OMB APPROVAL

OMB Number: 3235-0570

Expires: January 31, 2017

Estimated average burden

hours per response……20.6

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-01743

The Alger Funds II

(Exact name of registrant as specified in charter)

360 Park Avenue South New York, New York 10010

(Address of principal executive offices) (Zip code)

Mr. Hal Liebes

Fred Alger Management, Inc.

360 Park Avenue South

New York, New York 10010

(Name and address of agent for service)

Registrant's telephone number, including area code: 212-806-8800

Date of fiscal year end: October 31

Date of reporting period: April 30, 2016

ITEM 1. REPORT(S) TO STOCKHOLDERS.

|

| Table of Contents |

| The Alger Funds II |

| Shareholders’ Letter | 1 |

| Fund Highlights | 13 |

| Portfolio Summary | 21 |

| Schedules of Investments | 22 |

| Statements of Assets and Liabilities | 52 |

| Statements of Operations | 58 |

| Statements of Changes in Net Assets | 61 |

| Financial Highlights | 66 |

| Notes to Financial Statements | 83 |

| Additional Information | 108 |

Go Paperless With Alger Electronic Delivery Service

Alger is pleased to provide you with the ability to access regulatory materials online.

When documents such as prospectuses and annual and semi-annual reports are

available, we’ll send you an e-mail notification with a convenient link that will take you

directly to the fund information on our website. To sign up for this free service, simply

enroll at www.icsdelivery.com/alger.

Shareholders' Letter

April 30, 2016

Dear Shareholders,

Investor Stampede Creates Risks and Opportunities

Gary Larson’s quirky cartoon series “The Far Side” draws chuckles by having animals

exhibit human-like behavior. In one popular cartoon, a massive bison stampede extends

to the horizon. One insightful bison quips to a neighboring beast “As if we all knew where

we’re going.” The six-month reporting period ended April 30 was notable as a period filled

with economic uncertainty, diverging global monetary policies, and significant pressure on

interest rates. As with the cartoon, where this takes us as investors is unclear, yet in such

periods of deep uncertainty we are reminded that the best decisions are those that are the

most thoughtful and not based upon emotion. Many investors, in an unquenchable thirst

for income (and a misguided flight to “safety”) have rushed to bond-like equities, that is,

equities that pay steady dividends. The end result was striking. While the S&P 500 index

gained 0.43%, the Telecomm, Utilities, and Consumer Staples sectors climbed 14.68%,

12.90%, and 6.02%, respectively. These sectors have some of the poorest long-term growth

prospects in the current economic environment. On the other hand, higher growth sectors

like Information Technology, Health Care, and Consumer Discretionary each sustained

losses.

We have learned in our 52 years of investing that there is no free lunch. Success in investing is

not achieved by considering one factor, such as dividend yield, but instead by understanding

companies, their management, their industries, and their competitors. It is with this more

complete view that high-quality companies with strong growth potential can be identified.

Such companies, we maintain, can potentially provide investors with wealth creation from

capital appreciation and with protection from the erosion of inflation upon their savings.

Stampedes, of course, can have dire consequences. The recent investor stampede, we believe,

is dangerous, as investors have increased their exposure to the risk of higher interest rates

and, at the same time, the relatively high valuations of stocks with generally poor growth

prospects. We think the opportunities, long term, lie in the opposite direction. In particular,

these investors may miss the attractive investment opportunities that can be found within the

most vibrant industries in the U.S. and the world. America is seen as a leader in innovation

in the Health Care and IT sectors, and has the richest and most diverse consumer market in

the world. We believe it is within these sectors that superior companies and investments for

long-term growth and capital appreciation can be found.

Investing in overseas markets is more challenging with different dynamics at play. The

widely followed MSCI ACWI ex USA and MSCI Emerging Markets indices declined 1.51%

and 0.01%, respectively, during the reporting period with concerns over commodity prices

contributing to weakening investor sentiment. In many overseas markets, this is entirely

logical as the economies of many countries are strongly tied to their roles as commodities

producers. As in the U.S., defensive sectors tended to outperform abroad. Nevertheless,

international markets also have sectors that offer strong potential for long-term growth.

The rising middle class in many international markets is creating increased demand for

goods and services, which in turn is creating opportunities for leading companies. Our

team of international and emerging markets portfolio managers and analysts has a depth of

- 1 -

experience in navigating foreign markets and identifying through fundamental research high-

quality growth companies across the globe. In these markets, diversification is paramount,

so our international funds are well diversified, typically owning companies across the globe

and across industries.

Oil and the U.S. Economy

From late 2013 until the start of the reporting period, the price of West Texas Intermediate

(WTI) fell from $110.62 a barrel to $46.12. It then declined to a low of $26.19 a barrel as

of February 11, which was a 43.20% drop. The decline was accompanied by an 11.43%

decline of the S&P 500. In both 2015 and early 2016, many investors misread the decline in

oil as a harbinger of a U.S. recession in 2016. We have consistently argued otherwise, noting

that while cheap oil prices would, not surprisingly, drive down earnings in the energy and

closely related sectors, there were broad benefits to the U.S. economy from lower energy

prices. Cheap oil has bolstered Americans’ finances by slashing energy costs and allowing

Americans to strengthen their personal balance sheets by increasing their savings. It has

also supported retail shopping and spending on homes. The U.S. housing market continues

to improve in a steady fashion. Many indicators of consumer spending like ecommerce,

travel, leisure, automotive, and home durables are quite healthy, despite the weakness

reported in headlines about department store sales and the sales of other “old” economy

retailers. Changing patterns of consumer preferences – largely based, in our view, on both

ecommerce technology and on the rise of younger generations of Americans (the X and Y

generations) as the baby boomers increasingly retire – is a large phenomenon that creates

challenges for companies that have failed to adapt to the “new” marketplace and great

opportunities for those that have helped define it in our time. Amazon.com, Inc., Netflix,

Inc., Alphabet, Inc. (formerly Google), and Apple, Inc. are all doing quite well in this new

American marketplace, while the landscape, especially in retail, is littered with companies,

once good or even great, but today struggling to adapt their business models to the new and

obvious reality.

So despite fears, corporate fundamentals are fine in the U.S. S&P 500 earnings ex-materials

and ex-energy grew a healthy 6.3% in 2015, despite the additional headwind of a strong U.S.

dollar weighing on both exports and foreign earnings. For the first quarter of 2016, overall

results for the S&P 500 slowed from that pace, but we expect continued growth in earnings

in 2016 (again, ex-materials and ex-energy, though these might actually contribute to

earnings growth on a reported basis through declining losses in these sectors). We note that

oil appears to have bottomed in February and has since rebounded to close the reporting

period at $45.98. Investor sentiment remains very cautious in our view, and indeed almost

bearish, but there has been a significant rally in equities of late, with the S&P 500 generating

a 13.39% return from February 12 to April 30.

Global Economy Weakens

Concerns over global economic growth continue. In early 2015, the International Monetary

Fund forecasted that the global economy would grow 3.3% in 2015 and 3.8% in 2016. In

October, it lowered those numbers to 3.1% for 2015 and 3.6% for this year. It maintained

its 2015 estimate in January, but lowered its 2016 estimate to 3.4%. Also during the reporting

period, estimates for global corporate earnings per share for the MSCI World Index were

revised downward each month, declining from $106.72 in November to $101.20 as of April

30.

- 2 -

We are encouraged by the actions of many central banks across the globe, including the Bank

of Japan (BOJ), the People’s Bank of China, and the European Central Bank, to provide

additional economic stimulus. The BOJ, for its part, joined a handful of other countries that

have maintained negative interest rates. Many central banks have also expressed a willingness

to provide additional stimulus, and in the U.S., the Federal Reserve is taking a cautious

approach to normalizing monetary policy after raising the fed funds rate in December.

We note, as we did in the fall of 2015 in an Alger market commentary, that monetary

policy is not sufficient to stimulate fundamental, lasting growth in any economy. We hope

to see future governmental actions to improve structural growth in Europe, Asia, and other

foreign markets, and certainly we see that austerity policies are fading globally.

Further, in the significant changes occurring in international markets and economies, we

see many opportunities for investors. Economic and political concerns have dominated

investors’ mindset for a significant time now. But, as in the U.S., there are many companies

forging ahead in their markets and globally, showing both solid earnings growth and strong

fundamentals. We are always on the lookout for companies that are disrupting traditional

business models by exploiting large-scale changes. The internet continues to be an investable

trend but, especially in emerging markets, adoption of Western technology and lifestyles

(whether directly or in copycat fashion) is meeting with notable success in many regions

and sectors.

The U.S. Dollar, Emerging Markets, and Interest Rates

The previous end of the U.S. asset buying program, or quantitative easing, combined with

the Federal Reserve’s start to raising interest rates and anticipation of domestic economic

growth, has supported a strong U.S. dollar, especially relative to countries that have been

increasing monetary stimulus. At the start of the reporting period, the U.S. Dollar Index,

which measures U.S. currency against currencies of trading partners, was at 96.89, up

considerably from 79.14 in early 2014. Later in the reporting period, the Federal Reserve

signaled that it would take a cautious approach to raising interest rates, which caused the

strengthening of the U.S. dollar to moderate slightly, and the U.S. Dollar Index closed the

reporting period at 93.80. As mentioned previously, investors have fretted over the impact

of a strong dollar on U.S. exports and foreign earnings. We think the strong dollar does pose

challenges to U.S. exporters, especially those of undifferentiated commodity-like products

or services. In the end, however, we think U.S. companies with value-added products

and service models that are differentiated from the competition will do fine. Since global

competition is fierce, foreign companies seeking to succeed will invest in superior products

and services that will help them obtain their goals. We think there are many U.S. companies

that offer highly competitive products and services to the global market, even with the

recent disadvantage of a stronger U.S. dollar.

