Exhibit (c)(7)

Exhibit (c)(7)

AIMCO

AIMCO Properties, L.P.

Fairness Analysis

November 15, 2011

Duff & Phelps Disclaimer

The following pages contain material that was provided by Duff & Phelps, LLC (“Duff & Phelps”) to the Boards (as herein defined) to consider the Proposed Transactions, as herein defined.

The accompanying material was compiled on a confidential basis for the sole use of the Boards and not with a view toward public disclosure.

The information utilized in preparing this document was obtained from AIMCO OP (as herein defined) and public sources. Any estimates and projections contained herein have been prepared by the senior management of AIMCO OP and involve numerous and significant subjective determinations, which may or may not prove to be correct. No representation or warranty, expressed or implied, is made as to the accuracy or completeness of such information and nothing contained herein is, or shall be relied upon as, a representation, whether as to the past or the future. Duff & Phelps did not attempt to independently verify such information.

Because this material was prepared for use in the context of an oral presentation to the Boards, who are familiar with the business and affairs of AIMCO OP, Duff & Phelps does not take any responsibility for the accuracy or completeness of any of the material if used by persons other than those listed above.

These materials are not intended to represent an opinion but rather to serve as discussion materials for the Boards to review and as a basis upon which Duff & Phelps may render opinions.

An opinion: (i) does not address the merits of the underlying business decision to enter into the Proposed Transactions versus any alternative strategy or transaction; (ii) does not address any transaction related to each Proposed Transaction; (iii) is not a recommendation as to how any party should vote or act with respect to any matters relating to each Proposed Transaction or any related transactions, or whether to proceed with the Proposed Transactions or any related transaction, and (iv) would not create any fiduciary duty on Duff & Phelps’ part to any party.

Duff & Phelps—Confidential 2

Table of Contents

I. Introduction and Background

Valuation Analysis

– Angeles Income Properties, Ltd. 6

– Angeles Partners XII

– Consolidated Capital Institutional Properties/2 LP—Series A

– Consolidated Capital Institutional Properties/3 LP

– Consolidated Capital Properties IV LP

Appendix

Assumptions, Qualifications and Limiting Conditions

Property Value Allocation Waterfalls

Apartment Investment & Management Co. Trading History

Duff & Phelps—Confidential 3

I. Introduction and Background

Introduction and Background

The Engagement

AIMCO Properties, L.P. (the “AIMCO OP”) has engaged Duff & Phelps, LLC (“Duff & Phelps”) to serve as an independent financial advisor to AIMCO-GP, Inc., the general partner (the “General Partner”) of AIMCO OP (solely in its capacity as such), the board of directors of the General Partner (the “GP Board”), the board of directors of Apartment Investment and Management Company (“AIMCO”), the parent of the General Partner, (the “AIMCO Board”), and the boards of directors (or other managing body) of the Partnerships (as defined herein) and the general partners of the Partnerships being collectively referred to herein as the “LP GP” and the boards of directors (or other managing body) of the LP GP being collectively referred to herein as the “LP GP Board”, and collectively with the General Partner, the GP Board, the AIMCO Board, and the LP GP Board, the “Boards”), to provide an opinion (the “Opinion”) as to the fairness, from a financial point of view, to the limited partners of the Partnerships not affiliated with AIMCO OP (the “Unaffiliated Limited Partners”) of the consideration to be offered by AIMCO OP in each Proposed Transaction (defined below) (without giving effect to any impact of each Proposed Transaction on any particular Unaffiliated Limited Partner other than in its capacity as an Unaffiliated Limited Partner).

The Proposed Transaction

The proposed transaction (the “Proposed Transaction”) for each of the Partnerships (collectively, the “Proposed Transactions”) generally involves the a merger of a wholly owned subsidiary of AIMCO OP into the Partnership, in most cases following the conversion of the Partnership to a new Delaware limited partnership (each a “New Partnership”), in which each unit of limited partnership interest in a Partnership or New Partnership held by the Unaffiliated Limited Partners will be converted into the right to receive, at the election of such Unaffiliated Limited Partner, either (a) cash (the “Cash Consideration”) or (b) a number of partnership common units of AIMCO OP (“OP Units”) equal to the Cash Consideration divided by the average closing price of common stock of AIMCO over the ten consecutive days ending on the second trading day immediately prior to the consummation of the merger, except in those jurisdictions where the law prohibits the offer of OP Units (or registration or qualification would be prohibitively costly) (such cash and OP Units being the “Transaction Consideration”).

Duff & Phelps will opine as to the fairness, from a financial point of view, to the Unaffiliated Limited Partners of each of the Partnerships of the consideration to be offered by AIMCO OP in the Proposed Transactions relating to that Partnership (without giving effect to any impact of the Proposed Transactions on any particular Unaffiliated Limited Partner other than in its capacity as an Unaffiliated Limited Partner).

The OP Units are not listed on any securities exchange nor do they trade in an active secondary market. However, after a one-year holding period, OP Units are redeemable for shares of AIMCO common stock (on a one-for-one basis) or cash equal to the value of such shares, as AIMCO elects. AIMCO’s common stock is listed and traded on the NYSE under the symbol “AIV”.

Duff & Phelps—Confidential 5

Introduction and Background

Scope of Analysis

In connection with our analysis, Duff & Phelps has made such reviews, analyses and inquiries as we have deemed necessary and appropriate under the circumstances.

Reviewed the following documents:

– Reviewed each Partnership’s property level internal unaudited financial statements for the nine months ended September 30, 2011 and the Partnership’s property level unaudited annual financial statements for each of the three fiscal years ended December 31, 2010;

– Reviewed other internal documents relating to the history, current operations, and probable future outlook of the Partnership, including financial projections, provided to Duff & Phelps by management of AIMCO OP; and

– Reviewed documents related to the Proposed Transactions, including certain portions of drafts of the Information Statements/Prospectuses relating to the Proposed Transactions and certain portions of the exhibits and annexes thereto (collectively, the “Prospectuses”), and drafts of each Amended and Restated Agreement and Plan of Conversion and Merger or Amended and Restated Agreement and Plan of Merger, as applicable, relating to the Proposed Transactions (such drafts, the “Agreements”), and certain other documents related to the Proposed Transactions.

Reviewed the following information and/or documents related to the real estate holdings of the Partnership:

– Reviewed previously completed appraisal reports associated with the property or properties, as applicable, owned by the Partnership (such property or properties referred to herein as the “Properties”) prepared by KTR Real Estate Advisors LLC and/or Cogent Realty Advisors, LLC as of October 1, 2011 (each an “Appraisal”) and provided to Duff & Phelps by management of AIMCO OP;

– Reviewed facts and circumstances related to each Property to understand factors relevant to the Appraisal;

– Performed a site visit of certain Properties; and

– Reviewed market data for each of the subject markets and assessed current supply and demand trends.

Duff & Phelps—Confidential 6

Introduction and Background

Scope of Analysis (Continued)

Reviewed the following information and/or documents related to the Properties:

– Reviewed operating statements and balance sheets for the twelve month periods ending December 31, 2008, 2009, and 2010;

– Reviewed the year-to-date operating statement and balance sheet for the nine month period ending September 30, 2011;

– Reviewed budgeted financial statements for the twelve month period ending December 31, 2011;

– Reviewed rent rolls prepared as of September 2011; and

– Discussed the information referred to above and the background and other elements of the Proposed Transactions with the management of AIMCO OP.

Conducted such other analyses and considered such other factors as Duff & Phelps deemed appropriate.

