UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2005

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission File Number 0-24796

CENTRAL EUROPEAN MEDIA ENTERPRISES LTD.

(Exact name of registrant as specified in its charter)

| | BERMUDA | | 98-0438382 | |

| | (State or other jurisdiction of incorporation and organization) | | (IRS Employer Identification No.) | |

| | Clarendon House, Church Street, Hamilton | | HM CX Bermuda | |

| | (Address of principal executive offices) | | (Zip Code) | |

Registrant's telephone number, including area code: 441-296-1431

Securities registered pursuant to Section 12(b) of the Act: NONE

Securities registered pursuant to Section 12(g) of the Act:

CLASS A COMMON STOCK, $0.08 PAR VALUE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for each shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2005 (based on the closing sale price of $48.38 of the registrant's Common Stock, as reported by the Nasdaq Exchange on such date) was approximately US$ 1.5 billion.

Number of shares of Class A Common Stock outstanding as of February 13, 2006 : 31,032,994

Number of shares of Class B Common Stock outstanding as of February 13, 2006 : 6,966,533

DOCUMENTS INCORPORATED BY REFERENCE

Document | Location in Form 10-K in Which Document is Incorporated |

| Registrant's Proxy Statement for the Annual General Meeting of Shareholders to be held on June 7, 2006 | Part III |

| | | | Page |

PART I | |

| | | | 4 |

| | | | 28 |

| | | | 33 |

| | | | 34 |

| | | | 34 |

| | | | 38 |

| | | | |

PART II | |

| | | | 39 |

| | | | 39 |

| | | | 42 |

| | | | 77 |

| | | | 78 |

| | | | 146 |

| | | | 146 |

| | | | 148 |

| | | | |

PART III | |

| | | | 149 |

| | | | 149 |

| | | | 149 |

| | | | 149 |

| | | | 149 |

| | | | |

PART IV | |

| | | | 150 |

| | | | |

| 154 |

PART I

Forward-looking Statements

This report contains forward-looking statements, including statements regarding the renewal of broadcasting licenses in the Slovak Republic and Ukraine, the impact of legal proceedings in Ukraine, the results of modifying our sales strategy in the Czech Republic, the impact of the reorganization of our operations in the Czech Republic and the Slovak Republic, the results of additional investment in Croatia and Ukraine, the impact of the acquisition of control of our operations in the Slovak Republic, our ability to develop and implement multi-channel strategies generally, the growth of television advertising in our markets, the future economic conditions in our markets, future investments in television broadcast operations, the growth potential of advertising spending in our markets, and other business strategies and commitments. For these statements and all other forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy or are otherwise beyond our control and some of which might not even be anticipated. Future events and actual results, affecting our strategic plan as well as our financial position, results of operations and cash flows, could differ materially from those described in or contemplated by the forward-looking statements. Important factors that contribute to such risks include, but are not limited to, the general regulatory environments where we operate and application of relevant laws and regulations, the renewals of broadcasting licenses, our ability to implement strategies regarding sales and multi-channel distribution, the rate of development of advertising markets in countries where we operate, our ability to acquire necessary programming and the ability to attract audiences, our ability to obtain additional frequencies and licenses, and general market and economic conditions in these countries as well as in the United States and Western Europe.

GENERAL

Central European Media Enterprises Ltd. is a Bermuda company that, together with its subsidiaries and affiliates, invests in, develops and operates national commercial television channels and stations in Central and Eastern Europe. At present, we have operations in Croatia, the Czech Republic, Romania, the Slovak Republic, Slovenia and Ukraine.

Our registered offices are located at Clarendon House, Church Street, Hamilton HM CX Bermuda, and our telephone number is 441-296-1431. Communications can also be sent c/o CME Development Corporation at Aldwych House, 81 Aldwych, London, WC2B 4HN, United Kingdom, telephone number +44-20-7430-5430.

We make available, free of charge, on our website at http://www.cetv-net.com our Annual Reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission.

Unless otherwise noted, all statistical and financial information presented in this report has been converted into US dollars using appropriate exchange rates. All references to 'US$' or 'dollars' are to US dollars, all references to 'HRK' are to Croatian kuna, all references to 'CZK' are to Czech korunas, all references to 'RON' are to the New Romanian lei, all references to 'SIT' are to Slovenian tolars, all references to 'SKK' are to Slovak korunas, all references to 'UAH' are to Ukrainian hryvna, all references to 'Euro' are to the European Union Euro and all references to 'GBP' are to British Pounds. The exchange rates as of December 31, 2005 used in this report are 6.23 HRK/US$; 24.59 CZK/US$; 3.11 RON/US$; 202.43 SIT/US$; 31.95 SKK/US$; 5.05 UAH/US$; 0.85 Euro/US$ and 0.58 GBP/US$.

CORPORATE STRUCTURE

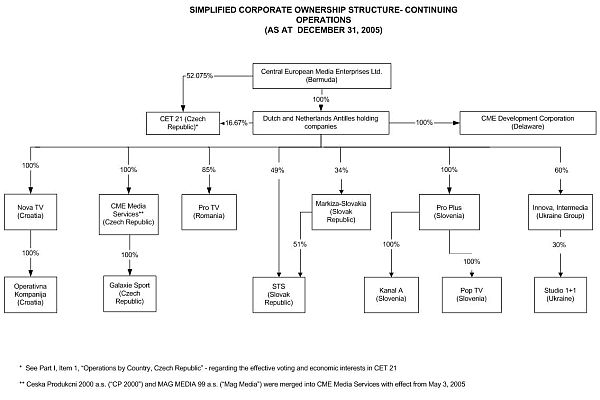

Central European Media Enterprises Ltd. was incorporated on June 15, 1994 under the laws of Bermuda. Our assets are held through a series of Dutch and Netherlands Antilles holding companies. In each market in which we operate, we have ownership interests both in license companies and in operating companies. License companies have been authorized by the relevant local regulatory authority to engage in television broadcasting in accordance with the terms of a particular license. We generate revenues primarily through our operating companies which acquire programming for broadcast by the corresponding license company and enter into agreements with advertisers and advertising agencies on behalf of the license company. In the Czech Republic, Romania and Ukraine, the license company also acts as an operating company. Our share of profits in the operating companies corresponds with our voting interest other than in the Slovak Republic and Ukraine, where we are entitled by contract to a share of profits in those operations that is in excess of our voting interest. Below is an overview of our operating structure at December 31, 2005, the accounting treatment for each entity and a chart entitled “Simplified Corporate Structure - Continuing Operations”.

Key Subsidiaries and Affiliates as at December 31, 2005 | | Voting Interest | | Share of Profits | | Accounting Treatment | | TV Channels |

Continuing Operations | | | | | | | | |

| | | | | | | | | |

Croatia | | | | | | | | |

Operating Company: | | | | | | | | |

| Operativna Kompanija d.o.o. (OK) | | 100% | | 100% | | Consolidated Subsidiary | | |

License Company: | | | | | | | | |

| Nova TV d.d. (Nova TV Croatia) | | 100% | | 100% | | Consolidated Subsidiary | | NOVA TV (Croatia) |

| | | | | | | | | |

Czech Republic | | | | | | | | |

Operating Company: | | | | | | | | |

| CME Media Services s.r.o. (CME Media Services) | | 100% | | 100% | | Consolidated Subsidiary | | |

| | | | | | | | | |

License Companies: | | | | | | | | |

| CET 21 s.r.o. (CET 21) | | 96.5% | | 96.5% | | Consolidated Subsidiary | | TV NOVA (Czech Republic) |

| Galaxie Sport s.r.o. (Galaxie Sport) | | 100% | | 100% | | Consolidated Subsidiary | | GALAXIE SPORT |

| | | | | | | | | |

Romania | | | | | | | | |

Operating Companies: | | | | | | | | |

| Media Pro International S.A. (MPI) | | 85% | | 85% | | Consolidated Subsidiary | | |

| Media Vision S.R.L. (Media Vision) | | 70% | | 70% | | Consolidated Subsidiary | | |

License Company: | | | | | | | | |

| Pro TV S.A. - formerly Pro TV S.R.L. (Pro TV) | | 85% | | 85% | | Consolidated Subsidiary | | PRO TV, ACASA, PRO CINEMA and PRO TV INTERNATIONAL |

Slovenia | | | | | | | | |

Operating Company: | | | | | | | | |

| Produkcija Plus d.o.o. (Pro Plus) | | 100% | | 100% | | Consolidated Subsidiary | | |

