- ADTN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

ADTRAN (ADTN) CORRESPCorrespondence with SEC

Filed: 19 Jul 16, 12:00am

July 19, 2016

Via EDGAR

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, D.C. 20549

Attention: Mr. Carlos Pacho

| Re: | ADTRAN, Inc. Form 10-K for Fiscal Year Ended December 31, 2015 Filed February 24, 2016 Form 10-Q for Fiscal Quarter Ended March 31, 2016 Filed May 4, 2016 SEC Comment Letter Dated June 20, 2016 File No. 000-24612 |

Ladies and Gentlemen:

On behalf of our client, ADTRAN, Inc. (“ADTRAN” or the “Company” or, in appropriate context, “we”), we are responding to the letter dated June 20, 2016 (the “Comment Letter”) from Carlos Pacho, Senior Assistant Chief Accountant, Division of Corporation Finance of the Securities and Exchange Commission (the “Commission”).

Set forth below are the responses to the comments of the Commission staff (the “Staff”) provided to us by ADTRAN. For ease of reference, each comment contained in the Comment Letter appears directly above the corresponding response.

Form 10-K for the Fiscal Year Ended December 31, 2015

Management’s Discussion and Analysis of Financial Condition

And Results of Operations, page 29

Liquidity and Capital Resources, page 38

| 1. | If significant to an understanding of your liquidity, please clarify the amount of cash, cash equivalents and short term investments held by foreign subsidiaries. Additionally, to the extent material, please describe any significant amounts that may not be available for U.S. operations related to cash, cash equivalent and short term investments held by foreign subsidiaries where you consider earnings to be permanently reinvested. Also, address the potential tax implications of repatriation. |

Response:

As of December 31, 2015, our cash and cash equivalents were $84.6 million and short-term investments were $34.4 million, which provided an available short-term liquidity of $118.9 million. Of these amounts, our foreign subsidiaries held cash of $38.9 million, representing approximately 33% of available short-term liquidity, which is used to fund on-going liquidity needs of these subsidiaries. We intend to permanently reinvest these funds outside of the U. S. and our current business plans do not indicate a need to repatriate to fund domestic operations. However, if these funds were repatriated to the U.S. or used for U.S. operations, certain amounts related to the earnings and profits of our foreign subsidiaries could be subject to U.S. tax for the incremental amount in excess of the foreign tax paid. Due to the timing and circumstances of repatriation of such earnings, if any, it is not practical to determine the amount of funds subject to repatriation or the associated unrecognized deferred tax liability related to the amount.

We will expand our Management’s Discussion and Analysis of Financial Condition and Results of Operations in Form 10-K for the fiscal Year Ended December 31, 2016 and for the preceding and future interim periods to disclose the amount of cash, cash equivalents and short term investments held by foreign subsidiaries, including the portion subject to U. S. income tax if no longer permanently reinvested.

Form 10-Q for Fiscal Quarter Ended March 31, 2016

Note 11. Segment Information, page 20

| 2. | We note in the first quarter of 2016 the Company determined two new reportable segments based on an organizational realignment and changes in the information the chief operating decision maker regularly reviews. To help us understand how you applied the guidance in FASB ASC 280 in identifying your operating and reportable segments, please provide us with the following information: |

| • | Provide your organization chart which identifies the positions, roles, or functions that report directly to your chief operating decision maker (“CODM”) and senior management team; |

| • | Tell us the title and describe the role of your CODM and each of the individuals who report to the CODM; |

| • | Identify for us each of the operating segments you have determined in accordance with FASB ASC 280; |

| • | Identify and describe the role of each of your segment managers; |

| • | Tell us how often the CODM meets with his/her direct reports, the financial information the CODM reviews to prepare for those meetings, the financial information discussed in those meetings, and who attends those meetings; |

| • | Describe the information regularly provided to the CODM and tell us how frequently it is prepared; |

| • | Describe the information regularly provided to the Board of Directors and tell us how frequently it is prepared; |

| • | Describe the information about Network Solutions product offerings that are provided to the CODM, tell us whether there are managers accountable for the product offerings, and if so, tell us to whom they are accountable; |

| • | Explain how budgets are prepared, who approves the budget at each step of the process, the level of detail discussed at each step, and the level at which the CODM makes changes to the budget; |

| • | Describe the level of detail communicated to the CODM when actual results differ from budgets and who is involved in meetings with the CODM to discuss budget-to-actual variances; and, |

| • | Describe the basis for determining the compensation of the individuals that report to the CODM. |

Response:

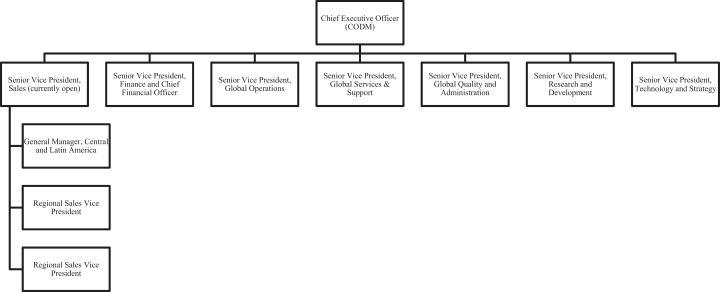

Provide your organization chart which identifies the positions, roles, or functions that report directly to your chief operating decision maker (“CODM”) and senior management team

The Company’s organization chart is attached as Appendix 1.

