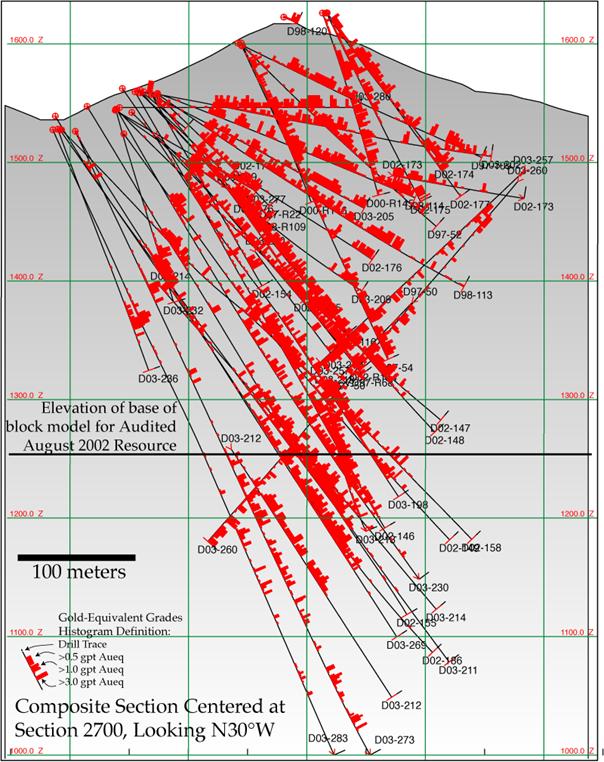

Figure 3. Composite section through central breccia pipe in Dolores Gold & Silver Deposit

In August 1997, a resource estimation model was completed, based on 107 drill holes. A drill indicated and inferred resource was estimated at 27.84 million tons with an average grade of 0.038 oz/ton (1.3 g/t) gold and 1.38 oz/ton (47.3 g/t) silver at a 0.015 oz/ton gold cut–off (historical estimate – no longer relevant).

In June 1998, an updated resource calculation was made as part of a pre–feasibility scoping study. The calculation was based on 160 drill holes totalling 35,000 metres of drilling over 1,800 metres of strike length. In September 1998, additional infill drilling was completed on the main zone at 25 metre centres along the 1,800 metre strike length. Incorporating the latest drill results, an updated resource calculation was completed in November 1998, with indicated and inferred resources for the main zone deposit totalling 61 million tonnes grading 1.42 g/t gold–equivalent (historical estimate – no longer relevant). All gold values were capped at 4.0 g/t and silver values were capped at 220 g/t. A cut–off grade of 0.5 g/t gold–equivalent was used. The data used for the resource study included 238 drill holes (127 diamond drill and 111 reverse–circulation drill holes) totalling 52,898 metres. The drill holes extended over 2,800 metres of strike length and 1,000 metres across strike.

In 2000, a program of infill drilling confirmed the continuity of high–grade gold and silver mineralization occurring within feeder structures surrounded by a broad zone of disseminated mineralization. The high–grade feeder structures extend for over 4,000 metres along strike and have been drill–tested to depths of up to 300 metres. Some of the best results from the 2000 drill program came from hole D00–R140 drilled on section 2175. The drill hole averaged 1.24g/t gold and 61.7g/t silver over 236 metres. A 15.2 metre section within this zone averaged 11.52g/t gold and 707.7g/t silver.

Since June of 2002, a drilling program, consisting of approximately 70,000 to 75,000 metres of infill, stepout, condemnation and geotechnical drilling has been underway. This drilling program is designed to bring the main zone resource to a final feasibility and to expand the mineralized potential of the district. Results from this program are being incorporated into revised resource models and mine planning, and incorporated into an independently engineered feasibility study

Mineralization

Gold and silver mineralization identified at surface occurs within a zone over 4,000 metres long and 1,000 metres in width at elevations that range from 1,400 metres to 1,700 metres above sea level. Mineralization has also been investigated to the depth of drilling at 1,1100 metres elevation or over 550 metres of vertical extent.

Precious metal values are contained within native gold, native silver, electrum, silver sulfides and silver sulfosalts. Feeders also contain quartz, sericite, pyrite (locally oxidized to limonite), with lesser amounts of epidote, chlorite, calcite, fluorite, galena, sphalerite, and occasional chalcopyrite.

At intermediate levels in the system, mineralized feeders widen into breccias containing druzy cavities, comb structures, crustifications and symmetrical banding in silica veins and veinlets. Strong hydrothermal brecciation is common and frequently overprints areas of original tectonic breccia and/or fractures. Pervasive silicification of the country rock and multiphase veining in both breccias and stockwork zones show strong correlation with high grade gold and silver mineralization, with lower grade material occurring between the feeders. Mineralization at this level also occurs within localized zones of intense propylitic alteration that may occur adjacent to the most strongly mineralized areas within the deposit.

The upper extent of widespread mineralization is generally confined to a few tens of metres above the contact of the latitic volcaniclastic tuffs with the underlying intermediate andesitic volcanics. It is likely that high porosities and permeabilities resulted in dispersal and lateral migration of hydrothermal fluids at the volcaniclastic contact with concomitant cooling generally restricting ascension of hydrothermal fluids. Alteration extends laterally for several hundred metres along and above the contact in a generally silicified, broken, brecciated, and variably argillized subhorizontal layer. This altered layer contains anomalous mercury, arsenic, and antimony throughout its extent. Ore grades of mineralization locally persist beyond tens of metres into the overlying tuff units but are restricted to narrower zones of fracturing. In the highest exposures of the central dome area, low–grade mineralization from 40 to 100 parts per billion (ppb) gold is known to occur within small discontinuous pods of chalcedonic to opalescent vein material.

The episodic nature and variable intensity of mineralizing activity has commonly resulted in overprinting of several features, including the formation of quartz stockworks along intrusive contacts, flooding of tectonic breccias with hydrothermal silica, silicification and dissemination of mineralization peripheral to structures, re–brecciation and precipitation of stockwork quartz in several phases, and hydrothermal brecciation that overprints original tectonic features. A relatively large breccia-pipe like body has been defined over a 400 metre length (20-60 metres wide) from the surface to depth greater than 500 metres, which contains consistent higher-grades of mineralization, indicating a primary mineralizing conduit. Oxidation throughout the area of the deposit is highly variable. Oxidation has been observed to the depth of drilling, particularly within the larger fracture zones, yet sulfides are also known to occur at surface in various localities of the property. The majority of the deposit can be classified as mixed oxide/sulfide with smaller percentages of totally oxidized material occurring along structures and near surface, with progressively increased sulfide content found at depth.

Sampling and Analysis

Rock Chip Sampling and Soil Sampling

Since 1993, in excess of 13,800 rock chip samples have been taken across zones of mineralization at the Dolores Property. Continuous rock chip samples were collected over five metre sample lengths (84% of total samples) along sample lines laid out perpendicular to the 330 degree strike of the altered, silicified and mineralized rock exposures.

Each sample site was flagged and marked with an aluminum tag. Soil samples were taken along those portions of the lines covered by overburden. A total of 1,800 soil samples were collected and analyzed. A surveyed baseline and grid lines spaced at 50 metre intervals were established for control of the rock chip and soil sampling. The area covered by the sampling program was approximately six square kilometres.

All samples were collected from the Dolores site by ALS Chemex Laboratories (“Chemex”), Bondar–Clegg or BSI Inspectorate (“Inspectorate”) personnel and taken to a sample preparation lab either at Chihuahua, Hemosillo or Durango. Following sample preparation, pulps are flown either to Vancouver, Canada or Reno, Nevada for final analysis.

The soil samples were dried and sieved to –80 mesh. The –80 mesh portion was sent to the Chemex lab in Vancouver, British Columbia. A 30 gram subsample was then analyzed for gold by fire–assay with an atomic absorption (AA) finish. Silver values were obtained by aqua–regia digestion followed by AA analysis.

For rock chip samples, a 30 gram sub–sample for gold analyses was used for fire–assay with an AA finish. Silver analyses were obtained by AA (background corrected) assay following aqua–regia digestion. One kilogram pulps were prepared, instead of the normal 0.2 kg pulps, after comparative analyses indicated the large sample size ensured greater sample assay consistency.

The rock chip and soil sampling programs were supervised by experienced, professional geologists. The samples taken are considered to be of acceptable quality and representative of the mineralization exposed at the sample sites. The sample results are considered to be reliable since all analyses were performed at well known reputable laboratories with quality control procedures in place.

Core Sampling and Reverse–Circulation Sampling

All core was carefully logged in a thorough manner by experienced, professional geologists in keeping with industry standards and mineralized sections were photographed before sampling. The mineralized sections were marked for sampling according to changes in rock type, changes in character and quantity of the mineralization and at structural contacts. As a result, core sample lengths are variable. Where there are no lithological or structural changes, sample intervals are typically two metres in length. All mineralized core was then split by core–splitter with one–half of the core placed in plastic or cloth sample bags along with a sample tag number and securely fastened. The other one–half was replaced in the core trays and stored in core racks on the property.

