UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registranto

Check the appropriate box:

| | |

| o | | Preliminary Proxy Statement |

| | |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| x | | Definitive Proxy Statement |

| | |

| o | | Definitive Additional Materials |

| | |

| o | | Soliciting Material Pursuant to §240.14a-12 |

ADVANCED ENERGY INDUSTRIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies:

|

| |

| | (2) | | Aggregate number of securities to which transaction applies:

|

| |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

| | (4) | | Proposed maximum aggregate value of transaction:

|

| |

| | (5) | | Total fee paid:

|

| | |

| o | | Fee paid previously with preliminary materials. |

| | |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid:

|

| |

| | (2) | | Form, Schedule or Registration Statement No.:

|

| |

| | (3) | | Filing Party:

|

| |

| | (4) | | Date Filed:

|

TABLE OF CONTENTS

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 6, 2009

To Our Stockholders:

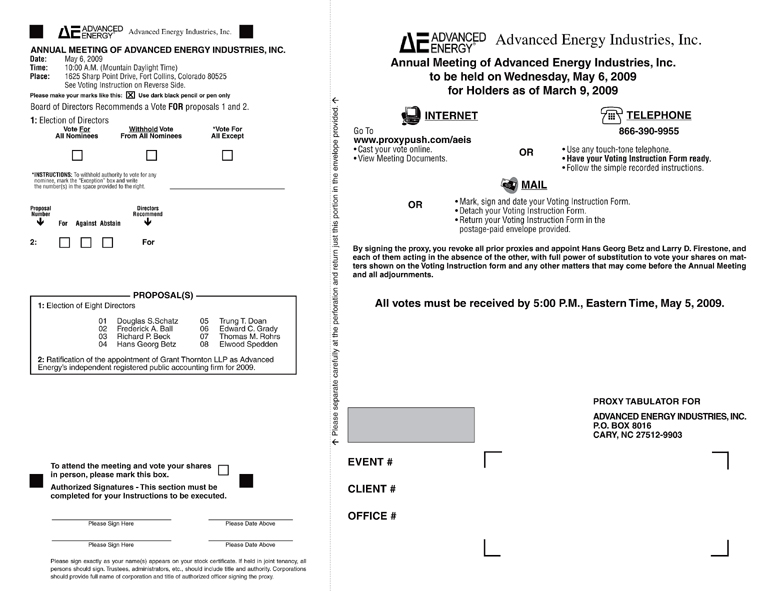

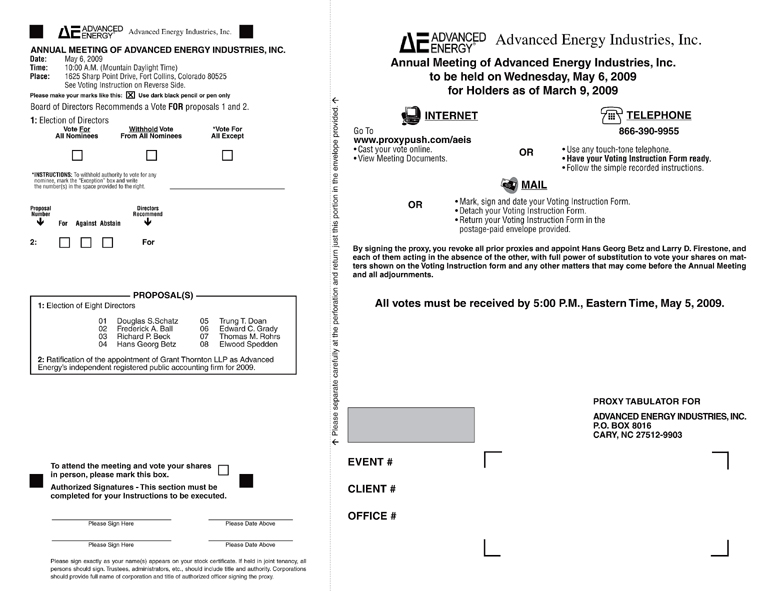

The 2009 Annual Meeting of Stockholders of Advanced Energy Industries, Inc. (“Advanced Energy” or the “Company”) will be held on Wednesday, May 6, 2009, at 10:00 a.m. Mountain Daylight Time, at Advanced Energy’s corporate offices, 1625 Sharp Point Drive, Fort Collins, Colorado 80525. At the meeting, you will be asked to vote on the following matters:

1. Election of eight directors.

2. Ratification of the appointment of Grant Thornton LLP as Advanced Energy’s independent registered public accounting firm for 2009.

3. Any other matters of business properly brought before the meeting.

Each of the matters 1 and 2 is described in detail in the accompanying proxy statement, dated March 25, 2009.

If you owned common stock of Advanced Energy at the close of business on March 9, 2009, you are entitled to receive this notice and to vote at the meeting.

All stockholders are cordially invited to attend the meeting in person. If you do not plan to attend the meeting and vote your shares of common stock in person, please authorize a proxy to vote your shares in one of the following ways:

| | |

| | • | Use the toll-free telephone number shown on your proxy card (this call is toll-free if made in the United States or Canada); |

| |

| | • | Go to the website address shown on your proxy card and authorize a proxy via the Internet; or |

| |

| | • | Mark, sign, date and promptly return the enclosed proxy card in the postage-paid envelope. |

Any proxy may be revoked at any time prior to its exercise at the annual meeting.

By Order of the Board of Directors,

John D. Pirnot

Corporate Secretary

Fort Collins, Colorado

March 25, 2009

| | |

| Date: | | March 25, 2009 |

| |

| To: | | Our Owners |

| |

| From: | | Hans Georg Betz |

| |

| Subject: | | Invitation to Our 2009 Annual Meeting of Stockholders |

Please come to our 2009 Annual Meeting of Stockholders to learn about Advanced Energy, what we have accomplished in the last year and our plans for 2009. The meeting will be held:

Wednesday, May 6, 2009

10:00 a.m. Mountain Daylight Time

Advanced Energy’s Corporate Offices

1625 Sharp Point Drive

Fort Collins, Colorado 80525

This proxy statement describes the matters that management of Advanced Energy intends to present to the stockholders for approval at the annual meeting. Accompanying this proxy statement is Advanced Energy’s 2008 Annual Report to Stockholders and a form of proxy. All voting on matters presented at the annual meeting will be by proxy or by ballot in person, in accordance with the procedures described in this proxy statement. Instructions for voting are included in the proxy statement. Your proxy may be revoked at any time prior to the meeting in the manner described in this proxy statement.

I look forward to seeing you at the meeting.

Hans Georg Betz

Chief Executive Officer and President

This proxy statement and the accompanying proxy card are first being sent to stockholders on or about March 25, 2009.

GENERAL

This proxy statement and the accompanying materials are being sent to stockholders of Advanced Energy as part of a solicitation for proxies for use at the 2009 Annual Meeting of Stockholders. The Board of Directors of Advanced Energy (the “Board of Directors” or the “Board”) is making this solicitation for proxies. By delivering the enclosed proxy card by any of the methods described on the card, you will appoint each of Hans Georg Betz and Lawrence D. Firestone as your agent and proxy to vote your shares of common stock at the meeting. In this proxy statement, “proxy holders” refers to Dr. Betz and Mr. Firestone in their capacities as your agents and proxies.

Advanced Energy’s principal executive offices are located at 1625 Sharp Point Drive, Fort Collins, Colorado 80525. The telephone number is(970) 221-4670.

Proposals

We intend to present two proposals to the stockholders at the meeting:

1. Election of eight directors.

2. Ratification of the appointment of Grant Thornton LLP as Advanced Energy’s independent registered public accounting firm for 2009.

We do not know of any other matters to be submitted to the stockholders at the meeting. If any other matters properly come before the meeting, the proxy holders intend to vote the shares they represent as the Board of Directors may recommend.

Record Date and Share Ownership

If you owned shares of Advanced Energy common stock in your name as of the close of business on Monday, March 9, 2009, you are entitled to vote on the proposals that are presented at the meeting. On that date, which is referred to as the “record date” for the meeting, 41,911,985 shares of Advanced Energy common stock were issued and outstanding and were held by approximately 573 stockholders of record, according to the records of American Stock Transfer & Trust Company, Advanced Energy’s transfer agent.

