Exhibit 1.2

MEMORANDUM OF ASSOCIATION

AND

ARTICLES OF ASSOCIATION

INDEX

| | |

| | | Page

|

MEMORANDUM OF ASSOCIATION | | 1 |

ARTICLES OF ASSOCIATION | | 6 |

Table A Excluded | | 6 |

Interpretation | | 6 |

Tenure of office of Managing Agents | | 6 |

Preliminary | | 7 |

Social Responsibilities of the Company | | 7 |

Capital – Shares | | 7 |

Underwriting and Brokerage | | 9 |

Certificates | | 9 |

Calls | | 9 |

Forfeiture, Surrender and Lien | | 10 |

Transfer and Transmission of Shares | | 12 |

Conversion of Shares into Stock | | 14 |

Increase, Reduction and Alteration in Capital | | 14 |

Buy-Back of Shares | | 15 |

Modification of Class Rights | | 16 |

Joint Holders | | 16 |

Dematerialisation of Securities | | 17 |

Borrowing Powers | | 18 |

General Meetings - Convening Meetings | | 19 |

Proceedings at General Meeting | | 20 |

Votes of Members | | 23 |

Directors | | 24 |

Retirement and Rotation of Directors | | 30 |

Age Limit for Directors | | 31 |

Removal of Directors | | 31 |

Increase or Reduction in the Number of Directors and Alteration in their qualifications | | 31 |

Proceedings of Board of Directors | | 31 |

Powers of Directors | | 33 |

Registers, Books and Documents | | 36 |

The Seal | | 37 |

Managing Agents | | 37 |

Managing or Whole-time Director(s) | | 38 |

Interest out of Capital | | 39 |

Dividends | | 39 |

Capitalization | | 40 |

Accounts | | 41 |

Annual Returns | | 42 |

Audit | | 42 |

Documents and Service of Documents | | 44 |

Authentication of Documents | | 45 |

Winding Up | | 45 |

Secrecy Clause | | 45 |

Indemnity and Responsibility | | 45 |

Subscribers Clause | | |

Managing Agency Agreement | | |

Resolutions to which Section 192 of the Act applies | | |

ABSTRACT

OF

ARTICLES OF ASSOCIATION

OF

TATA MOTORS LIMITED

| | | | |

| | | ARTICLE

| | PAGE

|

| TABLE A EXCLUDED | | | | |

| | |

Table A not to apply but Company to be governed by these Articles | | 1 | | 6 |

| | |

| INTERPRETATION | | | | |

| | |

Interpretation Clause | | | | |

“The Act” or “the said Act” | | 2 | | 6 |

“The Board” or “Board of Directors” | | 2 | | 6 |

“The Company” or “This Company” | | 2 | | 6 |

“Directors” | | 2 | | 6 |

“Dividend” | | 2 | | 6 |

Gender | | 2 | | 6 |

“Month” | | 2 | | 6 |

“Office” | | 2 | | 6 |

“Persons” | | 2 | | 6 |

Plural number | | 2 | | 6 |

“These Presents” or “Regulations” | | 2 | | 6 |

“Seal” | | 2 | | 6 |

Singular number | | 2 | | 6 |

“Writing” | | 2 | | 6 |

Expressions in the Act to bear the same meaning in Articles | | 2 | | 6 |

Marginal Notes | | 2 | | 6 |

| | |

| TENURE OF OFFICE OF MANAGING AGENTS | | | | |

| | |

Tenure of Office of Managing Agents | | 2A | | 6 |

| | |

| PRELIMINARY | | | | |

| | |

Agreements entered into by the Company | | 3 | | 7 |

Copies of Memorandum and Articles of Association to be given to members | | 4 | | 7 |

| | |

| SOCIAL RESPONSIBILITIES | | | | |

| | |

Social Responsibilities of the Company | | 4A | | 7 |

| | |

| CAPITAL | | | | |

| | |

| SHARES | | | | |

| | |

Capital | | 5 | | 7 |

Rights attached to Preference Shares | | 6/6A | | 7 |

Unclassified Shares | | 7 | | 7 |

Shares with non-voting rights | | 7(a) | | 8 |

Shares under the control of the Directors | | 8 | | 8 |

Power of General Meeting to offer shares to such persons as the Company may resolve | | 9 | | 8 |

Directors may allot shares as fully paid-up | | 10 | | 8 |

Shares to be numbered progressively and no shares to be sub-divided | | 11 | | 8 |

Acceptance of Shares | | 12 | | 8 |

Deposit and calls etc. to be a debt payable immediately | | 13 | | 8 |

Instalments on shares to be duly paid | | 14 | | 8 |

Company not bound to recognise any interest in shares other than that of the registered holders | | 15 | | 8 |

| | |

| UNDERWRITING AND BROKERAGE | | | | |

| | |

Commission for placing shares, debentures, etc. | | 16 | | 9 |

| | |

| CERTIFICATES | | | | |

| | |

Certificates of Shares | | 17(a) | | 9 |

Member’s right to certificates | | 17(b) | | 9 |

Limitation of time for issue of certificates | | 18 | | 9 |

As to issue of new certificate in place of one defaced, lost or destroyed | | 19 | | 9 |

| | |

| CALLS | | | | |

| | |

Board may make calls | | 20 | | 9 |

Calls on shares of same class to be made on uniform basis | | 21 | | 10 |

| | | | |

Notice of call | | 22 | | 10 |

Call to date from Resolution | | 23 | | 10 |

Directors may extend time | | 24 | | 10 |

Amount payable at fixed time or by instalments as calls | | 25 | | 10 |

When interest on call or instalment payable | | 26 | | 10 |

Judgement, decree or partial payment not to preclude forfeiture | | 27 | | 10 |

Proof on trial of suit for or money due on shares | | 28 | | 10 |

Payment in anticipation of calls may carry interest | | 29 | | 10 |

| | |

| FORFEITURE, SURRENDER AND LIEN | | | | |

| | |

If call or instalment not paid notice must be given | | 30 | | 10 |

Terms of notice | | 31 | | 11 |

In default of payment shares to be forfeited | | 32 | | 11 |

Entry of forfeiture in Register of Members | | 33 | | 11 |

Forfeited shares to be property of the company and may be sold etc. | | 34 | | 11 |

Power to annual forfeiture | | 35 | | 11 |

Shareholder still liable to pay money owing at time of forfeiture and interest | | 36 | | 11 |

Surrender of shares | | 37 | | 11 |

Company’s lien on shares | | 38 | | 11 |

As to enforcing lien by sale | | 39 | | 11 |

Application of proceeds of sale | | 40 | | 11 |

Certificate of forfeiture | | 41 | | 11 |

Title of purchaser and allottee of forfeited shares | | 42 | | 12 |

| | |

| TRANSFER AND TRANSMISSION OF SHARES | | | | |

| | |

Register of Transfers | | 43 | | 12 |

Form of Transfer | | 44 | | 12 |

Application for Transfer | | 45 | | 12 |

To be executed by transferor and transferee | | 46 | | 12 |

Transfer not to be registered except on production of instrument of transfer | | 47 | | 12 |

Directors may refuse to register transfer | | 48 | | 13 |

Notice of refusal to be given to transferor and transferee | | 49 | | 13 |

Transfer by legal representative | | 50 | | 13 |

Custody of transfer | | 51 | | 13 |

Closure of transfer books | | 52 | | 13 |

Title of Shares of deceased holder | | 53 | | 13 |

Registration - persons entitled to shares otherwise than by transfer (Transmission Clause) | | 54 | | 13 |

Refusal to register nominee | | 55 | | 13 |

Board may require evidence of transmission | | 56 | | 13 |

Fee on transfer or transmission | | 57 | | 13 |

Company not liable for disregard of a notice prohibiting registration of transfer | | 58 | | 14 |

| | |

| CONVERSION OF SHARES INTO STOCK | | | | |

| | |

Conversion of shares into stock and reconversion | | 59 | | 14 |

Transfer of stock | | 60 | | 14 |

Rights of stock holders | | 61 | | 14 |

Regulations | | 62 | | 14 |

| | |

| INCREASE, REDUCTION AND ALTERATION IN CAPITAL | | | | |

| | |

Increase of Capital | | 63 | | 14 |

Rights of Ordinary shareholders to further issue of capital | | 64 | | 14 |

Same as original capital | | 65 | | 15 |

Restrictions on purchase by Company of its own Shares | | 66 | | 15 |

Buy – Back of Shares | | 66A | | 15 |

Provision in case of redeemable Preference Shares | | 67 | | 15 |

Reduction of Capital | | 68 | | 15 |

Consolidation, division and sub-division | | 69 | | 15 |

Issue of furtherpari passu shares not to affect the right of shares already issued | | 70 | | 16 |

