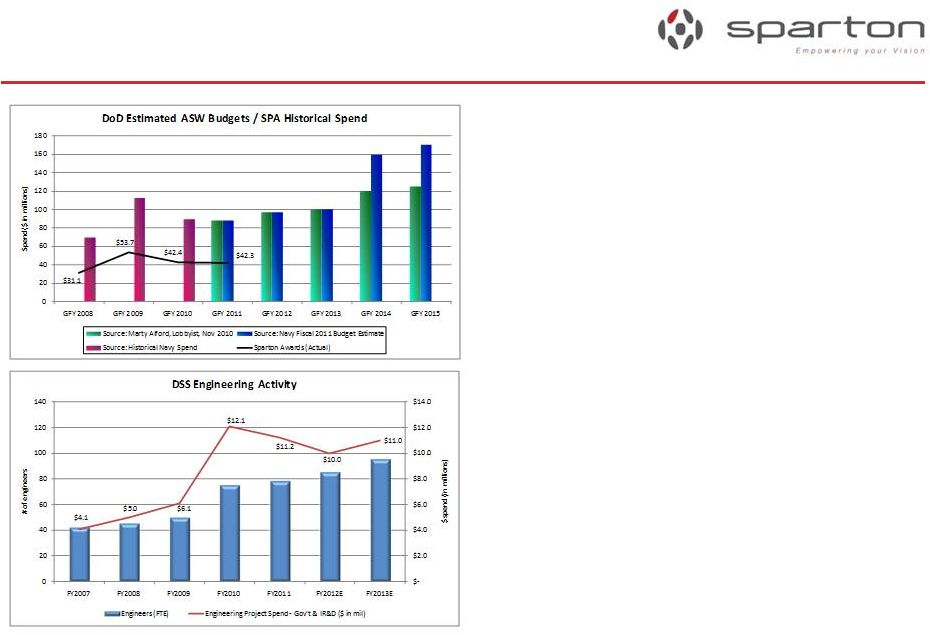

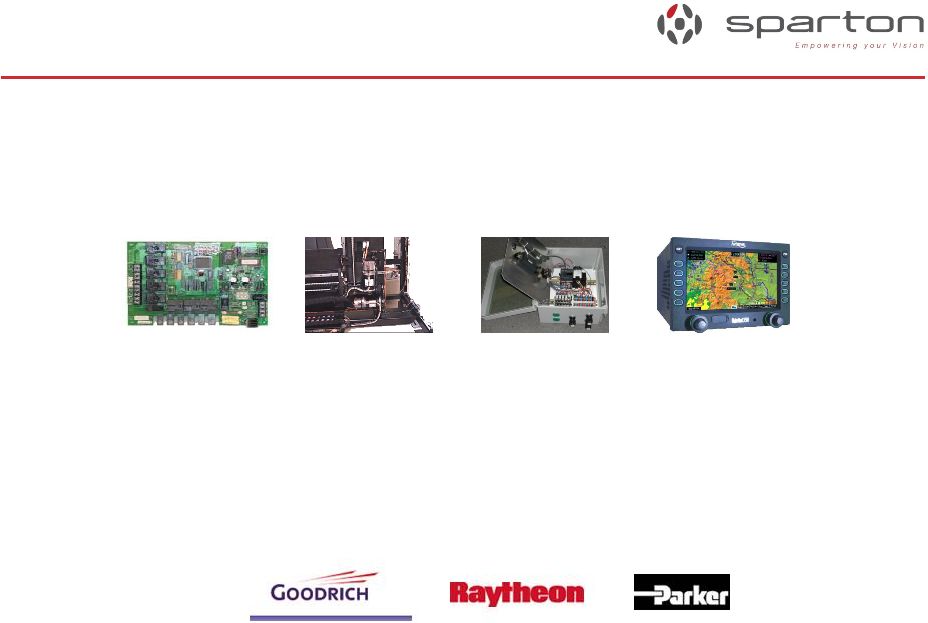

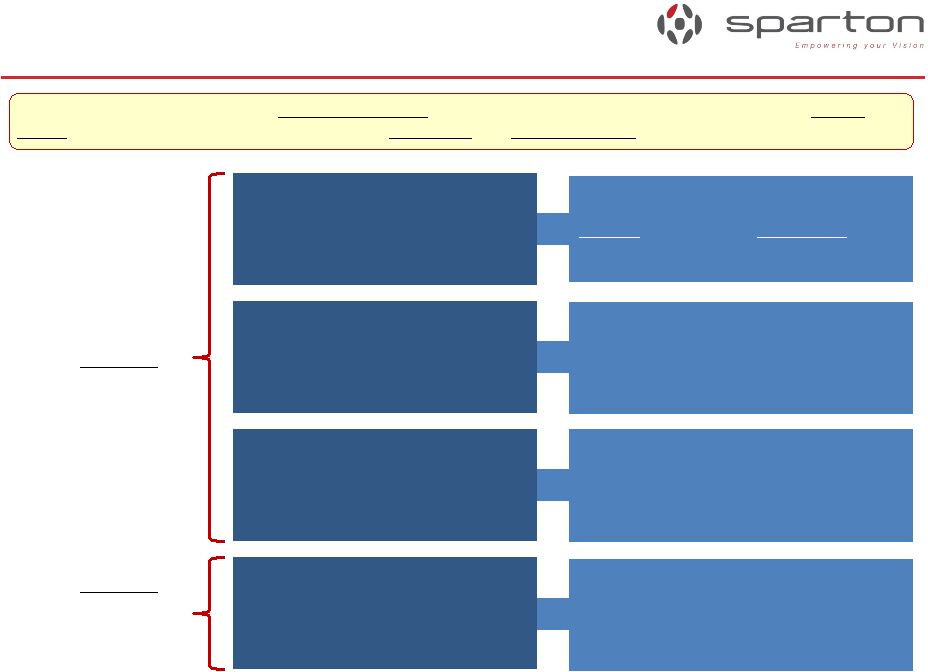

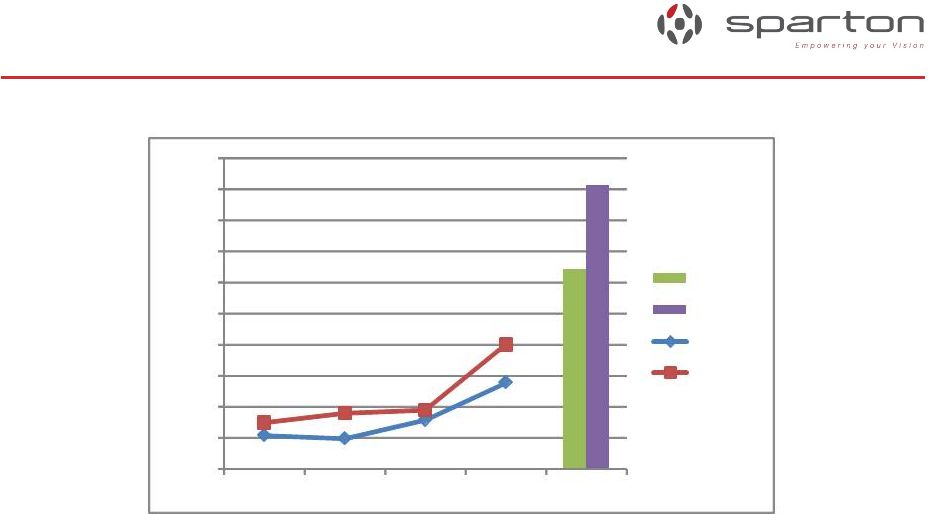

Defense & Security Systems Defense & Security Systems Market Outlook Market Outlook • Government FY2009 production peak was realized primarily in Sparton’s FY2011 – Reduced U.S. Navy sonobuoy production volume in Sparton’s FY2012 will be partially offset by the pursuit of new developmental engineering funds from the DoD for Antisubmarine Warfare related applications ($37 million over 5 years of engineering funds already announced) • High Altitude Antisubmarine Warfare (HAASW) • Deep Water Active Distributed System (DWADS) • Comms at Speed & Depth (CSD) {on-hold} • Q125 Technology Improvements • Q-36 ECP Program – Continued military actions taken by North Korea and China should have an impact in the use of sonobuoys in that region – The leak of government sensitive information may also put foreign nations on guard and require more monitoring of their territorial waterways – U.S. Navy plans to buy 117 P-8A anti-submarine warfare, anti- surface warfare, intelligence, surveillance and reconnaissance aircraft to replace its existing P-3 fleet. Initial operational capability is scheduled for 2013. – The Indian navy signed a contract for eight P-8I aircraft in January 2009. Boeing will deliver the first P-8I within 48 months of contract signing and the remaining seven by 2015. • Foreign sales are still somewhat unpredictable although a sharp increase was seen in the 2 nd quarter of FY2010 & 1 st nine months of FY2012 The Boeing P-8 Posiden aircraft to become the new launch vehicle for sonobuoys • 14 |