UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission File Number: 1-14106

DAVITA INC.

(Exact name of registrant as specified in charter)

| | | | | | | | |

| Delaware | | 51-0354549 |

| (State of incorporation) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| 2000 16th Street |

| Denver, | CO | 80202 |

Telephone number (720) 631-2100

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading symbol(s): | | Name of each exchange on which registered: |

| Common Stock, $0.001 par value | | DVA | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its final report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

As of June 30, 2024, the aggregate market value of the registrant's common stock outstanding held by non-affiliates based upon the closing price on the New York Stock Exchange was approximately $11.8 billion.

As of January 31, 2025, the number of shares of the registrant’s common stock outstanding was approximately 80.0 million shares.

Documents incorporated by reference

Portions of the registrant’s proxy statement for its 2025 annual meeting of stockholders are incorporated by reference in Part III of this Form 10-K.

DAVITA INC.

INDEX

| | | | | | | | | | | | | | |

| | | | | Page No. |

| | | PART I. | | |

| Item 1. | | | | |

| Item 1A. | | | | |

| Item 1B. | | | | |

| Item 1C. | | | | |

| Item 2. | | | | |

| Item 3. | | | | |

| Item 4. | | | | |

| | | | | |

| | | PART II. | | |

| Item 5. | | | | |

| Item 6. | | | | |

| Item 7. | | | | |

| Item 7A. | | | | |

| Item 8. | | | | |

| Item 9. | | | | |

| Item 9A. | | | | |

| Item 9B. | | | | |

| Item 9C. | | | | |

| | | | |

| | PART III. | | |

| Item 10. | | | | |

| Item 11. | | | | |

| Item 12. | | | | |

| Item 13. | | | | |

| Item 14. | | | | |

| | | | |

| | PART IV. | | |

| Item 15. | | | | |

| Item 16. | | | | |

| | | | |

| | | | |

| | | | |

PART I

Item 1. Business

Unless otherwise indicated in this report "DaVita", "the Company" "we", "us", "our" and other similar terms refer to DaVita Inc. and its consolidated subsidiaries. Our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are made available free of charge through our website, located at http://www.davita.com, as soon as reasonably practicable after the reports are filed with or furnished to the Securities and Exchange Commission (SEC). The SEC also maintains a website at http://www.sec.gov where these reports and other information about us can be obtained. The contents of our website are not incorporated by reference into this report.

Overview of DaVita Inc.

DaVita is a leading healthcare provider focused on transforming care delivery to improve quality of life for patients globally. As a comprehensive kidney care provider, we have been a leader in clinical quality and innovation for 25 years. We care for patients at every stage and setting along their kidney health journey–from earlier diagnosis and prevention through supporting the transplant process. This includes ensuring they are supported at home, in our dialysis centers, in the hospital and/or skilled nursing facilities. In our unwavering pursuit of a healthier tomorrow, we strive to reimagine what high quality care looks like: more preventative, better integrated, improved outcomes at the lowest total cost, and personalized at scale to deliver a better tomorrow regardless of location, insurance status or other factors. Our caring culture fuels our continuous drive toward achieving our mission to be the provider, partner and employer of choice.

Defining chronic kidney disease

There are five stages of chronic kidney disease (CKD). These stages are generally based on how well the kidneys work to filter waste and extra fluid out of the blood–with higher stages of CKD corresponding to progressing levels of kidney disease. Stage 1 CKD is the closest to healthy kidney function. Stage 5 CKD indicates that a patient has severe kidney damage.

A patient diagnosed with Stage 5 CKD has kidneys that have lost nearly all functionality or have failed. If an individual's kidneys fail, the person is then diagnosed with end stage renal disease (ESRD), also known as end stage kidney disease (ESKD). Because kidney function is essential for survival and the loss of kidney function is normally irreversible, ESKD patients require continued dialysis treatments or a kidney transplant to sustain life. Dialysis is the removal of toxins, fluids and salt from the blood of patients by artificial means. Patients suffering from ESKD generally require regular life-sustaining dialysis therapy for the rest of their lives or until they receive a kidney transplant.

The treatment goal for CKD patients prior to Stage 5 is to manage and slow the progression of the disease to preserve kidney functionality. Because kidney failure is typically caused by one or more comorbidities such as Type I and Type II diabetes, hypertension, polycystic kidney disease, long-term autoimmune attack on the kidneys or prolonged urinary tract obstruction, slowing the progression generally involves working with nephrologists and dieticians to help control blood pressure, monitor blood glucose and maintain healthy diet and exercise routines, among other things. If the kidney disease continues to progress, the goal is to support efforts for kidney transplantation where available and medically appropriate, and in the event transplantation is not possible, to work with the patient and his or her nephrologist to safely transition the patient to the dialysis treatment and modality of their choice.

Our businesses

We are a leading dialysis provider in the United States. Our U.S. dialysis and related lab services (U.S. dialysis) business treats patients with chronic kidney failure, ESKD, in the United States, and is our largest line of business. Our robust platform to deliver kidney care services also includes established nephrology and payor relationships.

In addition, as of December 31, 2024, our international operations provided dialysis and administrative services to a total of 509 outpatient dialysis centers located in 13 countries outside of the U.S., serving approximately 80,300 patients.

Finally, our U.S. integrated kidney care (IKC) business provided integrated care and disease management services to 70,400 patients in risk-based integrated care arrangements and to an additional 11,600 patients in other integrated care arrangements across the United States as of December 31, 2024.

We also maintain a few other ancillary services and investments outside of our U.S. dialysis, U.S. IKC, or international operations, which we refer to as our U.S. other ancillary services. We refer to our U.S. integrated kidney care business, U.S. other ancillary services and international operations as, collectively, our "ancillary services." We also have a separate corporate

administrative support function that supports our U.S. dialysis business and these ancillary services. Each of our businesses are described in greater detail in the sections that follow.

Our care model

Our patient-centric care model leverages our platform of kidney care services to maximize patient choice in both models and modalities of care. We believe that the flexibility we offer coupled with a focus on comprehensive kidney care supports our commitments to help improve equitable clinical outcomes and quality of life for our patients. According to the most recently published data, for the ten most recently reported years, we have continued as an industry leader in the Centers for Medicare & Medicaid Services’ (CMS) Quality Incentive Program (QIP), which promotes high quality services in outpatient dialysis facilities treating patients with ESKD. In addition, according to the most recently published data, for the nine most recently reported years, we have also continued as an industry leader under CMS’ Five-Star Quality Rating System (Star Rating), which rates eligible dialysis centers based on the quality of outcomes to help patients, their families, and caregivers make more informed decisions about where patients receive care. Following a pause in refreshed Star Ratings in October 2020 and October 2021 due to the COVID-19 pandemic, CMS reset the baseline with the October 2023 Star Rating release to reflect current performance and provide clinical differentiation through newly defined cutoff values. Under the new baseline, the lowest scoring 10% of facilities receive one star, the next 20% receive two stars, the next 40% receive three stars, the next 20% receive four stars and the highest 10% of facilities receive five stars in the baseline period for each subsequent evaluation period.

Our clinical outcomes are driven by our experienced and knowledgeable caregivers. We employ registered nurses, licensed practical or vocational nurses, patient care technicians, social workers, registered dietitians, biomedical technicians and other administrative and support teammates who strive to achieve superior clinical outcomes at our dialysis facilities. In addition to our teammates at our dialysis facilities, as of December 31, 2024, our domestic Chief Medical Officer leads a team of 23 nephrologists in our physician leadership team as part of our domestic Office of the Chief Medical Officer (OCMO). Our international Chief Medical Officer leads a team of 11 nephrologists in our physician leadership team as part of our international OCMO as of December 31, 2024. Our OCMO teammates represent a variety of academic, clinical practice, and clinical research backgrounds. We also have a Physician Council that serves as an advisory body to senior management, which was composed of 10 physicians with extensive experience in clinical practice and five Group Medical Directors as of December 31, 2024.