Tell us the title and describe the role of your CODM and each of the individuals who report to the CODM

The Company’s CODM is its Chief Executive Officer (CEO). The Company’s CEO is responsible for all strategic decisions and implementing the Company’s short and long-term goals. The following positions report directly to the Company’s CEO:

| • | Senior Vice President, Sales –Responsible for global sales of Network Solutions and Services & Support. This position is currently open. The following three positions are currently reporting directly to the CODM while the Company seeks to fill this position: |

| ¡ | General Manager – Central and Latin America – Primarily responsible for sales of Network Solutions and Services & Support to Services Providers (SPs) in Central and Latin America. |

| ¡ | Regional Sales Vice President – Primarily responsible for sales of Network Solutions and Services & Support to SPs in the United States, Canada and the Caribbean. |

| ¡ | Regional Sales Vice President – Primarily responsible for sales of Network Solutions and Services & Support to distributors and government agencies. |

| • | Senior Vice President, Finance and Chief Financial Officer – Responsible for all of the Company’s accounting and finance functions and investor relations. |

| • | Senior Vice President, Global Operations – Responsible for managing global production, logistics, customer service, business services, information technology, supply chain planning and procurement. |

| • | Senior Vice President, Global Services & Support – Responsible for all services fulfillment across the globe, as well as maintaining a high level of technical support. |

| • | Senior Vice President, Global Quality and Administration – Responsible for the management and continual improvement of the Company’s quality and human capital programs. |

| • | Senior Vice President, Research and Development – Responsible for all of the Company’s design and development resources and processes around the world. |

| • | Senior Vice President, Technology and Strategy – Responsible for developing the strategy, portfolio and direction for the Company’s global business to enable the delivery of customer solutions and market leadership into target market segments and the global customer base. |

Identify for us each of the operating segments you have determined in accordance with FASB ASC 280

In accordance with FASB ASC 280, the Company has identified two operating segments – 1) Network Solutions and 2) Services & Support. None of the Company’s operating segments were aggregated to determine its reportable segments. Although the General Manager – Central and Latin America and the two Regional Sales Vice Presidents are regionally based and temporarily report directly to the CODM, the CODM does not receive regional information to assess performance or allocate resources. The Company is currently in the process of realigning its sales function to be a single, global organization.

Identify and describe the role of each of your segment managers

The Company’s segment managers for its Network Solutions and Services & Support segments are the Senior Vice President, Global Operations, and the Senior Vice President, Services and Support, respectively, whose roles are described in the response above. Both of these segment managers report directly to the CODM.

Tell us how often the CODM meets with his/her direct reports, the financial information the CODM reviews to prepare for those meetings, the financial information discussed in those meetings, and who attends those meetings

The Company’s CODM has regularly scheduled weekly meetings with his direct reports. The CODM reviews actual and projected consolidated revenues for the current quarter, actual and projected consolidated revenues by major customer, and actual and projected revenues by operating segment on a daily basis and in preparation for the weekly meetings with his direct reports. In addition to the above items, actual and projected gross profit by operating segment and actual and projected consolidated operating expenses by functional area (selling, general and administrative expenses and research and development expense) are reviewed in the meeting. Customer sales and service opportunities and updates are also discussed.

Describe the information regularly provided to the CODM and tell us how frequently it is prepared

Monthly, the Company’s CODM is provided a reporting package that includes consolidated revenue and gross profit, revenues and gross profit by operating segment, consolidated operating expenses by functional area (selling, general and administrative expenses and research and development expense), revenue by customer, and a summary of the actual results compared to the current, quarterly income statement projection.

In addition to the monthly information described above, the Company’s CODM is provided a quarterly reporting package that includes consolidated financial statements (balance sheet, income statement, comprehensive income statement and statement of cash flows), reportable segment and category revenues, stock-based compensation expense, and a reconciliation of GAAP to Non-GAAP earnings per share.

Describe the information regularly provided to the Board of Directors and tell us how frequently it is prepared

The Company’s Board of Directors are provided a quarterly reporting package that includes consolidated financial statements (balance sheet, income statement, comprehensive income statement and statement of cash flows), reportable segment and category revenues, stock-based compensation expense, and a reconciliation of GAAP to Non-GAAP earnings per share. Additionally, information regarding the Company’s investment portfolio and performance is included.