Voting Procedures

Each share of Advanced Energy common stock that you hold entitles you to one vote on each of the proposals that are presented at the annual meeting. The inspector of the election will determine whether or not a quorum is present at the annual meeting. A quorum will be present at the meeting if a majority of the shares of common stock entitled to vote at the meeting are represented at the meeting, either by proxy or by the person who owns the shares. Advanced Energy’s transfer agent will deliver a report to the inspector of election in advance of the annual meeting, tabulating the votes cast by proxies returned to the transfer agent. The inspector of election will tabulate the final vote count, including the votes cast in person and by proxy at the meeting.

If a broker holds your shares, this proxy statement and a proxy card have been sent to the broker. You may have received this proxy statement directly from your broker, together with instructions as to how to direct the broker concerning how to vote your shares. Under the rules for Nasdaq-quoted companies, brokers cannot vote on certain matters without instructions from you. If you do not give your broker instructions or discretionary authority to vote your shares on such matters and your broker returns the proxy card without voting on a proposal, your shares will be recorded as “broker non-votes” with respect to the proposals on which the broker does not vote.

Broker non-votes and abstentions will be counted as present for purposes of determining whether a quorum is present. If a quorum is present, directors will be elected by a plurality of the votes present and each of the other matters described in this proxy statement will be approved by a majority of the votes cast on the proposal. Broker non-votes and abstentions will have no effect on the outcome of any of the matters described in this proxy statement.

2

The following table reflects the vote required for each proposal and the effect of broker non-votes and abstentions on the vote, assuming a quorum is present at the meeting:

| | | | | |

| | | | | Effect of Broker

|

| | | | | Non-Votes and

|

Proposal | | Vote Required | | Abstentions |

| |

| Election of directors | | The eight nominees who receive the most votes will be elected | | No effect |

| Ratification of the appointment of Grant Thornton LLP as Advanced Energy’s independent registered public accounting firm for 2009 | | Majority of the shares present at the meeting (by proxy or in person) and voting “For” or “Against” the proposal | | No effect |

If any other proposals are properly presented to the stockholders at the meeting, the number of votes required for approval will depend on the nature of the proposal. Generally, under Delaware law and the by-laws of Advanced Energy, the number of votes that may be required to approve a proposal is either a majority of the shares of common stock represented at the meeting and entitled to vote, or a majority of the shares of common stock represented at the meeting and casting votes either for or against the matter being considered. The enclosed proxy card gives discretionary authority to the proxy holders to vote on any matter not included in this proxy statement that is properly presented to the stockholders at the annual meeting.

Costs of Solicitation

Advanced Energy will bear the costs of soliciting proxies in connection with the annual meeting. In addition to soliciting your proxy by this mailing, proxies may be solicited personally or by telephone or facsimile by some of Advanced Energy’s directors, officers and employees, without additional compensation. We may reimburse our transfer agent, American Stock Transfer & Trust Company, our proxy agent, Mediant Communications, brokerage firms and other persons representing beneficial owners of Advanced Energy common stock for their expenses in sending proxies to the beneficial owners.

Delivery and Revocability of Proxies

You may vote your shares either by (i) marking the enclosed proxy card and mailing it in the enclosed postage prepaid envelope, (ii) voting online atwww.proxypush.com/aeis, or (iii) voting by telephone at(866) 390-9955. If you mail your proxy, please allow sufficient time for it to be received in advance of the annual meeting.

If you deliver your proxy and change your mind before the meeting, you may revoke your proxy by delivering notice to our Corporate Secretary at Advanced Energy Industries, Inc., 1625 Sharp Point Drive, Fort Collins, Colorado 80525, stating that you wish to revoke your proxy or by delivering another proxy with a later date. You may vote your shares by attending the meeting in person but, if you have delivered a proxy before the meeting, you must revoke it before the meeting begins. Attending the meeting will not automatically revoke your previously-delivered proxy.

Delivery of Documents to Stockholders Sharing an Address

If two or more stockholders share an address, Advanced Energy may send a single copy of this proxy statement and other soliciting materials, as well as the 2008 Annual Report to Stockholders, to the shared address, unless Advanced Energy has received contrary instructions from one or more of the stockholders sharing the address. If a single copy has been sent to multiple stockholders at a shared address, Advanced Energy will deliver a separate proxy card for each stockholder entitled to vote. Additionally, Advanced Energy will send an additional copy of this proxy statement, other soliciting materials and the 2008 Annual Report to Stockholders, promptly upon oral or written request by any stockholder to Investor Relations, Advanced Energy Industries, Inc., 1625 Sharp Point Drive, Fort Collins, Colorado 80525; telephone number(970) 221-4670. If any stockholders sharing an address receive multiple copies of this proxy statement, other soliciting materials and the 2008 Annual Report to Stockholders and would prefer in the future to receive only one copy, such stockholders may make such request to Investor Relations at the same address or telephone number.

3

PROPOSAL NO. 1

ELECTION OF DIRECTORS

A board of eight directors is to be elected at the annual meeting. The Board of Directors has nominated for election the persons listed below. Each of the nominees is currently a director of Advanced Energy. In the event that any nominee is unable to or declines to serve as a director at the time of the meeting, the proxy holders will vote in favor of a nominee designated by the Board of Directors, on recommendation by the Corporate Governance and Nominations Committee to fill the vacancy. We are not aware of any nominee who will be unable or who will decline to serve as a director. The term of office of each person elected as a director at the meeting will continue from the end of the meeting until the next Annual Meeting of Stockholders (expected to be held in the year 2010), or until a successor has been elected and qualified or until such director’s earlier resignation or removal.

NOMINEES

| | | | | | | | | | | |

Name | | Age | | Director Since | | Principal Occupation and Business Experience |

| |

| Douglas S. Schatz | | | 63 | | | | 1981 | | | Douglas S. Schatz is a co-founder of Advanced Energy and has been its Chairman since its incorporation in 1981. From incorporation in 1981 through July 2005, Mr. Schatz also served as Chief Executive Officer. From incorporation in 1981 through July 1999 and from March 2001 through July 2005, he also served as President. Mr. Schatz is currently on the boards of several private companies and organizations, both for-profit and non-profit. |

| Frederick A. Ball (1) | | | 46 | | | | 2008 | | | Frederick A. Ball has served on the Board of Directors of Advanced Energy since October 2008. Mr. Ball was appointed chief financial officer of Webroot Software in June 2004. Previously Mr. Ball has been the senior vice president and chief financial officer of BigBand Networks and of Borland Software Corporation. In addition, Mr. Ball served as Vice President, Mergers and Acquisitions for KLA-Tencor Corporation, a manufacturer of semiconductor equipment, and as the Vice President of Finance for KLA-Tencor Corporation following KLA’s merger with Tencor Instruments in 1997. Mr. Ball was with PricewaterhouseCoopers for over 10 years. Mr. Ball currently serves on the board of directors of Electro Scientific Industries, Inc. and is a member of its audit committee. |

| Richard P. Beck (1,2) | | | 75 | | | | 1995 | | | Richard P. Beck joined Advanced Energy in March 1992 as Vice President and Chief Financial Officer and became Senior Vice President in February 1998. In October 2001, Mr. Beck retired from the position of Chief Financial Officer, but remained as a Senior Vice President until May 2002. Mr. Beck was chairman of the board of Applied Films Corporation, a publicly held manufacturer of flat panel display equipment, until August 2006 when it was acquired and served on its audit and nominating and governance committees. He is also a director of TTM Technologies, Inc., a publicly held manufacturer of printed circuit boards, serves as a member of its nominating and governance committee, and is chairman of its audit committee. |