License Companies: | | | | | | | | |

| Pop TV d.o.o. (Pop TV) | | 100% | | 100% | | Consolidated Subsidiary | | POP TV |

Key Subsidiaries and Affiliates as at December 31, 2005 | | Voting Interest | | Share of Profits | | Accounting Treatment | | TV Channels |

Continuing Operations | | | | | | | | |

| | | | | | | | | |

| Kanal A d.o.o. (Kanal A) | | 100% | | 100% | | Consolidated Subsidiary | | KANAL A |

Slovak Republic | | | | | | | | |

Operating Company: | | | | | | | | |

| Slovenska Televizna Spolocnost s.r.o. (STS) | | 49% | | 70% | | Equity Accounted Affiliate | | |

License Company: | | | | | | | | |

| Markiza-Slovakia s.r.o. (Markiza) | | 34% | | 0.1% | | Equity Accounted Affiliate | | MARKIZA TV |

| | | | | | | | | |

Ukraine | | | | | | | | |

Operating Companies: | | | | | | | | |

| Innova Film GmbH (Innova) | | 60% | | 60% | | Consolidated Subsidiary | | |

| International Media Services Ltd. (IMS) | | 60% | | 60% | | Consolidated Subsidiary | | |

| Enterprise "Inter-Media" (Inter-Media) | | 60% | | 60% | | Consolidated Subsidiary | | |

License Company: | | | | | | | | |

| Broadcasting Company "Studio 1+1 LLC " (Studio 1+1) | | 18% | | 60% | | Consolidated Variable Interest Entity | | STUDIO 1+1 |

OPERATING ENVIRONMENT

Market and Audience Share

Our television channels reach an aggregate of approximately 82 million people in six countries. TV NOVA in the Czech Republic, our newest national channel, was ranked first in national all day audience share in 2005, as were MARKIZA TV in the Slovak Republic and POP TV, our primary channel in Slovenia. PRO TV in Romania and STUDIO 1+1 in Ukraine were ranked second in terms of national all day audience share for 2005 in competitive markets. In Croatia, NOVA TV was ranked fourth in terms of national all day audience share.

The rankings of our channels in the markets in which they broadcast are reflected below.

Country | | Channels | | Launch Date | | Technical Reach (1) | | 2005 Audience Share (2) | | Market Rank (2) |

| | | | | | | | | | | |

| Croatia | | NOVA TV (Croatia) | | August 2000 (3) | | 88% | | 14% | | 4 |

| Czech Republic | | TV NOVA (Czech Rep) | | February 1994 (4) | | 100% | | 41% | | 1 |

| | | GALAXIE SPORT | | April 2002 (5) | | 26% (7) | | Not Measured | | Not Measured |

| Romania | | PRO TV | | December 1995 | | 76% | | 16% | | 2 |

| | | ACASA | | February 1998 | | 65% | | 8% | | 4 |

| | | PRO CINEMA | | April 2004 | | 44% | | 1% | | 12 |

| Slovak Republic | | MARKIZA TV | | August 1996 | | 86% | | 31% | | 1 |

| Slovenia | | POP TV | | December 1995 | | 95% | | 27% | | 1 |

| | | KANAL A | | October 1991 (6) | | 86% | | 9% | | 4 |

| Ukraine | | STUDIO 1+1 | | January 1997 | | 95% | | 20% | | 2 |

| (1) | “Technical Reach” is a measurement of the percentage of a country’s population that is able to receive the signals of the indicated channels. Source: Internal estimates supplied by each country's operations. Each of our stations in the relevant country has estimated its own technical reach based on the location, power and frequency of each of its transmitters and the local population density and geography around that transmitter. The technical reach calculation is separate from the independent third party measurement that determines audience share. |

| (2) | National all day audience share and rank. Source: Croatia: Peoplemeters AGB Media Services, Czech Republic: ATO - Mediaresearch / GFK, Romania: Peoplemeters Taylor Nelson Sofres, Slovak Republic: Visio / MVK, Slovenia: Peoplemeters AGB Media Services, Ukraine: Peoplemeters GFK USM. There are four stations ranked in Croatia, four in Czech Republic, twenty three in Romania, six in the Slovak Republic, four in Slovenia, and six significant stations ranked in Ukraine. |

| (3) | We acquired NOVA TV (Croatia) in July 2004. |

| (4) | We acquired TV NOVA (Czech Republic) in May 2005. |

| (5) | We acquired GALAXIE SPORT in September 2005. |

| (6) | We acquired KANAL A in October 2000. |

| (7) | 26% technical reach in the Czech Republic. In addition, GALAXIE SPORT has a technical reach of 38% in the Slovak Republic. |

The following table shows the population, technical reach of our primary channel, number of television households, per capita GDP and cable penetration for those countries of Central and Eastern Europe where we conduct broadcast operations.

Country | | Population (in millions) (1) | | Technical Reach (in millions) (2) | | Television Households (in millions) (3) | | Per Capita GDP 2005 US$ (4) | | Cable Penetration (3) |

| | | | | | | | | | | |

| Croatia | | 4.3 | | 3.8 | | 1.5 | | $ 8,176 | | 16% |

| Czech Republic | | 10.2 | | 10.2 | | 3.9 | | $ 11,148 | | 26% |

| Romania | | 21.3 | | 16.2 | | 7.4 | | $ 4,460 | | 68% |

| Slovak Republic | | 5.4 | | 4.6 | | 1.9 | | $ 9,312 | | 35% |

| Slovenia | | 2.0 | | 1.9 | | 0.6 | | $ 17,050 | | 58% |

| Ukraine | | 47.4 | | 45.0 | | 18.4 | | $ 1,715 | | 19% |

Total | | 90.6 | | 81.7 | | 33.7 | | | | |

| (1) | Source: Global Insight Country Analysis (2005 data). |

| (2) | Source: Internal estimates supplied by each country's operations. Each of our operations has estimated its own technical reach based on the location, power and frequency of each of its transmitters and the local population density and geography around that transmitter. The technical reach is separate from the independent third party measurement that determines audience shares. |

| (3) | Source: Informa Telecoms and Media (2005 data). A Television Household is a residential dwelling with one or more television sets. Cable Penetration refers to the percentage of Television Households that subscribe to television services via cable channels. |

| (4) | Source: ING (September 2005 data). |

Regulation

In this report, we refer to broadcasting regulatory authorities or agencies in our operating countries as “The Media Council”. These authorities or bodies are as follows:

Croatia - Electronic Media Council

Czech Republic - The Council for Radio and Television Broadcasting

Romania - National Audio-Visual Council

Slovak Republic - Council of the Slovak Republic for Broadcasting and Television Transmission

Slovenia - Post and Electronic Communications Agency of the Republic of Slovenia

Ukraine - National Council for Television and Radio Broadcasting

Media Councils generally supervise broadcasters and their compliance with national broadcasting legislation. On accession to the European Union (the "EU") of any Central or Eastern European country in which we operate, our broadcast operations in such country become subject to EU legislation, including regulations on the origin of programming content. The Czech Republic, Slovenia and the Slovak Republic acceded to the EU on May 1, 2004.

The EU Television Without Frontiers directive (the "EU Directive") sets out the legal framework for television broadcasting in the EU, which among other things, requires broadcasters, where "practicable and by appropriate means," to reserve a majority of their broadcast time for "European works." Such works are defined as originating from an EU member state or a signatory to the Council of Europe's Convention on Transfrontier Television, as well as written and produced mainly by residents of the EU or Council of Europe member states. In addition, the EU Directive requires that at least 10% of either broadcast time or programming budget is dedicated to programs made by European producers who are independent of broadcasters. News, sports, games, advertising, teletext services and teleshopping are excluded from the calculation of these quotas. Further, the EU Directive provides for regulations on advertising, including limits on the amount of time that may be devoted to advertising, including direct sales advertising. The adoption by Croatia, which is currently in EU accession negotiations, and by Romania, which is scheduled for accession to the EU in 2007, of media legislation for privately owned broadcasters that is substantially in compliance with the EU Directive has had no material adverse effect on our operations.

License Renewal

Regulatory bodies in each country in which we operate control access to the available frequencies through licensing regimes. Management believes that the licenses for our television license companies will be renewed prior to expiry. In Romania, the Slovak Republic, Slovenia and Ukraine local regulations contain a qualified presumption for extensions of broadcast licenses according to which a license may be renewed if the licensee has operated substantially in compliance with the relevant licensing regime. To date, all expiring licenses have been renewed; however, there can be no assurance that licenses will continue to be renewed upon expiration of their current terms. The failure of any such license to be renewed could adversely affect the results of our operations.

