UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2007

Commission file number 1-6627

MICHAEL BAKER CORPORATION

(Exact name of registrant as specified in its charter)

| | |

Pennsylvania | | 25-0927646 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| |

Airside Business Park, 100 Airside Drive, Moon Township, PA | | 15108 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (412) 269-6300

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Class | | Name of each exchange on which registered |

| Common Stock, par value $1 per share | | American Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No ü

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes No ü

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No ü

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

| | | | |

Large accelerated filer | | Accelerated filer ü | | |

| | |

Non-accelerated filer | | Smaller reporting company | | |

(Do not check if smaller reporting company) | | | | |

Indicate by check mark if the registrant is a shell company of the Act (as defined in Rule 12b-2) of the Act).

Yes No ü

The aggregate market value of Common Stock held by non-affiliates as of June 30, 2007 (the last business day of the Company’s most recently completed second fiscal quarter) was $325.7 million. This amount is based on the closing price of the Company’s Common Stock on the American Stock Exchange for that date. Shares of Common Stock held by executive officers and directors of the Company and by the Company’s Employee Stock Ownership Plan are not included in the computation.

As of May 31, 2008, the Company had 8,833,298 outstanding shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

| | |

Document | | Parts of Form 10-K into which

Document is incorporated |

Financial Section of Annual Report to Shareholders

for the year ended December 31, 2007 | | I, II |

MICHAEL BAKER CORPORATION

FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2007

TABLE OF CONTENTS

Note with respect to Forward-Looking Statements:

This Annual Report on Form 10-K, and in particular the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of Exhibit 13.1 hereto, which is incorporated by reference into Item 7 of Part II, contains forward-looking statements concerning our future operations and performance. Forward-looking statements are subject to market, operating and economic risks and uncertainties that may cause our actual results in future periods to be materially different from any future performance suggested herein. Factors that may cause such differences include, among others: the events described in the “Risk Factors” section of this Form 10-K; increased competition; increased costs; changes in general market conditions; changes in industry trends; changes in the regulatory environment; changes in our relationship and/or contracts with the Federal Emergency Management Agency (“FEMA”); changes in anticipated levels of government spending on infrastructure, including the Safe, Accountable, Flexible, Efficient Transportation Equity Act – A Legacy for Users (“SAFETEA-LU”); changes in loan relationships or sources of financing; changes in management; changes in information systems; late SEC filings; and the restatement of financial results. Such forward-looking statements are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

EXPLANATORY NOTE

As more fully described in Note 2 to the consolidated financial statements under Item 8, “Financial Statements and Supplementary Data” herein, we have restated our consolidated balance sheet as of December 31, 2006 and our consolidated statements of income, of cash flows and of shareholders’ investment for the year ended December 31, 2006.

In addition, as disclosed in Note 21 to the consolidated financial statements, certain restatement adjustments affected interim quarterly financial information for 2007 and 2006. Such restatement adjustments have been reflected in the unaudited selected quarterly financial data appearing herein and, with respect to 2007, will be reflected in our 2008 Quarterly Reports on Form 10-Q, which the Company plans to file subsequent to this Annual Report on Form 10-K.

We have not amended our previously filed Quarterly Reports on Form 10-Q for the periods affected by the restatement adjustments, and accordingly, the financial statements and related financial information contained in such reports should not be relied upon.

All amounts in this Annual Report on Form 10-K affected by the restatement adjustments reflect such amounts as restated.

- 1 -

PART I

Item 1. Business.

General

In this Form 10-K, the terms “the Company,” “we,” “us,” or “our” refer to Michael Baker Corporation and its subsidiaries collectively. We were founded in 1940 and organized as a Pennsylvania corporation in 1946. Today, through our operating subsidiaries, we provide engineering and energy expertise for public and private sector clients worldwide.

Information regarding the amounts of our revenues, income from operations before Corporate overhead allocations, total assets, capital expenditures, and depreciation and amortization expense attributable to our reportable segments is contained in the “Business Segments” note to our consolidated financial statements, which are included within Exhibit 13.1 to this Form 10-K. Such information is incorporated herein by reference.

According to the annual listings published in June 2008 byEngineering News Record magazine (“ENR”) based on total engineering revenues for 2007, we ranked 40th among the top 500 U.S. design firms; 19th among “pure design” firms; 13th in water and 13th in water supply; 15th among transportation design firms, including 22nd in highways, 11th in bridges and 24th in airports; 28th among construction management-for-fee firms; 17th in pipelines (petroleum); and 61st among environmental firms. In addition, we believe that we are one of the largest providers of outsourced operations and maintenance services to the energy industry in the Gulf of Mexico.

Strategy

Our strategy is based on three concepts – growth, profitability and innovation.

Growth – We seek to grow both organically and through strategic acquisitions. Organically, we will grow by securing larger and more complex projects and programs that correspond well with our existing knowledge and capabilities in both the Engineering and Energy segments in the United States and abroad. Furthermore, we will seek to provide additional and related services to existing clients; for example, offering construction management services to a State Department of Transportation for which we are currently providing only design services. Our multi-hazard flood mapping and modernization program (MapMod) with FEMA is another prime example of our execution of this concept. With regard to acquisitions, we will seek opportunities that expand our skill sets or our geographical presence in our core Engineering business.

As part of the growth aspect of our strategy, we have engaged an investment banker to assist our Board of Directors in pursuing the sale of our Energy segment. This activity commenced during July 2007. Discussions with several potential buyers were in process at December 31, 2007; however, all substantive discussions related to a possible sale ceased during the first quarter of 2008 due to our Energy segment’s revenue-related restatement. We anticipate resuming our evaluation of strategic alternatives, including a potential sale of the Energy segment, during the third quarter of 2008. If we are able to consummate a sale of the Energy segment, any proceeds realized would be reinvested in our Engineering segment in order to continue to grow that business.

Profitability – We seek to consistently improve the profitability of our businesses through long-term, performance-based contracting arrangements with our clients. This strategy is evident in our

- 2 -

current mix of contracts, including the FEMA contract mentioned above for Engineering and our service contracts in the Energy segment.

Innovation – We strive to constantly and consistently innovate ways to deliver services to our clients. For example, we executed the design for an accelerated bridge replacement of a deteriorating 37-year-old bridge in Utah. This complex project involved precise engineering for design of the new bridge (which was constructed in an adjacent area) and support structures, as well as removal of the old bridge, maneuvering the new deck into position, and sliding it into place in a single weekend. Additionally, we utilize mapping and geographic information technology in a number of innovative ways, including estimating damage to homes and other facilities in the aftermath of hurricanes.

Business Segments

Our business segments have been determined based on how executive management makes resource decisions and assesses our performance. Our two reportable segments are Engineering and Energy. Information regarding these business segments is contained in our “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” which is included within Exhibit 13.1 to this Form 10-K. Such information is incorporated herein by reference.

