UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Annual Report Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

For the fiscal year ended December 31, 2011

Commission file number 1-6627

MICHAEL BAKER CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Pennsylvania | | 25-0927646 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

Airside Business Park, 100 Airside Drive, Moon Township, PA | | 15108 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (412) 269-6300

Securities registered pursuant to Section 12(b) of the Act:

| | |

|

|

Title of Class | | Name of each exchange on which registered |

Common Stock, par value $1 per share | | NYSE Amex |

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No ü

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes No ü

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ü No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ü No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | |

| | | Large accelerated filer | | Accelerated filer ü |

| | Non-accelerated filer | | Smaller reporting company |

Indicate by check mark if the registrant is a shell company of the Act (as defined in Rule 12b-2 of the Act).

Yes No ü

The aggregate market value of Common Stock held by non-affiliates as of June 30, 2011 (the last business day of the Company’s most recently completed second fiscal quarter) was $171.4 million. This amount is based on the closing price of the Company’s Common Stock on the New York Stock Exchange Amex for that date. Shares of Common Stock held by executive officers and directors of the Company and by the Company’s 401(k) plan are not included in the computation.

As of February 29, 2012, the Company had 9,565,312 outstanding shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

| | |

| Document | | Parts of Form 10-K into which Document is incorporated |

Financial Section of Annual Report to Shareholders for the year ended December 31, 2011 | | I, II |

Proxy Statement to be distributed in connection with the 2012 Annual Meeting of Shareholders | | III |

MICHAEL BAKER CORPORATION

FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

TABLE OF CONTENTS

Note with respect to Forward-Looking Statements:

This Annual Report on Form 10-K, and in particular the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of Exhibit 13.1 hereto, which is incorporated by reference into Item 7 of Part II, contains forward-looking statements concerning our future operations and performance. Forward-looking statements are subject to market, operating and economic risks and uncertainties that may cause our actual results in future periods to be materially different from any future performance suggested herein. Factors that may cause such differences include, among others: the events described in the “Risk Factors” section of this Form 10-K; increased competition; increased costs; changes in general market conditions; changes in industry trends; changes in the regulatory environment; changes in our relationship and/or contracts with the Federal Emergency Management Agency (“FEMA”) and/or other U.S. Federal Government Departments and Agencies; changes in anticipated levels of government spending on infrastructure, including the Safe, Accountable, Flexible, Efficient Transportation Equity Act — A Legacy for Users (“SAFETEA-LU”) and the American Recovery and Reinvestment Act of 2009; changes in loan relationships or sources of financing; changes in management; changes in information systems; and the restatement of financial results. Such forward-looking statements are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995.

PART I

Item 1. Business.

General

In this Form 10-K, the terms “the Company,” “we,” “us” or “our” refer to Michael Baker Corporation and its subsidiaries collectively. We were founded in 1940 and organized as a Pennsylvania corporation in 1946. Today, through our operating subsidiaries, we provide engineering expertise for public and private sector clients worldwide. Our business is principally in the United States of America (“U.S.”).

Acquisitions and Divestitures

Over the past several years, we have made a strategic determination to focus on growing our core Engineering Operations. As a result of this focus, we have transacted the following material acquisitions and divestitures to align with this core strategy:

RBF Acquisition. On October 3, 2011, we entered into a Stock Purchase Agreement (“SPA”) to acquire 100% of the outstanding shares of RBF Consulting (“RBF”), an engineering, planning, surveying and environmental firm based in Irvine, California. RBF provides comprehensive planning, design and construction management and inspection services for its clients including public and governmental agencies, the development community, private enterprise and non-profit agencies. The results of operations for RBF are reflected in our Federal and Transportation segments for the period from October 1, 2011 through December 31, 2011.

LPA Acquisition. On May 3, 2010, we acquired 100% of the outstanding shares of The LPA Group, Incorporated and substantially all of its subsidiaries and affiliates (“LPA”). LPA is an engineering, architectural and planning firm specializing primarily in the planning and design of airports, highways, bridges and other transportation infrastructure, headquartered in Columbia, South Carolina. LPA’s results are reflected in our Transportation segment for the year ended December 31, 2011 and for the period from May 3, 2010 through December 31, 2010.

Energy Disposition. Our former Energy segment (“Baker Energy”) provided a full range of services for operating third-party oil and gas production facilities worldwide. On September 30, 2009, we divested substantially all of our subsidiaries that pertained to our former Energy segment. Additionally, we sold our interest in B.E.S. Energy Resources Company, Ltd., a Baker Energy company, on December 18, 2009 to J.S. Technical Services Co., LTD., which is owned by our former minority partner in B.E.S. As such, the Energy business has been reclassified into “discontinued operations” in our accompanying consolidated financial statements. The results for the years ended December 31, 2011, 2010 and 2009 give effect to the dispositions.

Business Segments

Our business segments have been determined based on how executive management makes resource decisions and assesses our performance. Our two reportable segments are Transportation and Federal. Information regarding these business segments is contained in our “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and in the “Business Segments” note to our consolidated financial statements, which are included within Exhibit 13.1 to this Form 10-K. Such information is incorporated herein by reference.

The Transportation segment provides services for Surface Transportation, Aviation and Rail & Transit markets, and the Federal segment provides services for Defense, Environmental, Architecture, Geospatial Information Technology, Homeland Security, Municipal & Civil, Oil & Gas, Telecom & Utilities and Water markets. Among the services the Company provides to clients in these markets are project and program management, design-build (for which we only provide the design portion of services), construction management and inspection, consulting, planning, surveying, mapping, geographic information systems, architectural, interior design, site planning and design, constructability reviews, site assessment and restoration, strategic regulatory analysis and compliance.

- 1 -

We have designed a wide range of projects, such as highways, bridges, airports, busways, corporate headquarters, data centers and educational facilities. We also provide services in the water/wastewater, pipeline, emergency and consequence management, resource management, and telecommunications markets. Our business is susceptible to upward and downward fluctuations in federal and state government spending.

Our transportation services have benefited from the U.S. federal government’s Safe, Accountable, Flexible, Efficient Transportation Equity Act — A Legacy for Users (“SAFETEA-LU”) legislation and the American Recovery and Reinvestment Act of 2009 (Stimulus) in recent years. Additionally, we have benefited from increased federal government spending in the Department of Defense (“DoD”) and the Department of Homeland Security (“DHS”), including FEMA, US-VISIT and the U.S. Coast Guard. We partner with construction contractors to pursue selected design-build contracts which continue to be a growing project delivery method within the transportation and civil infrastructure markets.