Reverse circulation holes were sampled at 1.52 metre intervals. One–half of the samples, weighing from 12 to 16 kg, were sent for assay and the other one–half was placed in storage at the site for future reference. Core samples from

drilling programs carried out by the Company were sent to the same labs that were used to process rock chip samples and the same preparation, assaying and quality control procedures were applied.

Quality Control

Quality control of assay data at the Dolores property was ensured through a monitoring program (set up by an independent geochemist) that included use of prepared gold–silver standards, blank samples, check analyses, duplicate analyses by alternate labs, and metallic screen analyses. More than one out of every ten samples were a part of the quality assurance database and all geochemical analyses are performed at Chemex and Inspectorate, well known, industry–standard geochemical laboratories. Quality assurance was provided by check assays processed at Bondar–Clegg, Vancouver, B.C. and the two other laboratories listed above.

2001 Dolores Silver Re-analysis Program

During the summer of 2001, the Company discovered that silver grades for certain samples from the Dolores property were underestimated by the aqua–regia digestion assay techniques which had been used. It is considered likely that the under–reporting of grade is related to the presence of silver halide minerals in Dolores ores, possibly as a result of secondary enrichment of silver.

Selection of Samples

After initial check assays showed a significant increase in silver grades using multi–acid digestion techniques, an extensive silver re-analysis program was undertaken by the Company. Approximately 8,880 samples were re-analyzed. The samples selected for re-analysis were primarily consistent runs of greater than 10 g/t silver, or runs which had greater than 5 g/t silver along with significant amounts of gold.

Chain of Custody and Sampling issues

Splits were pulled from pulp material previously prepared by Chemex in Chihuahua and Hermosillo. About 35% of the material was stored at Chemex’s Chihuahua facility, with the remainder being stored at the Company’s Chihuahua warehouse. All sample retrieval and preparation was carried out by Chemex personnel. Approximately 400 drill samples and 100 underground samples were not found at either location, and are not incorporated in the data set.

Samples which had previously been fire–assayed were included in segments for rerun. It was not expected that there would be a significant change in these results, but they serve as an excellent check on the multi–acid digestion technique. Samples which returned a below detection limit result (<1 g/t Ag) with multi–acid digestion are ignored, because the aqua–regia technique is considered more accurate at these grades.

Results

For the drill samples submitted, there is a significant increase in the contained silver results using multi–acid digestion for oxidized material, with a more moderate increase for material categorized as mixed or sulfide. The most dramatic increases in silver grade were found in various peripheral zones that surround the main deposit, but the improvement in silver grades throughout the resource will increase the overall resource. The samples analyzed by fire–assay show excellent agreement with the multi–acid results, which provides confidence in the multi–acid technique for Dolores ores. See “Mineral Resource and Mineral Reserve Estimates” below.

Mineral Resource and Mineral Reserve Estimates

On November 16, 2004, RPA presented its final report entitled “Technical Report on the Mineral Resources Estimate for the Dolores Property, Mexico”. The report was prepared to comply with the requirements of NI 43–101 and subsequently filed on SEDAR. There are no mineral reserve estimates at this stage. The measured, indicated and inferred resources for the Dolores Property, at cut–off grades of 0.3, 0.4 0.5, 0.6, 0.7, 0.8, 0.9, 1.0, 1.5, 2.0, 3.0, 4.0 and 5.0 gpt Au Eq are taken from the RPA Report and shown in the following table. This resource estimation is based on construction of geological and computer block models, and variographic analysis. The Metric System is

used in this analysis. Tonnes are stated as metric tonnes of 1,000 kg. Gold and silver grades are reported in grams per tonne (gpt). All resources are calculated in accordance with NI 43-101.

The classified Mineral Resources Estimate at a range of cut-off grades is listed in the following tables.

Measured Resources

Cut-off g/tAuEq** | Tonnage Kt | Au g/t | Ag g/t | AuEq g/t* | Gold Ounces | Silver Ounces |

5.0 | 2,284 | 6.17 | 241.1 | 9.39 | 438,000 | 17,126,000 |

4.0 | 3,243 | 5.12 | 210.7 | 7.93 | 516,000 | 21,254,000 |

3.0 | 5,195 | 3.97 | 169.9 | 6.24 | 641,000 | 27,452,000 |

2.0 | 9,853 | 2.79 | 123.3 | 4.44 | 855,000 | 37,787,000 |

1.5 | 14,808 | 2.19 | 100.3 | 3.53 | 1,010,000 | 46,195,000 |

1.0 | 22,238 | 1.70 | 79.6 | 2.76 | 1,176,000 | 55,058,000 |

0.9 | 24,198 | 1.61 | 75.5 | 2.62 | 1,210,000 | 56,825,000 |

0.8 | 26,639 | 1.51 | 71.1 | 2.45 | 1,247,000 | 58,912,000 |

0.7 | 29,639 | 1.40 | 66.3 | 2.28 | 1,287,000 | 61,120,000 |

0.6 | 33,639 | 1.27 | 60.9 | 2.09 | 1,332,000 | 63,719,000 |

0.5 | 38,914 | 1.14 | 55.1 | 1.88 | 1,383,000 | 66,690,000 |

0.4 | 45,899 | 1.01 | 49.0 | 1.66 | 1,437,000 | 69,953,000 |

0.3 | 53,413 | 0.89 | 43.7 | 1.48 | 1,485,000 | 72,599,000 |

Indicated Resources

Cut-Off g/t AuEq** | TonnageKt | Au g/t | Ag g/t | AuEq g/t* | Gold Ounces | Silver Ounces |

5.0 | 1,459 | 5.89 | 211.0 | 8.70 | 267,000 | 9,575,000 |

4.0 | 2,215 | 4.80 | 183.9 | 7.25 | 330,000 | 12,667,000 |

3.0 | 3,863 | 3.64 | 148.6 | 5.62 | 437,000 | 17,854,000 |

2.0 | 7,813 | 2.54 | 110.2 | 4.00 | 616,000 | 26,779,000 |

1.5 | 11,967 | 2.01 | 90.6 | 3.22 | 747,000 | 33,723,000 |

1.0 | 17,225 | 1.62 | 74.4 | 2.61 | 868,000 | 39,860,000 |

0.9 | 18,531 | 1.55 | 71.2 | 2.50 | 891,000 | 41,038,000 |

0.8 | 20,201 | 1.46 | 67.4 | 2.36 | 917,000 | 42,349,000 |

0.7 | 22,704 | 1.35 | 62.5 | 2.18 | 953,000 | 44,135,000 |

0.6 | 26,443 | 1.21 | 56.4 | 1.97 | 997,000 | 46,387,000 |

0.5 | 31,892 | 1.06 | 49.7 | 1.72 | 1,050,000 | 49,299,000 |

0.4 | 39,373 | 0.91 | 43.0 | 1.48 | 1,110,000 | 52,659,000 |

0.3 | 47,652 | 0.78 | 37.5 | 1.28 | 1,161,000 | 55,580,000 |

Measured and and Indicated Resources

Cut-Off g/t AuEq** | Tonnage Kt | Au g/t | Ag g/t | AuEq g/t | Gold Ounces | Silver Ounces |

5.0 | 3,743 | 6.06 | 229.4 | 8.82 7 | 705,000 | 26,701,000 |

4.0 | 5,458 | 4.99 | 199.8 | 7.40 | 846,000 | 33,922,000 |

3.0 | 9,058 | 3.83 | 160.8 | 5.78 | 1,079,000 | 45,307,000 |

2.0 | 17,666 | 2.68 | 117.5 | 4.11 | 1,471,000 | 64,567,000 |

1.5 | 26,775 | 2.11 | 96.0 | 3.28 | 1,758,000 | 79,919,000 |

1.0 | 39,463 | 1.67 | 77.3 | 2.61 | 2,045,000 | 94,919,000 |

0.9 | 42,729 | 1.58 | 73.6 | 2.48 | 2,101,000 | 97,863,000 |

0.8 | 46,841 | 1.49 | 69.5 | 2.33 | 2,165,000 | 101,261,000 |

0.7 | 52,343 | 1.38 | 64.7 | 2.17 | 2,241,000 | 105,255,000 |

0.6 | 60,082 | 1.25 | 58.9 | 1.97 | 2,330,000 | 110,106,000 |

0.5 | 70,805 | 1.11 | 52.7 | 1.75 | 2,433,000 | 115,989,000 |

0.4 | 85,272 | 0.96 | 46.2 | 1.53 | 2,548,000 | 122,612,000 |

0.3 | 101,064 | 0.84 | 40.8 | 1.34 | 2,647,000 | 128,179,000 |

Inferred Resources

Cut-Off g/t AuEq** | Tonnage Kt | Au g/t | Ag g/t | AuEq g/t* | Gold Ounces | Silver Ounces |

5.0 | 721 | 7.41 | 140.6 | 9.28 | 166,000 | 3,151,000 |

4.0 | 998 | 6.16 | 133.2 | 7.94 | 191,000 | 4,133,000 |

3.0 | 1,589 | 4.70 | 117.7 | 6.27 | 232,000 | 5,815,000 |

2.0 | 3,303 | 3.11 | 86.2 | 4.25 | 319,000 | 8,856,000 |

1.5 | 5,364 | 2.37 | 69.1 | 3.29 | 395,000 | 11,529,000 |

1.0 | 8,724 | 1.76 | 55.3 | 2.49 | 476,000 | 15,005,000 |

0.9 | 9,643 | 1.64 | 52.7 | 2.35 | 493,000 | 15,806,000 |

0.8 | 10,710 | 1.53 | 50.0 | 2.20 | 510,000 | 16,656,000 |

0.7 | 12,282 | 1.39 | 46.3 | 2.01 | 532,000 | 17,687,000 |

0.6 | 14,665 | 1.23 | 41.7 | 1.79 | 562,000 | 19,020,000 |

0.5 | 17,908 | 1.07 | 37.2 | 1.57 | 595,000 | 20,720,000 |

0.4 | 22,223 | 0.91 | 32.6 | 1.35 | 631,000 | 22,533,000 |

0.3 | 28,089 | 0.77 | 28.0 | 1.14 | 668,000 | 24,462,000 |

* AuEq grade based on recoveries and ore types, average is 81:1 Ag:Au

** Cutoff grade AuEq calculated at a 75:1 Ag:Au ratio

*** Note: this geological resource has been estimated in accordance with the Canadian Institute of Mining and Metallurgy guidelines, which are different from the guidelines set forth in Guide 7 under Item 802 of Regulation S-K. See “Glossary.”

