| SCHEDULE 14A INFORMATION |

| |

| PROXY STATEMENT PURSUANT TO SECTION 14(a) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| | Filed by the Registrant | ☒ |

| | Filed by a Party other than the Registrant | ☐ |

| | | |

| Check the appropriate box: |

| |

| ☐ | Preliminary Proxy Statement |

| | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☒ | Definitive Proxy Statement |

| | |

| ☐ | Definitive Additional Materials |

| | |

| ☐ | Soliciting Material under Rule 14a-12 |

| | |

| Variable Insurance Products Fund III |

| (Name of Registrant as Specified In Its Charter) |

| | |

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ | No fee required. |

| | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total Fee Paid: |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

| | | Proxy Materials |

| | | |

| | PLEASE CAST YOUR VOTE NOW! VARIABLE INSURANCE PRODUCTS FUND III:

VIP GROWTH OPPORTUNITIES PORTFOLIO Dear Shareholder: A special meeting of shareholders of VIP Growth Opportunities Portfolio will be held on April 16, 2025, at 8:00 a.m. Eastern Time (ET). The purpose of the meeting is to provide you with the opportunity to vote on an important proposal that affects the fund and your investment in it. As a shareholder, you have the opportunity to voice your opinion on certain matters that affect your fund. Proxy campaigns are costly, so your timely vote will help to control proxy expenses that are borne by shareholders. This package contains important information about the proposal and the materials to use when casting your vote. Please read the enclosed materials and cast your vote on the proxy card(s) or voting instruction form(s). Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be. The following proposal has been carefully reviewed by the Board of Trustees: To reclassify the diversification status of the fund from diversified to non-diversified by eliminating a fundamental policy which provides that the fund may not with respect to 75% of the fund’s total assets, purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities, or securities of other investment companies) if, as a result, (a) more than 5% of the fund’s total assets would be invested in the securities of that issuer, or (b) the fund would hold more than 10% of the outstanding voting securities of that issuer. The Trustees, most of whom are not affiliated with Fidelity, are responsible for protecting your interests as a shareholder. The Trustees believe that the proposal is in the best interests of shareholders. They recommend that you approve this proposal. The following Q&A is provided to assist you in understanding the proposal, which is also described in greater detail in the enclosed proxy statement. Voting is quick and easy. Everything you need is included with the proxy materials. To cast your vote, simply complete the proxy card(s) or voting instruction form(s) enclosed in this package. Be sure to sign the card(s) or form(s) before mailing them in the postage-paid envelope. If you have any questions before you vote, please call Fidelity at 1-877-208-0098. We’ll be glad to help you get your vote in quickly. Thank you for your participation in this important initiative. Sincerely, Robert A. Lawrence

Chair |

| | | |

| | | |

| | | |

| | | |

Important information to help you understand and vote on the proposal

Please read the full text of the proxy statement. We’ve provided a brief overview of the proposal to be voted upon below. Your vote is important. We appreciate you placing your trust in Fidelity and look forward to helping you achieve your financial goals.

What am I being asked to vote on?

As more fully described in the attached proxy statement, shareholders of the fund are being asked to reclassify the diversification status of the fund from diversified to non-diversified by eliminating the related fundamental policy.

Approval of the proposal will be determined solely by the voting results of shareholders of the fund.

Have the funds’ Board of Trustees approved the proposal?

Yes. The Board of Trustees has carefully reviewed and approved modifying the policies for the fund. The Board of Trustees unanimously recommends that you vote in favor of and approve the proposal to reclassify the diversification status of the fund from diversified to non-diversified by eliminating the related fundamental policy.

What is the difference between diversified funds and non-diversified funds and why am I being asked to approve the change?

Under the Investment Company Act of 1940, as amended (“1940 Act”), a mutual fund is designated as diversified or non-diversified, which governs its ownership of securities of issuers. Your fund is currently designated as a diversified fund and therefore must operate in compliance with the 1940 Act diversification requirements.

A diversified fund is limited in its ownership of securities of any single issuer. If the proposal is approved, the fund would be permitted to invest a larger percentage of its assets in a smaller number of issuers, as described in greater detail under “MORE INFORMATION ABOUT THE PROPOSAL”.

Reclassifying the fund as non-diversified will give the fund’s portfolio managers increased flexibility to invest a greater percentage of the fund’s assets in fewer issuers or any one issuer. We believe this reclassification is in the interests of the fund and its shareholders because it provides the portfolio managers with increased investment flexibility and the potential for better investment performance.

How will reclassifying the diversification status of the fund impact the day-to-day management of the fund?

While the proposed change to the fund’s diversification policy would provide more flexibility for the fund’s investment adviser, the investment objective and principal investment strategies will remain unchanged.

What if shareholders do not approve the proposal?

If shareholders do not approve this proposal the fund will retain its current fundamental diversification investment policy.

Can you explain more about why this is important?