Value-based care arrangements continue to impact the kidney health space. These arrangements are fostering a much larger degree of collaboration between nephrologists and other providers, including transplant programs, resulting in a more complete understanding of each patient’s clinical needs. We believe this more complete understanding allows for better care coordination and earlier intervention, which we believe ultimately leads to improved clinical outcomes, lower overall costs and improved patient experiences. Our IKC business provides comprehensive care management for complex CKD patients nationwide, with payment models that include a variety of structures to advance and encourage integrated and value-based care. Among other arrangements, our IKC business has percent-of-premium arrangements in several Medicare Advantage ESRD Chronic Special Needs Plans and is an active participant in CMMI’s Comprehensive Kidney Care Contracting (CKCC) model that seeks to manage the care of late stage CKD and ESKD patients to delay the progression of kidney disease, promote home dialysis when appropriate, and incentivize transplants. Our IKC business also utilizes other value-based payment methodologies in its care coordination and disease management contracts, which include two-sided shared savings/shared losses and outcomes-based pay-for-performance compensation arrangements.

U.S. dialysis business

Our U.S. dialysis business is a leading provider of kidney dialysis services for patients suffering from ESKD. As of December 31, 2024, we provided dialysis, administrative and related laboratory services in the U.S. through a network of 2,657 outpatient dialysis centers in 46 states and the District of Columbia, serving a total of approximately 200,800 patients. We also have contracts to provide hospital inpatient dialysis services in approximately 760 hospitals throughout the U.S.

Based on the most recent 2024 annual data report from the United States Renal Data System (USRDS), there were over 554,000 ESKD dialysis patients in the U.S. in 2022. The underlying ESKD dialysis patient population grew at an approximate compound annual rate of 3.3% from 2012 to 2022 and 3.4% from 2017 to 2022 as compared to a decline in annual growth of 0.4% from 2021 to 2022. Despite this near term slowdown, which, among other things, included impacts from the COVID-19 pandemic on mortality rates amongst the ESKD dialysis patient population, the rate of growth has been relatively consistent over time. In general, a number of factors may impact ESKD growth rates, including, among others, mortality rates for dialysis patients or CKD patients, the growth and aging of the U.S. population, limitations on immigration in the U.S., transplant rates, incidence rates for diseases that cause kidney failure such as diabetes and hypertension, growth rates of minority populations with higher than average incidence rates of ESKD or other changes in demand for dialysis treatments over time, including for

example, as a result of the development and application of certain innovative technologies, drugs or other treatments. Certain of these factors, in particular mortality rates for dialysis or CKD patients, have been impacted by the COVID-19 pandemic.

Treatment options for ESKD

Treatment options for ESKD are dialysis and kidney transplantation.

Dialysis options

•Hemodialysis

Hemodialysis is the most common form of ESKD treatment. The hemodialysis machine uses a filter, called a dialyzer, to remove toxins, fluids and salt from the patient’s blood. The dialysis process occurs across a semi-permeable membrane that divides the dialyzer into two distinct chambers. While blood is circulated through one chamber, a pre-mixed fluid is circulated through the other chamber. The toxins, salt and excess fluids from the blood cross the membrane into the fluid, allowing cleansed blood to return back into the patient’s body.

Hemodialysis is usually performed at a freestanding outpatient dialysis center, at a hospital-based outpatient center, in a skilled nursing facility or at the patient's home. Our freestanding outpatient dialysis centers are staffed with members of our care team and store the supplies necessary for treatment. Treatments are usually performed three times per week.

Hospital inpatient hemodialysis services are required for patients with acute kidney failure primarily resulting from acute medical illness or trauma, patients in early stages of ESKD and ESKD patients who require hospitalization for other reasons. Hospital inpatient hemodialysis is generally performed at the patient’s bedside or in a dedicated treatment room in the hospital, as needed.

Some ESKD patients may perform hemodialysis with the help of a care partner in their home or residence through the use of a hemodialysis machine designed specifically for home therapy that is portable, smaller and easier to use. This is referred to as home hemodialysis (HHD). Patients receive training, support and monitoring from registered nurses, usually in our outpatient dialysis centers, in connection with their HHD treatment. HHD is typically performed with greater frequency than dialysis treatments performed in outpatient dialysis centers and on varying schedules.

•Peritoneal dialysis

Peritoneal dialysis uses the patient’s peritoneal or abdominal cavity to eliminate fluid and toxins and is typically performed at home. The most common methods of peritoneal dialysis are continuous ambulatory peritoneal dialysis (CAPD) and continuous cycling peritoneal dialysis (CCPD). Because it does not involve going to an outpatient dialysis center three times a week for treatment, peritoneal dialysis is generally an alternative to hemodialysis for patients who are healthier, more independent and desire more flexibility in their lifestyle.

CAPD introduces dialysis solution into the patient’s peritoneal cavity through a surgically placed catheter. Toxins in the blood continuously cross the peritoneal membrane into the dialysis solution. After several hours, the patient drains the used dialysis solution and replaces it with fresh solution. This procedure is usually repeated four times per day.

CCPD is performed in a manner similar to CAPD, but uses a mechanical device to cycle dialysis solution through the patient’s peritoneal cavity while the patient is sleeping or at rest.

•Kidney transplantation

Kidney transplantation, when successful, is considered the most desirable form of therapeutic intervention. However, in light of the shortage of suitable donors, side effects of immunosuppressive pharmaceuticals given to transplant recipients and dangers associated with transplant surgery, some patient populations have generally limited the use of this treatment option. In accordance with an executive order signed in July 2019 (the 2019 Executive Order), the U.S. Department of Health and Human Services (HHS) developed policies addressing, among other things, the goal of making more kidneys available for transplant. CMS, through CMMI, also subsequently released the framework for certain proposed and existing voluntary and mandatory payment models, including ESRD Treatment Choices Model (ETC) model, which would adjust payment incentives to encourage kidney transplants. For more information about these payment models, please see the discussion below under the heading "—Integrated Kidney Care, Medicare and Medicaid program reforms and Other Healthcare Regulations."

•Hemodiafiltration

Hemodiafiltration (HDF) is a form of augmented hemodialysis that includes a component of convection to remove additional molecules from the blood. Like hemodialysis, HDF can be performed at certain freestanding outpatient dialysis

centers and may also be performed in hospital in-patient centers. HDF usage varies by country, and the efficacy of this modality is still being assessed in the U.S.

U.S. dialysis services we provide

Outpatient hemodialysis services

The majority of services we provide to patients are outpatient hemodialysis treatments. As a condition of our enrollment in Medicare for the provision of dialysis services, we contract with a nephrologist or a group of associated nephrologists to provide medical director services at each of our dialysis centers. In addition, other nephrologists may apply for practice privileges to treat their patients at our centers. Each center has an administrator, often a registered nurse, who supervises the day-to-day operations of the center and its staff. The staff of each center typically consists of registered nurses, licensed practical or vocational nurses, patient care technicians, a social worker, a registered dietician, biomedical technician support and other administrative and support personnel.

The overall number of patients to whom we provided services in the U.S. in 2024 was relatively flat compared to 2023, primarily due to growth in new admits partially offset by elevated mortality rates, which continue to be elevated relative to our pre-COVID-19 mortality rates.

Hospital inpatient hemodialysis services

As of December 31, 2024, we have contracts to provide hospital inpatient dialysis services to patients in approximately 760 hospitals throughout the U.S. We render these services based on a contracted per-treatment fee that is individually negotiated with each hospital. When a hospital requests our services, we typically administer the dialysis treatment at the patient’s bedside or in a dedicated treatment room in the hospital, as needed.

