| | OMB APPROVAL |

| | OMB Number: | 3235-0570 |

| | Expires: | January 31, 2014 |

| UNITED STATES | Estimated average burden hours per response. . . . . . . . . . . . . . . . .20.6 |

| SECURITIES AND EXCHANGE COMMISSION | |

| Washington, D.C. 20549 | |

| | | | |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-01743 |

|

The Alger Funds II |

(Exact name of registrant as specified in charter) |

|

360 Park Ave South New York, New York | | 10010 |

(Address of principal executive offices) | | (Zip code) |

|

Mr. Hal Liebes Fred Alger Management, Inc. 360 Park Ave South New York, New York 10010 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 212-806-8800 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | October 31, 2011 | |

| | | | | | | | |

ITEM 1. REPORTS TO STOCKHOLDERS.

The Alger Funds II

ANNUAL REPORT | |

October 31, 2011 | |

Table of Contents

THE ALGER FUNDS II

Letter to Our Shareholders (Unaudited) | 1 |

| |

Fund Highlights (Unaudited) | 12 |

| |

Portfolio Summary (Unaudited) | 20 |

| |

Schedules of Investments | 21 |

| |

Statements of Assets and Liabilities | 53 |

| |

Statements of Operations | 57 |

| |

Statements of Changes in Net Assets | 59 |

| |

Financial Highlights | 62 |

| |

Notes to Financial Statements | 73 |

| |

Report of Independent Registered Public Accounting Firm | 95 |

| |

Additional Information (Unaudited) | 97 |

Go Paperless With Alger Electronic Delivery Service

Alger is pleased to provide you with the ability to access regulatory materials online. When documents such as prospectuses and annual and semi-annual reports are available, we’ll send you an e-mail notification with a convenient link that will take you directly to the fund information on our website. To sign up for this free service, simply enroll at www.icsdelivery.com/alger.

Dear Shareholders, | | December 1, 2011 |

A Challenging Year

Market volatility surged during the 12-month period ended October 31, 2011, as fears grew over the euro-zone sovereign debt crisis and U.S. deficit spending. As the year progressed, political paralysis on both sides of the Atlantic fueled pessimism over elected officials’ ability to resolve both of those issues. Investors also grew increasingly cautious as the global economic recovery appeared to lose steam. For the 12-month period, the S&P 500 Index generated an 8.09% return.

For Alger, challenging times are nothing new. Over the course of our more than 45-year history, we have honed our investment strategy during both up and down markets. In doing so, we have experienced Black Monday of 1987, the Asian Crisis of 1997, the dot com bubble burst of 2000, the terrorist attacks of 2001, and the subprime mortgage crisis of 2007 to 2010. Based on our review of past crises and our view of U.S. economic fundamentals, we maintain that equity markets—while still facing various challenges—have strong potential to rally once the euro-zone crisis is resolved. We also believe that investor pessimism—as measured by an equity risk premium that has reached a 55-year high and by high free-cash-flow yields—may be excessive, especially when viewed from a historical perspective.

Government Policies Drive Market Volatility

In some ways, markets performed in a predictable fashion during the reporting period. Markets advanced when investors perceived that progress was being made on the U.S. debt ceiling debate and on the euro-zone crisis. Conversely, markets declined when it appeared that those issues were worsening. For example, during the early portion of the third quarter of 2011, concerns grew that feuding parties in Congress would fail to raise the country’s $14.3 trillion debt ceiling, which could have prompted an unpopular government shutdown and a default on U.S. debt. The nations’ leaders finally agreed shortly before an August 2 deadline to raise the debt ceiling and to cut at least $2.1 trillion from the nation’s spending. In the process, however, many investors lost confidence in Washington’s ability to tackle tough problems, including structural budget issues that have contributed to deficit spending. Investors weren’t the only ones to express disappointment. Standard & Poor’s, which had been threatening for months to downgrade its U.S. debt rating, pulled the trigger shortly after the debt ceiling agreement was announced, signaling a lack of confidence in the nation’s ability to enact meaningful budget reform.

Broadly speaking, U.S. economic headline numbers also disappointed. The U.S. Department of Commerce lowered its early second quarter GDP growth estimate of 1.3% to 1% and the International Monetary Fund lowered its 2012 U.S. GDP forecast from 2.7% to 2%. Unemployment in July and August, meanwhile, lingered at a discouragingly high rate of 9.1%. The economic slowdown didn’t go unnoticed: the Conference Board’s Consumer Confidence Index for August tumbled from 59.2 to 44.5, its lowest level in more than two years.

1

In Europe, the sovereign debt problem lingered and at times appeared to worsen, with riots in Greece sparked by new austerity measures being implemented to fulfill requirements of debt relief programs. Debate over the nature, size, and conditions of relief programs continued among leaders of European nations and organizations such as the IMF, the European Financial Stability Facility and the European Central Bank (ECB), sparking fear among investors that the crisis may grind on and send Europe and possibly other regions into an economic slowdown. Concerns grew that troubled European countries would face a funding emergency as high interest rates made issuing debt difficult.

Euro-Zone Crisis in Perspective

Estimates of the range of potential euro-zone write-downs vary considerably, but losses could be as high as 600 billion euros, according to J.P. Morgan. That amount is comparable to losses from the 1997 Asian crisis on an inflation-adjusted basis, but it is dwarfed by the $2.7 trillion in losses resulting from the U.S. subprime mortgage crisis of 2007-2010. That crisis drove U.S. equity markets down more than 40%, until markets eventually rallied. We note that in the Asian Crisis, U.S. equity markets declined approximately 20% and then rallied 33% in the three months after the issue was resolved. We believe that once the fear of the euro crisis is alleviated, a market rally is likely. While it’s hard to say how and when the euro-zone issue will be resolved, elected officials and organizations such as the ECB and the IMF are under increasing pressure to take action. In the meantime, investors’ high level of fear is currently illustrated by an equity risk premium of 6.27%, according to J.P. Morgan. The 6.27% premium, in addition to exceeding the premium during the subprime mortgage crisis, is at a 55-year high, even though the potential scope of the euro-zone crisis is considerably smaller than the subprime debacle.

Reasons for Optimism with U.S. Economy

One reason that we believe a rally is possible once the euro-zone crisis is resolved is that in many ways, the U.S. economy, despite many gloomy headline developments, is stronger than during the subprime mortgage crisis. We believe that the U.S. economy has considerable potential for expanding. In the aftermath of the mortgage crisis, U.S. corporations have consistently expanded their earnings and exhibited strong discipline with spending, which has allowed them to reduce leverage and to accumulate record levels of cash. As of the second quarter, U.S. corporations held $2 trillion in cash, which is an all-time high. Corporate earnings have also been strong, with year-over year quarterly increases having occurred for every quarter since the third quarter of 2009. With strong balance sheets, many U.S. corporations are well prepared to weather moderating GDP growth and to continue to seek attractive opportunities in emerging markets and from large scale trends, such as the increasing use of Internet-connected devices. Deep corporate coffers, furthermore, are allowing businesses to buy back stock, implement or increase dividends, and engage in mergers and acquisitions, all of which support equity valuations and serve as economic stimuli.

Unemployment, of course, continues to be a hurdle for the U.S. economic recovery. It is important to realize, however, that the private sector is creating jobs, granted at

2

a discouragingly slow pace, while public employers downsize their workforces. At the same time, however, we believe that GDP growth may eventually surprise on the upside as real estate markets and industrial activity improve. So far, the languishing housing market has been a considerable drag on GDP, with well-above average inventories of homes in many markets. With large volumes of foreclosure sales, real estate values are depressed and tight lending requirements are making it difficult for many Americans to qualify for mortgages. Yet, our proprietary research also shows some glimmer of improvement, with some markets experiencing increases in prices and transaction volumes. This is particularly true with high-end real estate, but other select high-quality markets are also seeing improvements. U.S. industry, particularly automobile manufacturing, may also support GDP growth. Auto manufacturing increased 5.2% in July after having declined for three straight months following supply chain disruptions associated with the Japan disasters. Supply chain improvements since then have clearly facilitated an increase in manufacturing levels, but other factors may be involved. Indeed, demand for new cars in the U.S. has been growing among frugal consumers who have refrained from buying big ticket items. According to estimates from Edmunds.com, Americans are expected to buy only 12.6 million vehicles in 2011, down from 12.9 as estimated previously by the firm. That is a considerable decline from the 16 million to 17 million cars typically sold each year. In delaying new car purchases, consumers have allowed their autos to age considerably, with the average car in the U.S. being 11 years old, according to R. L. Polk & Co., which tracks automobile data. That is a considerable increase from 1995, when the average car was only 8.4 years old. American consumers, of course, will eventually need to replace their aging automobiles. When they do, they will provide a strong growth opportunity for the automobile industry and a boost to U.S. GDP.

Going Forward

Slowing economic growth, the euro-zone crisis, and the debt ceiling debate have clearly damaged investor sentiment. With that in mind, forecasting the timing and the scope of a possible equity rally is fraught with potential pitfalls, including uncertainty over how the U.S. will address deficit spending and the timeframe for a resolution of the euro-zone issue. We note, however, that equity valuations point to stocks being highly attractive. As of October 31, the S&P 500 price-to-earnings ratio was only 14.26 based on 2011 earnings of 87.92 per share, according to Standard & Poor’s. In comparison, the 50-year historical average P/E for the S&P 500 at the end of the third quarter was 19.11, according to Standard & Poor’s.

We remind readers that our bottom up stock selection is not based on making broad market judgments. Rather, we conduct careful analysis of companies and industry sectors. We believe our focus on companies that are best suited to respond to constant changes occurring among consumers and industries can provide our clients with attractive investment performance. We remain committed to our highly-disciplined, research-driven investment strategy that we believe helps us find the most compelling opportunities for our clients.

3

Portfolio Matters

Alger Spectra Fund

The Alger Spectra Fund returned 9.00% for the 12-month period ended October 31, 2011, compared to the 9.92% return of the Russell 3000 Growth Index.

For the reporting period, the Fund’s average portfolio allocation to long positions, which was increased by leverage, was 103.10% of assets. In aggregate, long positions contributed approximately 9.70% to performance. The Fund’s average allocation to short positions was -6.04%. The short positions had an approximately -0.70% contribution to performance.

During the period, the largest sector weightings in the Fund were in the Information Technology and Consumer Discretionary sectors. The largest sector overweight for the period was in Information Technology and the largest sector underweight for the period was in Consumer Staples. Relative outperformance in the Information Technology and Energy sectors was the most important contributor to performance, while Consumer Staples and Financials detracted from results.

