UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

|

Canterbury Park Holding Corporation |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

CANTERBURY PARK HOLDING CORPORATION

1100 Canterbury Road

Shakopee, Minnesota 55379

(952) 445-7223

_____________________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

June 2, 2005

________________________________

Notice is hereby given that the Annual Meeting of Shareholders of Canterbury Park Holding Corporation will be held at Canterbury Park, 1100 Canterbury Road, Shakopee, Minnesota 55379, on Thursday, June 2, 2005, beginning at 4:00 p.m., Central Daylight Time, for the following purposes:

1. To elect six (6) directors to hold office until the 2006 Annual Meeting of Shareholders or until their successors are elected.

2. To transact such other business as may properly come before the meeting or any adjournment or adjournments thereof.

The Board of Directors has fixed the close of business on April 15, 2005 as the record date for the determination of shareholders entitled to notice of and to vote at the meeting.

By Order of the Board of Directors

David C. Hansen

Secretary

Shakopee, Minnesota

April 25, 2005

TO ASSURE YOUR REPRESENTATION AT THE MEETING, PLEASE SIGN, DATE

AND RETURN YOUR PROXY IN THE ENCLOSED ENVELOPE, WHETHER OR NOT YOU

EXPECT TO ATTEND IN PERSON. SHAREHOLDERS WHO ATTEND THE MEETING

MAY REVOKE THEIR PROXIES AND VOTE IN PERSON IF THEY SO DESIRE.

CANTERBURY PARK HOLDING CORPORATION

________________________

PROXY STATEMENT

________________________

TABLE OF CONTENTS

i

CANTERBURY PARK HOLDING CORPORATION

________________________

PROXY STATEMENT

________________________

This Proxy Statement is furnished to the shareholders of Canterbury Park Holding Corporation (“CPHC” or the “Company”) in connection with the solicitation of proxies by the Board of Directors of the Company to be voted at the Annual Meeting of Shareholders to be held at Canterbury Park, 1100 Canterbury Road, Shakopee, Minnesota 55379, on Thursday, June 2, 2005, beginning at 4:00 p.m., Central Daylight Time, or at any adjournment or adjournments thereof. The cost of this solicitation will be paid by the Company. In addition to solicitation by mail, officers, directors and employees of the Company may solicit proxies by telephone, telegraph or in person. The Company may also request banks and brokers to solicit their customers who have a beneficial interest in the Company’s Common Stock registered in the names of nominees and will reimburse such banks and brokers for their reasonable out-of-pocket expenses.

A proxy may be revoked at any time before it is voted by submitting a new proxy properly signed and dated later than any prior proxy or by attending the Annual Meeting in person and completing a ballot at the Meeting. If not revoked, the shares represented by a valid proxy will be voted by the persons designated as proxies in accordance with the specifications indicated on the proxy. If not specified, the designated proxies will vote such shares “FOR” each of the director nominees’ names in Proposal One. In the event any other matters properly come before the meeting and call for a vote of shareholders, the persons named as proxies will vote in accordance with their judgment on such matters. The Company’s corporate offices are located at 1100 Canterbury Road, Shakopee, Minnesota 55379, and its telephone number is (952) 445-7223. The mailing of this Proxy Statement to shareholders of the Company commenced on or about April 28, 2005.

The total number of shares outstanding and entitled to vote at the meeting as of April 15, 2005 consisted of 3,890,169 shares of $.01 par value Common Stock. Each share of Common Stock is entitled to one vote. Cumulative voting in the election of directors is not permitted. Only shareholders of record at the close of business on April 15, 2005 will be entitled to vote at the meeting. The presence in person or by proxy of the holders of a majority of the shares entitled to vote at the Annual Meeting of Shareholders constitutes a quorum for the transaction of business.

Under Minnesota law, each item of business properly presented at a meeting of shareholders generally must be approved by the affirmative vote of the holders of a majority of the voting power of the shares present, in person or by proxy, and entitled to vote on that item of business. However, if the shares present and entitled to vote on any particular item of business would not constitute a quorum for the transaction of business at the meeting, then that item must be approved by holders of a majority of the minimum number of shares that would constitute such a quorum. Votes cast by proxy or in person at the Annual Meeting of Shareholders will be tabulated at the meeting to determine whether or not a quorum is present. Abstentions on a particular item of business will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but as unvoted for purposes of determining the approval of the matter. For shares held in street name, if a broker indicates on the proxy that it does not have discretionary authority as to such shares to vote on a particular matter, those shares will not be considered as present and entitled to vote with respect to that matter, but they are counted as present for the purpose of determining the presence of a quorum.

1

Our Board of Directors is committed to sound and effective corporate governance practices. We periodically review our governance policies and practices and compare them to those suggested by authorities in corporate governance and the practices of other public companies. We also review the provisions of the Sarbanes-Oxley Act of 2002, rules of the Securities and Exchange Commission (the “SEC”) and listing standards of the American Stock Exchange (“AMEX”) to ensure our continued compliance.

