UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-8598

The Commerce Funds

(Exact name of Registrant as specified in charter)

|

| 1000 Walnut St., Suite 1580, Kansas City, MO 64106 |

| (Address of principal executive offices) (Zip code) |

David W. Grim

Stradley Ronon Stevens & Young, LLP

2000 K Street, N.W., Suite 700

Washington, DC 20006-1871

(Name and address of agent for service)

Registrant’s telephone number, including area code:1-800-995-6365

Date of fiscal year end: 10/31

Date of reporting period: 04/30/24

| ITEM 1. | | REPORTS TO SHAREHOLDERS. |

|

These securities have not been approved or disapproved by the Securities and Exchange Commission, nor has the Securities and Exchange Commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. |

LIFE’S DIRECTION

At The Commerce Funds, we’re committed to providing sound investment choices to help you realize your most important financial goals, no matter where life takes you.

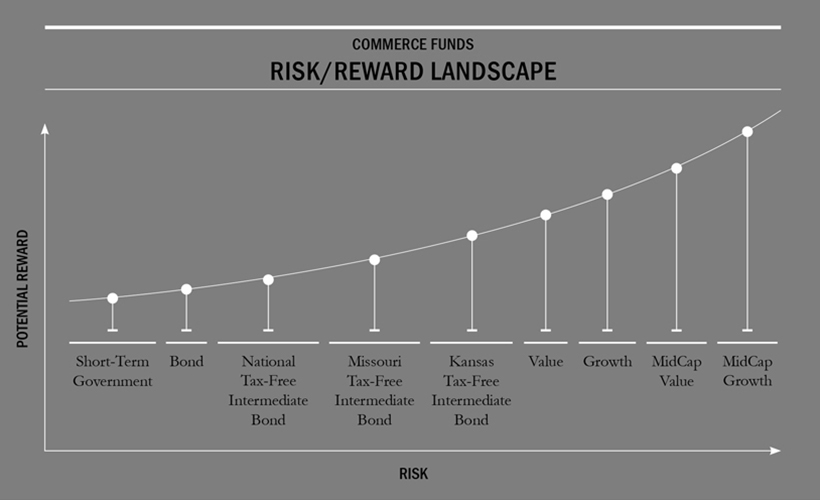

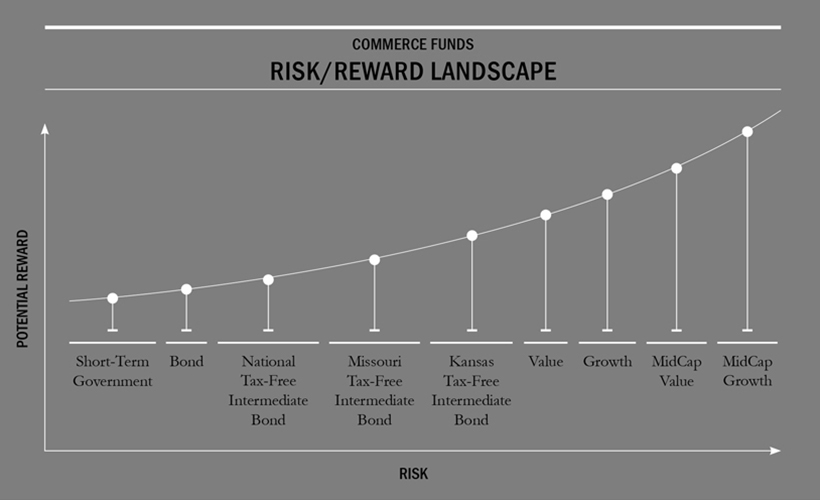

We offer a full range of mutual funds managed by Commerce Investment Advisors, Inc., a subsidiary of Commerce Bank. With a choice of 9 portfolios—each targeting a specific investment goal—we make it easy for you to invest with confidence not just today, but throughout all stages of your life.

Behind each of our Funds is a carefully defined investment philosophy and a commitment to high investment standards. This means, whether you are building a nest egg for retirement, planning for your child’s education, or saving for a special need, you can find investment options at The Commerce Funds.

In general, greater returns are associated with greater risks and increased risks create the potential for greater losses.

The reports concerning The Commerce Funds portfolios (each a “Fund” and together, the “Funds”) included in this shareholder report may contain certain forward-looking statements about the factors that may affect the performance of the Funds in the future. These statements are based on Fund management’s predictions and expectations concerning certain future events and their expected impact on the Funds, such as performance of the economy as a whole and of specific industry sectors, changes in the levels of interest rates, the impact of developing world events, and other factors that may influence the future performance of the Funds. Commerce Investment Advisors, Inc. (the “Adviser” or “Commerce”) believes these forward-looking statements to be reasonable, although they are inherently uncertain and difficult to predict. Actual events may cause adjustments in portfolio management strategies from those currently expected to be employed.

References to a specific company’s securities should not be construed as a recommendation or investment advice and there can be no assurance that as of the date of publication of this report, the securities mentioned in each Fund’s portfolio are still held or that the securities sold have not been repurchased.

THE COMMERCE FUNDS

Table of Contents

Please note:

The information in this semi-annual report is as of April 30, 2024 and is unaudited. The securities mentioned in this report may no longer be held by the Funds. To view more recent information about each Fund’s performance and portfolio or to obtain a prospectus, please visit our website at www.commercefunds.com. This report is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus, which contains more complete information about the Funds’ investment policies, management and expenses. Investors should read the prospectus carefully before investing.

You may also receive information about the Funds by calling toll free 1-800-995-6365 or by writing to P.O. Box 219525, Kansas City, Missouri, 64121-9525, or you may contact your investment professional. The Commerce Funds publish performance and portfolio information for each Fund at the end of every calendar quarter. Investors should read the prospectus carefully before investing or sending money.

Tailored Shareholder Reports: On October 26, 2022, the SEC adopted rule and form amendments (the “Amendments”) that require mutual funds registered on Form N-1A to provide shareholders with streamlined annual and semi-annual shareholder reports (“Tailored Shareholder Reports”). Tailored Shareholder Reports are meant to be three to four pages in length and will highlight key information such as a fund’s expenses, performance and portfolio holdings. Other, more detailed information that currently appears in fund shareholder reports will be made available online, filed with the SEC, and delivered to investors free of charge in paper or electronically upon request. The first Tailored Shareholder Reports to be prepared for these Funds will be for the reporting period ended October 31, 2024.

THE COMMERCE FUNDS

Performance Summaries

April 30, 2024 (Unaudited)

The following is performance information for the Funds. The returns represent past performance. Past performance is no guarantee of future results. The Funds’ investment returns will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The Funds are not subject to a sales charge, so a sales charge is not applied to their total returns. In addition to the Adviser’s decisions regarding issuer/industry investment selection and allocation, other factors may affect Fund performance. These factors include, but are not limited to, Fund operating fees and expenses, portfolio turnover, and subscription and redemption cash flows affecting the Funds. Please visit our website at www.commercefunds.com to obtain the most recent month-end returns.

| | | | | | | | | | |

Performance Review | | | | | | | | | | |

| | | |

| November 1, 2023 - April 30, 2024 | | Fund Total Return(a) | | | Index Total Return | | | Index |

| | | |

Equity Funds: | | | | | | | | | | |

| | | |

Growth | | | 21.66 | % | | | 23.56 | % | | Russell 1000® Growth(b) |

| | | |

Value | | | 15.54 | | | | 18.42 | | | Russell 1000® Value(c) |

| | | |

MidCap Growth | | | 16.50 | | | | 24.49 | | | Russell Midcap® Growth(d) |

| | | |

MidCap Value(e) | | | 15.01 | | | | 16.76 | | | Russell Midcap® Value(f) |

| | | |

Fixed Income Funds: | | | | | | | | | | |

| | | |

Bond | | | 5.49 | | | | 4.97 | | | Bloomberg U.S. Aggregate Bond(g) |

| | | |

Short-Term Government | | | 3.37 | | | | 2.18 | | | Bloomberg U.S. 1-5 Year Government Bond(h) |

| | | |

National Tax-Free Intermediate Bond | | | 7.05 | | | | 5.75 | | | Bloomberg 3-15 Year Blend Municipal Bond(i) |

| | | |

Missouri Tax-Free Intermediate Bond | | | 7.23 | | | | 5.75 | | | Bloomberg 3-15 Year Blend Municipal Bond(i) |

| | | |

Kansas Tax-Free Intermediate Bond | | | 6.65 | | | | 5.75 | | | Bloomberg 3-15 Year Blend Municipal Bond(i) |

| (a) | | Returns reflect any applicable fee waivers or expense reductions. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | | The Russell 1000® Growth Index, an unmanaged index, measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Index figures do not reflect any deduction for fees, taxes or expenses. |

| (c) | | The Russell 1000® Value Index, an unmanaged index, measures the performance of the large-cap value segment of the U.S. equity universe. It includes Russell 1000 companies with lower price-to-book ratios and lower expected growth values. The Index figures do not reflect any deduction for fees, taxes or expenses. |

| (d) | | The Russell Midcap® Growth Index, an unmanaged index, measures the performance of the mid-cap growth segment of the U.S. equity universe. It includes those Russell Midcap Index companies with higher price-to-book ratios and higher forecasted growth values. The Index figures do not reflect any deduction for fees, taxes or expenses. |

| (e) | | Commenced operations on November 13, 2023 |

| (f) | | The Russell Midcap Value Index, an unmanaged index, measures the performance of the midcap value segment of the US equity universe. It includes those Russell Midcap Index companies with relatively lower price-to-book ratios, lower I/B/E/S forecast medium term (2 year) growth and lower sales per share historical growth (5 years). |

| (g) | | The Bloomberg U.S. Aggregate Bond Index is an unmanaged index that measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities, and commercial mortgage backed securities. The Index figures do not reflect any deduction for fees, taxes or expenses. |

| (h) | | The Bloomberg U.S. 1-5 Year Government Bond Index measures the performance of U.S. dollar-denominated U.S. Treasury bonds, government related bonds (i.e., U.S. and non-U.S. agencies, sovereign, quasi-sovereign, supranational and local authority debt) and investment grade U.S. corporate bonds that have a remaining maturity of greater than or equal to one year and less than five years. The Index figures do not reflect any deduction for fees, taxes or expenses. |

| (i) | | The Bloomberg 3-15 Year Blend Municipal Bond Index is an unmanaged index comprised of investment-grade municipal securities ranging from 2 to 17 years in maturity. The Index figures do not reflect any deduction for fees, taxes or expenses. |

2

THE GROWTH FUND

Schedule of Investments

April 30, 2024 (Unaudited)