Under the 1940 Act, a fund that is classified as “diversified” is prohibited from investing more than 5% of its assets in a company, if, in aggregate, positions equal to 5% or more amount to 25% of a fund’s assets. Said another way, a “diversified” fund is not allowed to make additional purchases in securities which are greater than 5% of the fund’s total assets if the cumulative amount of 5%+ holdings is greater than 25% of the fund’s total assets. Today, certain stocks make up a substantially large percentage of certain growth indices. For example, the five biggest stocks by market capitalization and weight in the Russell 1000® Growth Index (the benchmark for VIP Growth Opportunities Fund) as of October 31, 2024 are:

•

| Microsoft (MSFT) at 11.01% |

•

| Alphabet (GOOG/GOOGL) at 6.76% |

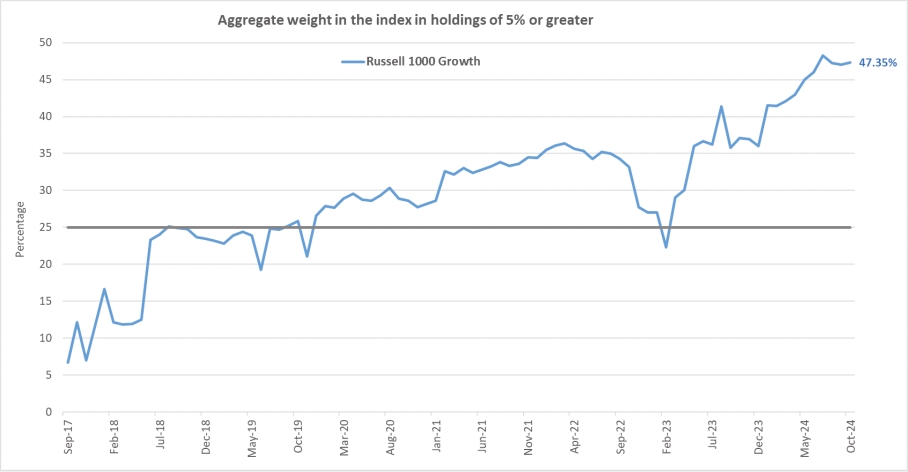

The Russell 1000® Growth Index has become increasingly concentrated. (Chart as of October 2024)

These five stocks noted above each account for more than 5% of the Russell 1000® Growth Index and their combined weight totals more than 47%, much higher than the 25% maximum amount that can be held by “diversified” funds. So, a “diversified” fund cannot buy these five stocks at their index weight, let alone actively express an overweight position. Shareholder approval of this proposal would allow the fund to operate as a non-diversified fund, providing portfolio managers with additional investment flexibility.

The Board of Trustees has unanimously approved the proposal and recommends that you vote to approve it.

What if there are not enough votes to reach quorum by the scheduled shareholder meeting date or if the policy modifications are not approved?

To facilitate receiving a sufficient number of votes, we may need to take further action. Broadridge Financial Solutions, Inc., a proxy solicitation firm, or Fidelity, may contact you by mail or telephone. Therefore, we encourage shareholders to vote as soon as they receive the enclosed proxy materials to avoid additional mailings or telephone calls, as well as increased expenses to the fund.

What role does the Board play?

The Trustees serve as the fund shareholders’ representatives. Members of the Board are fiduciaries and have an obligation to serve the best interests of shareholders. In addition, the Trustees review fund performance, oversee fund activities, and review contractual arrangements with companies that provide services to the fund.

General Questions on the Proxy

Who is Broadridge Financial Solutions, Inc.?

Broadridge Financial Solutions, Inc. is a third party proxy vendor that has been hired to call shareholders and record proxy votes. In order to hold a shareholder meeting, quorum must be reached. If quorum is not met, the meeting may adjourn to a future date. The campaign attempts to reach shareholders via multiple mailings to remind them to cast their vote. As the meeting approaches, phone calls may be made to clients who have not yet voted their shares so that the shareholder meeting does not have to be postponed.

Voting your shares immediately will help minimize additional solicitation expenses and prevent the need to call to you to solicit your vote.

How many votes am I entitled to cast?

As a shareholder, you are entitled to one vote for each dollar of net asset value you own of the fund on the record date, with fractional dollar amounts entitled to a proportional fractional vote. The record date is February 19, 2025.

How do I vote my shares?

Voting is quick and easy. To cast your vote, simply complete the proxy card(s) or voting instruction form(s) enclosed in this package. Be sure to sign the card(s) or form(s) before mailing them in the postage-paid envelope. If you need any assistance or have any questions regarding the proposal or how to vote your shares, please call Fidelity at 1-877-208-0098.

