- ADTN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

ADTRAN (ADTN) DEF 14ADefinitive proxy

Filed: 10 Mar 03, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. ____)

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

ADTRAN, INC.

(Name of Registrant as specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOTICE OF ANNUAL MEETING

AND

PROXY STATEMENT

March 10, 2003

Dear Stockholder:

You are cordially invited to attend the 2003 Annual Meeting of Stockholders of ADTRAN, Inc. to be held at ADTRAN’s headquarters at 901 Explorer Boulevard, Huntsville, Alabama, on Thursday, April 10, 2003, at 10:30 a.m., local time. The meeting will be held in the East Tower on the second floor.

The attached Notice of Annual Meeting and Proxy Statement describe the formal business to be transacted at the meeting. During the meeting, we also will report on ADTRAN’s operations during the past year and our plans for the future. Our directors and officers, as well as representatives from our independent auditors, PricewaterhouseCoopers LLP, will be present to respond to appropriate questions from stockholders.

Please mark, date, sign and return your proxy card in the enclosed envelope at your earliest convenience. This will assure that your shares will be represented and voted at the meeting, even if you do not attend.

Sincerely,

|

|

MARK C. SMITH |

Chairman of the Board |

and Chief Executive Officer |

ADTRAN, Inc.

901 Explorer Boulevard

Huntsville, Alabama 35806

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 10, 2003

NOTICE HEREBY IS GIVEN that the 2003 Annual Meeting of Stockholders of ADTRAN, Inc. will be held at the ADTRAN’s headquarters at 901 Explorer Boulevard, Huntsville, Alabama, on the second floor of the East Tower, on Thursday, April 10, 2003, at 10:30 a.m., local time, for the purposes of considering and voting upon:

| 1. | A proposal to elect seven directors to serve until the 2004 Annual Meeting of Stockholders; |

| 2. | A proposal to ratify the appointment of PricewaterhouseCoopers LLP as independent auditors of ADTRAN for the fiscal year ending December 31, 2003; and |

| 3. | Such other business as properly may come before the Annual Meeting or any adjournments thereof. The Board of Directors is not aware of any other business to be presented to a vote of the stockholders at the Annual Meeting. |

Information relating to the above matters is set forth in the attached Proxy Statement. Stockholders of record at the close of business on March 3, 2003 are entitled to receive notice of and to vote at the Annual Meeting and any adjournments thereof.

By Order of the Board of Directors.

|

|

MARK C. SMITH |

Chairman of the Board |

and Chief Executive Officer |

Huntsville, Alabama

March 10, 2003

PLEASE READ THE ATTACHED PROXY STATEMENT AND THEN PROMPTLY COMPLETE, EXECUTE AND RETURN THE ENCLOSED PROXY CARD IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE.

ADTRAN, Inc.

901 Explorer Boulevard

Huntsville, Alabama 35806

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 10, 2003

This Proxy Statement is furnished to the stockholders of ADTRAN, Inc. in connection with the solicitation of proxies by our Board of Directors to be voted at the 2003 Annual Meeting of Stockholders and at any adjournments thereof. The Annual Meeting will be held at ADTRAN’s headquarters, 901 Explorer Boulevard, Huntsville, Alabama, on Tuesday, April 10, 2003, at 10:30 a.m., local time. The meeting will be held in the East Tower on the second floor.

The approximate date on which this Proxy Statement and form of proxy card are first being sent or given to stockholders is March10, 2003.

VOTING

General

The securities that can be voted at the Annual Meeting consist of our common stock, $.01 par value per share, with each share entitling its owner to one vote on each matter submitted to the stockholders. The record date for determining the holders of common stock who are entitled to receive notice of and to vote at the Annual Meeting is March 3, 2003. On the record date, 38,145,059 shares of common stock were outstanding and eligible to be voted at the Annual Meeting.

Quorum and Vote Required

The presence, in person or by proxy, of a majority of the outstanding shares of our common stock is necessary to constitute a quorum at the Annual Meeting. In counting the votes to determine whether a quorum exists at the Annual Meeting, we will use the proposal receiving the greatest number of all votes “for” or “against” and abstentions (including instructions to withhold authority to vote).

In voting with regard to the proposal to elect directors (Proposal 1), stockholders may vote in favor of all nominees, withhold their votes as to all nominees or withhold their votes as to specific nominees. The vote required to approve Proposal 1 is governed by Delaware law and is a plurality of the votes cast by the holders of shares represented and entitled to vote at the Annual Meeting, provided a quorum is present. As a result, in accordance with Delaware law, votes that are withheld will be counted in determining whether a quorum is present but will have no other effect on the election of directors.

In voting with regard to the proposal to ratify the directors’ appointment of independent auditors (Proposal 2), stockholders may vote in favor of the proposal or against the proposal or may abstain from voting. The vote required to approve Proposal 2 is governed by Delaware law and is the affirmative vote of the holders of a majority of the shares represented and entitled to vote at the Annual Meeting, provided a quorum is present. As a result, abstentions will be considered in determining whether a quorum is present and the number of votes required to obtain the necessary majority vote and therefore, will have the same legal effect as voting against the proposal.

Under the rules of the New York and American Stock Exchanges (the “Exchanges”) that govern most domestic stock brokerage firms, member firms that hold shares in street name for beneficial owners

may, to the extent that such beneficial owners do not furnish voting instructions with respect to any or all proposals submitted for stockholder action, vote in their discretion upon proposals which are considered “discretionary” proposals under the rules of the Exchanges. These votes by brokers are considered as votes cast in determining the outcome of any discretionary proposal. We believe that Proposal 1 and Proposal 2 are discretionary. Member brokerage firms that have received no instructions from their clients as to “non-discretionary” proposals do not have discretion to vote on these proposals. If the brokerage firm returns a proxy card without voting on a non-discretionary proposal because it received no instructions, this is referred to as a “broker non-vote” on the proposal. “Broker non-votes” are considered in determining whether a quorum exists at the Annual Meeting, but “broker non-votes” are not considered as votes cast in determining the outcome of any proposal.

As of March 3, 2003 (the record date for the Annual Meeting), our directors and executive officers beneficially owned or controlled approximately 17,728,335 shares of our common stock, constituting approximately 46.5% of the outstanding common stock. We believe that these holders will vote all of their shares of common stock in favor of each of the proposals and, therefore, that the presence of a quorum and the approval of the proposals is reasonably assured.

Proxies

You should specify your choices with regard to each of the proposals on the enclosed proxy card. All properly executed proxy cards delivered by stockholders to ADTRAN in time to be voted at the Annual Meeting and not revoked will be voted at the Annual Meeting in accordance with the directions noted on the proxy card.In the absence of such instructions, the shares represented by a signed and dated proxy card will be voted “FOR” the election of all director nominees and “FOR” the ratification of the appointment of independent auditors. If any other matters properly come before the Annual Meeting, the persons named as proxies will vote upon such matters according to their judgment.

Any stockholder delivering a proxy has the power to revoke it at any time before it is voted (i) by giving written notice to Charlene Little, Assistant Secretary of ADTRAN, at 901 Explorer Boulevard, Huntsville, Alabama 35806 (for overnight delivery) or at P.O. Box 140000, Huntsville, Alabama 35814-4000 (for mail delivery), (ii) by executing and delivering to Ms. Little a proxy card bearing a later date or (iii) by voting in person at the Annual Meeting. Please note, however, that under the rules of the Exchanges and the Nasdaq National Market, any beneficial owner of our common stock whose shares are held in street name by a member brokerage firm may revoke his proxy and vote his shares in person at the Annual Meeting only in accordance with applicable rules and procedures of the Exchanges or the Nasdaq National Market, as employed by the beneficial owner’s brokerage firm.

In addition to soliciting proxies through the mail, we may solicit proxies through our directors, officers and employees in person and by telephone or facsimile. Brokerage firms, nominees, custodians and fiduciaries also may be requested to forward proxy materials to the beneficial owners of shares held of record by them. We will pay all expenses incurred in connection with the solicitation of proxies.