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| |

| | Common Stocks – 96.0% | | | | |

| | Automobiles* – 1.6% | |

| | 18,940 | | | Tesla, Inc. | | | $ 3,471,323 | |

| | |

| | Beverages – 1.0% | |

| | 12,165 | | | PepsiCo., Inc. | | | 2,139,945 | |

| | |

| | Biotechnology – 0.9% | |

| | 11,730 | | | AbbVie, Inc. | | | 1,907,767 | |

| | |

| | Broadline Retail – 6.3% | |

| | 67,300 | | | Amazon.com, Inc.* | | | 11,777,500 | |

| | 36,550 | | | eBay, Inc. | | | 1,883,787 | |

| | | | | | | | |

| | | | | | | 13,661,287 | |

| | |

| | Capital Markets – 1.7% | |

| | 3,780 | | | MSCI, Inc. | | | 1,760,686 | |

| | 17,860 | | | Tradeweb Markets, Inc. Class A | | | 1,816,541 | |

| | | | | | | | |

| | | | | | | 3,577,227 | |

| | |

| | Chemicals – 1.6% | |

| | 15,830 | | | RPM International, Inc. | | | 1,692,385 | |

| | 6,105 | | | Sherwin-Williams Co. | | | 1,829,119 | |

| | | | | | | | |

| | | | | | | 3,521,504 | |

| | |

| | Commercial Services & Supplies – 2.7% | |

| | 36,465 | | | Copart, Inc.* | | | 1,980,414 | |

| | 40,380 | | | Rollins, Inc. | | | 1,799,333 | |

| | 9,880 | | | Waste Management, Inc. | | | 2,055,238 | |

| | | | | | | | |

| | | | | | | 5,834,985 | |

| | |

| | Communications Equipment – 0.9% | |

| | 6,000 | | | Motorola Solutions, Inc. | | | 2,034,900 | |

| | |

| | Consumer Staples Distribution & Retail – 1.7% | |

| | 2,850 | | | Costco Wholesale Corp. | | | 2,060,265 | |

| | 24,765 | | | Performance Food Group Co.* | | | 1,681,048 | |

| | | | | | | | |

| | | | | | | 3,741,313 | |

| | |

| | Electrical Equipment – 0.8% | |

| | 6,560 | | | Rockwell Automation, Inc. | | | 1,777,498 | |

| | |

| | Electronic Equipment, Instruments & Components – 2.6% | |

| | 18,295 | | | Amphenol Corp. Class A | | | 2,209,487 | |

| | 7,350 | | | CDW Corp. | | | 1,777,671 | |

| | 41,990 | | | Vontier Corp. | | | 1,706,054 | |

| | | | | | | | |

| | | | | | | 5,693,212 | |

| | |

| | Financial Services – 4.6% | |

| | 6,715 | | | Corpay, Inc.* | | | 2,028,870 | |

| | 13,395 | | | Fiserv, Inc.* | | | 2,045,015 | |

| | 5,925 | | | Mastercard, Inc. Class A | | | 2,673,360 | |

| | 11,585 | | | Visa, Inc. Class A | | | 3,111,847 | |

| | | | | | | | |

| | | | | | | 9,859,092 | |

| | |

| | Ground Transportation – 0.9% | |

| | 56,050 | | | CSX Corp. | | | 1,861,981 | |

| | |

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| |

| Common Stocks – (continued) | | | | |

| | Health Care Equipment & Supplies – 1.8% | |

| | 18,930 | | | Abbott Laboratories | | | $ 2,006,012 | |

| | 5,935 | | | Stryker Corp. | | | 1,997,128 | |

| | | | | | | | |

| | | | | | | 4,003,140 | |

| | |

| | Health Care Providers & Services – 2.2% | |

| | 3,930 | | | McKesson Corp. | | | 2,111,235 | |

| | 5,675 | | | UnitedHealth Group, Inc. | | | 2,744,998 | |

| | | | | | | | |

| | | | | | | 4,856,233 | |

| | |

| | Hotels, Restaurants & Leisure – 3.6% | |

| | 9,905 | | | Hilton Worldwide Holdings, Inc. | | | 1,954,058 | |

| | 7,410 | | | McDonald’s Corp. | | | 2,023,226 | |

| | 23,075 | | | Starbucks Corp. | | | 2,041,907 | |

| | 39,675 | | | Travel & Leisure Co. | | | 1,727,450 | |

| | | | | | | | |

| | | | | | | 7,746,641 | |

| | |

| | Household Products – 0.9% | |

| | 17,965 | | | Church & Dwight Co., Inc. | | | 1,938,244 | |

| | |

| | Industrial Conglomerates – 0.9% | |

| | 10,425 | | | Honeywell International, Inc. | | | 2,009,210 | |

| | |

| | Insurance* – 0.9% | |

| | 20,720 | | | Arch Capital Group Ltd. | | | 1,938,149 | |

| | |

| | Interactive Media & Services – 9.0% | |

| | 78,740 | | | Alphabet, Inc. Class A* | | | 12,817,297 | |

| | 15,265 | | | Meta Platforms, Inc. Class A | | | 6,566,545 | |

| | | | | | | | |

| | | | | | | 19,383,842 | |

| | |

| | IT Services* – 0.9% | |

| | 15,450 | | | GoDaddy, Inc. Class A | | | 1,890,771 | |

| | |

| | Life Sciences Tools & Services – 0.9% | |

| | 3,595 | | | Thermo Fisher Scientific, Inc. | | | 2,044,548 | |

| | |

| | Machinery – 1.6% | |

| | 7,790 | | | Illinois Tool Works, Inc. | | | 1,901,617 | |

| | 7,280 | | | Lincoln Electric Holdings, Inc. | | | 1,598,178 | |

| | | | | | | | |

| | | | | | | 3,499,795 | |

| | |

| | Oil, Gas & Consumable Fuels – 1.7% | |

| | 11,760 | | | Cheniere Energy, Inc. | | | 1,855,963 | |

| | 16,945 | | | Targa Resources Corp. | | | 1,932,747 | |

| | | | | | | | |

| | | | | | | 3,788,710 | |

| | |

| | Pharmaceuticals – 3.9% | |

| | 5,960 | | | Eli Lilly & Co. | | | 4,655,356 | |

| | 15,425 | | | Jazz Pharmaceuticals PLC* | | | 1,708,319 | |

| | 12,390 | | | Zoetis, Inc. | | | 1,972,983 | |

| | | | | | | | |

| | | | | | | 8,336,658 | |

| | |

| | Residential REITs – 0.8% | |

| | 29,060 | | | Equity Lifestyle Properties, Inc. | | | 1,752,027 | |

| | |

| | Semiconductors & Semiconductor Equipment – 9.4% | |

| | 2,850 | | | Broadcom, Inc. | | | 3,705,770 | |

| | 19,210 | | | NVIDIA Corp. | | | 16,597,824 | |

| | | | | | | | |

| | | | | | | 20,303,594 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 3 |

THE GROWTH FUND

Schedule of Investments (continued)

April 30, 2024 (Unaudited)

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| |

| Common Stocks – (continued) | | | | |

| | Software – 17.4% | |

| | 36,235 | | | Bentley Systems, Inc. Class B | | | $ 1,903,424 | |

| | 6,485 | | | Cadence Design Systems, Inc.* | | | 1,787,461 | |

| | 1,475 | | | Fair Isaac Corp.* | | | 1,671,662 | |

| | 85,045 | | | Gen Digital, Inc. | | | 1,712,806 | |

| | 3,255 | | | Intuit, Inc. | | | 2,036,393 | |

| | 58,430 | | | Microsoft Corp. | | | 22,748,552 | |

| | 7,300 | | | Palo Alto Networks, Inc.* | | | 2,123,497 | |

| | 9,870 | | | PTC, Inc.* | | | 1,751,333 | |

| | 6,795 | | | Salesforce, Inc. | | | 1,827,447 | |

| | | | | | | | |

| | | | | | | 37,562,575 | |

| | |

| | Specialty Retail – 1.7% | |

| | 5,360 | | | Home Depot, Inc. | | | 1,791,419 | |

| | 7,140 | | | Tractor Supply Co. | | | 1,949,791 | |

| | | | | | | | |

| | | | | | | 3,741,210 | |

| | |

| | Technology Hardware, Storage & Peripherals – 10.2% | |

| | 118,210 | | | Apple, Inc. | | | 20,134,709 | |

| | 17,940 | | | NetApp, Inc. | | | 1,833,648 | |

| | | | | | | | |

| | | | | | | 21,968,357 | |

| | |

| | Textiles, Apparel & Luxury Goods* – 0.9% | |

| | 5,190 | | | Lululemon Athletica, Inc. | | | 1,871,514 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $110,806,652) | | | $207,717,252 | |

| | |

| | | | | | | | |

| |

| | Exchange Traded Fund – 2.5% | | | | |

| | 16,745 | | | iShares Russell 1000 Growth ETF | | | $ 5,405,956 | |

| | (Cost $5,085,459) | |

| | |

| Shares | | | Dividend Rate | | Value | |

| |

| | Investment Company – 1.4% | | | | |

|

| State Street Institutional US Government Money Market Fund –

Premier Class |

|

| | 2,964,407 | | | 5.250% | | | $ 2,964,407 | |

| | (Cost $2,964,407) | |

| | |

| | TOTAL INVESTMENTS – 99.9% | |

| | (Cost $118,856,518) | | | $216,087,615 | |

| | |

| OTHER ASSETS IN EXCESS OF

LIABILITIES – 0.1% | | | 142,706 | |

| | |

| | NET ASSETS – 100.0% | | | $216,230,321 | |

| | |

| | |

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

| * | | Non-income producing security. |

| | |

| Investment Abbreviation: |

| REIT | | —RealEstate Investment Trust |

|

PORTFOLIO COMPOSITION

| | | | | | | | |

| | | AS OF

4/30/24 | | | AS OF

10/31/23 | |

| |

Information Technology | | | 41.4 | % | | | 41.4 | % |

Consumer Discretionary | | | 14.1 | | | | 14.9 | |

Health Care | | | 9.7 | | | | 9.9 | |

Communication Services | | | 9.0 | | | | 8.8 | |

Financials | | | 7.1 | | | | 7.2 | |

Industrials | | | 6.9 | | | | 7.4 | |

Consumer Staples | | | 3.6 | | | | 3.5 | |

Exchange Traded Fund | | | 2.5 | | | | 1.6 | |

Energy | | | 1.8 | | | | 1.0 | |

Materials | | | 1.6 | | | | 1.7 | |

Investment Company | | | 1.4 | | | | 1.0 | |

Real Estate | | | 0.8 | | | | 1.7 | |

| |

| TOTAL INVESTMENTS | | | 99.9 | % | | | 100.1 | % |

| |

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Underlying investment categories of investment companies held by the Fund are not reflected in the table above. Consequently, the Fund’s overall investment category allocations may differ from the percentages contained in the table above.

