UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| | |

Filed by the Registrant Filed by the Registrant | | ☐ Filed by a Party other than the Registrant |

| | |

| Check the appropriate box: |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| ☐ | | Definitive Proxy Statement |

| | Definitive Additional Materials |

| ☐ | | Soliciting Material Pursuant to §240.14a-12 |

McKESSON CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | |

| Payment of Filing Fee (Check the appropriate box): |

| | No fee required. |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

Summer Governance Roadshow ----------- 2022 Annual Shareholders Meeting

Improving Health Outcomes for a Better Tomorrow Strength in Distribution 40M+ 99.9% pharmaceutical order accuracy in North America prescription deliveries Over 50% U.S. physicians served with medical-surgical products each year per year Technology Superior Specialty Assets Differentiation #1 US Oncology Research has played a role in 100+ Connected to payers distributor FDA-approved cancer therapies representing 94% of U.S. in community Supported ~14,000 specialty physicians through prescription volume oncology and distribution and GPO services key specialties Access to research data from > 2.5M records including >80 oncology indications Biopharma Services Support Network of More than 650 biopharma brands served 95% 750,000+ of therapeutic Increased value to biopharma and enabled >$6B in providers and over areas prescription savings 50,000 pharmacies 2

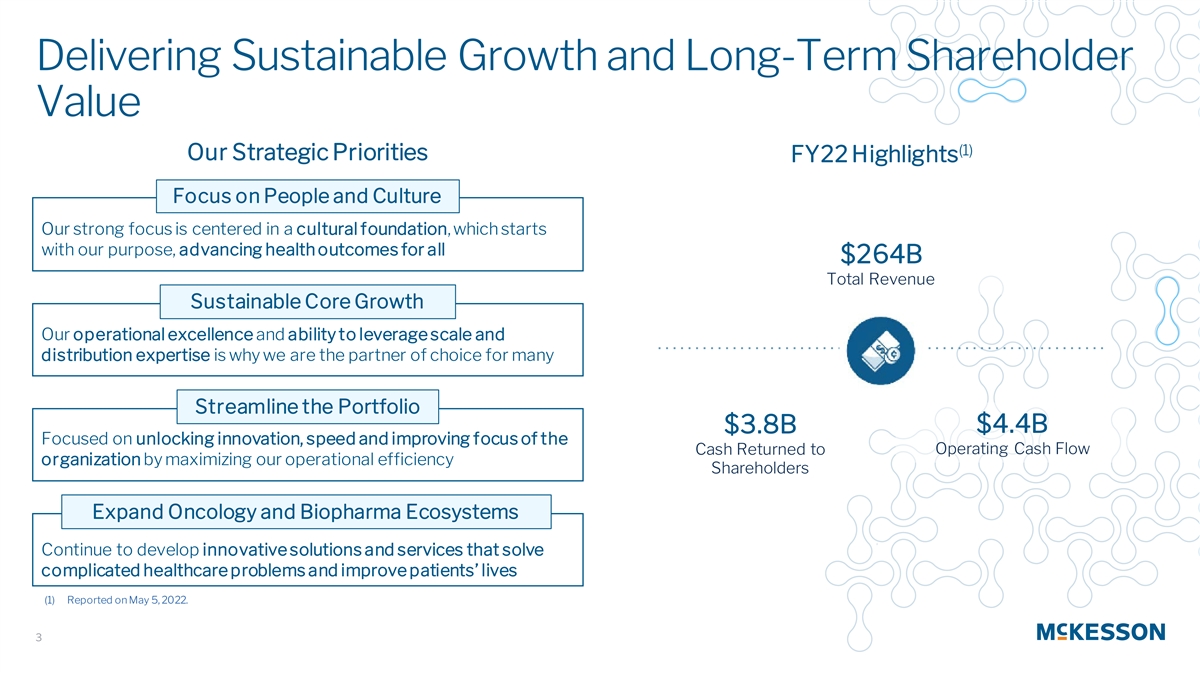

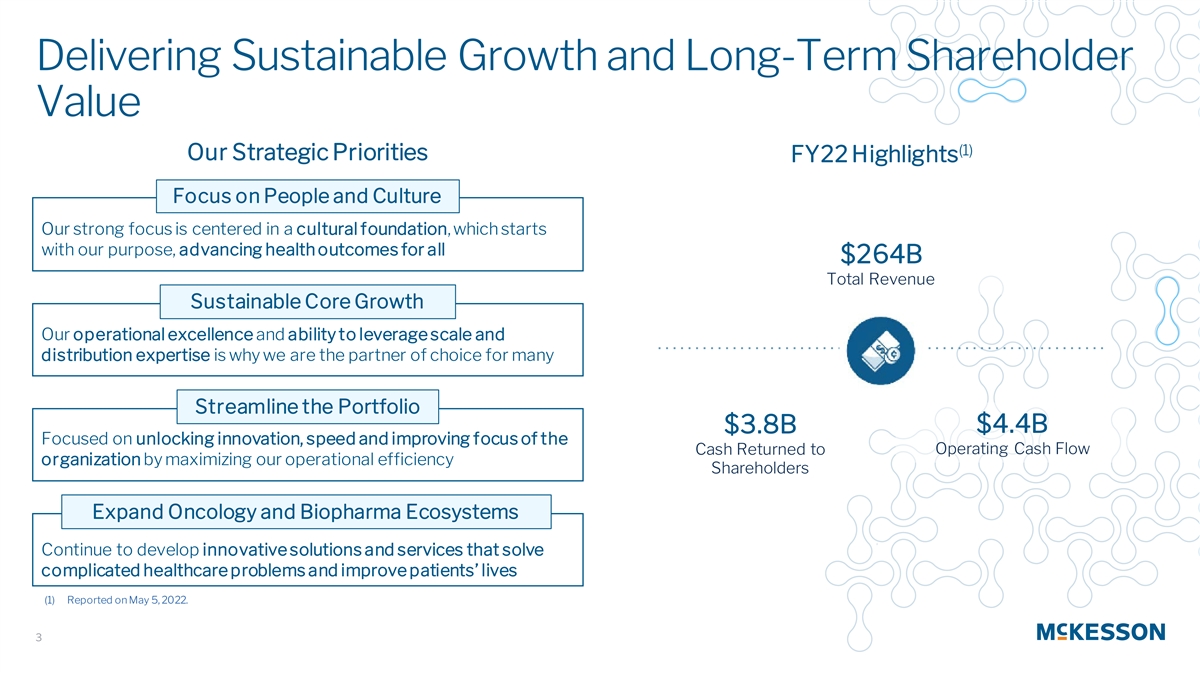

Delivering Sustainable Growth and Long-Term Shareholder Value (1) Our Strategic Priorities FY22 Highlights Focus on People and Culture Our strong focus is centered in a cultural foundation, which starts with our purpose, advancing health outcomes for all $264B Total Revenue Sustainable Core Growth Our operational excellence and ability to leverage scale