You can access our committee charters and other corporate governance documents in the Investor Relations section of our website at http://www.canterburypark.com or by writing to the Investor Relations Department at: Canterbury Park Holding Corporation, 1100 Canterbury Road, Shakopee, Minnesota 55379, or by emailing our Investor Relations Department at investorrelations@canterburypark.com.

Meeting Attendance. Our Board of Directors meets regularly during the year to review matters affecting our Company and to act on matters requiring Board approval. Each of our directors is expected to make a reasonable effort to attend all meetings of the Board, applicable committee meetings and our annual meeting of shareholders. During 2004, the Board of Directors met seven times. Each of the directors attended at least 75% of the meetings of the Board and committees on which he or she served. All of our directors attended our 2004 Annual Meeting of Shareholders, with the exception of Brian C. Barenscheer.

Board Committees. The Company’s Board of Directors has established an Audit Committee and a Compensation Committee. Only independent members of the Board serve on these committees. Following is information about each committee.

Audit Committee. The Audit Committee is responsible for the engagement, retention and replacement of the independent auditors, approval of transactions between the Company and a director or executive officer unrelated to service as a director or officer, approval of non-audit services provided by the Company’s independent auditor, oversight of the Company’s accounting, financial reporting and internal controls and the receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters. Deloitte & Touche, LLP, the member firms of Deloitte Touche Tohmatsu, and their respective affiliates (collectively, the “Deloitte Entities”), the Company’s independent public accountants, report directly to the Audit Committee. The Audit Committee operates under a formal charter, which was most recently amended as of March 29, 2004. The current members of the Audit Committee are Patrick R. Cruzen, Burton F. Dahlberg and Carin J. Offerman, each of whom is independent under SEC and AMEX listing standards. The Board of Directors believes that Mr. Cruzen qualifies as an Audit Committee financial expert. The Audit Committee met four times during 2004. The report of the Audit Committee is found on page 11.

Compensation Committee. The Compensation Committee provides oversight of the overall compensation strategy of the Company, reviews and recommends to the Board of Directors the compensation of the Company’s Chief Executive Officer and the other executive officers, administers the Company’s equity based compensation plans and oversees the Company’s 401(k) Plan and similar employee benefit plans. The Compensation Committee operates under a charter approved by the Board. The current members of the Compensation Committee are Patrick R. Cruzen and Dale H. Schenian, Chair, each of whom is independent under AMEX listing standards. The Compensation Committee met three times during 2004. The report of the Compensation Committee is found beginning on page 8.

The Board of Directors has adopted director independence guidelines that are consistent with the definitions of “independence” set forth in Section 301 of the Sarbanes-Oxley Act of 2002, Rule 10A-3 under the Securities Exchange Act of 1934 and AMEX listing standards. In accordance with these guidelines, the Board of Directors has reviewed and considered facts and circumstances relevant to the independence of each of our directors and director nominees and has determined that, each of the following directors qualifies as “independent” under AMEX listing standards: Patrick R. Cruzen, Burton F. Dahlberg, Carin J. Offerman and Dale H. Schenian.

2

The independent members of our Board of Directors are responsible for nominating the director nominees that will stand for election at our annual shareholder meetings. In selecting the nominees, the Board reviews the composition of the full Board to determine the qualifications and areas of expertise needed to further enhance the composition of the Board and works with management in attracting candidates with those qualifications. Among other things, the Board considers relevant experience, integrity, ability to make independent analytical inquiries, ownership of or commitment to purchase the Company’s common stock, understanding of the Company’s business, relationships and associations related to the Company’s business, personal health and a willingness to devote adequate time and effort to Board responsibilities, all in the context of an assessment of the perceived needs of the Company.

Although we have never received a submission in the past, the Board of Directors will consider qualified candidates for director that are submitted by our shareholders. Shareholders can submit qualified candidates, together with appropriate biographical information, to the Board of Directors at: Canterbury Park Holding Corporation, 1100 Canterbury Road, Shakopee, Minnesota 55379, Attention: Chief Executive Officer. Any shareholder desiring to submit a director candidate for consideration at our 2006 Annual Meeting must ensure that the submission is received by the Company no later than December 1, 2005 in order to provide adequate time for the Board to properly consider the candidate.

Through June 30, 2004, each non-employee member of the Board was paid an annual fee of $7,200 plus $600 for each Board or Board committee meeting attended, and Curtis A. Sampson and Dale H. Schenian received monthly payments of $2,500 and $1,677, respectively, in consideration for the additional responsibilities they perform for the Company in their capacities as Chair and Vice Chair of the Board. Effective July 1, 2004, the above amounts were increased and currently each non-employee member of the Board of Directors is paid and annual fee of $12,000 plus $800 for each Board or Board committee meeting attended, and Messrs. Sampson and Schenian receive monthly payments of $3,500 and $2,675, respectively, for their service as Chair and Vice Chair of the Company. In addition, Carin J. Offerman received $26,000, $57,000 and $13,000 in 2004, 2003 and 2002 respectively, under a special assignment by the Board of Directors to lead the Company’s efforts to build public support for amending Minnesota law to grant additional expanded gaming authority to the Company.