Duff & Phelps—Confidential 7

Introduction and Overview

Overall Portfolio Summary

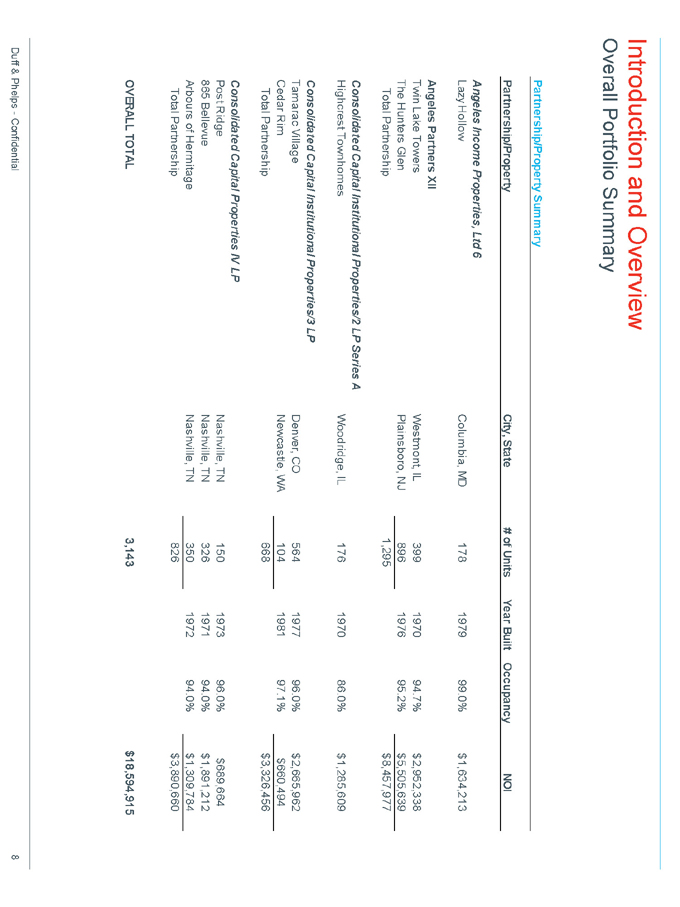

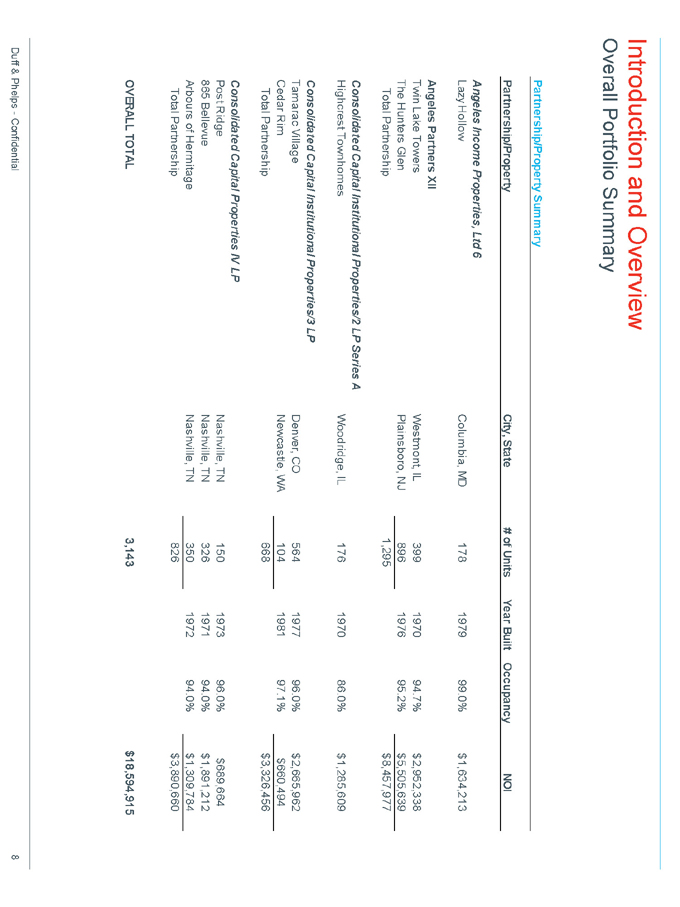

Partnership/Property Summary

Partnership/Property City, State # of Units Year Built Occupancy NOI

Angeles Income Properties, Ltd 6

Lazy Hollow Columbia, MD 178 1979 99.0% $1,634,213

Angeles Partners XII

Twin Lake Towers Westmont, IL 399 1970 94.7% $2,952,338

The Hunters Glen Plainsboro, NJ 896 1976 95.2% $5,505,639

Total Partnership 1,295 $8,457,977

Consolidated Capital Institutional Properties/2 LP Series A

Highcrest Townhomes Woodridge, IL 176 1970 86.0% $1,285,609

Consolidated Capital Institutional Properties/3 LP

Tamarac Village Denver, CO 564 1977 96.0% $2,665,962

Cedar Rim Newcastle, WA 104 1981 97.1% $660,494

Total Partnership 668 $3,326,456

Consolidated Capital Properties IV LP

Post Ridge Nashville, TN 150 1973 96.0% $689,664

865 Bellevue Nashville, TN 326 1971 94.0% $1,891,212

Arbours of Hermitage Nashville, TN 350 1972 94.0% $1,309,784

Total Partnership 826 $3,890,660

OVERALL TOTAL 3,143 $18,594,915

Duff & Phelps—Confidential 8

Introduction and Background

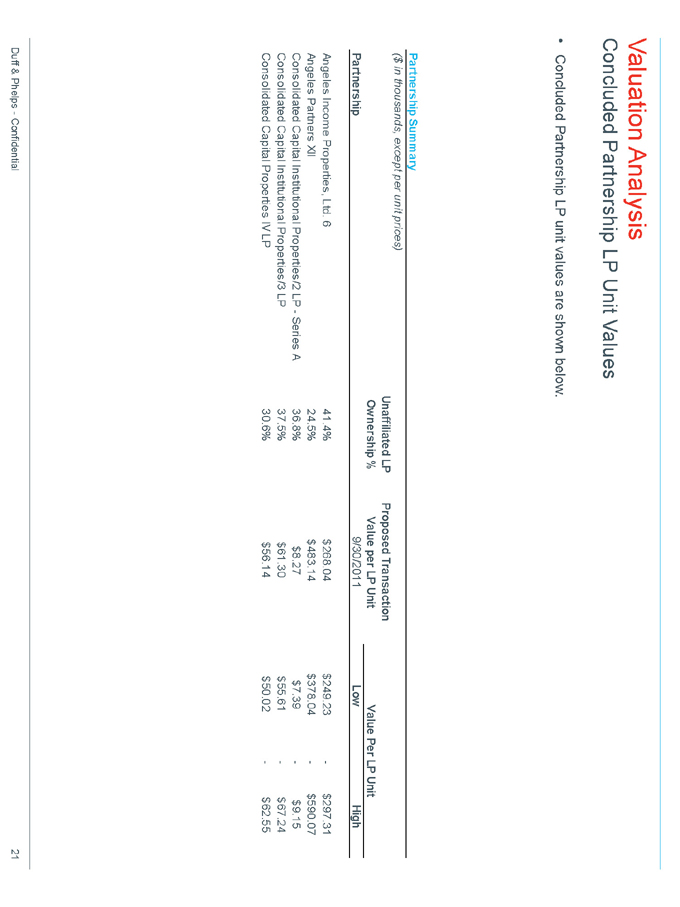

Concluded Partnership LP Unit Values

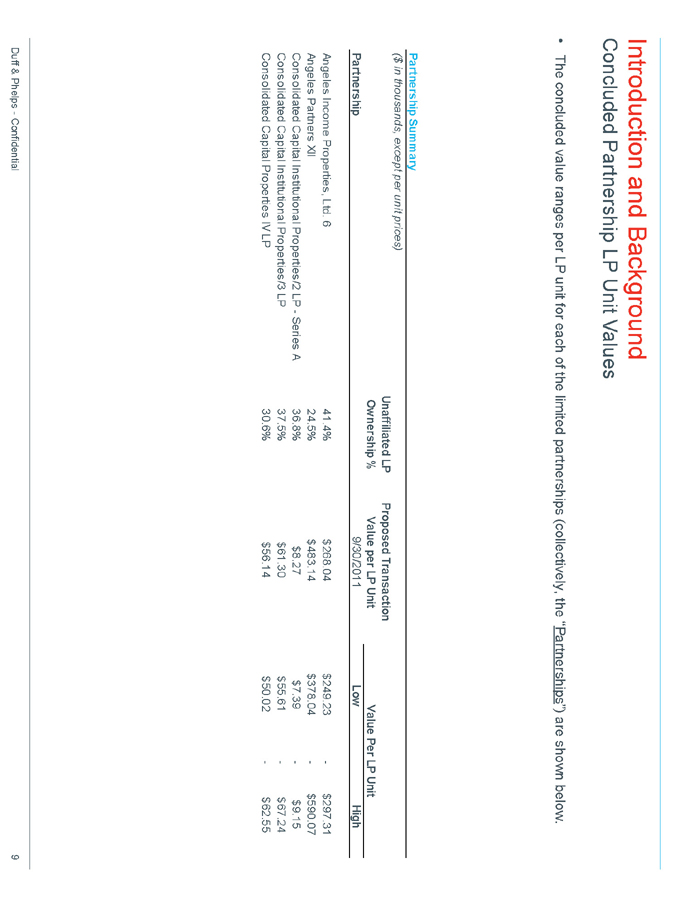

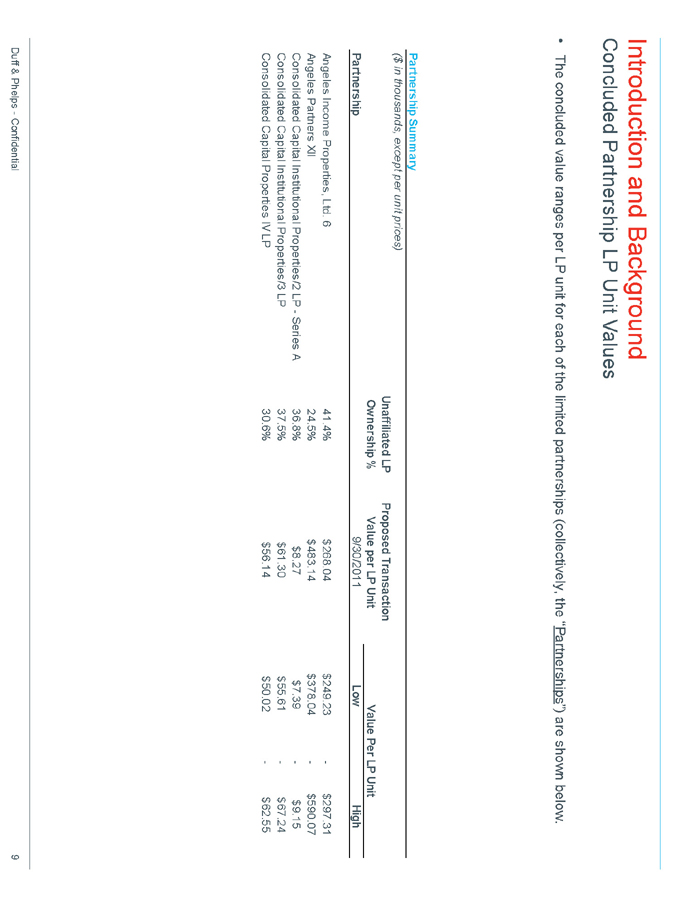

• The concluded value ranges per LP unit for each of the limited partnerships (collectively, the “Partnerships”) are shown below.

Partnership Summary

($ in thousands, except per unit prices)

Unaffiliated LP Proposed Transaction

Ownership % Value per LP Unit Value Per LP Unit

Partnership 9/30/2011 Low High

Angeles Income Properties, Ltd. 6 41.4% $268.04 $249.23—$297.31

Angeles Partners XII 24.5% $483.14 $378.04—$590.07

Consolidated Capital Institutional Properties/2 LP—Series A 36.8% $8.27 $7.39—$9.15

Consolidated Capital Institutional Properties/3 LP 37.5% $61.30 $55.61—$67.24

Consolidated Capital Properties IV LP 30.6% $56.14 $50.02—$62.55

Duff & Phelps—Confidential 9

II. Valuation Analysis

Valuation Analysis

Key Assumptions and Methodology

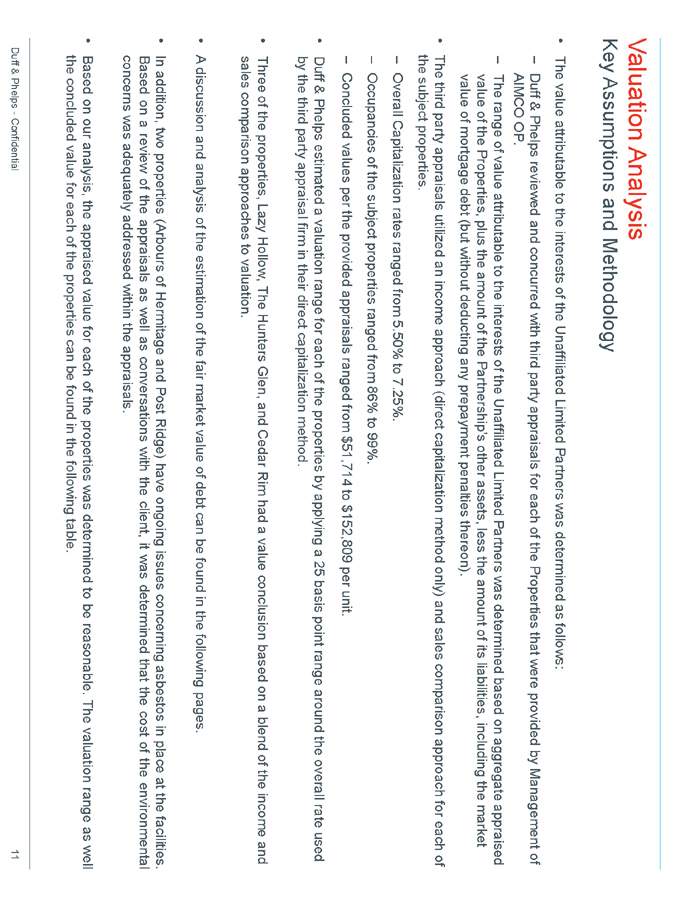

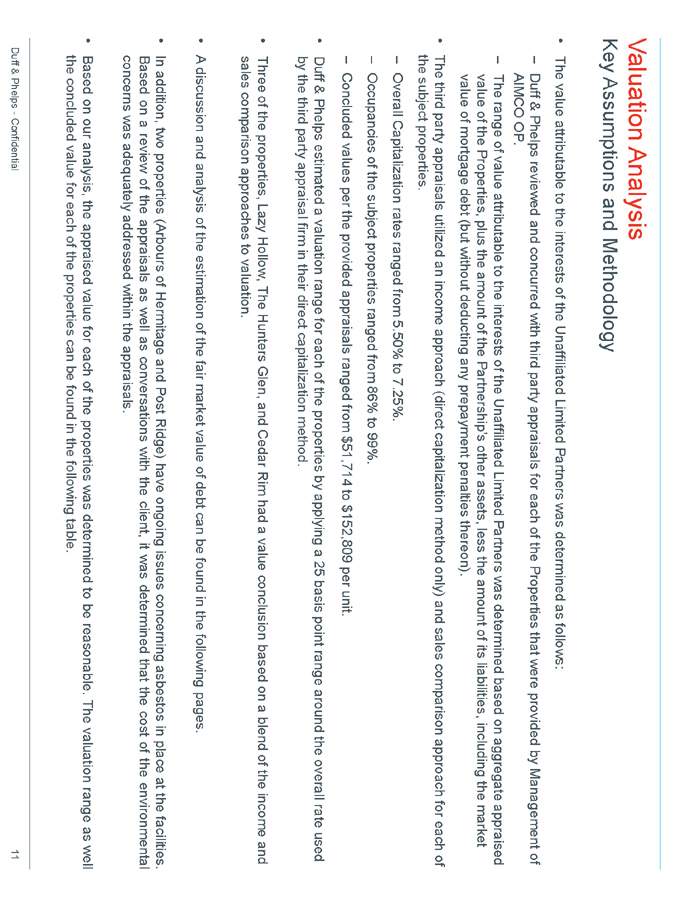

The value attributable to the interests of the Unaffiliated Limited Partners was determined as follows:

– Duff & Phelps reviewed and concurred with third party appraisals for each of the Properties that were provided by Management of AIMCO OP.

– The range of value attributable to the interests of the Unaffiliated Limited Partners was determined based on aggregate appraised value of the Properties, plus the amount of the Partnership’s other assets, less the amount of its liabilities, including the market value of mortgage debt (but without deducting any prepayment penalties thereon).

The third party appraisals utilized an income approach (direct capitalization method only) and sales comparison approach for each of the subject properties.

– Overall Capitalization rates ranged from 5.50% to 7.25%.

– Occupancies of the subject properties ranged from 86% to 99%.

– Concluded values per the provided appraisals ranged from $51,714 to $152,809 per unit.

Duff & Phelps estimated a valuation range for each of the properties by applying a 25 basis point range around the overall rate used by the third party appraisal firm in their direct capitalization method.

Three of the properties, Lazy Hollow, The Hunters Glen, and Cedar Rim had a value conclusion based on a blend of the income and sales comparison approaches to valuation.

A discussion and analysis of the estimation of the fair market value of debt can be found in the following pages.

In addition, two properties (Arbours of Hermitage and Post Ridge) have ongoing issues concerning asbestos in place at the facilities. Based on a review of the appraisals as well as conversations with the client, it was determined that the cost of the environmental concerns was adequately addressed within the appraisals.

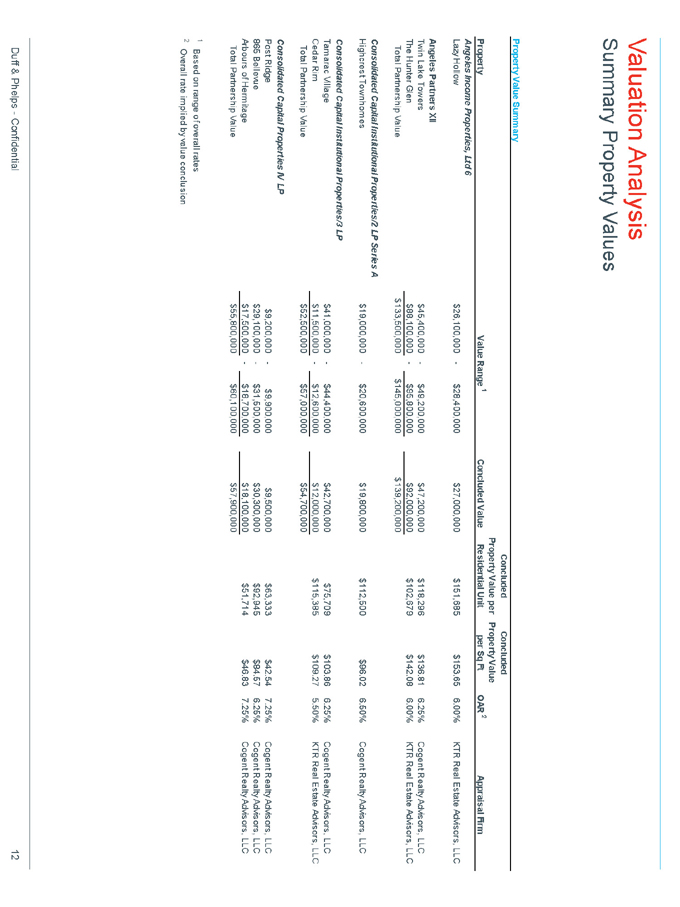

Based on our analysis, the appraised value for each of the properties was determined to be reasonable. The valuation range as well the concluded value for each of the properties can be found in the following table.

Duff & Phelps—Confidential 11

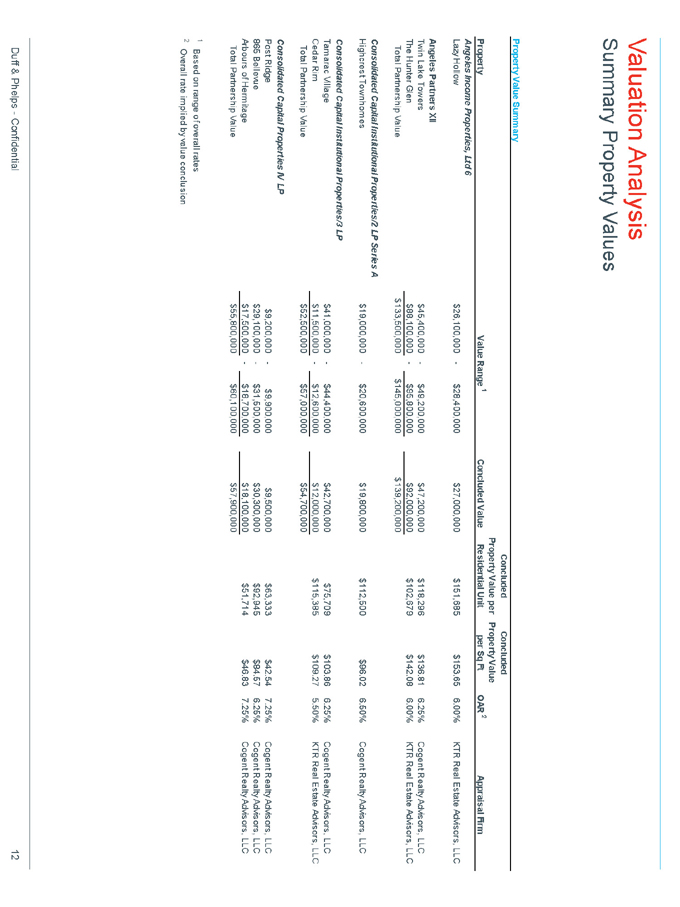

Valuation Analysis

Summary Property Values

Property Value Summary

Concluded Concluded

Property Value per Property Value

Property Value Range 1 Concluded Value Residential Unit per Sq Ft OAR 2 Appraisal Firm

Angeles Income Properties, Ltd 6

Lazy Hollow $26,100,000—$28,400,000 $27,000,000 $151,685 $153.65 6.00% KTR Real Estate Advisors, LLC

Angeles Partners XII

Twin Lake Towers $45,400,000—$49,200,000 $47,200,000 $118,296 $136.81 6.25% Cogent Realty Advisors, LLC

The Hunter Glen $88,100,000—$95,800,000 $92,000,000 $102,679 $142.08 6.00% KTR Real Estate Advisors, LLC