No issue with disproportionate right after 1st April, 1956 | | 71 | | 16 |

| | |

| MODIFICATION OF CLASS RIGHTS | | | | |

| | |

Power to modify class rights | | 72 | | 16 |

| | |

| JOINT – HOLDERS | | | | |

| | |

Joint-holders | | 73 | | 16 |

Company may refuse to register more than six persons | | 73(a) | | 16 |

Joint and several liability for all payments in respect of shares | | 73(b) | | 16 |

Title of survivors | | 73(c) | | 16 |

| | | | |

Receipts of one sufficient | | 73(d) | | 16 |

Delivery of certificate and giving of notices to first named holder | | 73(e) | | 16 |

Votes of joint-holders | | 73(f) | | 17 |

| | |

| DEMATERIALISATION OF SECURITIES | | | | |

Definitions | | 73A(1) | | 17 |

Dematerialisation of Securities | | 73A(2) | | 17 |

Options for investors | | 73A(3) | | 17 |

Securities in depositories to be in fungible form | | 73A(4) | | 17 |

Rights of depositories and beneficial owners | | 73A(5) | | 17 |

Service of documents | | 73A(6) | | 17 |

Transfer of Securities | | 73A(7) | | 17 |

Allotment of Securities dealt with in depository | | 73A(8) | | 17 |

Distinctive numbers of securities held in a depository | | 73A(9) | | 17 |

Register and index of beneficial owners | | 73A(10) | | 18 |

| | |

| BORROWING POWERS | | | | |

Power to Borrow | | 74 | | 18 |

Conditions on which money may be borrowed | | 75 | | 18 |

Bonds, debentures etc. to be subject to control of Directors | | 76 | | 18 |

Securities may be assignable free from equities | | 77 | | 18 |

Issue at discount etc. or with special privileges | | 78 | | 18 |

Mortgage of uncalled capital | | 79 | | 18 |

Indemnity may be given | | 80 | | 18 |

| | |

| GENERAL MEETING | | | | |

| | |

| CONVENING MEETINGS | | | | |

| | |

Annual General Meetings | | 81 | | 19 |

Extraordinary General Meeting | | 82 | | 19 |

Directors may call Extraordinary General Meeting | | 83 | | 19 |

Calling of Extraordinary General Meeting on requisition | | 84 | | 19 |

Notice of Meeting | | 85 | | 19 |

Contents of Notice | | 86 | | 19 |

Special Business | | 87 | | 20 |

Service of Notice | | 88 | | 20 |

Notice to be given to the Auditors | | 89 | | 20 |

As to omission to give Notice | | 90 | | 20 |

Resolutions requiring Special Notice | | 91 | | 20 |

| | |

| PROCEEDINGS AT GENERAL MEETING | | | | |

| | |

Quorum at General Meeting | | 92 | | 20 |

Proceedings when quorum not present | | 93 | | 20 |

Business at adjourned meetings | | 94 | | 20 |

Chairman of Directors or Vice-Chairman or a Director to be Chairman of General Meeting | | 95(1) | | 21 |

In case of their absence or refusal a member may act | | 95(2) | | 21 |

Business confined to election of Chairman whilst chair vacant | | 96 | | 21 |

Chairman with consent may adjourn meeting | | 97 | | 21 |

Notice to be given where a meeting adjourned for 30 days or more | | 98 | | 21 |

What would be the evidence of the passing of resolution where poll not demanded | | 99 | | 21 |

Demand for poll | | 100 | | 21 |

Time and Manner of taking poll | | 101 | | 21 |

Scrutineers at poll | | 102 | | 21 |

Demand for poll not to prevent transaction of other business | | 103 | | 21 |

Motion how decided in cases of equality of votes | | 104 | | 22 |

Reports, Statements and Registers to be laid on the table | | 105 | | 22 |

Registration of certain Resolutions and Agreements | | 106 | | 22 |

Minutes of General Meetings | | 107 | | 22 |

Inspection of minute books of General Meetings | | 108 | | 22 |

Publication of reports of proceedings of General Meetings | | 109 | | 22 |

| | |

| VOTES OF MEMBERS | | | | |

| | |

Votes may be given by proxy or attorney | | 110 | | 23 |

Number of Votes to which Members entitled | | 111 | | 23 |

No voting by proxy on show of hands | | 112 | | 23 |

Votes in respect of shares of deceased or insolvent members | | 113 | | 23 |

No member to vote unless calls are paid up | | 114 | | 23 |

Right of member to use his votes differently | | 115 | | 23 |

| | | | |

Proxies | | 116 | | 23 |

Appointment of proxy | | 117 | | 23 |

Deposit of instrument of appointment | | 118(1) | | 23 |

Inspection of proxies | | 118(2) | | 24 |

Form of proxy | | 119 | | 24 |

Custody of the instrument | | 120 | | 24 |

Validity of votes given by proxy notwithstanding death of member etc. | | 121 | | 24 |

Time for objection to votes | | 122 | | 24 |

Chairman of any meeting to be the judge of validity of any vote | | 123 | | 24 |

| | |

| DIRECTORS | | | | |

| | |

Number of Directors | | 124 | | 24 |

First Directors | | 125 | | 24 |

Special Director | | 126 | | 24 |

Steel Director | | 127 | | 25 |

I.C.I.C.I Director | | 127A | | 25 |

Financial Institutions’ Directors | | 127B | | 25 |

Debentures Director | | 128 | | 25 |

Debenture Director not bound to hold qualification shares | | 129 | | 25 |

Appointment of Alternate Director | | 130 | | 26 |

Casual Vacancy | | 131 | | 26 |

Appointment of Additional Directors | | 132 | | 26 |

Certain persons not to be appointed except by Special Resolution | | 133 | | 26 |

Share Qualification of Directors | | 134 | | 26 |

Remuneration of Directors | | 135(1) | | 26 |

Directors notbonafide residents of the place where meetings held may receive extra compensation and remuneration of committee | | 135(2) | | 27 |

Special remuneration to Director on Company’s business or otherwise performing extra services | | 135(3) | | 27 |

Directors may act notwithstanding vacancy | | 136 | | 27 |

When office of Director to become vacant | | 137(1) | | 27 |

Resignation | | 137(2) | | 27 |

Directors may contract with Company | | 138(1) | | 28 |

Disclosure of interest | | 138(2) | | 28 |

General Notice of Interest | | 138(4) | | 28 |

Interested Director not to participate or vote in Boards’ proceedings | | 138(6) | | 28 |

Register of contracts in which Directors are interested | | 139 | | 28 |

Directors may be directors of companies promoted by the company | | 140 | | 29 |

Disclosure by Director of appointments | | 141 | | 29 |

Disclosure of holdings | | 142 | | 29 |

Directors not to hold office or place of profit | | 143 | | 29 |

Loans to Directors | | 144 | | 29 |

Board Resolution at a meeting necessary for certain contracts | | 145 | | 29 |

| | |

| RETIREMENT AND ROTATION OF DIRECTORS | | | | |

| | |

Retirement by rotation | | 146 | | 30 |

Directors to retire annually how determined | | 147 | | 30 |

Ascertainment of Directors retiring by rotation | | 148 | | 30 |

Eligibility for re-appointment | | 149 | | 30 |

Company to fill up vacancy | | 150 | | 30 |

Provisions in default of appointment | | 151 | | 30 |

Notice of candidature for office of Director | | 152 | | 30 |

Individual resolution for Director’s appointments | | 153 | | 31 |

| | |

| AGE LIMIT FOR DIRECTORS | | | | |

| | |

Age Limit for Directors | | 154-156 | | 31 |

| | |

| REMOVAL OF DIRECTORS | | | | |

| | |

Removal of Directors | | 157 | | 31 |

| | |

INCREASE OR REDUCTION IN THE NUMBER OF DIRECTORS AND ALTERATION IN THEIR QUALIFICATIONS | | | | |

| | |

The Company may increase or reduce number of Directors and alter their qualifications | | 158 | | 31 |

| | |

| PROCEEDINGS OF BOARD OF DIRECTORS | | | | |

Meetings of Directors | | 159 | | 31 |

When meetings to be convened | | 160 | | 32 |

Quorum | | 161 | | 32 |

| | | | |

Adjournment of meeting for want of quorum | | 162 | | 32 |

Appointment of Chairman and Vice-Chairman | | 163 | | 32 |

Who to preside at meetings of the Board | | 164 | | 32 |

Question at Board Meeting how decided (casting vote) | | 165 | | 32 |

Directors may appoint Committees | | 166 | | 32 |

Meetings of Committees how to be governed | | 167 | | 32 |

Resolution by Circular | | 168 | | 32 |

Acts of Board or Committees valid notwithstanding defect in appointment | | 169 | | 33 |

Minutes of proceedings of Board of Directors and Committees to be kept | | 170 | | 33 |