Finally, it’s important to note that the strong U.S. dollar has also driven periods of capital

outflows from countries with weaker currencies, especially emerging markets. We believe

the sensitivity of global markets to the U.S. dollar is likely to cause the Federal Reserve to

exercise extreme caution when normalizing monetary policy. At the same time, an estimated

$8 trillion in debt is trading globally with negative yields. When the Federal Reserve eventually

takes further actions to normalize policy, it’s likely that higher interest rates will attract even

more investors to U.S. debt, which could limit increases in yields here at home.

- 3 -

The Appeal of Growth Equities and the Downside of the Investor Stampede

We believe growth stocks are well positioned to outperform the market and especially bond-

like equites that have recently reached extreme valuations. The recent market action has

left traditional growth stocks at attractive valuations, especially when assessing PEG ratios.

PEG ratios are determined by dividing a company’s price-to-earnings ratio, or P/E, by its

expected earnings growth rate. As of April 30 of this year, the 12-month forward earnings

PEG for the Russell 1000 Growth Index was 42% lower than that of the Russell 1000 Value

Index. For most of 2016, the difference in PEGs has exceeded anything that has occurred

since at least 2002. In addition, bond-like sectors such as Utilities and Consumer Staples

are trading at over a 20% premium to their 20-year average P/E ratio while growth sectors

like Information Technology and Health Care are trading at double-digit discounts. From a

historical perspective, low P/E ratios have typically indicated strong potential for stocks to

outperform and we believe the current valuations of growth stocks are no exception.

Over the long term, equity returns are driven by corporate fundamentals, including earnings

and revenue growth. While dividend yields play an important role in the total return an

investor should expect from equities, it is a mistake, in our view, to focus solely, or overly, on

the dividend yield of a stock itself. It is, after all, a company’s fundamental success growing

its sales and profits that ultimately will deliver the cash flow to support dividends and

future dividend growth. The recent stampede into bond-like equities shows many signs of

investors’ failure to discriminate between companies with strong longer term fundamentals

and those that simply happen to pay a relatively higher dividend yield today. Much like

fixed-income securities, these bond-like equities will be very interest-rate sensitive. Even a

small change in interest rates or inflation could hurt the performance of bond-like stocks,

especially those trading at high valuations with poor growth prospects or leveraged balance

sheets.

Reasons for Optimism

Concerns over global growth are likely to drive market volatility, but we maintain that the

U.S. will continue to be an economic leader. April marked the 74th consecutive month of

private-sector job growth in the U.S., which is an unprecedented accomplishment. Over the

last year, the majority of those who have returned to the labor force have been from among

the long-term unemployed, which is a category of Americans that has traditionally faced

substantial challenges with finding work. In addition to steady job creation, the nation’s

5.0% unemployment rate implies that the job market is healthy. We continue to believe that

low oil prices combined with low inflation and the Federal Reserve’s cautious approach to

raising interest rates will continue to support the country’s economy.

Corporate America is also strong. In the fourth quarter, S&P 500 companies ex-financials

held $1.44 trillion in cash, according to FactSet Research Systems, Inc. The figure represents

a 0.5% year-over-year decline, but is still the third-highest level in 10 years. Fixed capital

expenditures during the quarter also declined when compared to the record level of outlays

during the same quarter of 2014. Yet, the $170.4 billion in outlays for the final quarter

of 2015 represented the third-highest level in 10 years, despite a 41% drop in capital

expenditures by energy companies. Corporations are also buying back stock at a rapid pace,

with approximately 30% of S&P 500 constituents having reduced their share count by at

least 4% during the first quarter, according to S&P Capital IQ.

- 4 -

We urge investors to carefully assess the appeal of growth equities and to evaluate the role

of bond-like equities in their investment strategies. We are in an era of rapid and dynamic

change. New technologies such as the internet, smartphones, ebooks, and social media have

reached 50% market penetration in a fraction of the time that older innovations such as

washing machines, dishwashers, and landline telephones required. Medical innovation in

orthopedic, cardiac, and cancer treatments (to name only a few) has advanced and will

continue to advance in ways that were unimaginable only a generation or so ago. We think

every prudent, long-term investor should have a portfolio “overweight” in the industries,

companies, and trends that are changing nearly every aspect of modern day life.

Portfolio Matters

Alger Spectra Fund

The Alger Spectra Fund returned -4.66% for the fiscal six-month period ended April 30,

2016, compared to the -1.64% return of the Russell 3000 Growth Index.

During the period, the largest sector weightings were Information Technology and

Health Care. The largest sector overweight was Information Technology and the largest

sector underweight was Consumer Staples. During a period in which bond-like stocks

outperformed, all sectors detracted from the portfolio’s relative performance. Stock

selection, however, outperformed in the Information Technology and Energy sectors.

Within the Fund's benchmark, however, Information Technology and Energy categories

were the worst performers, so the portfolio's overweighting of those sectors offset the

benefits of strong stock selection.

For the reporting period, the Fund’s average portfolio allocation to long positions, which

was increased by leverage, was 99.21% of assets. In aggregate, long positions detracted

4.54 percentage points from absolute performance. The Fund’s average allocation to short

positions was -3.23%. The short positions detracted approximately 12 basis points from

performance.

Among the most important relative contributors were Apple, Inc.; Newell Brands, Inc.;

Honeywell International, Inc.; and Edwards Lifesciences Corp. Shares of Facebook, Inc.,

Cl. A also contributed to results. Facebook performed strongly in response to the company’s

social network continuing to take advertising market share from print and television media.

We believe investors were also encouraged by the growth of Instagram, which is the

company’s video- and photo-sharing network, and by the potential for Facebook to further

grow advertising revenues.

Conversely, detracting from overall results on a relative basis were Allergan PLC.; Vertex

Pharmaceuticals, Inc.; Anadarko Petroleum Corp.; and Norwegian Cruise Line Holdings Ltd.

Also detracting from performance was LinkedIn Corp. The company operates the world’s

largest social network for professionals and provides services for recruiters and human

resource professionals. LinkedIn also offers digital advertising and premium memberships.

During the first quarter, the company disclosed disappointing sales and it provided weak

profit guidance. It said Europe and Asia were weak areas.

Among short positions, The Boston Beer Company, Inc., Cl. A contributed to performance.

The company brews and distributes beer under the Samuel Adams brand. Boston Beer

stock declined in the fourth quarter after the company lowered its revenue outlook due to a

lack of successful new products. Short selling entails selling borrowed stock with the goal of

- 5 -

buying the stock in the future at a lower price and then returning the security to the lender.

As the price of Boston Beer declined, the portfolio’s cost of purchasing the stock declined,

resulting in the position having a positive impact on performance.

Short position The Valspar Corp., however, detracted from results. The manufacturer of

paint and coatings has been losing market share to The Sherwin-Williams Co. Shares of

Valspar performed strongly following news that Sherwin-Williams will acquire the company.

As the price of Valspar increased, the portfolio’s cost of purchasing the stock also increased,

so the position detracted from performance.

Alger Green Fund

The Alger Green Fund returned -3.52% for the fiscal six-month period ended April 30,

2016, compared to the -1.64% return of the Russell 3000 Growth Index.

The Fund seeks long-term capital appreciation by investing at least 80% of its net assets in

equity securities of companies of any size that, in the opinion of the Fund’s management,

conduct their business in an environmentally sustainable manner while demonstrating

promising growth potential. The Fund’s performance, therefore, can be challenged during

times when investor enthusiasm for environmentally sustainable companies declines, but it

can benefit when investors favor such companies.

During the period, the largest sector weightings were Information Technology and

Consumer Discretionary. The largest sector overweight was Industrials and the largest sector

underweight was Health Care. Relative outperformance in the Health Care and Industrials

sectors was the most important contributor to performance, while Consumer Discretionary

and Information Technology were among sectors that detracted from results.

Among the most important relative contributors were ITC Holdings Corp.; Tesla Motors,

Inc.; Johnson & Johnson; The Home Depot, Inc.; and Woodward Governor, Inc. Shares

of The Home Depot performed strongly late in 2015. The retailer of home-improvement

products is benefiting from increasing household net worth and a recovering housing

market. The shares contributed to performance as The Home Depot’s strong results stood

out during the fourth quarter, which was a period of poor quarterly reports by many

retailers. The Home Depot’s results were driven by good expense controls and healthy

revenue growth that was generated by solid customer counts.