The licenses to operate our terrestrial broadcast operations are effective for the following periods:

| Croatia | The license of NOVA TV (Croatia) expires in April 2010. |

| Czech Republic | The license of TV NOVA (Czech Republic) expires in January 2017. The GALAXIE SPORT license expires in March 2014. |

| Romania | Licenses expire on dates ranging from July 2006 to February 2014. |

| Slovak Republic | The license of MARKIZA TV in the Slovak Republic expires in September 2007. |

| Slovenia | The licenses of both our channels in Slovenia expire in August 2012. |

| Ukraine | The 15-hour license of STUDIO 1+1 expires in December 2006. The license to broadcast for the remaining nine hours in off prime expires in August 2014. |

OPERATIONS BY COUNTRY

CROATIA

General

Croatia is a parliamentary democracy with a population of approximately 4.3 million people. Per capita GDP is estimated to be US$ 8,176 in 2005 with a GDP growth rate of 3% for 2005. Approximately 99% of Croatian households have television and cable penetration is approximately 16%. According to our estimates, the Croatian television advertising market grew by approximately 4% in 2005 to approximately US$ 115 - 125 million.

In Croatia, we operate one national television channel NOVA TV (Croatia). The two other national broadcasters are the public broadcaster HRT, which operates two channels, and privately owned broadcaster RTL.

Operating and License Companies

We own 100% of Nova TV (Croatia), which holds a national terrestrial broadcast license for Croatia. Nova TV (Croatia) owns 100% of OK, which provides programming and advertising services for the NOVA TV (Croatia) channel.

Operations

NOVA TV (CROATIA)

NOVA TV (Croatia) reaches 88% of the Croatian population. Independent research shows that among the main television stations in Croatia, the NOVA TV (Croatia) channel had a national all day audience share of 13.6% and a national prime time audience share of 13.3%.

The chart below summarizes the national all day and prime time audience share figures for NOVA TV (Croatia):

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | |

NOVA TV (Croatia) | | | | | | | | | | | |

| All day | | | 11.8% | | | 15.3% | | | 15.6% | | | 12.0% | | | 13.6% | |

| Prime time | | | - | | | - | | | 12.7% | | | 10.9% | | | 13.3% | |

Source : 2005, 2004 and 2003 - AGB Media Services

Source : 2002 and 2001 - CATI - phone recall research

(No independent data is available for 2001 and 2002 prime time).

Programming

NOVA TV (Croatia) broadcasts approximately 19 hours per day and has a programming strategy to appeal to a broad audience through a wide range of programming, including movies and series, news, sitcoms, telenovellas, soap operas and game shows.

Approximately 21% of the NOVA TV (Croatia) channel's programming is locally produced, including a Croatian version of Nasa Mala Klinica (Our Little Clinic), a sitcom originally produced by Pro Plus in Slovenia; U Sridu (Bull’s Eye), a talk show; and Boomerang, an office-based sitcom.

OK has secured exclusive broadcast rights in Croatia to a variety of popular American and European series, films and telenovellas produced by major international studios, including MGM, Paramount Pictures and Walt Disney Television International for the NOVA TV (Croatia) channel. All foreign language programming is subtitled. Foreign news reports and film footage licensed from CNN, Reuters, APTN and SNTV are integrated into news programs on the NOVA TV (Croatia) channel.

The NOVA TV (Croatia) channel is required to comply with several restrictions on programming, including regulations on the origin of programming. These include the requirement that 20% of broadcast time consist of locally produced programming and 60% of such locally produced programming be shown during prime time.

Advertising

Our Croatian operations derive revenues principally from the sale of commercial advertising time on the NOVA TV (Croatia) channel, sold both through independent agencies and media buying groups. The NOVA TV (Croatia) channel currently serves approximately 250 advertisers, including multinational companies such as Johnson & Johnson, Wrigley, L’Oreal, Procter & Gamble, Coca Cola and Reckitt Benckiser. Our top ten advertising clients contributed approximately 39% to our total advertising revenues in Croatia in 2005.

Within the Croatian advertising market, television advertising accounts for approximately 48% of total advertising spending. NOVA TV (Croatia) competes for advertising revenues with other media such as print, radio, outdoor advertising and direct mail.

Privately owned broadcasters are permitted to broadcast advertising for up to 15% of their daily broadcast time with an additional 5% of daily broadcast time that may be used for direct sales advertising. Privately owned broadcasters may use up to 12 minutes per hour for advertising and teleshopping. The public broadcaster, which is also financed through a compulsory television license fee, is restricted to broadcasting 9 minutes of advertising per hour. There are restrictions on the frequency of advertising breaks, which are the same for public and privately owned broadcasters. There are also restrictions that relate to advertising content, including a ban on tobacco advertising.

Competition

At the beginning of 2004, NOVA TV (Croatia) and HRT, which was then operating three channels, were the only national broadcasters in Croatia. In April 2004, RTL launched a channel under a license issued by the Croatian government on the frequencies previously used by the public broadcaster HRT, a third channel, which had ceased broadcasting earlier in 2004. During 2005 NOVA TV (Croatia) achieved a national all day audience share of 13.6%, which made it the fourth ranked station nationally.

The chart below provides a comparison of our audience share and technical reach to our competitors:

Main Television Channels | | Ownership | | Year of first transmission | | Signal distribution | | Audience share (2005) | | Technical reach |

| | | | | | | | | | | |

| HRT 1 | | Public Television | | 1956 | | Terrestrial / satellite / cable | | 38.1% | | 99% |

| HRT 2 | | Public Television | | 1972 | | Terrestrial / satellite / cable | | 15.9% | | 99% |

| RTL | | Bertelsmann | | 2004 | | Terrestrial / satellite / cable | | 24.7% | | 95% |

NOVA TV (Croatia) | | CME | | 2000 | | Terrestrial / satellite / cable | | 13.6% | | 88% |

| Others | | | | | | | | 7.7% | | |

| | | | | | | | | 100.0% | | |

Source : AGB Puls and CME

Additional competitors for audience share include cable and satellite channels.

License Renewal

The NOVA TV (Croatia) channel operates pursuant to a license originally granted by the Telecommunications Agency of Croatia and is regulated by the Croatian Media Council pursuant to the Electronic Media Law and the Media Law. The license of NOVA TV (Croatia) is for a period of 10 years, expiring in April 2010. According to the Electronic Media Law a license can be extended. The Croatian Media Council has the authority to decide on an extension on the basis of a request for a renewal of a license filed six months before its expiration if a broadcaster has conducted its business in accordance with law and the license. The Croatian Media Council may hold a public tender in connection with a request to extend a license.

CZECH REPUBLIC

General

The Czech Republic, which acceded to the European Union on May 1, 2004, is a parliamentary democracy with a population of 10.2 million. Per capita GDP in 2005 is estimated to be US$ 11,148 with a GDP growth rate in 2005 of 4.7%. Approximately 98% of Czech households have television, and cable penetration is approximately 26%. According to our estimates, the Czech Republic television advertising market was approximately US$ 350 - 360 million in 2005, growing by 4% from 2004 in local currency.

In the Czech Republic, we operate one national television channel, TV NOVA (Czech Republic), as well as a cable channel, GALAXIE SPORT, both of which were acquired in 2005. The other two national broadcasters are the public broadcaster CT, operating two channels, and privately owned broadcaster TV Prima.

Operating and License Companies

We own 68.745% of CET 21, which holds the national terrestrial broadcast license for TV NOVA (Czech Republic). Our voting and economic interest in CET 21 is effectively 96.50% because CET 21 itself holds an undistributed 28.755% interest that is not entitled to voting rights or dividends. We own 100% of CME Media Services. With effect from May 3, 2005, former operating and advertising sales companies Ceska Produkcni 2000 a.s. and Mag Media 99 a.s. were merged into CME Media Services. CME Media Services and its subsidiaries provide services related to programming, production and advertising to CET 21.

Operations

TV NOVA (Czech Republic)

The TV NOVA (Czech Republic) channel reaches approximately 100% of the Czech Republic's television households. The TV NOVA (Czech Republic) channel had an average all day audience share for 2005 of 40.9% compared to 23.2% for its nearest commercial competitor, TV Prima.