The Fund is actively managed and, as such, its composition may differ over time.

| | |

| 4 | | The accompanying notes are an integral part of these financial statements. |

THE VALUE FUND

Schedule of Investments

April 30, 2024 (Unaudited)

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| |

| | Common Stocks – 93.7% | | | | |

| | Aerospace & Defense – 4.0% | | | | |

| | 18,750 | | | General Dynamics Corp. | | | $ 5,382,938 | |

| | 54,500 | | | RTX Corp. | | | 5,532,840 | |

| | | | | | | | |

| | | | | | | 10,915,778 | |

| | |

| | Air Freight & Logistics – 1.8% | |

| | 33,500 | | | United Parcel Service, Inc. Class B | | | 4,940,580 | |

| | |

| | Banks – 9.2% | | | | |

| | 142,000 | | | Bank of America Corp. | | | 5,255,420 | |

| | 40,500 | | | JPMorgan Chase & Co. | | | 7,765,470 | |

| | 217,500 | | | KeyCorp | | | 3,151,575 | |

| | 25,000 | | | PNC Financial Services Group, Inc. | | | 3,831,500 | |

| | 120,500 | | | U.S. Bancorp | | | 4,895,915 | |

| | | | | | | | |

| | | | | | | 24,899,880 | |

| | |

| | Beverages – 2.0% | |

| | 30,500 | | | PepsiCo., Inc. | | | 5,365,255 | |

| | |

| | Biotechnology – 3.6% | |

| | 29,000 | | | AbbVie, Inc. | | | 4,716,560 | |

| | 18,500 | | | Amgen, Inc. | | | 5,067,890 | |

| | | | | | | | |

| | | | | | | 9,784,450 | |

| | |

| | Building Products – 1.1% | |

| | 37,500 | | | A.O. Smith Corp. | | | 3,106,500 | |

| | |

| | Capital Markets – 7.8% | |

| | 6,250 | | | BlackRock, Inc. | | | 4,716,500 | |

| | 24,000 | | | CME Group, Inc. | | | 5,031,360 | |

| | 57,500 | | | Morgan Stanley | | | 5,223,300 | |

| | 38,500 | | | Northern Trust Corp. | | | 3,172,015 | |

| | 28,000 | | | T. Rowe Price Group, Inc. | | | 3,067,960 | |

| | | | | | | | |

| | | | | | | 21,211,135 | |

| | |

| | Chemicals – 2.6% | |

| | 16,500 | | | Air Products & Chemicals, Inc. | | | 3,899,610 | |

| | 129,500 | | | Huntsman Corp. | | | 3,089,870 | |

| | | | | | | | |

| | | | | | | 6,989,480 | |

| | |

| | Communications Equipment – 1.8% | |

| | 105,500 | | | Cisco Systems, Inc. | | | 4,956,390 | |

| | |

| | Consumer Staples Distribution & Retail – 1.1% | |

| | 41,000 | | | Sysco Corp. | | | 3,047,120 | |

| | |

| | Diversified Telecommunication Services – 1.9% | |

| | 128,000 | | | Verizon Communications, Inc. | | | 5,054,720 | |

| | |

| | Electric Utilities – 3.3% | |

| | 39,500 | | | American Electric Power Co., Inc. | | | 3,398,185 | |

| | 55,000 | | | Duke Energy Corp. | | | 5,404,300 | |

| | | | | | | | |

| | | | | | | 8,802,485 | |

| | |

| | Electrical Equipment – 3.8% | |

| | 16,750 | | | Eaton Corp. PLC | | | 5,330,855 | |

| | 47,000 | | | Emerson Electric Co. | | | 5,065,660 | |

| | | | | | | | |

| | | | | | | 10,396,515 | |

| | |

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| |

| Common Stocks – (continued) | | | | |

| | Financial Services – 1.8% | |

| | 46,000 | | | Apollo Global Management, Inc. | | | $ 4,985,480 | |

| | |

| | Food Products – 2.0% | |

| | 74,000 | | | Mondelez International, Inc. Class A | | | 5,323,560 | |

| | |

| | Health Care Equipment & Supplies – 1.9% | |

| | 63,000 | | | Medtronic PLC | | | 5,055,120 | |

| | |

| | Health Care Providers & Services – 3.2% | |

| | 10,250 | | | Elevance Health, Inc. | | | 5,417,945 | |

| | 15,500 | | | Laboratory Corp. of America Holdings | | | 3,121,235 | |

| | | | | | | | |

| | | | | | | 8,539,180 | |

| | |

| | Hotels, Restaurants & Leisure – 3.1% | |

| | 20,500 | | | Darden Restaurants, Inc. | | | 3,144,905 | |

| | 18,750 | | | McDonald’s Corp. | | | 5,119,500 | |

| | | | | | | | |

| | | | | | | 8,264,405 | |

| | |

| | Household Products – 2.0% | |

| | 32,750 | | | Procter & Gamble Co. | | | 5,344,800 | |

| | |

| | Industrial REITs – 1.6% | |

| | 41,500 | | | Prologis, Inc. | | | 4,235,075 | |

| | |

| | Insurance – 1.2% | |

| | 45,000 | | | MetLife, Inc. | | | 3,198,600 | |

| | |

| | IT Services – 1.7% | |

| | 28,000 | | | International Business Machines Corp. | | | 4,653,600 | |

| | |

| | Machinery – 2.9% | |

| | 19,500 | | | Illinois Tool Works, Inc. | | | 4,760,145 | |

| | 35,000 | | | Stanley Black & Decker, Inc. | | | 3,199,000 | |

| | | | | | | | |

| | | | | | | 7,959,145 | |

| | |

| | Media – 2.9% | |

| | 122,500 | | | Comcast Corp. Class A | | | 4,668,475 | |

| | 19,750 | | | Nexstar Media Group, Inc. | | | 3,161,185 | |

| | | | | | | | |

| | | | | | | 7,829,660 | |

| | |

| | Multi-Utilities – 1.3% | |

| | 68,000 | | | Dominion Energy, Inc. | | | 3,466,640 | |

| | |

| | Oil, Gas & Consumable Fuels – 7.9% | |

| | 58,500 | | | Chevron Corp. | | | 9,434,295 | |

| | 41,000 | | | EOG Resources, Inc. | | | 5,417,330 | |

| | 42,000 | | | ONEOK, Inc. | | | 3,323,040 | |

| | 19,500 | | | Valero Energy Corp. | | | 3,117,465 | |

| | | | | | | | |

| | | | | | | 21,292,130 | |

| | |

| | Pharmaceuticals – 4.3% | |

| | 33,500 | | | Johnson & Johnson | | | 4,843,765 | |

| | 52,000 | | | Merck & Co., Inc. | | | 6,719,440 | |

| | | | | | | | |

| | | | | | | 11,563,205 | |

| | |

| | Semiconductors & Semiconductor Equipment – 6.3% | |

| | 3,850 | | | Broadcom, Inc. | | | 5,006,039 | |

| | 37,500 | | | Microchip Technology, Inc. | | | 3,449,250 | |

| | 31,500 | | | Skyworks Solutions, Inc. | | | 3,357,585 | |

| | 30,500 | | | Texas Instruments, Inc. | | | 5,380,810 | |

| | | | | | | | |

| | | | | | | 17,193,684 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 5 |

THE VALUE FUND

Schedule of Investments (continued)

April 30, 2024 (Unaudited)

| | | | | | | | |

| Shares | | | Description | | Value | |

|

| | Common Stocks – (continued) | |

| | Software – 1.7% | |

| | 41,500 | | | Oracle Corp. | | | $ 4,720,625 | |

| | |

| | Specialized REITs – 1.1% | |

| | 12,000 | | | Public Storage | | | 3,113,400 | |

| | |

| | Specialty Retail – 2.8% | |

| | 41,000 | | | Best Buy Co., Inc. | | | 3,019,240 | |

| | 13,750 | | | Home Depot, Inc. | | | 4,595,525 | |

| | | | | | | | |

| | | | | | | 7,614,765 | |

| | |

| | TOTAL COMMON STOCKS | | | | |

| | (Cost $212,756,721) | | | $253,823,362 | |

| | |

| | | | | | | | |

| |

| | Exchange Traded Fund – 4.1% | | | | |

| | 65,000 | | | iShares Russell 1000 Value ETF | | | $ 11,147,500 | |

| | (Cost $10,500,697) | | | | |

| | |

| | | | | | | | |

| Shares | | | Dividend Rate | | Value | |

|

| | Investment Company – 2.3% | |

|

| State Street Institutional US Government Money Market Fund –

Premier Class |

|

| | 6,130,595 | | | 5.250% | | | $ 6,130,595 | |

| | (Cost $6,130,595) | | | | |

| | |

| | TOTAL INVESTMENTS – 100.1% | |

| | (Cost $229,388,013) | | | $271,101,457 | |

| | |

| LIABILITIES IN EXCESS OF

OTHER ASSETS – (0.1)% | | | (346,899) | |

| | |

| | NET ASSETS – 100.0% | | | $270,754,558 | |

| | |

| | |

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| | |

|

| Investment Abbreviation: |

| REIT—Real Estate Investment Trust |

|

PORTFOLIO COMPOSITION

| | | | | | | | |

| | | AS OF

4/30/24 | | | AS OF

10/31/23 | |

| |

Financials | | | 20.0 | % | | | 18.8 | % |

Industrials | | | 13.7 | | | | 14.8 | |

Health Care | | | 13.0 | | | | 14.8 | |

Information Technology | | | 11.5 | | | | 9.9 | |

Energy | | | 7.9 | | | | 8.4 | |

Consumer Staples | | | 7.1 | | | | 7.1 | |

Consumer Discretionary | | | 5.9 | | | | 6.2 | |

Communication Services | | | 4.8 | | | | 4.5 | |

Utilities | | | 4.6 | | | | 4.4 | |

Exchange Traded Fund | | | 4.1 | | | | 3.0 | |

Real Estate | | | 2.7 | | | | 2.9 | |

Materials | | | 2.5 | | | | 4.3 | |

Investment Company | | | 2.3 | | | | 0.9 | |

| |

| TOTAL INVESTMENTS | | | 100.1 | % | | | 100.0 | % |

| |

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Underlying investment categories of investment companies held by the Fund are not reflected in the table above. Consequently, the Fund’s overall investment category allocations may differ from the percentages contained in the table above.

The Fund is actively managed and, as such, its composition may differ over time.

| | |

| 6 | | The accompanying notes are an integral part of these financial statements. |

THE MIDCAP GROWTH FUND

Schedule of Investments

April 30, 2024 (Unaudited)