According to the annual listings published in “The 2011 Top 500 Design Firms Sourcebook” by Engineering News-Record (“ENR”) magazine andBuilding Design & Construction’s report “2011 Giants: Top 300 AEC Firms” based on total engineering revenues for 2010, we ranked as follows (as these rankings were compiled prior to our acquisition of RBF, their rankings are also listed as appropriate):

| | • | | Top 500 Design Firms — 31st (RBF ranked 104th) |

| | • | | Water Supply — 15th(RBF ranked 35th) |

| | • | | Multi-Unit Residential Buildings — 5th |

| | • | | Top 100 Green Design Firms — 18th |

| | • | | Top 25 Government Design Firms — 15th |

| | • | | Green Design Multi-Unit Residential Buildings — 1st |

| | • | | Top 100 “Pure Designers” — 14th(RBF ranked 72nd) |

| | • | | Top Construction Management-for-fee Firms — 21st |

| | • | | Top Environmental Firms — 77th |

| | • | | Top 150 Global Design Firms — 72nd |

| | • | | Engineers/Architects — 19th |

Primary Markets/Services

Many of the ancillary services we offer are provided to the entire spectrum of markets we serve. These services include, but are not limited to, geographic information systems, geotechnical engineering and design, services related to the National Environmental Policy Act (“NEPA”), project and program management, construction management and inspection services, and general architectural and engineering consulting services. The listing below describes, in more detail, services provided to the specific markets served by our Transportation segment and Federal segment.

Transportation

Aviation:

| | • | | Airfield Lighting, Signing & Navigation Aide Systems |

| | • | | Airport Facilities Planning & Design |

| | • | | Environmental Planning & Design |

| | • | | Master Planning & Airport Layout Plans |

| | • | | Roadway & Parking Facility Design |

| | • | | Runway, Taxiway & Apron Design |

- 2 -

Rail & Transit (Public Transit, High Speed Rail, Passenger Rail, Freight Rail):

| | • | | Architecture & Facilities Infrastructure Design |

| | • | | Rail Systems Engineering |

Surface Transportation:

| | • | | Bridge Inspection & Training |

| | • | | Intelligent Transportation Systems |

| | • | | Public Involvement & Social Media |

| | • | | Toll Roads Traffic Planning, Design & Analysis |

Federal

Architecture:

| | • | | Building Information Modeling (“BIM”) |

| | • | | Computer Aided Facility Management |

| | • | | Electrical & Mechanical Engineering |

| | • | | Fire Protection Engineering |

| | • | | Interior Design & Space Plannin |

| | • | | Maintenance Management Systems |

| | • | | Site, Structural & Civil Engineering |

| | • | | Sustainable Design (LEED® Certified Design) |

| | • | | Urban Planning & Design |

Defense:

| | • | | Conservation Conveyance |

| | • | | Facilities Planning, Design & Support |

| | • | | Installation/Site Restoration |

| | • | | Military Construction Program Support |

Environmental:

| | • | | Environmental Engineering, Permitting, Investigation & Restoration |

| | • | | Environmental Program Management |

| | • | | Environmental Risk Assessment |

| | • | | Health, Safety & Environmental |

| | • | | Petroleum Storage Tank Management |

- 3 -

Geospatial Information Technology:

| | • | | Application Design & Development |

| | • | | Data Access & Visualization |

| | • | | Global Positioning System Services |

| | • | | Mobile LiDAR (“Light Detection And Ranging”) Data Acquisition |

| | • | | Surveying, Mapping, Data Acquisition & Processing |

| | • | | Statewide Broadband Mapping |

Homeland Security:

| | • | | Damage Forecasting & Loss Estimation |

| | • | | Emergency Operations/Response Planning |

| | • | | Evacuation & Sheltering Plans |

| | • | | Hazard Mitigation Planning |

| | • | | Homeland Security Asset Management |

| | • | | Infrastructure Damage Assessments |

| | • | | Infrastructure Protection Planning & Design |

| | • | | Interagency Coordination & Public Outreach |

| | • | | Risk-Based Strategic Planning |

| | • | | Security, Threat, Vulnerability & Risk Assessments |

Municipal & Civil:

| | • | | Environmental Engineering Compliance |

| | • | | Hydrologic & Hydraulic Models & Studies |

| | • | | Municipal Infrastructure Engineering |

| | • | | Site Development Plans & Permitting |

| | • | | Surface & Deep Mining Permitting & Reclamation |

| | • | | Water/Wastewater Conveyance & Treatment |

Oil & Gas:

| | • | | Cold Region Engineering |

| | • | | Energy Development Services (Solar, Wind, Photovoltaic, Geothermal & Hydropower) |

| | • | | Environmental Field Services and Permitting |

| | • | | Feasibility and Front End Engineering Design (“FEED”) Studies |

| | • | | Failure Investigation & Analysis |

| | • | | Gas Well Site Development and Permitting |

| | • | | Operations and Maintenance Support |

| | • | | Pipeline and Facility Design |

| | • | | Program & Project Management |

- 4 -

Telecom & Utilities:

| | • | | Environmental Permitting |

| | • | | Geospatial Information Technology Services |

| | • | | Geotechnical Engineering |

| | • | | Project & Program Management |

| | • | | Public Safety and Emergency Services |

| | • | | Radio Frequency Studies |

| | • | | Routine Alignment Design |

| | • | | Site Design Structural Analysis |

Water:

| | • | | Flood Insurance Rate Maps & Studies |

| | • | | Floodplain Delineation & Studies |

| | • | | Stream Stabilization/Restoration |

| | • | | Surface Water Quality & TMDL Services |

| | • | | Floodplain Management & River Engineering |

| | • | | Hydrologic and Hydraulic Modeling |

| | • | | Source Water Supply & Protection |

| | • | | Water Resources Planning & Asset Management |

Strategy

Our strategy is based on four concepts — growth, profitability, innovation and sustainability.

Growth — We seek to grow both organically and through strategic acquisitions. Organically, we will seek to grow by securing larger and more complex projects and programs that correspond well with our existing knowledge and capabilities, primarily in the United States. For example, we have begun to expand beyond the Departments of Defense and Homeland Security and are now providing services to other federal departments and agencies such as the Departments of Energy and Interior. Furthermore, we will seek to provide additional and related services to existing clients; for example, offering construction management services to a State Department of Transportation for which we are currently providing only design services. With regard to acquisitions, we will seek opportunities that expand our skill sets and/or our geographical presence in our core businesses.

Profitability — We seek to consistently improve the profitability of our businesses through long-term, performance-based contracting arrangements with our clients. This strategy is evident in our current mix of contracts. We will also be pursuing projects that utilize alternative delivery methods, such as design-build, which traditionally carry a higher margin as well as performance incentives.

Innovation — We strive to constantly and consistently innovate ways to deliver services to our clients. For example, in both our Transportation and Architecture service areas, we are partnering with preferred contractors and pursuing an increased level of design-build contracts, as opposed to the traditional design-bid-build method of project delivery. Additionally, we utilize mapping and geographic information technology in a number of innovative ways.

Sustainability — We are aggressively incorporating long-term environmental, social and economic goals into our daily activities and culture to achieve improved efficiencies, performance and prosperity. As such, we are working methodically to build the appropriate tools and applications to help us succeed in this endeavor and to better serve our clients and the communities where we live and work.

- 5 -

Our Board of Directors continually reevaluates the strategic alternatives for the Company to assess the current strategy and to evaluate whether there are other alternative strategies to pursue in order to drive value to all the Company’s stakeholders.

