Summer Governance Roadshow ----------- 2024 Annual Meeting of Shareholders

2 Advancing Health Outcomes for All® Strength in Distribution 99% pharmaceutical order accuracy in North America 285,000+ customers served with medical-surgical products Leading distributor in oncology and specialty therapies Technology Differentiation Connected to payers representing 94% of U.S. prescription volume Access to research data from >2.4M patient records including >85 oncology indications Biopharma Services More than 650 biopharma brands served Increased value to biopharma and enabled >$8.8B in prescription savings Network of 950,000 providers and over 50,000 pharmacies Superior Specialty Assets 1.4+ million patients annually treated by The US Oncology Network physicians +1,000 clinical trials actively enrolling Supported 95% of therapeutic areas 40M+ pharmaceutical and medical supply deliveries annually

3 Progressing on Our Company Priorities Focus on People and Culture Commitment to investing in talent Recognized as one of America’s Greatest Workplaces for Diversity in 2024(2) Live through I2CARE values and stay grounded in the ILEAD leadership principles(3) Evolve and Grow the Portfolio Digital enablement and AI Technology modernization and process simplification Acquired Compile, Inc., a healthcare data platform that provides insights for biopharma companies Expand Oncology and Biopharma Platforms Differentiated assets and capabilities in community oncology Leadership in access, affordability, and adherence solutions Growth to support approximately 2,600 providers spanning 600 sites in 31 states Drive Sustainable Core Growth Scaled and durable distribution capabilities Leading pharmaceutical and medical supply networks Integrating artificial intelligence (AI) and machine learning Our Company Priorities FY24 Financial Highlights(1) $309B Total Revenue $3.3B Cash Returned to Shareholders $4.3B Operating Cash Flow (1) Full fiscal year 2024 (April 1, 2023 to March 31, 2024). (2) Newsweek. (3) I2CARE represents integrity, inclusion, customer-first, accountability, respect, and excellence. ILEAD represents inspire, leverage, execute, advance, and develop. $22.39 Earnings per Diluted Share

Focus on Good Corporate GovernanceShareholder Engagement in FY 2024 Key Themes Discussed Recent McKesson Actions Board Composition Sustainability Metrics in Executive Compensation Human Capital Management Emissions Reduction Targets Board Skills and Diversity Board Evaluations Management Succession Planning - Elected Deborah Dunsire, M.D. and Kevin M. Ozan to the Board in 2024 - Both appointees collectively bring valuable senior executive leadership experience and supplement the Board’s skills in healthcare, finance, accounting, M&A and risk management - Introduced sustainability priorities as a discretionary, downward modifier in the Management Incentive Plan in FY 2023 - Continued focus on delivering our Employee Value Proposition – providing meaningful work, demonstrating care for our employees and ensuring a culture of belonging - Received SBTi approval of our climate change targets in FY 2023 - Providing updates on progress to meeting our goals in shareholder engagements efforts and FY 2024 Impact Report - Enhanced Board skills matrix to link experience and skills to strategic priorities - Recruited 8 directors, including 4 women and/or 4 racially or ethnically diverse directors, in the past 5 years - Board evaluations conducted by independent third-party facilitator in FY 2023 - Provided feedback on effectiveness and considerations for strengthening Board oversight - Appointed new EVP, Chief Legal Officer, Michele Lau, and EVP, CIO and CTO, Francisco Fraga - Both bring significant leadership and depth of experience to their respective positions McKesson reached out to shareholders representing over 51% of our outstanding common stock and engaged with approximately 33%. The below table reflects key topics discussed and recent relevant updates 4

5 Oversight from Our Experienced and Diverse Board Our director nominees have a mix of backgrounds that allow them to effectively carry out their oversight responsibilities * = Committee Chair CT = Compensation & Talent C = Compliance A = Audit GS = Governance & Sustainability F = Finance Brian S. Tyler CEO, McKesson Joined Apr. 2019 Donald R. Knauss Ret. Chairman & CEO, Clorox Independent Chair as of Apr. 2022 Joined Oct. 2014 CT*, F, GS Richard H. Carmona Chief of Health Innovations, Canyon Ranch & 17th Surgeon General of U.S. Joined Sept. 2021 CT, C Dominic J. Caruso Ret. EVP & CFO, Johnson & Johnson Joined Sept. 2018 A*, C James H. Hinton Operating Partner, Welsh Carson Anderson & Stowe Joined Jan. 2022 CT, F W. Roy Dunbar Ret. CEO & Chairman, Network Solutions Joined Apr. 2022 A, GS Bradley E. Lerman EVP & Chief Legal Officer, Starbucks Joined Sept. 2018 A, C* Deborah Dunsire, M.D. Ret. President and CEO, H. Lundbeck A/S Joined June 2024 CT, F Kevin M. Ozan Ret. EVP and CFO, McDonald’s Corporation Joined Jan. 2024 F*, A Kathleen Wilson- Thompson Ret. EVP & Global CHRO, Walgreens Boots Alliance Joined Jan. 2022 CT, GS Maria N. Martinez Ret. EVP & COO, Cisco Systems Joined Oct. 2019 GS*, C 6 New directors in last 3 years 3.8 Average tenure (years) 45% Racially/Gender Diverse Cybersecurity/Technology Experience (6 Directors) Distribution/Supply Chain Experience (6 Directors) Business Transformation Experience (10 Directors) Healthcare Industry Experience (8 Directors) Select Board Qualifications & Skills: 🗹 Item 1: Election of Directors