Conversely, detracting from overall results on a relative basis were Acuity Brands, Inc.;

Chipotle Mexican Grill, Inc.; Harman International Industries, Inc.; and TerraForm Power,

Inc., Cl. A. Shares of Allergan PLC. also detracted from results. The company manufactures

and distributes both branded and generic pharmaceuticals globally. With an upcoming

presidential election, investors were concerned that increased government regulatory

intervention could negatively affect the company’s closing of a planned merger with Pfizer,

Inc. The deal was eventually halted by regulators in early April.

Alger Mid Cap Focus Fund

The Alger Mid Cap Focus Fund returned -5.68% for the fiscal six-month period ended

April 30, 2016, compared to the -1.54% return of the Russell Midcap Growth Index. Prior

to December 30, 2015, the Fund followed different investment strategies under the name

“Alger Analyst Fund” and was managed by a different portfolio manager.

- 6 -

During the reporting period, the largest sector weightings were Information Technology

and Consumer Discretionary. The largest sector overweight was Information Technology

and the largest sector underweight was Consumer Staples. The Information Technology

and Materials sectors provided the greatest contributions to relative performance, while

Financials and Health Care were among sectors that detracted from results.

Among the most important relative contributors were Newell Brands, Inc.; Coach, Inc.;

VCA Antech, Inc.; and FEI Co. Shares of HD Supply Holdings, Inc. also contributed to

performance. HD Supply Holdings is an industrial distributor of products for infrastructure,

housing, commercial buildings, and other construction applications. During the first quarter,

investors responded favorably to the healthy residential housing market and stronger-than-

expected guidance from the company. Investors also responded favorably to the company

refinancing expensive debt.

Conversely, detracting from overall results on a relative basis were Vertex Pharmaceuticals,

Inc.; WisdomTree Investments, Inc.; Weatherford International PLC.; Norwegian Cruise

Line Holdings Ltd.; and Signet Jewelers Ltd. Shares of asset manager WisdomTree

Investments, Inc. also detracted from performance. The company offers more than 75

exchange traded funds. The performance of WisdomTree shares weakened in the fourth

quarter in response to investors withdrawing assets from the company’s products.

Alger Dynamic Opportunities Fund

The Alger Dynamic Opportunities Fund returned -4.22% for the fiscal six-month period

ended April 30, 2016, compared to the 0.43% return of the Fund’s benchmark, the S&P

500 index.

The hedged equity Fund seeks long-term capital appreciation, downside protection, and

lower volatility by primarily investing in long and short exposures in equity securities of U.S.

companies. The Fund seeks to generate market-like equity returns over a full U.S. market

cycle. During shorter-term periods, the Fund may underperform when U.S. equity markets

generate strong gains, perform in line or modestly outperform when markets are flat, and

should outperform when markets decline.

During the reporting period, the Fund’s long exposure was 72.18% of assets. Long

positions, in aggregate, underperformed the Fund’s benchmark and detracted approximately

3.83 percentage points from absolute performance. The average exposure to short positions

was 15.73% of assets. Short positions trailed the performance of the Fund’s benchmark

and detracted approximately 39 basis points from performance. Net exposure, which is the

difference between long and short exposure, was 56.45%.

Based on the net exposure of long and short positions, the largest sector weightings were

Information Technology and Health Care. There was no sector overweight and the largest

underweight was Financials. Information Technology and Financials provided the greatest

contribution to relative performance, while other sectors detracted from results.

Among the most important relative contributors were Euronet Worldwide, Inc.; Cvent, Inc.;

Apple, Inc.; and Coach, Inc. Shares of Affiliated Managers Group, Inc. also contributed

to performance. The company is a manager of asset managers. Its stock price declined

following news that the company was forced to liquidate a fixed-income fund, which

- 7 -

represented less than 1% of the company’s assets. The shares subsequently performed

strongly in response to the company generating strong fund flows relative to the industry.

Conversely, detracting from overall results on a relative basis were Incyte Corp.; Shire PLC.;

Lions Gate Entertainment Corp.; and LendingClub Corp. Shares of Vertex Pharmaceuticals,

Inc. also detracted from results. Disappointing developments with the company's cystic

fibrosis drug hurt the share performance.

Among short positions, The Boston Beer Co., Inc., Cl. A contributed to performance while

Valspar Corp. detracted from performance. The performance of those short positions was

highlighted in the Alger Spectra Fund discussion.

Alger Emerging Markets Fund

The Alger Emerging Markets Fund returned -3.07% for the fiscal six-month period ended

April 30, 2016, compared to the -0.01% return of its benchmark, the MSCI Emerging

Markets Index.

During the reporting period, the largest sector weightings were Financials and Information

Technology. The largest sector overweight was Consumer Discretionary and the largest

sector underweight was Financials. Financials and Health Care provided the greatest

contributions to relative performance, while Consumer Discretionary and Energy were

among sectors that detracted from results.

Strong stock selection in Taiwan and an underweight of China resulted in those two countries

providing the greatest contributions to relative performance. Colombia and Thailand were

also among countries that supported relative performance. Stock selection in Russia, Brazil,

and South Africa, however, resulted in those three countries being the largest detractors

from relative performance.

Among the most important relative contributors were Gourmet Master Co., Ltd.; Airports

of Thailand Public Co. Ltd. NVDR; Ecopetrol SA; and KB Financial Group, Inc. Shares of

BB Seguridade Participacoes SA also supported performance. The company is a Brazilian

insurance broker. Its stock performance rebounded in line with other Brazilian financial

stocks during the quarter. In March, BB Seguridade management continued to maintain that

this will be a challenging year for the entire financial industry irrespective of any changes to

the political environment.

Conversely, detracting from overall results on a relative basis were China Everbright

International Ltd.; Mr Price Group Ltd.; Vipshop Holdings Ltd.; and Itau Unibanco Holding

SA Pfd. Shares of PAX Global Technology Limited also detracted from results. PAX Global

Technology is the world’s third-largest maker of electronic fund transfer point-of-sale (POS)

terminals and is the market leader in mainland China. During the early portion of this year,

the company released 2016 guidance that was weaker than expected and investors remained

concerned about potential weakness in its core market as well as in Brazil.

- 8 -

I thank you for putting your trust in Alger.

Daniel C. Chung, CFA

Chief Investment Officer

Fred Alger Management, Inc.

As of April 30, 2016, the following companies represented the stated percentages of Alger

assets under management: Amazon.com, Inc., 3.56%; Netflix, Inc.; 0.27%; Alphabet, Inc.;

(formerly Google), 05.81%; and Apple, Inc., 4.15%.

Investors cannot invest directly in an index. Index performance does not

reflect the deduction for fees, expenses, or taxes.

This report and the financial statements contained herein are submitted for the general

information of shareholders of the funds. This report is not authorized for distribution to

prospective investors in a fund unless proceeded or accompanied by an effective prospectus

for the fund. Fund performance returns represent the six-month period return of Class

A shares prior to the deduction of any sales charges and include the reinvestment of any

dividends or distributions.

The performance data quoted represent past performance, which is not an

indication or guarantee of future results.

Standardized performance results can be found on the following pages. The investment

return and principal value of an investment in a fund will fluctuate so that an investor’s

shares, when redeemed, may be worth more or less than their original cost. Current

performance may be lower or higher than the performance quoted. For performance data

current to the most recent month-end, visit us at www.alger.com or call us at (800) 992-3863.

The views and opinions of the funds’ management in this report are as of the date of the

Shareholders’ Letter and are subject to change at any time subsequent to this date. There

is no guarantee that any of the assumptions that formed the basis for the opinions stated

herein are accurate or that they will materialize. Moreover, the information forming the

basis for such assumptions is from sources believed to be reliable; however, there is no

guarantee that such information is accurate. Any securities mentioned, whether owned in a

fund or otherwise, are considered in the context of the construction of an overall portfolio

of securities and therefore reference to them should not be construed as a recommendation

or offer to purchase or sell any such security. Inclusion of such securities in a fund and

transactions in such securities, if any, may be for a variety of reasons, including, without

limitation, in response to cash flows, inclusion in a benchmark, and risk control. The

reference to a specific security should also be understood in such context and not viewed as

a statement that the security is a significant holding in a fund. Please refer to the Schedule

of Investments for each fund which is included in this report for a complete list of fund

holdings as of April 30, 2016. Securities mentioned in the Shareholders’ Letter, if not found

in the Schedule of Investments, may have been held by the funds during the fiscal period.

- 9 -

A Word about Risk

Growth stocks tend to be more volatile than other stocks as the price of growth stocks

tends to be higher in relation to their companies’ earnings and may be more sensitive

to market, political and economic developments. Investing in the stock market involves

gains and losses and may not be suitable for all investors. Stocks of small- and mid-sized

companies are subject to greater risk than stocks of larger, more established companies

owing to such factors as limited liquidity, inexperienced management, and limited financial

resources. Investing in foreign securities involves additional risk (including currency risk,

risks related to political, social or economic conditions, and risks associated with foreign

markets, such as increased volatility, limited liquidity, less stringent regulatory and legal

system, and lack of industry and country diversification), and may not be suitable for all

investors. Special risks associated with investments in emerging country issuers include

exposure to currency fluctuations, less liquidity, less developed or less efficient trading

markets, lack of comprehensive company information, political instability and different

auditing and legal standards.

