- VRE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Veris Residential (VRE) DEF 14ADefinitive proxy

Filed: 9 Apr 03, 12:00am

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrantý | ||

| Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Under Rule 14a-12 | |

MACK-CALI REALTY CORPORATION | ||||

(Name of Registrant as Specified In Its Charter) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

MACK-CALI REALTY CORPORATION

11 Commerce Drive

Cranford, New Jersey 07016

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

May 13, 2003

To Our Stockholders:

Notice is hereby given that the Annual Meeting of Stockholders (the "Annual Meeting") of Mack-Cali Realty Corporation (the "Company") will be held at the Hyatt Regency Jersey City on the Hudson, Harborside Financial Center, 2 Exchange Place, Jersey City, New Jersey 07302 on May 13, 2003 at 2:00 p.m., local time, for the following purposes:

The enclosed Proxy Statement includes information relating to these proposals. Additional purposes of the Annual Meeting are to receive reports of officers (without taking action thereon) and to transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

All stockholders of record as of the close of business on April 4, 2003 are entitled to notice of and to vote at the Annual Meeting. At least a majority of the outstanding shares of common stock of the Company present in person or by proxy is required for a quorum. You may vote electronically through the Internet or by telephone. The instructions on your proxy card describe how to use these convenient services. Of course, if you prefer, you can vote by mail by completing your proxy card and returning it in the enclosed postage-paid envelope.

| By Order of the Board of Directors, | |||

/s/ ROGER W. THOMAS Roger W. Thomas Secretary | |||

April 9, 2003

Cranford, New Jersey

THE BOARD OF DIRECTORS APPRECIATES AND ENCOURAGES YOUR PARTICIPATION IN THE COMPANY'S ANNUAL MEETING. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED. ACCORDINGLY, PLEASE AUTHORIZE A PROXY TO VOTE YOUR SHARES BY INTERNET, TELEPHONE OR MAIL. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY WITHDRAW YOUR PROXY, IF YOU WISH, AND VOTE IN PERSON. YOUR PROXY IS REVOCABLE IN ACCORDANCE WITH THE PROCEDURES SET FORTH IN THIS PROXY STATEMENT.

MACK-CALI REALTY CORPORATION

11 Commerce Drive

Cranford, New Jersey 07016

PROXY STATEMENT

General Information

This Proxy Statement is furnished to stockholders of Mack-Cali Realty Corporation, a Maryland corporation (the "Company"), in connection with the solicitation by the Board of Directors of the Company (the "Board of Directors") of proxies in the accompanying form for use in voting at the Annual Meeting of Stockholders of the Company (the "Annual Meeting") to be held on Tuesday, May 13, 2003, at 2:00 p.m., local time, at the Hyatt Regency Jersey City on the Hudson, Harborside Financial Center, 2 Exchange Place, Jersey City, New Jersey 07302, and any adjournment or postponement thereof.

This Proxy Statement, the Notice of Annual Meeting of Stockholders and the accompanying proxy card are first being mailed to the Company's stockholders on or about April 9, 2003.

Solicitation and Voting Procedures

Solicitation. The solicitation of proxies will be conducted by mail, and the Company will bear all attendant costs. These costs will include the expense of preparing and mailing proxy materials for the Annual Meeting and reimbursements paid to brokerage firms and others for their expenses incurred in forwarding solicitation material regarding the Annual Meeting to beneficial owners of the Company's common stock, par value $.01 per share (the "Common Stock"). The Company intends to use the services of MacKenzie Partners, Inc., 105 Madison Avenue, 14th Floor, New York, New York 10016, in soliciting proxies and, in such event, the Company expects to pay an amount not to exceed $10,000, plus out-of-pocket expenses, for such services. The Company may conduct further solicitation personally, telephonically, electronically or by facsimile through its officers, directors and regular employees, none of whom would receive additional compensation for assisting with the solicitation.

Householding of Proxy Materials. In accordance with a notice sent previously to beneficial owners holding shares in street name (for example, through a bank, broker or other holder of record) and who share a single address with other similar holders, only one Annual Report and Proxy Statement is being sent to that address unless contrary instructions were received from any stockholder at that address. This practice, known as "householding," is designed to reduce printing and postage costs. Any of such beneficial owners may discontinue householding by writing to the address or calling the telephone number provided for such purpose by their holder of record. Any such stockholder may also request prompt delivery of a copy of the Annual Report or Proxy Statement by contacting the Company at (908) 272-8000 or by writing to Roger W. Thomas, Secretary, Mack-Cali Realty Corporation, 11 Commerce Drive, Cranford, New Jersey 07016. Other beneficial owners holding shares in street name may be able to initiate householding if their holder of record has chosen to offer such service, by following the instructions provided by the record holder.

Voting. Stockholders of record may authorize the proxies named in the enclosed proxy card to vote their shares of Common Stock in the following manner:

1

Revocability of Proxies. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is exercised in the same manner in which it was given or by delivering to Roger W. Thomas, Mack-Cali Realty Corporation, 11 Commerce Drive, Cranford, New Jersey 07016, a written notice of revocation or a properly executed proxy bearing a later date, or by attending the Annual Meeting and giving notice of your intention to vote in person.

Voting Procedure. The presence at the Annual Meeting of a majority of the outstanding shares of Common Stock of the Company, represented either in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. The close of business on April 4, 2003 has been fixed as the record date (the "Record Date") for determining the holders of shares of Common Stock entitled to notice of and to vote at the Annual Meeting. Each share of Common Stock outstanding on the Record Date is entitled to one vote on all matters. As of the Record Date, there were 57,627,429 shares of Common Stock outstanding. Under Maryland law, stockholders will not have appraisal or similar rights in connection with any proposal set forth in this Proxy Statement.

Stockholder votes will be tabulated by the persons appointed by the Board of Directors to act as inspectors of election for the Annual Meeting. The New York Stock Exchange (the "NYSE") permits member organizations to give proxies, whether or not instructions have been received from beneficial owners, to vote as to the election of directors and also on matters of the type contained in Proposal Nos. 2 and 3. Shares represented by a properly executed and delivered proxy will be voted at the Annual Meeting and, when instructions have been given by the stockholder, will be voted in accordance with those instructions. If no instructions are given, the shares will be voted FOR the election of each of the four nominees for director named below and FOR Proposal Nos. 2 and 3. Abstentions and broker non-votes will have no effect on the outcome of the election of directors or Proposal No. 2, but will have the same effect as a negative vote on Proposal No. 3 (unless, with respect to such Proposal No. 3, the total votes cast on the Proposal represent more than 50% in interest of all securities entitled to vote on the Proposal, in which event abstentions and broker non-votes will not have any effect on the result of the vote on Proposal No. 3). Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum.

VOTING SECURITIES AND PRINCIPAL HOLDERS

The following table sets forth information as of March 25, 2003 with respect to each person or group who is known by the Company, in reliance on Schedules 13D and 13G filed with the Securities and Exchange Commission (the "SEC"), to beneficially own more than 5% of the Company's outstanding shares of Common Stock. Except as otherwise noted below, all shares of Common Stock are owned beneficially by the individual or group listed with sole voting and/or investment power.

| Name of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class (%)(1) | |||

|---|---|---|---|---|---|

| The Mack Group(2) | 9,750,002 | 14.5 | % | ||

| Cohen & Steers Capital Management, Inc.(3) | 5,485,345 | 9.5 | % | ||

| Security Capital Research and Management Incorporated(4) | 5,236,451 | 9.1 | % | ||

| Deutsche Bank AG(5) | 3,792,691 | 6.6 | % |

2

7,340,023 shares reserved for issuance upon the exercise of stock options or stock warrants granted or reserved for possible grant to certain employees and directors of the Company, except in all cases where such Units, stock options or stock warrants are owned by the reporting person or group. This information is as of March 25, 2003.

3

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Company's charter divides the Company's Board of Directors into three classes, with the members of each such class serving staggered three-year terms. The Board of Directors presently consists of thirteen members as follows: Class I directors, Brendan T. Byrne, Martin D. Gruss, Vincent Tese and Roy J. Zuckerberg, whose terms expire in 2004; Class II directors, Nathan Gantcher, Earle I. Mack, William L. Mack and Alan G. Philibosian, whose terms expire in 2005; and Class III directors, John J. Cali, John R. Cali, Mitchell E. Hersh, Irvin D. Reid and Robert F. Weinberg, whose terms expire in 2003.