Home-based dialysis services

Home-based dialysis services includes HHD and peritoneal dialysis. Many of our outpatient dialysis centers offer certain support services for dialysis patients who prefer and are able to perform either HHD or peritoneal dialysis in their homes. Home-based hemodialysis support services consist of providing equipment and supplies, training, patient monitoring, on-call support services and follow-up assistance. Registered nurses train patients and their families or other caregivers to perform either HHD or peritoneal dialysis. The 2019 Executive Order and related HHS guidance described above also included a stated goal of increasing the relative number of new ESKD patients that receive dialysis at home.

According to the most recent annual data report from the USRDS, in 2022 approximately 14% of ESKD dialysis patients in the U.S. utilized home-based dialysis.

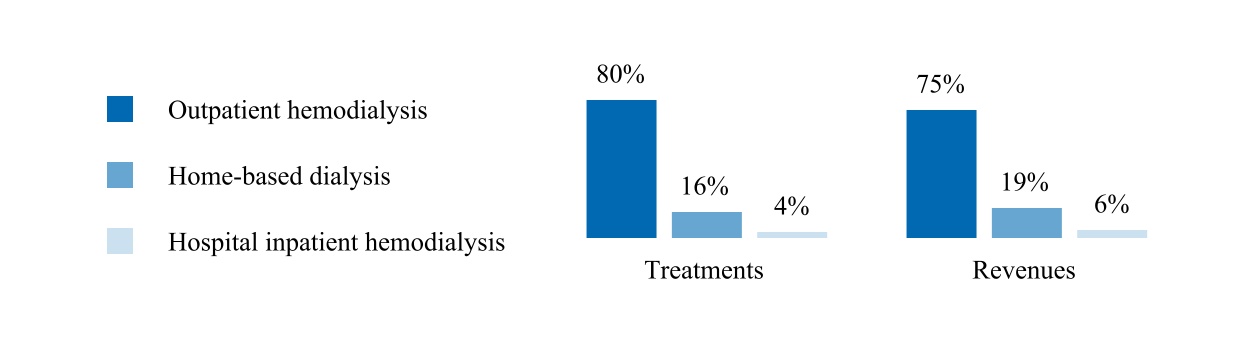

Treatments and revenues by modality:

The following graph summarizes our U.S. dialysis treatments by modality and U.S. dialysis patient service revenues by modality for the year ended December 31, 2024.

Other

ESKD laboratory services

We operate a separately licensed and highly automated clinical laboratory that specializes in ESKD patient testing. This specialized laboratory provides routine laboratory tests for dialysis and other physician-prescribed laboratory tests for ESKD patients. The vast majority of these tests are performed for our ESKD patients throughout the U.S. These tests are performed for

a variety of reasons, including to monitor a patient’s ESKD condition, including the adequacy of dialysis, as well as other medical conditions of the patient. Our laboratory utilizes information systems that provide information to certain members of the dialysis centers’ staff and medical directors regarding critical outcome indicators.

Management services

We currently operate or provide management and administrative services pursuant to management and administrative services agreements to 52 outpatient dialysis centers located in the U.S. in which we either own a noncontrolling interest or which are wholly-owned by third parties. Management fees are established by contract and are recognized as earned typically based on a percentage of revenues or cash collections generated by the outpatient dialysis centers.

Sources of revenue—concentrations and risks

Our U.S. dialysis revenues represent approximately 88% of our consolidated revenues for the year ended December 31, 2024. Our U.S. dialysis revenues are derived primarily from our core business of providing dialysis services and related laboratory services and, to a lesser extent, the administration of pharmaceuticals and management fees generated from providing management and administrative services to certain outpatient dialysis centers, as discussed above.

The sources of our U.S. dialysis revenues are principally from government-based programs, including Medicare and Medicare Advantage plans, Medicaid and managed Medicaid plans, other government-based programs including our agreement with the Veterans Administration, and commercial insurance plans. The following table summarizes our U.S. dialysis revenues by payor source for U.S. dialysis patient service revenues for the year ended December 31, 2024:

| | | | | | |

| Medicare and Medicare Advantage plans | 56 | % | |

| Medicaid and managed Medicaid plans | 8 | % | |

| Other government-based programs | 3 | % | |

| Total government-based programs | 67 | % | |

| Commercial (including hospital dialysis services) | 33 | % | |

| Total U.S. dialysis patient service revenues | 100 | % | |

Medicare revenue

Medicare fee for service

Since 1972, the federal government has provided healthcare coverage for qualified ESRD patients under the Medicare ESRD program regardless of age or financial circumstances. ESRD is the first and only disease state eligible for Medicare coverage both for dialysis and dialysis-related services and for all benefits available under the Medicare program.

Government dialysis related payment rates in the U.S. are principally determined by federal Medicare and state Medicaid policy. For patients with Medicare coverage, all ESRD payments for dialysis treatments are made under a single bundled payment rate that provides a fixed payment rate to encompass all goods and services provided during the dialysis treatment that are related to the dialysis treatment, including certain pharmaceuticals, such as erythropoiesis-stimulating agents (ESAs), calcimimetics, vitamin D analogs, oral-only renal phosphate binders and iron supplements, irrespective of the level of pharmaceuticals administered to the patient or additional services performed. Most lab services are also included in the bundled payment.

Although Medicare reimbursement limits the allowable charge per treatment, it provides industry participants with a relatively predictable and recurring revenue stream for dialysis services provided to patients without commercial insurance. For the year ended December 31, 2024, approximately 89% of our total U.S. dialysis patients were covered under some form of government-based program, with approximately 74% of our total U.S. dialysis patients covered under Medicare and Medicare Advantage plans.

Under this bundled payment rate system, known as the ESRD Prospective Payment System (PPS), the payments to a dialysis facility may be reduced by as much as 2% based on the facility’s performance in specified quality measures set annually by CMS through its QIP. CMS established QIP through the Medicare Improvements for Patients and Providers Act of 2008 to promote high quality services in outpatient dialysis facilities treating patients with ESRD. QIP associates a portion of Medicare reimbursement directly with a facility’s performance on quality of care measures. Reductions in Medicare reimbursement result when a facility’s overall score on applicable measures does not meet established standards.

Uncertainty about future payment rates remains a material risk to our business, as well as the potential implementation of or changes in coverage determinations or other rules or regulations by CMS or Medicare Administrative Contractors that may impact reimbursement. An important provision in the Medicare ESRD statute is an annual adjustment, or market basket update, to the ESRD PPS base rate. Absent action by Congress, the ESRD PPS base rate is updated annually by an inflation adjustment based on historical data and forecasts that may create a lag between these adjustments and actual inflationary increase. As a result, an inflation adjustment may not always cover the actual inflationary increase experienced. Due in part to continued higher than expected inflation rates, the annual update for the 2024 ESRD PPS base rate did not accurately forecast the cost increase experienced by providers.

In November 2024, CMS issued a final rule to update the Medicare ESRD PPS payment rate and policies for calendar year 2025. Among other things, the final rule updated both the ESRD and Acute Kidney Injury (AKI) dialysis payment rate for renal dialysis services furnished by ESRD facilities, extended payment for dialysis in a home setting for AKI, and outlined requirements for the ESRD QIP. CMS estimates that the overall impact of the rule will increase ESRD facilities' average reimbursement by a productivity-adjusted market basket increase of 2.2%. On January 1, 2025, phosphate binders, a drug class taken orally by many ESKD patients to reduce absorption of dietary phosphate, were incorporated into the ESRD PPS bundled payment rate. Phosphate binders are not considered accounted for in the ESRD PPS base rate at this time and will be reimbursed through a Transitional Drug Add-on Payment Adjustment (TDAPA). The TDAPA period is expected to continue for a period of at least two years.