and distribution expertise is why we are the partner of choice for many Streamline the Portfolio $4.4B $3.8B Focused on unlocking innovation, speed and improving focus of the Operating Cash Flow Cash Returned to organization by maximizing our operational efficiency Shareholders Expand Oncology and Biopharma Ecosystems Continue to develop innovative solutions and services that solve complicated healthcare problems and improve patients’ lives (1) Reported on May 5, 2022. 3

�� Proposal 1: Election of 11 Directors for a One Year Term Our Experienced and Well-Balanced Board Routine Board and Committee refreshment, paired with new independent Board chair Board Skills D onald R. Knauss Brian S. Tyler Richard H. D ominic J. W. Roy Dunbar James H. Hinton Ca rmona Ca ruso Senior Executive Leadership Chief Executive ŸŸŸŸŸŸŸŸŸŸŸ Officer In dependent Other Public Company Board ŸŸŸŸŸŸŸŸŸ Ch air as of Service Apr. 2022 J oined Apr. 2019 J oined Sept. 2021 J oined Sept. 2018 J oined Apr. 2022 J oined Jan. 2022 Business Transformation / ŸŸŸŸŸŸŸŸŸ M&A Financial / Accounting At least 1 ŸŸŸŸŸŸŸŸ independent director Healthcare Industry Experience ŸŸŸŸŸŸŸŸ joined our Bra dley E. Linda Mantia Ma ria Martinez S usan R. Salka Ka thleen Distribution / Supply Chain Board each Lerman Wilson- ŸŸŸŸ Experience T hompson year since Risk Management and 2018 ŸŸŸŸŸŸ Compliance J oined Sept. 2018 J oined Oct. 2020 J oined Oct. 2019 J oined Oct. 2014 J oined Jan. 2022 Sustainability and ESG ŸŸŸŸ Diversity Highlights Cyber / Technology ŸŸŸŸŸŸŸ Persons of Color Women Country Locations Veteran Status Outside U.S. Global / International ŸŸŸŸŸŸŸŸ 3 4 2 Experience 1 - two Black/African-American - three of whom chair a - two directors served in Marketing / Public Relations / - one director based in ŸŸŸŸŸ and one Hispanic - Board committee - the military - Communications Canada - 4 Carmona Caruso Dunbar Hinton Knauss Lerman Mantia Martinez Salka Tyler Wilson- Thompson

