Filed by REMEC, Inc.

pursuant to Rule 425 under the Securities Act of 1933 and

deemed filed under Rule 14d-2 of the Securities Exchange Act of 1934.

Subject Company: Spectrian Corporation

Commission File No.: 000-24360

The following is a series of slides used in connection with a presentation by Ronald Ragland, REMEC, Inc.'s Chairman and Chief Executive Officer, and David Morash, REMEC, Inc.'s Executive Vice President and Chief Financial Officer, during a presentation relating to the proposed acquisition of Spectrian Corporation by REMEC, Inc. at the CIBC World Markets Annual Investor Conference.

Safe Harbor

Forward-looking Statements

Certain statements in this presentation, including statements regarding anticipated cost savings and synergies of the proposed acquisition of Spectrian by REMEC and the opportunities that it will bring the combined company, are forward-looking statements that are subject to risks and uncertainties. Results could differ materially based on various factors including, and without limitation: the parties' ability to achieve the anticipated cost savings; the parties' ability to achieve the expected synergies, customer uncertainties related to the proposed acquisition or the economy in general, economic conditions and the related impact on wireless communication infrastructure spending; demand for REMEC's and Spectrian's products; rapid technological change and evolving industry standards and adverse changes in market conditions in both the United States and internationally. Further information on factors that could affect REMEC's results are included in REMEC's Annual Report on Form 10-K for the year ended January 31, 2002 on file with the Securities and Exchange Commission. Further information on factors that could affect Spectrian's results are included in Spectrian's Annual Report on Form 10-K for the year ended March 31, 2001 and Forms 10-Q for the interim quarters.

Total Microwave Solution | |

|

Overview

- •

- Wireless telecom, defense electronics

- •

- Broad microwave technology skills

- •

- Proven vertical integration strategy

- •

- Leadership in market sectors

- •

- Economic downturn fuels opportunity

- •

- Industry consolidation strategy

- •

- Global footprint with offshore manufacturing

Total Microwave Solution | |

|

REMEC Worldwide Locations

Total Microwave Solution | |

|

REMEC Market Segments

Total Microwave Solution | |

|

Strategy

- •

- Broad implementation technology for optimum integration systems solution

- •

- Broad product offering permits OEM partners a one-stop shop

- •

- Advanced technology in design and manufacturing process

- •

- Global OEM partner and niche product sales

- •

- Defense business balances commercial market volatility

- •

- Low cost global offshore manufacturing solutions

- •

- Continued effective industry consolidation

- •

- Retain strong financial resources

Total Microwave Solution | |

|

RF and microwave products for space, electronic warfare, missile and communications / navigation systems.

Design, development and production of subsystems, integrated assemblies and components for lower cost and improved performance.

Total Microwave Solution | |

|

F-22 Stealth Fighter

CNI

TRW

EW

[LOCKHEED MARTIN]

RADAR

[NORTHROP GRUMMAN] | |

|

Total Microwave Solution | |

|

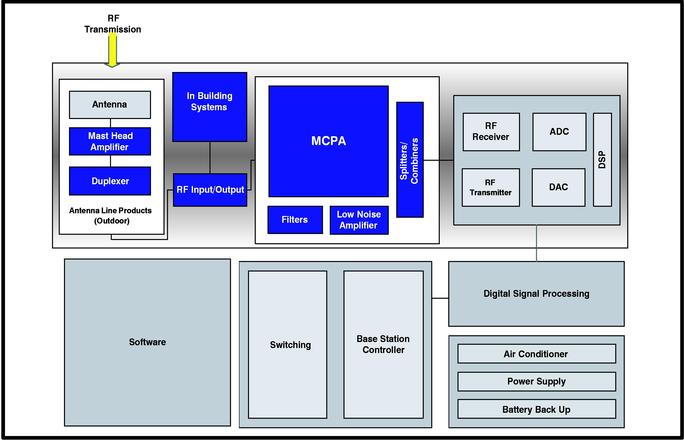

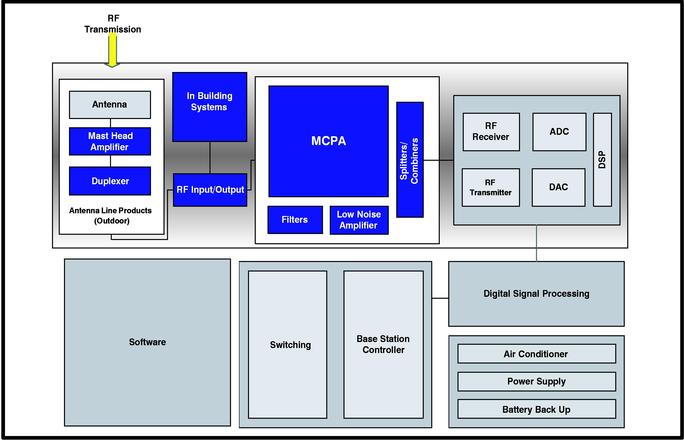

A range of products in demand for wireless communications systems including cellular, GSM, PCS / PCN and UMTS.