Under the Company’s Stock Plan, as amended, upon their election to the Board, each non-employee director receives an option to purchase 2,500 shares of the Company’s Common Stock and annually, on the first business day in February, each non-employee director also receives an option to purchase 3,000 shares of the Company’s Common Stock. All such options granted to non-employee directors vest six months from the date granted and are exercisable over a ten-year period. The purchase price of the shares of Common Stock subject to such options is the fair market value as determined under provisions of the Stock Plan. Randall D. Sampson, President, Chief Executive Officer and General Manager of the Company, receives no additional compensation for his service on the Board.

We have a Code of Conduct (the “Code”) applicable to all of the Company’s officers, directors, employees and consultants that establishes guidelines for professional and ethical conduct in the workplace. The Code also incorporates a special set of guidelines applicable to the Company’s senior financial officers, including the chief executive officer, principal financial officer, principal accounting officer and others involved in the preparation of the Company’s financial reports, that are intended to promote the ethical handling of conflicts of interest, full and fair disclosure in periodic reports filed by the Company and compliance with laws, rules and regulations concerning such periodic reporting. A copy of the Code of Conduct is available on our website at http://www.canterburypark.com and is also available without charge by writing to our Investor Relations Department at: Canterbury Park Holding Corporation, 1100 Canterbury Road, Shakopee, Minnesota 55379, or by emailing our Investor Relations Department at investorrelations@canterburypark.com.

3

PROPOSAL 1:

ELECTION OF DIRECTORS

The independent members of the Board of Directors have nominated and recommend for election as directors of the Company the six persons named below, each of whom is a current director of the Company. The Board of Directors believes that each nominee named below will be able to serve, but should a nominee be unable to serve as a director, the persons named in the proxies have advised that they will vote for the election of such substitute nominee as the independent members of the Board of Directors may propose.

Information regarding the directors, including information regarding their principal occupations currently and for the preceding five years, is set forth below. Ownership of Company Common Stock is given as of April 15, 2005. Percentage ownership presented for each director assumes shares outstanding increased by the respective number of options indicated. Unless otherwise noted, the persons indicated are believed by the Company to possess sole voting and investment power with respect to their stock ownership.

Name and Age | | Principal Occupation; Other Directorships | | Amount of

Stock

Ownership(1) | | Percent of

Outstanding

Stock | |

Patrick R. Cruzen

(58) | | President of Cruzen & Associates (gaming industry consulting firm) (since 1996); President and COO of Grand Casinos, Inc. (1994 - 1996); Director of PDS Gaming Corp. (gaming equipment supplier); Director of Cash Systems (a gaming cash service). | | 8,500 | | * | |

Burton F. Dahlberg

(72) | | Real Estate Consultant, Dahlberg Consulting L.L.C. (since 2003); President and COO of Kraus-Anderson Inc. (commercial real estate) (1968-2002); former President, Minnesota Thoroughbred Association. | | 2,500 | | * | |

Carin J. Offerman

(56) | | Private Investor; formerly President and CEO (1998-1999) and Vice President and COO (prior to 1998) of Offerman & Company (investment banking and brokerage firm). | | 78,750 | | 2.0 | % |

Curtis A. Sampson

(71)† | | Chairman of the Company; Chairman and CEO of Communications Systems, Inc. (connecting devices for telephones and computers); Chairman and CEO of Hector Communications Corporation (independent telephone companies). | | 914,470 | (2) | 23.4 | % |

Randall D. Sampson

(47)† | | President, Chief Executive Officer and General Manager of the Company (since 1994); Director, Communications Systems, Inc. | | 278,807 | (3) | 6.9 | % |

Dale H. Schenian

(63) | | Chairman, City Auto Glass Companies (auto glass repair and replacement); Director, Bremer Bank (bank holding company). | | 427,548 | (4) | 10.9 | % |

* Indicates ownership of less than one percent.

† Curtis A. Sampson is the father of Randall D. Sampson.

(1) Includes shares issuable upon the exercise of currently exercisable options, as follows: Mr. Cruzen, 8,500 shares; Mr. Dahlberg, 2,500 shares; Ms. Offerman, 20,000 shares; Mr. C. Sampson, 22,000 shares; Mr. R. Sampson, 144,666 shares; and Mr. Schenian, 24,000 shares.

(2) Includes 11,300 shares held by Mr. C. Sampson’s wife, as to which beneficial ownership is disclaimed.

(3) Includes 9,100 shares held by Mr. R. Sampson’s children.

(4) Includes 30,000 shares held by Mr. Schenian’s wife, as to which beneficial ownership is disclaimed.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE “FOR” EACH OF THE NOMINEES LISTED ABOVE

________________________

4

The following table sets forth, based upon information available as of April 15, 2005, the beneficial ownership of shares of the Company’s Common Stock (i) by each person known by the Company to own of record or beneficially five percent (5%) or more of the Company’s Common Stock, (ii) by the Named Executive Officers listed in the Summary Compensation Table below, and (iii) by all officers and directors of the Company as a group (including beneficial ownership attributed to such person or group through ownership of currently exercisable options to purchase Common Stock). Information regarding the beneficial ownership of the Company’s Directors can be found on page 4 under “Election of Directors.”