The resources in the preceding tables do not account for the material mined in the past. Historic production from the project area is reported as 371,771 short tons (337,233 tonnes) at an average grade of 0.286 opt (9.8 gpt) gold and 16.26 opt (563 gpt) silver. Of this total, the Company estimates that about 80% is within the area where resources have been estimated. In RPA’s opinion, “the mined volume constitutes such a small tonnage relative to the overall resource as to be inconsequential to the estimate”.

Proposed Budget 2005

The following table sets out the proposed 2005 exploration and development budget on the Dolores property.

Dolores 2005 Budget | | | |

Infill Drilling | | | |

Total # of holes planned (core) | 20 | | |

Total meters planned core: | 5,000 | | |

| | | |

| | | |

Exploration Drilling | | | |

Total # of holes planned (core) | 40 | | |

Total # of holes planned (RC) | 10 | | |

Total meters planned core: | 12,000 | | |

Total meters planned RC: | 3,000 | | |

| | | |

Condemnation Drilling | | | |

Total # of holes planned (core) | 15 | | |

Total # of holes planned (RC) | 20 | | |

Total meters planned (core) | 2,000 | | |

Total meters planned (RC) | 2,000 | | |

Total hours of drill road & pad construction : | 360 | | |

| | Unit Cost | Total Cost |

| | | |

All inclusive infill core drill costs (per meter - Includes assays and drill supplies) | | $110 | $550,000 |

All inclusive exploration core drill costs (per meter) | | $110 | 1,320,000 |

All inclusive condemnation core drill costs (per meter) | | $100 | 200,000 |

All inclusive exploration RC drill costs (per meter) | | $60 | 180,000 |

All inclusive condemnation RC drill costs (per meter) | | $50 | 100,000 |

Drill pad and road construction & maintenance (per hour) | | $75 | 27,000 |

Engineering and Metallurgical studies | Days | Daily Rate | |

Metallurgical (Lakefield and McClelland) man-days | 100 | $1,200 | 120,000 |

Engineering M3 (Lead firm) man-days | 500 | $1,500 | 750,000 |

Independent Mining Engineers (IMC) man-days | 70 | $1,200 | 70,000 |

Golder & Associates geotech man-days | 100 | $1,100 | 110,000 |

Roscoe Postle man days | 10 | $1,000 | 10,000 |

Road construction New North-south access road(2 cats + grader) days | 180 | $2,750 | 495,000 |

New road materials (culverts, etc) | | | 45,000 |

Field geologists (man-days) | 1,000 | $400 | 400,000 |

Geologist - geologic compilation (man-days) | 100 | $350 | 35,000 |

Tech (man-days) | 400 | $150 | 60,000 |

Dolores casual work force (man days) | 2,400 | $15 | 36,000 |

Camp supplies/travel averaged over year | 300 | $250 | 75,000 |

Subtotal | | | 4,583,000 |

Contingency | | 10% | 458,300 |

| | | $5,041,300 |

Once the bankable feasibility study has been completed, and assuming a positive recommendation is received, an additional budget will be proposed to initiate mine construction during the second half of 2005. The likely capital costs are not known to the Company, but they will be substantially more than the Company’s present financial resources. Substantial amounts of equity, or a combination of equity and debt financing, will be required to bring the Dolores property to production.

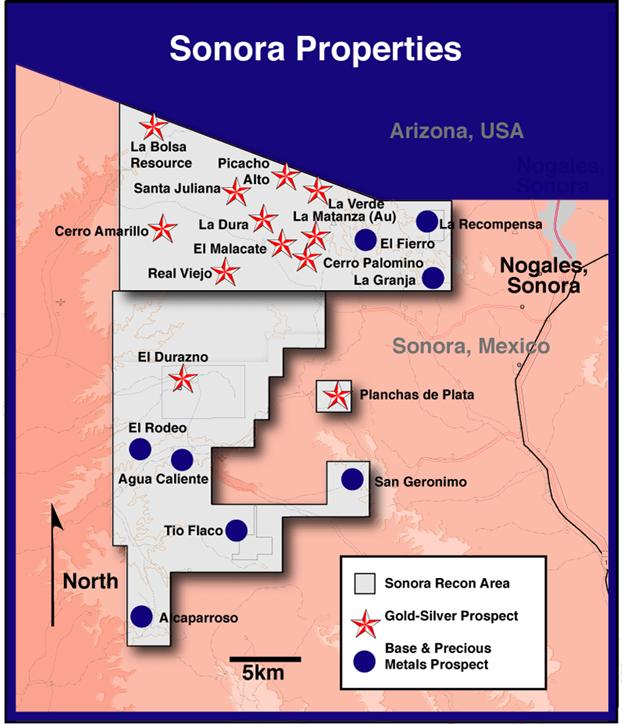

NORTHERN SONORA PROPERTY

The Company considers these properties to be worthy of future exploration expenditures and has been conducting, and will continue to conduct, exploration work on each of the following properties. Taxes and property assessments are paid through January 2005.

Description and Location

The Northern Sonora Property is located in the northern part of Sonora State, Mexico. The Northern Sonora Property consists of the six exploitation and four exploration concessions described below, comprising a total of approximately 15,145 hectares.

Northern Sonora Property Concessions

Concession Name | Title No. | Area (hectares) | Expiry Date |

Abe | 216305 | 996 | April 29, 2052 |

Oro Fino | 215622 | 649 | March 3, 2052 |

La Pistola | 220056 | 1,698 | June 3, 2053 |

La Gloria | 221626 | 1,087 | March 3, 2054 |

Los Adobes | 218455 | 6,173 | November 3, 2052 |

El Ruido | 218448 | 3,788 | November 3, 2052 |

El Callejon | 211609 | 14 | June 15, 2006 |

El Callejon 2 | 211623 | 20 | June 22, 2006 |

El Manzanal | 213593 | 220 | May 16, 2007 |

Anita | 221743 | 500 | March 18, 2010 |

Total Area | | 15,145 | |

Numerous areas of mineralization in separate geographic zones occur within the Northern Sonora Property, including: the La Bolsa property, on the Abe concession in the northwest corner of the Northern Sonora concession block; the Real Viejo silver prospect in the central portion of the concessions; the Planchas de Plata (Anita claim) silver prospect located to the southeast of the main concessions; and base metal mineralization related to porphyry systems, in the eastern portion of the concession block, including the El Fierro and La Recompensa mineralized systems.

The Company has obtained all required permits to conduct exploration drilling on the La Bolsa, La Dura, and Real Viejo projects through the next several exploration programs. The Northern Sonora property is not subject to any environmental liabilities.

Climate, Accessibility, Local Resource Infrastructure and Physiography

The climate in the area is high desert, semi–arid with average annual precipitation of approximately 20 cm. Most of the precipitation falls during the wet season lasting from July to mid September. Temperatures range from 5 degrees Celsius in winter to 48 degrees Celsius in summer. Exploration can be undertaken throughout the year.

The local economy is supported mainly by cattle ranching, with the nearby city of Nogales, Mexico (population exceeding 1 million), providing most of the economy for the region. Skilled and unskilled labour is abundantly available from nearby Nogales. Water for drilling is available from local sources including ponds and water wells. Surface rights to all known areas of mineralization and potential waste disposal, tailings, storage, heap leach pads and plant sites are held under agreements by the Company.

Site topography is characterized by low to moderately rugged terrain with elevations ranging from 1,000 to 1,800 metres above sea level.

Figure 4: Northern Sonora Properties

Nature of Transport

The project area is serviced by narrow, winding, dirt roads from Nogales. A network of roads to provide access for drilling has been established on several of the more advanced prospects located on the Northern Sonora property. Modern services are available at Nogales, within 30 kilometres of most of the prospects.

Sampling and Integrity of Samples

The Company has taken more than 5,500 surface samples over the project area since 1994, drilled 109 holes at La Bolsa, 33 holes on six separate target areas at El Malacate, 25 holes on the Real Viejo prospect, and completed extensive geological mapping and airborne geophysical surveys over the entire claim block. All assays were completed by either Bonder–Clegg, Chemex or Inspectorate under the same quality assurance regime as for the Dolores property.

