Page

|

| | |

| | Earnings Release |

| | |

| | Addendum A: Los Angeles Market Profile |

| | | |

| | Consolidated Statements of Operations |

| | |

| | Consolidated Balance Sheets |

| | | |

| | Schedule 1 – Funds From Operations and Adjusted Funds From Operations Reconciliation |

| | |

| | Schedule 2 – Funds From Operations and Adjusted Funds From Operations Information |

| | |

| | Schedule 3 – Property Net Operating Income |

| | | |

| | Schedule 4 – Apartment Home Summary |

| | |

| | Schedule 5 – Capitalization and Financial Metrics |

| | |

| | Schedule 6 – Same Store Operating Results |

| | | |

| | Schedule 7 – Real Estate Portfolio Data by Market |

| | |

| | Schedule 8 – Disposition and Acquisition Activity |

| | |

| | Schedule 9 – Real Estate Capital Additions Information |

| | |

| | Schedule 10 – Redevelopment/Development Portfolio |

| | |

| | Glossary and Reconciliations of Non-GAAP Financial and Operating Measures |

Aimco Reports Second Quarter Results

Denver, Colorado, August 2, 2018 - Apartment Investment and Management Company (“Aimco”) (NYSE: AIV) announced today second quarter results for 2018.

Chairman and Chief Executive Officer Terry Considine comments: “In the second quarter, Aimco produced solid results: Same Store Net Operating Income was up 3.2% year-over-year; Redevelopment contributed more earnings and further value creation; and 2018 paired trades were completed, increasing expected Free Cash Flow returns by 400 basis points.”

“We completed our exit from the affordable housing line of business, part of a strategic plan set in 2011. Since then, Aimco has made steady progress on other elements of the plan: selling $4.2 billion in lower-rated communities; improving portfolio quality to $2,090 in monthly revenue per apartment home; and reducing leverage by $1.8 billion. As a result, Net Asset Value per share more than doubled.”

Chief Financial Officer Paul Beldin adds: “Second quarter 2018 AFFO of $0.54 per share was $0.02 per share ahead of the high end of our guidance range, and Pro forma FFO of $0.61 per share met the high end of guidance. AFFO exceeded the midpoint of our expectations due to $0.01 per share of stronger property operating results with the remainder due to timing-related items.”

Financial Results: Second Quarter Pro forma FFO Flat; AFFO Up 6%

|

| | | | | | | | | | | | | | | | | | | | | |

| | SECOND QUARTER | | YEAR-TO-DATE |

| (all items per common share - diluted) | 2018 | | 2017 | | Variance | | 2018 | | 2017 | | Variance |

| Net income | $ | 0.02 |

| | $ | 0.10 |

| | (80 | %) | | $ | 0.54 |

| | $ | 0.17 |

| | 218 | % |

| Funds From Operations (FFO) | $ | 0.59 |

| | $ | 0.61 |

| | (3 | %) | | $ | 1.19 |

| | $ | 1.19 |

| | — | % |

| Add back legal and severance costs | $ | 0.02 |

| | $ | — |

| | — | % | | $ | 0.02 |

| | $ | — |

| | — | % |

| Pro forma Funds From Operations (Pro forma FFO) | $ | 0.61 |

| | $ | 0.61 |

| | — | % | | $ | 1.21 |

| | $ | 1.19 |

| | 2 | % |

| Deduct Capital Replacements | $ | (0.07 | ) | | $ | (0.10 | ) | | (30 | %) | | $ | (0.14 | ) | | $ | (0.17 | ) | | (18 | %) |

| Adjusted Funds From Operations (AFFO) | $ | 0.54 |

| | $ | 0.51 |

| | 6 | % | | $ | 1.07 |

| | $ | 1.02 |

| | 5 | % |

Net Income (per diluted common share) - Year-over-year, second quarter net income decreased due to higher depreciation from redevelopments placed into service and from apartment communities acquired during 2018 and to lower gains on the sale of real estate.

Pro forma FFO (per diluted common share) - Aimco’s second quarter Pro forma FFO was flat year-over-year. The following items contributed to Pro forma FFO:

| |

| • | $0.02 from Same Store Property Net Operating Income growth of 3.2%, driven by a 3.2% increase in revenue, offset by a 3.3% increase in expenses; and |

| |

| • | $0.03 from leasing activity related to renovated homes at Redevelopment communities, 2018 acquisitions, and the second quarter 2017 reacquisition of a 47% interest in the Palazzo communities, offset in part by lower Property Net Operating Income from apartment communities sold in 2017 and 2018. |

As compared to 2017, this increase of $0.05 to Pro forma FFO per share was offset by increased interest expense on corporate borrowings primarily related to acquisitions, increased personnel costs due to the timing of incentive compensation costs, and lower tax benefits.

Adjusted Funds From Operations (per diluted common share) - Year-over-year, second quarter AFFO increased 6% as a result of lower Capital Replacement spending. Approximately one-third of the decrease in Capital Replacement spending was due to Aimco’s paired trade activity including the sale of approximately 2,300 apartment homes in 2017 and an additional 513 apartment homes through June 30, 2018, and the remaining decrease is due to timing of 2018 capital spending. As Aimco concentrates its investment capital in higher quality, higher price point communities, Free Cash Flow margin is increasing as Capital Replacements decline as a percentage of Net Operating Income.

Operating Results: Second Quarter Same Store NOI Up 3.2%

|

| | | | | | | | | | | | | | | | |

| | SECOND QUARTER | YEAR-TO-DATE |

| | Year-over-Year | Sequential | Year-over-Year |

| | 2018 | 2017 | Variance | 1st Qtr. | Variance | 2018 | 2017 | Variance |

| Average Rent per Apartment Home | $1,819 | $1,772 | 2.7 | % | $1,808 | 0.6 | % | $1,813 | $1,767 | 2.6 | % |

| Other Income per Apartment Home* | 121 | 115 | 5.2 | % | 105 | 15.2 | % | 114 | 112 | 1.8 | % |

| Average Revenue per Apartment Home* | $1,940 | $1,887 | 2.8 | % | $1,913 | 1.4 | % | $1,927 | $1,879 | 2.6 | % |

| Average Daily Occupancy | 96.3 | % | 95.9 | % | 0.4 | % | 96.3 | % | — | % | 96.3 | % | 95.9 | % | 0.4 | % |

| | | | | | | | | |

| $ in Millions | | | | | | | | |

| Revenue, before utility reimbursements | $147.0 | $142.4 | 3.2 | % | $144.9 | 1.4 | % | $291.8 | $283.6 | 2.9 | % |

| Expenses, net of utility reimbursements | 38.5 | 37.3 | 3.3 | % | 38.9 | (1.1 | %) | 77.4 | 75.4 | 2.7 | % |

| NOI | $108.5 | $105.1 | 3.2 | % | $106.0 | 2.4 | % | $214.4 | $208.2 | 3.0 | % |

| |

| * | In 2018, Aimco changed its presentation of revenues and expenses to reflect utilities costs net of amounts reimbursed by residents, which were previously included in revenue. 2017 amounts have been revised to conform to this presentation. The change in presentation had no impact on revenue growth rates in second quarter 2018 and a 10 bps impact year-to-date. |

Same Store Rental Rates - Aimco measures changes in rental rates by comparing, on a lease-by-lease basis, the rate on a newly executed lease to the rate on the expiring lease for that same apartment. Newly executed leases are classified either as a new lease, where a vacant apartment is leased to a new customer, or as a renewal. The table below details changes in new and renewal lease rates.

|

| | | | | | | | | | | | |

| 2018 | 1st Qtr. | Apr | May | Jun | 2nd Qtr. | Year-to-Date |

| Renewal rent increases | 4.9 | % | 4.7 | % | 4.8 | % | 4.8 | % | 4.8 | % | 4.8 | % |

| New lease rent increases | 0.4 | % | 0.6 | % | 1.7 | % | 2.8 | % | 1.9 | % | 1.3 | % |

| Weighted average rent increases | 2.7 | % | 2.6 | % | 3.4 | % | 3.8 | % | 3.4 | % | 3.1 | % |

| Average Daily Occupancy | 96.3 | % | 96.4 | % | 96.4 | % | 96.1 | % | 96.3 | % | 96.3 | % |

Redevelopment

Redevelopment is Aimco’s second line of business where Aimco creates value by repositioning communities within the Aimco portfolio. Aimco also undertakes ground-up development when warranted by risk-adjusted investment returns, either directly in connection with the redevelopment of an existing apartment community or, on a more limited basis, at a new location. Aimco invests to earn risk-adjusted returns in excess of those expected from the apartment communities sold in paired trades to fund the redevelopment and development. Of these two activities, Aimco favors redevelopment because it permits adjustment of the scope and timing of spending to align with changing market conditions and customer preferences.

During the second quarter, Aimco invested $42 million in redevelopment and development. In Center City, Philadelphia, Aimco continued construction on the fourth and final tower of Park Towne Place; lease-up is

underway. At June 30, 2018, 90% of the redeveloped apartment homes in the community were leased and 28 of the 136 homes still under renovation were pre-leased.

During the second quarter, Aimco invested $10 million in the development of its Parc Mosaic community in Boulder, Colorado. Aimco expects completion of construction in late 2019 and initial occupancy in the summer of 2019.

During the second quarter, Aimco leased 181 apartment homes at its Redevelopment communities. At June 30, 2018, Aimco’s exposure to lease-up at active redevelopment and development projects was approximately 419 apartment homes, of which 108 were in the fourth tower of Park Towne Place, 215 were being constructed at Parc Mosaic, and 96 were located in three other active redevelopments.

During the third quarter, Aimco expects to exercise its option to acquire approximately two acres of land adjacent to its 21 Fitzsimons apartment community, located on the University of Colorado Anschutz Medical Campus, for the development of an apartment community. Over the next two years, Aimco expects to invest approximately $87 million to construct 253 apartment homes and 4,600 square feet of retail space. Aimco anticipates a stabilized net operating income yield in the low 6% range, driven by an 80% net operating income margin due to operational efficiencies from owning the adjacent property, and a Free Cash Flow internal rate of return greater than 10% resulting in value creation of at least 35%. Upon completion of the project, Aimco will own and operate 853 apartment homes on the campus. Employment on the campus has grown by 9% annually from 2015 to 2017 and exceeds 25,000 jobs today. This number is expected to grow to 46,000 jobs over the next 12 years. Aimco has multi-year options to acquire the balance of the land on the campus that is zoned for multifamily, enough for an additional 600 apartment homes.

Portfolio Management: Revenue Per Apartment Home Up 7% to $2,090

Aimco’s portfolio of apartment communities is diversified across “A,” “B” and “C+” price points, averaging “B/B+” in quality and is also diversified across several of the largest markets in the United States.