Among the most important relative contributors were Cisco Systems, Inc.; BlackRock, Inc.; Optimer Pharmaceuticals, Inc.; VistaPrint NV; and IAC/InterActiveCorp. Shares of biotechnology company Optimer Pharmaceuticals performed strongly after the company’s launch of Dificid exceeded investors’ expectations. The drug is an antibiotic used in treating Clostridium infections.

Conversely, detracting from overall results on a relative basis were Newfield Exploration Co.; International Business Machines Corp.; Human Genome Sciences, Inc.; Arch Coal, Inc.; and United Continental Holdings, Inc. Performance of shares of Human Genome Sciences and other biotech companies weakened during the year as investors became averse to risks associated with companies that planned to launch biotech drugs. Human Genome is currently marketing Benlysta, which is used in the treatment of lupus.

Among short positions, TD Ameritrade Holding Corp.; Ultra Petroleum Corp; and Illumina Inc. had the largest contribution to relative performance while Cablevision Systems Corp.; Biogen Idex Inc.; and Costco Wholesale Corp. had the largest adverse impact on relative returns.

Alger Green Fund

The Alger Green Fund returned -0.33% for the 12-month period ended October 31, 2011, compared to the 9.92% return of its benchmark, the Russell 3000 Growth Index.

During the period, the largest sector weightings in the Fund were in the Information Technology and Consumer Discretionary sectors. The largest sector overweight for the period was in Consumer Discretionary and the largest sector underweight for the period was in Energy. Relative outperformance in the Consumer Discretionary and Utilities sectors was the most important contributor to performance, while Information Technology and Energy detracted from results.

4

Among the most important relative contributors were Clean Harbors, Inc.; Deckers Outdoor Corp.; Westport Innovations, Inc.; Starbucks Corp.; and Cisco Systems, Inc. Clean Harbors provides environmental and hazardous waste management and disposal services. The company benefited from a cyclical recovery among its industrial client base and from cleanup efforts in the Gulf of Mexico. Synergies from the company’s acquisition of Eveready Inc. also helped performance.

Conversely, detracting from overall results on a relative basis were Trina Solar Ltd.; Metabolix, Inc.; First Solar, Inc.; EnerNOC, Inc.; and American Superconductor Corp. First Solar is a manufacturer of solar cells. It generated disappointing earnings as supply of solar cells overwhelmed demand.

Alger Analyst Fund

The Alger Analyst Fund returned 3.25% for the 12-month period ended October 31, 2011, compared to the 9.92% return of the Fund’s benchmark, the Russell 3000 Growth Index.

During the period, the largest sector weightings in the Fund were in the Information Technology and Consumer Discretionary sectors. The largest sector overweight for the period was in Consumer Discretionary and the largest sector underweight for the period was in Information Technology. Relative outperformance in the Health Care and Consumer Discretionary sectors was the most important contributor to performance, while Energy and Information Technology detracted from results.

Among the most important relative contributors were Healthspring, Inc.; Cisco Systems, Inc.; Optimer Pharmaceuticals, Inc.; Bucyrus International; and Alexion Pharmaceuticals, Inc. Shares of biotechnology company Optimer Pharmaceuticals performed strongly after the company’s launch of Dificid exceeded investors’ expectations. The drug is an antibiotic used in treating Clostridium infections.

Conversely, detracting from overall results on a relative basis were Apple, Inc.; Human Genome Sciences, Inc.; Nexen, Inc.; Arch Coal, Inc.; and Halliburton Company. Performance of shares of Human Genome Sciences and other biotech companies weakened during the year as investors became averse to risks associated with companies that had plans to launch biotech drugs. Human Genome is currently marketing Benlysta, which is used in the treatment of lupus.

Alger Dynamic Opportunities Fund

The Alger Dynamic Opportunities Fund returned 0.85%, compared to the 4.45% return of its blended benchmark of 50% S&P 500 Index and 50% 3-Month London Interbank Offered Rate for the 12-month period ended October 31, 2011.

The Fund had an average long exposure of 77.34% and a short exposure of -26.83%. Net exposure, which is the difference of long and short positions, was 50.52%. Its long positions performed roughly in line with the Fund’s benchmark and had an approximately 2.2% contribution to absolute performance gross of fees. The Fund had an average -26.83% allocation to short positions. Short positions detracted

5

approximately 1.35% from performance. The Fund had an average cash allocation of 51.43%.

During the period, the largest sector weightings in the Alger Dynamic Opportunities Fund were in the Information Technology and Industrials sectors. The largest sector overweight for the period was in Materials and the largest sector underweight for the period was in Financials. Relative outperformance in the Consumer Discretionary and Financials sectors was the most important contributor to performance, while Health Care and Consumer Staples detracted from results.

Among the most important relative contributors were Arcos Dorados Holdings, Inc.; Devon Energy Corp.; Aetna, Inc.; Cliffs Natural Resources, Inc.; and VistaPrint NV. Arcos Dorados Holdings is the world’s largest McDonald’s restaurant franchisee and the largest quick-service restaurant chain in Latin America and the Caribbean. Its shares performed well following the company’s initial public offering in April.

Conversely, detracting from overall results on a relative basis were Exxon Mobil Corp.; OpenTable, Inc.; Metabolix, Inc.; Human Genome Sciences, Inc.; and Arch Coal, Inc. Performance of shares of Human Genome Sciences and other biotech companies weakened during the year as investors became averse to risks associated with companies that had plans to launch biotech drugs. Human Genome is currently marketing Benlysta which is used in the treatment of lupus.

Among short positions, St. Jude Medical, Inc.; TD Ameritrade Holding Corp.; and Computer Sciences Corp. had the largest positive impact on relative performance while Biogen Idec, Inc.; Cablevision Systems Corp.; and Ericsson ADR were among top detractors from relative results.

Alger Emerging Markets Fund

The Alger Emerging Markets Fund returned -16.80% from its December 29, 2010 commencement of operations to October 31, 2011, compared to the -10.14% return of its benchmark, the MSCI Emerging Markets Index.

China, Columbia, Argentina, and Hungry were the largest overweightings while Korea, Chile, and Mexico were the largest underweightings. Regarding stock selection, holdings in Egypt, Turkey, Poland, and the Philippines had a positive impact on performance. Among countries where stock selection detracted from performance were Korea, Russia, and Brazil.

During the period, the largest sector weightings in the Fund were in the Financials and Materials sectors. The largest sector overweight for the period was in Consumer Discretionary and the largest sector underweight for the period was in Financials. Relative outperformance in the Utilities and Health Care sectors was the most important contributor to performance, while Consumer Discretionary and Energy detracted from results.

6

Among the most important relative contributors were NCSoft Corp.; GCL-Poly Energy Holdings Ltd.; Baidu, Inc.; SACI Falabella; and Companhia Hering. GCL-Poly produces polysilicon and wafers for solar energy and aims to be the world’s largest polysilicon producer. During the early portion of 2011, GCL shares performed well after the company announced that it had increased its production capacity.

Conversely, detracting from overall results on a relative basis were Mechel OAO ADS; HRT Participacoes em Petroleo SA; LSR Group; West China Cement Ltd.; and Vale SA. Vale is a constituent of various exchange traded funds that track various portions of the Brazil equity market. We believe that it suffered from its liquidity and size in the index during market volatility in the third quarter.

As always, we strive to deliver consistently superior investment results for you, our shareholders, and we thank you for your business and your continued confidence in Alger.

Respectfully submitted,

Daniel C. Chung, CFA

Chief Investment Officer

Investors cannot invest directly in an index. Index performance does not reflect the deduction for fees, expenses, or taxes.

This report and the financial statements contained herein are submitted for the general information of shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless proceeded or accompanied by an effective prospectus for the Fund. Fund performance returns represent the fiscal 12-month period return of Class A shares prior to the deduction of any sales charges and include the reinvestment of any dividends or distributions.

The performance data quoted represents past performance, which is not an indication or guarantee of future results.

Standardized performance results can be found on the following pages. The investment return and principal value of an investment in a Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the most recent month-end, visit us at www.alger.com or call us at (800) 992-3863.

The views and opinions of the Fund’s management in this report are as of the date of the Shareholders Letter and are subject to change at any time subsequent to this

7

date. There is no guarantee that any of the assumptions that formed the basis for the opinions stated herein are accurate or that they will materialize. Moreover, the information forming the basis for such assumptions is from sources believed to be reliable; however, there is no guarantee that such information is accurate. Any securities mentioned, whether owned in a Fund or otherwise, are considered in the context of the construction of an overall portfolio of securities and therefore reference to them should not be construed as a recommendation or offer to purchase or sell any such security. Inclusion of such securities in a fund and transactions in such securities, if any, may be for a variety of reasons, including without limitation, in response to cash flows, inclusion in a benchmark, and risk control. The reference to a specific security should also be understood in such context and not viewed as a statement that the security is a significant holding in a Fund. Please refer to the Schedule of Investments for each Fund which is included in this report for a complete list of Fund holdings as of October 31, 2011. Securities mentioned in the Shareholders’ Letter, if not found in the Schedule of Investments, may have been held by the Funds during the fiscal period.

A Word about Risk

Growth stocks tend to be more volatile than other stocks as the price of growth stocks tends to be higher in relation to their companies’ earnings and may be more sensitive to market, political and economic developments. Investing in the stock market involves gains and losses and may not be suitable for all investors. Stocks of small- and mid-sized companies are subject to greater risk than stocks of larger, more established companies owing to such factors as limited liquidity, inexperienced management, and limited financial resources. Investing in foreign securities involves additional risk (including currency risk, risks related to political, social or economic conditions, and risks associated with foreign markets, such as increased volatility, limited liquidity, less stringent regulatory and legal system, and lack of industry and country diversification), and may not be suitable for all investors.

Funds that participate in leveraging are subject to the risk that borrowing money to leverage will exceed the returns for securities purchased or that the securities purchased may actually go down in value; thus, the Fund’s net asset value can decrease more quickly than if the Fund had not borrowed. Some Alger Funds, such as the Alger Spectra Fund and the Alger Dynamic Opportunities Fund may engage in short sales, which presents additional risk. To engage in a short sale, a Fund arranges with a broker to borrow the security being sold short. In order to close out its short position, a Fund will replace the security by purchasing the security at the price prevailing at the time of replacement. The Fund will incur a loss if the price of the security sold short has increased since the time of the short sale and may experience a gain if the price has decreased since the short sale.