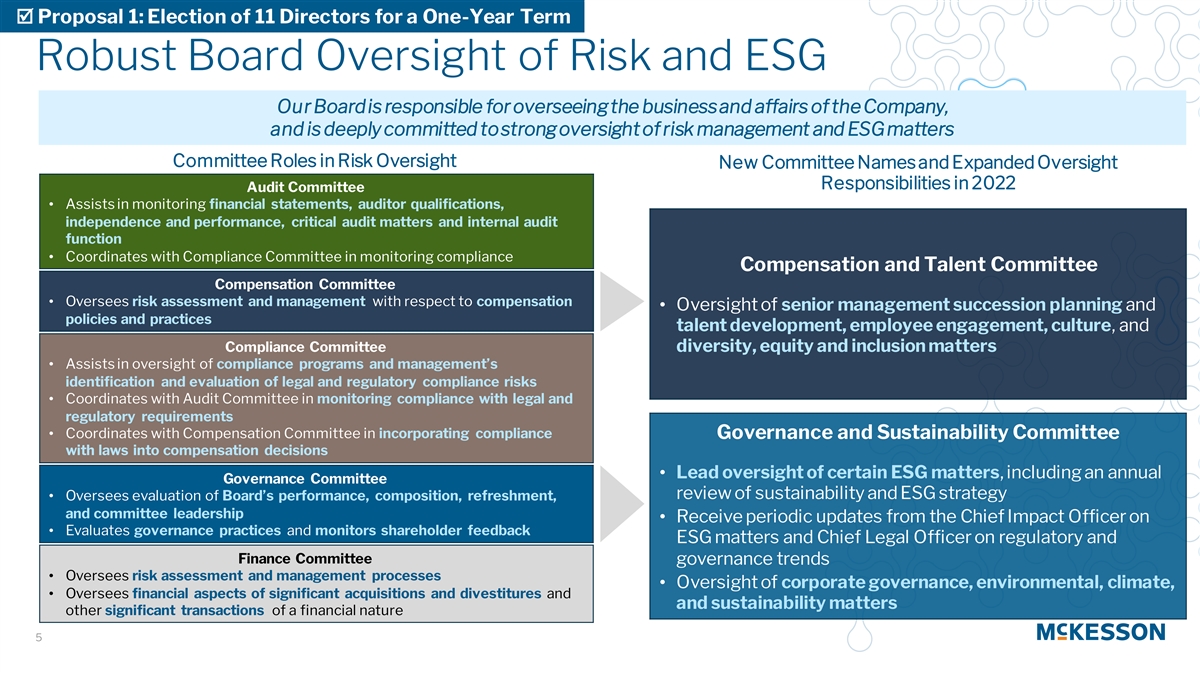

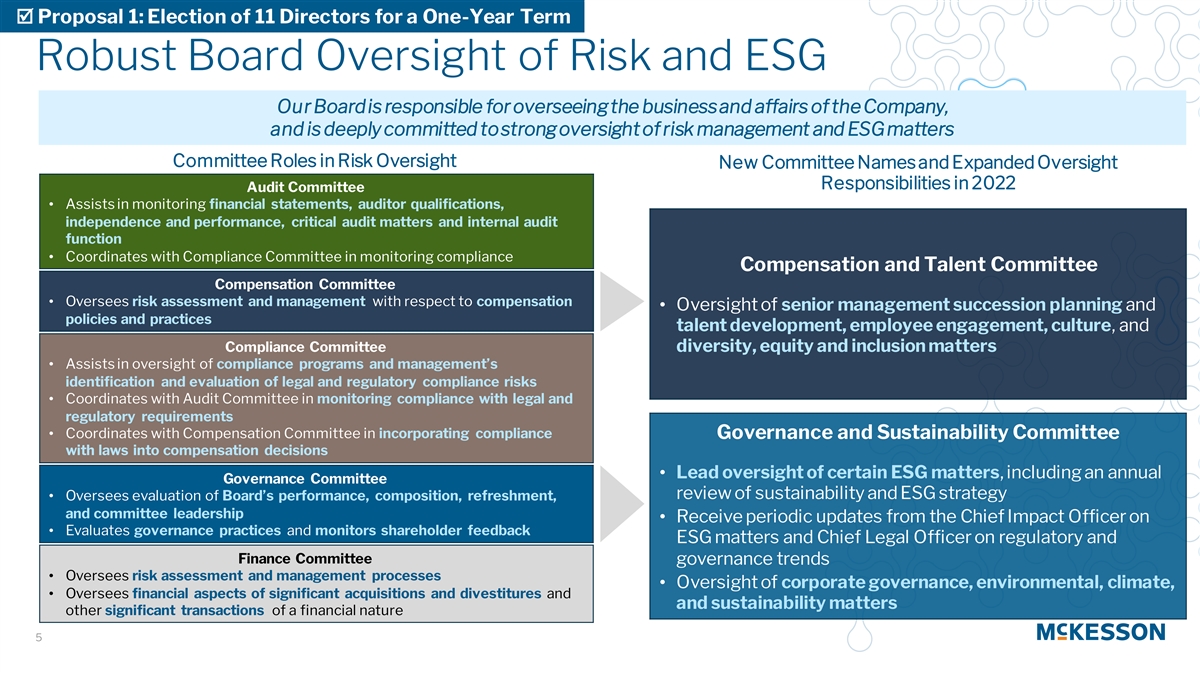

�� Proposal 1: Election of 11 Directors for a One-Year Term Robust Board Oversight of Risk and ESG Our Board is responsible for overseeing the business and affairs of the Company, and is deeply committed to strong oversight of risk management and ESG matters Committee Roles in Risk Oversight New Committee Names and Expanded Oversight Responsibilities in 2022 Audit Committee • Assists in monitoring financial statements, auditor qualifications, independence and performance, critical audit matters and internal audit function • Coordinates with Compliance Committee in monitoring compliance Compensation and Talent Committee Compensation Committee • Oversees risk assessment and management with respect to compensation • Oversight of senior management succession planning and policies and practices talent development, employee engagement, culture, and Compliance Committee diversity, equity and inclusion matters • Assists in oversight of compliance programs and management’s identification and evaluation of legal and regulatory compliance risks • Coordinates with Audit Committee in monitoring compliance with legal and regulatory requirements • Coordinates with Compensation Committee in incorporating compliance Governance and Sustainability Committee with laws into compensation decisions • Lead oversight of certain ESG matters, including an annual Governance Committee review of sustainability and ESG strategy • Oversees evaluation of Board’s performance, composition, refreshment, and committee leadership • Receive periodic updates from the Chief Impact Officer on • Evaluates governance practices and monitors shareholder feedback ESG matters and Chief Legal Officer on regulatory and Finance Committee governance trends • Oversees risk assessment and management processes • Oversight of corporate governance, environmental, climate, • Oversees financial aspects of significant acquisitions and divestitures and and sustainability matters other significant transactions of a financial nature 5

�� Proposal 3: Advisory Vote on Executive Compensation Overview of FY22 Compensation Program Following substantial structural changes made in FY20, and given positive feedback we continue to receive from shareholders regarding those changes, the Committee did not make any additional adjustments to the plans for FY22 Pay Element FY22 Metric Weight Rationale FY22 CEO Compensation Mix Attracts and retains high-performing executives by Base Salary -- -- Base Salary providing market-competitive fixed pay MIP (Annual Rewards operational performance and profitability; 9% Cash) Adjusted EPS 50% important driver of share price valuation and shareholder RSUs 15% expectations (Equity) 91% At-Risk PSUs Management 30% Rewards focus on operational performance and Compensation (Equity) Incentive Plan Adjusted Operating Profit 25% profitability; important driver of share price valuation and shareholder expectations 46% Rewards generating cash to invest in growth and return Free Cash Flow 25% capital to shareholders; important valuation metric FY22 Other NEOs Compensation Mix Measures long-term earnings power, drives returns for 3-Year Cumulative Adjusted Base Salary 50% the Company and directly correlates to share price EPS performance Performance RSUs MIP 19% Encourages leaders to make sound investments that Stock Units (Equity) (Annual 3-Year Average ROIC 25% generate strong returns for shareholders; important (60% of LTI) Cash) 81% 24% valuation metric 20% At-Risk PSUs Compensation MCK TSR vs. Comparator Rewards share price performance relative to comparator (Equity) 25% Group group over time 37% Restricted Stock Units -- -- Directly aligns with value delivered to shareholders (40% of LTI) 6