At the Annual Meeting, the stockholders will elect four directors to serve as Class III directors. The Class III directors who are elected at the Annual Meeting will serve until the Annual Meeting of Stockholders to be held in 2006 and until such directors' respective successors are elected or appointed and qualify or until any such director's earlier resignation or removal. The Board of Directors, acting upon the unanimous recommendation of its Nominating Committee, has nominated Martin S. Berger, John R. Cali, Mitchell E. Hersh and Irvin D. Reid for election as Class III directors at the Annual Meeting. In the event any nominee is unable or unwilling to serve as a Class III director at the time of the Annual Meeting, the proxies may be voted for the balance of those nominees named and for any substitute nominee designated by the present Board of Directors or the proxy holders to fill such vacancy or for the balance of those nominees named without nomination of a substitute, or the size of the Board of Directors may be reduced in accordance with the By-laws of the Company. At the conclusion of the Annual Meeting, the Board of Directors will consist of twelve members with each Class having four directors.

Martin S. Berger, director nominee, served as a member of the Board of Directors of the Company from 1998 until 2001 and served as Chairman of the Strategic Planning Committee of the Board of Directors of the Company from 2000 until 2001. Mr. Berger currently serves as a member of the Advisory Board of the Company. Prior to joining the Company, Mr. Berger served as co-chairman and general partner of The Robert Martin Company since its founding in 1957. Mr. Berger is chairman of the board and chief executive officer of City & Suburban Federal Savings Bank, president of the Construction Industry Foundation, and a board member of The White Plains Hospital Medical Center. Mr. Berger holds a B.S. degree in finance from New York University. Mr. Berger has served as a member of the Company's Board of Directors pursuant to an agreement with the Company entered into at the time of the Company's acquisition of 65 Class A properties from The Robert Martin Company LLC in January 1997, which was modified at the time of the Company's combination with the Mack organization in December 1997. See "Certain Relationships and Related Transactions—Robert Martin Agreement."

John R. Cali, director nominee, was appointed as a member of the Board of Directors of the Company and as a member of the Executive Committee of the Board of Directors of the Company in 2000. Mr. Cali served as Executive Vice President—Development of the Company until June 2000, and as Chief Administrative Officer of the Company until December 1997. In addition, Mr. Cali was a principal of Cali Associates and served as a member of its Long Range Planning Committee from 1981 to 1994 and its Executive Committee from 1987 to 1994 and was responsible for the development of Cali Associates' office system and the management of its office personnel. Mr. Cali also developed and organized the leasing and property management departments of Cali Associates and he was responsible for directing the development functions of the Company. Mr. Cali is a member of the University of Pennsylvania Board of Penn Medicine and serves as a member of its Finance Committee. Mr. Cali has a M.Ed. degree in counseling, organizational development and personnel from the University of Missouri. Mr. Cali serves as a member of the Board of Directors of the Company pursuant to an agreement dated as of June 27, 2000, among the Company and members of the Cali family. See "Certain Relationships and Related Transactions—Cali Agreement." Mr. Cali is the nephew of John J.

4

Cali, a member of the Company's Board of Directors until the Annual Meeting and, thereafter, a member of the Company's Advisory Board.

Mitchell E. Hersh, director nominee, was appointed as a member of the Board of Directors of the Company and as a member of the Executive Committee of the Board of Directors of the Company in 1997. Mr. Hersh also has served as Chief Executive Officer of the Company since 1999. Mr. Hersh is responsible for the strategic direction and long-term planning for the Company. He is also responsible for creating and implementing the Company's capital markets strategy and overall investment strategy. Previously, Mr. Hersh held the position of President and Chief Operating Officer of the Company from 1997 to 1999. Prior to joining the Company, Mr. Hersh served as a partner of the Mack organization since 1982 and as chief operating officer of the Mack organization since 1990, where he was responsible for overseeing the development, operations, leasing and acquisitions of the Mack organization's office and industrial portfolio. Mr. Hersh serves on the board of directors of the National Association of Real Estate Investment Trusts (NAREIT) and the New Jersey Chapter of the National Association of Industrial and Office Properties (NAIOP). Mr. Hersh has a B.A. degree in architecture from Ohio University. Mr. Hersh serves as a member of the Board of Directors of the Company pursuant to an agreement with the Company entered into at the time of the Company's combination with the Mack organization in December 1997. See "Certain Relationships and Related Transactions—Mack Agreement."

Irvin D. Reid, director nominee, was appointed as a member of the Board of Directors of the Company in 1994 and served as chairman of the Audit Committee of the Board of Directors of the Company from 1998 through 2002. Dr. Reid currently serves as a member of the Company's Audit Committee. Dr. Reid also serves as president of Wayne State University in Michigan. Prior to becoming the president of Wayne State University, Dr. Reid served as president of Montclair State University (formerly Montclair State College) in New Jersey from 1989 to 1997, and held positions of dean, School of Business Administration, and John Stagmaier Professor of Economics and Business Administration at the University of Tennessee at Chattanooga. Dr. Reid also is a member of the Federal Reserve Board of Chicago-Detroit Branch and of the Handleman Company. Dr. Reid received his B.S. degree and M.S. degree in general and experimental psychology from Howard University. He earned his M.A. and Ph.D. degrees in business and applied economics from The Wharton School of the University of Pennsylvania.

Vote Required and Board of Directors' Recommendation

Assuming a quorum is present, the affirmative vote of a plurality of the votes cast at the Annual Meeting, either in person or by proxy, is required for the election of a director. For purposes of the election of directors, abstentions and broker non-votes will have no effect on the result of the vote.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THE ELECTION OF ALL NOMINEES NAMED ABOVE.

5

DIRECTORS AND EXECUTIVE OFFICERS

Set forth below is certain information as of March 25, 2003 for (i) the members of the Board of Directors of the Company, (ii) the executive officers of the Company and (iii) the directors and executive officers of the Company as a group:

| Name and Position | Age | First Elected | Term Expires | Number of Shares(1)(2) | Percent of Shares Outstanding (%)(3) | Percent of Shares Outstanding (calculated on a fully-diluted basis)(%)(4) | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| William L. Mack, Chairman of the Board(5) | 63 | 1997 | 2005 | 3,483,442(11 | ) | 5.71 | 4.66 | |||||

| Mitchell E. Hersh, Chief Executive Officer and Director(5) | 52 | 1997 | 2003 | 623,900(12 | ) | 1.07 | * | |||||

| Timothy M. Jones, President. | 47 | — | — | 490,575(13 | ) | * | * | |||||

| Barry Lefkowitz, Executive Vice President and Chief Financial Officer | 41 | — | — | 196,587(14 | ) | * | * | |||||

| Roger W. Thomas, Executive Vice President, General Counsel and Secretary | 45 | — | — | 189,798(15 | ) | * | * | |||||

| Michael A. Grossman, Executive Vice President | 41 | — | — | 125,101(16 | ) | * | * | |||||

| Martin S. Berger(6) | 72 | 1998 | — | 539,532(17 | ) | * | * | |||||

| Brendan T. Byrne, Director(7) | 78 | 1994 | 2004 | 25,600(18 | ) | * | * | |||||

| John R. Cali, Director(5)(8) | 55 | 2000 | 2003 | 358,106(19 | ) | * | * | |||||

| Nathan Gantcher, Director(5)(9)(7) | 62 | 1999 | 2005 | 45,000(20 | ) | * | * | |||||

| Martin D. Gruss, Director(10) | 60 | 1997 | 2004 | 33,000(21 | ) | * | * | |||||

| Earle I. Mack, Director | 66 | 1997 | 2005 | 2,312,854(22 | ) | 3.86 | 3.09 | |||||

| Alan G. Philibosian, Director(9)(10) | 49 | 1997 | 2005 | 28,500(23 | ) | * | * | |||||

| Irvin D. Reid, Director(7) | 62 | 1994 | 2003 | 10,000(24 | ) | * | * | |||||

| Vincent Tese, Director(9)(10) | 60 | 1997 | 2004 | 35,000(25 | ) | * | * | |||||

| Roy J. Zuckerberg, Director(5)(7) | 66 | 1999 | 2004 | 40,000(26 | ) | * | * | |||||

| All directors and executive officers as a group | 8,536,995(27 | ) | 13.02 | 11.41 | ||||||||

6

Seat. Mr. Weinberg served as a member of the Board of Directors from January 31, 1997 until December 1, 1998, at which time Mr. Weinberg resigned and Mr. Berger was appointed to serve in such capacity. Mr. Berger served as a member of the Board of Directors of the Company from December 1, 1998 until March 6, 2001, at which time Mr. Berger resigned and Mr. Weinberg was appointed to serve in such capacity until the Annual Meeting. Since the Company is nominating for re-election a designee of Robert Martin at the Annual Meeting, Mr. Berger and Mr. Weinberg have agreed that Mr. Berger will be so nominated and the seat will be rotated between Mr. Berger and Mr. Weinberg every 12 months commencing on the 12 month anniversary of the Annual Meeting. When not serving on the Board of Directors, Mr. Berger or Mr. Weinberg, as appropriate, will serve as a member of the Advisory Board. See "Certain Relationships and Related Transactions—Robert Martin Agreement." Mr. Weinberg owns 542,532 shares of the Company's Common Stock, which includes 521,532 shares of Common Stock that may be issued upon the redemption of all of Mr. Weinberg's limited partnership interests in the Operating Partnership, vested options to purchase 20,000 shares of the Company's Common Stock, and 1,000 shares of Common Stock owned by Mr. Weinberg's wife.