By whom minutes to be signed and the effect of minutes recorded | | 171 | | 33 |

| | |

| POWERS OF DIRECTORS | | | | |

| | |

General powers of the Directors | | 172 | | 33 |

Consent of Company necessary for the exercise of certain powers | | 173 | | 33 |

Certain powers to be exercised by the Board only at meeting | | 174 | | 33 |

Certain powers of the Board | | 175 | | 34 |

| | |

| REGISTERS, BOOKS AND DOCUMENTS | | | | |

| | |

Registers, Books and Documents | | 176 | | 36 |

| | |

| THE SEAL | | | | |

| | |

Seal | | 177 | | 37 |

Deeds how executed | | 178 | | 37 |

Seals abroad | | 179 | | 37 |

| | |

| MANAGING AGENTS | | | | |

| | |

Appointment of Managing Agents | | 180 | | 37 |

Disclosure to members in case of contract appointing a Managing Agent | | 181 | | 37 |

General Management in hands of Managing Agents | | 182 | | 37 |

Managing Agents to have power to sub-delegate | | 183 | | 37 |

Board’s previous approval | | 184 | | 37 |

Contracts between Managing Agent or associate and Company for the sale or purchase of goods or the supply of services, etc. | | 185 | | 38 |

| | |

| MANAGING OR WHOLE-TIME DIRECTOR(S) | | | | |

| | |

Power to appoint Managing or Whole-time Director(s) | | 185A | | 38 |

What provisions they shall be subject to | | 185B | | 38 |

Remuneration of Managing or Whole-time Director(s) | | 185C | | 38 |

Powers and duties of Managing or Whole-time Director(s) | | 185D | | 39 |

| | |

| INTEREST OUT OF CAPITAL | | | | |

| | |

Payment of interest out of capital | | 186 | | 39 |

| | |

| DIVIDENDS | | | | |

| | |

Dividend | | 187 | | 39 |

Capital paid up in advance at interest not to earn Dividend | | 188 | | 39 |

Dividends in proportion to amount paid up | | 189 | | 39 |

The Company in General meeting may declare a Dividend | | 190 | | 39 |

Power of Directors to limit Dividend | | 191 | | 39 |

Interim Dividend | | 192 | | 39 |

Retention of Dividends until completion of transfer under Article 54 | | 193 | | 39 |

No member to receive dividend whilst indebted to the Company and Company’s right of reimbursement thereout | | 194 | | 40 |

Transfers of shares must be registered | | 195 | | 40 |

Dividends, how remitted | | 196 | | 40 |

Unclaimed Dividend | | 197 | | 40 |

Dividend and Call together | | 198 | | 40 |

Set-off allowed | | 198 | | 40 |

| | |

| CAPITALIZATION | | | | |

| | |

Capitalization | | 199 | | 40 |

Capitalization in respect of partly paid up shares | | 200 | | 41 |

| | |

| ACCOUNTS | | | | |

| | |

Books of Accounts to be kept | | 201 | | 41 |

Books of Account to be preserved | | 202 | | 41 |

Inspection by members of accounts and books of the Company | | 203 | | 41 |

Statements of Accounts to be furnished to General Meeting | | 204 | | 41 |

Balance Sheet and Profit and Loss Account | | 205 | | 41 |

Authentication of Balance Sheet and Profit and Loss Account | | 206 | | 42 |

| | | | |

Profit and Loss Account to be annexed and Auditor’s Report to be attached to the Balance Sheet | | 207 | | 42 |

Board’s Report to be attached to Balance Sheet | | 208 | | 42 |

Right of members to copies of Balance Sheet and Auditor’s Report | | 209 | | 42 |

| | |

| ANNUAL RETURNS | | | | |

| | |

Annual Returns | | 210 | | 42 |

| | |

| AUDIT | | | | |

| | |

Accounts to be audited | | 211 | | 42 |

Appointment of Auditors | | 212(1) | | 42 |

Qualification and disqualification of Auditors | | 212(7) | | 43 |

Audit of Branch Offices | | 213 | | 43 |

Remuneration of Auditors | | 214 | | 43 |

Rights and duties of Auditors | | 215(1) | | 43 |

Accounts when audited and approved to be conclusive except as to errors discovered within three months | | 216 | | 44 |

| | |

| DOCUMENTS AND SERVICE OF DOCUMENTS | | | | |

| | |

How document to be served on members | | 217(1) | | 44 |

Service on members having no registered address | | 218 | | 44 |

Service on persons acquiring shares on death or insolvency of member | | 219 | | 44 |

Persons entitled to notice of General Meetings | | 220 | | 44 |

Advertisement | | 221 | | 44 |

Members bound by document given to previous holders | | 222 | | 44 |

Notices by Company and signature thereto | | 223 | | 45 |

Service of notices by shareholders | | 224 | | 45 |

| | |

| AUTHENTICATION OF DOCUMENTS | | | | |

| | |

Authentication of documents and proceedings | | 225 | | 45 |

| | |

| WINDING UP | | | | |

| | |

Distribution of Assets | | 226 | | 45 |

Distribution of specie or kind | | 227(1) | | 45 |

Rights of shareholders in case of sale | | 228 | | 45 |

| | |

| SECRECY CLAUSE | | | | |

| | |

Secrecy Clause | | 229 | | 45 |

| | |

| INDEMNITY AND RESPONSIBILITY | | | | |

| | |

Directors’ and others’ rights to indemnity | | 230 | | 45 |

Not responsible for acts of others | | 231 | | 46 |

| | |

| ANNEXURES TO THE ARTICLES OF ASSOCIATION | | | | |

| | |

RESOLUTIONS TO WHICH SECTION 192 OF THE ACT APPLIES | | | | — |

MEMORANDUM OF ASSOCIATION

OF

TATA MOTORS LIMITED

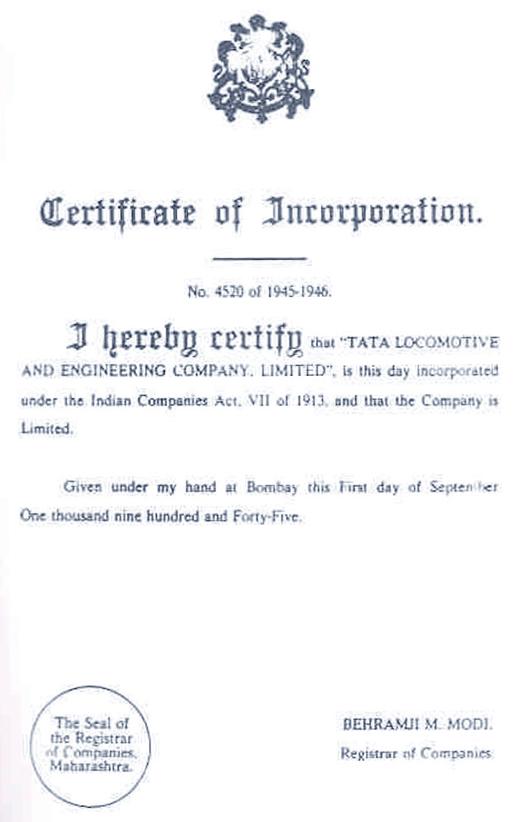

| I. | The name of the Company is“TATA MOTORS LIMITED” |

| II. | The Registered Office of the Company will be situate in the State of Maharashtra. |

| III. | The objects for which the Company is established are:- |

| 1. | To carry on the business of manufacturing, assembling, buying, selling, re-selling, exchanging, altering, importing, exporting, hiring, letting on hire, or distributing or dealing in locomotives, boilers, engines steam gas electrical or otherwise, turbines, tanks, motor vehicles, trucks, lorries, omnibuses, buses, motorcycles, cycle cars, scooters, bicycles, tricycles, cycles, tractors, bulldozers and steam rollers of every description and kind and all component parts, spare parts, accessories, equipment and apparatus for use in connection therewith. |

| 1A. | *To carry on the business of financing, re-financing of all kinds and descriptions of motor vehicles, tractors and other farm equipment, construction equipment, capital equipment, spares and components, whether manufactured by the Company or not, including used/second hand products as also services of every kind and description, through credit/financing products, including by way of hire purchase, financial and/or operating leases, loans and guarantees or otherwise. |

| 2. | To carry on the business of iron founders, mechanical and general engineers and manufacturers of implements and other machinery, tool-makers, brass-founders, metalworkers, boilermakers, millwrights, machinists, iron and steel converters, smiths, wood-workers, builders, painters, metallurgists, water supply engineers, gas-makers, printers, carriers and merchants, and to buy, sell, manufacture, repair, convert, alter, let on hire and deal in machinery, implements, rolling-stock and hardware of all kinds. |

| 3. | To carry on any business relating to the winning and working of minerals, the production and working of metals (other than the production of pig iron or steel) and the production, manufacture and preparation of any other materials which may be usefully or conveniently combined with the engineering or manufacturing business of the Company, or any contracts undertaken by the Company, and either for the purpose only of such contracts or as an independent business. |