How do I sign the proxy card?

| | | | | |

Individual Accounts: | | | Shareholders should sign exactly as their names appear on the account registration shown on the card or form. | |

Joint Accounts: | | | Either owner may sign, but the name of the person signing should conform exactly to a name shown in the registration. | |

All Other Accounts: | | | The person signing must indicate his or her capacity. For example, a trustee for a trust or other entity should sign, “Ann B. Collins, Trustee.” | |

| | | | | |

Important Notice Regarding the Availability of

Proxy Materials for the

Shareholder Meeting to be held on April 16, 2025

FIDELITY® VARIABLE INSURANCE PRODUCTS

GROWTH OPPORTUNITIES PORTFOLIO

A FUND OF VARIABLE INSURANCE PRODUCTS FUND III

245 SUMMER STREET, BOSTON, MASSACHUSETTS 02210

1-877-208-0098

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Shareholders of VIP Growth Opportunities Portfolio:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders (the Meeting) of VIP Growth Opportunities Portfolio (the fund), a series of Variable Insurance Products Fund III (the trust), will be held on April 16, 2025, at 8:00 a.m. Eastern Time (ET). The purpose of the Meeting is to consider and act upon the following proposal and to transact such other business as may properly come before the Meeting or any adjournments thereof.

(1)

To reclassify the diversification status of the fund from diversified to non-diversified by eliminating the following fundamental policy:

The fund may not with respect to 75% of the fund’s total assets, purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities, or securities of other investment companies) if, as a result, (a) more than 5% of the fund’s total assets would be invested in the securities of that issuer, or (b) the fund would hold more than 10% of the outstanding voting securities of that issuer.

The Board of Trustees has fixed the close of business on February 19, 2025, as the record date for the determination of the shareholders of the fund entitled to notice of, and to vote at, such Meeting and any adjournments thereof.

By order of the Board of Trustees,

NICOLE MACARCHUK

Secretary

February 19, 2025

Your vote is important – please vote your shares promptly.

The Meeting will be held in a virtual format only. Variable product owners, who have a voting interest in variable accounts holding shares of the trust, are invited to attend the Meeting by means of remote audio communication. You will not be able to attend the Meeting in person. To virtually attend the Meeting, you must register at www.viewproxy.com/fidelityadvisorfunds/broadridgevsm/. You will be required to enter your name, an email address, and the control number found on your proxy card, voting instruction form or notice you previously received. If you have lost or misplaced your control number, call Fidelity at 1-877-208-0098 to verify your identity and obtain your control number. Requests for registration must be received no later than 5:00 p.m. ET on Tuesday, April 15, 2025. Once your registration is approved, you will receive an email confirming your registration with an event link and optional dial-in information to attend the Meeting. A separate email will follow containing a password to enter at the event link in order to access the Meeting. You may vote during the Meeting at www.proxyvote.com/proxy. You will need your control number to vote, and you will need to follow the instructions available on the Meeting’s website during the Meeting in order to do so.

Questions from shareholders to be considered at the Meeting must be submitted to Broadridge at www.viewproxy.com/fidelityadvisorfunds/broadridgevsm/ no later than 8:00 a.m. ET on Tuesday, April 15, 2025.

Any variable product owner who does not expect to virtually attend the Meeting and vote is urged to indicate voting instructions on the enclosed proxy card or voting instruction form, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. In order to avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your voting interest may be. Please contact your insurance company for additional information regarding voting deadlines.

INSTRUCTIONS FOR EXECUTING PROXY CARD OR VOTING INSTRUCTION FORM

The following general rules for executing proxy cards or voting instruction forms may be of assistance to you and help avoid the time and expense involved in validating your vote if you fail to execute your proxy card or voting instruction form properly.

1.

| Individual Accounts: Your name should be signed exactly as it appears in the registration on the proxy card or voting instruction form. |

2.

| Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to a name shown in the registration. |

3.

| All other accounts should show the capacity of the individual signing. This can be shown either in the form of the account registration itself or by the individual executing the proxy card or voting instruction form. For example: |

| | | | | | | | | | |

A. | | | 1) | | | ABC Corp. | | | John Smith, Treasurer |

| | | 2) | | | ABC Corp. | | | John Smith, Treasurer |

| | | | | | c/o John Smith, Treasurer | | | |

B. | | | 1) | | | ABC Corp. Profit Sharing Plan | | | Ann B. Collins, Trustee |

| | | 2) | | | ABC Trust | | | Ann B. Collins, Trustee |

| | | 3) | | | Ann B. Collins, Trustee | | | Ann B. Collins, Trustee |

| | | | | | u/t/d 12/28/78 | | | |

C. | | | 1) | | | Anthony B. Craft, Cust. | | | Anthony B. Craft |

| | | | | | f/b/o Anthony B. Craft, Jr. | | | |

| | | | | | UGMA | | | |

| | | | | | | | | | |

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS OF

VARIABLE INSURANCE PRODUCTS FUND III:

FIDELITY® VARIABLE INSURANCE PRODUCTS

GROWTH OPPORTUNITIES PORTFOLIO

TO BE HELD ON APRIL 16, 2025

This Proxy Statement is furnished in connection with a solicitation of proxies made by, and on behalf of, the Board of Trustees of Variable Insurance Products Fund III (the trust) to be used at the Special Meeting of Shareholders of VIP Growth Opportunities Portfolio (the fund) and at any adjournments thereof (the Meeting), to be held on April 16, 2025, at 8:00 a.m. ET. The Board of Trustees and Fidelity Management & Research Company LLC (FMR or the Adviser), the fund’s investment adviser, have determined that the Meeting will be held in a virtual format only. The Meeting will be accessible solely by means of remote audio communication. You will not be able to attend the meeting in person.