Share Ownership of Principal Stockholders and Management

The following table sets forth information regarding the beneficial ownership of our common stock as of January 31, 2003, by (i) each person known to us to be the beneficial owner of more than 5% of our common stock, (ii) each of our directors, (iii) each of our executive officers named in the Summary Compensation Table herein and (iv) all of our directors and executive officers as a group, based in each case on information furnished to us by such persons. We believe that each of the named individuals and each director and executive officer included in the group has sole voting and investment power with regard to the shares shown except as otherwise noted.

2

Common Stock Beneficially Owned (1) | ||||||

Name and Relationship to Company | Number of Shares | Percent of Class | ||||

Mark C. Smith (2) Chairman of the Board, Chief Executive Officer | 12,248,800 | (3) | 32.2 | % | ||

Lonnie S. McMillian (2) Director Emeritus | 5,286,472 | (3) | 13.9 | % | ||

Howard A. Thrailkill President, Chief Operating Officer and Director | 246,876 | (1) | * |

| ||

James L. North Director Emeritus | 146,750 | (1) | * |

| ||

Thomas R. Stanton Senior Vice President and General Manager, Carrier Networks | 135,150 | (1) | * |

| ||

Steven L. Harvey Vice President—Competitive Service Provider and Enterprise Networks Sales | 116,251 | (1) | * |

| ||

Robert A. Fredrickson Vice President—Carrier Networks Sales | 115,526 | (1)(3) | * |

| ||

Roy J. Nichols Director | 46,000 | (1)(3) | * |

| ||

William L. Marks Director | 23,114 | (1) | * |

| ||

W. Frank Blount Director, Secretary | 18,750 | (1) | * |

| ||

Richard A. Anderson Director | 10,000 | (1) | * |

| ||

H. Fenwick Huss Director | — | (4) | * |

| ||

All directors and executive officers as a group (18 persons) | 18,679,465 | (1)(3) | 48.0 | % | ||

| * | Represents less than one percent of the outstanding shares of our common stock. |

| (1) | Beneficial ownership as reported in the table has been determined in accordance with Securities and Exchange Commission (the “SEC”) regulations and includes shares of our common stock that may be issued upon the exercise of stock options that are exercisable within 60 days of January 31, 2003 as follows: Mr. Thrailkill—226,876 shares; Mr. North—19,750 shares; Mr. Stanton—132,250 shares; Mr. Harvey—116,251 shares; Mr. Fredrickson—104,626 shares; Mr. Nichols—18,000 shares; Mr. Marks—19,750 shares; Mr. Blount—18,750 shares; Mr. Anderson���10,000 shares, and all directors and executive officers as a group—924,330 shares. Pursuant to SEC regulations, all shares not currently outstanding which are subject to options exercisable within 60 days are deemed to be outstanding for the purpose of computing “Percent of Class” held by the holder thereof but are not deemed to be outstanding for the purpose of computing the “Percent of Class” held by any other stockholder. |

| (2) | The address of Messrs. Smith and McMillian is 901 Explorer Boulevard, Huntsville, Alabama 35806. |

| (3) | The shares shown include: as to Mr. Smith, 12,248,800 shares held jointly with his wife; as to Mr. McMillian, 1,604,638 shares held by trusts for which Mr. McMillian is the trustee, 2,550,039 shares held jointly with his wife, 189,295 shares owned by his wife and 942,500 shares owned by a private foundation (as to which beneficial ownership is disclaimed); as to Mr. Nichols, 28,000 shares held in two trusts; as to Mr. Fredrickson, 4,900 shares owned jointly with his wife and 6,000 shares owned by his daughters; and as to all directors and executive officers as a group, 14,803,739 shares held jointly with spouses, 195,295 shares owned by spouses and other immediate family members and 1,632,638 shares held by trusts for which an executive officer or director is a beneficiary or trustee. |

3

| (4) | Dr. Huss was elected as a director by the Board of Directors on October 14, 2002. |

PROPOSAL 1—ELECTION OF DIRECTORS

Nominees

The Board of Directors currently consists of seven members. In October 2002, the Board of Directors elected H. Fenwick Huss as a director, in accordance with our bylaws. On December 4, 2002, directors Lonnie S. McMillian and James L. North resigned from the Board and were appointed as directors emeritus of ADTRAN. The Board has nominated Mark C. Smith, Howard A. Thrailkill, Richard A. Anderson, W. Frank Blount, H. Fenwick Huss, William L. Marks and Roy J. Nichols for re-election as directors at the 2003 Annual Meeting. Each of the nominees is currently a director of ADTRAN. If re-elected as a director at the Annual Meeting, each of the nominees would serve a one-year term expiring at the 2004 Annual Meeting of Stockholders and until his successor has been duly elected and qualified. There are no family relationships among the directors or the executive officers.

Each of the nominees has consented to serve another term as a director if re-elected. If any of the nominees should be unavailable to serve for any reason (which is not anticipated), the Board of Directors may designate a substitute nominee or nominees (in which event the persons named on the enclosed proxy card will vote the shares represented by all valid proxy cards for the election of such substitute nominee or nominees), allow the vacancies to remain open until a suitable candidate or candidates are located, or by resolution provide for a lesser number of directors.

The Board of Directors unanimously recommends that the stockholders vote “FOR” the proposal to re-elect Mark C. Smith, Howard A. Thrailkill, Richard A. Anderson, W. Frank Blount, H. Fenwick Huss, William L. Marks and Roy J. Nichols as directors for a one year term expiring at the 2004 Annual Meeting of Stockholders and until their successors have been duly elected and qualified.

Information Regarding Nominees for Director

Set forth below is certain information as of January 31, 2003, regarding the seven nominees for director, including their ages and principal occupations (which have continued for at least the past five years unless otherwise noted).

MARK C. SMITH is one of the co-founders of ADTRAN and has served as our Chairman of the Board and Chief Executive Officer since ADTRAN commenced operations in January 1986. He also served as our President from 1986 until November 1995. Mr. Smith is 62.

HOWARD A. THRAILKILL joined ADTRAN in 1992 as Executive Vice President and Chief Operating Officer. In November 1995, Mr. Thrailkill was elected as our President. Mr. Thrailkill has served as a director of ADTRAN since October 1995. Mr. Thrailkill is 64.

RICHARD A. ANDERSON has served as President–Customer Markets of BellSouth Corporation, with responsibility for all domestic local and long distance wireline retail operations, since 1999. From 1993 to 1999, Mr. Anderson held a number of positions with BellSouth, including President–Interconnection Services, President–BellSouth Business Systems, Vice President–Marketing, and Group President–BellSouth Business. In 1988, following BellSouth’s acquisition of Universal Communication Systems, he was appointed Vice President–Product Management for Universal Communication Systems and then promoted to Executive Vice President and Chief Operating Officer in 1989, in which position he led the transition to an integrated equipment services entity for BellSouth. He originally joined South Central Bell in Nashville, Tennessee as an Account Executive in 1981, where he held sales management

4

positions of increasing responsibility with BellSouth and AT&T in the cities of Memphis, Birmingham, Louisville and Nashville. Mr. Anderson serves on the boards of The Atlanta Ballet, SciTrek, Camp Twin Lakes, and the Dean’s Advisory Council for Murray State University College of Business and Public Affairs. Mr. Anderson became a member of our Board of Directors in February 2002. Mr. Anderson is 44.

W. FRANK BLOUNT has served as Chairman and Chief Executive Officer of JI Ventures, a high tech venture capital fund, since May 2000. He also served as Chairman and Chief Executive Officer of Cypress Communications, Inc., a leading building-centric communications provider, from June 2000 to February 2002. Mr. Blount served as Chief Executive Officer and as a director of Telstra Corporation, LTD, Australia’s principal telecommunications company, from January 1992 until March 1999. Prior to joining Telstra, he served in various executive positions for AT&T Corp., including Group President from 1988 to 1991. He currently serves as a director of Caterpillar, Inc., Entergy Corporation, Hanson PLC, and Alcatel, S.A. Mr. Blount has served as a director of ADTRAN since April 1999 and as Secretary of ADTRAN since December 2002. Mr. Blount is 64.

