Capital One Financial (COF) 8-KFinancial & Statistical Summary Reported Basis

Filed: 21 Apr 04, 12:00am

First Quarter 2004 Results

April 21, 2004

First Quarter 2004 Results

1

Forward looking statements

Please note that the following materials containing information regarding Capital One’s financial performance speak only as of the particular date or dates indicated in these materials. Capital One does not undertake any obligation to update or revise any of the information contained herein whether as a result of new information, future events or otherwise.

Certain statements in this presentation and other oral and written statements made by the Company from time to time, are forward-looking statements, including those that discuss strategies, goals, outlook or other non-historical matters; or project revenues, income, returns, earnings per share or other financial measures. To the extent any such information is forward-looking, it is intended to fit within the safe harbor for forward-looking information provided by the Private Securities Litigation Reform Act of 1995. Numerous factors could cause our actual results to differ materially from those described in forward-looking statements, including, among other things: continued intense competition from numerous providers of products and services which compete with our businesses; an increase in credit losses; financial, legal, regulatory or accounting changes or actions; changes in interest rates, general economic conditions affecting consumer income, spending and repayments; changes in our aggregate accounts or consumer loan balances and the growth rate and composition thereof; changes in the reputation of the credit card industry and/or the company with respect to practices and products; our ability to continue to securitize our credit cards and consumer loans and to otherwise access the capital markets at attractive rates and terms to fund our operations and future growth; our ability to successfully continue to diversify our assets, losses associated with new products or services or expansion internationally; any significant disruption of, or loss of public confidence in, the United States Mail service affecting our response rates and consumer payments; any significant disruption in our operations or technology platform, our ability to recruit experienced personnel to assist in the management and operations of new products and services; and other factors listed from time to time in reports we file with the Securities and Exchange Commission (the “SEC”) , including, but not limited to, factors set forth under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2003, and any subsequent quarterly reports on Form 10-Q. You should carefully consider the factors discussed above in evaluating these forward-looking statements.

All information in these slides is based on the consolidated results of Capital One Financial Corporation. Further information about Capital One can be obtained from the Corporation’s public filings with the SEC. A reconciliation of any non-GAAP financial measures included in this presentation can be found in the Company’s most recent Form 8-K or Form 10-Q concerning quarterly financial results, available on the Company’s website at www.capitalone.com in Investor Relations under “About Capital One.”

First Quarter 2004 Results 2

Capital One is off to a great start in 2004

• Generated $1.84 EPS in Q104

• Credit metrics continuing to improve

• Diversification generating meaningful profits

• Successful upmarket mix shift

• Well hedged against a rising rate environment

• Strong liquidity and capital position

Capital One is well on its way to becoming a diversified consumer financial services company

First Quarter 2004 Results 3

Three trends are continuing to drive our metrics

Mix Shift

• Continuing to shift mix upmarket and beyond US Card

Improving Economy

• Recent improvement in consumer payment patterns

Seasonality

• First quarter typically strongest credit and earnings

• EPS momentum from allowance reduction unsustainable

• Quarterly variability of EPS, but stable annual ROA

• 2004 EPS guidance unchanged at $5.30—$5.60

First Quarter 2004 Results 4

First quarter 2004

Financial Update

Business Update

First Quarter 2004 Results 5

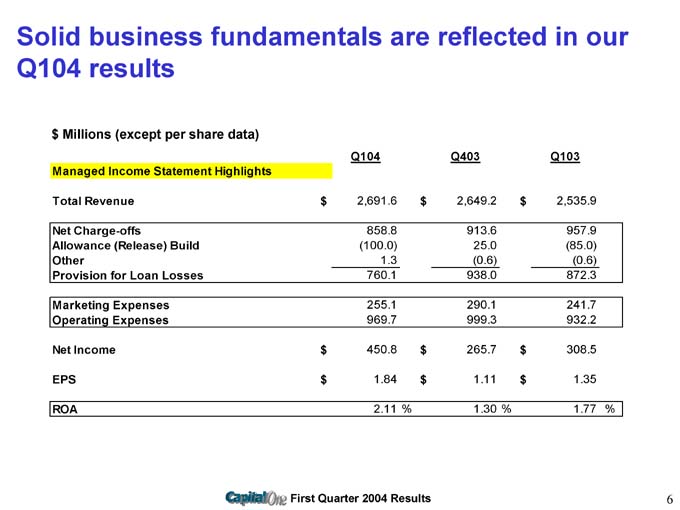

Solid business fundamentals are reflected in our Q104 results

$ Millions (except per share data)