The Alger Green Fund’s environmental focus may limit the investment options available to the Fund and may result in lower returns than returns of funds not subject to such investment considerations. For a more detailed discussion of the risks associated with a Fund, please see the Fund’s Prospectus.

8

Before investing, carefully consider a Fund’s investment objective, risks, charges, and expenses.

For a prospectus or a summary prospectus containing this and other information about the Alger Funds II call us at (800) 992-3863 or visit us at www.alger.com. Read it carefully before investing.

Fred Alger & Company, Incorporated, Distributor. Member NYSE Euronext, SIPC.

NOT FDIC INSURED. NOT BANK GUARANTEED. MAY LOSE VALUE.

Definitions:

· Standard & Poor’s is a credit rating agency and provider of financial data.

· Edmunds.com provides research and publications covering the automobile industry.

· Russell 3000 Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on the total market capitalization, which represents 98% of the U.S. Equity Market.

· Russell 1000 Growth Index is an unmanaged index designed to measure the performance of the largest 1,000 companies in the Russell 3000 Index with higher price-to-book ratios and higher forecasted growth values.

· The Standard & Poor’s 500 Index is an index of large-company common stocks and is considered to be representative of the U.S. stock market.

· The 3-Month London Interbank Offered Rate is based on rates that contributor banks in London offer each other for inter-bank deposits.

· The Morgan Stanley Capital International (MSCI) Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets.

9

FUND PERFORMANCE AS OF 9/30/11 (Unaudited)

AVERAGE ANNUAL TOTAL RETURNS

| | 1 YEAR | | 5 YEARS | | 10 YEARS | |

Alger Spectra Class A | | (3.33 | )% | 5.35 | % | 5.51 | % |

Alger Spectra Class C * | | 0.31 | % | 5.76 | % | 5.32 | % |

Alger Spectra Class I † | | 2.21 | % | 6.64 | % | 6.15 | % |

Alger Spectra Class Z ‡ | | 2.31 | % | 6.56 | % | 6.11 | % |

* | Historical performance prior to September 24, 2008, inception of the class, is that of the Fund’s Class A shares, adjusted to reflect Class C share’s higher operating expenses and current maximum sales charge. |

† | Historical performance prior to September 24, 2008, inception of the class, is that of the Fund’s Class A shares, which has been adjusted to remove the front-end sales charge imposed by Class A shares. |

‡ | Historical performance prior to December 29, 2010, inception of the class, is that of the Fund’s Class A shares, which has been adjusted to remove the front-end sales charge imposed by Class A shares. |

FUND PERFORMANCE AS OF 9/30/11 (Unaudited)

AVERAGE ANNUAL TOTAL RETURNS

| | 1

YEAR | | 5

YEARS | | SINCE

INCEPTION | |

Alger Green Class A (Inception 12/4/00)* | | (11.33 | )% | (1.02 | )% | (3.29 | )% |

Alger Green Class C (Inception 9/24/08)† | | (8.03 | )% | (0.68 | )% | (3.53 | )% |

Alger Green Class I (Inception 9/24/08)‡ | | (6.50 | )% | 0.02 | % | (2.83 | )% |

| | | | | | | |

Alger Analyst Class A (Inception 3/30/07) | | (11.29 | )% | n/a | | (3.36 | )% |

Alger Analyst Class C (Inception 9/24/08)† | | (8.08 | )% | n/a | | (2.96 | )% |

Alger Analyst Class I (Inception 9/24/08)‡ | | (6.40 | )% | n/a | | (2.23 | )% |

| | | | | | | |

Alger Dynamic Opportunities Class A (Inception 11/2/09) | | (7.14 | )% | n/a | | (2.00 | )% |

Alger Dynamic Opportunities Class C (Inception 12/29/10)§ | | (3.76 | )% | n/a | | 0.01 | % |

Alger Dynamic Opportunities Class Z (Inception 12/29/10)** | | (1.93 | )% | n/a | | 0.83 | % |

| | | | | | | |

Alger Emerging Markets Class A (Inception 12/29/10) | | n/a | | n/a | | (29.86 | )% |

Alger Emerging Markets Class C (Inception 12/29/10) | | n/a | | n/a | | (27.43 | )% |

Alger Emerging Markets Class I (Inception 12/29/10) | | n/a | | n/a | | (26.30 | )% |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains.

* | Performance figures prior to January 12, 2007, are those of the Alger Green Institutional Fund and performance prior to October 19, 2006, represents the performance of the Alger Socially Responsible Growth Institutional Fund Class I, the predecessor fund to the Alger Green Institutional Fund. The predecessor fund followed different investment strategies and had a different portfolio manager. As of January 12, 2007, the Alger Green Institutional Fund became the Alger Green Fund. |

† | Historical performance prior to September 24, 2008, inception of the class, is that of the Fund’s Class A shares, adjusted to reflect Class C share’s higher operating expenses and current maximum sales charge. |

‡ | Historical performance prior to September 24, 2008, inception of the class, is that of the Fund’s Class A shares, which has been adjusted to remove the front-end sales charge imposed by Class A shares. |

§ | Historical performance prior to December 29, 2010, inception of the class, is that of the Fund’s Class A shares, adjusted to reflect Class C share’s higher operating expenses and current maximum sales charge. |

10

** | Historical performance prior to December 29, 2010, inception of the class, is that of the Fund’s Class A shares, which has been adjusted to remove the front-end sales charge imposed by Class A shares. |

11

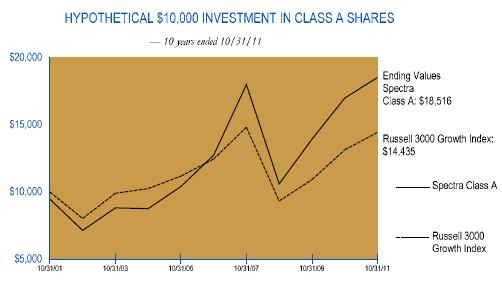

ALGER SPECTRA FUND

Fund Highlights Through October 31, 2011 (Unaudited)

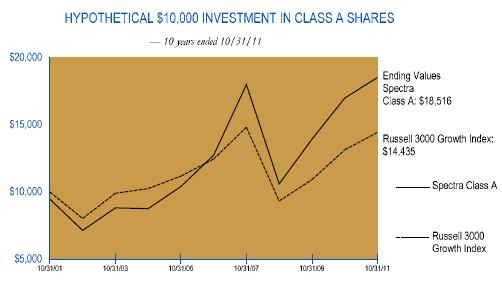

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Spectra Fund Class A shares, with an initial 5.25% maximum sales charge, and the Russell 3000 Growth Index (an unmanaged index of common stocks) for the ten years ended October 31, 2011. The figures for the Alger Spectra Fund Class A and the Russell 3000 Growth Index include reinvestment of dividends. Performance for the Alger Spectra Fund Class C, Class I and Class Z shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

PERFORMANCE COMPARISON AS OF 10/31/11

AVERAGE ANNUAL TOTAL RETURNS

| | 1 YEAR | | 5 YEARS | | 10 YEARS | | Since

12/31/1974 | |

Class A (Inception 7/28/69)*,† | | 3.26 | % | 6.63 | % | 6.35 | % | 15.73 | % |

Class C (Inception 9/24/08)†,‡,§ | | 7.24 | % | 7.02 | % | 6.15 | % | 15.04 | % |

Class I (Inception 9/24/08)†,** | | 9.14 | % | 7.91 | % | 6.99 | % | 15.91 | % |

Class Z (Inception 12/29/10)†,†† | | 9.27 | % | 7.84 | % | 6.95 | % | 15.90 | % |

Russell 3000 Growth Index | | 9.92 | % | 3.01 | % | 3.74 | % | n/a | |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to the most recent month end, visit us at www.alger.com or call us at (800) 992-3863.

* | Returns reflect the maximum initial sales charges. |

† | Historical performance has been calculated from December 31, 1974, the first full calendar year that Fred Alger Management, Inc. was the Fund’s investment advisor. The Fund operated as a closed-end fund from August 23, 1978 to February 12, 1996. The calculation of total return during that time assumes dividends were reinvested at market value. Had dividends not been reinvested, performance would have been lower. |

‡ | Historical performance prior to September 24, 2008, inception of the class, is that of the Fund’s Class A shares, adjusted to reflect Class C share’s higher operating expenses and current maximum sales charge. |

§ | Returns reflect the applicable contingent deferred sales charge. |

12

** | Historical performance prior to September 24, 2008, inception of the class, is that of the Fund’s Class A shares, which has been adjusted to remove the front-end sales charge imposed by Class A shares. |

†† | Historical performance prior to December 29, 2010, inception of the class, is that of the Fund’s Class A shares, which has been adjusted to remove the front-end sales charge imposed by Class A shares. |

13

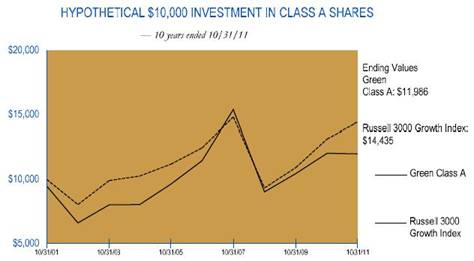

ALGER GREEN FUND

Fund Highlights Through October 31, 2011 (Unaudited)

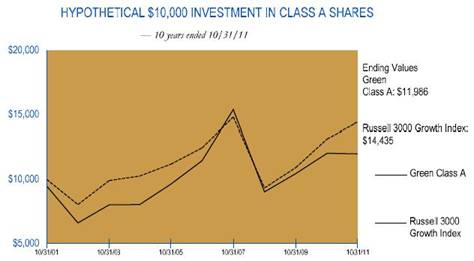

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Green Fund Class A shares, with an initial 5.25% maximum sales charge, and the Russell 3000 Growth Index (an unmanaged index of common stocks) for the ten years ended October 31, 2011. The figures for the Alger Green Fund Class A and the Russell 3000 Growth Index include reinvestment of dividends. Performance for the Alger Green Fund Class C and Class I shares will vary from the results shown above due to differences in expenses and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

PERFORMANCE COMPARISON AS OF 10/31/11

AVERAGE ANNUAL TOTAL RETURNS

| | 1 YEAR | | 5 YEARS | | 10 YEARS | | Since

12/4/2000 | |

Class A (Inception 12/4/00)*,† | | (5.50 | )% | (0.18 | )% | 1.83 | % | (2.44 | )% |

Class C (Inception 9/24/08)‡,§ | | (2.00 | )% | 0.19 | % | 1.62 | % | (2.68 | )% |

Class I (Inception 9/24/08)** | | (0.17 | )% | 0.92 | % | 2.37 | % | (1.96 | )% |

Russell 3000 Growth Index | | 9.92 | % | 3.01 | % | 3.74 | % | 0.18 | % |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to the most recent month end, visit us at www.alger.com or call us at (800) 992-3863.