Foreign currencies are subject to risks caused by inflation, interest rates, budget deficits and

low savings rates, political factors and government controls. Some of the countries where a

fund can invest may have restrictions that could limit the access to investment opportunities.

The securities of issuers located in emerging markets can be more volatile and less liquid

than those of issuers in more mature economies. Investing in emerging markets involves

higher levels of risk, including increased information, market, and valuation risks, and may

not be suitable for all investors.

Funds that participate in leveraging are subject to the risk that the cost of borrowing

money to leverage will exceed the returns for securities purchased or that the securities

purchased may actually go down in value; thus, the fund’s net asset value can decrease more

quickly than if the fund had not borrowed. The Alger Spectra Fund and the Alger Dynamic

Opportunities Fund may engage in short sales, which presents additional risk. To engage in

a short sale, a fund arranges with a broker to borrow the security being sold short. In order

to close out its short position, a fund will replace the security by purchasing the security at

the price prevailing at the time of replacement. The fund will incur a loss if the price of the

security sold short has increased since the time of the short sale and may experience a gain

if the price has decreased since the short sale.

The Alger Green Fund's environmental focus may limit the investment options available

to the Fund and may result in lower returns than returns of funds not subject to such

investment considerations. For a more detailed discussion of the risks associated with a

fund, please see the prospectus.

Before investing, carefully consider a fund’s investment objective, risks, charges,

and expenses.

For a prospectus or a summary prospectus containing this and other information

about the Alger Funds II call us at (800) 992-3863 or visit us at www.alger.com.

Read it carefully before investing.

Fred Alger & Company, Incorporated, Distributor. Member NYSE Euronext,

- 10 -

SIPC.

NOT FDIC INSURED. NOT BANK GUARANTEED. MAY LOSE VALUE.

Definitions:

• S&P 500 index: An index of large company stocks considered representative

of the U.S. stock market.

• Morgan Stanley Capital International (MSCI) All Country World Index

(ACWI) ex USA is an unmanaged, market capitalization-weighted index de-

signed to provide a broad measure of equity market performance throughout

the world, including both developing and emerging markets, but excluding

the United States.

• MSCI Emerging Markets Index: A free float-adjusted market capitalization

index designed to measure equity market performance in the global emerging

markets.

• Russell 3000 Growth Index: An index of common stocks designed to track

performance of companies with greater than average growth orientation in

general.

• Russell 1000 Growth Index: An index of common stocks designed to track

performance of large-capitalization companies with greater than average

growth orientation.

• Russell 1000 Value Index: An index designed to track the performance of

large-capitalization stocks that that have value characteristics.

• Russell Midcap Growth Index: An index of common stocks designed to

track performance of medium-capitalization companies with greater than

average growth orientation.

• The MSCI World Index: An index that captures large and mid cap repre-

sentation across 23 Developed Markets (DM) countries. The index covers

approximately 85% of the free float-adjusted market capitalization in each

country.

• FactSet Research Systems, Inc. is a multinational financial data and software

company.

• S&P Capital IQ provides research, data, and analysis on capital markets and

other topics for investment managers, investment banks, private equity funds,

advisory firms, corporations and universities.

• The U.S. Dollar Index measures U.S. currency against currencies of trading

partners.

- 11 -

| | | | | | |

| | FUND PERFORMANCE AS OF 3/31/16 (Unaudited) | | | |

| AVERAGE ANNUAL TOTAL RETURNS |

| | 1YEAR | | 5 YEARS | | 10 YEARS | |

| Alger Spectra Class A | (7.48 | )% | 10.31 | % | 10.37 | % |

| Alger Spectra Class C* | (4.03 | )% | 10.65 | % | 10.16 | % |

| Alger Spectra Class I† | (2.34 | )% | 11.52 | % | 11.04 | % |

| | 1YEAR | | 5 YEARS | | Since 12/29/2010 | |

| Alger Spectra Class Z | (2.06 | )% | 11.83 | % | 12.67 | % |

* Historical performance prior to September 24, 2008, inception of the class, is that of the Fund's Class A shares, adjusted to

reflect the current maximum sales charge and the higher operating expenses of Class C shares.

† Historical performance prior to September 24, 2008, inception of the class, is that of the Fund's Class A shares, which has

been adjusted to remove the front-end sales charge imposed by Class A shares.

Alger Green Fund’s Class A shares performance figures prior to January 12, 2007, are those of the Alger Green

Institutional Fund and performance prior to October 19, 2006, represents the performance of the Alger Socially

Responsible Growth Institutional Fund Class I, the predecessor fund to the Alger Green Institutional Fund. The

predecessor fund followed different investment strategies and had a different portfolio manager. As of January 12,

2007, the Alger Green Institutional Fund became the Alger Green Fund.

| | | | | | | | |

| FUND PERFORMANCE AS OF 3/31/16 (Unaudited) |

| AVERAGE ANNUAL TOTAL RETURNS |

| | 1 | | 5 | | 10 | | SINCE | |

| | YEAR | | YEARS | | YEARS | | INCEPTION | |

| Alger Green Class A (Inception 12/4/00) | (6.58 | )% | 7.29 | % | 5.44 | % | 1.45 | % |

| Alger Green Class C (Inception 9/24/08)* | (3.20 | )% | 7.57 | % | n/a | | 6.77 | % |

| Alger Green Class I (Inception 9/24/08)† | (1.37 | )% | 8.46 | % | n/a | | 7.61 | % |

| Alger Mid Cap Focus Class A (Inception 3/30/07) | (15.83 | )% | 6.56 | % | n/a | | 4.85 | % |

| Alger Mid Cap Focus Class C (Inception 9/24/08)* | (12.45 | )% | 7.05 | % | n/a | | 4.75 | % |

| Alger Mid Cap Focus Class I (Inception 9/24/08)† | (11.21 | )% | 7.69 | % | n/a | | 5.46 | % |

| Alger Dynamic Opportunities Class A (Inception 11/2/09) | (9.28 | )% | 2.51 | % | n/a | | 4.30 | % |

| Alger Dynamic Opportunities Class C (Inception | | | | | | | | |

| 12/29/10)‡ | (5.90 | )% | 2.84 | % | n/a | | 4.39 | % |

| Alger Dynamic Opportunities Class Z (Inception 12/29/10) | (3.95 | )% | 3.89 | % | n/a | | 4.79 | % |

| Alger Emerging Markets Class A (Inception 12/29/10) | (15.32 | )% | (4.32 | )% | n/a | | (4.26 | )% |

| Alger Emerging Markets Class C (Inception 12/29/10) | (12.33 | )% | (4.03 | )% | n/a | | (4.10 | )% |

| Alger Emerging Markets Class I (Inception 12/29/10) | (10.66 | )% | (3.30 | )% | n/a | | (3.38 | )% |

| Alger Emerging Markets Class Z (Inception 2/28/14) | (10.32 | )% | n/a | | n/a | | (5.20 | )% |

* Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to September

24, 2008, inception of the class, is that of the Fund's Class A shares, reduced to reflect the current maximum sales charge

and the higher operating expenses of Class C shares.

† Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to September

24, 2008, inception of the class, is that of the Fund's Class A shares, which has been adjusted to remove the front-end sales

charge imposed by Class A shares.

‡ Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to December

29, 2010, inception of the class, is that of the Fund's Class A shares, reduced to reflect the current maximum sales charge

and the higher operating expenses of Class C shares.

- 12 -

ALGER SPECTRA FUND

Fund Highlights Through April 30, 2016 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Spectra Fund

Class A shares, with an initial 5.25% maximum sales charge, and the Russell 3000 Growth Index (an unmanaged

index of common stocks) for the ten years ended April 30, 2016. The figures for the Alger Spectra Fund Class A and

the Russell 3000 Growth Index include reinvestment of dividends. Performance for the Alger Spectra Fund Class

C, Class I and Class Z shares will vary from the results shown above due to the operating expenses and the current

maximum sales charge of each share class. Investors cannot invest directly in any index. Index performance does

not reflect deduction for fees, expenses, or taxes.

| | | | | | | | |

| PERFORMANCE COMPARISON AS OF 4/30/16 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | | | Since | |

| | 1YEAR | | 5 YEARS | | 10 YEARS | | 12/31/1974 | |

| Class A (Inception 7/28/69) | (7.81 | )% | 9.12 | % | 10.22 | % | 15.53 | % |

| Class C (Inception 9/24/08)* | (4.34 | )% | 9.46 | % | 10.01 | % | 14.82 | % |

| Class I (Inception 9/24/08)† | (2.74 | )% | 10.31 | % | 10.89 | % | 15.69 | % |

| Russell 3000 Growth Index | 0.32 | % | 11.09 | % | 8.03 | % | n/a | |

| | | | | | | |

| | | | | | | Since | |

| | 1 | YEAR | 5 YEARS | | 10 YEARS | 12/29/2010 | |

| Class Z (Inception 12/29/10) | (2.39 | )% | 10.62 | % | n/a | 12.20 | % |

| Russell 3000 Growth Index | 0.32 | % | 11.09 | % | n/a | 12.26 | % |

- 13 -

ALGER SPECTRA FUND

Fund Highlights Through April 30, 2016 (Unaudited) (Continued)

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average

annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum

initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. Class A, C, and I historical performance

is calculated from December 31, 1974, the first full calendar year that Fred Alger Management, Inc. was the Fund's investment advisor.