The chart below summarizes the national all day and prime time audience share figures for TV NOVA (Czech Republic):

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | |

TV NOVA (Czech Republic) | | | | | | | | | | | |

| All day | | | 47.7% | | | 44.2% | | | 43.4% | | | 42.2% | | | 40.9% | |

| Prime time | | | 51.9% | | | 48.3% | | | 45.8% | | | 44.9% | | | 42.3% | |

Source: Taylor Nelson Sofres - ATO; ATO - Mediaresearch

Galaxie Sport

The GALAXIE SPORT channel broadcasts via cable high quality sports and sport-related programming in the Czech Republic and the Slovak Republic. The GALAXIE SPORT channel has secured valuable broadcast license rights to some of the most popular sports programming in its markets including the National Hockey League, Premier League (British Football), Serie A (Italian Football), Premiere Division (Spanish Football), the National Basketball Association, ATP Tennis tournaments, and motorcycle and automobile races. Beginning in 2006, Galaxie Sport will also have certain broadcast rights to Formula One programming as part of a contract, that includes broadcasts on TV NOVA (Czech Republic). The GALAXIE SPORT channel also produces 16 sports shows weekly, as well as daily sports news programs in the Czech and Slovak languages.

The combined Czech Republic and Slovak Republic markets have a population of approximately 15.6 million people representing approximately 5.8 million television households. Cable passes approximately 1.7 million households in the combined markets. Galaxie Sport currently has carriage agreements with all of the largest cable distributors in the Czech Republic and Slovak Republic, reaching over 700,000 subscribers.

Programming

The TV NOVA (Czech Republic) channel broadcasts 24 hours per day and has a programming strategy to appeal to a broad audience, especially during prime time, with news, movies, entertainment programs and sports highlights, and to target more specific demographics in off-peak broadcasting hours. Approximately 31% of the TV NOVA (Czech Republic) channel's programming is locally produced, including Televizni noviny (TV News), Cesko hleda SuperStar (Pop Idol), Ordinace v ruzove zahrade (original Czech series) and Ulice (daily soap opera). Televizni noviny, the nightly news program, achieves the highest ratings among all Czech television shows on a regular basis. Cesko hleda SuperStar (Pop Idol), Ordinace v ruzove zahrade (original Czech series) and Ulice (daily soap opera) are also among the top-rated shows in the Czech Republic.

The TV NOVA (Czech Republic) channel has secured exclusive broadcast rights in the Czech Republic to a variety of popular American and European series, films and telenovellas produced by major international studios including Universal, IFD, MGM, Carsey-Werner, Paramount Pictures, Twentieth Century Fox and Walt Disney Television International. All foreign language programming is dubbed into the Czech language. Foreign news reports and film footage licensed from CNN, Reuters, APTN and SNTV are integrated into news programs on the TV NOVA (Czech Republic) channel.

The TV NOVA (Czech Republic) channel is required to comply with certain restrictions on programming, including regulations on the origin of programming. These include the requirements that broadcasters shall, where practicable, reserve half of their broadcasting time for European productions; reserve, where practicable, at least 10% of their broadcasting time or spend 10% of their programming budget on independent European productions; and ensure, where practicable, that at least 10% of broadcasting time is dedicated to productions made within the last five years.

Advertising

The TV Nova (Czech Republic) channel derives revenues principally from the sale of commercial advertising time through media buying groups and independent agencies. Advertisers include large multinational firms such as Procter & Gamble, Henkel, Unilever, Wrigley, Kraft Jacobs, Ferrero, Suchard, Danone Group, Nestle and Reckitt Benckiser. The top ten advertisers on the TV NOVA (Czech Republic) channel contributed approximately 26% of its advertising revenues in 2005.

Within the Czech advertising market, television accounts for approximately 47% of total advertising spending. The television advertising market in the Czech Republic has shown slow growth over the past several years compared to general economic growth rates. The TV NOVA (Czech Republic) channel competes for advertising revenues with other media, such as print, radio, outdoor advertising, internet and direct mail.

Privately owned broadcasters in the Czech Republic are permitted to broadcast advertising for up to 12 minutes per hour (but not more than 15% of total daily broadcast time). The public broadcaster, which is also financed through a compulsory television license fee, is restricted to broadcasting advertising for a maximum of 1% of daily broadcast time (excluding teleshopping). From January 1, 2007, the maximum amount of daily broadcast time that can be used by the public broadcaster for advertising will be 0.5% (except teleshopping); and from January 1, 2008, the public broadcaster cannot broadcast advertising or teleshopping (except in respect of certain sporting or cultural events). There are restrictions on the frequency of advertising breaks during and between programs. There are also restrictions that relate to advertising content, including a ban on tobacco advertising and limitations on advertisements of alcoholic beverages.

Competition

The Czech Republic is served by two national public television stations, CT1 and CT2, which dominated the ratings until the TV NOVA (Czech Republic) channel began broadcasting in 1994, and by the national privately owned broadcaster TV Prima (co-owned by MTG and local owners).

The chart below provides a comparison of our audience share and technical reach to our competitors:

Main Television Channels | | Ownership | | Year of first transmission | | Signal distribution | | Audience share (2005) | | Technical reach |

| | | | | | | | | | | |

TV NOVA (Czech Republic) | | CME | | 1994 | | Terrestrial | | 40.9% | | 100% |

| TV Prima | | Modern Times Group/Local owners | | 1993 | | Terrestrial / satellite | | 23.2% | | 95% |

| CT 1 | | Public Television | | 1953 | | Terrestrial | | 21.7% | | 100% |

| CT 2 | | Public Television | | 1970 | | Terrestrial | | 8.1% | | 99% |

| Others | | | | | | | | 6.1% | | |

| | | | | | | | | 100.0% | | |

Source: CME and Ceske radiokomunikace; Mediaresearch - Peoplemeters provider Establishment and Continual Research data 2005

The TV NOVA (Czech Republic) channel also competes for audience with additional foreign terrestrial television stations located in Austria, Germany, the Slovak Republic and Poland, where originating signals reach the Czech Republic, as well as with foreign satellite stations.

Regulation and License Renewal

The broadcast operations of the TV NOVA (Czech Republic) channel are subject to regulations imposed by (i) the Broadcasting Act 2001, (ii) the Act on Advertising and (iii) conditions contained in the license granted by the Czech Republic Media Council pursuant to the Broadcasting Act 2001.

According to the Broadcasting Act 2001, a television broadcasting license can be extended once for an additional twelve years. The Czech Republic Media Council has granted one extension of the TV NOVA (Czech Republic) license, which expires in January 2017.

The GALAXIE SPORT license expires in March 2014.

ROMANIA

General

Romania is a parliamentary democracy with a population of approximately 21.3 million people. Per capita GDP is estimated to be US$ 4,460 in 2005 with a GDP growth rate of 5.3% for 2005. Approximately 86% of Romanian households have television, and cable penetration is approximately 68%. According to our estimates, the Romanian television advertising market grew by approximately 36% in 2005, to approximately US$ 150 - 160 million.

We operate three television channels in Romania, PRO TV, ACASA and PRO CINEMA as well as PRO TV INTERNATIONAL, a channel distributed by satellite to Romanians outside the country featuring programs rebroadcast from our Romanian channels. The two other significant national broadcasters in Romania are the public broadcaster TVR, operating two channels, and privately owned broadcaster Antena 1.

Operating and License Companies

Pro TV, which holds all broadcasting licenses for the PRO TV, ACASA and PRO CINEMA channels, is primarily responsible for broadcasting operations for the PRO TV, ACASA, PRO TV INTERNATIONAL and PRO CINEMA channels. MPI provides various broadcasting services to Pro TV. Media Vision provides production, dubbing and subtitling services to our Romanian television channels. The licenses for PRO FM and INFOPRO radio channels are held by Radio Pro (formerly known as Media Pro).

Operations

PRO TV, ACASA, PRO CINEMA and PRO TV INTERNATIONAL

PRO TV was launched in December 1995. PRO TV reaches approximately 76% of the Romanian population, including almost 90% of urban areas. PRO TV broadcasts from studios located in Bucharest to terrestrial broadcast facilities and to approximately 790 cable systems throughout Romania. The PRO TV channel is currently the top-rated television channel in its coverage area and had a national all day audience share of 15.7% during 2005, which made it second (of 23 ranked stations) in Romania. Advertisers, however, evaluate audience share within a channel’s coverage area and by this measure PRO TV was ranked first.

The ACASA channel, a cable channel launched in 1998, reaches approximately 65% of Romanian television households and 83% of urban households. During 2005, ACASA had a national all day audience share of 8.1%, which made it fourth (of 23 ranked stations) in Romania. ACASA is also ranked fourth in terms of all day audience share in its coverage area.

PRO CINEMA, a cable channel launched in April 2004, reaches approximately 44% of Romanian television households and approximately 65% of urban households. In 2005, PRO CINEMA had a national all day audience of 0.8%, which made it twelfth (of 23 ranked stations) in Romania.