WILLIAM L. MARKS has served as Chairman of the Board and Chief Executive Officer of Whitney Holding Corp., the holding company for Whitney National Bank of New Orleans, since 1990, and served in various executive and management capacities with AmSouth Bank, N.A. from 1984 to 1990. Mr. Marks currently serves as a director of CLECO Corporation and CLECO Power, LLC. Mr. Marks has served as a director of ADTRAN since 1993. Mr. Marks is 59.

ROY J. NICHOLS has served as Chairman of the Board of Torch Concepts, Inc., a software development company specializing in business intelligence applications, since January 2000, and as its Chief Executive Officer since August 2000. He served as Vice Chairman of the Board, President and Chief Executive Officer of Nichols Research Corporation (a defense and information systems company), where he worked from 1976 until its merger with Computer Sciences Corporation in November 1999. Mr. Nichols also serves as a director of Sparta, Inc. and Applied Genomics, Inc. Mr. Nichols has served as a director of ADTRAN since 1994. Mr. Nichols is 64.

H. FENWICK HUSS has served as Associate Dean of the J. Mack Robinson College of Business at Georgia State University since 1998. Prior to serving as Associate Dean, Dr. Huss was the Director of the School of Accountancy at Georgia State from 1996 to 1998. He has been a member of the School of Accountancy faculty since 1989. He also served on the faculty of the University of Maryland as an assistant professor from 1983 to 1989, and is a visiting professor at the Universite Paris 1 Pantheon-Sorbonne. Dr. Huss was elected to our Board of Directors in October 2002. Dr. Huss is 52.

Information Regarding Directors Emeritus

Set forth below is certain information as of January 31, 2002, regarding our two directors emeritus, including their ages and principal occupations (which have continued for at least the past five years unless otherwise noted).

LONNIE S. MCMILLIAN is one of the co-founders of ADTRAN and currently serves as our director emeritus. Mr. McMillian served as our Secretary and director from 1986 to December 2002. Mr. McMillian served as Senior Vice President of ADTRAN from January 1996 until his retirement in June 2001. Mr. McMillian served as our Vice President–Engineering from January 1986 until August 1996 and as our Treasurer from January 1986 to January 1997. Mr. McMillian is 74.

JAMES L. NORTH is an attorney with James L. North & Associates in Birmingham, Alabama and has been counsel to ADTRAN since its incorporation in November 1985. Mr. North has been a

5

practicing attorney since 1965. Mr. North currently serves as our director emeritus and served as a director of ADTRAN from 1993 to December 2002. Mr. North is 66.

Meetings and Committees of the Board of Directors

The Board of Directors conducts its business through meetings of the full Board and through committees of the Board, consisting of an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. During the fiscal year ended December 31, 2002, the Board of Directors held nine meetings and the Audit Committee held nine meetings. The Compensation Committee did not take any actions in 2002 separate from the full Board. The Nominating and Corporate Governance Committee held one meeting. No director attended less than 75% of the aggregate of meetings of the Board of Directors and meetings of the committees of which he is a member.

The Audit Committee is responsible for assisting the Board of Directors in fulfilling its oversight responsibilities with respect to: (i) the financial reports and other financial information provided by us to the public or any governmental body; (ii) our compliance with legal and regulatory requirements; (iii) our systems of internal controls regarding finance, accounting and legal compliance that have been established by management and the Board; (iv) the qualifications and independence of our independent auditors; (v) the performance of our internal audit function and independent auditors; and (vi) our auditing, accounting, and financial reporting processes generally. In connection with these responsibilities, the Board has delegated to the Audit Committee the authority to select and hire our independent auditors and determine their fees and retentions terms. The Audit Committee is composed of W. Frank Blount, H. Fenwick Huss, William L. Marks and Roy J. Nichols, each of whom is independent as defined by Rule 4200(a)(14) of the National Association of Securities Dealers’ listing standards.

The Compensation Committee is responsible for setting the compensation of the Chairman of the Board and Chief Executive Officer and assisting the Board in discharging its responsibilities regarding the compensation of our other executive officers. In addition, the Compensation Committee is responsible for administering our Amended and Restated 1996 Employees Incentive Stock Option Plan, which had previously been the responsibility of our Stock Option Plan Committee. In 2002, the two committees were combined into the current Compensation Committee. The Compensation Committee is composed of W. Frank Blount, H. Fenwick Huss, William L. Marks and Roy J. Nichols.

The Nominating and Corporate Governance Committee is responsible for assisting the Board in identifying and attracting highly qualified individuals to serve as directors of ADTRAN and selecting director nominees and recommending them to the Board for election at annual meetings of stockholders. The Nominating and Corporate Governance Committee is composed of W. Frank Blount, William L. Marks and Roy J. Nichols.

The Board of Directors will consider stockholders’ nominees for election as directors at our 2004 Annual Meeting of Stockholders if submitted to us on or before November 10, 2003.See “Stockholder Proposals for 2004 Annual Meeting” below.

Audit Committee Report

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities relating to the accuracy and integrity of ADTRAN’s financial reporting. In March 2003, our Board of Directors adopted an updated Audit Committee Charter which sets forth the responsibilities of the Audit Committee. A copy of the Audit Committee Charter is filed as an appendix to this Proxy Statement. In addition, in December 2002, the Audit Committee also hired a Director of Internal Audit to perform the internal audit function for ADTRAN. The Director of Internal Audit reports directly to the Audit Committee.

6

The Audit Committee held nine meetings during the fiscal year ended December 31, 2002. Representatives of PricewaterhouseCoopers LLP, our independent auditors, attended each meeting. The Audit Committee reviewed and discussed with management and PricewaterhouseCoopers LLP our audited financial statements for the fiscal year ended December 31, 2002 and our unaudited quarterly financial statements for the quarters ended March 31, June 30 and September 30, 2002. The Audit Committee reviewed and discussed key corporate processes and the related adequacy of controls, with the objective of improving financial integrity and reporting accuracy. The Audit Committee also discussed with PricewaterhouseCoopers LLP the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards, AU § 380).

The Audit Committee also received the written disclosures and the letter from PricewaterhouseCoopers LLP that are required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and has discussed with PricewaterhouseCoopers LLP its independence. The Audit Committee reviewed the audit and non-audit services provided by PricewaterhouseCoopers LLP for the fiscal year ended December 31, 2002 and determined to engage PricewaterhouseCoopers LLP as the independent auditors of ADTRAN for the fiscal year ending December 31, 2003.

Based upon its review of the audited financial statements and the discussions noted above, the Audit Committee recommended that the Board of Directors include the audited financial statements in our Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the SEC.

Audit Committee:

W. Frank Blount

H. Fenwick Huss

William L. Marks

Roy J. Nichols

Director Compensation

Non-employee directors of ADTRAN are paid an annual fee of $10,000, plus $1,000 for each Board or committee meeting attended in person and $500 for each Board or committee meeting attended by telephone. Directors who are employees of ADTRAN receive no directors’ fees. All directors are reimbursed for their reasonable expenses in connection with the performance of their duties.

Our non-employee directors, including our directors emeritus, are entitled to participate in our Amended and Restated 1995 Directors Stock Option Plan (the “Directors Plan”). As of January 31, 2003, there were a total of 200,000 shares reserved for issuance under the Directors Plan, of which 146,250 shares were subject to outstanding options. The Directors Plan provides for the grant of nonqualified stock options to directors who are not otherwise employees of ADTRAN. As of January 31, 2003, there were five directors and two directors emeritus eligible to participate in the Directors Plan. The Directors Plan is administered by the Board of Directors. Subject to the terms of the Directors Plan, the Board has the authority to determine the terms and provisions of the option agreements, to interpret the provisions of the Directors Plan, to prescribe, amend and rescind any rules and regulations relating to the Directors Plan, and to make all determinations necessary or advisable for the administration of the Directors Plan.

