Exhibit 10.1

October 3, 2011

Gail S. Page

Vermilion, Inc.

12117 Bee Caves Road

Building Three, Suite 100

Austin, Texas 78738

Dear Gail,

Reference is made to 85,000 shares of Restricted Stock Unit (“RSU”) granted to you by the Compensation Committee of the Board of Directors (the “Board”) of Vermillion, Inc. on March 18, 2011. The 85,000 RSUs shall vest and be distributed to you quarterly in 12 equal installments over three years, with the vesting commencement date starting from March 18, 2011. Until now, 7,083 RSUs were distributed to you on June 18, 2011 and 7,083 RSUs were distributed to you on September 19, 2011.

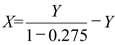

To incentivize you to continue holding shares of the Company so that you do not have to sell your shares to cover tax liabilities incurred upon the distribution of the vested RSUs, the Company hereby agrees to make tax gross-up payment to you for each of the distributions already made and to be made to you in connection with the 85,000 RSUs. The tax gross-up payment for each distribution of the vested RSUs shall be calculated using the following formula:

Where

| | | | |

| | X = | | The tax gross-up payment to be made to you by the Company each time RSUs are distributed to you. |

| | |

| | Y = | | The fair market value of the RSUs distributed to you, calculated by multiplying (i) the closing price of the Company’s share of common stock quoted on NASDAQ on the date of the distribution with (ii) the total number of RSUs distributed to you on the date of the distribution. |

Applying this formula, the Company shall make a tax gross-up payment in the amount of $10,827.22 for the distribution of 7,082 RSUs on June 18, 2011 and a tax gross-up payment in the amount of $7,925.63 for the distribution of 7,083 RSUs on September 19, 2011. Both amounts shall be payable to you no later than October 15, 2011. All future payments of the tax gross-ups shall be calculated based on the formula mentioned above and shall be made by the Company to you within 15 calendar days after the distribution of the RSUs.

Please confirm your understanding of and agreement with the terms described in this letter agreement by signing a copy of this letter agreement.

|

Sincerely yours, |

|

| VERMILLION, INC. |

|

/s/ Sandra A. Gardiner |

Sandra A. Gardiner |

Vice President and Chief Financial Officer |

|

| ACCEPTED AND AGREED TO this |

| 3rd day of October, 2011. |

|

/s/ Gail S. Page |

| Gail S. Page |

| Chief Executive Officer |