The Fund operated as a closed-end fund from August 23, 1978 to February 12, 1996, during which time the calculation of total return

assumes dividends were reinvested at market value. Had dividends not been reinvested, performance would have been lower. The chart

and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of

Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their

original cost. Current performance may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.

com or call us at (800) 992-3863.

* Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to September

24, 2008, inception of the class, is that of the Fund's Class A shares, reduced to reflect the current maximum sales charge

and the higher operating expenses of Class C shares.

† Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to September

24, 2008, inception of the class, is that of the Fund's Class A shares, which has been adjusted to remove the front-end sales

charge imposed by Class A shares.

- 14 -

ALGER GREEN FUND

Fund Highlights Through April 30, 2016 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Green Fund

Class A shares, with an initial 5.25% maximum sales charge, and the Russell 3000 Growth Index (an unmanaged

index of common stocks) for the ten years ended April 30, 2016. The figures for the Alger Green Fund Class A and

the Russell 3000 Growth Index include reinvestment of dividends. Performance for the Alger Green Fund Class C

and Class I shares will vary from the results shown above due to the operating expenses and the current maximum

sales charge of each share class. Investors cannot invest directly in any index. Index performance does not reflect

deduction for fees, expenses, or taxes.

| | | | | | | | |

| | | | | | | | |

| PERFORMANCE COMPARISON AS OF 4/30/16 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | | | Since | |

| | 1YEAR | | 5 YEARS | | 10 YEARS | | 12/4/2000 | |

| Class A (Inception 12/4/00) | (8.69 | )% | 6.63 | % | 5.20 | % | 1.33 | % |

| Russell 3000 Growth Index | 0.32 | % | 11.09 | % | 8.03 | % | 4.07 | % |

| | | | | | | |

| PERFORMANCE COMPARISON AS OF 4/30/16 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | | Since | |

| | 1YEAR | | 5 YEARS | | 10 YEARS | 12/4/2000 | |

| Class C (Inception 9/24/08)* | (5.22 | )% | 6.95 | % | n/a | 6.47 | % |

| Class I (Inception 9/24/08)† | (3.52 | )% | 7.81 | % | n/a | 7.29 | % |

| Russell 3000 Growth Index | 0.32 | % | 11.09 | % | n/a | 11.19 | % |

- 15 -

ALGER GREEN FUND

Fund Highlights Through April 30, 2016 (Unaudited) (Continued)

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average

annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum

initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. Performance figures prior to January 12,

2007, are those of the Alger Green Institutional Fund and performance prior to October 19, 2006, represents the performance of the

Alger Socially Responsible Growth Institutional Fund Class I, the predecessor fund to the Alger Green Institutional Fund. The pre-

decessor fund followed different investment strategies and had a different portfolio manager. As of January 12, 2007, the Alger Green

Institutional Fund became the Alger Green Fund. The chart and table above do not reflect the deduction of taxes that a shareholder

would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the

Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the

performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

- 16 -

ALGER MID CAP FOCUS FUND

Fund Highlights Through April 30, 2016 (Unaudited)

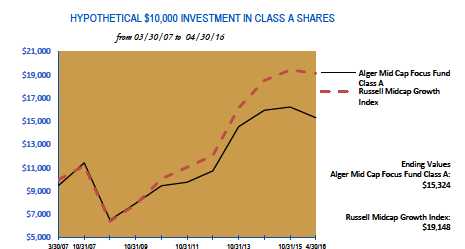

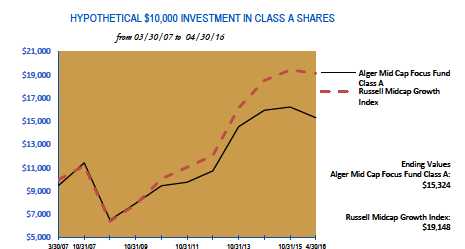

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Mid Cap

Focus Fund Class A shares, with an initial 5.25% maximum sales charge, and the Russell Midcap Growth Index (an

unmanaged index of common stocks) from March 30, 2007, the inception date of the Alger Mid Cap Focus Fund

Class A, through April 30, 2016. Prior to December 30, 2015, the Fund followed different investment strategies

under the name “Alger Analyst Fund” and was managed by a different portfolio manager. Accordingly, performance

prior to that date does not reflect the Fund’s current investment strategies and investment personnel. The figures for

the Alger Mid Cap Focus Fund Class A and the Russell Midcap Growth Index include reinvestment of dividends.

Performance for the Alger Mid Cap Focus Fund Class C and Class I shares will vary from the results shown above

due to the operating expenses and the current maximum sales charge of each share class. Investors cannot invest

directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

| | | | | | | |

| PERFORMANCE COMPARISON AS OF 4/30/16 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | | Since | |

| | 1YEAR | | 5 YEARS | | 10 YEARS | 3/30/2007 | |

| Class A (Inception 3/30/07) | (13.43 | )% | 5.87 | % | n/a | 4.81 | % |

| Class C (Inception 9/24/08)* | (9.97 | )% | 6.34 | % | n/a | 4.71 | % |

| Class I (Inception 9/24/08)† | (8.67 | )% | 7.00 | % | n/a | 5.42 | % |

| Russell Midcap Growth Index | (4.13 | )% | 9.20 | % | n/a | 7.41 | % |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average

annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum

initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the

deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return

and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance

may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

* Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to September

24, 2008, inception of the class, is that of the Fund's Class A shares, reduced to reflect the current maximum sales charge

and the higher operating expenses of Class C shares.

† Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to September

24, 2008, inception of the class, is that of the Fund's Class A shares, which has been adjusted to remove the front-end sales

charge imposed by Class A shares.

- 17 -

ALGER DYNAMIC OPPORTUNITIES FUND

Fund Highlights Through April 30, 2016 (Unaudited)

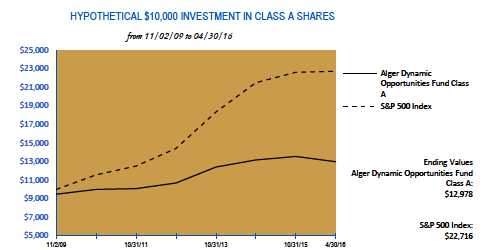

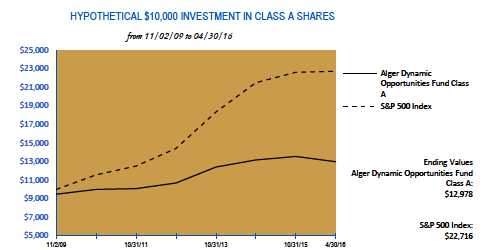

The chart above illustrates the change in value of a hypothetical $10,000 investment made in Alger Dynamic

Opportunities Fund Class A shares, with an initial 5.25% maximum sales charge, and the S&P 500 Index and

the Blended S&P 500/3-Month London Interbank Offered Rate (“LIBOR”) (an unmanaged indices of common

stocks) from November 2, 2009, the inception date of the Alger Dynamic Opportunities Fund Class A, through

April 30, 2016. The figures for the Alger Dynamic Opportunities Fund Class A and the S&P 500 Index and the

Blended S&P 500/LIBOR include reinvestment of dividends. Performance for the Alger Dynamic Opportunities

Fund Class C and Class Z shares will vary from the results shown above due to the operating expenses and the

current maximum sales charge of each share class. Investors cannot invest directly in any index. Index performance

does not reflect deduction for fees, expenses, or taxes.

| | | | | | | |

| PERFORMANCE COMPARISON AS OF 4/30/16 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | | Since | |

| | 1YEAR | | 5 YEARS | | 10 YEARS | 11/2/2009 | |

| Class A (Inception 11/2/09) | (9.52 | )% | 1.72 | % | n/a | 4.10 | % |

| Class C (Inception 12/29/10)* | (6.12 | )% | 2.07 | % | n/a | 4.17 | % |

| S&P 500 Index | 1.21 | % | 11.02 | % | n/a | 13.48 | % |

| Blended S&P 500 / LIBOR | 1.02 | % | 5.74 | % | n/a | 6.94 | % |

| | | | | | | |

| | | | | | | Since | |

| | 1YEAR | | 5 YEARS | | 10 YEARS | 12/29/2010 | �� |

| Class Z (Inception 12/29/10) | (4.24 | )% | 3.11 | % | n/a | 4.53 | % |

| S&P 500 Index | 1.21 | % | 11.02 | % | n/a | 12.06 | % |

| Blended S&P 500 / LIBOR | 1.02 | % | 5.74 | % | n/a | 6.23 | % |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average

annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum

initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the

deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return

and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance

may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

- 18 -

ALGER DYNAMIC OPPORTUNITIES FUND

Fund Highlights Through April 30, 2016 (Unaudited) (Continued)

* Since inception performance is calculated since the inception of the Class A shares. Historical performance prior to

December 29, 2010, inception of the class, is that of the Fund's Class A shares, reduced to reflect the current maximum

sales charge and the higher operating expenses of Class C shares.