As part of its portfolio strategy, Aimco seeks to sell up to 10% of its portfolio annually and to reinvest the proceeds from such sales in accretive uses such as capital enhancements, redevelopments, occasional developments, and selective acquisitions with projected Free Cash Flow internal rates of return higher than expected from the communities being sold. Through this disciplined approach to capital recycling, Aimco has significantly increased the quality and expected growth rate of its portfolio.

|

| | | | | | | | |

| | SECOND QUARTER |

| | 2018 | 2017 | Variance |

| Apartment Communities | 138 |

| 141 |

| (3 | ) |

| Apartment Homes | 37,897 |

| 39,187 |

| (1,290 | ) |

| Average Revenue per Apartment Home* | $ | 2,090 |

| $ | 1,950 |

| 7 | % |

| Portfolio Average Rents as a Percentage of Local Market Average Rents | 112 | % | 113 | % | (1 | %) |

| Percentage A (2Q 2018 Average Revenue per Apartment Home $2,770) | 50 | % | 53 | % | (3 | %) |

| Percentage B (2Q 2018 Average Revenue per Apartment Home $1,839) | 35 | % | 33 | % | 2 | % |

| Percentage C+ (2Q 2018 Average Revenue per Apartment Home $1,669) | 15 | % | 14 | % | 1 | % |

| NOI Margin | 72 | % | 71 | % | 1 | % |

| Free Cash Flow Margin | 66 | % | 65 | % | 1 | % |

| |

| * | In 2018, Aimco changed its presentation of revenues and expenses to reflect utilities costs net of amounts reimbursed by residents, which were previously included in revenue. 2017 amounts have been revised to conform to this presentation. |

Second Quarter Real Estate Portfolio - For its entire portfolio, Aimco’s average monthly revenue per apartment home was $2,090 for second quarter 2018, a 7% increase compared to second quarter 2017. This increase is due to year-over-year growth in Same Store revenue as well as Aimco’s acquisition activities, lease-up of redevelopment and acquisition properties, and sale of communities with average monthly revenues per apartment home lower than those of the retained portfolio.

Acquisitions - Aimco evaluates potential acquisitions with an eye for unique and opportunistic investments and funds acquisitions pursuant to its strict paired trade discipline. As previously announced, in April 2018 Aimco agreed to acquire six communities in the Philadelphia area. On May 1st, Aimco purchased four communities including 665 apartment homes and 153,000 square feet of office and retail space for $308 million. The purchase of the fifth apartment community is conditioned upon the City of Camden’s approval of the transfer of the existing PILOT tax agreement, which has not yet been received. The purchase of the sixth apartment community is expected upon completion of construction in the first half of 2019.

In the first quarter, Aimco purchased for $160 million Bent Tree Apartments, a 748-apartment home community in Fairfax County, Virginia. Since acquisition, results have exceeded underwriting, with new lease rates increasing by 8%, 5% before capital investments, and occupancy increasing by approximately 300 basis points to 97%.

Dispositions - On July 25, 2018, Aimco sold for $590 million its Asset Management business and its four affordable apartment communities located in Hunters Point. After payment of transaction costs and repayment of property-level debt encumbering the Hunters Point apartment communities, net proceeds to Aimco were approximately $512 million.

On July 27, 2018, Aimco sold for $170 million Chestnut Hill Village, an 821-apartment home community located in north Philadelphia.

Aimco used proceeds from the two sales to fund 2018 acquisitions, completing the paired trades. The sale of Chestnut Hill Village rebalanced Aimco’s capital allocation to Philadelphia from a lower-rated apartment community in north Philadelphia to communities in the more desirable Center City and University City submarkets.

Aimco used proceeds from these sales to repay in full its revolving credit facility and its term loan. Aimco plans to use the remaining proceeds to reduce property-level borrowings and to fund an expected increase in 2018 redevelopment activity.

Balance Sheet

Aimco Leverage

Aimco’s leverage strategy seeks to increase financial returns while using leverage with appropriate caution. Aimco limits risk through balance sheet structure, employing low leverage, primarily non-recourse and long-dated property debt; builds financial flexibility by maintaining ample unused and available credit as well as holding properties with substantial value unencumbered by property debt; and uses partners’ capital when it enhances financial returns or reduces investment risk.

Aimco total leverage includes Aimco share of long-term, non-recourse, property debt encumbering apartment communities in its Real Estate portfolio, outstanding borrowings under its revolving credit facility and term loan, and outstanding preferred equity. Aimco leverage excludes the non-recourse property debt obligations of consolidated partnerships served by its Asset Management business.

|

| | | | | | | | | | | |

| | | | Pro forma* |

| $ in Millions | June 30, 2018 Actual | June 30, 2018 Pro forma | % of Total | Weighted Avg. Maturity (Yrs.) |

| Aimco share of long-term, non-recourse property debt | $ | 3,801 |

| | $ | 3,801 |

| 94 | % | 7.0 |

|

| Term loan | 250 |

| | — |

| — | % | |

| Outstanding borrowings on revolving credit facility | 220 |

| | — |

| — | % | |

| Non-recourse property debt related to assets held for sale | 68 |

| | — |

| — | % | |

| Preferred Equity** | 226 |

| | 226 |

| 6 | % | 40.0 |

|

| Total Leverage | $ | 4,565 |

| | $ | 4,027 |

| 100 | % | 8.9 |

|

| Cash, restricted cash and investments in securitization trust assets | (171 | ) | | (378 | ) | | |

| Net Leverage, as adjusted | $ | 4,394 |

| | $ | 3,649 |

| | |

| |

| * | Aimco used the proceeds, net of transaction costs, from the sales of its Asset Management business, its four affordable apartment communities located in Hunters Point, and Chestnut Hill Village, to repay outstanding borrowings on its revolving credit facility and its term loan. |

| |

| ** | Aimco’s Preferred Equity is perpetual in nature; however, for illustrative purposes, Aimco has computed the weighted average maturity of its total leverage assuming a 40-year maturity for its Preferred Equity. |

Leverage Ratios

Aimco target leverage ratios are Proportionate Debt and Preferred Equity to Adjusted EBITDA below 7.0x and Adjusted EBITDA to Interest Expense and Preferred Dividends greater than 2.5x. Aimco calculates Adjusted EBITDA, Pro forma EBITDA and Adjusted Interest Expense used in its leverage ratios based on current quarter amounts, annualized.

|

| |

| Proportionate Debt to Pro forma EBITDA* | 6.5x |

| Proportionate Debt and Preferred Equity to Pro forma EBITDA* | 6.9x |

| Adjusted EBITDA to Adjusted Interest Expense | 3.4x |

| Adjusted EBITDA to Adjusted Interest Expense and Preferred Dividends | 3.1x |

| |

| * | The Proportionate Debt to Pro forma EBITDA and Proportionate Debt and Preferred Equity to Pro forma EBITDA ratios have been calculated on a pro forma basis to reflect the impact of the July 2018 dispositions of Aimco’s Asset Management business, its four affordable apartment communities located in Hunters Point, and Chestnut Hill Village. Pro forma EBITDA has also been adjusted to reflect the acquisition of the four Philadelphia apartment communities as if the transaction had closed on April 1, 2018. These adjustments reduced the ratios of Proportionate Debt to Adjusted EBITDA and Proportionate Debt and Preferred Equity to Adjusted EBITDA by 0.7x. |

Aimco expects its Proportionate Debt to Adjusted EBITDA and Proportionate Debt and Preferred Equity to Adjusted EBITDA ratios to decrease to 6.3x and 6.7x, respectively, before year-end.

Liquidity

At June 30, 2018, Aimco held cash and restricted cash of $88 million and had the capacity to borrow $368 million under its revolving credit facility, after consideration of outstanding borrowings of $220 million and $12 million of letters of credit backed by the facility. Aimco uses its credit facility primarily for working capital and other short-term purposes and to secure letters of credit. After the completion of the July dispositions, Aimco used the proceeds to repay outstanding borrowings on the revolving credit facility and term loan. On a pro forma basis, Aimco would have had the capacity to borrow $593 million under its revolving credit facility and additional cash of approximately $207 million.

Aimco also manages its financial flexibility by maintaining an investment grade rating and holding apartment communities that are unencumbered by property debt. At June 30, 2018, Aimco held unencumbered apartment communities with an estimated fair market value of approximately $2 billion.

Dividend - As previously announced, the Aimco Board of Directors declared a quarterly cash dividend of $0.38 per share of Class A Common Stock for the quarter ended June 30, 2018. On an annualized basis, this represents an increase of 6% compared to the dividends paid during 2017. This dividend is payable on August 31, 2018, to stockholders of record on August 17, 2018.

2018 Outlook

|

| | | | |

($ Amounts represent Aimco Share) | YEAR-TO-DATE JUNE 30, 2018 | FULL YEAR 2018 | PREVIOUS FULL YEAR 2018 |

| | | | | |

| Net Income per share | $0.54 | $4.25 to $4.33 | $4.05 to $4.55 |

| Pro forma FFO per share | $1.21 | $2.40 to $2.48 | $2.39 to $2.49 |

| AFFO per share | $1.07 | $2.09 to $2.17 | $2.08 to $2.18 |

| | | | |

| Select Components of FFO | | | |

| Same Store Operating Measures | | | |

| Revenue change compared to prior year | 2.9% | 2.50% to 3.00% | 2.10% to 3.10% |

| Expense change compared to prior year | 2.7% | 2.80% to 3.40% | 2.60% to 3.60% |

| NOI change compared to prior year | 3.0% | 2.20% to 3.00% | 1.70% to 3.10% |

| | | | |

| Other Earnings | | | |

| Asset Management Contribution | $16M | $22M | $22M to $24M |

| Tax Benefits | $8M | $16M to $18M | $16M to $18M |

| | | | |

| Offsite Costs | | | |

| Property management expenses | $10M | $20M | $20M |

| General and administrative expenses | $25M | $44M | $44M |

| Total Offsite Costs | $35M | $64M | $64M |

| | | | |

| Capital Investments | | | |

| Redevelopment/Development | $88M | $160M to $200M | $120M to $200M |

| Capital Enhancements | $46M | $80M to $100M | $80M to $100M |

| | | | |

| Transactions | | | |

| Property dispositions | $65M | $825M | $790M to $870M |

| Property acquisitions [1] | $468M | $468M to $551M | $551M |

| | | | |

| Portfolio Quality | | | |

| Average revenue per apartment home | $2,090 | ~$2,100 | ~$2,100 |

| | | | |

| Balance Sheet | | | |

| Proportionate Debt to Adjusted EBITDA [2] | 6.5x | ~6.3x | ~6.3x |

| Proportionate Debt and Preferred Equity to Adjusted EBITDA [2] | 6.9x | ~6.7x | ~6.7x |

| | |

| [1] | Aimco does not predict or guide to acquisitions.The variability in 2018 acquisitions relates to the uncertain purchase of the previously announced Camden, New Jersey community, which is conditioned upon the City of Camden’s approval of the transfer of the existing PILOT tax agreement. |

| [2] | Aimco leverage ratios have been calculated on a pro forma basis to reflect the July 2018 dispositions of Aimco’s Asset Management business, its four affordable apartment communities located in Hunters Point, and Chestnut Hill Village. EBITDA has also been adjusted to reflect the acquisition of the four Philadelphia apartment communities as if the transaction had closed on April 1, 2018. These adjustments reduced the ratios of Proportionate Debt to Adjusted EBITDA and Proportionate Debt and Preferred Equity to Adjusted EBITDA by 0.7x. |

|

| |

| ($ Amounts represent Aimco Share) | THIRD QUARTER 2018 |

| | |

| Net income per share | $3.62 to $3.66 |

| Pro forma FFO per share | $0.58 to $0.62 |

| AFFO per share | $0.49 to $0.53 |

Earnings Conference Call Information

|

| |

| Live Conference Call: | Conference Call Replay: |

| Friday, August 3, 2018 at 1:00 p.m. ET | Replay available until November 3, 2018 |

| Domestic Dial-In Number: 1-888-317-6003 | Domestic Dial-In Number: 1-877-344-7529 |

| International Dial-In Number: 1-412-317-6061 | International Dial-In Number: 1-412-317-0088 |

| Passcode: 2156813 | Passcode: 10121597 |

Live webcast and replay: investors.aimco.com |

Supplemental Information

The full text of this Earnings Release and the Supplemental Information referenced in this release are available on Aimco’s website at investors.aimco.com.