| 4. | To carry on business as manufacturers, importers and exporters of and dealers in machinery articles and goods of all classes and kinds whatsoever including electrical and engineering materials, goods, machinery and requisites and as Electrical, Mechanical and General Engineers and Contractors and as manufacturers and workers in materials of any nature and kind. |

| 5. | To carry on business as manufacturers and makers of and dealers in metal (other than as manufacturers and makers of pig iron or steel), wood, enamel, aluminum, alloys, plastics and any other products, articles and things of every description and kind and to carry on and conduct workshops, engineering works of every description and kind and foundries of iron, brass and other metals, wood and any other substances and to buy, sell, manipulate and deal both wholesale and retail in such products, commodities, goods, articles and things. |

| 6. | To carry on the trades or business of manufactures of ferromanganese, colliery proprietors, Coke manufacturers, Miners, smelters, engineers and tin plate makers in all their respective branches. |

| 7. | To prospect and search for, get, work, raise, make merchantable, sell and deal in coal, oil, limestone, manganese, ferro-manganese, magnesite, copper, clay, fire-clay, slate, stone, brick earth, bricks, and other materials (excluding the making and selling of pig iron from iron ore), minerals and substances, and to manufacture and sell briquettes and other fuel, and generally to undertake and carry on any business transaction or operation commonly undertaken or carried on by explorers, prospectors or concessionaries and to search for, win, work, get, calcine, reduce, amalgamate, dress, refine and prepare for the market any quarts and ore and mineral substances and to buy, sell, manufacture and deal in minerals and mineral products, plant and machinery, and other things capable, of being used in connection with mining or metallurgical operations or required by the workmen and others employed by the Company. |

| 8. | To purchase, take on lease or otherwise acquire, any mines, mining rights, and metalliferous land and any interest therein, and to explore, work, exercise, develop and turn to account the same. To expend such sums of moneys as may seem desirable for all such prospecting and surveying operations with the object of obtaining any such mines, mining rights and metalliferous lands and deposits as aforesaid and otherwise for the acquisition of any property and rights whatsoever which the Company is authorised to acquire under any of its objects. |

| 9. | To buy, sell, manufacture, and deal in minerals, plant, machinery, implements, conveniences, provisions and things capable of being used in connection with metallurgical operations, or required by workmen and others employed by the Company. |

| 10. | To carry on the business of manufacturing, assembling, buying, selling, re-selling, exchanging, altering, importing, exporting, hiring, letting on hire, or distributing or dealing in ships, boats, barges, launches, submarines and other under-water vessels, aeroplanes, aero-engines, airships, seaplanes, flying boats, hydroplanes and aircrafts and aerial conveyances of every description and kind for transport or conveyance of passengers, merchandise or goods of every description whether propelled or moved or assisted by means of petrol, spirit, electricity, steam, oil, vapour, gas, petroleum, mechanical, animal or any other motive power and all component parts, spare parts, accessories, equipment and apparatus for use in connection therewith. |

| 11. | To carry on the trade or business of manufacturing, assembling, buying, selling, re-selling, exchanging, altering, importing, exporting, hiring, letting on hire, or distributing or dealing in railway carriages, wagons, carts, vehicles, rolling stocks and conveyances of all kinds whether for railway, tramway, road, field or other traffic or purposes, and also railways and tramway plant, and all machinery, materials, and things applicable or used as accessory thereto and of letting or supplying all or any of the things hereinbefore specified to coal proprietors, railway and other companies, and other persons, from year to year or for a term of years, or otherwise, at annual or other rents, and of repairing and maintaining the same respectively, whether belonging to this Company or not, and of selling exchanging and otherwise dealing in the same respectively. |

*Amended vide Court Order dated June 24, 2005, pursuant to Scheme of Reorganisation and Amalgamation of Tata Finance Limited with Tata Motors Limited.

1

| 12. | To enter into any contracts or arrangements with any government, state or authorities, municipal, local or otherwise that may seem conducive to the Company’s objects or any of them and to obtain from any such government, state or authority, any rights, privileges and concessions which the Company may think it desirable to obtain and to carry out, execute and comply with any such contracts, arrangements, rights, privileges and concessions. |

| 13. | To construct, execute, carry out, equip, improve, work, develop, administer, manage or control public works and conveniences of all kinds, which expression in this memorandum, includes railways, tramways, docks, harbours, piers, wharves, canals, reservoirs, embankments, irrigations, reclamation, improvement, sewage, drainage, sanitary, water, gas, electric light, telephonic, telegraphic, and power supply works, and hotels, warehouses, markets and public buildings, and all other works or conveniences of public utility. |

| 14. | To carry on business as quarry masters and stone merchants and to buy, sell, get, work, shape, hew, carve, polish, crush and prepare for market or use stone of all kinds. |

| 15. | To carry on business as road and pavement makers and repairers and manufacturers of and dealers in lime, cement, mortar, concrete and building materials of all kinds and as builders and contractors for the execution of works and buildings of all kinds in the construction of which stone is required. |

| 16. | To construct, carry out, maintain, improve, manage, work, control, and superinted any roads, ways, tramways, railways, bridges, reservoirs, watercourses, aqueducts, warves, furnaces, saw-mill, crushing works, hydraulic works, electrical works, factories, warehouses, shops and other works and conveniences which may seem directly or indirectly conducive to any of the objects of the Company, and to contribute to, subsidise, or otherwise aid or take part in any such operations. |

| 17. | To carry on the trades or businesses of manufacturers of blasting ballistic and pyrotechnic apparatus and other articles and things of a similar or analogous description or use or of and in the several components parts thereof. |

| 18. | To carry on the trades or businesses of manufacturers of and dealers in explosives, ammunition, fireworks and other explosive products and accessories of all kinds and of whatsoever composition and whether for military, sporting, mining or industrial, purposes or for pyrotechnical display or for any other purpose. |

| 19. | To carry on the business of manufacturers of every sort of missile, arm and weapon for warlike, sporting or other purposes. |

| 20. | To carry on the business of waterproofers and manufacturers of India-rubber, leather, imitation leather, leather cloth, plastic, oil cloth, linoleum, tarpaulins, hospital sheetings and surgical bandages. |

| 21. | To carry on the business of a water-works Company in all its branches and to sink wells and shafts and to make, build and construct, lay down and maintain dams, reservoirs, waterworks, cisterns, culverts, filterbeds, mains and other pipes and appliances and to execute and do all other acts and things necessary or convenient for obtaining, storing, selling, delivering, measuring, distributing and dealing in water. |

| 22. | To purchase, take on lease or in exchange, or otherwise acquire, either absolutely or by lease, license, concession, grant or otherwise any lands, mines and mineral rights, easements, rights and privileges and licenses for mining in, or over any lands which may be acquired by the Company, and to lease out any such lands for building or agricultural use and to sell or otherwise dispose of the lands, mines and other property of the Company. |

| 23. | To acquire by concession, grant, purchase, barter, lease, license or otherwise any tract or tracts of country, together with such, rights as may be agreed upon and granted by Government or the rulers or owners thereof, and to expend such sums of money as may be deemed requisite and advisable in the exploration, survey and, development thereof. |

| 24. | To acquire by concession, grant, purchase, amalgamation, barter, lease, license or otherwise, either absolutely or conditionally and either solely or jointly with others any houses, lands, farms, quarries, water rights, way leaves and other works, privileges, rights and hereditaments and any machinery, plant, utensils, trademarks and other moveable, and immoveable property of any description. |

| 25. | To acquire, provide and maintain hangars, garages, sheds, aerodromes and accommodation for or in relation to aerial conveyances. |

| 26. | To carry on the business of railway, tramway, airway, omnibus, van, carriage and boat proprietors and carriers of passengers and goods by land, sea or air. |

| 27. | To search for and to purchase or otherwise acquire from any government, state or authority any licenses, concessions, grants, decrees, rights, powers and privileges whatsoever which may seem to the Company capable of being turned to account, and in particular any water rights or concession, either for the purpose of obtaining motive power or otherwise and to work, develop, carry out, exercise and turn to account the same. |

| 28. | To carry on the businesses of a General Electric Power and Supply Company and Gas Works Company in all their respective branches, and to construct, lay down, establish, fix and carry out all necessary power stations, cables, wires, lines accumulators, lamps and works and to generate, accumulate, distribute and supply electricity and gas and to light cities, towns, streets, docks, markets, theatres, buildings and places both public and private. |

| 29. | To acquire the right to use or manufacture and to put up telegraphs, telephones, phonographs, dynamos, accumulators and all apparatus now known or which may hereafter be invented, in connection with the generation, accumulation, distribution, supply and employment of electricity, or any power that can be used as a substitute therefor, including all cables, wires or appliances for connecting apparatus at a distance with other apparatus, and including the formation of exchanges or centres. |

| 30. | To carry on the business of electricians and electrical engineers, suppliers of electricity for the purposes of light, heat, motive power or otherwise, and manufacturers of and dealers in apparatus and things required for or capable of being used in connection with the generation, distribution, supply, accumulation and employment of electricity, galvanism, magnetism or otherwise. |