- 19 -

ALGER EMERGING MARKETS FUND

Fund Highlights Through April 30, 2016 (Unaudited)

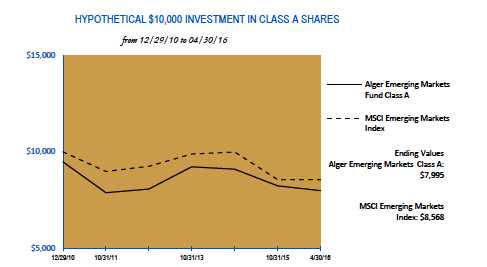

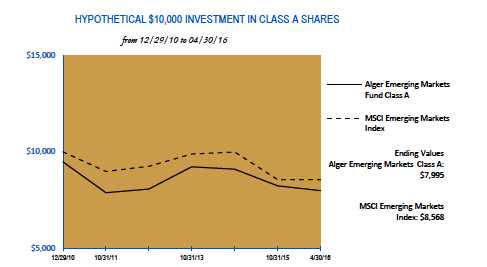

The chart above illustrates the change in value of a hypothetical $10,000 investment made in Alger Emerging

Markets Fund Class A shares, with an initial 5.25% maximum sales charge, and the MSCI Emerging Markets Index

(an unmanaged index of common stocks) from December 29, 2010, the inception date of the Alger Emerging

Markets Fund Class A, through April 30, 2016. The figures for the Alger Emerging Markets Fund Class A and the

MSCI Emerging Markets Index include reinvestment of dividends. Performance for the Alger Emerging Markets

Fund Class C, Class I and Class Z shares will vary from the results shown above due to differences in expense and

sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect

deduction for fees, expenses, or taxes.

| | | | | | | |

| PERFORMANCE COMPARISON AS OF 4/30/16 |

| AVERAGE ANNUAL TOTAL RETURNS |

| | | | | | | Since | |

| | 1YEAR | | 5 YEARS | | 10 YEARS | 12/29/2010 | |

| Class A (Inception 12/29/10) | (19.69 | )% | (4.84 | )% | n/a | (4.11 | )% |

| Class C (Inception 12/29/10) | (16.70 | )% | (4.53 | )% | n/a | (3.95 | )% |

| Class I (Inception 12/29/10) | (15.30 | )% | (3.82 | )% | n/a | (3.24 | )% |

| MSCI Emerging Markets Index | (17.56 | )% | (4.28 | )% | n/a | (2.86 | )% |

| | | | | | |

| | | | | | Since | |

| | 1YEAR | | 5 YEARS | 10 YEARS | 2/28/2014 | |

| Class Z (Inception 2/28/14) | (14.86 | )% | n/a | n/a | (4.75 | )% |

| MSCI Emerging Markets Index | (17.56 | )% | n/a | n/a | (3.65 | )% |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average

annual total returns include changes in share price and reinvestment of dividends and capital gains. Class A returns reflect the maximum

initial sales charge and Class C returns reflect the applicable contingent deferred sales charge. The chart and table above do not reflect the

deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return

and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance

may be higher or lower than the performance quoted. For updated performance, visit us at www.alger.com or call us at (800) 992-3863.

- 20 -

PORTFOLIO SUMMARY†

April 30, 2016

| | | | | | | | | | | | |

| ` | | | | | | | | | | | | |

| | | | | | | | | Alger Mid Cap Focus | | | Alger Dynamic | |

| SECTORS | | Alger Spectra Fund* | | | Alger Green Fund | | | Fund | | | Opportunities Fund* | |

| Consumer Discretionary | | 19.3 | % | | 24.8 | % | | 20.7 | % | | 15.4 | % |

| Consumer Staples | | 8.4 | | | 7.0 | | | 0.0 | | | 5.5 | |

| Energy | | 1.4 | | | 0.0 | | | 1.3 | | | 1.0 | |

| Financials | | 3.7 | | | 2.3 | | | 7.2 | | | 29.5 | |

| Health Care | | 18.8 | | | 9.8 | | | 14.8 | | | 8.0 | |

| Industrials | | 9.8 | | | 16.5 | | | 18.8 | | | 2.1 | |

| Information Technology | | 34.1 | | | 24.6 | | | 23.0 | | | 25.8 | |

| Market Indices | | 0.0 | | | 0.0 | | | 0.0 | | | (1.0 | ) |

| Materials | | 0.9 | | | 2.7 | | | 4.9 | | | (0.3 | ) |

| Utilities | | 0.0 | | | 2.4 | | | 0.0 | | | (0.3 | ) |

| Short-Term Investments and | | | | | | | | | | | | |

| Net Other Assets | | 3.6 | | | 9.9 | | | 9.3 | | | 14.3 | |

| | | 100.0 | % | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| | | |

| | | Alger Emerging Markets | |

| COUNTRY | | Fund | |

| Brazil | | 7.2 | % |

| Cayman Islands | | 3.1 | |

| China | | 20.7 | |

| Colombia | | 1.7 | |

| Germany | | 0.5 | |

| Hong Kong | | 1.9 | |

| India | | 10.2 | |

| Indonesia | | 3.3 | |

| Luxembourg | | 1.6 | |

| Malaysia | | 1.4 | |

| Mexico | | 5.7 | |

| Peru | | 0.7 | |

| Philippines | | 1.0 | |

| Russia | | 1.4 | |

| South Africa | | 4.9 | |

| South Korea | | 14.9 | |

| Switzerland | | 1.7 | |

| Taiwan | | 9.7 | |

| Thailand | | 2.0 | |

| Turkey | | 0.5 | |

| United Arab Emirates | | 0.7 | |

| United Kingdom | | 1.2 | |

| United States | | 0.1 | |

| Cash and Net Other Assets | | 3.9 | |

| | | 100.0 | % |

* Includes short sales as a reduction of sector exposure.

† Based on net assets for each Fund

- 21 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2016 (Unaudited)

| | | | | | |

| COMMON STOCKS—96.3% | | SHARES | | | | VALUE |

| ADVERTISING—0.0% | | | | | | |

| Choicestream, Inc.*,@,(a) | | 178,292 | $ | 74,883 |

| AEROSPACE & DEFENSE—4.9% | | | | | | |

| Honeywell International, Inc.+ | | 1,729,000 | | | 197,572,830 |

| Lockheed Martin Corp. | | 134,455 | | | | 31,244,653 |

| The Boeing Co.+ | | 224,100 | | | | 30,208,680 |

| TransDigm Group, Inc.* | | 21,000 | | | | 4,785,270 |

| | | | | | 263,811,433 |

| AIRLINES—1.3% | | | | | | |

| Delta Air Lines, Inc. | | 563,400 | | | | 23,476,878 |

| Southwest Airlines Co | | 792,200 | | | | 35,340,042 |

| Spirit Airlines, Inc.* | | 266,800 | | | | 11,720,524 |

| | | | | | 70,537,444 |

| ALTERNATIVE CARRIERS—0.6% | | | | | | |

| Level 3 Communications, Inc.* | | 617,100 | | | 32,249,646 |

| APPAREL ACCESSORIES & LUXURY GOODS—0.8% | | | | | | |

| Hanesbrands, Inc. | | 496,300 | | | | 14,407,589 |

| PVH Corp. | | 172,000 | | | | 16,443,200 |

| Under Armour, Inc., Cl. A* | | 253,000 | | | | 11,116,820 |

| | | | | | 41,967,609 |

| APPLICATION SOFTWARE—2.2% | | | | | | |

| Adobe Systems, Inc.* | | 528,500 | | | | 49,795,270 |

| salesforce.com, inc.* | | 913,721 | | | | 69,260,052 |

| | | | | | 119,055,322 |

| AUTO PARTS & EQUIPMENT—1.3% | | | | | | |

| Delphi Automotive PLC. | | 653,273 | | | | 48,100,491 |

| Lear Corp. | | 148,100 | | | | 17,050,753 |

| WABCO Holdings, Inc.* | | 64,697 | | | | 7,256,415 |

| | | | | | 72,407,659 |

| AUTOMOBILE MANUFACTURERS—0.1% | | | | | | |

| Tesla Motors, Inc.* | | 23,500 | | | | 5,657,860 |

| BIOTECHNOLOGY—4.7% | | | | | | |

| ACADIA Pharmaceuticals, Inc.* | | 457,161 | | | | 14,766,300 |

| Biogen, Inc.*+ | | 180,780 | | | | 49,712,692 |

| BioMarin Pharmaceutical, Inc.* | | 438,094 | | | | 37,097,800 |

| Celgene Corp.* | | 614,100 | | | | 63,504,081 |

| Gilead Sciences, Inc. | | 510,047 | | | | 44,991,246 |

| Incyte Corp.* | | 110,900 | | | | 8,014,743 |

| Vertex Pharmaceuticals, Inc.*+ | | 416,128 | | | | 35,096,236 |

| | | | | | 253,183,098 |

| BREWERS—1.6% | | | | | | |

| Anheuser-Busch InBev SA# | | 54,500 | | | | 6,767,810 |

| Molson Coors Brewing Co., Cl. B | | 858,000 | | | | 82,050,540 |

| | | | | | 88,818,350 |

| BROADCASTING—2.0% | | | | | | |

| CBS Corp., Cl. B | | 1,977,200 | | | 110,545,252 |

| BROADCASTING & CABLE TV—0.2% | | | | | | |

| Discovery Communications, Inc., Series A* | | 388,400 | | | 10,607,204 |

- 22 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2016 (Unaudited) (Continued)