7

8

Biographical information concerning the director nominees is set forth above under the caption "Proposal No. 1—Election of Directors." Biographical information concerning the remaining directors and executive officers is set forth below.

William L. Mack has served as a member of the Board of Directors of the Company since 1997 and as its Chairman since 2000. Mr. Mack also serves as Chairman of the Company's Executive Committee. Prior to December 1997, Mr. Mack served as managing partner of the Mack organization, where he pioneered the development of large, Class A office properties and helped to increase the Mack organization's portfolio to approximately 20 million square feet. In addition, Mr. Mack is a founder and managing partner of Apollo Real Estate Advisors, L.P. Mr. Mack also currently serves as a member of the board of directors of The Bear Stearns Companies, Inc., where he is also a member of its Audit Committee, Metropolis Realty Trust, Inc., Metropolitan Regional Advisory Board of the Chase Manhattan Bank, Wyndham International, Inc. and Vail Resorts, Inc. Mr. Mack is a trustee and is on the executive committee of the North Shore-Long Island Jewish Health System. He also is a trustee of the University of Pennsylvania and serves on the board of overseers of The Wharton School. Mr. Mack attended The Wharton School of Business and Finance at the University of Pennsylvania and has a B.S. degree in business administration, finance and real estate from New York University. Mr. Mack serves as a member of the Board of Directors of the Company pursuant to an agreement with the Company entered into at the time of the Company's combination with the Mack organization in December 1997. See "Certain Relationships and Related Transactions—Mack Agreement." Mr. Mack is the brother of Earle I. Mack.

John J. Cali has served as Chairman Emeritus of the Board of Directors of the Company since 2000. Mr. Cali served as Chairman of the Board of Directors of the Company from 1994 to June 2000, as a member of the Executive Committee of the Board of Directors of the Company from 1997 to June 2000 and as Chief Executive Officer of the Company from 1994 to 1995. In addition, Mr. Cali was a principal of Cali Associates and a member of its Executive and Long Range Planning Committees from 1949 to 1994. Mr. Cali co-founded Cali Associates in 1949. Mr. Cali serves as a member of the board of directors of The Garden State Cancer Center. Mr. Cali is also a member of the board of directors of The Montclair Economic Development Corp. Mr. Cali graduated from Indiana University. Mr. Cali serves as a member of the Board of Directors of the Company pursuant to an agreement dated as of June 27, 2000, among the Company and members of the Cali family. Mr. Cali is the uncle of John R. Cali. Mr. Cali has resigned from the Board of Directors, effective immediately following the Annual Meeting, and will become, at that time, a member of the Company's Advisory Board. See "Certain Relationships and Related Transactions—Cali Agreement."

Timothy M. Jones has served as President of the Company since 1999. He is responsible for overseeing the portfolio management, leasing, development and operations areas of the Company. Previously, he served as Executive Vice President and Chief Investment Officer of the Company from 1997 to 1999. Prior to joining the Company, Mr. Jones served as executive vice president and chief operating officer of The Robert Martin Company, where he was responsible for the daily corporate operations and management of the firm's six-million square foot portfolio in New York and Connecticut. Prior to joining The Robert Martin Company, Mr. Jones served as a vice president in Chemical Bank's Real Estate Division, as president of Clifton Companies in Stamford, Connecticut and president of Federated National Company in State College, Pennsylvania. Mr. Jones has a B.A. degree in economics from Yale University and a Masters degree in business from Columbia University.

Barry Lefkowitz has served as Chief Financial Officer of the Company since 1994, and as Executive Vice President of the Company since 1997. Mr. Lefkowitz oversees the firm's strategic financial planning and forecasting, financial accounting and reporting, capital markets activities and investor relations. Mr. Lefkowitz served as a Vice President of the Company from 1994 to 1997. Prior to joining the Company, Mr. Lefkowitz served as a senior manager with the international accounting firm of Deloitte & Touche LLP, specializing in real estate, with emphasis on mergers and acquisitions.

9

In addition to having served as co-chairman of the National Association of Real Estate Investment Trusts (NAREIT) Accounting Committee, he is a member of the American Institute of Certified Public Accountants (AICPA), the New Jersey Society of Certified Public Accountants (NJSCPA) and the New York State Society of Certified Public Accountants (NYSSCPA). Mr. Lefkowitz holds a B.S. degree in accounting from Brooklyn College.

Roger W. Thomas has served as General Counsel of the Company since 1994, and as Executive Vice President and Secretary of the Company since 1997. Mr. Thomas' responsibilities include structuring and implementing the Company's acquisitions and mergers, corporate governance, supervising outside legal counsel, insuring legal compliance and the preparation of required disclosure documents. Mr. Thomas also assists the Company in investment strategies, financial activities, acquisitions and dispositions. Mr. Thomas served as a Vice President and Assistant Secretary of the Company from 1994 to 1997. Prior to joining the Company, Mr. Thomas was a partner at the law firm of Dreyer & Traub in New York, specializing in real estate and commercial transactions. Mr. Thomas holds a B.S.B.A. in finance and a J.D. degree (with honors) from the University of Denver.

Michael A. Grossman has served as Executive Vice President of the Company since 2000. He is responsible for overseeing the Company's New York, Connecticut and Northern New Jersey (Bergen and Passaic counties) regions. Previously, Mr. Grossman served as Senior Vice President of the Company in 2000, and as Vice President of the Company from 1997 to January 2000. Prior to joining the Company, Mr. Grossman served as vice president of leasing for The Robert Martin Company since 1991, where he was responsible for leasing throughout Westchester and Fairfield counties. Mr. Grossman is a member of the Westchester Board of Realtors, Commercial and Industrial Division, treasurer of the National Association of Industrial and Office Parks from 1997 to 1998, and a member of the March of Dimes Real Estate Committee, Westchester chapter. Mr. Grossman attended the University of South Florida and is a graduate of New York City Technical College.

Brendan T. Byrne has served as a member of the Board of Directors of the Company since 1994 and as a member of the Audit Committee of the Board of Directors since 1999. Governor Byrne became Chairman of the Company's Audit Committee in 2002. Governor Byrne served two consecutive terms as governor of the State of New Jersey prior to 1982 and has been a senior partner with Carella, Byrne, Bain, Gilfillan, Cecchi, Stewart & Olstein, a Roseland, New Jersey law firm, since 1982. Governor Byrne currently serves as a member of the board of directors of Chelsea Property Group, Inc. and serves as a member of its audit and compensation committees. Governor Byrne graduated from Princeton University's School of Public Affairs and received his LL.B from Harvard Law School.

Nathan Gantcher has served as a member of the Board of Directors of the Company since 1999, as a member of the Audit Committee of the Board of Directors of the Company since 1999, and as a member of each of the Nominating Committee of the Board of Directors and the Executive Committee of the Board of Directors since 2000. Mr. Gantcher has served as the co-chairman, president and chief executive officer of Alpha Investment Management L.L.C. since 2001. Prior to joining Alpha Investment Management L.L.C., Mr. Gantcher was a private investor from 1999 to 2001. Mr. Gantcher served as vice chairman of CIBC Oppenheimer Corp. from 1997 to 1999. Prior to becoming vice chairman of CIBC Oppenheimer Corp., Mr. Gantcher served as co-chief executive officer of Oppenheimer & Co., Inc. Mr. Gantcher currently serves as chairman of the board of trustees of Tufts University and as a member of each of the Council of Foreign Relations and the Overseers Committee of the Columbia University Graduate School of Business. Mr. Gantcher also serves as a member of the board of directors of Neuberger Berman, a NYSE listed company, and serves as a member of its Audit and Compensation Committees. Mr. Gantcher received his A.B. in economics and biology from Tufts University and his M.B.A. from the Columbia University Graduate School of Business.