The purpose of the Meeting is set forth in the accompanying Notice. The solicitation is being made primarily by the mailing of this Proxy Statement and the accompanying proxy or voting instruction form on or about February 19, 2025. Supplementary solicitations may be made by mail, telephone, facsimile, electronic means or by personal interview by representatives of the trust. In addition, Broadridge Financial Solutions, Inc. (Broadridge) may be paid on a per-call basis to solicit shareholders by telephone on behalf of the fund at an anticipated cost of approximately $3,000. The fund may also arrange to have votes recorded by telephone. Broadridge may be paid on a per-call basis for vote-by-phone solicitations on behalf of the fund at an anticipated cost of approximately $750.

The expenses in connection with preparing this Proxy Statement and its enclosures and all solicitations will be paid by the fund.

The fund will reimburse insurance companies and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of shares. The costs will be allocated on a pro rata basis to each class of the fund based on the net assets of each class relative to the total net assets of the fund.

The principal business address of FMR is 245 Summer Street, Boston, Massachusetts 02210. FMR Investment Management (UK) Limited, at 1 St. Martin’s Le Grand, London, EC1A 4AS, United Kingdom; Fidelity Management & Research (Hong Kong) Limited, at Floor 19, 41 Connaught Road Central, Hong Kong; and Fidelity Management & Research (Japan) Limited, at Kamiyacho Prime Place at 1-17, Toranomon-4-Chome, Minato-ku, Tokyo, Japan are also sub-advisers to the fund. The principal business address of Fidelity Distributors Company LLC (FDC), the fund’s principal underwriter and distribution agent, is 900 Salem Street, Smithfield, Rhode Island 02917.

If the enclosed proxy or voting instruction form is executed and returned, it may nevertheless be revoked at any time prior to its use by written notification received by the trust, by the execution of a later-dated proxy or voting instruction form, or by attending the virtual Meeting and voting.

All proxies solicited by the Board of Trustees that are properly executed and received by the Secretary prior to the Meeting, and are not revoked, will be voted at the Meeting. Shares represented by such proxies will be voted in accordance with the instructions thereon. If no specification is made on a properly executed proxy or voting instruction form, it will be voted FOR the matters specified on the proxy or voting instruction form. All shares that are voted and votes to ABSTAIN will be counted towards establishing a quorum. Most insurance company variable accounts will vote all of their shares in the same proportion as the voting instructions actually received from variable product owners. See page 4.

One-third of the fund’s outstanding voting securities entitled to vote constitutes a quorum for the transaction of business at the Meeting. If a quorum is not present at the Meeting, or if a quorum is present at the Meeting but sufficient votes to approve the proposed item are not received, or if other matters arise requiring shareholder attention, the persons named as proxy agents may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares present at the Meeting or represented by proxy. When voting on a proposed adjournment, the persons named as proxy agents will vote FOR the proposed adjournment all shares that they are entitled to vote with respect to the item, unless directed to vote AGAINST the item, in which case such shares will be voted AGAINST the proposed adjournment with respect to that item. A shareholder vote may be taken on the item in this Proxy Statement prior to such adjournment if sufficient votes have been received and it is otherwise appropriate.

Shares of each class of the fund issued and outstanding as of December 31, 2024, are indicated in the following table:

| | | | |

VIP Growth Opportunities Portfolio – Initial Class | | | 8,340,194 |

VIP Growth Opportunities Portfolio – Investor Class | | | 16,101,149 |

VIP Growth Opportunities Portfolio – Service Class | | | 2,078,708 |

VIP Growth Opportunities Portfolio – Service Class 2 | | | 21,180,099 |

| | | | |

As of December 31, 2024, the Trustees, Members of the Advisory Board (if any) and officers of the fund owned, in the aggregate, less than 1% of each class’s outstanding shares with respect to the fund.

