Fiscal 2011 2 nd Quarter Financial Results Conference Call February 2010 Exhibit 99.2 |

2 Safe Harbor Statement Safe Harbor Statement Certain statements herein constitute forward-looking statements within the meaning of the Securities Act of 1933, as amended and the Securities Exchange Act of 1934, as amended. When used herein, words such as “believe,” “expect,” “anticipate,” “project,” “plan,” “estimate,” “will” or “intend” and similar words or expressions as they relate to the Company or its management constitute forward- looking statements. These forward-looking statements reflect our current views with respect to future events and are based on currently available financial, economic and competitive data and our current business plans. The Company is under no obligation to, and expressly disclaims any obligation to, update or alter its forward- looking statements whether as a result of such changes, new information, subsequent events or otherwise. Actual results could vary materially depending on risks and uncertainties that may affect our operations, markets, prices and other factors. Important factors that could cause actual results to differ materially from those forward-looking statements include those contained under the heading of risk factors and in the management’s discussion and analysis contained from time-to- time in the Company’s filings with the Securities and Exchange Commission. |

3 • Fiscal 2011 2 nd Quarter Consolidated Results • 2 nd Quarter Segmented Operating Results • Liquidity & Capital Resources • SMS Colorado 2 nd Quarter Financial Results • Growth Investments • Outlook • Q & A Today’s Agenda Today’s Agenda |

4 Consolidated Financial Results Consolidated Financial Results Fiscal 2011 Q2 Fiscal 2011 Q2 ($ in 000’s, except per share) 2010 2009 Net Sales 46,331 47,223 (892) Gross Profit 7,547 8,135 (588) 16.3% 17.2% Selling and Administrative Expense 5,689 5,109 580 Internal R&D Expense 155 - 155 Restructuring / Impairment Charges - 1,007 (1,007) Gain On Acquisition - - - Operating Income 1,581 1,479 102 3.4% 3.1% Income Before Provision For (Benefit From) Income Tax 1,549 1,319 230 Provision For (Benefit From) Income Taxes 114 (1,929) 2,043 Net Income 1,435 3,248 (1,813) 3.1% 6.9% Income per Share, Basic and Diluted 0.14 0.33 (0.19) 3 Months ending Dec 31, Year over Year Variance |