10

Martin D. Gruss has served as a member of the Board of Directors of the Company since 1997 and as a member of the Executive Compensation and Option Committee of the Board of Directors since 1999. Mr. Gruss is the senior partner of Gruss & Co., a private investment firm. From 1989 to 1993, Mr. Gruss served as a director of Acme Metals Incorporated. Mr. Gruss currently serves as a member of the board of overseers of the Wharton School and as a trustee of the Lawrenceville School. Mr. Gruss has a B.S. degree in economics from the Wharton School of the University of Pennsylvania and a J.D. degree from New York University School of Law.

Earle I. Mack has served as a member of the Board of Directors of the Company since 1997. Prior to December 1997, Mr. Mack served as senior partner, chief financial officer and a director of the Mack organization, where he pioneered the development of large, Class A office properties and helped to increase the Mack organization's portfolio to approximately 20 million square feet. Mr. Mack serves as a member of the board of directors of DiGiorgio/White Rose Corp. and as a member of its executive and executive compensation committees. Mr. Mack also is the chairman of the board of directors of the Benjamin N. Cardozo School of Law and the chairman emeritus of the New York State Council on the Arts. Mr. Mack has a B.S. degree in business administration from Drexel University and also attended Fordham Law School. Mr. Mack serves as a member of the Board of Directors of the Company pursuant to an agreement with the Company entered into at the time of the Company's combination with the Mack organization in December 1997. See "Certain Relationships and Related Transactions—Mack Agreement." Mr. Mack is the brother of William L. Mack.

Alan G. Philibosian has served as a member of the Board of Directors of the Company and as a member of the Executive Compensation and Option Committee of the Board of Directors of the Company since 1997, and as a member of the Nominating Committee of the Board of Directors since 2000. Mr. Philibosian is an attorney practicing in Englewood, New Jersey, and since 1997 has his own practice. Mr. Philibosian served as a commissioner of The Port Authority of New York and New Jersey from January 1995 through January 2003. While Commissioner, he served as chairman of the audit, construction and vice-chairman of the finance committees. Mr. Philibosian also serves on the board of directors of NorCrown Bank, Livingston, New Jersey, and the Armenian Missionary Association of America, Paramus, New Jersey. Mr. Philibosian graduated from Rutgers College, and received his J.D. degree from Boston College Law School and his LL.M. degree in taxation from New York University.

Vincent Tese has served as a member of the Board of Directors of the Company since 1997, as chairman of the Executive Compensation and Option Committee of the Board of Directors of the Company since 1998 and as chairman of the Nominating Committee of the Board of Directors since 2000. Mr. Tese served as New York State Superintendent of Banks from 1983 to 1985, chairman and chief executive officer of the Urban Development Corporation from 1985 to 1994, director of economic development for New York State from 1987 to 1994 and commissioner and vice chairman of the Port Authority of New York and New Jersey from 1991 to 1995. Mr. Tese also served as a partner in the law firm of Tese & Tese, a partner in the Sinclair Group, a commodities trading and investment management company, and a co-founder of Cross Country Cable TV. Mr. Tese currently serves as chairman of Wireless Cable International, Inc. and as a member of the board of directors of The Bear Stearns Companies, Inc., Bowne & Company, Inc., Cablevision, Inc., Lynch Interactive Corp., and National Wireless Holdings, Inc., and as a trustee of New York University School of Law and New York Presbyterian Hospital. Mr. Tese has a B.A. degree in accounting from Pace University, a J.D. degree from Brooklyn Law School and a LL.M. degree in taxation from New York University School of Law.

Robert F. Weinberg became a member of the Board of Directors of the Company on March 6, 2001. Mr. Weinberg had served as a member of the Advisory Board of the Company since 1998 and previously as a member of the Board of Directors of the Company from 1997 until 1998. Mr. Weinberg served as co-chairman and general partner of The Robert Martin Company since its founding in 1957. Mr. Weinberg is presently the chairman of the Outreach Committee on Orderly Growth in Westchester,

11

a director of City & Suburban Federal Savings Bank and a director of the Westchester County Association. Mr. Weinberg earned a B.S. degree in Mechanical Engineering from New York University, an M.S. degree in Building Engineering & Construction from M.I.T. and a J.D. degree from Brooklyn Law School. Mr. Weinberg serves as a member of the Board of Directors of the Company and shares his board seat with Martin S. Berger pursuant to an agreement with the Company entered into at the time of the Company's acquisition of 65 Class A properties from Robert Martin in January 1997. Mr. Weinberg has resigned from the Board of Directors, effective immediately following the Annual Meeting, and will become, at that time, a member of the Company's Advisory Board. See "Certain Relationships and Related Transactions—Robert Martin Agreement."

Roy J. Zuckerberg has served as a member of the Board of Directors of the Company since 1999, as a member of the Audit Committee of the Board of Directors of the Company since 1999 and as a member of the Executive Committee of the Board of Directors since 2000. Mr. Zuckerberg is currently a senior director of the Goldman Sachs Group, Inc. Mr. Zuckerberg served as vice chairman of Goldman, Sachs & Co., a member of its executive committee and head of its Equities Division. Mr. Zuckerberg served as chairman of the Securities Industry Association and was a member of the Senior Advisors Group to the President's Council on Year 2000 Conversion. Mr. Zuckerberg is chairman of the board and a member of the executive committee of North Shore-Long Island Jewish Health System, Inc., a trustee of the American Red Cross in Greater New York and a director of the Brookdale Foundation. He is on the executive committee of the UJA-Federation. He also serves as chair of the investment committee of the University of Massachusetts Foundation. Mr. Zuckerberg received a B.S. from Lowell Technological Institute in 1958 and served in the United States Army.

Certain Relationships and Related Transactions

Cali Agreement. On June 27, 2000, both Brant Cali and John R. Cali resigned their positions as officers of the Company, and Brant Cali resigned as a director of the Company. John R. Cali was appointed to the Board of Directors of the Company to take the seat previously held by Brant Cali. As required by Brant Cali and John R. Cali's former employment agreements with the Company, among other things, the Company will permit Brant Cali and John R. Cali (and their dependents) to participate in the health and disability insurance programs of the Company for a period of four years from such date.

For as long as members of the Cali family (or entities wholly owned by the Cali family, Cali family trusts or the heirs of any member of the Cali Group) maintain at least the "Minimum Percentage" (as defined below) of the Cali family's aggregate equity position in the Units in the Operating Partnership (measured exactly as it existed on June 27, 2000), the Company has agreed to nominate one designee of the Cali family for election to the Board of Directors at each of the Annual Meeting and the Company's 2006 annual meeting of stockholders, provided such person shall be subject to the prior approval of the Board of Directors, which approval shall not be unreasonably withheld. In compliance with this requirement, the Company has nominated John R. Cali for re-election at the Annual Meeting. "Minimum Percentage" shall mean (i) 90% or (ii) 87.5%, if the Cali family's aggregate equity position in the Units in the Operating Partnership is reduced below 90% solely as a result of sales of Units by the Operating Partnership to the Company.

For as long as (i) the Cali family is represented on the Board of Directors, (ii) the Cali family (or entities wholly owned by the Cali family, Cali family trusts, or the heirs of any member of the Cali Group) maintains at least the Minimum Percentage of the Cali family's aggregate equity position in the Units of the Operating Partnership (measured exactly as it existed on June 27, 2000) and (iii) the Board of Directors determines in its reasonable discretion to continue the Executive Committee of the Board of Directors, the Cali family shall be entitled to designate John R. Cali or another Cali-designated board member to serve as a member of the Executive Committee of the Board of Directors, provided such person shall be subject to the prior approval of the Board of Directors, which

12

approval may not be unreasonably withheld. John R. Cali currently serves on the Executive Committee of the Board of Directors.