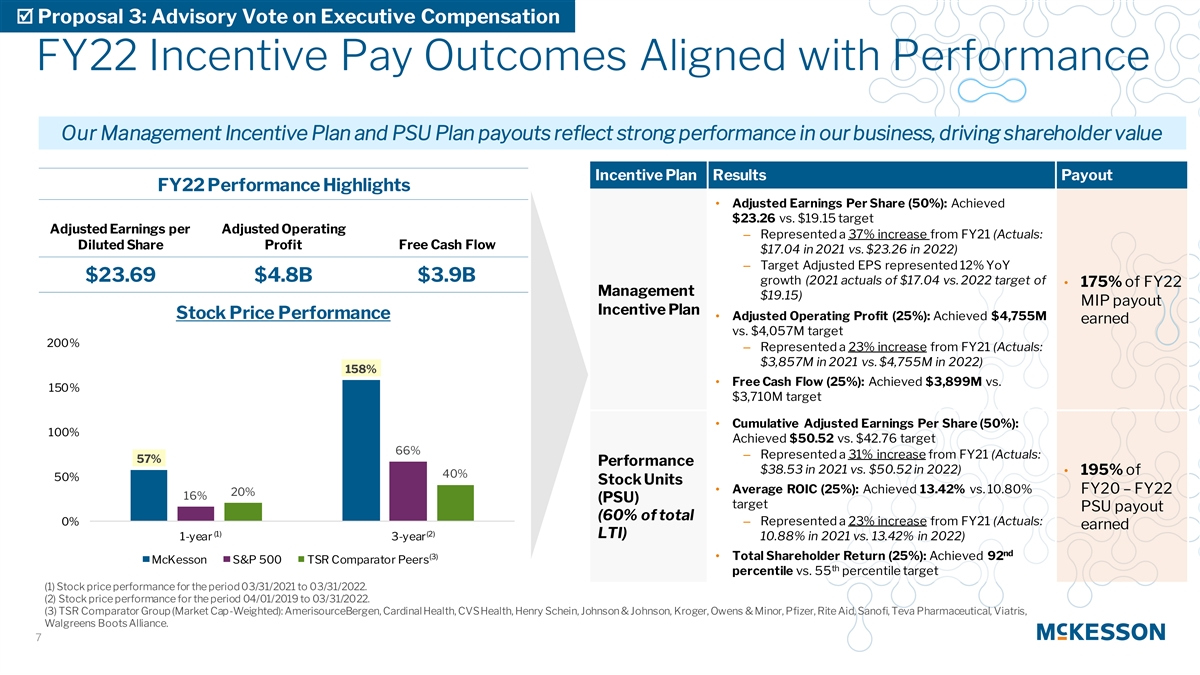

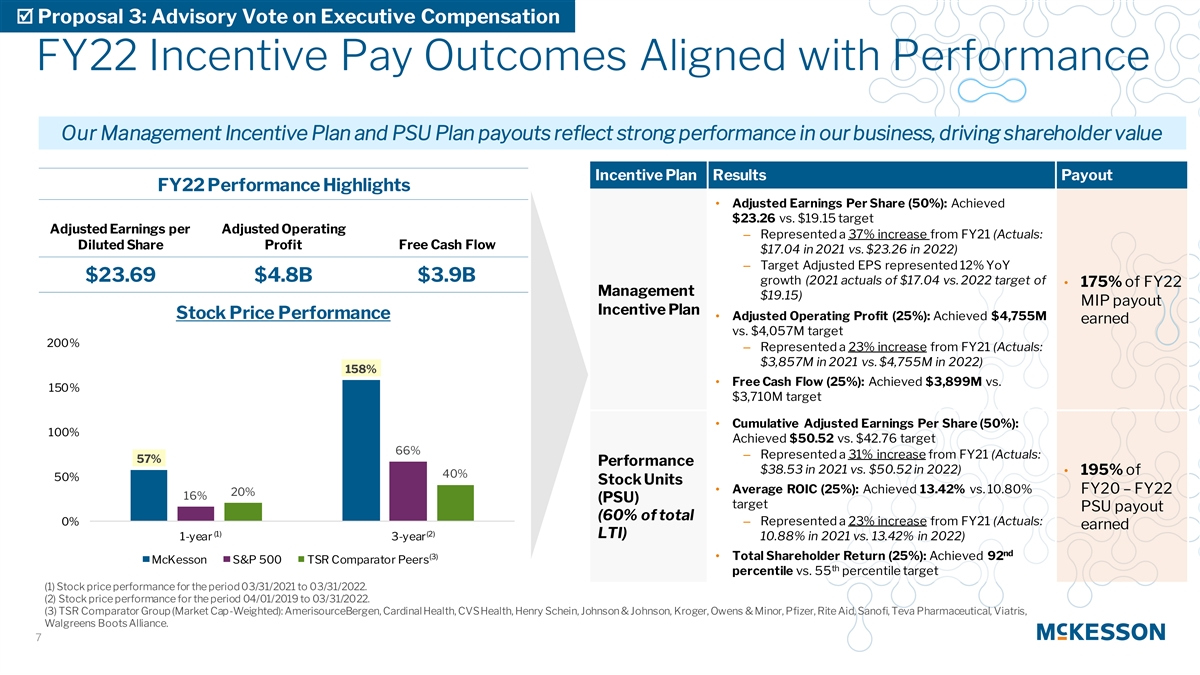

�� Proposal 3: Advisory Vote on Executive Compensation FY22 Incentive Pay Outcomes Aligned with Performance Our Management Incentive Plan and PSU Plan payouts reflect strong performance in our business, driving shareholder value Incentive Plan Results Payout FY22 Performance Highlights • Adjusted Earnings Per Share (50%): Achieved $23.26 vs. $19.15 target Adjusted Earnings per Adjusted Operating – Represented a 37% increase from FY21 (Actuals: Diluted Share Profit Free Cash Flow $17.04 in 2021 vs. $23.26 in 2022) – Target Adjusted EPS represented 12% YoY $23.69 $4.8B $3.9B growth (2021 actuals of $17.04 vs. 2022 target of • 175% of FY22 Management $19.15) MIP payout Incentive Plan Stock Price Performance • Adjusted Operating Profit (25%): Achieved $4,755M earned vs. $4,057M target 200% – Represented a 23% increase from FY21 (Actuals: $3,857M in 2021 vs. $4,755M in 2022) 158% • Free Cash Flow (25%): Achieved $3,899M vs. 150% $3,710M target • Cumulative Adjusted Earnings Per Share (50%): 100% Achieved $50.52 vs. $42.76 target 66% – Represented a 31% increase from FY21 (Actuals: 57% Performance $38.53 in 2021 vs. $50.52 in 2022) • 195% of 40% 50% Stock Units • Average ROIC (25%): Achieved 13.42% vs. 10.80% FY20 – FY22 20% 16% (PSU) target PSU payout (60% of total – Represented a 23% increase from FY21 (Actuals: 0% earned (1) (2) LTI) 1-year 3-year 10.88% in 2021 vs. 13.42% in 2022) nd (3)• Total Shareholder Return (25%): Achieved 92 McKesson S&P 500 TSR Comparator Peers th percentile vs. 55 percentile target (1) Stock price performance for the period 03/31/2021 to 03/31/2022. (2) Stock price performance for the period 04/01/2019 to 03/31/2022. (3) TSR Comparator Group (Market Cap-Weighted): AmerisourceBergen, Cardinal Health, CVS Health, Henry Schein, Johnson & Johnson, Kroger, Owens & Minor, Pfizer, Rite Aid, Sanofi, Teva Pharmaceutical, Viatris, Walgreens Boots Alliance. 7