Q104 Q403 Q103

Managed Income Statement Highlights

Total Revenue $ 2,691.6 $ 2,649.2 $ 2,535.9

Net Charge-offs 858.8 913.6 957.9

Allowance (Release) Build (100.0) 25.0 (85.0)

Other 1.3 (0.6) (0.6)

Provision for Loan Losses 760.1 938.0 872.3

Marketing Expenses 255.1 290.1 241.7

Operating Expenses 969.7 999.3 932.2

Net Income $ 450.8 $ 265.7 $ 308.5

EPS $ 1.84 $ 1.11 $ 1.35

ROA 2.11 % 1.30 % 1.77 %

First Quarter 2004 Results 6

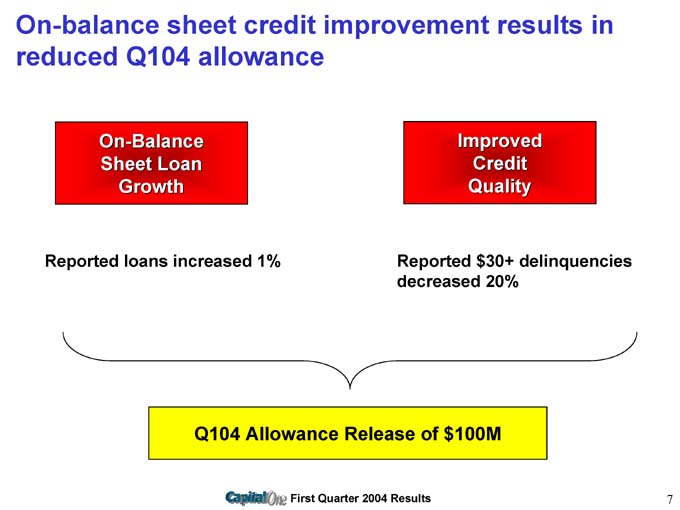

On-balance sheet credit improvement results in reduced Q104 allowance

On-Balance Sheet Loan Growth

Reported loans increased 1%

Improved Credit Quality

Reported $30+ delinquencies decreased 20%

Q104 Allowance Release of $100M

First Quarter 2004 Results

7

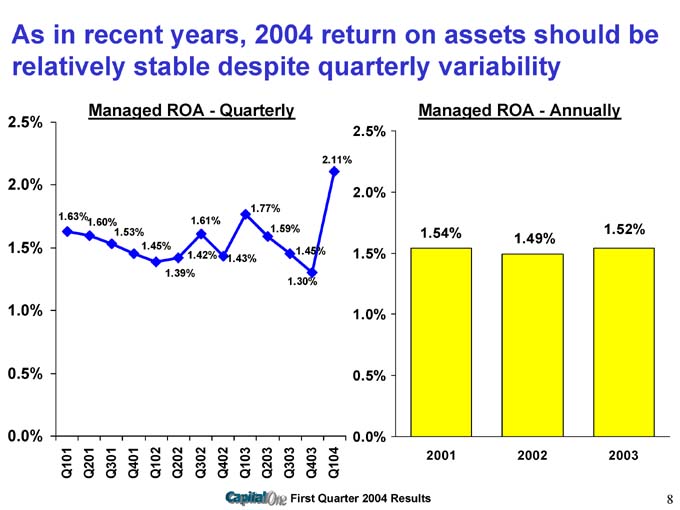

As in recent years, 2004 return on assets should be relatively stable despite quarterly variability

