||||||||||||||||||

| Port Imperial South - Garage | Weehawken, NJ | 70.0% | Fn 1 | N/A | N/A | $537 | $590 | $31,098 | ||||||||||||||||||

| Port Imperial South - Retail | Weehawken, NJ | 70.0% | 18,064 | 92.0% | 92.0% | 147 | 115 | — | ||||||||||||||||||

| Port Imperial North - Garage | Weehawken, NJ | 70.0% | Fn 1 | N/A | N/A | 25 | 12 | — | ||||||||||||||||||

| Port Imperial North - Retail | Weehawken, NJ | 100.0% | 8,400 | 100.0% | 100.0% | (275) | 46 | — | ||||||||||||||||||

| Riverwalk at Port Imperial | West New York, NJ | 100.0% | 29,923 | 80.0% | 80.0% | 61 | 164 | — | ||||||||||||||||||

| Commercial Total | 85.1% | 56,387 | 86.8% | 86.8% | $495 | $927 | $31,098 | |||||||||||||||||||

| Shops at 40 Park2 | Morristown, NJ | 25.0% | 50,973 | 69.0% | 69.0% | 68 | (46) | — | ||||||||||||||||||

| Commercial Total with Shops at 40 Park | 80.9% | 107,360 | 78.4% | 78.4% | $563 | $881 | $31,098 | |||||||||||||||||||

| Developable Land Parcel Units3 | ||||||||

| Total Units | VRE Share | |||||||

| NJ Waterfront | 2,351 | 1,565 | ||||||

| Massachusetts | 849 | 849 | ||||||

| Other | 939 | 939 | ||||||

| Developable Land Parcel Units Total at December 31, 2024 | 4,139 | 3,353 | ||||||

| Less: One land parcel rezoned from hotel to retail use | 112 | 112 | ||||||

| Less: 65 Livingston sold in January 2025 | 252 | 252 | ||||||

| Less: Two land parcels under binding contract for sale | 527 | 527 | ||||||

| Developable Land Parcel Units Remaining4 | 3,248 | 2,462 | ||||||

| NOI at Share | Occupancy | Blended Lease Rate2 | ||||||||||||||||||||||||||||||

| Apartments | 4Q 2024 | 3Q 2024 | Change | 4Q 2024 | 3Q 2024 | Change | 4Q 2024 | 3Q 2024 | Change | |||||||||||||||||||||||

| New Jersey Waterfront | 5,067 | $37,733 | $38,836 | (2.8)% | 93.8% | 95.3% | (1.5)% | 1.2% | 6.6% | (5.4)% | ||||||||||||||||||||||

| Massachusetts | 1,167 | 6,787 | 6,765 | 0.3% | 93.9% | 94.8% | (0.9)% | —% | 0.7% | (0.7)% | ||||||||||||||||||||||

| Other3 | 1,387 | 6,299 | 6,226 | 1.2% | 94.0% | 94.5% | (0.5)% | (1.7)% | 0.5% | (2.2)% | ||||||||||||||||||||||

| Total | 7,621 | $50,819 | $51,827 | (1.9)% | 93.9% | 95.1% | (1.2)% | 0.5% | 4.6% | (4.1)% | ||||||||||||||||||||||

| NOI at Share | Occupancy | Blended Lease Rate2 | ||||||||||||||||||||||||||||||

| Apartments | 4Q 2024 | 4Q 2023 | Change | 4Q 2024 | 4Q 2023 | Change | 4Q 2024 | 4Q 2023 | Change | |||||||||||||||||||||||

| New Jersey Waterfront | 5,067 | $37,733 | $34,756 | 8.6% | 93.8% | 94.6% | (0.8)% | 1.2% | 7.8% | (6.6)% | ||||||||||||||||||||||

| Massachusetts | 1,167 | 6,787 | 6,570 | 3.3% | 93.9% | 93.9% | —% | —% | 0.5% | (0.5)% | ||||||||||||||||||||||