The chart below summarizes the national all day and prime time audience share figures for our Romanian channels:

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | |

PRO TV | | | | | | | | | | | |

| All day | | | 15.2% | | | 14.9% | | | 15.4% | | | 15.8% | | | 15.7% | |

| Prime time | | | 15.9% | | | 16.3% | | | 17.1% | | | 17.2% | | | 16.6% | |

ACASA | | | | | | | | | | | | | | | | |

| All day | | | 5.6% | | | 6.0% | | | 6.6% | | | 7.4% | | | 8.1% | |

| Prime time | | | 6.2% | | | 6.8% | | | 7.8% | | | 7.7% | | | 9.1% | |

PRO CINEMA | | | | | | | | | | | | | | | | |

| All Day | | | - | | | - | | | - | | | 0.6% | | | 0.8% | |

| Prime Time | | | - | | | - | | | - | | | 0.6% | | | 0.7% | |

Source: Peoplemeters Taylor Nelson Sofres

The PRO TV INTERNATIONAL channel is a channel that rebroadcasts PRO TV and ACASA programs to cable and satellite operators in North America, Europe and in Israel, using the existing PRO TV and ACASA satellite infrastructure.

Programming

The PRO TV channel broadcasts 24 hour per day and has a programming strategy to appeal to a broad audience through a wide range of programming, including movies and series, news, sitcoms, police series, soap operas and game shows. More than 40% of PRO TV's programming is comprised of locally produced programming, including news and sports programs as well as Vacanta Mare (Big Holiday), Teo and La Bloc (In the Apartment Block). Vacanta Mare (Big Holiday) and La Bloc (In the Apartment Block) were among the top-rated shows in 2005.

The PRO TV channel has secured exclusive broadcast rights in Romania to a variety of popular American and European programs and films produced by such companies as Warner Bros. and DreamWorks. The PRO TV channel also licenses foreign news reports and film footage from Reuters, APTN and ENEX to integrate into its news programs. All foreign language programs and films are subtitled in Romanian.

Pro TV is required to comply with several restrictions on programming, including regulations on the origin of programming. These include requirements that in the future 50% of all programming be of European origin and 10% of all programming be supplied by independent European producers. The Media Law stipulates that compliance with these and similar provisions is not required prior to January 1, 2008.

The ACASA channel broadcasts 24 hours per day and targets a female audience with programming including telenovellas, films and soap operas as well as news, daily local productions for women and family, talk shows and entertainment. ACASA's audience demographics are complementary to PRO TV's, providing an attractive advertising platform for advertisers across our group of channels. Approximately 31% of ACASA’s programming is locally produced, including Lacrimi de iubire (Tears of Love), Povestiri Adevarate (True Stories) and Pacatele Evei (Eve’s Sins). Lacrimi de iubire (Tears of Love) is one of the top-rated shows in 2005.

PRO CINEMA broadcasts 21 hours per day and is focused on movies, series and documentaries that have not attracted sufficient audiences on PRO TV but are still popular among the educated, upwardly mobile urban population.

Advertising

Our Romanian operation derives revenues principally from the sale of commercial advertising time on the PRO TV, ACASA and PRO CINEMA channels, sold both through independent agencies and media buying groups. The PRO TV channel currently serves approximately 190 advertisers, including multinational companies such as Wrigley, Henkel and Procter & Gamble. Our top ten advertising clients contributed approximately 28% to our total advertising revenues in Romania in 2005.

Within the Romanian advertising market, television accounts for approximately 60% of total advertising spending. Television competes for advertising revenues with other media such as print, radio, outdoor advertising and direct mail.

Privately owned broadcasters are permitted to broadcast advertising for up to 15% of their daily broadcast time, and an additional 5% of daily broadcast time may be used for direct sales advertising. Privately owned broadcasters may use up to 12 minutes per hour for advertising and teleshopping. The public broadcaster, which is also financed through a compulsory television license fee, is restricted to broadcasting advertising for 8 minutes per hour. There are also restrictions on the frequency of advertising breaks (for example, news and children's programs shorter than 30 minutes cannot be interrupted). These restrictions apply to both public and privately owned broadcasters. There are also restrictions that relate to advertising content, including a ban on tobacco advertising and restrictions on alcohol advertising and regulations on advertising targeted at children or during children's programming. In addition, members of the news department of PRO TV are prohibited from appearing in advertisements.

Competition

Prior to the launch of the PRO TV channel, TVR 1, a channel of the public broadcaster, was the dominant channel in Romania. During 2005, PRO TV and ACASA achieved national all day audience shares of 15.7% and 8.1% respectively, ranking them second and fourth in national all day audience share. PRO CINEMA achieved an audience share of 0.8% during 2005. TVR 1’s continued leading national position is influenced by its higher technical reach, to approximately 99% of the Romanian population, including areas in which it is the only significant broadcaster, compared to a 76% technical reach for PRO TV and 65% for ACASA (as a cable channel based on relevant cable penetration). Within our coverage area, PRO TV is first and ACASA is fourth in terms of all day audience share for 2005. Other competitors include the second channel of the public broadcaster, TVR 2, and privately owned broadcasters Antena 1 and Prima TV.

The chart below provides a comparison of our audience share and technical reach to our competitors:

Main Television Channels | | Ownership | | Year of first transmission | | Signal distribution | | Audience share (2005) | | Technical reach |

| | | | | | | | | | | |

| TVR 1 | | Public Television | | 1956 | | Terrestrial / satellite / cable | | 18.9% | | 99% |

PRO TV | | CME | | 1995 | | Terrestrial / satellite / cable | | 15.7% | | 76% |

| Antena 1 | | Local owner | | 1993 | | Terrestrial / satellite / cable | | 13.5% | | 71% |

ACASA | | CME | | 1998 | | Satellite / cable | | 8.1% | | 65% |

| TVR 2 | | Public Television | | 1968 | | Terrestrial / satellite / cable | | 5.2% | | 78% |

| Prima TV | | SBS | | 1994 | | Terrestrial / satellite / cable | | 4.6% | | 57% |

PRO CINEMA | | CME | | 2004 | | Satellite / cable | | 0.8% | | 44% |

| Others | | | | | | | | 33.2% | | |

| | | | | | | | | 100.0% | | |

Source : Peoplemeters Taylor Nelson Sofres

Additional competitors include cable and satellite stations.

License Renewal

PRO TV ACASA, PRO CINEMA and RADIO PRO operate pursuant to licenses and regulations issued by the Romanian Media Council. Pro TV holds all local television licenses for the PRO TV channel and the cable broadcasting licenses for ACASA and PRO CINEMA. To date, licenses have been renewed as they expire. The terrestrial television license for Bucharest was renewed in October 2003 for a further nine years. The remaining broadcasting licenses expire on dates ranging from July 2006 to February 2014.

Ownership

At December 31, 2005, we owned an 85% voting and economic interest in Pro TV, which holds all of the licenses for the stations comprising the PRO TV, ACASA, PRO CINEMA and PRO TV INTERNATIONAL channels. Adrian Sarbu, the general director of our Romanian operations, owned the remaining 15% voting and economic interests of Pro TV. During 2005 we increased our voting and economic interest from 80% to 85% following the sale by Mr. Sarbu of a 2% interest in Pro TV on February 28, 2005 and the sale of an additional 3% interest on July 29, 2005 (for further information, see Part II, Item 8, Note 3, “Acquisitions and Disposals, Romania”).

Following the adoption of a new Media Law in 2002, we have transferred broadcasting licenses and operations from MPI to Pro TV.

Our interest in our Romanian operations is generally governed by a Co-operation Agreement entered into by Mr. Sarbu and ourselves. The articles of Pro TV replicate the governing bodies and minority shareholder protective rights that exist in respect of MPI in the Co-operation Agreement. We have the right to appoint three of the five members of the Council of Administration that directs the affairs of Pro TV and MPI. Although we have majority voting power in Pro TV and MPI, the affirmative vote of Mr. Sarbu is required with respect to certain financial and corporate matters. The financial and corporate matters which require approval of the minority shareholder are in the nature of protective rights, which are not an impediment to consolidation for accounting purposes.

At December 31, 2005, we had a 70% voting and economic interest in Media Vision. The remainder was owned by Mr. Sarbu.

On February 17, 2006, we purchased an additional 5% of Pro TV, MPI and Media Vision from Mr. Sarbu for consideration of US$ 27.2 million (for further information, see Part II, Item 8, Note 21, “Subsequent Events”). We now own a 90% voting and economic interest in Pro TV and MPI and a 75% voting and economic interest in Media Vision. We also have a put option agreement with Mr. Sarbu that grants him the right to sell us his remaining interest in Pro TV and MPI from March 1, 2009 for a twenty-year period thereafter.