Under the terms of the Directors Plan, an eligible director is granted a nonqualified stock option to purchase 10,000 shares of common stock upon such director’s initial election to the Board, and receives an additional nonqualified stock option to purchase 5,000 shares of common stock as of December 31 of each subsequent calendar year in which the director is still serving as an eligible director. The options have a term of ten years, and the exercise price of the options is the fair market value of our common

7

stock on the date of grant. The exercise price may be paid in cash, shares of common stock, or both. The options generally vest as of the first anniversary of the grant date; however, all non-vested options previously granted to an eligible director immediately vest upon such director becoming “Disabled” (as defined in the Directors Plan), upon his death or upon a “Change in Control” of ADTRAN (as defined in the Directors Plan). Generally, unexercised options terminate three months after an optionee ceases serving as a director. However, the post-service exercise period is extended to a year after termination due to “Disability,” and unexercised options terminate immediately if the director is terminated for “Cause” (as defined in the Directors Plan) prior to a “Change in Control.” In addition, if a director dies during service, or during a period following termination of service when his options have not yet terminated as provided above, the director’s beneficiary can exercise the options for up to one year after the date of the director’s death. The options will not be exercisable past their expiration date, however, regardless of the reason for termination of the director’s service. No options may be granted under the Directors Plan more than ten years after its date of adoption. The Directors Plan will terminate on the later of (a) the complete exercise or lapse of the last outstanding option granted under the Directors Plan or (b) the last date upon which options may be granted under the Directors Plan, subject to its earlier termination by the Board at any time.

Effective December 20, 2001, the Board of Directors amended the Directors Plan to permit the non-employee directors to participate in a stock option exchange program that we effected. The stock option exchange program, which is described in more detail in a Tender Offer Statement on Schedule TO that we filed with the SEC on January 28, 2002, permitted employees, officers and directors (collectively, the “qualified participants”) who held options granted before September 30, 2000 with an exercise price of at least $40.00 per share and who had not received options after July 23, 2001 to tender these options in exchange for new options to be granted at least six months and two days after the cancellation of the tendered options. To receive the new options, the qualified participant had to remain an employee or director of ADTRAN at the end of that six month and two day period. Each new option is exercisable for a number of shares of common stock equal to three shares for every four shares subject to the tendered option, plus the remaining shares, if any, to the extent the number of shares underlying the tendered option was not divisible by four.

Pursuant to the amendment to the Directors Plan, the grant of stock options scheduled to occur on December 31, 2001 was eliminated. Messrs Blount, Marks, Nichols and North, who were all non-employee directors as of December 31, 2001, participated in the stock option exchange program and, pursuant to the amendment to the Director Plan, were each granted an option exercisable for 5,000 shares of our common stock on August 30, 2002, following the six month and two day period after the cancellation of all tendered options.

The Directors Plan was also amended to provide for the grant of new options to the non-employee directors who participated in the stock option exchange program. The new options were granted on August 30, 2002 to the participating non-employee directors and are exercisable for shares of our common stock in the following amounts: Mr. Blount—3,750 shares; Mr. Marks—3,750 shares; Mr. Nichols—9,000 shares; and Mr. North—3,750 shares. Each new option granted to the participating non-employee directors was fully vested upon grant and will expire on the expiration date of the option that was tendered in exchange for such new option.

In addition, on December 31, 2002, in accordance with the terms of the Directors Plan, options exercisable for 5,000 shares of common stock were granted to Messrs. Anderson, Blount, Marks, Nichols and North. Mr. McMillian has waived all option grants for which he is eligible under the Directors Plan. Mr. Anderson, who was elected to the Board on February 14, 2002, was granted an option on that date to purchase 10,000 shares of our common stock under the Directors Plan. Dr. Huss, who became a member of the Board on October 14, 2002, was granted an option on that date to purchase 10,000 shares of our common stock under the Directors Plan.

8

EXECUTIVE COMPENSATION

Compensation Summary

The following table sets forth, for the fiscal years ended December 31, 2002, 2001 and 2000, the total compensation earned by our Chief Executive Officer and each of our four other most highly compensated executive officers who were serving as executive officers as of December 31, 2002 (collectively referred to as the “named executive officers”). For information regarding the various factors considered by the Compensation Committee and the Board of Directors in determining the compensation of the Chief Executive Officer and, generally, our other executive officers, see “Compensation Committee Report on Executive Compensation” below.

TABLE 1: Summary Compensation Table

Annual Compensation | Long Term Compensation | |||||||||||

Name and Principal Position | Year | Salary(1) | Bonus (2) | All Other Compensation (3) | Securities Under- | |||||||

Mark C. Smith | 2002 2001 2000 | 284,865 308,288 300,000 | $

| -0- -0- 97,500 | $ | 6,000 | -0- -0- -0- | |||||

Howard A. Thrailkill | 2002 2001 2000 | 280,558 303,519 295,000 |

| -0- -0- 95,875 | | 6,000 | 111,250 | |||||

Robert A. Fredrickson | 2002 2001 2000 | 185,602 185,816 175,000 |

| 158,013 140,339 284,620 | | 6,000 | 66,000 | |||||

Steven L. Harvey | 2002 2001 2000 | 168,312 180,272 175,000 |

| 197,178 309,224 316,172 | | 6,000 | 69,751 | |||||

Thomas R. Stanton | 2002 2001 2000 | 246,096 265,365 250,000 |

| -0- -0- 125,000 | | 6,000 | 102,750 | |||||

| (1) | Includes amounts deferred at the election of the executive officers pursuant to our Section 401(k) retirement plan and our deferred compensation plan. |

| (2) | Includes amounts paid pursuant to the officer bonus plan and earned as commissions on sales. No bonuses were awarded in fiscal 2001 or 2002; consequently, amounts indicated for 2001 and 2002 consist solely of commissions on sales. |

| (3) | Consists of ADTRAN’s contributions to the executive officers’ Section 401(k) retirement plan accounts. |

9

Option Grants

The following table sets forth information regarding the number and terms of stock options granted to the named executive officers during the fiscal year ended December 31, 2002. Included in such information, in accordance with the rules and regulations of the SEC, is the potential realizable value of each option granted, calculated using the 5% and 10% option pricing model.

TABLE 2: Option Grants In Last Fiscal Year

Individual Grants | Potential Realization Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (2) | ||||||||||||||

Name | Number of Securities Underlying Options Granted (#) | % of Total Options Granted to Employees in Fiscal Year | Exercise or Base Price ($/Sh) (1) | Expiration Date | 5% ($) | 10% ($) | |||||||||

Mark C. Smith | -0- | — |

| — | — |

| — |

| — | ||||||

Howard A. Thrailkill | 5,749(3) | 0.3% | $ | 17.39 | 07/12/10(6) | $

| 47,734 419,307 726,373 | $ | 114,330 | ||||||

Robert A. Fredrickson | 5,749(8) | 0.3 | | 17.39 | 07/12/10(6) |

| 47,734 201,355 475,444 | | 114,330 | ||||||

Steven L. Harvey | 3,751(10) | 0.2 | | 17.39 | 07/16/06(6) |

| 14,057 47,734 201,355 475,444 | | 30,273 | ||||||

Thomas R. Stanton | 2,250(13) | 1.1 | | 17.39 | 11/15/05(6) |

| 6,167 5,621 47,734 325,899 713,167 | | 12,951 | ||||||

| (1) | The exercise price of an option may be paid in cash, by delivery of already owned shares of our common stock or by a combination of the above, subject to certain conditions. |

| (2) | Amounts represent hypothetical gains assuming exercise at the end of the option term and assuming rates of stock price appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date. The 5% and 10% assumed rates of appreciation are mandated by the rules of the SEC. These assumptions are not intended to forecast future appreciation of our stock price. The potential realizable value computation does not take into account federal or state income tax consequences of option exercises or sales of appreciated stock. The actual gains, if any, on the stock option exercises will depend on the future performance of our common stock, the optionee’s continued employment through applicable vesting periods and the date on which the options are exercised and the underlying shares are sold. The closing price of our common stock on March 3, 2003, the record date, was $30.95 per share. |

| (3) | The indicated number of options were granted to Mr. Thrailkill on August 30, 2002 pursuant to the stock option exchange program. The options vest as follows: one share vests on July 12, 2003 and the remaining shares vest on July 12, 2004. |

| (4) | The indicated number of options were granted to Mr. Thrailkill on August 30, 2002 pursuant to the stock option exchange program. The options vest as follows: 28,126 shares vested on August 30, 2002, 14,061 shares vest on July 12, 2003 and 8,314 shares vest on July 12, 2004. |

