The information in this preliminary prospectus supplement and the accompanying prospectus is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities, and are not soliciting an offer to buy these securities, in any jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(5)

Registration No 333-254191

Subject to completion, dated October 27, 2023

PRELIMINARY PROSPECTUS SUPPLEMENT

(To prospectus dated March 12, 2021)

Capital One Financial Corporation

$ % Fixed-to-Floating Rate Senior Notes Due 2027

$ % Fixed-to-Floating Rate Senior Notes Due 2031

$ Floating Rate Senior Notes Due 2027

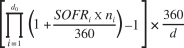

We will pay interest on the % fixed-to-floating rate senior notes due 2027 (the “2027 notes”) semi-annually during the fixed rate period from and including the original issue date to but excluding , 2026 (the “2027 Notes Interest Reset Date”) (the “2027 Notes Fixed Rate Period”) in arrears on each and and quarterly during the floating rate period from and including the 2027 Notes Interest Reset Date to but excluding the , 2027 maturity date (the “2027 Notes Floating Rate Period”) in arrears on each , , and . We will make the first interest payment on the 2027 notes on , 2024. Interest will accrue (i) from and including the original issue date to but excluding the 2027 Notes Interest Reset Date at a fixed rate of % per annum and (ii) from and including the 2027 Notes Interest Reset Date to but excluding the 2027 notes maturity date at a rate equal to the base rate (as described herein) plus % (the “2027 Notes Spread”).

We will pay interest on the % fixed-to-floating rate senior notes due 2031 (the “2031 notes” and, together with the 2027 notes, the “fixed-to-floating rate notes”) semi-annually during the fixed rate period from and including the original issue date to but excluding , 2030 (the “2031 Notes Interest Reset Date”) (the “2031 Notes Fixed Rate Period”) in arrears on each and and quarterly during the floating rate period from and including the 2031 Notes Interest Reset Date to but excluding the , 2031 maturity date (the “2031 Notes Floating Rate Period”) in arrears on each , , and . We will make the first interest payment on the 2031 notes on , 2024. Interest will accrue (i) from and including the original issue date to but excluding the 2031 Notes Interest Reset Date at a fixed rate of % per annum and (ii) from and including the 2031 Notes Interest Reset Date to but excluding the 2031 notes maturity date at a rate equal to the base rate (as described herein) plus % (the “2031 Notes Spread”).

We will pay interest on the floating rate senior notes due 2027 (the “floating rate notes” and, together with the fixed-to-floating rate notes, the “notes”) quarterly from and including the original issue date to but excluding the , 2027 maturity date (the “Floating Rate Notes Floating Rate Period”) in arrears on each , , and . We will make the first interest payment on the floating rate notes on , 2024. Interest will accrue from and including the original issue date to but excluding the floating rate notes maturity date at a rate equal to the base rate (as described herein) plus % (the “Floating Rate Notes Spread”).

We may redeem the 2027 notes at our option on , 2026 (which is the date that is one year prior to the maturity date of the 2027 notes), in whole but not in part, at a redemption price equal to 100% of the principal amount of the 2027 notes to be redeemed, plus accrued and unpaid interest thereon to the redemption date. See “Description of the Notes—Optional Redemption.”

We may redeem the 2031 notes at our option on , 2030 (which is the date that is one year prior to the maturity date of the 2031 notes), in whole but not in part, at a redemption price equal to 100% of the principal amount of the 2031 notes to be redeemed, plus accrued and unpaid interest thereon to the redemption date. See “Description of the Notes—Optional Redemption.”

We may redeem the floating rate notes at our option on , 2026 (which is the date that is one year prior to the maturity date of the floating rate notes), in whole but not in part, at a redemption price equal to 100% of the principal amount of the floating rate notes to be redeemed, plus accrued and unpaid interest thereon to the redemption date. See “Description of the Notes—Optional Redemption.”