Other3 | 1,387 | 6,299 | 6,017 | 4.7% | 94.0% | 94.0% | —% | (1.7)% | 5.0% | (6.7)% | ||||||||||||||||||||||

| Total | 7,621 | $50,819 | $47,343 | 7.3% | 93.9% | 94.4% | (0.5)% | 0.5% | 6.2% | (5.7)% | ||||||||||||||||||||||

| Apartments | 4Q 2024 | 3Q 2024 | 2Q 2024 | 1Q 2024 | 4Q 2023 | |||||||||||||||

| New Jersey Waterfront | 5,067 | $4,441 | $4,371 | $4,291 | $4,274 | $4,219 | ||||||||||||||

| Massachusetts | 1,167 | 2,962 | 2,946 | 2,931 | 2,893 | 2,925 | ||||||||||||||

Other3 | 1,387 | 3,442 | 3,421 | 3,411 | 3,374 | 3,307 | ||||||||||||||

| Total | 7,621 | $4,033 | $3,980 | $3,923 | $3,899 | $3,855 | ||||||||||||||

| Multifamily Same Store1 | ||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended December 31, | Twelve Months Ended December 31, | Sequential | ||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | Change | % | 2024 | 2023 | Change | % | 4Q24 | 3Q24 | Change | % | |||||||||||||||||||||||||||||||||

| Apartment Rental Income | $69,149 | $66,603 | $2,546 | 3.8% | $272,198 | $258,816 | $13,382 | 5.2% | $69,149 | $68,862 | $287 | 0.4% | ||||||||||||||||||||||||||||||||

| Parking/Other Income | 7,226 | 6,768 | 458 | 6.8% | 28,481 | 26,431 | 2,050 | 7.8% | 7,226 | 6,930 | 296 | 4.3% | ||||||||||||||||||||||||||||||||

| Total Property Revenues2 | $76,375 | $73,371 | $3,004 | 4.1% | $300,679 | $285,247 | $15,432 | 5.4% | $76,375 | $75,792 | $583 | 0.8% | ||||||||||||||||||||||||||||||||

| Marketing & Administration | 2,618 | 2,559 | 59 | 2.3% | 9,733 | 9,741 | (8) | (0.1)% | 2,618 | 2,444 | 174 | 7.1% | ||||||||||||||||||||||||||||||||

| Utilities | 2,278 | 2,181 | 97 | 4.4% | 9,521 | 9,057 | 464 | 5.1% | 2,278 | 2,491 | (213) | (8.6)% | ||||||||||||||||||||||||||||||||

| Payroll | 4,525 | 4,666 | (141) | (3.0)% | 17,531 | 17,956 | (425) | (2.4)% | 4,525 | 4,398 | 127 | 2.9% | ||||||||||||||||||||||||||||||||

| Repairs & Maintenance | 4,486 | 4,423 | 63 | 1.4% | 16,564 | 15,436 | 1,128 | 7.3% | 4,486 | 4,095 | 391 | 9.5% | ||||||||||||||||||||||||||||||||

| Controllable Expenses | $13,907 | $13,829 | $78 | 0.6% | $53,349 | $52,190 | $1,159 | 2.2% | $13,907 | $13,428 | $479 | 3.6% | ||||||||||||||||||||||||||||||||

| Other Fixed Fees | 719 | 728 | (9) | (1.2)% | 2,879 | 2,918 | (39) | (1.3)% | 719 | 745 | (26) | (3.5)% | ||||||||||||||||||||||||||||||||

| Insurance | 1,388 | 1,743 | (355) | (20.4)% | 5,649 | 6,464 | (815) | (12.6)% | 1,388 | 702 | 686 | 97.7% | ||||||||||||||||||||||||||||||||