Managed ROA – Quarterly

1.63% 1.60% 1.53% 1.45% 1.39% 1.61% 1.42% 1.43% 1.77% 1.59% 1.45% 1.30% 2.11%

Managed ROA—Annually

2001 1.54%

2002 1.49%

2003 1.52%

First Quarter 2004 Results 8

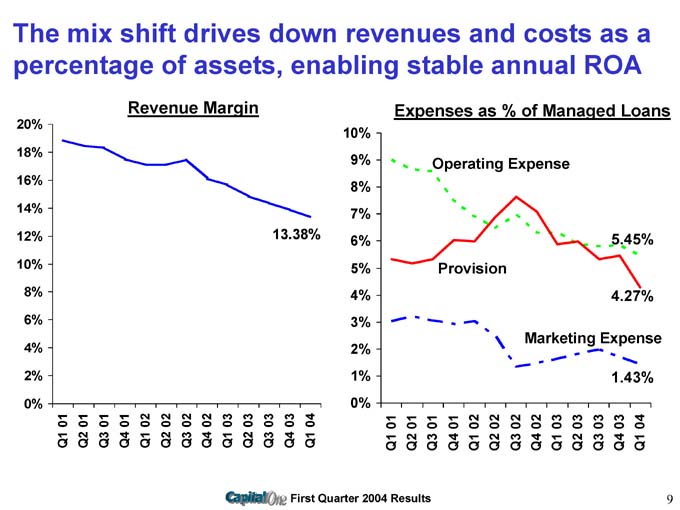

The mix shift drives down revenues and costs as a percentage of assets, enabling stable annual ROA

Revenue Margin

13.38%

Expenses as % of Managed Loans

Operating Expense 5.45%

Provision 4.27%

Marketing Expense 1.43%

First Quarter 2004 Results 9

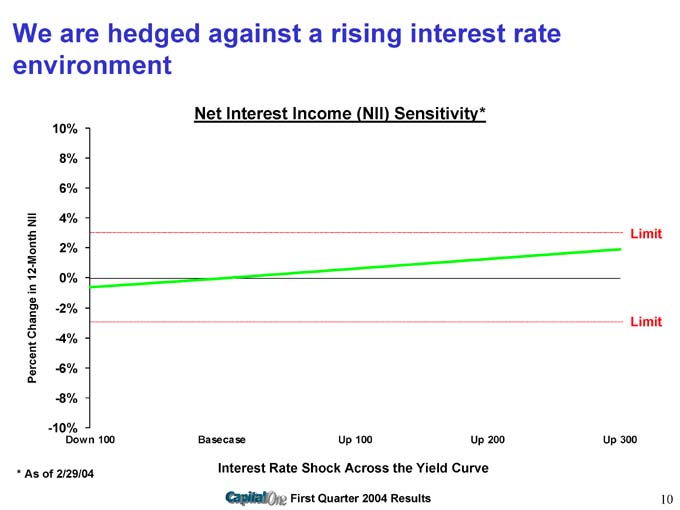

We are hedged against a rising interest rate environment

Net Interest Income (NII) Sensitivity*

* As of 2/29/04

Interest Rate Shock Across the Yield Curve

First Quarter 2004 Results 10

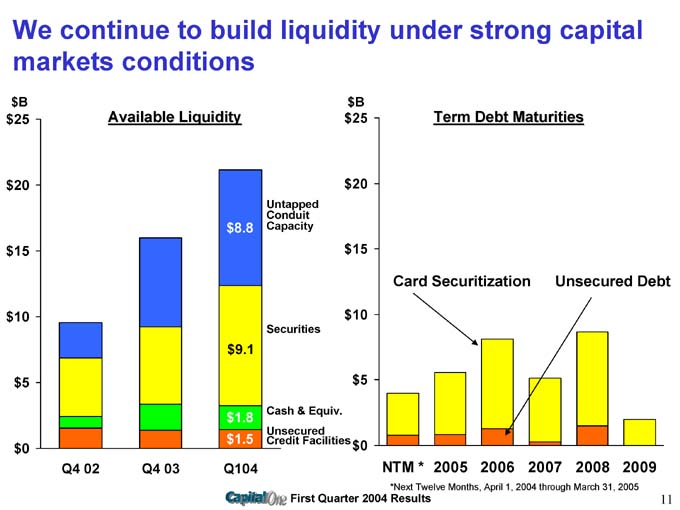

We continue to build liquidity under strong capital markets conditions

Available Liquidity

$8.8 Untapped Conduit Capacity

$9.1 Securities Cash & Equiv.