Glossary & Reconciliations of Non-GAAP Financial and Operating Measures

Financial and operating measures found in this Earnings Release and the Supplemental Information include certain financial measures used by Aimco management that are measures not defined under accounting principles generally accepted in the United States (“GAAP”). Certain Aimco terms and Non-GAAP measures are defined in the Glossary in the Supplemental Information and Non-GAAP measures reconciled to the most comparable GAAP measures.

About Aimco

Aimco is a real estate investment trust focused on the ownership and management of quality apartment communities located in select markets in the United States. Aimco is one of the country’s largest owners and operators of apartments, with ownership interests in 133 communities in 17 states and the District of Columbia. Aimco common shares are traded on the New York Stock Exchange under the ticker symbol AIV, and are included in the S&P 500. For more information about Aimco, please visit our website at www.aimco.com.

Contact

Suzanne Sorkin, Vice President, Investor Relations/FP&A

Investor Relations 303-793-4661, investor@aimco.com

Forward-looking Statements

This Earnings Release and Supplemental Information contain forward-looking statements within the meaning of the federal securities laws, including, without limitation, statements regarding projected results and specifically forecasts of third quarter and full year 2018 results, including but not limited to: FFO, Pro forma FFO and selected components thereof; AFFO; Aimco redevelopment/development investments and projected yield on such investments, timelines and Net Operating Income contribution; expectations regarding sales of Aimco apartment communities and the use of proceeds thereof; and Aimco liquidity and leverage metrics.

These forward-looking statements are based on management’s judgment as of this date, which is subject to risks and uncertainties. Risks and uncertainties include, but are not limited to: Aimco’s ability to maintain current or meet projected occupancy, rental rate and property operating results; the effect of acquisitions, dispositions, redevelopments and developments; Aimco’s ability to meet budgeted costs and timelines, and achieve budgeted rental rates related to Aimco redevelopments and developments; and Aimco’s ability to comply with debt covenants, including financial coverage ratios.

Actual results may differ materially from those described in these forward-looking statements and, in addition, will be affected by a variety of risks and factors, some of which are beyond Aimco’s control, including, without limitation:

| |

| • | Real estate and operating risks, including fluctuations in real estate values and the general economic climate in the markets in which Aimco operates and competition for residents in such markets; national and local economic conditions, including the pace of job growth and the level of unemployment; the amount, location and quality of competitive new housing supply; the timing of acquisitions, dispositions, redevelopments and developments; and changes in operating costs, including energy costs; |

| |

| • | Financing risks, including the availability and cost of capital markets’ financing; the risk that cash flows from operations may be insufficient to meet required payments of principal and interest; and the risk that earnings may not be sufficient to maintain compliance with debt covenants; |

| |

| • | Insurance risks, including the cost of insurance, and natural disasters and severe weather such as hurricanes; and |

| |

| • | Legal and regulatory risks, including costs associated with prosecuting or defending claims and any adverse outcomes; the terms of governmental regulations that affect Aimco and interpretations of those regulations; and possible environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of apartment communities presently or previously owned by Aimco. |

In addition, Aimco’s current and continuing qualification as a real estate investment trust involves the application of highly technical and complex provisions of the Internal Revenue Code and depends on Aimco’s ability to meet the various requirements imposed by the Internal Revenue Code, through actual operating results, distribution levels and diversity of stock ownership.

Readers should carefully review Aimco’s financial statements and the notes thereto, as well as the section entitled “Risk Factors” in Item 1A of Aimco’s Annual Report on Form 10-K for the year ended December 31, 2017, and the other documents Aimco files from time to time with the Securities and Exchange Commission.

These forward-looking statements reflect management’s judgment as of this date, and Aimco assumes no obligation to revise or update them to reflect future events or circumstances. This press release does not constitute an offer of securities for sale.

Addendum A: Los Angeles Market Profile

From time to time, Aimco comments on its most important markets for investment. Los Angeles is one such market and this profile is intended to provide additional market color for the investment community.

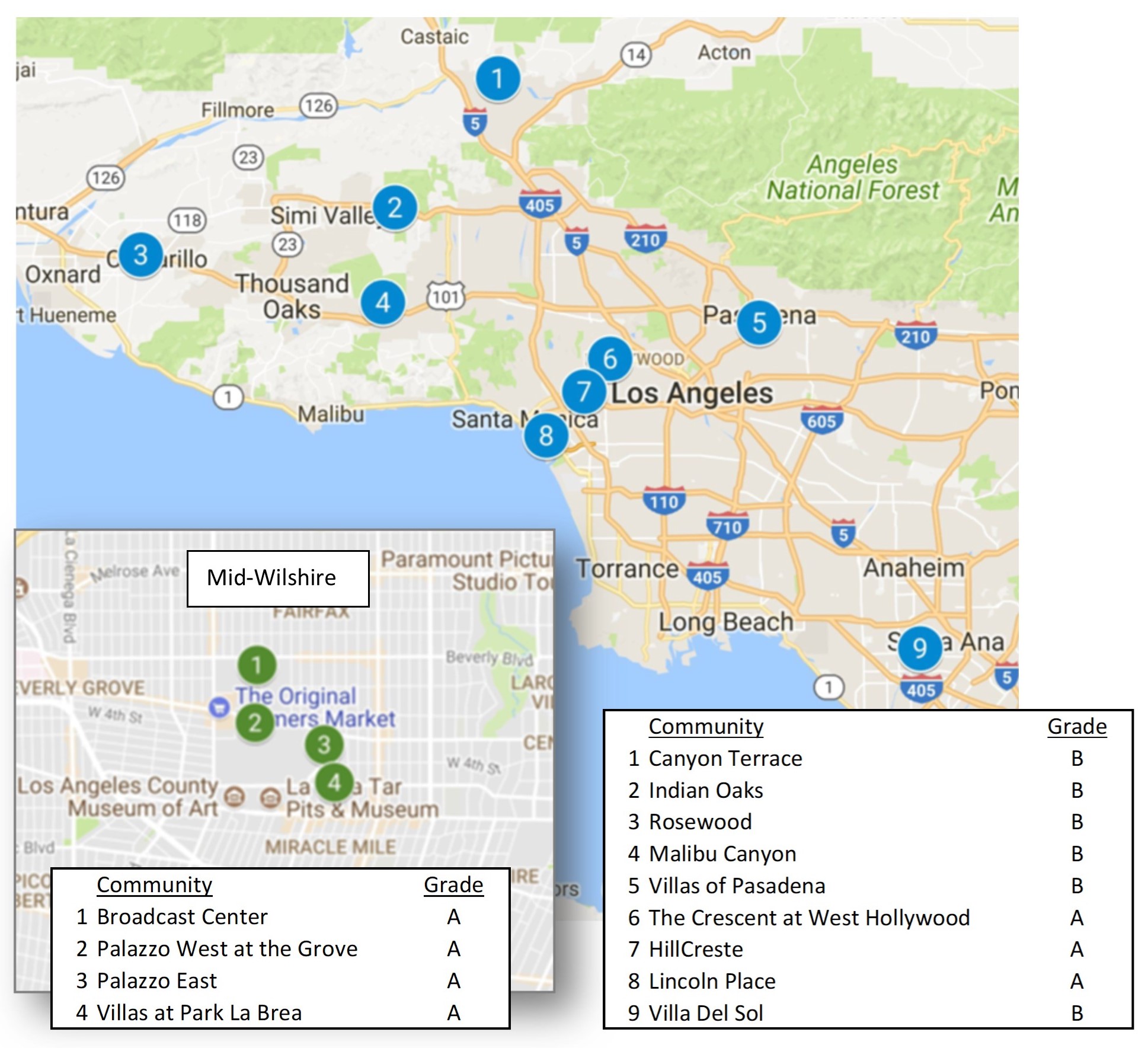

Los Angeles, the second most populous metro in the U.S. and one of the nation’s most powerful economic engines, is a significant market for Aimco, representing 21% of Gross Asset Value and 18% of total NOI. While Aimco owns thirteen properties throughout LA County, the majority of the company’s investment is concentrated in four assets in the Mid-Wilshire submarket (as defined by MPF Research), an area known for the LA County Museum of Art, the Miracle Mile shopping district, LA’s historic Original Farmer’s Market which is beloved by locals and popular with tourists, and The Grove, the upscale outdoor shopping mall.

LA County is the 20th largest economy in the world,1 with GDP contribution roughly equal to that of San Francisco, San Jose, and Riverside/San Bernardino combined.2 LA’s economy is vibrant and extremely diversified which has led to steadier GDP growth over time, making LA less volatile than a single industry, boom-or-bust economy like its West Coast brethren San Francisco and Seattle. More recently, LA County added 502,000 jobs between 2012 and 2017 and the economy is projected to grow 2.3% annually in terms of real GDP over the next two years, 10 basis points ahead of the U.S.3

Over the last several years, LA has increasingly become an innovation hub, attracting technology and venture capital firms. This has given rise to “Silicon Beach” in LA, which is now home to over 500 tech startup companies. According to the PwC/CB Insights MoneyTree Report, over the last four years (3Q14-2Q18), venture funding to companies in LA/Orange County has averaged $1.3B per quarter, up from an average of $600M per quarter in the four years prior (2Q14-3Q10), a 120% increase compared to Silicon Valley which saw a 40% increase over the same period to $2.7B on average per quarter over the last four years.4

LA’s submarkets are perhaps as diverse as its economy, with specific and segmented submarkets such as Downtown LA (DTLA), Mid-Wilshire, and Marina del Rey, among many others. While each submarket may be located only five to 10 miles from each other, the city’s notorious traffic delays can make it feel like these submarkets are much farther apart. Residents often choose Mid-Wilshire for its proximity to employment opportunities while also providing a short commute to the beach and coastal activities on the weekends. Aimco’s four assets in Mid-Wilshire, including the three Palazzo communities and Broadcast Center, have walk scores ranging from 82-925 and are in close proximity to The Grove and the Farmer’s Market.