4

| | | | | | | | | | | |

Name | | Age | | Director Since | | Principal Occupation and Business Experience |

| |

| Hans Georg Betz | | | 62 | | | | 2004 | | | Dr. Hans Georg Betz has been our Chief Executive Officer and President since August 2005 and has been a member of our Board of Directors since July 2004. From August 2001 until he became our Chief Executive Officer and President, Dr. Betz served as chief executive officer of West Steag Partners GmbH, a German-based venture capital company focused on the high-technology industry. In his over 30-year career in the electronics industry, Dr. Betz also served as chief executive officer of STEAG Electronic Systems AG and a managing director at Leybold AG. Dr. Betz currently serves as a director of Mattson Technology, Inc., a publicly held supplier of advanced process equipment used to manufacture semiconductors, and serves as a member of its compensation committee. |

| Trung T. Doan (1,3) | | | 50 | | | | 2005 | | | Trung T. Doan joined the Board of Directors of Advanced Energy in November 2005. Mr. Doan is currently the chairman and chief executive officer of SemiLEDs Corporation, a manufacturer of high-brightness light emitting diodes. Prior to founding SemiLEDs, Mr. Doan was the corporate vice president of Applied Global Services product group at Applied Materials. Mr. Doan held various management and executive positions at companies such as Intel Corp., Honeywell International, and at Micron Technology, Inc. where he had worked from 1988 to 2003 and last held the position of Vice President of Process Development. Earlier, he served as president and chief executive officer of Jusung Engineering, Inc., a major semiconductor and LCD equipment company in Korea. Mr. Doan previously served on the Advanced Energy Board of Directors from July 2000 until January 2004. |

5

| | | | | | | | | | | |

Name | | Age | | Director Since | | Principal Occupation and Business Experience |

| |

| Edward C. Grady (2,3) | | | 61 | | | | 2008 | | | Edward C. Grady has served on the Board of Directors of Advanced Energy since May 2008. From February 2003 until his retirement in October 2007, Mr. Grady was the president and chief executive officer of Brooks Automation, Inc., a leading worldwide provider of automation solutions to the global semiconductor and related industries, and continues to serve as a senior executive consultant. Prior to joining Brooks, he was a partner at Propel Partners, a venture firm in Palo Alto, California. Prior to this he ran several divisions at KLA-Tencor and helped to grow the business to a level in excess of $1 billion in revenues. Before KLA-Tencor, he served as president and chief executive officer of Hoya Micro Mask, and vice president of worldwide sales for EPI, a division in MEMC. Mr. Grady currently serves on the board of directors of the following publicly held companies: Evergreen Solar, Inc., a developer and manufacturer of solar panels and other solar energy products; Verigy Ltd., a provider of automated test systems for the semiconductor industry; and Electro Scientific Industries, Inc., a supplier of production equipment for micro-engineering applications. |

| Thomas M. Rohrs (1,3) | | | 58 | | | | 2006 | | | Thomas M. Rohrs has served on the Board of Directors of Advanced Energy since May 2006. Mr. Rohrs has been chairman of the board of directors of Electroglas, Inc., a provider of automated probing technologies, since April 2006, and was its chief executive officer until February 2009. From 1997 to 2002, Mr. Rohrs was with Applied Materials, Inc., most recently as senior vice president of global operations and a member of the executive committee. Mr. Rohrs also served as a strategic development advisor in the Applied Materials customer support group from 2003 to 2004. In addition to Electroglas, Mr. Rohrs serves on the board of directors of Magma Design Automation, Inc., a company that develops software for electronic design automation. |

| Elwood Spedden (2,3) | | | 71 | | | | 1995 | | | Elwood Spedden has served on the Board of Directors of Advanced Energy since September 1995. Mr. Spedden was chief executive officer of Photon Dynamics, Inc., a publicly held manufacturer of flat panel display test equipment, from January 2003 until his retirement in January 2004. From July 1996 to June 1997, Mr. Spedden was a vice president of KLA-Tencor Semiconductor, a publicly held manufacturer of automatic test equipment used in the fabrication of semiconductors. |

| | |

| (1) | | Member of the Audit and Finance Committee. |

| |

| (2) | | Member of the Corporate Governance and Nominations Committee. |

| |

| (3) | | Member of the Compensation Committee. |

6

The Board of Directors has determined that each of the nominees, other than Douglas S. Schatz and Hans Georg Betz, is an “independent director” as defined in Rule 4200(a)(15) of the Marketplace Rules of the Nasdaq Stock Market. To be considered independent, the Board must affirmatively determine that neither the director nor any immediate family member of the director had any direct or indirect material relationship with the Company within the last three years. The Board of Directors has made an affirmative determination that none of the independent directors has any relationship with Advanced Energy that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The independent directors, if all of them are elected at the annual meeting, will constitute a majority of the Board of Directors. There is no family relationship among any of the directors and any of the Company’s executive officers. The Company’s executive officers serve at the discretion of the Board.

Required Vote

The eight nominees will be elected to the Board upon receipt of a favorable vote (FOR) of a plurality of the votes cast at the meeting. Stockholders do not have the right to cumulate their votes for the election of directors. Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR each of the eight nominees. Votes withheld from a nominee will be counted for purposes of determining whether a quorum is present, but will not be counted as an affirmative vote for such nominee.

The Board of Directors recommends a vote “FOR” the election of each of the nominees named above.

Director Compensation

Director compensation for the fiscal year ended December 31, 2008 was as follows:

| | |

| | • | $20,000 annual retainer paid quarterly in July, October, February and April; |

| |

| | • | An additional $50,000 annual retainer for the Chair of the Board, paid quarterly in July, October, February and April; |

| |

| | • | $3,000 per day for each full Board meeting, whether such meeting is held in person or telephonically; |

| |

| | • | $4,000 per Audit and Finance Committee meeting for the Chair and $1,750 per meeting for each other committee member, whether such meeting is held in person or telephonically; |

| |

| | • | $2,000 per Compensation Committee meeting or Corporate Governance & Nominations Committee meeting for such Committee’s Chair and $750 for each other Committee member, whether such meeting is held in person or telephonically; |

| |

| | • | 15,000 restricted stock units to non-employee directors upon initial election or appointment to the Board; and |

| |

| | • | 6,000 restricted stock units annually to non-employee directors on the date of re-election at the annual meeting. |

| |

| | • | Restricted stock units awarded to non-employee directors will vest as to 25% of the underlying shares on each annual anniversary of the grant date until fully vested on the fourth anniversary of the grant date. |

7

The following table shows director compensation information for 2008:

2008 Director Compensation

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Change

| | | | | | | |

| | | | | | | | | | | | | | | in Pension

| | | | | | | |

| | | | | | | | | | | | | | | Value and

| | | | | | | |

| | | | | | | | | | | | | | | Nonqualified

| | | | | | | |

| | | | | | | | | | | | Non-Equity

| | | Deferred

| | | | | | | |

| | | Fees Earned or

| | | | | | | | | Incentive Plan

| | | Compensation

| | | All Other

| | | | |

| | | Paid in Cash

| | | Stock Awards

| | | Option Awards

| | | Compensation

| | | Earnings

| | | Compensation

| | | Total

| |

Name | | ($) | | | ($)(3) | | | ($)(9) | | | ($) | | | ($) | | | ($) | | | ($) | |

| |

| Douglas S. Schatz | | | 106,000 | | | | 37,364 | | | | 176,115 | (10) | | | — | | | | — | | | | — | | | | 319,479 | |

| Frederick A. Ball | | | 12,666 | | | | 2,661 | (4) | | | — | | | | — | | | | — | | | | — | | | | 15,327 | |

| Richard P. Beck | | | 85,000 | | | | 108,384 | (5) | | | — | | | | — | | | | — | | | | — | | | | 193,384 | |

| Hans Georg Betz(1) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Trung T. Doan | | | 65,000 | | | | 108,384 | (5) | | | — | | | | — | | | | — | | | | — | | | | 173,384 | |

| Edward C. Grady | | | 31,000 | | | | 15,917 | (6) | | | — | | | | — | | | | — | | | | — | | | | 46,917 | |

| Barry Z. Posner(2) | | | 21,250 | | | | 102,017 | (7) | | | — | | | | — | | | | — | | | | — | | | | 123,267 | |

| Thomas M. Rohrs | | | 69,000 | | | | 116,441 | (8) | | | — | | | | — | | | | — | | | | — | | | | 185,441 | |

| Elwood Spedden | | | 60,000 | | | | 108,384 | (5) | | | — | | | | — | | | | — | | | | — | | | | 168,384 | |