10

| (5) | The indicated options were granted to the named executive officers on October 16, 2002 pursuant to the Amended and Restated 1996 Employees Incentive Stock Option Plan. The options vest in four equal annual installments beginning on the first anniversary of the date of grant. |

| (6) | The indicated option has the same expiration date as the corresponding option tendered by the named executive officer in the stock option exchange program. |

| (7) | The indicated option was granted for a term of ten years, subject to earlier termination upon occurrence of certain events related to termination of employment or change of control of ADTRAN. |

| (8) | The indicated option was granted to Mr. Fredrickson on August 30, 2002 pursuant to the stock option exchange program. The option vests as follows: one share vests on July 12, 2003 and the remaining shares vest on July 12, 2004. |

| (9) | The indicated option was granted to Mr. Fredrickson on August 30, 2002 pursuant to the stock option exchange program. The option vests as follows: 15,000 shares vested on August 30, 2002, 7,499 shares vest on July 12, 2003 and 1,752 shares vest on July 12, 2004. |

| (10) | The indicated option was granted to Mr. Harvey on August 30, 2002 pursuant to the stock option exchange program. The option was fully vested on the date of grant. |

| (11) | The indicated option was granted to Mr. Harvey on August 30, 2002 pursuant to the stock option exchange program. The option vests as follows: one share vests on July 12, 2003 and the remaining shares vest on July 12, 2004. |

| (12) | The indicated option was granted to Mr. Harvey on August 30, 2002 pursuant to the stock option exchange program. The option vests as follows: 15,000 shares vested on August 30, 2002, 7,499 shares vest on July 12, 2003 and 1,752 shares vest on July 12, 2004. |

| (13) | The indicated option was granted to Mr. Stanton on August 30, 2002 pursuant to the stock option exchange program. The option was fully vested on the date of grant. |

| (14) | The indicated option was granted to Mr. Stanton on August 30, 2002 pursuant to the stock option exchange program. The option was fully vested on the date of grant. |

| (15) | The indicated option was granted to Mr. Stanton on August 30, 2002 pursuant to the stock option exchange program. The option vests as follows: one share vests on July 12, 2003 and the remaining shares vest on July 12, 2004. |

| (16) | The indicated option was granted to Mr. Stanton on August 30, 2002 pursuant to the stock option exchange program. The option vests as follows: 22,500 shares vested on August 30, 2002, 11,249 shares vest on July 12, 2003 and 5,502 shares vest on July 12, 2004. |

Option Exercises

The following table sets forth option exercises by the named executive officers during the fiscal year ended December 31, 2002, including the aggregate value of gains on the date of exercise. The table also sets forth (i) the number of shares covered by options (both exercisable and unexercisable) as of December 31, 2002 and (ii) the respective value for “in-the-money” options, which represents the positive spread between the exercise price of existing options and the fair market value of our common stock at December 31, 2002.

11

TABLE 3: Aggregated Option Exercises In Last Fiscal Year And Fiscal Year-End Option Values

Number of Securities Underlying Unexercised Options at | Value of the Unexercised | |||||||||||||

Name | Shares Acquired on Exercise (#) | Value Realized ($) | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||

Mark C. Smith | -0- | $-0- | -0- | -0- | $ | -0- | $ | -0- | ||||||

Howard A. Thrailkill | -0- | -0- | 226,876 | 184,374 |

| 1,834,579 |

| 1,680,758 | ||||||

Robert A. Fredrickson | -0- | -0- | 103,626 | 107,000 |

| 841,971 |

| 1,002,670 | ||||||

Steven L. Harvey | -0- | -0- | 115,251 | 107,000 |

| 912,815 |

| 1,002,670 | ||||||

Thomas R. Stanton | -0- | -0- | 132,250 | 151,500 |

| 1,099,023 |

| 1,440,445 | ||||||

Replacement Grants During the Last Ten Completed Fiscal Years

In fiscal year 2002, we instituted a stock option exchange program which permitted qualified participants who held options granted before September 30, 2000 with an exercise price of at least $40.00 per share and who had not received options after July 23, 2001 to tender these options in exchange for new options to be granted at least six months and two days after the cancellation of the tendered options. Each new option is exercisable for a number of shares of common stock equal to three shares for every four shares subject to the tendered option, plus the remaining shares, if any, to the extent that the number of shares underlying the tendered option was not divisible by four. A more detailed description of this stock option exchange program is included in the “Compensation Committee Report on Executive Compensation” in this Proxy Statement. Except for this stock option exchange program, no other cancellation or repricing has occurred during the last ten years.

The following table sets forth the exercise price of stock options previously awarded to our executive officers who participated in the stock option exchange program and the exercise price of stock options received by those executive officers in the stock option exchange program.

12

TABLE 4: Replacement Grants During the Last Ten Completed Fiscal Years

Name | Date (1) | Number of Securities Underlying Replacement Options (#) (2) | Market Price of Stock at Time of Replacement Grant ($) | Exercise Price at Time of Replacement Grant ($) | New Exercise Price ($) | Length of Original Option Term Remaining at Date of Replacement Grant (3) | |||||||

Howard A. Thrailkill | 8/30/02 8/30/02 | 5,749(4) | $17.39 | $ | 69.813 | $17.39 | 7 years, 11 months 7 years, 11 months | ||||||

Robert A. Fredrickson | 8/30/02 8/30/02 | 5,749(5) | 17.39 | | 69.813 | 17.39 | 7 years, 11 months 7 years, 11 months | ||||||

Steven L. Harvey | 8/30/02 8/30/02 8/30/02 | 3,751(6) | 17.39 17.39 | | 56.250 | 17.39 17.39 | 3 years, 11 months 7 years, 11 months 7 years, 11 months | ||||||

Thomas R. Stanton | 8/30/02 8/30/02 8/30/02 8/30/02 | 2,250(7) | 17.39 | | 46.250 | 17.39 | 3 years, 2 months 3 years, 11 months 7 years, 11 months 7 years, 11 months | ||||||

P. Steven Locke | 8/30/02 8/30/02 | 13,248(8) 1,752(8) | 17.39 17.39 |

| 66.500 66.500 | 17.39 17.39 | 7 years, 11 months 7 years, 11 months | ||||||

Everette R. Ramage | 8/30/02 8/30/02 8/30/02 8/30/02 | 1,838(9) 1,162(9) 7,983(9) 10,768(9) | 17.39 17.39 17.39 17.39 |

| 65.750 65.750 69.813 69.813 | 17.39 17.39 17.39 17.39 | 3 years, 11 months 3 years, 11 months 7 years, 11 months 7 years, 11 months | ||||||

Kevin W. Schneider | 8/30/02 8/30/02 8/30/02 8/30/02 | 1,838(10) 37(10) 7,983(10) 10,768(10) | 17.39 17.39 17.39 17.39 |

| 65.750 65.750 69.813 69.813 | 17.39 17.39 17.39 17.39 | 3 years, 11 months 3 years, 11 months 7 years, 11 months 7 years, 11 months | ||||||