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

|

| Common Stocks – 97.7% | |

| | Aerospace & Defense – 1.3% | |

| | 39,735 | | | Howmet Aerospace, Inc. | | | $ 2,652,311 | |

| | |

| | Biotechnology* – 3.7% | |

| | 31,655 | | | BioMarin Pharmaceutical, Inc. | | | 2,556,458 | |

| | 113,175 | | | Exelixis, Inc. | | | 2,655,085 | |

| | 62,725 | | | Ionis Pharmaceuticals, Inc. | | | 2,588,034 | |

| | | | | | | | |

| | | | | | | 7,799,577 | |

| | |

| | Broadline Retail – 1.3% | |

| | 51,635 | | | eBay, Inc. | | | 2,661,268 | |

| | |

| | Capital Markets – 6.0% | |

| | 149,580 | | | Blue Owl Capital, Inc. | | | 2,825,566 | |

| | 5,500 | | | FactSet Research Systems, Inc. | | | 2,292,895 | |

| | 9,015 | | | Morningstar, Inc. | | | 2,548,090 | |

| | 4,795 | | | MSCI, Inc. | | | 2,233,463 | |

| | 25,740 | | | Tradeweb Markets, Inc. Class A | | | 2,618,015 | |

| | | | | | | | |

| | | | | | | 12,518,029 | |

| | |

| | Chemicals – 1.2% | |

| | 22,785 | | | RPM International, Inc. | | | 2,435,944 | |

| | |

| | Commercial Services & Supplies – 3.9% | |

| | 14,670 | | | MSA Safety, Inc. | | | 2,646,468 | |

| | 57,300 | | | Rollins, Inc. | | | 2,553,288 | |

| | 14,815 | | | Tetra Tech, Inc. | | | 2,884,777 | |

| | | | | | | | |

| | | | | | | 8,084,533 | |

| | |

| | Consumer Staples Distribution & Retail – 1.3% | |

| | 8,510 | | | Casey’s General Stores, Inc. | | | 2,719,626 | |

| | |

| | Electrical Equipment – 1.2% | |

| | 9,520 | | | Rockwell Automation, Inc. | | | 2,579,539 | |

| | |

| | Electronic Equipment, Instruments & Components – 5.1% | |

| | 23,935 | | | Amphenol Corp. Class A | | | 2,890,630 | |

| | 10,695 | | | CDW Corp. | | | 2,586,693 | |

| | 17,805 | | | Keysight Technologies, Inc.* | | | 2,634,072 | |

| | 60,275 | | | Vontier Corp. | | | 2,448,973 | |

| | | | | | | | |

| | | | | | | 10,560,368 | |

| | |

| | Entertainment* – 1.2% | |

| | 18,075 | | | Take-Two Interactive Software, Inc. | | | 2,581,291 | |

| | |

| | Financial Services – 1.2% | |

| | 23,820 | | | Apollo Global Management, Inc. | | | 2,581,612 | |

| | |

| | Food Products – 1.0% | |

| | 26,005 | | | Lamb Weston Holdings, Inc. | | | 2,167,257 | |

| | |

| | Ground Transportation – 2.3% | |

| | 13,755 | | | JB Hunt Transport Services, Inc. | | | 2,236,150 | |

| | 14,515 | | | Landstar System, Inc. | | | 2,531,561 | |

| | | | | | | | |

| | | | | | | 4,767,711 | |

| | |

| | Health Care Equipment & Supplies* – 1.2% | |

| | 5,065 | | | IDEXX Laboratories, Inc. | | | 2,495,829 | |

| | |

| | Health Care Providers & Services – 3.5% | |

| | 11,090 | | | Cencora, Inc. | | | 2,651,064 | |

| | 4,180 | | | Chemed Corp. | | | 2,374,240 | |

| | 6,445 | | | Molina Healthcare, Inc.* | | | 2,204,835 | |

| | | | | | | | |

| | | | | | | 7,230,139 | |

| | |

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

|

| Common Stocks – (continued) | |

| | Hotels, Restaurants & Leisure – 5.2% | |

| | 5,940 | | | Domino’s Pizza, Inc. | | | $ 3,143,864 | |

| | 12,745 | | | Hilton Worldwide Holdings, Inc. | | | 2,514,333 | |

| | 57,070 | | | Travel & Leisure Co. | | | 2,484,828 | |

| | 19,655 | | | Yum! Brands, Inc. | | | 2,776,269 | |

| | | | | | | | |

| | | | | | | 10,919,294 | |

| | |

| | Household Products – 1.3% | |

| | 26,050 | | | Church & Dwight Co., Inc. | | | 2,810,534 | |

| | |

| | Insurance – 2.4% | |

| | 29,095 | | | Arch Capital Group Ltd.* | | | 2,721,547 | |

| | 10,655 | | | Primerica, Inc. | | | 2,257,368 | |

| | | | | | | | |

| | | | | | | 4,978,915 | |

| | |

| | IT Services* – 3.6% | |

| | 5,585 | | | Gartner, Inc. | | | 2,304,315 | |

| | 22,520 | | | GoDaddy, Inc. Class A | | | 2,755,998 | |

| | 14,130 | | | VeriSign, Inc. | | | 2,394,752 | |

| | | | | | | | |

| | | | | | | 7,455,065 | |

| | |

| | Life Sciences Tools & Services – 8.1% | |

| | 18,220 | | | Agilent Technologies, Inc. | | | 2,496,869 | |

| | 37,330 | | | Bio-Techne Corp. | | | 2,359,629 | |

| | 28,860 | | | Bruker Corp. | | | 2,251,369 | |

| | 10,615 | | | IQVIA Holdings, Inc.* | | | 2,460,239 | |

| | 2,055 | | | Mettler-Toledo International, Inc.* | | | 2,527,033 | |

| | 7,700 | | | Waters Corp.* | | | 2,379,608 | |

| | 6,805 | | | West Pharmaceutical Services, Inc. | | | 2,432,651 | |

| | | | | | | | |

| | | | | | | 16,907,398 | |

| | |

| | Machinery – 6.1% | |

| | 40,950 | | | Donaldson Co., Inc. | | | 2,956,590 | |

| | 28,785 | | | Graco, Inc. | | | 2,308,557 | |

| | 10,480 | | | Lincoln Electric Holdings, Inc. | | | 2,300,674 | |

| | 27,015 | | | Otis Worldwide Corp. | | | 2,463,768 | |

| | 30,035 | | | Toro Co. | | | 2,630,766 | |

| | | | | | | | |

| | | | | | | 12,660,355 | |

| | |

| | Media* – 1.3% | |

| | 32,145 | | | Trade Desk, Inc. Class A | | | 2,663,213 | |

| | |

| | Oil, Gas & Consumable Fuels – 5.2% | |

| | 16,485 | | | Cheniere Energy, Inc. | | | 2,601,663 | |

| | 33,995 | | | ONEOK, Inc. | | | 2,689,684 | |

| | 24,600 | | | Targa Resources Corp. | | | 2,805,876 | |

| | 4,755 | | | Texas Pacific Land Corp. | | | 2,740,307 | |

| | | | | | | | |

| | | | | | | 10,837,530 | |

| | |

| | Pharmaceuticals* – 1.1% | |

| | 21,500 | | | Jazz Pharmaceuticals PLC | | | 2,381,125 | |

| | |

| | Professional Services – 3.8% | |

| | 18,275 | | | Booz Allen Hamilton Holding Corp. | | | 2,698,669 | |

| | 13,140 | | | Broadridge Financial Solutions, Inc. | | | 2,541,408 | |

| | 21,815 | | | Paychex, Inc. | | | 2,591,840 | |

| | | | | | | | |

| | | | | | | 7,831,917 | |

| | |

| | Real Estate Management & Development* – 1.2% | |

| | 27,860 | | | CoStar Group, Inc. | | | 2,550,026 | |

| | |

| | Residential REITs – 1.2% | |

| | 40,955 | | | Equity LifeStyle Properties, Inc. | | | 2,469,177 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 7 |

THE MIDCAP GROWTH FUND

Schedule of Investments (continued)

April 30, 2024 (Unaudited)

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

|

| Common Stocks – (continued) | |

| | Semiconductors & Semiconductor Equipment – 2.7% | |

| | 25,050 | | | Teradyne, Inc. | | | $ 2,913,816 | |

| | 16,600 | | | Universal Display Corp. | | | 2,622,468 | |

| | | | | | | | |

| | | | | | | 5,536,284 | |

| | |

| | Software – 9.7% | |

| | 7,815 | | | ANSYS, Inc.* | | | 2,538,937 | |

| | 57,485 | | | Dynatrace, Inc.* | | | 2,604,645 | |

| | 2,150 | | | Fair Isaac Corp.* | | | 2,436,659 | |

| | 124,290 | | | Gen Digital, Inc. | | | 2,503,201 | |

| | 10,685 | | | Manhattan Associates, Inc.* | | | 2,201,751 | |

| | 42,750 | | | Nutanix, Inc. Class A* | | | 2,594,925 | |

| | 14,140 | | | PTC, Inc.* | | | 2,509,002 | |

| | 6,375 | | | Tyler Technologies, Inc.* | | | 2,942,381 | |

| | | | | | | | |

| | | | | | | 20,331,501 | |

| | |

| | Specialty Retail – 5.6% | |

| | 34,145 | | | Best Buy Co., Inc. | | | 2,514,438 | |

| | 12,840 | | | Five Below, Inc.* | | | 1,879,006 | |

| | 18,255 | | | Ross Stores, Inc. | | | 2,364,935 | |

| | 10,440 | | | Tractor Supply Co. | | | 2,850,955 | |

| | 5,120 | | | Ulta Beauty, Inc.* | | | 2,072,781 | |

| | | | | | | | |

| | | | | | | 11,682,115 | |

| | |

| | Technology Hardware, Storage & Peripherals – 1.3% | |

| | 25,690 | | | NetApp, Inc. | | | 2,625,775 | |

| | |

| | Textiles, Apparel & Luxury Goods* – 2.5% | |

| | 2,930 | | | Deckers Outdoor Corp. | | | 2,398,117 | |

| | 43,980 | | | Skechers USA, Inc. Class A | | | 2,904,879 | |

| | | | | | | | |

| | | | | | | 5,302,996 | |

| | |

| | TOTAL COMMON STOCKS | | | | |

| | (Cost $153,598,412) | | | $203,778,254 | |

| | |

| | | | | | | | |

|

| | Exchange Traded Fund – 1.5% | |

| | |

| | 29,150 | | | iShares Russell Mid-Cap Growth ETF | | | $ 3,131,876 | |

| | (Cost $3,127,610) | | | | |

| | |

| | | | | | | | |

| Shares | | | Dividend Rate | | Value | |

|

| | Investment Company – 0.8% | |

|

| State Street Institutional US Government Money Market Fund –

Premier Class |

|

| | 1,760,548 | | | 5.250% | | | $ 1,760,548 | |

| | (Cost $1,760,548) | | | | |

| | |

| | TOTAL INVESTMENTS – 100.0% | |

| | (Cost $158,486,570) | | | $208,670,678 | |

| | |

| LIABILITIES IN EXCESS OF

OTHER ASSETS – 0.0% | | | (37,028) | |

| | |

| | NET ASSETS – 100.0% | | | $208,633,650 | |

| | |

| | |

|

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. |

| |

| * | | Non-income producing security. |

| | |

|

| Investment Abbreviation: |

| REIT—Real Estate Investment Trust |

|

PORTFOLIO COMPOSITION

| | | | | | | | |

| | | AS OF

4/30/24 | | | AS OF

10/31/23 | |

| |

Information Technology | | | 22.3 | % | | | 20.2 | % |

Industrials | | | 18.5 | | | | 21.6 | |

Health Care | | | 17.6 | | | | 18.7 | |

Consumer Discretionary | | | 14.7 | | | | 12.1 | |

Financials | | | 9.6 | | | | 9.7 | |

Energy | | | 5.2 | | | | 3.7 | |

Consumer Staples | | | 3.7 | | | | 3.6 | |

Communication Services | | | 2.5 | | | | 1.2 | |

Real Estate | | | 2.4 | | | | 2.4 | |

Exchange Traded Fund | | | 1.5 | | | | 3.1 | |

Materials | | | 1.2 | | | | 1.2 | |

Investment Company | | | 0.8 | | | | 3.0 | |

| |

| TOTAL INVESTMENTS | | | 100.0 | % | | | 100.5 | % |

| |

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Underlying investment categories of investment companies held by the Fund are not reflected in the table above. Consequently, the Fund’s overall investment category allocations may differ from the percentages contained in the table above.