Pursuant to the Cali Agreement, John J. Cali serves as a consultant to the Company and is paid an annual salary of $150,000 until June 27, 2003. Mr. Cali has resigned from the Board of Directors, effective immediately following the Annual Meeting, and will become, at that time, a member of the Company's Advisory Board. Mr. Cali will be paid $50,000 in connection with his service as a consultant to the Advisory Board during his first year as a member of the Advisory Board. In connection with Mr. Cali's resignation, the Board of Directors has reduced the size of the Board of Directors from thirteen to twelve members and the number of Class III directors from five to four.

Mack Agreement. In connection with the Company's combination with the Mack organization in December 1997, William L. Mack, Mitchell E. Hersh and Earle I. Mack were appointed to the Company's Board of Directors. If any of Messrs. Mack or Mr. Hersh shall withdraw from the Board of Directors for any reason during their terms, the members of the Mack Group are entitled to designate their successors. In addition, for as long as members of the Mack Group maintain at least the "Mack Significant Interest" (as defined below), the Mack Group has the right to re-nominate, and the Company will support, Messrs. Mack and Hersh (or their successors) for re-election to the Board of Directors for successive three-year terms upon the expiration of each three-year term. "Mack Significant Interest" shall mean legal and beneficial ownership, in the aggregate, of not less than 3,174,603 shares of Common Stock and/or Units (on a fully converted basis) by Earle Mack, David Mack, Frederic Mack and William Mack, subject to certain restrictions and to adjustment for stock splits and other customary and similar stock dilutions.

Robert Martin Agreement. In connection with the Company's acquisition of 65 Class A properties from Robert Martin in January 1997, the Company granted Robert Martin the right to designate one RM Board Seat for six years, ending at the Annual Meeting. Robert Martin designated Martin S. Berger and Robert F. Weinberg to jointly share the RM Board Seat, as follows: Mr. Weinberg served as a member of the Board of Directors of the Company from January 1997 until December 1, 1998, at which time Mr. Weinberg resigned and Mr. Berger was appointed to serve in such capacity. Mr. Berger served as a member of the Board of Directors of the Company from December 1, 1998 until March 6, 2001, at which time Mr. Berger resigned and Mr. Weinberg was appointed to serve in such capacity until the Annual Meeting. Since the Company is electing to nominate for re-election to its Board of Directors a designee of Robert Martin at the Annual Meeting, Mr. Berger and Mr. Weinberg have agreed that Mr. Berger will be so nominated and the seat will be rotated among Mr. Berger and Mr. Weinberg every 12 months commencing on the 12 month anniversary of the Annual Meeting. When not serving on the Board of Directors, Mr. Weinberg or Mr. Berger, as appropriate, will serve as a member of the Company's Advisory Board. Upon the death of Mr. Berger or Mr. Weinberg, the surviving person shall solely fill the remainder of the term of the RM Board Seat.

Tax Protection Agreements. The Company may not dispose of or distribute certain of its properties, currently comprising 141 properties with an aggregate net book value of approximately $1.8 billion (as of December 31, 2002), which were originally contributed by members of either the Mack Group (which includes William L. Mack, director; Earle I. Mack, director; and Mitchell E. Hersh, chief executive officer and director), the Robert Martin Group (which includes Robert F. Weinberg, director; Martin W. Berger, a former director and a member of the Company's Advisory Board; and Timothy M. Jones, president) or the Cali Group (which includes John J. Cali, director, and John R. Cali, director), without the express written consent of a representative of the Mack Group, the Robert Martin Group or the Cali Group, as applicable, except in a manner which does not result in recognition of any built-in-gain (which may result in an income tax liability) or which reimburses the appropriate Mack Group, Robert Martin Group or Cali Group members for the tax consequences of the recognition of such built-in-gains (collectively, the "Property Lock-Ups"). The aforementioned

13

restrictions do not apply in the event that the Company sells all of its properties or in connection with a sale transaction which the Company's Board of Directors determines is reasonably necessary to satisfy a material monetary default on any unsecured debt, judgment or liability of the Company or to cure any material monetary default on any mortgage secured by a property. The Property Lock-Ups expire periodically through 2008. Upon the expiration of the Property Lock-Ups, the Company is required to use commercially reasonable efforts to prevent any sale, transfer or other disposition of the subject properties from resulting in the recognition of built-in gain to the appropriate Mack Group, Robert Martin Group or Cali Group members.

Acquisitions and Other Transactions. Certain directors and executive officers of the Company (or members of their immediate families or related trusts) and persons who hold more than 5% of the outstanding shares of Common Stock (or Units in the Operating Partnership) had direct or indirect interests in certain transactions involving the Company, the Operating Partnership or their affiliates in the last fiscal year as follows:

14

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires the Company's executive officers, directors and persons who beneficially own more than 10% of the Company's Common Stock to file initial reports of ownership and reports of changes of ownership (Forms 3, 4 and 5) of the Common Stock with the SEC and the NYSE. Executive officers, directors

15

and greater than 10% holders are required by SEC regulations to furnish the Company with copies of such forms that they file.

To the Company's knowledge, based solely on the Company's review of the copies of such reports received by the Company, the Company believes that for the fiscal year 2002, all Section 16(a) filing requirements applicable to its executive officers, directors and greater than 10% beneficial owners were complied with, except that each of Irvin D. Reid, Vincent Tese, Roy Zuckerberg, Nathan Gantcher, Martin D. Gruss, William L. Mack and Alan G. Philibosian, directors of the Company, reported his credit of deferred stock units and stock dividends of 216.880, 216.880, 211.455, 211.455, 216.880, 216.880 and 108.440, respectively, accrued for the quarter ended September 30, 2002, and issued on October 3, 2002, under the Directors' Deferred Compensation Plan on a Form 5 in February 2003, rather than on a Form 4 which should have been filed on October 7, 2002.

Meetings of Committees of the Board of Directors

During 2002, the entire Board of Directors met nine times. No director attended fewer than 75% of the aggregate of the total number of meetings of the Board of Directors (held during the period for which he has been a director) and the total number of meetings held by all committees of the Board of Directors on which he served (during the periods that he served).

The Board of Directors has four committees: the Executive Committee, the Audit Committee, the Executive Compensation and Option Committee and the Nominating Committee.

The Executive Committee consists of William L. Mack, chairman, John R. Cali, Nathan Gantcher, Mitchell E. Hersh and Roy J. Zuckerberg. The Executive Committee acts for the Board of Directors in between regularly scheduled meetings of the Board of Directors, within certain parameters prescribed by the Board of Directors. The Executive Committee met six times during 2002.

The Audit Committee consists of Brendan T. Byrne, chairman, Nathan Gantcher, Irvin D. Reid and Roy J. Zuckerberg. The Audit Committee authorizes and approves the engagement of independent accountants, reviews with the independent accountants the scope and results of the audit engagement, approves professional audit and permissible non-audit services provided by the independent accountants, reviews the independence of the independent accountants, considers the range of audit and non-audit fees and reviews the adequacy of the Company's internal accounting controls. The Audit Committee met four times during 2002. The Board of Directors believes that each of the members of the Audit Committee is an "independent" director within the meaning of applicable and proposed NYSE and SEC rules. On March 4, 2003, the Company amended and restated its Audit Committee Charter to address final and proposed rules promulgated by the SEC and the NYSE, respectively. A copy of the Amended and Restated Audit Committee Charter is attached to this Proxy Statement as Annex A.

The SEC has adopted rules to implement certain requirements of the Sarbanes-Oxley Act of 2002 pertaining to public company audit committees. One of the rules adopted by the SEC requires a company to disclose whether it has an "Audit Committee Financial Expert" serving on its audit committee. Companies must comply with this disclosure requirement beginning with annual reports for fiscal years ending on or after July 15, 2003. Although it is not required to do so at this time, the Board of Directors has determined that the Company will comply with this disclosure in this Proxy Statement since the Board of Directors does not anticipate that there will be a change in the members comprising the Audit Committee during fiscal 2003. Based on its review of the criteria of an Audit Committee Financial Expert under the rules adopted by the SEC, the Board of Directors believes that each of Brendan T. Byrne, Nathan Gantcher, Irvin D. Reid and Roy J. Zuckerberg meet the definition of an Audit Committee Financial Expert.

16

The Executive Compensation and Option Committee consists of Vincent Tese, chairman, Martin D. Gruss and Alan G. Philibosian. The Executive Compensation and Option Committee establishes remuneration levels for executive officers of the Company and implements incentive programs, including the Company's employee and director stock option plans. The Executive Compensation and Option Committee met once during 2002.

