Fiscal 2016 1st Quarter Financial Results November 10, 2015 Exhibit 99.2

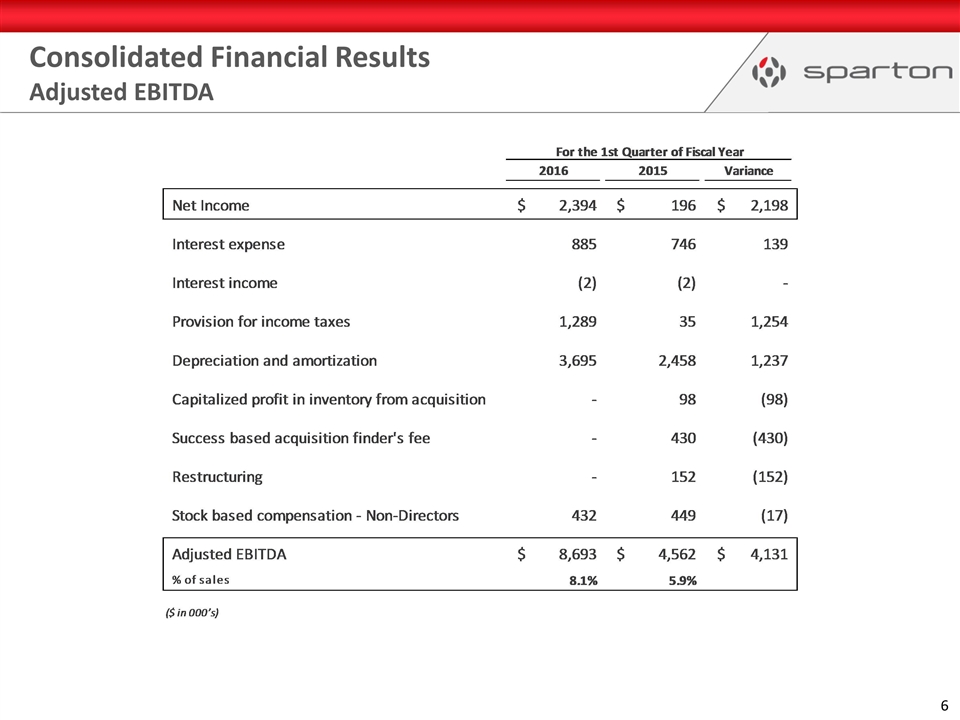

Safe Harbor Statement Certain statements herein constitute forward-looking statements within the meaning of the Securities Act of 1933, as amended and the Securities Exchange Act of 1934, as amended. When used herein, words such as “believe,” “expect,” “anticipate,” “project,” “plan,” “estimate,” “will” or “intend” and similar words or expressions as they relate to the Company or its management constitute forward-looking statements. These forward-looking statements reflect our current views with respect to future events and are based on currently available financial, economic and competitive data and our current business plans. The Company is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements whether as a result of such changes, new information, subsequent events or otherwise. Actual results could vary materially depending on risks and uncertainties that may affect our operations, markets, prices and other factors. Important factors that could cause actual results to differ materially from those forward-looking statements include those contained under the heading of risk factors and in the management’s discussion and analysis contained from time-to-time in the Company’s filings with the Securities and Exchange Commission. Adjusted EBITDA and related reconciliation presented here represents earnings before interest, taxes, depreciation and amortization as adjusted for gross profit effects of capitalized profit in inventory from acquisitions, acquisition contingency settlements, certain restructuring expenses, and stock based compensation expense. The Company believes Adjusted EBITDA is commonly used by financial analysts and others in the industries in which the Company operates and, thus, provides useful information to investors. The Company does not intend, nor should the reader consider, Adjusted EBITDA an alternative to net income, net cash provided by operating activities or any other items calculated in accordance with GAAP. The Company's definition of Adjusted EBITDA may not be comparable with Adjusted EBITDA as defined by other companies. Accordingly, the measurement has limitations depending on its use.