Total Partnership Value $133,500,000 $145,000,000 $139,200,000

Consolidated Capital Institutional Properties/2 LP Series A

Highcrest Townhomes $19,000,000—$20,600,000 $19,800,000 $112,500 $96.02 6.50% Cogent Realty Advisors, LLC

Consolidated Capital Institutional Properties/3 LP

Tamarac Village $41,000,000—$44,400,000 $42,700,000 $75,709 $103.86 6.25% Cogent Realty Advisors, LLC

Cedar Rim $11,500,000—$12,600,000 $12,000,000 $115,385 $109.27 5.50% KTR Real Estate Advisors, LLC

Total Partnership Value $52,500,000 $57,000,000 $54,700,000

Consolidated Capital Properties IV LP

Post Ridge $9,200,000—$9,900,000 $9,500,000 $63,333 $42.54 7.25% Cogent Realty Advisors, LLC

865 Bellevue $29,100,000—$31,500,000 $30,300,000 $92,945 $84.57 6.25% Cogent Realty Advisors, LLC

Arbours of Hermitage $17,500,000—$18,700,000 $18,100,000 $51,714 $46.83 7.25% Cogent Realty Advisors, LLC

Total Partnership Value $55,800,000 $60,100,000 $57,900,000

1 | | Based on range of overall rates |

2 | | Overall rate implied by value conclusion |

Duff & Phelps—Confidential 12

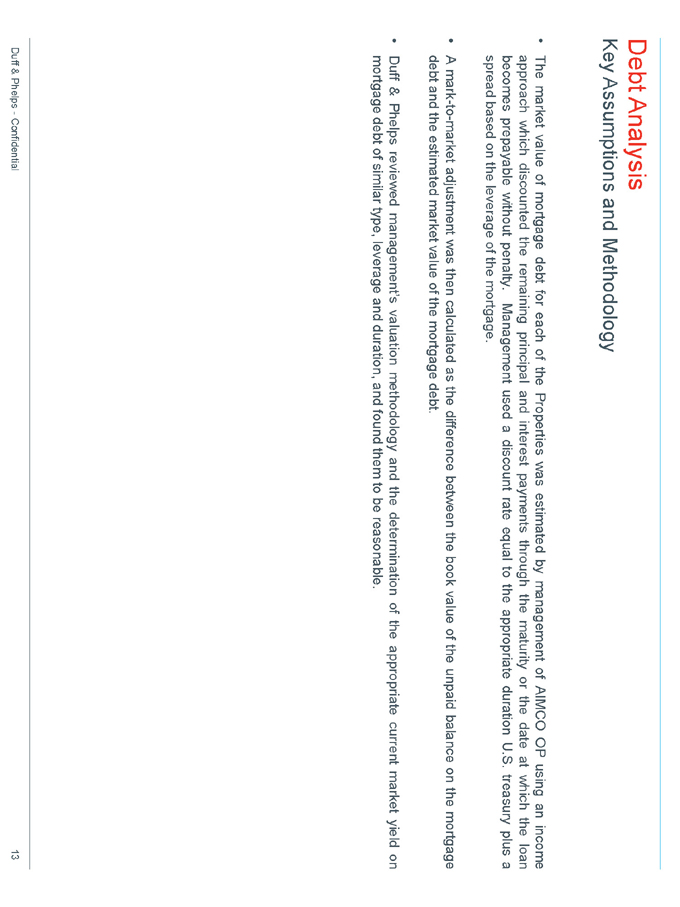

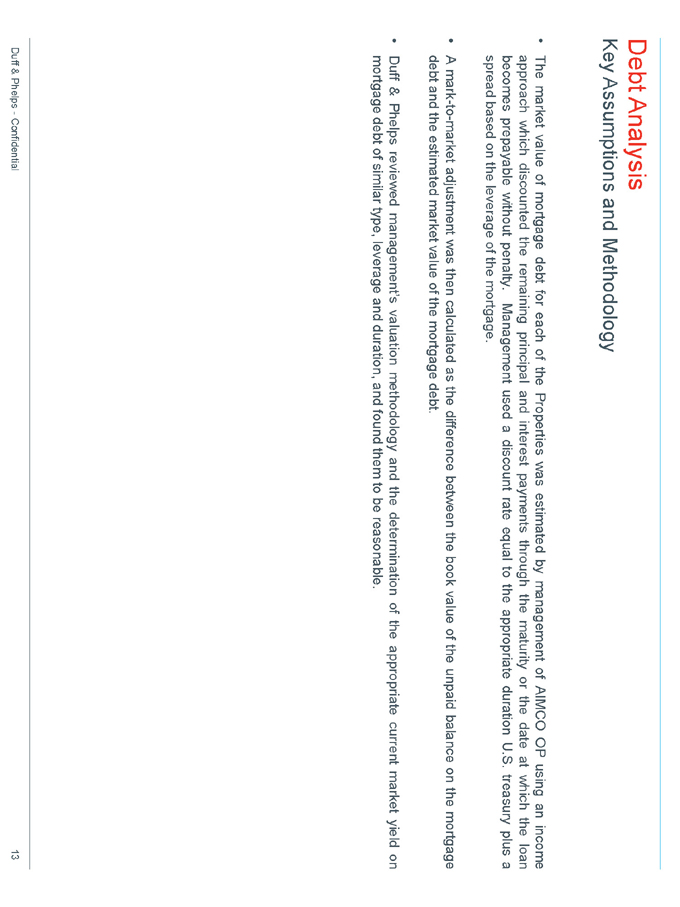

Debt Analysis

Key Assumptions and Methodology

The market value of mortgage debt for each of the Properties was estimated by management of AIMCO OP using an income approach which discounted the remaining principal and interest payments through the maturity or the date at which the loan becomes prepayable without penalty. Management used a discount rate equal to the appropriate duration U.S. treasury plus a spread based on the leverage of the mortgage.

A mark-to-market adjustment was then calculated as the difference between the book value of the unpaid balance on the mortgage debt and the estimated market value of the mortgage debt.

Duff & Phelps reviewed management’s valuation methodology and the determination of the appropriate current market yield on mortgage debt of similar type, leverage and duration, and found them to be reasonable.

Duff & Phelps—Confidential 13

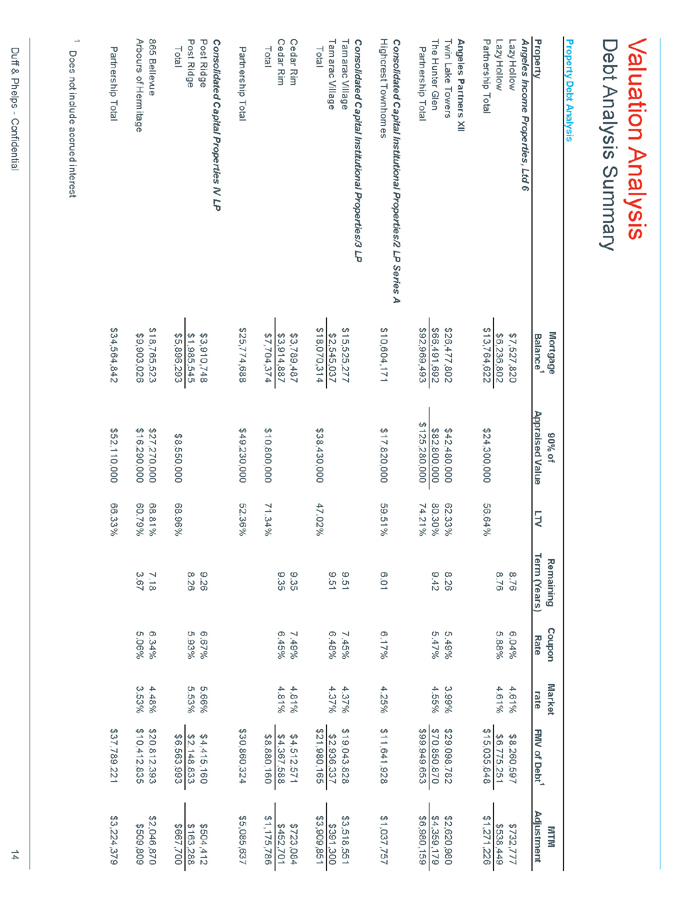

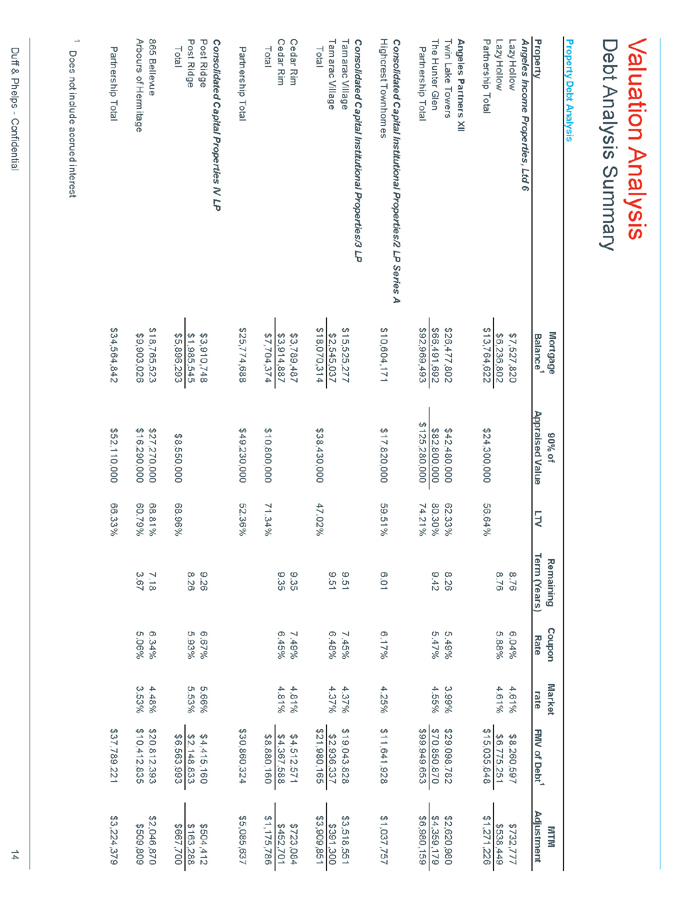

Valuation Analysis

Debt Analysis Summary

Property Debt Analysis

Mortgage 90% of Remaining Coupon Market MTM

Property Balance1 Appraised Value LTV Term (Years) Rate rate FMV of Debt1 Adjustment

Angeles Income Properties, Ltd 6

Lazy Hollow $7,527,820 8.76 6.04% 4.61% $8,260,597 $732,777

Lazy Hollow $6,236,802 8.76 5.88% 4.61% $6,775,251 $538,449

Partnership Total $13,764,622 $24,300,000 56.64% $15,035,848 $1,271,226

Angeles Partners XII

Twin Lake Towers $26,477,802 $42,480,000 62.33% 8.26 5.49% 3.99% $29,098,782 $2,620,980

The Hunter Glen $66,491,692 $82,800,000 80.30% 9.42 5.47% 4.55% $70,850,870 $4,359,179

Partnership Total $92,969,493 $125,280,000 74.21% $99,949,653 $6,980,159

Consolidated Capital Institutional Properties/2 LP Series A

Highcrest Townhomes $10,604,171 $17,820,000 59.51% 6.01 6.17% 4.25% $11,641,928 $1,037,757

Consolidated Capital Institutional Properties/3 LP

Tamarac Village $15,525,277 9.51 7.45% 4.37% $19,043,828 $3,518,551

Tamarac Village $2,545,037 9.51 6.48% 4.37% $2,936,337 $391,300

Total $18,070,314 $38,430,000 47.02% $21,980,165 $3,909,851

Cedar Rim $3,789,487 9.35 7.49% 4.81% $4,512,571 $723,084

Cedar Rim $3,914,887 9.35 6.45% 4.81% $4,367,588 $452,701

Total $7,704,374 $10,800,000 71.34% $8,880,160 $1,175,786

Partnership Total $25,774,688 $49,230,000 52.36% $30,860,324 $5,085,637

Consolidated Capital Properties IV LP

Post Ridge $3,910,748 9.26 6.67% 5.66% $4,415,160 $504,412

Post Ridge $1,985,545 8.26 5.93% 5.53% $2,148,833 $163,288

Total $5,896,293 $8,550,000 68.96% $6,563,993 $667,700

865 Bellevue $18,765,523 $27,270,000 68.81% 7.18 6.34% 4.48% $20,812,393 $2,046,870

Arbours of Hermitage $9,903,026 $16,290,000 60.79% 3.67 5.06% 3.53% $10,412,835 $509,809

Partnership Total $34,564,842 $52,110,000 66.33% $37,789,221 $3,224,379

1 | | Does not include accrued interest |

Duff & Phelps—Confidential 14

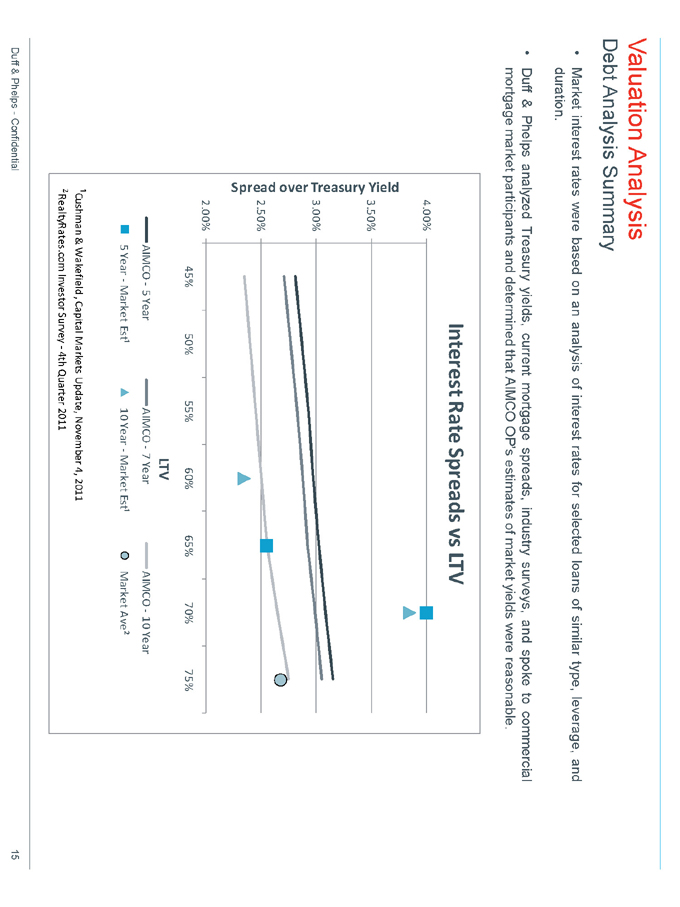

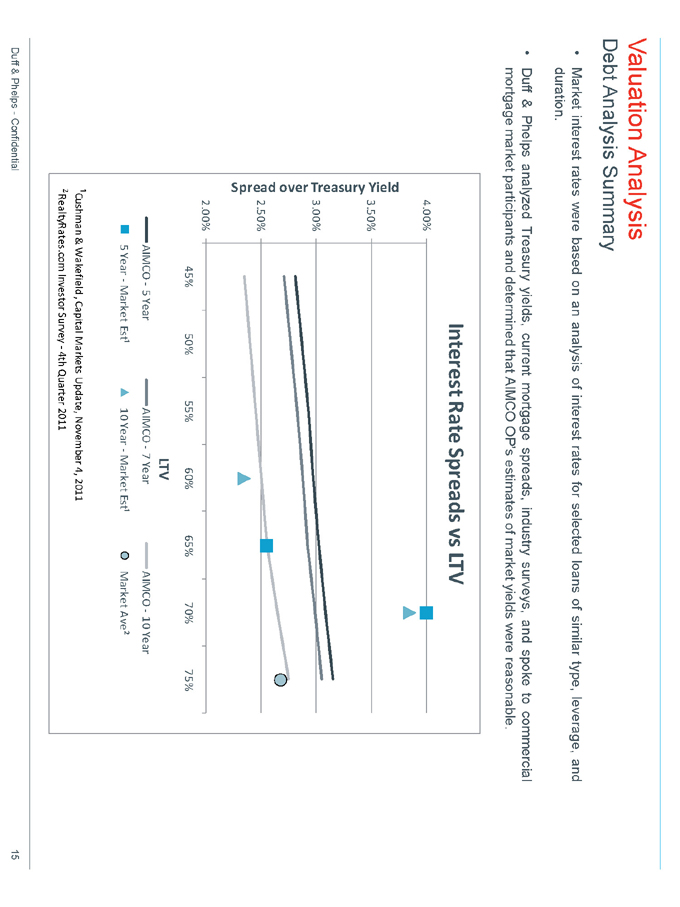

Valuation Analysis

Debt Analysis Summary

Market interest rates were based on an analysis of interest rates for selected loans of similar type, leverage, and duration.