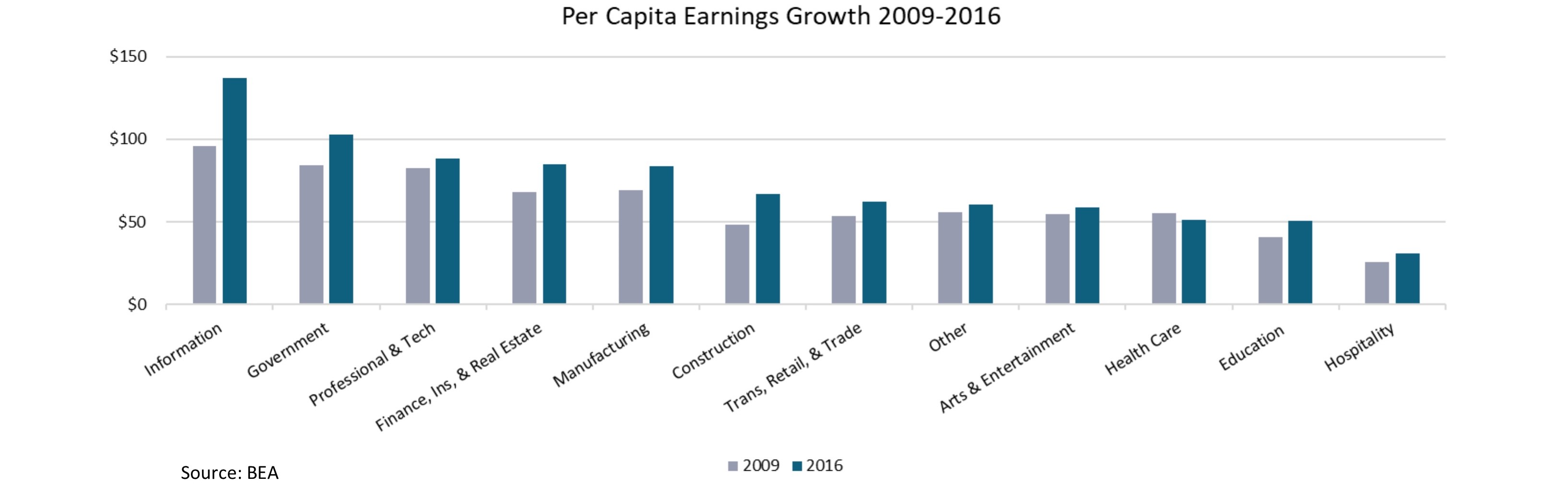

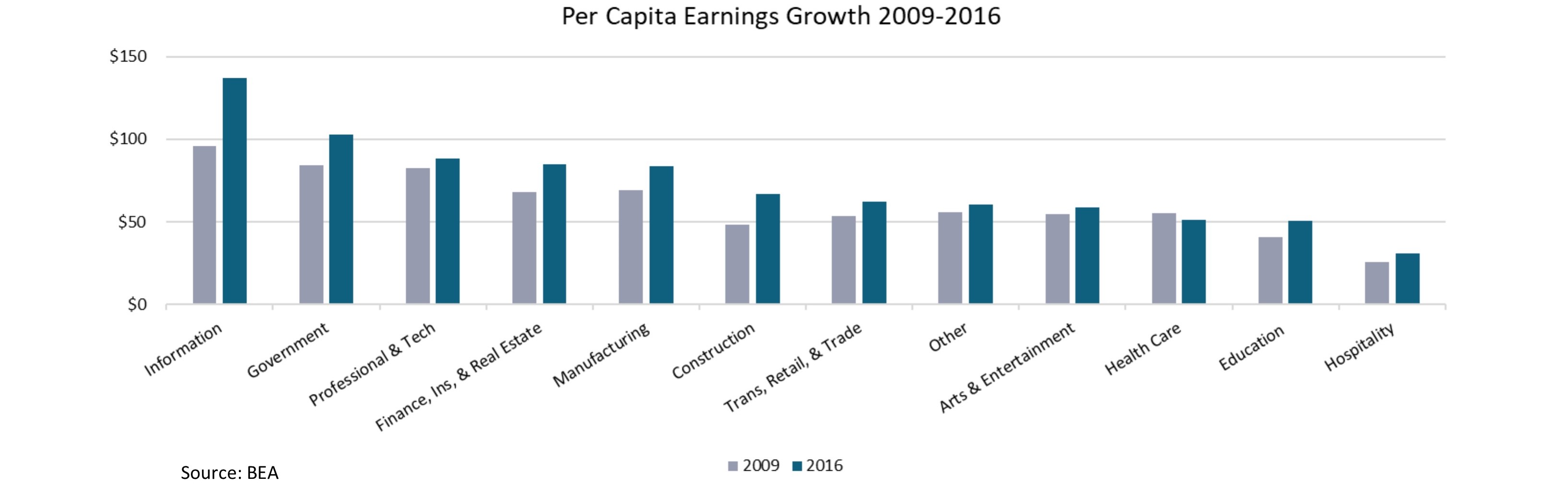

In Mid-Wilshire, Aimco is able to serve a highly educated and desirable customer. 64% of the prime renter cohort (age 25-34) living in the neighborhood surrounding the Palazzos and Broadcast Center have a Bachelor’s degree or higher, compared to 37% in LA as a whole and 35% in the state of California.6 Employment in the neighborhood surrounding Aimco’s Mid-Wilshire communities7 is weighted to Information, Professional Services and Arts/Entertainment jobs as compared to the broader LA market. These industries, which were among the highest paying and fastest growing for LA from 2009-2016, have yielded 50 bps of rent growth outperformance for the surrounding neighborhood versus the LA market for this same period.8

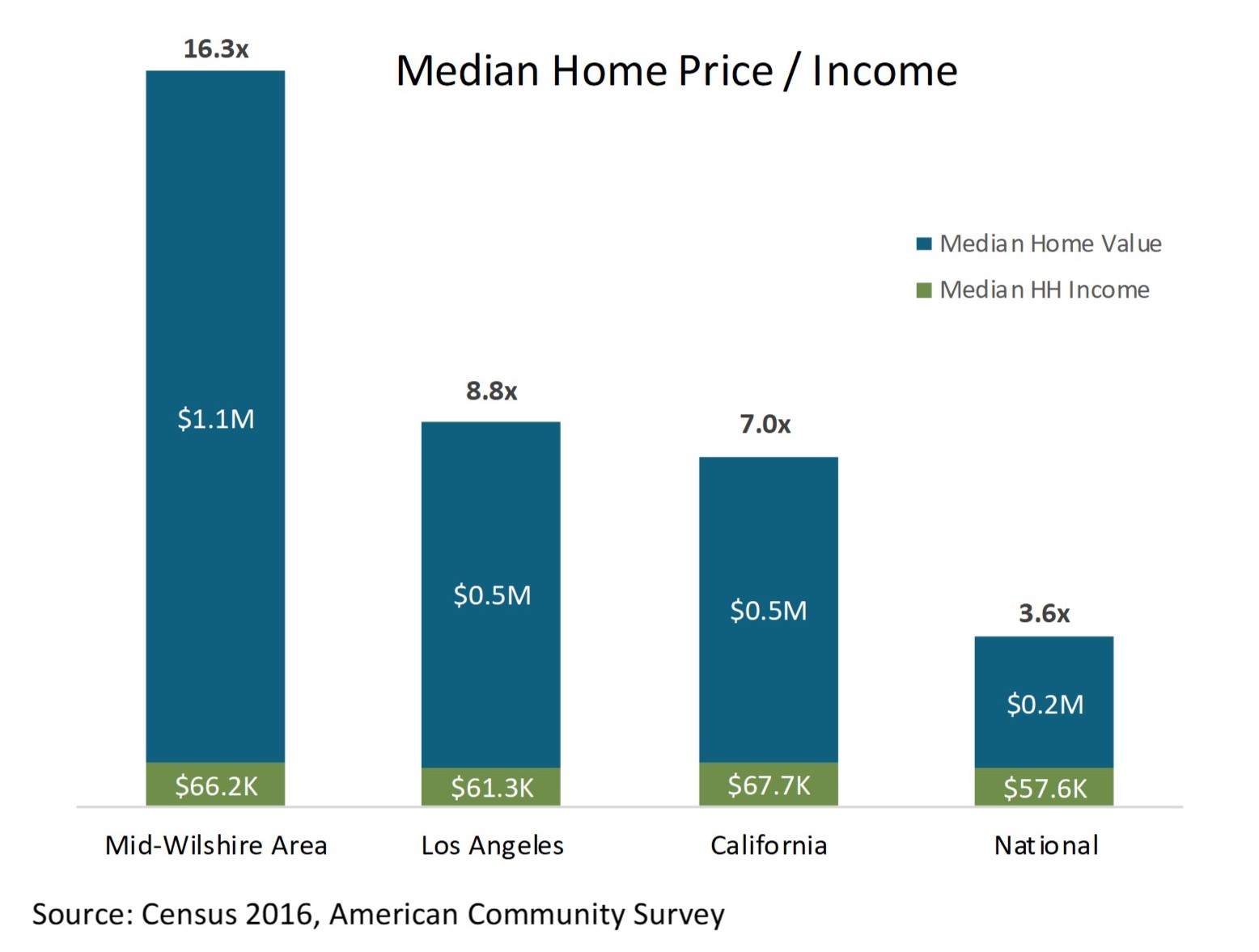

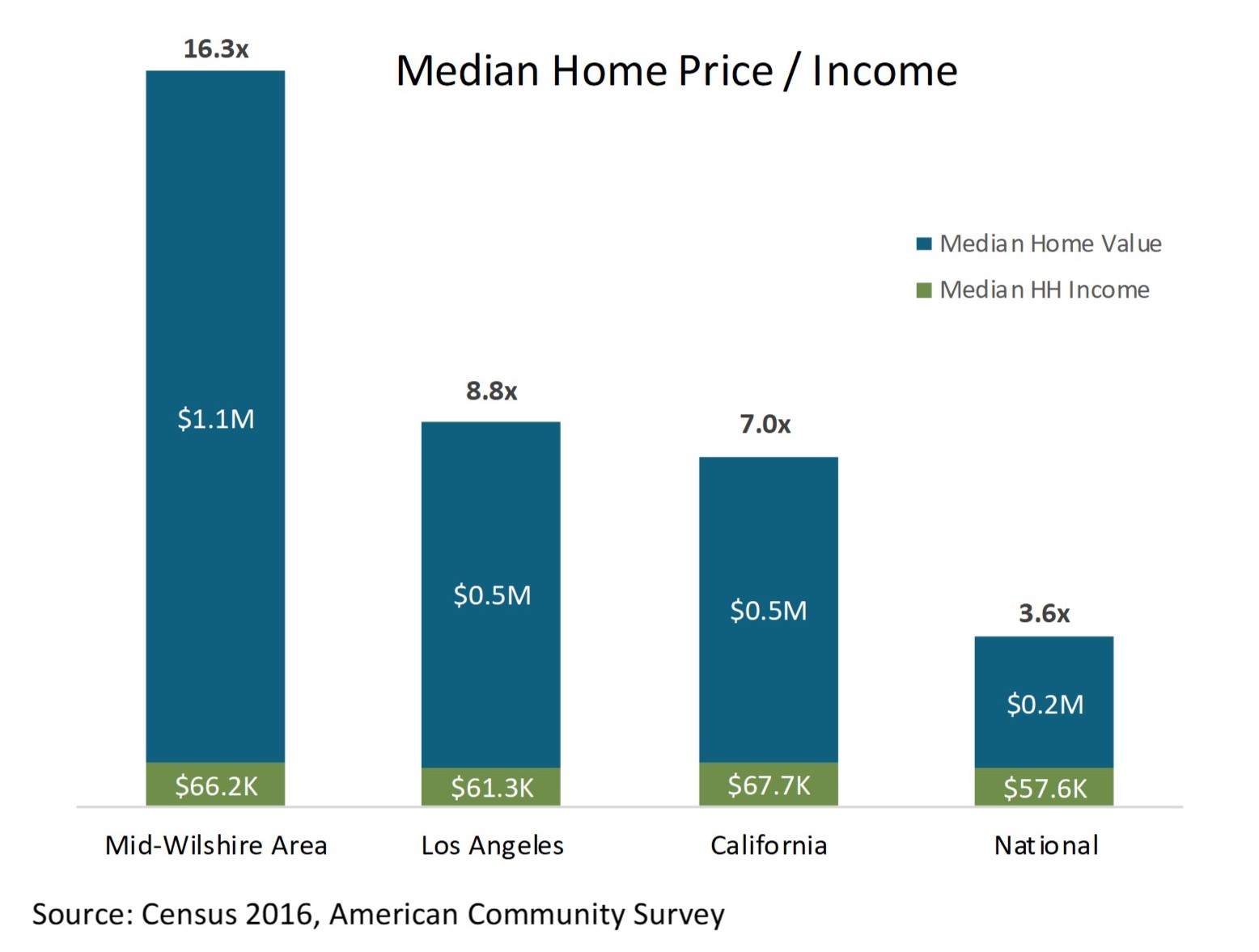

Home affordability in LA is the second lowest in the nation,9 with only 45% of metro households in owned housing. The homeownership rate falls to 26% for the neighborhood surrounding the Palazzos and Broadcast Center, as the median home price of $1.1M (vs. $538k in LA County) makes home ownership expensive for those that want to live close to job and cultural centers in the Mid-Wilshire area.6 In this neighborhood, 72% of households with a Bachelor’s degree or higher, are renters compared to 46% for Los Angeles.6

Given all of LA’s positive attributes, it is no surprise that multifamily developers have increasingly allocated capital to LA, despite it being considered a relatively high barrier-to-entry market with complex land use regulations and numerous zoning and political constraints. In 2018, MPF Research forecasts 12,700 multifamily deliveries in LA but this represents only 1.1% of existing inventory, 40 bps lower than the average for other gateway markets. Roughly 30% of these LA deliveries are in the DTLA submarket and 20% are expected in the Mid-Wilshire submarket, but only 500 units are within a one-mile radius of Aimco’s Mid-Wilshire communities. In 2019, 16,100 units are expected to be delivered in LA, or 1.4% of existing inventory, with roughly 30% in DTLA and only 12% located in the Mid-Wilshire submarket. Aimco does not own any communities in DTLA and typically doesn’t consider DTLA to be directly competitive with its Mid-Wilshire communities. In fact, in 2018, only 2% of Aimco’s Mid-Wilshire residents that moved out have provided a forwarding address in DTLA.