| Real Estate Taxes | 9,542 | 9,728 | (186) | (1.9)% | 38,061 | 35,881 | 2,180 | 6.1% | 9,542 | 9,090 | 452 | 5.0% | ||||||||||||||||||||||||||||||||

| Non-Controllable Expenses | $11,649 | $12,199 | $(550) | (4.5)% | $46,589 | $45,263 | $1,326 | 2.9% | $11,649 | $10,537 | $1,112 | 10.6% | ||||||||||||||||||||||||||||||||

| Total Property Expenses | $25,556 | $26,028 | $(472) | (1.8)% | $99,938 | $97,453 | $2,485 | 2.5% | $25,556 | $23,965 | $1,591 | 6.6% | ||||||||||||||||||||||||||||||||

| Same Store GAAP NOI | $50,819 | $47,343 | $3,476 | 7.3% | $200,741 | $187,794 | $12,947 | 6.9% | $50,819 | $51,827 | $(1,008) | (1.9)% | ||||||||||||||||||||||||||||||||

| Real Estate Tax Adjustments3 | — | — | — | — | 1,689 | (1,689) | — | — | — | |||||||||||||||||||||||||||||||||||

| Normalized Same Store NOI | $50,819 | $47,343 | $3,476 | 7.3% | $200,741 | $186,105 | $14,636 | 7.9% | $50,819 | $51,827 | $(1,008) | (1.9)% | ||||||||||||||||||||||||||||||||

| Normalized SS NOI Margin | 66.5% | 64.5% | 2.0% | 66.8% | 65.2% | 1.6% | 66.5% | 68.4% | (1.9)% | |||||||||||||||||||||||||||||||||||

| Total Units | 7,621 | 7,621 | 7,621 | 7,621 | 7,621 | 7,621 | ||||||||||||||||||||||||||||||||||||||

| % Ownership | 85.2% | 85.2% | 85.2% | 85.2% | 85.2% | 85.2% | ||||||||||||||||||||||||||||||||||||||

| % Occupied | 93.9% | 94.4% | (0.5)% | 93.9% | 94.4% | (0.5)% | 93.9% | 95.1% | (1.2)% | |||||||||||||||||||||||||||||||||||

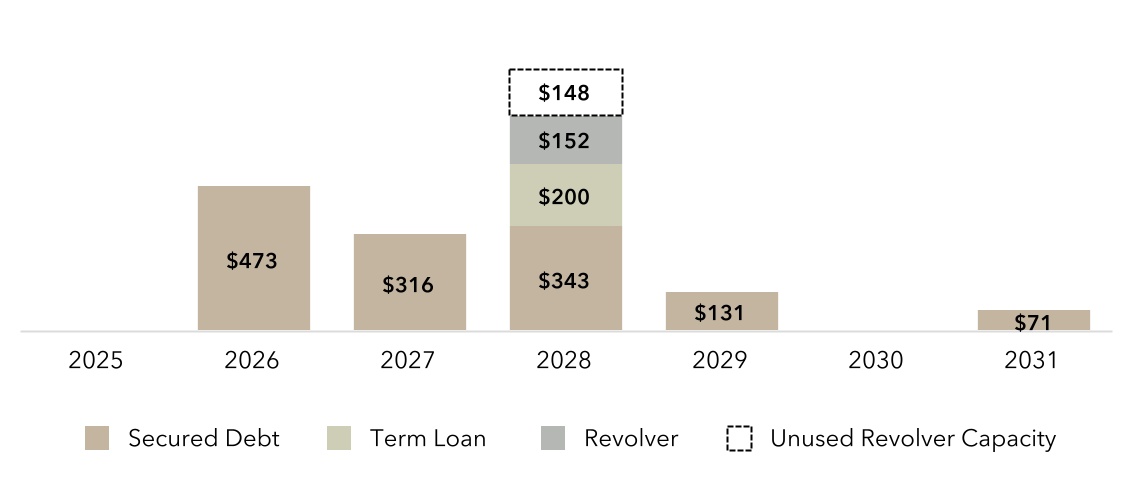

| Lender | Effective Interest Rate(1) | December 31, 2024 | December 31, 2023 | Date of Maturity | |||||||||||||