Duff & Phelps analyzed Treasury yields, current mortgage spreads, industry surveys, and spoke to commercial mortgage market participants and determined that AIMCO OP’s estimates of market yields were reasonable.

Interest Rate Spreads vs LTV

Spread over Treasury Yield

4.00%

3.50%

3.00%

2.50%

2.00%

45% 50% 55% 60% 65% 70% 75%

LTV

AIMCO—5 Year AIMCO—7 Year AIMCO—10 Year

5 | | Year—Market Est¹ 10 Year—Market Est¹ Market Ave² |

¹Cushman & Wakefield , Capital Markets Update, November 4, 2011 ²RealtyRates.com Investor Survey—4th Quarter 2011

Duff & Phelps—Confidential 15

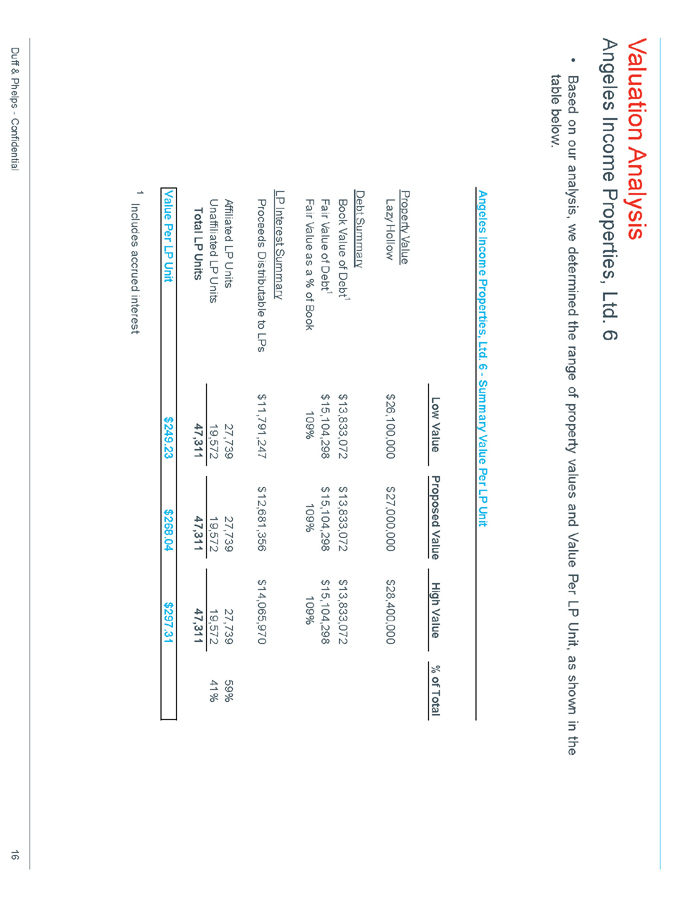

Valuation Analysis

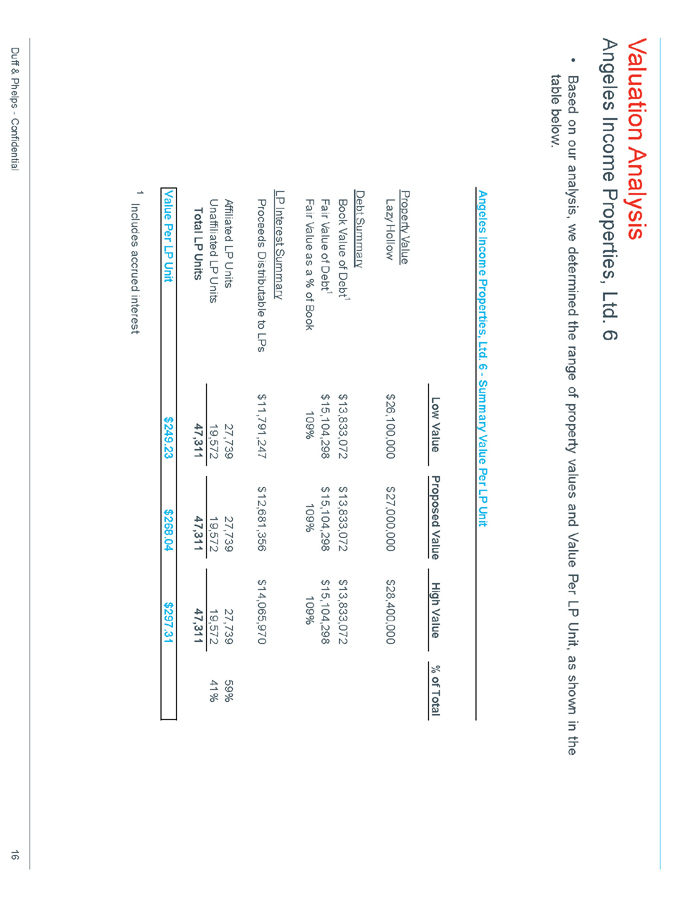

Angeles Income Properties, Ltd. 6

Based on our analysis, we determined the range of property values and Value Per LP Unit, as shown in the table below.

Angeles Income Properties, Ltd. 6—Summary Value Per LP Unit

Low Value Proposed Value High Value% of Total

Property Value

Lazy Hollow $26,100,000 $27,000,000 $28,400,000

Debt Summary

Book Value of Debt1 $13,833,072 $13,833,072 $13,833,072

Fair Value of Debt1 $15,104,298 $15,104,298 $15,104,298

Fair Value as a % of Book 109% 109% 109%

LP Interest Summary

Proceeds Distributable to LPs $11,791,247 $12,681,356 $14,065,970

Affiliated LP Units 27,739 27,739 27,739 59%

Unaffiliated LP Units 19,572 19,572 19,572 41%

Total LP Units 47,311 47,311 47,311

Value Per LP Unit $249.23 $268.04 $297.31

1 | | Includes accrued interest |

Duff & Phelps—Confidential 16

Valuation Analysis

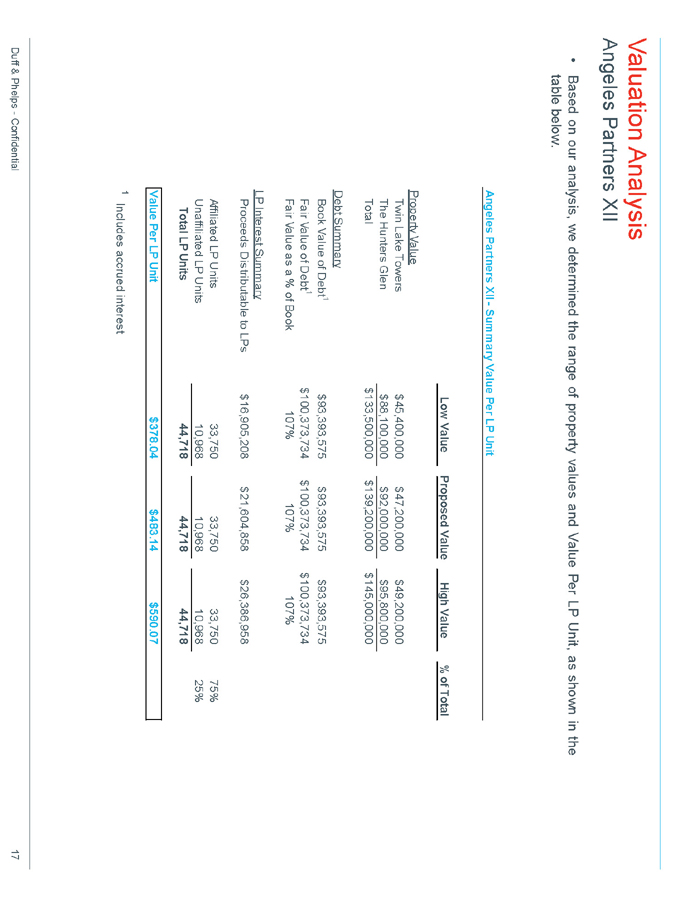

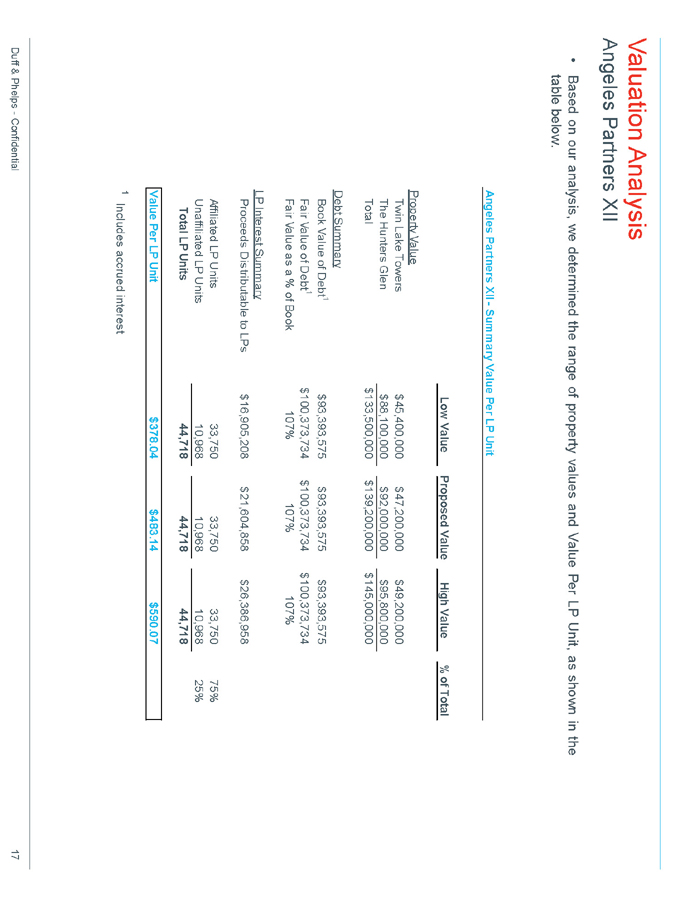

Angeles Partners XII

Based on our analysis, we determined the range of property values and Value Per LP Unit, as shown in the table below.

Angeles Partners XII—Summary Value Per LP Unit

Low Value Proposed Value High Value% of Total

Property Value

Twin Lake Towers $45,400,000 $47,200,000 $49,200,000

The Hunters Glen $88,100,000 $92,000,000 $95,800,000

Total $133,500,000 $139,200,000 $145,000,000

Debt Summary

Book Value of Debt1 $93,393,575 $93,393,575 $93,393,575

Fair Value of Debt1 $100,373,734 $100,373,734 $100,373,734

Fair Value as a % of Book 107% 107% 107%

LP Interest Summary

Proceeds Distributable to LPs $16,905,208 $21,604,858 $26,386,958

Affiliated LP Units 33,750 33,750 33,750 75%

Unaffiliated LP Units 10,968 10,968 10,968 25%

Total LP Units 44,718 44,718 44,718

Value Per LP Unit $378.04 $483.14 $590.07

1 | | Includes accrued interest |

Duff & Phelps—Confidential 17

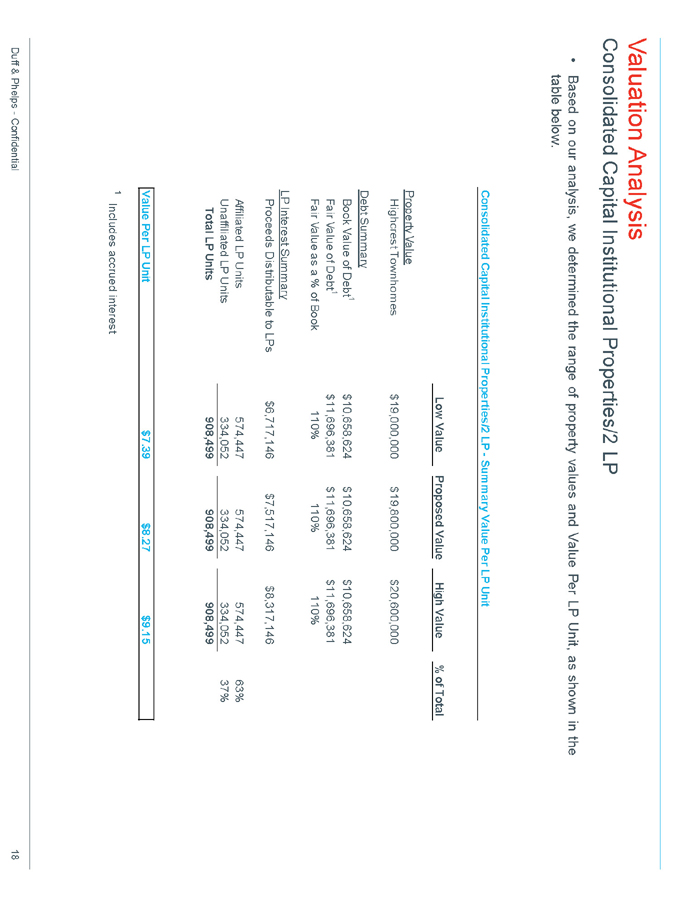

Valuation Analysis

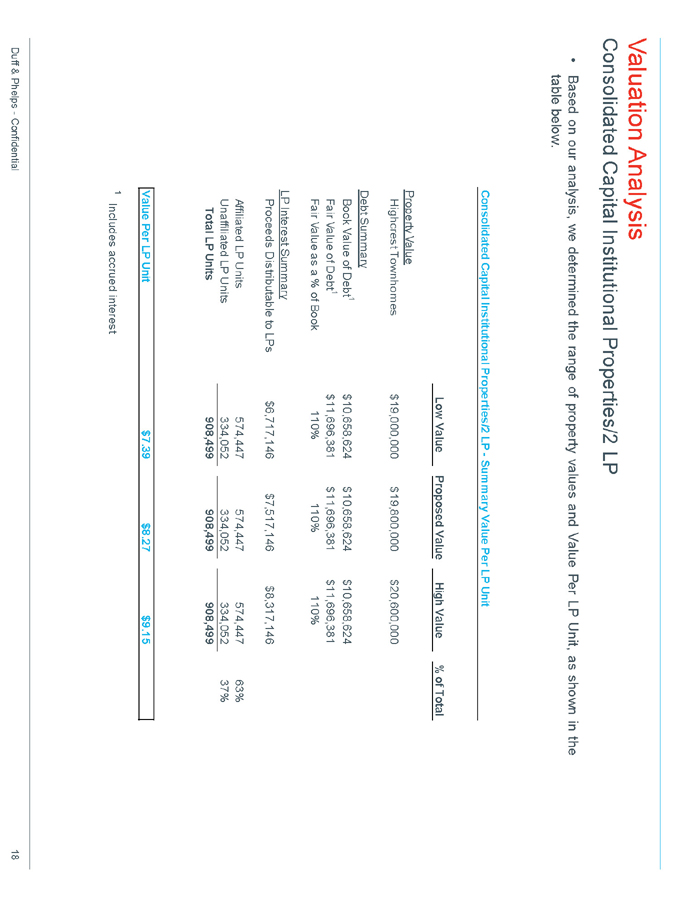

Consolidated Capital Institutional Properties/2 LP

Based on our analysis, we determined the range of property values and Value Per LP Unit, as shown in the table below.