1st Quarter Business Review Consolidated Financial Results MDS Segment Operating Results ECP Segment Operating Results Liquidity & Capital Resources Fiscal 2016 Outlook Q & A Today’s Agenda

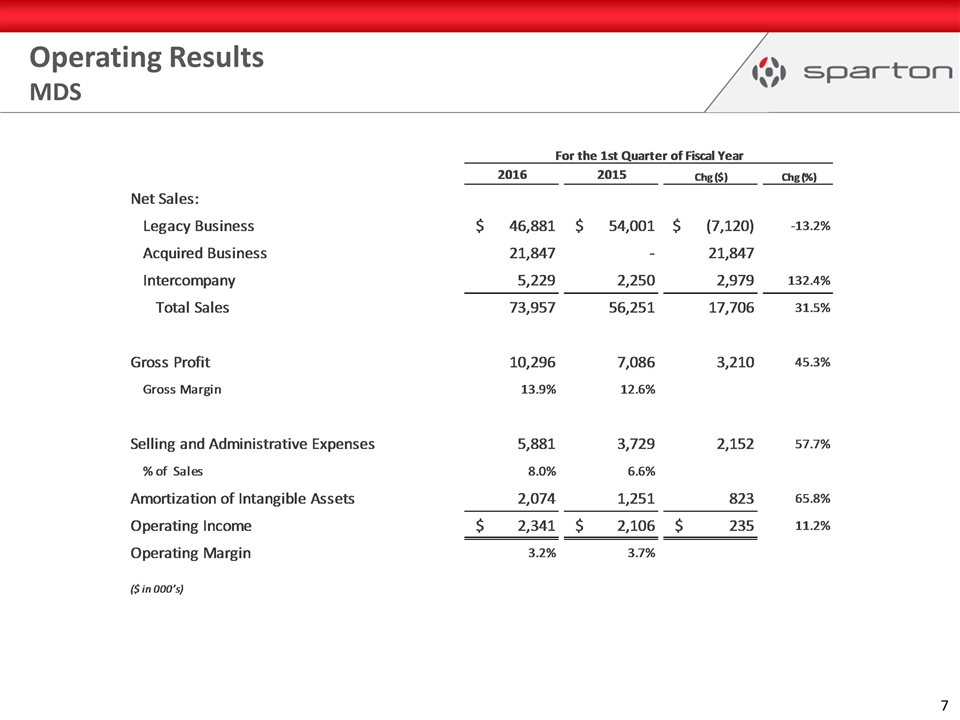

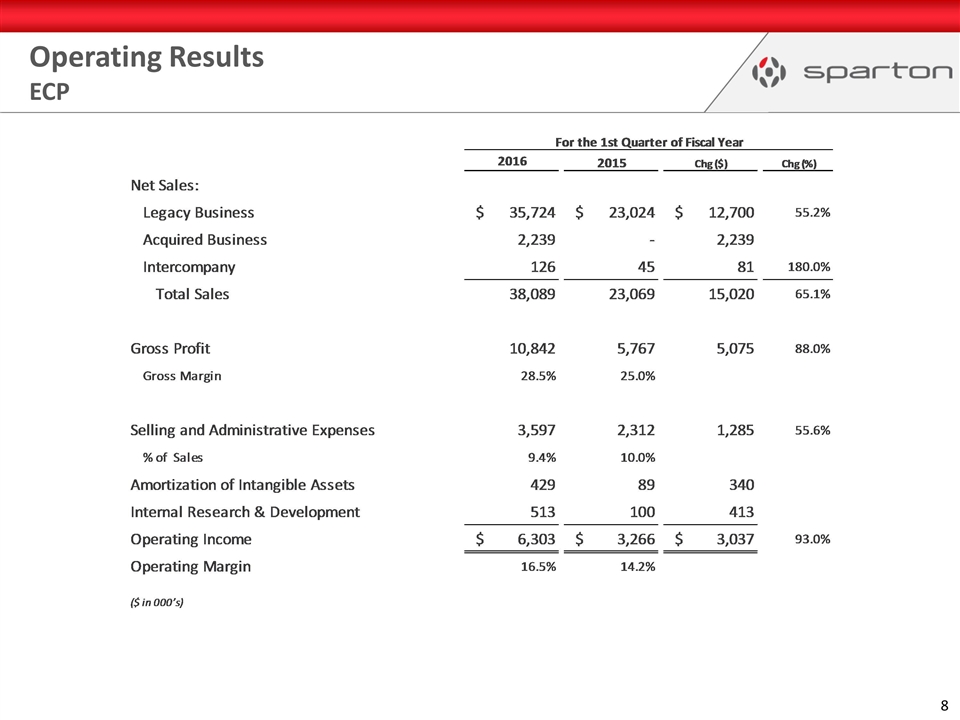

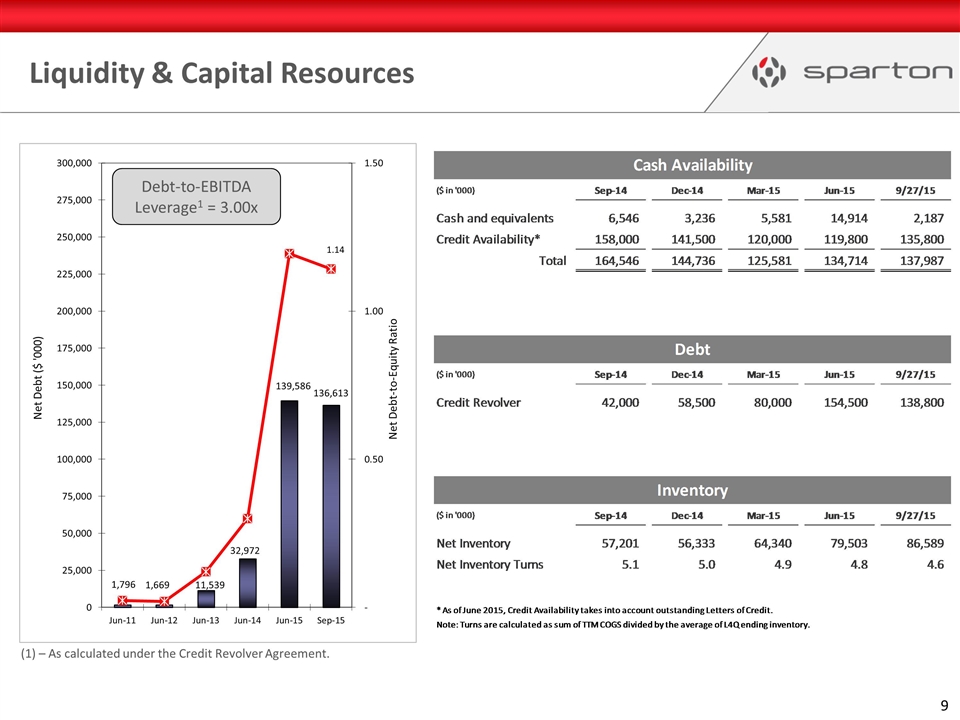

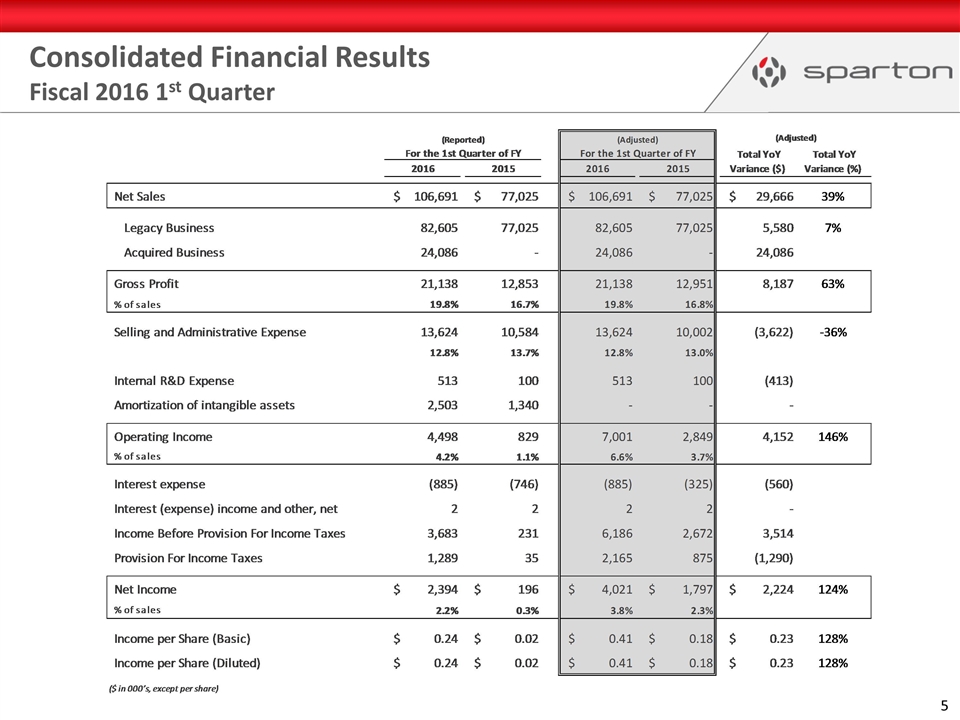

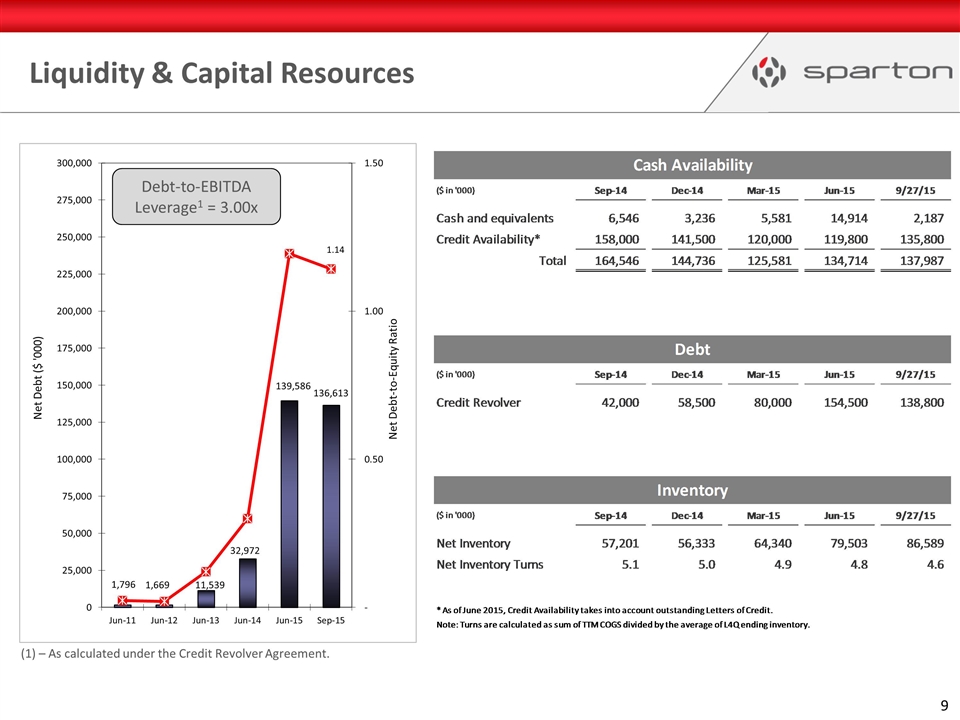

Revenue growth was up 39%, with the legacy business organic growth being 7%. 240 new program or product wins were awarded with a first time revenue potential of $23.5 million as compared to 78 new product or program wins with a first time revenue potential of $16.0 million in the prior year quarter. 100 in MDS with a first time revenue potential of $10.7 million versus 10 with a first time revenue potential of $7.9 million in the prior year quarter. 140 in ECP (ASW, Aydin and NavEx) with first time revenue potential of $12.8 million versus 68 with a first time revenue potential of $8.1 million in the prior year quarter. Quarter end sales backlog of approximately $277 million, representing a 14% increase over the prior year quarter. Total sales to the U.S. Navy increased to $24.5 million from $18.4 million in Q1 fiscal 2015; sonobuoy sales to foreign governments increased to $4.4 million from $1.0 million. Consolidated gross margin was 19.8%, compared to the 16.7% in the prior year quarter. The debt-to-EBITDA leverage as calculated under the Revolving Credit Facility as of September 27, 2015 was 3.00 compared to 3.47 as of June 30, 2015 as a result of the improvement in operating results on a trailing twelve month basis. 1st Quarter Business Review