| Permanent Loans Repaid in 2024 | |||||||||||||||||

Soho Lofts(2) | Flagstar Bank | 3.77% | — | 158,777 | 07/01/29 | ||||||||||||

145 Front at City Square(3) | US Bank | SOFR+1.84% | — | 63,000 | 12/10/26 | ||||||||||||

Signature Place(4) | Nationwide Life Insurance Company | 3.74% | — | 43,000 | 08/01/24 | ||||||||||||

Liberty Towers(5) | American General Life Insurance Company | 3.37% | — | 265,000 | 10/01/24 | ||||||||||||

| Permanent Loans Repaid in 2024 | $— | $529,777 | |||||||||||||||

| Secured Permanent Loans | |||||||||||||||||

| Portside 2 at East Pier | New York Life Insurance Co. | 4.56% | 95,427 | 97,000 | 03/10/26 | ||||||||||||

| BLVD 425 | New York Life Insurance Co. | 4.17% | 131,000 | 131,000 | 08/10/26 | ||||||||||||

| BLVD 401 | New York Life Insurance Co. | 4.29% | 115,515 | 117,000 | 08/10/26 | ||||||||||||

Portside at East Pier(6) | KKR | SOFR + 2.75% | 56,500 | 56,500 | 09/07/26 | ||||||||||||

The Upton(7) | Bank of New York Mellon | SOFR + 1.58% | 75,000 | 75,000 | 10/27/26 | ||||||||||||

RiverHouse 9 at Port Imperial(8) | JP Morgan | SOFR + 1.41% | 110,000 | 110,000 | 06/21/27 | ||||||||||||

| Quarry Place at Tuckahoe | Natixis Real Estate Capital, LLC | 4.48% | 41,000 | 41,000 | 08/05/27 | ||||||||||||

| BLVD 475 | The Northwestern Mutual Life Insurance Co. | 2.91% | 164,712 | 165,000 | 11/10/27 | ||||||||||||

| Haus25 | Freddie Mac | 6.04% | 343,061 | 343,061 | 09/01/28 | ||||||||||||

| RiverHouse 11 at Port Imperial | The Northwestern Mutual Life Insurance Co. | 4.52% | 100,000 | 100,000 | 01/10/29 | ||||||||||||

| Port Imperial Garage South | American General Life & A/G PC | 4.85% | 31,098 | 31,645 | 12/01/29 | ||||||||||||

The Emery at Overlook Ridge(9) | Flagstar Bank | 3.21% | 70,653 | 72,000 | 01/01/31 | ||||||||||||

| Secured Permanent Loans Outstanding | $1,333,966 | $1,339,206 | |||||||||||||||

| Secured and/or Repaid Permanent Loans | $1,333,966 | $1,868,983 | |||||||||||||||

| Unamortized Deferred Financing Costs | (10,492) | (15,086) | |||||||||||||||

| Secured Permanent Loans | $1,323,474 | $1,853,897 | |||||||||||||||

| Secured RCF & Term Loans: | |||||||||||||||||

Revolving Credit Facility(10) | Various Lenders | SOFR + 2.72% | $152,000 | $— | 04/22/27 | ||||||||||||