Describe the information about Network Solutions product offerings that are provided to the CODM, tell us whether there are managers accountable for the product offerings, and if so, tell us to whom they are accountable

The Company’s Network Solutions product offerings include hardware products and next-generation virtualized solutions used in service provider or business networks, as well as prior-generation products. For the Company’s Network Solutions operating segment, the CODM receives actual and projected revenue, actual and projected gross profit information and revenue information by customer. The Senior Vice President, Global Operations, who reports directly to the CODM, is accountable for the Network Solutions operating segment.

Explain how budgets are prepared, who approves the budget at each step of the process, the level of detail discussed at each step, and the level at which the CODM makes changes to the budget

An income statement projection is prepared each quarter and is used to monitor the performance of the Company. The overall process is driven by the CODM, who establishes revenue and profitability targets, which are used to develop the projection. There are no other approvals during the process. The income statement projection includes revenue information by reportable segment, which is provided by the Company’s global sales and service teams, and gross profit information by reportable segment, which is provided by global operations, services and accounting. Operating expenses and other income/expense are projected on a consolidated basis only and are not allocated to the Company’s operating segments. Department managers provide information at a trial balance level to develop the operating expense projection. Once complete, the Senior Vice President, Finance and Chief Financial Officer presents the income statement projection to the CODM in a summarized format that includes revenue and gross profit by operating segment, and operating expenses and other income/expense at a consolidated level. Any changes requested by the CODM are done at the summarized level presented to him.

Describe the level of detail communicated to the CODM when actual results differ from budgets and who is involved in meetings with the CODM to discuss budget-to-actual variances

The income statement projection is reviewed during the weekly staff meetings that the CODM has with his direct reports (see Appendix 1). Changes to the projection and the actual results versus the projection are discussed in these weekly meetings. The CODM discusses any significant variances with his direct reports during the weekly staff meeting. The CODM’s direct reports provide the key drivers of any significant variance to the projection, such as revenue information by segment or customer for revenue variances, or significant items that impact the actual operating expenses by functional area (selling, general and administrative expenses and research and development expense).

Describe the basis for determining the compensation of the individuals that report to the CODM

Our executive compensation program consists of base salary, commissions for sales executives, an annual Variable Incentive Cash Compensation (VICC) program, and long-term equity incentives in the form of stock options and performance-based restricted stock units. Executive officers are also eligible to participate in a nonqualified deferred compensation program and in certain benefit programs that are generally available to all of our employees, such as medical insurance programs, life insurance programs and our 401(k) plan. The Compensation Committee of our Board of Directors oversees our executive compensation program.

The Company’s sales executives generally receive half of their cash compensation (not including any annual VICC, if any) in base salary and half in commissions. Neither of the Company’s segment managers receives commissions.

The VICC plan is designed to motivate and reward executives for their contribution to the Company’s performance during the fiscal year. In 2016, all of the Senior Vice Presidents that report to the CODM, including the segment managers, are eligible to participate in the VICC plan, which is comprised of total company growth goals (total revenue and total operating income) and individual objectives.

The number of performance shares earned by executives is based on the Company’s total shareholder return against a peer group over a three-year performance period.

Annually, changes in the compensation for the individuals that report to the CODM are submitted to the Compensation Committee for approval.

| 3. | Furthermore, please include a reconciliation of the segments ‘reportable segments’ measures of profit of loss to your consolidated income before income taxes. Refer to ASC 280-10-50-32. |

Response:

The Company respectfully advises the Staff that on page 20, it disclosed that “We evaluate the performance of our new segments based on gross profit; therefore, selling, general and administrative expenses, research and development expenses, interest and dividend income, interest expense, net realized investment gain/loss, other income/expense and provision for taxes are reported on a company-wide, functional basis only.” Additionally, the Company disclosed gross profit by reportable segment, which agrees in total to gross profit on the consolidated income statement on page 4, in the following table:

| Three Months Ended | ||||||||||||||||

| March 31, 2016 | March 31, 2015 | |||||||||||||||

(In thousands) | Sales | Gross Profit | Sales | Gross Profit | ||||||||||||

Network Solutions | $ | 123,883 | $ | 59,810 | $ | 129,505 | $ | 57,945 | ||||||||

Services & Support | 18,321 | 5,984 | 13,330 | 7,618 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total | $ | 142,204 | $ | 65,794 | $ | 142,835 | $ | 65,563 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Since the Company’s segment gross profit agrees in total to the consolidated income statement, the Company concluded that the reconciliation between segment profit or loss to the Company’s consolidated income before taxes was apparent from the face of the consolidated income statement and separate reconciliation would be repetitive.

The acknowledgments from the Company requested in the Comment Letter are being filed together with this letter. Should you have any questions or need further information, please contact either the undersigned at the above-referenced telephone number or atthomas.wardell@dentons.com or Douglas Eingurt at 404-527-4056 ordoug.eingurt@dentons.com.

| Very truly yours, |

| /s/ Thomas Wardell |

| Thomas Wardell |

| cc: | Thomas Stanton Roger Shannon Douglas Eingurt |

Appendix 1.