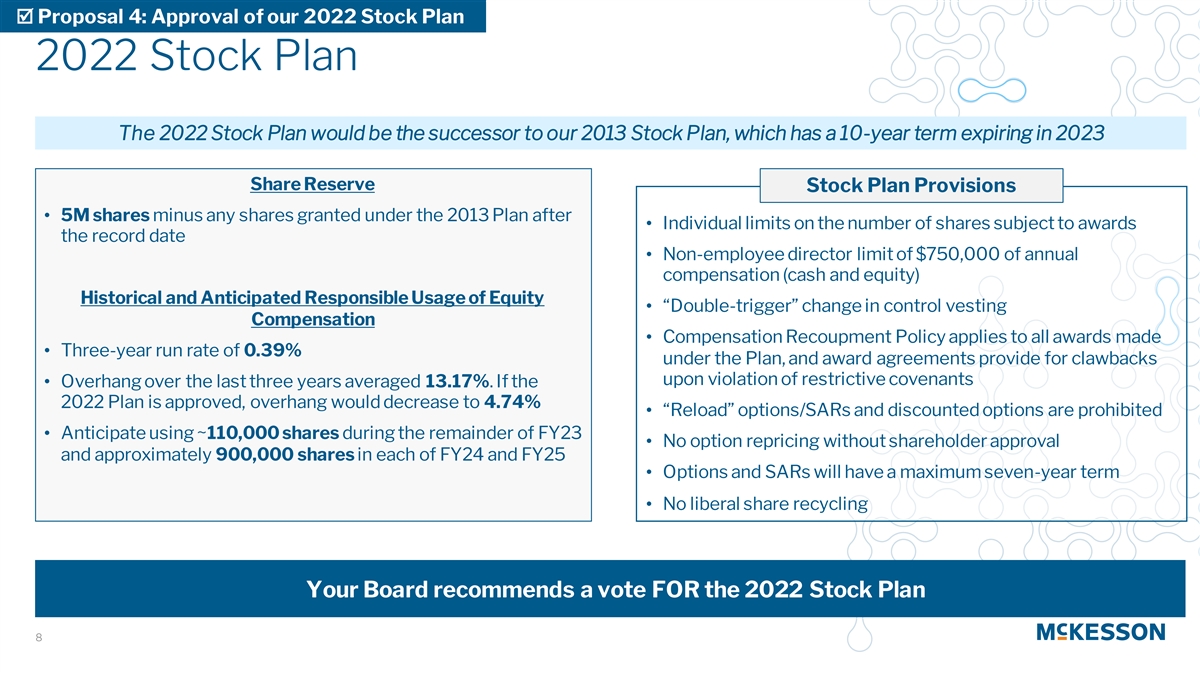

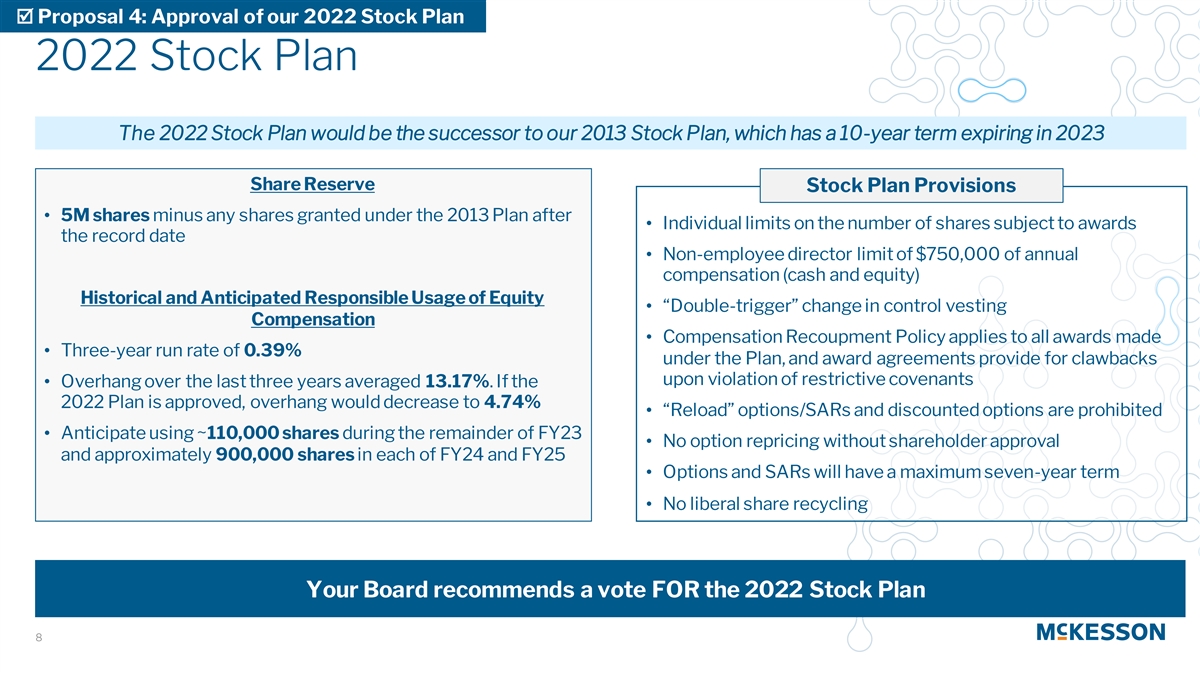

�� Proposal 4: Approval of our 2022 Stock Plan 2022 Stock Plan The 2022 Stock Plan would be the successor to our 2013 Stock Plan, which has a 10-year term expiring in 2023 Share Reserve Stock Plan Provisions • 5M shares minus any shares granted under the 2013 Plan after • Individual limits on the number of shares subject to awards the record date • Non-employee director limit of $750,000 of annual compensation (cash and equity) Historical and Anticipated Responsible Usage of Equity • “Double-trigger” change in control vesting Compensation • Compensation Recoupment Policy applies to all awards made • Three-year run rate of 0.39% under the Plan, and award agreements provide for clawbacks upon violation of restrictive covenants • Overhang over the last three years averaged 13.17%. If the 2022 Plan is approved, overhang would decrease to 4.74% • “Reload” options/SARs and discounted options are prohibited • Anticipate using ~110,000 shares during the remainder of FY23 • No option repricing without shareholder approval and approximately 900,000 shares in each of FY24 and FY25 • Options and SARs will have a maximum seven-year term • No liberal share recycling Your Board recommends a vote FOR the 2022 Stock Plan 8

�� Proposal 5: Amendment to our 2000 Employee Stock Purchase Plan Employee Stock Purchase Plan An amendment to the 2000 Employee Stock Purchase Plan would increase the number of shares of common stock reserved for issuance under the plan by 2,000,000 shares Share Reserve ESPP Benefits • 2M shares are proposed for addition • The ESPP provides the broader employee population with a chance to purchase shares of the Company’s common stock at 85% of fair market value Current Reserve • The purpose is to advance and promote the interests of • Purchases generally occur once per quarter shareholders by allowing eligible employees to hold a • At the April 2022 purchase date, approximately 62,427 shares proprietary interest in the Company, while also attracting, were issued motivating, and retaining talent • Approximately 1,800,000 shares remain available for issuance Your Board recommends a vote FOR the amendment to our 2000 Employee Stock Purchase Plan 9