| | | | | | |

| COMMON STOCKS—(CONT.) | | SHARES | | | | VALUE |

| BUILDING PRODUCTS—0.3% | | | | | | |

| Fortune Brands Home & Security, Inc. | | 167,640 | $ | 9,288,932 |

| Lennox International, Inc. | | 34,800 | | | | 4,696,260 |

| | | | | | 13,985,192 |

| CABLE & SATELLITE—1.7% | | | | | | |

| Comcast Corporation, Cl. A | | 1,488,855 | | | 90,462,830 |

| CASINOS & GAMING—0.2% | | | | | | |

| Red Rock Resorts, Inc., Cl. A* | | 713,700 | | | 13,303,368 |

| COMMUNICATIONS EQUIPMENT—0.5% | | | | | | |

| Arista Networks, Inc.* | | 228,935 | | | | 15,251,650 |

| Ciena Corp.* | | 528,300 | | | | 8,891,289 |

| Cisco Systems, Inc. | | 99,800 | | | | 2,743,502 |

| | | | | | 26,886,441 |

| CONSUMER FINANCE—0.1% | | | | | | |

| LendingClub Corp.* | | 717,681 | | | | 5,669,680 |

| DATA PROCESSING & OUTSOURCED SERVICES—3.7% | | | | | | |

| Sabre Corp. | | 776,400 | | | | 22,476,780 |

| Visa, Inc., Cl. A+ | | 2,314,781 | | | 178,793,684 |

| | | | | | 201,270,464 |

| DIVERSIFIED CHEMICALS—0.1% | | | | | | |

| EI Du Pont de Nemours & Co. | | 87,730 | | | | 5,782,284 |

| DRUG RETAIL—1.4% | | | | | | |

| CVS Caremark Corp. | | 587,781 | | | | 59,071,990 |

| Walgreens Boots Alliance, Inc. | | 221,650 | | | | 17,572,412 |

| | | | | | 76,644,402 |

| ELECTRICAL COMPONENTS & EQUIPMENT—0.4% | | | | | | |

| Eaton Corp., PLC. | | 315,600 | | | 19,968,012 |

| ENVIRONMENTAL & FACILITIES SERVICES—0.4% | | | | | | |

| Stericycle, Inc.* | | 243,700 | | | 23,287,972 |

| FOOD RETAIL—0.4% | | | | | | |

| The Kroger Co. | | 664,000 | | | 23,498,960 |

| FOOTWEAR—0.1% | | | | | | |

| NIKE, Inc., Cl. B | | 84,400 | | | | 4,974,536 |

| GENERAL MERCHANDISE STORES—0.7% | | | | | | |

| Dollar General Corp. | | 254,264 | | | | 20,826,764 |

| Dollar Tree, Inc.* | | 203,000 | | | | 16,181,130 |

| | | | | | 37,007,894 |

| HEALTH CARE EQUIPMENT—3.5% | | | | | | |

| Boston Scientific Corp.* | | 1,376,400 | | | | 30,170,688 |

| DexCom, Inc.* | | 415,433 | | | | 26,745,576 |

| Edwards Lifesciences Corp.* | | 428,300 | | | | 45,489,743 |

| Intuitive Surgical, Inc.* | | 11,300 | | | | 7,077,868 |

| Medtronic PLC. | | 379,500 | | | | 30,037,425 |

| STERIS PLC. | | 501,122 | | | | 35,414,292 |

| Stryker Corp. | | 141,800 | | | | 15,457,618 |

| | | | | | 190,393,210 |

| HEALTH CARE FACILITIES—0.8% | | | | | | |

| Amsurg Corp.* | | 130,816 | | | | 10,593,480 |

| HCA Holdings, Inc.* | | 77,051 | | | | 6,211,851 |

- 23 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2016 (Unaudited) (Continued)

| | | | | | |

| COMMON STOCKS—(CONT.) | | SHARES | | | | VALUE |

| HEALTH CARE FACILITIES—(CONT.) | | | | | | |

| Universal Health Services, Inc., Cl. B | | 181,200 | $ | 24,222,816 |

| | | | | | 41,028,147 |

| HOME ENTERTAINMENT SOFTWARE—1.1% | | | | | | |

| Activision Blizzard, Inc. | | 245,700 | | | | 8,469,279 |

| Electronic Arts, Inc.* | | 814,358 | | | | 50,368,042 |

| | | | | | 58,837,321 |

| HOME IMPROVEMENT RETAIL—0.9% | | | | | | |

| Lowe's Companies, Inc. | | 72,400 | | | | 5,503,848 |

| The Home Depot, Inc. | | 326,358 | | | | 43,696,073 |

| | | | | | 49,199,921 |

| HOTELS RESORTS & CRUISE LINES—1.6% | | | | | | |

| Ctrip.com International Ltd.#* | | 271,960 | | | | 11,860,175 |

| Diamond Resorts International, Inc.* | | 369,600 | | | | 7,839,216 |

| Norwegian Cruise Line Holdings Ltd.* | | 819,558 | | | | 40,068,191 |

| Royal Caribbean Cruises Ltd. | | 332,600 | | | | 25,743,240 |

| | | | | | 85,510,822 |

| HOUSEWARES & SPECIALTIES—1.9% | | | | | | |

| Newell Brands, Inc. | | 2,304,690 | | | 104,955,583 |

| HYPERMARKETS & SUPER CENTERS—0.5% | | | | | | |

| Costco Wholesale Corp. | | 178,600 | | | 26,456,018 |

| INDUSTRIAL CONGLOMERATES—0.8% | | | | | | |

| 3M Co. | | 104,000 | | | | 17,407,520 |

| General Electric Co. | | 865,322 | | | | 26,608,651 |

| | | | | | 44,016,171 |

| INTEGRATED OIL & GAS—0.3% | | | | | | |

| TOTAL SA# | | 268,700 | | | 13,636,525 |

| INTEGRATED TELECOMMUNICATION SERVICES—1.3% | | | | | | |

| AT&T, Inc. | | 968,800 | | | | 37,608,816 |

| Verizon Communications, Inc. | | 615,300 | | | | 31,343,382 |

| | | | | | 68,952,198 |

| INTERNET RETAIL—4.3% | | | | | | |

| Amazon.com, Inc.*+ | | 328,653 | | | 216,776,232 |

| NetFlix, Inc.* | | 148,380 | | | | 13,358,652 |

| The Priceline Group, Inc.*+ | | 2,100 | | | | 2,821,686 |

| | | | | | 232,956,570 |

| INTERNET SOFTWARE & SERVICES—13.6% | | | | | | |

| Alphabet, Inc., Cl. C*+ | | 522,952 | | | 362,410,966 |

| comScore, Inc.* | | 667,340 | | | | 20,433,951 |

| Facebook, Inc., Cl. A*+ | | 2,091,518 | | | 245,920,686 |

| LinkedIn Corp., Cl. A* | | 120,800 | | | | 15,137,448 |

| Match Group, Inc.* | | 1,280,000 | | | | 14,592,000 |

| Palantir Technologies, Inc., Cl. A*,@ | | 348,292 | | | | 3,831,212 |

| Stamps.com, Inc.* | | 166,000 | | | | 13,671,760 |

| Twitter, Inc.* | | 105,600 | | | | 1,543,872 |

| Yahoo! Inc.* | | 1,537,595 | | | | 56,275,977 |

| | | | | | 733,817,872 |

| INVESTMENT BANKING & BROKERAGE—0.3% | | | | | | |

| Morgan Stanley | | 380,259 | | | | 10,289,809 |

- 24 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2016 (Unaudited) (Continued)

