Fiscal Year 2019 STIP Awards

On August 22, 2018, the Committee, with the approval of the Board of Directors, approved financial targets for awards for fiscal year 2019 under the STIP for the Named Executive Officers. The awards are based on achieving targets for EBITDA and Net Sales for fiscal year 2019. The STIP Pool for the Company for fiscal year 2019 was set at $2,539,139, assuming achievement of 100% of the targets by all participating key employees. For retention purposes, the participants, including named executive officers, are guaranteed a minimum payout of 100% of target if they remain employed by the Company in September 2019. Targets for Messrs. McCormack, Madlock and Korwin were set at $150,000, $120,000 and $120,000, respectively. Additionally, if the Company is sold during fiscal 2019, participants would be paid 50% of the targeted STIP if they are employed by the Company at the time of sale. Additional detail regarding such awards, including actual awards in fiscal year 2019, will be included in the next annual proxy statement.

Fiscal Year 2017 STIP Awards

For fiscal 2017 STIP awards,non-executive participants were paid 100% of the target awards as a retention measure. As a result, additional STIP awards in the amount of $745,000 were paid in fiscal 2018.

Bonuses

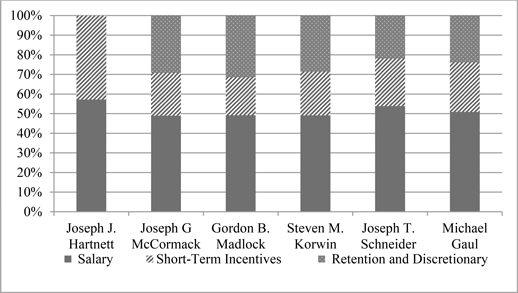

The Committee may recommend bonuses in addition to or in lieu of bonuses earned under the STIP based on the Committee’s evaluation of the individual performance and level of responsibility of the Named Executive Officers and other members of management. In determining discretionary annual incentive bonuses for the Named Executive Officers, the Committee evaluates the Chief Executive Officer’s recommendations based on individual performance. The Committee independently evaluates the individual performance of the Chief Executive Officer. The results of those evaluations are used by the Committee to recommend bonuses for the Named Executive Officers to the Board of Directors.

Retention Bonuses

On April 25, 2018, the Committee, with the approval of the Board of Directors, approved and adopted a cash retention bonus pool. Under the arrangement, the Company will pay certain executives and key employees a cash retention bonus, in the event that the participant remains continuously employed with the Company and there is no Change in Control (as defined in the 2010 LTIP) prior to September 14, 2019 or earlier in the event the participant is involuntarily terminated after June 30, 2018.

Participants employed on or after June 30, 2018 and involuntarily terminated prior to September 14, 2019 will be entitled to 50% of the approved cash retention bonus plus a pro rata portion of the remaining 50%. Each participant’s pro rata portion will be equal to the number of full calendar months that have elapsed during the period June 30, 2018 through August 31, 2019, including the calendar month in which the termination occurs, divided by 14 (which is the number of calendar months occurring during the period June 30, 2018 through August 31, 2019).

Participants who remain employed by the Company through September 14, 2019 will receive payment on that date or within 14 days of involuntary termination if termination occurs during the period June 30, 2018 through September 14, 2019.

Participants in the arrangement include the Principal Financial Officer and certain of the Named Executive Officers. For a description of the amounts of potential retention bonuses due to the Principal Financial Officer and certain of the Named Executive Officers, see “Employment Agreements and Potential Payments upon Termination or Change in Control”below.

Long-Term Incentives

Our long-term incentive program historically involved the grant of restricted stock. During fiscal year 2015, the Committee worked with Meridian to better align the types of equity awarded under the 2010 LTIP with the market, and recommended to the Board of Directors that future awards include a mix of restricted stock units and options. The grants are designed to (i) align the interest of our key employees with our shareholders through the employees’ ownership of equity, (ii) accomplish our corporate strategy by requiring the vesting of such awards to be tied to the achievement of certain performance goals, and (iii) encourage the long-term employment of key employees.

Due to the potential sale of the Company, no awards under the 2010 LTIP were made for the 2018 fiscal year.

The Company annually reviews the long-term incentive elements of its compensation package, including the beneficial and detrimental aspects of particular compensation components such as restricted stock awards and stock options, to determine the continuing efficacy of such programs.

13