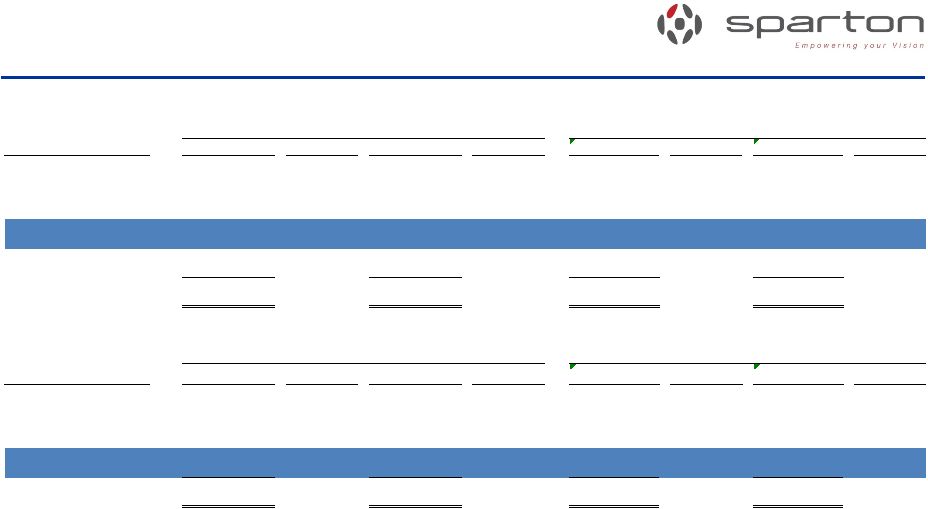

5 Medical Operating Results Medical Operating Results SEGMENT FY11 % of Total FY10 % Change 2010 % of Total 2009 % Change Medical $ 25,650 55% $ 17,358 48% $ 44,695 49% $ 36,914 21% EMS 10,512 23% 14,324 -27% 22,840 25% 31,927 -28% DSS 13,179 28% 19,022 -31% 30,776 33% 32,367 -5% Eliminations (3,010) -6% (3,481) -14% (6,213) -7% (5,881) 6% Totals $ 46,331 100% $ 47,223 -2% $ 92,098 100% $ 95,327 -3% SEGMENT FY11 GP % FY10 GP % 2010 GP % 2009 GP % Medical $ 3,790 14.8% $ 2,463 14.2% $ 5,657 12.7% $ 5,397 14.6% EMS 749 7.1% 711 5.0% 1,656 7.3% 1,729 5.4% DSS 3,008 22.8% 4,961 26.1% 7,260 23.6% 8,381 25.9% Totals $ 7,547 16.3% $ 8,135 17.2% $ 14,573 15.8% $ 15,507 16.3% ($ in 000’s, except per share) 2nd Quarter Sales 2nd Quarter Gross Profit Fiscal Year Sales Fiscal Year Gross Profit |

6 EMS Operating Results EMS Operating Results SEGMENT FY11 % of Total FY10 % Change 2010 % of Total 2009 % Change Medical $ 25,650 55% $ 17,358 48% $ 44,695 49% $ 36,914 21% EMS 10,512 23% 14,324 -27% 22,840 25% 31,927 -28% DSS 13,179 28% 19,022 -31% 30,776 33% 32,367 -5% Eliminations (3,010) -6% (3,481) -14% (6,213) -7% (5,881) 6% Totals $ 46,331 100% $ 47,223 -2% $ 92,098 100% $ 95,327 -3% SEGMENT FY11 GP % FY10 GP % 2010 GP % 2009 GP % Medical $ 3,790 14.8% $ 2,463 14.2% $ 5,657 12.7% $ 5,397 14.6% EMS 749 7.1% 711 5.0% 1,656 7.3% 1,729 5.4% DSS 3,008 22.8% 4,961 26.1% 7,260 23.6% 8,381 25.9% Totals $ 7,547 16.3% $ 8,135 17.2% $ 14,573 15.8% $ 15,507 16.3% ($ in 000’s, except per share) 2nd Quarter Sales 2nd Quarter Gross Profit Fiscal Year Sales Fiscal Year Gross Profit |

7 DSS Operating Results DSS Operating Results SEGMENT FY11 % of Total FY10 % Change 2010 % of Total 2009 % Change Medical $ 25,650 55% $ 17,358 48% $ 44,695 49% $ 36,914 21% EMS 10,512 23% 14,324 -27% 22,840 25% 31,927 -28% DSS 13,179 28% 19,022 -31% 30,776 33% 32,367 -5% Eliminations (3,010) -6% (3,481) -14% (6,213) -7% (5,881) 6% Totals $ 46,331 100% $ 47,223 -2% $ 92,098 100% $ 95,327 -3% SEGMENT FY11 GP % FY10 GP % 2010 GP % 2009 GP % Medical $ 3,790 14.8% $ 2,463 14.2% $ 5,657 12.7% $ 5,397 14.6% EMS 749 7.1% 711 5.0% 1,656 7.3% 1,729 5.4% DSS 3,008 22.8% 4,961 26.1% 7,260 23.6% 8,381 25.9% Totals $ 7,547 16.3% $ 8,135 17.2% $ 14,573 15.8% $ 15,507 16.3% ($ in 000’s, except per share) 2nd Quarter Sales 2nd Quarter Gross Profit Fiscal Year Sales Fiscal Year Gross Profit |