Domestic and Foreign Operations

For the years ended December 31, 2011 and 2010 our percentages of total contract revenues derived from work performed for U.S.-based clients within the U.S. totaled 95% and for the year ended December 31, 2009 totaled 90%.

Contract Backlog

Information relating to the contract backlog is set forth in the “Contract Backlog” section of Exhibit 13.1 to this Form 10-K. Such information is incorporated herein by reference.

Significant Customers

Contracts with various branches, departments and agencies of the U.S. federal government accounted for 31%, 37% and 49% of our total contract revenues for the years ended December 31, 2011, 2010 and 2009, respectively. Our contracts with FEMA accounted for approximately 8%, 11% and 15% of our revenues in 2011, 2010 and 2009, respectively.

Competitive Conditions

Our business is highly competitive with respect to all principal services we offer. We compete with numerous public and private firms that provide some or all of the services that we provide. Our competitors range from large national and international architectural, engineering and construction services firms to a vast number of smaller, more localized firms. Our competitors vary based on the type of the services being proposed.

The competitive conditions in our businesses relate to the nature of the contracts being pursued. Public-sector contracts, consisting mostly of contracts with federal and state governmental entities, are generally awarded through a competitive process, subject to the contractors’ qualifications and experience. We employ cost estimating, scheduling and other techniques for the preparation of these competitive bids. Private-sector contractors compete primarily on the basis of qualifications, quality of performance and price of services. Most private and public-sector contracts for professional services are awarded on a negotiated basis.

We believe that the principal competitive factors in the areas of services that we offer are quality of service, reputation, experience, technical proficiency, local geographic presence and cost of service. We believe that we are well positioned to compete effectively by emphasizing the quality of services we offer and our widely known reputation in providing professional engineering services. We are also dependent upon the availability of staff and our ability to recruit qualified employees.

Seasonality

Based upon our experience, our total contract revenues and income from operations have historically been slightly lower for our first and fourth fiscal quarters than for the remaining quarters due to the effect of winter weather conditions, particularly in the Mid-Atlantic and Midwest regions of the United States. Typically, these seasonal weather conditions unfavorably impact our performance of construction management services.

Personnel

As of December 31, 2011, we had 3,246 total employees, of which our operations had 3,188 employees and our corporate staff included 58 employees. Of our total employees, 2,837 were full-time and 409 were part-time. We believe that our relations with employees are good.

- 6 -

With the RBF acquisition we added a total of approximately 30 surveyors in Southern California who belong to The International Union of Operating Engineers, Local Union No. 12 (“Local No. 12”) and in Northern California who belong to Operating Engineers Local Union No. 3 (Technical Engineers and General Surveying for Northern California and Northern Nevada) (“Local No. 3”). RBF is a member of two employer-representative associations, the Southern California Association of Civil Engineers and Land Surveyors and the California & Nevada Civil Engineers and Land Surveyors Association. These associations provide assistance with pay rate and benefits negotiations with the respective labor unions and the current labor agreement for Local No. 12 is in effect from October 1, 2010 to October 1, 2013 and for Local No. 3 is in effect from April 1, 2012 to February 28, 2015. We believe our relations with our unions are good.

Executive Officers

Our executive officers and certain significant employees as of February 29, 2012:

Bradley L. Mallory — Age 59; President and Chief Executive Officer of Michael Baker Corporation since February 2008. Formerly Chief Operating Officer of Michael Baker Corporation from October 2007 to February 2008; President of Michael Baker Jr., Inc. from November 2003 to October 2007; Senior Vice President of Michael Baker Jr., Inc. from March 2003 to October 2003; and Secretary of Transportation of the Commonwealth of Pennsylvania from 1995 to 2003.

Michael J. Zugay — Age 60; Joined Michael Baker Corporation in February 2009 and has served as Executive Vice President and Chief Financial Officer since April 2009 and Chief Administrative Officer since August 2011. Prior to joining Michael Baker Corporation, Mr. Zugay was Senior Vice President, Chief Financial Officer and Corporate Secretary of iGate Corporation from April 2001 to March 2008 and held various other positions at iGate from March 1995 to April 2001. Prior to that he served as President and CEO of Bliss-Salem, Inc.

H. James McKnight — Age 67; Executive Vice President, Chief Legal Officer and Corporate Secretary since June 2000. Mr. McKnight has been employed by Michael Baker Corporation since 1995, serving as Senior Vice President, General Counsel and Secretary from 1998 to 2000 and as Vice President, General Counsel and Secretary from 1995 to 1998.

Joseph R. Beck — Age 67; Chief Practice Officer since January 2012, Senior Vice President of Corporate Development since September 2008 and Director of Corporate Development since March 2008. Mr. Beck joined Michael Baker Corporation as an Operations Manager in June 2004. Prior to joining Michael Baker Corporation, Mr. Beck was a private consultant and an adjunct professor at the University of Pittsburgh from 2002 to 2004 and was a Senior Vice President with The IT Group from 1994 to 2002.

Jeremy N. Gill — Age 33; Vice President and Chief Information Officer since October 2007. Mr. Gill joined Michael Baker Jr., Inc in 2000 as a Technical Consultant. Mr. Gill served in a number of capacities of increasing responsibility for Michael Baker Jr., Inc and Michael Baker Corporation from 2000-2007.

David G. Greenwood — Age 60; Executive Vice President — Marketing of Michael Baker Jr., Inc., a subsidiary of Michael Baker Corporation, since April 2005. Mr. Greenwood previously served in various operational and marketing capacities since 1973, including Vice President and Senior Vice President of Michael Baker Jr., Inc. from 1994 to April 2005.

David G. Higie — Age 55; Vice President of Corporate Communications and Investor Relations for Michael Baker Corporation since 2006. Mr. Higie joined Michael Baker Corporation in 1996 as Director of Corporate Communications.

James M. Kempton — Age 37; Vice President, Corporate Controller and Treasurer of Michael Baker Corporation since April 2009, Vice President and Corporate Controller since December 2008 and Assistant Corporate Controller from January 2007 through November 2008. Mr. Kempton was previously employed with Ernst and Young from

- 7 -

1997 to 2007 in various positions, including Senior Manager in the Assurance and Advisory Business Services practice.

Samuel C. Knoch — Age 55; Vice President and Chief Risk Officer since March 2009. Prior to joining Michael Baker Corporation, Mr. Knoch was Chief Financial Officer from August 1996 to October 2008 and Treasurer from April 1997 to October 2008 at Tollgrade Communications, Inc. Prior to that appointment, he served as Corporate Controller and Director of Internal Audit at Amsco International, Inc. from July 1993 to August 1996.

G. John Kurgan — Age 62; Executive Vice President since 2007 and Chief Operating Officer since August 2011. Mr. Kurgan was previously a Senior Vice President of Michael Baker Jr., Inc. from 1995 to 2007. Mr. Kurgan has held various positions since joining Michael Baker Jr., Inc. in 1974.

