Filed by Capital One Financial Corporation

(Commission File No.: 001-13300)

Pursuant to Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12 of the

Securities and Exchange Act of 1934, as amended

Subject Company: Discover Financial Services

(Commission File No.: 001-33378)

The following are copies of materials posted to the website www.capitalonediscover.com on April 26, 2024.

The following transcript is an excerpt from former SEC Chairman Jay Clayton's appearance on CNBC's "Squawk Box" on February 23, 2024.

Andrew Sorkin: Can we pivot, talking about regulation, to your thoughts on Discover Capital One? Whether you think a deal like that is going to be allowed in this environment?

Joseph Kernen: Well... Yeah, discover. Discover, not discovery.

Andrew Sorkin: I thought we were going to talk about discovery. We can talk about Warner Brothers discovery, which, by the way, I think the people confused the two.

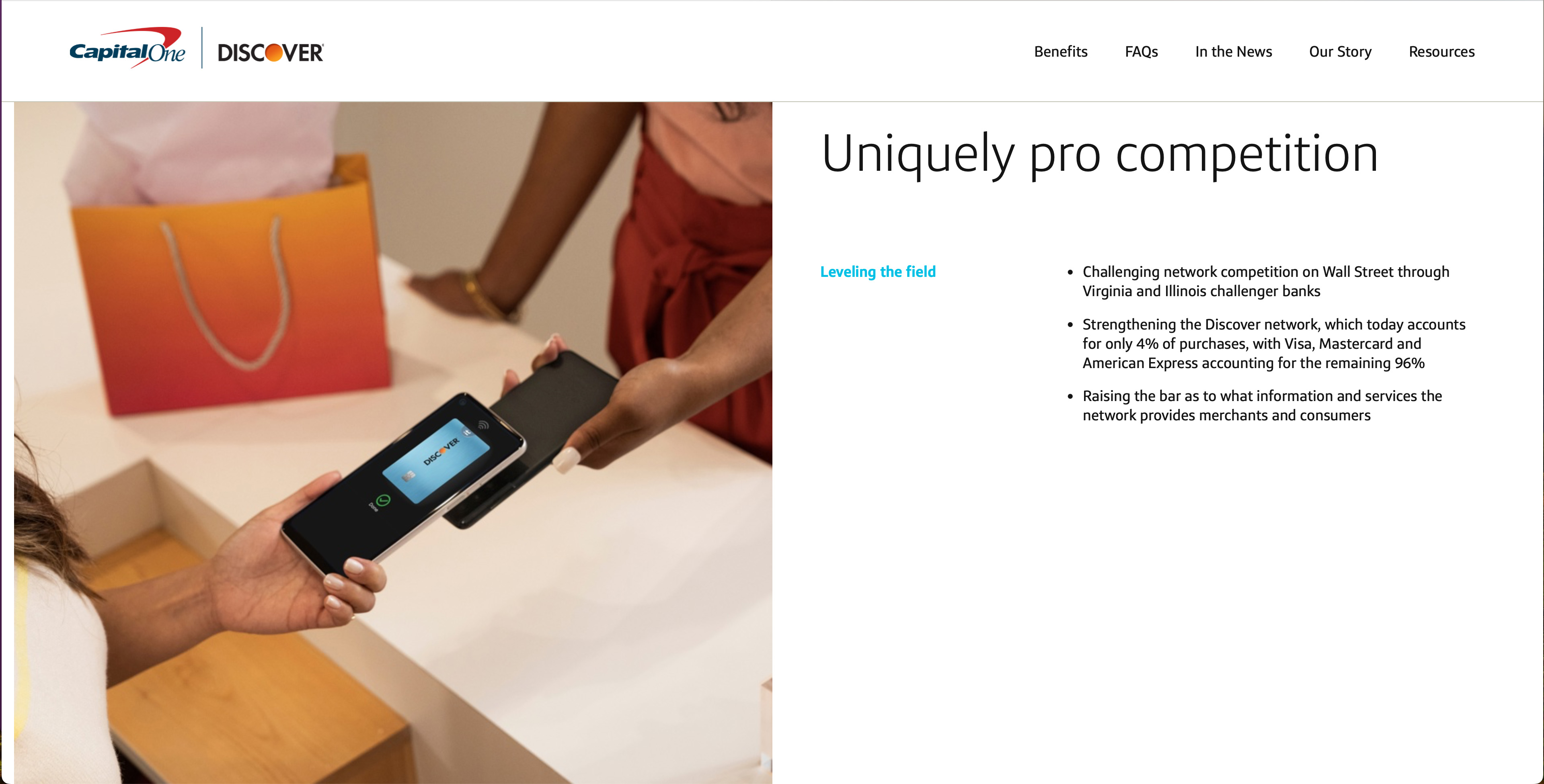

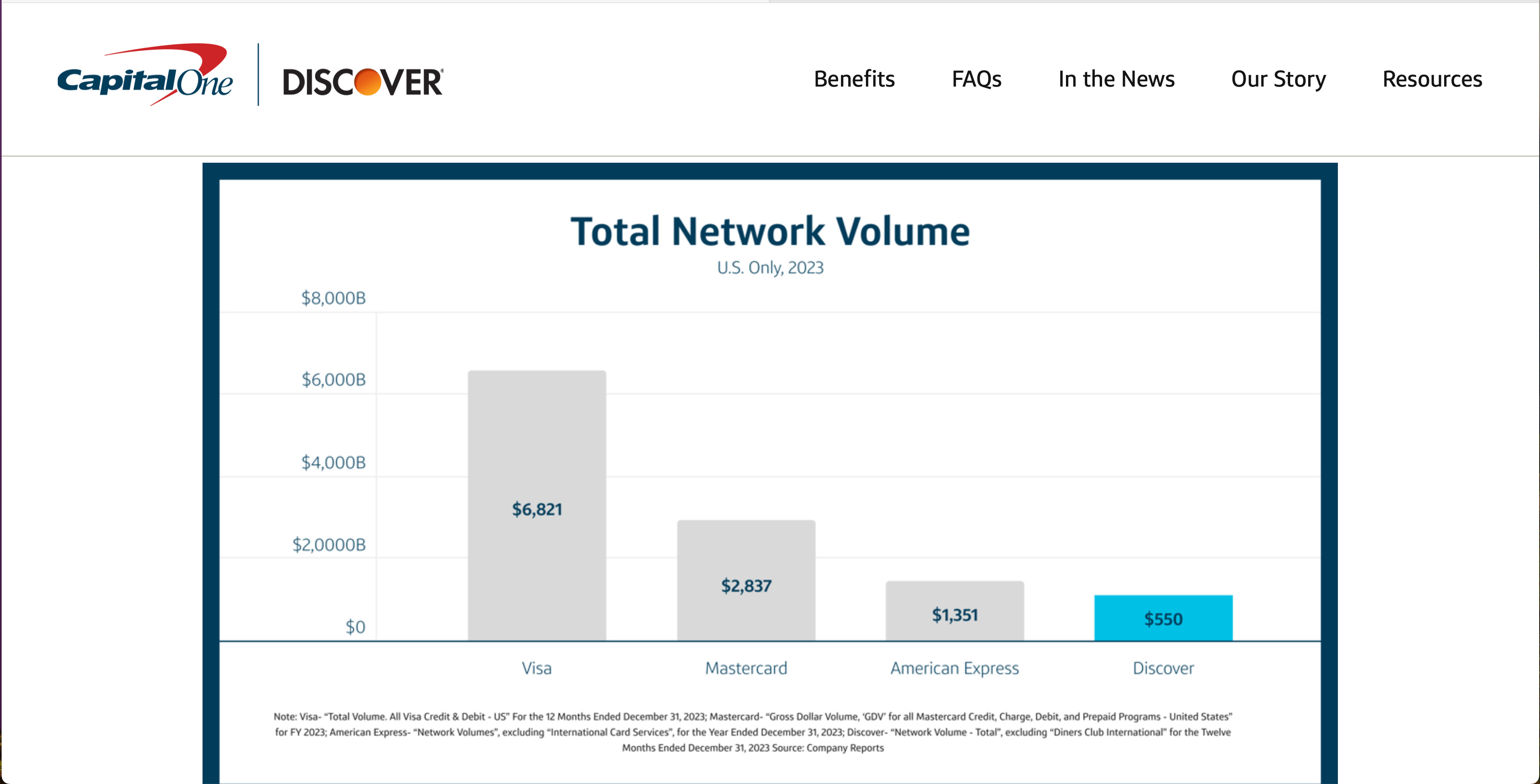

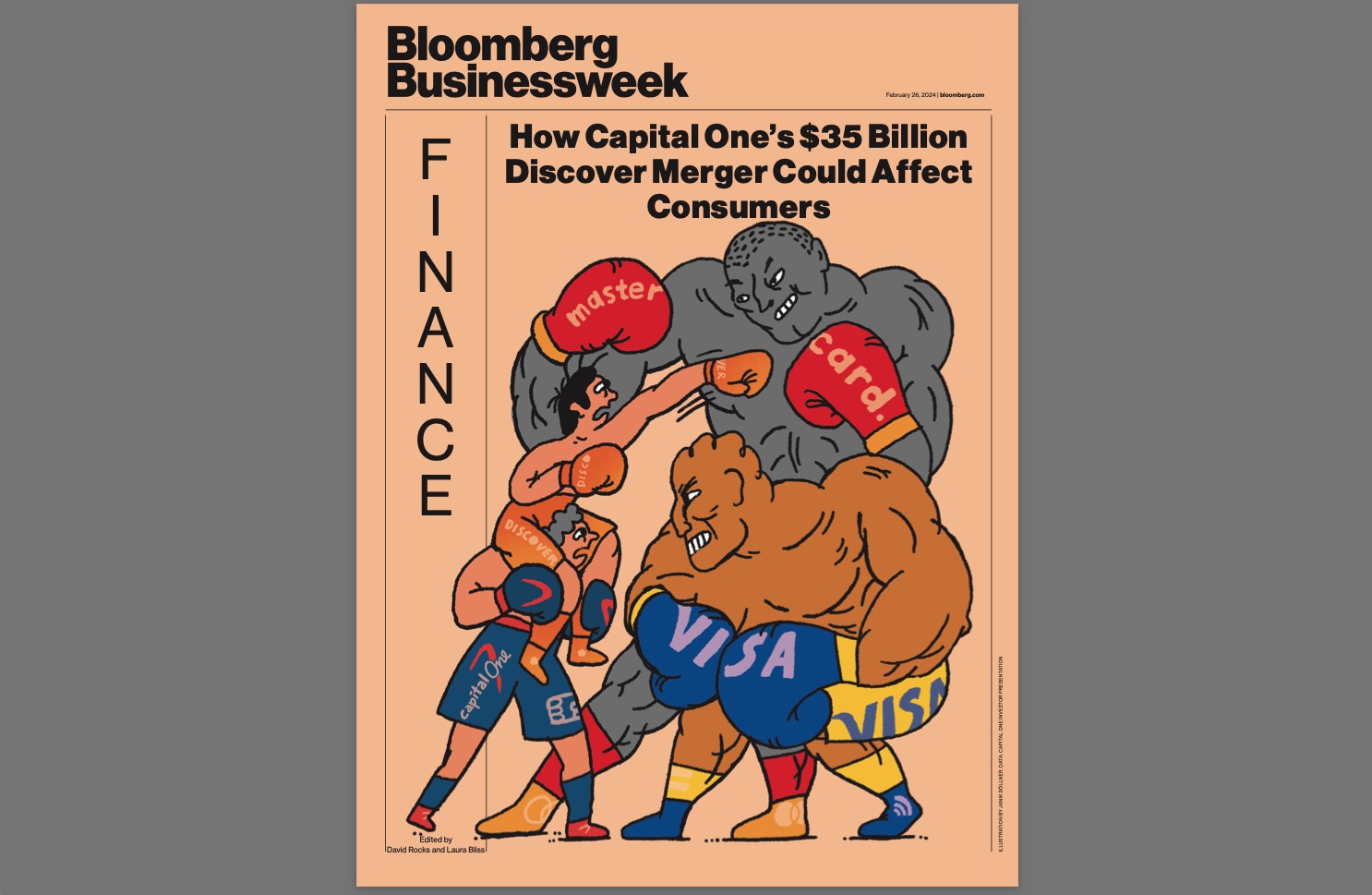

Jay Clayton: No, I should say Sullivan and Cromwell worked on the deal. I'm not working on the deal, but just let me say that up front. People have been waiting for competition between Visa and MasterCard for decades. It would shock me if you weren't allowed to add heft to a potential competitor to Visa and MasterCard. That's just looking at a market.

