Capital One Financial (COF) 8-KFinancial & Statistical Summary Reported Basis

Filed: 20 Jul 05, 12:00am

Exhibit 99.2

July 20, 2005

Forward-Looking Information

Forward-Looking Information

Please note that the following materials containing information regarding Capital One’s financial performance speak only as of the particular date or dates indicated in these materials. Capital One does not undertake any obligation to update or revise any of the information contained herein whether as a result of new information, future events or otherwise.

Certain statements in this presentation and other oral and written statements made by the Company from time to time, are forward-looking statements, including those that discuss strategies, goals, outlook or other non-historical matters including the benefits of the business combination transaction involving Capital One and Hibernia Corporation and the new company’s plans, objectives, expectations, and intentions; or project revenues, income, returns, earnings per share or other financial measures for Capital One or the new company. To the extent any such information is forward-looking, it is intended to fit within the safe harbor for forward-looking information provided by the Private Securities Litigation Reform Act of 1995. Numerous factors could cause our actual results to differ materially from those described in forward-looking statements, including, among other things: continued intense competition from numerous providers of products and services which compete with our businesses; an increase or decrease in credit losses; financial, legal, regulatory or accounting changes or actions; changes in interest rates; general economic conditions affecting consumer income, spending and repayments; changes in our aggregate accounts or consumer loan balances and the growth rate and composition thereof; changes in the reputation of the credit card industry and/or the company with respect to practices and products; our ability to continue to securitize our credit cards and consumer loans and to otherwise access the capital markets at attractive rates and terms to fund our operations and future growth; our ability to successfully continue to diversify our assets; losses associated with new products or services or expansion internationally; the company’s ability to execute on its strategic and operational plans; any significant disruption in our operations or technology platform; our ability to effectively control our costs; the success of marketing efforts; our ability to execute effective tax planning strategies; our ability to recruit and retain experienced management personnel; our ability to successfully integrate acquired businesses, including Hibernia; the ability to obtain regulatory approvals of the Capital One - Hibernia transaction on the proposed terms and schedule; the failure of Hibernia stockholders to approve the transaction; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; and other factors listed from time to time in reports we file with the Securities and Exchange Commission (the “SEC”) , including, but not limited to, factors set forth under the caption “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2004, and any subsequent quarterly reports on Form 10-Q. You should carefully consider the factors discussed above in evaluating these forward-looking statements. All information in these slides is based on the consolidated results of Capital One Financial Corporation. Further information about Capital One can be obtained from the Corporation’s public filings with the SEC. A reconciliation of any non-GAAP financial measures included in this presentation can be found in the Company’s most recent Form 8-K or Form 10-Q concerning quarterly financial results, available on the Company’s website at www.capitalone.com in Investor Relations under “About Capital One.” based on new information or otherwise.

Additional Information About the Hibernia Transaction

Hibernia shareholders are urged to read the definitive proxy statement/prospectus regarding the proposed merger of Capital One Financial Corp. (“Capital One”) and Hibernia Corporation (“Hibernia”), which was first mailed to Hibernia shareholders on or about June 20, 2005 because it contains important information. You may obtain a free copy of the definitive proxy statement/prospectus and other related documents filed by Capital One and Hibernia with the Securities and Exchange Commission (“SEC”) at the SEC’s website at www.sec.gov. The definitive proxy statement/prospectus and the other documents may also be obtained for free by accessing Capital One’s website at www.capitalone.com under the tab “Investors” and then under the heading “SEC & Regulatory Filings” or by accessing Hibernia’s website at www.hibernia.com under the tab “About Hibernia” and then under the heading “Investor Relations—SEC Filings.”

Capital One, Hibernia and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from Hibernia stockholders in favor of the merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the Hibernia stockholders in connection with the proposed merger is set forth in the definitive proxy statement/prospectus filed with the SEC. You can find information about Capital One’s executive officers and directors in its definitive proxy statement filed with the SEC on March 21, 2005. You can find information about Hibernia’s executive officers and directors in its definitive proxy statement filed with the SEC on March 15, 2005. You can obtain free copies of these documents from Capital One and Hibernia using the contact information above.