The Nominating Committee consists of Vincent Tese, chairman, Nathan Gantcher and Alan G. Philibosian. The Nominating Committee makes recommendations for nominees to the Board of Directors of the Company. Although there are no formal procedures for stockholders to make recommendations for committee appointments or recommendations for nominees to the Board of Directors, the Nominating Committee will consider recommendations from stockholders, which should be addressed to Roger W. Thomas, the Company's Secretary, at the Company's address set forth on the first page of this Proxy Statement. The Nominating Committee met twice during 2002.

Report of the Audit Committee of the Board of Directors

The Audit Committee of the Board of Directors of the Company, on behalf of the Board of Directors of the Company, serves as an independent and objective party to monitor and provide general oversight of the Company's financial accounting and reporting process, selection of critical accounting policies, system of internal control, audit process for monitoring compliance with laws and regulations and the Company's standards of business conduct. The Audit Committee performs these oversight responsibilities in accordance with its Audit Committee Charter, which was amended and restated on March 4, 2003 to address final and proposed rules promulgated by the SEC and the NYSE, respectively, and which is attached to this Proxy Statement as Annex A. The Audit Committee met four times during 2002.

The Company's management has primary responsibility for preparing the Company's financial statements and the Company's reporting process. The Company's independent accountants, PricewaterhouseCoopers LLP, are responsible for expressing an opinion on the conformity of the Company's audited financial statements to accounting principles generally accepted in the United States of America. The Audit Committee discussed with the Company's independent accountants and auditors the overall scope and plans for their respective audits. The Audit Committee met with the independent accountants, with and without management present, to discuss the results of their examinations, their evaluations of the Company's internal controls, and the overall quality of the Company's financial reporting.

In this context, the Audit Committee hereby reports as follows:

17

The foregoing Audit Committee Report does not constitute soliciting material and shall not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933, as amended, or Exchange Act, except to the extent the Company specifically incorporates this Audit Committee Report by reference therein.

Each of the members of the Audit Committee is independent as defined under the existing and proposed listing standards of the NYSE and meets all other requirements of such Exchange and of applicable and proposed rules of the SEC.

AUDIT COMMITTEE

BRENDAN T. BYRNE, CHAIRMAN

NATHAN GANTCHER

IRVIN D. REID

ROY J. ZUCKERBERG

Compensation of Directors

Directors' Fees. In 2002, each non-employee director was paid an annual fee of $20,000, plus $1,000 per Board meeting attended, $500 per committee meeting attended and $250 per scheduled telephonic meeting participation. On December 3, 2002, in light of the additional responsibilities imposed by the Sarbanes-Oxley Act of 2002 and the SEC upon the Chairman of the Audit Committee, the Board of Directors approved an increase of $10,000 in the annual fee paid to the Chairman of the Audit Committee. The Company does not pay director fees to employee directors, who in fiscal 2002 consisted of Mitchell E. Hersh. Each director also was reimbursed for expenses incurred in attending Board and committee meetings. For fiscal year 2002, the Company's non-employee directors received directors' fees or fee equivalents (See "Compensation of Directors-Directors' Deferred Compensation Plan" below) in the amounts set forth in the table below.

Directors' Deferred Compensation Plan. Pursuant to the Directors' Deferred Compensation Plan, effective as of January 1, 1999, each non-employee director is entitled to defer all or a specified portion of the annual fee to be paid to such director. The account of a director who elects to defer such compensation under the Directors' Deferred Compensation Plan is credited with the hypothetical number of stock units, calculated to the nearest thousandths of a unit, determined by dividing the amount of compensation deferred on the deferral date by the closing market price of the Company's Common Stock as reported on the Consolidated Tape of NYSE listed shares on the deferral date. Any stock dividend declared by the Company on its Common Stock results in a proportionate increase in units in the director's account as if such director held shares of Common Stock equal to the number of units in such director's account. Payment of a director's account may only be made in a lump sum in shares of Common Stock equal to the number of units in a director's account after either the director's service on the Board of Directors has terminated or there has been a change in control of the Company. In 2002, the director accounts of Nathan Gantcher, Martin D. Gruss, William L. Mack, Alan G. Philibosian, Irvin D. Reid, Vincent Tese, and Roy J. Zuckerberg were credited with the stock units set forth in the table below.

18

| Director | Cash Fees | Deferred Stock Units(1) | Cash Value of Deferred Stock Units | |||||

|---|---|---|---|---|---|---|---|---|

| William L. Mack | $ | 8,500 | 626.457 | $ | 20,000 | |||

| John J. Cali(2) | 26,000 | 0 | 0 | |||||

| Brendan T. Byrne | 28,500 | 0 | 0 | |||||

| John R. Cali | 28,500 | 0 | 0 | |||||

| Nathan Gantcher | 11,500 | 626.457 | 20,000 | |||||

| Martin D. Gruss | 6,250 | 626.457 | 20,000 | |||||

| Earle I. Mack | 25,750 | 0 | 0 | |||||

| Alan G. Philibosian | 16,750 | 313.228 | 10,000 | |||||

| Irvin D. Reid | 6,500 | 626.457 | 20,000 | |||||

| Vincent Tese | 5,750 | 626.457 | 20,000 | |||||

| Robert F. Weinberg(3) | 26,000 | 0 | 0 | |||||

| Roy Zuckerberg | 10,500 | 626.457 | 20,000 | |||||

| Total | $ | 200,500 | 4,071.970 | $ | 130,000 | |||

Directors' Stock Option Plans. The Company has two director stock option plans: the Director Stock Option Plan of Mack-Cali Realty Corporation (the "Director Stock Option Plan") and the 2000 Director Stock Option Plan (the "2000 Director Stock Option Plan"). References to "Director Option Plans" herein refer to the Director Stock Option Plan and the 2000 Director Stock Option Plan, collectively. Pursuant to the Director Option Plans, each non-employee director is automatically granted a non-qualified option to purchase 5,000 shares of Common Stock in connection with the director's initial election or appointment to the Board of Directors. These grants under the Director Option Plans are made at an exercise price equal to the "fair market value" (as defined under the Director Option Plans) at the time of the grant of the shares of Common Stock subject to such option. The Executive Compensation and Option Committee may make additional discretionary option grants to eligible directors, consistent with the terms of the Director Option Plans. The Board of Directors may amend, suspend or terminate the Director Option Plans at any time, except that any amendments that would materially increase the cost of either of the Director Option Plans to the Company must be approved by the holders of the majority of issued and outstanding shares of Common Stock of the Company entitled to vote.

19

The following table sets forth certain information concerning the compensation of the chief executive officer and the four most highly compensated executive officers of the Company other than the chief executive officer (collectively, the "Named Executive Officers") for each of the Company's last three fiscal years:

| | | | | | Long-Term Compensation | | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | Awards | Payouts | | |||||||||

| | Annual Compensation(1) | | | Securities Underlying Options/ Warrants(#) | | | ||||||||||

| Name and Principal Position | Other Annual Compensation($) | Restricted Stock Award(s)($) | LTIP Payouts ($)(5) | All Other Compensation | ||||||||||||

| Year | Salary($) | Bonus($) | ||||||||||||||

Mitchell E. Hersh Chief Executive Officer | 2002 2001 2000 | 1,050,000 1,050,000 1,050,000 | 500,000 460,000 440,000 | 164,058 113,946 104,119 | (2) (3) (4) | 0 0 0 | 0 0 200,000 | (6) | 381,531 264,990 242,138 | 0 0 0 | ||||||

Timothy M. Jones President | 2002 2001 2000 | 515,000 515,000 515,000 | 415,000 395,000 380,000 | 98,435 68,367 62,472 | (2) (3) (4) | 0 0 0 | 0 0 120,000 | (6) | 228,919 158,994 145,283 | 0 0 0 | ||||||

Barry Lefkowitz Executive Vice President and Chief Financial Officer | 2002 2001 2000 | 395,000 385,000 385,000 | 320,000 275,000 250,000 | 68,485 47,572 43,469 | (2) (3) (4) | 0 0 0 | 0 0 100,000 | (6) | 159,266 110,632 101,091 | 0 0 0 | ||||||

Roger W. Thomas Executive Vice President, General Counsel and Secretary | 2002 2001 2000 | 335,000 325,000 325,000 | 250,000 195,000 185,000 | 61,765 40,170 36,706 | (2) (3) (4) | 0 0 0 | 0 0 100,000 | (6) | 143,639 93,418 85,362 | 0 0 0 | ||||||