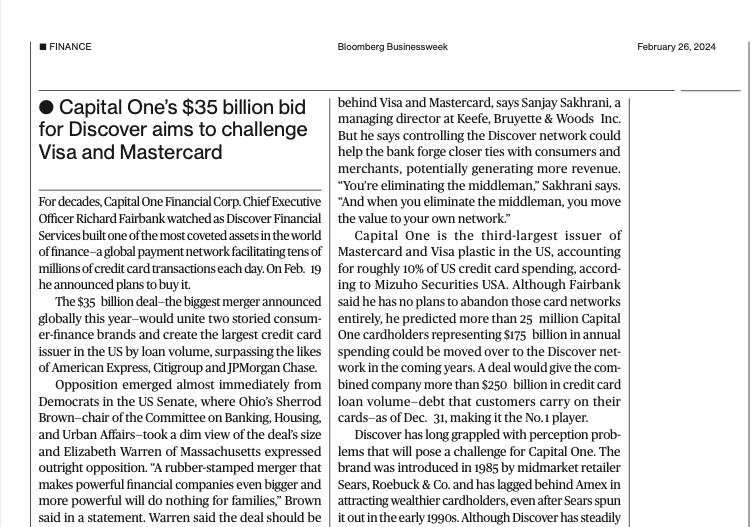

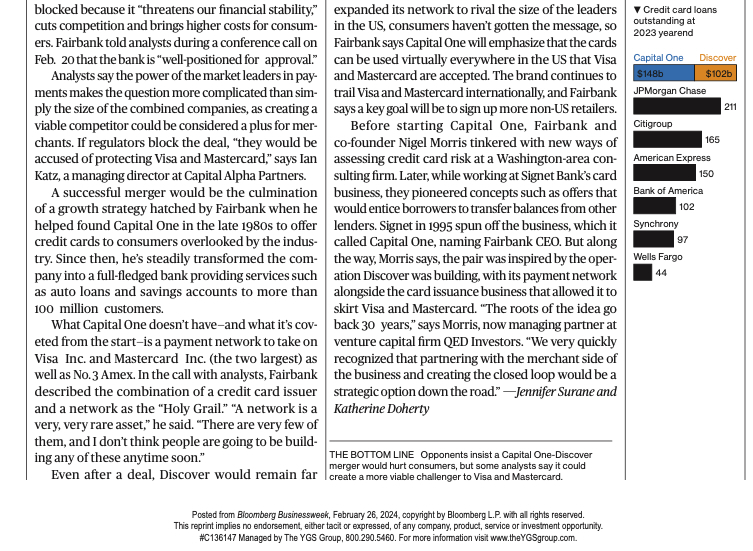

Andrew Sorkin: So I made that argument the day came out and said, this would be a good thing because people think that Visa and MasterCard are like a tax on the entire economy. And if you could have another competitor in there, that would be actually very valuable. But there's this other argument being made that in terms of banking, you don't want more consolidation and that making Capital One a stronger, a stronger, becomes a, first of all, becomes the number one credit card company in the country over JP Morgan and Citigroup, and whether you think that there's just too much consolidation and the Treasury would somehow try to either, Treasury prevent it or DOJ would prevent it.

Jay Clayton: Now, I'm not going to say that I watch every minute of this show all the time, but you had the Stellantis CEO on.

Andrew Sorkin: Yes.

Jay Clayton: And what was his thing on how many car companies there are going to be in the world?

Andrew Sorkin: Five. Five or six, yeah.

Jay Clayton: I would say that we're sort of still way overbanked.

Andrew Sorkin: We're way overbanked.

Jay Clayton: Right?

Andrew Sorkin: Yes. We're way overbanked.

Joseph Kernen: We're going to have to pretend to your employers that you're not watching us. What do you mean you don't want to pretend you don't watch? You know, you don't want to cop to that, that you watch the show.

Jay Clayton: You know, I try to diversify a little bit. Hold on.

Joseph Kernen: We’re not Fox.

Andrew Sorkin: When we made the argument, I remember after the Silicon Valley bank blow. Some of us made the argument that we were overbanked. And people thought that was sacrilegious to say that this country is overbanked. We still have, what, 4,000 banks in this country, which is cuckoo for Cocoa Puffs relative to every other country in the world.

Jay Clayton: There are two different issues, which is, you know, of course we're overbanked, but the regional bank, who is going to serve the small and medium-sized businesses in this country? That is a real issue. And are we going to have banks of the size that do that? But, you know, there's no doubt we're overbanked, and there's no doubt that the inability of banks to consolidate over the last four years has been a negative.

Forward Looking Statements

Information in this communication, other than statements of historical facts, may constitute forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements about the benefits of the proposed transaction between Capital One Financial Corporation (“Capital One”) and Discover Financial Services (“Discover”), including future financial and operating results (including the anticipated impact of the transaction on Capital One’s and Discover’s respective earnings and tangible book value), statements related to the expected timing of the completion of the transaction, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. Forward-looking statements may be identified by terminology such as “may,” “will,” “should,” “targets,” “scheduled,” “plans,” “intends,” “goal,” “anticipates,” “expects,” “believes,” “forecasts,” “outlook,” “estimates,” “potential,” or “continue” or negatives of such terms or other comparable terminology.