The Fund is actively managed and, as such, its composition may differ over time.

| | |

| 8 | | The accompanying notes are an integral part of these financial statements. |

THE MIDCAP VALUE FUND

Schedule of Investments

April 30, 2024 (Unaudited)

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| |

| | Common Stocks – 94.7% | | | | |

| | Aerospace & Defense – 2.4% | | | | |

| | 1,535 | | | Huntington Ingalls Industries, Inc. | | | $ 425,088 | |

| | 2,110 | | | L3Harris Technologies, Inc. | | | 451,645 | |

| | | | | | | | |

| | | | | | | 876,733 | |

| | |

| | Air Freight & Logistics – 1.1% | | | | |

| | 1,580 | | | FedEx Corp. | | | 413,612 | |

| | |

| | Automobile Components – 2.2% | | | | |

| | 12,470 | | | Gentex Corp. | | | 427,721 | |

| | 3,100 | | | Lear Corp. | | | 390,197 | |

| | | | | | | | |

| | | | | | | 817,918 | |

| | |

| | Automobiles – 1.1% | | | | |

| | 4,075 | | | Thor Industries, Inc. | | | 405,137 | |

| | |

| | Banks – 3.6% | | | | |

| | 10,175 | | | Bank OZK | | | 454,314 | |

| | 33,485 | | | Huntington Bancshares, Inc. | | | 451,043 | |

| | 29,470 | | | KeyCorp | | | 427,020 | |

| | | | | | | | |

| | | | | | | 1,332,377 | |

| | |

| | Capital Markets – 8.0% | | | | |

| | 3,470 | | | Blackstone, Inc. | | | 404,637 | |

| | 2,080 | | | CME Group, Inc. | | | 436,051 | |

| | 2,325 | | | Evercore, Inc. Class A | | | 421,987 | |

| | 27,980 | | | Invesco Ltd. | | | 396,477 | |

| | 11,080 | | | Lazard, Inc. | | | 426,580 | |

| | 5,915 | | | State Street Corp. | | | 428,778 | |

| | 3,780 | | | T. Rowe Price Group, Inc. | | | 414,175 | |

| | | | | | | | |

| | | | | | | 2,928,685 | |

| | |

| | Chemicals – 7.0% | | | | |

| | 1,880 | | | Air Products & Chemicals, Inc. | | | 444,319 | |

| | 2,665 | | | Celanese Corp. | | | 409,371 | |

| | 17,590 | | | Huntsman Corp. | | | 419,698 | |

| | 4,455 | | | LyondellBasell Industries NV Class A | | | 445,366 | |

| | 3,170 | | | PPG Industries, Inc. | | | 408,930 | |

| | 6,165 | | | Scotts Miracle-Gro Co. | | | 422,549 | |

| | | | | | | | |

| | | | | | | 2,550,233 | |

| | |

| | Consumer Staples Distribution & Retail – 2.3% | | | | |

| | 8,000 | | | Kroger Co. | | | 443,040 | |

| | 5,535 | | | Sysco Corp. | | | 411,361 | |

| | | | | | | | |

| | | | | | | 854,401 | |

| | |

| | Electric Utilities – 2.5% | | | | |

| | 9,205 | | | Alliant Energy Corp. | | | 458,409 | |

| | 6,165 | | | Pinnacle West Capital Corp. | | | 454,052 | |

| | | | | | | | |

| | | | | | | 912,461 | |

| | |

| | Electrical Equipment – 2.4% | | | | |

| | 4,005 | | | Emerson Electric Co. | | | 431,659 | |

| | 1,585 | | | Rockwell Automation, Inc. | | | 429,471 | |

| | | | | | | | |

| | | | | | | 861,130 | |

| | |

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| |

| Common Stocks – (continued) | | | | |

| | Electronic Equipment, Instruments & Components – 3.8% | |

| | 13,785 | | | Corning, Inc. | | | $ 460,143 | |

| | 1,925 | | | Littelfuse, Inc. | | | 443,982 | |

| | 4,245 | | | TD SYNNEX Corp. | | | 500,231 | |

| | | | | | | | |

| | | | | | | 1,404,356 | |

| | |

| | Gas Utilities – 1.2% | | | | |

| | 3,855 | | | Atmos Energy Corp. | | | 454,504 | |

| | |

| | Ground Transportation – 1.2% | | | | |

| | 2,440 | | | Landstar System, Inc. | | | 425,560 | |

| | |

| | Health Care Equipment & Supplies – 2.3% | | | | |

| | 1,850 | | | Becton Dickinson & Co. | | | 434,010 | |

| | 2,025 | | | STERIS PLC | | | 414,234 | |

| | | | | | | | |

| | | | | | | 848,244 | |

| | |

| | Health Care Providers & Services – 2.3% | | | | |

| | 1,365 | | | HCA Healthcare, Inc. | | | 422,905 | |

| | 2,090 | | | Laboratory Corp. of America Holdings | | | 420,863 | |

| | | | | | | | |

| | | | | | | 843,768 | |

| | |

| | Health Care REITs – 1.2% | | | | |

| | 14,445 | | | Omega Healthcare Investors, Inc. | | | 439,272 | |

| | |

| | Hotels, Restaurants & Leisure – 1.2% | | | | |

| | 2,750 | | | Darden Restaurants, Inc. | | | 421,878 | |

| | |

| | Household Durables – 1.0% | | | | |

| | 3,945 | | | Whirlpool Corp. | | | 374,223 | |

| | |

| | Household Products – 1.2% | | | | |

| | 2,970 | | | Clorox Co. | | | 439,174 | |

| | |

| | Insurance – 5.9% | | | | |

| | 3,705 | | | Cincinnati Financial Corp. | | | 428,631 | |

| | 10,080 | | | CNA Financial Corp. | | | 442,915 | |

| | 6,120 | | | MetLife, Inc. | | | 435,010 | |

| | 5,295 | | | Principal Financial Group, Inc. | | | 419,046 | |

| | 8,425 | | | Unum Group | | | 427,148 | |

| | | | | | | | |

| | | | | | | 2,152,750 | |

| | |

| | IT Services – 1.2% | | | | |

| | 4,995 | | | Amdocs Ltd. | | | 419,530 | |

| | |

| | Leisure Products – 1.3% | | | | |

| | 8,005 | | | Hasbro, Inc. | | | 490,706 | |

| | |

| | Life Sciences Tools & Services – 1.2% | | | | |

| | 3,075 | | | Agilent Technologies, Inc. | | | 421,398 | |

| | |

| | Machinery – 9.5% | | | | |

| | 5,660 | | | Allison Transmission Holdings, Inc. | | | 416,293 | |

| | 1,555 | | | Cummins, Inc. | | | 439,272 | |

| | 2,550 | | | Dover Corp. | | | 457,215 | |

| | 1,680 | | | Illinois Tool Works, Inc. | | | 410,105 | |

| | 3,720 | | | Oshkosh Corp. | | | 417,644 | |

| | 5,410 | | | Pentair PLC | | | 427,877 | |

| | 4,740 | | | Stanley Black & Decker, Inc. | | | 433,236 | |

| | 5,175 | | | Timken Co. | | | 461,714 | |

| | | | | | | | |

| | | | | | | 3,463,356 | |

| | |

| | |

| The accompanying notes are an integral part of these financial statements. | | 9 |

THE MIDCAP VALUE FUND

Schedule of Investments (continued)

April 30, 2024 (Unaudited)

| | | | | | | | |

| | |

| Shares | | | Description | | Value | |

| |

| | Common Stocks – (continued) | | | | |

| | Media – 2.4% | | | | |

| | 13,810 | | | Interpublic Group of Cos., Inc. | | | $ 420,376 | |

| | 4,795 | | | Omnicom Group, Inc. | | | 445,168 | |

| | | | | | | | |

| | | | | | | 865,544 | |

| | |

| | Multi-Utilities – 3.8% | | | | |

| | 5,055 | | | Consolidated Edison, Inc. | | | 477,192 | |

| | 6,425 | | | Sempra | | | 460,223 | |

| | 5,600 | | | WEC Energy Group, Inc. | | | 462,784 | |

| | | | | | | | |

| | | | | | | 1,400,199 | |

| | |

| | Oil, Gas & Consumable Fuels – 4.8% | | | | |

| | 5,640 | | | ONEOK, Inc. | | | 446,237 | |

| | 765 | | | Texas Pacific Land Corp. | | | 440,870 | |

| | 2,655 | | | Valero Energy Corp. | | | 424,455 | |

| | 11,715 | | | Williams Cos., Inc. | | | 449,387 | |

| | | | | | | | |

| | | | | | | 1,760,949 | |

| | |

| | Professional Services – 1.2% | | | | |

| | 3,760 | | | Paychex, Inc. | | | 446,726 | |

| | |

| | Residential REITs – 2.5% | | | | |

| | 2,455 | | | AvalonBay Communities, Inc. | | | 465,395 | |

| | 1,865 | | | Essex Property Trust, Inc. | | | 459,256 | |

| | | | | | | | |

| | | | | | | 924,651 | |

| | |

| | Retail REITs – 1.2% | | | | |

| | 7,575 | | | Regency Centers Corp. | | | 448,591 | |

| | |

| | Semiconductors & Semiconductor Equipment – 4.9% | |

| | 5,105 | | | Microchip Technology, Inc. | | | 469,558 | |

| | 3,560 | | | MKS Instruments, Inc. | | | 423,569 | |

| | 4,265 | | | Skyworks Solutions, Inc. | | | 454,606 | |

| | 2,695 | | | Universal Display Corp. | | | 425,756 | |

| | | | | | | | |

| | | | | | | 1,773,489 | |

| | |

| | Specialized REITs – 4.6% | | | | |

| | 4,320 | | | Crown Castle, Inc. | | | 405,130 | |

| | 3,245 | | | Digital Realty Trust, Inc. | | | 450,341 | |

| | 3,185 | | | Extra Space Storage, Inc. | | | 427,682 | |

| | 12,615 | | | Weyerhaeuser Co. | | | 380,594 | |

| | | | | | | | |

| | | | | | | 1,663,747 | |

| | |

| | Specialty Retail – 1.1% | | | | |

| | 5,545 | | | Best Buy Co., Inc. | | | 408,334 | |

| | |

| | Textiles, Apparel & Luxury Goods – 1.1% | | | | |

| | 2,445 | | | Ralph Lauren Corp. | | | 400,100 | |

| | |

| | TOTAL COMMON STOCKS | |

| | (Cost $33,338,326) | | | $34,643,736 | |

| | |

| | | | | | | | |

| |

| | Exchange Traded Fund – 3.6% | | | | |

| | 11,000 | | | iShares Russell Mid-Cap Value ETF | | | $ 1,307,460 | |

| | (Cost $1,212,927) | | | | |

| | |

| | | | | | | | |

| Shares | | | Dividend Rate | | Value | |

| |

| | Investment Company – 1.4% | | | | |

|

| State Street Institutional US Government Money Market Fund –

Premier Class |

|

| | 508,687 | | | 5.250% | | | $ 508,687 | |

| | (Cost $508,687) | | | | |

| | |

| | TOTAL INVESTMENTS – 99.7% | |

| | (Cost $34,059,940) | | | $36,459,883 | |

| | |

| OTHER ASSETS IN EXCESS OF

LIABILITIES – 0.3% | | | 99,643 | |

| | |

| | NET ASSETS – 100.0% | | | $36,559,526 | |

| | |

|

| The percentage shown for each investment category

reflects the value of investments in that category as a

percentage of net assets. |

|

| | |

|

| Investment Abbreviation: |

| REIT | | —RealEstate Investment Trust |

|

PORTFOLIO COMPOSITION

| | | | |

| | | AS OF

4/30/24 | |

| |

Industrials | | | 17.7 | % |

Financials | | | 17.5 | |

Information Technology | | | 9.8 | |

Real Estate | | | 9.5 | |

Consumer Discretionary | | | 9.1 | |

Utilities | | | 7.6 | |

Materials | | | 7.0 | |

Health Care | | | 5.8 | |

Energy | | | 4.8 | |

Exchange Traded Fund | | | 3.6 | |

Consumer Staples | | | 3.5 | |

Communication Services | | | 2.4 | |

Investment Company | | | 1.4 | |

| |

| TOTAL INVESTMENTS | | | 99.7 | % |

| |

The Fund commenced operations on November 13, 2023. As such, portfolio composition for the Fund is only presented as of April 30, 2024.