Consolidated Capital Institutional Properties/2 LP—Summary Value Per LP Unit

Low Value Proposed Value High Value% of Total

Property Value

Highcrest Townhomes $19,000,000 $19,800,000 $20,600,000

Debt Summary

Book Value of Debt1 $10,658,624 $10,658,624 $10,658,624

Fair Value of Debt1 $11,696,381 $11,696,381 $11,696,381

Fair Value as a % of Book 110% 110% 110%

LP Interest Summary

Proceeds Distributable to LPs $6,717,146 $7,517,146 $8,317,146

Affiliated LP Units 574,447 574,447 574,447 63%

Unaffiliated LP Units 334,052 334,052 334,052 37%

Total LP Units 908,499 908,499 908,499

Value Per LP Unit $7.39 $8.27 $9.15

1 | | Includes accrued interest |

Duff & Phelps—Confidential 18

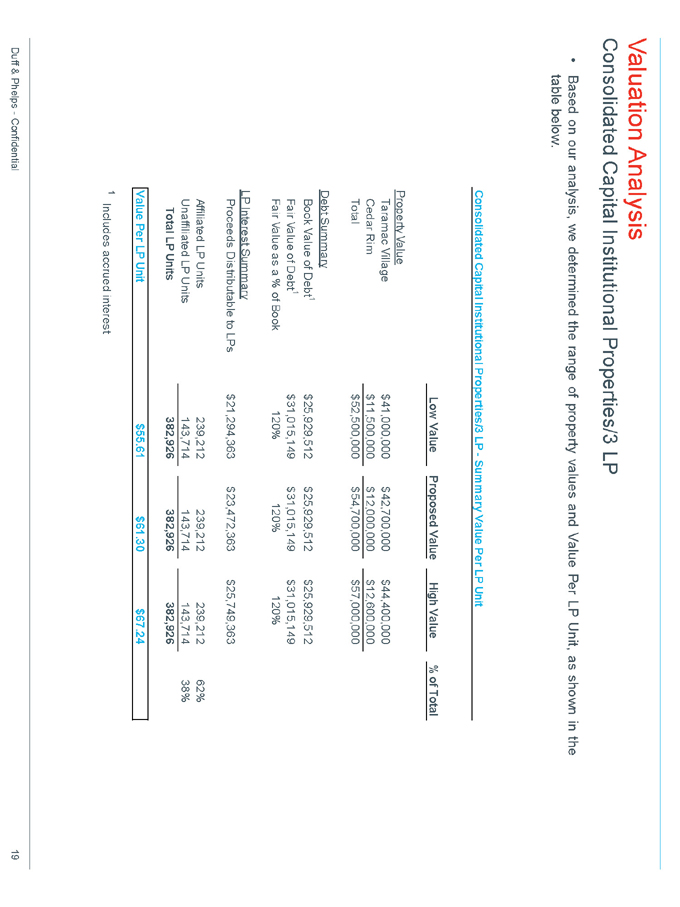

Valuation Analysis

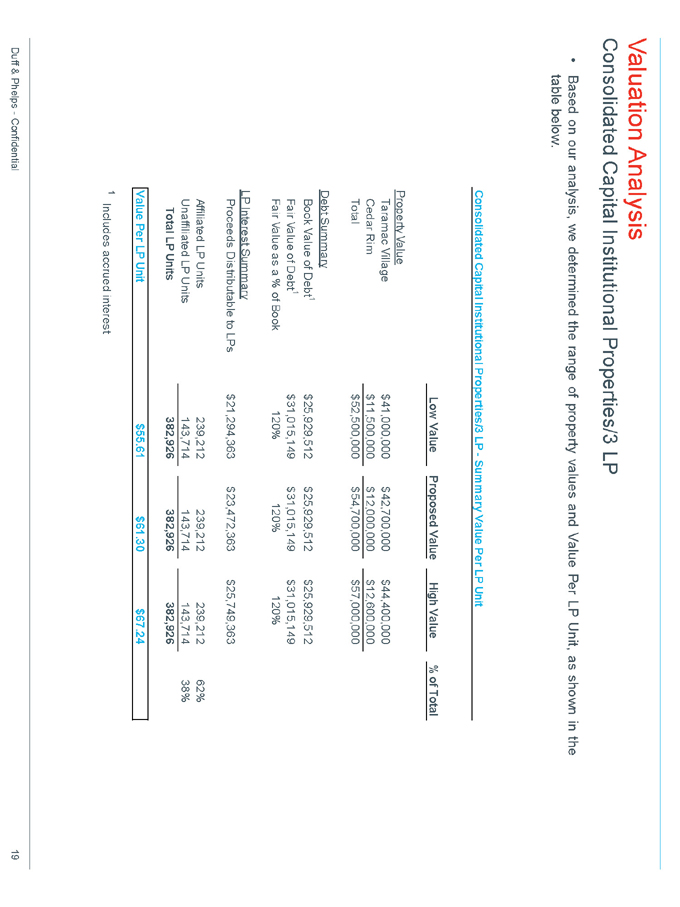

Consolidated Capital Institutional Properties/3 LP

Based on our analysis, we determined the range of property values and Value Per LP Unit, as shown in the table below.

Consolidated Capital Institutional Properties/3 LP—Summary Value Per LP Unit

Low Value Proposed Value High Value% of Total

Property Value

Taramac Village $41,000,000 $42,700,000 $44,400,000

Cedar Rim $11,500,000 $12,000,000 $12,600,000

Total $52,500,000 $54,700,000 $57,000,000

Debt Summary

Book Value of Debt1 $25,929,512 $25,929,512 $25,929,512

Fair Value of Debt1 $31,015,149 $31,015,149 $31,015,149

Fair Value as a % of Book 120% 120% 120%

LP Interest Summary

Proceeds Distributable to LPs $21,294,363 $23,472,363 $25,749,363

Affiliated LP Units 239,212 239,212 239,212 62%

Unaffiliated LP Units 143,714 143,714 143,714 38%

Total LP Units 382,926 382,926 382,926

Value Per LP Unit $55.61 $61.30 $67.24

1 | | Includes accrued interest |

Duff & Phelps—Confidential 19

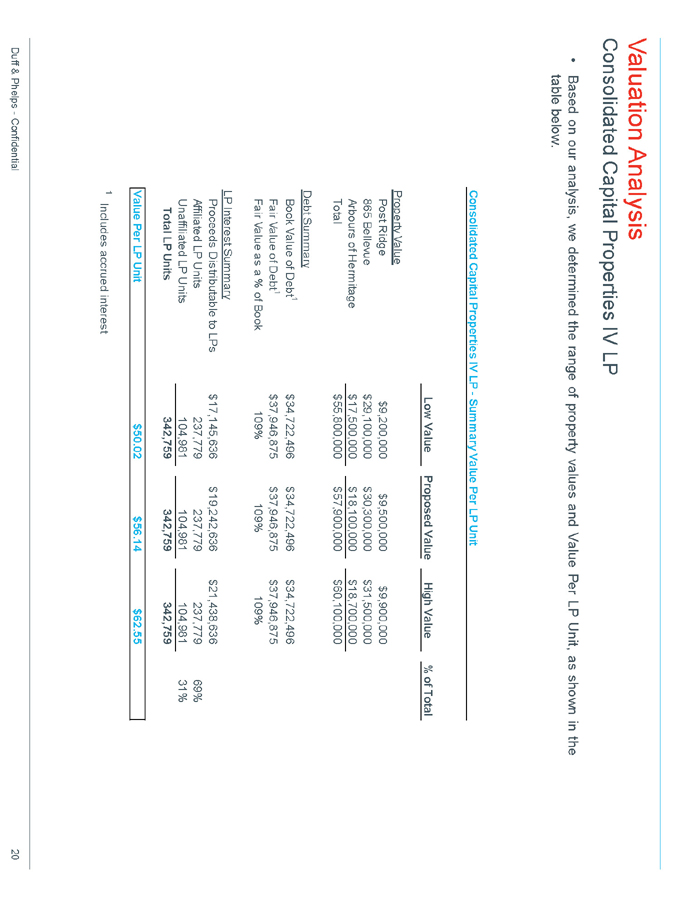

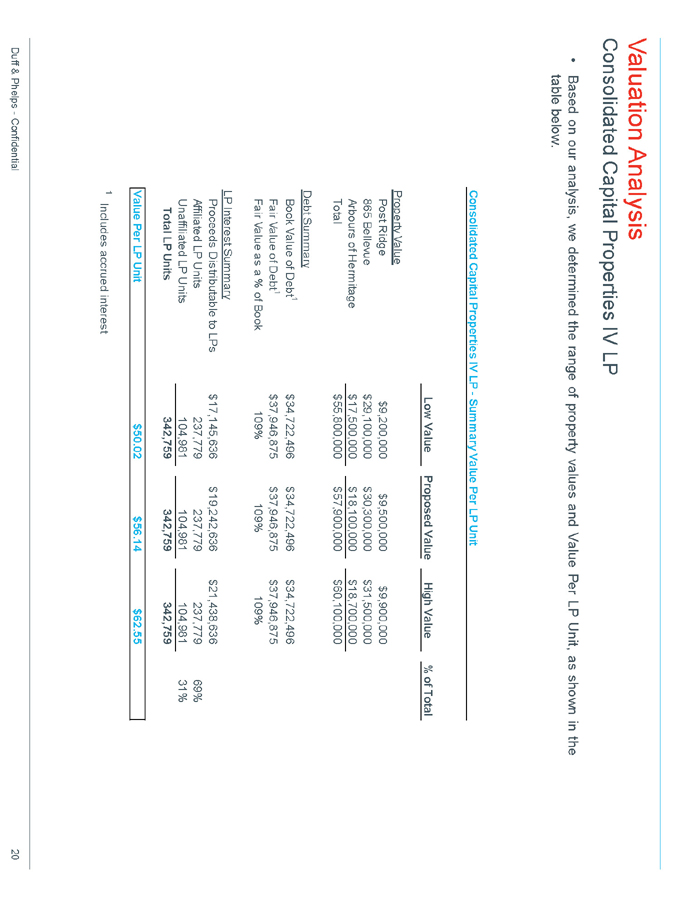

Valuation Analysis

Consolidated Capital Properties IV LP

Based on our analysis, we determined the range of property values and Value Per LP Unit, as shown in the table below.

Consolidated Capital Properties IV LP—Summary Value Per LP Unit

Low Value Proposed Value High Value% of Total

Property Value

Post Ridge $9,200,000 $9,500,000 $9,900,000

865 Bellevue $29,100,000 $30,300,000 $31,500,000

Arbours of Hermitage $17,500,000 $18,100,000 $18,700,000

Total $55,800,000 $57,900,000 $60,100,000

Debt Summary

Book Value of Debt1 $34,722,496 $34,722,496 $34,722,496

Fair Value of Debt1 $37,946,875 $37,946,875 $37,946,875

Fair Value as a % of Book 109% 109% 109%

LP Interest Summary

Proceeds Distributable to LPs $17,145,636 $19,242,636 $21,438,636

Affiliated LP Units 237,779 237,779 237,779 69%

Unaffiliated LP Units 104,981 104,981 104,981 31%

Total LP Units 342,759 342,759 342,759

Value Per LP Unit $50.02 $56.14 $62.55

1 | | Includes accrued interest |

Duff & Phelps—Confidential 20

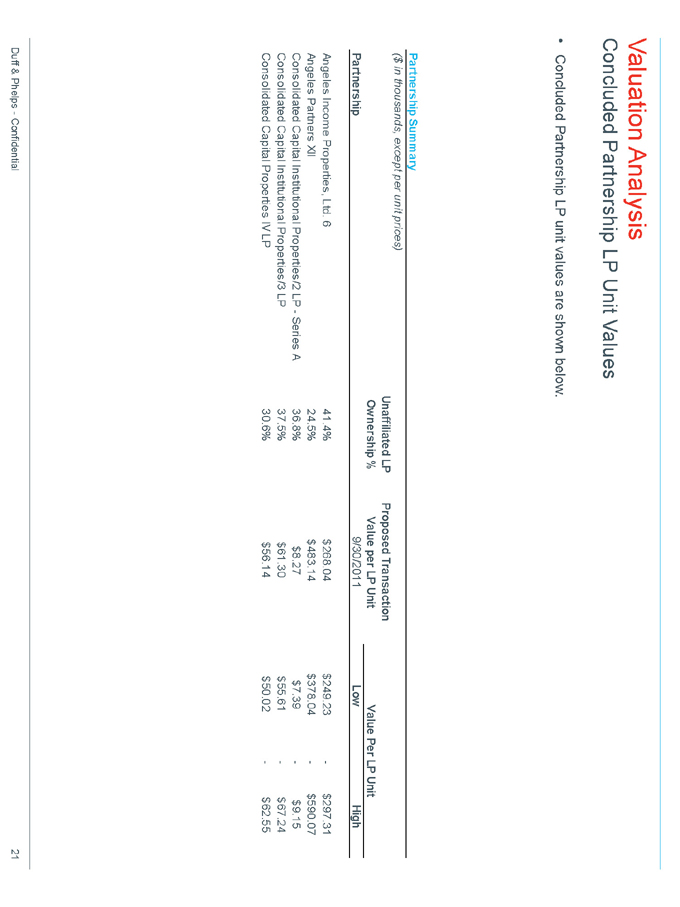

Valuation Analysis

Concluded Partnership LP Unit Values

• Concluded Partnership LP unit values are shown below.