Name and Address of Beneficial Owner(1) | | Amount and Nature of

Beneficial Ownership | | Percent

of Class(2) | |

Curtis A. Sampson | | 914,470 (3 | ) | 23.4 | % |

Dale H. Schenian | | 427,548 (4 | ) | 10.9 | % |

Randall D. Sampson† | | 278,807 (5 | ) | 6.9 | % |

Gabelli Asset Management, Inc.

One Corporate Center

Rye, New York 10580-1435 | | 192,300 (6 | ) | 4.9 | % |

David C. Hansen† | | 33,428 (7 | ) | * | |

John R. Harty† | | 28,797 (8 | ) | * | |

Mark A. Erickson† | | 88,511 (9 | ) | 2.2 | % |

Michael J. Garin† | | 99,577 (10 | ) | 2.5 | % |

All directors and officers as a group (10 persons) | | 2,183,188 (11 | ) | 50.5 | % |

† Named Executive Officer of the Company.

* Indicates ownership of less than one percent.

(1) The address for each of the directors and officers listed is: 1100 Canterbury Road, Shakopee, Minnesota 55379.

(2) Based upon 3,890,169 shares of Common Stock outstanding increased, for each calculation, by the number of shares that would be issued upon exercise of options held by the named person or group.

(3) Includes 22,000 shares issuable upon the exercise of currently exercisable options, as well as 11,300 shares held by Mr. C. Sampson’s spouse as to which beneficial ownership is disclaimed.

(4) Includes 24,000 shares issuable upon the exercise of currently exercisable options, as well as 30,000 shares held by Mr. Schenian’s spouse as to which beneficial ownership is disclaimed.

(5) Includes 144,666 shares issuable upon the exercise of currently exercisable options, and 9,100 shares held by Mr. R. Sampson’s children.

(6) Based upon the Schedule 13D filed with the SEC by Gabelli Asset Management, Inc. on August 30, 2004, which covers shares owned by Gabelli Funds, LLC, MJG Associates, Inc., GAMCO Investors, Inc., and Mario Gabelli.

(7) Includes 31,000 shares issuable upon the exercise of currently exercisable options.

(8) Includes 26,600 shares issuable upon the exercise of currently exercisable options.

(9) Includes 76,000 shares issuable upon the exercise of currently exercisable options, and 292 shares held by Mr. Erickson’s children.

(10) Includes 79,400 shares issuable upon the exercise of currently exercisable options, and 300 shares held by Mr. Garin’s children.

(11) Includes 434,666 shares issuable upon the exercise of currently exercisable options held by all officers and directors as a group.

5

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires that executive officers and directors and beneficial holders of 10% or more of the Company’s securities file reports of their beneficial ownership with the Securities and Exchange Commission (“SEC”) on Forms 3, 4 and 5. According to the Company’s records, all reports required to be filed during the period of January 1, 2004 through December 31, 2004 were timely filed, except as follows: a Form 4 was not timely filed by Messrs. C. Sampson, Hansen, Harty, Garin and Erickson to report stock options granted in February 2004; and a Form 4 was not timely filed by Messrs. Barenscheer, Cruzen, C. Sampson, and D. Schenian and Ms. Offerman to report a stock option grant in February 2004. A Form 4 for each of the above transactions was subsequently filed with the SEC.

The following table presents for the three fiscal years ended December 31, 2004, 2003 and 2002 cash and other compensation paid to or accrued by the Company for its President and CEO and the four executive officers whose total annual compensation exceeded $100,000, in all capacities served (each a “Named Executive Officer”), as well as information relating to stock options.

Summary Compensation Table

| | Annual Compensation | | Long-Term

Compensation

Awards | | | |

Name and Principal Position | | Year | | Salary | | Bonus(1) | | Securities

Underlying

Options | | All Other Compensation(2) | |

Randall D. Sampson, | | 2004 | | $143,403 | | $62,598 | | 10,000 | | $6,446 | |

President and Chief | | 2003 | | $135,895 | | $47,852 | | 10,000 | | $5,811 | |

Executive Officer | | 2002 | | $124,703 | | $32,423 | | 10,000 | | $5,720 | |

| | | | | | | | | | | |

David C. Hansen, | | 2004 | | $112,980 | | $43,894 | | 7,500 | | $1,695 | |

Vice President of Finance and | | 2003 | | $110,661 | | $25,809 | | 7,500 | | $807 | |

Chief Financial Officer | | 2002 | | $98,231 | | $19,155 | | 7,500 | | $0 | |

| | | | | | | | | | | |

John R. Harty, | | 2004 | | $102,518 | | $30,755 | | 7,500 | | $1,508 | |

Vice President | | 2003 | | $99,984 | | $23,247 | | 7,500 | | $1,513 | |

of Marketing | | 2002 | | $89,569 | | $17,466 | | 7,500 | | $1,361 | |

| | | | | | | | | | | |

Michael J. Garin, | | 2004 | | $91,127 | | $27,338 | | 7,500 | | $1,367 | |

Vice President | | 2003 | | $89,858 | | $23,319 | | 7,500 | | $1,299 | |

of Hospitality | | 2002 | | $81,237 | | $16,287 | | 7,500 | | $1,193 | |

| | | | | | | | | | | |

Mark A. Erickson, | | 2004 | | $91,127 | | $27,338 | | 7,500 | | $1,367 | |

Vice President | | 2003 | | $89,858 | | $23,280 | | 7,500 | | $1,299 | |

of Facilities | | 2002 | | $79,112 | | $15,487 | | 7,500 | | $1,191 | |

Note: Certain columns have not been included in this table because the information called for therein is not applicable to the Company or the individual named above for the periods indicated.