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Underlying investment categories of investment companies held by the Fund are not reflected in the table above. Consequently, the Fund’s overall investment category allocations may differ from the percentages contained in the table above.

The Fund is actively managed and, as such, its composition may differ over time.

| | |

| 10 | | The accompanying notes are an integral part of these financial statements. |

THE BOND FUND

Schedule of Investments

April 30, 2024 (Unaudited)

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

|

Corporate Obligations – 42.5% | |

Aerospace/Defense – 0.7% | |

| Boeing Co.(a) | |

| $ 5,000,000 | | | 5.805 | % | | 05/01/50 | | $ | 4,421,813 | |

|

| General Electric Co. | |

| 3,413,000 | | | 6.150 | | | 08/07/37 | | | 3,503,997 | |

| | | | | | | | | | |

| | | | | | | | | 7,925,810 | |

| |

Auto Manufacturers – 2.4% | |

| BMW U.S. Capital LLC(a)(b) | |

| 1,475,000 | | | 3.750 | | | 04/12/28 | | | 1,393,867 | |

| 5,000,000 | | | 5.150 | | | 04/02/34 | | | 4,815,700 | |

|

| Ford Motor Credit Co. LLC | |

| 2,500,000 | | | 4.134 | | | 08/04/25 | | | 2,438,239 | |

| 2,000,000 | | | 6.050 | (a) | | 03/05/31 | | | 1,968,872 | |

|

| General Motors Co.(a) | |

| 3,450,000 | | | 6.600 | | | 04/01/36 | | | 3,549,122 | |

|

| General Motors Financial Co., Inc.(a) | |

| 2,000,000 | | | 2.400 | | | 04/10/28 | | | 1,769,019 | |

| 1,615,000 | | | 3.100 | | | 01/12/32 | | | 1,331,548 | |

|

| Mercedes-Benz Finance North America LLC(b) | |

| 3,900,000 | | | 4.800 | | | 03/30/28 | | | 3,824,655 | |

| 2,000,000 | | | 5.050 | | | 08/03/33 | | | 1,937,271 | |

|

| Volkswagen Group of America Finance LLC(a)(b) | |

| 4,000,000 | | | 6.450 | | | 11/16/30 | | | 4,136,835 | |

| | | | | | | | | | |

| | | | | | | | | 27,165,128 | |

| |

Banks – 6.9% | |

| Bank of America Corp. | |

| 3,000,000 | | | 4.450 | | | 03/03/26 | | | 2,938,248 | |

|

| (3 mo. USD Term SOFR + 1.302%), | |

| 6,749,000 | | | 3.419 | (a)(c) | | 12/20/28 | | | 6,253,591 | |

|

| Citigroup, Inc. | |

| 3,500,000 | | | 4.450 | | | 09/29/27 | | | 3,371,591 | |

|

| (Secured Overnight Financing Rate + 2.086%), | |

| 4,400,000 | | | 4.910 | (a)(c) | | 05/24/33 | | | 4,133,424 | |

|

| (Secured Overnight Financing Rate + 1.379%), | |

| 2,000,000 | | | 2.904 | (a)(c) | | 11/03/42 | | | 1,366,632 | |

|

HSBC Holdings PLC(a)(c) (Secured Overnight Financing Rate + 2.650%) | |

| 3,150,000 | | | 6.332 | | | 03/09/44 | | | 3,223,476 | |

|

Huntington Bancshares, Inc.(a)(c) (Secured Overnight Financing Rate + 2.050%) | |

| 4,000,000 | | | 5.023 | | | 05/17/33 | | | 3,689,554 | |

|

JPMorgan Chase & Co. (Secured Overnight Financing Rate + 0.885%), | |

| 1,500,000 | | | 6.239 | (a)(c) | | 04/22/27 | | | 1,504,402 | |

|

| (Secured Overnight Financing Rate + 1.560%), | |

| 1,000,000 | | | 4.323 | (a)(c) | | 04/26/28 | | | 966,515 | |

|

| (3 mo. USD Term SOFR + 1.592%), | |

| 2,000,000 | | | 4.452 | (a)(c) | | 12/05/29 | | | 1,913,552 | |

|

| (3 mo. USD Term SOFR + 1.422%), | |

| 1,650,000 | | | 3.702 | (a)(c) | | 05/06/30 | | | 1,512,987 | |

| 2,520,000 | | | 5.600 | | | 07/15/41 | | | 2,505,994 | |

| |

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

|

Corporate Obligations – (continued) | |

Banks – (continued) | |

| KeyBank NA | |

| $ 3,000,000 | | | 3.400 | % | | 05/20/26 | | $ | 2,816,577 | |

|

Morgan Stanley(a)(c) (Secured Overnight Financing Rate + 1.200%) | |

| 2,900,000 | | | 2.511 | | | 10/20/32 | | | 2,335,330 | |

|

| Northern Trust Corp.(a) | |

| 4,000,000 | | | 3.150 | | | 05/03/29 | | | 3,651,385 | |

| 1,500,000 | | | 1.950 | | | 05/01/30 | | | 1,243,588 | |

|

| PNC Bank NA | |

| 3,830,000 | | | 4.050 | | | 07/26/28 | | | 3,584,509 | |

|

| Truist Financial Corp. | |

| 3,500,000 | | | 2.500 | (a) | | 08/01/24 | | | 3,470,937 | |

|

| (Secured Overnight Financing Rate + 2.300%), | |

| 1,900,000 | | | 6.123 | (a)(c) | | 10/28/33 | | | 1,896,861 | |

|

| (Secured Overnight Financing Rate + 1.852%), | |

| 1,776,000 | | | 5.122 | (a)(c) | | 01/26/34 | | | 1,654,222 | |

|

U.S. Bancorp (Secured Overnight Financing Rate + 1.230%), | |

| 1,000,000 | | | 4.653 | (a)(c) | | 02/01/29 | | | 963,617 | |

|

| (Secured Overnight Financing Rate + 1.600%), | |

| 7,000,000 | | | 4.839 | (a)(c) | | 02/01/34 | | | 6,459,073 | |

|

| (Secured Overnight Financing Rate + 1.860%), | |

| 1,350,000 | | | 5.678 | (a)(c) | | 01/23/35 | | | 1,318,487 | |

|

| UBS Group AG | |

| (1 yr. CMT + 0.850%), | |

| 2,000,000 | | | 1.494 | (a)(b)(c) | | 08/10/27 | | | 1,810,870 | |

| (1 yr. CMT + 1.750%), | |

| 2,500,000 | | | 4.751 | (a)(b)(c) | | 05/12/28 | | | 2,419,324 | |

|

| Wells Fargo & Co. | |

| 2,500,000 | | | 4.100 | | | 06/03/26 | | | 2,422,058 | |

| 1,500,000 | | | 4.650 | | | 11/04/44 | | | 1,247,111 | |

| 5,000,000 | | | 4.750 | | | 12/07/46 | | | 4,172,376 | |

|

| Wells Fargo Bank NA(d) | |

| 2,000,000 | | | 6.180 | | | 02/15/36 | | | 1,925,982 | |

| | | | | | | | | | |

| | | | | | | | | 76,772,273 | |

| |

Beverages(a) – 0.7% | |

| Anheuser-Busch InBev Worldwide, Inc. | |

| 1,000,000 | | | 4.600 | | | 04/15/48 | | | 862,898 | |

| 6,000,000 | | | 4.439 | | | 10/06/48 | | | 5,027,038 | |

|

| PepsiCo, Inc. | |

| 2,190,000 | | | 4.450 | | | 04/14/46 | | | 1,884,320 | |

| | | | | | | | | | |

| | | | | | | | | 7,774,256 | |

| |

Biotechnology(a) – 0.3% | |

| Amgen, Inc. | |

| 1,000,000 | | | 5.600 | | | 03/02/43 | | | 964,210 | |

| 3,175,000 | | | 2.770 | | | 09/01/53 | | | 1,843,330 | |

| | | | | | | | | | |

| | | | | | | | | 2,807,540 | |

| |

Chemicals(a) – 0.2% | |

| Linde, Inc. | |

| 2,000,000 | | | 3.200 | | | 01/30/26 | | | 1,927,653 | |

|

| Sherwin-Williams Co. | |

| 1,075,000 | | | 2.200 | | | 03/15/32 | | | 853,677 | |

| | | | | | | | | | |

| | | | | | | | | 2,781,330 | |

| |

| | |

| The accompanying notes are an integral part of these financial statements. | | 11 |

THE BOND FUND

Schedule of Investments (continued)

April 30, 2024 (Unaudited)

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

|

Corporate Obligations – (continued) | |

Commercial Services – 1.6% | |

| Corp. of Gonzaga University | |

| $ 3,500,000 | | | 4.158 | % | | | 04/01/46 | | | $ | 2,667,088 | |

|

| Emory University(a) | |

| 2,000,000 | | | 1.566 | | | | 09/01/25 | | | | 1,897,486 | |

|

| Equifax, Inc.(a) | |

| 2,000,000 | | | 5.100 | | | | 12/15/27 | | | | 1,969,920 | |

|

| Henry J Kaiser Family Foundation | |

| 6,250,000 | | | 3.356 | | | | 12/01/25 | | | | 6,055,779 | |

|

| Northwestern University | |

| 1,000,000 | | | 4.643 | | | | 12/01/44 | | | | 908,352 | |

|

| PayPal Holdings, Inc.(a) | |

| 3,600,000 | | | 5.250 | | | | 06/01/62 | | | | 3,241,198 | |

|

| Thomas Jefferson University | |

| 1,375,000 | | | 2.368 | | | | 11/01/25 | | | | 1,290,082 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 18,029,905 | |

| |

Computers(a) – 0.3% | |

| CGI, Inc. | |

| 4,000,000 | | | 2.300 | | | | 09/14/31 | | | | 3,105,287 | |

| |

Computers & Peripherals(a) – 0.4% | |

| Amazon.com, Inc. | |

| 2,000,000 | | | 4.700 | | | | 12/01/32 | | | | 1,942,191 | |

|

| Meta Platforms, Inc. | |

| 2,320,000 | | | 3.850 | | | | 08/15/32 | | | | 2,105,681 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 4,047,872 | |