The following briefly describes our business segments:

Engineering

Our Engineering segment provides a variety of design and related consulting services, principally in the United States of America (“U.S.”). Such services include program management, design-build, construction management, consulting, planning, surveying, mapping, geographic information systems, architectural and interior design, construction inspection, constructability reviews, site assessment and restoration, strategic regulatory analysis, and regulatory compliance. The Engineering segment has designed a wide range of projects, such as highways, bridges, airports, busways, corporate headquarters, data centers, correctional facilities and educational facilities. This segment also provides services in the water/wastewater, pipeline, emergency and consequence management, resource management, and telecommunications markets. This segment is susceptible to upward and downward fluctuations in federal and state government spending.

Our transportation services have benefited from the U.S. federal government’s SAFETEA-LU legislation in recent years. Additionally, we have benefited from increased federal government spending in the Department of Defense and the Department of Homeland Security, including FEMA, US-VISIT and the Coast Guard. We partner with other contractors to pursue selected design-build contracts, which continue to be a growing project delivery method within the transportation and civil infrastructure markets.

Energy

Our Energy segment provides a full range of services to operating energy production facilities worldwide. This segment’s comprehensive services range from complete outsourcing solutions to specific services such as training, personnel recruitment, pre-operations engineering, maintenance management systems, field operations and maintenance, procurement, and supply chain management. The Energy segment serves both major and smaller independent oil and gas producing companies, but does not pursue exploration opportunities for our own account or own any oil or natural gas reserves.

One delivery method employed by the segment is managed services, an operating model that has broadened the Energy segment’s service offerings in the offshore Gulf of Mexico and the onshore U.S.

- 3 -

This model has the potential to enhance our operating margins as well as our clients’. Onshore, we have taken over full managerial and administrative responsibility for clients’ producing properties. Offshore, the segment has organized a network of marine vessels, helicopters, shore bases, information technology, safety and compliance systems, specialists, and a leadership team that manages the sharing of resources, thereby resulting in improved profitability for participants. Presently, we are working under managed services agreements with oil and gas producers in the Gulf of Mexico and in the Powder River Basin in Wyoming. Several of these managed services contracts have incentive features that could result in additional payments to us based on our performance.

The segment also operates in over a dozen foreign countries, with major projects in Venezuela, Thailand, Algeria and Nigeria. The local political environment in certain of these countries subjects our related trade receivables, due from subsidiaries of major oil companies, to lengthy collection delays. Based upon our experience with these clients, after giving effect to our related allowance for doubtful accounts balance at December 31, 2007, we believe that these receivable balances will be fully collectible within one year. This segment also has some exposure to currency-related gains and losses but a substantial amount of our foreign transactions are settled in the same currency, thereby greatly reducing our exposure to material currency transaction gains and losses.

Domestic and Foreign Operations

For the years ended December 31, 2007, 2006 and 2005, our percentages of total contract revenues derived from work performed for U.S.-based clients within the U.S. totaled 89%, 87% and 88%, respectively. The majority of our domestic revenues comprises engineering work performed in the Mid-Atlantic region of the U.S. and operations and maintenance work performed by our Energy segment in Texas, Louisiana, Wyoming, and the Gulf of Mexico. Our foreign revenues are derived primarily from our Energy segment.

Contract Backlog

| | | | | | |

| | | As of December 31, |

| (in millions) | | 2007 | | 2006 |

Engineering | | | | | | |

Funded | | $ | 425.6 | | $ | 337.3 |

Unfunded | | | 696.6 | | | 719.8 |

| | | | | | |

Total Engineering | | | 1,122.2 | | | 1,057.1 |

Energy | | | 191.7 | | | 238.6 |

| | | | | | |

Total | | $ | 1,313.9 | | $ | 1,295.7 |

| | | | | | |

For our Engineering segment, funded backlog consists of that portion of uncompleted work represented by signed contracts and/or approved task orders, and for which the procuring agency has appropriated and allocated the funds to pay for the work. Total backlog incrementally includes that portion of contract value for which options have not yet been exercised or task orders have not been approved. We refer to this incremental contract value as unfunded backlog. U.S. government agencies, and many state and local governmental agencies, operate under annual fiscal appropriations and fund various contracts only on an incremental basis. In addition, our clients may terminate contracts at will or not exercise option years. Our ability to realize revenues from our backlog depends on the availability of funding for various federal, state and local government agencies; therefore, no assurance can be given that all backlog will be realized.

- 4 -

In the Energy segment, our managed services contracts typically have one to five year terms and up to ninety-day cancellation provisions. Our labor services contracts in the Energy segment typically have one to three year terms and up to thirty-day cancellation provisions. For these managed services and labor contracts, backlog includes our forecast of the next twelve months’ revenues based on existing contract terms and operating conditions. For our managed services contracts, fixed management fees related to the contract term beyond twelve months are not included in backlog. Backlog related to fixed-price contracts within the Energy segment is based on the related contract value. On a periodic basis, backlog is reduced as related revenue is recognized. Oil and gas industry merger, acquisition and divestiture transactions affecting our clients can result in increases and decreases in our Energy segment’s backlog.

Engineering

The increase in Engineering’s backlog as of December 31, 2007 resulted from new work orders totaling $10 million being performed by us for our unconsolidated Engineering subsidiary operating in Iraq, the addition of two environmental services contracts totaling $16 million and various new transportation contract awards. As of December 31, 2007 and December 31, 2006, approximately $57 million and $64 million of our funded backlog, respectively, related to the $750 million FEMA Map Mod Program contract to assist FEMA in conducting a large-scale overhaul of the nation’s flood hazard maps, which commenced late in the first quarter of 2004. This contract includes data collection and analysis, map production, product delivery, and effective program management; and seeks to produce digital flood hazard data, provide access to flood hazard data and maps via the Internet, and implement a nationwide state-of-the-art infrastructure that enables all-hazard mapping. Although we expect additional funding authorizations, we do not anticipate realizing all of our unfunded FEMA backlog balance (totaling $323 million at December 31, 2007) through the contract award period, which concludes March 10, 2009. We expect work and revenue related to authorizations prior to March 10, 2009 to continue for approximately three years. In the future, we may be required to reduce our FEMA backlog as better estimates become available. During 2008, we will compete for contracts in FEMA’s planned Risk Mapping, Analysis and Planning MAP Program (“Risk MAP Program”), which is intended to be the successor to the FEMA Map Mod Program.

Energy

The decrease in Energy’s backlog for 2007 primarily resulted from the completion of certain existing domestic onshore managed service contracts. Several new onshore managed services projects are currently in the discussion and proposal stages.

Significant Customers

Contracts with various branches of the U.S. government accounted for 27%, 27% and 31% of our total contract revenues for the years ended December 31, 2007, 2006 and 2005, respectively. Our contracts with FEMA accounted for approximately 14%, 15% and 20% of our revenues in 2007, 2006 and 2005, respectively.

Competitive Conditions

Our business is highly competitive with respect to all principal services we offer. Our Engineering and Energy segments compete with numerous public and private firms that provide some or all of the services that we provide. In the Engineering segment, our competitors range from large national and

- 5 -

international architectural, engineering and construction services firms to a vast number of smaller more localized firms. In the Energy segment, we compete with units of large oil and gas services firms, and smaller privately-held companies.