Outside of the Mid-Wilshire submarket, Aimco owns nine other communities in nine distinct submarkets in LA including Santa Clarita Valley, Hollywood, Brentwood/Westwood/Beverly Hills, Simi Valley/Moorpark, Woodland Hills, Camarillo, Southeast LA, Marina del Rey and Burbank/Glendale/Pasadena. Six of the nine communities are Class B assets, while three are Class A.

In addition to new supply, LA faces other challenges, including state and local budget issues and a difficult regulatory environment. One issue currently in the spotlight for multifamily investors is the potential repeal of Costa-Hawkins. Costa-Hawkins is a law passed in 1995 that prohibits California cities and other jurisdictions from enacting rent control on residential units built after February 1, 1995. It also mandates vacancy de-control, allowing landlords to bring rents to market when a tenant moves out. Californians will vote on the repeal in November. If Costa-Hawkins is repealed, rent control will not be immediately enacted, rather individual municipalities will be free to decide what, if any, rent control to enact.

It is by design that Aimco does not own any communities in San Francisco, Berkeley and Santa Monica, which historically have chosen rent control more stringent than elsewhere in California. Whether or not Costa-Hawkins is repealed, Aimco remains bullish on the LA multifamily market.

Sources:

| |

| 1) | Discover Los Angeles, “Facts About Los Angeles”, www.discoverlosangeles.com, December 15, 2017 |

| |

| 2) | U.S. Bureau of Economic Analysis, “Gross Domestic Product by Metropolitan Area, 2016”, September 20, 2017 |

| |

| 3) | Los Angeles County Economic Development Corporation (LAEDC), “Economic Forecast & Industry Outlook: California and Los Angeles County 2018-2019”, February 2018 |

| |

| 4) | PWC / CB Insights, “MoneyTree Report”, Q2 2018 |

| |

| 5) | www.walkscore.com, July 17, 2018 |

| |

| 6) | Census 2016, “American Community Survey” |

| |

| 7) | As defined by Public Use Microdata Area (PUMA) in Census 2016, “American Community Survey” |

| |

| 9) | National Association of Home Builders (NAHB), “Housing Opportunity Index”, 1st Quarter 2018 |

|

| | | | | | | | | | | | | | | | |

| Consolidated Statements of Operations | | | | | | | | |

| (in thousands, except per share data) (unaudited) | | | | | | | | |

| | | | | | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | June 30, | | June 30, |

| | | 2018 | | 2017 | | 2018 | | 2017 |

| REVENUES | | | | | | | | |

| Rental and other property revenues attributable to Real Estate | | $ | 231,130 |

| | $ | 227,703 |

| | $ | 456,523 |

| | $ | 452,931 |

|

| Rental and other property revenues of partnerships served by Asset Management business | | 19,000 |

| | 18,533 |

| | 37,808 |

| | 37,095 |

|

| Tax credit and transaction revenues | | 57 |

| | 2,856 |

| | 3,576 |

| | 5,547 |

|

| Total revenues | | 250,187 |

| | 249,092 |

| | 497,907 |

| | 495,573 |

|

| | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | |

| Property operating expenses attributable to Real Estate | | 76,031 |

| | 79,082 |

| | 154,318 |

| | 158,708 |

|

| Property operating expenses of partnerships served by Asset Management business | | 9,062 |

| | 8,391 |

| | 18,257 |

| | 17,587 |

|

| Depreciation and amortization | | 97,485 |

| | 89,155 |

| | 190,033 |

| | 176,323 |

|

| General and administrative expenses | | 13,882 |

| | 10,108 |

| | 25,237 |

| | 21,071 |

|

| Other expenses, net | | 4,366 |

| | 2,650 |

| | 7,324 |

| | 4,389 |

|

| Total operating expenses | | 200,826 |

| | 189,386 |

|

| 395,169 |

| | 378,078 |

|

| Operating income | | 49,361 |

| | 59,706 |

| | 102,738 |

| | 117,495 |

|

| Interest income | | 2,884 |

| | 2,012 |

| | 5,056 |

| | 4,204 |

|

| Interest expense | | (49,906 | ) | | (46,858 | ) | | (97,701 | ) | | (94,740 | ) |

| Other, net | | 200 |

| | 200 |

| | 424 |

| | 665 |

|

| Income before income taxes and gain on dispositions | | 2,539 |

| | 15,060 |

| | 10,517 |

| | 27,624 |

|

| Income tax benefit | | 4,395 |

| | 5,023 |

| | 41,783 |

| | 10,008 |

|

| Income before gain on dispositions | | 6,934 |

| | 20,083 |

| | 52,300 |

| | 37,632 |

|

| Gain on dispositions of real estate, inclusive of related income tax | | 222 |

| | 1,508 |

| | 50,546 |

| | 1,114 |

|

| Net income | | 7,156 |

| | 21,591 |

| | 102,846 |

| | 38,746 |

|

| Noncontrolling interests: | | | | | | | | |

| Net income attributable to noncontrolling interests in consolidated real estate partnerships | | (45 | ) | | (813 | ) | | (6,251 | ) | | (1,764 | ) |

| Net income attributable to preferred noncontrolling interests in Aimco OP | | (1,934 | ) | | (1,939 | ) | | (3,871 | ) | | (3,888 | ) |

| Net income attributable to common noncontrolling interests in Aimco OP | | (140 | ) | | (787 | ) | | (3,895 | ) | | (1,344 | ) |

| Net income attributable to noncontrolling interests | | (2,119 | ) | | (3,539 | ) | | (14,017 | ) | | (6,996 | ) |

| Net income attributable to Aimco | | 5,037 |

| | 18,052 |

| | 88,829 |

| | 31,750 |

|

| Net income attributable to Aimco preferred stockholders | | (2,149 | ) | | (2,149 | ) | | (4,297 | ) | | (4,297 | ) |

| Net income attributable to participating securities | | (71 | ) | | (60 | ) | | (190 | ) | | (119 | ) |

| Net income attributable to Aimco common stockholders | | $ | 2,817 |

| | $ | 15,843 |

| | $ | 84,342 |

| | $ | 27,334 |

|

| | | | | | | | | |

| Net income attributable to Aimco per common share – basic and diluted | | $ | 0.02 |

| | $ | 0.10 |

| | $ | 0.54 |

| | $ | 0.17 |

|

| | | | | | | | | |

| | | | | | | | | |

| Weighted average common shares outstanding – basic | | 156,703 |

| | 156,305 |

| | 156,656 |

| | 156,282 |

|

| | | | | | | | | |

| Weighted average common shares outstanding – diluted | | 156,833 |

| | 156,715 |

| | 156,786 |

| | 156,735 |

|

| | | | | | | | | |

|

| | | | | | | | | |

| Consolidated Balance Sheets |

| (in thousands) (unaudited) |

| | | | | | |

| | | | June 30, 2018 | | December 31, 2017 |

| Assets | | | | |

| Real estate | | $ | 8,171,651 |

| | $ | 7,927,753 |

|

| Accumulated depreciation | | (2,452,947 | ) | | (2,522,358 | ) |

| Net real estate | | 5,718,704 |

| | 5,405,395 |

|

| Cash and cash equivalents | | 46,703 |

| | 60,498 |

|

| Restricted cash | | 41,117 |

| | 34,827 |

|

| Goodwill | | 37,808 |

| | 37,808 |

|

| Other assets | | 327,756 |

| | 234,931 |

|

| Assets held for sale | | 94,314 |

| | 17,959 |

|

| Assets of partnerships served by Asset Management business [1]: | | | | |

| Real estate, net | | 216,875 |

| | 224,873 |

|

| Cash and cash equivalents | | 20,696 |

| | 16,288 |

|

| Restricted cash | | 30,055 |

| | 30,928 |

|

| Other assets | | 10,328 |

| | 15,533 |

|

| Total Assets | | $ | 6,544,356 |

| | $ | 6,079,040 |

|

| | | | | | |

| Liabilities and Equity | | | | |

| Non-recourse property debt secured by Aimco Real Estate communities | | $ | 3,810,824 |

| | $ | 3,563,041 |

|

| Debt issue costs | | (19,586 | ) | | (17,932 | ) |

| Non-recourse property debt, net | | 3,791,238 |

| | 3,545,109 |

|

| Term loan, net | | 249,801 |

| | 249,501 |

|

| Revolving credit facility borrowings | | 220,170 |

| | 67,160 |

|

| Accrued liabilities and other | | 216,789 |

| | 213,027 |

|

| Liabilities related to assets held for sale | | 68,610 |

| | — |

|

| | | | | | |

| Liabilities of partnerships served by Asset Management business [1]: | | | | |

| Non-recourse property debt, net | | 224,112 |

| | 227,141 |

|

| Accrued liabilities and other | | 17,519 |

| | 19,812 |

|

| Total Liabilities | | 4,788,239 |

| | 4,321,750 |

|

| | | | | | |

| Preferred noncontrolling interests in Aimco OP | | 101,332 |

| | 101,537 |

|

| Equity: | | | | |

| Perpetual preferred stock | | 125,000 |

| | 125,000 |

|

| Class A Common Stock | | 1,574 |

| | 1,572 |

|

| Additional paid-in capital | | 3,887,260 |

| | 3,900,042 |

|

| Accumulated other comprehensive income | | 3,208 |

| | 3,603 |

|

| Distributions in excess of earnings | | (2,402,101 | ) | | (2,367,073 | ) |

| Total Aimco equity | | 1,614,941 |

| | 1,663,144 |

|

| Noncontrolling interests in consolidated real estate partnerships | | (2,984 | ) | | (1,716 | ) |

| Common noncontrolling interests in Aimco OP | | 42,828 |

| | (5,675 | ) |

| Total equity | | 1,654,785 |

| | 1,655,753 |

|

| Total liabilities and equity | | $ | 6,544,356 |

| | $ | 6,079,040 |

|

| | |

| [1] | On July 25, 2018, Aimco completed the sale of its Asset Management business and derecognized these assets and liabilities. As of June 30, 2018, these amounts are classified as held for sale on Aimco’s GAAP balance sheet. |

|

| | | | | | | | | | | | | | | | | |

| Supplemental Schedule 1 | | | | | | | | |

| | | | | | | | | | |

| Funds From Operations and Adjusted Funds From Operations Reconciliation | | | | |

| Three and Six Months Ended June 30, 2018 Compared to Three and Six Months Ended June 30, 2017 |

| (in thousands, except per share data) (unaudited) | | | | |

| | | | | | | | | | |

| | | | Three Months Ended June 30, | | Six Months Ended June 30, |

| | | | 2018 | | 2017 | | 2018 | | 2017 |

| Net income attributable to Aimco common stockholders | | $ | 2,817 |

| | $ | 15,843 |

| | $ | 84,342 |

| | $ | 27,334 |

|

| Adjustments: | | | | | | | | |

| Real estate depreciation and amortization, net of noncontrolling partners’ interest | | 95,238 |

| | 84,649 |

| | 185,632 |

| | 167,530 |

|

| Gain on dispositions and other, net of noncontrolling partners’ interest | | (217 | ) | | (1,741 | ) | | (47,240 | ) | | (2,180 | ) |