Michael J. Ziemianski — Age 54; Vice President and Chief Resource Officer since June 2008. Mr. Ziemianski joined Michael Baker Corporation in 2006 as Manager of Corporate Recruiting. Prior to joining Michael Baker Corporation, Mr. Ziemianski was Director of Human Resources at Rapidigm Inc. from 2001 to 2006.

Our executive officers and significant employees serve at the discretion of the Board of Directors and are elected by the Board or appointed annually for a term of office extending through the election or appointment of their successors.

Available Information

Our Internet website address iswww.mbakercorp.com. We post our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports to our website as soon as reasonably practical after such reports are electronically filed with the Securities and Exchange Commission (“SEC”). We make these reports available on our website free of charge. These reports and any amendments to them are also available at the SEC’s website,www.sec.gov. We also post press releases, earnings releases, the Code of Ethics for Senior Officers, the Code of Business Conduct, the Statement of Policy with Respect to Related Party Transactions and the Charters related to the Governance and Nominating Committee, Audit Committee, Environmental, Health, Safety and Compliance Committee and Compensation Committee to our website. The information contained on our website is not incorporated by reference into this Form 10-K and shall not be deemed “filed” under the Securities Exchange Act of 1934, as amended.

In addition to other information referenced in this report, we are subject to a number of specific risks outlined below. If any of these events or uncertainties actually occurs, our business, financial condition, results of operations and cash flows, and/or the market price of our Common Stock could be materially affected. You should carefully consider the following factors and other information contained in this Annual Report on Form 10-K before deciding to invest in our Common Stock.

Our business strategy is to grow the business both organically and through acquisitions. This strategy of growth may subject us to certain risks and uncertainties.

As part of our strategy, we seek to grow both organically and through strategic acquisitions. Our organic initiatives may involve entering new markets or service lines where we currently do not have a presence. Risks associated with achieving our organic growth objectives include higher than anticipated levels of competition, incorrect assumptions about the timing of market development and size, and the relative experience levels of key company personnel involved in the development of new markets on our behalf. In addition, we may invest resources currently into organic growth initiatives that may take a significant amount of time to come to fruition, or may never materialize at all. This would result in reduced margins and cash flow. Acquisitions also present a myriad of risks, including failure to realize anticipated synergies, difficulties with the integration of the acquired business and/or with the retention of key management personnel from the acquired company, cultural differences with the acquired

- 8 -

company, significant transaction costs associated with the purchase and assimilation of the business, the risk of subjecting our company to unknown liabilities associated with the acquired business, and the potential impairment of intangible assets and goodwill associated with the transaction. In addition, there is a risk that we may not be able to identify suitable targets at appropriate valuations that will enable us to execute on our growth strategy. Also, as part of executing an acquisition, we may utilize equity in the Company to partially fund the transaction, which could dilute share ownership. In the event we use our cash or borrowings under our Credit Agreement as consideration for certain acquisitions we may make, we could significantly reduce our liquidity.

Our goodwill or other intangible assets could become impaired and result in a material reduction in our profits.

We have made acquisitions which have resulted in the recording of goodwill and intangible assets in our financial statements, and we plan to make additional acquisitions going forward. Our goodwill balance is evaluated for potential impairment during the second quarter of each year and as considered necessary based upon the identification of certain triggering events. The evaluation of impairment involves comparing the current fair value of the reporting unit to the carrying amount, including goodwill. To determine the fair value of the reporting unit, we utilize both the “Income Approach,” which is based on estimates of future net cash flows and the “Market Approach,” which observes transactional evidence and operational results involving similar businesses. We also perform an analysis of our intangible assets to test for impairment whenever events occur that indicate impairment could exist. Examples of such events are i) significant adverse changes in its market value, useful life, physical condition, or in the business climate that could affect its value; ii) a current-period operating or cash flow losses or a projection or forecast that demonstrates continuing losses associated with the use of the intangible asset; and iii) a current expectation that, more likely than not, the intangible asset will be sold or otherwise disposed of before the end of its previously estimated useful life. If goodwill or other intangible assets become impaired, a material write-off in the required amount could lead to a reduction or elimination of our profits.

Our revenues are primarily derived from the public sector. Changes and fluctuations in the public sector’s spending priorities, or the loss of business from one of these key customers, could materially affect our future revenue and growth prospects.

Our primary customers, which comprise a substantial portion of our revenue and backlog, include agencies of the U.S. federal government and state and local governments and agencies that depend on funding or partial funding provided by the U.S. federal government. Consequently, any loss of one or more of these key customers, including FEMA, as well as any significant changes or fluctuations in the government’s spending priorities as a result of policy changes or economic downturns may directly affect our future revenue streams. Legislatures may appropriate funds for a given project on a year-by-year basis, even though the project may take more than one year to perform. As a result, at the beginning of a project, the related contract may only be partially funded, and additional funding is committed only as appropriations are made in each subsequent year. These appropriations, and the timing of payment of appropriated amounts, may be influenced by, among other things, the state of the economy, competing political priorities, curtailments in the use of government contracting firms, increases in raw material costs, delays associated with a lack of a sufficient number of government staff to oversee contracts, budget constraints, the timing and amount of tax receipts, and the overall level of government expenditures.

Our inability to continue to win or renew government contracts could result in material reductions in our revenues and profits.

We have increased our contract activity with the U.S. federal, state and local governments in recent years. We compete for and win a number of these contracts based on application of a quality based standard. Our ability to earn revenues and maintain margins from our existing and future government projects will depend upon the continuation of these quality based selection standards as well as the availability of funding by our served and targeted government agencies. We cannot control whether those clients will fund or continue funding our outstanding projects.

- 9 -

If our relationship or reputation with government clients deteriorates for any reason and affects our ability to win new contracts or renew existing ones, we could experience an adverse impact to our financial results.

We are engaged in highly competitive markets that pose challenges to continued revenue growth.

Our business is characterized by competition for contracts within the government and private sectors in which service contracts are typically awarded through competitive bidding processes. We compete with a large number of other service providers who offer the principal services we offer. In this competitive environment, we must provide technical proficiency, quality of service, and experience to ensure future contract awards and revenue and profit growth. Changes in funding availability to either the public or private sectors may increase competitive pressure within our industry which could result in a reduction in revenues and margins in the future.

Unpredictable economic cycles or uncertain demand for our engineering capabilities and related services could cause our revenues to fluctuate or contribute to delays or the inability of customers to pay our fees.

Demand for our services is affected by the general level of economic activity in the markets in which we operate, both in the U.S. and internationally. Our customers, and the markets in which we compete to provide services, are likely to experience periods of economic decline from time to time. Adverse economic conditions may decrease our customers’ willingness to make capital expenditures or otherwise reduce their spending to purchase our services. In addition, adverse economic conditions could alter the overall mix of services that our customers seek to purchase, and increased competition during a period of economic decline could result in us accepting contract terms that are less favorable to us than we might be able to negotiate under other circumstances. Adverse economic conditions, changes in our mix of services or a less favorable contracting environment may cause our revenues and margins to decline. Moreover, our customers may experience difficult business climates from time to time that may decrease our clients’ ability to obtain financing and could cause delays or failures to pay our fees as a result.