2

Our second quarter results keep us on track to deliver on 2005 expectations

Second Quarter

Q205 diluted EPS of $2.03

Q205 managed ROA of 2.11%

$83 billion in managed loans

Diversification beyond US Card continuing to deliver growth and profits

Strong credit quality and margins

Continued strength in liquidity and capital

2005 Expectations

12-15% loan growth rate; continuing bias toward lower loss assets (excluding Hibernia)

1.7% to 1.8% managed ROA, with quarter to quarter variability (excluding Hibernia)

Continuing diversification of assets, liabilities, profits (excluding Hibernia)

Diluted EPS between $6.60 and $7.00 (including Hibernia)

3

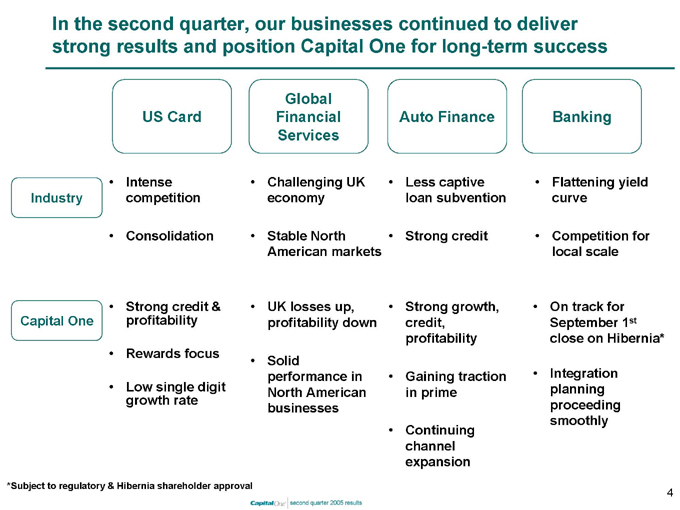

In the second quarter, our businesses continued to deliver strong results and position Capital One for long-term success

US Card

Global Financial Services

Auto Finance

Banking

Industry

Intense competition

Challenging UK economy

Less captive loan subvention

Flattening yield curve

Consolidation

Stable North American markets

Strong credit

Competition for local scale

Capital One

Strong credit & profitability

UK losses up, profitability down

Strong growth, credit, profitability

On track for September 1st close on Hibernia*

Rewards focus

Solid performance in North American businesses

Gaining traction in prime

Integration planning proceeding smoothly

Low single digit growth rate

Continuing channel expansion

*Subject to regulatory & Hibernia shareholder approval

4

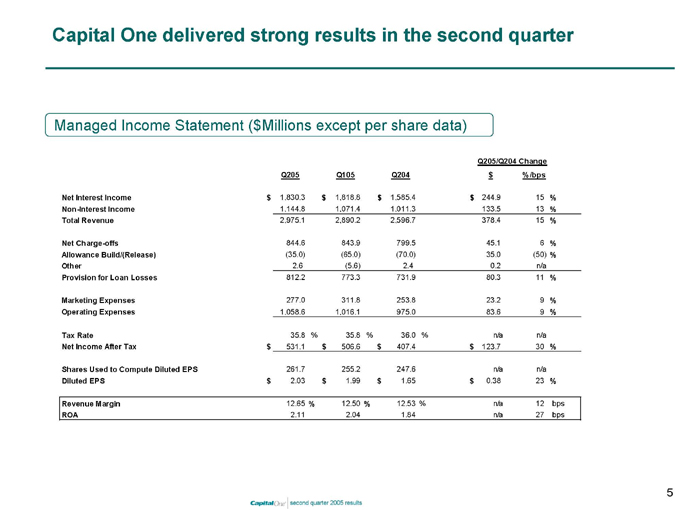

Capital One delivered strong results in the second quarter

Managed Income Statement ($Millions except per share data)