$1.8 Unsecured

$1.5 Credit Facilities

Term Debt Maturities

Card Securitization

Unsecured Debt

*Next Twelve Months, April 1, 2004 through March 31, 2005

First Quarter 2004 Results 11

First Quarter 2004

Financial Update

Business Update

First Quarter 2004 Results 12

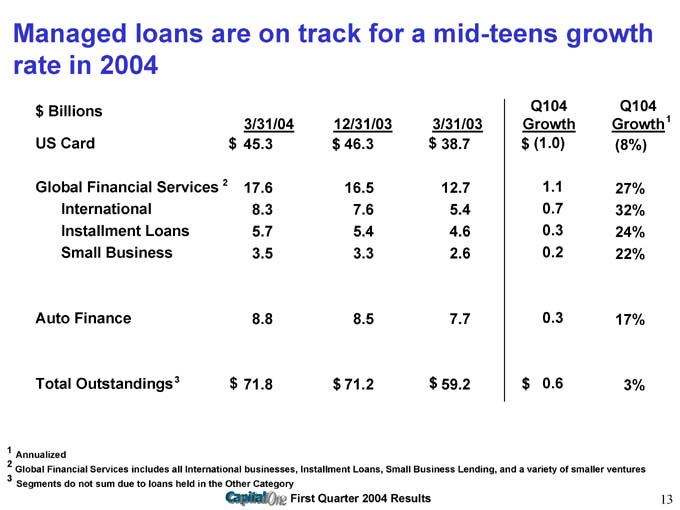

Managed loans are on track for a mid-teens growth rate in 2004

$ Billions Q104 Q104

3/31/04 12/31/03 3/31/03 Growth Growth1

US Card $ 45.3 $ 46.3 $ 38.7 $ (1.0) (8%)

Global Financial Services 2 17.6 16.5 12.7 1.1 27%

International 8.3 7.6 5.4 0.7 32%

Installment Loans 5.7 5.4 4.6 0.3 24%

Small Business 3.5 3.3 2.6 0.2 22%

Auto Finance 8.8 8.5 7.7 0.3 17%

Total Outstandings3 $ 71.8 $ 71.2 $ 59.2 $ 0.6 3%

1 Annualized

2 Global Financial Services includes all International businesses, Installment Loans, Small Business Lending, and a variety of smaller ventures

3 Segments do not sum due to loans held in the Other Category

First Quarter 2004 Results 13

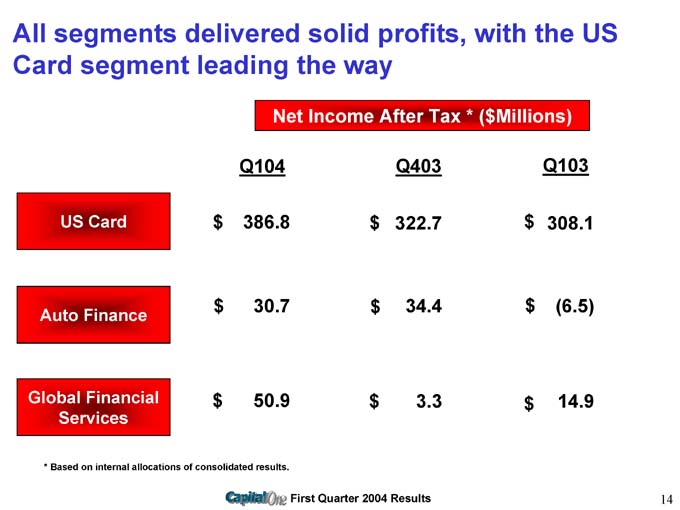

All segments delivered solid profits, with the US Card segment leading the way

Net Income After Tax * ($Millions)

Q104 Q403 Q103

US Card $ 386.8 $ 322.7 $ 308.1

Auto Finance $ 30.7 $ 34.4 $(6.5)

Global Financial Services $ 50.9 $ 3.3 $14.9

* Based on internal allocations of consolidated results.