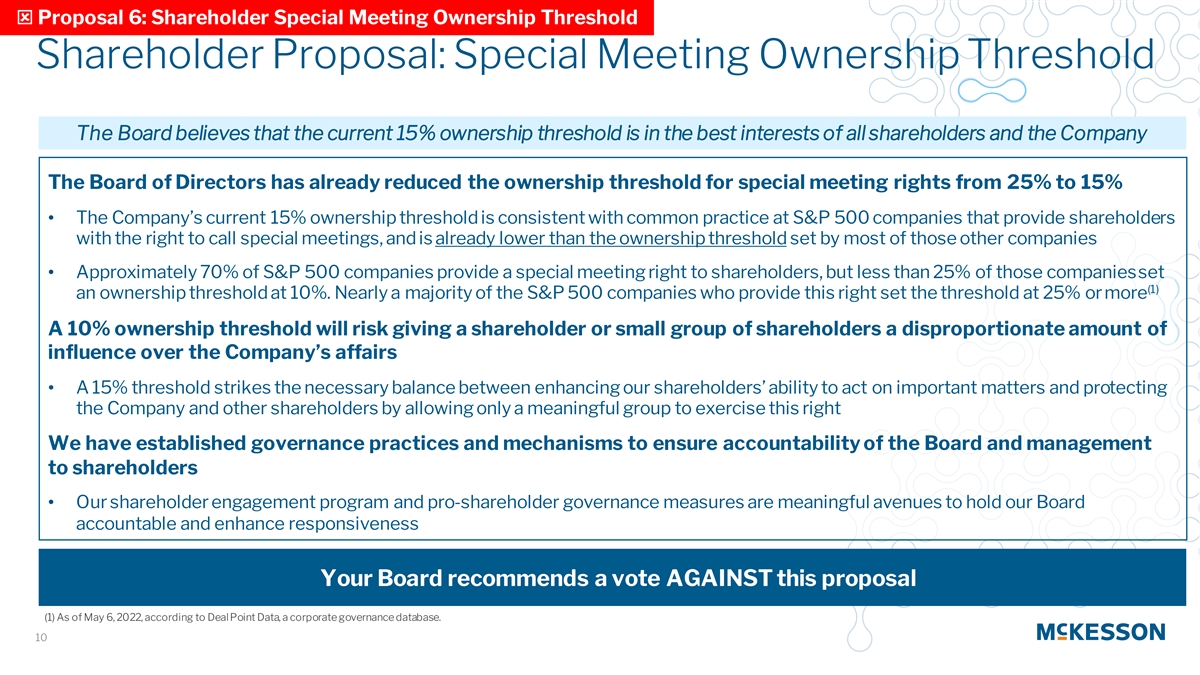

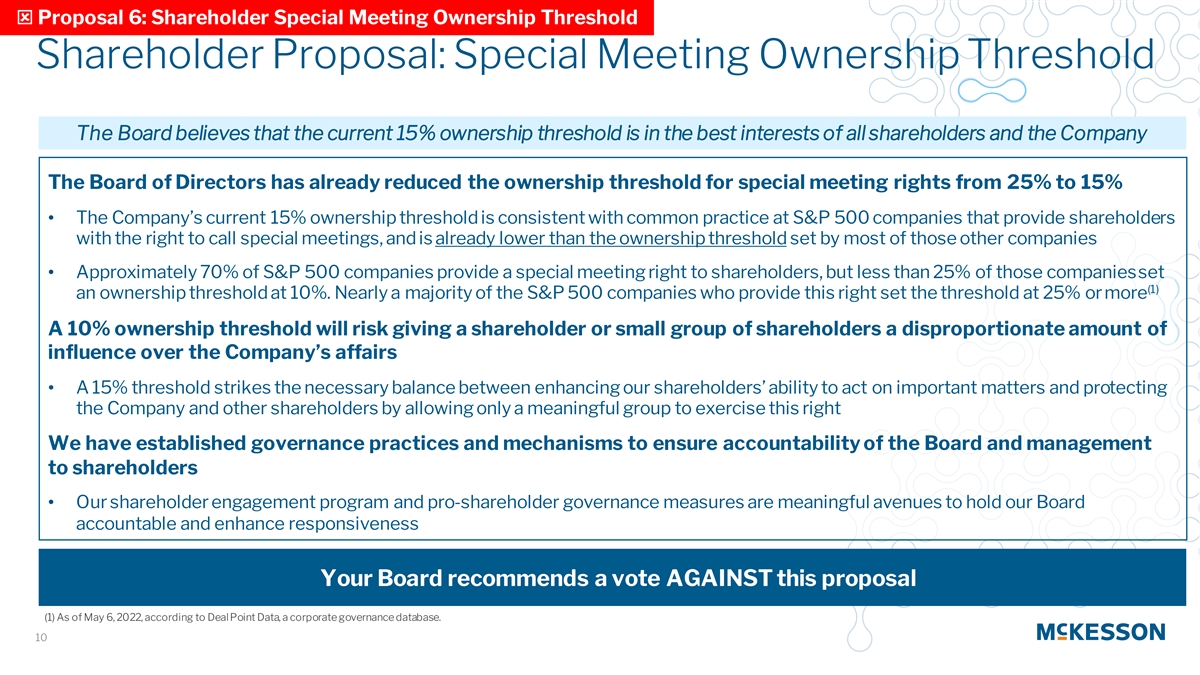

�� Proposal 6: Shareholder Special Meeting Ownership Threshold Shareholder Proposal: Special Meeting Ownership Threshold The Board believes that the current 15% ownership threshold is in the best interests of all shareholders and the Company The Board of Directors has already reduced the ownership threshold for special meeting rights from 25% to 15% • The Company’s current 15% ownership threshold is consistent with common practice at S&P 500 companies that provide shareholders with the right to call special meetings, and is already lower than the ownership threshold set by most of those other companies • Approximately 70% of S&P 500 companies provide a special meeting right to shareholders, but less than 25% of those companies set (1) an ownership threshold at 10%. Nearly a majority of the S&P 500 companies who provide this right set the threshold at 25% or more A 10% ownership threshold will risk giving a shareholder or small group of shareholders a disproportionate amount of influence over the Company’s affairs • A 15% threshold strikes the necessary balance between enhancing our shareholders’ ability to act on important matters and protecting the Company and other shareholders by allowing only a meaningful group to exercise this right We have established governance practices and mechanisms to ensure accountability of the Board and management to shareholders • Our shareholder engagement program and pro-shareholder governance measures are meaningful avenues to hold our Board accountable and enhance responsiveness Your Board recommends a vote AGAINST this proposal (1) As of May 6, 2022, according to Deal Point Data, a corporate governance database. 10