(1) Dr. Betz serves as the Company’s Chief Executive Officer and President and, as an employee of the Company, is not eligible for Director Compensation.

| | |

| (2) | | Mr. Posner’s term expired May 7, 2008. |

| |

| (3) | | The amounts in this column reflect the compensation expense recognized for 2008 financial statement reporting purposes related to stock awards granted in accordance with Statement of Financial Accounting Standards No. 123, “Accounting for Stock Based Compensation” (FAS 123R). The assumptions used to calculate the value of stock awards are set forth under Note 2 of the Notes to Consolidated Financial Statements included in Advanced Energy’s Annual Report onForm 10-K for 2008 filed with the SEC on February 27, 2009. |

| |

| (4) | | Reflects compensation expense related to: |

| | |

| (a) | | The stock award of 15,000 shares of common stock, vesting over four years, made on October 28, 2008 at $8.97 per share. |

| | |

| (5) | | Reflects compensation expense related to: |

| | |

| (a) | | The stock award of 2,000 shares of common stock, vesting over four years, made on May 24, 2006 at $13.50 per share. |

| |

| (b) | | The stock award of 16,000 shares of common stock, vesting over four years, made on May 2, 2007 at $24.88 per share. |

| |

| (c) | | The stock award of 6,000 shares of common stock, vesting over four years, made on May 7, 2008 at $14.43 per share. |

| | |

| (6) | | Reflects compensation expense related to: |

| | |

| (a) | | The stock award of 15,000 shares of common stock, vesting over four years, made on May 7, 2008 at $14.43 per share. |

| | |

| (7) | | Reflects compensation expense related to: |

| | |

| (a) | | The stock award of 2,000 shares of common stock, vesting over four years, made on May 24, 2006 at $13.50 per share. |

| |

| (b) | | The stock award of 16,000 shares of common stock, vesting over four years, made on May 2, 2007 at $24.88 per share. |

| | |

| (8) | | Reflects compensation expense related to: |

| | |

| (a) | | The stock award of 5,000 shares of common stock, vesting over four years, made on May 24, 2006 at $13.50 per share. |

8

| | |

| (b) | | The stock award of 16,000 shares of common stock, vesting over four years, made on May 2, 2007 at $24.88 per share. |

| |

| (c) | | The stock award of 6,000 shares of common stock, vesting over four years, made on May 7, 2008 at $14.43 per share. |

| | |

| (9) | | Amounts shown do not reflect compensation actually received by the named director. Instead, the amounts shown are the compensation costs recognized by the Company in 2008 for option awards as determined pursuant to FAS 123R. These compensation costs reflect option awards granted in and prior to fiscal 2008. The assumptions used to calculate the value of option awards are set forth under Note 2 of the Notes to Consolidated Financial Statements included in Advanced Energy’s Annual Report onForm 10-K for 2008 filed with the SEC on February 27, 2009. |

| |

| (10) | | Reflects the compensation costs recognized by the Company in 2008 for stock option grants with the following fair values as of the grant date: |

| | |

| (a) | | $103,948 for a stock option grant to purchase 21,250 shares of common stock made on July 20, 2004 at $12.80 per share. Mr. Schatz was President of Advanced Energy when this grant was issued; |

| |

| (b) | | $82,573 for a stock option grant to purchase 21,250 shares of common stock made on October 19, 2004 at $10.37 per share. Mr. Schatz was President of Advanced Energy when this grant was issued; |

| |

| (c) | | $251,046 for a stock option grant to purchase 92,700 shares of common stock made on January 31, 2005 at $7.15 per share. Mr. Schatz was President of Advanced Energy when this grant was issued. |

Board of Directors Meetings

The Board of Directors held nine meetings in 2008. In 2008, the Board of Directors had an Audit and Finance Committee, a Corporate Governance and Nominations Committee and a Compensation Committee. In 2008, each incumbent director attended at least 75% of the aggregate number of meetings of the Board of Directors (held during the period for which he was a director) and the committees (held during the period for which he served on such committees) on which he served.

Members of the Board of Directors are welcomed and encouraged to attend, but are not required to attend, the Company’s annual stockholder meetings. The annual meeting of the Company’s stockholders held on May 7, 2008 was attended by one member of the Board, Dr. Betz.

Audit and Finance Committee

Composition and Meetings

In 2008, the Audit and Finance Committee consisted of Messrs. Beck (Chairman), Rohrs and Doan. On February 19, 2009, Mr. Ball was added as a member of the Audit and Finance Committee by appointment of the Board of Directors. Each of the members of the Audit and Finance Committee is an “independent director” within the meaning of Rule 4200(a)(15) of the Marketplace Rules of the Nasdaq Stock Market. The Board of Directors has evaluated the credentials of Messrs. Beck and Ball and determined that they are “audit committee financial experts” within the meaning of Item 401(h) of SECRegulation S-K. The Board of Directors has also determined that each of the members of the Audit and Finance Committee is “independent” within the meaning ofSection 10-A of the Securities Exchange Act of 1934. The Audit and Finance Committee met six times in 2008.

Policy on Audit and Finance Committee Approval of Audit and Permissible Non-Audit Services of the Independent Registered Public Accounting Firm

The Audit and Finance Committee approves all audit and permissible non-audit services provided by the independent registered public accounting firm. These services may include audit services, audit related services, tax services and other services. Approval is provided on aservice-by-service basis. In 2008, the Audit and Finance

9

Committee approved all of the audit and non-audit services provided by Advanced Energy’s independent registered public accounting firm.

Audit and Finance Committee Charter and Responsibilities

The Audit and Finance Committee is governed by a written charter, which is available on our website atwww.advanced-energy.com. The Audit and Finance Committee is responsible for, among other things:

| | |

| | • | selecting Advanced Energy’s independent registered public accounting firm; |

| |

| | • | approving the scope, fees and results of the audit engagement; |

| |

| | • | determining the independence and evaluating the performance of Advanced Energy’s independent registered public accounting firm and internal auditors; |

| |

| | • | approving in advance any audit and non-audit services and fees charged by the independent registered public accounting firm; |

| |

| | • | evaluating comments made by the independent registered public accounting firm with respect to accounting procedures and internal controls and determining whether to bring such comments to the attention of Advanced Energy’s management; |

| |

| | • | reviewing the internal accounting procedures and controls with Advanced Energy’s financial and accounting staff and approving any significant changes; |

| |

| | • | reviewing and approving related party transactions; and |

| |

| | • | establishing and maintaining procedures for, and a policy of, open access to the members of the Audit and Finance Committee by the employees of and consultants to Advanced Energy to enable the employees and consultants to report to the Audit and Finance Committee concerns held by such employees and consultants regarding the financial reporting of the corporation and potential misconduct. |

The Audit and Finance Committee also conducts financial reviews with Advanced Energy’s independent registered public accounting firm prior to the release of financial information in the Company’sForms 10-K and10-Q.

Management has primary responsibility for Advanced Energy’s financial statements and the overall reporting process, including systems of internal controls. The independent registered public accounting firm audits the annual financial statements prepared by management, expresses an opinion as to whether those financial statements fairly present the financial position, results of operations and cash flows of Advanced Energy in conformity with accounting principles generally accepted in the United States and discusses with the Audit and Finance Committee any issues they believe should be raised.

Report of the Audit and Finance Committee

The Audit and Finance Committee has reviewed Advanced Energy’s audited financial statements, and met together and separately with both management and Grant Thornton LLP, the Company’s current independent registered public accounting firm to discuss Advanced Energy’s quarterly and annual financial statements and reports prior to issuance. In addition, the Audit and Finance Committee has discussed with the independent registered public accounting firm the matters outlined in Statement on Auditing Standards No. 61 (Communication with Audit Committees) to the extent applicable and received the written disclosures and the letter from the independent registered public accounting firm required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). The Audit and Finance Committee has also discussed with the independent registered public accounting firm their independence.

Based on its review and discussion of the foregoing matters and information, the Audit and Finance Committee recommended to the Board of Directors that the audited financial statements be included in Advanced Energy’s 2008 Annual Report onForm 10-K. The Audit and Finance Committee has recommended the appointment of Grant

10

Thornton LLP as the Company’s independent registered public accounting firm for 2009, subject to stockholder approval.