Michael A. Grossman Executive Vice President(8) | 2002 2001 2000 | 330,000 315,000 250,000 | 215,000 185,000 160,000 | 83,407 7,292 6,664 | (2) (3) (4) | 0 0 0 | 0 0 30,000 | (7) | 193,970 16,959 15,497 | 0 0 0 | ||||||

20

recipient on either an annual basis over a five-year vesting period or on a cumulative basis over a seven-year maximum vesting period. The number of shares of restricted stock scheduled to be vested and earned on each vesting date on an annual basis, provided certain performance requirements set forth in the following sentence are satisfied, generally is equal to 15% of the restricted stock on the vesting date in year one, 15% of the restricted stock on the vesting date in year two, 20% of the restricted stock on the vesting date in year three, and 25% of the restricted stock on the vesting date in each of year four and year five. Vesting of the restricted stock on an annual basis commenced January 1, 2000, provided one of the following financial tests is met for the measurement period ending on the last day of the Company's fiscal year immediately preceding such vesting date: (A) the Company achieves an eight percent (8%) increase in its funds from operations per common share or (B) stockholders achieve a twelve and three quarters percent (12.75%) total return (dividends, assuming reinvestment upon applicable payment date, plus stock appreciation per share of Common Stock). The Company met the first of such tests for the measurement period ended December 31, 1999. On January 1, 2000, the following shares of restricted stock vested: 9,375, 5,625, 3,914, 3,304 and 600 shares for Messrs. Hersh, Jones, Lefkowitz, Thomas and Grossman, respectively, together with tax gross-up payments relating thereto. The value of the vested restricted stock and the tax gross-up payments relating thereto are based upon a $25.8281 stock price, which was the price of the Company's Common Stock on the date of vesting. The Company met the test set forth in (A) above for the measurement period ended December 31, 2000. On January 1, 2001, the following shares of restricted stock vested: 9,375, 5,625, 3,914, 3,305 and 600 shares for Messrs. Hersh, Jones, Lefkowitz, Thomas and Grossman, respectively, together with tax gross-up payments relating thereto. The value of the vested restricted stock and the tax gross-up payments relating thereto are based upon a $28.2656 stock price, which was the price of the Company's Common Stock on the date of vesting. The Company also met the test set forth in (A) above for the measurement period ended December 31, 2001. On January 1, 2002, the following shares of restricted stock vested: 12,500, 7,500, 5,218, 4,706 and 6,355 shares for Messrs. Hersh, Jones, Lefkowitz, Thomas and Grossman, respectively, together with tax gross-up payments relating thereto. The value of the vested restricted stock for the measurement period ended December 31, 2001, and the tax gross-up payments relating thereto are based upon a $30.5225 stock price, which was the price of the Company's Common Stock on the date of vesting.

On January 2, 2003, the Company, with the consent of Messrs. Hersh, Jones, Lefkowitz, Thomas and Grossman, respectively, amended the existing restricted stock agreements of each such Named Executive Officer to (i) vest the shares of restricted stock scheduled to vest in 2003 (which otherwise would not have vested in 2003), (ii) lengthen the vesting period for the shares of restricted stock scheduled to vest in 2004 by four years and (iii) replace the existing performance targets with performance targets determined annually by the Executive Compensation and Option Committee in each applicable year. In addition, on January 2, 2003, Messrs. Hersh, Jones, Lefkowitz, Thomas and Grossman were issued 60,000, 36,000, 28,000, 24,000 and 20,000 shares of restricted stock, respectively. There are certain tax gross-up payments that will be made upon vesting of such shares of restricted stock and the prior shares of restricted stock. With respect to the shares of restricted stock issued in 2003, as well as prior unvested shares of restricted stock, the number of shares scheduled to be vested and earned on each vesting date on an annual basis during the five to seven year vesting period, provided certain performance requirements are satisfied, generally is equal to 15% of such restricted stock on the vesting date in year one, 15% of such restricted stock on the vesting date in year two, 20% of such restricted stock on the vesting date in year three, 25% of such restricted stock on the vesting date in year four and 25% of such restricted stock on the vesting date in year five, with any unvested shares of restricted stock carried forward into subsequent years including, year six and year seven. See "Employment Contracts; Termination of Employment." On January 2, 2003, the following shares of restricted stock vested: 15,625, 9,375, 6,523, 5,858 and 7,482 shares for Messrs. Hersh, Jones, Lefkowitz, Thomas and Grossman, respectively, together with tax gross-up payments relating thereto. The value of such vested restricted stock, and the tax gross-up payments relating thereto are based upon a $29.73 stock price, which was the price of the Company's Common Stock on the date of vesting.

21

AGGREGATED OPTION/WARRANT/SAR EXERCISES IN

LAST FISCAL YEAR AND FISCAL YEAR-END OPTION/SAR VALUES

| | | | Number of Securities Underlying Unexercised Options/Warrants/SARs at Fiscal Year-End(#) | Value of Unexercised In-The-Money Options/Warrants/SARs at Fiscal Year-End ($) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Shares Acquired on Exercise(#) | | ||||||||||

| Name | Value Realized ($) | |||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||

| Mitchell E. Hersh | 10,000 | 78,559.55 | 409,976 | 80,000 | 244,125.00 | 279,000 | ||||||

| Timothy M. Jones | 6,000 | 46,317.76 | 332,295 | 48,000 | 146,475.00 | 167,400 | ||||||

| Barry Lefkowitz | 5,000 | 38,745.53 | 132,137 | 40,000 | 122,062.50 | 139,500 | ||||||

| Roger W. Thomas | 5,000 | 38,745.53 | 132,137 | 40,000 | 122,062.50 | 139,500 | ||||||

| Michael A. Grossman | 7,000 | 22,607.54 | 79,832 | 13,000 | 47,206.25 | 48,275 | ||||||

During 2002, the Company did not grant any options to its Named Executive Officers. In addition, during 2002, there were no awards under any long-term incentive plan made by the Company to its Named Executive Officers.

Employment Contracts; Termination of Employment

Mitchell E. Hersh Employment Agreement. On July 1, 1999, following the appointment of Mitchell E. Hersh as Chief Executive Officer of the Company on April 18, 1999, the Company and Mr. Hersh amended and restated Mr. Hersh's employment agreement with the Company (the "Amended and Restated Hersh Agreement"), providing for a constant four year term. Mr. Hersh's current annual base salary is $1,050,000, with annual increases within the discretion of the Executive Compensation and Option Committee. Mr. Hersh also is eligible to receive an annual bonus, restricted share awards and options within the discretion of the Board of Directors or the Executive Compensation and Option Committee, as the case may be. Pursuant to the Employee Stock Option Plan, Mr. Hersh was awarded 62,500 shares of restricted stock as of July 1, 1999, and with respect to each tax year in which such shares of restricted stock vest and are distributed to him, Mr. Hersh is entitled to receive a tax gross-up payment from the Company equal to forty-three percent (43%) of the fair market value of such restricted shares at the time of vesting, exclusive of dividends (the "Tax Gross-Up Payments"). Mr. Hersh is required to devote substantially all of his business time to the affairs of the Company and, subject to certain excluded activities, generally is restricted during the term of his employment and in the event his employment is terminated by the Company for cause (as defined in the Amended and Restated Hersh Agreement) or by him without good reason (as defined in the Amended and Restated Hersh Agreement), for a period of one year thereafter, from conducting any office-service, flex or office property development, acquisition or management activities within the continental United States. Mr. Hersh is entitled to (i) receive the aggregate of a cash payment of $8,000,000 (the "Fixed Amount"), reimbursement of expenses incurred prior to the date of termination, and the Tax-Gross-Up Payments applicable to any vested shares of restricted stock, (ii) immediate vesting of all options and incentive compensation payments or programs otherwise subject to a vesting schedule, (iii) require the Company to repurchase his vested options and (iv) receive continuation of health coverage through the end of his unexpired employment period should his employment be terminated by the Company without cause, by him for good reason or on account of his disability (as defined in the Amended and Restated Hersh Agreement) or death. Should Mr. Hersh terminate his employment on or within six months following a change in control (as defined in the Amended and Restated Hersh Agreement), Mr. Hersh's termination shall be treated as a termination for good reason. In addition, upon a change in control, and irrespective of whether Mr. Hersh's employment is terminated, the vesting of all options and other incentive compensation is accelerated and Mr. Hersh is entitled to receive a tax gross-up payment to cover any excise taxes payable due to the change in control. On January 2, 2003, the Company, with the consent of Mr. Hersh, amended Mr. Hersh's 1999 restricted stock grant to vest the