Danny J. Windham | 8/30/02 8/30/02 | 5,749(11) 39,251(11) | 17.39 17.39 |

| 69.813 69.813 | 17.39 17.39 | 7 years, 11 months 7 years, 11 months | ||||||

| (1) | Represents the date that new options were granted under the stock option exchange program. The options tendered in the stock option exchange program were accepted and cancelled by ADTRAN on February 26, 2002. |

| (2) | Represents the number of shares underlying options granted on August 30, 2002. |

| (3) | The expiration date, and therefore the option term, of each new option is the same as that of the corresponding tendered option. |

| (4) | Mr. Thrailkill tendered options exercisable for a total of 75,000 shares of common stock in connection with these option grants. |

| (5) | Mr. Fredrickson tendered options exercisable for a total of 40,000 shares of common stock in connection with these option grants. |

| (6) | Mr. Harvey tendered options exercisable for a total of 45,000 shares of common stock in connection with these option grants. |

13

| (7) | Mr. Stanton tendered options exercisable for a total of 65,000 shares of common stock in connection with these option grants. |

| (8) | Mr. Locke tendered options exercisable for a total of 20,000 shares of common stock in connection with these option grants. |

| (9) | Mr. Ramage tendered options exercisable for a total of 29,000 shares of common stock in connection with these option grants. |

| (10) | Mr. Schneider tendered options exercisable for a total of 27,500 shares of common stock in connection with these option grants. |

| (11) | Mr. Windham tendered options exercisable for a total of 60,000 shares of common stock in connection with these option grants. |

EQUITY COMPENSATION PLAN INFORMATION

The following table gives information about our common stock that may be issued under all of our existing equity compensation plans as of December 31, 2002, which include:

| • | ADTRAN, Inc. Amended and Restated 1996 Employees Incentive Stock Option Plan, as amended |

| • | ADTRAN, Inc. Amended and Restated 1995 Directors Stock Option Plan, as amended |

| • | ADTRAN, Inc. 1986 Employee Incentive Stock Option Plan, as amended |

Plan Category | (a) Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | (b) Weighted Average Exercise Price of Outstanding Options, Warrants and Rights | (c) Number of Securities Remaining Available | (d) Total of Securities Reflected in | |||||

Equity Compensation Plans Approved by Stockholders | 5,496,316 | $ | 24.85 | 2,726,358 | 8,222,674 | ||||

Equity Compensation Plans Not Approved by Stockholders | — |

| 0.00 | — | — | ||||

TOTAL | 5,496,316 | $ | 24.85 | 2,726,358 | 8,222,674 | ||||

Compensation Committee Report on Executive Compensation

This Report of the Compensation Committee of the Board of Directors on Executive Compensation discusses the methods that were used to determine executive compensation for the fiscal year ended December 31, 2002. The report specifically reviews the methods employed in setting the compensation of our Chairman of the Board and Chief Executive Officer (the “Chief Executive Officer”) and generally with respect to all executive officers.

For 2002, the compensation of our Chief Executive Officer was determined by the Compensation Committee and the Board of Directors without any reference to quantitative measures of individual or company performance but based instead solely on a subjective evaluation of the performance of the Chief Executive Officer and ADTRAN.

The compensation paid to our other executive officers for 2002 was determined by the Chief Executive Officer in his discretion and was recommended by him to the Compensation Committee and the full Board for approval. Similar to the determination of the Chief Executive Officer’s compensation, the Chief Executive Officer based the compensation levels of the other executive officers not on any quantitative measures of individual or company performance but upon his subjective evaluation of the

14

performance of the individual executive officers and ADTRAN. The Compensation Committee and the full Board approved the recommendations of the Chief Executive Officer with regard to the 2002 compensation of each of our other executive officers.

In 1997, the Board of Directors established a bonus incentive compensation program (the “Bonus Program”) for certain of our executive officers. Bonuses granted under the Bonus Program are determined by a formula based on (i) targeted increases in our per share after tax earnings from the end of a fiscal year to the end of the following fiscal year and (ii) achievement of specified operational targets on a divisional level such as unit volume targets and revenue targets. In addition, from time to time, the Chief Executive Officer has granted additional bonuses to executive officers based upon his assessment of their individual performance. For fiscal 2002, we did not award any individual performance bonuses or any bonuses under the Bonus Program.

Stock Option Exchange Program

We believe that one of the keys to our continued growth and success is the retention of our most valuable assets, our employees and directors. In early 2002, we determined that some of our outstanding options under the ADTRAN, Inc. Amended and Restated 1996 Employees Incentive Stock Option Plan, as amended, the ADTRAN, Inc. Amended and Restated 1995 Directors Stock Option Plan, as amended, and the ADTRAN, Inc. 1986 Employee Incentive Stock Option Plan, as amended (collectively, the “Stock Incentive Plans”), whether or not they were currently exercisable, had exercise prices that were significantly higher than the current market price of our common stock. We concluded that those options were unlikely to be exercised in the foreseeable future. As a result, we instituted a stock option exchange program to provide an opportunity for us to offer these employees and directors a valuable incentive to stay with our company. By making the offer to exchange outstanding eligible options for new options that would have an exercise price equal to the fair market value of our common stock on the grant date, we intended to provide our employees and directors with the benefit of owning options that over time could have a greater potential to increase in value, create better performance incentives for employees and directors and thereby maximize stockholder value.

The stock option exchange program, which is described in more detail in a Tender Offer Statement on Schedule TO that we filed with the SEC on January 28, 2002, permitted qualified participants who held options granted before September 30, 2000 with an exercise price of at least $40.00 per share and who had not received options after July 23, 2001 to tender these options in exchange for new options to be granted at least six months and two days after the cancellation of the tendered options. To receive the new options, the qualified participant had to remain an employee or director of ADTRAN at the end of that six month and two day period. Each new option is exercisable for a number of shares of common stock equal to three shares for every four shares subject to the tendered option, plus the remaining shares, if any, to the extent the number of shares underlying the tendered option was not divisible by four.

A total of 1,434,400 options were tendered and cancelled under the stock option exchange program. On August 30, 2002, a total of 991,683 new options were granted to qualified participants. The exercise price of the new options was $17.39 per share, which was the closing market price of our common stock on the Nasdaq National Market on that date. Each new option granted to the qualified participants vests in accordance with the vesting schedule of the corresponding tendered option and will expire on the expiration date of the corresponding tendered option. Eight of our executive officers participated in the stock option exchange program. Their names and the number of options they received in connection with the stock option exchange program are set forth in the “Replacement Grants During the Last Ten Completed Fiscal Years” table included in this Proxy Statement. (See “Table 4: Replacement Grants During the Last Ten Completed Fiscal Years.”) Messrs. Blount, Marks, Nichols and North of our

15

Board of Directors also participated in the stock option exchange program. (See “Director Compensation” in this Proxy Statement.)

Limitations on the Deductibility of Executive Compensation

Pursuant to the Omnibus Budget Reconciliation Act of 1993, certain non-performance-based compensation in excess of $1,000,000 to executives of public companies is no longer deductible to these companies. Qualifying performance-based incentive compensation, however, would be both deductible and excluded for purposes of calculating the $1,000,000 compensation threshold. In this regard, the Compensation Committee must determine whether any actions with respect to this new limit should be taken by ADTRAN. Our executive compensation for 2002 did not exceed the legal limitations. The Compensation Committee will continue to monitor this situation and will take appropriate action if it is warranted in the future.

Compensation Committee:

W. Frank Blount

H. Fenwick Huss

Williams L. Marks

Roy J. Nichols

Compensation Committee Interlocks and Insider Participation

None of our executive officers or directors serves as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors or Compensation Committee.

Certain Relationships and Related Transactions

James L. North, a partner in the law firm of James L. North & Associates, is one of our directors emeritus and as of December 31, 2002, beneficially owned 146,750 shares of our common stock. We paid James L. North & Associates fees of $120,000 for legal services rendered to us during 2002. All bills for services rendered by James L. North & Associates are reviewed and approved by our Chief Financial Officer. We believe that the fees for such services are comparable to those charged by other firms for services rendered to us.

For fiscal year 2002, we received payments, directly and indirectly, from BellSouth Corporation in the amount of approximately $31.1 million for products supplied to BellSouth. We also paid $409,419 to BellSouth for services provided by BellSouth to us. Richard A. Anderson, one of our directors, is the President—Customer Markets of BellSouth.