(1) Bonus amounts reported were earned in the year indicated, but paid out following the end of the fiscal year.

(2) All other compensation consisted of Company contributions to the Company’s 401(k) Plan and an automobile expense allowance (as applicable).

6

Option Grants in 2004

Name | | Options Granted | | % of Total Options Granted To Employees in Fiscal Year | | Exercise Price Per Share | | Market Price on Date of Grant | | Expiration Date | | | |

| |

| |

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term | |

5% | | 10% | |

Randall D. Sampson | | 10,000 | | 13.0% | | $16.75 | | $16.75 | | 04/07/2010 | | $57,000 | | $129,200 | |

David C. Hansen | | 7,500 | | 9.7% | | $16.75 | | $16.75 | | 04/07/2010 | | $42,750 | | $96,900 | |

John R. Harty | | 7,500 | | 9.7% | | $16.75 | | $16.75 | | 04/07/2010 | | $42,750 | | $96,900 | |

Michael J. Garin | | 7,500 | | 9.7% | | $16.75 | | $16.75 | | 04/07/2010 | | $42,750 | | $96,900 | |

Mark A. Erickson | | 7,500 | | 9.7% | | $16.75 | | $16.75 | | 04/07/2010 | | $42,750 | | $96,900 | |

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

| | Number of Shares Acquired on Exercise | | Value

Realized | | Number of Securities Underlying Unexercised Options at FY-End | | Value of Unexercised In-the-Money Options at FY-End(1) | |

Name | | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

Randall D. Sampson | | 15,000 | | $200,250 | | 143,000 | | 10,000 | | $2,245,433 | | $39,167 | |

David C. Hansen | | 500 | | $4,925 | | 18,500 | | 7,500 | | $174,175 | | $29,375 | |

John R. Harty | | 3,900 | | $40,914 | | 15,100 | | 7,500 | | $129,095 | | $29,375 | |

Michael J. Garin | | 1,600 | | $27,920 | | 66,900 | | 7,500 | | $952,243 | | $29,375 | |

Mark A. Erickson | | 11,000 | | $175,457 | | 63,500 | | 7,500 | | $890,575 | | $29,375 | |

(1) Based on closing price of $20.20 per share of the Company’s Common Stock on December 31, 2004.

Our executive compensation programs are administered by the Compensation Committee of the Board of Directors. The Committee is currently composed of independent, non-employee directors, none of whom was at any time during the past fiscal year an officer or employee of the Company, was formerly an officer of the Company or any of its subsidiaries, or had any employment relationship with the Company. Randall D. Sampson, President and Chief Executive Officer of the Company, participated in the deliberations of the Compensation Committee that occurred during fiscal 2004 regarding executive compensation and compensation of other employees, but did not take part in deliberations regarding his own compensation. Mr. Sampson’s participation in the deliberations of the Compensation Committee included providing information on the performance of people who work at the Company and recommendations regarding the appropriate levels of compensation for the Company’s officers.

7

The Compensation Committee, appointed by the Company’s Board of Directors, has primary responsibility in regard to determinations relating to executive compensation and administration of the Company’s stock option plans, including authorizing awards under the Company’s Stock Plan. The Compensation Committee operates under a written charter adopted by the full Board of Directors.

It is the objective of the Compensation Committee to pay compensation at levels that will attract, motivate and retain executives with superior leadership and management abilities and to structure the forms of compensation paid in order that their interests will be closely aligned with the Company achieving superior financial performance. With these objectives in mind, it has been the Company’s practice to provide a mix of base salary, bonus and equity based compensation. The Compensation Committee believes that these forms of compensation provide an appropriate combination of fixed and variable pay and incentives for short-term operational performance balanced with incentives to achieve long-term stock price performance.

Base salaries of the Company’s executive officers are generally established by reference to base salaries paid to executives in similar positions with similar responsibilities. Base salaries are reviewed annually and adjustments are usually made in March of each year based primarily on individual and Company performance during the immediately preceding fiscal year. Consideration is given by the Compensation Committee to both measurable financial performance, as well as subjective judgments by the Compensation Committee in regard to factors such as development and execution of strategic plans, changes in areas of responsibility, the development and management of employees and participation in industry, regulatory and political initiatives beneficial to the Company. The Compensation Committee does not, however, assign specific weights to these various quantitative and qualitative factors in reaching its decisions. In March 2004, after taking into consideration 2003 results and subjective factors applicable to each individual, the Committee approved increases in base compensation averaging 4.50% for the five executive officers named in the Executive Compensation tables above retroactive to the anniversary date of their employment. By way of comparison, the Company’s revenues increased approximately 14.7% in fiscal 2003 over fiscal 2002, and the Company’s net income increased approximately 26.1% in fiscal 2003 compared to fiscal 2002.