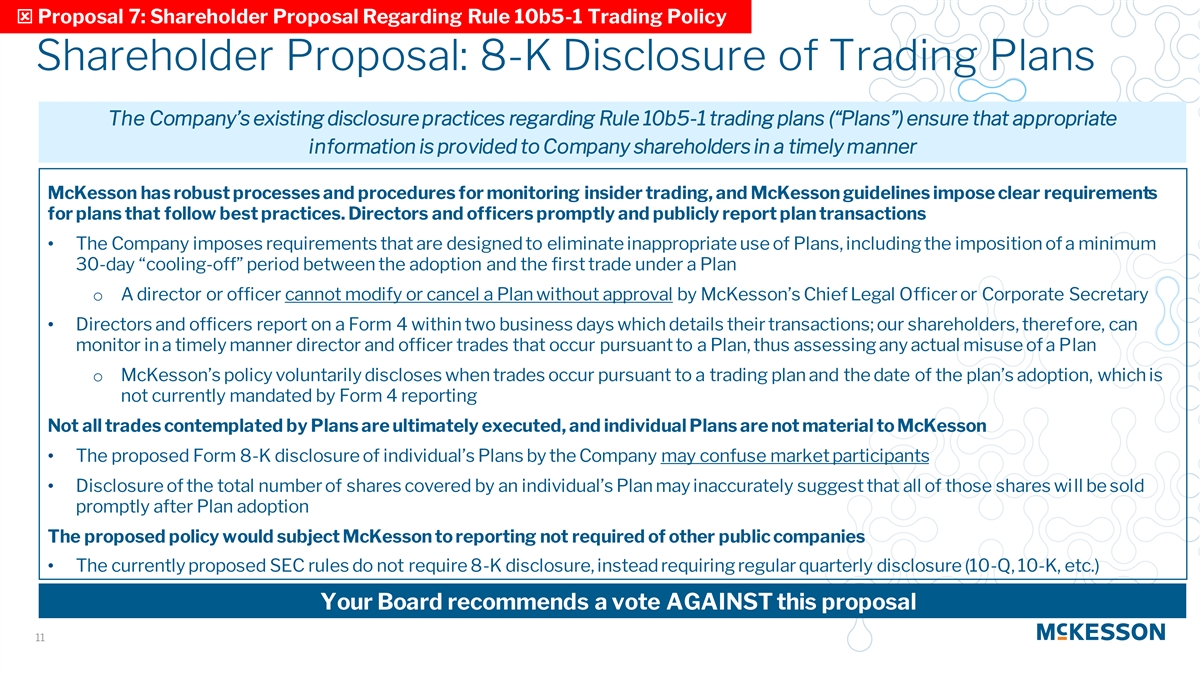

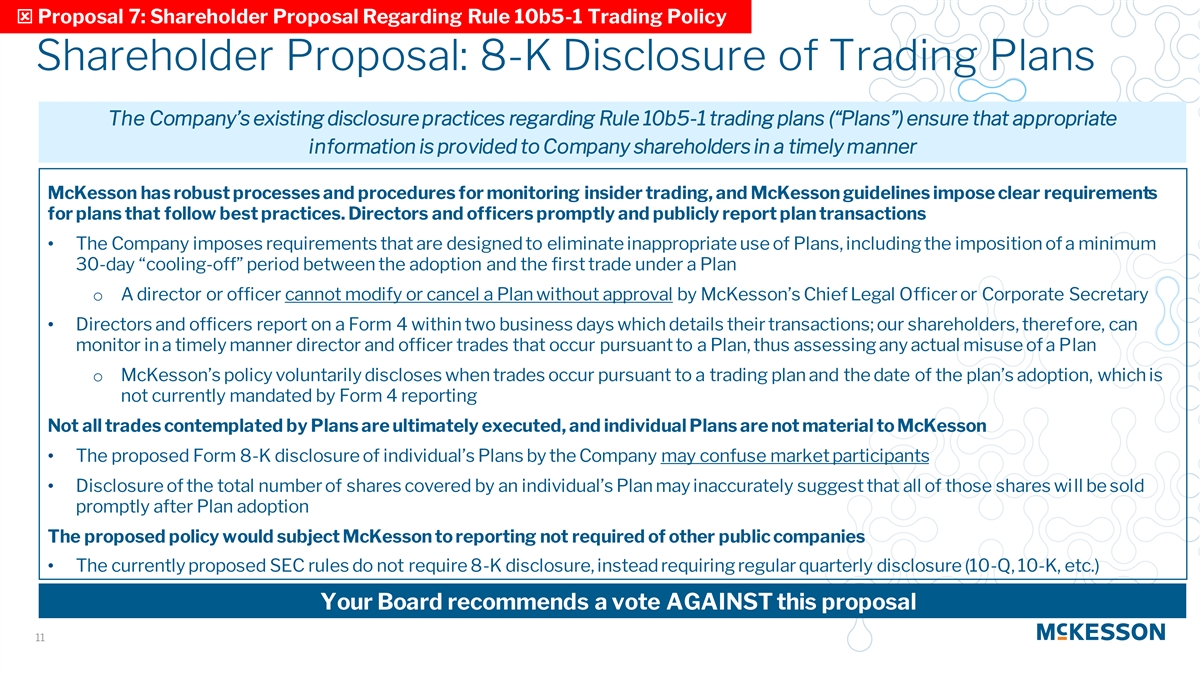

�� Proposal 7: Shareholder Proposal Regarding Rule 10b5-1 Trading Policy Shareholder Proposal: 8-K Disclosure of Trading Plans The Company’s existing disclosure practices regarding Rule 10b5-1 trading plans (“Plans”) ensure that appropriate information is provided to Company shareholders in a timely manner McKesson has robust processes and procedures for monitoring insider trading, and McKesson guidelines impose clear requirements for plans that follow best practices. Directors and officers promptly and publicly report plan transactions • The Company imposes requirements that are designed to eliminate inappropriate use of Plans, including the imposition of a minimum 30-day “cooling-off” period between the adoption and the first trade under a Plan o A director or officer cannot modify or cancel a Plan without approval by McKesson’s Chief Legal Officer or Corporate Secretary • Directors and officers report on a Form 4 within two business days which details their transactions; our shareholders, therefore, can monitor in a timely manner director and officer trades that occur pursuant to a Plan, thus assessing any actual misuse of a Plan o McKesson’s policy voluntarily discloses when trades occur pursuant to a trading plan and the date of the plan’s adoption, which is not currently mandated by Form 4 reporting Not all trades contemplated by Plans are ultimately executed, and individual Plans are not material to McKesson • The proposed Form 8-K disclosure of individual’s Plans by the Company may confuse market participants • Disclosure of the total number of shares covered by an individual’s Plan may inaccurately suggest that all of those shares will be sold promptly after Plan adoption The proposed policy would subject McKesson to reporting not required of other public companies • The currently proposed SEC rules do not require 8-K disclosure, instead requiring regular quarterly disclosure (10-Q, 10-K, etc.) Your Board recommends a vote AGAINST this proposal 11