| |

Distribution/Wholesale(a) – 0.3% | |

| WW Grainger, Inc. | |

| 3,260,000 | | | 4.600 | | | | 06/15/45 | | | | 2,841,794 | |

| |

Diversified Financial Services – 1.4% | |

| Aircastle Ltd.(a) | |

| 1,000,000 | | | 4.250 | | | | 06/15/26 | | | | 966,761 | |

|

| Aviation Capital Group LLC(a)(b) | |

| 5,500,000 | | | 1.950 | | | | 09/20/26 | | | | 4,995,809 | |

|

| Brookfield Finance, Inc.(a) | |

| 3,100,000 | | | 4.700 | | | | 09/20/47 | | | | 2,559,355 | |

|

Capital One Financial Corp.(a)(c) (Secured Overnight Financing Rate + 2.370%) | |

| 3,000,000 | | | 5.268 | | | | 05/10/33 | | | | 2,841,886 | |

|

| CDP Financial, Inc.(b) | |

| 1,000,000 | | | 3.150 | | | | 07/24/24 | | | | 994,502 | |

|

| Charles Schwab Corp.(a) | |

| 1,225,000 | | | 2.750 | | | | 10/01/29 | | | | 1,080,021 | |

| 2,500,000 | | | 1.950 | | | | 12/01/31 | | | | 1,958,382 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 15,396,716 | |

| |

Electrical Equipment – 4.2% | |

| Arizona Public Service Co. | |

| 2,150,000 | | | 6.875 | | | | 08/01/36 | | | | 2,214,337 | |

|

| Consumers Energy Co.(a) | |

| 3,290,000 | | | 3.950 | | | | 07/15/47 | | | | 2,569,438 | |

|

| Emerson Electric Co. | |

| 1,000,000 | | | 6.125 | | | | 04/15/39 | | | | 1,033,167 | |

|

| Entergy Louisiana LLC(a) | |

| 3,000,000 | | | 3.780 | | | | 04/01/25 | | | | 2,929,018 | |

| |

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

|

Corporate Obligations – (continued) | |

Electrical Equipment – (continued) | |

| Evergy Kansas Central, Inc.(a) | |

| $ 7,435,000 | | | 5.900 | % | | | 11/15/33 | | | $ | 7,536,513 | |

|

| Florida Power & Light Co.(a) | |

| 1,250,000 | | | 4.550 | | | | 10/01/44 | | | | 1,031,988 | |

|

| Louisville Gas & Electric Co.(a) | |

| 1,850,000 | | | 4.650 | | | | 11/15/43 | | | | 1,540,896 | |

|

| National Grid USA | |

| 3,375,000 | | | 8.000 | | | | 11/15/30 | | | | 3,697,198 | |

|

| National Rural Utilities Cooperative Finance Corp.(a) | |

| 4,000,000 | | | 5.800 | | | | 01/15/33 | | | | 4,056,086 | |

|

| Nevada Power Co.(a) | |

| 1,250,000 | | | 3.125 | | | | 08/01/50 | | | | 779,081 | |

|

| Ohio Power Co. | |

| 2,870,000 | | | 5.850 | | | | 10/01/35 | | | | 2,816,657 | |

|

| Pacific Gas & Electric Co.(a) | |

| 1,000,000 | | | 4.550 | | | | 07/01/30 | | | | 927,648 | |

| 1,000,000 | | | 4.950 | | | | 07/01/50 | | | | 813,302 | |

|

| PacifiCorp | |

| 2,200,000 | | | 6.100 | | | | 08/01/36 | | | | 2,206,422 | |

|

| PG&E Wildfire Recovery Funding LLC | |

| 1,008,517 | | | 3.594 | | | | 06/01/32 | | | | 955,433 | |

|

| PPL Electric Utilities Corp.(a) | |

| 2,225,000 | | | 4.750 | | | | 07/15/43 | | | | 1,959,711 | |

|

| Public Service Enterprise Group, Inc.(a) | |

| 5,500,000 | | | 8.625 | | | | 04/15/31 | | | | 6,108,314 | |

|

| Southern California Edison Co. | |

| 1,000,000 | | | 5.550 | | | | 01/15/37 | | | | 955,470 | |

|

| Wisconsin Power & Light Co.(a) | |

| 1,000,000 | | | 1.950 | | | | 09/16/31 | | | | 787,919 | |

|

| Wisconsin Public Service Corp.(a) | |

| 3,000,000 | | | 3.300 | | | | 09/01/49 | | | | 2,002,843 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 46,921,441 | |

| |

Energy Minerals(a) – 0.3% | |

| HF Sinclair Corp. | |

| 3,850,000 | | | 5.875 | | | | 04/01/26 | | | | 3,858,421 | |

| |

Entertainment(a) – 0.1% | |

| Warnermedia Holdings, Inc. | |

| 1,000,000 | | | 3.755 | | | | 03/15/27 | | | | 942,836 | |

| |

Food(a)(b) – 0.6% | |

| Nestle Holdings, Inc. | |

| 6,700,000 | | | 4.300 | | | | 10/01/32 | | | | 6,371,861 | |

| |

Gas(a) – 0.6% | |

| Atmos Energy Corp. | |

| 1,400,000 | | | 4.125 | | | | 03/15/49 | | | | 1,098,402 | |

|

| Boston Gas Co.(b) | |

| 2,900,000 | | | 3.001 | | | | 08/01/29 | | | | 2,525,611 | |

|

| Northwest Natural Gas Co. | |

| 4,650,000 | | | 3.869 | | | | 06/15/49 | | | | 3,171,248 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 6,795,261 | |

| |

Healthcare-Products(a) – 0.2% | |

| Baxter International, Inc. | |

| 3,000,000 | | | 2.539 | | | | 02/01/32 | | | | 2,404,753 | |

| |

| | |

| 12 | | The accompanying notes are an integral part of these financial statements. |

THE BOND FUND

Schedule of Investments (continued)

April 30, 2024 (Unaudited)

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

|

Corporate Obligations – (continued) | |

Healthcare-Services – 2.2% | |

| Adventist Health System(a) | |

| $ 7,000,000 | | | 2.952 | % | | | 03/01/29 | | | $ | 6,176,687 | |

|

| Ascension Health | |

| 3,000,000 | | | 2.532 | (a) | | | 11/15/29 | | | | 2,614,094 | |

| 1,500,000 | | | 3.945 | | | | 11/15/46 | | | | 1,197,812 | |

|

| Baptist Health South Florida, Inc. | |

| 3,695,000 | | | 4.342 | | | | 11/15/41 | | | | 3,079,937 | |

|

| Community Health Network, Inc. | |

| 2,225,000 | | | 4.237 | | | | 05/01/25 | | | | 2,169,076 | |

|

| Mayo Clinic | |

| 2,600,000 | | | 3.774 | | | | 11/15/43 | | | | 2,083,934 | |

|

| SSM Health Care Corp.(a) | |

| 4,990,000 | | | 3.823 | | | | 06/01/27 | | | | 4,757,374 | |

| 3,000,000 | | | 4.894 | | | | 06/01/28 | | | | 2,941,652 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 25,020,566 | |