As a result of the Budget Control Act of 2011 (BCA) and subsequent activity in Congress, a $1.2 trillion sequester (across-the-board spending cuts) in discretionary programs took effect in 2013 reducing Medicare payments (currently by 2%), which was subsequently extended into fiscal year 2032.

Most ESRD patients receiving dialysis services become eligible for primary Medicare coverage at various times, depending on their age or disability status, as well as whether they are covered by a commercial insurance plan. Generally, for a patient not covered by a commercial insurance plan, Medicare can become the primary payor for qualified ESRD patients receiving dialysis services either immediately or after a three-month waiting period. In most cases, for a patient covered by a commercial insurance plan, Medicare will either become the primary payor after 33 months, which includes the three-month waiting period, or earlier if the patient’s commercial insurance plan coverage terminates or if the patient chooses Medicare over the commercial plan. When Medicare becomes the primary payor, the payment rates we receive for that patient shift from the commercial insurance plan rates to Medicare payment rates, which are on average significantly lower than commercial insurance rates.

Medicare pays 80% of the amount set by the Medicare system for each covered dialysis treatment. The patient is responsible for the remaining 20%. In many cases, a secondary payor, such as Medicare supplemental insurance, a state Medicaid program or a commercial health plan, covers all or part of these balances. If a patient does not have secondary insurance coverage, we are generally unsuccessful in our efforts to collect from the patient the remaining 20% portion of the ESRD composite rate that Medicare does not pay. In those instances, however, we are able to recover some portion of this unpaid patient balance from Medicare through an established cost reporting process by identifying these Medicare bad debts on each center’s Medicare cost report. For additional detail on the associated risks, see the risk factor in Part I Item 1A. "Risk Factors" under the heading "Changes in federal and state legislation or regulations..."

Medicare Advantage revenue

Medicare Advantage (MA, managed Medicare or Medicare Part C) plans are offered by private health insurers who contract with CMS to provide their members with Medicare Part A, Part B and/or Part D benefits. These MA plans include health maintenance organizations, preferred provider organizations, private fee-for-service (FFS) organizations, special needs plans (SNPs) or Medicare medical savings account plans. Since January 1, 2021, under the 21st Century Cures Act (the Cures Act) Medicare-eligible beneficiaries with ESRD can choose coverage under an MA plan. MA plans usually provide reimbursement to us at a negotiated rate that is generally higher than Medicare FFS rates. CMS releases an annual MA notice that includes, among other things, a MA payment rate for MA plans and updates certain policies associated with risk adjustments. We continue to monitor MA notices, regulatory updates and guidance, as well as enforcement for impact on our business.

Medicaid revenue

Medicaid programs are state-administered programs partially funded by the federal government. These programs are intended to provide health coverage for patients whose income and assets fall below state-defined levels and who are otherwise uninsured. These programs also serve as supplemental insurance programs for co-insurance payments due from Medicaid-eligible patients with primary coverage under the Medicare program. Some Medicaid programs also pay for additional services,

including some oral medications that are not covered by Medicare. We are enrolled in the Medicaid programs in the states in which we conduct our business.

Commercial revenue

As discussed above, if a patient has commercial insurance, then that commercial insurance plan is generally responsible for payment of dialysis services for up to the first 33 months before that patient becomes eligible to elect to have Medicare as their primary payor for dialysis services. Although commercial payment rates vary, average commercial payment rates negotiated with commercial payors are generally significantly higher than Medicare rates. The payments we receive from commercial payors generate nearly all of our profits and all of our non-hospital dialysis profits come from commercial payors. Payment methods from commercial payors can include a single per treatment rate, referred to as bundled rates, or in other cases separate payments for dialysis treatments and pharmaceuticals, if used as part of the treatment, referred to as FFS rates. Commercial payment rates are the result of negotiations between us and commercial payors or third party administrators. Our commercial contracts sometimes contain annual price escalator provisions. We are comprehensively contracted, and the vast majority of patients insured through commercial health plans are covered by one of our commercial contracts, though we also receive payments for a limited set of commercial patients that are covered by a health plan that considers us out-of-network. While our out-of-network payment rates are on average higher than in-network commercial contract payment rates, we have made efforts to be contracted with the majority of commercial payors offering health plans.

Approximately 27% of our U.S. dialysis patient service revenues and approximately 11% of our U.S. dialysis patients are associated with non-hospital commercial payors for the year ended December 31, 2024. Non-hospital commercial patients as a percentage of our total U.S. dialysis patients for 2024 increased slightly compared to 2023. Less than 1% of our U.S. dialysis revenues are due directly from patients. No single commercial payor accounted for more than 10% of total U.S. dialysis revenues for the year ended December 31, 2024. See Note 2 to the consolidated financial statements included in this report for disclosure on our concentration related to our commercial payors on a total consolidated revenue basis.

Both the number of our patients under commercial plans and the rates under these commercial plans are subject to change based on a number of factors. For additional detail on these factors and other risks associated with our commercial revenue, see the risk factors in Part I Item 1A. "Risk Factors" under the headings "Our business is subject to a complex set of governmental laws, regulations and other requirements...;" "Changes in federal and state legislation or regulations...;" "If the number or percentage of patients with higher-paying commercial insurance declines...;" and "External conditions, including those related to general economic, marketplace and global health conditions..."

Physician relationships

Joint venture partners

We own and operate certain of our dialysis centers through entities that are structured as joint ventures. We generally hold controlling interests in these joint ventures, with nephrologists, hospitals, management services organizations, and/or other healthcare providers holding minority equity interests. These joint ventures are typically formed as limited liability companies. For the year ended December 31, 2024, revenues from joint ventures in which we have a controlling interest represented approximately 30% of our U.S. dialysis revenues. We expect to continue to enter into new U.S. dialysis-related joint ventures in the ordinary course of business.

Community physicians

An ESKD patient generally seeks treatment or support for their home treatment at an outpatient dialysis center near their home where their treating nephrologist has practice privileges. Our relationships with local nephrologists and our ability to provide quality dialysis services and to meet the needs of their patients are key factors in the success of our dialysis operations. Nearly 5,300 nephrologists currently refer patients to our outpatient dialysis centers.

Medical directors

Participation in the Medicare ESRD program requires that dialysis services at an outpatient dialysis center be under the general supervision of a medical director. Per these requirements, this individual is usually a board certified nephrologist. We engage physicians or groups of physicians to serve as medical directors for each of our outpatient dialysis centers. At some outpatient dialysis centers, we also separately contract with one or more other physicians or groups to serve as assistant or associate medical directors over other modalities such as home dialysis. We have over 900 individual physicians and physician groups under contract to provide medical director services.

Medical directors for our dialysis centers enter into written contracts with us that specify their duties and fix their compensation. These agreements range in duration, but generally are for periods of ten years. The compensation of our medical

directors is the result of arm’s length negotiations, consistent with fair market value, and generally depends upon an analysis of various factors such as the physician’s duties, responsibilities, professional qualifications and experience, as well as the time and effort required to provide such services.

Our medical director contracts and joint venture operating agreements generally include covenants not to compete or own interests in dialysis centers operated by other providers within a defined geographic area for various time periods, as applicable. These non-compete agreements do not restrict or limit the physicians from practicing medicine or prohibit the physicians from referring patients to any outpatient dialysis center, including dialysis centers operated by other providers.