As of December 31, 2024, the following owned of record and/or beneficially 5% or more of the outstanding shares:

| | | | | | | | | | | | | |

VIP Growth Opportunities Portfolio - Initial Class | | | LEGG MASON PARTNERS FUND ADVISERS | | | PITTSBURGH | | | PA | | | 32.13% |

VIP Growth Opportunities Portfolio - Initial Class | | | NYLIAC | | | PARSIPPANY | | | NJ | | | 11.70% |

VIP Growth Opportunities Portfolio - Service Class | | | PHOENIX LIFE INSURANCE CO | | | EAST GREENBUSH | | | NY | | | 31.50% |

VIP Growth Opportunities Portfolio - Service Class | | | NATIONWIDE LIFE INSURANCE COMPANY | | | COLUMBUS | | | OH | | | 25.33% |

VIP Growth Opportunities Portfolio - Service Class | | | PHOENIX LIFE INSURANCE CO | | | EAST GREENBUSH | | | NY | | | 15.97% |

VIP Growth Opportunities Portfolio - Service Class | | | THE GUARDIAN INSURANCE & ANNUITY CO | | | BETHLEHEM | | | PA | | | 10.45% |

VIP Growth Opportunities Portfolio - Service Class | | | LINCOLN NATIONAL LIFE INSURANCE CO | | | FORT WAYNE | | | IN | | | 8.09% |

VIP Growth Opportunities Portfolio - Service Class 2 | | | NYLIAC | | | PARSIPPANY | | | NJ | | | 82.58% |

| | | | | | | | | | | | | |

As of December 31, 2024, the following owned of record and/or beneficially 25% or more of the outstanding shares:

| | | | | | | | | | | | | |

VIP Growth Opportunities Portfolio | | | NYLIAC | | | PARSIPPANY | | | NJ | | | 38.67% |

| | | | | | | | | | | | | |

A shareholder owning of record or beneficially more than 25% of a fund’s outstanding shares may be considered a controlling person. That shareholder’s vote could have a more significant effect on matters presented at a shareholders’ meeting than votes of other shareholders.

FMR has advised the trust that certain shares are registered to FMR or an FMR affiliate. To the extent that FMR and/or another entity or entities of which FMR LLC is the ultimate parent has discretion to vote, these shares will be voted at the Meeting FOR the proposal. Otherwise, these shares will be voted in accordance with the plan or agreement governing the shares. Although the terms of the plans and agreements vary, generally the

shares must be voted either (i) in accordance with instructions received from shareholders or (ii) in accordance with instructions received from shareholders and, for shareholders who do not vote, in the same proportion as certain other shareholders have voted.

Shareholders of record at the close of business on February 19, 2025, will be entitled to vote at the Meeting. Each such shareholder will be entitled to one vote for each dollar of net asset value held on that date, with fractional dollar amounts entitled to a proportional fractional vote.

Shares of the trust are currently sold only to life insurance companies. Each company holds its shares in a separate account (the Variable Account), which serves as the funding vehicle for its variable insurance products. In accordance with its view of present applicable law, each company will vote its shares held in its respective Variable Account at the Meeting in accordance with instructions received from persons having a voting interest in the Variable Account. Those persons who have a voting interest at the close of business on February 19, 2025, will be entitled to submit instructions to their company. For ease of reference, persons with a voting interest in a Variable Account may be referred to as “shareholders” in this Proxy Statement.

Fund shares held in a Variable Account for which no timely instructions are received will be voted by most companies in proportion to the voting instructions that are received with respect to all contracts participating in a Variable Account. This means that a small number of votes could determine the outcome.

Accordingly, if you wish to vote, you should complete the enclosed proxy card or voting instruction form as a participant in a Variable Account. All forms which are properly executed and received prior to the Meeting, and which are not revoked, will be voted as described above. If the enclosed voting instruction form is executed and returned, it may nevertheless be revoked at any time prior to the Meeting by written notification received by your company, by execution of a later-dated form received by your company, or by attending the virtual Meeting and voting.

For a free copy of the fund’s annual report for the fiscal year ended December 31, 2023, call 1-877-208-0098, visit Fidelity’s web site at institutional.fidelity.com, or write to FDC at 900 Salem Street, Smithfield, Rhode Island 02917.

VOTE REQUIRED: Approval of Proposal 1 requires the affirmative vote of a “majority of the outstanding voting securities” of the fund. Under the Investment Company Act of 1940 (1940 Act), the vote of a “majority of the outstanding voting securities” means the affirmative vote of the lesser of (a) 67% or more of the voting securities present at the Meeting or represented by proxy if the holders of more than 50% of the outstanding voting securities are present or represented by proxy or (b) more than 50% of the outstanding voting securities. With respect to Proposal 1, votes to ABSTAIN will have the same effect as votes cast AGAINST Proposal 1.

PROPOSAL 1

TO RECLASSIFY THE DIVERSIFICATION STATUS OF

THE FUND FROM DIVERSIFIED TO NON-DIVERSIFIED

BY ELIMINATING THE RELATED FUNDAMENTAL POLICY

Shareholders are being asked to review and consider reclassifying the diversification status of the fund from diversified to non-diversified by eliminating the following fundamental policy:

The fund may not with respect to 75% of the fund’s total assets, purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities, or securities of other investment companies) if, as a result, (a) more than 5% of the fund’s total assets would be invested in the securities of that issuer, or (b) the fund would hold more than 10% of the outstanding voting securities of that issuer.