The competitive conditions in our businesses relate to the nature of the contracts being pursued. Public-sector contracts, consisting mostly of contracts with federal and state governmental entities, are generally awarded through a competitive process, subject to the contractors’ qualifications and experience. Our business segments employ cost estimating, scheduling and other techniques for the preparation of these competitive bids. Private-sector contractors compete primarily on the basis of qualifications, quality of performance and price of services. Most private and public-sector contracts for professional services are awarded on a negotiated basis.

We believe that the principal competitive factors (in various orders of importance) in the areas of services we offer are quality of service, reputation, experience, technical proficiency, local geographic presence and cost of service. We believe that we are well positioned to compete effectively by emphasizing the quality of services we offer and our widely known reputation in providing professional engineering services in the Engineering segment and technical and operations and maintenance services in the Energy segment. We are also dependent upon the availability of staff and our ability to recruit qualified employees. A shortage of qualified technical professionals currently exists in the engineering industry in the U.S.

Seasonality

Based upon our experience, our Engineering segment’s total contract revenues and income from operations have historically been slightly lower for our first fiscal quarter than for the remaining quarters due to the effect of winter weather conditions, particularly in the Mid-Atlantic and Midwest regions of the United States. Typically, these seasonal weather conditions unfavorably impact our performance of construction management services. Our Energy segment is not as directly impacted by seasonal weather conditions.

Personnel

At December 31, 2007, we had 4,546 total employees, of which our Engineering segment had 2,239 employees, our Energy segment had 2,263 employees, and our Corporate staff included 44 employees. Of our total employees, 4,252 were full-time and 294 were part-time. Certain employees of our 53%-owned Nigerian subsidiary are subject to an industry-based, in-country collective bargaining agreement. The remainder of our workforce is not subject to collective bargaining arrangements. We believe that our relations with employees are good.

Executive Officers

The following represents a listing of our executive officers as of May 31, 2008.

Bradley L. Mallory – Age 55; President and Chief Executive Officer of Michael Baker Corporation since February 2008. Formerly Chief Operating Officer of Michael Baker Corporation from October 2007 to February 2008; President of Engineering of Michael Baker Jr., Inc. from November 2003 to October 2007; Senior Vice President of Michael Baker Jr., Inc. from March 2003 to October 2003; and Secretary of Transportation of the Commonwealth of Pennsylvania from 1995 to 2003.

- 6 -

Richard L. Shaw – Age 81; Chairman of the Board since 1993. Formerly Chief Executive Officer from September 2006 to February 2008; Chief Executive Officer from 1999 to 2001; President and Chief Executive Officer from 1993 through 1994; and President and Chief Executive Officer from 1984 to 1992. Mr. Shaw has held various positions since joining Michael Baker in 1952.

Craig O. Stuver – Age 47; Acting Chief Financial Officer of Michael Baker Corporation since September 2007, and Senior Vice President, Corporate Controller, Treasurer and Chief Accounting Officer since 2001. Prior to joining us, Mr. Stuver served as a vice president of finance for Marconi Communications from 2000 to 2001. Mr. Stuver was also previously employed by us from 1992 to 2000, serving in various capacities including Senior Vice President, Corporate Controller and Treasurer briefly in 2000 and as Vice President, Corporate Controller and Assistant Treasurer from 1997 to 2000.

H. James McKnight – Age 63; Executive Vice President, General Counsel and Secretary since June 2000. Mr. McKnight has been employed by us since 1995, serving as Senior Vice President, General Counsel and Secretary from 1998 to 2000 and as Vice President, General Counsel and Secretary from 1995 to 1998.

Joseph R. Beck – Age 63; Director of Corporate Development since March 2008. Mr. Beck joined Michael Baker Corporation as an Operations Manager in June 2004. Prior to joining Michael Baker Corporation, Mr. Beck was a Senior Vice President with The IT Group from 1994 to 2002 and was a private consultant and an adjunct professor at the University of Pittsburgh from 2002 to 2004.

David G. Greenwood – Age 56; Executive Vice President – Marketing, Engineering Segment since April 2005. Mr. Greenwood previously served in various operational and marketing capacities with us since 1973, including Vice President and Senior Vice President of Michael Baker Jr., Inc. from 1994 to April 2005.

David G. Higie – Age 52; Vice President of Corporate Communications and Investor Relations for Michael Baker Corporation since 2006. Mr. Higie joined Michael Baker Corporation in 1996 as Director of Corporate Communications.

James R. Johnson – Age 55; Senior Vice President – Marketing, Energy Segment since August 2005. Mr. Johnson previously served as a Senior Regional Manager of Operations with Baker Hughes Inc. from 1991 to 2005. Prior to joining Baker Hughes, Mr. Johnson served as a Senior Business Development Manager with Eastman Christiansen Inc. from 1986 to 1991.

G. John Kurgan – Age 58; Executive Vice President – Engineering Segment since 2007. Mr. Kurgan was previously a Senior Vice President of Michael Baker Jr., Inc. from 1995 to 2007. Mr. Kurgan has held various positions since joining Michael Baker in 1974.

John D. Whiteford – Age 48; Acting General Manager of our Energy Segment since July 2006. Formerly Executive Vice President of Michael Baker Jr., Inc., and Manager of our North Region from 2000 to 2006. Mr. Whiteford previously served in various capacities with us since 1983, including Vice President of our Energy segment from 1997 to 2000.

Edward L. Wiley – Age 65; Executive Vice President – Engineering Segment since 2005. Mr. Wiley has also served as an Executive Vice President of Michael Baker Jr., Inc. Mr. Wiley has held various positions since joining Michael Baker in 1965.

- 7 -

Our executive officers serve at the discretion of the Board of Directors and are elected by the Board or appointed annually for a term of office extending through the election or appointment of their successors.

Available Information

Our Internet website address iswww.mbakercorp.com. We post our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports to our website as soon as reasonably practicable after such reports are electronically filed with the Securities and Exchange Commission (“SEC”). These reports and any amendments to them are also available at the SEC’s website, www.sec.gov. We also post press releases, earnings releases, the Code of Ethics for Senior Officers and the Charters related to the Governance and Nominating Committee, Audit Committee and Compensation Committee to our website. The information contained on our website is not incorporated by reference into this Form 10-K and shall not be deemed “filed” under the Securities Exchange Act of 1934, as amended.

Item 1A. Risk Factors.

In addition to other information referenced in this report, we are subject to a number of specific risks outlined below. If any of these events or uncertainties actually occurs, our business, financial condition, results of operations and cash flows, and/or the market price of our common stock could be materially affected. You should carefully consider the following factors and other information contained in this Annual Report on Form 10-K before deciding to invest in our common stock.

Changes and fluctuations in the government spending priorities could materially affect our future revenue and growth prospects.