16

STOCK PERFORMANCE GRAPH

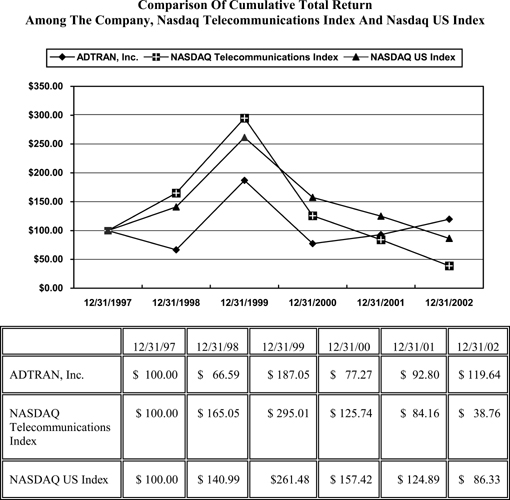

Our common stock began trading on the Nasdaq National Market on August 9, 1994. The price information reflected for our common stock in the following performance graph and accompanying table represents the closing sales prices of the common stock for the period from December 31, 1996 through December 31, 2002 on an annual basis. The graph and the accompanying table compare the cumulative total stockholders’ return on our common stock with the Nasdaq Telecommunications Index and the Nasdaq US Index. The calculations in the following graph and table assume that $100 was invested on December 31, 1996 in each of our common stock, the Nasdaq Telecommunications Index and the Nasdaq US Index and also assume dividend reinvestment. The closing sale price of our common stock on the Nasdaq National Market was $30.95 per share on March 3, 2003.

17

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and regulations of the SEC thereunder require our directors, officers and persons who own more than 10% of our common stock, as well as certain affiliates of such persons, to file initial reports of their ownership of our common stock and subsequent reports of changes in such ownership with the SEC. Directors, officers and persons owning more than 10% of our common stock are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file. Based solely on our review of the copies of such reports received by us, we believe that during the fiscal year ended December 31, 2002, our directors, officers and owners of more than 10% of our common stock complied with all applicable filing requirements.

PROPOSAL 2—RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee of our Board of Directors, in accordance with its charter and authority delegated to it by the Board, has appointed the firm of PricewaterhouseCoopers LLP to serve as our independent auditors for the fiscal year ending December 31, 2003, and the Board of Directors has directed that such appointment be submitted to our stockholders for ratification at the Annual Meeting. PricewaterhouseCoopers LLP has served as our independent auditors since 1986 and is considered by our Audit Committee to be well qualified. If the stockholders do not ratify the appointment of PricewaterhouseCoopers LLP, the Audit Committee will reconsider the appointment.

Representatives of PricewaterhouseCoopers LLP will be present at the Annual Meeting and will have an opportunity to make a statement if they desire to do so. They also will be available to respond to appropriate questions from stockholders.

Fees Billed to ADTRAN by PricewaterhouseCoopers LLP in 2002

Audit Fees

Audit fees for the fiscal year ended December 31, 2002 for the audit of our annual financial statements and the review of the financial statements included in our Quarterly Reports on Form 10-Q totaled $261,320, of which $196,920 had been billed to us by PricewaterhouseCoopers LLP as of December 31, 2002.

Financial Information Systems Design and Implementation Fees

We did not engage PricewaterhouseCoopers LLP to provide advice to us regarding financial information systems design and implementation during the fiscal year ended December 31, 2002.

All Other Fees

Audit-Related Fees. Fees billed to us by PricewaterhouseCoopers LLP during the fiscal year ended December 31, 2002 for audit-related services rendered to us, including benefit plan audit services, services in connection with our stock option exchange program and miscellaneous accounting consulting services, totaled $65,400.

Tax Fees. Fees billed to us by PricewaterhouseCoopers LLP during the fiscal year ended December 31, 2002 for tax services rendered to us, including tax return preparation and compliance services and tax consulting services, totaled $155,390.

The Audit Committee of the Board of Directors has determined that the provision of these services is compatible with the maintenance of the independence of PricewaterhouseCoopers LLP.

18

The Audit Committee of the Board of Directors and the Board unanimously recommend that the stockholders vote “FOR” the proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent auditors.

STOCKHOLDERS’ PROPOSALS FOR 2003 ANNUAL MEETING

Proposals of stockholders, including nominations for the Board of Directors, intended to be presented at the 2004 Annual Meeting of Stockholders should be submitted by certified mail, return receipt requested, and must be received by us at our executive offices in Huntsville, Alabama, on or before November 10, 2003 to be eligible for inclusion in our proxy statement and form of proxy relating to that meeting and to be introduced for action at the meeting. Any stockholder proposal must be in writing and must comply with Rule 14a-8 under the Exchange Act and must set forth (i) a description of the business desired to be brought before the meeting and the reasons for conducting the business at the meeting, (ii) the name and address, as they appear on our books, of the stockholder submitting the proposal, (iii) the class and number of shares that are beneficially owned by such stockholder, (iv) the dates on which the stockholder acquired the shares, (v) documentary support for any claim of beneficial ownership as required by Rule 14a-8, (vi) any material interest of the stockholder in the proposal, (vii) a statement in support of the proposal and (viii) any other information required by the rules and regulations of the SEC.

OTHER MATTERS THAT MAY COME BEFORE THE ANNUAL MEETING

Our Board of Directors knows of no matters other than those referred to in the accompanying Notice of Annual Meeting of Stockholders which may properly come before the Annual Meeting. However, if any other matter should be properly presented for consideration and voting at the Annual Meeting or any adjournments thereof, it is the intention of the persons named as proxies on the enclosed form of proxy card to vote the shares represented by all valid proxy cards in accordance with their judgment of what is in the best interest of ADTRAN.

By Order of the Board of Directors. | ||

| ||

Mark C. Smith | ||

Chairman of the Board and | ||

Chief Executive Officer | ||

Huntsville, Alabama

March 10, 2003

Our 2002 Annual Report, which includes audited financial statements, has been mailed to our stockholders with these proxy materials. The Annual Report does not form any part of the material for the solicitation of proxies.

19

APPENDIX A

CHARTER OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS OF

ADTRAN, INC.

| 1. | Purpose |

The Audit Committee (the “Committee”) of the Board of Directors of ADTRAN, Inc. (the “Company”) shall assist the Board of Directors (the “Board”) in fulfilling its oversight responsibilities with respect to: (i) the financial reports and other financial information provided by the Company to the public or any governmental body; (ii) the Company’s compliance with legal and regulatory requirements; (iii) the Company’s systems of internal controls regarding finance, accounting and legal compliance that have been established by management and the Board; (iv) the qualifications and independence of the Company’s independent auditors; (v) the performance of the Company’s internal audit function and independent auditors; and (vi) the Company’s auditing, accounting, and financial reporting processes generally. To this end, the Committee will maintain free and open communication with the Board, the independent auditors, the Company’s internal auditor and financial management of the Company. The Committee will also prepare the report of the Committee required by the rules of the Securities and Exchange Commission to be filed in the Company’s annual proxy statement. Consistent with its functions, the Committee will encourage continuous improvement of, and will foster adherence to, the Company’s policies, procedures and practices at all levels.

The Committee will primarily fulfill its responsibilities by carrying out the activities enumerated in Section 5 of this Charter.