Income tax adjustments related to gain on dispositions and other items [1] | | 85 |

| | 410 |

| | (30,635 | ) | | 1,442 |

|

| Common noncontrolling interests in Aimco OP’s share of above adjustments | | (4,610 | ) | | (3,783 | ) | | (5,167 | ) | | (7,633 | ) |

| Amounts allocable to participating securities | | (82 | ) | | (41 | ) | | (97 | ) | | (79 | ) |

| FFO Attributable to Aimco common stockholders | | $ | 93,231 |

| | $ | 95,337 |

| | $ | 186,835 |

| | $ | 186,414 |

|

| Litigation costs, net of common noncontrolling interests in Aimco OP and participating securities [2] | | 1,557 |

| | — |

| | 1,906 |

| | — |

|

| Severance costs, net of common noncontrolling interests in Aimco OP and participating securities [3] | | 1,215 |

| | — |

| | 1,215 |

| | — |

|

| Pro forma FFO Attributable to Aimco common stockholders | | $ | 96,003 |

| | $ | 95,337 |

| | $ | 189,956 |

| | $ | 186,414 |

|

| Capital Replacements, net of common noncontrolling interests in Aimco OP and participating securities | | (11,710 | ) | | (15,360 | ) | | (21,477 | ) | | (26,306 | ) |

| AFFO Attributable to Aimco common stockholders | | $ | 84,293 |

| | $ | 79,977 |

| | $ | 168,479 |

| | $ | 160,108 |

|

| | | | | | | | | | |

| Weighted average common shares outstanding | | 156,703 |

| | 156,305 |

| | 156,656 |

| | 156,282 |

|

| Dilutive common share equivalents | | 130 |

| | 410 |

| | 130 |

| | 453 |

|

| Total shares and dilutive share equivalents | | 156,833 |

| | 156,715 |

| | 156,786 |

| | 156,735 |

|

| | | | | | | | | | |

| Net income attributable to Aimco per common share – diluted | | $ | 0.02 |

| | $ | 0.10 |

| | $ | 0.54 |

| | $ | 0.17 |

|

| FFO per share – diluted | | $ | 0.59 |

| | $ | 0.61 |

| | $ | 1.19 |

| | $ | 1.19 |

|

| Pro forma FFO per share – diluted | | $ | 0.61 |

| | $ | 0.61 |

| | $ | 1.21 |

| | $ | 1.19 |

|

| AFFO per share – diluted | | $ | 0.54 |

| | $ | 0.51 |

| | $ | 1.07 |

| | $ | 1.02 |

|

| | | | | | | | | | |

| [1] | Income taxes related to gain on dispositions and other items for the six months ended June 30, 2018 includes a $33.6 million tax benefit related to an intercompany transfer of assets related to Aimco’s Asset Management business. On July 25, 2018, Aimco completed the sale of this business. In the third quarter, the sale related taxes will be reflected within Aimco’s statement of operations within gain on dispositions of real estate, inclusive of related income tax. Accordingly, Aimco has excluded the benefit related to the reorganization from FFO. |

| [2] | Aimco is engaged in litigation with Airbnb to protect its property right to select its residents and their neighbors. Due to the unpredictable nature of these cases and associated legal costs, Aimco excludes such costs from Pro forma FFO and AFFO. |

| [3] | In connection with the sale of its Asset Management business, Aimco incurred severance costs of $1.2 million during the second quarter. Aimco excludes such costs from Pro forma FFO because it believes these costs are clearly and closely related to the sale of the business. |

|

| | | | | | | | | | | | | | | | |

| Supplemental Schedule 2(a) | | | | |

| | | | | | | | | |

| Funds From Operations and Adjusted Funds From Operations Information | | (Page 1 of 2) | |

| Three and Six Months Ended June 30, 2018 Compared to Three and Six Months Ended June 30, 2017 | | | | |

| (consolidated amounts, in thousands) (unaudited) | | | | |

| | | | | |

| | | Three Months Ended | | Six Months Ended |

| | | June 30, | | June 30, |

| | | 2018 | | 2017 | | 2018 | | 2017 |

| Real Estate [1] | | | | | | | | |

| Revenues, before utility reimbursements [2] | | | | | | | | |

| Same Store | | $ | 147,627 |

| | $ | 143,037 |

| | $ | 293,148 |

| | $ | 284,943 |

|

| Redevelopment/Development | | 44,854 |

| | 42,434 |

| | 88,622 |

| | 84,314 |

|

| Acquisition | | 11,488 |

| | 4,268 |

| | 18,031 |

| | 7,967 |

|

| Other Real Estate | | 11,295 |

| | 10,893 |

| | 22,563 |

| | 21,731 |

|

| Total revenues, before utility reimbursements | | 215,264 |

| | 200,632 |

| | 422,364 |

| | 398,955 |

|

| Expenses, net of utility reimbursements [2] | | | | | | | | |

| Same Store | | 38,692 |

| | 37,439 |

| | 77,817 |

| | 75,723 |

|

| Redevelopment/Development | | 15,052 |

| | 14,714 |

| | 29,310 |

| | 28,889 |

|

| Acquisition | | 3,541 |

| | 1,736 |

| | 5,739 |

| | 3,535 |

|

| Other Real Estate | | 3,894 |

| | 3,717 |

| | 7,907 |

| | 7,620 |

|

| Total expenses, net of utility reimbursements | | 61,179 |

| | 57,606 |

| | 120,773 |

| | 115,767 |

|

| Real Estate net operating income | | 154,085 |

| | 143,026 |

| | 301,591 |

| | 283,188 |

|

| | | | | | | | | |

| Property management expenses | | (4,512 | ) | | (5,072 | ) | | (9,676 | ) | | (10,074 | ) |

| Casualties | | (585 | ) | | (2,060 | ) | | (1,595 | ) | | (3,875 | ) |

| Other expenses, net | | (2,200 | ) | | (371 | ) | | (2,886 | ) | | (756 | ) |

| Interest expense on non-recourse property debt | | (41,486 | ) | | (41,672 | ) | | (81,646 | ) | | (84,265 | ) |

| Interest income | | 1,885 |

| | 1,744 |

| | 3,734 |

| | 3,465 |

|

| FFO related to Sold and Held for Sale communities [3] | | 4,961 |

| | 12,063 |

| | 9,829 |

| | 23,148 |

|

| Contribution from Real Estate | | 112,148 |

| | 107,658 |

| | 219,351 |

| | 210,831 |

|

| | | | | | | | | |

| Asset Management [4] | | | | | | | | |

| FFO related to communities served by Asset Management business | | 7,542 |

| | 7,760 |

| | 14,674 |

| | 14,729 |

|

| Tax credit income, net | | (32 | ) | | 2,516 |

| | 1,785 |

| | 5,029 |

|

| Other income | | 42 |

| | 420 |

| | 1,688 |

| | 882 |

|

| Asset management expenses | | (961 | ) | | (1,005 | ) | | (1,983 | ) | | (2,026 | ) |

| Contribution from Asset Management | | 6,591 |

| | 9,691 |

| | 16,164 |

| | 18,614 |

|

| | | | | | | | | |

| General and administrative and investment management expenses | | (13,882 | ) | | (10,108 | ) | | (25,237 | ) | | (21,071 | ) |

| Depreciation and amortization related to non-real estate assets | | (2,187 | ) | | (2,494 | ) | | (4,379 | ) | | (4,887 | ) |

| Other expenses, net | | (952 | ) | | (1,604 | ) | | (2,790 | ) | | (2,080 | ) |

| Interest expense on corporate borrowings | | (4,124 | ) | | (1,434 | ) | | (7,449 | ) | | (2,430 | ) |

| Historic tax credit benefit | | 1,345 |

| | 1,895 |

| | 1,345 |

| | 3,096 |

|

| Other tax benefits, net | | 3,047 |

| | 3,129 |

| | 6,843 |

| | 6,970 |

|

| Preferred dividends and distributions | | (4,083 | ) | | (4,088 | ) | | (8,168 | ) | | (8,185 | ) |

| Common noncontrolling interests in Aimco OP | | (4,750 | ) | | (4,570 | ) | | (9,062 | ) | | (8,977 | ) |

| Amounts allocated to participating securities | | (153 | ) | | (101 | ) | | (287 | ) | | (198 | ) |

| Aimco share of amounts associated with unconsolidated partnerships | | 506 |

| | 419 |

| | 1,025 |

| | 983 |

|

| Noncontrolling interests’ share of the above amounts | | (275 | ) | | (3,056 | ) | | (521 | ) | | (6,252 | ) |

| FFO Attributable to Aimco common stockholders | | $ | 93,231 |

| | $ | 95,337 |

| | $ | 186,835 |

| | $ | 186,414 |

|

| Pro forma adjustment for litigation costs [5] | | 1,557 |

| | — |

| | 1,906 |

| | $ | — |

|

| Pro forma adjustment for severance costs [6] | | 1,215 |

| | — |

| | 1,215 |

| | — |

|

| Pro Forma FFO Attributable to Aimco common stockholders | | $ | 96,003 |

| | $ | 95,337 |

| | $ | 189,956 |

| | $ | 186,414 |

|

| Capital Replacements, net of noncontrolling interests’ share | | (11,710 | ) | | (15,360 | ) | | (21,477 | ) | | (26,306 | ) |

| AFFO Attributable to Aimco common stockholders | | $ | 84,293 |

| | $ | 79,977 |

| | $ | 168,479 |

| | $ | 160,108 |

|

Please see the following page for footnote descriptions

|

| | |

| Supplemental Schedule 2(a) (continued) | |

| | | |

| Funds From Operations and Adjusted Funds From Operations Information | (Page 2 of 2) |

| | | |

| [1] | Contribution from Real Estate consists of property net operating income and other items of income or expense that relate to this portfolio, including property management expenses, casualty losses, interest expense related to non-recourse property debt encumbering the communities in this portfolio, and interest income Aimco earns on its investment in a securitization trust that holds certain Aimco property debt. |

| [2] | In 2018, Aimco changed its presentation of revenues and expenses to reflect utilities costs net of amounts reimbursed by residents, which were previously included in revenue. 2017 amounts have been revised to conform to this presentation. |

| [3] | At June 30, 2018, Aimco had its four affordable apartment communities located in Hunters Point and Chestnut Hill Village located in north Philadelphia classified as held for sale. |

| [4] | At June 30, 2018, Aimco had 39 consolidated Asset Management apartment communities. |

| [5] | Aimco is engaged in litigation with Airbnb to protect Aimco’s property right to select its residents and their neighbors. Due to the unpredictable nature of these cases and associated legal costs, Aimco excludes such costs from Pro forma FFO and AFFO. The amount presented is net of noncontrolling interests share of such costs. |

| [6] | In connection with the sale of its Asset Management business, Aimco incurred severance costs of $1.2 million during second quarter. Aimco excludes such costs from Pro forma FFO because it believes these costs are clearly and closely related to the sale of the business. The amount is presented net of noncontrolling interests share of such costs. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Schedule 2(b) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Partially Owned Entities | | | | | | | | | | | | | | |