La Bolsa Property: Location and Access

The La Bolsa property is located on the Abe concession in the northern part of Sonora State, Mexico, approximately 30 kilometres west of the Mexican city of Nogales, and 97 kilometres SSW of Tucson, Arizona. The property is best accessed from Tucson, by taking Highway I–19 approximately 110 kilometres south to Nogales. Access to the property from Nogales is by four-wheel drive vehicle over a combination of paved and dirt roads.

History of Property

There is no known written information pertaining to the La Bolsa property although historic pits, shafts, adits and exploratory trenches occur within the property. The greatest concentration of these are found on top of, and on the east flank of the main mineralized hill where an access tunnel, several shafts, and over half a dozen surface pits were dug to exploit high grade (to 0.48 opt gold and 8.3 opt silver – verified by the Company) carbonate–rich breccias and veining.

Ownership

The La Bolsa property was staked by Minera Minefinders which is the registered owner of all the exploration concessions. The property is not subject to any underlying royalties or title encumbrances.

Although the Company is the registered owner of the mineral rights to the La Bolsa property, the surface rights to much of the Abe Concession are owned by Roberto Pierson Suarez (“Pierson”). Terms for an exploration and exploitation surface rights agreement with Pierson (the “Pierson Agreement”) were accepted during the third quarter of 1997, and a final agreement was executed and filed with the appropriate Mexican authorities on October 13, 1997.

The Pierson Agreement has a term of 20 years and is renewable for an additional 20 years. Under the agreement, the Company is to pay Pierson annual rent of $20,000, increasing by 10% per year, and an additional annual fee of $200 for each Pierson–owned hectare that the Company actually encumbers as part of its mining operations for activities such as building roads. The Company paid the annual rent and disturbance fee during the period from 1999 to 2004. The Company will continue to hold this property and advance it to a feasibility study as market conditions allow. In addition, the Pierson Agreement provides that the Company is to pay Pierson a one–time fee of $500,000 for each mine that the Company puts into production on a Pierson–owned property.

Geology and Mineralization

The geological setting of the La Bolsa property consists of Tertiary volcanic and sedimentary units shown to overlie or intrude Cretaceous and Jurassic sedimentary and volcanic rocks consisting of interbedded siltstone, sandstone, conglomerate, limestone, and rhyolite flows and tuffs.

Several Tertiary volcanic and volcaniclastic rock types have been identified on the property. Volcaniclastic and tuff beds are correlated to the lowermost units of the Tertiary Montana Peak Formation in the Oro Blanco Mining District of Arizona, located to the immediate north.

The La Bolsa property contains an inferred resource of 8.3 million tons grading 0.025 oz/t gold and 0.254 opt silver. Mineralization and alteration is characterized by intense silicification, sericitization and quartz–calcite or quartz–adularia stockwork veining and brecciation hosted by volcaniclastic sediments and intermediate volcanic flows intruded by felsic dikes and plugs. Quartz–calcite veins up to 4.56 metresin width have been noted at the surface although most of the quartz–veining occurs as stockworks. Pink replacement textures have been described as

potassic alteration or adularization but no pattern has been defined. The presence of pyrite is suggested by iron–oxide pseudomorphs and hematite and limonite along fractures. Carbonate veins and breccia zones are found throughout the mineralized La Bolsa property.

Exploration Activity

The La Bolsa mineralized system was discovered and staked in 1994 by Company personnel while exploring the Hill of Gold prospect in the Oro Blanco Mining District (Arizona) adjacent to the international boundary. Further prospecting, mapping and rock geochemical sampling (1,200 samples) outlined a coincident gold–silver anomaly which extends for about 800 metres and averages about 120 metres in width. Approximately 994 metres of surface trench rock sampling by the Company produced significant values, including 125 metres averaging 1.10 g/t gold in Trench 95–1 and 152 metres averaging 1.10 g/t gold along sample line 1000S. During late 1995 and early 1996, 42 reverse circulation drill holes totalling 4,835 metres and 7 diamond drill holes totalling 614.5 metres were completed.

In mid–1996, a preliminary resource estimate concluded there was gold mineralized material of 122,600 equivalent ounces of gold (i.e., 4,087,000 tons at .030 opt using .01 cut-off), including modest silver credits. Bottle-roll cyanide leach metallurgical test work on eight samples of mineralized drill cuttings leached over a period of 72 hours had recoveries ranging from 57% to 95%, while four samples (including a split of the 57%/72 hr. sample) leached for 96 hours had extraction rates in the 80.6% to 86.0% range. Silver recoveries were reported to be relatively high, with low reagent consumption, suggesting amenability of the samples to heap leach extraction techniques.

The Company completed the first phase exploration drilling program on the La Bolsa property in 1996 with the resultant discovery and mineralized deposit estimation of up to 122,000 ounces gold equivalent. Mineralization is open down dip to the east and along strike both north and south with excellent potential to expand this resource. The Company received ecological permitting to drill an additional 150 holes on this property. Access road preparation and drill pad construction commenced upon approval of the permit. A second phase drilling program began in May 1998 and was completed in August 1998. Results from this drilling included 26 mineralized holes from the 28 holes drilled to extend the La Bolsa property. A revised resource estimate utilizing polygonal methods tabulated 8.3 million tons, grading .025 opt gold and .254 opt silver, containing 208,000 ounces of gold and 2.1 million ounces of silver, at a .01 opt cut–off grade. Mineralization remains open to the south and east and additional drilling will be required to advance the present deposit to a reserve.

Additional work on the resource area was carried out in 2003 to advance the property nearer to the feasibility study stage. The drilling program completed in 2003 included drilling of 23 core holes for 2,085 metres, and 11 RC holes for 1,838metres. In 2004, an additional 15 core holes totalling 1,418 metres were drilled.

Work Program

Additional exploration is required at the La Bolsa property to bring the project to the pre–feasibility stage. This will entail infill, diamond and reverse circulation drilling, and surface channel sampling to enable upgrading of resources to the measured or indicated category of pre–feasibility purposes. Systematic check assays, bulk density testing, geostatistical analysis of the assay database, preliminary mining studies, ongoing metallurgical testwork, and economic evaluations will be required and have been provided for in the proposed budget.

Exploration efforts will continue on the La Bolsa property in 2005 with additional step-out and infill drilling, metallurgical test work and scoping-prefeasibility study. The 2005 budget for la Bolsa is presented below.

La Bolsa Project 2005 Budget | | | |

| | | |

Drilling | | | |

Total number of holes planned (core) | 15 | | |

Total number of holes planned (RC) | 15 | | |

Total meters planned core: | 3000 | | |

Total meters planned RC: | 2000 | | |

Total number of days for completion: | 90 | | |

Total hours road construction (includes 15 hrs of main road cleanup): | 110 | | |

| | | |

| | Unit Cost | Total Cost |

All inclusive drill costs (per meter - includes assays and drill supplies) | | $100 | $150,000 |

All inclusive drill costs (per meter - includes assays and drill supplies) | | $50 | 75,000 |

Engineering and metallurgical studies | | $1,000 | 180,000 |

Road construction (per hour) | | $65 | 7,150 |

Field geologists (2 - per day) | | $700 | 63,000 |

Geologist - geologic compilation (per day) | | $350 | 15,500 |

Tech (per day) | | $100 | 9,000 |

Samplers (2 - per day) | | $40 | 3,000 |

Camp supplies/travel (per day) | | $150 | 13,500 |

Subtotal | | | 516,150 |

Contingency | | 10% | 51,615 |

| | | $567,765 |

Northern Sonora Projects: Description and Location

Following the initial success on the La Bolsa discovery, the Company staked eight additional concessions expanding the Northern Sonora Property to its present size. Work on these additional concessions during the period from 1996 through 2001 included regional and detailed geologic mapping, extensive geochemical sampling programs, and an airborne geophysical survey. This comprehensive exploration effort resulted in the discovery of eight additional gold–silver mineralized systems and two porphyry copper related base metal systems.

The El Malacate property located in the central portion of the Northern Sonora property was explored from 2001 through the end of 2003 and written off at year end 2003.

Ownership

The concessions were staked on behalf of, and are 100% controlled by Minera Minefinders. Surface rights to the area belong to various ranchers. An agreement (the “Milner Agreement”) was signed in May 2000 with Fred Milner covering the area of his Los Adobes Ranch that encompasses 7,492 hectares and includes the El Malacate, La Matanza, La Dura, La Verde, El Tapon, and Picacho Alto prospects. The agreement provides for surface rights for exploration, development, and mining within his property, in return for an annual payment of $10,000, compensation of $350,000 for the first mine to go into production on his property and $250,000 for any other mines that go into production on his property. A second surface rights agreement was completed for the remaining area encompassing the El Malacate property. This agreement, referred to as the Maldonado property agreement, is similar to the Milner Agreement, with the initial annual rental payment of $5,000 having been made in 2001, but with the exception that there is no lump sum payment for the construction of a mine.