Our primary customers, which compose a substantial portion of our revenue and backlog, include agencies of the U.S. federal government and state and local governments and agencies that depend on funding or partial funding provided by the U.S. federal government. Consequently, any significant changes and fluctuations in the government’s spending priorities as a result of policy changes or economic downturns may directly affect our future revenue streams. Legislatures may appropriate funds for a given project on a year-by-year basis, even though the project may take more than one year to perform. As a result, at the beginning of a project, the related contract may only be partially funded, and additional funding is committed only as appropriations are made in each subsequent year. These appropriations, and the timing of payment of appropriated amounts, may be influenced by, among other things, the state of the economy, competing political priorities, curtailments in the use of government contracting firms, rise in raw material costs, delays associated with a lack of a sufficient number of government staff to oversee contracts, budget constraints, the timing and amount of tax receipts, and the overall level of government expenditures. Additionally, reduced spending by the U.S. government may create competitive pressure within our industry which could result in lower revenues and margins in the future.

Unpredictable economic cycles or uncertain demand for our engineering capabilities and related services could cause our revenues to fluctuate or contribute to delays or the inability of customers to pay our fees.

Demand for our engineering and other services is affected by the general level of economic activity in the markets in which we operate, both in the U.S. and internationally. Our customers,

- 8 -

particularly our private sector customers, and the markets in which we compete to provide services, are likely to experience periods of economic decline from time to time. Adverse economic conditions may decrease our customers’ willingness to make capital expenditures or otherwise reduce their spending to purchase our services, which could result in diminished revenues and margins for our business. In addition, adverse economic conditions could alter the overall mix of services that our customers seek to purchase, and increased competition during a period of economic decline could result in us accepting contract terms that are less favorable to us than we might be able to negotiate under other circumstances. Changes in our mix of services or a less favorable contracting environment may cause our revenues and margins to decline. Moreover, our customers may experience difficult business climates from time to time and could delay or fail to pay our fees as a result.

Our ability to recruit, train, and retain professional personnel of the highest quality is a competitive advantage. Our future inability to do so would adversely affect our competitiveness.

Our contract obligations in our engineering and energy markets are performed by our staff of well-qualified engineers, technical professionals, and management personnel. A shortage of qualified technical professionals currently exists in the engineering industry in the U.S. Our future growth potential requires the effective recruiting, training, and retention of these employees. Our inability to retain these well-qualified personnel and recruit additional well-qualified personnel would adversely affect our business performance and limit our ability to perform new contracts.

If we are unable to accurately estimate and control our contract costs, then we may incur losses on our contracts, which could decrease our operating margins and significantly reduce or eliminate our profits.

It is important for us to control our contract costs so that we can maintain positive operating margins. Under our fixed-price contracts, we receive a fixed price regardless of what our actual costs will be. Consequently, we realize a profit on fixed-price contracts only if we control our costs and prevent cost over-runs on the contracts. Under our time-and-materials contracts, we are paid for labor at negotiated hourly billing rates and for other expenses. Profitability on our contracts is driven by billable headcount and our ability to manage costs. Under each type of contract, if we are unable to control costs, we may incur losses on our contracts, which could decrease our operating margins and significantly reduce or eliminate our profits.

Due to the nature of the work we perform to complete engineering and energy contracts, we are subject to potential liability claims and contract disputes.

Our engineering and energy contracts often involve projects where design, construction, systems failures, or accidents could result in substantially large or punitive damages for which we could have liability. Our engineering practice involves professional judgments regarding the planning, design, development, construction, operations and management of facilities and public infrastructure projects. Although we have adopted a range of insurance, risk management safety and risk avoidance programs designed to reduce potential liabilities, there can be no assurance that such programs will protect us fully from all risks and liabilities.

We may also experience a delay or withholding of payment for services due to performance disputes. If we are unable to resolve these disputes and collect these payments, we would incur profit reductions and reduced cash flows.

- 9 -

If we miss a required performance standard, fail to timely complete, or otherwise fail to adequately perform on a project, then we may incur a loss on that project, which may reduce or eliminate our overall profitability.

We may commit to a client that we will complete a project by a scheduled date. We may also commit that a project, when completed, will achieve specified performance standards. If the project is not completed by the scheduled date or fails to meet required performance standards, we may either incur significant additional costs or be held responsible for the costs incurred by the client to rectify damages due to late completion or failure to achieve the required performance standards. The uncertainty of the timing of a project can present difficulties in planning the amount of personnel needed for the project. If the project is delayed or canceled, we may bear the cost of an underutilized workforce that was dedicated to fulfilling the project. In addition, performance of projects can be affected by a number of factors beyond our control, including unavoidable delays from weather conditions, changes in the project scope of services requested by clients or labor or other disruptions. In some cases, should we fail to meet required performance standards, we may also be subject to agreed-upon financial damages, which are determined by the contract. To the extent that these events occur, the total costs of the project could exceed our estimates or, in some cases, incur a loss on a project, which may reduce or eliminate our overall profitability.

We are subject to procurement laws and regulations associated with our government contracts. If we do not comply with these laws and regulations, we may be prohibited from completing our existing government contracts or suspended from government contracting and subcontracting for some period of time.

Our compliance with the laws and regulations relating to the procurement, administration, and performance of our government contracts is dependent upon our ability to ensure that we properly design and execute compliant procedures.

Our termination from any of our larger government contracts or suspension from future government contracts for any reason would result in material declines in expected revenue. Because U.S. federal laws permit government agencies to terminate a contract for convenience, the U.S. federal government may terminate or decide not to renew our contracts with little or no prior notice.

We are subject to routine U.S. federal, state and local government audits related to our government contracts. If audit findings are unfavorable, we could experience a reduction in our profitability.

Our government contracts are subject to audit. These audits may result in the determination that certain costs claimed as reimbursable are not allowable or have not been properly allocated to government contracts according to federal government regulations.

We are subject to audits for several years after payment for services has been received. Based on these audits, government entities may adjust or seek reimbursement for previously paid amounts. None of the audits performed to date on our government contracts have resulted in any significant adjustments to our financial statements. It is possible, however, that an audit in the future could have an adverse effect on our revenue, profits, and cash flow.

- 10 -

Our inability to continue to win or renew government contracts could result in material reductions in our revenues and profits.

We have increased our contract activity with the U.S. federal, state and local governments in recent years. Our ability to earn revenues from our existing and future government projects will depend upon the availability of funding by our served and targeted government agencies. We cannot control whether those clients will fund or continue funding our outstanding projects.

If our relationship or reputation with government clients deteriorates for any reason and affects our ability to win new contracts or renew existing ones, we could experience a material revenue decline.

Our involvement in partnerships, ventures, and use of subcontractors exposes us to additional legal and market reputation damages.

Our methods of service delivery include the use of partnerships, subcontractors, joint ventures and other ventures. If our partners or subcontractors fail to satisfactorily perform their obligations as a result of financial or other difficulties, we may be unable to adequately perform or deliver our contracted services. Under these circumstances, we may be required to make additional investments and provide additional services to ensure the adequate performance and delivery of the contracted services. Additionally, we may be exposed to claims for damages that are a result of a partner’s or subcontractor’s performance. We could also suffer contract termination and damage to our reputation as a result of a partner’s or subcontractor’s performance.

We are engaged in highly competitive markets that pose challenges to continued revenue growth.

Our business is characterized by competition for contracts within the government and private sectors in which service contracts are typically awarded through competitive bidding processes. We compete with a large number of other service providers who offer the principal services we offer. In this competitive environment, we must provide technical proficiency, quality of service, and experience to ensure future contract awards and revenue and profit growth.