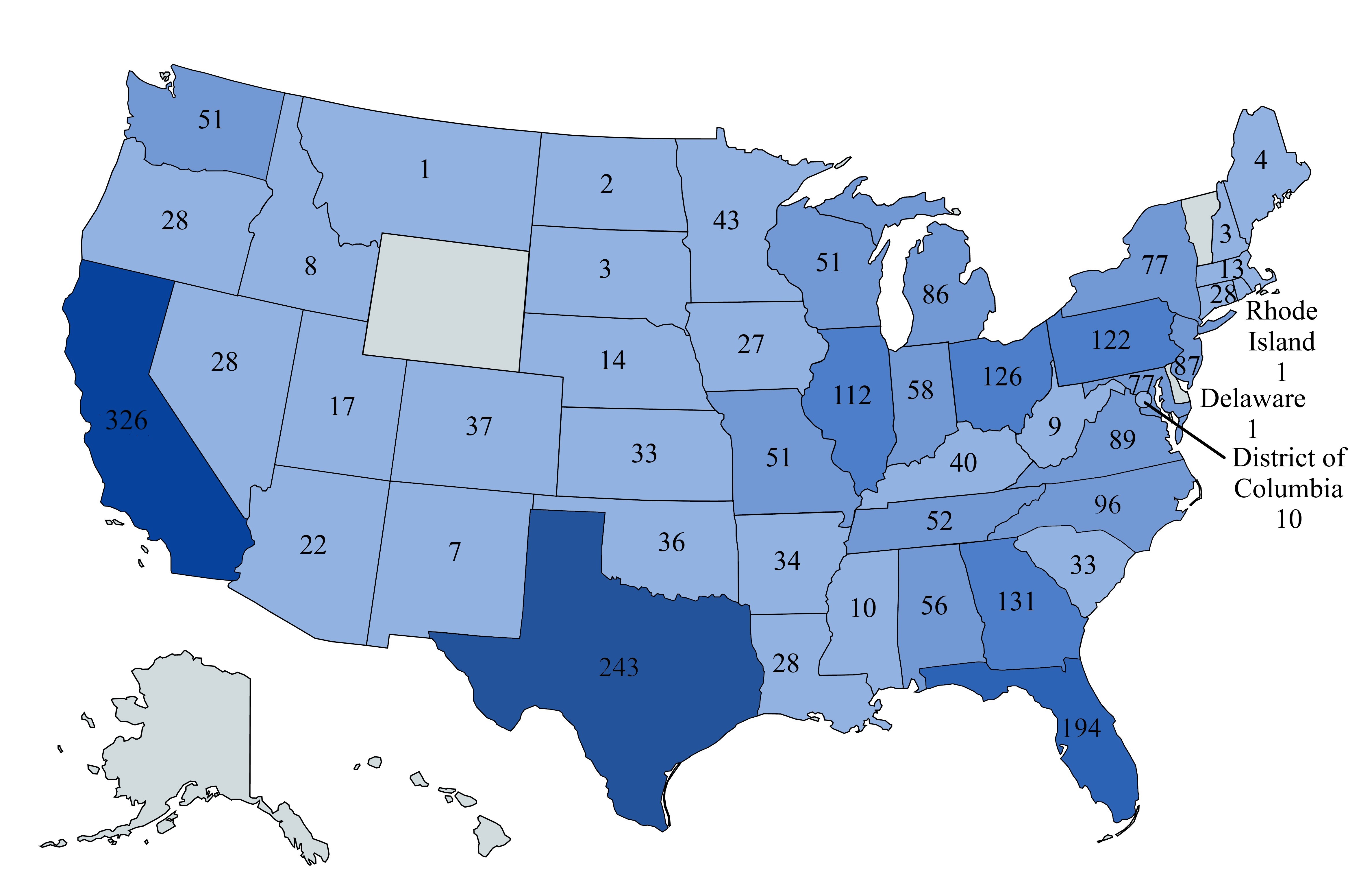

Location of our U.S. dialysis centers

We operated 2,657 outpatient dialysis centers in the U.S. as of December 31, 2024 and 2,605 of these centers are consolidated in our financial statements. Of the remaining 52 nonconsolidated U.S. outpatient dialysis centers, we own noncontrolling interests in 49 centers and provide management and administrative services to three centers that are wholly-owned by third parties. The locations of the 2,605 U.S. outpatient dialysis centers consolidated in our financial statements at December 31, 2024, were as follows:

Ancillary services, including our international operations

Our ancillary services relate primarily to our core business of providing kidney care services. As of December 31, 2024, these consisted primarily of our U.S. integrated kidney care (IKC) business, certain U.S. other ancillary businesses (including our clinical research programs, transplant software business, and venture investment group), and our international operations.

We have made and continue to make investments in building our integrated care capabilities, including the operation of certain strategic business initiatives that are intended to integrate and coordinate care among healthcare participants across the renal care continuum from CKD to ESKD to kidney transplant. Through improved technology and data sharing, as well as an increasing focus on value-based contracting and care, these initiatives seek to bring together physicians, nurses, dieticians, pharmacists, hospitals, dialysis clinics, transplant centers, payors and other specialists with a view towards improving clinical outcomes for our patients and reducing the overall cost of comprehensive kidney care. Certain of our ancillary services are described below.

U.S. Integrated Kidney Care

•Integrated Kidney Care. DaVita Integrated Kidney Care (DaVita IKC), provides advanced integrated care management services to health plans and government programs for members/beneficiaries diagnosed with ESKD and CKD. Through a combination of health monitoring, clinical coordination, innovative interventions, predictive analytics, medical claims analysis and information technology, we endeavor to assist our health plan and government program customers and patients in obtaining superior renal healthcare and improved clinical outcomes, as well as helping to reduce overall medical costs. Integrated kidney care management revenues from commercial and Medicare Advantage insurers can be based upon either an established contract fee recognized as earned for services provided over the contract period, or related to the operation of risk-based and value-based care programs, including shared savings, pay-for-performance, and capitation contracts. DaVita IKC also contracts with payors to support MA ESKD chronic condition special needs plans (C-SNPs) to provide ESKD patients full service healthcare and integrated care management services. DaVita IKC currently participates in both the involuntary and certain voluntary payment models administered by CMMI. As described below under the heading "—Government regulation—CMMI Payment Models", we have invested resources, and expect to continue to invest substantial resources in these models as part of our overall plan to grow our integrated kidney care business and value-based care initiatives. See Note 1, Other revenues, in the Company's consolidated financial statements for more information on how the Company accounts for its integrated care arrangements.

The Company is also developing, and has entered into, various forms of technology-based, administrative, financial and other collaboration and incentive arrangements with physician partners and other providers in support of our innovative care model, developing and expanding IKC programs and arrangements.

U.S. Other Ancillary services

•Clinical research programs. DaVita Clinical Research (DCR) is a provider-based specialty clinical research organization with a wide spectrum of services for clinical drug research and device development. DCR uses its extensive real-world healthcare expertise to assist in the design, recruitment and completion of retrospective and prospective studies. Revenues are based upon study generated fees, as determined by contract with drug companies and other sponsors, and are recognized as earned according to the contract terms.

•Transplant software business. DaVita's transplant software business, MedSleuth, works with transplant centers across the U.S. to provide greater connectivity among transplant candidates, transplant centers, physicians and care teams to help improve the experience and outcomes for kidney and liver transplant patients.

•Venture group. DaVita Venture Group (DVG) focuses on innovative products, solutions and businesses that improve care for patients with kidney disease and related conditions. DVG identifies companies and products for acquisitions, strategic partnerships, and venture investment opportunities. DVG’s focus includes innovation in digital health, pharmaceuticals, medical devices, and care delivery models.

For additional discussion of our ancillary services, see Part II Item 7, "Management’s Discussion and Analysis of Financial Condition and Results of Operations."

International dialysis operations

We operated, managed or administered 509 outpatient dialysis centers located in 13 countries outside of the U.S. serving approximately 80,300 patients as of December 31, 2024. Our international dialysis operations have continued to grow steadily and expand as a result of acquiring and developing outpatient dialysis centers in various strategic markets. Our international operations are included in our ancillary services.