| Three and Six Months Ended June 30, 2018 Compared to Three and Six Months Ended June 30, 2017 | | | | | | | | |

| (Proportionate amounts, in thousands) (unaudited) | | | | | | | | |

| | | | | | | | | | |

| | | | Noncontrolling Interests [1] | | Unconsolidated [2] | | Noncontrolling Interests [1] | | Unconsolidated [2] |

| | | | Three Months Ended June 30, | | Three Months Ended June 30, | | Six Months Ended June 30, | | Six Months Ended June 30, |

| | | | 2018 | | 2017 | | 2018 | | 2017 | | 2018 | | 2017 | | 2018 | | 2017 |

| Real estate | | | | | | | | | | | | | | | | |

| Revenues, before utility reimbursements | | $ | 786 |

| | $ | 6,432 |

| | $ | 584 |

| | $ | 524 |

| | $ | 1,562 |

| | $ | 12,950 |

| | $ | 1,144 |

| | $ | 1,094 |

|

| Expenses, net of utility reimbursements | | 263 |

| | 2,017 |

| | 177 |

| | 195 |

| | 529 |

| | 4,062 |

| | 348 |

| | 287 |

|

| | Net operating income | | 523 |

| | 4,415 |

| | 407 |

| | 329 |

| | 1,033 |

| | 8,888 |

| | 796 |

| | 807 |

|

| | | | | | | | | | | | | | | | | | |

| Property management expenses, net | | (34 | ) | | (122 | ) | | (63 | ) | | (61 | ) | | (66 | ) | | (246 | ) | | (127 | ) | | (122 | ) |

| Casualties | | (1 | ) | | (33 | ) | | — |

| | — |

| | 5 |

| | (45 | ) | | — |

| | — |

|

| Other Expense, net | | (16 | ) | | (14 | ) | | — |

| | — |

| | (23 | ) | | (40 | ) | | — |

| | — |

|

| Interest expense on non-recourse property debt on Real Estate Operations | | (183 | ) | | (1,444 | ) | | (80 | ) | | (85 | ) | | (359 | ) | | (2,875 | ) | | (164 | ) | | (172 | ) |

| FFO related to Sold and Held For Sale Apartment Communities | | — |

| | 199 |

| | — |

| | — |

| | (40 | ) | | 392 |

| | — |

| | — |

|

| | Contribution from Real Estate | | 289 |

| | 3,001 |

| | 264 |

| | 183 |

| | 550 |

| | 6,074 |

| | 505 |

| | 513 |

|

| | | | | | | | | | | | | | | | | | |

| Contribution from Asset Management | | — |

| | 64 |

| | 242 |

| | 236 |

| | — |

| | 198 |

| | 517 |

| | 468 |

|

| | | | | | | | | | | | | | | | | | |

| Other non-property expenses, net | | (14 | ) | | (9 | ) | | — |

| | — |

| | (29 | ) | | (20 | ) | | 3 |

| | 2 |

|

| FFO / Pro forma FFO | | $ | 275 |

| | $ | 3,056 |

| | $ | 506 |

| | $ | 419 |

| | $ | 521 |

| | $ | 6,252 |

| | $ | 1,025 |

| | $ | 983 |

|

| Noncontrolling interests’ share of Capital Replacements (4) | | (71 | ) | | 495 |

| | — |

| | — |

| | (113 | ) | | 320 |

| | — |

| | — |

|

| AFFO | | $ | 204 |

| | $ | 3,551 |

| | $ | 506 |

| | $ | 419 |

| | $ | 408 |

| | $ | 6,572 |

| | $ | 1,025 |

| | $ | 983 |

|

| | | | | | | | | | | | | | | | | | |

| Total apartment communities [3] | | 9 | | 4 | | | | | | | | |

| Total apartment homes [3] | | 3,592 | | 142 | | | | | | | | |

| Noncontrolling interests’ share of consolidated apartment homes/Aimco share of unconsolidated apartment homes [3] | | 187 | | 72 | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| [1] | Amounts represent the noncontrolling interests’ proportionate share of consolidated amounts. The decrease from 2017 to 2018 is primarily due to the June 30, 2017 reacquisition of the limited partners’ interest in the Palazzo joint venture. |

| [2] | Amounts represent Aimco’s proportionate share of the unconsolidated real estate partnerships’ operations. | | | | | | | | |

| [3] | Apartment community information excludes Sold Communities. | | | | | | | | |

| [4] | Consists of noncontrolling interests’ in consolidated real estate partnerships proportionate share of Capital Replacements. This adjustment excludes Capital Replacements allocated to common noncontrolling interests in the Aimco Operating Partnership |

|

| | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Schedule 3(a) | |

| | | | | | | | | | | | | |

| Property Net Operating Income - Real Estate | | | | | | | | | | |

| Trailing Five Quarters | | | | | | | | | | | |

| (consolidated amounts, in thousands) (unaudited) | | | | | | | | | | | |

| | | | Three Months Ended | |

| | | | June 30, 2018 | | March 31, 2018 | | December 31, 2017 | | September 30, 2017 | | June 30, 2017 | |

| Revenues, before utility reimbursements [1] | | | | | | | | | | | |

| | Same Store | | $ | 147,627 |

| | $ | 145,520 |

| | $ | 145,440 |

| | $ | 145,120 |

| | $ | 143,037 |

| |

| | Redevelopment/Development | | 44,854 |

| | 43,768 |

| | 43,365 |

| | 44,015 |

| | 42,434 |

| |

| | Acquisition | | 11,488 |

| | 6,543 |

| | 4,846 |

| | 4,662 |

| | 4,268 |

| |

| | Other Real Estate | | 11,295 |

| | 11,268 |

| | 11,383 |

| | 10,928 |

| | 10,893 |

| |

| | Total revenues, before utility reimbursements | | $ | 215,264 |

| | $ | 207,099 |

| | $ | 205,034 |

| | $ | 204,725 |

| | $ | 200,632 |

| |

| | | | | | | | | | | | | |

| Expenses, net of utility reimbursements [1] | | | | | | | | | | | |

| | Same Store | | $ | 38,692 |

| | $ | 39,125 |

| | $ | 35,746 |

| | $ | 37,542 |

| | $ | 37,439 |

| |

| | Redevelopment/Development | | 15,052 |

| | 14,259 |

| | 15,915 |

| | 14,717 |

| | 14,714 |

| |

| | Acquisition | | 3,541 |

| | 2,197 |

| | 1,674 |

| | 1,767 |

| | 1,736 |

| |

| | Other Real Estate | | 3,894 |

| | 4,028 |

| | 3,963 |

| | 3,810 |

| | 3,717 |

| |

| | Total expenses, net of utility reimbursements | | $ | 61,179 |

| | $ | 59,609 |

| | $ | 57,298 |

| | $ | 57,836 |

| | $ | 57,606 |

| |

| | | | | | | | | | | | | |

| Property Net Operating Income | | | | | | | | | | | |

| | Same Store | | $ | 108,935 |

| | $ | 106,395 |

| | $ | 109,694 |

| | $ | 107,578 |

| | $ | 105,598 |

| |

| | Redevelopment/Development | | 29,802 |

| | 29,509 |

| | 27,450 |

| | 29,298 |

| | 27,720 |

| |

| | Acquisition | | 7,947 |

| | 4,346 |

| | 3,172 |

| | 2,895 |

| | 2,532 |

| |

| | Other Real Estate | | 7,401 |

| | 7,240 |

| | 7,420 |

| | 7,118 |

| | 7,176 |

| |

| | Total Property Net Operating Income | | $ | 154,085 |

| | $ | 147,490 |

| | $ | 147,736 |

| | $ | 146,889 |

| | $ | 143,026 |

| |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Property net operating income in the table above is presented on a consolidated basis, which includes 100% of consolidated real estate partnership results and excludes the results of unconsolidated real estate partnerships, which are accounted for using the equity method of accounting. | |

| | | |

| [1] | In 2018, Aimco changed its presentation of revenues and expenses to reflect utilities costs net of amounts reimbursed by residents, which were previously included in revenue. 2017 amounts have been revised to conform to this presentation. | |

|

| | | | | | | | | | | | | | | | | | | | |

| Supplemental Schedule 3(b) | | | | | | | | | | |

| | | | | | | | | | | |

| Property Net Operating Income - Sold and Held For Sale Communities | | | | | | | | | | |

| Trailing Five Quarters | | | | | | | | | | |

| (consolidated amounts, in thousands) (unaudited) | | | | | | | | | | |

| | | | | | | | | | | |

| | | Three Months Ended |

| | | June 30, 2018 | | March 31, 2018 | | December 31, 2017 | | September 30, 2017 | | June 30, 2017 |

| Sold and Held for Sale Property Net Operating Income [1] | | | | | | | | | | |

| Sold Apartment Communities | | $ | 345 |

| | $ | 326 |

| | $ | 6,001 |

| | $ | 8,310 |

| | $ | 7,592 |

|

| Held for Sale Apartment Communities [2] | | 5,759 |

| | 5,508 |

| | 5,714 |

| | 5,429 |

| | 5,497 |

|

| Total Sold and Held for Sale Property Net Operating Income | | $ | 6,104 |

| | $ | 5,834 |

| | $ | 11,715 |

| | $ | 13,739 |

| | $ | 13,089 |

|

| | | | | | | | | | | |

|

| |

| Property net operating income for Sold and Held for Sale communities presented above reflects consolidated, or 100%, amounts and is included in the FFO related to sold and held for sale apartment communities lines on Supplemental Schedule 2. |

| | |

| [1] | Amounts presented exclude the property net operating income of apartment communities served by Aimco’s Asset Management business. |

| [2] | At June 30, 2018 Aimco classified its four affordable apartment communities located in Hunters Point and Chestnut Hill Village located in north Philadelphia as held for sale. |

|

| | | | | | | | | | |

| Supplemental Schedule 4 | | | | |

| | | | | | | | |

| Apartment Home Summary | | | | |

| As of June 30, 2018 | | | | | |

| (unaudited) | | | | | |

| | | | Number of Apartment Communities | | Number of Apartment Homes | | Aimco Share of Apartment Homes |

| Real Estate Portfolio: | | | | | |

| | Consolidated | | | | | |

| | | Same Store | 95 |

| | 26,367 |

| | 26,220 |

|

| | | Redevelopment/Development | 13 |

| | 6,284 |

| | 6,273 |

|

| | | Acquisitions | 6 |

| | 1,876 |

| | 1,876 |

|

| | | Other Real Estate | 15 |

| | 1,803 |

| | 1,774 |

|

| | | Held for Sale | 5 |

| | 1,425 |

| | 1,425 |

|

| | Total Consolidated | 134 |

| | 37,755 |

| | 37,568 |

|

| | Unconsolidated | 4 |

| | 142 |

| | 72 |

|

| | Total Real Estate Portfolio | 138 |

| | 37,897 |

| | 37,640 |

|

| | | | | | | | |

| Apartment Communities Served by Asset Management Business: | | | | | |

| | Consolidated | 39 |

| | 6,211 |

| | n/a |

|

| | Unconsolidated | 7 |

| | 687 |

| | n/a |

|

| | | | | | | | |

| Total | 184 |

| | 44,795 |

| | 37,640 |

|

|

| | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Schedule 5(a) | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Capitalization and Financial Metrics | | | | | | | | |