Our international business operations are subject to unique risks and challenges that create increased uncertainty in these markets.

Our international operations are subject to unique risks. These risks can include: potentially dynamic political and economic environments; civil disturbances, unrest, or violence; volatile labor conditions due to strikes and general difficulties in staffing international operations with highly qualified personnel; and logistical and communication challenges. Unexpected changes in regulatory requirements in foreign countries as well as inconsistent regulations, diverse licensing, and legal and tax requirements that differ from one country to another could also adversely affect our international projects.

We also could be subject to exposure to liability due to the Foreign Corrupt Practices Act.

Our goodwill or other intangible assets could become impaired and result in a material reduction in our profits.

We have made acquisitions which have resulted in the recording of goodwill and intangible assets within our organization. Our goodwill balance of each reporting unit, as defined by SFAS 142, is evaluated for potential impairment during the second quarter of each year and in certain other

- 11 -

circumstances. Reporting units for purposes of this test are identical to our operating segments. The evaluation of impairment involves comparing the current fair value of the business to the recorded value, including goodwill. To determine the fair value of the business, we utilize both the “Income Approach,” which is based on estimates of future net cash flows and the “Market Approach,” which observes transactional evidence involving similar businesses. If these assets become impaired, a material write-off in the required amount could lead to reductions in our profits.

We use “percentage-of-completion” accounting methods for many of our projects. This method may result in volatility in stated revenues and profits.

Our revenues and profits for many of our contracts are recognized ratably as those contracts are performed. This rate is based primarily on the proportion of labor costs incurred to date to total labor costs projected to be incurred for the entire project. This method of accounting requires us to calculate revenues and profit to be recognized in each reporting period for each project based on our predictions of future outcomes, including our estimates of the total cost to complete the project, project schedule and completion date, the percentage of the project that is completed and the amounts of any probable unapproved change orders. Our failure to accurately estimate these often subjective factors could result in reduced profits or losses for certain contracts.

Our government contracts may give the government the right to modify, delay, curtail or terminate our contracts at their convenience at any time prior to their completion. Therefore, our backlog is subject to unexpected adjustments, delays and cancellations.

We cannot assure that our funded or unfunded backlog will be realized as revenues or that, if realized, it will result in profits. Projects may remain in our backlog for an extended period of time prior to project execution and, once project execution begins, revenues may occur unevenly over current and future periods. In addition, our ability to earn revenues from our backlog depends on the availability of funding for various U.S. federal, state, local and foreign government agencies. In addition, most of our domestic and international industrial clients have termination for convenience provisions in their contracts. Therefore, project terminations, suspensions or reductions in scope may occur from time to time with respect to contracts reflected in our backlog. Project cancellations, delays and scope adjustments could further reduce the dollar amount of our backlog and the revenues and profits that we actually earn.

We are not insured for a significant portion of our claims exposure, which could materially and adversely affect our operating income and profitability.

We are self-insured or carry deductibles for most of our claims exposure. Because of these deductibles and self-insured retention amounts, we have significant exposure to fluctuations in the number and severity of claims. As a result, our insurance and claims expense could increase in the future. Under certain conditions, we may elect or be required to increase our self-insured or deductible amounts, which would increase our already significant exposure to expense from claims. If any claim exceeds our coverage, we would bear the excess expense, in addition to our other self-insured amounts. If the frequency or severity of claims or our expenses increase, our operating income and profitability could be materially adversely affected.

- 12 -

Foreign governmental regulations could adversely affect our business.

Many aspects of our foreign operations are subject to governmental regulations in the countries in which we operate, including regulations relating to currency conversion, repatriation of earnings, taxation of our earnings and the earnings of our personnel, the increasing requirement in some countries to make greater use of local employees and suppliers, including, in some jurisdictions, mandates that provide for greater local participation in the ownership and control of certain local business assets.

Our operations are also subject to the risk of changes in laws and policies which may impose restrictions on our business, including trade restrictions, and could have a material adverse effect on our operations. Our future operations and earnings may be adversely affected by new legislation, new regulations or changes in, or new interpretations of, existing regulations, and the impact of these changes could be material.

Item 1B. Unresolved Staff Comments.

With respect to comments received from the staff of the Securities and Exchange Commission on our periodic and current reports required under the Securities Act of 1933, no staff comments currently remain unresolved.

Item 2. Properties.

Our headquarters office is located in Moon Township, Pennsylvania. This building, which we lease, has approximately 117,000 square feet of office space and is used by our Corporate and Engineering staff. Our Engineering and Energy segments primarily occupy leased office space in stand-alone or multi-tenant buildings at costs based on prevailing market prices at lease inception. In addition to our Moon Township offices, our Engineering segment also has a major leased office in Alexandria, VA, and leased other office space totaling approximately 500,000 square feet in the U.S. and Mexico as of December 31, 2007. Likewise, our Energy segment has its principal offices in Houston, TX, and leases office space totaling approximately 144,000 square feet in the U.S. and abroad. These leases expire at various dates through the year 2016.

We also own a 75,000 square foot office building located in Beaver, Pennsylvania, which is situated on approximately 230 acres and utilized by our Engineering segment. We believe that our current facilities will be adequate for the operation of our business during the next year, and that suitable additional office space is readily available to accommodate any needs that may arise.

Item 3. Legal Proceedings.

We have been named as a defendant or co-defendant in legal proceedings wherein damages are claimed. Such proceedings are not uncommon to our business. We believe that we have recognized adequate provisions for probable and reasonably estimable liabilities associated with these proceedings, and that their ultimate resolutions will not have a material impact on our consolidated financial position or annual results of operations or cash flows.

Class Action Complaints.Subsequent to our February 2008 announcement of our intention to restate our financial statements for the first three quarters of 2007, four separate complaints were filed by holders of our common stock against us, as well as certain of our current and former officers, in the United States District Court for the Western District of Pennsylvania. The complaints in these lawsuits

- 13 -

purport to have been made on behalf of a class of plaintiffs consisting of purchasers of our common stock between March 19, 2007 and February 22, 2008. The complaints alleged that we and certain of our current and former officers made materially false and misleading statements in violation of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and SEC Rule 10b-5 promulgated thereunder. The plaintiffs seek unspecified compensatory damages, attorneys’ fees, and other fees and costs.

In June 2008, all of the cases were consolidated into a single action. Following the appointment of the lead plaintiff and approval of its selection of counsel, a consolidated amended complaint will likely be filed. We intend to defend this lawsuit vigorously.

Item 4. Submission of Matters to a Vote of Security Holders.

Not applicable.

- 14 -

PART II

| Item 5. Market | for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market Information

Information relating to the market for our Common Stock and other matters related to the holders thereof is set forth in the “Supplemental Financial Information” section of Exhibit 13.1 to this Form 10-K. Such information is incorporated herein by reference.

Holders

As of May 31, 2008, we had 1,092 holders of our Common Stock.