Q205/Q204 Change

Q205 Q105 Q204 $%/bps

Net Interest Income $1,830.3 $1,818.8 $1,585.4 $244.9 15%

Non-Interest Income 1,144.8 1,071.4 1,011.3 133.5 13%

Total Revenue 2,975.1 2,890.2 2,596.7 378.4 15%

Net Charge-offs 844.6 843.9 799.5 45.1 6%

Allowance Build/(Release) (35.0) (65.0) (70.0) 35.0 (50)%

Other 2.6 (5.6) 2.4 0.2 n/a

Provision for Loan Losses 812.2 773.3 731.9 80.3 11%

Marketing Expenses 277.0 311.8 253.8 23.2 9%

Operating Expenses 1,058.6 1,016.1 975.0 83.6 9%

Tax Rate 35.8% 35.8% 36.0% n/a n/a

Net Income After Tax $531.1 $506.6 $407.4 $123.7 30%

Shares Used to Compute Diluted EPS 261.7 255.2 247.6 n/a n/a

Diluted EPS $2.03 $1.99 $1.65 $0.38 23%

Revenue Margin 12.65% 12.50% 12.53% n/a 12 bps

ROA 2.11 2.04 1.84 n/a 27 bps

5

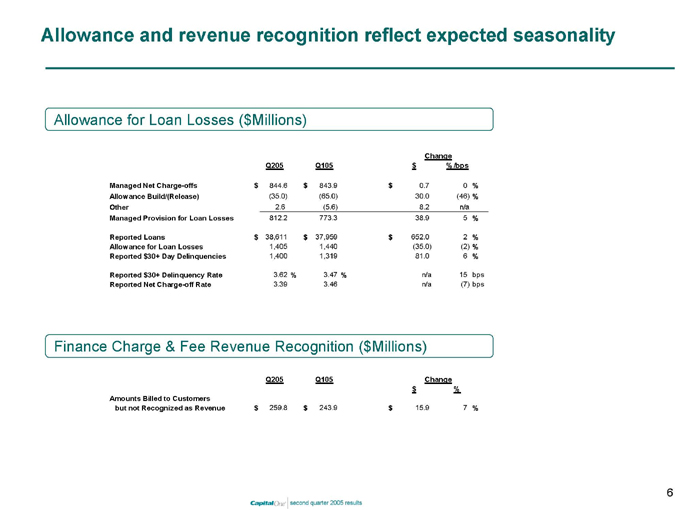

Allowance and revenue recognition reflect expected seasonality

Allowance for Loan Losses ($Millions)

Change

Q205 Q105 $%/bps

Managed Net Charge-offs $844.6 $843.9 $0.7 0%

Allowance Build/(Release) (35.0) (65.0) 30.0 (46)%

Other 2.6 (5.6) 8.2 n/a

Managed Provision for Loan Losses 812.2 773.3 38.9 5%

Reported Loans $38,611 $37,959 $652.0 2%

Allowance for Loan Losses 1,405 1,440 (35.0) (2)%

Reported $30+ Day Delinquencies 1,400 1,319 81.0 6%

Reported $30+ Delinquency Rate 3.62% 3.47% n/a 15 bps

Reported Net Charge-off Rate 3.39 3.46 n/a (7) bps

Finance Charge & Fee Revenue Recognition ($Millions)