Geology and Mineralization

The geologic setting of the Northern Sonora property consists of Tertiary intermediate to felsic flows and tuffs overlying a diverse package of conglomerate, sandstone, siltstone, and thinly layered limestones with interspersed intermediate volcanic flows and tuffs. The entire area is believed underlain by Mesozoic metavolcanic and metasedimentary units. The structural regime is dominated by an older series of northeast trending structures cut by a later series of northwest trending horsts and grabens. Gold mineralization is localized at the edges of several circular features, which are interpreted as related to Tertiary volcanism. There is an earlier mineralizing event, primarily

containing silver with accessory base metals and gold, which is emplaced along the older set of northeast trending structures.

Mineralized systems include the El Malacate, La Dura, Real Viejo, Santa Juliana, La Verde, El Tapon, and Picacho Alto and Planchas de Plata prospects which are dominantly silver–lead–zinc ±gold systems. These are confined to ENE trending structural zones occurring within Jurassic to Cretaceous felsic volcanics. These systems vary in size from 500 to 2,000 metres strike length. The Alcaparroso, Agua Caliente, El Fiero and La Recompensa targets are large porphyry related base–metal (Cu–Mo–Zn–Pb) targets located within the eastern and southern portions of the claim block. Alteration at each of these systems includes square kilometrescomprised of strong iron oxides, sericitic and argillic alteration, and scattered quartz tourmaline stockworks in Jurassic to Cretaceous felsic volcanics. Intruding the project area are a series of rhyolite, granodiorite, and diorite dikes and plugs. Approximately 190 samples have been collected yielding values up to 38,000 ppm Cu, 370 ppm Mo, 400 ppm Pb, and 500 ppm Zn. Subsequent exploration, including initial drill programs in 2004 have resulted in dropping the Alcaparroso and Agua Caliente prospects.

Exploration Activity

In 1996, the Company contracted an independent consulting firm to produce a reconnaissance geological map of the Northern Sonora property and to sample possible mineralized areas. The area examined covered approximately 110 square kilometres, and 126 rock samples were collected. Six of the samples contained between 1.0 and 7.0 g/t gold, while 76 samples (60% of total) were anomalous in one or more elements.

Additional geological mapping and geochemical sampling has been completed over an area exceeding 150 square kilometresto the east of the La Bolsa property. Eight major areas of anomalous gold mineralization were identified and are being evaluated through comprehensive exploration programs. Exploration is being expanded to include completion of additional drilling programs leading to a possible pre–feasibility decision.

Results from a helicopter–borne magnetic, radiometric and electromagnetic survey, including colour aerial photography, covering more than 90,000 hectares of the combined La Reserva/El Correo, Northern Sonora and Oro Blanco properties, were evaluated during 1998. The purpose of this survey was to assist with mapping lithology, structure, alteration and potential mineralized zones. The Company also evaluated the results of a detailed ground geophysics study, including magnetic and VLF electromagnetic surveys, and an induced polarization / resistivity survey for the combined purposes of drill target definition and as an orientation survey for the La Bolsa and La Reserva/El Correo properties.

Work in 2003 included drilling of 24 additional holes (19 RC and 5 core, totalling 3680 meters) within the El Malacate project area. This drilling did not significantly enhance the mineralization encountered in previous drilling and the prospect was written off at year end. At the La Dura silver prospect the Company completed 5 RC holes totalling 640 meters. Additional drilling completed in 2003 included 3 RC holes, totalling 288 meters on the Agua Caliente gold-copper prospect and 3 RC holes, totalling 640 meters on the Alcaparroso porphyry copper prospect. Results from these programs resulted in dropping the La Dura, Agua Caliente and Alcaparroso prospects.

Nearby historic mining activity, with the most extensive workings found in areas of previous silver mining including those at La Dura Mine, Real Viejo Mine, Santa Juliana Mine, and La Recompensa Mine. Hundreds of smaller workings have also been encountered throughout the property. There are no historic records for these workings and only the La Recompensa Mine has been recorded on existing maps.

Work Program

The following table shows the proposed work program for the Real Viejo prospect for 2005:

Real Viejo 2005 budget | | | |

| | | |

Drilling | | | |

Total number of holes planned (Core & RC) | 30 | | |

Total meters planned: | 4,500 | | |

Total number of days for completion: | 65 | | |

Total hours road construction: | 90 | | |

| | Unit Cost | Total Cost |

| | | |

All inclusive drill costs (per meter - Includes assays and drill supplies) | | $80 | $360,000 |

Assays (rock-chip and soil ~ 600) | | $20 | 12,000 |

Road construction (per hour) | | $65 | 5,850 |

Field geologists (2 - per day) | | $700 | 45,500 |

Geologist - geologic compilation (per day) | | $350 | 11,375 |

Tech (per day) | | $100 | 6,500 |

Samplers (2 - per day) | | $40 | 2,600 |

| | | |

Camp supplies/travel (per day) | | $150 | 9,750 |

Subtotal | | | 453,575 |

Contingency | | 10% | 45,000 |

| | | $498,575 |

The proposed 2005 exploration budget for the Planchas de Plata silver district is presented below.

Planchas de Plata Project (Anita Claim) 2005 budget | | | |

| | | |

Drilling | | | |

Total number of holes planned (Core): | 25 | | |

Total number of holes planned (RC): | 20 | | |

Total meters planned (Core): | 3,500 | | |

Total meters planned (RC): | 2,500 | | |

Total number of days for completion: | 100 | | |

Total hours road construction (includes 30 hrs. main road cleanup): | 100 | | |

| | | |

| | Unit Cost | Total Cost |

| | | |

Core drill costs ( includes drill supplies) | | $90 | $315,000 |

RC drill costs ( includes drill supplies) | | $50 | 125,000 |

Assays rock chip and soil ~ 1000 | | $20 | 20,000 |

Road construction (per hour) | | $65 | 6,500 |

Field geologists (2 - per day) | | $700 | 70,000 |

Geologist - geologic compilation (per day) | | $350 | 17,500 |

Tech (per day) | | $100 | 10,000 |

Samplers (2 - per day) | | $40 | 4,000 |

| | | |

Camp supplies/travel (per day) | | $150 | 15,000 |

Subtotal | | | 583,000 |

Contingency | | 10% | 58,000 |

| | | $641,000 |

OTHER PROPERTIES

The Company has interests in other mineral properties in Mexico as summarized below. The properties have not been advanced sufficiently to have a material impact on the Company’s portfolio of properties.

La Reserva/El Correo Property

The La Reserva/El Correo Property has been reduced and claims converted to exploitation concessions listed below. The Alcaparroso, and Agua Caliente concessions were dropped in 2004.

La Reserva/El Correo Property Concessions

Concession Name | Title No. | Area (hectares) | Expiry Date |

| | | |

Alcaparroso** | 221169 | - | December 2, 2053 |

Tio Flaco* | 221168 | 708 | December 2, 2053 |

Agua Caliente** | 221170 | - | December 2, 2053 |

El Correo | 217446 | 2,718 | July 15, 2052 |

Cadena de Oro | 205198 | 366 | July 7, 2053 |

El Durazno | 212967 | 440 | February 19, 2007 |

Total area remaining | | 4,232 | |

* Exploitation titles replacing Exploration title 202980 La Reserva Fraccion 1.

** dropped in 2004

San Antonio Property

The San Antonio property is located some 120 km SSE of the city of Zacatecas, Mexico, in the municipality of Villa Hidalgo, Zacatecas. The project lies close (12 km northwest) to the historic mining district of Pinos, that from 1894 to 1934 produced approximately 200,000 oz gold and 5 M oz silver from veins and mantos within Cretaceous limestone sequences.

It originally consisted of eight concessions totalling some 817 hectares. Following initial surface exploration and review of drilling results from adjacent projects most of the property was dropped in 2004, as shown in the following table:

San Antonio Property Concessions

Concession Name | Title No. | Area (hectares) | Expiry Date |

Gran Maria 1** | 208071 | - | August 25, 2004 |

Gran Maria 1 Fraccion I** | 208072 | - | August 25, 2004 |

Gran Maria Fraccion III** | 208073 | - | August 25, 2004 |

Gran Maria 2** | 208181 | - | August 31, 2004 |

Gran Maria 5** | 207501 | - | June 24, 2004 |

Gran Maria 6 | 210695 | 108.00 | November 17, 2005 |

La Laguna | 213046 | 314.79 | March 1, 2007 |

La Laguna Fraccion A | 213046 | 0.34 | March 1, 2007 |

Total area remaining | | 423.13 | |

** dropped in 2004

INTERESTS IN UNITED STATES PROPERTIES

The Company has interests in three claim areas in Nevada, U.S.A.; the Gutsy/Buckskin Mountain properties, the Clear property and the Dottie property. In 2004 approximately $1 million was spent on advancing these properties including geological mapping and geochemical sampling, and 19 drill holes totalling 5,486 metres.

These properties are not sufficiently advanced to make them material to the Company’s asset base, but work budgets of approximately $620,000 are planned for 2005 on the Gutsy and Clear properties. Results and evaluation of the 2005 drilling campaign on Dottie are not yet available; an appropriate budget will be allocated on completion of the evaluation.

The Company’s Oro Blanco property in Arizona adjoins the La Bolsa property in northern Sonora. No work is anticipated on this property in 2005.