Complete systems, integrated modules and components for signal conditioning, transport and distribution to improve performance and decrease rollout cost.

Total Microwave Solution | |

|

Coverage enhancement | |

|

| |

Cellular / PCS basestations |

In-building solutions | |

|

| | |

Total Microwave Solution | |

|

| |

Components & Modules |

Fixed Wireless Access | |  |

| |

Modular Point-to-Point Radio |

| | |

Total Microwave Solution | |

|

Manufacture and testing of equipment for a range of applications and technologies both for internal design / development divisions and for external customers.

Offshore facilities enable significant cost reduction with quick development and turnaround capabilities.

Total Microwave Solution | |

|

Manufacturing

|

High volume commercial manufacturing

Extensive manufacturing and test capability

Very attractive economics and tax

Low cost skilled labor pool

ISO 9002 certified |

|

High volume commercial manufacturing

Very attractive economics

Available educated technical labor pool

High growth rate / 3x expansion

ISO 9002 certified |

|

Automated high speed surface mount assembly

Unique microwave assembly processes

Sophisticated supply chain management / product test

High growth rate / 3x expansion

ISO 9002 certified |

Total Microwave Solution | |

|

Advanced devices and subsystems including microwave MMICs and highly integrated assemblies for broadband wireless and fiber optic applications

Total Microwave Solution | |

|

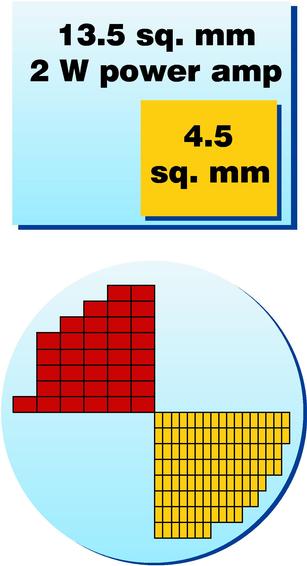

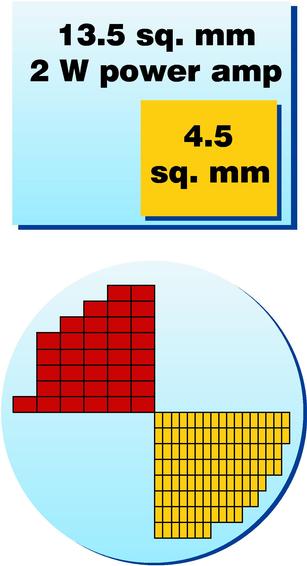

MMIC GaAs Power Amplifiers

| |

Nanowave GaAs MMIC amplifiers achieve 3x size reduction and greatly improved performance over existing foundry products based on new FET and circuit IP.

3x size reduction creates

> 3x more MMICs per GaAs wafer

(higher yields vs. fixed defects)

=

> 3x lower cost ICs |

| | |

Total Microwave Solution | |

|

REMEC & Spectrian

Total Microwave Solution | |

|

REMEC/Spectrian Combination

- •

- Accelerates our goal of achieving revenue base of $500M

- •

- REMEC restructure permits optimum synergies from combination

- •

- Power amplification critical mass and legacy strengthens base station integrated solution

- •

- Combined microwave engineering and R&D team will be formidable

- •

- Regional, customer and product merge have minimal overlap

- •

- Spectrian flexible outsource model allows rapid full utilization of fully offshore manufacturing facilities

- •

- Combines two strong balance sheets

- •

- Integration of management teams

Total Microwave Solution | |

|

REMEC and Spectrian

- •

- Merger agreement announced on May 19

- •

- Stock-for-stock deal (cash option up 25%)