The Audit and Finance Committee

Richard P. Beck, Chairman

Frederick A. Ball

Thomas M. Rohrs

Trung T. Doan

Corporate Governance and Nominations Committee

Composition and Meetings

The Corporate Governance and Nominations Committee consists of Messrs. Beck (Chairman), Grady and Spedden. Prior to July 29, 2008, the Corporate Governance and Nominations Committee consisted of Messrs. Beck (Chairman), Spedden and Doan, and prior to May 7, 2008, Dr. Posner was also a member. Each of the members of the Corporate Governance and Nominations Committee was and is an “independent director” within the meaning of Rule 4200(a)(15) under the Marketplace Rules of the Nasdaq Stock Market. The Corporate Governance and Nominations Committee met four times in 2008.

Corporate Governance and Nominations Committee Charter and Responsibilities

The Corporate Governance and Nominations Committee is governed by a written charter and Corporate Governance Guidelines that are available on our website atwww.advanced-energy.com.

The Corporate Governance and Nominations Committee is responsible for:

| | |

| | • | ensuring that a majority of the directors will be independent; |

| |

| | • | establishing qualifications and standards to serve as a director; |

| |

| | • | identifying and recommending individuals qualified to become directors; |

| |

| | • | considering any candidates recommended by stockholders; |

| |

| | • | determining the appropriate size and composition of the Board; |

| |

| | • | ensuring that the independent directors meet in executive session quarterly; |

| |

| | • | reviewing other directorships, positions and business and personal relationships of directors and candidates for conflicts of interest, effect on independence, ability to commit sufficient time and attention to the Board and other suitability criteria; sponsoring and overseeing performance evaluations for the Board as a whole, conducting director peer evaluations, coordinating evaluations of the other committees with the other committees chairpersons; |

| |

| | • | sponsoring and overseeing performance evaluations for the Board as a whole, conducting director peer evaluations, coordinating evaluations of the other committees with the other committees chairpersons; |

| |

| | • | developing and reviewing periodically, at least annually, the corporate governance policies and guidelines of Advanced Energy, and recommending any changes to the Board; and |

| |

| | • | considering any other corporate governance issues that arise from time to time and referring them to the Board. If the Board requests, the Corporate Governance and Nominations Committee will develop appropriate recommendations to the Board. |

Director Nominations

The Corporate Governance and Nominations Committee of the Board considers candidates for director nominees proposed by directors and stockholders. This committee may retain recruiting professionals to assist in identifying and evaluating candidates for director nominees. As set forth in the Company’s Guidelines, the

11

Corporate Governance and Nominations Committee strives for a mix of skills and diverse perspectives (functional, cultural and geographic) that is effective for the Board. Every effort is made to complement and supplement skills within the existing Board and strengthen any identified insufficiencies. In selecting the nominees, the Board assesses the independence, character and acumen of candidates. The Board also endeavors to establish a number of areas of collective core competency of the Board. Therefore, the Board assesses whether a candidate possesses skills including business judgment, leadership, strategic vision and knowledge of management, accounting, finance, industry, technology, manufacturing, international markets and marketing. Additional criteria include a candidate’s personal and professional ethics, integrity and values, as well as his or her willingness to devote sufficient time to prepare for and attend meetings and participate effectively on the Board.

The Corporate Governance and Nominations Committee of the Board evaluates and interviews potential director candidates. All members of the Board may interview the final candidates. The Corporate Governance and Nominations Committee will consider nominations by stockholders. The same identifying and evaluating procedures apply to all candidates for director nomination, including candidates submitted by stockholders.

The Corporate Governance and Nominations Committee will consider any and all director candidates recommended by our stockholders. If you are a stockholder and wish to recommend a candidate for nomination to the Board of Directors, you should submit your recommendation in writing to the Corporate Governance and Nominations Committee, in care of the Secretary of Advanced Energy at 1625 Sharp Point Drive, Fort Collins, Colorado 80525. Your recommendation should include your name and address, the number of shares of Advanced Energy common stock that you own, the name of the person you recommend for nomination, the reasons for your recommendation, a summary of the person’s business history and other qualifications as a director of Advanced Energy and whether such person has agreed to serve, if elected, as a director of Advanced Energy. Please also see the information under “Proposals of Stockholders” on page 30 of this proxy statement.

The Corporate Governance and Nominations Committee will apply the same processes and criteria in evaluating director candidates recommended by stockholders as it applies in evaluating director candidates recommended by directors, members of management or any other person.

Compensation Committee

Composition and Meetings

The Compensation Committee consists of Messrs. Spedden (Chairman), Rohrs, Doan and Grady. Prior to May 7, 2008, the Compensation Committee consisted of Messrs. Spedden (Chairman), Rohrs and Doan, and Dr. Posner. Each of the members of the Compensation Committee is a “non-employee director” within the meaning ofRule 16b-3 under the Securities Exchange Act of 1934, an “outside director” within the meaning of Section 162(m) under the Internal Revenue Code and an “independent director” within the meaning of Rule 4200(a)(15) of the Marketplace Rules of the Nasdaq Stock Market. The Compensation Committee met six times in 2008.

Committee Charter and Responsibilities

The Compensation Committee is governed by a written charter, which is available on our website atwww.advanced-energy.com. The Compensation Committee is responsible for recommending salaries, incentives and other compensation for directors and officers of Advanced Energy, administering Advanced Energy’s incentive compensation and benefit plans and recommending to the Board of Directors policies relating to such compensation and benefit plans. The Compensation Committee has also from time to time retained an independent compensation consultant to assist and advise the Compensation Committee in fulfilling these responsibilities.

12

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

On February 19, 2009, the Audit and Finance Committee approved the continued appointment of Grant Thornton LLP for 2009 as the Company’s independent registered public accounting firm. If the stockholders fail to ratify the appointment of Grant Thornton LLP, the Audit and Finance Committee will reconsider its selection. Even if the selection is ratified, the Audit and Finance Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit and Finance Committee feels that such a change would be in the best interests of Advanced Energy and our stockholders.

A representative of Grant Thornton LLP is expected to be present at the meeting and will have an opportunity to make a statement if he or she so desires. Moreover, the representative is expected to be available to respond to appropriate questions from the stockholders.

Audit Fees

For the fiscal years ended December 31, 2008 and 2007, fees billed by Grant Thornton LLP for professional services consisted of audit and audit-related fees and were $1,233,911 and $1,211,300, respectively. Audit fees were for professional services rendered for the audit of Advanced Energy’s consolidated financial statements and internal controls over financial reporting, review of interim financial statements, and services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements.

The Audit and Finance Committee approved all services provided by Grant Thornton LLP during 2008.

Required Vote

Ratification of the appointment of Grant Thornton LLP as the independent registered public accounting firm for Advanced Energy for 2009 requires the affirmative(FOR)vote of a majority of the shares of common stock cast on the matter. For purposes of determining the number of votes cast on the matter, only those cast “For” or “Against” are included. Abstentions and broker non-votes are not included.

The Board of Directors recommends a vote “FOR” the ratification of the appointment of Grant Thornton LLP as Advanced Energy’s independent registered public accounting firm.