Because the above investment policy is fundamental, it cannot be changed or eliminated without shareholder approval. The Trustees, including all of the Independent Trustees, recommend that shareholders vote to eliminate the above limitation for the fund.

Section 5(b)(1) of the 1940 Act requires funds to be classified as either diversified or non-diversified, and a fund’s status as diversified is considered a fundamental policy. Diversified funds are subject to the above restrictions and non-diversified funds are not. As a result, a non-diversified fund has increased flexibility to invest a greater percentage of its assets in the securities of fewer issuers. As a result, changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a more diversified fund.

Under the 1940 Act, a non-diversified fund is permitted to operate as a diversified fund, but a diversified fund cannot become non-diversified unless shareholders approve the change.

The primary benchmark of the fund is the Russell 1000® Growth Index. The fund’s portfolio managers evaluate and consider all of the holdings in the fund’s benchmark index as potential investment opportunities. Over the past several years, certain stocks contained in the Russell 1000® Growth Index have experienced an increase in their market capitalizations. Some of the largest increases have been observed in what are generally considered to be technology stocks. As a result, large-cap growth indices and other indices with higher weightings to technology stocks have become much more concentrated at the individual stock level. This level of index concentration coupled with the limitations placed on diversified funds can constrain the portfolio manager’s ability to fully achieve target exposures to individual securities, which is impacting fund performance. The proposed change to the fund’s diversification classification is intended to provide the fund with greater long-term flexibility in executing its investment strategy, although it is not expected to substantially affect the way the fund is currently managed.

Although increased levels of concentration have fluctuated in this index in the past, this market concentration may persist.

Furthermore, due to the 1940 Act diversification requirement, the fund must underweight at least some holdings relative to their weights in the index even if the portfolio managers find them to be attractive investment opportunities. The diversification status forces the portfolio to be underweight in the benchmark’s top holdings, meaning the fund’s portfolio managers cannot choose to equal or overweight positions relative to its benchmark. This limitation can ultimately diminish the opportunity to outperform the benchmark on a risk-return basis. FMR believes reclassifying the fund as non-diversified is in the best interests of the fund and its shareholders because the non-diversified status will provide portfolio managers with additional investment flexibility.

If shareholders do not approve this proposal, then the fund will retain the current fundamental diversification investment policy.

Even if the proposal is approved, the fund would continue to remain subject to diversification tests under Subchapter M of the Internal Revenue Code that apply to regulated investment companies. To qualify, among other requirements, the fund must limit its investment so that, at the close of each quarter of the taxable year, (1) not more than 25% of the fund’s total assets will be invested in the securities of a single issuer, and (2) with respect to 50% of its total assets, not more than 5% will be invested in the securities of a single issuer and the fund will not own more than 10% of the outstanding voting securities of a single issuer.

Conclusion. The Board of Trustees has concluded that the proposal will benefit the fund and its shareholders. The Trustees recommend voting FOR the proposal. If the proposal is approved by shareholders, the proposed change will take effect on or about May 1, 2025, or on the first day of the month following shareholder approval if the meeting is adjourned. If shareholders do not approve this proposal, then the fund will retain the current fundamental diversification investment policy.

Other Business

The Board knows of no other business to be brought before the Meeting. However, if any other matters properly come before the Meeting, it is the intention that proxies that do not contain specific instructions to the contrary will be voted on such matters in accordance with the judgment of the persons therein designated.

Submission of Certain Shareholder Proposals

The trust does not hold annual shareholder meetings. Shareholders wishing to submit proposals for inclusion in a proxy statement for a subsequent shareholder meeting should send their written proposals to the Secretary of the fund, attention “Fund Shareholder Meetings,” 245 Summer Street, Mailzone V10A, Boston, Massachusetts 02210. Proposals must be received a reasonable time before the fund begins to print and send its proxy materials to be considered for inclusion in the proxy materials for the meeting. Timely submission of a proposal does not, however, necessarily mean the

proposal will be included. With respect to proposals submitted on an untimely basis and presented at a shareholder meeting, persons named as proxy agents will vote in their discretion.

Notice to Insurance Companies

Please advise the trust, in care of Client Services at 1-877-208-0098, whether other persons are beneficial owners of shares for which proxies are being solicited and, if so, the number of copies of the Proxy Statement and Form N-CSR you wish to receive in order to supply copies to the variable contract owners of the respective shares.

Fidelity and Fidelity Investments & Pyramid Design are registered service marks of FMR LLC. © 2025 FMR LLC. All rights reserved.

The third party marks appearing above are the marks of their respective owners.

