REVERSE OF SECURITY

Capital One Financial Corporation

4.927% Fixed-to-Floating Rate Senior Notes Due 2028

This Security is one of a duly authorized issue of debt securities of the Company, of the series hereinafter specified, all issued or to be issued under a Senior Indenture, dated as of November 1, 1996 (the “Base Indenture”), as supplemented by a First Supplemental Indenture, dated as of November 2, 2021 (the “Supplemental Indenture” and, together with the Base Indenture, the “Senior Indenture”) and each, duly executed and delivered by the Company to The Bank of New York Mellon Trust Company, N.A., formerly known as The Bank of New York Trust Company, N.A. (as successor to Harris Trust and Savings Bank), as trustee (hereinafter, the “Trustee”). Reference to the Senior Indenture and the Officer’s Certificate thereunder establishing the terms of this Security is hereby made for a description of the respective rights and duties thereunder of the Trustee, the Company and the Holders of the Securities. This Security is one of a series designated as the “4.927% Fixed-to-Floating Rate Senior Notes Due 2028” of the Company (hereinafter called the “Notes”), issued under the Senior Indenture. Each Holder by accepting a Note, agrees to be bound by all terms and provisions of the Senior Indenture, as amended from time to time, applicable to the Notes.

Neither the Senior Indenture nor the Notes limit or otherwise restrict the amount of indebtedness which may be incurred or other securities which may be issued by the Company. The Notes issued under the Senior Indenture are direct, unsecured obligations of the Company and will mature on May 10, 2028. The Notes rank on parity with all other unsecured, unsubordinated indebtedness of the Company.

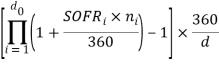

The Company promises to pay interest on the principal amount of this Security (i) from and including May 9, 2022 to, but excluding, May 10, 2027 (the “Fixed Rate Period”), at a fixed rate of 4.927% per annum, semi-annually in arrears, on May 10 and November 10 of each year (each such date, a “Fixed Rate Interest Payment Date”), commencing on November 10, 2022 and ending on May 10, 2027, and (ii) from and including May 10, 2027 to but excluding the Stated Maturity (the “Floating Rate Period”), at an annual rate equal to the Base Rate (as defined and computed below) plus 2.057% (the “Spread”), quarterly in arrears, on the second Business Day (as defined below) following each Floating Rate Interest Period End-Date (as defined below) (each such Business Day, a “Floating Rate Interest Payment Date” and together with any Fixed Rate Period Payment Date, an “Interest Payment Date), until the principal hereof is paid or made available for payment.

Notwithstanding the above, the Floating Rate Interest Payment Date with respect to the final Floating Rate Interest Payment Period (as defined below) shall be the Stated Maturity.

The Company will pay interest to the holder in whose name this Security is registered at the close of business on the fifteenth calendar day (whether or not a Business Day (as defined below)), immediately preceding the related Fixed Rate Interest Payment Date or Floating Rate Interest Payment Period End-Date (as defined below), as applicable (such date being referred to herein as the “Regular Record Date”), except that the Company will pay interest at the Stated