Our ability to recruit, train and retain professional personnel of the highest quality has helped to build our reputation and establish a competitive advantage. Our future inability to attract and retain talent would adversely affect our competitiveness.

Our contract obligations in the markets we serve are performed by a staff of well-qualified engineers, technical professionals and management personnel. Our future growth potential requires the effective recruiting, training, and retention of these employees. Our inability to retain these well-qualified personnel and recruit additional well-qualified personnel would adversely affect our business performance and limit our ability to perform new contracts.

Our international business operations are subject to unique risks and challenges that create increased uncertainty in these markets.

Our international operations are subject to unique risks. These risks can include: potentially dynamic social, political and economic environments; civil disturbances, unrest, or violence including terrorism associated with operating in a war zone; volatile labor conditions due to strikes and general difficulties in staffing international operations with highly qualified personnel; and logistical and communication challenges. Unexpected changes in regulatory requirements in foreign countries as well as inconsistent regulations, diverse licensing, and legal and tax requirements that differ from one country to another could also adversely affect our international projects.

Our involvement in partnerships, joint ventures and use of subcontractors exposes us to additional legal and market reputation damages.

Our methods of service delivery include the use of partnerships, subcontractors, joint ventures and other ventures. If our partners or subcontractors fail to satisfactorily perform their obligations as a result of financial or other difficulties, we may be unable to adequately perform or deliver our contracted services. Under these circumstances, we may be required to make additional investments and provide additional services to ensure the adequate

- 10 -

performance and delivery of the contracted services. Additionally, we may be exposed to claims for damages that are a result of a partner’s or subcontractor’s performance. We could also suffer contract termination and damage to our reputation as a result of a partner’s or subcontractor’s performance.

In addition, we may participate in partnerships, joint ventures or other ventures in which we do not hold the controlling interest. To the extent the partner with the controlling interest in such an arrangement makes decisions that negatively impact that entity, our business, financial condition and results of operations could be negatively impacted.

We are subject to laws and regulations associated with our government contracts. If we do not comply with these laws and regulations, we may be prohibited from completing our existing government contracts or suspended from government contracting and subcontracting for some period of time or debarred.

Our compliance with the laws and regulations relating to the procurement, administration, and performance of our government contracts is dependent upon our ability to ensure that we properly design and execute compliant procedures. Our termination from any of our larger government contracts or suspension from future government contracts for any reason would result in material declines in expected revenue. Because U.S. federal laws permit government agencies to terminate a contract for convenience, the U.S. federal government may terminate or decide not to renew our contracts with little or no prior notice.

Our operations are also subject to the risk of changes in laws and policies which may impose restrictions on our business, including trade restrictions, and could have a material adverse effect on our operations. Our future operations and earnings may be adversely affected by new legislation, new regulations or changes in, or new interpretations of, existing regulations and the impact of these changes could be material.

Employee, partner, joint venture or subcontractor misconduct or our overall failure to comply with laws or regulations could weaken our ability to win contracts, which could result in reduced revenues and profits.

Misconduct, fraud, non-compliance with applicable laws and regulations, or other improper activities by one of our employees, agents or partners could have a significant negative impact on our business and reputation. Such misconduct could include the failure to comply with government procurement regulations, regulations regarding the protection of classified information, regulations prohibiting bribery and other foreign corrupt practices, regulations regarding the pricing of labor and other costs in government contracts, regulations on lobbying or similar activities, regulations pertaining to the internal controls over financial reporting, environmental laws, and any other applicable laws or regulations. For example, we regularly provide services that may be highly sensitive or that relate to critical national security matters; if a security breach were to occur, our ability to procure future government contracts could be severely limited. The precautions we take to prevent and detect these activities may not be effective, and we could face unknown risks or losses. Our failure to comply with applicable laws or regulations or acts of misconduct could subject us to fines and penalties, loss of security clearance, and suspension or debarment from contracting, which could weaken our ability to win contracts and result in reduced revenues and profits and could have a material adverse impact on our business, financial condition, and results of operations.

Violations of foreign governmental regulations, including the U.S. Foreign Corrupt Practices Act and similar worldwide anti-corruption laws could result in fines, penalties and criminal sanctions against the Company, its officers or both and could adversely affect our business.

Our foreign operations are subject to governmental regulations in the countries in which we operate as well as U.S. laws. These include regulations relating to currency conversion, repatriation of earnings, taxation of our earnings and the earnings of our personnel, and the increasing requirement in some countries to make greater use of local employees and suppliers, including, in some jurisdictions, mandates that provide for greater local participation in the ownership and control of certain local business assets.

- 11 -

The U.S. Foreign Corrupt Practices Act (FCPA) and similar other worldwide anti-corruption laws, such as the U.K. Bribery Act, prohibit improper payments to non-U.S. officials for the purpose of obtaining or retaining business. Although we have established an internal control structure, corporate policies, compliance and training processes to reduce the risk of violation, we cannot ensure that these procedures will protect us from violations of such policies by our employees or agents. Failure to comply with applicable laws or regulations could subject us to fines and penalties and suspension or debarment from contracting. Events of non-compliance could harm our reputation, reduce our revenues and profits and subject us to criminal and civil enforcement actions. Violations of such laws or allegations of violation could disrupt our business and result in material adverse results to our operating results or future profitability.

If we are unable to accurately estimate and control our contract costs, then we may incur losses on our contracts, which could decrease our operating margins and significantly reduce or eliminate our profits.

It is important for us to control our contract costs so that we can maintain positive operating margins. A significant portion of our contracts are being conducted on a fixed price or not to exceed basis. Under our fixed-price contracts, we receive a fixed price regardless of what our actual costs will be. Our not to exceed contracts require that we invoice costs up to a maximum dollar amount determined by the contract. Consequently, we realize a profit on fixed-price and not to exceed contracts only if we properly estimate and control our costs on the contracts. Under our time-and-materials contracts, we are paid for labor at negotiated hourly billing rates and for other expenses. Profitability on our contracts is driven by billable headcount and our ability to manage costs. Under each type of contract, if we are unable to control costs, we may incur losses on our contracts, which could decrease our operating margins and significantly reduce or eliminate our profits.

We use “percentage-of-completion” accounting methods for many of our projects. This method may result in volatility in reported revenues and profits.

Our revenues and profits for many of our contracts are recognized ratably as those contracts are performed. This rate is based primarily on the proportion of labor costs incurred to date to total labor costs projected to be incurred for the entire project. This method of accounting requires us to calculate revenues and profit to be recognized in each reporting period for each project based on our predictions of future outcomes, including our estimates of the total cost to complete the project, project schedule and completion date, the percentage of the project that is completed and the amounts of any change orders that have been generally agreed upon but not approved. Our failure to accurately estimate these often subjective factors could result in reduced profits or losses for certain contracts.

If we miss a required performance standard, fail to timely complete, or otherwise fail to adequately perform on a project, then we may incur a loss on that project, which may reduce or eliminate our overall profitability.