2

| 31. | To deal with, manufacture and render saleable, coke, coal-tar, pitch, asphaltum, ammoniacal liquor, and other residual products obtained in the manufacture of gas. |

| 32. | To construct, manufacture, and maintain works for holding, receiving and purifying gas, and all other buildings and works, meters, pipes, fittings, machinery, apparatus, and appliances convenient or necessary for the purposes of the Company. |

| 33. | To manufacture, buy, sell, let on hire and deal in stoves, engines, and other apparatus and conveniences. |

| 34. | To carry on the business of a telephone and telegraph Company, and in particular to establish work, manage, control and regulate telephone exchanges and works, and to transmit and facilitate the transmission of telephonic and telegraphic communications and messages. |

| 35. | To construct, maintain, lay down, carry out, work, sell, let on hire and deal in telephonic and all kinds of works machinery apparatus conveniences and things capable of being used in connection with any of these objects and in particular any cables, wires, lines, stations, exchanges, reservoirs, accumulators, lamps, meters and engines. |

| 36. | To carry on all or any of the business of lithographers, printers, publishers and stationers. |

| 37. | To establish, provide, maintain and conduct or otherwise subsidise research laboratories and experimental workshops for scientific and technical research and experiments and to undertake and carry on all scientific, and technical researches, experiments, and tests of all kinds and to promote studies and research both scientific and technical, investigation and invention by providing, subsidising, endowing or assisting laboratories, workshops, libraries, lectures, meetings and conferences and by providing the remunerations of scientific or technical professors or teachers and by providing for the award of exhibitions, scholarships, prizes, grants and bursaries to students or independent students or otherwise and generally to encourage, promote and reward studies, researches, investigation, experiment, tests and invention of any kind that may be considered likely to assist any of the business which the Company is authorised to carry on. |

| 38. | To erect, construct, enlarge, alter and maintain buildings and structures of every kind necessary or convenient for the Company’s business. |

| 39. | To let out on hire all or any of the property of the Company whether immoveable or moveable including all and every description of apparatus or appliances, and to hold, use, cultivate, work, manage, improve, carry on and develop the undertaking land and immoveable and moveable property and assets of any kind of the Company or any part thereof. |

| 40. | To purchase or by any other means acquire and protect prolong and renew, any patents, patent rights, brevets d’invention, licences, protections and concessions which may appear likely to be advantageous or useful to the Company, and to use and turn to account and manufacture under or grant licenses or privileges in respect of the same and to spend money in experimenting upon and testing and improving or seeking to improve any patent, inventions or rights which the Company may acquire or propose to acquire. |

| 41. | To buy, sell, manufacture, refine, manipulate, import, export, and deal both wholesale and retail in commodities, substances, apparatus, articles and things of all kinds capable of being used or which can conveniently be dealt in by the Company in connection with any of its objects. |

| 42. | To transact and carry on all kinds of agency business. |

| 43. | To carry on any other trade whether manufacturing or otherwise which may seem to the Company capable of being carried on in connection with any of the Company’s objects or calculated directly or indirectly to enhance the value of or render profitable any of the Company’s properties or rights. |

| 44. | To be interested in, promote and undertake the formation and establishment of such institutions, businesses or companies (industrial, agricultural, trading, manufacturing or other) as may be considered to be conducive to the profit and interest of the Company, and to carry on any other business, (industrial, agricultural, trading, manufacturing or other) which may seem to the Company capable of being conveniently carried on in connection with any of these objects or otherwise calculated directly or indirectly to render any of the Company’s properties or rights for the time being profitable, and also to acquire, promote, aid, foster, subsidise or acquire interests in any industry or undertaking. |

| 45. | To enter into partnership or into any arrangement for sharing or pooling profits, amalgamation, union of interests, co-operation, joint adventure, reciprocal concessions or otherwise with any person, firm or company carrying on or engaged in or about to carry on or engage in any business or transaction which this Company is authorised to carry on or engage in, or any business undertaking or transaction which may seem capable of being carried on or conducted so as directly or indirectly to benefit this Company. |

| 46. | To amalgamate with any Company or Companies. |

(Alteration confirmed by an Order passed on the 15th January, 1971 by the Bombay High Court)

| 47. | To pay for any properties, rights or privileges acquired by the Company, either in shares of the Company or partly in shares and partly in cash, or otherwise. |

| 48. | To pay all the costs, charges, and expenses of and incidental to the promotion, formation, registration and establishment of the Company and the issue of its capital including any underwriting or other commissions, brokers’ fees and charges in connection therewith, and to remunerate or make donations (by cash or other assets or by the allotment of fully or partly paid shares or by a call or option on shares, debentures, debenture stock or securities of this or any other company or in any other manner, whether out of the Company’s capital or profits or otherwise) to any person, firm or company for services rendered or to, be rendered in introducing any property or business to the Company or in placing or assisting to place or guaranteeing the subscription, of any shares, debentures, debenture stock or other securities of the Company, or in or about the formation or promotion of the Company or for any other reason which the Company may think proper. |

| 49. | To draw, accept and make and to endorse, discount and negotiate promissory notes, hundies, bills of exchange, bills of lading and other negotiable or transferable instruments. |

3

| 50. | To borrow or raise money or to receive money on deposit at interest, or otherwise in such manner as the Company may think fit, and in particular by the issue of debentures or debenture stock perpetual or otherwise including debentures or debenture stock convertible into shares of this Company, or perpetual annuities; and in security of any such money so borrowed, raised, or received, to mortgage, pledge or charge the whole or any part of the property, assets or revenue of the Company, present or future, including its uncalled capital by special assignment or otherwise or to transfer or convey the same absolutely or in trust and to give the lenders power of sale and other powers as may seem expedient; and to purchase, redeem, or payoff any such securities. |

| 51. | To accumulate funds and to lend, invest or otherwise employ moneys belonging to or entrusted to the Company upon any shares, securities or investments upon such terms as may be thought proper and from time to time to vary such transactions in such manner as the Company may think fit. |

| 52. | To invest moneys of the Company in any investments moveable or immoveable and vary such investments in such manner as may from time to time seem expedient and be determined. |

| 53. | To sell and in any other manner deal with or dispose of the undertaking of the Company, or any part thereof, for such consideration as the Company may think fit, and in particular for shares, debentures and other securities of any other company having objects altogether or in part similar to those of the Company. |

| 54. | To sell, improve, manage, work, develop, lease, mortgage, abandon or otherwise deal with all or any part of the property, rights and concessions of the Company. |

| 55. | To guarantee the payment of money unsecured or secured by or payable under or in respect of promissory notes, bonds, debentures, debenture stock, contracts, mortgages, charges, obligations, instruments and securities of any company or of any authority, supreme, municipal, local or otherwise or of any person whomsoever, whether incorporated or not incorporated and generally to guarantee or become sureties for the performance of any contracts or obligations. |

| 56. | To undertake and execute any trust the undertaking of which may seem to the Company desirable either gratuitously or otherwise. |

| 57. | To provide for the welfare of employees or ex-employees of the Company and the wives and families or the dependents or connections of such persons by building or contributing to the building of houses, dwellings or chawls or by grants of money, pensions, allowances, bonus or other payments or by creating and from time to time subscribing or contributing to provident and other associations, institutions, funds or trusts and by providing or subscribing or contributing towards places of instruction and recreation, hospitals and dispensaries, medical and other attendance and other assistance as the Company shall think fit. |

| 58. | To subscribe or otherwise to assist, support, endow or to guarantee money to charitable, benevolent, religious, scientific, national or other institutions, societies, clubs, funds or objects, which shall have any moral or other claim to support or aid by the Company either by reason of locality of operation or of public and general utility or otherwise. |

| 59. | To adopt such means of making known the products of the Company as may seem expedient and in particular by advertising in the press, by circulars, by purchase and exhibition of works or art or interest, by publication of books and periodicals and by granting prizes, rewards and donations. |

| 60. | To distribute any of the property of the Company amongst the members in specie or kind but so that no distribution amounting to a reduction of capital be made except with the sanction (if any) for the time being required by law. |

| 61. | To dedicate, present or otherwise dispose of either voluntarily with or without consideration or for value, any property of the Company deemed to be of national, public or local interest, to any national trust, public body, museum, corporation, or authority or any trustees for or on behalf of any of the same or of the public. |

| 62. | To appropriate, use or lay out land belonging to the Company for streets, parks, pleasure grounds, allotments, and other conveniences and to present any such land so laid out to the public or to any persons or company conditionally or unconditionally as the Company thinks fit. |

| 63. | To aid pecuniarily or otherwise, any association body or movement having for an object the solution, settlement or surmounting of industrial or labour problems or troubles or the promotion of industry or trade. |

| 64. | To do all or any of the above things and all such other things as are incidental or may be thought conducive to the attainment of the above objects or any of them in India or elsewhere in any other part of the world and as principals, agents, contractors, trustees or otherwise and by or through trustees, agents or otherwise and either alone or in conjunction with others and so that the word “Company” in this Memorandum when applied otherwise than to this Company shall be deemed to include any authority, partnership or other body or persons, whether incorporated or not incorporated and the intention is that the objects set forth in each of the several paragraphs of this Clause shall have the widest possible construction and shall be in no wise limited or restricted by reference to or inference from the terms of any other paragraph of this Clause or the name of the Company. |

| IV. | The liability of the Members is limited. |

| V. | The Capital of the Company is Rs. 410,00,00,000/- divided into 41,00,00,000 Ordinary Shares of Rs. 10/- each.* |

*Amended vide Court Order dated June 24, 2005, pursuant to Scheme of Reorganisation and Amalgamation of Tata Finance Limited with Tata Motors Limited.