�� Proposal 7: Shareholder Proposal Regarding Rule 10b5-1 Trading Policy An 8-K is Not the Appropriate Disclosure Form for 10b5-1 The SEC’s Form 4 is a more appropriate vehicle to disclose securities holdings of officers and directors Form 4 Form 8-K Section 16 Officers and Directors Issuer/Registrant Reporting Person: To disclose transactions and holdings of directors, To disclose events material to the officers and beneficial owners of publicly traded Issuer/Registrant (e.g., an event pertinent to an Form’s Purpose: companies Issuer’s business or financial operations) Date of an actual trade Number and type of shares traded Share price As proposed by the proponent, the disclosure would merely indicate that a 10b5-1 plan was Reporting person’s relationship to the Issuer/Registrant, Details Disclosed: adopted, modified or canceled, not that an actual among other information trade occurred Voluntary reporting of when trades occur pursuant to a trading plan and the date of the plan’s adoption (while not currently mandated, part of MCK’s current disclosures) • 8-K disclosure creates the perception that the Company supports the personal investment decisions of its officers and directors • Disclosure through an 8-K inaccurately implies that the Company deems trades under 10b5-1 plans to be of material importance to the Company and/or its investors Please see www.sec.gov for the official instructions and other requirements applicable to Forms 4 and 8-K. 12

We Request Your Support at the 2022 Annual Meeting The Board asks that you vote FOR all management proposals and AGAINST the shareholder proposals Management Proposals 1 Election of 11 Directors for a One Year Term FOR �� 2 Ratification of Selection of Deloitte & Touche as Independent Registered Public Accounting Firm for Fiscal Year 2023 FOR �� 3 Advisory Vote on Executive Compensation FOR �� 4 Approval of our 2022 Stock Plan FOR �� 5 Approval of Amendment to our 2000 Employee Stock Purchase Plan FOR �� Shareholder Proposals 6 Shareholder Proposal on Shareholder Special Meeting Ownership Threshold AGAINST �� 7 Shareholder Proposal on Rule 10b5-1 Trading Policy AGAINST �� 13

Filed by the Registrant

Filed by the Registrant