We may commit to a client that we will complete a project by a scheduled date. We may also commit that a project, when completed, will achieve specified performance standards. If the project is not completed by the scheduled date or fails to meet required performance standards, we may either incur significant additional costs or be held responsible for the costs incurred by the client to rectify damages due to late completion or failure to achieve the required performance standards. The uncertainty of the timing of a project can present difficulties in planning the amount of personnel needed for the project. If the project is delayed or canceled, we may bear the cost of an underutilized workforce that was dedicated to fulfilling the project. In addition, performance of projects can be affected by a number of factors beyond our control, including unavoidable delays from weather conditions, changes in the project scope of services requested by clients or labor or other disruptions. In some cases, should we fail to meet required performance standards, we may also be subject to agreed-upon financial damages, which are determined by the contract. To the extent that these events occur, the total costs of the project could exceed our estimates resulting in lower future project profitability, or project losses, some which could be significant.

- 12 -

Our government and certain private sector contracts may give the customer the right to modify, delay, curtail or terminate our contracts at their convenience at any time prior to their completion. Therefore, our backlog is subject to unexpected adjustments, delays and cancellations.

We cannot assure that our funded or unfunded backlog will be realized as revenues or that, if realized, it will result in profits. Projects may remain in our backlog for an extended period of time prior to project execution and, once project execution begins, revenues may occur unevenly over current and future periods. Our ability to earn revenues from our backlog depends on the availability of funding for various U.S. federal, state, local and foreign government agencies. In addition, most of our private domestic industrial clients have termination for convenience provisions in their contracts. Therefore, project terminations, suspensions or reductions in scope may occur from time to time with respect to contracts reflected in our backlog. Project cancellations, delays and scope adjustments could further reduce the dollar amount of our backlog and the revenues and profits that we actually earn.

We are subject to routine U.S. federal, state and local government audits related to our government contracts. If audit findings are unfavorable, we could experience a reduction in our profitability.

Our government contracts are subject to audit. These audits may result in the determination that certain costs claimed as reimbursable are not allowable or have not been properly allocated to government contracts according to federal government regulations. We are subject to audits for several years after payment for services has been received. Based on these audits, government entities may adjust or seek reimbursement for previously paid amounts. It is possible, however, that an audit in the future could have an adverse effect on our revenue, profits and cash flow.

Our profits and revenues could suffer if we are involved in legal proceedings, investigations and disputes.

We engage in services that can result in substantial injury or damages that may expose us to legal proceedings, investigations and disputes. For example, in the ordinary course of our business, we may be involved in legal disputes regarding personal injury and wrongful death claims, employee or labor disputes, professional liability claims, and general commercial disputes involving project cost overruns and liquidated damages as well as other claims. In addition, we frequently make professional judgments and recommendations about environmental and engineering conditions of project sites for our clients. In the event that these professional judgments and recommendations are included in the final work product delivered to our clients, we have no ability to control the manner in which our clients use such information. As a result, we may be deemed to be responsible if this information is relied upon by others without appropriate disclaimers and the information is later determined to be inaccurate. Any unfavorable legal ruling against us could result in substantial monetary damages or even criminal violations. We maintain insurance coverage as part of our overall legal and risk management strategy to minimize our potential liabilities. In addition, our insurance policies contain exclusions that insurance providers may use to deny us insurance coverage. If we sustain liabilities that exceed our insurance coverage or for which we are not insured, it could have a material adverse impact on our results of operations and financial condition, including our profits and revenues.

We are self-insured or carry deductibles for a significant portion of our estimated claims exposure. If actual losses exceed our estimate it could result in under or uninsured claims that may materially and adversely affect our operating income and profitability.

We are self-insured or carry deductibles for most of our insurance coverages, including certain insurance programs related to discontinued businesses. Because of these deductibles and self-insured retention amounts, we have significant exposure to fluctuations in the number and severity of claims. As a result, our insurance and claims expense could increase in the future. Under certain conditions, we may elect or be required to increase our self-insured or deductible amounts, which would increase our already significant exposure to expense from claims. If any claim exceeds our coverage, we would bear the excess expense, in addition to our other self-insured amounts. If the frequency or severity of claims or our expenses increase, our operating income and profitability could be materially adversely affected.

- 13 -

Due to the nature of the work we perform to complete our contracts, we are subject to potential liability claims and contract disputes.

Our contracts often involve projects where design, construction or systems failures or accidents, could result in substantially large or punitive damages for which we could have liability. Our practice involves professional judgments regarding the planning, design, development, construction, operations and management of facilities and public infrastructure projects. Although we have adopted a range of insurance, risk management, safety and risk avoidance programs designed to reduce potential liabilities, there can be no assurance that such programs will protect us fully from all risks and liabilities.

Certain of our clients require that we satisfy various safety criteria in order to bid and compete for contract awards. Although we have dedicated resources assigned to maintaining and implementing effective health, safety and environmental (HSE) work procedures, failure to maintain adequate safety standards could result in reduced profitability and could have a material adverse impact on our business.

Our quarterly financial results may fluctuate significantly, which could have a material adverse impact on the price of our common stock.

Our quarterly operating results may fluctuate significantly, which could negatively impact the price of our common stock, due to numerous factors, including:

| • | | Cyclical spending, together with changes in levels of spending, by our public and private clients; |

| • | | Project mix and employee utilization; |

| • | | Termination of engagements without penalty; |

| • | | Economic and political conditions; |

| • | | Timing of the execution of change orders and other contract adjustments; |

| • | | Weather conditions that delay project execution; |

| • | | Changes in the competitive marketplace for our services; |

| • | | Transaction costs associated with acquisitions, assumptions of liabilities of acquired businesses and integration costs; and |

| • | | Claims and settlements of litigation. |

Any significant change to these factors could cause a significant fluctuation in our quarterly results.

Our inability to achieve the Credit Agreement’s financial covenants, after a cure period, or the inability of one or more financial institutions in the consortium to meet its commitment under our Credit Agreement could impact our liquidity for working capital needs or our growth strategy.

Our unsecured Credit Agreement (“Credit Agreement”) is with a consortium of financial institutions and provides for a commitment of $125 million through September 30, 2015. The commitment includes the sum of the principal amount of revolving credit loans outstanding and the aggregate face value of outstanding standby letters of credit. The Credit Agreement requires us to meet minimum equity, leverage, interest and rent coverage, and current ratio covenants. If any of these financial covenants or certain other conditions of borrowing is not achieved, under certain circumstances, after a cure period, the banks may demand the repayment of all borrowings outstanding and/or require deposits to cover the outstanding letters of credit. In addition, in future periods we may leverage our Credit Agreement for working capital needs or to facilitate our growth strategy, specifically utilizing our available credit to fund strategic acquisitions, which may impact our liquidity. Our inability to achieve the Credit Agreement’s financial covenants, after a cure period, or the inability of one or more financial institutions in the consortium to meet its commitment under our Credit Agreement could impact our liquidity for working capital needs or our growth strategy.