* | Returns reflect the maximum initial sales charges. |

† | Performance figures prior to January 12, 2007, are those of the Alger Green Institutional Fund and performance prior to October 19, 2006, represents the performance of the Alger Socially Responsible Growth Institutional Fund Class I, the predecessor fund to the Alger Green Institutional Fund. The predecessor fund followed different investment strategies and had a different portfolio manager. As of January 12, 2007, the Alger Green Institutional Fund became the Alger Green Fund. |

‡ | Historical performance prior to September 24, 2008, inception of the class, is that of the Fund’s Class A shares, adjusted to reflect Class C share’s higher operating expenses and current maximum sales charge. |

§ | Returns reflect the applicable contingent deferred sales charge. |

** | Historical performance prior to September 24, 2008, inception of the class, is that of the Fund’s Class A shares, which has been adjusted to remove the front-end sales charge imposed by Class A shares. |

14

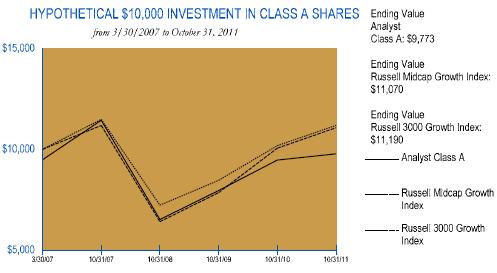

ALGER ANALYST FUND#

Fund Highlights Through October 31, 2011 (Unaudited)

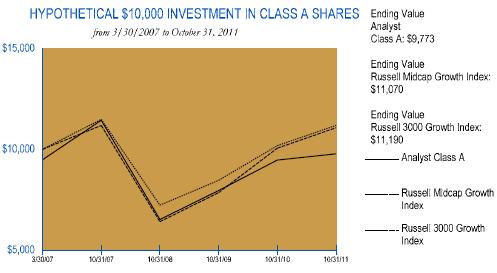

The chart above illustrates the change in value of a hypothetical $10,000 investment made in the Alger Analyst Fund Class A shares, with an initial 5.25% maximum sales charge, the Russell Midcap Growth Index and the Russell 3000 Growth Index (unmanaged indices of common stocks) from March 30, 2007, the inception date of the Alger Analyst Fund Class A, through October 31, 2011. The figures for the Alger Analyst Fund Class A, the Russell Midcap Growth Index and the Russell 3000 Growth Index include reinvestment of dividends. Performance for the Alger Analyst Fund Class C and Class I shares will vary from the results shown above due to differences in expenses and sales charges those classes bear.

Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

PERFORMANCE COMPARISON AS OF 10/31/11

AVERAGE ANNUAL TOTAL RETURNS

| | 1 YEAR | | 5 YEARS | | 10 YEARS | | Since

3/30/2007 | |

Class A (Inception 3/30/07)* | | (2.18 | )% | n/a | | n/a | | (0.50 | )% |

Class C (Inception 9/24/08)†,‡ | | 1.45 | % | n/a | | n/a | | (0.09 | )% |

Class I (Inception 9/24/08)§ | | 3.25 | % | n/a | | n/a | | 0.65 | % |

Russell Midcap Growth Index | | 10.08 | % | n/a | | n/a | | 2.24 | % |

Russell 3000 Growth Index | | 9.92 | % | n/a | | n/a | | 2.48 | % |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to the most recent month end, visit us at www.alger.com or call us at (800) 992-3863.

* | Returns reflect the maximum initial sales charges. |

† | Historical performance prior to September 24, 2008, inception of the class, is that of the Fund’s Class A shares, adjusted to reflect Class C share’s higher operating expenses and current maximum sales charge. |

‡ | Returns reflect the applicable contingent deferred sales charge. |

15

§ | Historical performance prior to September 24, 2008, inception of the class, is that of the Fund’s Class A shares, which has been adjusted to remove the front-end sales charge imposed by Class A shares. |

# | Effective 10/1/11, the Fund changed its benchmark to the Russell Midcap Growth Index to better reflect the aggregate capitalization range of the Securities in the Fund’s portfolio. |

16

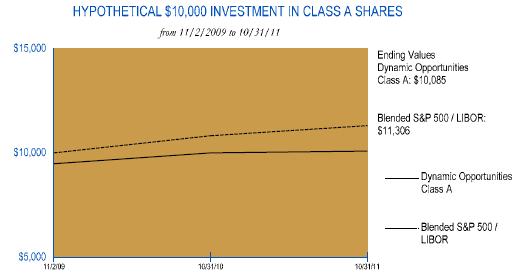

ALGER DYNAMIC OPPORTUNITIES FUND

Fund Highlights Through October 31, 2011(Unaudited)

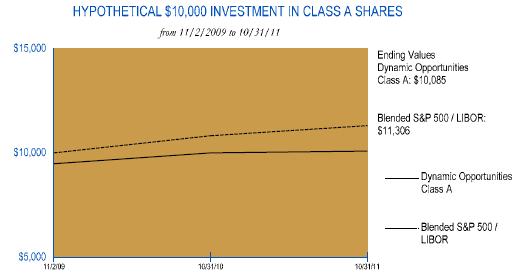

The chart above illustrates the change in value of a hypothetical $10,000 investment made in Alger Dynamic Opportunities Fund Class A shares, with an initial 5.25% maximum sales charge, and the Blended S&P 500/3-Month London Interbank Offered Rate (“LIBOR”) from November 2, 2009, the inception date of the Alger Dynamic Opportunities Fund Class A, through October 31, 2011. The figures for the Alger Dynamic Opportunities Fund Class A, and the Blended S&P 500/LIBOR include reinvestment of dividends. Performance for the Alger Dynamic Opportunities Fund Class C and Class Z shares will vary from the results shown above due to differences in expense and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

PERFORMANCE COMPARISON AS OF 10/31/11

AVERAGE ANNUAL TOTAL RETURNS

| | 1 YEAR | | 5 YEARS | | 10 YEARS | | Since

11/2/2009 | |

Class A (Inception 11/2/09)* | | (4.40 | )% | n/a | | n/a | | 0.43 | % |

Class C (Inception 12/29/10)†,‡ | | (0.93 | )% | n/a | | n/a | | 2.37 | % |

Class Z (Inception 12/29/10)§ | | 1.04 | % | n/a | | n/a | | 3.26 | % |

Blended S&P 500 / LIBOR | | 4.45 | % | n/a | | n/a | | 6.35 | % |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to the most recent month end, visit us at www.alger.com or call us at (800) 992-3863.

* | Returns reflect the maximum initial sales charges. |

† | Historical performance prior to December 29, 2010, inception of the class, is that of the Fund’s Class A shares, adjusted to reflect Class C share’s higher operating expenses and current maximum sales charge. |

‡ | Returns reflect the applicable contingent deferred sales charge. |

17

§ | Historical performance prior to December 29, 2010, inception of the class, is that of the Fund’s Class A shares, which has been adjusted to remove the front-end sales charge imposed by Class A shares. |

18

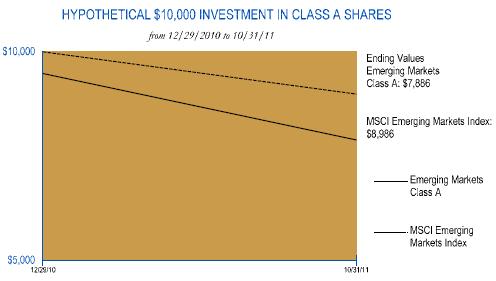

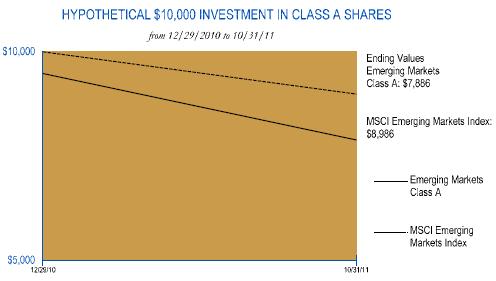

ALGER EMERGING MARKETS FUND

Fund Highlights Through October 31, 2011 (Unaudited)

The chart above illustrates the change in value of a hypothetical $10,000 investment made in Alger Emerging Markets Fund Class A shares, with an initial 5.25% maximum sales charge, and the MSCI Emerging Markets Index (an unmanaged index of common stocks) from December 29, 2010, the inception date of the Alger Emerging Markets Fund Class A, through October 31, 2011. The figures for the Alger Emerging Markets Fund Class A, and the MSCI Emerging Markets Index include reinvestment of dividends. Performance for the Alger Emerging Markets Fund Class C and Class I shares will vary from the results shown above due to differences in expense and sales charges those classes bear. Investors cannot invest directly in any index. Index performance does not reflect deduction for fees, expenses, or taxes.

PERFORMANCE COMPARISON AS OF 10/31/11

AVERAGE ANNUAL TOTAL RETURNS

| | 1 YEAR | | 5 YEARS | | 10 YEARS | | Since

12/29/2010 | |

Class A (Inception 12/29/10)* | | n/a | | n/a | | n/a | | (21.14 | )% |

Class C (Inception 12/29/10)† | | n/a | | n/a | | n/a | | (18.52 | )% |

Class I (Inception 12/29/10) | | n/a | | n/a | | n/a | | (17.20 | )% |

MSCI Emerging Markets Index | | n/a | | n/a | | n/a | | (10.14 | )% |

The performance data quoted represents past performance, which is not an indication or a guarantee of future results. The Fund’s average annual total returns include changes in share price and reinvestment of dividends and capital gains. The chart and table above do not reflect the deduction of taxes that a shareholder would have paid on Fund distributions or on the redemption of Fund shares. Investment return and principal will fluctuate and the Fund’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance current to the most recent month end, visit us at www.alger.com or call us at (800) 992-3863.