NUMBER OF EMPLOYEES

As at December 31, 2004, the Company had a total of 25 employees and consultants. None of the Company's employees belong to a union or are subject to a collective agreement. The Company considers its employee relations to be good.

COMPETITION

The Company competes with other mining companies for the acquisition of mineral claims, permits, concessions and other mineral interests as well as for the recruitment and retention of qualified employees. There is significant competition for the limited number of gold acquisition opportunities and, as a result, the Company may be unable to acquire attractive gold mining properties on terms it considers acceptable.

RISK FACTORS

The Company’s securities should be considered a highly speculative investment and investors should carefully consider the following information about these risks, together with other information contained herein. If any of the following risks actually occur, our business, results of operations and financial condition could suffer significantly.

History of Losses

The Company is an exploration stage company with no history of profitability. There can be no assurance that the operations of the Company will be profitable in the future. The Company has limited financial resources and will require additional financing to further explore, develop, acquire and retain its property interests and if financing is unavailable for any reason, the Company may become unable to acquire and retain its mineral concessions and carry out its business plan.

Risks of Exploration and Development

All of the properties in which the Company has an interest or the right to earn an interest are in the exploration stages only and are without a known body of commercial ore. As an exploration company, the Company has no revenues, except interest income on cash balances, and therefore a history of losses. The level of profitability of the Company in future years will depend to a great degree on precious and base metal prices and whether any of the Company’s exploration stage properties can be brought into production. The exploration for and development of mineral deposits involves significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate.

Development of the Company’s properties will only follow upon obtaining satisfactory results. Mineral exploration and development involves a high degree of risk and few properties which are explored are ultimately developed into producing mines. There is no assurance that the Company’s exploration and development activities will result in any

discoveries of commercial bodies of ore. The long–term profitability of the Company’s operations will be in part directly related to the cost and success of its exploration programs, which may be affected by a number of factors.

Amendments to current laws, regulations, and permits governing operations and activities of mining companies or more stringent implementation thereof could require increases in capital expenditures, production costs, reduction in levels of production of future mining operations, or require delays in development or abandonment of new mining properties.

The Company’s mining operations may be subject to foreign, federal, state, provincial and local laws and regulations governing the protection of the environment, including laws and regulations relating to air and water quality, mine reclamation, waste disposal, and the protection of endangered or threatened species. The Company’s mining activities may be subject to foreign, federal, state, provincial and local laws and regulations for protection of surface and ground water.

If the Company undertakes new operations in other provinces, states or countries, or significantly expands its existing mining operations, the Company may be required to obtain pre–construction environmental and land use review and to comply with permitting, control and mitigation requirements of the jurisdiction in which such operations are to be located. Compliance with new requirements could impose costs on the Company in the future, the materiality of which cannot reasonably be predicted at this time.

Dilution

The Company has a number of outstanding stock options. If and when these are exercised, the issued and outstanding capital of the Company may be substantially increased, thus diluting shareholder interests in the Company.

DIVIDEND RECORD AND POLICY

The Company has not paid any dividends since incorporation and intends to retain earnings to finance the growth and development of its business. It does not intend to pay dividends on common shares in the immediate future. The payment of dividends in future will depend, among other factors, on earnings, capital requirements, and operating and financial condition.

MANAGEMENT’S DISCUSSION AND ANALYSIS

Reference is made to “Management’s Discussion and Analysis”, dated March 21, 2005, which has been filed on SEDAR at www.sedar.com and is incorporated by reference in this AIF.

CAPITAL STRUCTURE

The authorized capital of the Corporation consists of unlimited common shares without par value. As at March 21 2005, the Corporation had a total of 36,476,841 common shares issued and outstanding, all of which are fully paid and not subject to any future call or assessment. The common shares rank equally as to voting rights, participation in a distribution of the assets of the Corporation on a liquidation, dissolution or winding-up, and the entitlement to dividends. The holders of the common shares are entitled to receive notice of all meetings of shareholders and to attend and vote the shares at the meetings. Each common share carries with it the right to one vote.

As at March 21, 2005, the Coporation also had a total of 3,440,000 options outstanding. The options are exercisable for up to five years from the dates of grant at prices ranging from CDN$1.05 to CDN$12.53.

MARKET FOR SECURITIES

The Corporation’s common shares are listed and posted for trading on the Toronto Stock Exchange (“TSX”) under the stock symbol “MFL”, and on the American Stock Exchange (“AMEX”) under the symbol “MFN”.

The following table gives the monthly trading ranges for the Corporation’s common shares and the number of shares traded (“Volume”)

| Toronto Stock Exchange (prices in Canadian dollars) | | American Stock Exchange (prices in US dollars) |

2004 | High | Low | Close | Volume | | High | Low | Close | Volume |

January | $12.71 | $10.60 | $11.00 | 7,161,634 | | $9.99 | $8.00 | $8.28 | 1,440,100 |

February | 13.05 | 10.74 | 12.50 | 2,047,573 | | 9.90 | 8.05 | 9.16 | 939,300 |

March | 13.50 | 12.20 | 1305 | 5,862,159 | | 10.24 | 9.09 | 9.90 | 1,953,400 |

April | 13.87 | 8.25 | 8.85 | 4,623,262 | | 10.57 | 5.60 | 6.34 | 1,944,600 |

May | 10.57 | 7.75 | 10.30 | 2,497,056 | | 7.54 | 5.59 | 7.40 | 1,447,200 |

June | 10.54 | 8.36 | 9.05 | 1,846,779 | | 7.70 | 6.06 | 6.70 | 891,500 |

July | 10.00 | 8.38 | 9.15 | 2,393,278 | | 7.66 | 6.35 | 6.85 | 734,900 |

August | 9.95 | 7.85 | 8.80 | 1,640,097 | | 7.54 | 6.00 | 6.72 | 844,500 |

September | 8.85 | 7.60 | 8.70 | 1,402,210 | | 7.00 | 5.92 | 6.89 | 887,900 |

October | 9.50 | 8.30 | 8.90 | 3,034,810 | | 7.54 | 6.63 | 7.33 | 723,400 |

November | 10.55 | 8.19 | 9.55 | 7,262,709 | | 8.78 | 6.73 | 8.10 | 927,100 |

December | 9.70 | 7.86 | 8.15 | 2,197,595 | | 8.18 | 6.31 | 6.86 | 895,900 |

DIRECTORS AND OFFICERS

Each director is elected by the shareholders at the annual general meeting and holds office until the first annual general meeting following the director’s election (or appointment by the board to fill a vacancy). Each officer holds office at the pleasure of the board of directors.

Directors and Officers

Name and Place of Residence |

Position with the

Company |

Principal Occupation

|

Director or Officer Since |

Mark H. Bailey

Bellingham, Washington,

U.S.A. | President, Chief Executive Officer and Director | President and Chief Executive Officer of the Company | President -July 27, 1995

CEO – Oct. 31, 1995

Director – July 27, 1995 |

James M. Dawson(1)

Richmond, British Columbia, Canada | Director | President, Dawson Geological Consultants Ltd., a geological consulting company | Director -March 18, 1996 |

H. Leo King(1)

Vancouver, British Columbia, Canada | Director | President, International Barytex Resources Ltd., a mining company | Director -May 15, 1996 |

Robert L. Leclerc(1)

Henderson, Nevada U.S.A. | Director & non-executive Chairman | Business Consultant | Director - March 27, 1997

Chairman June 10, 2004 |

Anthonie Luteijn Delta, British Columbia | Director | Retired Mining Executive | Director -June 10, 2004 |

Paul C. MacNeill

West Vancouver, British Columbia, Canada | Director and Corporate Secretary | Barrister and Solicitor | Director – Sept. 15, 1995

Corporate Secretary – July 27, 1995 |

Tench C. Page

Reno, Nevada

U.S.A. | Vice–President, Exploration | Vice–President, Exploration of the Company | Vice President -July 27, 1995 |

Ronald J. Simpson

Calgary, Alberta, Canada | Chief Financial Officer | Chief Financial Officer of the Company | CFO -May 17, 2004 |

(1) | Member of the Audit Committee. |

Each of these individuals has been engaged in the principal occupation set forth opposite his name during the past five years except for: Paul C. MacNeill who, prior to November 2002, was a partner with the Vancouver law firm of Campney & Murphy, Barristers & Solicitors; H. Leo King who, prior to 2001, was the General Manager for International Barytex Resources Ltd., a mining company; Robert L. Leclerc who, prior to February 2003 was the Chairman and Chief Executive Officer of Echo Bay Mines Ltd., a mining company; and Ronald J. Simpson, who prior to May 2004, was the Vice-President, Finance and Administration and chief financial officer of TVI Pacific Inc., a mining company.

Shareholdings of Directors and Officers

To the best of the Company’s knowledge as at March 21, 2005, directors and officers, as a group, beneficially owned, directly or indirectly, or exercised control over 1,328,800 common shares (not including common shares issuable upon the exercise of stock options) representing 3.64 % of the then outstanding common shares.