Q205 Q105 Change

$ %

Amounts Billed to Customers

but not Recognized as Revenue $259.8 $243.9 $15.9 7%

6

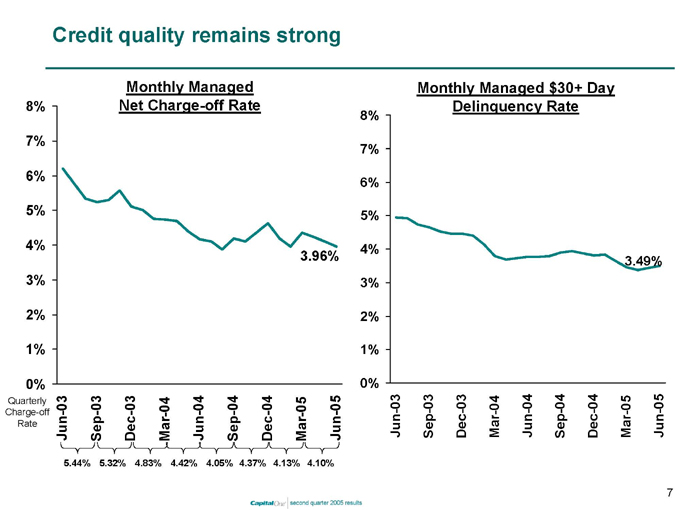

Credit quality remains strong

Monthly Managed Net Charge-off Rate

8% 7% 6% 5% 4% 3% 2% 1% 0%

3.96%

8% 7% 6% 5% 4% 3% 2% 1% 0%

Monthly Managed $30+ Day Delinquency Rate

3.49%

Quarterly Charge-off Rate

Jun-03 Sep-03 Dec-03 Mar-04 Jun-04 Sep-04 Dec-04 Mar-05 Jun-05

Jun-03 Sep-03 Dec-03 Mar-04 Jun-04 Sep-04 Dec-04 Mar-05 Jun-05

5.44% 5.32% 4.83% 4.42% 4.05% 4.37% 4.13% 4.10%

7

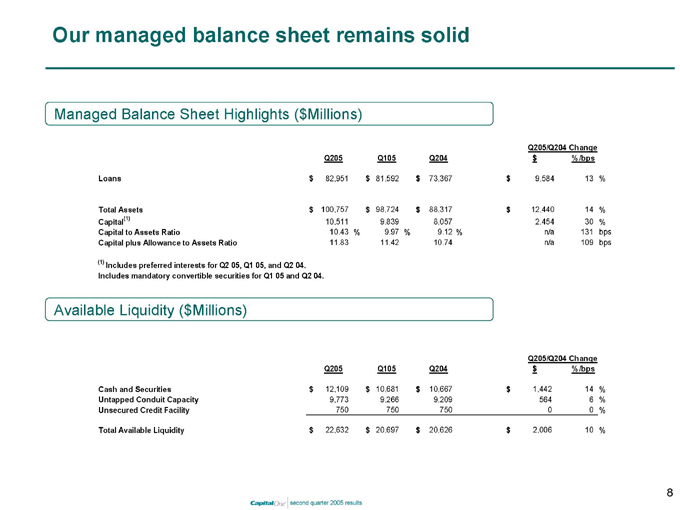

Our managed balance sheet remains solid

Managed Balance Sheet Highlights ($Millions)

Q205/Q204 Change

Q205 Q105 Q204 $%/bps

Loans $82,951 $81,592 $73,367 $9,584 13%

Total Assets $100,757 $98,724 $88,317 $12,440 14%

Capital(1) 10,511 9,839 8,057 2,454 30%

Capital to Assets Ratio 10.43% 9.97% 9.12% n/a 131 bps

Capital plus Allowance to Assets Ratio 11.83 11.42 10.74 n/a 109 bps

(1) Includes preferred interests for Q2 05, Q1 05, and Q2 04. Includes mandatory convertible securities for Q1 05 and Q2 04.

Available Liquidity ($Millions)

Q205/Q204 Change

Q205 Q105 Q204 $%/bps

Cash and Securities $12,109 $10,681 $10,667 $1,442 14%

Untapped Conduit Capacity 9,773 9,266 9,209 564 6%

Unsecured Credit Facility 750 750 750 0 0%

Total Available Liquidity $22,632 $20,697 $20,626 $2,006 10%

8

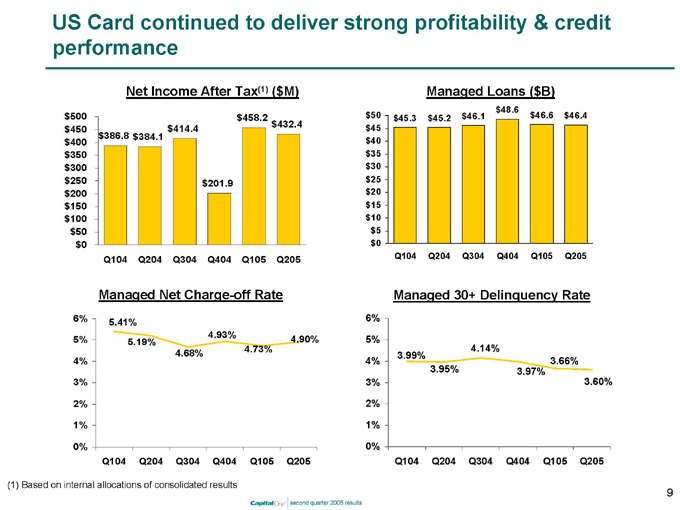

US Card continued to deliver strong profitability & credit performance

Net Income After Tax(1) ($M) $500 $450 $400 $350 $300 $250 $200 $150 $100 $50 $0 $386.8 $384.1 $414.4 $201.9 $458.2

432.4

Q104 Q204 Q304 Q404 Q105 Q205

Managed Loans ($B) $50 $45 $40 $35 $30 $25 $20 $15 $10 $5 $0 $45.3 $45.2 $46.1 $48.6 $46.6 $46.4