Dividends

Our present policy is to retain any earnings to fund our operations and growth. We have not paid any cash dividends since 1983 and have no plans to do so in the foreseeable future. Our Credit Agreement with our banks places certain limitations on dividend payments.

Sales of Unregistered Securities

We did not sell any unregistered securities during the year ended December 31, 2007.

Purchases of Equity Securities

Neither we nor any affiliated purchaser bought any Michael Baker Corporation equity securities during the fourth quarter of 2007.

- 15 -

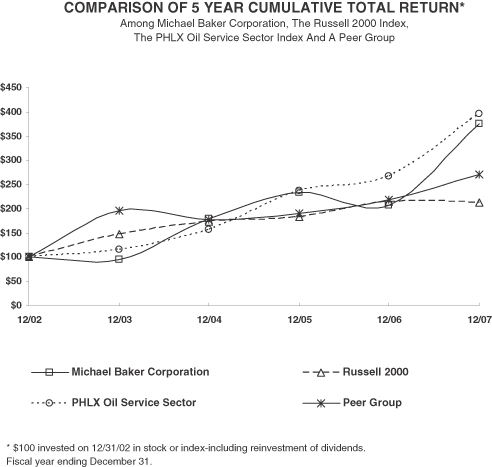

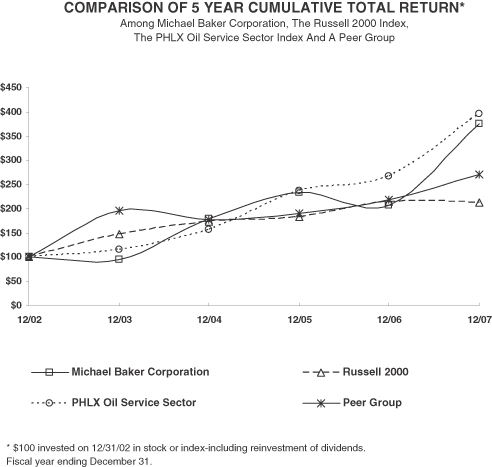

Performance Graph

The following graph shows the changes over the past five-year period in the value of $100 invested in (1) the Common Stock Michael Baker Corporation, (2) the PHLX Oil Service Sector, (3) the Russell 2000 Index, and (4) our peer group (consisting of URS Corporation and Tetra Tech, Inc.). The values of each investment are based on share price appreciation, with reinvestment of all dividends, assuming any were paid. For each graph, the investments are assumed to have occurred at the beginning of each period presented.

- 16 -

| Item 6. Selected | Financial Data. |

A summary of selected financial data for the five years ended December 31, 2007 is set forth in the “Selected Financial Data” section of Exhibit 13.1 to this Form 10-K. Such summary is incorporated herein by reference.

| Item 7. Management’s | Discussion and Analysis of Financial Condition and Results of Operations. |

A discussion and analysis of our results of operations, cash flow and financial condition is set forth in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of Exhibit 13.1 to this Form 10-K. This discussion is incorporated herein by reference.

| Item 7A. Quantitative | and Qualitative Disclosures About Market Risk. |

As of December 31, 2007 and 2006, we had interest rate risk related to highly liquid investments included in our cash and cash equivalents (“variable-rate investments”), which totaled $10.4 million as of December 31, 2007 and $0.3 million as of December 31, 2006. Assuming a 10% decrease in interest rates on these variable-rate investments (i.e., a decrease from the actual weighted average interest rate of 3.84% as of December 31, 2007, to a weighted average interest rate of 3.45%), annual interest income would have been approximately $40,000 lower in 2007 based on the outstanding balance of variable-rate investments as of December 31, 2007. Assuming a 10% decrease in interest rates on these variable-rate investments (i.e., a decrease from the actual weighted average interest rate of 4.44% as of December 31, 2006, to a weighted average interest rate of 4.00%), annual interest income would have been approximately $1,200 lower in 2006 based on the outstanding balance of variable-rate investments as of December 31, 2006. In addition, as of December 31, 2006, our primary interest rate risk related to our variable-rate debt obligations, which totaled $11.0 million. Assuming a 10% increase in interest rates on these variable-rate debt obligations (i.e., an increase from the actual weighted average interest rate of 8.00% as of December 31, 2006, to a weighted average interest rate of 8.80%), annual interest expense would have been approximately $88,300 higher in 2006. We had no variable-rate debt obligations as of December 31, 2007 and no interest rate swap or exchange agreements as of December 31, 2007 and 2006. Based on the foregoing discussion, we have no material exposure to interest rate risk.

We have several foreign subsidiaries that transact portions of their local activities in currencies other than the U.S. Dollar. At December 31, 2007, such currencies included the British Pound, Mexican Peso, Nigerian Naira, Thai Baht and Venezuelan Bolivar. These subsidiaries composed 9.2% of our consolidated total assets at December 31, 2007, and 4.8% of our consolidated revenues for the year then ended. In assessing our exposure to foreign currency exchange rate risk, we recognize that the majority of our foreign subsidiaries’ assets and liabilities reflect ordinary course accounts receivable and accounts payable balances. These receivable and payable balances are substantially settled in the same currencies as the functional currencies of the related foreign subsidiaries, thereby not exposing us to material transaction gains and losses. Accordingly, assuming that foreign currency exchange rates could change unfavorably by 10%, we have no material exposure to foreign currency exchange rate risk. We have no foreign currency exchange contracts.

Based on the nature of our business, we have no direct exposure to commodity price risk.

- 17 -

Item 8. Financial Statements and Supplementary Data.

Our consolidated financial statements, together with the report thereon of our independent registered public accounting firm (Deloitte & Touche LLP), and supplementary financial information are set forth within Exhibit 13.1 to this Form 10-K. Such financial statements, the report thereon, and the supplementary financial information are incorporated herein by reference.

Deloitte & Touche LLP audited our consolidated financial statements as of and for the years ended December 31, 2007, 2006 and 2005.

| Item 9. Changes | in and Disagreements with Accountants on Accounting and Financial Disclosure. |

Not applicable.

Item 9A. Controls and Procedures.

Conclusions Regarding the Effectiveness of Disclosure Controls and Procedures

Under the supervision and with participation of our management, including our Chief Executive Officer and Acting Chief Financial Officer, we evaluated our disclosure controls and procedures, as such term is defined in Rules 13a-15(e) and 15d-15(f) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as of December 31, 2007. This evaluation considered various procedures designed to ensure that information we disclose in reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to management, including our Chief Executive Officer and Acting Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure. Based upon that evaluation, our Chief Executive Officer and Acting Chief Financial Officer concluded that our disclosure controls and procedures were not effective as of December 31, 2007. Notwithstanding this determination, our management has concluded that the financial statements included in this Form 10-K fairly present in all material respects our financial position, results of operations and cash flows for the periods presented in conformity with generally accepted accounting principles in the United States (“GAAP”).