SLOVAK REPUBLIC

General

The Slovak Republic, which acceded to the European Union on May 1, 2004, is a parliamentary democracy with a population of approximately 5.4 million people. Per capita GDP is estimated to be US$ 9,312 in 2005 with a GDP growth rate of 5.1% in 2005. Approximately 99% of households have television and cable penetration is 35%. According to our estimates, the Slovak Republic television advertising market grew by approximately 7% in 2005 to US$ 90 - 100 million. In local currency the television advertising market grew by approximately 4% in 2005.

In the Slovak Republic, we operate one national television channel, MARKIZA TV. The two other significant national broadcasters are the public broadcaster STV, operating two channels, and privately owned broadcaster TV JOJ.

Operating and License Companies

Markiza holds the television broadcast license for MARKIZA TV. Markiza and our operating company, STS, have entered into a series of agreements pursuant to which STS is permitted to conduct certain television broadcast operations for MARKIZA TV in accordance with the license.

Operations

MARKIZA TV

MARKIZA TV was launched as a national television channel in the Slovak Republic in August 1996. The MARKIZA TV channel reaches approximately 86% of the Slovak Republic's population, including all of its major cities. The MARKIZA TV channel had an average national all day audience share for 2005 of 31.1% versus 19.2% for its nearest competitor, STV 1. In October 2004, the journal method of measuring audience share and ratings was replaced with peoplemeters (an electronic audience measurement device). The introduction of peoplemeters has resulted in lower audience share and ratings being recorded for all national broadcasters (see Part II, Item 7, “Analysis of Segment Results, Slovak Republic”). Since the introduction of peoplemeters, the national all day audience share of MARKIZA TV has fallen from 40% to 31%.

The chart below summarizes national all day and prime time audience share figures for MARKIZA TV:

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | |

MARKIZA TV | | | | | | | | | | | | | | | | |

| All day | | | 50.3% | | | 48.2% | | | 45.8% | | | 39.6% | | | 31.1% | |

| Prime time | | | 50.7% | | | 47.4% | | | 45.5% | | | 40.0% | | | 32.8% | |

Source: TNS

Programming

The MARKIZA TV channel broadcasts 24 hours per day and has a programming strategy to appeal to a broad audience through news, movies, entertainment and sports programming (including coverage of Formula One racing), with specific groups targeted in off-peak broadcasting hours. Approximately 39% of the MARKIZA TV network’s programming is locally produced, including Televizne noviny (TV News), Sportove noviny (Sports News), Hodina pravdy (The Hour of Truth), Mojsejovci and Milionár (Millionaire). Televizne noviny (TV News) is consistently the top-ranked show in the Slovak Republic. Hodina pravdy (The Hour of Truth) and Mojsejovci were also among the most popular shows in 2005.

STS has secured for the MARKIZA TV channel exclusive broadcast rights to a variety of popular American and European series, films and telenovellas produced by major international studios including Warner Bros., Universal, IFD, MGM, Carsey-Werner, Paramount Pictures, Twentieth Century Fox and Walt Disney Television International. All foreign language programming (other than that in the Czech language) is dubbed into the Slovak language. Foreign news reports and film footage licensed from CNN, Reuters, APTN and SNTV are integrated into news programs on the MARKIZA TV channel.

Markiza is required to comply with several restrictions on programming, including regulations on the origin of programming. These include the requirement that 10% of programming be public interest programming (which includes news and topical shows), a minimum of 51% of first runs of films and series be European production; and no more than 20% of programming be in the Czech language.

Advertising

STS and Markiza derive revenues principally from the sale of commercial advertising time through media buying groups and independent agencies. Advertisers include large multinational firms such as Procter & Gamble, Coca Cola, L’Oreal, Wrigley, Ferrero and Reckitt Benckiser, though no one advertiser dominates the market. Our top ten advertisers contributed approximately 27% to our total advertising revenues in the Slovak Republic in 2005.

Within the Slovak advertising market, television accounts for approximately 50% of total advertising spending. MARKIZA TV also competes for advertising revenues with other media, such as print, radio, outdoor advertising and direct mail.

Privately owned broadcasters are permitted to broadcast advertising for up to 12 minutes per hour but not more than 15% of total daily broadcast time. The public broadcaster, which is also financed through a compulsory license fee, is restricted to broadcasting 8 minutes of advertising per hour but not more than 3% of total broadcast time. There are restrictions on the frequency of advertising breaks during and between programs. These restrictions are the same for public and privately owned broadcasters. There are also restrictions that relate to advertising content, including a ban on tobacco advertising and a ban on advertisements of alcoholic beverages (excluding beer) between 6:00 am and 10:00 pm.

Competition

The Slovak Republic is served by two national public television stations, STV1 and STV2, which dominated the ratings until the MARKIZA TV channel began broadcasting in 1996. STV1 reaches nearly the entire Slovak population. MARKIZA TV also competes with the privately owned broadcaster TV JOJ.

The chart below provides a comparison of our audience share and technical reach to our competitors:

Main Television Channels | | Ownership | | Year of first transmission | | Signal distribution | | Audience share (2005) | | Technical reach |

| | | | | | | | | | | |

MARKIZA TV | | CME | | 1996 | | Terrestrial | | 31.1% | | 86% |

| STV 1 | | Public Television | | 1956 | | Terrestrial | | 19.2% | | 97% |

| TV JOJ | | Local owner | | 2002 | | Terrestrial | | 14.7% | | 61% |

| STV 2 | | Public Television | | 1969 | | Terrestrial | | 5.7% | | 89% |

| Others | | | | | | | | 29.3% | | |

| | | | | | | | | 100.0% | | |

Source : Informa Telecoms and Media, Visio / MVK and CME.

The MARKIZA TV channel also competes with additional foreign terrestrial television stations located in Austria, the Czech Republic and Hungary, where originating signals reach the Slovak Republic, and foreign satellite stations.

License Renewal

MARKIZA TV’s broadcast operations are subject to regulations imposed by (i) the Act on Broadcasting and Retransmission of September 2000, (ii) the Act on Advertising and (iii) conditions contained in the license granted by the Slovak Republic Media Council pursuant to the Act on Broadcasting and Retransmission.

The current broadcasting license for MARKIZA TV expires in September 2007. Markiza filed an application for renewal with the Slovak Republic Media Council in February 2006 and expects a response by early March 2006.

Ownership

On January 23, 2006, we acquired control of our Slovak operations and increased our economic interest from 70% to 80%. We now own an 89.8% voting interest in STS and are entitled to 80% of the profits and an 80% voting interest and a 0.1% economic interest in Markiza, which holds a 51% voting interest in STS (see Part II, Item 7, “Analysis of Segment Results, Slovak Republic”).

Following the acquisition of this controlling interest, we now appoint three members of the Board of Representatives and two are appointed by our partners. All significant financial and operational decisions of the Board of Representatives require a simple majority vote. Three executives, two of whom are appointed by us, conduct the affairs of Markiza.

SLOVENIA

General

Slovenia, which acceded to the European Union on May 1, 2004, is a parliamentary democracy with a population of 2.0 million people. Per capita GDP is estimated to be US$ 17,050 in 2005, the highest per capita GDP in Central and Eastern Europe, with a GDP growth rate of 3.7% for 2005. Approximately 99% of Slovenian households have television and cable penetration is approximately 58%. According to our estimates, the Slovenian television advertising market grew by approximately 3% in US dollars during 2005 to US$ 60 - 70 million.

In Slovenia, we operate two national television channels, POP TV and KANAL A. The other significant national broadcaster is the public broadcaster, operating SLO 1 and SLO 2.

Operating and License Companies

Pro Plus provides programming to and sells advertising for the broadcast license holders Pop TV and Kanal A. Pop TV holds all of the licenses for the POP TV channel and Kanal A holds all the licenses for the KANAL A channel.

Operations

POP TV and KANAL A

The POP TV channel is the leading national commercial television broadcaster in Slovenia and reaches approximately 95% of the population of Slovenia, including the capital Ljubljana and Maribor, Slovenia's second largest city. In 2005, the POP TV channel had an audience share of 27.3% all day and 32.3% in prime time, the largest in Slovenia.

The KANAL A channel reaches 86% of the population of Slovenia, including Ljubljana and Maribor. Independent research shows that among main television stations in 2005, the KANAL A channel had a national all day audience share of 8.5% and 9.8% in prime time, making it the fourth most watched television channel in Slovenia.