Term Loan(10) | Various Lenders | SOFR + 2.73% | 200,000 | — | 04/22/27 | ||||||||||||

| RCF & Term Loan Balances | $352,000 | $— | |||||||||||||||

| Unamortized Deferred Financing Costs | (3,161) | — | |||||||||||||||

| Total RCF & Term Loan Debt | $348,839 | $— | |||||||||||||||

| Total Debt | $1,672,313 | $1,853,897 | |||||||||||||||

| Balance | % of Total | Weighted Average Interest Rate | Weighted Average Maturity in Years | |||||||||||

| Fixed Rate & Hedged Debt | ||||||||||||||

| Fixed Rate & Hedged Secured Debt | $1,683,966 | 99.9% | 5.05% | 2.76 | ||||||||||

| Variable Rate Debt | ||||||||||||||

| Variable Rate Debt1 | 2,000 | 0.1% | 7.08% | 2.31 | ||||||||||

| Totals / Weighted Average | $1,685,966 | 100.0% | 5.05% | 2.76 | ||||||||||

| Unamortized Deferred Financing Costs | (13,654) | |||||||||||||

| Total Consolidated Debt, net | $1,672,312 | |||||||||||||

| Partners’ Share | (72,770) | |||||||||||||

| VRE Share of Total Consolidated Debt, net2 | $1,599,542 | |||||||||||||

| Unconsolidated Secured Debt | ||||||||||||||

| VRE Share | $293,450 | 53.2% | 4.72% | 4.00 | ||||||||||

| Partners’ Share | 257,796 | 46.8% | 4.72% | 4.00 | ||||||||||

| Total Unconsolidated Secured Debt | $551,246 | 100.0% | 4.72% | 4.00 | ||||||||||

| Pro Rata Debt Portfolio | ||||||||||||||

| Fixed Rate & Hedged Secured Debt | $1,899,646 | 100.0% | 4.95% | 3.10 | ||||||||||

| Variable Rate Secured Debt | — | —% | —% | — | ||||||||||

| Total Pro Rata Debt Portfolio | $1,899,646 | 100.0% | 4.95% | 3.10 | ||||||||||

| Pro Forma | |||||

| Total Consolidated Debt, net on 12/31/24 | 1,685,966 | ||||

| Partners' Share | (72,770) | ||||

| VRE Share of Total Consolidated Debt, net as of 12/31/24 | 1,613,196 | ||||

| Repayment of outstanding Revolver borrowings from sale of 65 Livingston in January 2025 | (7,000) | ||||

| VRE Share of Total Consolidated Debt, net on 2/20/25 | 1,606,196 | ||||

| VRE Share of Total Unconsolidated Debt, net on 12/31/24 | 293,450 | ||||

| Total Pro Rata Debt Portfolio | 1,899,646 | ||||

| $ in thousands except per SF | |||||||||||||||||

| Location | Transaction Date | Number of Buildings | SF | Gross Asset Value | |||||||||||||

| 2024 Dispositions | |||||||||||||||||

| Land | |||||||||||||||||

| 2 Campus Drive | Parsippany-Troy Hills, NJ | 1/3/2024 | N/A | N/A | $9,700 | ||||||||||||

| 107 Morgan | Jersey City, NJ | 4/16/2024 | N/A | N/A | 54,000 | ||||||||||||

| 6 Becker/85 Livingston | Roseland, NJ | 4/30/2024 | N/A | N/A | 27,900 | ||||||||||||

| Subtotal Land | $91,600 | ||||||||||||||||

| Multifamily | |||||||||||||||||

| Metropolitan Lofts1 | Morristown, NJ | 1/12/2024 | 1 | 54,683 | $30,300 | ||||||||||||

| Subtotal Multifamily | 1 | 54,683 | $30,300 | ||||||||||||||

| Office | |||||||||||||||||

| Harborside 5 | Jersey City, NJ | 3/20/2024 | 1 | 977,225 | $85,000 | ||||||||||||

| Subtotal Office | 1 | 977,225 | $85,000 | ||||||||||||||

| Retail | |||||||||||||||||

| Shops at 40 Park2 | Morristown, NJ | 10/22/2024 | 1 | 50,973 | $15,700 | ||||||||||||