- 14 -

Our business depends on continuous uninterrupted service to clients

As a provider of professional services, we rely heavily on computer, information and communications technology and related systems in order to properly operate and control our business. Our computer and communications systems and operations could be damaged or interrupted by natural disasters, telecommunications failures, acts of war or terrorism, computer viruses, physical or electronic security breaches and similar events or disruptions. If we are unable to continually add software and hardware, effectively upgrade our systems and network infrastructure and take other steps to improve the efficiency of and protect our systems, systems operation could be interrupted or delayed. Additionally, because of our geographic diversification, severe weather can cause our employees to miss work and interrupt the delivery of our services, resulting in a loss of revenue. In the event we experience a temporary or permanent interruption at one or more of our locations (including our corporate headquarters building), our business could be materially adversely affected and we may be required to pay contractual damages or face the suspension or loss of a client’s business.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

Our headquarters office is located in Moon Township, Pennsylvania. This building, which we lease, has approximately 117,000 square feet of office space and is used by our corporate and operations staff. We primarily occupy leased office space in stand-alone or multi-tenant buildings at costs based on prevailing market prices at lease inception. In addition to our Moon Township offices, we also have leased office space totaling approximately 536,000 square feet in the U.S., which includes major offices in Irvine, CA, Alexandria, VA and Columbia, SC. These leases expire at various dates through the year 2021.

We also own a 75,000 square foot office building located in Beaver, Pennsylvania, which is situated on approximately 177 acres. We believe that our current facilities will be adequate for the operation of our business during the next year, and that suitable additional office space is readily available to accommodate any needs that may arise.

Item 3. Legal Proceedings.

We have been named as a defendant or co-defendant in legal proceedings wherein damages are claimed. Such proceedings are not uncommon to our business. We believe that we have recognized adequate provisions for probable and reasonably estimable liabilities associated with these proceedings, and that their ultimate resolutions will not have a material impact on our consolidated financial position or annual results of operations or cash flows. We currently have no material pending legal proceedings, other than ordinary routine litigation incidental to the business, to which we or any of our subsidiaries is a party or of which any of our property is the subject.

Item 4. Mine Safety Disclosures.

Not applicable.

- 15 -

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities.

Market Information

Information relating to the market for our Common Stock and other matters related to the holders thereof is set forth in the “Supplemental Financial Information” section of Exhibit 13.1 to this Form 10-K. Such information is incorporated herein by reference.

Holders

As of February 29, 2012, we had 1,214 holders of record of our Common Stock.

Dividends

Our policy has been to retain any earnings to fund our future operations and growth and as such, we have not paid any cash dividends. Our Credit Agreement with our banks places an aggregate limit of $5.0 million for the term of the agreement on dividend payments. Our Board of Directors will review this policy from time to time in light of our financial condition, liquidity, capital resources, restrictions under our credit facilities and other factors.

Sales of Unregistered Securities

The Company issued 203,218 shares of the Company’s common stock to the former owners of RBF as part of the purchase of RBF. The fair market value of the stock on the acquisition date approximated $3.6 million based on the closing price of $17.65 per share on October 3, 2011. These shares are restricted for resale under the SPA for a period commencing on the October 3, 2011 closing date and continuing for a period through and including the twelve-month anniversary of the closing date. In addition, these shares were not registered under Securities Act of 1933 (“the Act”), therefore to be traded these shares must meet the conditions set forth in Rule 144 of the Act, which includes a holding period of at least six months. We did not sell any other unregistered securities during the year ended December 31, 2011.

Purchases of Equity Securities

Neither we nor any affiliated purchaser bought any Michael Baker Corporation equity securities during the fourth quarter of 2011.

- 16 -

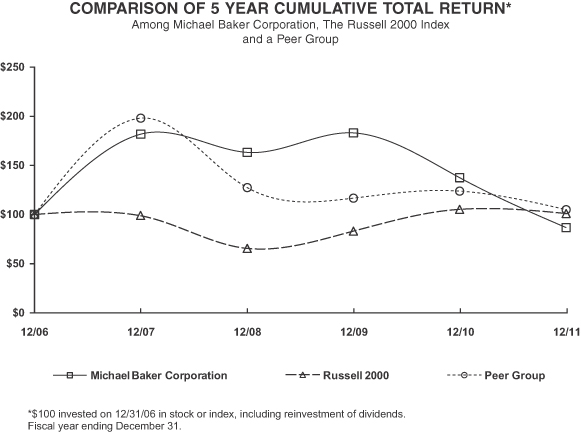

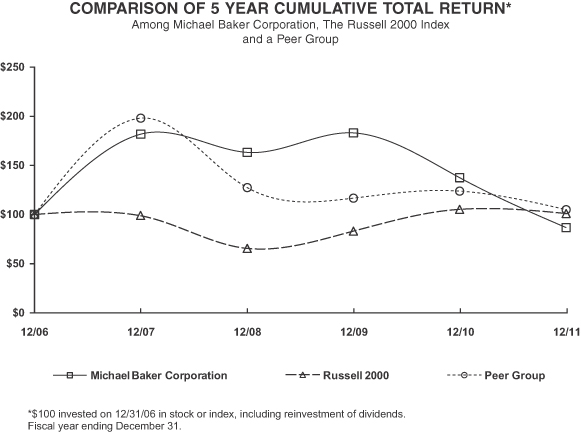

Performance Graph

The following graph shows the changes over the past five-year period in the value of $100 invested in (1) the Common Stock of Michael Baker Corporation, (2) the Russell 2000 Index and (3) our peer group (consisting of AECOM Technology Corp., Hill International, Inc., Jacobs Engineering Group, Inc., Stantec, Inc. and URS Corp.). The values of each investment are based on share price appreciation, with reinvestment of all dividends, assuming any were paid. For the graph, the investments are assumed to have occurred at the beginning of each period presented.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 12/06 | | | 12/07 | | | 12/08 | | | 12/09 | | | 12/10 | | | 12/11 | |

Michael Baker Corporation | | | 100.00 | | | | 181.46 | | | | 162.96 | | | | 182.78 | | | | 137.31 | | | | 86.58 | |

Russell 2000 | | | 100.00 | | | | 98.43 | | | | 65.18 | | | | 82.89 | | | | 105.14 | | | | 100.75 | |

Peer Group | | | 100.00 | | | | 197.91 | | | | 127.11 | | | | 116.56 | | | | 123.72 | | | | 104.70 | |

| * | The stock price performance included in this graph is not necessarily indicative of future stock price performance. |

- 17 -

Item 6. Selected Financial Data.

A summary of selected financial data for the five years ended December 31, 2011 is set forth in the “Selected Financial Data” section of Exhibit 13.1 to this Form 10-K. Such summary is incorporated herein by reference.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

A discussion and analysis of our results of operations, cash flows and financial condition is set forth in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of Exhibit 13.1 to this Form 10-K. This discussion is incorporated herein by reference.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

As of December 31, 2011, we had highly liquid investments totaling $1.0 million included in our cash and cash equivalents and highly-rated corporate, U.S. Treasury and U.S. federally-sponsored agency bonds (“variable-rate investments”), totaling $12.3 million as of December 31, 2011. The majority of the Company’s cash and cash equivalents held in highly rated financial institutions with a portion of those amounts held in money market funds comprised primarily of short-term, high-quality fixed-income securities as of December 31, 2011. Our Credit Agreement provides for a commitment of $125 million through September 30, 2015. As of December 31, 2011, there were no borrowings (“variable-rate debt”) outstanding under the Credit Agreement. Based on the amounts of our investments and borrowings, we have no material exposure to interest rate risk.