The chart below summarizes the national all day and prime time audience share figures for POP TV and KANAL A:

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | |

POP TV | | | | | | | | | | | |

| All day | | | 29.0% | | | 29.2% | | | 29.5% | | | 27.6% | | | 27.3% | |

| Prime time | | | 32.0% | | | 32.3% | | | 34.0% | | | 31.9% | | | 32.2% | |

KANAL A | | | | | | | | | | | | | | | | |

| All day | | | 11.5% | | | 11.0% | | | 10.2% | | | 8.3% | | | 8.5% | |

| Prime time | | | 12.0% | | | 11.0% | | | 10.9% | | | 9.4% | | | 9.8% | |

Source: Media Services AGB

Programming

POP TV broadcasts 18 hours per day and has a programming strategy to appeal to a broad audience through a wide variety of programming including series, movies, news, variety and game shows and features. Approximately 21% of programming is locally produced, including Preverjeno! (Confirmed!), Trenja (Friction), the local series Nasa Mala Klinika (Our Little Clinic) and the reality show The Bar. KANAL A broadcasts for 16 hours per day and has a programming strategy to complement the programming strategy of the POP TV channel with a mixture of locally produced programs such as Extra Magazine and E+ and acquired foreign programs, including films and series.

Pro Plus has secured exclusive program rights in Slovenia to a variety of successful American and Western European programs and films produced by studios such as Warner Bros., Twentieth Century Fox and Paramount. Pro Plus has agreements with CNN, Reuters and APTN to receive foreign news reports and film footage to integrate into news programs. All foreign language programs and films are subtitled in Slovenian with the exception of some children’s programming that is dubbed.

Pop TV and Kanal A are required to comply with several restrictions on programming, including regulations on the origin of programming. These include the requirement that 20% of a station's daily programming consist of locally produced programming, of which at least 60 minutes must be broadcast between 6:00 pm and 10:00 pm. Two percent of the station's annual broadcast time must be Slovenian origin audio-visual works and this amount must increase each year until it reaches five percent of annual broadcast time. In the future a majority, increased from the current 40%, of the station's annual broadcast time will be required to be European origin programming, and 50% of such works will have to have been produced in the last five years.

Advertising

Pro Plus derives revenues from the sale of commercial advertising time on the POP TV and KANAL A channels. Current multinational advertisers include firms such as Reckitt Benckiser, Danone Group, Procter & Gamble, Wrigley and Beiersdorf, although no one advertiser dominates the market. Our top ten advertisers contributed approximately 30% to our total advertising revenues in Slovenia in 2005.

Within the Slovenian advertising market, television accounts for approximately 59% of total advertising spending. In addition, the POP TV and KANAL A channels compete for revenues with other media, such as print, radio, outdoor advertising, the internet and direct mail.

Peoplemeters are currently present in 450 homes in Slovenia and are the primary source for the POP TV and KANAL A channels' rating information.

Privately owned broadcasters are allowed to broadcast advertising for up to 12 minutes in any hour. The public broadcaster, which is also financed through a compulsory television license fee, is subject to the same restrictions on advertising time. There are restrictions on the frequency of advertising breaks during programs. There are also restrictions that relate to advertising content, including a ban on tobacco advertising and a prohibition on the advertising of any alcoholic beverages from 7.00 am to 9.30 pm and generally for alcoholic beverages with an alcoholic content of more than 15%.

Competition

Prior to the launch of POP TV, the television market in Slovenia had been dominated by the public broadcaster SLO 1.

The chart below provides a comparison of our audience share and technical reach to our competitors:

Main Television Channels | | Ownership | | Year of first transmission | | Signal distribution | | Audience share (2005) | | Technical reach |

| | | | | | | | | | | |

POP TV | | CME | | 1995 | | Terrestrial / cable | | 27.3% | | 95% |

| SLO 1 | | Public Television | | 1958 | | Terrestrial / satellite / cable | | 25.5% | | 100% |

| SLO 2 | | Public Television | | 1967 | | Terrestrial / satellite / cable | | 8.7% | | 99% |

KANAL A | | CME | | 1991 | | Terrestrial / cable | | 8.5% | | 86% |

| Others | | | | | | | | 30.0% | | |

| | | | | | | | | 100.0% | | |

Source : Media Services AGB and CME Research

The POP TV and KANAL A channels also compete with foreign television stations, particularly Croatian, Italian, German and Austrian stations. Cable penetration is 58%, which is greater than many other countries in Central and Eastern Europe, and approximately 18% of households have satellite television.

License Renewals

The POP TV and KANAL A channels operate under licenses regulated pursuant to the Law on Media adopted in 2001 and pursuant to the Electronic Communications Act which came into effect on May 1, 2004. According to the Electronic Communications Act, the Slovenian Media Council may extend a license at the request of the broadcaster if it is in compliance with all the license conditions. In 2002 the Slovenian Media Council extended all of the licenses held by Pop TV and Kanal A until August 2012.

Ownership

On June 24, 2005, we acquired from Marijan Jurenec his 3.15% interest in Pro Plus (see Part II, Item 8, Note 3, “Acquisitions and Disposals, Slovenia”). Following this transaction, we own 100% of the voting and economic interests in Pro Plus. Pro Plus owns 100% of Pop TV and Kanal A.

UKRAINE

General

Ukraine, the most populous market served by us, is a parliamentary democracy with a population of 47.4 million people. Per capita GDP is estimated to be US$ 1,715 in 2005, the lowest of all our markets, with a GDP growth rate in 2005 of 5.0%. Nearly 100% of Ukrainian households have television and cable penetration is approximately 19%. According to our estimates, the Ukrainian television advertising market grew by approximately 38% in 2005 to US$ 180 - 190 million.

In Ukraine, we operate one national television channel, STUDIO 1+1. The other five significant national broadcasters are the public broadcaster UT1 as well as privately owned broadcasters Inter, Novij Kanal, ICTV and STV.

Operating and License Companies

The Studio 1+1 Group is comprised of several entities involved in the broadcasting operations of Studio 1+1, the license company. Innova provides programming and production services to Studio 1+1. The sale of Studio 1+1’s advertising air time has been out-sourced to Video International, a Ukrainian subsidiary of a Russian advertising sales company, in which we have neither an economic nor a voting interest.

Following completion on January 11, 2006, we own a 65.5% interest in Ukrpromtorg 2003 LLC (“Ukrpromtorg”), which owns 92.2% of Gravis LLC, which operates the GRAVIS channel and CHANNEL 7 in Kiev; 100% of Nart LLC, which holds a satellite broadcasting license; and 75% of Stimul LLC, which operates TV STIMUL in Kirovograd (see Part II, Item 8, Note 21, “Subsequent Events, Ukraine”).

Operations

STUDIO 1+1

The STUDIO 1+1 channel broadcasts programming and sells advertising under two licenses granted to it by the Ukrainian Media Council on Ukrainian National Frequency Two ("UT-2") and reaches approximately 95% of Ukraine's population. The STUDIO 1+1 channel began broadcasting on UT-2 in January 1997 under a license permitting 15 hours of broadcasting per day, primarily in prime time. In July 2004 the station was awarded a second license allowing it to broadcast for the remaining nine hours not covered by the station's 15-hour license. STUDIO 1+1 has been broadcasting a full 24-hour schedule since early September 2004. The STUDIO 1+1 channel had a national all day audience share of 20.0% in 2005 and a 22.2% prime time audience share.

The chart below summarizes the national all day and prime time audience share figures for STUDIO 1+1:

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | |

STUDIO 1+1 | | | | | | | | | | | |

| All day | | | 21.9% | | | 22.2% | | | 19.1% | | | 20.9% | | | 20.0% | |

| Prime time | | | 28.9% | | | 27.4% | | | 25.8% | | | 26.9% | | | 22.2% | |

Source: GFK USM

Programming

The STUDIO 1+1 channel broadcasts for 24 hours per day and has a programming strategy to appeal to a broad audience through a wide variety of programming, including series (popular Russian police and action series in particular), movies and locally produced Ukrainian shows, features and news. Approximately 40% of programming is either in-house or out-sourced local production, which consists primarily of a daily breakfast show, news broadcasts and news related programs, talk shows, documentaries, game shows, sport and lifestyle magazine shows and comedy shows.