13

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of Advanced Energy common stock as of March 9, 2009 by:

| | |

| | • | each person known to us to beneficially own more than 5% of the outstanding common stock; |

| |

| | • | each director and nominee for director; |

| |

| | • | each named executive officer identified on page 22; and |

| |

| | • | the current directors and executive officers as a group. |

| | | | | | | | | |

Name of Stockholder | | Shares Beneficially Owned | | | Percent Owned | |

| |

| Douglas S. Schatz, Chairman of the Board of Directors | | | 9,020,090 | (1)(2)(8) | | | 21.0 | % |

| Royce & Associates, LLC | | | 4,357,767 | (3) | | | 10.4 | % |

| T. Rowe Price Associates, Inc. | | | 3,942,850 | (4) | | | 9.4 | % |

| Barclays Global Investors, NA | | | 2,351,105 | (5) | | | 5.6 | % |

| The Bank of New York Mellon Corporation | | | 450,227 | (6) | | | 1.1 | % |

| Hans Georg Betz, Director, Chief Executive Officer and President | | | 285,845 | (2) | | | * | |

| Lawrence D. Firestone, Executive Vice President and Chief Financial Officer | | | 77,501 | (2) | | | * | |

| Charles S. Rhoades, Chief Operating Officer(11) | | | 71,876 | | | | * | |

| Richard P. Beck, Director | | | 65,074 | (2)(7)(8) | | | * | |

| Elwood Spedden, Director | | | 32,000 | (2)(7)(8) | | | * | |

| Trung T. Doan, Director | | | 25,500 | (2)(7)(8) | | | * | |

| Yuval Wasserman, Executive Vice President Sales, Service, and Marketing | | | 18,124 | (2) | | | * | |

| Thomas M. Rohrs, Director | | | 12,000 | (7)(8) | | | * | |

| Edward C. Grady, Director | | | 3,750 | (7)(8) | | | * | |

| Barry Z. Posner, Director(12) | | | 1,500 | | | | * | |

| Frederick A. Ball, Director | | | — | | | | * | |

| All executive officers and directors, as a group (12 persons) | | | 9,613,260 | (8)(9)(10) | | | 22.9 | % |

| | |

| (1) | | Includes 8,655,722 shares held by the family trust of Mr. Schatz and his wife, and 136,668 shares held by a charitable foundation of which Mr. Schatz and members of his immediate family are the trustees. Mr. Schatz may be deemed to share with the other trustees voting and dispositive power with respect to the charitable foundation’s 136,668 shares. Mr. Schatz disclaims beneficial ownership of the 136,668 shares held by the charitable foundation. Mr. Schatz’s address isc/o Advanced Energy Industries, Inc., 1625 Sharp Point Drive, Fort Collins, Colorado 80525. |

| |

| (2) | | Includes beneficial ownership of the following numbers of shares that may be acquired within 60 days of March 9, 2009 pursuant to stock options granted or assumed by Advanced Energy: |

| | | | | |

| • Douglas S. Schatz | | | 227,700 | |

| • Richard P. Beck | | | 22,500 | |

| • Hans Georg Betz | | | 260,000 | |

| • Trung T. Doan | | | 15,000 | |

| • Lawrence D. Firestone | | | 77,501 | |

| • Elwood Spedden | | | 25,000 | |

| • Yuval Wasserman | | | 18,124 | |

| | |

| (3) | | Information as to the amount and nature of beneficial ownership was obtained from the Schedule 13 filed with the SEC on January 23, 2009 by Royce & Associates, LLC reports dispositive power over 4,357,767 shares, or 10.4%. The address for Royce & Associates, LLC is 1414 Avenue of the Americas, New York, New York 10019. |

| |

| (4) | | Information as to the amount and nature of beneficial ownership was obtained from the Schedule 13 filed with the SEC on February 11, 2009 by T. Rowe Price Associates, Inc. reports dispositive power over |

14

| | |

| | 3,942,850 shares, or 9.4%. The address for T. Rowe Price Associates, Inc. is 100 E. Pratt Street, Baltimore, Maryland 21202. |

| |

| (5) | | Information as to the amount and nature of beneficial ownership was obtained from the Schedule 13 filed with the SEC on February 5, 2009 by Barclays Global Investors, N.A. reports dispositive power over 2,351,105 shares, or 5.6%. The address for Barclays Global Investors, N.A. is 400 Howard Street, San Francisco, California 94105. |

| |

| (6) | | Information as to the amount and nature of beneficial ownership was obtained from the Schedule 13 filed with the SEC on February 12, 2009 by The Bank of New York Mellon Corporation reports dispositive power over 450,277 shares, or 1.1%. The address for The Bank of New York Mellon Corporation is One Wall Street, 31st Floor, New York, New York 10286. |

| |

| (7) | | Includes beneficial ownership of the following numbers of shares that will be acquired within 60 days of March 9, 2009 pursuant to stock awards (also called “restricted stock units”) granted or assumed by Advanced Energy: |

| | | | | |

| • Richard P. Beck | | | 5,500 | |

| • Trung T. Doan | | | 5,500 | |

| • Edward C. Grady | | | 3,750 | |

| • Thomas M. Rohrs | | | 5,500 | |

| • Elwood Spedden | | | 5,500 | |

| | |

| (8) | | The shares reported in the table do not include awards that will be granted to each non-employee director if such person is reelected or initially elected to the Board of Directors at the annual meeting. |

| |

| (9) | | The shares reported in the table include 645,825 shares that the 12 executive officers and directors collectively have the right to acquire within 60 days of March 9, 2009 pursuant to stock options granted by Advanced Energy. |

| |

| (10) | | The shares reported in the table include 25,750 shares that the 12 executive officers and directors collectively will acquire within 60 days of March 9, 2009 pursuant to stock awards granted by Advanced Energy. |

| |

| (11) | | Mr. Rhoades resigned effective April 30, 2008; subsequently, all awards will expire on April 30, 2009. |

| |

| (12) | | Mr. Posner’s term expired on May 7, 2008. |

15

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Compensation Philosophy and Objectives

Our Company’s long-term success depends on our ability to fulfill the expectations of our customers in a competitive environment and deliver value to stockholders. To achieve these goals, it is critical that we be able to attract, motivate, and retain highly talented individuals at all levels of the organization who are committed to the Company’s values and objectives.

The Company’s executive compensation program is based on the same objectives that guide the Company in establishing all of its compensation programs:

| | |

| | • | Compensation should be based on the level of job responsibility, individual performance, and Company performance. As employees progress to higher levels in the organization, an increasing proportion of their pay should be linked to Company performance and stockholder returns because those employees are more able to affect the Company’s results. |

| |

| | • | Compensation should reflect the value of the job in the marketplace. To attract and retain a highly skilled work force, we must remain competitive with the pay of other premier employers who compete with us for talent. |

| |

| | • | Compensation should reward performance. Our programs should deliver top-tier compensation for top-tier individual performance and Company success, and should deliver correspondingly lower compensation where performance falls short of expectations. In addition, objectives of pay-for-performance and retention must be balanced. |

| |

| | • | Compensation should foster the long-term focus required for the Company’s success. While many Company employees receive a mix of both annual and longer-term incentives, employees at higher levels have an increasing proportion of their compensation tied to longer-term performance because they are in a greater position to influence longer-term results. |

| |

| | • | To be effective, employees must be able to understand how performance-based compensation programs affect their pay, both directly through individual performance accomplishments and indirectly through the Company’s achievement of its strategic and operational goals. |

| |

| | • | Compensation programs must align with the Company’s business and financial models and support its mission, values and operating plans. |

| |

| | • | While compensation programs and individual pay levels will always reflect differences in job responsibilities, geographies, and marketplace considerations, the overall structure of the compensation and benefit programs should be broadly similar and egalitarian across the organization. |

Overview of Executive Compensation Program

The Compensation Committee

The Compensation Committee of the Board has responsibility for establishing, implementing and monitoring adherence with the Company’s compensation philosophy. Accordingly, the Compensation Committee strives to develop and maintain competitive, progressive programs that attract, retain and motivate high-caliber employees, foster teamwork, and maximize the long-term success of Advanced Energy by appropriately rewarding our employees for their achievements.

In 2008, the Compensation Committee consisted of Mr. Spedden (Chairman), Messrs. Rohrs and Doan, and Dr. Posner up to May 7, 2008, at which time Dr. Posner ceased to be a member of the committee because his term as a director of the Company expired. On July 29, 2008, Mr. Grady was appointed to the Compensation Committee. Each of the members of the Compensation Committee was and is a “non-employee director” within the meaning ofRule 16b-3 under the Securities Exchange Act of 1934, an “outside director” within the meaning of Section 162(m)

16

under the Internal Revenue Code and an “independent director” within the meaning of Rule 4200(a)(15) of the Marketplace Rules of the Nasdaq Stock Market. The Compensation Committee met six times in 2008.

The Compensation Committee believes that the most effective executive compensation program is one that is designed to reward the achievement of specific annual, long-term and strategic goals by the Company, and that aligns interests of our executive officers with those of the stockholders by rewarding performance that meets or exceeds established goals, with the ultimate objective of exceeding corporate expectations and improving stockholder value. The Compensation Committee evaluates each executive officer’s performance and his compensation to ensure that the Company maintains its ability to attract and retain our executive officers and that each element of compensation provided to our executive officers remains competitive relative to the compensation paid to similarly situated executives of our peer companies.