Bonuses are intended to provide executives with an opportunity to receive additional cash compensation, but only if they earn it through Company and individual performance. After year-end results are available, the Committee determines each officers’ bonus based on the Company’s financial performance, as well as the Compensation Committee’s assessment of individual performance in the executives’ area of responsibility based on objective and subjective factors. The total amount of bonuses paid to the five executive officers named in the Executive Compensation tables above for individual and Company performance in fiscal 2004 was $192,023, a 33.8% increase from the total of $143,507 in bonuses paid to the same individuals for individual and Company performance in fiscal 2003. By way of comparison, the Company’s revenues increased 14.7% and the Company’s net income increased 34.6% in 2004 as compared to 2003.

The Committee regards cash compensation paid to the Company’s executive officers as reasonable in relation to published information regarding compensation of executives with similar responsibilities and the Company’s financial performance.

Stock options are awarded to the Company’s executives under the Company’s Stock Plan. Stock options represent an additional vehicle for aligning management’s and stockholders’ interests, specifically motivating executives to remain focused on factors that will enhance the market value of the Company’s common stock. If there is no price appreciation in the common stock, the option holders receive no benefit from the stock options, because options are granted with an option exercise price at least equal to the fair market value of the common stock on the date of grant. During the first quarter of fiscal 2004, the Committee granted stock options to purchase 40,000 shares of common stock to the five executive officers named in the Executive Compensation tables above, which represented approximately 51.9% of the total options granted to all officers and key employees in 2004.

8

Mr. Randall D. Sampson participates in the same executive compensation plans provided to other senior executives and is evaluated by the same factors applicable to the other executives as described above. Mr. Sampson’s base compensation was increased 4.50% as of March 2004, reflecting the favorable financial results in 2003 compared to 2002 discussed above. Similarly, Mr. Sampson was awarded bonus compensation of $62,598 for his performance and Company performance in 2004 as compared to a bonus of $47,852 paid for individual and Company performance in 2003. In addition, Mr. Sampson was granted options to purchase 10,000 shares of Company common stock in the first quarter of 2004, an option award equal to the stock option grant he received in 2003.

The Committee believes that the quality and motivation of all our employees, and especially our executives and key employees, are essential to the Company’s success. The Committee also recognizes the need to ensure that the Company’s compensation policies and programs serve the interests of its shareholders. To that end, the Committee has engaged a compensation consultant to assist it with evaluating the Company’s current policies and programs, including the continued use of share-based payments as a part of compensation packages, and is committed to ensuring that the Company’s compensation policies and program remain aligned with the goal of enhancing shareholder value through programs that attract, motivate and retain executives and key employees.

Submitted by the Compensation Committee of the Board of Directors |

| Dale H. Schenian, Chair | Patrick R. Cruzen |

9

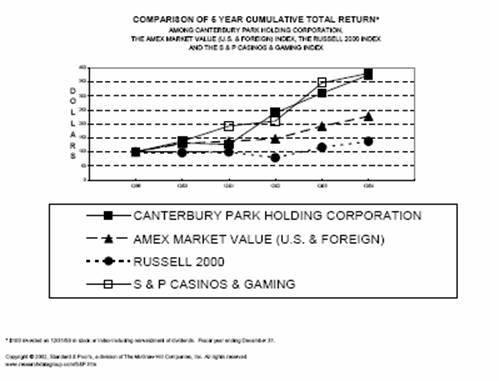

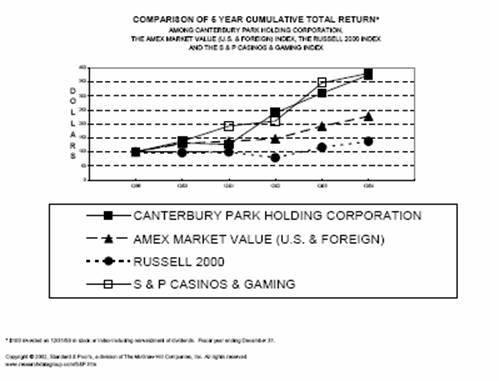

The following graph presents, at the end of each of the Company’s last five fiscal years, the cumulative total return on the Common Stock of the Company as compared to the cumulative total return of the AMEX Market Value (U.S. & Foreign) Index, the Russell 2000 Index and the S & P Casinos & Gaming Index. Company information and each index assumes the investment of $100 on the last business day before January 1, 2000 and the reinvestment of all dividends.