As of December 31, 2024, the international outpatient dialysis centers we operate or provide administrative services to were located as follows:

| | | | | |

| Brazil | 100 | |

| Colombia | 72 | |

| Chile | 63 | |

| Poland | 63 | |

| Germany | 49 | |

| Malaysia | 44 | |

| United Kingdom | 27 | |

| Saudi Arabia | 26 | |

| Ecuador | 22 | |

| China | 12 | |

| Japan | 12 | |

| Portugal | 12 | |

| Singapore | 7 | |

| | 509 | |

For additional discussion of our international business, see Part II Item 7, "Management’s Discussion and Analysis of Financial Condition and Results of Operations."

Corporate administrative support

Corporate administrative support consists primarily of labor, benefits and long-term incentive compensation costs, as well as professional fees for departments which provide support to more than one of our different operating lines of business. These expenses are included in our consolidated general and administrative expenses.

Government regulation

We operate in a complex regulatory environment with an extensive and evolving set of federal, state, local and international governmental laws, regulations and other requirements. These laws, regulations and other requirements are promulgated and overseen by a number of different legislative, regulatory, administrative and quasi-regulatory bodies, each of which may have varying interpretations, judgments or related guidance. As such, we utilize considerable resources on an ongoing basis to monitor, assess and respond to applicable legislative, regulatory and administrative requirements, but there is no guarantee that we will be successful in our efforts to adhere to all of these requirements.

If any of our personnel, representatives, third party vendors or operations are alleged to have violated these or other laws, regulations or requirements, we could experience material harm to our reputation and stock price, and it could impact our relationships and/or contracts related to our business, among other things. If any of our personnel, representatives, third party vendors or operations are found to violate these or other laws, regulations or requirements, we could suffer additional severe consequences that could have a material adverse effect on our business, results of operations, financial condition and cash flows. Additional discussion on certain of these laws, regulations and other requirements is set forth below in this section.

Our business is and we expect that our industry will continue to be subject to extensive and complex federal, state, local and international laws, regulations and other requirements, the scope and effect of which are difficult to predict. We are also currently subject to various legal proceedings, such as lawsuits, investigations, audits and inquiries by various government and regulatory agencies, as described in Note 15 to the consolidated financial statements, and our operations and activities could be reviewed or challenged by regulatory authorities at any time in the future. In addition, each of the laws, regulations and other requirements, including interpretations thereof, that govern our business may continue to change over time, and there is no assurance that we will be able to accurately predict the nature, timing or extent of such changes or the impact of such changes on the markets in which we conduct business or on the other participants that operate in those markets. For additional detail on risks related to each of the foregoing, as well as the consequences of any violation of applicable laws, regulations or other requirements, see the discussion in Part I Item 1A. "Risk Factors" under the headings, "Our business is subject to a complex set of governmental laws, regulations and other requirements...;" and "We are, and may in the future be, a party to various lawsuits, demands, claims, qui tam suits, governmental investigations and audits and other legal matters..."

Licensure and Certification

Our dialysis centers are certified by CMS, as required for the receipt of Medicare payments. Certain of our payor contracts also condition payment on Medicare certification. In some states, our outpatient dialysis centers also are required to

secure additional state licenses and permits. Governmental authorities, primarily state departments of health, periodically inspect our centers to determine if we satisfy applicable federal and state standards and requirements, including the conditions for coverage in the Medicare ESRD program.

We have experienced some delays in obtaining Medicare certifications from CMS, though changes by CMS in the prioritizing of dialysis providers as well as legislation allowing private entities to perform initial dialysis facility surveys for certification has helped to decrease or limit certain delays.

In addition, pursuant to the Provider Enrollment Rule, CMS has authority to revoke provider enrollment and to impose a Medicare reapplication bar where a prospective provider's Medicare enrollment application is denied because the provider submitted incomplete, false, or misleading information for providers who are terminated from the Medicare program. CMS may also deny enrollment to providers who have affiliations with other providers that CMS has determined pose undue risk of fraud, waste or abuse. If we fail to comply with these and other applicable requirements on our licensure and certification programs, particularly in light of increased penalties that include a 10-year bar to Medicare re-enrollment, under certain circumstances it could have a material adverse impact on our business, results of operations, financial condition, cash flows and reputation.

In addition to certification by CMS, our dialysis centers are also certified by each state Medicaid program, are licensed in those states that require licensing for dialysis clinics, and are required to obtain licenses, permits and certificates, including for such areas as biomedical waste. Failure to obtain the correct certifications, permits and certificates as well as a failure to adhere to the requirements thereunder, may result in penalties, fines, and the loss of the right to operate, any of which could have a material adverse impact on our business, results of operations, financial condition, cash flows and reputation.

Federal Anti-Kickback Statute

The federal Anti-Kickback Statute prohibits, among other things, knowingly and willfully offering, paying, soliciting or receiving remuneration, directly or indirectly, in cash or kind, to induce or reward either the referral of an individual for, or the purchase, or order or recommendation of, any good or service, for which payment may be made under federal and state healthcare programs such as Medicare and Medicaid.

Federal criminal penalties for the violation of the federal Anti-Kickback Statute include imprisonment, fines and exclusion of the provider from future participation in the federal healthcare programs, including Medicare and Medicaid. Violations of the federal Anti-Kickback Statute are punishable by imprisonment for up to ten years and statutory fines of up to $100,000 or both. Larger criminal fines can be imposed under the provisions of the U.S. Sentencing Guidelines and the Alternate Fines Statute. Individuals and entities convicted of violating the federal Anti-Kickback Statute are subject to mandatory exclusion from participation in Medicare, Medicaid and other federal healthcare programs for a minimum of five years. Civil penalties for violation of this law include statutory amounts of up to $100,000 (adjusted for inflation) in monetary penalties per violation, assessments of up to three times the total payments between the parties to the arrangement, and permissive exclusion from participation in the federal healthcare programs or suspension from future participation in Medicare and Medicaid. The Patient Protection and Affordable Care Act and the Health Care Reconciliation Act of 2010, as amended (collectively, the ACA), amended the federal Anti-Kickback Statute to clarify that the defendant may not need to have actual knowledge of the federal Anti-Kickback Statute or have the specific intent to violate it and to provide that any claims for items or services resulting from a violation of the federal Anti-Kickback Statute are considered false or fraudulent for purposes of the False Claims Act (FCA) and can result in treble damages and other penalties under the FCA.

The federal Anti-Kickback Statute includes statutory exceptions and regulatory safe harbors that protect certain arrangements. Business transactions and arrangements that are structured fully within an applicable safe harbor do not violate the federal Anti-Kickback Statute. When an arrangement is not structured fully within a safe harbor, the arrangement must be evaluated on a case-by-case basis in light of the parties’ intent and the arrangement’s potential for abuse, and may be subject to greater scrutiny by enforcement agencies.

In the ordinary course of our business operations, DaVita and its ancillary businesses and subsidiaries enter into numerous arrangements with physicians and other potential referral sources, that potentially implicate the Anti-Kickback Statute. Examples of such arrangements include, among other things, medical director agreements, joint ventures, leases and subleases with entities in which physicians, hospitals or medical groups hold ownership interests, consulting agreements, hospital services agreements, discharge planning services agreements, acute dialysis services agreements, value-based care arrangements, employment and coverage agreements, and incentive performance arrangements. In addition, some referring physicians may own DaVita Inc. common stock. Furthermore, our dialysis centers and subsidiaries sometimes enter into certain rebate, pricing, or other contracts to acquire certain discounted items and services that may be reimbursed by a federal healthcare program.

Agreements and other arrangements can still be appropriate under the federal Anti-Kickback Statute even if they fail to meet all parameters of a relevant safe harbor provision; and we endeavor to structure our arrangements within applicable safe harbors, although some arrangements are not structured fully within a safe harbor.

If any of our current or previous business transactions or arrangements, including but not limited to those described above, were found to violate the federal Anti-Kickback Statute, we, among other things, could face criminal, civil or administrative sanctions, including possible exclusion from participation in Medicare, Medicaid and other state and federal healthcare programs.