* | Returns reflect the maximum initial sales charges. |

† | Returns reflect the applicable contingent deferred sales charge. |

19

PORTFOLIO SUMMARY†

October 31, 2011 (Unaudited)

SECTORS | | Alger Spectra

Fund* | | Alger Green

Fund | | Alger Analyst

Fund | | Alger Dynamic

Opportunities

Fund* | |

Consumer Discretionary | | 15.9 | % | 19.8 | % | 21.2 | % | 7.7 | % |

Consumer Staples | | 7.7 | | 8.8 | | 7.1 | | 1.5 | |

Energy | | 10.1 | | 2.2 | | 9.1 | | 4.8 | |

Exchange Traded Funds | | 0.0 | | 0.0 | | 0.0 | | (3.5 | ) |

Financials | | 3.2 | | 1.0 | | 5.6 | | 2.5 | |

Health Care | | 12.7 | | 8.0 | | 10.9 | | 7.4 | |

Industrials | | 12.1 | | 16.3 | | 12.3 | | 4.0 | |

Information Technology | | 28.4 | | 30.5 | | 18.4 | | 13.8 | |

Materials | | 4.6 | | 6.6 | | 9.9 | | 4.2 | |

Telecommunication Services | | 1.8 | | 0.0 | | 0.8 | | 0.0 | |

Utilities | | 0.0 | | 3.4 | | 0.0 | | 0.0 | |

Short-Term Investments and Net Other Assets | | 3.5 | | 3.4 | | 4.7 | | 57.6 | |

| | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % |

COUNTRY | | Alger

Emerging

Markets Fund | |

Brazil | | 15.1 | % |

Chile | | 1.7 | |

China | | 12.2 | |

Columbia | | 1.0 | |

Hong Kong | | 2.8 | |

India | | 7.3 | |

Indonesia | | 2.2 | |

Macau | | 1.3 | |

Malaysia | | 3.3 | |

Mexico | | 4.8 | |

Mongolia | | 0.5 | |

Netherlands | | 1.0 | |

Philippines | | 0.7 | |

Poland | | 0.8 | |

Russia | | 4.4 | |

Singapore | | 0.9 | |

South Africa | | 6.5 | |

South Korea | | 14.8 | |

Switzerland | | 0.5 | |

Taiwan | | 10.9 | |

Thailand | | 1.4 | |

Turkey | | 1.2 | |

United States | | 2.5 | |

Cash and Net Other Assets | | 2.2 | |

| | 100.0 | % |

† | Based on net assets for each Fund. |

* | Includes short sales as a reduction of sector exposure. |

20

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments‡ October 31, 2011

| | SHARES | | VALUE | |

COMMON STOCKS—98.5% | | | | | |

ADVERTISING—1.7% | | | | | |

Focus Media Holding Ltd.#* | | 832,300 | | $ | 22,621,914 | |

| | | | | |

AEROSPACE & DEFENSE—1.7% | | | | | |

Goodrich Corp. | | 92,665 | | 11,363,509 | |

United Technologies Corp. | | 120,500 | | 9,396,590 | |

| | | | 20,760,099 | |

AIR FREIGHT & LOGISTICS—1.8% | | | | | |

FedEx Corp. + | | 57,600 | | 4,713,408 | |

United Parcel Service, Inc., Cl. B + | | 249,100 | | 17,496,784 | |

| | | | 22,210,192 | |

APPAREL ACCESSORIES & LUXURY GOODS—1.4% | | | | | |

Hanesbrands, Inc. * | | 272,600 | | 7,188,462 | |

PVH Corp. | | 135,800 | | 10,104,878 | |

| | | | 17,293,340 | |

APPAREL RETAIL—0.7% | | | | | |

Abercrombie & Fitch Co., Cl. A | | 118,700 | | 8,831,280 | |

| | | | | |

APPLICATION SOFTWARE—1.1% | | | | | |

Adobe Systems, Inc. * | | 136,400 | | 4,011,524 | |

Nice Systems Ltd. #* | | 104,095 | | 3,722,437 | |

Salesforce.com, Inc. * | | 41,400 | | 5,513,238 | |

| | | | 13,247,199 | |

ASSET MANAGEMENT & CUSTODY BANKS—0.4% | | | | | |

Affiliated Managers Group, Inc. * | | 27,250 | | 2,523,623 | |

Blackstone Group LP | | 207,400 | | 3,050,854 | |

| | | | 5,574,477 | |

AUTO PARTS & EQUIPMENT—0.8% | | | | | |

Lear Corp. | | 199,350 | | 9,351,509 | |

| | | | | |

BIOTECHNOLOGY—2.2% | | | | | |

Dendreon Corp. * | | 363,600 | | 3,977,784 | |

Gilead Sciences, Inc. * | | 241,421 | | 10,057,599 | |

Human Genome Sciences, Inc. * | | 198,130 | | 2,032,814 | |

Optimer Pharmaceuticals, Inc. * | | 304,400 | | 4,343,788 | |

Pharmasset, Inc. * | | 16,900 | | 1,189,760 | |

United Therapeutics Corp. * | | 127,400 | | 5,571,202 | |

| | | | 27,172,947 | |

BROADCASTING—0.2% | | | | | |

CBS Corp., Cl. B | | 102,400 | | 2,642,944 | |

| | | | | |

CABLE & SATELLITE—0.5% | | | | | |

Comcast Corporation, Cl. A | | 287,700 | | 6,746,565 | |

| | | | | |

CASINOS & GAMING—1.0% | | | | | |

Las Vegas Sands Corp.* | | 252,100 | | 11,836,095 | |

| | | | | |

COAL & CONSUMABLE FUELS—0.7% | | | | | |

Arch Coal, Inc. | | 487,590 | | 8,883,890 | |

| | | | | |

COMMUNICATIONS EQUIPMENT—3.0% | | | | | |

Ciena Corp. * | | 294,400 | | 3,880,192 | |

Cisco Systems, Inc. | | 402,100 | | 7,450,913 | |

| | | | | | |

21

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

COMMUNICATIONS EQUIPMENT—(CONT.) | | | | | |

F5 Networks, Inc. * | | 6,500 | | $ | 675,675 | |

Finisar Corp. * | | 103,100 | | 2,112,519 | |

Juniper Networks, Inc. * | | 76,800 | | 1,879,296 | |

QUALCOMM, Inc. + | | 394,417 | | 20,351,918 | |

Riverbed Technology, Inc. * | | 34,480 | | 950,958 | |

| | | | 37,301,471 | |

COMPUTER HARDWARE—7.1% | | | | | |

Apple, Inc. *+ | | 213,472 | | 86,409,197 | |

Dell, Inc. * | | 148,300 | | 2,344,623 | |

| | | | 88,753,820 | |

COMPUTER STORAGE & PERIPHERALS—1.8% | | | | | |

EMC Corp. * | | 504,899 | | 12,375,074 | |

NetApp, Inc. * | | 97,600 | | 3,997,696 | |

Seagate Technology PLC | | 383,900 | | 6,199,985 | |

| | | | 22,572,755 | |

CONSTRUCTION & ENGINEERING—0.1% | | | | | |

Chicago Bridge & Iron Co., NV# | | 48,200 | | 1,763,156 | |

| | | | | |

CONSTRUCTION & FARM MACHINERY & HEAVY TRUCKS—2.2% | | | | | |

Caterpillar, Inc. | | 97,900 | | 9,247,634 | |

Cummins, Inc. | | 32,030 | | 3,184,743 | |

Deere & Co. | | 100,400 | | 7,620,360 | |

WABCO Holdings, Inc. * | | 161,100 | | 8,088,831 | |

| | | | 28,141,568 | |

DATA PROCESSING & OUTSOURCED SERVICES—1.3% | | | | | |

Mastercard, Inc.+ | | 45,165 | | 15,683,095 | |

| | | | | |

DIVERSIFIED BANKS—0.9% | | | | | |

Wells Fargo & Co. | | 409,400 | | 10,607,553 | |

| | | | | |

DIVERSIFIED METALS & MINING—0.7% | | | | | |

Freeport-McMoRan Copper & Gold, Inc. | | 99,000 | | 3,985,740 | |

Molycorp, Inc. * | | 127,400 | | 4,875,598 | |

| | | | 8,861,338 | |

DRUG RETAIL—1.4% | | | | | |

CVS Caremark Corp. | | 478,100 | | 17,355,030 | |

| | | | | |

EDUCATION SERVICES—0.5% | | | | | |

New Oriental Education & Technology Group#* | | 205,300 | | 6,085,092 | |

| | | | | |

ENVIRONMENTAL & FACILITIES SERVICES—0.5% | | | | | |

Republic Services, Inc. | | 201,500 | | 5,734,690 | |

| | | | | |

FERTILIZERS & AGRICULTURAL CHEMICALS—1.0% | | | | | |

Monsanto Co. | | 86,200 | | 6,271,050 | |

Mosaic Co., /The | | 110,193 | | 6,452,902 | |

| | | | 12,723,952 | |

FOOTWEAR—1.2% | | | | | |

Deckers Outdoor Corp. * | | 17,600 | | 2,028,224 | |

NIKE, Inc., Cl. B | | 72,500 | | 6,985,375 | |

| | | | | | |

22

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

FOOTWEAR—(CONT.) | | | | | |

Salvatore Ferragamo Italia SpA * | | 387,730 | | $ | 6,282,211 | |

| | | | 15,295,810 | |

GENERAL MERCHANDISE STORES—1.4% | | | | | |

Dollar General Corp. * | | 135,800 | | 5,385,828 | |

Target Corp. | | 227,700 | | 12,466,575 | |

| | | | 17,852,403 | |

HEALTH CARE EQUIPMENT—1.4% | | | | | |

Covidien PLC + | | 330,312 | | 15,537,877 | |

Insulet Corp. * | | 109,101 | | 1,780,528 | |

| | | | 17,318,405 | |

HEALTH CARE FACILITIES—0.6% | | | | | |

Universal Health Services, Inc., Cl. B | | 191,580 | | 7,657,453 | |

| | | | | |

HEALTH CARE SERVICES—1.3% | | | | | |

Express Scripts, Inc.* | | 356,000 | | 16,279,880 | |

| | | | | |