As an oversight body, the Committee does not have responsibility for day-to-day operations and financial reporting. It is not the responsibility of the Committee to plan or conduct audits or to determine that the Corporation’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles; rather, this is the responsibility of management and the independent auditors.

| 2. | Composition and Organization |

The Committee will consist of three or more directors as determined by the Board, each of whom must be an “independent director,” as defined by applicable listing standards of The Nasdaq Stock Market Inc. (“Nasdaq”) and as may be modified or defined by the Securities and Exchange Commission (“SEC”) pursuant to its rule-making authority under the Securities Exchange Act of 1934, as amended. Each member of the Committee will be appointed annually by the Board and will serve as long as he or she remains an independent member of the Board, or until he or she resigns or is removed by the Board and his or her successor is duly elected and qualified. The members of the Committee may be removed by the Board at any time. Unless a chairman of the Committee (the “Chair”) is elected by the full Board, the members of the Committee may designate a Chair by majority vote of the full Committee membership. The Committee shall have the power to create subcommittees with such powers as the Committee shall from time to time confer.

| 3. | Qualifications |

Each member of the Committee must be able to read and understand fundamental financial statements, including the Company’s balance sheet, income statement and cash flow statement. The Chair must have past employment experience in finance or accounting, requisite professional certification in accounting or any other comparable experience or background which results in the individual’s financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities or other experience as required by applicable law. In addition, the Committee will comply with the “audit committee financial expert” requirements set forth in applicable rules and regulations of the SEC and Nasdaq.

| 4. | Meetings |

The Committee will meet at least four times annually. As part of its job to foster open communication, the Committee will meet at least quarterly with management, the internal auditor and the independent auditors in separate executive sessions to discuss any matters that the Committee or any of these groups believe should be discussed privately. In addition, the Committee will meet with the independent auditors and management quarterly to review the Company’s financials, consistent with Section 5 below.

| 5. | Responsibilities and Duties |

To fulfill its responsibilities and duties the Committee will:

| 1. | Document / Report Review |

| (a) | Review this Charter at least annually and update, as necessary. |

| (b) | Review any reports or other financial information submitted to any governmental body, or the public, including any certification, report, opinion, or review rendered by the independent auditors. |

| (c) | Review the regular internal reports to management prepared by the internal auditing department and management’s response. |

| (d) | Review with financial management and the independent auditors each Form 10-Q and Form 10-K prior to its filing. |

| (e) | Review, at least annually, a report by the independent auditors describing: (i) the independent auditors’ internal quality-control procedures and (ii) any material issues raised by the most recent internal quality-control review, or peer review, of the independent auditors, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the independent auditors, and any steps taken to deal with any such issues. |

| (f) | Review a formal written statement submitted by the independent auditors to the Company at least annually which delineates all relationships between the independent auditors and the Company, consistent with Independence Standards Board Standard No. 1. |

A-2

| (g) | Review a report of the independent auditors prior to the filing of the Form 10-K or the release of any audited financial statements of the Company with respect to: |

| (i) | all critical accounting policies and practices used; |

| (ii) | all alternative treatments of financial information within generally accepted accounting principles (GAAP) that have been discussed with management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditor; and |

| (iii) | other material written communications between the independent auditors and management, such as any management letter or schedule of unadjusted differences. |

| (h) | Review with management, including both the Chief Executive Officer and Chief Financial Officer: (i) on a quarterly basis, the report of the Disclosure Controls Committee and the internal control system, and (ii) on an annual basis, the internal control report to be filed with the Company’s annual report on Form 10-K. |

| (i) | Prepare (or cause to be prepared) the report of the Committee to be included in the Company’s annual proxy statement. |

| 2. | Independent Auditors and Other Advisors |

| (a) | Select and hire the independent auditors, considering independence and effectiveness. On an annual basis, the Committee should review and discuss with the independent auditors all disclosed relationships the independent auditors have with the Company to determine the independent auditors’ objectivity and independence, consistent with Independence Standards Board Standard No. 1. |

| (b) | Have the sole power to approve the independent auditors’ fees. |

| (c) | Approve all audit and non-audit services provided by the independent auditors,prior to the Company’s receipt of such services. All approved non-audit services shall be disclosed in the Company’s periodic reports required by Section 13(a) of the Securities Exchange Act of 1934. |

| (d) | Review and evaluate the qualifications, performance and independence of the independent auditors; when circumstances warrant, discharge the independent auditors; and nominate independent auditors for stockholder approval in the Company’s annual proxy statement. The independent auditors will be accountable to the Board and the Committee, as representatives of the stockholders of the Company. |

| (e) | Periodically consult with the independent auditors out of the presence of management about internal controls and the fullness and accuracy of the Company’s financial statements. |

| (f) | Set clear hiring policies for employees or former employees of the independent auditors, including the requirement that no person be hired as Chief Executive |

A-3

Officer, Chief Financial Officer, Controller, Chief Accounting Officer or any equivalent position if such person was employed by the independent auditors and participated in any capacity in the audit of the Company during the one year period preceding the date of initiation of such audit. |

| (g) | Hire and determine the fees and other retention terms for legal, accounting and other advisors to the Committee as it sees fit, without Board approval. |

| 3. | Financial Reporting Processes |

| (a) | Discuss the annual audited financial statements and quarterly financial statements with management, the internal auditor and the independent auditors, including the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operation.” |

| (b) | Discuss earnings press releases, as well as financial information and earnings guidance provided to analysts and rating agencies. |

| (c) | In consultation with the independent auditors and the internal auditor, review the integrity of the Company’s internal and external financial reporting processes. |

| (d) | Consider the independent auditors’ judgments about the quality and appropriateness of the Company’s accounting principles as applied in its financial reporting. |

| (e) | Consider and approve, if appropriate, major changes to the Company’s accounting principles and practices as suggested by the independent auditors, management or the internal auditing department. |

| 4. | Process Improvement |

| (a) | Establish regular and separate systems of reporting to the Committee by each of management, the independent auditors and the internal auditor regarding any significant judgments made in management’s preparation of the financial statements and the view of each as to appropriateness of such judgments. |

| (b) | Following completion of the annual audit, review separately with each of management, the independent auditors and the internal auditing department any problems or difficulties encountered during the course of the audit, including any restrictions on the scope of work or access to required information, and management’s response to the problems or difficulties. |

| (c) | Review any significant disagreement between management and the independent auditors or the internal auditing department in connection with the preparation of the financial statements. |

| (d) | Review with the independent auditors, the internal auditing department and management the extent to which changes or improvements in financial or accounting practices, as approved by the Committee, have been implemented. |

A-4

| (e) | Report to the Board on a regular basis and forward copies of the minutes of all meetings to the Board. |

| (f) | Establish procedures for: (i) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or audit matters; and (ii) the confidential anonymous submission by employees of concerns regarding accounting or auditing matters. |

| (g) | Annually review and evaluate the performance of the Committee. |

| 5. | Legal Compliance |

| (a) | Review activities, organizational structure, and qualifications of the internal audit department. |

| (b) | Review, with the Company’s counsel, any legal matter that could have a significant impact on the Company’s financial statements and compliance programs and policies. |

| (c) | Review and discuss the Company’s risk assessment and risk management policies. |

| (d) | Review and approve all related party transactions. |

| (e) | Perform any other activities consistent with this Charter, the Company’s Bylaws and governing law, as the Committee or the Board deems necessary or appropriate. |

A-5

REVOCABLE PROXY

COMMON STOCK

ADTRAN, Inc.

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS FOR THE 2003 ANNUAL MEETING OF STOCKHOLDERS

The undersigned hereby appoints Howard A. Thrailkill and James E. Matthews, and each of them, proxies, with full power of substitution, to act for and in the name of the undersigned to vote all shares of common stock of ADTRAN, Inc. (the “Company”) which the undersigned is entitled to vote at the 2003 Annual Meeting of Stockholders of the Company, to be held at the headquarters of the Company, 901 Explorer Boulevard, Huntsville, Alabama, on the second floor of the East Tower, on Thursday, April 10, 2003, at 10:30 a.m., local time, and at any and all adjournments thereof, as indicated below.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE BELOW-LISTED PROPOSALS

| 1) | Elect as directors the seven nominees listed below to serve until the 2004 Annual Meeting of Stockholders and until their successors are elected and qualified (except as marked to the contrary below): |

¨ FOR ALL NOMINEES listed below (except as marked to the contrary below). | ¨ WITHHOLD AUTHORITY to vote for all nominees listed below. |

INSTRUCTION: | To withhold authority to vote for any individual nominee, strike a line through the nominee’s name in the list below. Mark C. Smith, Howard A. Thrailkill, Richard A. Anderson, W. Frank Blount, H. Fenwick Huss, William L. Marks and Roy J. Nichols |