4

We the several persons whose names and addresses are subscribed are desirous of being formed into a Company, in pursuance of this Memorandum of Association and respectively agree to take the number of shares in the Capital of the Company set opposite our respective names.

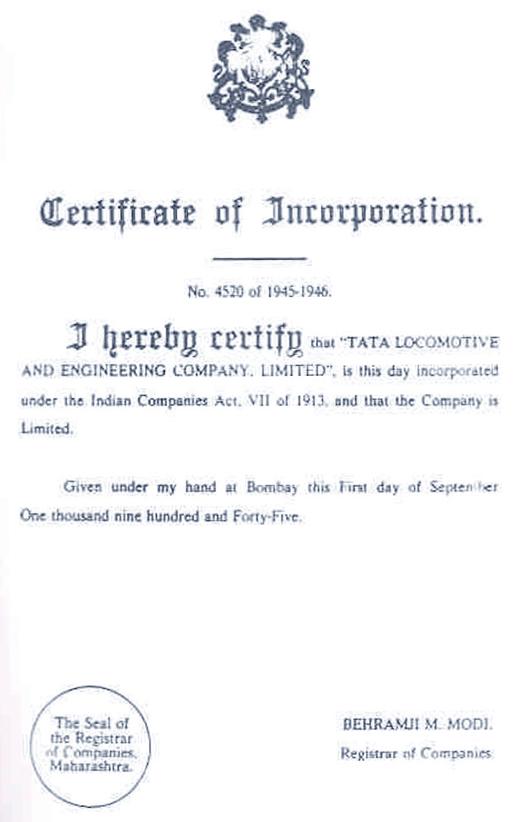

Dated this first day of September 1945.

| | | | | | |

Names of Subscribers

| | Address and Description of Subscribers

| | Number of Shares taken by each Subscriber

| | Witnesses

|

J. R. D. TATA | | Director, Tata Sons Ltd., Bombay House, Bruce Street, Fort, Bombay | | One | | Witness to all signatures A. B. PARAKH Assistant to Director-in-Charge Tata Iron and Steel Company Ltd., Bombay House, Bruce Street Fort, Bombay |

S.D.SAKLATVALA | | Director, Tata Sons Ltd., Bombay House, Fort, Bombay | | One | |

H. P. MODY | | Do | | One | |

A. D. SHROFF | | Do | | One | |

JOHN MATTHAI | | Do | | One | |

J. D. CHOKSI | | Director, Tata Sons Ltd., Bombay House, Bruce Street, Fort, Bombay | | One | |

R. D. LAM | | Secretary, Tata Sons Ltd., Bombay House, Bruce Street, Fort, Bombay | | One | |

K. M. MADAN | | Secretary and Chief Accountant, Tata Iron & Steel Co. Ltd., Bombay House, Fort, Bombay | | One | |

5

|

These Articles of Association were approved and adopted by the Company by Special Resolution at the Annual General Meeting held on 10th August 1961 |

| | | | | | |

| | | | | ARTICLES OF ASSOCIATION |

| | | | | OF |

| | | | | TATA MOTORS LIMITED |

| | | | | TABLE A EXCLUDED |

| Table A not to apply but Company to be governed by these Articles | | 1. | | The regulations contained in Table A, in the First Schedule to the Companies Act, 1956, shall not apply to this Company, but the regulations for the management of the Company and for the observance of the Members thereof and their representatives shall, subject to any exercise of the statutory powers of the Company in reference to the repeal or alteration of, or addition to, its regulations by Special Resolution, as prescribed by the said Companies Act, 1956, be such as are contained in these Articles. |

| | | | | INTERPRETATION |

| Interpretation Clause | | 2. | | In the interpretation of these Articles the following expressions shall have the following meanings, unless repugnant to the subject or context:- |

| “The Act” or “the said Act” | | | | “The Act” or “the said Act” means “The Companies Act, 1956” as amended up to date or other the Act or Acts for the time being in force, in India containing the provisions of the Legislature in relation to Companies. |

| “The Board” or “Board of Directors” | | | | “The Board” or the “Board of Directors” means a meeting of the Directors duly called and constituted or as the case may be the Directors’ assembled at a Board, or the requisite number of Directors entitled to pass a Circular Resolution in accordance with these Articles. |

| “The Company” or “This Company” | | | | “The Company” or “This Company” means “Tata Motors Limited”. |

| | |

| “Directors” | | | | “Directors” means the Directors for the time being of the Company or as the case may be the Directors assembled at a Board. |

| “Dividend” | | | | “Dividend” includes bonus. |

| Gender | | | | Words importing the masculine gender also include the feminine gender. |

| “Month” | | | | “Month” means a calendar month. |

| “Office” | | | | “Office” means the Registered Office for the time being of the Company. |

| “Persons” | | | | “Persons” includes corporations as well as individuals. |

| Plural number | | | | Words importing the plural number also include the singular number. |

| “These presents” or “Regulations” | | | | “These presents” or “Regulations” means these Articles of Association as originally framed or altered from time to time and includes the Memorandum where the context so requires. |

| | |

| “Seal” | | | | “Seal” means the Common Seal for the time being of the Company. |

| Singular number | | | | Words importing the singular number include the plural number. |

| “Writing” | | | | “Writing” shall include printing and lithography and any other mode or modes of representing or reproducing words in a visible form. |

| Expressions in the Act to bear the same meaning in Articles | | | | Subject as aforesaid any words or expression defined in the Act shall except where the subject or context forbids bear the same meaning in these Articles. |

| | |

| Marginal notes | | | | The marginal notes hereto shall not affect the construction hereof. |

| | | | | TENURE OF OFFICE OF MANAGING AGENTS |

| Tenure of office of Managing Agents | | 2.A | | All references whatsoever to Managing Agents, their powers, functions and duties under these Articles and under any agreement entered into by them with the Company, shall be applicable only if and so long as there are Managing Agents in accordance with the provisions of the law. |

6

| | | | | | |

| | | | | PRELIMINARY |

Agreements entered into by the Company | | 3. | | The Company has entered into the following Agreements:- |

| | | (1) | | An agreement dated the Twenty-seventh day of September One thousand nine hundred and forty-five and made between TATA SONS LTD, of the one part and the COMPANY of the other part |

| | | | | (a) | | for acquiring (through Tata Sons Ltd.) the Singhbhum Workshops situate at Tatanagar, Singhbhum in the Province of Bihar, belonging to the Government of India; |

| | | | | (b) | | for obtaining a transfer from Tata Sons Ltd. to itself of the rights subject to the obligations of Tata Sons Ltd. contained in the arrangements made by that Company with the Government of India for the manufacture of locomotive boilers and locomotives at the said Singhbhum Workshops. |

| | | (2) | | An agreement dated the Twenty-seventh day of September One thousand nine hundred and forty-five and made between the COMPANY of the one part and TATA SONS LTD., of the other part which Agreement provided for the appointment of Tata Sons Ltd., their successors and assigns as the Managing Agents of the Company. |

| | | | | The basis on which the Company was established was that the Company should enter into the said Agreements upon the terms therein set forth and should be bound by the conditions therein contained and accordingly it should be no objection to the said documents or any of them that Mr. Jehangir Ruttonji Dadabhoy Tata, Sir Hormusji Peroshaw Mody and Dr. John Matthai who were members and Directors of Tata Sons Ltd., were interested in the Agreements 1 and 2 above and in the consideration thereby conferred as Directors of the Company or that any person being interested in either or both of the said Agreements was or might be a promoter or a Director of the Company or stood in a fiduciary position towards the company or that in the circumstances the Directors did not constitute an independent Board and every member present or future shall be deemed to join the Company on this basis. |