HOME IMPROVEMENT RETAIL—1.5% | | | | | |

Lowe’s Companies, Inc. | | 870,272 | | 18,293,117 | |

| | | | | |

HOMEBUILDING—0.7% | | | | | |

Lennar Corp., Cl. A | | 113,500 | | 1,877,290 | |

Toll Brothers, Inc. * | | 374,600 | | 6,533,024 | |

| | | | 8,410,314 | |

HOUSEHOLD PRODUCTS—2.1% | | | | | |

Procter & Gamble Co., /The | | 400,500 | | 25,627,995 | |

| | | | | |

HUMAN RESOURCE & EMPLOYMENT SERVICES—0.2% | | | | | |

Towers Watson & Co. | | 32,500 | | 2,135,250 | |

| | | | | |

INDUSTRIAL CONGLOMERATES—0.9% | | | | | |

Tyco International Ltd. | | 257,221 | | 11,716,417 | |

| | | | | |

INDUSTRIAL MACHINERY—2.8% | | | | | |

Eaton Corp. | | 111,000 | | 4,975,020 | |

Ingersoll-Rand PLC | | 125,400 | | 3,903,702 | |

Stanley Black & Decker, Inc. | | 337,560 | | 21,553,206 | |

Timken Co. | | 119,200 | | 5,020,704 | |

| | | | 35,452,632 | |

INTEGRATED OIL & GAS—4.0% | | | | | |

ConocoPhillips | | 376,500 | | 26,223,225 | |

Royal Dutch Shell PLC # | | 330,100 | | 23,407,391 | |

| | | | 49,630,616 | |

INTERNET RETAIL—1.8% | | | | | |

Amazon.com, Inc. * | | 99,200 | | 21,180,192 | |

NetFlix, Inc. * | | 10,300 | | 845,424 | |

| | | | 22,025,616 | |

INTERNET SOFTWARE & SERVICES—6.4% | | | | | |

Cornerstone OnDemand, Inc. * | | 123,800 | | 1,783,958 | |

eBay, Inc. * | | 492,500 | | 15,676,275 | |

Google, Inc., Cl. A * | | 44,455 | | 26,345,812 | |

IAC/InterActiveCorp. *+ | | 313,546 | | 12,802,083 | |

| | | | | | |

23

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

INTERNET SOFTWARE & SERVICES—(CONT.) | | | | | |

VistaPrint NV * | | 526,245 | | $ | 18,376,475 | |

Yahoo! Inc. * | | 307,100 | | 4,803,044 | |

| | | | 79,787,647 | |

IT CONSULTING & OTHER SERVICES—3.0% | | | | | |

Cognizant Technology Solutions Corp., Cl. A * | | 75,700 | | 5,507,175 | |

Gartner, Inc. * | | 68,600 | | 2,642,472 | |

International Business Machines Corp. + | | 158,613 | | 29,284,718 | |

| | | | 37,434,365 | |

LEISURE FACILITIES—0.3% | | | | | |

Six Flags Entertainment Corp. | | 86,696 | | 3,112,386 | |

| | | | | |

LIFE SCIENCES TOOLS & SERVICES—0.9% | | | | | |

Life Technologies Corp. * | | 29,500 | | 1,199,765 | |

Thermo Fisher Scientific, Inc. * | | 208,812 | | 10,496,979 | |

| | | | 11,696,744 | |

MANAGED HEALTH CARE—3.2% | | | | | |

Aetna, Inc. | | 657,100 | | 26,126,295 | |

CIGNA Corp. | | 148,200 | | 6,571,188 | |

UnitedHealth Group, Inc. | | 157,000 | | 7,534,430 | |

| | | | 40,231,913 | |

MORTGAGE REITS—0.6% | | | | | |

Annaly Capital Management, Inc. | | 441,800 | | 7,444,330 | |

| | | | | |

MOVIES & ENTERTAINMENT—0.7% | | | | | |

Liberty Media Corp., Capital, Cl. A* | | 106,597 | | 8,188,782 | |

| | | | | |

OIL & GAS EQUIPMENT & SERVICES—3.9% | | | | | |

Baker Hughes, Inc. | | 508,100 | | 29,464,719 | |

Halliburton Company | | 345,100 | | 12,892,936 | |

National Oilwell Varco, Inc. | | 87,700 | | 6,255,641 | |

| | | | 48,613,296 | |

OIL & GAS EXPLORATION & PRODUCTION—1.4% | | | | | |

Chesapeake Energy Corp. | | 194,000 | | 5,455,280 | |

Kodiak Oil & Gas Corp. * | | 503,400 | | 3,478,494 | |

Pioneer Natural Resources Co. | | 62,400 | | 5,235,360 | |

Whitinig Petroleum Corp. * | | 59,000 | | 2,746,450 | |

| | | | 16,915,584 | |

OIL & GAS REFINING & MARKETING—0.5% | | | | | |

Marathon Petroleum Corp. | | 189,400 | | 6,799,460 | |

| | | | | |

OTHER DIVERSIFIED FINANCIAL SERVICES—0.5% | | | | | |

JPMorgan Chase & Co.+ | | 179,143 | | 6,227,011 | |

| | | | | |

PACKAGED FOODS & MEATS—0.7% | | | | | |

Unilever NV | | 249,800 | | 8,625,594 | |

| | | | | |

PAPER PRODUCTS—0.5% | | | | | |

International Paper Co. | | 225,700 | | 6,251,890 | |

| | | | | |

PHARMACEUTICALS—2.9% | | | | | |

Allergan, Inc. | | 13,600 | | 1,144,032 | |

Auxilium Pharmaceuticals, Inc. * | | 31,800 | | 494,808 | |

| | | | | | |

24

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

PHARMACEUTICALS—(CONT.) | | | | | |

Bristol-Myers Squibb Co. | | 200,400 | | $ | 6,330,636 | |

Johnson & Johnson | | 197,600 | | 12,723,464 | |

Pfizer, Inc. + | | 690,599 | | 13,300,937 | |

Teva Pharmaceutical Industries Ltd. # | | 41,800 | | 1,707,530 | |

| | | | 35,701,407 | |

PRECIOUS METALS & MINERALS—0.4% | | | | | |

SPDR Gold Trust* | | 28,989 | | 4,851,019 | |

| | | | | |

RAILROADS—0.8% | | | | | |

CSX Corp. | | 432,200 | | 9,599,162 | |

| | | | | |

RESEARCH & CONSULTING SERVICES—0.6% | | | | | |

IHS, Inc., Cl. A * | | 27,097 | | 2,275,877 | |

Verisk Analytic, Inc., Cl. A * | | 129,600 | | 4,555,440 | |

| | | | 6,831,317 | |

RESIDENTIAL REITS—0.6% | | | | | |

American Campus Communities, Inc. | | 14,300 | | 556,699 | |

Home Properties, Inc. | | 114,400 | | 6,738,160 | |

| | | | 7,294,859 | |

RESTAURANTS—1.4% | | | | | |

McDonald’s Corp. | | 147,661 | | 13,710,324 | |

Starbucks Corp. | | 74,800 | | 3,167,032 | |

| | | | 16,877,356 | |

SEMICONDUCTOR EQUIPMENT—0.1% | | | | | |

Lam Research Corp.* | | 23,460 | | 1,008,545 | |

| | | | | |

SEMICONDUCTORS—3.1% | | | | | |

Avago Technologies Ltd. | | 276,000 | | 9,320,520 | |

Broadcom Corp., Cl. A * | | 112,700 | | 4,067,343 | |

Inphi Corp. * | | 239,900 | | 2,648,496 | |

ON Semiconductor Corp. * | | 466,693 | | 3,532,866 | |

Skyworks Solutions, Inc. *+ | | 294,566 | | 5,835,352 | |

Taiwan Semiconductor Manufacturing Co., Ltd. # | | 518,900 | | 6,548,518 | |

Texas Instruments, Inc. | | 138,400 | | 4,253,032 | |

Xilinx, Inc. | | 76,600 | | 2,563,036 | |

| | | | 38,769,163 | |

SOFT DRINKS—2.7% | | | | | |

Coca-Cola Co., /The | | 233,900 | | 15,980,048 | |

Hansen Natural Corp. * | | 13,300 | | 1,184,897 | |

PepsiCo, Inc. + | | 286,615 | | 18,042,414 | |

| | | | 35,207,359 | |

SPECIALIZED FINANCE—0.1% | | | | | |

CME Group, Inc. | | 4,600 | | 1,267,576 | |

| | | | | |

SPECIALTY CHEMICALS—1.9% | | | | | |

Celanese Corp. | | 138,570 | | 6,034,724 | |

Cytec Industries, Inc. | | 230,100 | | 10,278,567 | |

Rockwood Holdings, Inc. * | | 146,500 | | 6,744,860 | |

| | | | 23,058,151 | |

| | | | | | |

25

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

STEEL—0.1% | | | | | |

Allegheny Technologies, Inc. | | 38,600 | | $ | 1,791,040 | |

| | | | | |

SYSTEMS SOFTWARE—1.7% | | | | | |

Oracle Corp.+ | | 625,245 | | 20,489,279 | |

| | | | | |

TOBACCO—1.9% | | | | | |

Philip Morris International, Inc.+ | | 330,294 | | 23,077,642 | |

| | | | | |

TRADING COMPANIES & DISTRIBUTORS—0.9% | | | | | |

United Rentals, Inc. * | | 313,700 | | 7,343,717 | |

WESCO International, Inc. * | | 73,200 | | 3,547,272 | |

| | | | 10,890,989 | |

TRUCKING—0.3% | | | | | |

Hertz Global Holdings, Inc.* | | 317,042 | | 3,677,687 | |

| | | | | |

WIRELESS TELECOMMUNICATION SERVICES—1.8% | | | | | |

American Tower Corp., Cl. A * | | 208,100 | | 11,466,310 | |

Vodafone Group PLC # | | 392,500 | | 10,927,200 | |

| | | | 22,393,510 | |

TOTAL COMMON STOCKS

(Cost $1,172,657,686) | | | | 1,224,566,942 | |

| | | | | |

CONVERTIBLE PREFERRED STOCK—0.2% | | | | | |

PHARMACEUTICALS—0.2% | | | | | |

Merrimack Pharmaceuticals, Inc., Series G*,(L3),(a)