| Subtotal Retail | 1 | 50,973 | $15,700 | ||||||||||||||

| 2024 Dispositions Total | $222,600 | ||||||||||||||||

| 2025 Dispositions-to-Date | |||||||||||||||||

| Land | |||||||||||||||||

| 65 Livingston | Roseland, NJ | 1/24/2025 | N/A | N/A | $7,300 | ||||||||||||

| 2025 Dispositions-to-Date | $7,300 | ||||||||||||||||

| Under Binding Contract | |||||||||||||||||

| Wall Land | Wall Township, NJ | N/A | N/A | ||||||||||||||

| 1 Water Street | White Plains, NY | N/A | N/A | ||||||||||||||

| 4Q 2024 | 3Q 2024 | ||||||||||

| Total | Total | ||||||||||

| Net Income (loss) | $ | (14,023) | $ | (10,907) | |||||||

| Deduct: | |||||||||||

| Loss (income) from discontinued operations | 1,015 | (206) | |||||||||

| Realized gains (losses) and unrealized gains (losses) on disposition of rental property and impairments, net | (1,899) | — | |||||||||

| Management fees | (751) | (794) | |||||||||

| Interest and other investment income | (111) | (181) | |||||||||

| Equity in (earnings) loss of unconsolidated joint ventures | (1,015) | 268 | |||||||||

| (Gain) loss from extinguishment of debt, net | — | (8) | |||||||||

| (Gain) loss on sale of unconsolidated joint venture interests | 154 | — | |||||||||

| Other (income) expense, net | 396 | 310 | |||||||||

| Add: | |||||||||||

| Property management | 3,877 | 3,762 | |||||||||

| General and administrative | 10,040 | 8,956 | |||||||||

| Transaction-related costs | 159 | — | |||||||||

| Depreciation and amortization | 21,182 | 21,159 | |||||||||

| Interest expense | 23,293 | 21,507 | |||||||||

| Provision for income taxes | 2 | 39 | |||||||||

| Land and other impairments, net | — | 2,619 | |||||||||

| Net operating income (NOI) | $ | 42,319 | $ | 46,524 | |||||||

| Summary of Consolidated Multifamily NOI by Type (unaudited): | 4Q 2024 | 3Q 2024 | |||||||||

| Total Consolidated Multifamily - Operating Portfolio | $ | 41,612 | $ | 43,477 | |||||||

| Total Consolidated Commercial | 495 | 927 | |||||||||

| Total NOI from Consolidated Properties (excl. unconsolidated JVs/subordinated interests) | $ | 42,107 | $ | 44,404 | |||||||

| NOI (loss) from services, land/development/repurposing & other assets | 398 | 427 | |||||||||

| Total Consolidated Multifamily NOI | $ | 42,505 | $ | 44,831 | |||||||

| Property | Units | Percentage Occupied | VRE's Nominal Ownership1 | 4Q 2024 NOI2 | Total Debt | VRE Share of 4Q NOI | VRE Share of Debt | ||||||||||||||||

| Multifamily | |||||||||||||||||||||||

| Urby Harborside | 762 | 94.4% | 85.0% | $6,455 | $182,604 | $5,487 | $155,213 | ||||||||||||||||

| RiverTrace at Port Imperial | 316 | 94.4% | 22.5% | 2,243 | 82,000 | 505 | 18,450 | ||||||||||||||||

| Capstone at Port Imperial | 360 | 95.1% | 40.0% | 3,243 | 135,000 | 1,297 | 54,000 | ||||||||||||||||

| Riverpark at Harrison | 141 | 95.7% | 45.0% | 626 | 30,192 | 282 | 13,586 | ||||||||||||||||

| Metropolitan at 40 Park | 130 | 93.7% | 25.0% | 771 | 34,100 | 193 | 8,525 | ||||||||||||||||

| Station House | 378 | 91.8% | 50.0% | 2,005 | 87,350 | 1,003 | 43,675 | ||||||||||||||||