Copies of Memorandum and Articles of Association to be given to members | | 4. | | Copies of the Memorandum of Association and these presents and other documents mentioned in Section 39 of the Act shall be furnished by the Company to any member at his request within 7 days of the requirement subject to the payment of a fee of Re. 1/-. |

| | | | | SOCIAL RESPONSIBILITIES OF THE COMPANY |

| Social Responsibilities of the Company | | 4A. | | The Company shall have among its objectives the promotion and growth of the national economy through increased productivity, effective utilisation of material and manpower resources and continued application of modern scientific and managerial techniques in keeping with the national aspirations; and the Company, shall be mindful of its social and moral responsibilities to the consumers, employees, shareholders, society and the local community. |

| | | | | CAPITAL |

| | | | | SHARES |

| Capital | | 5. | | *The Capital of the Company is as reflected in Clause V of the Memorandum of Association from time to time. |

| | |

| | | 6. | | “DELETED” |

| | |

| | | 6A. | | “DELETED” |

| | |

| | | 6B. | | “DELETED” |

| | |

| | | 6C. | | “DELETED” |

| | |

| | | 7. | | The unclassified shares for the time being in the capital of the Company may be issued either with the sanction of the Company in General Meeting or by the Directors and upon such terms and conditions and with such right and privileges annexed thereto as by the General Meeting sanctioning the issue of such shares shall be directed and if no direction be given and in all other cases as the Directors shall determine; and in particular such shares may be issued with a preferential or qualified right to dividends and in distribution of the assets of the Company and any preference shares may be issued on the terms that they are or at the option of the Company are liable to be redeemed. |

| | |

| | | * | | Amended vide Court Order dated June 24, 2005, pursuant to Scheme of Re-organisation and amalgamation of Tata Finance Limited with Tata Motors Limited |

7

| | | | | | |

| Shares with non-voting rights | | 7A | | In the event it is permitted by the Law to issue shares with non-voting rights attached to them, the Directors may issue such shares upon such terms and conditions and with such rights and privileges annexed thereto as thought fit and as may be permitted by the Law. |

| Shares under the control of the Directors | | 8. | | Subject to the provisions of the Act and Article 64 and the other Articles, the shares in the capital of the Company for the time being (including any shares forming part of any increased capital of the Company) shall be under the control of the Directors who may allot or otherwise dispose of the same or any of them to such persons, in such proportion and on such terms and conditions and either at a premium or at par or (subject to compliance with the provisions of Section 79 of the Act) at a discount and at such times as they may from time to time, think fit and proper, and with full power with the sanction of the Company in General Meeting to give to any person the option to call for or be allotted shares of any class of the Company either at par or at a premium or subject as aforesaid at a discount such option being exercisable at such time and for such consideration as the Directors think fit. |

| Power of General Meeting to offer shares to such Company may resolve | | 9. | | In addition to and without derogating from the powers for that purpose conferred on the Directors under Articles 7 and 8 and on the Company under Articles 7 and 8, the Company in general meeting may determine to issue further shares of the authorised but unissued capital of the Company and may determine that any shares (whether forming part of the original capital or of any increased capital of the Company) shall be offered to such persons (whether members or holders of debentures of the Company or not) in such proportions and on such terms and conditions and either at a premium or at par or, subject to compliance with the provisions of Section 79 of the Act, at a discount, as such general meeting shall determine and with full power to give to any person (whether a member or holder of debentures of the Company or not) the option to call for or be allotted shares of any class of the Company either at a premium or at par or (subject to compliance with the provisions of Section 79 of the Act) at a discount, such option being exercisable at such times and for such consideration as may be directed by such general meeting, or the Company in general meeting may make any other provision whatsoever for the issue, allotment or disposal of any shares. Subject to any direction given by general meeting as aforesaid, the provisions of Article 64 hereof shall apply to any issue of new shares. |

| Directors may allot shares as fully paid-up | | 10. | | Subject to the provisions of the Act and these Articles, the Directors may allot and issue shares in the capital of the Company as payment or part payment for any property sold or transferred, goods or machinery supplied or for services rendered to the Company either in or about the formation or promotion of the Company or the conduct of its business and any shares which may be so allotted may be issued as fully paid or partly paid-up otherwise than in cash, and, if so issued, shall be deemed to be fully paid-up or partly paid-up shares as aforesaid. |

Shares to be numbered Progressively and no share to be sub-divided | | 11. | | The shares in the capital of the Company shall be numbered progressively according to their several denominations, and except in the manner hereinafter mentioned, no shares shall be sub-divided. |

| Acceptance of shares | | 12. | | An application signed by or on behalf of an applicant for shares in the Company, followed by an allotment of any share therein, shall be an acceptance of shares within the meaning of these Articles, and every person who thus or otherwise accepts any shares and whose name is on the Register shall for the purpose of these Articles be a member. |

| Deposit and calls etc. to be a debt payable immediately | | 13. | | The money (if any) which the Directors shall, on the allotment of any shares being made by them, require or direct to be paid by way of deposit, call or otherwise, in respect of any shares allotted by them, shall, immediately on the insertion of the name of the allottee in the Register of Members as the name or the holder of such shares, become a debt due to and recoverable by the Company from the allottee thereof, and shall be paid by him accordingly. |

| Instalments on shares to be duly paid | | 14. | | If by the conditions of allotment of any share the whole or part of the amount or issue price thereof shall be payable by instalments, every such instalment shall when due be paid to the Company by the person who for the time being and from time to time shall be the registered holder of the share or his legal representative. |

| Company not bound to recognise any interest in shares other than that of the registered holders | | 15. | | Except as required by law no person shall be recognised by the Company as holding any share upon any trust and the Company shall not be bound by, or be compelled in any way, to recognise (even when having notice thereof) any equitable, contingent, future, or partial interest in any share or any interest in any fractional part of a share, (or except only as by these Articles or as ordered by a Court of competent jurisdiction or by law otherwise provided) any other rights in respect of any share except an absolute right to the entirety thereof in the registered holder. |

8

| | | | | | |

| | | | | UNDERWRITING AND BROKERAGE |

| Commission for Placing shares, Debentures, etc. | | 16. | | The Company may subject to the provisions of Section 76 and other applicable provisions (if any) of the Act at any time pay a commission to any person in consideration of his subscribing or agreeing to subscribe or his procuring or agreeing to procure subscriptions, whether absolutely or conditionally, for any shares in or debentures of the Company but so that the amount or rate of commission does not exceed in the case of shares 5% of the price at which the shares are issued and in the case of debentures 2 1/2% of the price at which the debentures. are issued. The commission may be satisfied by the payment of cash or the allotment of fully or partly paid shares or debentures or partly in the one way and partly in the other. The Company may also on any issue of shares or debentures pay such brokerage as may be lawful. |

| | | | | CERTIFICATES |

| Certificates of Shares | | 17. | | (a) | | The certificates of title to shares shall be issued under the Seal of the Company which shall be affixed in the presence of and signed by (i) two Directors or persons acting on behalf of the Directors under a duly registered Power of Attorney; and (ii) the Secretary or some other person appointed by the Board for the purpose; |

| | | | | PROVIDED that, if the composition of the Board permits or if, at least one of the aforesaid two Directors shall be a person other than a Managing Director or Whole-time Director or, so long as the Company has Managing Agents, a person other than a Director appointed by the Managing Agents under Article 126 or a Director to whom Article 133 applies. |

| | | | | A Director may sign a share certificate by affixing his signature thereon by means of any machine, equipment or other mechanical means such as engraving in metal or lithography. |

| | | | | PROVIDED ALWAYS that notwithstanding anything contained in this article the certificates of title to shares may be executed and issued in accordance with such other provisions of the Act or the Rules made thereunder, as may be in force for the time being and from time to time. |

| Members’ rights to certificates | | | | (b) | | Every member shall be entitled without payment to one certificate for all the shares of each class or denomination registered in his name or if the Directors so approve (upon paying such fee or fees or at the discretion of the Directors without payment of fees as the Directors may from time to time determine) to several certificates each for one or more shares of each class. Every certificate of shares shall specify the number and denoting numbers of the shares in respect of which it is issued and the amount paid thereon and shall be in such form as the Directors shall prescribe or approve. |