Cease Trade Orders

On May 29, 2001, a cease trade order was issued to all directors and officers of Rift Resources Ltd.because of the failure of that company to file financial statements. That company was insolvent and unable to engage accountants and auditors to prepare and audit financial statements. On February 25, 2002, a similar order was issued against DMR Resources Ltd., for failure to file financial statements. That company was also insolvent and was also unable to engage accountants and auditors to prepare and audit financial statements. Ronald J. Simpson, who is the Corporation’s Chief Financial Officer, was the chief financial officer of these companies at the relevant times. The orders are still in effect.

Conflicts of Interest

Other than as disclosed below, to the best of the Company’s knowledge, there are no existing or potential conflicts of interest between the Company and any director or officer of the Company, except that certain of the directors and officers serve as directors, officers, promoters and members of management of other public companies and therefore it is possible that a conflict may arise between their duties as a director or officer of the Company and their duties as a director or officer of such other companies. (See “Risk Factors – Conflicts of Interest”)

The directors and officers of the Company are aware of the existence of laws governing accountability of directors and officers for corporate opportunity and requiring disclosures by directors of conflicts of interest and the Company will rely upon such laws in respect of any directors’ and officers’ conflicts of interest or in respect of any breaches of duty by any of its directors or officers. All such conflicts will be disclosed by such directors or officers in accordance with theBusiness Corporations Act(Ontario) and they will govern themselves in respect thereof to the best of their ability in accordance with the obligations imposed upon them by law.

COMMITTEES OF THE BOARD OF DIRECTORS – AUDIT COMMITTEE

The only Board committee is the Audit Committee, comprising Robert L. Leclerc, James Martin Dawson and H. Leo King, all of whom, in the opinion of the directors, are independent and are financially literate.

Mr. R.L. Leclerc is a lawyer, and was the chief executive officer of a large law firm from 1993 to 1996. From 1997 to 2003 he was chief executive officer of a public company in the business of mining precious metals, and that was listed for trading in Canada and the U.S.A. In those capacities he was ultimately responsible for the activity and authority of the chief financial officers who reported to him, and for the implementation and maintenance of internal control systems and for compliance with the required public reporting.

Mr. J.M. Dawson has been a professional consulting geologist for over thirty years, and has been a director of public companies in the mineral resource industry for almost twenty years. Also, he has managed his own consulting geological firm for many years. In these capacities he has acquired a knowledge and understanding of the financial issues and accounting principles that are relevant in assessing this Company’s financial disclosures and internal control systems.

Mr. H.L. King is also a professional geologist who has nearly twenty years of experience in senior executive positions within the base and precious metals mining industry. He is the president and is a director of several public companies, and his responsibilities have included the operation of internal control systems and compliance with public financial disclosure requirements. In discharging these responsibilities Mr. King has acquired the requisite skill and knowledge in understanding the accounting principles, and their application, adopted by this Company in its financial disclosures.

The members of the Audit Committee do not have fixed terms and are appointed and replaced from time to time by resolution of the directors.

The Audit Committee meets with the President and Chief Executive Officer and the Chief Financial Officer of the Company and the independent auditors to review and inquire into matters affecting financial reporting, the system of internal accounting and financial controls as well as audit procedures and audit plans. The Audit Committee also recommends to the Board of Directors the auditors to be appointed. In addition, this Committee reviews and

recommends to the Board for approval the annual financial statements, the Management Discussion and Analysis, and undertakes other activities required by regulatory authorities.

The full text of the Audit Committee Charter is attached to this AIF as an Appendix.

Audit Fees

The following table shows the aggregate fees billed to the Company by its external auditor in each of the last two years.

| 2004 | 2003 |

Audit Fees | $34,817 | $28,890 |

Consultations on accounting matters, reviews of financial information and other assurance related services | 12,781 | 7,010 |

Tax compliance, taxation advice and tax planning for international operations | 3,815 | - |

All other fees, consisting of work related to prospectuses and registration statement. | 24,381 | 19,268 |

| $75,794 | $55,168 |

TRANSFER AGENT AND REGISTRAR

The Corporation’s Transfer Agent and Registrar for its common shares is CIBC Mellon Trust Company at its offices in Vancouver, British Columbia and Toronto, Ontario.

MATERIAL CONTRACTS

The Company has contracts, that are or may become material to its success, for the exploration and exploitation of minerals, and for surface rights, at its Dolores and Northern Sonora properties. Details of these are given elsewhere in this AIF – please see “Principal Property – The Dolores Property – Description and Location” and “Northern Sonora Property – La Bolsa Property: Location and Access – Ownership” and “Northern Sonora Property – Northern Sonora Projects: Description and Location – Ownership”.

INTERESTS OF EXPERTS

Mark H. Bailey,M.Sc., P.Geo., a director and President and Chief Officer of the Corporation is a Qualified Person as defined in National Instrument 43-101 (“NI43-101”). During 2004 several news releases were issued in which it was stated that he supervised the preparation of the technical information in those releases. Mr. Bailey expects to stand for re-election as a director when his term expires. He owns 420,700 common shares of the Corporation and 925,000 options to purchase common shares.

On December 6, 2004 the Corporation filed an independent study by Roscoe Postle Associates Inc. (“RPA”) entitled “Technical Report on the Mineral Resources Estimate for the Dolores Property, Mexico”. The principal authors of the report were David W. Rennie, P. Eng., and C. Stewart Wallis, P. Geo., who are both independent Qualified Persons as defined in NI43-101. The report has been incorporated by reference in this AIF. To the best of the Corporation’s knowledge, none of RPA, David W. Rennie and C. Stewart Wallis owns any interest in the Corporation.

ADDITIONAL INFORMATION

Additional information about the Company may be found on SEDAR at www.sedar.com

Further information including directors’ and officers’ remuneration and indebtedness, principal holders of the Corporation’s securities and options to purchase securities, if applicable, is contained in the Company’s Management Proxy Circular for the annual general meeting held on June 10, 2004. It is anticipated that the Management Proxy Circular for the next annual general meeting, which will contain more recent information on those matters, will be filed and published in May 2005. Additional financial information is provided in the Company’s comparative consolidated financial statements and Management’s Discussion and Analysis for the year ended December 31, 2004, both of which may be found on SEDAR at www.sedar.com.

Appendix

to Annual Information Form dated March 21, 2005

MINEFINDERS CORPORATION LTD.

CHARTER OF THE AUDIT COMMITTEE

The number of members of the Committee will be at least three, none of whom are officers or employees of the Corporation or any of its affiliates or subsidiaries and all of whom are, in the view of the Board of Directors of the Corporation, free of any relationship that would interfere with the exercise of independent judgement. Qualification for committee membership shall, in addition, comply with applicable securities regulatory requirements.

(a) | recommend annually to the Board the independent auditors to be appointed by the shareholders of the Corporation; |

(b) | review with the independent auditors the annual audit plan including, but not limited to, the scope of the work to be carried out by the independent auditors, any significant problems that the auditors are able to foresee, the impact on the financial statements and the Corporation of any new or proposed changes in accounting principles; |

(c) | review the annual financial statements, including notes, with the independent auditors and recommend them to the Board for approval prior to release to the public or filing with securities regulatory authorities; |

(d) | review the quarterly financial statements with the independent auditors prior to release to the public or filing with securities regulatory authorities; |

(e) | report immediately to the Board any instances of fraud or misappropriation of assets that come to the attention of the Committee; |

(f) | receive from the independent auditors a formal written statement delineating all relationships between the auditors and the Corporation, consistent with applicable accounting standards, and actively engage in a dialogue with the auditors with respect to any disclosed relationships or services that may have an impact on their objectivity and independence; |

(g) | take, or recommend that the full Board take, appropriate action to oversee the independence of the auditors; |

(h) | as to management of the Corporation generally: (i) ensure that an adequate internal control structure and procedures for financial reporting are established and maintained; (ii) periodically assess the effectiveness of such structures and procedures, as well as secure appropriate reports or attestations from the independent auditors in respect thereof; and (iii) review budgets and periodically assess actual spending compared with budgeted amounts; and |

(i) | undertake and perform such other duties as may be required of the Committee by applicable law or regulation. |

In performing its functions and duties: |

(aa) | the Committee shall meet at least quarterly with management and the independent auditors to discuss the accounts, records and financial position of the Corporation; |

(bb) | the members of the Committee may inspect all the books and records of the Corporation; and |

(cc) | the Committee may, in its discretion and at the expense of the Corporation, engage financial and other advisors. |

The Committee is responsible for the duties set forth in this charter but is not responsible for either the preparation of the financial statements or the auditing of the financial statements. Management has the responsibility for preparing the financial statements and the independent auditors have the responsibility for auditing the financial statements. The review of the financial statements by the Committee is not of the same quality as the audit performed by the independent auditors.

This charter was adopted by the Board of Directors of Minefinders Corporation Ltd. on April 1, 2003

EXHIBIT 2

Minefinders Corporation Ltd.

(An Exploration Stage Company)

Consolidated Financial Statements

(Thousands of United States dollars)

December 31, 2004

Minefinders Corporation Ltd.