| As of June 30, 2018 | | | | | | | | | | | | |

| (dollars in thousands) (unaudited) | | | | | | | | |

| | | | | | | | | | | | | |

| Leverage Balances and Characteristics [1] |

| | | | | | | | | |

| Debt | | Aimco Amounts | | Aimco Share of Unconsolidated Partnerships | | Noncontrolling Interests | | Total Aimco Share | | Weighted Average Maturity (Years) | | Weighted Average Stated Interest Rate |

| Fixed rate loans payable | | $ | 3,677,707 |

| | $ | 6,861 |

| | $ | (16,415 | ) | | $ | 3,668,153 |

| | 7.1 |

| | 4.52 | % |

| Floating rate loans payable | | 118,613 |

| | — |

| | — |

| | $ | 118,613 |

| | 4.7 |

| | 3.16 | % |

| Floating rate tax-exempt bonds | | 14,504 |

| | — |

| | — |

| | 14,504 |

| | 15.0 |

| | 3.04 | % |

| Total non-recourse property debt | | $ | 3,810,824 |

| | $ | 6,861 |

| | $ | (16,415 | ) | | $ | 3,801,270 |

| [2] | 7.0 |

| | 4.48 | % |

| Term loan | | 250,000 |

| | — |

| | — |

| | 250,000 |

| | 0.3 |

| [3] | 3.44 | % |

| Revolving credit facility borrowings | | 220,170 |

| | — |

| | — |

| | 220,170 |

| | 3.6 |

| | 3.45 | % |

| Non-recourse property debt related to assets held for sale | | 67,667 |

| | — |

| | — |

| | 67,667 |

| | [4] | | [4] |

| Preferred Equity | | 226,332 |

| | — |

| | — |

| | 226,332 |

| | 40.0 |

| [5] | 7.22 | % |

| Total Leverage | | $ | 4,574,993 |

| | $ | 6,861 |

| | $ | (16,415 | ) | | $ | 4,565,439 |

| | 8.2 |

| | 4.51 | % |

| Cash and restricted cash | | (87,820 | ) | | — |

| | 1,085 |

| | (86,735 | ) | | | | |

| Securitization trust assets | | (84,565 | ) | | — |

| | — |

| | (84,565 | ) | [6] | | | |

| Adjustment for July 2018 sales proceeds | | (745,000 | ) | | — |

| | — |

| | (745,000 | ) | [7] | | | |

| Net Leverage, as adjusted | | $ | 3,657,608 |

| | $ | 6,861 |

| | $ | (15,330 | ) | | $ | 3,649,139 |

| | 8.9 |

| [7] | |

|

| | | | | | |

| Leverage Ratios Second Quarter 2018 | | | | | | |

| | | | | | | |

| Proportionate Debt to Pro forma EBITDA [8] | | | | 6.5x |

| Proportionate Debt and Preferred Equity to Pro forma EBITDA [8] | | | | 6.9x |

| Adjusted EBITDA to Adjusted Interest | | | | 3.4x |

| Adjusted EBITDA to Adjusted Interest and Preferred Dividends | | | | 3.1x |

| |

| | | | | Amount | | Covenant |

| Fixed Charge Coverage Ratio | | | | 2.00x | | 1.40x |

| | | | | | | |

| Credit Ratings | | | | | | |

| | | | | | | |

| Standard and Poor’s | | Corporate Credit Rating | | BBB- (stable) |

| Fitch Ratings | | Issuer Default Rating | | BBB- (stable) |

|

| | | | | | | | | | | |

| [1] | Aimco leverage excludes the non-recourse property debt obligations of consolidated partnerships served by its Asset Management business. |

| [2] | Represents the carrying amount of Aimco’s debt. At June 30, 2018, Aimco’s debt had a mark-to-market asset of $68.2 million. Aimco computed the fair value of its debt utilizing a Money-Weighted Average Interest Rate on its fixed-rate property debt of 3.96%, which rate takes into account the timing of amortization and maturities, and a market rate of 4.38% that considers the duration of the existing property debt using a similar lending source, the loan-to-value and coverage, as well as timing of amortization and maturities. |

| [3] | During the second quarter, Aimco extended the term loan’s maturity date to September 30, 2018. Subsequent to the sale of its Asset Management portfolio in July 2018, Aimco repaid the term loan with proceeds from the sale. |

| [4] | Non-recourse property debt related to assets held for sale consists of debt encumbering Aimco’s four affordable apartment communities located in Hunters Point, which were sold on July 25, 2018, as a part of the transaction. This debt was repaid at closing and, as such, Aimco did not include the impact of the remaining maturity and interest rates on its total leverage. |

| [5] | Preferred Equity is perpetual in nature; however, for illustrative purposes, Aimco has computed the weighted average of its total leverage assuming a 40-year maturity for its Preferred Equity. |

| [6] | In 2011, $673.8 million of Aimco’s loans payable were securitized in a trust holding only these loans. Aimco purchased the subordinate positions in the trust that holds these loans for $51.5 million. These investments have a face value of $100.9 million and a carrying amount of $84.6 million, and are included in other assets (attributable to the Real Estate portfolio) on Aimco’s Consolidated Balance Sheet at June 30, 2018. The amount of these investments effectively reduces Aimco’s leverage. |

| [7] | Represents the proceeds, net of transaction costs, from the sales of Aimco’s Asset Management business, its four affordable apartment communities located in Hunters Point and Chestnut Hill Village. Aimco used these proceeds to repay outstanding borrowings on the revolving credit facility and the term loan, resulting in weighted average maturity on a pro forma basis of 8.9 years. |

| [8] | The Proportionate Debt to Pro forma EBITDA and Proportionate Debt and Preferred Equity to Pro forma EBITDA ratios have been calculated on a pro forma basis to reflect the impact of the July 2018 dispositions of Aimco’s Asset Management business, its four affordable apartment communities located in Hunters Point, and Chestnut Hill Village, described above. Pro forma EBITDA has also been adjusted to reflect the acquisition of the four Philadelphia apartment communities as if the transaction had closed on April 1, 2018. These adjustments reduced the ratios of Proportionate Debt to Adjusted EBITDA and Proportionate Debt and Preferred Equity to Adjusted EBITDA by 0.7x. |

|

| | | | | | | | | | | | | | | | | | | |

| Supplemental Schedule 5(b) |

| | | | | | | | | | | | |

| Capitalization and Financial Metrics | | | | | | |

| As of June 30, 2018 | | | | | |

| (share, unit and dollar amounts in thousands) (unaudited) | | | | |

| | | | | | | | | | | | |

| Aimco Share Non-Recourse Property Debt |

| | | | Amortization | | Maturities | | Total | | Maturities as a Percent of Total | | Average Rate on Maturing Debt |

| 2018 3Q | | $ | 20,464 |

| | $ | — |

| | $ | 20,464 |

| | — | % | | — | % |

| 2018 4Q | | 21,326 |

| | 6,649 |

| | 27,975 |

| | 0.18 | % | | 3.58 | % |

| Total 2018 | | 41,790 |

| | 6,649 |

| | 48,439 |

| | 0.18 | % | | 3.58 | % |

| | | | | | | | | | | | |

| 2019 1Q | | 21,351 |

| | 54,103 |

| | 75,454 |

| | 1.46 | % | | 4.56 | % |

| 2019 2Q | | 20,355 |

| | 212,577 |

| | 232,932 |

| | 5.74 | % | | 5.77 | % |

| 2019 3Q | | 18,968 |

| | 213,437 |

| | 232,405 |

| | 5.77 | % | | 5.74 | % |

| 2019 4Q | | 19,226 |

| | — |

| | 19,226 |

| | — | % | | — | % |

| Total 2019 | | 79,900 |

| | 480,117 |

| | 560,017 |

| | 12.97 | % | | 5.62 | % |

| | | | | | | | | | | | |

| 2020 | | 74,757 |

| | 330,951 |

| | 405,708 |

| | 8.94 | % | | 5.40 | % |

| 2021 | | 57,140 |

| | 605,139 |

| [1] | 662,279 |

| | 16.35 | % | | 5.39 | % |

| 2022 | | 50,230 |

| | 286,715 |

| | 336,945 |

| | 7.75 | % | | 4.84 | % |

| 2023 | | 39,466 |

| | 282,156 |

| | 321,622 |

| | 7.62 | % | | 4.05 | % |

| 2024 | | 34,290 |

| | 252,191 |

| | 286,481 |

| | 6.82 | % | | 3.39 | % |

| 2025 | | 28,325 |

| | 187,447 |

| | 215,772 |

| | 5.07 | % | | 3.53 | % |

| 2026 | | 23,166 |

| | 155,571 |

| | 178,737 |

| | 4.20 | % | | 3.34 | % |

| 2027 | | 15,132 |

| | 215,557 |

| | 230,689 |

| | 5.83 | % | | 3.37 | % |

| Thereafter | | 249,863 |

| | 203,866 |

| | 453,729 |

| | 5.51 | % | | 3.45 | % |

| Total | | $ | 694,059 |

| | $ | 3,006,359 |

| | $ | 3,700,418 |

| | | | |

| Securitization Trust Assets | | | | 100,852 |

| [1] | | | |

| Aimco share non-recourse property debt | | $ | 3,801,270 |

| | | | |

| | | | | | | | | | | | |

|

| | | | | | | | | | | | |

| Preferred Equity | | | | | | | | |

| | | | | | | | | |

| | | Shares/Units Outstanding as of June 30, 2018 | | Date First Available for Redemption by Aimco | | Coupon | | Amount |

| Class A Perpetual Preferred Stock | | 5,000 |

| | 5/17/2019 | | 6.875 | % | | $ | 125,000 |

|

| | | | | | | | | |

| Preferred Partnership Units | | 3,814 |

| | | | 7.635 | % | | 101,332 |

|

| Total Preferred Equity | | | | | | 7.215 | % | | $ | 226,332 |

|

|

| | | |

| Common Stock, Partnership Units and Equivalents |

| | | |

| | As of | |

| | June 30, 2018 | |

| Class A Common Stock outstanding | 156,698 |

| |

| Participating unvested restricted stock | 262 |

| |

| Dilutive options, share equivalents and non-participating unvested restricted stock | 173 |

| |

| Total shares and dilutive share equivalents | 157,133 |

| |

| Common Partnership Units and equivalents | 8,337 |

| [2] |

| Total shares, units and dilutive share equivalents | 165,470 |

| |

|

| | | | | | | | | | | |

| [1] | The securitized property loans mature in 2021, and will repay Aimco’s subordinate positions in the securitization trust, which reduces Aimco’s 2021 refunding requirements from $706.0 million to $605.1 million, or 16.4% of total non-recourse property debt outstanding at June 30, 2018. |

| [2] | Year-to-date, Aimco has repurchased 1.8 million Common Partnership Units for $7.6 million, a 20% discount to Aimco’s net asset value. |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Supplemental Schedule 6(a) |

| |

| Same Store Operating Results |

| Three Months Ended June 30, 2018 Compared to Three Months Ended June 30, 2017 |

| (proportionate amounts, in thousands, except community, home and per home data) (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Revenues, Before Utility Reimbursements [1] | | Expenses, Net of Utility Reimbursements [1] | | Net Operating Income | | | Net Operating Income

Margin | | Average Daily

Occupancy

During Period | | Average Revenue per Aimco Apartment Home |

| | | Apartment Communities | Apartment Homes | Aimco Share of Apartment Homes | | 2Q

2018 | 2Q

2017 | Growth | | 2Q

2018 | 2Q

2017 | Growth | | 2Q

2018 | 2Q

2017 | Growth | | | 2Q

2018 | | 2Q

2018 | 2Q

2017 | | 2Q

2018 | 2Q

2017 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Atlanta | | 5 | 817 |

| 817 |