All forward-looking statements are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of Capital One or Discover to differ materially from any results expressed or implied by such forward-looking statements. Such factors include, among others, (1) the risk that the cost savings and any revenue synergies and other anticipated benefits from the transaction may not be fully realized or may take longer than anticipated to be realized, the risk that revenues following the transaction may be lower than expected and/or the risk that certain expenses, such as the provision for credit losses, of Discover, or Capital One following the transaction, may be greater than expected, (2) disruption to the parties’ businesses as a result of the announcement and pendency of the transaction, (3) the risk that the integration of Discover’s business and operations into Capital One, including the integration into Capital One’s compliance management program, will be materially delayed or will be more costly or difficult than expected, or that Capital One is otherwise unable to successfully integrate Discover’s businesses into its own, including as a result of unexpected factors or events, (4) the failure to obtain the necessary approvals by the stockholders of Capital One or Discover, (5) the ability by each of Capital One and Discover to obtain required governmental approvals of the transaction on the timeline expected, or at all, and the risk that such approvals may result in the imposition of conditions that could adversely affect Capital One after the closing of the transaction or adversely affect the expected benefits of the transaction, (6) reputational risk and the reaction of each company’s customers, suppliers, employees or other business partners to the transaction, (7) the failure of the closing conditions in the merger agreement to be satisfied, or any unexpected delay in closing the transaction or the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, (8) the dilution caused by the issuance of additional shares of Capital One’s common stock in the transaction, (9) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (10) risks related to management and oversight of the expanded business and operations of Capital One following the transaction due to the increased size and complexity of its business, (11) the possibility of increased scrutiny by, and/or additional regulatory requirements of, governmental authorities as a result of the transaction or the size, scope and complexity of Capital One’s business operations following the transaction, (12) the outcome of any legal or regulatory proceedings that may be currently pending or later instituted against Capital One before or after the transaction, or against Discover, and (13) general competitive, economic, political and market conditions and other factors that may affect future results of Capital One and Discover, including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Additional factors which could affect future results of Capital One and Discover can be found in Capital One’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, and Discover’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, in each case filed with the SEC and available on the SEC’s website at http://www.sec.gov. Capital One and Discover disclaim any obligation and do not intend to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by federal securities laws.

Important Information About the Transaction and Where to Find It

Capital One intends to file a registration statement on Form S-4 with the SEC to register the shares of Capital One’s common stock that will be issued to Discover stockholders in connection with the proposed transaction. The registration statement will include a joint proxy statement of Capital One and Discover that will also constitute a prospectus of Capital One. The definitive joint proxy statement/prospectus will be sent to the stockholders of each of Capital One and Discover in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS WHEN THEY BECOME AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE JOINT PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by Capital One or Discover through the website maintained by the SEC at http://www.sec.gov or by contacting the investor relations department of Capital One or Discover at:

| | | | | |

| Capital One Financial Corporation | Discover Financial Services |

1680 Capital One Drive McLean, VA 22102 Attention: Investor Relations investorrelations@capitalone.com (703) 720-1000

| 2500 Lake Cook Road Riverwoods, IL 60015 Attention: Investor Relations investorrelations@discover.com (224) 405-4555

|

Before making any voting or investment decision, investors and security holders of Capital One and Discover are urged to read carefully the entire registration statement and joint proxy statement/prospectus when they become available, including any amendments thereto, because they will contain important information about the proposed transaction. Free copies of these documents may be obtained as described above.

Participants in Solicitation

Capital One, Discover and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of each of Capital One and Discover in connection with the proposed transaction. Information regarding the directors and executive officers of Capital One and Discover and other persons who may be deemed participants in the solicitation of the stockholders of Capital One or of Discover in connection with the proposed transaction will be included in the joint proxy statement/prospectus related to the proposed transaction, which will be filed by Capital One with the SEC. Information about the directors and executive officers of Capital One and their ownership of Capital One common stock can also be found in Capital One’s definitive proxy statement in connection with its 2024 annual meeting of stockholders, as filed with the SEC on March 20, 2024, and other documents subsequently filed by Capital One with the SEC. Information about the directors and executive officers of Discover and their ownership of Discover common stock can also be found in Discover’s definitive proxy statement in connection with its 2024 annual meeting of stockholders, as filed with the SEC on March 15, 2024, and other documents subsequently filed by Discover with the SEC. Additional information regarding the interests of such participants will be included in the joint proxy statement/prospectus and other relevant documents regarding the proposed transaction filed with the SEC when they become available.