The Studio 1+1 Group has secured exclusive territorial or local language broadcast rights in Ukraine to a variety of successful high quality Russian, American and Western European programs and films from many of the major studios, including Warner Bros., Paramount Pictures, Universal Pictures and Columbia Pictures. Studio 1+1 has agreements with Reuters for foreign news packages and other footage to be integrated into its programming. All non-Ukrainian language programs and films (including those in the Russian language) are dubbed or subtitled in Ukrainian.

Studio 1+1 is required to comply with certain restrictions on programming, including regulations on the origin of programming. These include the requirement that 80% of all programming must be in the Ukrainian language (including acquired programming that is dubbed).

On January 12, 2006, the Ukraine parliament adopted an amended version of the Ukraine Media Law that includes modifications to the regulations on the origin of programming. Under the amended Ukraine Media Law, at least 50% of programming broadcast by Studio 1+1 must consist of Ukrainian audio-visual works. This amended Ukraine Media Law is expected to come into force in March 2006.

Advertising

The Studio 1+1 Group derives revenues principally from the sale of commercial advertising time through both media buying groups and independent agencies. Video International sells advertising for the Studio 1+1 Group on an exclusive basis until the end of the term of the 15-hour broadcasting license on December 31, 2006. Advertisers include large multinational firms such as Procter & Gamble, Kraft Foods, Samsung, Unilever, Coca-Cola, Wrigley, Colgate - Palmolive, Mars and Nestle. Our top ten advertising clients contributed approximately 30% to our total advertising revenues in Ukraine in 2005.

Within the Ukrainian advertising market, television accounts for approximately 47% of total advertising spending. STUDIO 1+1 also competes for advertising revenues with other media, such as print, radio, outdoor advertising and direct mail.

Privately owned broadcasters are allowed to broadcast advertising for 15% of their total broadcast time. The public broadcaster, which is also financed through a compulsory license fee, is subject to the same restrictions on advertising time. There are restrictions on the frequency of advertising breaks both during and between programs. There are also restrictions that relate to advertising content, including a ban on tobacco advertising and a prohibition on the advertising of alcoholic beverages before 11:00 pm.

Competition

Three national television channels serve Ukraine: the public broadcaster UT-1, STUDIO 1+1, and Inter, another privately owned broadcaster. In addition, ICTV, STV and Novi Kanal, which are all privately owned broadcasters, have used a series of regional frequencies to establish regional networks. Inter, the STUDIO 1+1 channel's main competitor, has a programming philosophy similar to that of STUDIO 1+1.

The chart below provides a comparison of our audience share and technical reach to our competitors:

Main Television Channels | | Ownership | | Year of first transmission | | Signal distribution | | Audience share (2005) | | Technical reach |

| | | | | | | | | | | |

| Inter | | Local owners | | 1997 | | Terrestrial / satellite / cable | | 25.5% | | 78% |

STUDIO 1+1 | | CME | | 1997 | | Terrestrial / satellite / cable | | 20.0% | | 95% |

| Novi Kanal | | Local owners | | 1998 | | Terrestrial | | 9.1% | | 50% |

| ICTV | | Local owners | | Unknown | | Terrestrial | | 7.2% | | n/a |

| STV | | Local owners | | Unknown | | Terrestrial | | 5.2% | | n/a |

| UT-1 | | Public Television | | 1952 | | Terrestrial / cable | | 1.8% | | 98% |

| Others | | | | | | | | 31.2% | | |

| | | | | | | | | 100.0% | | |

Source : GFK USM and CME Research

License Renewal

Licenses in Ukraine are renewed by the Ukraine Media Council in accordance with the terms of the 1995 Act on Television and Radio Broadcasting. Studio 1+1’s main 15-hour broadcast license, covering prime time, expires on December 31, 2006. An application for renewal can be filed from six to nine months prior to the expiration and we expect to file an application during the second quarter of 2006. The Ukraine Media Law provides a presumption of license renewal provided that Studio 1+1 applies on time and does not infringe Ukrainian Media Council rules prior to the expiration of the current term. We believe we are currently in compliance with all these conditions. The remaining nine hours of Studio 1+1’s schedule are broadcast pursuant to a 10-year broadcast license expiring in August 2014.

Ownership

The Studio 1+1 Group consists of several entities in which we hold direct or indirect interests. The Key Agreement among Boris Fuchsmann, Alexander Rodnyansky, Studio 1+1, Innova, IMS, CME Ukraine Holding GmbH and us, entered into as at December 23, 1998, gives us a 60% economic interest in all Studio 1+1 Group companies and a 60% ownership interest in all the group companies except for the license company Studio 1+1, due to regulatory restrictions on direct foreign ownership of broadcasting companies in Ukraine. Accordingly, we hold a 60% ownership interest and are entitled to 60% of the profits in each of Innova, IMS and TV Media Planet. Innova owns 100% of Inter-Media, a Ukrainian company, which in turn holds a 30% interest in Studio 1+1. At present our indirect ownership interest in Studio 1+1 is 18%.

On December 30, 2004, we entered into an additional agreement with Boris Fuchsmann, Alexander Rodnyansky and Studio 1+1, which re-affirms our entitlement to 60% of any distribution from Studio 1+1 to its shareholders until such time as Ukrainian legislation allows us to increase our voting and economic interest in Studio 1+1 to 60% (see Item 3, “Legal Proceedings, Ukraine”).

Significant decisions involving entities in the Studio 1+1 Group are taken by the shareholders and require majority consent. Certain fundamental corporate matters of the other entities require the vote of 61% of the shareholders except for certain decisions involving the license company Studio 1+1, which require a 75% vote.

Alexander Rodnyansky, a previous general director, is the Honorary President of Studio 1+1 and continues as the 70% shareholder in the license company. Mr. Rodnyansky is also the general director of the Russian broadcaster CTC Media based in Moscow.

CORPORATE OPERATIONS

In addition to group management and corporate administration, our central organization provides oversight and support to our television operations. The functions include network management, financial planning and analysis, financial control and legal services.

SEASONALITY

We, like other television operators, experience seasonality, with advertising sales tending to be lowest during the third quarter of each calendar year due to the summer holiday period (typically July and August), and highest during the fourth quarter of each calendar year. See Part II, Item 6, “Selected Financial Data” for further discussion.

EMPLOYEES

As of February 13, 2006, our operating companies had a total of approximately 2,800 employees (including freelance staff and contractors) and we had a corporate staff of 41 employees in London and Amsterdam. None of our employees or the employees of any of our subsidiaries are covered by a collective bargaining agreement. We believe that our relations with our employees are good.

FINANCIAL INFORMATION BY OPERATING SEGMENT AND BY GEOGRAPHICAL AREA

For financial information by operating segment and geographic area, see Part II, Item 8, Note 17, "Segment Data".

This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties. See "Forward-looking Statements" in Part I, Item 1. Our actual results in the future could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks described below and elsewhere in this Annual Report on Form 10-K.

Risks Relating to our Business and Operations

Our operating results are dependent on the importance of television as an advertising medium

We generate almost all of our revenues from the sale of advertising airtime on television channels in our markets. In the advertising market, television competes with various other advertising media, such as print, radio, the internet and outdoor advertising. In all of the countries in which we operate, television constitutes the single largest component of all advertising spending. There can be no assurances that the television advertising market will maintain its current position among advertising media or that changes in the regulatory environment will not favor other advertising media or other television broadcasters. Increases in competition among advertising media arising from the development of new forms of advertising media could have an adverse effect on our maintaining and developing our advertising revenues and, as a result, on our results of operations and cash flows.

Our advertising revenues depend on our stations’ technical reach, the pricing of advertising time, television viewing levels, changes in audience preferences, shifts in population and other demographics, technological developments relating to media and broadcasting, competition from other broadcasters and other media operators, and seasonal trends in the advertising market in the countries in which we operate. There can be no assurance that we will be able to continue to respond successfully to such developments. Any decline in the appeal of television generally or of our channels specifically, whether as a result of the growth in popularity of other forms of media or a decline in the attractiveness of television as an advertising medium, could have a material adverse effect on our results of operations and cash flows.

Our broadcasting licenses may not be renewed and may be subject to revocation

We require broadcasting and, in some cases, distribution licenses as well as other authorizations from national regulatory authorities in our markets in order to conduct our broadcasting business. Our current broadcasting licenses expire at various times between 2006 and 2017, including the broadcasting license in the Slovak Republic, for which we have applied for renewal in February 2006, and the broadcasting license covering fifteen hours (primarily prime and off prime time) in Ukraine which expires in December 2006. We cannot guarantee that our current licenses or other authorizations will be renewed or that they will not be subject to revocation, particularly in Ukraine, where there is relatively greater political risk as a result of less developed political and legal institutions.