Partnership Summary

($ in thousands, except per unit prices)

Unaffiliated LP Proposed Transaction

Ownership % Value per LP Unit Value Per LP Unit

Partnership 9/30/2011 Low High

Angeles Income Properties, Ltd. 6 41.4% $268.04 $249.23—$297.31

Angeles Partners XII 24.5% $483.14 $378.04—$590.07

Consolidated Capital Institutional Properties/2 LP—Series A 36.8% $8.27 $7.39—$9.15

Consolidated Capital Institutional Properties/3 LP 37.5% $61.30 $55.61—$67.24

Consolidated Capital Properties IV LP 30.6% $56.14 $50.02—$62.55

Duff & Phelps—Confidential 21

Appendix A Assumptions, Qualifications and Limiting

Conditions

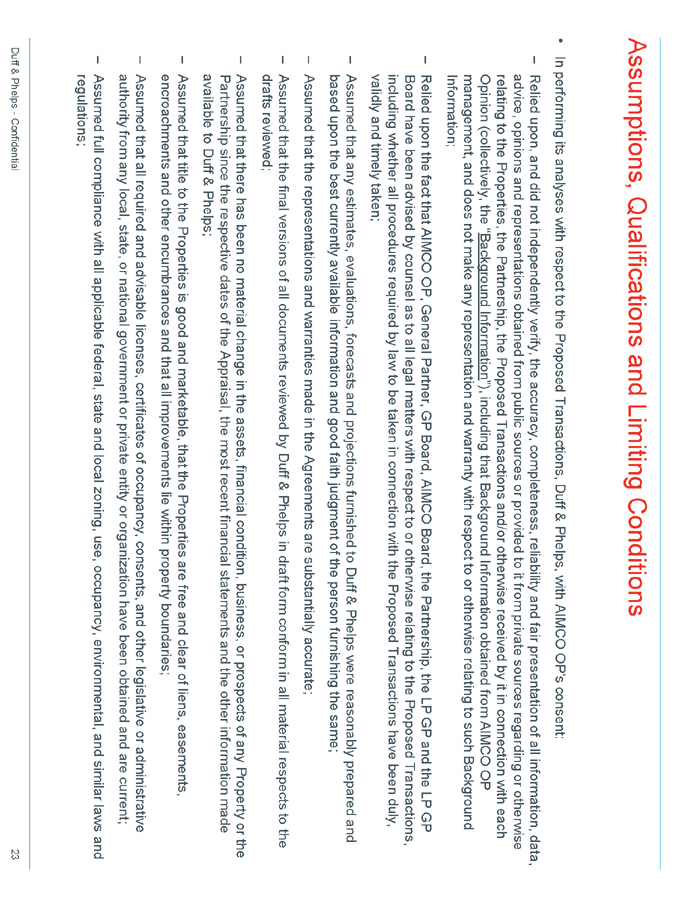

Assumptions, Qualifications and Limiting Conditions

In performing its analyses with respect to the Proposed Transactions, Duff & Phelps, with AIMCO OP’s consent:

– Relied upon, and did not independently verify, the accuracy, completeness, reliability and fair presentation of all information, data, advice, opinions and representations obtained from public sources or provided to it from private sources regarding or otherwise relating to the Properties, the Partnership, the Proposed Transactions and/or otherwise received by it in connection with each

Opinion (collectively, the “Background Information”), including that Background Information obtained from AIMCO OP management, and does not make any representation and warranty with respect to or otherwise relating to such Background Information;

– Relied upon the fact that AIMCO OP, General Partner, GP Board, AIMCO Board, the Partnership, the LP GP and the LP GP Board have been advised by counsel as to all legal matters with respect to or otherwise relating to the Proposed Transactions, including whether all procedures required by law to be taken in connection with the Proposed Transactions have been duly, validly and timely taken;

– Assumed that any estimates, evaluations, forecasts and projections furnished to Duff & Phelps were reasonably prepared and based upon the best currently available information and good faith judgment of the person furnishing the same;

– Assumed that the representations and warranties made in the Agreements are substantially accurate;

– Assumed that the final versions of all documents reviewed by Duff & Phelps in draft form conform in all material respects to the drafts reviewed;

– Assumed that there has been no material change in the assets, financial condition, business, or prospects of any Property or the Partnership since the respective dates of the Appraisal, the most recent financial statements and the other information made available to Duff & Phelps;

– Assumed that title to the Properties is good and marketable, that the Properties are free and clear of liens, easements, encroachments and other encumbrances and that all improvements lie within property boundaries;

– Assumed that all required and advisable licenses, certificates of occupancy, consents, and other legislative or administrative authority from any local, state, or national government or private entity or organization have been obtained and are current;

– Assumed full compliance with all applicable federal, state and local zoning, use, occupancy, environmental, and similar laws and regulations;

Duff & Phelps—Confidential 23

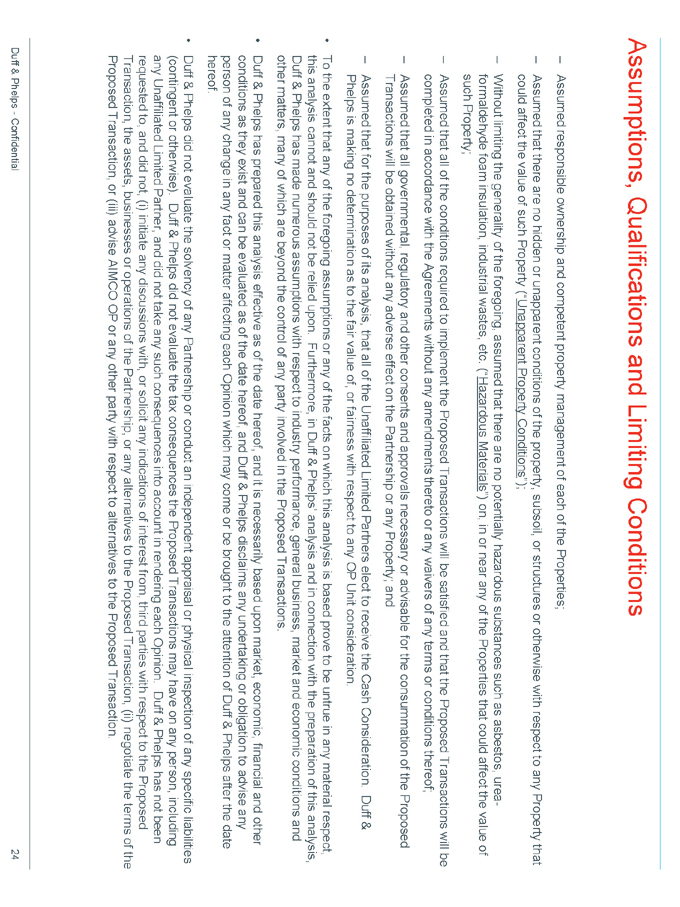

Assumptions, Qualifications and Limiting Conditions

– Assumed responsible ownership and competent property management of each of the Properties;

– Assumed that there are no hidden or unapparent conditions of the property, subsoil, or structures or otherwise with respect to any Property that could affect the value of such Property (“Unapparent Property Conditions”);

– Without limiting the generality of the foregoing, assumed that there are no potentially hazardous substances such as asbestos, urea-formaldehyde foam insulation, industrial wastes, etc. (“Hazardous Materials”) on, in or near any of the Properties that could affect the value of such Property;

– Assumed that all of the conditions required to implement the Proposed Transactions will be satisfied and that the Proposed Transactions will be completed in accordance with the Agreements without any amendments thereto or any waivers of any terms or conditions thereof;

– Assumed that all governmental, regulatory and other consents and approvals necessary or advisable for the consummation of the Proposed Transactions will be obtained without any adverse effect on the Partnership or any Property; and

– Assumed that for the purposes of its analysis, that all of the Unaffiliated Limited Partners elect to receive the Cash Consideration. Duff & Phelps is making no determination as to the fair value of, or fairness with respect to any OP Unit consideration.

To the extent that any of the foregoing assumptions or any of the facts on which this analysis is based prove to be untrue in any material respect, this analysis cannot and should not be relied upon. Furthermore, in Duff & Phelps’ analysis and in connection with the preparation of this analysis, Duff & Phelps has made numerous assumptions with respect to industry performance, general business, market and economic conditions and other matters, many of which are beyond the control of any party involved in the Proposed Transactions.

Duff & Phelps has prepared this analysis effective as of the date hereof, and it is necessarily based upon market, economic, financial and other conditions as they exist and can be evaluated as of the date hereof, and Duff & Phelps disclaims any undertaking or obligation to advise any person of any change in any fact or matter affecting each Opinion which may come or be brought to the attention of Duff & Phelps after the date hereof.

Duff & Phelps did not evaluate the solvency of any Partnership or conduct an independent appraisal or physical inspection of any specific liabilities (contingent or otherwise). Duff & Phelps did not evaluate the tax consequences the Proposed Transactions may have on any person, including any Unaffiliated Limited Partner, and did not take any such consequences into account in rendering each Opinion. Duff & Phelps has not been requested to, and did not, (i) initiate any discussions with, or solicit any indications of interest from, third parties with respect to the Proposed Transaction, the assets, businesses or operations of the Partnership, or any alternatives to the Proposed Transaction, (ii) negotiate the terms of the Proposed Transaction, or (iii) advise AIMCO OP or any other party with respect to alternatives to the Proposed Transaction.

Duff & Phelps—Confidential 24

Assumptions, Qualifications and Limiting Conditions

Duff & Phelps is not expressing any opinion as to the market price or value of the Partnership’s, the New Partnership’s or AIMCO OP’s equity (or anything else) after the announcement or the consummation of the Proposed Transaction. Without limiting the generality of the foregoing, Duff & Phelps is not expressing any opinion as to the liquidity of, rights and/or risks associated with owning, or any other feature or characteristic of, the OP Units. Each Opinion should not be construed as a valuation opinion, credit rating, solvency opinion, an analysis of the Partnership’s, the New Partnership’s or AIMCO OP’s credit worthiness, as tax advice, or as accounting advice. Duff & Phelps has not made, and assumes no responsibility to make, any representation, or render any opinion, as to any legal matter (including with respect to title to or any encumbrances relating to any Property).

Duff & Phelps did not investigate any of the physical conditions of any Property and has not made, and assumes no responsibility to make, any representation, or render any opinion, as to the physical condition of any Property. No independent surveys of the Properties were conducted. Duff & Phelps did not arrange for any engineering studies that may be required to discover any Unapparent Property Condition. Duff & Phelps did not arrange for or conduct any soil analysis or geological studies or any investigation of any water, oil, gas, coal, or other subsurface mineral and use rights or conditions or arrange for or conduct any other environmental analysis, including with respect to any Hazardous Materials, which may or may not be present on, in or near any of the Properties.

In rendering each Opinion, Duff & Phelps is not expressing any opinion with respect to the amount or nature of any compensation to any of AIMCO

OP’s and/or AIMCO’s respective officers, directors, or employees, or any class of such persons, relative to the consideration to be received by the Unaffiliated Limited Partners in the Proposed Transaction, or with respect to the fairness of any such compensation.

Each Opinion is furnished solely for the use and benefit of each of the Boards in connection with and for purposes of their evaluation of the Proposed Transactions and is not intended to, and does not, confer any rights or remedies upon any other person, and is not intended to be used, and may not be used, by any other person or for any other purpose, without Duff & Phelps’ express consent. Each Opinion (i) does not address the merits of the underlying business decision to enter into the Proposed Transaction versus any alternative strategy or transaction; (ii) does not address any transaction related to the Proposed Transaction; (iii) is not a recommendation as to how any party should vote or act with respect to any matters relating to the Proposed Transaction or any related transaction, or whether to proceed with the Proposed Transaction or any related transaction, and (iv) does not indicate that the consideration paid is the best possibly attainable under any circumstances; instead, it merely states whether the consideration in the Proposed Transaction is within a range suggested by certain financial analyses. The decision as to whether to proceed with the Proposed Transaction or any related transaction may depend on an assessment of factors unrelated to the financial analysis on which each Opinion is based. Each Opinion should not be construed as creating any fiduciary duty on the part of Duff & Phelps to any party.

Duff & Phelps—Confidential 25

Appendix B

Property Value Allocation Waterfalls

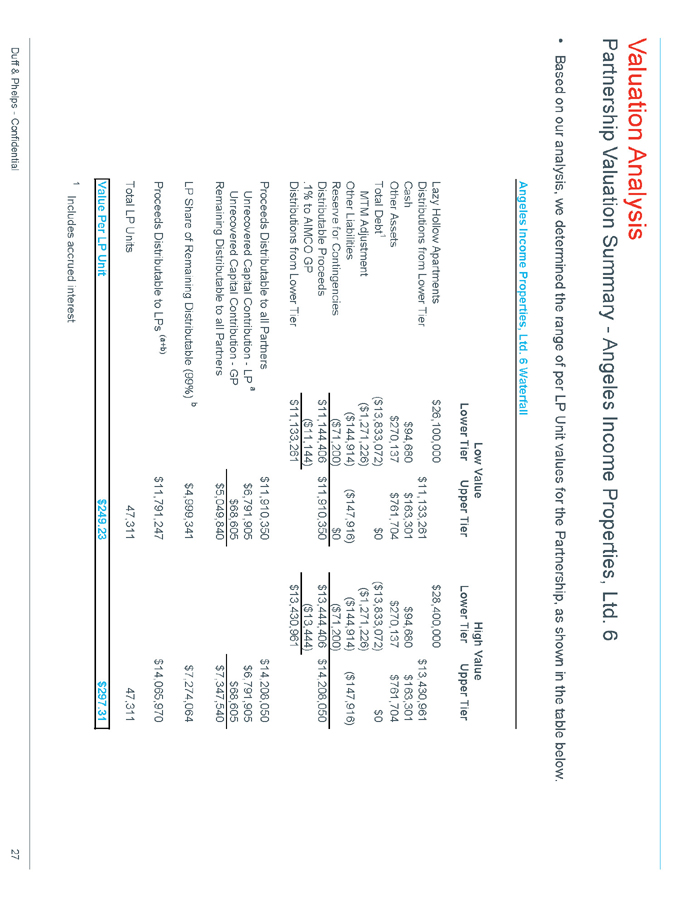

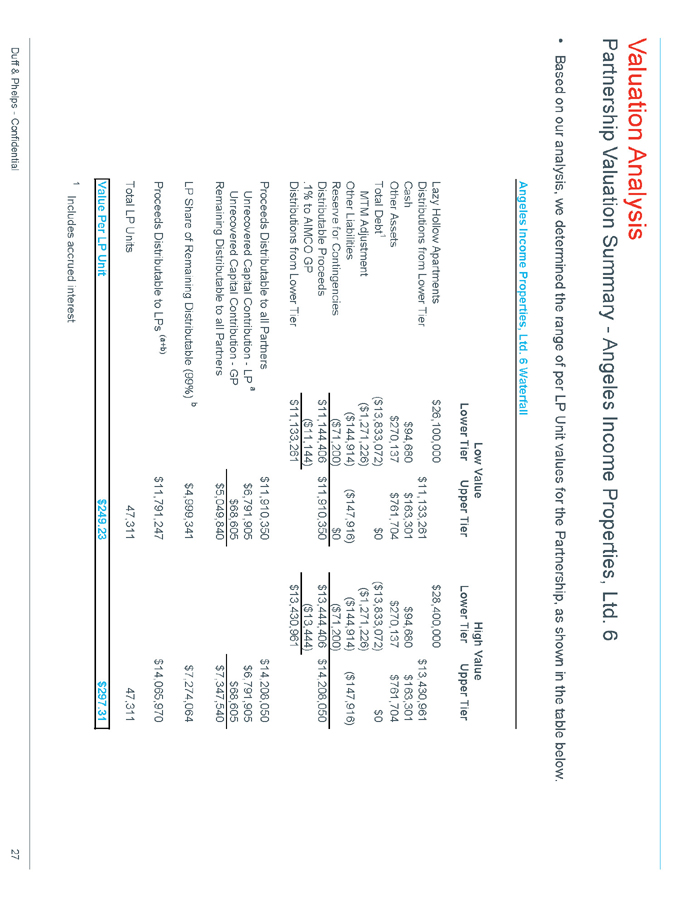

Valuation Analysis

Partnership Valuation Summary—Angeles Income Properties, Ltd. 6

• Based on our analysis, we determined the range of per LP Unit values for the Partnership, as shown in the table below.