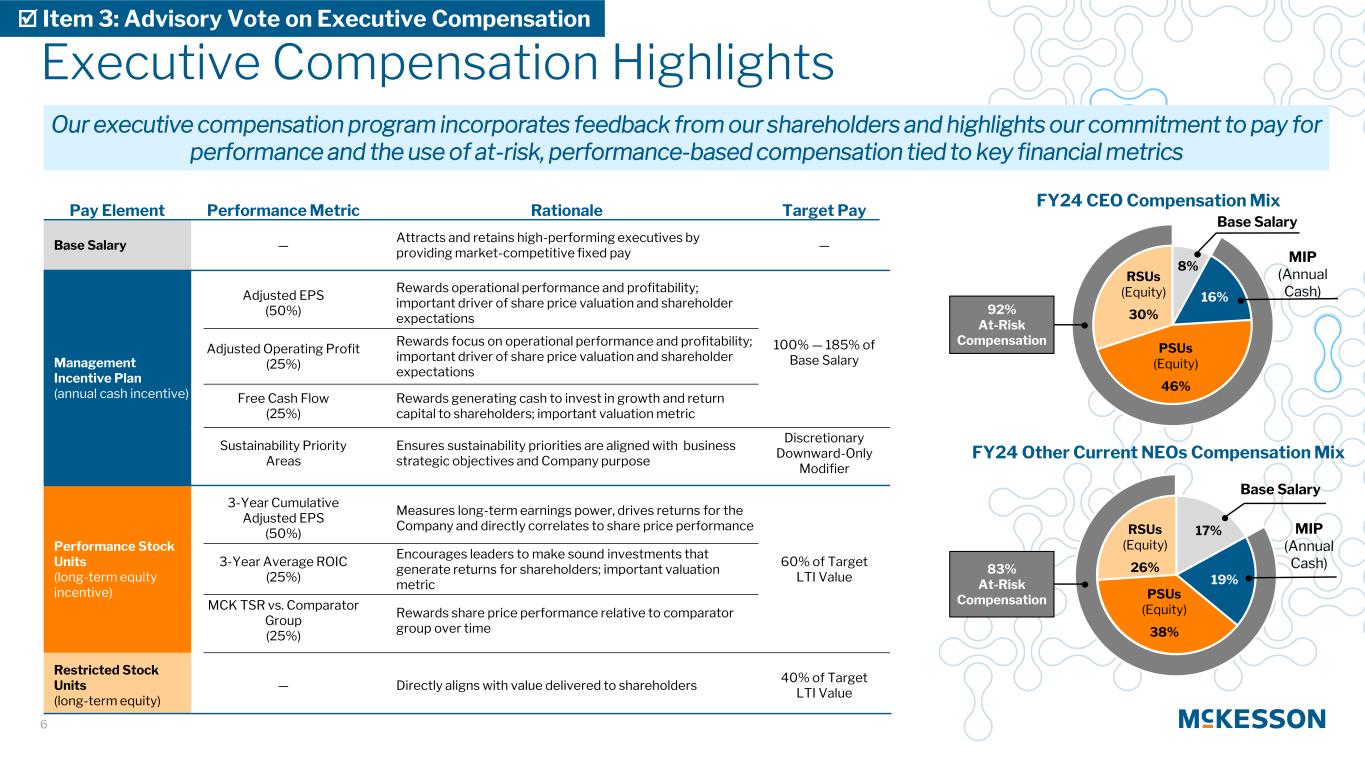

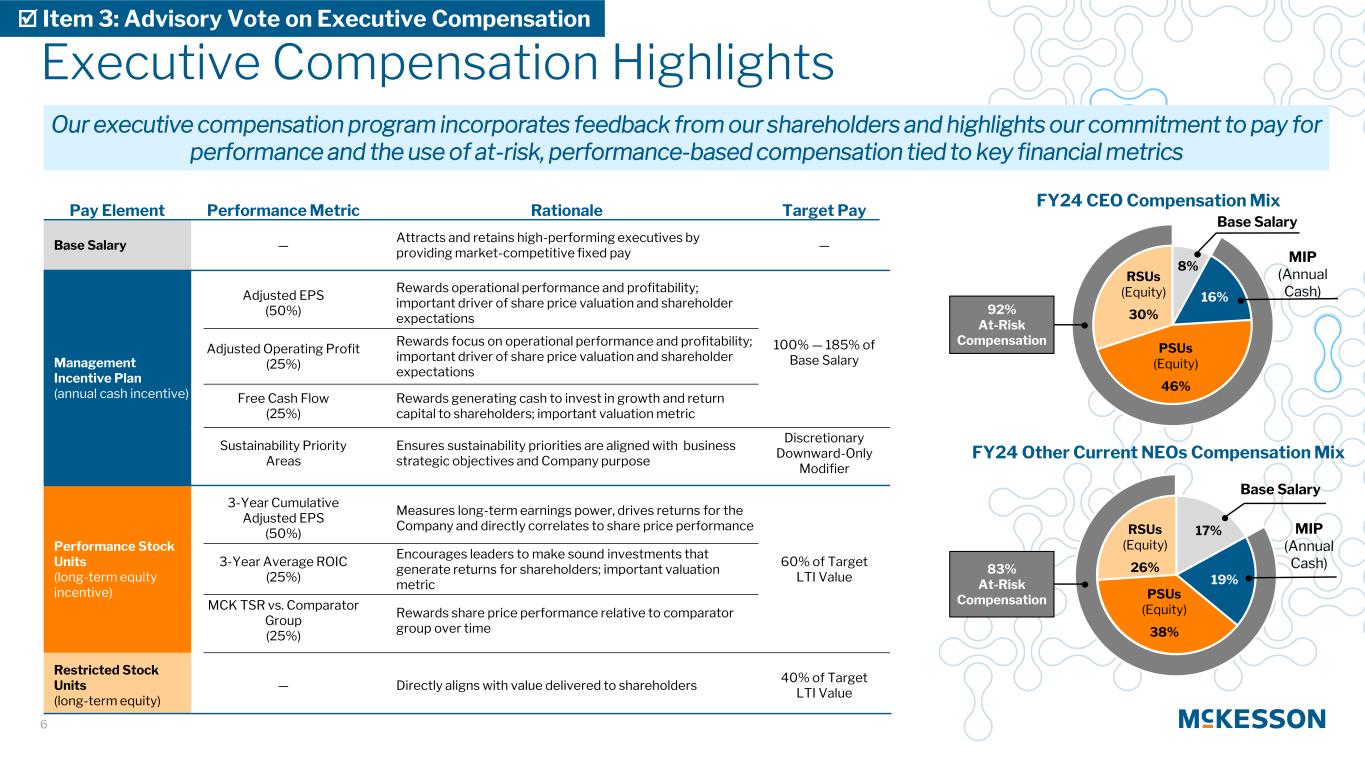

Base Salary MIP (Annual Cash) PSUs (Equity) 46% RSUs (Equity) 30% Base Salary MIP (Annual Cash) PSUs (Equity) 38% RSUs (Equity) 26% 6 Executive Compensation Highlights Our executive compensation program incorporates feedback from our shareholders and highlights our commitment to pay for performance and the use of at-risk, performance-based compensation tied to key financial metrics FY24 CEO Compensation Mix 8% 16% FY24 Other Current NEOs Compensation Mix 92% At-Risk Compensation Pay Element Performance Metric Rationale Target Pay Base Salary — Attracts and retains high-performing executives by providing market-competitive fixed pay — Management Incentive Plan (annual cash incentive) Adjusted EPS (50%) Rewards operational performance and profitability; important driver of share price valuation and shareholder expectations 100% — 185% of Base Salary Adjusted Operating Profit (25%) Rewards focus on operational performance and profitability; important driver of share price valuation and shareholder expectations Free Cash Flow (25%) Rewards generating cash to invest in growth and return capital to shareholders; important valuation metric Sustainability Priority Areas Ensures sustainability priorities are aligned with business strategic objectives and Company purpose Discretionary Downward-Only Modifier Performance Stock Units (long-term equity incentive) 3-Year Cumulative Adjusted EPS (50%) Measures long-term earnings power, drives returns for the Company and directly correlates to share price performance 60% of Target LTI Value 3-Year Average ROIC (25%) Encourages leaders to make sound investments that generate returns for shareholders; important valuation metric MCK TSR vs. Comparator Group (25%) Rewards share price performance relative to comparator group over time Restricted Stock Units (long-term equity) — Directly aligns with value delivered to shareholders 40% of Target LTI Value 17% 19% 83% At-Risk Compensation 🗹 Item 3: Advisory Vote on Executive Compensation