- •

- SPCT shareholders to own 27% to 36% of combined entity

- •

- Likely closing date: July 30 to Sept 30

Total Microwave Solution | |

|

About Spectrian

- •

- Global RF and microwave products company

- •

- Low-cost international manufacturing facilities

- •

- Broad product line in mobile wireless, broadband, defense and manufacturing

- •

- Based in Sunnyvale, California

For more information, please see Spectrian's presentation

Total Microwave Solution | |

|

A Strong Strategic Combination

- •

- Complementary customer bases

- •

- Complete combined RF and microwave product line

- •

- New fully-integrated product offering

- •

- Strong North American, European and Asian engineering centers

- •

- $150M in cash, with no debt

Total Microwave Solution | |

|

Combined Product Offering

Total Microwave Solution | |

|

Financials

Total Microwave Solution | |

|

Spectrian Strategic Synergies

Total Microwave Solution | |

|

Financial Impact of Synergies—Year 1

| Sales Synergies | | $ | 3.0 MM |

| Manufacturing / Purchasing | | | 5.6 MM |

| Operations | | | 1.7 MM |

| QA | | | 0.5 MM |

| R & D | | | 4.0 MM |

| S & M | | | 1.6 MM |

| G & A | | | 1.9 MM |

| Finance | | | 0.7 MM |

| IT | | | 1.3 MM |

| H/R | | | 0.5 MM |

| Facilities | | | 2.0 MM |

| | |

|

| | | $ | 22.8 MM |

Total Microwave Solution | |

|

Consolidated Financial Position

- •

- Approximately $150MM in cash

- •

- $10MM tax refund, $4MM to come

- •

- $10MM in building sales closings

- •

- No debt

- •

- Consolidated net worth of $450MM

Total Microwave Solution | |

|

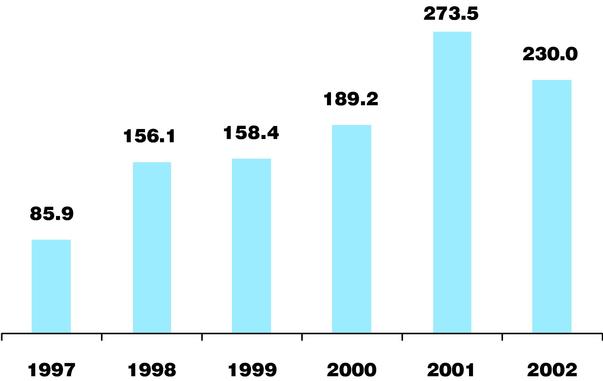

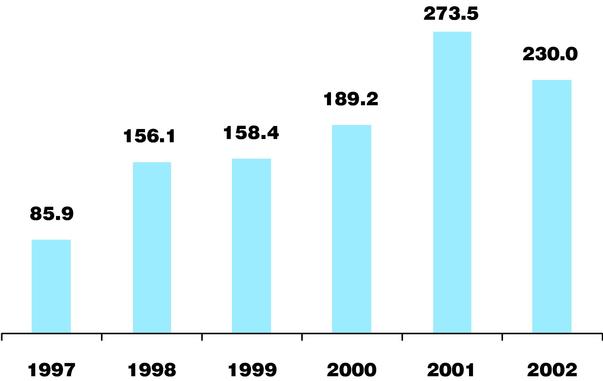

Revenue (Prior to Pooling)

Total Microwave Solution | |

|

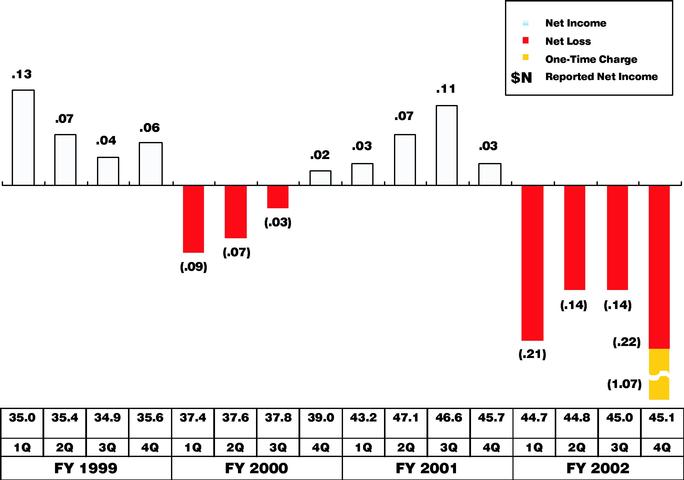

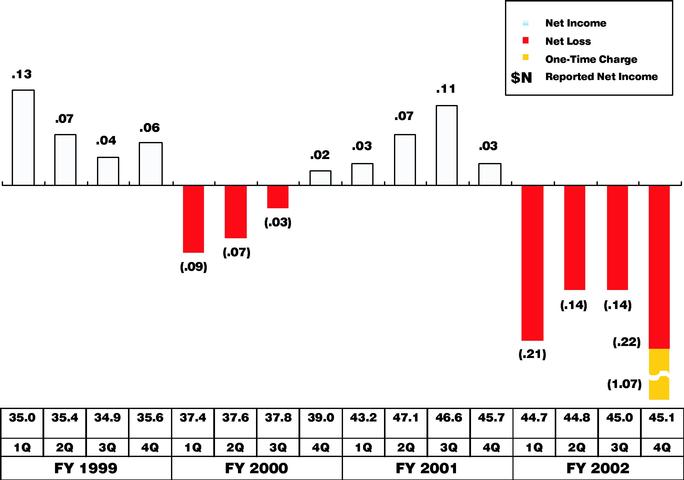

Net Income (Prior to Pooling)