Comparison of Five-Year Cumulative Total Return

| | 12/99 | | 12/00 | | 12/01 | | 12/02 | | 12/03 | | 12/04 | |

Canterbury Park Holding Corporation | | $100.00 | | $131.86 | | $126.58 | | $239.44 | | $309.88 | | $374.62 | |

AMEX Market Value (U.S. & Foreign) | | 100.00 | | 130.14 | | 137.33 | | 146.61 | | 191.55 | | 227.57 | |

Russell 2000 | | 100.00 | | 96.98 | | 99.39 | | 79.03 | | 116.38 | | 137.71 | |

S & P Casinos & Gaming | | 100.00 | | 138.31 | | 192.36 | | 210.30 | | 346.57 | | 380.94 | |

10

Deloitte & Touche LLP (“Deloitte”) has been the auditor for the Company since 1994 and has been selected by the Audit Committee to serve as such for the current fiscal year. A representative of Deloitte is expected to be present at the Annual Meeting of Shareholders and will have an opportunity to make a statement and will be available to respond to appropriate questions.

The following is a summary of the fees billed to the Company by Deloitte for professional services rendered for the fiscal years ended December 31, 2004, and December 31, 2003. The Audit Committee considered and discussed with Deloitte the provision of non-audit services to the Company and the compatibility of providing such services with maintaining its independence as the Company’s auditor.

Fee Category | | 2004 | | 2003 | |

Audit Fees | | $ | 79,800 | | $ | 71,200 | |

Audit-Related Fees | | 10,400 | | 8,500 | |

Tax Fees | | 0 | | 0 | |

All Other Fees | | 18,000 | | 0 | |

Total Fees | | $ | 108,200 | | $ | 79,700 | |

| | | | | | | | |

Audit Fees. This category consists of fees billed for professional services rendered for the audit of our annual financial statements and review of financial statements included in our quarterly reports.

Audit-Related Fees. This category consists of fees billed for assurance and related services, such as our employee benefit plan audits, that are reasonably related to the performance of the audit or review of our financial statements and are not otherwise reported under “Audit Fees.”

Tax Fees. This category consists of fees billed for professional services for tax compliance, tax advice and tax planning. These services include assistance regarding federal and state tax compliance and acquisitions.

All Other Fees. This category consists of fees billed for reviews of other SEC filings.

In addition to approving the engagement of the independent auditor to audit the Company’s consolidated financial statements, it is the policy of the Committee to approve all use of the Company’s independent auditor for non-audit services prior to any such engagement. To minimize relationships that could appear to impair the objectivity of the independent auditor, it is the policy of the Committee to restrict the non-audit services that may be provided to the Company by the Company’s independent auditor primarily to services that clearly would not compromise the independence of the auditor.

The Audit Committee of the Board of Directors is responsible for independent, objective oversight of the Company’s financial accounting and reporting, by overseeing the system of internal controls established by management and monitoring the participation of management and the independent auditors in the financial reporting process. The Audit Committee operates under a written charter that was first adopted and approved by the Board of Directors in June 2000 and subsequently revised to conform to AMEX and SEC.

11

The Audit Committee held four meetings during fiscal year 2004 with management and the Company’s independent registered public accounting firm, Deloitte & Touche LLP (“Deloitte”). The meetings were designed to facilitate and encourage private communication between the Audit Committee and the auditors.

The Audit Committee reviewed and discussed the audited financial statements with management and Deloitte. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent accountants. The discussions with Deloitte also included the matters required by Statement on Auditing Standards No. 61, as amended by SAS 89 and SAS 90 (Audit Committees Communications).

Deloitte provided to the Audit Committee the written disclosures and the letter regarding its independence as required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). This information was discussed with Deloitte.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the SEC.

Submitted by the Audit Committee of the Company’s Board of Directors:

| Burton F. Dahlberg | Patrick R. Cruzen | Carin J. Offerman |

THE PRECEDING REPORT SHALL NOT BE DEEMED INCORPORATED BY REFERENCE BY ANY GENERAL STATEMENT INCORPORATING BY REFERENCE THIS PROXY STATEMENT INTO ANY FILING UNDER THE SECURITIES ACT OF 1933 (THE “1933 ACT”) OR THE SECURITIES EXCHANGE ACT OF 1934 (THE “1934 ACT”), EXCEPT TO THE EXTENT THE COMPANY SPECIFICALLY INCORPORATES THIS INFORMATION BY REFERENCE, AND SHALL NOT OTHERWISE BE DEEMED FILED UNDER THE 1933 ACT OR THE 1934 ACT.

Any shareholder who desires to contact our Board of Directors may do so by writing to the Board of Directors, generally, or to an individual Director at: Canterbury Park Holding Corporation, 1100 Canterbury Road, Shakopee, Minnesota 55379. Communications received electronically or in writing are distributed to the full Board of Directors, a committee or an individual Director, as appropriate, depending on the facts and circumstances described in the communication received. For example, a complaint regarding accounting, internal accounting controls or auditing matters will be forwarded to the Chair of the Audit Committee for review. Complaints and other communications may be submitted on a confidential or anonymous basis.

The proxy rules of the Securities and Exchange Commission permit shareholders of the Company, after timely notice to the Company, to present proposals for shareholder action in the Company’s proxy statement where such proposals are consistent with applicable law, pertain to matters appropriate for shareholder action and are not properly omitted by Company action in accordance with the Commission’s proxy rules. The next annual meeting of the shareholders of Canterbury Park Holding Corporation is expected to be held on or about June 1, 2006 and proxy materials in connection with that meeting are expected to be mailed on or about April 28, 2006. Shareholder proposals prepared in accordance with the Commission’s proxy rules must be received at the Company’s corporate office, 1100 Canterbury Road, Shakopee, Minnesota 55379, Attention: President, by December 30, 2005, in order to be considered for inclusion in the Board of Directors’ Proxy Statement and proxy card for the 2006 Annual Meeting of Shareholders. Any such proposals must be in writing and signed by the shareholder.