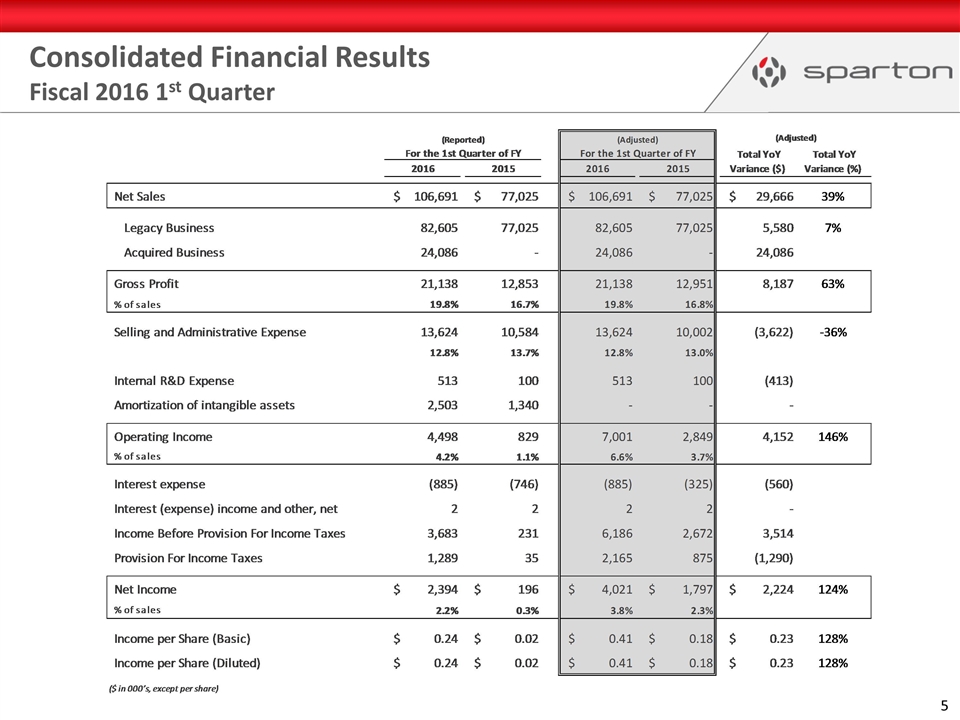

Consolidated Financial Results Fiscal 2016 1st Quarter 5

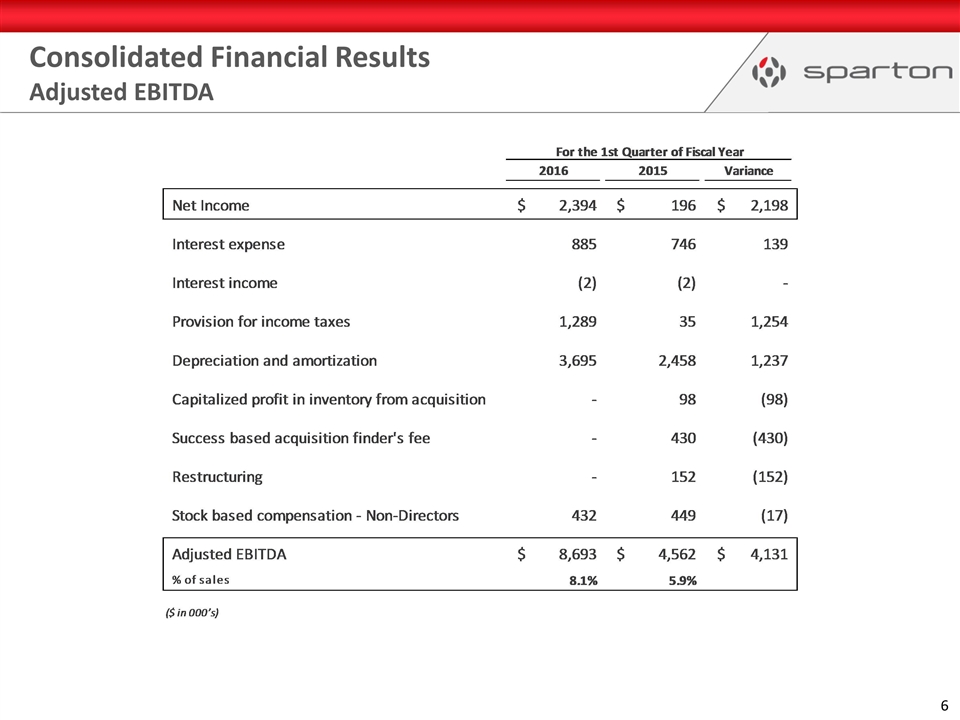

Consolidated Financial Results Adjusted EBITDA 6

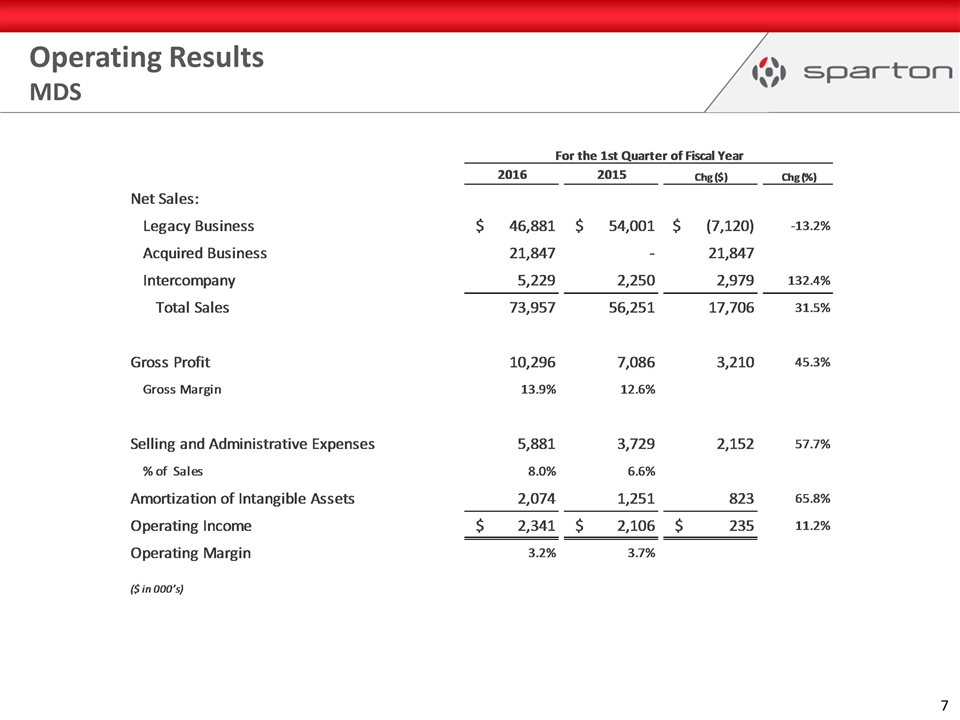

Operating Results MDS 7

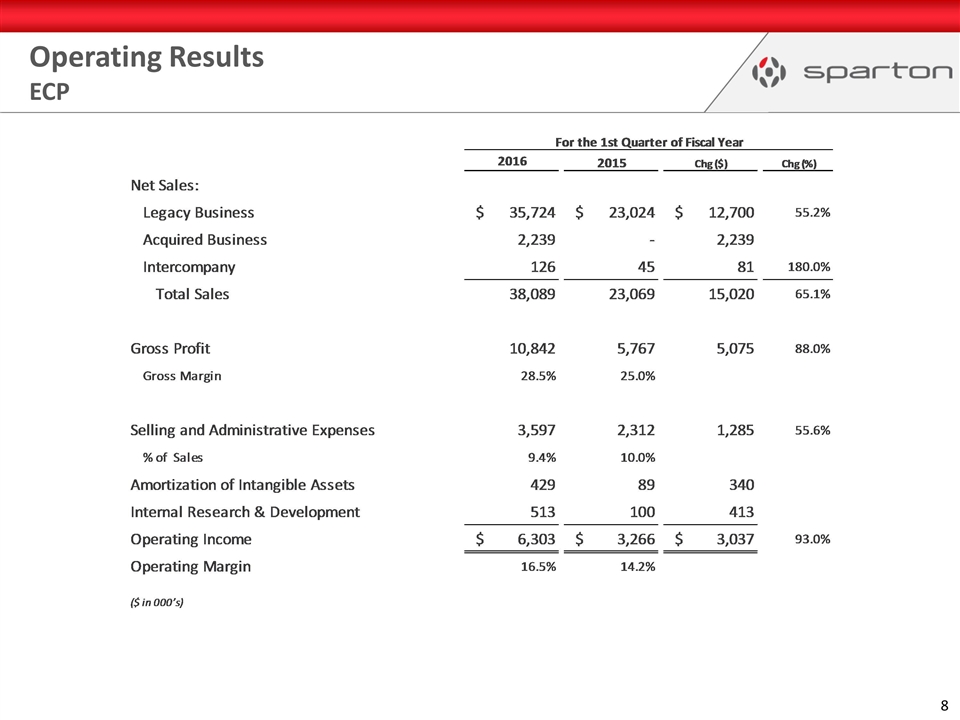

Operating Results ECP 8

Liquidity & Capital Resources (1) – As calculated under the Credit Revolver Agreement.

Complete the integration and cost synergies of the latest acquisitions Accelerate organic growth initiatives Improve margins through multiple cost savings initiatives Execute the 2020 Vision (Phase II of Sparton’s Strategic Growth Plan) Upcoming investor relations events Non-deal road show with Sidoti in St. Louis, Milwaukee, and Detroit on November 11th – 12th IDEAS Southwest Investors Conference in Dallas on November 18th – 19th ROTH Capital Partners Industrials Conference in Chicago on December 15th CJS Securities in the NYC area on January 13th Fiscal 2016 Outlook

“Reach $1 billion by 2020, expanding our manufacturing and design services while providing more engineered components and products to meet the needs of our customers and markets” Q&A