The Compensation Committee has the authority to engage its own independent advisors to assist in making determinations with respect to the compensation of executives and other employees. The Compensation Committee engaged Compensation Strategies, Inc. in 2008 to provide updated market data regarding the compensation practices of Advanced Energy’s peer companies along with comparisons of the Company’s practices with respect to best practices within the industry. Compensation Strategies has not provided any other services to the Company and has received no compensation other than with respect to the services provided to the Compensation Committee.

Role of Executive Officers in Compensation Decisions

The Compensation Committee meets with the Company’s Chief Executive Officer and other senior executives in order to obtain recommendations with respect to the Company’s compensation programs and practices for executives and other employees. The Chief Executive Officer annually reviews the performance of each executive officer, other than himself. The Chief Executive Officer’s performance is reviewed by the Compensation Committee in executive session. With support from market compensation data, management makes recommendations to the Compensation Committee on the base salaries, bonus targets and equity compensation for the executive officers and other employees. The Compensation Committee considers, but is not bound by, and does not always accept, management’s recommendations with respect to executive compensation.

While management attends certain meetings of the Compensation Committee, the Compensation Committee also regularly holds executive sessions not attended by any members of management or by non-independent directors. The Compensation Committee makes all compensation decisions for the executive officers and approves recommendations regarding equity awards to all employees of the Company. The conclusions reached and recommendations based on these reviews, including with respect to salary adjustments and annual stock options or other equity award amounts, are presented to the Compensation Committee. The Compensation Committee can, and for 2008 did, exercise its discretion in modifying those recommended awards.

Benchmarking

One factor that the Compensation Committee considers when making compensation decisions is the compensation paid to executives of a peer group of companies. The Compensation Committee also considers data obtained from management’s recruitment activities, as well as factors such as historical rates of compensation, individual performance, competitive positioning, shareholder value achieved, and alignment with the Company’s overall compensation philosophy.

The peer group includes a range of companies with which the Compensation Committee believes the Company competes for talent or from which the Company is likely to recruit talent. In establishing compensation benchmarks for 2008, the Compensation Committee considered major high technology competitors for executive talent and companies of a size and scope similar to that of Advanced Energy as measured by market capitalization, revenue,

17

net income and total stockholder return, and data was appropriately size-adjusted. For 2008, the companies comprising this group of peer companies (the “Compensation Peer Group”) were:

| | | | | |

| Asyst Techs., Inc. | | Credence Systems Corp. | | Novellus Systems., Inc. |

| ATMI, Inc. | | Cymer, Inc. | | Photronics, Inc. |

| Axcelis Technologies, Inc. | | Entegris, Inc. | | PowerSecure International, Inc. |

| AZZ Inc. | | KLA-Tencor Corp. | | Rudolph Technologies., Inc. |

| Brooks Automation, Inc. | | LAM Research Corp. | | Varian Semiconductor Equipment Assoc. |

| Cognex Corp. | | Mattson Technology, Inc. | | Veeco Instruments, Inc. |

| Coherent, Inc. | | MKS Instruments, Inc. | | |

To assist in the benchmarking process, the Compensation Committee in 2008 specifically requested that Compensation Strategies conduct reviews of the Company’s total compensation program for officers of the Company as well as for other senior managers and executives as compared to the Compensation Peer Group. Compensation Strategies provided the Compensation Committee with relevant market data, competitive assessments of the Company’s compensation practices compared to those of the Compensation Peer Group, and alternatives to consider when making compensation decisions for the executive officers of the Company.

Components of Executive Compensation

For 2008, the principal components of compensation for named executive officers were: (1) Base Salary, (2) Performance-Based Incentive Compensation, (3) Long-Term Equity Incentive Compensation, (4) Personal Benefits and Perquisites, and (5) Other Compensation. In determining the amount and relative allocation among each element of compensation for each named executive officer, the Compensation Committee considered the data of the Compensation Peer Group and made a determination based on its desire to offer comparable mix of compensation, individual circumstances of each executive and its own judgment of the appropriate balance of cash and equity, and short- and long-term compensation it believes will reward superior performance and foster achievement of our strategic goals.

Base Salary

Base salaries are set at levels that the Compensation Committee deems to be sufficient to attract and retain highly talented executive officers capable of fulfilling the Company’s key objectives. Base salaries are also set with the goal of rewarding executive officers on a day-to-day basis for their time and services while encouraging them to strive for performance-based and long-term incentives. The Compensation Committee generally aims to establish base salaries for our executive officers between the 40th and 60th percentile of base salaries for similarly situated officers at companies in the Compensation Peer Group. Salary levels are typically considered annually as part of the Company’s performance review process.

The 2008 base salary for each of our executive officers, other than Charles S. Rhoades, was determined based upon such officer’s base salaries for the preceding year, individual performance future potential, scope of his or her responsibilities and experience; an internal review of the executive’s current total compensation, both individually and relative to other executive officers; and financial performance of the Company during the prior year. Base salary for Mr. Rhoades, through his separation date of April 30, 2008, was determined pursuant to a transition agreement entered into with Mr. Rhoades on December 31, 2007.

In October 2008, as a result of declining global economic conditions and the company’s internal business forecasts management recommended and the Compensation Committee approved temporary ten percent reductions in the base salaries of the Company’s executive officers. In December 2008, management recommended and the Compensation Committee approved continuation of the ten percent base salary reduction into 2009, subject to restoration of such salaries to original levels in the event that the Company’s sustainable revenue exceeds by at least 5% the revenue level forecasted in the Company’s internal operating plan.

18

Annual Performance-Based Incentive Compensation

In 2008, the executive officers were eligible to participate in the Leadership Performance Incentive Plan (“LPIP”), under which incentive awards would be distributed from a bonus pool based upon the Company’s operating results in 2008 and each executive officer’s individual performance. Under the LPIP, the Company would have funded a bonus pool equal to 10% of the Company’s 2008 operating income if 2008 annual revenue and post-bonus operating income thresholds had been met. Revenue and operating income thresholds under the LPIP are set annually based upon achievement of the Company’s annual operating plan and approved by the Board of Directors.

The Compensation Committee aims to set each officer’s annual target bonus around the 65th percentile of the annual target bonus potentials for similarly situated officers at the companies in the Compensation Peer Group, in order to provide relatively high incentive compensation opportunities that reward goal achievement but that also take into consideration business cyclicality. In determining each officer’s annual target bonus, the Compensation Committee also considers the proposed amounts of base salary, equity incentive and other compensation as well as stockholder value created upon achievement of the specified performance targets. Target bonuses for executives in 2008 were:

| | |

| | • | Chief Executive Officer — 70% of base salary |

| |

| | • | Executive Vice Presidents including Chief Financial Officer — 50% of base salary |

If the bonus pool had been funded, individual performance objectives applicable to each participant would have been considered to determine the amount of the bonus. Individual performance objectives were set to reward exceptional individual performance with bonus modifiers based on the individual’s performance above target amounts, up to a maximum of 150% of such participant’s target bonus. In accordance with the goal of retaining key talent, an executive was required to remain an employee for the entire fiscal year to be eligible for any award under the incentive bonus plan.

Individual performance objectives for the Company’s executive officers are set annually by the Compensation Committee based upon the critical needs and goals of the Company for that year. For 2008, individual performance objectives for the Company’s executive officers were based upon each officer’s individual contributions to the Company’s overall performance in the categories of (1) long-term strategic planning and execution, (2) organizational development, (3) business process development, (4) reputation and quality of critical customer and investor relationships, and (5) improving efficiencies and decreasing costs. In addition, the Chief Executive Officer had individual performance objectives with respect to financial performance and company-wide quality improvement. The Compensation Committee maintained the discretion to evaluate each executive officer’s performance against these objectives and did not set specific metrics against these objectives for 2008.