The term VIP as used in this document refers to Fidelity®Variable Insurance Products.

| | | | |

1.9918600.100 | | | VAGO25-PXS-0225 |

| | | | |

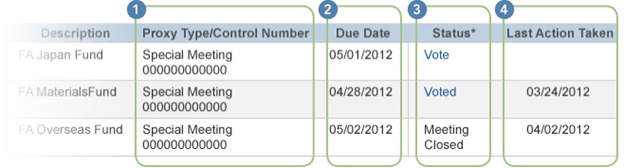

Proxy Help posted on institutional.fidelity.com

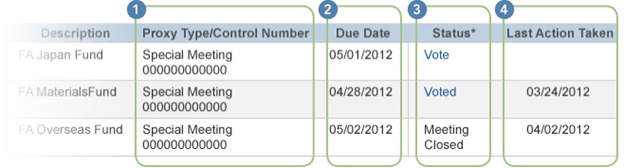

Proxy Materials Table

Proxy Type/Control Number

This column explains what type of shareholder meeting is taking place, and provides you with a unique control number that you'll need to confirm your identity to submit a proxy vote. You might be asked to insert a security code in addition to the control number.

Due Date

The Due Date column reflects the meeting date minus one day. If you would like to cast a proxy vote online or by telephone, you will have the opportunity to do so up until 11:59 PM EST on the day prior to the scheduled meeting. If you would like to vote on the day of the meeting, you may do so by attending the meeting.

Status

The status column tells you which action you can take for a particular meeting, whether it's casting a vote (Vote), changing a vote (Voted), or Meeting Closed.

Last Action Taken

This column shows the date on which you last voted or changed your vote, regardless of the method you used to submit your vote – by mail, telephone, or online.

913167.3

RD_13569_26752

Proxy Voting Q&A posted on fidelity.com

Proxy Voting by Shareholders of Fidelity Funds

Thank you for investing with Fidelity!

A mutual fund is an investment company, and your investment in shares of a Fidelity mutual fund makes you a shareholder of the fund. As a shareholder, you are entitled to vote on matters presented at a fund’s shareholder meeting.

Mutual funds, like other companies, hold shareholder meetings to present and discuss important management decisions that require shareholder input, including proposed changes to fund services or certain policies.

| · | You are entitled to one vote for each dollar of net asset value you own. |

The Trustees of your Fidelity Fund— most of whom are not affiliated with Fidelity—are responsible for considering your interests as a shareholder.

| · | One privilege of a mutual fund shareholder is to participate in electing the Trustees for your Fidelity Fund. |

| · | In turn, the Trustees, after careful review, may request your vote on other proposals that affect the fund and your investment in it. |

We believe that voting by proxy online or by phone is the most convenient way for you to participate in a Fidelity Fund vote.

| · | You can cast a proxy vote online, over the telephone, or through postal mail. |

| · | That way, your vote can be counted without your having to attend the meeting in person. |

| · | Or you may attend a shareholder meeting to vote in person. |

We appreciate your placing your trust in Fidelity, and thank you for allowing us to help you achieve your financial goals.

+ Expand all - Collapse all

Frequently Asked Questions

| + | When will I receive the information I need to vote? |

| + | How can I submit a proxy vote? |

| + | I consented for eDelivery of proxy materials—is it possible to receive hard copy paper materials instead? |

| + | I used to enter a PIN when voting proxy—why is this no longer required? |

| + | I voted and I would like to change my vote—is this possible? |

| + | Who are "Computershare", "Broadridge" and D.F. King? |

| + | How can I opt out of telephone calls about shareholder proxy voting? |

Frequently Asked Questions

- What is proxy voting?

When your vote is requested on proposals that affect the fund and your investment in it, you could, if you wanted, attend the shareholder meeting in person—or you could vote by proxy online or by phone. This way, your vote can be counted without your having to attend the meeting in person.

Top

-When will I receive the information I need to vote?

A proxy statement, which provides details regarding the meeting and the management and shareholder proposals, if any, that will be voted on at the meeting, is provided to shareholders before the meeting is held. The proxy statement may be sent to you via U.S. mail or email, if you have consented to electronic delivery, or you may receive a notice linking you to a website where you can review it online.

Top

-How can I submit a proxy vote?

You may submit a proxy vote through U.S. mail, over the telephone, or online, based on the instructions contained in the proxy statement. Votes must be submitted prior to the close of voting in order to be counted. Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be.

Top

-I consented for eDelivery of proxy materials—is it possible to receive hard copy paper materials instead?

By consenting to eDelivery of proxy, you have agreed to online receipt of important proxy materials. To request a written copy of any Fidelity Fund proxy materials via telephone please call 800-343-3548. On the voting screen, you may also choose to change your eDelivery preferences for future proxy campaigns.

Your retirement benefit plan account mail preferences for statements, prospectuses, proxies and other benefit information will apply to your Fidelity BrokerageLink® Account. You may change this electronic delivery default for your BrokerageLinkSM account at any time by logging on to NetBenefits and updating your mail preferences. [if shareholder clicks on the “log in” icon a window appears where they can log in to NetBenefits and update their mail preferences.]