| |

Insurance – 5.9% | |

| Americo Life, Inc.(b) | |

| 5,206,000 | | | 3.450 | | | | 04/15/31 | | | | 4,011,890 | |

|

| Aon North America, Inc.(a) | |

| 2,175,000 | | | 5.750 | | | | 03/01/54 | | | | 2,103,972 | |

|

| Arch Capital Group Ltd. | |

| 2,149,000 | | | 7.350 | | | | 05/01/34 | | | | 2,364,929 | |

|

| Arthur J Gallagher & Co.(a) | |

| 1,000,000 | | | 5.450 | | | | 07/15/34 | | | | 971,405 | |

|

| Assured Guaranty U.S. Holdings, Inc.(a) | |

| 4,715,000 | | | 3.150 | | | | 06/15/31 | | | | 3,997,878 | |

|

| AXIS Specialty Finance LLC(a) | |

| 3,000,000 | | | 3.900 | | | | 07/15/29 | | | | 2,796,576 | |

|

| Berkshire Hathaway Finance Corp.(a) | |

| 4,220,000 | | | 4.200 | | | | 08/15/48 | | | | 3,507,163 | |

|

| Equitable Financial Life Global Funding(b) | |

| 3,000,000 | | | 1.300 | | | | 07/12/26 | | | | 2,714,941 | |

| 5,000,000 | | | 1.750 | | | | 11/15/30 | | | | 3,931,162 | |

|

| Guardian Life Global Funding(b) | |

| 5,000,000 | | | 1.250 | | | | 11/19/27 | | | | 4,348,316 | |

|

| Horace Mann Educators Corp.(a) | |

| 2,000,000 | | | 7.250 | | | | 09/15/28 | | | | 2,098,510 | |

|

| Loews Corp. | |

| 3,000,000 | | | 6.000 | | | | 02/01/35 | | | | 3,100,846 | |

|

| MassMutual Global Funding II(b) | |

| 2,670,000 | | | 1.550 | | | | 10/09/30 | | | | 2,107,800 | |

|

| MetLife, Inc.(a) | |

| 2,055,000 | | | 10.750 | | | | 08/01/69 | | | | 2,715,438 | |

|

| New York Life Global Funding(b) | |

| 9,000,000 | | | 4.550 | | | | 01/28/33 | | | | 8,411,958 | |

|

| Principal Life Global Funding II(b) | |

| 2,600,000 | | | 5.500 | | | | 06/28/28 | | | | 2,566,607 | |

|

| Prudential Insurance Co. of America(b) | |

| 2,775,000 | | | 8.300 | | | | 07/01/25 | | | | 2,832,131 | |

|

| Reinsurance Group of America, Inc.(a) | |

| 2,500,000 | | | 3.150 | | | | 06/15/30 | | | | 2,181,293 | |

| 1,811,000 | | | 6.000 | | | | 09/15/33 | | | | 1,817,958 | |

| (3 mo. USD Term SOFR + 2.927%), | |

| 2,000,000 | | | 8.256 | (c) | | | 12/15/65 | | | | 1,940,000 | |

| |

| | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | Value | |

|

Corporate Obligations – (continued) | |

Insurance – (continued) | |

| Reliance Standard Life Global Funding II(b) | |

| $ 1,750,000 | | | 2.750 | % | | 01/21/27 | | $ | 1,598,190 | |

|

| Teachers Insurance & Annuity Association of America(a)(b) | |

| 3,000,000 | | | 4.270 | | | 05/15/47 | | | 2,343,802 | |

|

| Travelers Cos., Inc.(a) | |

| 2,000,000 | | | 4.100 | | | 03/04/49 | | | 1,598,441 | |

| | | | | | | | | | |

| | | | | | | | | 66,061,206 | |

| |

Machinery-Diversified – 0.3% | |

| John Deere Capital Corp. | |

| 4,000,000 | | | 4.350 | | | 09/15/32 | | | 3,755,586 | |

| |

Media – 0.2% | |

| Comcast Corp. | |

| 1,250,000 | | | 6.400 | | | 05/15/38 | | | 1,292,258 | |

| 1,500,000 | | | 2.800 | (a) | | 01/15/51 | | | 894,508 | |

| | | | | | | | | | |

| | | | | | | | | 2,186,766 | |

| |

Metals & Mining – 0.2% | |

| Southern Copper Corp. | |

| 2,000,000 | | | 5.875 | | | 04/23/45 | | | 1,941,742 | |

| |

Oil-Field Services – 1.9% | |

| Apache Corp.(a) | |

| 2,835,000 | | | 5.100 | | | 09/01/40 | | | 2,359,703 | |

|

| BP Capital Markets America, Inc.(a) | |

| 4,000,000 | | | 3.543 | | | 04/06/27 | | | 3,813,773 | |

|

| Equinor ASA | |

| 1,795,000 | | | 6.800 | | | 01/15/28 | | | 1,876,799 | |

|

| Phillips 66(a) | |

| 3,000,000 | | | 4.650 | | | 11/15/34 | | | 2,744,227 | |

|

| Saudi Arabian Oil Co.(b) | |

| 5,000,000 | | | 3.500 | | | 04/16/29 | | | 4,588,800 | |

|

| Schlumberger Investment SA(a) | |

| 3,600,000 | | | 2.650 | | | 06/26/30 | | | 3,115,436 | |

|

| Tosco Corp. | |

| 2,095,000 | | | 8.125 | | | 02/15/30 | | | 2,373,274 | |

| | | | | | | | | | |

| | | | | | | | | 20,872,012 | |

| |

Paper and Forest Products – 0.7% | |

| Georgia-Pacific LLC(a)(b) | |

| 5,000,000 | | | 2.100 | | | 04/30/27 | | | 4,535,082 | |

|

| International Paper Co. | |

| 2,925,000 | | | 8.700 | | | 06/15/38 | | | 3,497,737 | |

| | | | | | | | | | |

| | | | | | | | | 8,032,819 | |

| |

Pharmaceuticals – 1.4% | |

| Bristol-Myers Squibb Co.(a) | |

| 3,250,000 | | | 3.900 | | | 02/20/28 | | | 3,104,227 | |

|

| CVS Pass-Through Trust(b) | |

| 1,924,978 | | | 7.507 | | | 01/10/32 | | | 1,959,633 | |

|

| Johnson & Johnson | |

| 4,970,000 | | | 5.950 | | | 08/15/37 | | | 5,289,343 | |

|

| Pfizer, Inc. | |

| 2,000,000 | | | 1.750 | (a) | | 08/18/31 | | | 1,579,982 | |

| 2,900,000 | | | 7.200 | | | 03/15/39 | | | 3,340,861 | |

| | | | | | | | | | |

| | | | | | | | | 15,274,046 | |

| |

| | |

| The accompanying notes are an integral part of these financial statements. | | 13 |

THE BOND FUND

Schedule of Investments (continued)

April 30, 2024 (Unaudited)

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

|

Corporate Obligations – (continued) | |

Pipelines – 1.8% | |

| DCP Midstream Operating LP | |

| $ 3,397,000 | | | 8.125 | % | | | 08/16/30 | | | $ | 3,799,446 | |

|

| Energy Transfer LP(a) | |

| 3,000,000 | | | 4.900 | | | | 03/15/35 | | | | 2,745,235 | |

|

| Kinder Morgan Energy Partners LP | |

| 4,175,000 | | | 5.800 | | | | 03/15/35 | | | | 4,100,638 | |

|

| ONEOK, Inc.(a) | |

| 2,635,000 | | | 3.950 | | | | 03/01/50 | | | | 1,867,753 | |

|

| Tennessee Gas Pipeline Co. LLC | |

| 628,000 | | | 8.375 | | | | 06/15/32 | | | | 713,468 | |

| 1,450,000 | | | 7.625 | | | | 04/01/37 | | | | 1,616,408 | |

|

| TransCanada PipeLines Ltd.(a) | |

| 1,000,000 | | | 4.625 | | | | 03/01/34 | | | | 907,725 | |

|

| Transcanada Trust(a)(c) | |

| (3 mo. USD LIBOR + 3.208%) | |

| 4,660,000 | | | 5.300 | | | | 03/15/77 | | | | 4,316,966 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 20,067,639 | |

| |

Real Estate(a) – 3.8% | |

|

| Alexandria Real Estate Equities, Inc. | |

| 2,500,000 | | | 5.250 | | | | 05/15/36 | | | | 2,349,403 | |

|

| AvalonBay Communities, Inc. | |

| 1,500,000 | | | 1.900 | | | | 12/01/28 | | | | 1,292,988 | |

|

| Camden Property Trust | |

| 6,000,000 | | | 4.900 | | | | 01/15/34 | | | | 5,640,956 | |

|

| DOC DR LLC | |

| 1,325,000 | | | 2.625 | | | | 11/01/31 | | | | 1,066,604 | |

|

| Healthcare Realty Holdings LP | |

| 1,075,000 | | | 2.050 | | | | 03/15/31 | | | | 809,965 | |

|

| Kimco Realty OP LLC | |

| 1,000,000 | | | 3.850 | | | | 06/01/25 | | | | 978,463 | |

|

| Mid-America Apartments LP | |

| 1,900,000 | | | 1.100 | | | | 09/15/26 | | | | 1,714,332 | |

|

| Omega Healthcare Investors, Inc. | |

| 4,500,000 | | | 4.750 | | | | 01/15/28 | | | | 4,264,443 | |

|

| Prologis Targeted U.S. Logistics Fund LP(b) | |

| 4,000,000 | | | 5.500 | | | | 04/01/34 | | | | 3,882,094 | |

|

| Realty Income Corp. | |

| 2,400,000 | | | 0.750 | | | | 03/15/26 | | | | 2,194,752 | |

| 2,400,000 | | | 3.950 | | | | 08/15/27 | | | | 2,292,618 | |

|

| SBA Tower Trust(b) | |

| 1,575,000 | | | 2.836 | | | | 01/15/50 | | | | 1,539,778 | |

|

| Scentre Group Trust 1/Scentre Group Trust 2(b) | |

| 4,000,000 | | | 3.750 | | | | 03/23/27 | | | | 3,787,037 | |

|

| Simon Property Group LP | |

| 1,500,000 | | | 6.250 | | | | 01/15/34 | | | | 1,550,298 | |

|

| Sun Communities Operating LP | |

| 1,000,000 | | | 2.700 | | | | 07/15/31 | | | | 806,861 | |

|

| Ventas Realty LP | |

| 2,910,000 | | | 3.500 | | | | 02/01/25 | | | | 2,857,228 | |

|

| Welltower OP LLC | |

| 5,900,000 | | | 2.750 | | | | 01/15/32 | | | | 4,812,837 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 41,840,657 | |

| |

Semiconductors(a) – 0.7% | |

| Broadcom, Inc.(b) | |

| 3,500,000 | | | 3.469 | | | | 04/15/34 | | | | 2,896,817 | |

| |

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

|

Corporate Obligations – (continued) | |

Semiconductors(a) – (continued) | |

| Texas Instruments, Inc. | |

| $ 6,000,000 | | | 3.650 | % | | | 08/16/32 | | | $ | 5,380,850 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,277,667 | |

| |

Software(a) – 0.3% | |

|

| Salesforce, Inc. | |

| 2,850,000 | | | 1.950 | | | | 07/15/31 | | | | 2,299,857 | |

| 1,000,000 | | | 2.900 | | | | 07/15/51 | | | | 628,176 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 2,928,033 | |

| |

Telecommunications – 0.7% | |

|

| AT&T, Inc. | |

| 4,000,000 | | | 6.250 | | | | 03/29/41 | | | | 4,025,031 | |

|

| Bell Telephone Co. of Canada or Bell Canada(a) | |

| 3,850,000 | | | 5.100 | | | | 05/11/33 | | | | 3,690,463 | |

|

| Sprint Spectrum Co. LLC/Sprint Spectrum Co. II LLC/Sprint Spectrum Co. III LLC(a)(b) | |

| 500,000 | | | 4.738 | | | | 09/20/29 | | | | 497,060 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 8,212,554 | |

| |

Transportation – 1.0% | |

|

| Burlington Northern Santa Fe LLC(a) | |

| 1,220,000 | | | 4.950 | | | | 09/15/41 | | | | 1,123,786 | |

|

| Canadian National Railway Co. | |

| 1,190,000 | | | 6.200 | | | | 06/01/36 | | | | 1,259,267 | |

| 1,310,000 | | | 2.450 | (a) | | | 05/01/50 | | | | 764,719 | |

|

| Canadian Pacific Railway Co. | |

| 1,980,000 | | | 5.750 | | | | 01/15/42 | | | | 1,902,200 | |

| 1,635,000 | | | 4.950 | (a) | | | 08/15/45 | | | | 1,442,392 | |

| 1,500,000 | | | 4.700 | (a) | | | 05/01/48 | | | | 1,262,272 | |

| 2,500,000 | | | 6.125 | (a)(e) | | | 09/15/15 | | | | 2,469,690 | |

|

| Kansas City Southern Railway Co.(a) | |

| 500,000 | | | 4.950 | | | | 08/15/45 | | | | 391,739 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 10,616,065 | |

| |

Trucking & Leasing(a) – 0.2% | |

| GATX Corp. | |

| 3,155,000 | | | 3.100 | | | | 06/01/51 | | | | 1,925,096 | |

| |

| TOTAL CORPORATE OBLIGATIONS | |

(Cost $528,614,058) | | | | | | | $ | 472,954,938 | |

| |

| | | | | | | | | | | | |

|

| U.S. Treasury Obligations – 16.9% | |

| U.S. Treasury Bonds | |

| $12,000,000 | | | 1.750 | % | | | 08/15/41 | | | $ | 7,612,500 | |

| 10,000,000 | | | 2.750 | | | | 08/15/42 | | | | 7,394,531 | |

| 3,000,000 | | | 3.125 | | | | 08/15/44 | | | | 2,309,297 | |

| 2,125,000 | | | 2.500 | | | | 02/15/45 | | | | 1,456,953 | |

| 5,000,000 | | | 2.500 | | | | 02/15/46 | | | | 3,387,500 | |

| 38,000,000 | | | 2.750 | | | | 11/15/47 | | | | 26,551,016 | |

| 6,000,000 | | | 3.000 | | | | 02/15/48 | | | | 4,393,359 | |

| 22,800,000 | | | 3.125 | | | | 05/15/48 | | | | 17,066,156 | |

| 7,000,000 | | | 2.250 | | | | 08/15/49 | | | | 4,340,820 | |

|

| U.S. Treasury Inflation-Indexed Bonds | |

| 9,611,560 | | | 0.750 | | | | 02/15/42 | | | | 7,282,698 | |

| |

| | |

| 14 | | The accompanying notes are an integral part of these financial statements. |

THE BOND FUND

Schedule of Investments (continued)

April 30, 2024 (Unaudited)

| | | | | | | | | | | | |

Principal

Amount | | Interest

Rate | | | Maturity

Date | | | Value | |

|

U.S. Treasury Obligations – (continued) | |

|

| U.S. Treasury Inflation-Indexed Notes | |

| $ 6,422,100 | | | 0.375 | % | | | 01/15/27 | | | $ | 6,072,133 | |

| U.S. Treasury Notes | |

| 5,000,000 | | | 2.875 | | | | 05/31/25 | | | | 4,875,586 | |

| 5,000,000 | | | 1.500 | | | | 08/15/26 | | | | 4,624,609 | |

| 2,000,000 | | | 2.250 | | | | 02/15/27 | | | | 1,862,813 | |

| 6,380,000 | | | 0.625 | | | | 05/15/30 | | | | 5,019,515 | |

| 5,000,000 | | | 1.375 | | | | 11/15/31 | | | | 3,953,516 | |