In February 2009, the Compensation Committee met to determine the amounts of cash bonuses, if any, to award to the executive officers of the Company. Upon reviewing the financial performance of the Company for the fiscal year 2008, the committee determined that neither the 2008 annual revenue threshold nor the post-bonus operating income threshold had been met. As a result, the committee determined that no bonuses were to be awarded to the executive officers under the 2008 incentive compensation plan.

Long-Term Equity Incentive Compensation

The Company grants stock options and restricted stock units to the executive officers as long-term incentives and to align the executive officers’ interests with those of the Company’s stockholders. For 2008, all awards granted to the Company’s executive officers were in the form of stock options in order to maximize the alignment of the executive’s performance with the Company’s long-term interests. The initial award of restricted stock units granted to the Company’s Chief Executive Officer upon hire in 2005 continues to vest.

Prior to May 7, 2008 equity-based incentives were granted under the Company’s stockholder-approved 2003 Stock Option Plan, as amended January 31, 2005 and February 21, 2007. Subsequent to the annual stockholder meeting held on May 7, 2008, equity-based incentives were granted under the Company’s 2008 Omnibus Incentive Plan approved by the stockholders at the annual meeting. The Compensation Committee has granted equity awards at its scheduled meetings or by unanimous written consent, and the grants become effective and are priced based on

19

the closing price on the date of the Board of Directors meeting associated with such meeting or written consent. During 2008, equity based incentive awards were granted quarterly based upon an annual target recommendation from management, which the Compensation Committee had discretion to adjust at any time.

The number of options granted to each executive officer in 2008 was based upon a review by the Compensation Committee of each executive officer’s base salary, bonus potential, and individual performance and accomplishments, with the result in each case aimed at achieving total equity compensation between the 60th and 70th percentile of the total equity compensation paid to executive officers in comparable positions as reported by the Compensation Peer Group, based upon data contained in market research commissioned by the Compensation Committee. After considering the proposed amounts of base salary, target bonus and other compensation for each executive officer, the Compensation Committee determined that the amount of total executive equity-based compensation should be set at this level in order to emphasize the goals of retention and growth and to ensure strong alignment between executive performance and stockholder interests.

Personal Benefits and Perquisites

As U.S. employees, the executives were eligible to participate in health and welfare benefits, as offered to our U.S. workforce, designed to attract and retain its workforce in a competitive marketplace. These benefits help ensure that the Company has a healthy and focused workforce through reliable and competitive health and other personal benefits. These benefits were considered in relation to the total compensation package, but did not materially impact decisions regarding other elements of executive officer compensation.

All U.S. employees of the Company, including the executive officers, are eligible to participate in the Company’s 401(k) savings plan and are eligible to receive matching contributions by the Company of 50 percent of the first 6 percent of compensation contributed to the plan by the employee. In January 2009, the Compensation Committee determined to discontinue the Company’s matching contributions under the 401(k) savings plan as a cost reduction initiative as a result of declining global economic conditions and the Company’s internal business forecast.

All U.S. employees of the Company, including the executive officers, are eligible to participate in the Company’s Employee Stock Purchase Plan (ESPP), which provides participants with a right to purchase a limited number of shares of common stock of the Company at a purchase price equal to the lesser of 85% of the fair market value of the stock on either the opening or closing date of an offering under the plan. In February 2009, the Compensation Committee determined to discontinue the Company’s discount and look-back under the ESPP as a further cost reduction initiative.

Other Compensation

In 2008, the Company was a party to a change in control (“CIC”) agreement with each of the Chief Executive Officer, the Chief Financial Officer, and the Executive Vice President of Sales, Marketing and Service. The CIC agreements provide each of these executives with severance payments and certain benefits in the event of a termination without Cause or other involuntary termination following an actual or during a pending change in control. The Company entered into the CIC agreements in order to keep management focused on the Company’s stated corporate objectives irrespective of whether the achievement of such objectives makes the Company attractive for acquisition, and to avoid the distraction and loss of key management that could occur in connection with a rumored or actual change in corporate control.

Under the CIC agreements effective March 29, 2008, in the event of an executive’s termination without cause following an actual or during a pending change in control, the executive is entitled to receive: (a) all then accrued compensation and a pro-rata portion of executive’s target bonus for the year in which the termination is effected, (b) a lump sum payment equal to the executive’s then current annual base salary plus his or her target bonus for the year in which the termination is effected (or in the case of the Chief Executive Officer, two times such amount), (c) continuation of insurance and other benefits for 18 months following the date of termination, (d) an amount equal to the contributions that would have been made to the company’s retirement plans on behalf of executive, if the executive had continued to be employed for 12 months following the date of termination, and (e) reimbursement, up to $15,000, for outplacement services. In addition, all stock options and other equity awards then held by the

20

executive so terminated become fully vested and exercisable. The terms of the CIC agreements were determined by the Compensation Committee based on consideration of marketplace benchmark data and the Company’s retention objectives.

Tax and Accounting Implications

Section 162(m) of the Internal Revenue Code of 1986 generally limits to $1 million the corporate deduction for compensation paid to certain executive officers, unless the compensation is “performance-based” (as defined in Section 162(m)). Each of the members of the Board of Directors and the Compensation Committee carefully considers the potential impact of the limitation on executive compensation and considers it to be in the best interests of Advanced Energy and the stockholders to seek to qualify as tax deductible virtually all executive compensation. The Board of Directors and the Compensation Committee also recognize the need to consider factors other than tax deductibility in making compensation decisions and thus reserve the flexibility to award compensation that is not necessarily performance-based. During 2008, none of the executive officers of the Company had compensation in excess of $1,000,000.

Compensation Committee Interlocks and Insider Participation

The current members of the Compensation Committee are Messrs. Spedden (Chairman), Doan, Grady and Rohrs. None of such directors is or has been an officer or employee of Advanced Energy, nor has any of such persons had a direct or indirect interest in any business transaction with Advanced Energy involving an amount in excess of $120,000 or any other interlock relationship required to be reported under the rules of the Securities and Exchange Commission.

During 2008, no executive officer of Advanced Energy served as a member of the board of directors or compensation committee of another company that has any executive officers or directors serving on Advanced Energy’s Board of Directors or its Compensation Committee.

Compensation Committee Report

The information contained in this report shall not be deemed to be “soliciting material” or “filed” with the SEC or subject to the liabilities of Section 18 of the Exchange Act, except to the extent that the Company specifically incorporates such information by reference in a document filed under the Securities Act or the Exchange Act

The Compensation Committee of the Board has reviewed and discussed with management the Compensation Discussion and Analysis for fiscal 2008. Based upon the review and discussions, the Compensation Committee recommended to the Board, and the Board has approved, that the Compensation Discussion and Analysis be included in the Company’s Proxy Statement for its 2009 Annual Meeting of Stockholders.

This report is submitted by the Compensation Committee.

Elwood Spedden, Chairman

Trung T. Doan

Edward C. Grady

Thomas M. Rohrs

21

Management

| | | | | | | | | |

Name | | Age | | Position | | Principal Occupation and Business Experience |

| |

| Hans Georg Betz | | | 62 | | | Chief Executive Officer | | Dr. Hans Georg Betz joined the Board of Directors of Advanced Energy in July 2004. In August 2005, Dr. Betz became our Chief Executive Officer and President. Prior to August 2005, he served as chief executive officer of West Steag Partners GmbH, a German-based venture capital company focused on the high-technology industry. Previously, he was chief executive officer of STEAG Electronic Systems AG from 1996 to 2001 after having served as a member of its Management Board since 1992, and a managing director at Leybold AG from 1987 to 1992. Dr. Betz serves as a director of Mattson Technology, Inc., a publicly held supplier of advanced process equipment used to manufacture semiconductors, and serves as a member of its compensation committee. |

| Lawrence D. Firestone | | | 51 | | | Executive Vice President and Chief Financial Officer | | Lawrence D. Firestone joined us in August 2006 as Executive Vice President and Chief Financial Officer. Prior to joining the Company, Mr. Firestone served as the chief financial officer and secretary and treasurer from 1999 to 2006 at Applied Films Corporation, a supplier of thin film deposition equipment. Prior to joining Applied Films, Mr. Firestone served as vice president and chief operating officer of Avalanche Industries, a contract manufacturer of custom cables and harnesses from 1996 to 1999. |