| Total Multifamily | 2,087 | 94.1% | 55.0% | $15,343 | $551,246 | $8,766 | $293,450 | ||||||||||||||||

| Total UJV | 2,087 | 94.1% | 55.0% | $15,343 | $551,246 | $8,766 | $293,450 | ||||||||||||||||

| Retail Sold in 4Q | |||||||||||||||||||||||

| Shops at 40 Park3 | N/A | 69.0% | 25.0% | 68 | — | 17 | — | ||||||||||||||||

| Total Retail Sold in 4Q | N/A | 69.0% | 25.0% | $68 | $— | $17 | $— | ||||||||||||||||

| Balance as of December 31, 2024 | Initial Spread | Deferred Financing Costs | 5 bps reduction KPI | Updated Spread | SOFR or SOFR Cap | All In Rate | |||||||||||||||||

| Secured Revolving Credit Facility (Unhedged) | $2,000,000 | 2.10% | 0.67% | (0.05)% | 2.72% | 4.36% | 7.08% | ||||||||||||||||

| Secured Revolving Credit Facility | $150,000,000 | 2.10% | 0.67% | (0.05)% | 2.72% | 3.50% | 6.22% | ||||||||||||||||

| Secured Term Loan | $200,000,000 | 2.10% | 0.68% | (0.05)% | 2.73% | 3.50% | 6.23% | ||||||||||||||||

| Location | Ownership | Apartments | Rentable SF1 | Average Size | Year Complete | |||||||||||||||

| NJ Waterfront | ||||||||||||||||||||

| Haus25 | Jersey City, NJ | 100.0% | 750 | 617,787 | 824 | 2022 | ||||||||||||||

| Liberty Towers | Jersey City, NJ | 100.0% | 648 | 602,210 | 929 | 2003 | ||||||||||||||

| BLVD 401 | Jersey City, NJ | 74.3% | 311 | 273,132 | 878 | 2016 | ||||||||||||||

| BLVD 425 | Jersey City, NJ | 74.3% | 412 | 369,515 | 897 | 2003 | ||||||||||||||

| BLVD 475 | Jersey City, NJ | 100.0% | 523 | 475,459 | 909 | 2011 | ||||||||||||||

| Soho Lofts | Jersey City, NJ | 100.0% | 377 | 449,067 | 1,191 | 2017 | ||||||||||||||

| Urby Harborside | Jersey City, NJ | 85.0% | 762 | 474,476 | 623 | 2017 | ||||||||||||||

| RiverHouse 9 at Port Imperial | Weehawken, NJ | 100.0% | 313 | 245,127 | 783 | 2021 | ||||||||||||||

| RiverHouse 11 at Port Imperial | Weehawken, NJ | 100.0% | 295 | 250,591 | 849 | 2018 | ||||||||||||||

| RiverTrace | West New York, NJ | 22.5% | 316 | 295,767 | 936 | 2014 | ||||||||||||||

| Capstone | West New York, NJ | 40.0% | 360 | 337,991 | 939 | 2021 | ||||||||||||||

| NJ Waterfront Subtotal | 85.0% | 5,067 | 4,391,122 | 867 | ||||||||||||||||

| Massachusetts | ||||||||||||||||||||

| Portside at East Pier | East Boston, MA | 100.0% | 180 | 154,859 | 862 | 2015 | ||||||||||||||

| Portside 2 at East Pier | East Boston, MA | 100.0% | 296 | 230,614 | 779 | 2018 | ||||||||||||||

| 145 Front at City Square | Worcester, MA | 100.0% | 365 | 304,936 | 835 | 2018 | ||||||||||||||

| The Emery at Overlook Ridge | Revere, MA | 100.0% | 326 | 273,140 | 838 | 2020 | ||||||||||||||

| Massachusetts Subtotal | 100.0% | 1,167 | 963,549 | 826 | ||||||||||||||||

| Other | ||||||||||||||||||||

| The Upton | Short Hills, NJ | 100.0% | 193 | 217,030 | 1,125 | 2021 | ||||||||||||||