Discretion to refuse sub-division or consolidation of certificates | | 17A. | | Notwithstanding anything contained in Article 17, the Board may in its absolute discretion refuse applications for the sub-division or consolidation of share, debenture or bond certificates in denominations of less than the marketable lot except when sub-division or consolidation is required to be made to comply with a statutory provision or an order of a competent Court of law. |

| Limitation of time for issue of certificates | | 18. | | The Company shall within three months after the allotment of any of its shares or debentures and within two months after the application for the registration of the transfer of any such shares or debentures complete and have ready for delivery the certificates of all shares and debentures allotted or transferred, unless the conditions of issue of the shares or debentures otherwise provided and the Company shall otherwise comply with the requirements of Section 113 and other applicable provisions (if any) of the Act. |

| As to issue of new certificate in place of one defaced, lost or destroyed | | 19. | | If any certificate be worn out, defaced, torn or be otherwise mutilated or rendered useless from any cause whatsoever, or if there be no space on the back thereof for endorsement of transfers, then upon production thereof to the Directors they may order the same to be cancelled and may issue a new certificate in lieu thereof, and if any certificate be lost or destroyed, then upon proof thereof to the satisfaction of the Directors and on such indemnity as the Directors deem adequate being given, a new certificate in lieu thereof shall be given to the party entitled to such lost or destroyed certificate on payment, if any, of such sum not exceeding Re.1/- as the Directors may in their discretion determine. The Directors may in their discretion waive payment of such fee in the case of any certificate or certificates. |

| | | | | CALLS |

| Board may make calls | | 20. | | The Board of Directors may from time to time, but subject to the conditions hereinafter mentioned, make such calls as they think fit upon the members in respect of all moneys unpaid on the shares held by them respectively and not by the conditions of allotment thereof made payable at fixed times and each member shall pay the amount of every calls so made on him to the Company or where payable to a person other than the Company to the person and at the time or times appointed by the Directors. A call may be made payable by instalments. |

9

| | | | | | |

Calls on shares of same class to be made on uniform basis | | 21. | | Where after the commencement of the Act, any calls for future share capital are made on shares, such calls shall be made on a uniform basis on all shares falling under the same class. For the purposes of this Article, shares of the same nominal value on which different amounts have been paid-up shall not be deemed to fall under the same class. |

| Notice of call | | 22. | | Fifteen days’ notice at the least of every call otherwise than on allotment shall be given specifying the time of payment and if payable to any person other than the Company the name of the person to whom the call shall be paid; provided that before the time for payment of such call the Directors may by notice in writing to the members, revoke the same. |

| Call to date from Resolution | | 23. | | A call shall be deemed to have been made at the time when the resolution of the Board of Directors authorising such call was passed and may be made payable by the members whose names appear on the Register of Members on such date or at the discretion of the Directors on such subsequent date as shall be fixed by the Directors. |

| Directors may extend time | | 24. | | The Directors may from time to time, at their discretion, extend the time fixed for the payment of any call; and may extend such time as to all or any of the members who from residence at a distance or other cause, the Director may deem entitled to such extension, but no member shall be entitled to such extension save as a matter of grace and favour. |

Amount payable at fixed time or by instalments as calls | | 25. | | If by the terms of issue of any share or otherwise any amount is made payable at any fixed time or by instalments at fixed times (whether on account of the amount of share or by way of premium) every such amount or instalment shall be payable as if it were a call duly made by the Board or Directors and of which due notice has been given and all the provisions herein contained in respect of calls shall relate to such amount or instalment accordingly. |

| When interest on call or instalment payable | | 26. | | If the sum payable in respect of any call or instalment be not paid on or before the day appointed for payment thereof the holder for the time being or allottee of the share in respect of which a call shall have been made or the instalment shall be due shall pay interest on the same at such rate of interest as may be determined by the Directors from time to time from the day appointed for the payment thereof to the time of actual payment but the Directors may waive payment of such interest wholly or in part. |

Judgement, Decree or partial payment not to preclude forfeiture | | 27. | | Neither a judgment nor a decree in favour of the Company for calls or other moneys due in respect of any shares nor any part payment or satisfaction thereunder nor the receipt by the Company of a portion of any money which shall from time to time be due from any member in respect of any shares either by way of principal or interest nor any indulgence granted by the Company in respect of the payment of any money shall preclude the forfeiture of such shares as herein provided. |

| Proof on trial of suit for money due on shares | | 28. | | Subject to the provisions of the Act and these Articles, on the trial or hearing of any action or suit brought by the Company against any member or his legal representative for the recovery of any money claimed to be due to the Company in respect of any shares it shall be sufficient to prove that the name of the member in respect of whose shares the money is sought to be recovered appears entered on the Register of Members as the holder of the shares in respect of which such money is sought to be recovered; that the resolution making the call is duly recorded in the minute book; and that notice of such call was duly given in pursuance of these presents; and it shall not be necessary to prove the appointment of the Directors who made such call nor any other matter whatsoever but the proof of the matters aforesaid shall be conclusive evidence of the debt. |

| Payment in Anticipation of calls may carry Interest | | 29. | | The Directors may, if they think fit, receive from any member willing to advance the same, all or any part of the moneys due upon the shares held by him beyond the sums actually called for; and upon the moneys so paid in advance or so much thereof as from time to time exceeds the amount of the calls then made upon the shares in respect of which such advance has been made the Company may pay interest at such rate as the member paying such sum in advance and the Directors agree upon and the Company may at any time repay the amount so advanced upon giving to such member three months’ notice in writing. |

| | | | | FORFEITURE, SURRENDER AND LIEN |

| If call or Instalment not paid notice must be given | | 30. | | If any member fails to pay the whole or any part of any call or instalment or any money due in respect of any shares either by way of principal or interest on or before the day appointed for the payment of the same the Directors may at any time thereafter during such time as the call or instalment or any part thereof or other moneys remain unpaid or a judgment or decree in respect thereof remains unsatisfied in whole or in part serve a notice on such member or on the person (if any) entitled to the share by transmission requiring him to pay such call or instalment or such part thereof or other moneys as remain unpaid together with any interest that may have accrued and all expenses (legal or otherwise) that may have been incurred by the Company by reason of such non-payment. |

10

| | | | | | |

| Terms of notice | | 31. | | The notice shall name a day (not being less than 14 days from the date of the notice) on or before

which such call instalment or such part or other moneys as aforesaid and such interest and expenses

as aforesaid are to be paid and if payable to any person other than the Company the person to whom

such payment is to be made. The notice shall also state that in the event of non-payment at or before

the time and (if payable to any person other than the Company) to the person appointed the shares

in respect of which the call was made or instalment is payable will be liable to be forfeited. |

| | |

In default of payment, shares to be forfeited | | 32. | | If the requirement of any such notice as aforesaid shall not be complied with, any of the shares in

respect of which such notice has been given, may at any time thereafter before payment of all calls

or instalments, interest and expenses or other moneys or dues in respect thereof, be forfeited by a

resolution of the Directors to that effect. Such forfeiture shall include all dividends declared in

respect of the forfeited shares and not actually paid before the forfeiture. |

| | |

Entry of forfeiture in Register of Members | | 33. | | When any share shall have been so forfeited, an entry of the forfeiture with the date thereof shall be

made in the Register of Members. |

| | |

Forfeited shares to be property of the Company and may be sold etc. | | 34. | | Any share so forfeited shall be deemed to be the property of the Company and may be sold, re-

allotted or otherwise disposed of either to the original holder thereof, or to any other person, upon

such terms and in such manner as the Directors shall think fit. |

| | |

Power to annul Forfeiture | | 35. | | The Directors may at any time before any share so forfeited shall have been sold, re-allotted or

otherwise disposed of annul the forfeiture thereof upon such conditions as they think fit. |

| | |

| Shareholder still liable to pay money owing at time of forfeiture and interest | | 36. | | Any member whose shares have been forfeited shall notwithstanding the forfeiture, be liable to pay

and shall forthwith pay to the Company all calls instalments interest expenses and other moneys

owing upon or in respect of such shares at the time of the forfeiture together with interest thereon

from the time of the forfeiture until payment at such rate of interest as may be determined by the

Directors from time to time and the Directors may enforce the payment of the whole or a portion

thereof as if it were a new call made at the date of the forfeiture but shall not be under any

obligation to do so. |

| | |

| Surrender of shares | | 37. | | The Directors may subject to the provisions of the Act, accept a surrender of any share from or by

any member desirous of surrendering on such terms as they think fit. |

| | |

| Company’s lien on shares | | 38. | | The Company shall have no lien on its fully paid shares. In the case of partly paid-up shares the

Company shall have a first and paramount lien only for all moneys called or payable at a fixed time

in respect of such shares. Any such lien shall extend to all dividends from time to time declared in

respect of such shares. Unless otherwise agreed the registration of a transfer of shares shall operate

as a waiver of the Company’s lien, if any, on such shares. The Directors may at any time declare

any shares to be wholly or in part exempt from the provisions of this Article. |

| | |

| As to enforcing lien by sale | | 39. | | For the purpose of enforcing such lien the Directors may sell the shares subject thereto in such

manner as they shall think fit, but no sale shall be made until such period as aforesaid shall have

arrived and until notice in writing of the intention to sell shall have been served on such member or

the person (if any) entitled by transmission to the shares and default shall have been made by him in