Based on the nature of our business, we have no direct exposure to commodity price risk. We have no material exposure to foreign currency exchange rate risk and no foreign currency exchange contracts.

Item 8. Financial Statements and Supplementary Data.

Our consolidated financial statements as of December 31, 2011 and 2010 and for the three years ended December 31, 2011, together with the report thereon of our independent registered public accounting firm (Deloitte & Touche LLP), and supplementary financial information are set forth within Exhibit 13.1 to this Form 10-K. Such financial statements, the report thereon, and the supplementary financial information are incorporated herein by reference.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

Not applicable.

Item 9A. Controls and Procedures.

Conclusions Regarding the Effectiveness of Disclosure Controls and Procedures

Under the supervision and with participation of our management, including our Chief Executive Officer and Chief Financial Officer, we evaluated our disclosure controls and procedures, as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as of December 31, 2011. This evaluation considered various procedures designed to ensure that information we disclose in reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to management, including our Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures were effective as of December 31, 2011. Our assessment of and conclusion on the effectiveness of our disclosure controls and procedures did not include an assessment of and conclusion on the effectiveness of the internal control over financial reporting of RBF, which was acquired in October 2011.

- 18 -

Management’s Report on Internal Control Over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f). Our internal control over financial reporting is a process designed under the supervision of our principal executive and principal financial officers to provide reasonable assurance regarding the reliability of financial reporting and the preparation of our consolidated financial statements for external purposes in accordance with Generally Accepted Accounting Principles. Our internal control over financial reporting includes policies and procedures that:

(i) Pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect transactions and dispositions of our assets;

(ii) Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures are being made only in accordance with authorizations of management and our directors; and

(iii) Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of company assets that could have a material effect on our financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect all misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, we conducted an assessment of the effectiveness of our internal control over financial reporting as of December 31, 2011. The assessment was based on criteria established in the frameworkInternal Control — Integrated Framework, issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

Based on this evaluation, the Company’s Chief Executive Officer and Chief Financial Officer have concluded that the Company’s internal control over financial reporting was effective as of December 31, 2011. As permitted for acquired businesses, the scope of our assessment of the effectiveness of internal control over financial reporting does not include RBF, which was acquired effective October 1, 2011. RBF represented 26% of our consolidated assets, and 5% of our consolidated revenues as of and for the year ended December 31, 2011. Our assessment of internal control over financial reporting for fiscal year 2012 will include RBF.

The effectiveness of the Company’s internal control over financial reporting as of December 31, 2011 has been audited by Deloitte and Touche LLP, an independent registered public accounting firm, as stated in their report which is included herein.

Changes in Internal Control Over Financial Reporting

There were no changes in our “internal control over financial reporting” (as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) that occurred during the quarter ended December 31, 2011, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting. However, during the fourth quarter of 2011, the Company completed the acquisition of RBF. We are in the process of integrating RBF. We are analyzing, evaluating and, where necessary, implementing changes in controls and procedures relating to RBF as the integration proceeds. As a result, this process may result in additions or changes to our internal control over financial reporting.

- 19 -

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Michael Baker Corporation

We have audited the internal control over financial reporting of Michael Baker Corporation and subsidiaries (the “Company”) as of December 31, 2011, based on criteria established in Internal Control — Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. As described in Management’s Report on Internal Control over Financial Reporting, management excluded from its assessment the internal control over financial reporting at RBF Consulting, which was acquired on October 3, 2011, and whose financial statements constitute 26% and 5% of the Company’s consolidated assets and consolidated revenues, respectively, as of and for the year ended December 31, 2011. Accordingly, our audit did not include the internal control over financial reporting at RBF Consulting. The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed by, or under the supervision of, the company’s principal executive and principal financial officers, or persons performing similar functions, and effected by the company’s board of directors, management, and other personnel to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of the inherent limitations of internal control over financial reporting, including the possibility of collusion or improper management override of controls, material misstatements due to error or fraud may not be prevented or detected on a timely basis. Also, projections of any evaluation of the effectiveness of the internal control over financial reporting to future periods are subject to the risk that the controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2011, based on the criteria established in Internal Control — Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated financial statements as of and for the year ended December 31, 2011 of the Company and our report dated March 13, 2012 expressed an unqualified opinion on those consolidated financial statements.

/s/ Deloitte & Touche LLP

Pittsburgh, Pennsylvania

March 13, 2012

- 20 -

| Item 9B. | Other Information. |

Not applicable.

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance. |

Information required by Items 401, 405, 406 and 407(c)(3), (d)(4) and (d)(5) of Regulation S-K appears in our definitive Proxy Statement, which will be distributed in connection with the 2012 Annual Meeting of Shareholders and which will be filed with the Securities and Exchange Commission pursuant to Regulation 14A, or in Part I of this Form 10-K under the caption “Executive Officers.” This information is incorporated herein by reference.

Code of Ethics for Senior Officers

Michael Baker has adopted a Code of Ethics for Senior Officers that includes the provisions required under applicable Securities and Exchange Commission regulations for a code of ethics. A copy of the Code of Ethics for Senior Officers is posted on Michael Baker’s website athttp://www.mbakercorp.comand is available in print to any shareholder who requests it. In the event that we make any amendments to or waivers from this Code, we will discuss the amendment or waiver and the reasons for such on Michael Baker’s website.

The obligations of the Code of Ethics for Senior Officers supplement, but do not replace, the Code of Business Conduct applicable to Michael Baker’s directors, officers and employees. A copy of the Code of Business Conduct is posted on Michael Baker’s website athttp://www.mbakercorp.comand is available in print to any shareholder who requests it.

| Item 11. | Executive Compensation. |

Information required by Items 402 and 407(e)(4) and (e)(5) of Regulation S-K appears in our definitive Proxy Statement, which will be distributed in connection with the 2012 Annual Meeting of Shareholders and which will be filed with the Securities and Exchange Commission pursuant to Regulation 14A. This information is incorporated herein by reference.

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

Information required by Item 403 of Regulation S-K appears in our definitive Proxy Statement, which will be distributed in connection with the 2012 Annual Meeting of Shareholders and which will be filed with the Securities and Exchange Commission pursuant to Regulation 14A. This information is incorporated herein by reference.

Equity Compensation Plan Information

The following table provides information as of December 31, 2011 about equity awards under our equity compensation plans and arrangements in the aggregate:

| | | | | | | | | | | | |

| Plan Category | | (a)

Number of securities to

be issued upon exercise | | | (b)

Weighted-average

exercise price | | | (c)

Securities available

for future issuance | |