Top

-I used to enter a PIN when voting proxy—why is this no longer required?

By using Fidelity.com to access the online voting site, a secure transaction with your control number information has been established and the PIN is no longer required to securely complete this transaction.

Top

-I voted and I would like to change my vote—is this possible?

Yes, you can vote again using the "Voted" link in the Action column as long as voting is still open. The latest valid vote cast will be recorded and the Last Action Taken date will update. If you do not complete the process of re-voting, the last vote cast remains on record.

Top

Does my vote matter?

Your vote is extremely important, no matter how large or small your holdings may be.

In order to take action at a Fidelity Funds shareholder meeting, a quorum must be achieved. Quorum is achieved when a sufficient number of shareholders are represented in person or by proxy at the shareholder meeting. If quorum is not achieved, the meeting may adjourn to a future date.

Fidelity and/or a third-party proxy vendor attempts to reach shareholders via multiple mailings or emails to remind them to cast their votes. As the meeting date approaches, phone calls may be made to shareholders who have not yet voted.

Voting your shares immediately when you receive notification will help the meeting achieve quorum and minimize additional expense and efforts to contact you by email or phone to solicit your vote.

Top

-Who are "Computershare", "Broadridge" and D.F. King?

The shareholder proxy voting process is typically managed on behalf of the Fidelity funds by a proxy vendor. Fidelity may hire a third-party proxy vendor to call shareholders and record proxy votes. Computershare, Broadridge and D.F. King are examples of third-party proxy vendors that may have been retained by the Fidelity Funds.

Top

-How can I opt out of telephone calls about shareholder proxy voting?

Please call Fidelity at 800-343-3548 to make this request.

Top

Log Into Your Accounts For Proxy Materials (if any)Log In Required. [if shareholder clicks on the “log in” icon a window appears where they can log in to NetBenefits for proxy materials.]

620855.8.0

Proxy Voting Q&A posted on institutional.fidelity.com

Learn More

What is Proxy Voting?

When will I receive the information I need to vote?

How can I submit a proxy vote?

I consented for eDelivery of proxy materials, is it possible to receive hard copy paper materials instead?

I used to enter a control number when voting proxy, why is this now no longer required?

I voted and I would like to change my vote, is this possible?

When can I expect to receive proxy materials?

Q: What is Proxy Voting?

A:

Mutual Funds may hold special meetings of shareholders to seek approval of changes to fund services or policies that require shareholder approval. As a shareholder, you are entitled to vote on these important matters. You could, if you wanted, attend the shareholder meeting to cast your vote, or you could cast a proxy vote, which allows you to cast your vote through the mail, over the telephone, or online. This way, your vote can be counted without you having to attend the meeting.

Top

Q: When will I receive the information I need to vote?

A:

A proxy statement, which provides details regarding the meeting and the management and shareholder proposals, if any, that will be voted on at the meeting, is provided to shareholders before the meeting is held. The proxy statement may be sent to you via U.S. mail, or email, if you have consented to electronic delivery, or you may receive a notice linking you to a website where you can review it online.

Top

Q: How can I submit a proxy vote?

A:

You may submit a proxy vote through U.S. mail, over the telephone, or online, based on the instructions contained in the proxy statement. Votes must be submitted prior to the close of voting in order to be counted. Please vote your shares promptly. Your vote is extremely important, no matter how large or small your holdings may be. Please note, online and telephone voting is available up until 11:59 PM EST on the day prior to the scheduled meeting. In order to vote on the day of the meeting, you must attend the meeting.

Top

Q: I consented for eDelivery of proxy materials, is it possible to receive hard copy paper materials instead?

A:

By consenting to eDelivery, you have agreed to online receipt of important proxy materials. You can request a written copy of the proxy materials by clicking on “Request copy of shareholder materials,” on the same screen you are prompted to vote your shares. To request a written copy of any Fidelity Advisor Fund or Fidelity Fund proxy material via telephone, please call 877-208-0098. If you would like to change your eDelivery preferences for future proxy materials, click here to update your information or change your delivery method. [if shareholder clicks on “click here” a window appears where they can change their edelivery preferences on institutional.fidelity.com.]

Top

Q: I used to enter a control number when voting proxy, why is this now no longer required?

A:

By using institutional.fidelity.com to access the online voting site, a secure transaction with your control number information has been established and the control number is no longer required to securely complete this transaction.

Top

Q: I voted and I would like to change my vote, is this possible?

A:

Yes, you can vote again using the “Voted” link in the “Action” column as long as voting is still open for that holding. The latest vote cast will be recorded and the “Last Action Taken” date will update. If you do not complete the process of re-voting, the last vote cast remains on record.

Top

1059179.2

RD_13569_26751