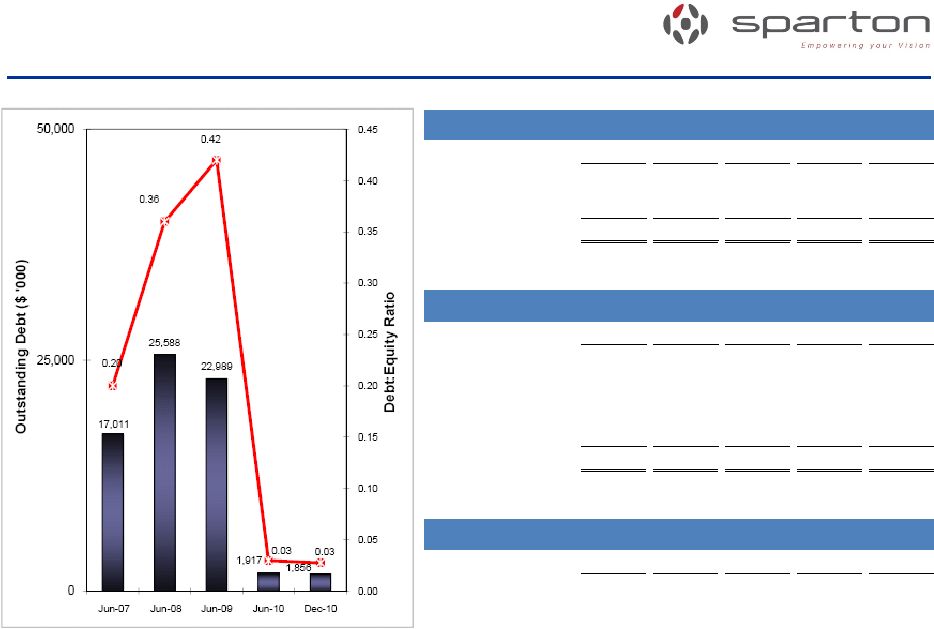

8 Liquidity & Capital Resources Liquidity & Capital Resources ($ in '000) Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Cash and equivalents 12,012 16,144 30,589 27,281 29,941 LOC Availability 15,461 15,868 16,897 17,769 17,389 Total 27,473 32,012 47,486 45,050 47,330 ($ in '000) Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Credit Revolver - - - - - Long Bank Term Debt - - - - - Former Astro Owners 1,029 1,029 - - - IRB (Ohio) 1,973 1,945 1,917 1,887 1,856 Total 3,002 2,974 1,917 1,887 1,856 ($ in '000) Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Net Inventory 31,888 28,808 26,514 36,629 35,076 Cash Availability Debt Inventory |

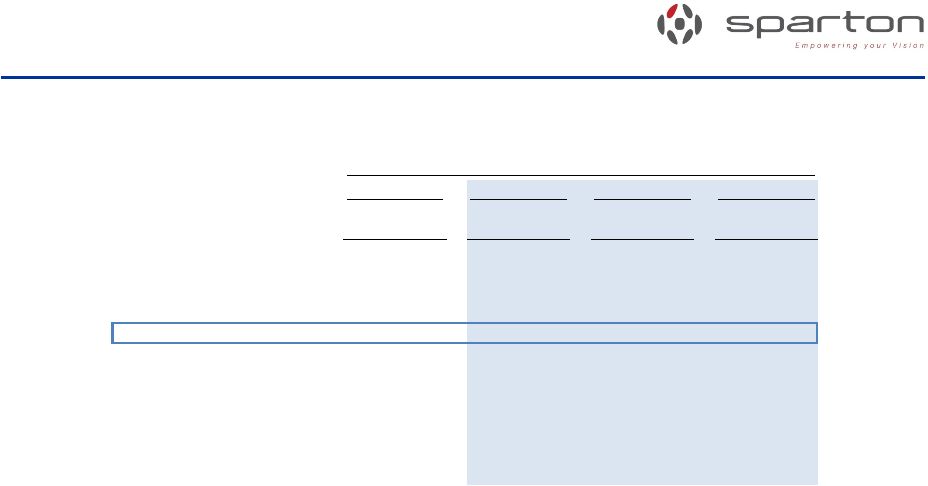

9 SMS Colorado 2 nd Quarter Financial Results ($ in 000’s) 2009 2010 2010 2010 Colorado Pro Forma Colorado Strongsville Total Medical Net Sales $ 6,990 $ 11,356 $ 14,294 $ 25,650 Gross Profit (99) 1,765 2,025 3,790 Gross Margin -1.4% 15.5% 14.2% 14.8% Operating Income (Loss) (430) 1,110 740 1,850 Operating Margin -6.2% 9.8% 5.2% 7.2% Net Income (Loss) $ (44) $ 1,204 $ - $ 1,204 Net Profit Margin -0.6% 10.6% 0.0% 4.7% 3 months ending Dec 31, |