| | | | | | |

| COMMON STOCKS—(CONT.) | | SHARES | | | | VALUE |

| INVESTMENT BANKING & BROKERAGE—(CONT.) | | | | | | |

| The Goldman Sachs Group, Inc. | | 28,700 | $ | 4,709,957 |

| | | | | | 14,999,766 |

| LEISURE PRODUCTS—0.5% | | | | | | |

| Coach, Inc. | | 695,700 | | | 28,015,839 |

| LIFE SCIENCES TOOLS & SERVICES—2.1% | | | | | | |

| Thermo Fisher Scientific, Inc.+ | | 768,314 | | | 110,829,294 |

| MANAGED HEALTH CARE—2.3% | | | | | | |

| Aetna, Inc. | | 173,177 | | | | 19,442,582 |

| Humana, Inc. | | 74,600 | | | | 13,209,422 |

| UnitedHealth Group, Inc. | | 708,924 | | | | 93,351,112 |

| | | | | | 126,003,116 |

| MOVIES & ENTERTAINMENT—0.5% | | | | | | |

| The Walt Disney Co. | | 78,100 | | | | 8,064,606 |

| Time Warner, Inc. | | 254,800 | | | | 19,145,672 |

| | | | | | 27,210,278 |

| OIL & GAS EQUIPMENT & SERVICES—0.4% | | | | | | |

| Halliburton Company | | 356,800 | | | | 14,739,408 |

| Weatherford International PLC.* | | 1,030,730 | | | | 8,379,835 |

| | | | | | | 23,119,243 |

| OIL & GAS EXPLORATION & PRODUCTION—0.7% | | | | | | |

| EOG Resources, Inc. | | 368,900 | | | | 30,478,518 |

| Pioneer Natural Resources Co. | | 55,200 | | | | 9,168,720 |

| | | | | | 39,647,238 |

| OTHER DIVERSIFIED FINANCIAL SERVICES—0.3% | | | | | | |

| Bank of America Corp. | | 1,147,812 | | | 16,712,143 |

| PACKAGED FOODS & MEATS—1.0% | | | | | | |

| Mead Johnson Nutrition Co., Cl. A+ | | 32,400 | | | | 2,823,660 |

| Pinnacle Foods, Inc. | | 363,300 | | | | 15,472,947 |

| The Kraft Heinz Co. | | 294,657 | | | | 23,003,872 |

| The WhiteWave Foods Co.* | | 254,800 | | | | 10,245,508 |

| TreeHouse Foods, Inc.* | | 38,000 | | | | 3,359,200 |

| | | | | | 54,905,187 |

| PHARMACEUTICALS—5.0% | | | | | | |

| Allergan PLC.*+ | | 531,666 | | | 115,137,589 |

| Bristol-Myers Squibb Co.+ | | 1,242,725 | | | | 89,699,891 |

| Eli Lilly & Co. | | 291,917 | | | | 22,048,491 |

| Pacira Pharmaceuticals, Inc.* | | 631,407 | | | | 34,165,433 |

| Shire PLC. | | 113,486 | | | | 7,082,480 |

| | | | | | 268,133,884 |

| RAILROADS—0.3% | | | | | | |

| Union Pacific Corp. | | 205,947 | | | 17,964,757 |

| RESEARCH & CONSULTING SERVICES—0.5% | | | | | | |

| Verisk Analytics, Inc., Cl. A* | | 334,300 | | | 25,934,994 |

| RESTAURANTS—1.5% | | | | | | |

| McDonald's Corp. | | 282,422 | | | | 35,723,559 |

| Starbucks Corp.+ | | 764,860 | | | | 43,008,078 |

| | | | | | 78,731,637 |

- 25 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2016 (Unaudited) (Continued)

| | | | | | |

| COMMON STOCKS—(CONT.) | | SHARES | | | | VALUE |

| SECURITY & ALARM SERVICES—0.5% | | | | | | |

| Tyco International PLC. | | 705,305 | | $ | | 27,168,349 |

| SEMICONDUCTORS—2.7% | | | | | | |

| Broadcom Ltd. | | 409,020 | | | | 59,614,665 |

| Microsemi Corp.* | | 993,531 | | | | 33,571,412 |

| NXP Semiconductors NV* | | 519,461 | | | | 44,299,634 |

| Skyworks Solutions, Inc. | | 134,425 | | | | 8,982,279 |

| | | | | | 146,467,990 |

| SOFT DRINKS—2.1% | | | | | | |

| Monster Beverage Corp.* | | 88,800 | | | | 12,806,736 |

| PepsiCo, Inc.+ | | 953,015 | | | | 98,122,424 |

| | | | | | 110,929,160 |

| SPECIALIZED CONSUMER SERVICES—0.5% | | | | | | |

| ServiceMaster Global Holdings, Inc.* | | 642,900 | | | 24,635,928 |

| SPECIALIZED FINANCE—0.2% | | | | | | |

| S&P Global, Inc. | | 100,601 | | | 10,749,217 |

| SPECIALTY CHEMICALS—0.8% | | | | | | |

| Celanese Corp. | | 84,300 | | | | 5,960,010 |

| PPG Industries, Inc. | | 158,900 | | | | 17,540,971 |

| The Sherwin-Williams Co. | | 74,900 | | | | 21,519,519 |

| | | | | | 45,020,500 |

| SPECIALTY STORES—0.9% | | | | | | |

| Dick's Sporting Goods, Inc. | | 173,200 | | | | 8,026,088 |

| Signet Jewelers Ltd. | | 369,798 | | | | 40,145,271 |

| | | | | | 48,171,359 |

| SYSTEMS SOFTWARE—5.8% | | | | | | |

| Fortinet, Inc.* | | 442,900 | | | | 14,398,679 |

| Microsoft Corp.+ | | 4,823,475 | | | 240,546,698 |

| Oracle Corp. | | 205,500 | | | | 8,191,230 |

| Red Hat, Inc.* | | 267,300 | | | | 19,611,801 |

| ServiceNow, Inc.* | | 378,000 | | | | 27,019,440 |

| TubeMogul, Inc.* | | 272,533 | | | | 3,532,028 |

| | | | | | 313,299,876 |

| TECHNOLOGY HARDWARE STORAGE & PERIPHERALS—4.6% | | | | | | |

| Apple, Inc.+ | | 2,644,295 | | | 247,876,213 |

| TOBACCO—1.5% | | | | | | |

| Altria Group, Inc. | | 828,100 | | | | 51,930,151 |

| Philip Morris International, Inc. | | 299,300 | | | | 29,367,316 |

| | | | | | 81,297,467 |

| TRADING COMPANIES & DISTRIBUTORS—0.9% | | | | | | |

| HD Supply Holdings, Inc.* | | 1,350,971 | | | | 46,311,286 |

| TRUCKING—0.1% | | | | | | |

| Old Dominion Freight Line, Inc.* | | 40,100 | | | | 2,648,605 |

| TOTAL COMMON STOCKS | | | | | | |

| (Cost $4,758,716,795) | | | | | 5,198,201,479 |

| PREFERRED STOCKS—0.7% | | SHARES | | | | VALUE |

| ADVERTISING—0.0% | | | | | | |

| Choicestream, Inc., Cl. A*,@,(a) | | 1,537,428 | | | | 645,720 |

- 26 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2016 (Unaudited) (Continued)

| | | | | | | |

| PREFERRED STOCKS—(CONT.) | | SHARES | | | | | VALUE |

| ADVERTISING—(CONT.) | | | | | | | |

| Choicestream, Inc., Cl. B*,@,(a) | | 3,765,639 | | | $ | | 1,581,568 |

| | | | | | | | 2,227,288 |

| BIOTECHNOLOGY—0.3% | | | | | | | |

| Prosetta Biosciences, Inc.*,@,(a) | | 2,912,012 | | | 13,162,294 |

| INTERNET SOFTWARE & SERVICES—0.3% | | | | | | | |

| Palantir Technologies, Inc., Cl. B*,@ | | 1,420,438 | | | | | 15,624,818 |

| Palantir Technologies, Inc., Cl. D*,@ | | 185,062 | | | | | 2,035,682 |

| | | | | | 17,660,500 |

| PHARMACEUTICALS—0.1% | | | | | | | |

| Intarcia Therapeutics, Inc.*,@ | | 171,099 | | | | | 5,654,822 |

| TOTAL PREFERRED STOCKS | | | | | | | |

| (Cost $32,736,484) | | | | | | | 38,704,904 |

| MASTER LIMITED PARTNERSHIP—0.7% | | SHARES | | | | | VALUE |

| ASSET MANAGEMENT & CUSTODY BANKS—0.7% | | | | | | | |

| The Blackstone Group LP. | | 1,416,791 | | | 38,876,745 |

| (Cost $46,214,948) | | | | | | | 38,876,745 |

| REAL ESTATE INVESTMENT TRUST—2.1% | | SHARES | | | | | VALUE |

| MORTGAGE—0.7% | | | | | | | |

| Blackstone Mortgage Trust, Inc., Cl. A | | 1,352,004 | | | 37,153,070 |

| RESIDENTIAL—0.2% | | | | | | | |

| American Campus Communities, Inc. | | 247,900 | | | | | 11,093,525 |

| SPECIALIZED—1.2% | | | | | | | |

| Crown Castle International Corp. | | 778,300 | | | 67,618,704 |

| TOTAL REAL ESTATE INVESTMENT TRUST | | | | | | | |

| (Cost $115,956,766) | | | | | 115,865,299 |

| SPECIAL PURPOSE VEHICLE—0.1% | | SHARES | | | | | VALUE |

| CONSUMER FINANCE—0.1% | | | | | | | |

| JS Kred SPV I, LLC.@ | | 2,715,111 | | | | | 2,715,111 |

| (Cost $2,715,111) | | | | | | | 2,715,111 |

| Total Investments | | | | | | | |

| (Cost $4,956,340,104)(b) | | 99.9 | % | | 5,394,363,538 |

| Other Assets in Excess of Liabilities | | 0.1 | % | | | | 2,787,643 |

| NET ASSETS | | 100.0 | % | | $ | | 5,397,151,181 |

- 27 -

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments April 30, 2016 (Unaudited) (Continued)

# American Depositary Receipts.

(a) Deemed an affiliate of the Alger fund complex during the year for purposes of Section 2(a)(3) of the Investment

Company Act of 1940. See Affiliated Securities in Notes to Financial Statements.

(b) At April 30, 2016, the net unrealized appreciation on investments, based on cost for federal income tax purposes

of $5,052,632,080, amounted to $341,731,458 which consisted of aggregate gross unrealized appreciation of

$573,806,968 and aggregate gross unrealized depreciation of $232,075,510.