(Cost $2,843,610) | | 406,230 | | 2,843,610 | |

| | | | | |

PREFERRED STOCKS—0.4% | | | | | |

OTHER DIVERSIFIED FINANCIAL SERVICES—0.4% | | | | | |

JPMorgan Chase & Co., 8.63%, 09/1/13*

(Cost $5,391,283) | | 194,990 | | 5,327,127 | |

| | | | | | |

| | PRINCIPAL

AMOUNT | | | |

CONVERTIBLE CORPORATE BONDS—0.3% | | | | | |

CABLE & SATELLITE—0.2% | | | | | |

XM Satellite Radio, Inc., 7.00%, 12/1/14(L2)(b) | | 1,500,000 | | 1,905,000 | |

| | | | | |

HOMEBUILDING—0.1% | | | | | |

Lennar Corp., 2.75%, 12/15/20(L2)(b) | | 1,989,000 | | 2,051,156 | |

| | | | | |

TOTAL CONVERTIBLE CORPORATE BONDS

(Cost $3,558,599) | | | | 3,956,156 | |

| | | | | |

Total Investments

(Cost $1,184,451,178)(c) | | 99.4 | % | 1,236,693,835 | |

Other Assets in Excess of Liabilities | | 0.6 | | 4,300,824 | |

| | | | | |

NET ASSETS | | 100.0 | % | $ | 1,240,994,659 | |

| | | | | | |

‡ | Securities classified as Level 1 for ASC 820 disclosure purposes based on valuation inputs unless otherwise noted. |

26

+ | All or a portion of this security is held as collateral for securities sold short. |

* | Non-income producing security. |

# | American Depository Receipts. |

(a) | Restricted Security - Investment in security not registered under the Securities Act of 1933. The investment is deemed to be illiquid and may be sold only to qualified institutional buyers. Security was acquired on April 6, 2011 for a cost of $2,843,610 and represents 0.2% of the net assets of the Fund. |

(b) | Pursuant to Securities and Exchange Commission Rule 144A, these securities may be sold prior to their maturity only to qualified institutional buyers. These securities are deemed to be liquid and represent 0.3% of the net assets of the Fund. |

(c) | At October 31, 2011, the net unrealized appreciation on investments, based on cost for federal income tax purposes of $1,216,087,197, amounted to $20,606,638 which consisted of aggregate gross unrealized appreciation of $82,817,684 and aggregate gross unrealized depreciation of $62,211,046. |

(L2) | Security classified as Level 2 for ASC 820 disclosure purposes based on valuation inputs. |

(L3) | Security classified as Level 3 for ASC 820 disclosure purposes based on valuation inputs. |

Industry classifications are unaudited.

See Notes to Financial Statements.

27

THE ALGER FUNDS II | ALGER SPECTRA FUND

Schedule of Investments (Continued) - Securities Sold Short‡ October 31, 2011

| | SHARES | | VALUE | |

COMMON STOCKS—(3.1)% | | | | | |

APPLICATION SOFTWARE—(0.2)% | | | | | |

AutoNavi Holdings Ltd.# | | 78,400 | | $ | 1,009,008 | |

Citrix Systems, Inc. | | 19,000 | | 1,383,770 | |

| | | | 2,392,778 | |

AUTOMOBILE MANUFACTURERS—(0.1)% | | | | | |

Brilliance China Automotive Holdings Ltd. | | 573,936 | | 618,910 | |

| | | | | |

CONSTRUCTION & FARM MACHINERY & HEAVY TRUCKS—(0.1)% | | | | | |

Weichai Power Co., Ltd. | | 257,700 | | 1,293,448 | |

| | | | | |

DEPARTMENT STORES—(0.2)% | | | | | |

Kohl’s Corp. | | 11,500 | | 609,615 | |

JC Penney Co., Inc. | | 43,200 | | 1,385,856 | |

| | | | 1,995,471 | |

DIVERSIFIED SUPPORT SERVICES—(0.4)% | | | | | |

KAR Auction Services, Inc. | | 389,700 | | 5,358,375 | |

| | | | | |

FOOD RETAIL—(1.0)% | | | | | |

Whole Foods Market, Inc. | | 175,900 | | 12,685,908 | |

| | | | | |

HEALTH CARE SERVICES—(0.1)% | | | | | |

Quest Diagnostics, Inc. | | 10,900 | | 608,220 | |

| | | | | |

HYPERMARKETS & SUPER CENTERS—(0.1)% | | | | | |

Costco Wholesale Corp. | | 14,800 | | 1,232,100 | |

| | | | | |

INTERNET SOFTWARE & SERVICES—0.0% | | | | | |

Monster Worldwide, Inc. | | 40,100 | | 370,123 | |

| | | | | |

IT CONSULTING & OTHER SERVICES—0.0% | | | | | |

SAIC, Inc. | | 44,200 | | 549,406 | |

| | | | | |

OIL & GAS EQUIPMENT & SERVICES—0.0% | | | | | |

CARBO Ceramics, Inc. | | 3,200 | | 434,720 | |

| | | | | |

OIL & GAS EXPLORATION & PRODUCTION—(0.4)% | | | | | |

Continental Resources, Inc. | | 40,400 | | 2,450,260 | |

QEP Resources, Inc. | | 71,700 | | 2,548,935 | |

| | | | 4,999,195 | |

SPECIALIZED REITS—(0.3)% | | | | | |

Host Hotels & Resorts, Inc. | | 118,300 | | 1,688,141 | |

LaSalle Hotel Properties | | 84,900 | | 2,029,959 | |

| | | | 3,718,100 | |

TRUCKING—(0.2)% | | | | | |

Landstar System, Inc. | | 58,400 | | 2,606,392 | |

| | | | | |

TOTAL (proceeds $38,750,084) | | | | $ | 38,863,146 | |

‡ | Securities classified as Level 1 for ASC 820 disclosure purposes based on valuation inputs unless otherwise noted. |

| |

# | American Depository Receipts. |

Industry classifications are unaudited.

See Notes to Financial Statements.

