Free signup for more

- Track your favorite companies

- Receive email alerts for new filings

- Personalized dashboard of news and more

- Access all data and search results

Filing tables

Filing exhibits

SPA similar filings

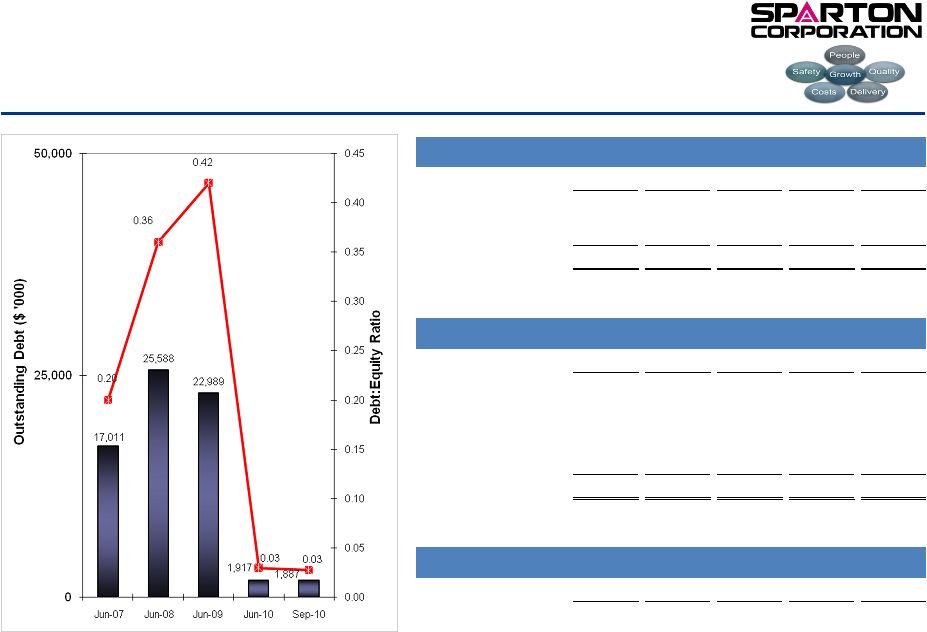

- 15 Feb 11 Fiscal 2011 Second Quarter Financial Results

- 9 Feb 11 Sparton Corporation Reports $0.14 EPS for Fiscal 2011 Second Quarter

- 14 Dec 10 Entry into a Material Definitive Agreement

- 17 Nov 10 Fiscal 2011 First Quarter Financial Results

- 9 Nov 10 Recognizes $2.4 Million Gain on Acquisition

- 28 Oct 10 Amendments to the Registrant's Code of Ethics, or Waiver of a Provision of the Code of Ethics

- 10 Sep 10 Fiscal Year 2010 Financial Results

Filing view

External links