12

The Bylaws of the Company establish an advance notice procedure with regard to (i) certain business to be brought before an annual meeting of shareholders of the Company and (ii) the nomination by shareholders of candidates for election as directors.

Properly Brought Business. The Bylaws provide that at the annual meeting only such business may be conducted as is of a nature that is appropriate for consideration at an annual meeting and has been either specified in the notice of the meeting, otherwise properly brought before the meeting by or at the direction of the Board of Directors, or otherwise properly brought before the meeting by a shareholder who has given timely written notice to the Secretary of the Company of such shareholder’s intention to bring such business before the meeting. To be timely, the notice must be given by such shareholder to the Secretary of the Company not less than 45 days nor more than 75 days prior to a meeting date corresponding to the previous year’s annual meeting. Notice relating to the conduct of such business at an annual meeting must contain certain information as described in Section 2.9 of the Company’s Bylaws, which are available for inspection by shareholders at the Company’s principal executive offices pursuant to Section 302A.461, subd. 4 of the Minnesota Statutes. Nothing in the Bylaws precludes discussion by any shareholder of any business properly brought before the annual meeting in accordance with the Company’s Bylaws.

Shareholder Nominations. The Bylaws provide that a notice of proposed shareholder nominations for the election of directors must be timely given in writing to the Secretary of the Company prior to the meeting at which directors are to be elected. To be timely, the notice must be given by such shareholder to the Secretary of the Company not less than 45 days nor more than 75 days prior to a meeting date corresponding to the previous year’s annual meeting. The notice to the Company from a shareholder who intends to nominate a person at the meeting for election as a director must contain certain information as described in Section 3.7 of the Company’s Bylaws, which are available for inspection by shareholders as described above. If the presiding officer of a meeting of shareholders determines that a person was not nominated in accordance with the foregoing procedure, such person will not be eligible for election as a director.

Management knows of no other matters that will be presented at the meeting. If any other matters arise at the meeting, it is intended that the shares represented by the proxies in the accompanying form will be voted in accordance with the judgment of the persons named in the proxy.

The Company is transmitting with this Proxy Statement its Annual Report for the year ended December 31, 2004. Shareholders may request the Company’s 2004 Annual Report on Form 10-K as filed with the Securities and Exchange Commission by writing to the undersigned at the Company’s address on the first page of this Proxy Statement or may obtain it without charge at the Company’s website, http://www.canterburypark.com.

By Order of the Board of Directors,

David C. Hansen,

Secretary

13

òPlease detach hereò

1. | Election of directors: | 01 | Patrick R. Cruzen | 04 | Randall D. Sampson | o | Vote FOR | o | Vote WITHHELD |

| | 02 | Carin J. Offerman | 05 | Dale H. Schenian | | all nominees | | from all nominees |

| | 03 | Curtis A. Sampson | 06 | Burton F. Dahlberg | | (except as indicated) | | |

| | | | | | | | | |

| | | | | | | | | |

Directors recommend a vote "FOR" each of the above-named Directors.

(Instructions: To withhold authority to vote for any indicated nominee,

write the number(s) of the nominee(s) in the box provided to the right.) | | |

|

2. In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting.

UNLESS OTHERWISE SPECIFIED, THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED "FOR" THE ELECTION OF DIRECTORS NAMED IN PROPOSAL ONE AND "FOR" PROPOSAL TWO.

Address Change? Mark Box

Indicate changes below: o

Date _________________________________, 2005

Please date and sign exactly as your name(s) appears below indicating, where proper, official position or representative capacity in which you are signing. When signing as executor, administrator, trustee or guardian, give full title as such; when shares have been issues in names of two or more persons, all should sign. |

CANTERBURY PARK HOLDING CORPORATION

ANNUAL MEETING OF SHAREHOLDERS

June 2, 2005

4:00 p.m. Central Daylight Time

Canterbury Park Holding Corporation

1100 Canterbury Road

Shakopee, Minnesota

Canterbury Park Holding Corporation

1100 Canterbury Road

Shakopee, Minnesota 55379 proxy

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 2, 2005

The undersigned hereby appoints Patrick R. Cruzen, Carin J. Offerman, and Randall D. Sampson, or any of them, as proxies, with full power of substitution, to vote all the shares of common stock that the undersigned would be entitled to vote if personally present at the Annual Meeting of Shareholders of Canterbury Park Holding Corporation to be held Thursday, June 2, 2005, at 4:00 p.m. Central Daylight Time at Canterbury Park, 1100 Canterbury Road, Shakopee, Minnesota 55379, or at any adjournments thereof, upon any and all matters which may properly be brought before the meeting or adjournment thereof, hereby revoking all former proxies.

See reverse for voting instructions.