22

15,625 shares of restricted stock scheduled to vest in 2003 (which otherwise would not have vested), lengthen the vesting period of the remaining 15,625 unvested shares of restricted stock scheduled to vest in 2004 by four years, and replace the existing performance goals with an annual performance goal to be set by the Executive Compensation and Stock Option Committee at the beginning of each year (the "2003 Hersh Restricted Stock Amendment"). In addition, on January 2, 2003, 60,000 shares of restricted stock were issued to Mr. Hersh (the "2003 Hersh Restricted Stock Grant") with vesting subject to the attainment of annual performance goals to be set by the Executive Compensation and Stock Option Committee in each year and an entitlement to tax gross up payments upon such vesting. Accordingly, of the total 75,625 unvested shares of restricted stock currently issued to Mr. Hersh, the number of shares scheduled to be vested and earned on each vesting date on an annual basis over a five to seven year period, provided certain performance requirements are satisfied, generally is equal to 15% of such restricted stock on the vesting date in year one, 15% of such restricted stock on the vesting date in year two, 20% of such restricted stock on the vesting date in year three, 25% of such restricted stock on the vesting date in year four and 25% of such restricted stock on the vesting date in year five, with any unvested stock carried forward into subsequent years including year six and year seven.

Timothy M. Jones Employment Agreement. On July 1, 1999, following the appointment of Timothy M. Jones as President of the Company on April 18, 1999, the Company and Mr. Jones amended and restated Mr. Jones' employment agreement with the Company (the "Amended and Restated Jones Agreement"). The terms and conditions of the Amended and Restated Jones Agreement are generally similar to those of the Amended and Restated Hersh Agreement, except that (i) Mr. Jones' current annual base salary is $515,000, with annual increases within the sole discretion of the Chief Executive Officer, (ii) Mr. Jones was awarded 37,500 shares of restricted stock in 1999 and (iii) the Fixed Amount Mr. Jones will receive is $2,700,000. On January 2, 2003, Mr. Jones was awarded an additional 36,000 shares of restricted stock (the "Jones 2003 Restricted Stock Grant") and his prior restricted stock grant was amended (the "Jones 2003 Restricted Stock Amendment"), the terms and conditions of each of which are generally similar to those of the 2003 Hersh Restricted Stock Grant and the 2003 Hersh Restricted Stock Amendment, respectively, resulting in a total of 45,375 unvested shares of restricted stock currently issued to Mr. Jones.

Barry Lefkowitz Employment Agreement. On July 1, 1999, the Company and Barry Lefkowitz amended and restated Mr. Lefkowitz's employment agreement with the Company (the "Amended and Restated Lefkowitz Agreement"). The terms and conditions of the Amended and Restated Lefkowitz Agreement are generally similar to those of the Amended and Restated Jones Agreement, except that (i) Mr. Lefkowitz's current annual base salary is $395,000, (ii) Mr. Lefkowitz was awarded 26,094 shares of restricted stock in 1999 and (iii) the Fixed Amount Mr. Lefkowitz will receive is $2,500,000. On January 2, 2003, Mr. Lefkowitz was awarded an additional 28,000 shares of restricted stock and his prior restricted stock grant was amended, the terms and conditions of each of which are generally similar to those of the Jones 2003 Restricted Stock Grant and the Jones 2003 Restricted Stock Amendment, respectively, resulting in a total of 34,524 unvested shares of restricted stock currently issued to Mr. Lefkowitz.

Roger W. Thomas Employment Agreement. On July 1, 1999, the Company and Roger W. Thomas amended and restated Mr. Thomas' employment agreement with the Company (the "Amended and Restated Thomas Agreement"). The terms and conditions of the Amended and Restated Thomas Agreement are generally similar to those of the Amended and Restated Jones Agreement, except that (i) Mr. Thomas' current annual base salary is $350,000, (ii) Mr. Thomas was awarded 22,031 shares of restricted stock in 1999 and (iii) the Fixed Amount Mr. Thomas will receive is $2,500,000. Mr. Thomas was awarded an additional 1,000 shares of restricted stock in March of 2001. On January 2, 2003, Mr. Thomas was awarded an additional 24,000 shares of restricted stock and each of his prior restricted stock agreements was amended, the terms and conditions of each of which are generally similar to

23

those of the Jones 2003 Restricted Stock Grant and the Jones 2003 Restricted Stock Amendment, respectively, resulting in a total of 29,858 unvested shares of restricted stock currently issued to Mr. Thomas.

Michael A. Grossman Employment Agreement. On December 5, 2000, the Company entered into an employment agreement with Michael A. Grossman (the "Grossman Agreement"). The terms and conditions of the Grossman Agreement are generally similar to those of the Amended and Restated Jones Agreement, except that (i) the Grossman Agreement provides for an initial three year term, and a constant one year term beginning in December 2002, (ii) Mr. Grossman's current annual base salary is $340,000, (iii) in March 2001, Mr. Grossman was awarded 18,519 shares of restricted stock in addition to the 4,000 shares of restricted stock previously granted to him in 1999, and with respect to each tax year in which such restricted stock vests, Mr. Grossman is entitled to receive a Tax Gross-Up Payment, (iv) the Fixed Amount Mr. Grossman will receive is $1,000,000 and (v) should Mr. Grossman terminate his employment following a change in control, Mr. Grossman's termination will not be treated as a termination for good reason. On January 2, 2003, Mr. Grossman was awarded an additional 20,000 shares of restricted stock and each of his prior restricted stock agreements was amended, the terms and conditions of each of which are generally similar to those of the Jones 2003 Restricted Stock Grant and the Jones 2003 Restricted Stock Amendment, respectively, resulting in a total of 27,482 unvested shares of restricted stock currently issued to Mr. Grossman.

Executive Compensation and Option Committee Interlocks and Insider Participation

The Executive Compensation and Option Committee consists of Vincent Tese, Martin D. Gruss and Alan G. Philibosian. There are no interlocking relationships involving the Company's Board of Directors or Executive Compensation and Option Committee and the board of directors or compensation committee of any other company, which would require disclosure under the executive compensation rules of the SEC.

Report of the Executive Compensation and Option Committee of the Board of Directors on Executive Compensation

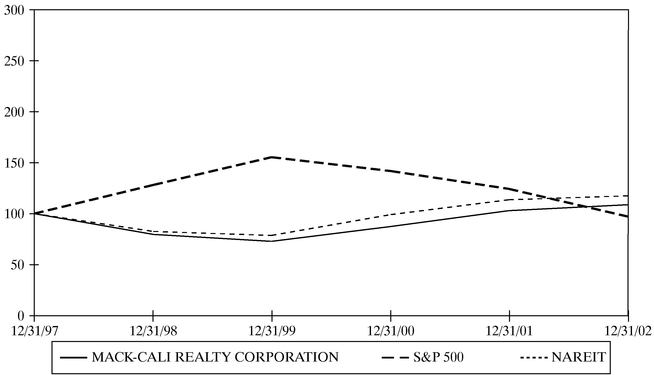

Notwithstanding anything to the contrary set forth in any of the Company's previous filings under the Securities Act of 1933, as amended, or the Exchange Act that might incorporate future filings, including this Proxy Statement, in whole or in part, the following report and the Performance Graph which follows shall not be deemed to be incorporated by reference into any such filings.

Executive Compensation Philosophy. The Executive Compensation and Option Committee will annually consider the appropriate combination of cash and stock-based compensation and weigh the competitiveness of the Company's overall compensation arrangements in relation to comparable real estate investment trusts. From time to time, the Executive Compensation and Option Committee may retain compensation and other management consultants to assist with, among other things, structuring the Company's various compensation programs and determining appropriate levels of salary, bonus and other compensatory awards payable to the Company's executive officers and key employees, as well as to guide the Company in the development of near-term and long-term individual performance objectives necessary to achieve long-term profitability.

The Executive Compensation and Option Committee believes that a fundamental goal of the Company's executive compensation program should be to provide incentives to create value for the Company's stockholders.

Base Salaries. The base compensation levels for the Company's executive officers in 2002 were set to compensate the executive officers for the functions they will perform as well as to be consideration for certain non-competition provisions in the employment agreements, and were based on the

24