Q104 Q204 Q304 Q404 Q105 Q205

Managed Net Charge-off Rate

6% 5% 4% 3% 2% 1% 0%

5.41%

5.19%

4.68%

4.93%

4.73%

4.90%

Q104 Q204 Q304 Q404 Q105 Q205

Managed 30+ Delinquency Rate

6% 5% 4% 3% 2% 1% 0%

3.99%

3.95%

4.14%

3.97%

3.66%

3.60%

Q104 Q204 Q304 Q404 Q105 Q205

(1) Based on internal allocations of consolidated results

9

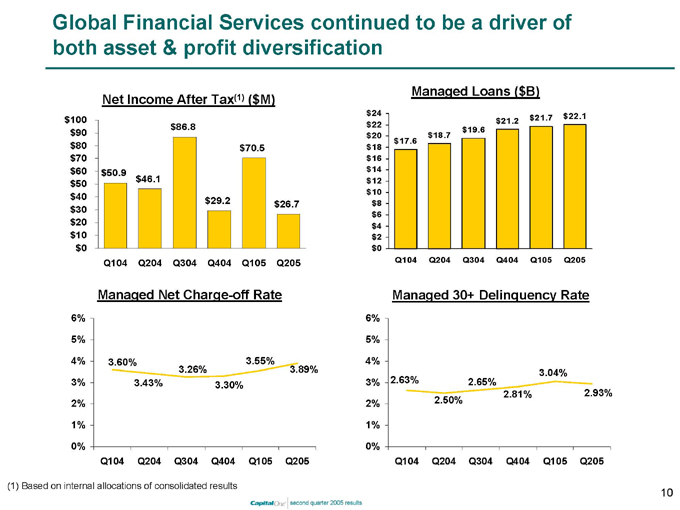

Global Financial Services continued to be a driver of both asset & profit diversification

Net Income After Tax(1) ($M) $100 $90 $80 $70 $60 $50 $40 $30 $20 $10 $0 $50.9 $46.1 $86.8 $29.2 $70.5 $26.7

Q104 Q204 Q304 Q404 Q105 Q205

Managed Net Charge-off Rate

6% 5% 4% 3% 2% 1% 0%

3.60%

3.43%

3.26%

3.30%

3.55%

3.89%

Q104 Q204 Q304 Q404 Q105 Q205

Managed Loans ($B) $24 $22 $20 $18 $16 $14 $12 $10 $8 $6 $4 $2 $0 $17.6 $18.7 $19.6 $21.2 $21.7 $22.1

Q104 Q204 Q304 Q404 Q105 Q205

Managed 30+ Delinquency Rate

6% 5% 4% 3% 2% 1% 0%

2.63%

2.50%

2.65%

2.81%

3.04%

2.93%

Q104 Q204 Q304 Q404 Q105 Q205

(1) Based on internal allocations of consolidated results

10

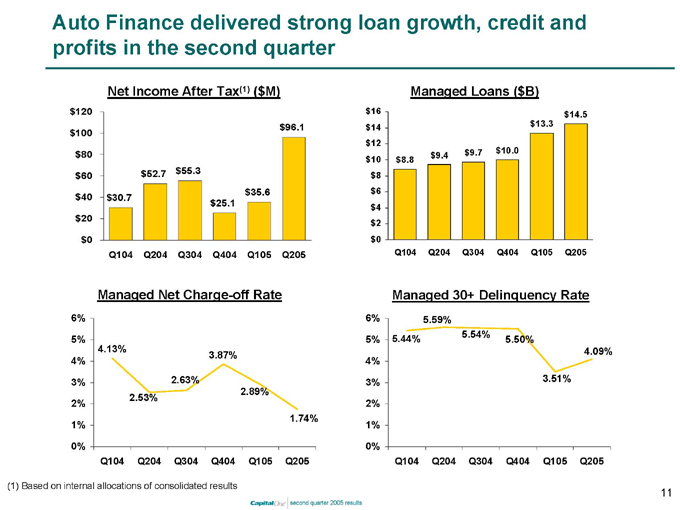

Auto Finance delivered strong loan growth, credit and profits in the second quarter

Net Income After Tax(1) ($M) $120 $100 $80 $60 $40 $20 $0 $30.7 $52.7 $55.3 $25.1 $35.6 $96.1

Q104 Q204 Q304 Q404 Q105 Q205

Managed Net Charge-off Rate

6% 5% 4% 3% 2% 1% 0%

4.13%

2.53%

2.63%

3.87%

2.89%

1.74%

Q104 Q204 Q304 Q404 Q105 Q205

Managed Loans ($B) $16 $14 $12 $10 $8 $6 $4 $2 $0 $8.8 $9.4 $9.7 $10.0 $13.3 $14.5

Q104 Q204 Q304 Q404 Q105 Q205

Managed 30+ Delinquency Rate

6% 5% 4% 3% 2% 1% 0%

5.44%

5.59%

5.54%

5.50%

3.51%

4.09%

Q104 Q204 Q304 Q404 Q105 Q205

(1) Based on internal allocations of consolidated results

11