7 Amending the Certificate of Incorporation to provide exculpatory provisions to the officers of the Company is in the best interests of both the Company and shareholders The Board Believes Exculpatory Provisions Enable Officers to Act in the Best Interests of Shareholders • Officers, like directors, are exposed to a substantial risk of lawsuits that could seek to impose personal monetary liability • We believe officers should have personal responsibility in the context of breaches of the duty of loyalty, acts or omissions not in good faith or that involve intentional misconduct or a knowing violation of law, or any transaction in which the officer derived an improper personal benefit, and the proposed amendment does not eliminate those risks • The amendments are intended to reduce the scope of officers’ potential personal liability, in particular, the potential distractions associated with frivolous litigation that could divert management attention and potentially waste corporate resources • These protections would allow McKesson to continue to attract and retain highly qualified officers and enable them to exercise good business judgment The Board Determined to Recommend to Shareholders they Approve this Amendment • Under prior Delaware law, statutory exculpatory provisions were only extended to directors of corporations, however, recent legislature amended Delaware General Corporation Law (DGCL) to extend similar provisions to officers • On January 31, 2024, the Board approved amendments to the Company Charter in light of changes made to the DGCL and recommends that shareholders also approve these amendments Approve Amendment for Officer Exculpation 🗹 Item 4: Approve Amendment to Certificate of Incorporation to Provide for Officer Exculpation Your Board recommends a vote FOR this proposal

8 The policy is unnecessary given McKesson already has an independent Board Chair, and McKesson’s shareholders are best served when the Board has flexibility to make decisions on a case-by-case basis Your Board recommends a vote AGAINST this proposal Don Knauss Currently Serves as Independent Board Chair • An independent Board Chair has led our Board since 2019, when Brian Tyler became our CEO Shareholders are Best Served When Leadership Choices are made by the Board on a Case-by-Case Basis • While current practice is to appoint an independent Chair, our Board’s deep knowledge of the Company positions them best to determine the most effective leadership structure • In situations where the Board Chair is not independent, McKesson’s Corporate Governance Guidelines require the appointment of a Lead Independent Director with clearly defined responsibilities; a prescriptive policy that unnecessarily restricts the Board’s ability to structure its leadership is not in shareholders’ best interest The Board Regularly Evaluates and Reviews its Leadership Structure • The Board and the Governance and Sustainability Committee evaluate the Board’s leadership structure at least annually • We regularly discuss our leadership structure with our shareholders as part of our year-round shareholder engagement program 🗷 Item 5: Shareholder Proposal on Independent Board Chairman We Recommend Against Shareholder Proposal 5

9 The report does not provide meaningful value, given our existing commitment to hiring and retaining the most talented people and our comprehensive healthcare benefits and policies Your Board recommends a vote AGAINST this proposal McKesson Aspires to be the Best Place to Work in Healthcare • The first pillar of our enterprise strategy is focused on people and culture as we aspire to be the best place to work in healthcare • The Board engages in regular oversight of talent, including employee inclusion, engagement and advancement McKesson Provides a Comprehensive Total Rewards Package, Including Medical Benefits • These benefits support our employees’ physical, emotional and financial well-being, including providing travel and lodging benefits that include travel for any covered health service if such covered service is not available from a local provider within 100 miles of an employee’s home • We take employee privacy seriously, especially when it comes to health information The Proposal Imposes Unnecessary Burden Without Any Meaningful Benefit to Employees or Shareholders • The scope of the requested report is overly broad and burdensome, requiring a thorough review of all existing and proposed laws, regulations, and policies, and would quickly become out-of-date as the legal landscape on this topic frequently changes • We use our resources to meet the needs of our employees, and responding as needed to best support our workforce 🗷 Item 6: Shareholder Proposal on Report on Risks of State Policies Restricting Reproductive Health Care We Recommend Against Shareholder Proposal 6

10 We Request Your Support at the 2024 Annual Meeting Management Proposals 1 Election of Directors 🗹 FOR 2 Ratification of Appointment of Deloitte & Touche as the Company’s Independent Registered Public Accounting Firm 🗹 FOR 3 Advisory Vote on Executive Compensation 🗹 FOR 4 Approve Amendment to Certificate of Incorporation to Provide for Officer Exculpation 🗹 FOR Shareholder Proposals 5 Shareholder Proposal on Independent Board Chairman 🗷 AGAINST 6 Shareholder Proposal on Report on Risks of State Policies Restricting Reproductive Health Care 🗷 AGAINST The Board asks that you vote FOR all management proposals and AGAINST the shareholder proposals

Filed by the Registrant

Filed by the Registrant