(An Exploration Stage Company)

Consolidated Financial Statements

(Thousands of United States dollars)

December 31, 2004

Consolidated Financial Statements

Balance Sheets | 3 |

Statements of Loss and Deficit | 4 |

Statements of Cash Flows | 5 |

Statements of Mineral Properties and Deferred Exploration Costs | 6 |

Summary of Significant Accounting Policies | 7 - 11 |

Notes to the Financial Statements | 12 - 21 |

| | | |

BDO Dunwoody LLP | 600-925 W Georgia St. | |

Chartered Accountants and Advisors | Vancouver, BC, Canada V6C 3L2 |

| Telephone: (604) 688-5421 | |

| Telefax: (604) 688-5132 | |

| E-mail: vancouver@bdo.ca | |

| www.bdo.ca | |

| | | | | | |

Auditors' Report

To the Shareholders of

Minefinders Corporation Ltd.

We have audited the Consolidated Balance Sheets of Minefinders Corporation Ltd. (an Exploration Stage Company) as at December 31, 2004 and 2003 and the Consolidated Statements of Loss and Deficit, Cash Flows and Mineral Properties and Deferred Exploration Costs for each of the years in the three-year period ended December 31, 2004. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with Canadian generally accepted auditing standards. Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of the Company as at December 31, 2004 and 2003 and the results of its operations and its cash flows for each of the years in the three-year period ended December 31, 2004 in accordance with Canadian generally accepted accounting principles.

/s/ BDO Dunwoody LLP

Chartered Accountants

Vancouver, Canada

February 8, 2005

BDO Dunwoody LLP is a Limited Liability Partnership registered in Ontario

2

Minefinders Corporation Ltd.

(An Exploration Stage Company)

Consolidated Balance Sheets

(Thousands of United States dollars)

December 31 | 2004 | 2003 |

Assets | | |

Current | | |

Cash and cash equivalents (Note 2) | $ 42,352 | $ 45,677 |

Receivables | 156 | 27 |

Prepaid expenses | 135 | 71 |

| 42,643 | 45,775 |

Mineral properties and deferred exploration | | |

costs (Note 3) | 44,762 | 34,519 |

Equipment(Note 4) | 187 | 112 |

| $ 87,592 | $ 80,406 |

Liabilities and Shareholders' Equity

Liabilities

Current | | |

Accounts payable and accrued liabilities | $ 879 | $ 797 |

| | |

Shareholders' equity | | |

Capital stock (Note 5) | 85,526 | 84,278 |

Contributed surplus (Note 8) | 6,803 | 4,418 |

Deficit accumulated in the exploration stage | (17,379) | (14,530) |

Cumulative translation adjustment | 11,763 | 5,443 |

| | |

| 86,713 | 79,609 |

| | |

| $ 87,592 | $ 80,406 |

Approved by the Board of Directors:

The accompanying notes and summary of significant accounting policies are an integral part of these consolidated financial statements.

3

Minefinders Corporation Ltd.

(An Exploration Stage Company)

Consolidated Statements of Loss and Deficit

(Thousands of United States dollars, except per share data)

For the years ended December 31 | 2004 | 2003 | 2002 |

Administrative costs | | | |

Accounting and auditing | $ 347 | $ 143 | $80 |

Amortization | 11 | 12 | 3 |

Consulting fees | 304 | 180 | 155 |

Corporate relations | 485 | 532 | 260 |

Legal | 279 | 300 | 198 |

Office services and expenses | 365 | 303 | 156 |

Stock option compensation (Note 8) | 1,376 | 1,148 | 1,107 |

Shareholder reports and filing fees | 195 | 295 | 59 |

Travel | 39 | 61 | 74 |

| 3,401 | 2,974 | 2,092 |

| | | |

Other operating items | | | |

Write-off of mineral properties and deferred | | | |

exploration costs (Note 3) | 339 | 1,055 | 488 |

| | | |

Loss from operations | (3,740) | (4,029) | (2,580) |

Investment and other items | | | |

Foreign exchange loss | (111) | (303) | (34) |

(Loss) gain on sale of assets | (1) | (1) | 2 |

Interest income | 1,003 | 398 | 116 |

| | | |

| | | |

Net loss for the year | (2,849) | (3,935) | (2,496) |

Deficit accumulated in the exploration stage, | | | |

beginning of year | (14,530) | (10,595) | (8,099) |

| | | |

Deficit accumulated in the exploration stage, | | | |

end of year | $ (17,379) | $ (14,530) | $ (10,595) |

| | | |

Loss per share – basic and diluted | $ (0.08) | $ (0.12) | $ (0.10) |

| | | |

Weighted average shares outstanding | 36,398,504 | 31,491,892 | 25,280,665 |

The accompanying notes and summary of significant accounting policies are an integral part of these consolidated financial statements.

4

Minefinders Corporation Ltd.

(An Exploration Stage Company)

Consolidated Statements of Cash Flows

(Thousands of United States dollars)

For the years ended December 31 | 2004 | 2003 | 2002 |

| | | |

Cash flows used in operating activities | | | |

Net loss for the year | $ (2,849) | $ (3,935) | $ (2,496) |

Items not involving cash | | | |

Amortization | 11 | 12 | 3 |

Loss (gain) on sale of asset | 1 | 1 | (2) |

Write-off of mineral properties and deferred exploration costs | 339 | 1,055 | 488 |

Stock option compensation | 1,376 | 1,148 | 1,107 |

| | | |

Net change in non-cash working capital balances | | | |

Receivables | (129) | (4) | (10) |

Prepaid expenses | (64) | 11 | (56) |

Accounts payable and accrued liabilities | 82 | 226 | 499 |

| (1,233) | (1,486) | (467) |

Cash flows used in investing activities | | | |

Mineral properties and exploration costs | (6,221) | (5,713) | (2,968) |

Purchase of equipment | (148) | (91) | (68) |

Proceeds from disposal of equipment | - | - | 4 |

| (6,369) | (5,804) | (3,032) |

Cash flows provided by financing activitiesNet proceeds on issuance of common shares | 1,248 | 44,439 | 9,347 |

Effect of exchange rates on cash and cash equivalents | 3,029 | 2,558 | (177) |

Increase (decrease) in cash and cash equivalents | (3,325) | 39,707 | 5,671 |

Cash and cash equivalents, beginning of year | 45,677 | 5,970 | 299 |

Cash and cash equivalents, end of year | $ 42,352 | $ 45,677 | $ 5,970 |

Supplemental Information | | | |

| | | |

Non-cash investing and financing activities: | | | |

Amortization of equipment included in deferred exploration costs | $ 64 | $ 62 | $ 26 |

Stock option compensation (Note 8) | $ 2,385 | $ 2,238 | $ 2,180 |

| | | |

The accompanying notes and summary of significant accounting policies are an integral part of these consolidated financial statements.

5

Minefinders Corporation Ltd.

(An Exploration Stage Company)

Consolidated Statements of Mineral Properties

and Deferred Exploration Costs

(Thousands of United States dollars)

For the years ended December 31 | 2004 | 2003 | 2002 |

| | | |

Mineral properties | $ 126 | $ 130 | $ 130 |

| | | |

Deferred exploration costs | | | |

Assaying | 344 | 633 | 236 |

Amortization | 64 | 62 | 26 |

Communication and delivery | 141 | 100 | 41 |

Drilling and trenching | 2,470 | 2,652 | 1,443 |

Engineering/feasibility study | 1,153 | 199 | 13 |

Environmental | 55 | 22 | 1 |

Geophysical surveying and mapping | 8 | 60 | 42 |

Heavy equipment | 31 | 6 | 6 |

Legal | 86 | 30 | 18 |

Licenses and recording fees | 358 | 385 | 390 |

Metallurgical | 269 | 144 | 2 |

Road building | 215 | 109 | 29 |

Site assembly | 125 | - | - |

Stock option compensation (Note 8) | 1,009 | 1,090 | 1,073 |

Supplies | 126 | 143 | 85 |

Taxes | 321 | 271 | 146 |

Technical and professional services | 1,111 | 964 | 775 |

Travel | 195 | 136 | 89 |

| 8,081 | 7,006 | 4,515 |

| | | |

| 8,207 | 7,136 | 4,645 |

Less costs recovered | - | - | (332) |

| | | |

Mineral properties and deferred exploration costs during the year | 8,207 | 7,136 | 4,313 |

| | | |

Balance, beginning of year | 34,519 | 23,079 | 18,996 |

| | | |

Less: Write-off of mineral properties and deferred exploration costs (Note 3) | (339) | (1,055) | (488) |

Value-added taxes recovered | (913) | - | - |

| | | |

Foreign exchange adjustment | 3,288 | 5,359 | 258 |

Balance,end of year (Note 3) | $ 44,765 | $ 34,519 | $ 23,079 |

The accompanying notes and summary of significant accounting policies are an integral part of these consolidated financial statements.

6

Minefinders Corporation Ltd.

(An Exploration Stage Company)

Summary of Significant Accounting Policies

(Thousands of United States dollars, except number of shares and per share data)

December 31, 2004 and 2003

Basis of Consolidation | These consolidated financial statements are prepared in accordance with Canadian generally accepted accounting principles and include the accounts of the Company and its wholly-owned subsidiaries, Minera Minefinders S.A. de C.V., Compania Minera Dolores S.A. de C.V., and Servicios Mineros Sierra S.A. de C.V. (all in Mexico), and Minefinders (U.S.A.) Inc. (in the United States). All inter-company transactions and balances are eliminated on consolidation. |