First Quarter 2004 Results 14

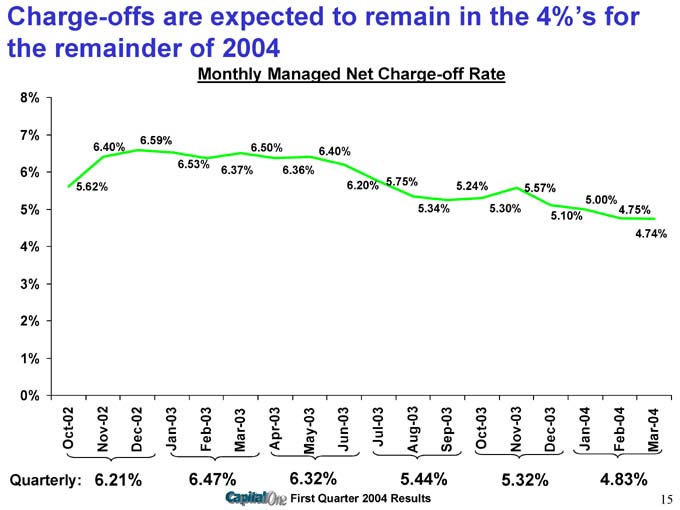

Charge-offs are expected to remain in the 4%’s for the remainder of 2004

Monthly Managed Net Charge-off Rate

8%

Quarterly: 6.21% 6.47% 6.32% 5.44% 5.32% 4.83%

First Quarter 2004 Results 15

Charge-offs improved across all segments in Q104

Managed Net Charge-off Rate by Segment

US Card

Auto

Global Financial Services

First Quarter 2004 Results 16

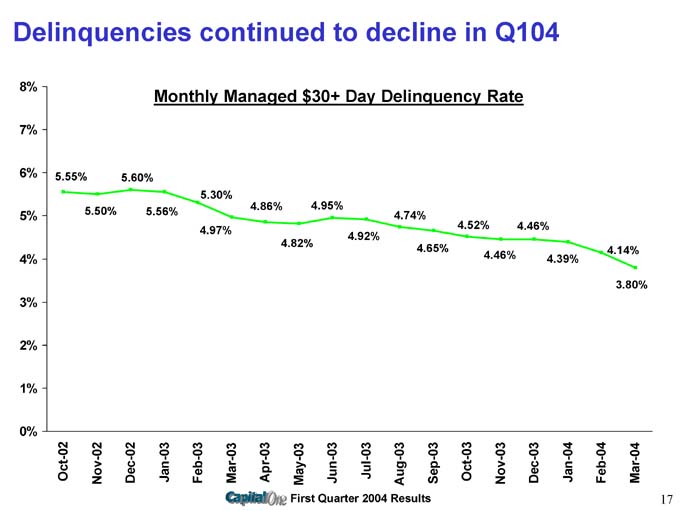

Delinquencies continued to decline in Q104

Monthly Managed $30+ Day Delinquency Rate

First Quarter 2004 Results 17

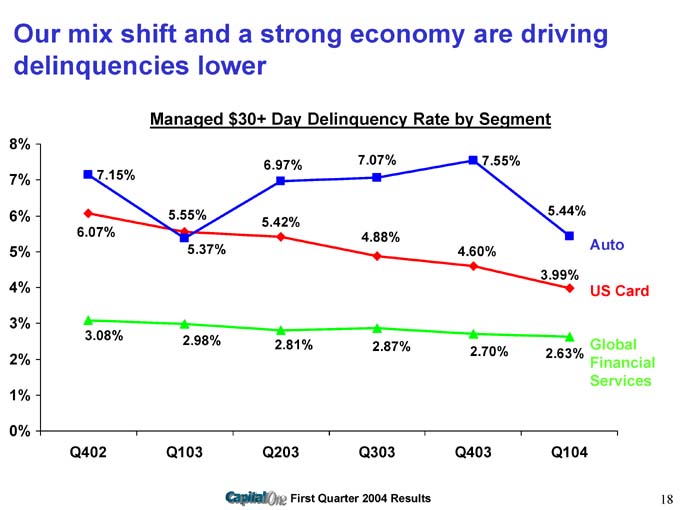

Our mix shift and a strong economy are driving delinquencies lower

Managed $30+ Day Delinquency Rate by Segment

Auto

US Card

Global Financial Services

First Quarter 2004 Results 18

We’re building Capital One for long-term success

Diversified Businesses

• Rigorous, conservative underwriting

• Multiple products

• Multiple geographies

Strong Balance Sheet

• Multiple funding sources

• Strong liquidity and capital

• Hedged against rising interest rates

Stable, Profitable, Diversified Consumer Financial Services Company

First Quarter 2004 Results 19