Management’s Report on Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f). Our internal control over financial reporting is a process designed under the supervision of our principal executive and principal financial officers to provide reasonable assurance regarding the reliability of financial reporting and the preparation of our consolidated financial statements for external purposes in accordance with GAAP. Our internal control over financial reporting includes policies and procedures that:

(i) Pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect transactions and dispositions of our assets;

- 18 -

(ii) Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with GAAP, and that receipts and expenditures are being made only in accordance with authorizations of management and our directors; and

(iii) Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of company assets that could have a material effect on our financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect all misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Under the supervision and with the participation of our management, including our Chief Executive Officer and Acting Chief Financial Officer, we conducted an assessment of the effectiveness of our internal control over financial reporting as of December 31, 2007. The assessment was based on criteria established in the framework Internal Control – Integrated Framework, issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

A material weakness is a control deficiency, or combination of control deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements would not be prevented or detected on a timely basis. Management identified the following material weaknesses as of December 31, 2007:

| | 1. | We did not maintain effective controls over the posting of manual journal entries. Specifically, appropriately experienced personnel did not review manual journal entries in sufficient detail to identify accounting errors associated with manual revenue accruals within our Energy segment’s domestic onshore managed services projects. This control deficiency resulted in the misstatement of our revenue and unbilled revenue accounts and required restatement to the previously issued 2006 financial statements and unaudited interim financial information as described in Note 2 and Note 21, respectively, to the audited consolidated financial statements included in this Form 10-K. Additionally, this control deficiency could result in a misstatement in the aforementioned accounts that would result in a material misstatement to the annual or interim consolidated financial statements that would not be prevented or detected. Accordingly, we have determined that this control deficiency constitutes a material weakness. |

| | 2. | We did not maintain effective project accounting related controls, including monitoring, over our Energy segment’s domestic onshore managed services projects. Specifically, we did not have a complement of operations and accounting personnel reviewing project profitability or unbilled revenue realizability in sufficient detail to identify the accounting errors. These control deficiencies resulted in the misstatement of our revenue and unbilled revenue accounts and required restatement to previously issued 2006 financial statements and unaudited interim financial information as described in Note 2 and Note 21, respectively, to the audited consolidated financial statements included in this Form 10-K. Additionally, these control deficiencies, when aggregated, could result in a misstatement in the aforementioned accounts that would result in a material misstatement to the annual or interim consolidated financial statements that would not be prevented or detected. Accordingly, we have determined that these control deficiencies, in the aggregate, constitute a material weakness. |

- 19 -

Based on this evaluation, the Company’s Chief Executive Officer and Acting Chief Financial Officer have concluded that the Company’s internal control over financial reporting was not effective at December 31, 2007.

Changes in Internal Control Over Financial Reporting

There was no change in our “internal control over financial reporting” (as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) that occurred during the quarter ended December 31, 2007, and that have materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Plan for Remediation

We believe the steps described below, some of which we have already taken as noted herein, together with others that are ongoing or that we plan to take, will remediate the material weaknesses discussed above:

| | (1) | We improved our manual journal entry process within our Energy segment by requiring representatives from Finance and Project Accounting to review manual revenue related journal entries, thus further segregating the review and approval functions, updating and then re-communicating our revised policies and procedures; and training personnel on manual revenue related journal entry requirements (began in the first quarter of 2008). |

| | (2) | We enhanced our reviews of project profitability and unbilled revenue realizability on all Energy segment domestic onshore managed services projects by improving and then re-communicating our policies and procedures. Improvements included, but were not limited to, standardizing the processes for gathering, reporting and reviewing project financials; requiring the appropriate operations and financial personnel review of this financial information; and requiring documentation and distribution of the project profitability analyses to Corporate Finance (began in the first quarter of 2008). In addition, in the first quarter of 2008, we conducted training on revenue recognition requirements. |

| | (3) | We re-emphasized to our Energy segment senior management the need to focus on effective operations and financial personnel collaboration as a means of mitigating significant risks and strengthening our control environment. In this regard, we have stressed the importance of operations and financial personnel collaborating and interacting during the monthly accounting close and financial reporting processes (began in the first quarter of 2008). |

| | (4) | We are in the process of reviewing staff competencies within our Energy segment and will use the results of that review in our overall financial statement risk assessment process. This process will include an assessment of the knowledge and experience of management and supervisory personnel within the Energy segment’s Finance Department (began in the second quarter of 2008). |

| | (5) | We made personnel changes that strengthen the control environment within the Energy segment’s Finance Department. Specifically, we hired a Controller and a Project Accountant for the Energy segment, and terminated the Energy segment’s CFO and Manager of Project Accounting in the second quarter of 2008. With assistance from the new Controller, we began working to fill additional financial positions, including project accountants and an Assistant Controller – Projects (began in the second quarter of 2008). |

- 20 -

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Michael Baker Corporation

We have audited Michael Baker Corporation and subsidiaries’ (the “Company”) internal control over financial reporting as of December 31, 2007, based on criteria established inInternal Control – Integrated Frameworkissued by the Committee of Sponsoring Organizations of the Treadway Commission. The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on that risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed by, or under the supervision of, the company’s principal executive and principal financial officers, or persons performing similar functions, and effected by the company’s board of directors, management, and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of the inherent limitations of internal control over financial reporting, including the possibility of collusion or improper management override of controls, material misstatements due to error or fraud may not be prevented or detected on a timely basis. Also, projections of any evaluation of the effectiveness of the internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis. The following material weaknesses were identified and included in management’s assessment:

| | 1. | The Company did not maintain effective controls over the posting of manual journal entries. Specifically, appropriately experienced personnel did not review manual journal entries in |

- 21 -

| | sufficient detail to identify accounting errors associated with manual revenue accruals within the Company’s Energy segment’s domestic onshore managed services projects. This control deficiency resulted in the misstatement of revenue and unbilled revenue accounts and required restatement to the previously issued 2006 consolidated financial statements and unaudited interim financial information as described in Note 2 and Note 21, respectively, to the audited consolidated financial statements included in this Form 10-K. Additionally, this control deficiency could result in a misstatement in the aforementioned accounts that would result in a material misstatement to the annual or interim consolidated financial statements that would not be prevented or detected. Accordingly, the Company has determined that this control deficiency constitutes a material weakness. |

| | 2. | The Company did not maintain effective project accounting related controls, including monitoring, over the Company’s Energy segment’s domestic onshore managed services projects. Specifically, the Company did not have a complement of operations and accounting personnel reviewing project profitability or unbilled revenue realizability in sufficient detail to identify the accounting errors. These control deficiencies resulted in the misstatement of revenue and unbilled revenue accounts and required restatement to the previously issued 2006 consolidated financial statements and unaudited interim financial information as described in Note 2 and Note 21, respectively, to the audited consolidated financial statements included in this Form 10-K. Additionally, these control deficiencies, when aggregated, could result in a misstatement in the aforementioned accounts that would result in a material misstatement to the annual or interim consolidated financial statements that would not be prevented or detected. Accordingly, the Company has determined that these control deficiencies, in the aggregate, constitute a material weakness. |

These material weaknesses were considered in determining the nature, timing, and extent of audit tests applied in our audit of the consolidated financial statements and financial statement schedule as of and for the year ended December 31, 2007, of the Company and this report does not affect our reports on such consolidated financial statements and financial statement schedule.