Stark Law

The Stark Law is a strict liability civil law that prohibits a physician who has a financial relationship, or who has an immediate family member who has a financial relationship, with entities providing Designated Health Services (DHS), from referring Medicare and Medicaid patients to such entities for the furnishing of DHS, unless an exception applies. The types of financial arrangements between a physician and a DHS entity that trigger the self-referral prohibitions of the Stark Law are broad and include direct and indirect ownership and investment interests and compensation arrangements. The Stark Law also prohibits the DHS entity receiving a prohibited referral from presenting, or causing to be presented, a claim or billing for the services arising out of the prohibited referral. If the Stark Law is implicated, the financial relationship must fully satisfy a Stark Law exception. If an exception to the Stark Law is not satisfied, then the parties to the arrangement could be subject to sanctions. Sanctions for violation of the Stark Law include denial of payment for claims for services provided in violation of the prohibition, refunds of amounts collected in violation of the prohibition, a civil penalty of up to $15,000 (adjusted for inflation) for each service arising out of the prohibited referral, a statutory civil penalty of up to $100,000 (adjusted for inflation) against parties that enter into a scheme to circumvent the Stark Law prohibition, civil assessment of up to three times the amount claimed, and potential exclusion from the federal healthcare programs, including Medicare and Medicaid. Furthermore, Stark Law violations and failure to return overpayments timely can form the basis for FCA liability as discussed below.

The definition of DHS under the Stark Law excludes services paid under a composite rate, even if some of the components bundled in the composite rate are DHS. Although the ESRD bundled payment system is no longer titled a composite rate, we believe that the former composite rate payment system and the current bundled system are both composite systems excluded from the Stark Law. Since most services furnished to Medicare beneficiaries provided in our dialysis centers are reimbursed through a bundled rate, we believe that the services performed in our facilities generally are not DHS. Certain separately billable drugs (drugs furnished to an ESRD patient that are not for the treatment of ESRD that CMS allows our centers to bill for using the so-called AY modifier) may be considered DHS. However, we have implemented certain billing controls designed to limit DHS being billed out of our dialysis clinics. Likewise, the definition of inpatient hospital services, for purposes of the Stark Law, also excludes inpatient dialysis performed in hospitals that are not certified to provide ESRD services. Consequently, we believe that our arrangements with such hospitals for the provision of dialysis services to hospital inpatients should not trigger the Stark Law referral prohibition.

In addition, although prescription drugs are DHS, there is an exception in the Stark Law for calcimimetics, ESAs and other specifically enumerated dialysis drugs when furnished in or by an ESRD facility such that the arrangement for the furnishing of the drugs does not violate the Stark Law.

In the ordinary course of business operations, DaVita and its ancillary businesses and subsidiaries have many different types of financial arrangements with referring physicians that potentially implicate the Stark Law, including, but not limited to, medical director agreements, joint ventures, leases and subleases with entities in which physicians, hospitals or medical groups hold ownership interests, consulting agreements, hospital services agreements, discharge planning services agreements, acute dialysis services agreements, value-based care arrangements, employment agreements and incentive performance arrangements. In addition, some referring physicians may own our common stock in reliance on the Stark Law exception for investment interests in large publicly traded companies.

If our interpretation of the applicability of the Stark Law to our operations is incorrect, the controls we have implemented fail, an arrangement is entered into outside of our processes, or we were to fail to satisfy an applicable exception to the Stark Law, we could be found to be in violation of the Stark Law and required to change our practices, face civil penalties, pay substantial fines, return certain payments received from Medicare and beneficiaries or otherwise experience a material adverse effect.

In addition, it might be necessary to restructure existing compensation agreements with our medical directors and to repurchase or to request the sale of ownership interests in subsidiaries and partnerships held by referring physicians or, alternatively, to refuse to accept referrals for DHS from these physicians, or take other actions to modify our operations. Any finding by CMS or other regulatory or enforcement authorities that we have violated the Stark Law or related penalties and

restructuring or other required actions could have a material adverse effect on our business, results of operations, financial condition, cash flows, stock price and reputation.

False Claims Act

The federal FCA is a means of policing false claims, false bills or false requests for payment in the healthcare delivery system. In part, the FCA authorizes the imposition of up to three times the government’s damages and civil penalties, plus up to approximately $28,000 per claim, on any person who, among other acts:

•Knowingly presents or causes to be presented to the federal government, a false or fraudulent claim for payment or approval;

•Knowingly makes, uses or causes to be made or used, a false record or statement material to a false or fraudulent claim;

•Knowingly makes, uses, or causes to be made or used, a false record or statement material to an obligation to pay the government, or knowingly conceals or knowingly and improperly, avoids or decreases an obligation to pay or transmit money or property to the federal government; or

•Conspires to commit the above acts.

In addition, the FCA imposes severe penalties for the knowing and improper retention of overpayments collected from government payors. Under these provisions, a provider is required to refund overpayments within 60 days of obtaining knowledge of the overpayment. A provider is deemed to have knowledge of the overpayment if it has actual knowledge, or if it acts with reckless disregard or deliberate ignorance of the overpayment. An overpayment impermissibly retained could subject us to liability under the FCA, exclusion from government healthcare programs, and penalties under the federal Civil Monetary Penalty statute. As a result of these provisions, our procedures for identifying and processing overpayments may be subject to greater scrutiny.

The federal government has used the FCA to prosecute a wide variety of alleged false claims and fraud allegedly perpetrated against Medicare and state healthcare programs, including coding errors, billing for services not rendered, the submission of false cost reports, billing for services at a higher payment rate than appropriate, billing under a comprehensive code as well as under one or more component codes included in the comprehensive code and billing for care that is not considered medically necessary. The ACA provides that claims tainted by a violation of the federal Anti-Kickback Statute are false for purposes of the FCA. Some courts have held that filing claims or failing to refund amounts collected in violation of the Stark Law can form the basis for liability under the FCA. In addition to the provisions of the FCA, which provide for civil enforcement, the federal government can use several criminal statutes to prosecute persons who are alleged to have submitted false or fraudulent claims for payment to the federal government.

Fraud and abuse under state law

State fraud and abuse laws related to anti-kickback, physician self-referral, beneficiary inducement and false claims often mirror those requirements of the applicable federal laws, or, in some instances contain additional or different requirements. If we were found to violate these state laws and regulations, we, among other things, could face criminal, civil or administrative sanctions, including loss of licensure or possible exclusion from Medicaid and other state and federal healthcare programs.

In addition to these fraud waste and abuse laws, some states in which we operate dialysis centers have laws prohibiting physicians from holding financial interests in various types of medical facilities to which they refer patients. Some of these laws could potentially be interpreted broadly as prohibiting physicians who hold shares of our publicly traded stock or are physician owners from referring patients to our dialysis centers if the centers use our laboratory subsidiary to perform laboratory services for their patients or do not otherwise satisfy an exception to the law. States also have laws similar to or stricter than the federal Anti-Kickback Statute that may affect our ability to receive referrals from physicians with whom we have financial relationships, such as our medical directors and value-based care partners, or with other referral sources, including hospitals. Some state anti-kickback laws also include civil and criminal penalties. Some of these laws include exemptions that may be applicable to our medical directors, value-based care partners and other physician and referral source relationships or for financial interests limited to shares of publicly traded stock. Some, however, may include no explicit exemption for certain types of agreements and/or relationships entered into with referral sources such as physicians and hospitals. If these laws are interpreted to apply to referring sources with whom we contract for items or services, including medical directors, value-based care partners, and hospitals, to referring physicians or hospitals with whom we hold joint ownership interests, or to referring entities or individuals who hold interests in DaVita Inc. limited solely to our publicly traded stock, and for which no applicable exception exists, we may be required to terminate or restructure our relationships with or refuse referrals from these referring

entities or individuals and could be subject to criminal, civil and administrative sanctions, refund requirements and exclusions from participation in government healthcare programs, including Medicare and Medicaid.