Total Microwave Solution | |

|

Balance Sheet Highlights ($ Thousands)

| | 1/31/02

|

|---|

| Cash | | $ | 66.5 |

| Working Capital | | | 127.1 |

| Total Assets | | | 330.6 |

| Long Term Debt | | | — |

| Equity | | | 281.9 |

Total Microwave Solution | |

|

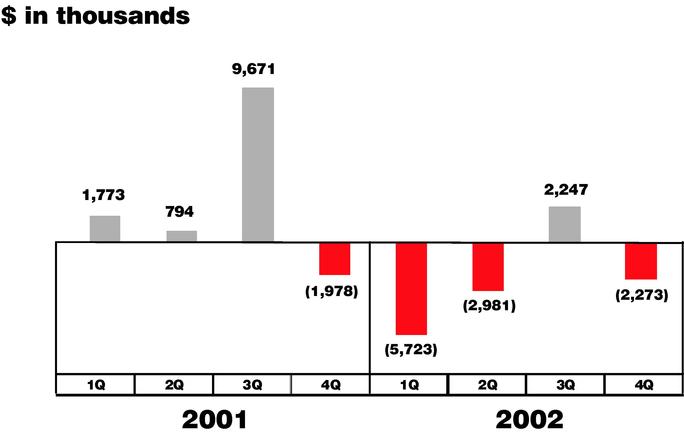

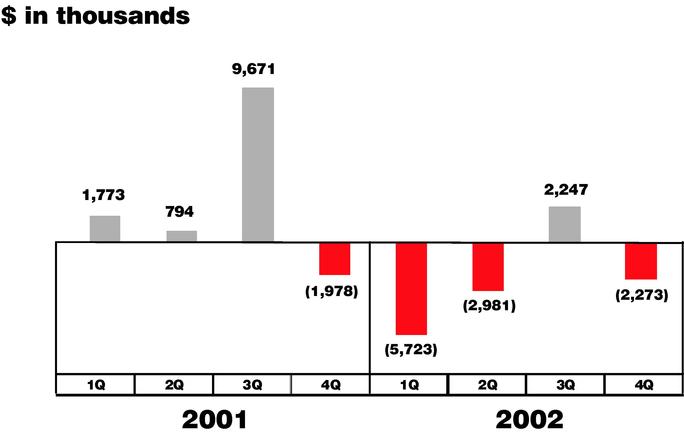

Quarterly Operating Cash Flow

Total Microwave Solution | |

|

Focus on Shareholder Value

- •

- Restructure business to focus on product lines

- •

- Reorganization to eliminate redundant operations

- •

- Close or consolidate certain facilities

- •

- One-time charge

- •

- $33.6 M

- •

- in process R&D $6.2

- •

- Annual cost reductions of ~$40 M by Q4 of CY 2001

- —

- Projected $10 M additional by Q2 of CY 2002

- •

- Offshore manufacturing completed by end of Q2

- •

- Maximized efficiency from capital spending

- •

- Centralize cash to use assets more efficiently

Total Microwave Solution | |

|

Focus on Shareholder Value—Continued

- •

- Sell buildings to raise approximately $30 M

- •

- Expanded accounting and reporting systems

- •

- Centralize supply chain management to reduce costs

- •

- Worldwide tax planning

- •

- Increased R & D spending

- •

- Bonuses tied to business performance

- —

- Improve cash flow

- —

- Focus on cash ROI

Total Microwave Solution | |

|

Financial Targets

- •

- Sales of $300 M in CY2002

- •

- Profitability in second half of CY 2002

- •

- Gross margin of 30% by Q4 of CY 2002

- •

- Net income of 5% by Q4 of CY 2002

- •

- Resume growth, target of

- —

- 30% commercial

- —

- 15% defense

Total Microwave Solution | |

|

Financial Targets—Continued

- •

- Operating cash flow of $1 million / month

- •

- R&D increase at MRI / MMDS / Nanowave

- •

- Acquisitions accretive / synergistic / technology fill

- •

- Taxes

- —

- Net operating loss carry forward

- —

- Driving to an effective tax rate of 25%

Total Microwave Solution | |

|

Summary

- •

- Complete Spectrian Acquisition

- •

- Competitive field significantly reduced

- •

- Strong balance sheet

- •

- Restructured for substantial growth

- •

- Significant market opportunities

- •

- Return to profit & positive cash flow

- •

- Confident game plan

Total Microwave Solution | |

|