Angeles Income Properties, Ltd. 6 Waterfall

Low Value High Value

Lower Tier Upper Tier Lower Tier Upper Tier

Lazy Hollow Apartments $26,100,000 $28,400,000

Distributions from Lower Tier $11,133,261 $13,430,961

Cash $94,680 $163,301 $94,680 $163,301

Other Assets $270,137 $761,704 $270,137 $761,704

Total Debt1($13,833,072) $0($13,833,072) $0

MTM Adjustment($1,271,226)($1,271,226)

Other Liabilities($144,914)($147,916)($144,914)($147,916)

Reserve for Contingencies($71,200) $0($71,200)

Distributable Proceeds $11,144,406 $11,910,350 $13,444,406 $14,208,050

.1% | | to AIMCO GP($11,144)($13,444) |

Distributions from Lower Tier $11,133,261 $13,430,961

Proceeds Distributable to all Partners $11,910,350 $14,208,050

Unrecovered Capital Contribution—LP a $6,791,905 $6,791,905

Unrecovered Capital Contribution—GP $68,605 $68,605

Remaining Distributable to all Partners $5,049,840 $7,347,540

LP Share of Remaining Distributable (99%) b $4,999,341 $7,274,064

Proceeds Distributable to LPs (a+b) $11,791,247 $14,065,970

Total LP Units 47,311 47,311

Value Per LP Unit $249.23 $297.31

1 | | Includes accrued interest |

Duff & Phelps—Confidential 27

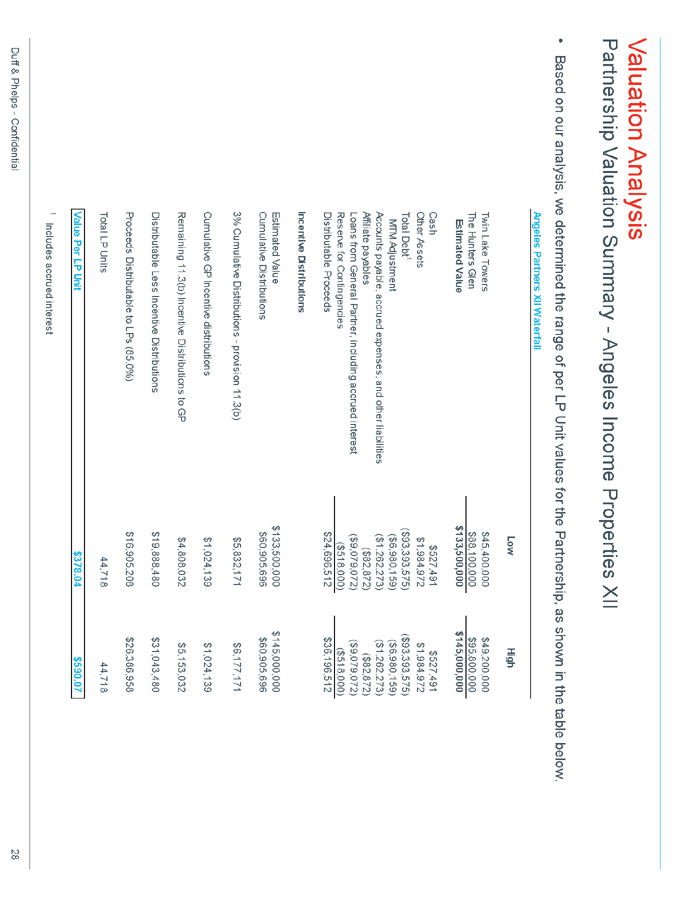

Valuation Analysis

Partnership Valuation Summary—Angeles Income Properties XII

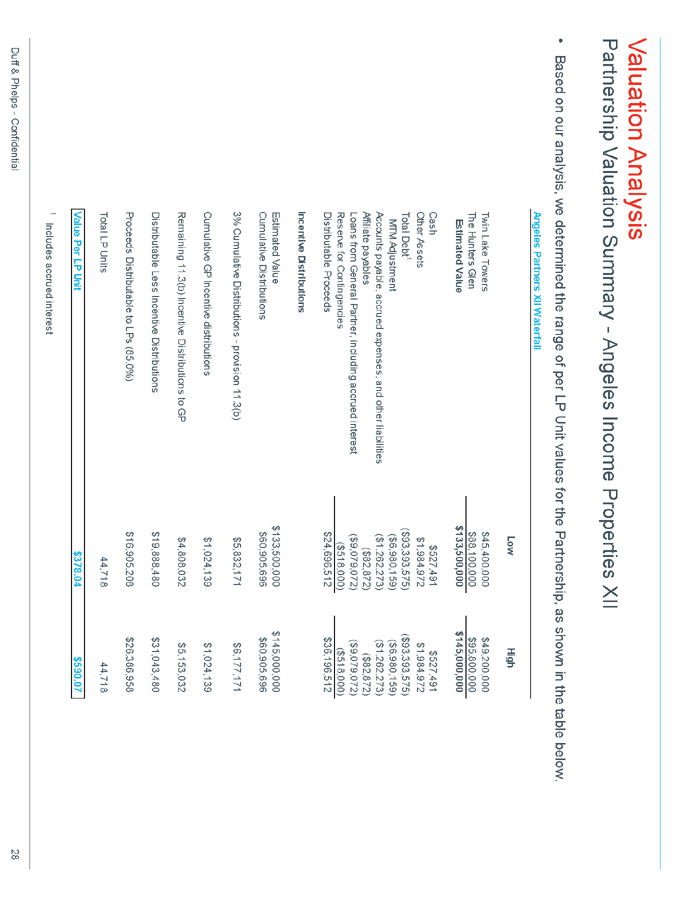

• Based on our analysis, we determined the range of per LP Unit values for the Partnership, as shown in the table below.

Angeles Partners XII Waterfall

Low High

Twin Lake Towers $45,400,000 $49,200,000

The Hunters Glen $88,100,000 $95,800,000

Estimated Value $133,500,000 $145,000,000

Cash $527,491 $527,491

Other Assets $1,984,972 $1,984,972

Total Debt1($93,393,575)($93,393,575)

MTM Adjustment($6,980,159)($6,980,159)

Accounts payable, accrued expenses, and other liabilities($1,262,273)($1,262,273)

Affiliate payables($82,872)($82,872)

Loans from General Partner, including accrued interest($9,079,072)($9,079,072)

Reserve for Contingencies($518,000)($518,000)

Distributable Proceeds $24,696,512 $36,196,512

Incentive Distributions

Estimated Value $133,500,000 $145,000,000

Cumulative Distributions $60,905,696 $60,905,696

3% Cumulative Distributions—provision 11.3(b) $5,832,171 $6,177,171

Cumulative GP Incentive distributions $1,024,139 $1,024,139

Remaining 11.3(b) Incentive Distributions to GP $4,808,032 $5,153,032

Distributable Less Incentive Distributions $19,888,480 $31,043,480

Proceeds Distributable to LPs (85.0%) $16,905,208 $26,386,958

Total LP Units 44,718 44,718

Value Per LP Unit $378.04 $590.07

1 | | Includes accrued interest |

Duff & Phelps—Confidential 28

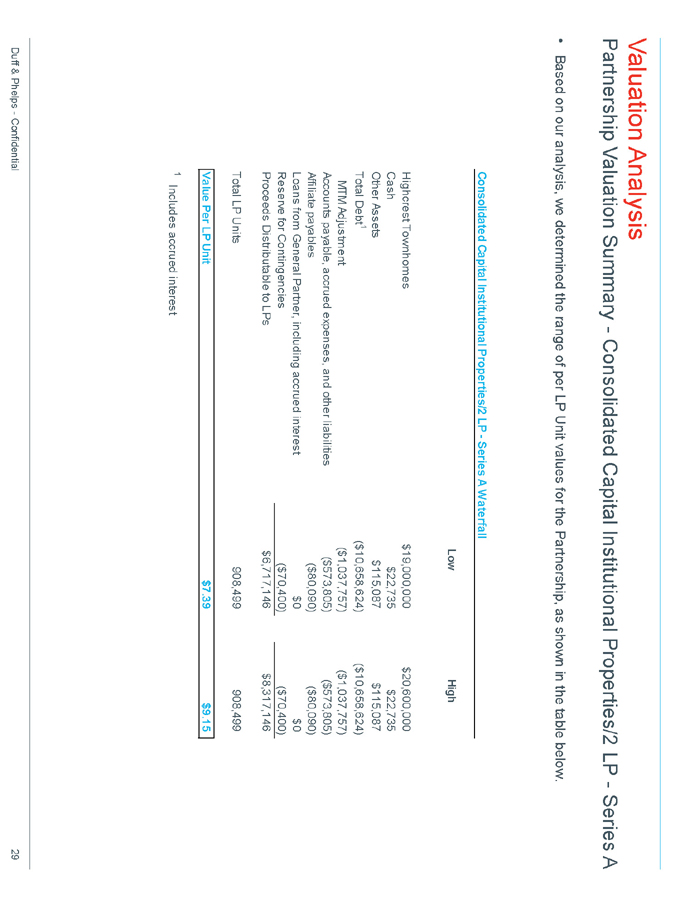

Valuation Analysis

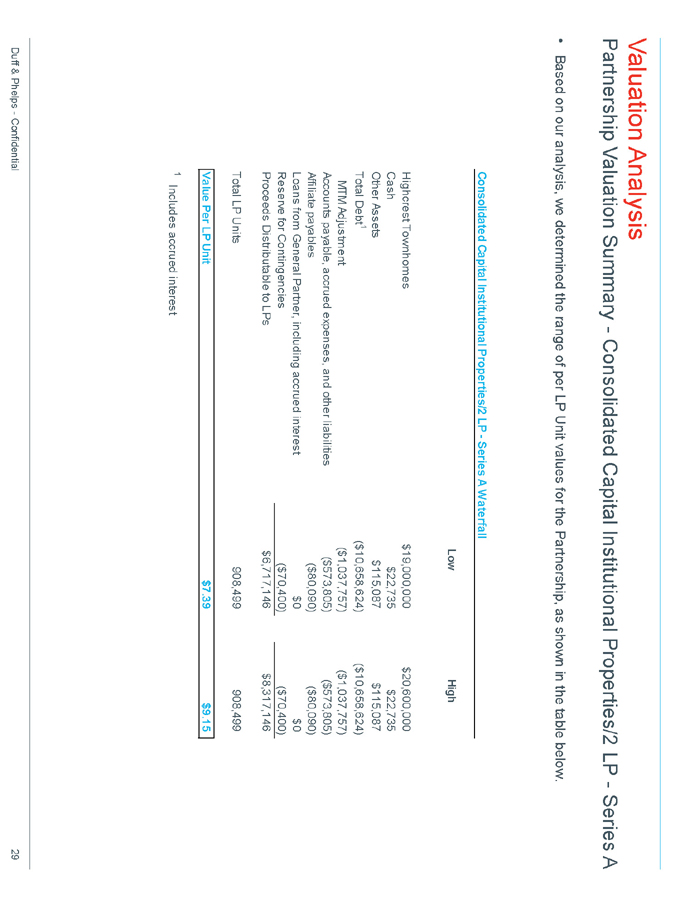

Partnership Valuation Summary—Consolidated Capital Institutional Properties/2 LP—Series A

• Based on our analysis, we determined the range of per LP Unit values for the Partnership, as shown in the table below.