| The James | Park Ridge, NJ | 100.0% | 240 | 215,283 | 897 | 2021 | ||||||||||||||

| Signature Place | Morris Plains, NJ | 100.0% | 197 | 203,716 | 1,034 | 2018 | ||||||||||||||

| Quarry Place at Tuckahoe | Eastchester, NY | 100.0% | 108 | 105,551 | 977 | 2016 | ||||||||||||||

| Riverpark at Harrison | Harrison, NJ | 45.0% | 141 | 124,774 | 885 | 2014 | ||||||||||||||

| Metropolitan at 40 Park | Morristown, NJ | 25.0% | 130 | 124,237 | 956 | 2010 | ||||||||||||||

| Station House | Washington, DC | 50.0% | 378 | 290,348 | 768 | 2015 | ||||||||||||||

| Other Subtotal | 73.8% | 1,387 | 1,280,939 | 924 | ||||||||||||||||

Operating Portfolio2 | 85.2% | 7,621 | 6,635,610 | 871 | ||||||||||||||||

| Three Months Ended December 31, | Twelve Months Ended December 31, | ||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| BLVD 425 | $ | 96 | $ | 72 | $ | 423 | $ | 202 | |||||||||

| BLVD 401 | (571) | (568) | (2,258) | (2,487) | |||||||||||||

| Port Imperial Garage South | (2) | (12) | (5) | (52) | |||||||||||||

| Port Imperial Retail South | 18 | 29 | 52 | 113 | |||||||||||||

| Other consolidated joint ventures | (36) | (25) | (136) | (95) | |||||||||||||

| Net losses in noncontrolling interests | $ | (495) | $ | (504) | $ | (1,924) | $ | (2,319) | |||||||||

| Depreciation in noncontrolling interests | 744 | 712 | 2,923 | 2,853 | |||||||||||||

| Funds from operations - noncontrolling interest in consolidated joint ventures | $ | 249 | $ | 208 | $ | 999 | $ | 534 | |||||||||

| Interest expense in noncontrolling interest in consolidated joint ventures | 786 | 789 | 3,146 | 3,163 | |||||||||||||

| Net operating income before debt service in consolidated joint ventures | $ | 1,035 | $ | 997 | $ | 4,145 | $ | 3,697 | |||||||||

| Company Information | ||||||||

| Corporate Headquarters | Stock Exchange Listing | Contact Information | ||||||

| Veris Residential, Inc. | New York Stock Exchange | Veris Residential, Inc. | ||||||

| 210 Hudson St., Suite 400 | Investor Relations Department | |||||||

| Jersey City, New Jersey 07311 | Trading Symbol | 210 Hudson St., Suite 400 | ||||||

| (732) 590-1010 | Common Shares: VRE | Jersey City, New Jersey 07311 | ||||||

| Mackenzie Rice | ||||||||

| Director, Investor Relations | ||||||||

| E-Mail: investors@verisresidential.com | ||||||||

| Web: www.verisresidential.com | ||||||||

| Executive Officers | ||||||||

| Mahbod Nia | Amanda Lombard | Taryn Fielder | ||||||

| Chief Executive Officer | Chief Financial Officer | General Counsel and Secretary | ||||||

| Anna Malhari | Jeff Turkanis | |||||||

| Chief Operating Officer | EVP & Chief Investment Officer | |||||||

| Equity Research Coverage | ||||||||

| Bank of America Merrill Lynch | BTIG, LLC | Citigroup | ||||||

| Josh Dennerlein | Thomas Catherwood | Nicholas Joseph | ||||||

| Evercore ISI | Green Street Advisors | JP Morgan | ||||||

| Steve Sakwa | John Pawlowski | Anthony Paolone | ||||||

| Truist | ||||||||

| Michael R. Lewis | ||||||||