Corporate Practice of Medicine and Fee-Splitting

There are states in which we operate that have laws that prohibit business entities not owned by health care providers, such as our Company and our subsidiaries, from practicing medicine, employing physicians and other licensed health care providers providing certain clinical services or exercising control over medical or clinical decisions by physicians and potentially other types of licensed health care providers (known collectively as the corporate practice of medicine). These states may also prohibit entities from engaging in certain financial arrangements, such as fee-splitting, with physicians and potentially other types of licensed health care providers. Violations of the corporate practice of medicine, fee-splitting and related laws vary by state and may result in physicians and potentially other types of licensed health care providers being subject to disciplinary action, as well as to forfeiture of revenues from payors for services rendered. Violations may also bring both civil and, in more extreme cases, criminal liability for engaging in medical practice without a license and violating the corporate practice of medicine, fee-splitting and related laws. Some of the relevant laws, regulations, and agency interpretations in states with corporate practice of medicine restrictions have been subject to limited judicial and regulatory interpretation.

Civil Monetary Penalties Statute

The Civil Monetary Penalties Statute, 42 U.S.C. § 1320a-7a, authorizes the imposition of civil money penalties, assessments, and exclusion against an individual or entity based on a variety of prohibited conduct, including, but not limited to:

•Presenting, or causing to be presented, claims for payment to Medicare, Medicaid, or other third-party payors that the individual or entity knows or should know are for an item or service that was not provided as claimed or is false or fraudulent;

•Offering remuneration to a federal healthcare program beneficiary that the individual or entity knows or should know is likely to influence the beneficiary to order or receive healthcare items or services from a particular provider;

•Arranging contracts with an entity or individual excluded from participation in the federal healthcare programs;

•Violating the federal Anti-Kickback Statute;

•Making, using, or causing to be made or used, a false record or statement material to a false or fraudulent claim for payment for items and services furnished under a federal healthcare program;

•Making, using, or causing to be made any false statement, omission, or misrepresentation of a material fact in any application, bid, or contract to participate or enroll as a provider of services or a supplier under a federal healthcare program; and

•Failing to report and return an overpayment owed to the federal government.

Substantial civil monetary penalties may be imposed under the federal Civil Monetary Penalty Statute and vary, depending on the underlying violation. In addition, an assessment of not more than three times the total amount claimed for each item or service may also apply, and a violator may be subject to exclusion from participation in federal and state healthcare programs.

Foreign Corrupt Practices Act

We are subject to the provisions of the Foreign Corrupt Practices Act (FCPA) in the United States and similar laws in other countries, which generally prohibit companies and those acting on their behalf from making improper payments to foreign government officials and others for the purpose of obtaining or retaining business. A violation of the FCPA or other similar laws by us and/or our agents or representatives could result in, among other things, the imposition of fines and penalties, changes to our business practices, the termination of or other adverse impacts under our debt arrangements and contracts or debarment from bidding on contracts, and/or harm to our reputation.

Privacy and Security

The Health Insurance Portability and Accountability Act of 1996 and its implementing privacy and security regulations, as amended by the federal Health Information Technology for Economic and Clinical Health Act (HITECH Act) (collectively referred to as HIPAA), require us to provide certain protections to patients and their health information. The HIPAA privacy and security regulations extensively regulate the use and disclosure of PHI and require covered entities, which include

healthcare providers, to implement and maintain administrative, physical and technical safeguards to protect the security of such information. Additional security requirements apply to electronic PHI. These regulations also provide patients with substantive rights with respect to their health information.

The HIPAA privacy and security regulations also require us to enter into written agreements with certain contractors, known as business associates, to whom we disclose PHI. Covered entities may be subject to penalties for, among other activities, failing to enter into a business associate agreement where required by law or as a result of a business associate violating HIPAA if the business associate is found to be an agent of the covered entity and acting within the scope of the agency. Business associates are also directly subject to liability under the HIPAA privacy and security regulations. In instances where we act as a business associate to a covered entity, there is the potential for additional liability beyond our status as a covered entity.

Covered entities must report breaches of unsecured PHI to affected individuals without unreasonable delay but not to exceed 60 days of discovery of the breach by a covered entity or its agents. Notification must also be made to the HHS and, for breaches of unsecured PHI involving more than 500 residents of a state or jurisdiction, to the media. All non-permitted uses or disclosures of unsecured PHI are presumed to be breaches unless the covered entity or business associate establishes that there is a low probability the information has been compromised. Various state laws and regulations may also require us to notify affected individuals, and U.S. state attorneys general, or other regulators or law enforcement, in the event of a data breach involving individually identifiable information without regard to whether there is a low probability of the information being compromised.

Penalties for impermissible use or disclosure of PHI were increased by the HITECH Act by imposing tiered penalties of more than $50,000 per violation and up to $1.5 million per year for identical violations. In addition, HIPAA provides for criminal penalties of up to $250,000 and ten years in prison, with the severest penalties for obtaining and disclosing PHI with the intent to sell, transfer or use such information for commercial advantage, personal gain or malicious harm. Further, state attorneys general may bring civil actions seeking either injunction or damages in response to violations of the HIPAA privacy and security regulations that threaten the privacy of state residents.

In addition to the protection of PHI, healthcare companies must meet privacy and security requirements applicable to other categories of personal information. Companies may process consumer information in conjunction with website and corporate operations. They may also handle employee information, including Social Security Numbers, payroll information, and other categories of sensitive information, to further their employment practices. In processing this additional information, companies must comply with the applicable privacy and security requirements of comprehensive privacy and data protection laws, consumer protection laws, labor and employment laws, and its publicly-available notices. In addition, federal and state laws governing the use of artificial intelligence and machine learning technologies are evolving. As the regulation of these technologies matures, we may face additional compliance costs and legal risk to our operations.

Outside of the United States, the requirements of applicable privacy and data protection laws and regulations, and any related implementation guidance from and enforcement postures of local country regulators, may present varying implementation and compliance considerations for our local country operations. These include the European Union General Data Protection Regulation (GDPR), the United Kingdom General Data Protection Regulation (UK GDPR), and other non-GDPR laws, such as the Brazilian Lei Geral de Proteção de Dados (LGPD), the Saudi Arabia Personal Data Protection Law and the Data Security Law of the People's Republic of China (DSL), among others. This variation presents compliance costs and legal risks to our international operations. When providing services or using personal data, we must ensure compliance with the applicable legislation and local legal requirements.

The GDPR imposes a comprehensive data protection regime with the potential for regulatory fines as well as data breach litigation by impacted data subjects. Under the GDPR, regulatory penalties may be passed by data protection authorities for up to the greater of 4% of worldwide turnover or €20 million. The UK GDPR carries similar compliance and operational costs, and carries similar fines of up to the greater of £17.5 million or 4% of global turnover. In non-GDPR countries, the cost of non-compliance varies but can also be just as significant as those under the GDPR. For example, the maximum fine for non-compliance with the LGPD is 50 million Brazilian real (approximately $8 million) or 2% of the company’s annual revenue, while the maximum fine for non-compliance with the DSL is RMB 50 million (approximately $7 million) or 5% of the previous year's turnover. In addition to fines, data protection authorities in non-GDPR countries may also impose criminal sanctions as well as other penalties, such as orders to cease processing personal data, orders to delete personal data, or warnings and reprimands.

Privacy and data protection laws are also evolving nationally, providing for enhanced state privacy rights that are broader than the current federal privacy rights, and may add additional compliance costs and legal risks to our U.S. operations. For example, the California Consumer Privacy Act of 2018 (CCPA), which was significantly amended by the California Privacy