Consolidated Capital Institutional Properties/2 LP—Series A Waterfall

Low High

Highcrest Townhomes $19,000,000 $20,600,000

Cash $22,735 $22,735

Other Assets $115,087 $115,087

Total Debt1($10,658,624)($10,658,624)

MTM Adjustment($1,037,757)($1,037,757)

Accounts payable, accrued expenses, and other liabilities($573,805)($573,805)

Affiliate payables($80,090)($80,090)

Loans from General Partner, including accrued interest $0 $0

Reserve for Contingencies($70,400)($70,400)

Proceeds Distributable to LPs $6,717,146 $8,317,146

Total LP Units 908,499 908,499

Value Per LP Unit $7.39 $9.15

1 | | Includes accrued interest |

Duff & Phelps—Confidential 29

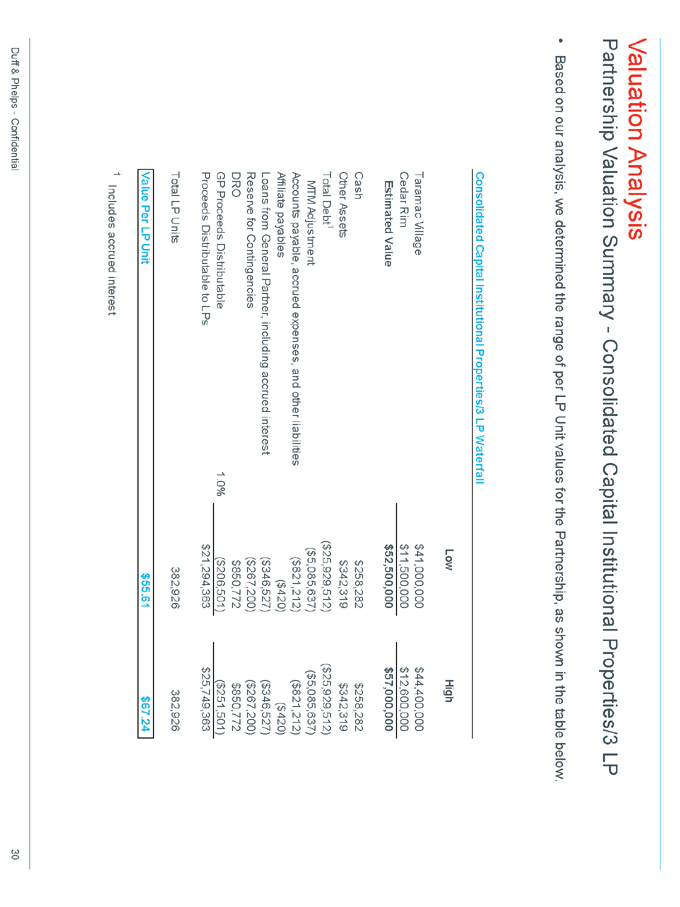

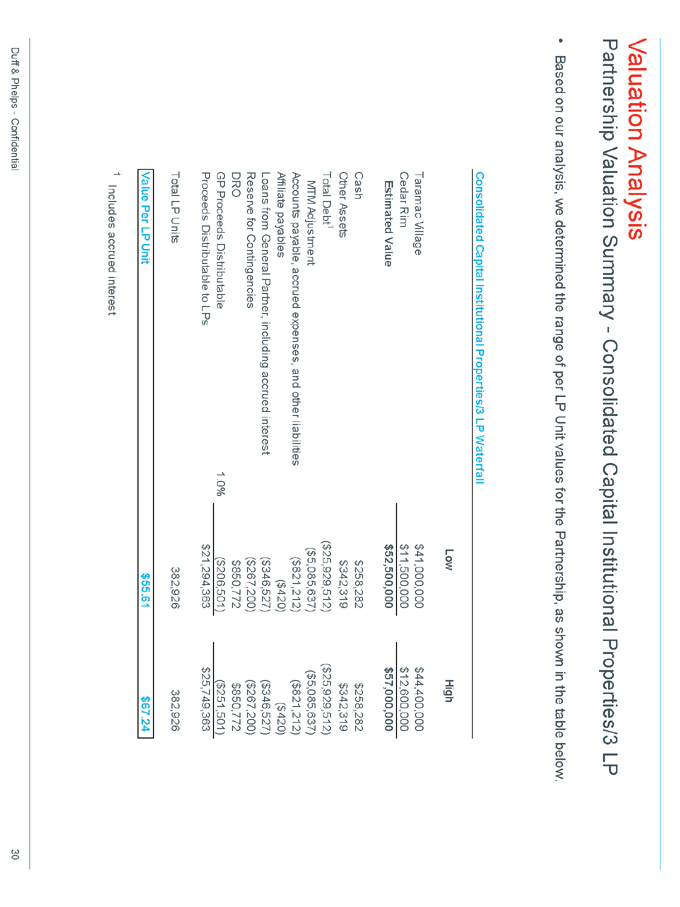

Valuation Analysis

Partnership Valuation Summary—Consolidated Capital Institutional Properties/3 LP

• Based on our analysis, we determined the range of per LP Unit values for the Partnership, as shown in the table below.

Consolidated Capital Institutional Properties/3 LP Waterfall

Low High

Taramac Village $41,000,000 $44,400,000

Cedar Rim $11,500,000 $12,600,000

Estimated Value $52,500,000 $57,000,000

Cash $258,282 $258,282

Other Assets $342,319 $342,319

Total Debt1($25,929,512)($25,929,512)

MTM Adjustment($5,085,637)($5,085,637)

Accounts payable, accrued expenses, and other liabilities($821,212)($821,212)

Affiliate payables($420)($420)

Loans from General Partner, including accrued interest($346,527)($346,527)

Reserve for Contingencies($267,200)($267,200)

DRO $850,772 $850,772

GP Proceeds Distributable 1.0%($206,501)($251,501)

Proceeds Distributable to LPs $21,294,363 $25,749,363

Total LP Units 382,926 382,926

Value Per LP Unit $55.61 $67.24

1 | | Includes accrued interest |

Duff & Phelps—Confidential 30

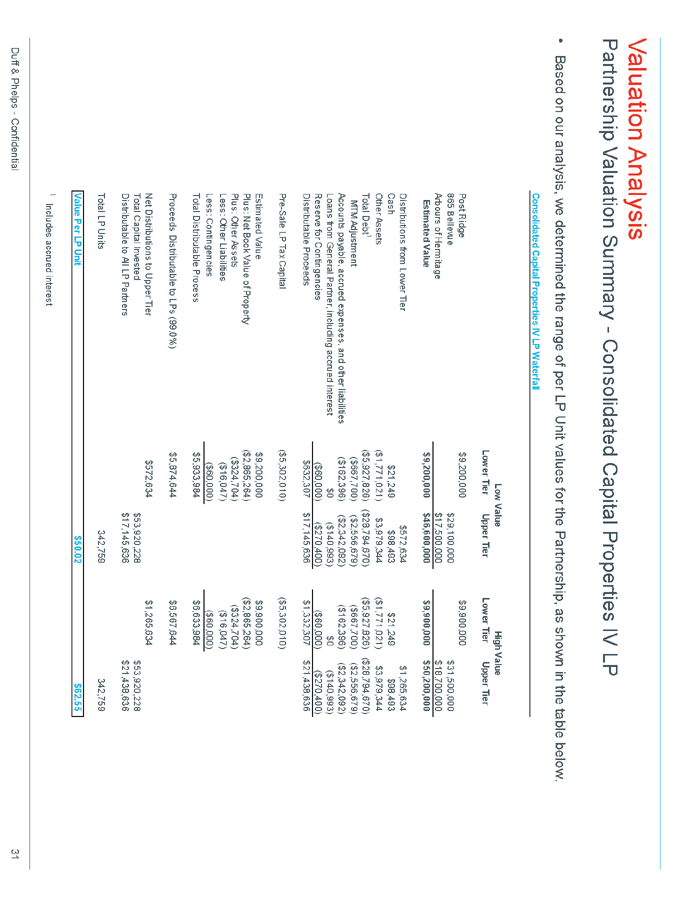

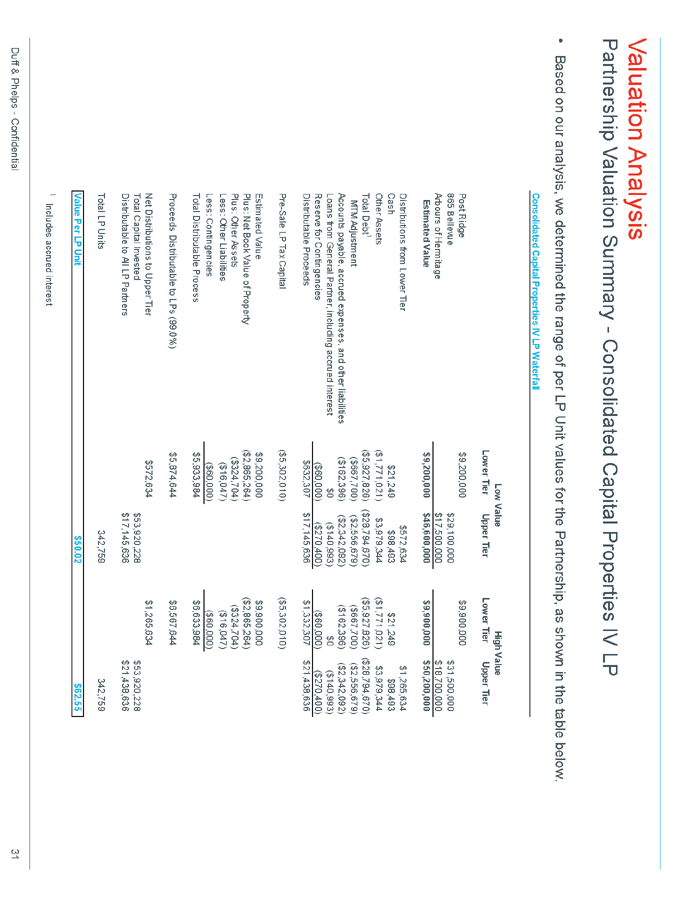

Valuation Analysis

Partnership Valuation Summary—Consolidated Capital Properties IV LP

• Based on our analysis, we determined the range of per LP Unit values for the Partnership, as shown in the table below.

Consolidated Capital Properties IV LP Waterfall

Low Value High Value

Lower Tier Upper Tier Lower Tier Upper Tier

Post Ridge $9,200,000 $9,900,000

865 Bellevue $29,100,000 $31,500,000

Arbours of Hermitage $17,500,000 $18,700,000

Estimated Value $9,200,000 $46,600,000 $9,900,000 $50,200,000

Distributions from Lower Tier $572,634 $1,265,634

Cash $21,249 $98,493 $21,249 $98,493

Other Assets($1,771,021) $3,979,344($1,771,021) $3,979,344

Total Debt1($5,927,826)($28,794,670)($5,927,826)($28,794,670)

MTM Adjustment($667,700)($2,556,679)($667,700)($2,556,679)

Accounts payable, accrued expenses, and other liabilities($162,396)($2,342,092)($162,396)($2,342,092)

Loans from General Partner, including accrued interest $0($140,993) $0($140,993)

Reserve for Contingencies($60,000)($270,400)($60,000)($270,400)

Distributable Proceeds $632,307 $17,145,636 $1,332,307 $21,438,636

Pre-Sale LP Tax Capital($5,302,010)($5,302,010)

Estimated Value $9,200,000 $9,900,000

Plus: Net Book Value of Property($2,865,264)($2,865,264)

Plus: Other Assets($324,704)($324,704)

Less: Other Liabilities($16,047)($16,047)

Less: Contingencies($60,000)($60,000)

Total Distributable Process $5,933,984 $6,633,984

Proceeds Distributable to LPs (99.0%) $5,874,644 $6,567,644

Net Distributions to Upper Tier $572,634 $1,265,634

Total Capital Invested $53,920,228 $53,920,228

Distributable to All LP Partners $17,145,636 $21,438,636

Total LP Units 342,759 342,759

Value Per LP Unit $50.02 $62.55

1 | | Includes accrued interest |

Duff & Phelps—Confidential 31

Appendix C

Apartment Investment & Management Co.

Trading History

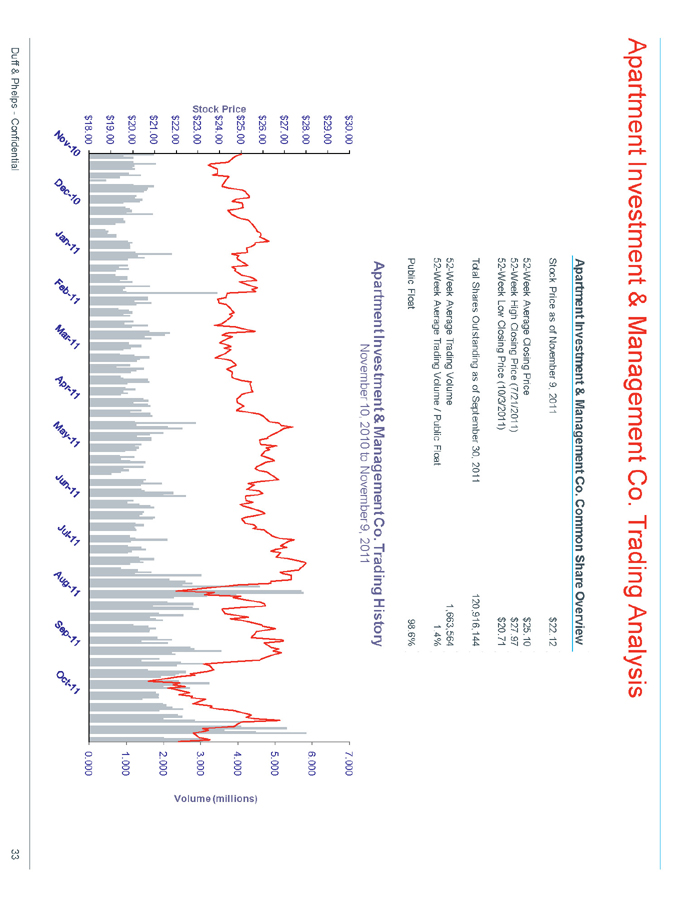

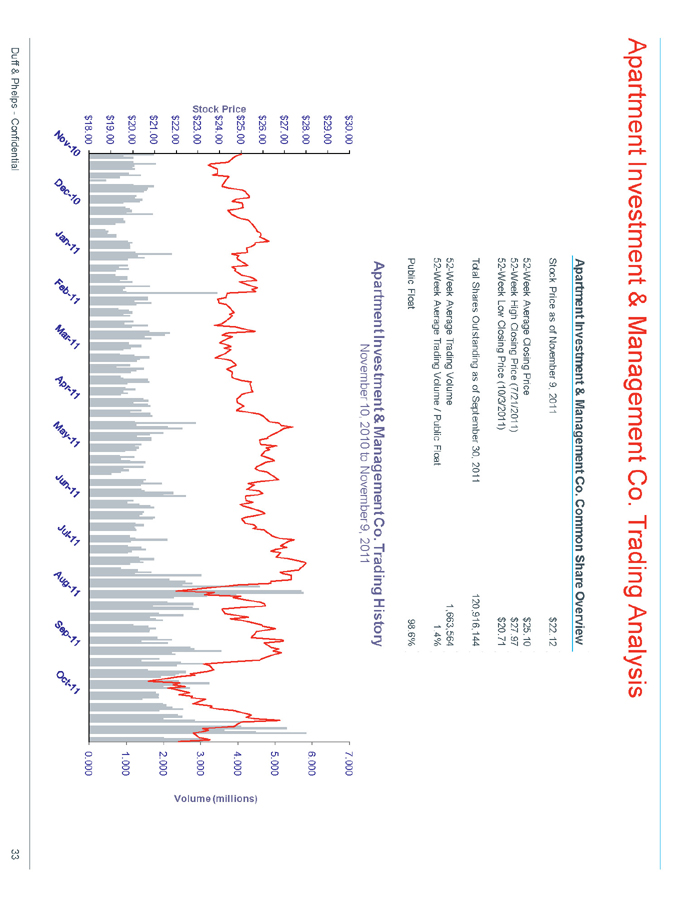

Apartment Investment & Management Co. Trading Analysis

Apartment Investment & Management Co. Common Share Overview

Stock Price as of November 9, 2011 $22.12

52-Week Average Closing Price $25.10

52-Week High Closing Price (7/21/2011) $27.97

52-Week Low Closing Price (10/3/2011) $20.71

Total Shares Outstanding as of September 30, 2011 120,916,144

52-Week Average Trading Volume 1,663,564

52-Week Average Trading Volume / Public Float 1.4%

Public Float 98.6%

Apartment Investment & Management Co. Trading History

November 10, 2010 to November 9, 2011

$30.00 7.000

$29.00

$28.00 6.000

$27.00

5.000

$26.00

Price $25.00 4.000

Stock $24.00

$23.00 3.000

$22.00

2.000

$21.00

$20.00 1.000

$19.00

$18.00 0.000

Volume (millions)

Duff & Phelps - Confidential 33