28

THE ALGER FUNDS II | ALGER GREEN FUND

Schedule of Investments‡ October 31, 2011

| | SHARES | | VALUE | |

COMMON STOCKS—96.4% | | | | | |

AEROSPACE & DEFENSE—0.7% | | | | | |

General Dynamics Corp. | | 5,030 | | $ | 322,876 | |

| | | | | |

AIR FREIGHT & LOGISTICS—2.8% | | | | | |

FedEx Corp. | | 8,040 | | 657,913 | |

United Parcel Service, Inc., Cl. B | | 10,510 | | 738,223 | |

| | | | 1,396,136 | |

APPLICATION SOFTWARE—1.0% | | | | | |

Adobe Systems, Inc.* | | 17,145 | | 504,234 | |

| | | | | |

AUTO PARTS & EQUIPMENT—1.3% | | | | | |

Johnson Controls, Inc. | | 18,900 | | 622,377 | |

| | | | | |

AUTOMOBILE MANUFACTURERS—1.0% | | | | | |

Tesla Motors, Inc.* | | 16,050 | | 471,389 | |

| | | | | |

BROADCASTING—1.5% | | | | | |

Discovery Communications, Inc., Series A* | | 16,965 | | 737,299 | |

| | | | | |

CHEMICALS—0.6% | | | | | |

Metabolix, Inc.* | | 59,770 | | 306,620 | |

| | | | | |

COAL & CONSUMABLE FUELS—0.3% | | | | | |

Solazyme, Inc.* | | 12,305 | | 125,142 | |

| | | | | |

COMMUNICATIONS EQUIPMENT—1.4% | | | | | |

Cisco Systems, Inc. | | 36,280 | | 672,268 | |

| | | | | |

COMPUTER HARDWARE—5.5% | | | | | |

Apple, Inc.* | | 6,795 | | 2,750,481 | |

| | | | | |

COMPUTER STORAGE & PERIPHERALS—1.6% | | | | | |

EMC Corp.* | | 32,465 | | 795,717 | |

| | | | | |

CONSTRUCTION & ENGINEERING—0.7% | | | | | |

Aecom Technology Corp.* | | 17,030 | | 356,268 | |

| | | | | |

CONSTRUCTION & FARM MACHINERY & HEAVY TRUCKS—2.4% | | | | | |

Cummins, Inc. | | 4,985 | | 495,659 | |

Westport Innovations, Inc. * | | 22,390 | | 677,297 | |

| | | | 1,172,956 | |

CONSUMER ELECTRONICS—0.5% | | | | | |

Skullcandy, Inc.* | | 15,700 | | 247,275 | |

| | | | | |

DATA PROCESSING & OUTSOURCED SERVICES—1.8% | | | | | |

Visa, Inc., Cl. A | | 9,290 | | 866,385 | |

| | | | | |

DISTRIBUTORS—1.0% | | | | | |

LKQ Corp.* | | 17,110 | | 499,270 | |

| | | | | |

DIVERSIFIED CHEMICALS—0.8% | | | | | |

Solutia, Inc.* | | 24,445 | | 397,231 | |

| | | | | |

DIVERSIFIED SUPPORT SERVICES—0.4% | | | | | |

EnerNOC, Inc.* | | 24,535 | | 217,625 | |

| | | | | |

ELECTRIC UTILITIES—3.4% | | | | | |

Duke Energy Corp. | | 38,085 | | 777,696 | |

ITC Holdings Corp. | | 11,980 | | 870,706 | |

| | | | 1,648,402 | |

| | | | | | |

29

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

ELECTRICAL COMPONENTS & EQUIPMENT—1.4% | | | | | |

Woodward Governor Co. | | 20,090 | | $ | 680,649 | |

| | | | | |

ELECTRONIC EQUIPMENT & INSTRUMENTS—0.8% | | | | | |

Itron, Inc.* | | 11,000 | | 404,690 | |

| | | | | |

ELECTRONIC MANUFACTURING SERVICES—1.8% | | | | | |

Trimble Navigation Ltd.* | | 21,300 | | 860,733 | |

| | | | | |

ENVIRONMENTAL & FACILITIES SERVICES—5.6% | | | | | |

Clean Harbors, Inc. * | | 17,415 | | 1,014,771 | |

Covanta Holding Corp. | | 37,680 | | 552,389 | |

Tetra Tech, Inc. * | | 29,295 | | 639,510 | |

Waste Management, Inc. | | 16,780 | | 552,565 | |

| | | | 2,759,235 | |

FOOTWEAR—2.2% | | | | | |

Deckers Outdoor Corp. * | | 5,120 | | 590,029 | |

NIKE, Inc., Cl. B | | 5,215 | | 502,465 | |

| | | | 1,092,494 | |

GENERAL MERCHANDISE STORES—1.8% | | | | | |

Target Corp. | | 16,375 | | 896,531 | |

| | | | | |

HEALTH CARE SERVICES—1.1% | | | | | |

Express Scripts, Inc.* | | 11,735 | | 536,642 | |

| | | | | |

HOME IMPROVEMENT RETAIL—0.7% | | | | | |

Lowe’s Companies, Inc. | | 16,280 | | 342,206 | |

| | | | | |

HOUSEHOLD APPLIANCES—0.3% | | | | | |

SodaStream International Ltd.* | | 3,665 | | 124,903 | |

| | | | | |

HOUSEHOLD PRODUCTS—1.8% | | | | | |

Procter & Gamble Co., /The | | 14,149 | | 905,395 | |

| | | | | |

HYPERMARKETS & SUPER CENTERS—2.6% | | | | | |

Wal-Mart Stores, Inc. | | 22,735 | | 1,289,529 | |

| | | | | |

INDUSTRIAL GASES—0.6% | | | | | |

Praxair, Inc. | | 3,050 | | 310,094 | |

| | | | | |

INTEGRATED OIL & GAS—1.5% | | | | | |

Chevron Corp. | | 7,095 | | 745,330 | |

| | | | | |

INTERNET RETAIL—3.0% | | | | | |

Amazon.com, Inc. * | | 5,180 | | 1,105,981 | |

Expedia, Inc. | | 13,795 | | 362,257 | |

| | | | 1,468,238 | |

INTERNET SOFTWARE & SERVICES—5.3% | | | | | |

eBay, Inc. * | | 23,260 | | 740,366 | |

Google, Inc., Cl. A * | | 2,415 | | 1,431,226 | |

Yahoo! Inc. * | | 28,795 | | 450,354 | |

| | | | 2,621,946 | |

INVESTMENT BANKING & BROKERAGE—1.0% | | | | | |

Goldman Sachs Group, Inc., /The | | 4,650 | | 509,408 | |

| | | | | |

IT CONSULTING & OTHER SERVICES—2.2% | | | | | |

International Business Machines Corp. | | 5,795 | | 1,069,931 | |

| | | | | | |

30

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

LIFE SCIENCES TOOLS & SERVICES—0.4% | | | | | |

Life Technologies Corp.* | | 4,985 | | $ | 202,740 | |

| | | | | |

MANAGED HEALTH CARE—1.0% | | | | | |

WellPoint, Inc. | | 7,140 | | 491,946 | |

| | | | | |

METAL & GLASS CONTAINERS—2.4% | | | | | |

Ball Corp. | | 19,430 | | 671,695 | |

Crown Holdings, Inc. * | | 14,355 | | 485,055 | |

| | | | 1,156,750 | |

MOVIES & ENTERTAINMENT—1.0% | | | | | |

Walt Disney Co., /The | | 14,710 | | 513,085 | |

| | | | | |

OIL & GAS REFINING & MARKETING—0.4% | | | | | |

Gevo, Inc.* | | 26,175 | | 194,480 | |

| | | | | |

PACKAGED FOODS & MEATS—1.5% | | | | | |

General Mills, Inc. | | 18,610 | | 717,043 | |

| | | | | |

PHARMACEUTICALS—5.5% | | | | | |

Abbott Laboratories | | 11,275 | | 607,384 | |

Johnson & Johnson | | 15,690 | | 1,010,279 | |

Merck & Co., Inc. | | 7,775 | | 268,238 | |

Pfizer, Inc. | | 41,647 | | 802,121 | |

| | | | 2,688,022 | |

RAILROADS—1.2% | | | | | |

Norfolk Southern Corp. | | 7,640 | | 565,284 | |

| | | | | |

RESTAURANTS—4.9% | | | | | |

Chipotle Mexican Grill, Inc. * | | 1,430 | | 480,652 | |

McDonald’s Corp. | | 10,770 | | 999,994 | |

Starbucks Corp. | | 21,640 | | 916,237 | |

| | | | 2,396,883 | |

SEMICONDUCTORS—4.5% | | | | | |

Broadcom Corp., Cl. A * | | 13,575 | | 489,922 | |

Cree, Inc. * | | 12,625 | | 336,330 | |

First Solar, Inc. * | | 2,550 | | 126,914 | |

Intel Corp. | | 40,690 | | 998,532 | |

Trina Solar Ltd. #* | | 32,235 | | 260,136 | |

| | | | 2,211,834 | |

SOFT DRINKS—2.9% | | | | | |

Coca-Cola Co., /The | | 20,445 | | 1,396,802 | |

| | | | | |

SPECIALTY CHEMICALS—2.2% | | | | | |

Celanese Corp. | | 11,860 | | 516,503 | |

Rockwood Holdings, Inc. * | | 12,295 | | 566,062 | |

| | | | 1,082,565 | |

SPECIALTY STORES—0.6% | | | | | |

Teavana Holdings, Inc.* | | 12,860 | | 293,980 | |

| | | | | |

SYSTEMS SOFTWARE—4.6% | | | | | |

Microsoft Corp. | | 42,495 | | 1,131,642 | |

Oracle Corp. | | 33,985 | | 1,113,688 | |

| | | | 2,245,330 | |

| | | | | | |

31

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

TRUCKING—0.9% | | | | | |

Hertz Global Holdings, Inc. * | | 22,145 | | $ | 256,882 | |

Zipcar, Inc. * | | 9,255 | | 189,265 | |

| | | | 446,147 | |

TOTAL COMMON STOCKS

(Cost $41,530,886) | | | | 47,330,796 | |

| | | | | |

| | PRINCIPAL

AMOUNT | | | |

CONVERTIBLE CORPORATE BONDS—0.2% | | | | | |

ENVIRONMENTAL & FACILITIES SERVICES—0.2% | | | | | |

Covanta Holding Corp., 3.25%, 6/1/14(L2)(a)

(Cost $110,000) | | 110,000 | | 121,275 | |

| | | | | |

Total Investments

(Cost $41,640,886)(b) | | 96.6 | % | 47,452,071 | |

Other Assets in Excess of Liabilities | | 3.4 | | 1,686,862 | |

| | | | | |

NET ASSETS | | 100.0 | % | $ | 49,138,933 | |

‡ | Securities classified as Level 1 for ASC 820 disclosure purposes based on valuation inputs unless otherwise noted. |

| |

* | Non-income producing security. |

# | American Depository Receipts. |

(a) | Pursuant to Securities and Exchange Commission Rule 144A, these securities may be sold prior to their maturity only to qualified institutional buyers. These securities are deemed to be liquid and represent 0.2% of the net assets of the Fund. |

(b) | At October 31, 2011, the net unrealized appreciation on investments, based on cost for federal income tax purposes of $41,722,865, amounted to $5,729,206 which consisted of aggregate gross unrealized appreciation of $9,256,514 and aggregate gross unrealized depreciation of $3,527,308. |

(L2) | Security classified as Level 2 for ASC 820 disclosure purposes based on valuation inputs. |

Industry classifications are unaudited.

See Notes to Financial Statements.

32

THE ALGER FUNDS II | ALGER ANALYST FUND

Schedule of Investments‡ October 31, 2011

| | SHARES | | VALUE | |

COMMON STOCKS—95.3% | | | | | |

ADVERTISING—0.7% | | | | | |

Focus Media Holding Ltd.#* | | 783 | | $ | 21,282 | |

| | | | | |

AEROSPACE & DEFENSE—2.9% | | | | | |

Esterline Technologies Corp. * | | 481 | | 26,888 | |

Precision Castparts Corp. | | 304 | | 49,597 | |

Spirit Aerosystems Holdings, Inc., Cl. A * | | 1,089 | | 18,589 | |

| | | | 95,074 | |

AIR FREIGHT & LOGISTICS—0.6% | | | | | |

United Parcel Service, Inc., Cl. B | | 280 | | 19,667 | |

| | | | | |

ALTERNATIVE CARRIERS—0.8% | | | | | |

Cogent Communications Group, Inc.* | | 1,601 | | 25,696 | |

| | | | | |

APPAREL ACCESSORIES & LUXURY GOODS—0.8% | | | | | |

Coach, Inc. | | 422 | | 27,460 | |

| | | | | |

APPAREL RETAIL—1.2% | | | | | |

Abercrombie & Fitch Co., Cl. A | | 502 | | 37,349 | |

| | | | | |

APPLICATION SOFTWARE—2.2% | | | | | |

Adobe Systems, Inc. * | | 389 | | 11,440 | |

Informatica Corp. * | | 510 | | 23,205 | |

Nice Systems Ltd. #* | | 162 | | 5,793 | |

Salesforce.com, Inc. * | | 164 | | 21,840 | |

Taleo Corp., Cl. A * | | 235 | | 7,614 | |

| | | | 69,892 | |

ASSET MANAGEMENT & CUSTODY BANKS—0.7% | | | | | |

KKR & Co., LP | | 1,615 | | 21,770 | |

| | | | | |

AUTO PARTS & EQUIPMENT—0.5% | | | | | |

Dana Holding Corp.* | | 1,047 | | 14,805 | |

| | | | | |

AUTOMOBILE MANUFACTURERS—1.1% | | | | | |

Honda Motor Co., Ltd.# | | 1,219 | | 36,448 | |

| | | | | |

BIOTECHNOLOGY—3.4% | | | | | |

Dendreon Corp. * | | 3,950 | | 43,212 | |

Pharmasset, Inc. * | | 359 | | 25,274 | |

United Therapeutics Corp. * | | 952 | | 41,631 | |

| | | | 110,117 | |

BROADCASTING—0.9% | | | | | |

Discovery Communications, Inc., Series C* | | 772 | | 30,548 | |

| | | | | |

CABLE & SATELLITE—1.5% | | | | | |

Comcast Corporation, Cl. A | | 1,342 | | 31,469 | |

Sirius XM Radio, Inc. * | | 10,383 | | 18,586 | |

| | | | 50,055 | |

CASINOS & GAMING—2.8% | | | | | |

Las Vegas Sands Corp. * | | 917 | | 43,053 | |

MGM Resorts International * | | 2,058 | | 23,708 | |

Wynn Resorts Ltd. | | 185 | | 24,568 | |

| | | | 91,329 | |

COMMUNICATIONS EQUIPMENT—1.1% | | | | | |

QUALCOMM, Inc. | | 687 | | 35,449 | |

| | | | | | |

33

| | SHARES | | VALUE | |

COMMON STOCKS—(CONT.) | | | | | |

COMPUTER HARDWARE—1.9% | | | | | |

Apple, Inc.* | | 151 | | $ | 61,122 | |

| | | | | |

CONSTRUCTION & ENGINEERING—0.9% | | | | | |

Fluor Corp. | | 513 | | 29,164 | |

| | | | | |

CONSTRUCTION & FARM MACHINERY & HEAVY TRUCKS—1.0% | | | | | |