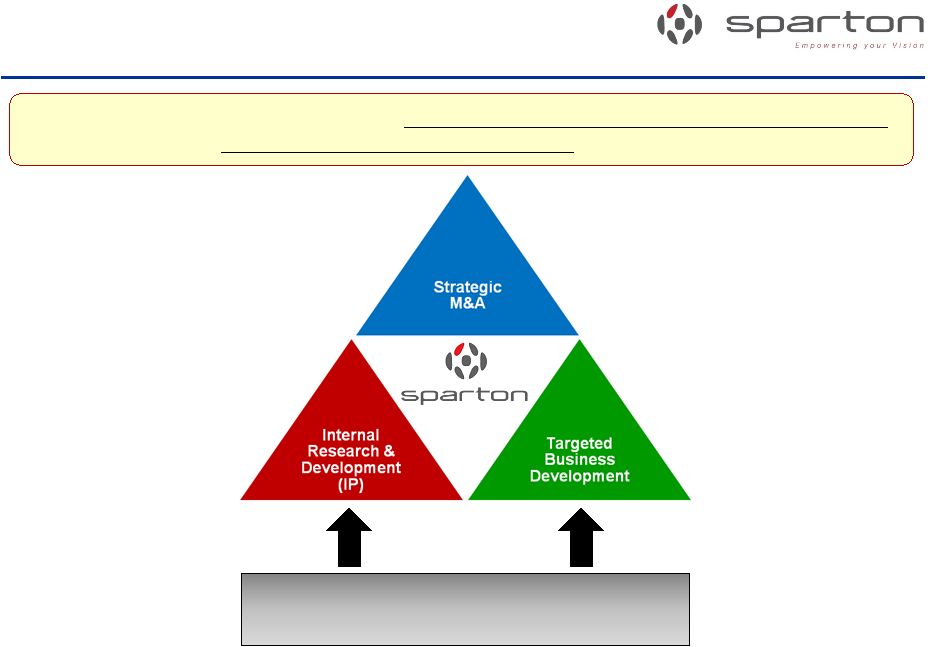

10 Growth Investments Growth Investments Focus: Use growth investments to achieve sustainable year-over-year revenue and profit increases and to further place protective barriers around Sparton. Supported by market research & go-to-market programs |

11 Business Development Business Development Marketing Initiative Progress Marketing Initiative Progress • New Brand Identity – Logo – Tagline – Key Attributes • Trade Show Booth – Design Completed – Construction Phase – CY2011 Schedule Presented – Preview: January 14th, 2011 – Launch: MD&M-West Feb 2011 • Collateral Materials – PowerPoint, Brochures, Etc. • Website – Launch Corporate & Medical first – DSS and Complex Systems to follow Schedule of Events National Sales Meeting Jan 13 Schaumburg Cross Sell & Goal Setting Launch New Website Feb 8 Worldwide Web Update Corp & Medical 1st MD & M West Feb 8-10 Anaheim Medical AmCon (regional) Mar 2-3 Orlando EMS Contract Manufacturing SATCON Expo Mar 14-17 Washington DC Navigation & Exploration Navy League Apr 11-13 Maryland Advanced Security AmCon (regional) Apr 26-27 Denver EMS Contract Manufacturing MD & M East Jun 7-10 New York Medical AUVSI Aug 16-19 Washington Navigation & Exploration SEG ‘11 (O&G) Sep 18-23 San Antonio Oil & Gas Exploration MD & M Twin City Nov 2-3 Minneapolis Medical BioMEDevice West Dec 6-7 San Jose Medical |

12 • Focus on sustained profitability – Continue margin improvements in EMS – Further improvements in operating performance through lean and quality efforts • Implement the strategic growth plan – Anticipate modest organic revenue growth – Enhance the Business Development organization – Develop and launch a new marketing strategy – Invest in new product development • Delphi Medical Systems will continue to be accretive • Continue to look at complementary and compatible acquisitions Fiscal 2011 Outlook Fiscal 2011 Outlook |

13 Q & A Q & A |