In our opinion, because of the effect of the material weaknesses identified above on the achievement of the objectives of the control criteria, the Company has not maintained effective internal control over financial reporting as of December 31, 2007, based on the criteria established inInternal Control – Integrated Frameworkissued by the Committee of Sponsoring Organizations of the Treadway Commission.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements and financial statement schedule as of and for the year ended December 31, 2007, of the Company and our reports dated June 27, 2008 expressed unqualified opinions on those consolidated financial statements and financial statement schedule. Our report on the consolidated financial statements included an explanatory paragraph regarding the Company’s adoption of Financial Accounting Standards Board Interpretation No. 48,Accounting for Uncertainty in Income Taxes – an Interpretation of FASB Statement No. 109 in 2007.

|

|

| /s/ Deloitte & Touche LLP |

Pittsburgh, Pennsylvania June 27, 2008 |

- 22 -

Item 9B. Other Information.

Effective April 25, 2001, we entered into a Consulting Agreement with Richard L. Shaw when he previously retired from his position as Chief Executive Officer. Through subsequent amendments, this agreement has been extended through April 26, 2009. The Consulting Agreement provides an annual compensation amount for consulting services in addition to us covering the costs of health insurance and maintains life insurance for Mr. Shaw. The Consulting Agreement also provides for a supplemental retirement benefit commencing at the expiration of the consulting term.

Effective September 14, 2006, Mr. Shaw’s compensation for the consulting services under the agreement was temporarily suspended due to his re-employment by us as our Chief Executive Officer. Effective March 1, 2008, compensation under the Consulting Agreement resumed upon Mr. Shaw’s retirement.

- 23 -

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

Directors

The following table sets forth certain information regarding our directors and nominees as of May 31, 2008. All of the directors with the exception of Mr. Mark E. Kaplan and Mr. Bradley L. Mallory were elected directors by Michael Baker’s shareholders at the 2007 Annual Meeting. Except as otherwise indicated, each director and nominee has held the principal occupation listed or another executive position with the same entity for at least the past five years.

Mr. William J. Copeland, whose term of service is expiring in 2008, has not been re-nominated to serve on the Board. However, in recognition of Mr. Copeland’s years of service, and to continue to leverage Mr. Copeland’s years of experience and industry knowledge, the Board will appoint Mr. Copeland as an Emeritus Director to serve a one-year term expiring in 2009. As an Emeritus Director, Mr. Copeland may attend and participate in Board meetings, but he will not have voting rights.

| | |

Robert N. Bontempo, Ph.D. Age 48 Director since 1997 | | Professor at Columbia University School of Business since 1994. Formerly: Assistant Professor of International Business at Columbia University Graduate School of Business from 1989 to 1994. |

| |

William J. Copeland Age 89 Director since 1983 | | Retired. Formerly: Chairman of the Board of Michael Baker Corporation; Vice Chairman of the Board of PNC Financial Corp. and Pittsburgh National Bank. |

| |

Nicholas P. Constantakis, CPA Age 68 Director since 1999 | | Retired. Formerly: Partner, Andersen Worldwide SC (independent public accountants and consultants) from 1961 to 1997. Holds numerous investment company directorships in the Federated Fund Complex where he is a member of the Audit Committee. From 2005 to 2008, he was Chairman of the Audit Committee of the Funds. |

| |

Mark E. Kaplan, CPA Age 46 Director since February 2008 | | Senior Vice President and Chief Financial Officer of Duquesne Light Holdings since 2005 and a Director of the Wesmark Funds, a mutual fund complex, where he is the Chairman of the Wesmark Funds Audit Committee. Formerly: Managing Director of CLJ Consulting Group (management consulting) from 2004 to 2005; Served in various capacities with Weirton Steel Corporation (integrated steel mill), including as President and Chief Financial Officer, from 1995 until 2004. |

| |

Robert H. Foglesong Age 62 Director since April 2006 | | Special Assistant with Mississippi State University and a Director of Massey Engineering, Stark Aerospace Inc., and CDEX Inc. Dr. Fogelsong serves on the Compensation Committee of CDEX Inc. and on the Finance Committee and Compensation Committee of Stark Aerospace Inc. Formerly: President of Mississippi State University. Prior to Mississippi State University, General Foglesong had a 33-year career with the United States Air Force, including serving as Vice Commander, and retiring in 2006 as a four star general and Commander, United States Air Force Europe. Founded and leads the Appalachian Leadership and Education Foundation. |

- 24 -

| | |

Roy V. Gavert, Jr. Age 74 Director since 1988 | | Chairman of Horton Company (manufacturer of valves for household appliances) since 1989. Formerly: President and Chief Executive Officer of Kiplivit North America, Inc. (manufacturing); Chairman of World Class Processing, Inc. (manufacturing); retired Executive Vice President, Westinghouse Electric Corporation. Director Fincom, Inc.; formerly a Trustee of Bucknell University. |

| |

Bradley L. Mallory Age 55 Director since February 2008 | | President and Chief Executive Officer of Michael Baker Corporation since February 2008. Formerly Chief Operating Officer of Michael Baker Corporation from October 2007 to February 2008; President of Engineering of Michael Baker Jr., Inc. from November 2003 to October 2007; Senior Vice President of Michael Baker Jr., Inc. from March 2003 to October 2003; and Secretary of Transportation of the Commonwealth of Pennsylvania from 1995 to 2003. |

| |

John E. Murray, Jr., S.J.D. Age 75 Director since 1997 | | Chancellor of Duquesne University since 2001; Professor of Law of Duquesne University since prior to 1995. Formerly: President of Duquesne University from 1988 until 2001. Holds numerous investment company directorships in the Federated Fund Complex. |

| |

Pamela S. Pierce Age 53 Director since 2005 | | Executive Vice President of ZTown Investments, Inc. (private oil and gas producers); Member, Board of Managers and Chair of the Compensation Committee of Laredo Petroleum, Inc. (private oil and gas producers). Formerly: President of Huber Energy until 2004; President and Chief Executive Officer of Mirant Americas Energy Capital and Production Company from 2000 until 2002. |

| |

Richard L. Shaw Age 81 Director since 1965 | | Chairman of the Board since 1993. Formerly Chief Executive Officer from September 2006 to February 2008; Chief Executive Officer from 1999 to 2001; President and Chief Executive Officer from 1993 through 1994; and President and Chief Executive Officer from 1984 to 1992. Mr. Shaw has held various positions since joining Michael Baker in 1952. |

The Audit Committee

The Audit Committee met ten times in 2007. The Audit Committee members are Dr. Bontempo, Mr. Constantakis, Mr. Gavert and Mr. Kaplan. Dr. Bontempo served as the Audit Committee’s Chairman until his resignation on November 1, 2007, when Mr. Constantakis was appointed Chairman. Mr. Kaplan was appointed to the Audit Committee in February 2008. The Board of Directors has concluded that all Audit Committee members are independent as defined by the American Stock Exchange listing standards. In addition, the Board has determined that both Mr. Constantakis and Mr. Kaplan qualify as “audit committee financial experts,” as such is defined by the regulations of the Securities and Exchange Commission.

Executive Officers